ACCA F9 assignment 2

ACCA是什么意思

ACCA是什么意思【ACCA协会介绍】英国特许公认会计师公会(The Association of Chartered Certified Accountants)简称ACCA,成立于1904年,是目前世界上领先的专业会计师团体,也是国际学员最多、学员规模发展最快的专业会计师组织。

ACCA 总部设在伦敦,在美国洛杉矶、加拿大多伦多、澳大利亚悉尼建有分会,在世界上70多个城市均设有办事处。

ACCA自1988年进入中国以来,经历20余年快速发展,目前在中国拥有超过22,000名会员及41,000名学员,并在北京、上海、成都、广州、深圳、香港以及澳门设有共7个办事处。

ACCA为全世界有志投身于财务、会计以及管理领域的专才提供首选的资格认证,一贯坚持最高的标准,提高财会人员的专业素质,职业操守以及监管能力,并秉承为公众利益服务的原则。

在英国,立法许可ACCA会员从事审计、投资顾问和破产执行的工作。

ACCA会员资格得到欧盟立法以及许多国家公司法的承认。

ACCA在欧洲会计专家协会(FEE)、亚太会计师联合会(CAPA)和加勒比特许会计师协会(ICAC)等会计组织中起着非常重要的作用。

在国际上,ACCA是国际会计准则理事会(IASB)的创始成员,也是国际会计师联合会(IFAC)的成员。

【ACCA资质介绍】ACCA是国际认可范围最高的财务人员资格证书!ACCA专业资格考试是最具权威性的国际认证资格考试,目前在170个国家和地区拥有近32.5万学员和12.2万会员,设有250多个考点,操作上具有真正的国际性。

长期以来,ACCA禀承并发扬了创始者不断进步的思想,与其它会计组织相比,ACCA更为开放:ACCA向有能力的优秀人员敞开大门,而不因他们的不同背景拒绝接纳——不管年龄、性别、学历或种族上的差异,人们都能报名注册,在经过一系列的专业考试、并取得三年相关工作经验、经ACCA资格评审委员会评定后,就能获得会员资格。

