企业会计准则投资性房地产英文财政部

浅谈《企业会计准则第3号——投资性房地产》

●

第 2 卷 第 5期 1

Ju a o un nFnne& E oo iBU iesy or l f n a iac n Y cnm c nvrt i

V 12 . - o 1 N0 5

.

浅谈《 企业会计准则第 3号——投资性房地产》

徐 小瑛

( 广西大学 商学院, 广西 南宁 500 ) 304

关键词 : 投资性房地产; 国际会计准则; 公允价值 摘 要 : 政部 20 年 2月颁布 了新的企业会计准则。其 中首次颁布 了《 财 06 企业会计准则第 3号——投 贤 性房地产》 此项准则的颁布将会对企业投资性房地产的确认、 , 计量、 披露等提供客观的依据。通过该准则- 9 国际会计准则4 0号——投资性房地产的分析- 9比较, 指出二者之间的异同以及优缺点, 从而为完善我国投资 性房地产 会计准则提 出设想。

收稿 日期 :0 6— 7— 9 20 0 2 作者简介 : 徐小瑛 (9 0 18 一 )女 , , 广西桂林人 , 硕士研究 生 , 研究 方向为财务管理 。

维普资讯

徐小瑛: 浅谈《 企业会计准则第 3号——投资性房地产》 资性房地产转换为 自用房地 产时。 当 以其转换 当 日 应 的公允价值作为 自用房地产 的账面价值 , 公允价值与 原账面价值的差额计入当期损益。自用房地 产或存货 转换为采用公允价值模式计量 的投 资性房地产时 , 投 资性房地产按照转换 当 日的公允价 值计价 , 转换 当 日 的公允价值小于原账面价值的, 其差额计人当期损益 ; 转换 当日的公允价值大于原账 面价值的 , 其差额计入 所有者权益。 国际会计准则中还涉及到价值重估 、 折旧处理 , 针 对不同情况更加细化 。我国与国际会计准则基本上一 致, 但从我国企业的实际情况出发 , 笔者认为该准则更 为符合我国的实际情况, 便于操作和 了解。同时避免 了企业通过投资性房地产与其他 资产之间的转换来进 行利润操纵 , 充分体现了会计 的谨慎性原则。 ( 四)投资性房地产的披露要求 企业会计准则第 3 号中要求企业应当在附注中披 露与投资性房地产有 关的下列信息 : 一是 投资性房地 产的种类 、 金额和计量模式。二 是 采用成本 模式 的,

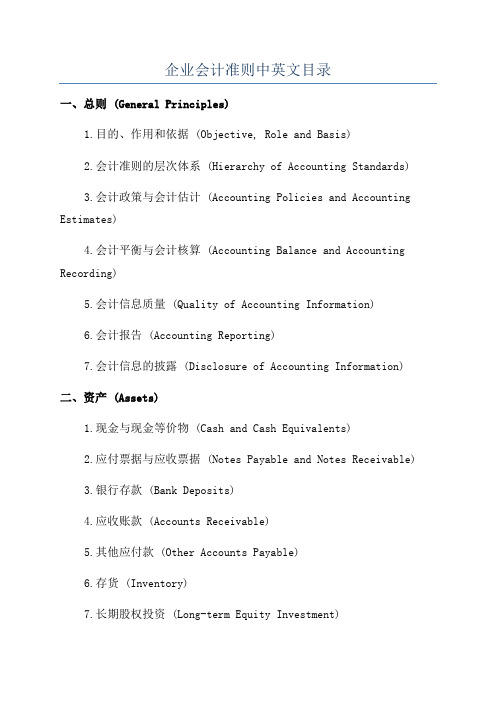

企业会计准则中英文目录

企业会计准则中英文目录一、总则 (General Principles)1.目的、作用和依据 (Objective, Role and Basis)2.会计准则的层次体系 (Hierarchy of Accounting Standards)3.会计政策与会计估计 (Accounting Policies and Accounting Estimates)4.会计平衡与会计核算 (Accounting Balance and Accounting Recording)5.会计信息质量 (Quality of Accounting Information)6.会计报告 (Accounting Reporting)7.会计信息的披露 (Disclosure of Accounting Information)二、资产 (Assets)1.现金与现金等价物 (Cash and Cash Equivalents)2.应付票据与应收票据 (Notes Payable and Notes Receivable)3.银行存款 (Bank Deposits)4.应收账款 (Accounts Receivable)5.其他应付款 (Other Accounts Payable)6.存货 (Inventory)7.长期股权投资 (Long-term Equity Investment)8.固定资产 (Fixed Assets)9.无形资产 (Intangible Assets)10.长期应收款 (Long-term Receivables)11.投资性房地产 (Investment Property)12.生产性生物资产 (Productive Biological Assets)13.油气资产 (Oil and Gas Assets)三、负债 (Liabilities)2.应付利息 (Interest Payable)3.应付股利 (Dividends Payable)4.应付票据与应收票据 (Notes Payable and Notes Receivable)5.应计费用 (Accrued Expenses)6.长期借款 (Long-term Loans)7.应付账款 (Accounts Payable)8.其他应付款 (Other Accounts Payable)9.预计负债 (Provisions)10.长期负债 (Long-term Liabilities)11.租赁负债 (Lease Liabilities)12.金融负债和金融资产净值表 (Financial Liabilities and Net Asset Value of Financial Assets)四、所有者权益 (Equity)1.实收资本 (Paid-in Capital)2.其他各类股东权益 (Other Shareholders' Equity)3.盈余公积 (Surplus Reserve)4.未分配利润 (Undistributed Profits)5.专项储备 (Special Reserves)7.减少股本 (Reduction of Share Capital)8.外币货币报表 (Foreign Currency Financial Statements)五、收入 (Revenue)1.主营业务收入 (Main Operating Revenue)2.其他业务收入 (Other Operating Revenue)3.政府补助 (Government Grants)4.资本公积 (Capital Surplus)六、费用 (Expenses)1.销售费用 (Selling Expenses)2.管理费用 (Administrative Expenses)3.财务费用 (Financial Expenses)4.税费 (Taxes)5.其他费用 (Other Expenses)6.计提费用和资产减值准备 (Accruals and Asset Impairment Provisions)七、附注 (Appendix)1.一般附注 (General Appendix)2.财务责任附注 (Financial Responsibility Appendix)3.重要会计政策与会计估计附注 (Significant Accounting Policies and Estimates Appendix)4.重要交易与事件附注 (Significant Transactions and Events Appendix)5.重要法律事项附注 (Significant Legal Matters Appendix)6.全面收购会计处理和合并附注 (Full Acquisition Accounting Treatment and Merger Appendix)7.资产、负债和所有者权益变动情况附注 (Changes in Assets, Liabilities and Shareholders' Equity Appendix)8.指标说明附注 (Indicator Description Appendix)以上是企业会计准则的中英文目录,目录共涵盖了准则的主要内容,包括总则、资产、负债、所有者权益、收入、费用和附注等方面。

新会计准则中英对照

新会计准则中英对照新会计准则中英对照财政部在人民大会堂同时发布新的会计准则和审计准则体系,其中新会计准则于2007年1月1日起在上市公司中执行,其他企业鼓励执行。

