公司理财复习重点2

公司理财复习资料

公司理财复习资料一、公司理财概述公司理财是指企业利用自身的资金进行投资、融资和风险管理等活动的过程。

它是企业经营管理的重要组成部分,对于企业的发展和盈利能力具有重要影响。

公司理财的目标是实现资金的最优配置,提高企业的资金利用效率和经营绩效。

二、公司理财的基本原则1.资金安全原则:保证企业资金的安全性,防范各种风险。

2.流动性原则:保持企业资金的流动性,确保企业能够及时满足各项支付需求。

3.收益性原则:追求资金的最大收益,提高企业的盈利能力。

4.风险与收益的平衡原则:在追求高收益的同时,要合理控制风险,确保企业的稳定发展。

三、公司理财的主要内容1.资金筹集:包括自有资金的调配和融资活动,如股权融资、债权融资等。

2.资金投资:根据企业的经营需求和风险偏好,进行资金的投资,如购买股票、债券、房地产等。

3.资金运营:通过优化企业的资金结构和流动性管理,提高企业的资金使用效率。

4.风险管理:对企业面临的各种风险进行评估和控制,如市场风险、信用风险、流动性风险等。

四、公司理财的方法和工具1.资金预测与规划:通过对企业的财务数据进行分析,预测未来的资金需求,制定合理的资金规划。

2.投资组合管理:通过分散投资的方式降低风险,提高投资收益。

3.财务风险管理:采取多种方法,如保险、期货、衍生品等,对企业面临的财务风险进行管理和避免。

4.资金流动性管理:通过合理的现金管理、短期投资等方式,保持企业的资金流动性,确保支付能力和运营的顺畅。

五、公司理财的挑战与对策1.市场风险:企业面临的市场变化和不确定性,需要及时调整投资组合,降低风险。

2.信用风险:与供应商、客户等交易伙伴的信用风险,需要建立合理的信用管理制度。

3.流动性风险:企业面临的资金流动性不足,需要合理规划资金运营,保持充足的流动性。

4.利率风险:由于利率波动导致的资金成本变化,需要采取利率风险管理工具,如利率互换、利率期货等。

六、公司理财的案例分析1.投资决策:某公司面临投资决策,通过对市场行情、竞争对手等因素的分析,选择了具有较高收益和较低风险的投资项目。

公司理财复习重点

公司理财复习重点公司理财是企业运营管理中至关重要的一个方面。

它涉及到资金的筹集、投资和使用,以及财务风险的管理。

对于学习和复习公司理财的重要知识点,下面将介绍一些关键内容,帮助读者更好地理解和应用这些知识。

一、财务报表财务报表是公司理财的基础,主要包括资产负债表、损益表和现金流量表。

学习财务报表需要掌握基本的会计知识,包括资产、负债、所有者权益、收入和费用等概念。

同时,了解财务报表的编制方法和解读技巧也是必不可少的。

资产负债表反映了公司在某一时点上的资产、负债和所有者权益情况。

学习资产负债表时,要理解资产和负债的分类及其变动情况对公司财务状况的影响。

损益表反映了公司在一定时期内的收入、费用和利润情况。

学习损益表时,要了解收入和费用的分类,以及它们对公司盈利能力的影响。

现金流量表反映了公司在一定时期内的现金流入和流出情况。

学习现金流量表时,要理解现金流量的分类,包括经营活动、投资活动和筹资活动等,并分析其对公司的现金状况和经营能力的影响。

二、财务分析方法财务分析是利用财务数据和指标对公司财务状况和经营情况进行评估的方法。

常用的财务分析方法包括财务比率分析、财务趋势分析和财务比较分析。

财务比率分析是通过计算几个代表公司的财务指标来评价其财务状况和经营能力。

常用的财务比率包括流动比率、速动比率、负债比率、资产周转率和利润率等。

而财务趋势分析则可以通过比较不同期间的财务数据来评估公司的发展趋势,判断其是否具有可持续性。

另外,财务比较分析可以将公司的财务数据与同行业或同类公司进行比较,帮助判断其在行业中的地位和竞争力。

三、资本预算和投资决策资本预算是指对公司长期投资项目的决策过程。

在进行资本预算时,需要运用财务评价方法来评估投资项目的盈利能力和风险。

常用的财务评价方法包括净现值法、内部收益率法和投资回收期法。

净现值法通过计算项目的现金流量与其折现值之间的差额来评估项目的可行性。

内部收益率法是指通过计算项目的内部收益率来比较项目的投资回报率和公司的资本成本。

XXX《公司理财》重点知识整理

XXX《公司理财》重点知识整理第一章导论1.公司目标:为所有者创造价值公司价值在于其产生现金流能力。

2.财务管理的目标:最大化现有股票的每股现值。

3.公司理财可以看做对一下几个问题进行研究:1.资本预算:公司应该投资什么样的长期资产。

2.资本结构:公司如何筹集所需要的资金。

3.净运营资本管理:如何管理短期经营活动产生的现金流。

4.公司制度的优点:有限责任,易于转让所有权,永续经营。

缺点:公司税对股东的双重课税。

第二章会计报表与现金流量资产=负债+所有者权益(非现金项目有折旧、递延税款)EBIT(经营性净利润)=净销售额-产品成本-折旧XXX折旧及摊销现金流量总额CF(A)。