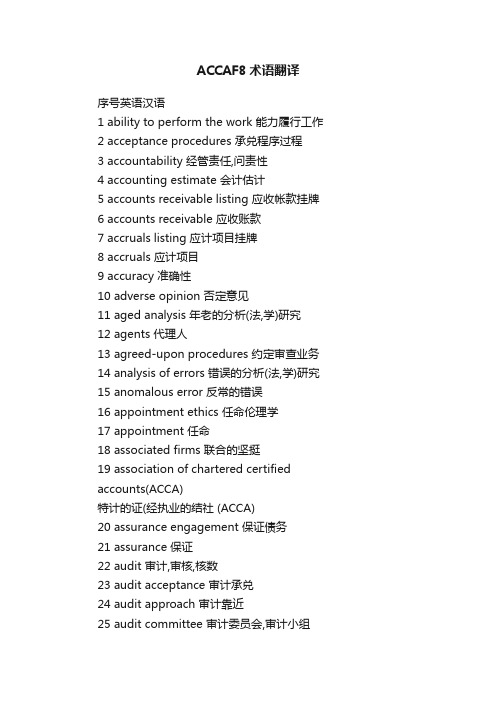

(完整word版)ACCA 专业词汇表

序号英语汉语1 ability to perform the work 履行职责的工作能力2 acceptance procedures 承接业务的程序3 accountability 经管责任4 accounting estimate 会计估计5 accounts receivable listing 应收帐款名单6 accounts receivable 应收账款7 accruals listing 应计项目名单8 accruals 应计项目9 accuracy 准确性10 adverse opinion 否定意见11 aged analysis 帐龄分析法12 agents 代理人13 agreed-upon procedures 程序审查(约定审计业务)14 analysis of errors 分析错误15 anomalous error 不正常的错误16 appointment ethics 任命(职业道德)17 appointment 任命18 associated firms 联合企业19 association of chartered certified accounts(ACCA) 注册会计师(ACCA)20 assurance engagement 承担鉴证业务21 assurance 鉴证22 audit 审计,审核,核数23 audit acceptance 接受审计24 audit approach 审计方法25 audit committee 审计委员会,审计小组26 ahudit engagement 审计业务约定书27 audit evaluation 审计评价28 audit evidence 审计证据29 audit plan 审计计划30 audit program 审计程序31 audit report as a means of communication 审计报告(交流方式)32 audit report 审计报告33 audit risk 审计风险34 audit sampling 审计抽样35 audit staffing 审计工作人员36 audit timing 审计及时37 audit trail 审计线索38 auditing standards 审计准则39 auditors' duty of care 审计职业审慎性40 auditors' report 审计报告41 authority attached to ISAs 遵循ISA(国际审计准则)42 automated working papers (电脑)自动生产的工作底稿43 bad debts 坏账44 bank 银行45 bank reconciliation 银行对账单,余额调节表46 beneficial interests 收益权47 best value 最好的价值48 business risk 经营风险49 cadbury committee cadbury 委员会50 cash count 现金盘点51 cash system 现金循环52 changes in nature of engagement 改变债务的性质上53 charges and commitments 费用和佣金54 charities 慈善团体56 chronology of an audit 审计的年表57 CIS application controls CIS 应用控制58 CIS environments stand-alone microcomputers CIS 环境单机微型计算器59 client screening 顾客甄别60 closely connected 紧密联系61 clubs 俱乐部62 communications between auditors and management 在审计员和管理者间沟通63 communications on internal control 内部控制上的沟通64 companies act 公司法65 comparative financial statements 比较财务报表66 comparatives 比较的67 competence 能力68 compilation engagement 承接编制(业务)69 completeness 完整性70 completion of the audit 审计终结71 compliance with accounting regulations 符合会计规则72 computers assisted audit techniques (CAA Ts) 计算器援助的审计技术(CAATs)73 confidence 信任74 confidentiality 保密性75 confirmation of accounts receivable 应收帐款询证函76 conflict of interest 利益冲突77 constructive obligation 工程应付款78 contingent asset 或有资产79 contingent liability 或有负债80 control environment 控制环境81 control procedures 控制程序82 control risk 控制风险[键入文字]83 controversy 争论84 corporate governance 公司治理85 corresponding figures 相关的数值86 cost of conversion 转换成本,加工成本87 cost 成本88 courtesy 优待89 creditors 债权人90 current audit files 本期审计档案91 database management system (DBMS) 数据库管理制度(数据管理系统)92 date of report 报告的日期93 depreciation 折旧94 design of the sample (抽样)样品的选取95 detection risk 检查风险96 direct verification approach 直接核查法97 directional testing 有方向的抽查98 directors' emoluments 董事酬金99 directors' serve contracts 董事服务合约100 disagreement with management 与经营管理者意见不一致 101 disclaimer of opinion 拒绝表示意见102 distributions 分销,分派,分配103 documentation of understanding and assessment of controlrisk控制风险评估的文件编集104 documenting the audit process 审计程序的审计文档 105 due care 应有关注106 due skill and care 应有的技能和谨慎107 economy 经济108 education 教育109 effectiveness 效用,效果110 efficiency 效益,效率111 eligibility / ineligibility 合格、资格/ 无资格 112 emphasis of matter 强调某事项114 engagement letter 业务约定书115 error 错误116 evaluating of results of audit procedures 审计程序结果的评估117 examinations 检查118 existence 存在性119 expectations 期望差距120 expected error 预期的错误121 experience 经验122 expert 专家123 external audit 独立审计124 external review reports 外部复核报告125 fair公正 126 fee negotiation费用谈判127 final assessment of control risk 控制风险的最终评定 128 final audit期末审计 129 financial statement assertions 财政报告公布 130 financial财务 131 finished goods 产成品 132 flowcharts流程图 133 fraud and error 舞弊 134 fraud欺诈 135 fundamental principles 基本原理136 general CIS controls 一般的 CIS 控制 137 general reports to mangement 对管理者的一般报告 138 going concern assumption 持续经营假设 139 going concern持续经营140 goods on sale or return 待出售或者退回商品 141 goodwill 商誉 142 governance统治143 greenbury committeegreenbury 委员会 144 guidance for internal auditors 内部审计员执业指南 145 hampel committee hampel 委员会 146 haphazard selection 随意选择 147 hospitality款待 148 human resources人力资源149 IAPS 1000 inter-bank confirmation proceduresIAPS 1000银行询证程序150 IAPS 1001 CIS environments-stand-alone microcomputersIAPS 1001 CIS 环境-单机微型计算器151 IAPS 1002 CIS environments-on-line computer systemsIAPS 1002 CIS 环境-(与主机)联机计算器系统 152 IAPS 1003 CIS environments-database systems IAPS 1003 CIS 环境- 数据库系统153IAPS 1005 the special considerations in the audit of small entities IAPS 1005小企业审计中的特别考虑154 IAS 2 inventories IAS 2 库存 155 IAS 10 events after the balance sheet date 资产负债表日后事项 156 IFAC's code of ethics for professional accountants IFAC's 职业会计的师道德准则 157 income tax所得税158 incoming auditors 对收入进行审计的审计员 159 independent estimate 独立估计160 ineligible for appointment 无资格被任命 161 information technology信息技术[键入文字]162 inherent risk 固有风险 164 insurance 保险 165 intangibles 无形 166 integrity 完整性 167 interim audit 中期审计 168 internal auditing 内部审计 169 internal auditors内部审计师170 internal control evaluation questionnaires (ICEQs) 内部控制评价调查表(问卷) 171 internal control questionnaires (ICQs) 内部控制调查表 172 internal control system 内部控制系统 173 internal review assignment内部审计的委派174 international audit and assurance standards board (IAASB)国际审计和鉴证准则委员会(IAASB) 175 international auditing practice statements (IAPSs) 国际审计实务声明 (IAPSs) 176 international federation of accountants (IFAC) 国际会计师联合会 (IFAC) 177 inventory system 盘存制度 178 inventory valuation 存货估价 179 ISA 230 documentation 230审计文档 180 ISA 240 fraud and error240 欺诈和错误 181 ISA 250 consideration of law and regulations250 法律法规的考虑182 Isa 260 communications of audit matters with those chargegovernance260 与高官的审计事项沟通183 isa 300 planning 300 审计计划 184 isa 310 knowledge of the business 310 对企业的了解 185 isa 320 audit materiality 320审计重要性 186 isa 400 accounting and internal control 400 会计和内部控制187isa 402 audit considerations relating to entities using service organisations 402 企业外聘服务机构的审计考虑188 isa 500 audit evidence 500审计证据189isa 501 audit evidence-additional considerations for specific items 501审计证据-特殊情况的特殊考虑190 isa 510 external confirmations 510外部询证 191 isa 520 analytical procedures 520分析性复核程序 192 isa 530 audit sampling 530审计抽样 193 isa 540 audit of accounting estimates 540会计估计的审计 194 isa 560 subsequent events 560期后事项 195 isa 580 management representations 580管理当局声明书 196 isa 610 considering the work of internal auditing 610 内部审计的考虑 197 isa 620 using the work of an expert620 使用专家的工作198 isa 700 auditors' report on financial statements 700财务报表的审计报告 199 isa 710 comparatives 710可比性200 isa 720 other information in documents containing auditedfinancial statements720 与财务报表审计相关的其他信息201 isa 910 engagement to review financial statements 910 受托复阅财务报表206 legal and regulations 法律和规则207 legal obligation 法定义务,法定责任208 levels of assurance 鉴证程度209 liability 负债210 limitation on scope 审计范围限制211 limitation of audit 审计的局限性212 limitations of controls system 控制系统的局限性213 litigation and claims 诉讼和赔偿214 litigation 诉讼215 loans 借款,贷款216 long term liabilities 长期负债217 lowballing 低价招揽审计业务218 management 管理219 management integrity 经营完整220 management representation letter 管理当局声明书221 marketing 推销,营销,市场学222 material inconsistency 重要的矛盾223 material misstatements of fact 重大误报224 materiality 重要性225 measurement 计量226 microcomputers 微型计算器227 modified reports 变更报告229 nature 性质230 negative assurance 消极鉴证231 net realizable value 可实现净值232 non-current asset register 非现金资产的登记本233 non-executive directors 非执行董事234 non-sampling risk 非抽样风险235 non-statutory audits 非法定审计236 objectivity 客观性237 obligating event 或有事项238 obligatory disclosure 或有事项披露240 occurrence 出现241 on-line computer systems (与主机)联机计算器系统 242 opening balances 期初余额243 operational audits 经营审计244 operational work plans 经营工作计划[键入文字]245 opinion shopping 意见购买246 other information 其他的信息247 outsourcing internal audit 内审外包248 overall review of financial statements 财务报表的全面复核 249 overdue fees 滞纳金250 overhead absorption 制造费用分配251 periodic plan 定期的计划252 permanent audit files 永久审计档案253 personal relationships 个人的亲属关系254 planning 计划255 population 抽样总体256 precision 精密,准确258 preliminary assessment of control risk 控制风险的初次评估 259 prepayments 预付款项260 presentation and disclosure 表述,披露261 problems of accounting treatment 会计处理的问题262 procedural approach 程序方法263 procedures 程序264 procedures after accepting nomination 接受任命后的审计程序 265 procurement 采购266 professional duty of confidentiality 保密的职业职责268 provision 备抵,准备269 public duty 公共职责270 public interest 公众利益271 publicity 宣传272 purchase ledger 采购分类账273 purchases and expenses system 采购和费用循环276 qualified opinion 保留意见278 qualitative aspects of errors 错误的性质279 random selection 随机选择280 reasonable assurance 合理保证281 reassessing sampling risk 再评估抽样风险282 reliability 可靠性283 remuneration 报酬284 report to management 对经营的报告285 reporting 报告286 research and development costs 研究和开发成本287 reservation of title 资格保留288 reserves 准备,储备289 revenue and capital expenditure 收入和资本支出290 review 复核291 review and capital expenditure 复核和资本支出295 rights and obligations 权力和义务297 risk and materiality 风险和重要性298 risk-based approach 以风险为导向的方法 300 rotation of auditor appointments 审计师的轮换301 rules of professional conduct 职业道德守则303 sales system 销售制度304 sales tax 销售税金,营业税305 sales 销售,销货306 sample size 样本量307 sampling risk 抽样风险308 sampling units 抽样单元309 schedule of unadjusted errors 未调整的错误表310 scope and objectives of internal audit 内部审计的范围和目标 311 segregation of duties 职责划分312 service organization 服务机构313 significant fluctuations or unexpected relationships 重要影响或未预期的亲属关系314 small entity 小企业316 sole traders 个体营业者318 specimen letter on internal control 内部控制上的样本证书319 stakeholders 利益相关者320 standardised working papers 标准工作底稿321 statement 1:integrity,objectivity and independence 声明1: 完整,客观性和独立 322 statement 2:the professional duty of confidence 声明2: 信任的职业责任323 statement 3: advertising ,publicity and obtainingprofessional work声明3: 广告,宣传和获得职业工作324 statement 5:changes in professional appointment 声明5: 审计聘任的变更325 statistical sampling 统计抽样326 statutory audit 法定审计328 statutory duty 法定责任329 stewardship 保管责任人330 strategic plan 战略性计划331 stratification 分层332 subsequent events 期后事项333 substantive procedures 实证性测试程序334 substantive tests 实质性测试335 sufficient appropriate audit evidence 充分的适当审计证据338 supervision 监督339 supervisory and monitoring roles 监督和监控的角色340 suppliers' statements 供应商的声明341 system and internal controls 系统和内部控制342 systematic selection 系统选择法343 systems-based approach 系统为导向的方法[键入文字]344 tangible non-current assets 有形的非流动资产 345 tendering 投标,清偿346 terms of the engagement 委任的条款347 tests of control 控制的测试348 the AGM 股东大会349 the board 委员会350 three Es 三E原则351 timing 准时352 tolerable error 可容忍误差353 trade accounts payable and purchases 应付帐款354 trade accounts payable listing 应付帐款名单355 training 培训356 treasury 国库,库房357 TRUE 真实358 turnbull committee turnbull 委员会359 ultra vires 越权360 uncertainty 不确定性361 undue dependence 未到(支付)期的未决 362 unqualified audit report 无保留的审计报告 364 using the knowledge 使用知识365 using the work of an expert 使用专家的工作366 valuation 计价,估价367 value for money 现金(交易)价格368 voluntary disclosure 自愿披露369 wages and salaries 工资,薪金370 wages system 工资系统371 work in progress 在产品372 working papers 工作底稿。

ACCA F4-F9模拟题及解析(5)