新会计准则英汉对照目录Effective 2007 for Listed Companies1. 企业会计准则---------基本准则(Accounting Standard for Business Enterprises - Basic Standard)2. 企业会计准则第1 号---------存货(Accounting Standard for Business Enterprises No. 1 - Inventories)3. 企业会计准则第2 号---------长期股权投资 br/(Accounting Standard for Business Enterprises No. 2 - Long-term equity investments)4. 企业会计准则第3 号---------投资性房地产(Accounting Standard for Business Enterprises No. 3 - Investment properties)5. 企业会计准则第4 号---------固定资产 br/(Accounting Standard for Business Enterprises No. 4 - Fixed assets) br/6. 企业会计准则第5 号---------生物资产 br/(Accounting Standard for Business Enterprises No. 5 - Biological assets) br/7. 企业会计准则第6 号---------无形资产 br/(Accounting Standard for Business Enterprises No. 6 - Intangible assets) br/8. 企业会计准则第7 号---------非货币性资产:) br/Exchange of non-monetary assets) br/9. 企业会计准则第8 号---------资产减值 br/(Accounting Standard for Business Enterprises No. 8 - Impairment of assets) br/10. 企业会计准则第9 号---------职工薪酬 br/(Accounting Standard for Business Enterprises No. 9 –Employee compensation ) br/11. 企业会计准则第10 号--------企业年金基金 br/(Accounting Standard for Business Enterprises No. 10 - Enterprise annuity fund) br/12. 企业会计准则第11 号--------股份支付 br/(Accounting Standard for Business Enterprises No. 11 - Share-based payment) br/13. 企业会计准则第12 号--------债务重组 br/(Accounting Standard for Business Enterprises No. 12 - Debt restructurings) br/14. 企业会计准则第13 号--------或有事项 br/(Accounting Standard for Business Enterprises No. 13 - Contingencies) br/15. 企业会计准则第14 号--------收入 br/(Accounting Standard for Business Enterprises No. 14 - Revenue) br/16. 企业会计准则第15 号--------建造合同 br/(Accounting Standard for Business Enterprises No. 15 - Construction contracts) br/17. 企业会计准则第16 号--------政府补助 br/(Accounting Standard for Business Enterprises No. 16 - Government grants) br/18. 企业会计准则第17 号--------借款费用 br/Borrowing costs) br/19. 企业会计准则第18 号--------所得税 br/(Accounting Standard for Business Enterprises No. 18 - Income taxes) br/20. 企业会计准则第19 号--------外币折算 br/(Accounting Standard for Business Enterprises No. 19 - Foreign currency translation) br/。

企业会计准则第3号——投资性房地产

计提折 旧或进行摊销 ,应 当以资产负债表 日投资 性 业 应 当在 附注 中披 露 的与投 资 性房地 产有 关 的信

企业应 当在 附录中披 露与投资性房地产有关 的

下列信息:

1投 资性房地产 的种类 、 . 金额和计量方式:

2采用 成本 模式 的 , 资性房地 产 的折 旧或摊 . 投

第 3 为投 资性房地产 的后 续计量 。本章具 体 章

第1 章为总则 。总则 中明确 了本准则是 为 了规 说 明 了企业在 资产负债表 日对 投资性房 地产进行 后 范投资性房地产 的确 认 、 计量和相 关信息 的披露 , 以 续计 量所能采取 的方法和前提 条件 。这 里重要 的一 及投资性房地 产 的特 征,同时列示 了本准 则不适用 或资本增值, 或两者兼有而 持有 的房地产 。 投资性房

时满足 下列 条件:

章 明确 了投资性房地 产确认的具体条 件 、初始计量

方法 以及后续支出的处理方式。其具体 规定是:

1确 认 条 件 ; .

() 资性 房地 产所在 地 有活 跃 的房地 产交 易 1投 《 对外 经贸 财会》 志 2 0 杂 0 6年第 5期

8

维普资讯

维普资讯

准 则解读 系 列之 二

随着 中国房地产 业的不断发展 ,房地产业对 国

() 1 该投 资性 房地 产包 含 的经济 利益 很可 能流 () 2 该投 资性房 地产的成本能够可靠计量 。

2 初始计量 : .

民经 济的影响越来越 大 , 房地产市场 越来越规范 , 越 入企业 。 来越 多的企业 出于投 资 目的持有各 类房地产 。鉴 于 此类房地产价值 巨大 ,会对企业 的会计信息造成 巨