=经营性现金流量-资本性支出-净运营资本增长额= CF(B) + CF(S)经营性现金流量OCF =息税前利润+折旧-税资本性输出=固定资产增长额+折旧净运营资本=流动资产-流动欠债第三章财务报表阐发与财务模型1.短期偿债能力指标(流动性指标)流动比率=流动资产/流动负债(一般情况大于一)速动比率= (流动资产-存货)/流动负债(酸性实验比率)现金比率=现金/流动欠债流动性比率是短期债权人关心的,越高越好;但对公司而言,高流动性比率意味着流动性好,大概现金等短期资产运用效率低下。

对于一家拥有强大借款能力的公司。

看似较低的流动性比率可能并非坏的旌旗灯号2.长期偿债能力指标(财务杠杆指标)欠债比率= (总资产-总权益)/总资产or (长期负债+流动欠债)/总资产权益乘数=总资产/总权益= 1 +负债权益比利息倍数=。

EBIT/利息现金对利息的保障倍数(Cash coverage ) =EBITDA/利息3.资产管理或资金周转指标存货周转率=产品贩卖成本/存货存货周转天数365天/存货周转率应收账款周转率=(赊)贩卖额/应收账款总资产周转率=销售额/总资产= 1/资本密集度4.盈利性指标销售利润率=净利润/销售额资产收益率ROA =净利润/总资产权益收益率ROE =净利润/总权益5.市场价值度量指标市盈率=每股价格/每股收益EPS其中EPS =净利润/刊行股票数市值面值比=每股市场价值/每股账面价值企业价值XXX市值+有息欠债市值-现金EV乘数= EV/EBITDA6.XXX恒等式ROE =销售利润率(经营效率)资产周转率(资产运用效力)x权益乘数(财杠)ROA =销售利润率资产周转率7.贩卖百分比法假设项目随销售额变动而成比例变动,目的在于提出一个生成预测财务报表的快速实用方法。

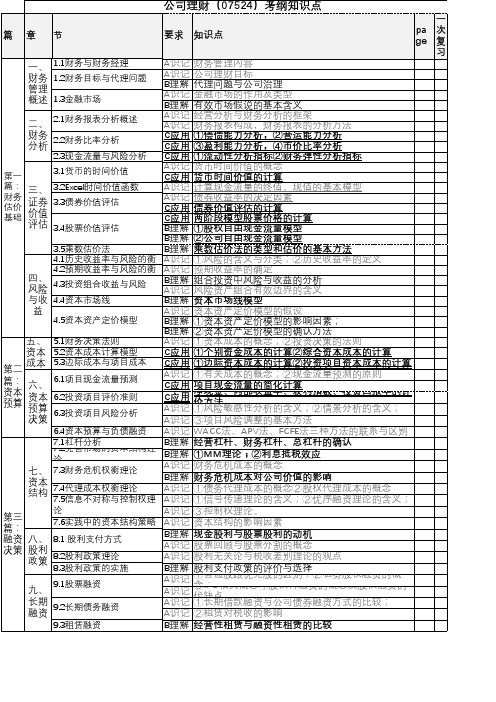

公司理财 考纲知识点

第三 篇:

论 7.6实践中的资本结构策略

融资 八、 8.1 股利支付方式

决策

股利 政策

8.2股利政策理论 8.3股利政策的实施

九、 9.1股票融资

长期 融资

9.2长期债务融资

A识记 ③控制权理论。

A识记 资本结构的影响因素

B理解 现金股利与股票股利的动机

A识记 股票回顾与股票分割的概念

A识记 股利无关论与税收差别理论的观点

②①可买转权换、债卖券权的分估析价;②股票债券期权估价;③隐含 期①权实物期权的类型;②实物期权估价的B/S模型

A识记 ③实物期权分析与折现现金流量的比较

A识记 远期、期货、互换和期权合约的特点

A识记 ①外汇风险的概念;②外汇风险的类型;

A识记 ③期权组合分析

B理解 远期、货币期权市场风险对冲机制

具与

A识记 经营分析与财务分析的框架 A识记 财务报表构成,财务报表的分析方法

财务 分析

2.2财务比率分析

C应用 ①偿债能力分析,②营运能力分析 C应用 ③盈利能力分析,④市价比率分析

2.3现金流量与风险分析 C应用 ①流动性分析指标②财务弹性分析指标

第一

3.1货币的时间价值

A识记 货币时间价值的概念 C应用 货币时间价值的计算

篇: 财务 估价 基础

三、 证券 价值 评估

3.2Excel时间价值函数 3.3债券价值评估

3.4股票价值评估

A识记 计算现金流量的终值、现值的基本模型 A识记 债券收益率的决定因素 C应用 债券价值评估的计算 C应用 两阶段模型股票价格的计算 B理解 ①股权自由现金流量模型