ACCA F4-F9模拟题及解析(5)1. (a) In order for auditors to operate effectively and to provide an opinion on an entity’s financial statements, they are given certain rights.Required:State THREE rights of an auditor, excluding those related to resignation and removal. (3 marks) (b) HKSA 315 Identifying and Assessing the Risks of Material Misstatement through Understanding the Entity and Its Environment requires auditors to obtain an understanding of control activities relevant to the audit.Control activities are the policies and procedures that help ensure that management directives are carried out;and which are designed to prevent and detect fraud and error occurring. An example of a control activity is themaintenance of a control account.Required:Apart from maintenance of a control account, explain FOUR control activities a company may undertake to prevent and detect fraud and error. (4 marks)(c) Describe THREE limitations of external audits. (3 marks)(10 marks)2. Sunflower Stores Co (Sunflower) operates 25 food supermarkets. The company’s year end is 31 December 2012.The audit manager and partner recently attended a planning meeting with the finance director and have provided you with the planning notes below.You are the audit senior, and this is your first year on this audit. In order to familiarise yourself with Sunflower, the audit manager has asked you to undertake some research in order to gain an understanding of Sunflower, so that you are able to assist in the planning process. He has then asked that you identify relevant audit risks from the notes below and also consider how the team should respond to these risks.Sunflower has spent $1·6 million in refurbishing all of its supermarkets; as part of this refurbishment programme their central warehouse has been extended and a smaller warehouse, which was only occasionally used, has been disposed of at a profit. In order to finance this refurbishment, a sum of $1·5 million was borrowed from the bank.This is due to be repaid over five years.The company will be performing a year-end inventory count at the central warehouse as well as at all 25 supermarkets on 31 December. Inventory is valued at selling price less an average profit margin as the finance director believes that this is a close approximation to cost.Prior to 2012, each of the supermarkets maintained their own financial records and submitted returns monthly to head office. During 2012 all accounting records have been centralised within head office. Therefore at the beginning of the year, each supermarket’s opening balances were transferred into head office’s accounting records. The increased workload at head office has led to some changes in the finance department and in November 2012 the financial controller left. His replacement will start in late December.Required:(a) List FIVE sources of information that would be of use in gaining an understanding of Sunflower Stores Co,and for each source describe what you would expect to obtain. (5 marks)(b) Using the information provided, describe FIVE audit risks and explain the auditor’s response to each risk in planning the audit of Sunflower Stores Co. (10 marks)(c) The finance director of Sunflower Stores Co is considering establishing an internal audit department.Required:Describe the factors the finance director should consider before establishing an internal audit department.(5 marks)(20 marks)3.(a) Identify and explain each of the FIVE fundamental principles contained within ACCA’s Code of Ethics and Conduct. (5 marks)(b) Rose Leisure Club Co (Rose) operates a chain of health and fitness clubs. Its year end was31 October 2012.You are the audit manager and the year-end audit is due to commence shortly. The following three matters have been brought to your attention.(i) Trade payables and accruals Rose’s finance director has notified you that an error occurred in the closing of the purchase ledger at the year end. Rather than it closing on 1 November, it accidentally closed one week earlier on 25 October. All purchase invoices received between 25 October and the year end have been posted to the 2013 year-end purchase ledger. (6 marks) (ii) Receivables Rose’s trade receivables have historically been low as most members pay monthly in advance. However, during the year a number of companies have taken up group memberships at Rose and hence the receivables balance is now material. The audit senior has undertaken a receivables circularisation for the balances at the year end; however, there are a number who have not responded and a number of responses with differences. (5 marks)(iii) Reorganisation The company recently announced its plans to reorganise its health and fitness clubs. This will involve closing some clubs for refurbishment, retraining some existing staffand disposing of some surplus assets. These plans were agreed at a board meeting in October and announced to their shareholders on 29 October. Rose is proposing to make a reorganisation provision in the financial statements. (4 marks)Required:Describe substantive procedures you would perform to obtain sufficient and appropriate audit evidence in relation to the above three matters.Note: The mark allocation is shown against each of the three matters above.(20 marks)4.(a) Explain the purpose of, and procedures for, obtaining written representations. (5 marks)(b) The directors of a company have provided the external audit firm with an oral representation confirming that the bank overdraft balances included within current liabilities are complete. Required:Describe the relevance and reliability of this oral representation as a source of evidence to confirm the completeness of the bank overdraft balances. (3 marks)(c) You are the audit manager of Violet & Co and you are currently reviewing the audit files for several of your clients for which the audit fieldwork is complete. The audit seniors have raised the following issues:Daisy Designs Co (Daisy)Daisy’s year end is 30 September, however, subsequent to the year end the company’s sales ledger has been corrupted by a computer virus. Daisy’s finance director was able to produce the financial statements prior to this occurring; however, the audit team has been unable to access the sales ledger to undertake detailed testing of revenue or year-end receivables. All other accounting records are unaffected and there are no backups available for the sales ledger. Daisy’s revenue is $15·6m, its receivables are $3·4m and profit before tax is $2m.Fuchsia Enterprises Co (Fuchsia)Fuchsia has experienced difficult trading conditions and as a result it has lost significant market share. The cash flow forecast has been reviewed during the audit fieldwork and it shows a significant net cash outflow.Management are confident that further funding can be obtained and so have prepared the financial statements on a going concern basis with no additional disclosures; the audit senior is highly sceptical about this. The prior year financial statements showed a profit before tax of $1·2m; however, the current year loss before tax is $4·4m and the forecast net cash outflow for the next 12 months is $3·2m.Required:For each of the two issues:(i) Discuss the issue, including an assessment of whether it is material;(ii) Recommend procedures the audit team should undertake at the completion stage to try to resolve the issue; and(iii) Describe the impact on the audit report if the issue remains unresolved.Notes: 1 The total marks will be split equally between each issue.2 Audit report extracts are NOT required. (12 marks)(20 marks)试题及答案1.(a)Auditors’ rights– Right of access at all times to the company’s books, accounts and vouchers.– Right to require from an officer of the company such information or explanations as they think necessary for the performance of their duties as auditors.– Right to receive all communications relating to written resolutions.– Right to receive all notices of, and other communications relating to, any general meeting which a member of the company is entitled to receive.– Right to attend any general meeting of the company.– Right to be heard at any general meeting which an auditor attends on any part of the business of the meeting which concerns them as auditor.(b) Control activities Segregation of duties – assignment of roles/responsibilities to different people, thereby reducing the risk of fraud and error occurring.Information processing – computer controls including general IT controls, which cover a range of applications and support the overall IT environment and application controls which are manual or automated controls which operate on a cycle/business process level.Authorisation – approval of transactions by a suitably responsible official to ensure transactions are genuine.Physical controls – restricting access to physical assets such as cash, inventory and plant and equipment, thereby reducing the risk of theft.Performance reviews – comparison or review of the performance of the business by looking at areas such as budget v actual results.Arithmetical controls – controls which check the arithmetical accuracy of accounting records. Account reconciliations – comparison of an account balance with another source; often this source is from a third party, such as the bank, with differences being investigated.(c)Limitations of external auditsAn external audit has a number of limitations which reduce its usefulness:Sampling – it is not practical for an auditor to test 100% of transactions and so they have to apply sampling methodologies in selecting balances/transactions to test. Therefore, there could be an error in an item not selected for testing by the auditor.Subjectivity – financial statements include judgemental and subjective areas and therefore the auditor is required to use their judgement in assessing whether the financial statements are true and fair.Inherent limitations of internal control systems – an internal control system is operated by people and hence is liable to human error. In addition, there is the possibility of controls override by management and of collusion and fraud. It is impossible to remove all of these inherent limitations and as the auditor relies on the internal control systems, this can reduce the usefulness of the audit.Evidence is persuasive not conclusive – the opinion is based on audit evidence gathered; however, while this evidence can indicate possible issues affecting the audit opinion, evidence involves estimates and judgements and hence does not give a definite conclusion.Audit report format – the format of the opinion is determined by International Standards on Auditing. However, the terminology used is not usually understood by non-accountants. This means that users may not actually understand the audit opinion given.Historic information – the audit report is often issued some time after the year end, and so the financial information can be quite different to the current position. In the current marketplace where companies’ financial positions can change quite quickly, the audit opinion may no longer be relevant as it is out of date.2 (a)Understanding an entitySource of information Information expect to obtainPrior year audit file Identification of issues that arose in the prior year audit and howthese were resolved. Also whether any points brought forward were noted for consideration for this year’s audit.Prior year financial statements Provides information in relation to the size of the entity as well as the key accounting policies and disclosure notes.Accounting systems notes Provides information on how each of the key accounting systems operates.Discussions with management Provides information in relation to any important issues which havearisen or changes to the company during the year.Current year budgets and management Provides relevant financial information for the year to date. Will help accounts of Sunflower Stores Co (Sunflower) the auditor to identify whether Sunflower has changed materially since last year. In addition, this will be useful for preliminary analytical review and risk identification.Permanent audit file Provides information in relation to matters of continuing importancefor the company and the audit team, such as statutory books information or important agreements. Sunflower’s website Recent press releases from the company may provide background on changes to the business during the year as this could lead to additional audit risks.Prior year report to management Provides information on the internal control deficiencies noted in the prior year; if these have not been rectified by management then theycould arise in the current year audit as well.Financial statements of competitors This will provide information about Sunflower’s competitors, in relation to their financial results and their accounting policies. This will be important in assessing Sunflower’s performance in the year and also when undertaking the going concern review.(b)Audit risks and auditor responses Audit risk Auditor response Sunflower has spent $1·6m on refurbishing its 25 food supermarkets. This expenditure needs to be reviewed to assess whether it is of a capital nature and should be included within non-current assets or expensed as repairs. Review a breakdown of the costs and agree to invoices to assess the nature of the expenditure and, if capital, agree to inclusion within the asset register and, if repairs, agree tothe income statement.During the year a small warehouse has been disposed of at a profit. The asset needs to have been correctly removed from property plant and equipment to ensure the non-current asset register is not overstated, and the profit on disposal should be included within the income statement. Review the non-current asset register to ensure that the asset has been removed. Also confirm the disposal proceeds as well as recalculating the profit on disposal.Consideration should be given as to whether the profit on disposal is significant enough to warrant separate disclosure within the income statement.Sunflower has borrowed $1·5m from the bank via a five year loan. This loan needs to be correctly split between current and non-current liabilities.In addition, Sunflower may have given the bank a charge over its assets as security for the loan. There is a risk that the disclosure of any security given is not complete.During the audit the team would need to confirm that the $1·5m loan finance was received. In addition, the split between current and non-current liabilities and the disclosures for this loanshould be reviewed in detail to ensure compliance with relevant accounting standards.The loan agreement should be reviewed to ascertain whether any security has been given, and this bank should be circularised as part of the bank confirmation process.Sunflower will be undertaking a number of simultaneous inventory counts on 31 December including the warehouse and all 25 supermarkets. It is not practical for the auditor to attend all of these counts; hence it may not be possible to gain sufficient appropriate audit evidence over inventory counts.The team should select a sample of sites to visit. It is likely that the warehouse contains most goods and therefore should be selected. In relation to the 25 supermarkets, the team should visit those with material inventory balances and/or those with a history of inventory count issues.