企业会计准则第3号—投资性房地产

企业会计准则第3号—投资性房地产企业会计准则第3号—投资性房地产是对投资性房地产进行会计处理的准则。

投资性房地产是指企业在购买、建造或者租赁房地产用于获得租金或者增值的情况下所持有的房地产。

企业会计准则第3号规定了投资性房地产的会计核算、报告和披露要求,以确保相关信息能够准确、完整地反映企业的财务状况和经营成果。

根据企业会计准则第3号,投资性房地产应当经历三个阶段的会计处理:首次确认、持有期间、处置期间。

首次确认阶段,企业应当按照成本进行确认,包括购买成本、建造成本和租赁预付款等。

此外,还应当确认与投资性房地产有关的初始直接相关费用,并在首次确认时进行计量。

持有期间阶段,企业应当根据成本模型或公允价值模型进行计量。

成本模型要求以成本减少累计计提的减值准备进行计量,而公允价值模型要求以公允价值进行计量,并将变动计入其他综合收益。

处置期间阶段,企业应当根据实际或预计出售时的公允价值进行计量,并将差额计入当期损益。

投资性房地产的报告和披露要求包括财务报表和附注的披露内容。

财务报表应当包括投资性房地产的概述、成本、公允价值、减值准备、租金收入和处置收益等信息。

附注应当包括投资性房地产的主要会计政策、计量方法、风险管理和潜在风险等信息。

企业会计准则第3号对于企业正确处理投资性房地产的会计核算有重要意义。

准确、完整地报告和披露投资性房地产的相关信息,有助于投资者、债权人和其他利益相关方了解企业的财务状况和经营成果,提高投资决策的准确性和科学性。

然而,企业会计准则第3号在实际应用中也存在一些问题和挑战。

一方面,投资性房地产的公允价值可能难以准确确定,特别是在市场波动较大或者投资性房地产较少的地区。

另一方面,企业在计量投资性房地产时可能存在主观性和估计性,导致信息的可比性和可靠性受到影响。

因此,在实施企业会计准则第3号时,企业应当结合具体情况进行审慎判断,并严格按照相关规定进行会计处理、报告和披露。

同时,监管部门应当加强对企业的监督和指导,提高企业会计准则应用的质量和规范性,进一步保护投资者和利益相关方的权益。

企业会计准则第3号──投资性房地产

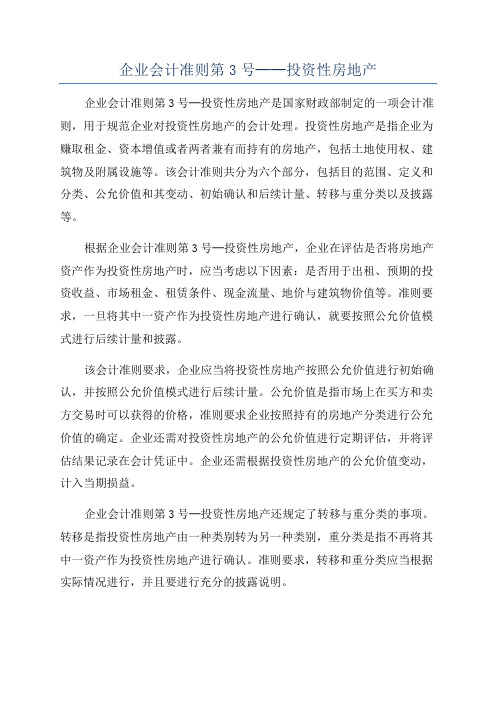

企业会计准则第3号──投资性房地产企业会计准则第3号─投资性房地产是国家财政部制定的一项会计准则,用于规范企业对投资性房地产的会计处理。

投资性房地产是指企业为赚取租金、资本增值或者两者兼有而持有的房地产,包括土地使用权、建筑物及附属设施等。

该会计准则共分为六个部分,包括目的范围、定义和分类、公允价值和其变动、初始确认和后续计量、转移与重分类以及披露等。

根据企业会计准则第3号─投资性房地产,企业在评估是否将房地产资产作为投资性房地产时,应当考虑以下因素:是否用于出租、预期的投资收益、市场租金、租赁条件、现金流量、地价与建筑物价值等。

准则要求,一旦将其中一资产作为投资性房地产进行确认,就要按照公允价值模式进行后续计量和披露。

该会计准则要求,企业应当将投资性房地产按照公允价值进行初始确认,并按照公允价值模式进行后续计量。

公允价值是指市场上在买方和卖方交易时可以获得的价格,准则要求企业按照持有的房地产分类进行公允价值的确定。

企业还需对投资性房地产的公允价值进行定期评估,并将评估结果记录在会计凭证中。

企业还需根据投资性房地产的公允价值变动,计入当期损益。

企业会计准则第3号─投资性房地产还规定了转移与重分类的事项。

转移是指投资性房地产由一种类别转为另一种类别,重分类是指不再将其中一资产作为投资性房地产进行确认。

准则要求,转移和重分类应当根据实际情况进行,并且要进行充分的披露说明。

最后,企业在编制财务报表时,应当按照准则的要求对投资性房地产进行披露。

准则要求,企业应当披露投资性房地产的计量基础、主要假设、公允价值计算结果、公允价值变动及其影响、投资性房地产的转移与重分类等信息。

企业还需对投资性房地产的风险及管理政策进行充分的披露说明。

企业会计准则第3号─投资性房地产的制定和实施,旨在提高企业对投资性房地产的会计处理的准确性和可比性,进一步规范企业的财务报告,为投资者提供准确、全面的信息,以保护投资者的权益。

这将有助于提高企业透明度与市场竞争力,促进企业投资性房地产市场的稳定发展。

国际会计准则之投资性房地产

国际会计准则第40号——投资性房地产财政部会计司组织翻译目的本准则的目的是规投资性房地产的会计处理和相关披露要求。

围1、本准则适用于投资性房地产的确认、计量和披露。

2、除其它问题外,本准则涉及在融资租赁承租人财务报表中投资性房地产的计量和经营租赁出租人财务报表中投资性房地产的计量。

本准则不涉及《国际会计准则第17号——租赁》所包括的下列事项:(1)融资租赁或经营租赁的划分;(2)投资性房地产赚取的租赁收益的确认(参见《国际会计准则第18号——收入》);(3)在经营租赁承租人财务报表中房地产的计量;(4)在融资租赁出租人财务报表中房地产的计量;(5)售后租回交易的会计;(6)融资租赁和经营租赁的披露。

3、本准则不适用于:(1)森林和类似再生性自然资源;(2)矿产权、矿产勘探开采、石油、天然气和类似非再生性自然资源。

定义4、本准则使用的下列术语,其含义为:投资性房地产,指为赚取租金或为资本增值,或两者兼有而(由业主或融资租赁的承租人)持有的房地产(土地或建筑物,或建筑物的一部分,或两者兼有),但不包括:(1)用于商品或劳务的生产或供应,或用于管理目的的房地产;或(2)在正常经营过程中销售的房地产。