(c)Internal audit departmentPrior to establishing an internal audit (IA) department, the finance director of Sunflower should consider the following:(i) The costs of establishing an IA department will be significant, therefore prior to committing to these costs and management time, a cost benefit analysis should be performed.(ii) The size and complexity of Sunflower should be considered. The larger, more complex and diverse a company is, then the greater the need for an IA department. At Sunflower there are 25 supermarkets and a head office and therefore it would seem that the company is diverse enough to gain benefit from an IA department.(iii) The role of any IA department should be considered. The finance director should consider what tasks he would envisage IA performing. He should consider whether he wishes them to undertake inventory counts at the stores, or whether he would want them to undertake such roles as internal controls reviews.(iv) Having identified the role of any IA department, the finance director should consider whether there are existing managers or employees who could perform these tasks, therefore reducing the need to establish a separate IA department.(v) The finance director should assess the current control environment and determine whether there are departments or stores with a history of control deficiencies. If this is the case, then it increases the need for an IA department.(vi) If the possibility of fraud is high, then the greater the need for an IA department to act as both a deterrent and also to possibly undertake fraud investigations. As Sunflower operates 25 food supermarkets, it will have a significant risk of fraud of both inventory and cash.3. (a)Fundamental principlesIntegrity –to be straightforward and honest in all professional and business relationships. Objectivity–to not allow bias, conflict of interest or undue influence of others to override professional or business judgements.Professional Competence and Due Care – to maintain professional knowledge and skill at the level required to ensure that a client receives competent professional services, and to act diligently and in accordance with applicable technical and professional standards.Confidentiality – to respect the confidentiality of information acquired as a result of professional and business relationships and, therefore, not to disclose any such information to third parties without proper authority, nor use the information for personal advantage. Professional Behaviour – to comply with relevant laws and regulations and avoid any action that discredits the profession.15Audit risk Auditor response Sunflower’s inventory valuation policy is selling price less average profit margin. Inventory should be valued at the lower of cost and net realisable value (NRV) and if this is not the case, then inventory could be under or overvalued.HKAS 2 Inventories allows this as an inventory valuation method as long as it is a close approximation to cost. If this is not the case, then inventory could be under or overvalued.Testing should be undertaken to confirm cost and NRV of inventory and that on a line-by-line basis the goods are valued correctly.In addition, valuation testing should focus on comparing the cost of inventory to the selling price less margin to confirm whether this method is actually a close approximation to cost. The opening balances for each supermarket have been transferred into the head office’s accounting records at the beginning of the year. There is a risk that if this transfer has not been performed completely and accurately, the opening balances may not be correct.Discuss with management the process undertaken to transfer the data and the testing performed to confirm the transfer was complete and accurate.Computer-assisted audit techniques could be utilised by the team to sample test the transfer of data from each supermarket to head office to identify any errors.There has been an increased workload for the finance department, the financial controller has left and his replacement will only start in late December.This increases the inherent risk within Sunflower as errors may have been made within the accounting records by the overworked finance team members. The new financial controller may not be sufficiently experienced to produce the financial statements and resolve any audit issues.The team should remain alert throughout the audit for dditional errors within the financedepartment.In addition, discuss with the finance director whether he will be able to provide the team with assistance for any audit issues the new financial controller is unable to resolve.(b)Substantive procedures(i)Trade payables and accruals– Calculate the trade payable days for Rose Leisure Clubs Co (Rose) and compare to prior years, investigate any significant difference, in particular any decrease for this year.– Compare the total trade payables and list of accruals against prior year and investigate any significant differences.– Discuss with management the process they have undertaken to quantify the understatement of trade payables due to the cut-off error and consider the materiality of the error.– Discuss with management whether any correcting journal entry has been included for the understatement.– Select a sample of purchase invoices received between the period of 25 October and the year end and follow them through to inclusion within accruals or as part of the trade payables journal adjustment.– Review after date payments; if they relate to the current year, then follow through to the purchase ledger or accrual listing to ensure they are recorded in the correct period.– Obtain supplier statements and reconcile these to the purchase ledger balances, and investigate any reconciling items.– Select a sample of payable balances and perform a trade payables’ circularisation, follow up any non-replies and any reconciling items between the balance confirmed and the trade payables’ balance.– Select a sample of goods received notes before the year end and after the year end and follow through to inclusion in the correct period’s payables balance, to ensure correct cut-off. (ii)Receivables– For non-responses, with the client’s permission, the team should arrange to send a follow up circularisation.– If the receivable does not respond to the follow up, then with the client’s permission, the senior should telephone the customer and ask whether they are able to respond in writing to the circularisation request.– If there are still non-responses, then the senior should undertake alternative procedures to confirm receivables.– For responses with differences, the senior should identify any disputed amounts, and identifywhether these relate to timing differences or whether there are possible errors in the records of Rose.– Any differences due to timing, such as cash in transit, should be agreed to post year-end cash receipts in the cash book.– The receivables ledger should be reviewed to identify any possible mispostings as this could be a reason for a response with a difference.– If any balances have been flagged as disputed by the receivable, then these should be discussed with management to identify whether a write down is necessary.(iii)Reorganisation– Review the board minutes where the decision to reorganise the business was taken, ascertain if this decision was made pre year end.– Review the announcement to shareholders in late October, to confirm that this was announced before the year end.– Obtain a breakdown of the reorganisation provision and confirm that only direct expenditure from restructuring is included.– Review the expenditure to confirm that there are no retraining costs included.– Cast the breakdown of the reorganisation provision to ensure correctly calculated.– For the costs included within the provision, agree to supporting documentation to confirm validity of items included.– Obtain a written representation confirming management discussions in relation to the announcement of the reorganisation.– Review the adequacy of the disclosures of the reorganisation in the financial statements to ensure they are in accordance with HKAS 37 Provisions, Contingent Liabilities and Contingent Assets.4.(a)Written representationsWritten representations are necessary information that the auditor requires in connection with the audit of the entity’s financial statements. Accordingly, similar to responses to inquiries, written representations are audit evidence.The auditor needs to obtain written representations from management and, where appropriate, thosecharged with governance that they believe they have fulfilled their responsibility for the preparation of the financial statements and for the completeness of the information provided to the auditor.Written representations are needed to support other audit evidence relevant to the financial statements or specific assertions in the financial statements, if determined necessary by theauditor or required by other Hong Kong Standards on Auditing.This may be necessary for judgemental areas where the auditor has to rely on management explanations. Written representations can be used to confirm that management have communicated to the auditor all deficiencies in internal controls of which management are aware.Written representations are normally in the form of a letter, written by the company’s management and addressed to the auditor. The letter is usually requested from management but can also be requested from the chief operating officer or chief financial officer. Throughout the fieldwork, the audit team will note any areas where representations may be required.During the final review stage, the auditors will produce a draft representation letter. The directors will review this and then produce it on their letterhead.It will be signed by the directors and dated as at the date the audit report is signed, but not after.(b) Oral representationA representation from management confirming that overdrafts are complete would be relevant evidence. Overdrafts are liabilities and therefore the main focus for the auditor is completeness.With regards to reliability, the evidence is oral rather than written and so this reduces its reliability. The directors could in the future deny having given this representation, and the auditors would have no documentary evidence to prove what the directors had said.This evidence is obtained from management rather than being auditor generated, and is therefore less reliable. Management may wish to provide biased evidence in order to reduce the amount of liabilities in the financial statements. The auditors are unbiased and so evidence generated directly by them will be better.External evidence obtained from the company’s banks could be used to confirm the bank overdraft balances and this would be more independent than relying on management’s internal confirmations.(c)Daisy Designs Co (Daisy)(i)Daisy’s sales ledger has been corrupted by a computer virus; hence no detailed testing has been performed on revenue and receivables. The audit team will need to see if they can confirm revenue and receivables in an alternative manner.If they are unable to do this, then two significant balances in the financial statements will not have been confirmed.Revenue and receivables are both higher than the total profit before tax (PBT) of $2m; receivables are 170% of PBT and revenue is nearly eight times the PBT; hence this is a very material issue. (ii) Procedures to be adopted include:– Discuss with management whether they have any alternative records which detail revenue andreceivables for the year.– Attempt to perform analytical procedures, such as proof in total or monthly comparison to last year, to gain comfort in total for revenue and for receivables.(iii)The auditors will need to modify the audit report as they are unable to obtain sufficient appropriate evidence in relation to two material and pervasive areas, being receivables and revenue. Therefore a disclaimer of opinion will be required.A basis for disclaimer of opinion paragraph will be required to explain the limitation in relation to the lack of evidence over revenue and receivables. The opinion paragraph will be a disclaimer of opinion and will state that we are unable to form an opinion on the financial statements. Fuchsia Enterprises Co (Fuchsia)(i)Fuchsia is facing going concern problems as it has experienced difficult trading conditions and it has a negative cash outflow. However, the financial statements have been prepared on a going concern basis, even though it is possible that the company is not a going concern. The prior year financial statements showed a profit of $1·2m and the current financial statements show a loss before tax of $4·4m, the net cash outflow of $3·2m represents 73% of this loss(3·2/4·4m) and hence is a material issue.(ii) Management are confident that further funding can be obtained; however, the team is sceptical and so the following procedures should be adopted:– Discuss with management whether any finance has now been secured.– Review the correspondence with the finance provider to confirm the level of funding that is to be provided and this should be compared to the net cash outflow of $3·2m.– Review the most recent board minutes to understand whether management’s view on Fuchsia’s going concern has altered.– Review the cash flow forecasts for the year and assess the reasonableness of the assumptions adopted.(iii) If management refuse to amend the going concern basis of the financial statements or at the very least make adequate going concern disclosures, then the audit report will need to be modified. As the going concern basis is probably incorrect and the error is material and pervasive, then an adverse opinion would be necessary.A basis for adverse opinion paragraph will be required to explain the inappropriate use of the going concern assumption.The opinion paragraph will be an adverse opinion and will state that the financial statements do not give a true and fair view.。