自用房地产,指为用于商品或劳务的生产或供应,或用于管理目的而(由业主营融资租赁的承租人)持有的房地产。

公允价值,指在公平交易中,熟悉情况的当事人自愿据以进行资产交换的金额。

成本,指资产购置或建造时,为取得该资产而支付的现金或现金等价物的金额、或其它对价的公允价值。

账面金额,指在资产负债表中确认的资产金额。

5、房地产投资是为了赚取租金或资本增值,或两者兼有。

因此,投资性房地产产生的现金流量在很大程度上独立于企业持有的其它资产。

这一点将投资性房地产与自用房地产区分开来。

商品或劳务的主产或供应过程中使用的房地产(或用于管理目的房地产)产生的现金流量不仅归属于该项房地产,而且归属于在生产或供应过程中所使用的其它资产。

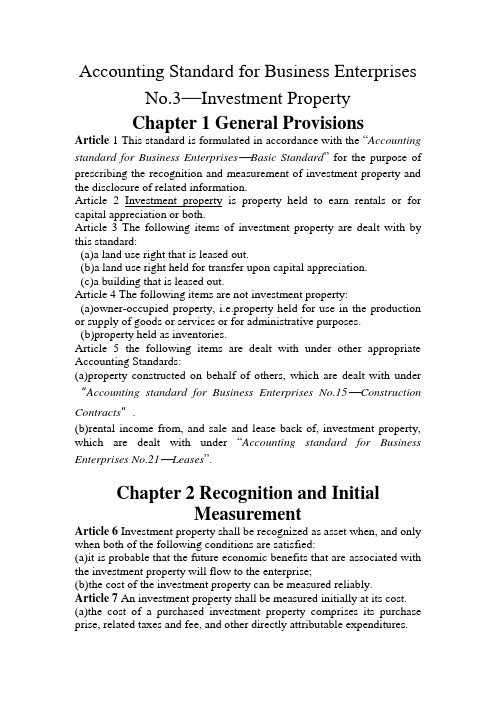

企业会计准则投资性房地产英文财政部

Accounting Standard for Business Enterprises No.3—Investment PropertyChapter 1 General ProvisionsArticle 1 This standard is formulated in accordance with the “Accounting standard for Business Enterprises—Basic Standard”for the purpose of prescribing the recognition and measurement of investment property and the disclosure of related information.Article 2 Investment property is property held to earn rentals or for capital appreciation or both.Article 3 The following items of investment property are dealt with by this standard:(a)a land use right that is leased out.(b)a land use right held for transfer upon capital appreciation.(c)a building that is leased out.Article 4 The following items are not investment property:(a)owner-occupied property, i.e.property held for use in the production or supply of goods or services or for administrative purposes.(b)property held as inventories.Article 5 the following items are dealt with under other appropriate Accounting Standards:(a)property constructed on behalf of others, which are dealt with under “Accounting standard for Business Enterprises No.15—Construction Contracts”.(b)rental income from, and sale and lease back of, investment property, which are dealt with under “Accounting standard for Business Enterprises No.21—Leases”.Chapter 2 Recognition and InitialMeasurementArticle 6 Investment property shall be recognized as asset when, and only when both of the following conditions are satisfied:(a)it is probable that the future economic benefits that are associated with the investment property will flow to the enterprise;(b)the cost of the investment property can be measured reliably.Article 7 An investment property shall be measured initially at its cost. (a)the cost of a purchased investment property comprises its purchase prise, related taxes and fee, and other directly attributable expenditures. (b)the cost of a self-constructed investment property is its cost at the date when the construction or development is complete.(c)the cost of an investment property obtained in other ways shall be determined in accordance with the appropriate Specific Accounting Standard for Business Enterprises.Article 8 Subsequent costs incurred for an investment property that meet the recognition criteria stipulated in Article 6 shall be included in the cost of the investment property. Subsequent costs that fail to meet the recognition criteria in Article 6 shall be recognized in profit or loss in the period in which they are incurred.Chapter 3 Subsequent Measurement Article 9An enterprise shall use the cost model for subsequent measurement of investment property at the balance sheet date, except as stipulated in Article 10 of this Standard.Subsequent measurement of buildings accounted for using the cost model is dealt with under “Accounting Standard for Business Enterprises No.4—Fixed Assets”.Subsequent measurement of land use right accounted for using the cost model is dealt with under “Accounting Standard for Business Enterprises No.6—Intangible Assets”.Article 10 If there is clear evidence that the fair value of an investment property can be reliably determinable on a continuing basis, the fair value model may be used for subsequent measurement of the investment property.Both of the following conditions shall be met if the fair value model is to be used:(a)there is a active property market in the location in which the investment property is situated;(b)the enterprise can obtain the market price and other relevant information regarding the same type of or similar properties from the property market, so as to reasonably estiamte the fair value of the investment property.Article 11 When the fair value model is used, no depreciation or amotization is provided for an investment property. The carrying amount of the investment property shall be adjusted to its fair value at the balance sheet date. The difference between the fair value and the original carrying amount is recognized in profit or loss for the current period.Article 12 Once a measurement model for investment property is chosen, an enterprise shall not change the model arbitrarily. A change from the cost model to the fair value model shall be accounted for as a change in accounting policy and dealt with in accordance with “Accounting Standard for Business Enterprises No.28—Changes in Accounting policies and Accounting Estimates and Corrections of Errors” .For investment property accounted for using the fair value model, achange from the fair value model to the cost model is not permitted.Chapter 4 TransfersArticle 13 Transfers to, or from, investment property shall be made when, and only when, there is a change in use, clearly evidenced by one of the following conditions:(a)commencement1of owner-occupation, for a transfer from investment property to owner-occupied property.(b)end of development with a view to sale, and commencement of an operating lease to another party, for a transfer from inventories to investment property.(c)end of owner-occupation, and commencement of being held to earn rentals2or for capital appreciation3, for an transfer from owner-occupied land use right to investment property.(d)end of owner-occupation, and commencement of an operating lease to ahother party, for a transfer from owner-occupation building to investment property.Article 14For a transfer from investment property carried at the cost model to owner-occupied property, or a transfer from owner-occupied property or inventories to investment property carried at the cost model, the carrying amount of a property before its transfer shall be regarded as the recorded amount after its transfer.Article 15For a transfer from investment property carried at the fair value model to owner-occupied property, its fair value at the date of transfer is regarded as the carrying amount of the owner –occupied property. The difference between the fair value and the original carrying amount is recognized in profit or loss for the current period.Article 16 For a transfer from owner-occupied property or inventories to investment property carried at the fair value model, the investment property is measured at its fair value at the date of the transfer. If the fair value at the date of transfer is less than the original carrying amount, the difference is charged to profit or loss for the current period. If the fair value at the date of transfer exceeds the original carrying amount, the difference is recognized in owners’equity.Chapter 5 DisposalsArticle 17 An investment property shall be derecognized on disposal or 1[kə'mensmənt] 名词n. [U][C] 1.开始,发端2.【美】学位授予典礼;毕业典礼2['rentl] 名词n. 1.租金;租金收入[C]The quarterly rental will be $50,000.每季度租金为五万元。

投资性房地产【外文翻译】

外文翻译外文题目IAS 40 Investment Property外文出处International Accounting Standards外文作者International Accounting Standards Committee 原文:IAS 40 Investment PropertyObjectiveThe objective of this Standard is to prescribe the accounting treatment for investment property and related disclosure requirements.Scope1. This Standard should be applied in the recognition, measurement and disclosure of investment property.2. Among other things, this Standard deals with the measurement in a lessee's financial statements of investment property held under a finance lease and with the measurement in a lessor's financial statements of investment property leased out under an operating lease. This Standard does not deal with matters covered in IAS 17, Leases, including:(a) classification of leases as finance leases or operating leases;(b) recognition of lease income earned on investment property (see also IAS 18, evenue);(c) measurement in a lessee's financial statements of property held under an operating lease;(d) measurement in a lessor's financial statements of property leased out under a finance lease;(e) accounting for sale and leaseback transactions; and(f) disclosure about finance leases and operating leases.3. This Standard does not apply to:(a) biological assets attached to land related to agricultural activity (see IAS 41,Agriculture); and(b) mineral rights, the exploration for and extraction of minerals, oil, natural gas and similar non-regenerative resources.Definitions4. The following terms are used in this Standard with the meanings specified: Investment property is property (land or a building - or part of a building - or both) held (by the owner or by the lessee under a finance lease) to earn rentals or for capital appreciation or both, rather than for:(a) use in the production or supply of goods or services or for administrative purposes; or(b) sale in the ordinary course of business.Owner-occupied property is property held (by the owner or by the lessee under a finance lease) for use in the production or supply of goods or services or for administrative purposes.Fair value is the amount for which an asset could be exchanged between knowledgeable, willing parties in an arm's length transaction.Cost is the amount of cash or cash equivalents paid or the fair value of other consideration given to acquire an asset at the time of its acquisition or construction. Carrying amount is the amount at which an asset is recognised in the balance sheet. 5. Investment property is held to earn rentals or for capital appreciation or both.Therefore, an investment property generates cash flows largely independently of the other assets held by an enterprise. This distinguishes investment property from owneroccupied property. The production or supply of goods or services (or the use of property for administrative purposes) generates cash flows that are attributable not merely to property, but also to other assets used in the production or supply process.IAS 16, Property, Plant and Equipment, applies to owner-occupied property.6. The following are examples of investment property:(a) land held for long-term capital appreciation rather than for short-term sale in the ordinary course of business;(b) land held for a currently undetermined future use. (If an enterprise has notdetermined that it will use the land either as owner-occupied property or for short-term sale in the ordinary course of business, the land is considered to be held for capital appreciation);(c) a building owned by the reporting enterprise (or held by the reporting enterprise under a finance lease) and leased out under one or more operating leases; and(d) a building that is vacant but is held to be leased out under one or more operating leases.7. The following are examples of items that are not investment property and therefore fall outside the scope of this Standard:(a) property held for sale in the ordinary course of business or in the process of construction or development for such sale (see IAS 2, Inventories), for example property acquired exclusively with a view to subsequent disposal in the near future or for development and resale;(b) property being constructed or developed on behalf of third parties (see IAS 11,Construction Contracts);(c) owner-occupied property (see IAS 16, Property, Plant and Equipment), including (among other things) property held for future use as owner-occupied property, property held for future development and subsequent use as owner-occupied property, property occupied by employees (whether or not the employees pay rent at market rates) and owner-occupied property awaiting disposal; and(d) property that is being constructed or developed for future use as investment property. IAS 16 applies to such property until construction or development is complete, at which time the property becomes investment property and this Standard applies. However, this Standard does apply to existing investment property that is being redeveloped for continued future use as investment property (see paragraph 52).8. Certain properties include a portion that is held to earn rentals or for capital appreciation and another portion that is held for use in the production or supply of goods or services or for administrative purposes. If these portions could be sold separately (or leased out separately under a finance lease), an enterprise accounts for the portions separately. If the portions could not be sold separately, the property isinvestment property only if an insignificant portion is held for use in the production or supply of goods or services or for administrative purposes.9. In certain cases, an enterprise provides ancillary services to the occupants of a property held by the enterprise. An enterprise treats such a property as investment property if the services are a relatively insignificant component of the arrangement as a whole. An example would be where the owner of an office building provides security and maintenance services to the lessees who occupy the building.10. In other cases, the services provided are a more significant component. For example, if an enterprise owns and manages a hotel, services provided to guests are a significant component of the arrangement as a whole. Therefore, an owner-managed hotel is owner-occupied property, rather than investment property.11. It may be difficult to determine whether ancillary services are so significant that a property does not qualify as investment property. For example, the owner of a hotel sometimes transfers certain responsibilities to third parties under a management contract. The terms of such management contracts vary widely. At one end of the spectrum, the owner's position may, in substance, be that of a passive investor. At the other end of the spectrum, the owner may simply have outsourced certain day-to-day functions while retaining significant exposure to variation in the cash flows generated by the operations of the hotel.12. Judgement is needed to determine whether a property qualifies as investment property. An enterprise develops criteria so that it can exercise that judgement consistently in accordance with the definition of investment property and with the related guidance in paragraphs 5to 11. Paragraph 66(a)requires an enterprise to disclose these criteria when classification is difficult.13. Under IAS 17, Leases, a lessee does not capitalise property held under an operating lease. Therefore, the lessee does not treat its interest in such property as investment property.14. In some cases, an enterprise owns property that is leased to, and occupied by, its parent or another subsidiary. The property does not qualify as investment property in consolidated financial statements that include both enterprises, because the property isowner-occupied from the perspective of the group as a whole. However, from the perspective of the individual enterprise that owns it, the property is investment property if it meets the definition in paragraph 4. Therefore, the lessor treats the property as investment property in its individual financial statements.Recognition15. Investment property should be recognised as an asset when, and only when:(a) it is probable that the future economic benefits that are associated with the investment property will flow to the enterprise; and(b) the cost of the investment property can be measured reliably.16. In determining whether an item satisfies the first criterion for recognition, an enterprise needs to assess the degree of certainty attaching to the flow of future economic benefits on the basis of the available evidence at the time of initial recognition. The second criterion for recognition is usually readily satisfied because the exchange transaction evidencing the purchase of the asset identifies its cost.Initial Measurement17. An investment property should be measured initially at its cost. Transaction costs should be included in the initial measurement.18. The cost of a purchased investment property comprises its purchase price, and any directly attributable expenditure. Directly attributable expenditure includes, for example, professional fees for legal services, property transfer taxes and other transaction costs.19. The cost of a self-constructed investment property is its cost at the date when the construction or development is complete. Until that date, an enterprise applies IAS 16, Property, Plant and Equipment. At that date, the property becomes investment property and this Standard applies (see paragraphs 51(e) and 59 below).20. The cost of an investment property is not increased by start-up costs (unless they are necessary to bring the property to its working condition), initial operating losses incurred before the investment property achieves the planned level of occupancy or abnormal amounts of wasted material, labour or other resources incurred in constructing or developing the property.21. If payment for an investment property is deferred, its cost is the cash price equivalent. The difference between this amount and the total payments is recognized as interest expense over the period of credit.Subsequent Expenditure22. Subsequent expenditure relating to an investment property that has already been recognised should be added to the carrying amount of the investment property when it is probable that future economic benefits, in excess of the originally assessed standard of performance of the existing investment property, will flow to the enterprise. All other subsequent expenditure should be recognised as an expense in the period in which it is incurred.23. The appropriate accounting treatment for expenditure incurred subsequently to the acquisition of an investment property depends on the circumstances which were taken into account on the initial measurement and recognition of the related investment. For instance, when the carrying amount of an investment property already takes into account a loss in future economic benefits, subsequent expenditure to restore the future economic benefits expected from the asset is capitalised. This is also the case when the purchase price of an asset reflects the enterprise's obligation to incur expenditure that is necessary in the future to bring the asset to its working condition. An example of this might be the acquisition of a building requiring renovation. In such circumstances, the subsequent expenditure is added to the carrying amount.Measurement Subsequent to Initial Recognition24. An enterprise should choose either the fair value model in paragraphs 27 to 49 or the cost model in paragraph 50as its accounting policy and should apply that policy to all of its investment property.25. IAS 8, Net Profit or Loss for the Period, Fundamental Errors and Changes in Accounting Policies, states that a voluntary change in accounting policy should be made only if the change will result in a more appropriate presentation of events or transactions in the financial statements of the enterprise. It is highly unlikely that a change from the fair value model to the cost model will result in a more appropriate presentation.26. This Standard requires all enterprises to determine the fair value of investment property for the purpose of measurement (fair value model) or disclosure (cost model). An enterprise is encouraged, but not required, to determine the fair value of investment property on the basis of a valuation by an independent valuer who holds a recognised and relevant professional qualification and who has recent experience in the location and category of the investment property being valued.Fair Value Model27. After initial recognition, an enterprise that chooses the fair value model should measure all of its investment property at its fair value, except in the exceptional cases described in paragraph 47.28. A gain or loss arising from a change in the fair value of investment property should be included in net profit or loss for the period in which it arises.29. The fair value of investment property is usually its market value. Fair value is measured as the most probable price reasonably obtainable in the market at the balance sheet date in keeping with the fair value definition. It is the best price reasonably obtainable by the seller and the most advantageous price reasonably obtainable by the buyer. This estimate specifically excludes an estimated price inflated or deflated by special terms or circumstances such as atypical financing, sale and leaseback arrangements, special considerations or concessions granted by anyone associated with the sale.Source:International Accounting Standards Committee.International Accounting Standards ,IAS 40 Investment Property[s].2004:37-40译文:投资性房地产目的本准则的目的是规范投资性房地产的会计处理和相关披露要求。

企业会计准则第3号—投资性房地产

共五十六页

课堂 练习题 (kètáng)