ACCA P1P2P3复习以及答题技巧汇总

ACCA P1P2P3复习以及答题技巧汇总ACCA P1《公司治理,风险和道德》是ACCA专业核心模块的第一门课程,它总共分为四个部分。

1.介绍在代理关系的环境下,企业的整个治理。

这个部分主要是董事的角色和责任以及外部审计师和内部审计师的角色和责任;2.介绍内部监察、内部控制以及实施有效的治理得到的反馈,包括关于决策和决策支持部门的合规问题;3.介绍管理层如何识别、评估和控制风险;4.介绍在会计师责任的背景下个人的以及职业道德和道德框架-职业价值观以及在各种各样的情况下的职业行为。

ACCA P1学习方法首先大家注意公司治理来自于F4中的agency thoery也就是我们经常说的代理理论。

正因为公司的投资人不直接参与公司的管理,从而导致管理者与持有人之间产生一些利益上的冲突,所以上市公司通过完善公司治理来增强监督、减少冲突、降低风险,从而达到股东投资回报最大化。

其次,大家要关注NED(非执行董事)在公司治理中的重要作用,以及他们发挥监督作用具备的条件,这其中要求NED要充分独立。

虽然NED不是公司雇员,和公司之间没有雇佣关系,但是他们对完善和实施公司的发展战略有着重要的作用,另外NED要有足够的时间参与公司的日常经营。

再次,我请同学们关注TURNBULL REPORT和COMBINED CODE中对internal control和risk management的要求。

什么样的internal control system是完善而且有效的,如何进行risk assessment以及如何进行风险处理。

需要强调的五点:第一、考官的历年考题中只有两种格式:Memo 和letter。

烦请大家注意这两种格式第二、大家注意自己写出来的句子要专业,比如有效的内部控制要写sound internal control system, risk embedded等等第三、答题要有逻辑性,适当的通过分段,分层次来讲述自己的观点第四、要注意senario中引号的句子,这些句子一般是考点最后,希望大家多动笔,少用眼睛考虑问题。

ACCA考试F阶段、P阶段大纲全解析

本文由高顿ACCA整理发布,转载请注明出处

课程类别

课程序号

课程名称(中)

课程名称(英)

知识课程

F1

会计师与企业

Accountant in Business (AB/FAB)

F2

管理会计

Management Accounting (MA/FMA)

F3

财务会计

Financial Accounting (FA/FFA)

本文由高顿ACCA整理发布,转载请注明出处,更多ACCA资讯请关注高顿ACCA官网:

选修课程

(4选2)

P4

高级财务管理

Advanced Financial Management (AFM)

P5

高级业绩管理

Advanced Performance Management (APM)

P6

高级税务

Advanced Taxation (ATX)

P7

高级审计与认证业务

Advanced Audit and Assurance (AAA)

技能课程

F4

公司法与商法

Corporate and Business Law (CL)

F5

业绩管理

Performance Management (PM)

F6

税务

Taxation (TX)

F7

财务报告

Financial Reporting (FR)

F8

审计与认证业务

Audit and Assurance (AA)

F9

财务管理

Financial Management (FM)

课程类别

课程序号

课程名称(中)

ACCAF8术语翻译

ACCAF8术语翻译序号英语汉语1 ability to perform the work 能力履行工作2 acceptance procedures 承兑程序过程3 accountability 经管责任,问责性4 accounting estimate 会计估计5 accounts receivable listing 应收帐款挂牌6 accounts receivable 应收账款7 accruals listing 应计项目挂牌8 accruals 应计项目9 accuracy 准确性10 adverse opinion 否定意见11 aged analysis 年老的分析(法,学)研究12 agents 代理人13 agreed-upon procedures 约定审查业务14 analysis of errors 错误的分析(法,学)研究15 anomalous error 反常的错误16 appointment ethics 任命伦理学17 appointment 任命18 associated firms 联合的坚挺19 association of chartered certified accounts(ACCA)特计的证(经执业的结社 (ACCA)20 assurance engagement 保证债务21 assurance 保证22 audit 审计,审核,核数23 audit acceptance 审计承兑24 audit approach 审计靠近25 audit committee 审计委员会,审计小组26 ahudit engagement 审计业务约定书27 audit evaluation 审计评价28 audit evidence 审计证据29 audit plan 审计计划30 audit program 审计程序31 audit report as a means of communication 审计报告如一个通讯方法32 audit report 审计报告33 audit risk 审计风险34 audit sampling 审计抽样35 audit staffing 审计工作人员36 audit timing 审计定时37 audit trail 审计线索38 auditing standards 审计准则39 auditors' duty of care 审计(查帐)员的抚养责任40 auditors' report 审计报告41 authority attached to ISAs 代理权附上到国际砂糖协定42 automated working papers 自动化了工作文件43 bad debts 坏账44 bank 银行45 bank reconciliation 银行对账单,余额调节表46 beneficial interests 受益权47 best value 最好的价值48 business risk 经营风险49 cadbury committee cadbury 委员会50 cash count 现金盘点51 cash system 兑现系统52 changes in nature of engagement 改变债务的性质上53 charges and commitments 费用和评论54 charities 宽大55 chinese walls chinese 墙壁56 chronology of an audit 一审计的年代表57 CIS application controls CIS 申请控制58 CIS environments stand-alone microcomputers CIS 环境单机微型计算器59 client screening 委托人甄别60 closely connected 接近地连接61 clubs 俱乐部62 communications between auditors and management 通讯在审计(查帐)员和经营之间63 communications on internal control 内部控制上的通讯64 companies act 公司法65 comparative financial statements 比较财务报表66 comparatives 比较的67 competence 能力68 compilation engagement 编辑债务69 completeness 完整性70 completion of the audit 审计的结束71 compliance with accounting regulations 符合~的作法会计规则72 computers assisted audit techniques (CAATs) 计算器援助的审计技术 (CAATs)73 confidence 信任74 confidentiality 保密性75 confirmation of accounts receivable 应收帐款的查证76 conflict of interest 利益冲突77 constructive obligation 建设的待付款78 contingent asset 或有资产79 contingent liability 或有负债80 control environment 控制环境81 control procedures 控制程序82 control risk 控制风险83 controversy 论战84 corporate governance 公司治理,公司管制85 corresponding figures 相应的计算86 cost of conversion 转换成本,加工成本87 cost 成本88 courtesy 优待89 creditors 债权人90 current audit files 本期审计档案91 database management system (DBMS) 数据库管理制度 (数据管理系统)92 date of report 报告的日期93 depreciation 折旧,贬值94 design of the sample 样品的设计95 detection risk 检查风险96 direct verification approach 直接核查法97 directional testing 方向的抽查98 directors' emoluments 董事酬金99 directors' serve contracts 董事服务合约100 disagreement with management 与经营的不一致101 disclaimer of opinion 拒绝表示意见102 distributions 分销,分派103 documentation of understanding and assessmentof control risk控制风险的协商和评定的文件编集104 documenting the audit process 证明审计程序105 due care 应有关注106 due skill and care 到期的技能和谨慎107 economy 经济108 education 教育109 effectiveness 效用,效果110 efficiency 效益,效率111 eligibility / ineligibility 合格 / 无被选资格112 emphasis of matter 物质的强调113 engagement economics 债务经济学114 engagement letter 业务约定书115 error 差错116 evaluating of results of audit procedures 审计手序的结果评估117 examinations 检查118 existence 存在性119 expectations 期望差距120 expected error 预期的错误121 experience 经验122 expert 专家123 external audit 独立审计124 external review reports 外部的评论报告125 fair 公正126 fee negotiation 费谈判127 final assessment of control risk 控制风险的确定评定128 final audit 期末审计129 financial statement assertions 财政报告宣称130 financial 财务131 finished goods 产成品132 flowcharts 流程图133 fraud and error 舞弊134 fraud 欺诈135 fundamental principles 基本原理136 general CIS controls 一般的 CIS 控制137 general reports to mangement 对 (牛犬等的)疥癣的一般报告138 going concern assumption 持续经营假设139 going concern 持续经营140 goods on sale or return 货物准许退货买卖141 goodwill 商誉142 governance 统治143 greenbury committee greenbury 委员会144 guidance for internal auditors 指导为内部审计员145 hampel committee hampel 委员会146 haphazard selection 随意选择147 hospitality 款待148 human resources 人力资源149 IAPS 1000 inter-bank confirmation procedures IAPS 1000 在中间- 银行查证程序过程150 IAPS 1001 CIS environments-stand-alonemicrocomputersIAPS 1001 CIS 环境-单机微型计算器151 IAPS 1002 CIS environments-on-line computersystemsIAPS 1002 CIS 环境-(与主机)联机计算器系统152 IAPS 1003 CIS environments-database systems IAPS 1003 CIS 环境- 数据库系统153 IAPS 1005 the special considerations in theaudit of small entities在小的个体审计中的 IAPS 1005 特别的考虑154 IAS 2 inventories 信息家电 2 库存155 IAS 10 events after the balance sheet date在平衡 sheeet 日期後面的信息家电 10 事件156 IFAC's code of ethics for professionalaccountantsIFAC's 道德准则为职业会计师157 income tax 所得税158 incoming auditors 收入审计(查帐)员159 independent estimate 独立的估计160 ineligible for appointment 无被选资格的为任命161 information technology 信息技术162 inherent risk 固有风险163 initial communication 签署通讯164 insurance 保险165 intangibles 无形166 integrity 完整性167 interim audit 中期审计168 internal auditing 内部审计169 internal auditors 内部审计师170 internal control evaluation questionnaires(ICEQs)内部控制评价调查表171 internal control questionnaires (ICQs) 内部控制调查表172 internal control system 内部控制系统173 internal review assignment 内部的评论转让174 international audit and assurance standardsboard (IAASB)国际的审计和保证标准登船 (IAASB)175 international auditing practice statements(IAPSs)国际的审计实务声明 (IAPSs)176 international federation of accountants (IFAC) 国际会计师联合会 (IFAC)177 inventory system 盘存制度178 inventory valuation 存货估价179 ISA 230 documentation 文件编制180 ISA 240 fraud and error 国际砂糖协定 240 欺诈和错误181 ISA 250 consideration of law and regulations 法和规则的国际砂糖协定 250 考虑182 Isa 260 communications of audit matters withthose charge governance审计物质的国际砂糖协定 260 通讯由于那些索价统治183 isa 300 planning isa 300 计划编制184 isa 310 knowledge of the business 企业的 isa 310 知识185 isa 320 audit materiality 审计重要性186 isa 400 accounting and internal control isa 400 会计和内部控制187 isa 402 audit considerations relating toentities using service organisations与正在使用的个体有关的 isa 402个审计考虑服务组织188 isa 500 audit evidence 审计证据189 isa 501 audit evidence-additionalconsiderations for specific itemsisa 501个审计证据- 补偿为特殊条款190 isa 510 external confirmations isa 510个外部的查证191 isa 520 analytical procedures 分析性程序192 isa 530 audit sampling 审计抽样193 isa 540 audit of accounting estimates 解释估计的 isa 540 审计194 isa 560 subsequent events 期后事项195 isa 580 management representations 管理当局声明书196 isa 610 considering the work of internalauditingisa 610 以内部审计的工作看来197 isa 620 using the work of an expert isa 620 使用专家的工作198 isa 700 auditors' report on financialstatements财务报表上的 isa 700 审计(查帐)员的报告199 isa 710 comparatives isa 710个比较的200 isa 720 other information in documentscontaining audited financial statementsisa 720 证券包含 audited 财务报表的其他信息201 isa 910 engagement to review financialstatementsisa 910 债务复阅财务报表202 isas and rss isas 和 rss203 joint monitoring unit 连接检验单位204 knowledge of the entity's business 个体的企业知识205 law and regulations 法和规则206 legal and regulations 法定权利和规则207 legal obligation 法定义务,法定责任208 levels of assurance 保险程度,保障水平209 liability 负债210 limitation on scope 审计范围限制211 limitation of audit 审计的提起诉讼的限期212 limitations of controls system 控制系统的提起诉讼的限期213 litigation and claims 诉讼和赔偿214 litigation 诉讼215 loans 借款,贷款216 long term liabilities 长期负债217 lowballing lowballing218 management 管理219 management integrity 经营完整220 management representation letter 管理当局声明书221 marketing 推销,营销,市场学222 material inconsistency 决定性的前后矛盾223 material misstatements of fact 重大误报224 materiality 重要性225 measurement 计量226 microcomputers 微型计算器227 modified reports 变更报告228 narrative notes 叙述证券229 nature 性质230 negative assurance 消极保证231 net realizable value 可实现净值232 non-current asset register 非本期的财产登记233 non-executive directors 非执行董事234 non-sampling risk 非抽样风险235 non-statutory audits 目标236 objectivity 客观性237 obligating event 负有责任事件238 obligatory disclosure 有拘束的揭示239 obtaining work 获得工作240 occurrence 出现241 on-line computer systems (与主机)联机计算器系统242 opening balances 期初余额243 operational audits 经营审计,作业审计244 operational work plans 操作上的工作计划245 opinion shopping 意见购物246 other information 其他的信息247 outsourcing internal audit 支援外包的内部核数248 overall review of financial statements 财务报表的包括一切的评论249 overdue fees 超储未付费250 overhead absorption 管理费用分配251 periodic plan 定期的计划252 permanent audit files 永久审计档案253 personal relationships 个人的亲属关系254 planning 计划编制255 population 抽样总体256 precision 精密257 preface to ISAs and RSs 国际砂糖协定的序文和债券附卖回交易258 preliminary assessment of control risk 控制风险的预备评定259 prepayments 预付款项260 presentation and disclosure 提示和揭示261 problems of accounting treatment 会计处理的问题262 procedural approach 程序上的靠近263 procedures 程序264 procedures after accepting nomination 程序过程在接受提名之后265 procurement 采购266 professional duty of confidentiality 保密的职业责任267 projection of errors 错误的规划268 provision 备抵,准备269 public duty 公共职责270 public interest 公众利益271 publicity 宣传272 purchase ledger 购货分类账273 purchases and expenses system 买和费用系统274 purchases cut-off 买截止275 put on enquiry 询价上的期货买卖276 qualified opinion 保留意见277 qualifying disclosure 合格揭示278 qualitative aspects of errors 错误的性质上的方面279 random selection 随机选择280 reasonable assurance 合理保证281 reassessing sampling risk 再评价抽样风险282 reliability 可靠性283 remuneration 报酬284 report to management 对经营的报告285 reporting 报告286 research and development costs 研究和开发成本287 reservation of title 保留288 reserves 准备,储备289 revenue and capital expenditure 岁入和资本支出290 review 评论291 review and capital expenditure 评论和资本支出292 review 评论293 review engagement 复阅债务294 rights 认股权295 rights and obligations 认股权和待付款296 rights to information 对信息的认股权297 risk and materiality 风险和重要性298 risk-based approach 以风险为基础的方式299 romalpa case romalpa 个案300 rotation of auditor appointments 审计(查帐)员任命的循环301 rules of professional conduct 职业道德守则302 sales cut-off 销售截止303 sales system 销售(货)制度304 sales tax 销售税,营业税305 sales 销售,销货306 sample size 样本量307 sampling risk 抽样风险308 sampling units 抽样单位309 schedule of unadjusted errors 未调整的错误表310 scope and objectives of internal audit 内部核数的范围和目标311 segregation of duties 职责划分312 service organization 服务组织313 significant fluctuations or unexpectedrelationships可重视的 (市价)波动或不能预料的亲属关系314 small entity 小的个体315 smaller entities 比较小的个体316 sole traders 个体营业者317 sources of knowledge 知识的根源318 specimen letter on internal control 内部控制上的样本证书319 stakeholders 赌款保存人320 standardised working papers 标准化工作文件321 statement 1:integrity,objectivity andindependence声明 1: 完整,客观性和独立322 statement 2:the professional duty of confidence 声明 2: 信任的职业责任323 statement 3: advertising ,publicity andobtaining professional work声明 3: 广告法(学) ,宣传和获得专业性工作324 statement 5:changes in professionalappointment声明 5: 在职业上的任命中的改变325 statistical sampling 统计抽样326 statutory audit 法定审计327 statutory books 法定卷册328 statutory duty 法定责任329 stewardship 总管的职务330 strategic plan 战略性计划331 stratification 分层332 subsequent events 期后事项333 substantive procedures 实词程序过程334 substantive tests 实质性测试335 sufficient appropriate audit evidence 充分的适当审计证据336 summarising errors summarising 错误337 sundry accruals 杂的应计项目338 supervision 监督339 supervisory and monitoring roles 监督的和检验角色340 suppliers' statements 供应商的声明341 system and internal controls 系统和内部的控制342 systematic selection 系统选择法343 systems-based approach 以系统为基础的方式344 tangible non-current assets 有形的非流动资产345 tendering 投标,清偿346 terms of the engagement 债务的条件347 tests of control 控制的证人348 the AGM 周年大会349 the board 委员会350 three Es 三 Es351 timing 定时352 tolerable error 可容忍误差353 trade accounts payable and purchases 贸易应付帐款和买354 trade accounts payable listing 贸易应付帐款挂牌355 training 培训356 treasury 国库,库房357 TRUE 真实358 turnbull committee turnbull 委员会359 ultra vires 越权360 uncertainty 不确定性361 undue dependence 未到(支付)期的未决362 unqualified audit report 无条件的审计报告363 unqualified report 无条件的报告364 using the knowledge 使用知识365 using the work of an expert 使用专家的工作366 valuation 计价,估价367 value for money 现金(交易)价格368 voluntary disclosure 自愿披露369 wages and salaries 工资,薪金370 wages system 工资系统371 work in progress 在产品372 working papers 工作底稿。