3.某企业投资性房地产采用成本计量模式。 2009年1月31日购入一幢建筑物用于出租。该 建筑物的成本为270万元,预计使用年限为5 年,预计净残值为18万元.采用年数(nián 总和 shù) 法计提折旧。2010年应计提的折旧额为

投资性房地产累计折旧 投资性房地产减值准备 贷:投资性房地产 注意1:房地产公司作为存货的房地产用“ 开发产品”科目; 注意2:流动资产与非流动资产之间的减值

共五十六页

投资性房地产的转换(zhuǎnhuàn)和处置

2.非投资性房地产转换为投资性房地产: (1)作为存货的房地产转换为投资性房地产 借:投资性房地产(存货在转换日的账面价值)

注意: (7)一项房地产,部分用于赚取租金或资本 增值,部分用于生产商品、提供劳务或经营管 理: 用于赚取租金或资本增值的部分,如果能够单 独计量和出售(chūshòu)的,可以将该部分确认为 投资性房地产;不能够单独计量和出售(chūshòu) 的,不确认为投资性房地产。

共五十六页

课堂 练习题 (kètáng)

存货跌价准备(zhǔnbèi)(已计提的跌价准备(zhǔnbèi) )

贷:开发产品(账面余额)

共五十六页

投资性房地产的转换(zhuǎnhuàn)和处置

(2)自用房地产转换为投资性房地产 借:投资性房地产

累计折旧或累计摊销

固定资产减值准备(zhǔnbèi)或无形资产减值准备

(zhǔnbèi)

贷:固定资产或无形资产

价值为75万元。转换日“固定资产”的入账

价值为( A )万元。

A.100

B.80

C.70

企业会计准则第3号--投资性房地产

元)

借:其他业务支出

18

贷:累计折旧

18

新准则处理办法:

2、公允价值模式

(1)1994年12月31日建成时:

借:固定资产

360

贷:在建工程

360

(2)1995摊销折旧:

借:制造费用

18

贷:累计折旧

18

(3)1996年出租时:

借:投资性房地产

400

累计折旧

18

贷:固定资产

360

资本公积

58

(4)1996—2005年不计提折旧

三、新准则与原会计制度 差异比较

(一)会计科目的差异 (二)初始计量的差异 (三)后续计量的差异

(四)新准则有关投资性房地产转 换的规定 (五)处置

(五)处置

例:某工业企业1994年12月31日在自由土地 上建成一座厂房,此在建工程账面成本为360 万元(摊销期限20年,按平均年限法摊销, 预计无净残值),建成初衷是作为自用车间。 但由于销路不畅于1996年1月1日将此厂房出 租,出租时公允价值为400万元,租期10年。 1999年按照国家规定安装消防设备花费15万 元。2006年1月1日到期后将此厂房改建为第 五车间,此时公允价值为270万元。请进行账

二、主要内容:

1、在“总则”部分 2、在“确认和初始计量”部分 3、在“后续计量”部分 4、在“转换”部分 5、在“处置”部分 6、新准则同时规定在附注中披露的 内容

投资性房地产,是指为赚取租金或资本增值, 或两者兼有而持有的房地产。包括:

(1)出租的土地使用权。 (2)长期持有并准备增值后转让的土地使用 权。

《企业会计准则第3号---投资性房地产》

比较与分析

一、制定背景:

企业会计准则第3号-投资性房地产

企业会计准那么第3号──投资性房地产一、目的与实施X围投资性房地产是指以赚取租金或资本增值为目的而持有的房地产。

《国际会计准那么第40号——投资性房地产》将房地产的X围定义为房屋和土地,而在中国,土地归国家或集体所有,企业只能取得土地使用权。

因此,本准那么中的房地产实际上指的是“土地使用权〞和建筑物,而不是所有权。

对于投资性房地产业务2000年颁发的《企业会计制度》中没有专门的规定。

2004年,财政部在“关于执行《企业会计制度》和相关会计准那么问题解答〔四〕〞中,对房地产企业用于对外出租的房地产给出过专门的解释。

新准那么借鉴了国际会计准那么的类似规定,无论从形式还是内容都较原规定更完整、规X,尤其特殊的是引入了“公允价值〞的计价方法,允许企业在期末符合条件的前提下,按照公允价值对投资性房地产价值进展重新计价,并将公允价值与账面价值之间的差额,计入当期损益。

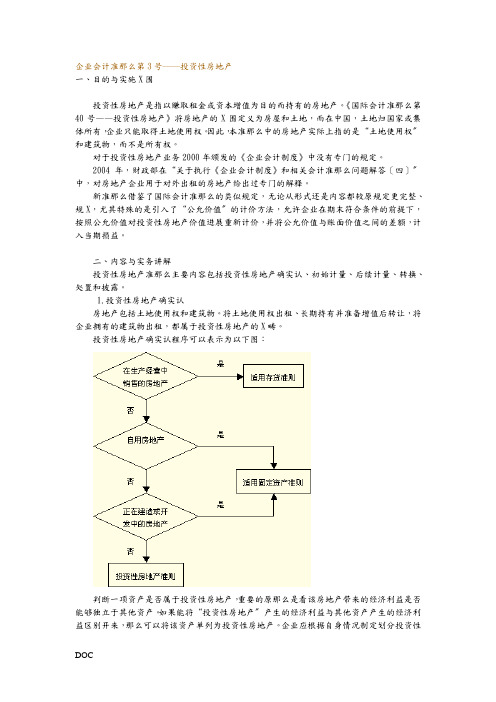

二、内容与实务讲解投资性房地产准那么主要内容包括投资性房地产确实认、初始计量、后续计量、转换、处置和披露。

1.投资性房地产确实认房地产包括土地使用权和建筑物。

将土地使用权出租、长期持有并准备增值后转让,将企业拥有的建筑物出租,都属于投资性房地产的X畴。

投资性房地产确实认程序可以表示为以下图:判断一项资产是否属于投资性房地产,重要的原那么是看该房地产带来的经济利益是否能够独立于其他资产。

如果能将“投资性房地产〞产生的经济利益与其他资产产生的经济利益区别开来,那么可以将该资产单列为投资性房地产。

企业应根据自身情况制定划分投资性房地产与自用房地产之间的标准,并在会计报告附注中披露投资性房地产的种类。

按照本准那么的规定,投资性房地产同时满足以下条件的,才能予以确认:〔1〕该投资性房地产包含的经济利益很可能流入企业;〔2〕该投资性房地产的本钱能够可靠计量。

2.初始计量投资性房地产初始计量按照取得本钱计量。

如果是外购房地产,包括购置价款和可直接归属于该资产的相关税费;如果是自行建造的房地产,包括使该资产到达预定可使用状态前所发生的所有必要支出。

新企业会计准则科目英文版

Deposit for Capital Recognizance Fixed Assets Accumulative Depreciation Reserve for Fixed Assets Impairment Construction in Process

58 59 60 61 62

1605

2721 独立账户负债 2801 2802 2811 2901 长期应付款 未确认融资费 用 专项应付款 递延所得税负 债

1461 存货跌价准备 1501 待摊费用 保险专用

1511 独立账户资产 1521 持有至到期投 资 持有至到期投 资减值准备 可供出售金融 资产

Capital in Independent Accounts Held-To-Maturity Investment Reserve for Held-To-Maturity Investment Impairment Financial Assets Available for Sale Long-term Equity Investment Reserve for Long-term Equity Investment Impairment Investment Real Estate Long-term Accounts Receivable Unrealized Financing Profits

周转材料 贵金属 抵债资产 损余物资

建造承包商 专用 银行专用 金融共用 保险专用

Revolving Materials Expensive Metals Capital for Debt Payment Salvage Value Of Insured Properties Reserve For Stock Depreciation Unamortized Expenditures

《企业会计准则第3号——投资性房地产》应用指南

《企业会计准则第3号——投资性房地产》应用指南企业会计准则第3号,投资性房地产(下文简称《准则》)是由中国国家会计准则委员会制定的关于企业会计准则第3号的应用指南,本文将对《准则》进行解读与分析。

首先,《准则》的目的在于规范投资性房地产的会计处理,进一步增强会计信息的可比性和透明度。

《准则》适用于所有以出租、财政租赁或资本化为目的的房地产。

在应用本《准则》时,企业应根据其交易性和长期持有的分类来确定投资性房地产的会计处理方法。

《准则》明确了投资性房地产的定义和分类。

投资性房地产是指企业出租、财政租赁或资本化以获取租金、增值或进行受益于投资物业的资金投资的房地产。

企业应根据投资性房地产的使用目的和预期获取的收益来确定其分类,分为交易性和长期持有两类。

交易性投资性房地产是指准备进行快速出售或进行,或按成本衡量的房地产,而长期持有投资性房地产是指拥有并准备在相当长时间内使用或出租的房地产。

《准则》对投资性房地产的计量提供了详细的规定。

交易性投资性房地产应按公允价值计量并计入当期损益,同时公允价值变动应记入利润表。

而长期持有投资性房地产应按成本计量,并通过资产减值测试进行减值测试,如有必要,进行资产减值准备的冲销。

《准则》进一步明确了投资性房地产的资产减值测试和资产减值准备的确定方法。

企业应当根据投资性房地产的特定情况和市场条件,进行资产减值测试,如若发现有减值迹象,则应进行资产减值准备。

而对于长期持有投资性房地产,企业应当根据公允价值模型或成本模型进行减值测试,选择较低的值进行资产计量。

《准则》还对投资性房地产的信息披露提出了要求。

企业应在财务报表中明确披露投资性房地产的分类、计量、减值测试、减值准备等信息,以便投资者和其他利益相关者了解企业的投资性房地产相关情况。

综上所述,《企业会计准则第3号,投资性房地产》应用指南对企业会计处理投资性房地产提供了指导,并规定了投资性房地产的定义、分类、计量、减值测试和披露要求。

新会计准则英文版

新会计准则英文版新企业会计准则中英对照(仅供B组小伙伴参考)1.存货 Inventory2.长期股权投资 Long-term Equity Investment3.投资性房地产 Investment Real Estate4.固定资产 Fixed Assets5.生物资产 Biological Assets6.无形资产 Intangible Assets7.非货币性资产交换 Exchange of Non-monetary Assets8.资产减值 Assets Impairment9.职工薪酬 Wages and Salaries of Employees10.企业年金基金 Enterprise Annuity Fund11.股份支付 Share-based Payments12.债务重组 Debt Restructuring13.或有事项 Contingencies14.收入 Revenues15.建造合同 Construction Contracts16.政府补助 Government Grants17.借款费用 Borrowing Costs18.所得税 Income T ax19.外币折算 Foreign Currency Translation20.企业合并 Business Combination21.租赁 Leases22.金融工具确认和计量Recognition and Measurement of Financial Instrument23.金融资产转移 Transfer of Financial Assets24.套期保值 Hedging25.原保险合同 Direct Insurance Contracts26.再保险合同 Reinsurance Contracts27.石油天然气开采 Exploitation of Petroleum and Natural Gas28.会计政策、会计估计变更和差错更正 Changes in Accounting Policies andEstimates and Corrections of Errors29.资产负债表日后事项 Events after the Balance Sheet Date30.财务报表列报 Financial Statement Presentation31.现金流量表 Cash Flow Statement32.中期财务报告 Interim Financial Reporting33.合并财务报表 Consolidate Financial Statement34.每股收益 Earning Per Share/EPS35.分部报告 Segment Reporting36.关联方披露 Disclosure of Related Parties37.金融工具列报 Presentation of Financial Instruments38.首次执行企业会计准则Initial Adoption of Accounting Standard for Enterprises。

企业会计准则——投资性房地产

例:2007年,甲企业的一栋写字楼对外出租,采用成本 模式进行后续计量。2009年2月1日,假设企业持有的投 资性房地产满足采用公允价值模式条件,企业决定采用 公允价值模式对该写字楼进行后续计量。2009年2月1日, 该写字楼原价为9000万元,已提折旧270万元,账面价 值8730万元,公允价值为9500万元。甲企业按净利润的 10%提盈余公积。

二、投资性房地产的范围

4、企业拥有并自行经营的旅馆饭店,不 属于投资性房地产。

将其拥有的旅馆饭店部分或全部出租,且 出租的部分能够单独计量的,出租的部分 可确认为投资性房地产。

三、投资性房地产的后续计量

投资性房地产应当按照成本进行初始确认和计量,其 后续计量模式有两种: (一)通常应当采用成本模式进行计量 (二)只有符合规定条件的,才可以采用公允价值模 式进行计量 相关规定: 1、计量模式一经确定,不得随意变更。成本模式转 为公允价值模式的,应当作为会计政策变更,将转换时 公允价值与账面价值的差额,调整期初留存收益(未分 配利润)。 2、已采用公允价值模式的,不得转为成本模式。 3、同一企业只能采用一种模式对所有投资性房地产 进行后续计量,不利同时采用两种计量模式。

四、房地产的转换

转换形式包括: 1、投资性房地产开始自用,相应地由投资性房地产转换 为固定资产或无形资产。如企业将出租的厂房收回用于 生产本企业的产品。从事房地产开发的企业将出租的开 发产品收回,作为企业的办公楼使用。 2、作为存货的房地产,改为出租,相应地由存货转换为 投资性房地产 3、自用土地使用权停止自用,用于赚取租金或资本增值, 相应地由无形资产转换为投资性房地产 4、自用建筑物停止自用,改为出租,相应地由固定资产 转换为投资性房地产 5、房地产企业将用于经营出租的房地产重新开发用于对 外销售,从投资性房地产转为存货。

国际会计准则第40号投资性房地产.doc

国际会计准则第40号——投资性房地产财政部会计司组织翻译目的本准则的目的是规范投资性房地产的会计处理和相关披露要求。

范围1、本准则适用于投资性房地产的确认、计量和披露。

2、除其它问题外,本准则涉及在融资租赁承租人财务报表中投资性房地产的计量和经营租赁出租人财务报表中投资性房地产的计量。

本准则不涉及《国际会计准则第17号——租赁》所包括的下列事项:(1)融资租赁或经营租赁的划分;(2)投资性房地产赚取的租赁收益的确认(参见《国际会计准则第18号——收入》);(3)在经营租赁承租人财务报表中房地产的计量;(4)在融资租赁出租人财务报表中房地产的计量;(5)售后租回交易的会计;(6)融资租赁和经营租赁的披露。