accounting assignment

The first transaction applies to “money measurement” concept, but it is not compliance. Because the employees have been included in the financial statement as on asset. It occurs normally because if employees work very well, their monetary value will be increasing. But they are included in an asset is good for company. So many financial statements normally include employees. Therefore, this example is different between money measurements concept, because money measurement concept applies most employees but this example applies key employees. This concept can never tell us everything such as business has good or bad managers, whether there are serious problems with the workforce, however, if only key employees included in financial statement, everyone can know who is the good manager.The second transaction applies to “Going concern” concept, but it has been violated. The company recently purchased an electronic fax machine worth $500, they have included that in the balance sheet as a fixed asset. However, the machine worth is not going to concern, the really concern is the cost price. So the company should count the fax machine cost less accumulated depreciation as their fix assets, is not count the machine worth. This concept implies that the business will continue to operate for the foreseeable future. It assumes that the owners of a company intend to continue its trading over the long term (at least 12 more months). It that is not the case, they will need to disclose that fact and present slightly different financial statements.The third transaction applies to “Prudence” concept, but it has been diso beyed, because the company should not overstate their income. Although, the lawyers are confident that the company will get the compensation ($1,000,000) within six months, but this is not really received. So the company must not include this as an income in their financial statements of the current year. If the company assuredly gets the compensation, they can include this as their income. This concept guides the accountants should make sure that assets and income are not overstated and liabilities and expenses are not understated. When they make a judgment, they need to be cautions and prudent.The fourth transaction applies to “Substance over form” conc ept, but it is not compliance. Because the company has recently acquired a machinery for $200,000 on hire purchase, it has paid machinery on hire purchase, from a legal point of view, themachinery does not belong to the company until all the hire purchase instalments have been paid, and an option has been taken up whereby the company takes over legal possession of the machinery. So the company has not included this machinery in their financial statements. This concept guides that must be accounted for and presented in accordance with their substance This concept guides that must be accounted for and presented in accordance with their substance and economic reality and not merely their legal form. When the all money are paid by the company that can included this machinery in their financial statements.For example: With Hire Purchase agreements we pay a hire fee for an agreed period, then there is the option at the end of the lease to purchase the asset and take ownership. Yet when we prepare the accounts, we record the asset from the start of the agreement and treat the hire fees as a liability and not an expense. This is the classic example of substance over form.Another example is goods bought on credit. You will notice that many invoices carry the legal disclaimer …title of these goods shall not pass until payment has been received in full‟. Yet in the accounts, the goods are ours as soon as we receive them and NOT when we pay for them. The …substance‟ of the transaction is that the goods are ours, even t hough the legal …form‟ differs.The fifth transaction applies to “C onsistency” concept, but it has been disobeyed, the concept of consistency means that accounting methods once adopted must be applied consistently in future. Also same methods and techniques must be used for similar situations. It implies that a business must refrain from changing its accounting policy unless on reasonable grounds. If for any valid reasons the accounting policy is changed, a business must disclose the nature of change, the reasons for the change and its effects on the items of financial statements. Consistency concept is important because of the need for comparability, that is, it enables investors and other users of financial statements to easily and correctly compare the financial statements of a company. So if the company is charging depreciation using the straight line method, they must stick with the straight line method.Examplespany A has been using declining balance depreciation method for its ITequipment. According to consistency concept it should continue to usedeclining balance depreciation method in respect of its IT equipment in thefollowing periods. If the company wants to change it to another depreciationmethod, say for example the straight line method, it must provide in its financialreport, the reason(s) for the change, the nature of the change and the effects of the change on items such as accumulated depreciation.pany B is a retailer dealing in shoes. It used first-in-first-out methodinventory valuation in respect of shoes at Branch X and weighted average inventory valuation method in respect of similar shoes at Branch Y. Here, the auditors must investigate whether there are any valid reasons for the different treatment of similar inventory located at different locations. If not, they must direct the company to use any one of the valuation method uniformly for the whole class of inventory.。

一文读懂ACCA各科目之间的关系及备考科目搭配

ACCA所有考试科目中F1(AB)是SBL的基础F2(MA)是F5(PM)和P5(APM)的基础F2(MA)是F9(FM)的基础F6(TX)是P6(ATX)的基础F7(FR)是F3(FA)的延伸,是SBR的基础P4(AFM)是F9(FM)的延伸F8(AA)是P7(AAA)的基础1.F1(AB)是SBL的基础满满干货| 一文读懂ACCA各科目之间的关系及备考科目搭配F1(AB)是SBL的基础,这两个科目内部知识点有递进关系,涵盖企业以及所处环境分析、财务人员从业角色、公司治理以及内部控制、管理学相关、人力资源学相关以及从业人员职业道德。