3、本准则不适用于:(1)森林和类似再生性自然资源;(2)矿产权、矿产勘探开采、石油、天然气和类似非再生性自然资源。

定义4、本准则使用的下列术语,其含义为:投资性房地产,指为赚取租金或为资本增值,或两者兼有而(由业主或融资租赁的承租人)持有的房地产(土地或建筑物,或建筑物的一部分,或两者兼有),但不包括:(1)用于商品或劳务的生产或供应,或用于管理目的的房地产;或(2)在正常经营过程中销售的房地产。

自用房地产,指为用于商品或劳务的生产或供应,或用于管理目的而(由业主营融资租赁的承租人)持有的房地产。

公允价值,指在公平交易中,熟悉情况的当事人自愿据以进行资产交换的金额。

成本,指资产购置或建造时,为取得该资产而支付的现金或现金等价物的金额、或其它对价的公允价值。

账面金额,指在资产负债表中确认的资产金额。

5、房地产投资是为了赚取租金或资本增值,或两者兼有。

因此,投资性房地产产生的现金流量在很大程度上独立于企业持有的其它资产。

这一点将投资性房地产与自用房地产区分开来。

商品或劳务的主产或供应过程中使用的房地产(或用于管理目的房地产)产生的现金流量不仅归属于该项房地产,而且归属于在生产或供应过程中所使用的其它资产。

- 1、下载文档前请自行甄别文档内容的完整性,平台不提供额外的编辑、内容补充、找答案等附加服务。

- 2、"仅部分预览"的文档,不可在线预览部分如存在完整性等问题,可反馈申请退款(可完整预览的文档不适用该条件!)。

- 3、如文档侵犯您的权益,请联系客服反馈,我们会尽快为您处理(人工客服工作时间:9:00-18:30)。

Accounting Standard for Business Enterprises No.3—Investment PropertyChapter 1 General ProvisionsArticle 1 This standard is formulated in accordance with the “Accounting standard for Business Enterprises—Basic Standard”for the purpose of prescribing the recognition and measurement of investment property and the disclosure of related information.Article 2 Investment property is property held to earn rentals or for capital appreciation or both.Article 3 The following items of investment property are dealt with by this standard:(a)a land use right that is leased out.(b)a land use right held for transfer upon capital appreciation.(c)a building that is leased out.Article 4 The following items are not investment property:(a)owner-occupied property, i.e.property held for use in the production or supply of goods or services or for administrative purposes.(b)property held as inventories.Article 5 the following items are dealt with under other appropriate Accounting Standards:(a)property constructed on behalf of others, which are dealt with under “Accounting standard for Business Enterprises No.15—Construction Contracts”.(b)rental income from, and sale and lease back of, investment property, which are dealt with under “Accounting standard for Business Enterprises No.21—Leases”.Chapter 2 Recognition and InitialMeasurementArticle 6 Investment property shall be recognized as asset when, and only when both of the following conditions are satisfied:(a)it is probable that the future economic benefits that are associated with the investment property will flow to the enterprise;(b)the cost of the investment property can be measured reliably.Article 7 An investment property shall be measured initially at its cost. (a)the cost of a purchased investment property comprises its purchase prise, related taxes and fee, and other directly attributable expenditures. (b)the cost of a self-constructed investment property is its cost at the date when the construction or development is complete.(c)the cost of an investment property obtained in other ways shall be determined in accordance with the appropriate Specific Accounting Standard for Business Enterprises.Article 8 Subsequent costs incurred for an investment property that meet the recognition criteria stipulated in Article 6 shall be included in the cost of the investment property. Subsequent costs that fail to meet the recognition criteria in Article 6 shall be recognized in profit or loss in the period in which they are incurred.Chapter 3 Subsequent Measurement Article 9An enterprise shall use the cost model for subsequent measurement of investment property at the balance sheet date, except as stipulated in Article 10 of this Standard.Subsequent measurement of buildings accounted for using the cost model is dealt with under “Accounting Standard for Business Enterprises No.4—Fixed Assets”.Subsequent measurement of land use right accounted for using the cost model is dealt with under “Accounting Standard for Business Enterprises No.6—Intangible Assets”.Article 10 If there is clear evidence that the fair value of an investment property can be reliably determinable on a continuing basis, the fair value model may be used for subsequent measurement of the investment property.Both of the following conditions shall be met if the fair value model is to be used:(a)there is a active property market in the location in which the investment property is situated;(b)the enterprise can obtain the market price and other relevant information regarding the same type of or similar properties from the property market, so as to reasonably estiamte the fair value of the investment property.Article 11 When the fair value model is used, no depreciation or amotization is provided for an investment property. The carrying amount of the investment property shall be adjusted to its fair value at the balance sheet date. The difference between the fair value and the original carrying amount is recognized in profit or loss for the current period.Article 12 Once a measurement model for investment property is chosen, an enterprise shall not change the model arbitrarily. A change from the cost model to the fair value model shall be accounted for as a change in accounting policy and dealt with in accordance with “Accounting Standard for Business Enterprises No.28—Changes in Accounting policies and Accounting Estimates and Corrections of Errors” .For investment property accounted for using the fair value model, achange from the fair value model to the cost model is not permitted.Chapter 4 TransfersArticle 13 Transfers to, or from, investment property shall be made when, and only when, there is a change in use, clearly evidenced by one of the following conditions:(a)commencement1of owner-occupation, for a transfer from investment property to owner-occupied property.(b)end of development with a view to sale, and commencement of an operating lease to another party, for a transfer from inventories to investment property.(c)end of owner-occupation, and commencement of being held to earn rentals2or for capital appreciation3, for an transfer from owner-occupied land use right to investment property.(d)end of owner-occupation, and commencement of an operating lease to ahother party, for a transfer from owner-occupation building to investment property.Article 14For a transfer from investment property carried at the cost model to owner-occupied property, or a transfer from owner-occupied property or inventories to investment property carried at the cost model, the carrying amount of a property before its transfer shall be regarded as the recorded amount after its transfer.Article 15For a transfer from investment property carried at the fair value model to owner-occupied property, its fair value at the date of transfer is regarded as the carrying amount of the owner –occupied property. The difference between the fair value and the original carrying amount is recognized in profit or loss for the current period.Article 16 For a transfer from owner-occupied property or inventories to investment property carried at the fair value model, the investment property is measured at its fair value at the date of the transfer. If the fair value at the date of transfer is less than the original carrying amount, the difference is charged to profit or loss for the current period. If the fair value at the date of transfer exceeds the original carrying amount, the difference is recognized in owners’equity.Chapter 5 DisposalsArticle 17 An investment property shall be derecognized on disposal or 1[kə'mensmənt] 名词n. [U][C] 1.开始,发端2.【美】学位授予典礼;毕业典礼2['rentl] 名词n. 1.租金;租金收入[C]The quarterly rental will be $50,000.每季度租金为五万元。