F1(AB)会简单教大家用一些模型去分析企业所处的内部以及外部环境,在SBL课程中,会把这些知识点深入并细化的讲解,比如分析内外部环境之后企业将如何面对环境的变化,在专业层面上更偏战略。

F1(AB)是对职业道德、企业社会责任的简单介绍,SBL课程在公司治理、财务从业人员的职业道德中做了更深入的介绍。

由于ACCA考试规则的限制,无法同时报考F1(AB)和SBL,学完F1(AB)可以奠定一个基础的商业思维,对于备考SBL,F1(AB)的知识点是大量的基础知识。

F1(AB)和SBL的考试全部为文字类试题,需要考生在理解知识点的同时大量记忆背诵,因此在选择时避免和F4(LW)以及F8(AA)同时备考,增加记忆难度。

2.F2(MA)是F5(PM)和P5(APM)的基础、F2(MA)是F9(FM)的基础满满干货| 一文读懂ACCA各科目之间的关系及备考科目搭配F2(MA)是F5(PM)和P5(APM)的基础,课程涉及管理会计与财务会计的区别,涵盖管理会计、管理信息、成本会计、预算和标准成本、业绩衡量、短期决策方法,将会学到如何处理基本的成本信息,并能向管理层提供能用作预算和决策的信息。

F2(MA)和F5(PM)可以考虑先后或者同时学习,在相邻考季中备考,F2(MA)中的variance,在F5(PM)中更加灵活。

ACCA笔记 F9 FM 文字题总结

PART A[1]As agents of the company’s shareholders,the directors may not always act inways which increase the wealth of shareholders,a phenomenon called theagency problem.[2]They can be encouraged to increase or maximize shareholders wealth bymanagerial reward schemes such as performance-related pay and shareoption schemes.Through these methods,the goals of shareholders anddirectors may increase in congruence.解决代理问题的⽅法有managerialreward schemes。

Managerial reward schemes⼜包括share option schemes和performance-related pay这两种⽅法。

[3]Performance-related pay links part of remuneration of directors to someaspect of cooperate performance.One problem here is that is difficult tochoose an aspect of cooperate performance which is not influenced by theactions of directors,leading to the possibility of managers influencingcooperate affairs for their own benefit rather than the benefit of shareholders.[4]Share option schemes bring the goals of shareholders and directors closertogether to the extent that directors become shareholders themselves.Unfortunately,a general increase in share prices can lead to directors beingreward for poor performance,while a decrease in share prices can lead todirectors not being reward for good performance.[5]However,share option schemes can lead to a culture of performanceimprovement and so can bring continuing benefit to shareholders.股票期权计划可以带来绩效改善的⽂化,因此可以为股东带来持续的利益。

ACCA必考知识点

ACCA必考知识点ACCA(Association of Chartered Certified Accountants)作为国际性的注册会计师组织,其考试内容相当广泛,涵盖了会计、财务、税务、审计等多个领域。

以下是ACCA考试中的一些重要知识点:1.国际财务报告准则(IFRS):考生需熟悉IFRS的核心概念和准则,并了解各项财务报表的编制要求和披露要求。

2.管理会计:包括预算编制、成本管理、绩效管理等。

考生需了解不同类型的成本、成本计算方法、成本-体量利润分析、预算编制和分析、投资决策等相关内容。

3.财务管理:主要包括资本预算决策、财务风险管理、资金成本、资本结构和资本市场等内容。

考生需熟悉投资决策方法、财务风险评估与管理、资本结构理论和成本等概念。

4.税务:考生需了解税法和税务规定,包括个人所得税、公司所得税、增值税等。

此外,还需要了解跨国公司税务筹划和税务合规等内容。

5.审计与审计规范:考生需了解审计的目的和范围,以及审计的程序和方法。

还需要了解国际审计准则和内部控制的相关知识。

6.商法和公司法:考生需了解与商业活动相关的法律和法规,包括合同法、公司法、劳动法等。

7.伦理与专业行为准则:ACCA强调会计师的道德素养和道德风险管理。

考生需了解职业道德原则、职业观念和反洗钱法规。

8.商业伦理与社会责任:考生需要了解商业伦理的核心原则和企业社会责任的要求。

9.资本市场:考生需要了解股票市场、债券市场和货币市场的基本知识,包括证券发行、股票投资组合管理等。

10.管理信息系统:考生需要了解信息系统的开发、实施和管理,以及信息安全和数据分析等内容。

此外,ACCA考试还有一些与个人发展和交流有关的知识,如沟通技巧、领导力和团队合作等。

考生可以根据自己的实际情况和所报考的科目选择相应的重点知识点进行学习和准备。

总结起来,ACCA考试的知识点涉及面相当广泛,需要考生全面的了解和掌握。

准备ACCA考试需要进行系统的学习和复习,掌握基本概念和重要原理,同时也要注重实践能力的培养和应用能力的提升。

acca阶段划分

acca阶段划分

ACCA 考试分为四个阶段,每个阶段都需要通过相应的考试才能进入下一阶段:

1. 知识课程(F1-F3):这是 ACCA 考试的第一阶段,主要涉及基础的财务和管理知识,包括财务会计、管理会计、商业法等。

这一阶段的考试主要测试学生对基本概念和原理的理解。

2. 技能课程(F4-F9):这是 ACCA 考试的第二阶段,主要涉及更深入的财务和管理技能,包括财务报告、审计、税务、财务管理等。

这一阶段的考试主要测试学生在实际工作中应用知识的能力。

3. 核心课程(P1-P3):这是 ACCA 考试的第三阶段,主要涉及战略管理和领导能力,包括公司治理、风险管理、战略财务管理等。

这一阶段的考试主要测试学生在复杂的商业环境中做出决策和管理的能力。

4. 选修课程(P4-P7):这是 ACCA 考试的最后一个阶段,学生可以选择自己感兴趣的领域进行深入学习,包括高级财务管理、高级审计与认证业务、高级税务等。

通过完成这四个阶段的考试,学生可以获得 ACCA 资格证书,并成为全球认可的专业会计师。

每个阶段的考试都需要学生具备相应的知识和技能,并且需要进行系统的学习和准备。

ACCA(F1-F3)学习方法总结

ACCA(F1-F3)学习方法总结ACCA共有16门课程,其中基础阶段主要分为知识课程和技能课程两个部分。

知识课程主要涉及财务会计和管理会计方面的核心知识,也为接下去进行技能阶段的详细学习搭建了一个平台。

F1-F3由于是ACCA全部课程体系内容中最为基础的三门课程,又作为财务会计体系中的入门课程,知识难度并不高,同时通过考试的压力也并不大。

F1:Accountant inBusiness(AB)F1这门课的内容很杂,主要涉及到以下三门主要学科:组织行为学,人力资源管理,会计和审计。

F1要求学生学习时一定要通看课本和老师讲义,而且应该做大量阅读,注意广度,以理解为主,不要对某方面知识死钻牛角尖。

F1的学习绝对不可猜题,复习时也绝对不可有遗漏或空白。

学习方法:1.完整学习网课内容,理解和记忆主要知识点,勤做笔记,完成练习,加深对知识点的认识和印象。

章节结束及时总结,清晰每章内容和关键知识点,完成讲义的自我梳理和配套的练习,熟悉每章的知识结构。

实战练习,熟悉考点,把握基本的答题规律2.对基础知识进行梳理,对知识点有整体把握。

根据冲刺串讲课程,复习精要知识点,复述相关概念。

整理第一阶段的错题,查漏补缺,加强薄弱环节。

3.罗列复习纲要,对知识点进行复述式记忆,发现薄弱知识点,进行答疑和重新梳理。

对所有错题所考查的知识点再次梳理,对不熟悉和遗漏的知识点多次记忆。

对样卷和ACCA官网模拟题进行仿真训练,严格控制考试时间,并自我认真审阅。

F2:Management Accounting(MA)F2主要向学员介绍成本会计和管理会计的体系,以及管理会计如何发挥支持企业计划、决策、控制的作用。

主要包括:管理会计起源、成本的分类、成本核算的方法、预算控制、差异分析、绩效评估相关知识点。

学习方法:1.报了网课或者面授的话,那么聆听老师的讲解是非常重要的。

对于老师发下来的讲义一定要认真研读,讲义往往是老师对于这门课的精炼总结,涵盖了所有的考点,仔细研究讲义可以专注于对高频考点的学习、提高学习效率,同时也能节省自己的时间和精力。

ACCA F4-F9模拟题及解析(6)