B理解 ②公司自由现金流量模型

篇: 资本 预算

公司理财-知识重点

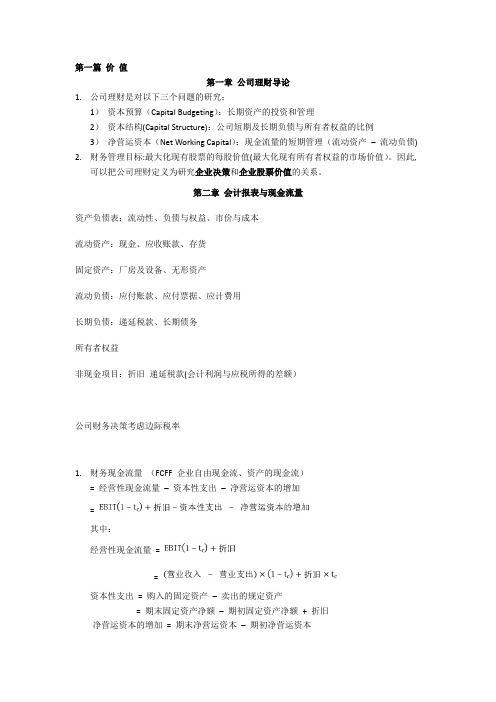

第一篇价值第一章公司理财导论1.公司理财是对以下三个问题的研究:1)资本预算(Capital Budgeting):长期资产的投资和管理2)资本结构(Capital Structure):公司短期及长期负债与所有者权益的比例3)净营运资本(Net Working Capital):现金流量的短期管理(流动资产–流动负债) 2.财务管理目标:最大化现有股票的每股价值(最大化现有所有者权益的市场价值)。

因此,可以把公司理财定义为研究企业决策和企业股票价值的关系。

第二章会计报表与现金流量资产负债表:流动性、负债与权益、市价与成本流动资产:现金、应收账款、存货固定资产:厂房及设备、无形资产流动负债:应付账款、应付票据、应计费用长期负债:递延税款、长期债务所有者权益非现金项目:折旧递延税款(会计利润与应税所得的差额)公司财务决策考虑边际税率1.财务现金流量(FCFF 企业自由现金流、资产的现金流)= 经营性现金流量–资本性支出–净营运资本的增加=其中:经营性现金流量==资本性支出= 购入的固定资产–卖出的规定资产= 期末固定资产净额–期初固定资产净额+ 折旧净营运资本的增加= 期末净营运资本–期初净营运资本注:EBIT = 销售收入–销售成本–销售费用、一般费用及管理费用–折旧+ 其他利润这里,可以看出NOPAT = NOPLAT2.计算项目的现金流:看第六章。

3.会计现金流量表= 经营活动产生的现金流量+ 投资活动产生的现金流量+ 筹资活动产生的现金流量第三章财务报表分析与财务模型1.盈余的度量指标:1 ) Net Income: 净利润= 总收入–总支出2)EPS:每股收益= 净利润/发行在外的总股份数3)EBIT: 息税前利润= 经营活动总收入–经营活动总成本= 净利润+ 财务费用+ 所得税(可排除资本结构(利息支出)和税收的影响)4) EBITDA: 息税及折旧和摊销前利润= EBIT + 折旧和摊销财务比率分析一、变现能力比率1、流动比率=流动资产÷流动负债2、速动比率=(流动资产-存货)÷流动负债3、营运资本=流动资产-流动负债二、资产管理比率1、存货周转率(次数)=主营业务成本÷平均存货2、应收账款周转率=主营业务收入÷平均应收账款3、营业周期=存货周转天数+应收账款周转天数总资产周转率=销售收入/总资产三、负债比率1、产权比率=负债总额÷股东权益2、已获利息倍数=息税前利润÷利息费用=EBIT/I四、盈利能力比率净资产收益率=净利润÷平均净资产销售利润率=净利润/销售额ROA资产收益率=净利润/总资产权益收益率ROE=净利润/总权益五、杜邦财务分析体系所用指标1、权益收益率=资产净利率ROA×权益乘数=ROA*(1+负债权益比)=销售净利率×总资产周转率×权益乘数 =资产收益率/权益乘数2、权益乘数=资产/总权益六、上市公司财务报告分析所用指标1、每股收益(EPS)=(EBIT-I)(1-T)/普通股总股数=每股净资产×净资产收益率(当年股数没有发生增减变动时,后者也适用)2、市盈率=普通股每股市价/普通股每股收益3、每股股利=股利总额/年末普通股股份总数4、股利支付率=股利总额/净利润总额=市盈率×股票获利率(当年股数没有发生增减变动时,后者也适用)5、股票获利率=普通股每股股利/普通股每股市价(又叫:当期收益率、本期收益率)6、股利保障倍数=每股收益/每股股利7、每股净资产=年度末股东权益/年度末普通股数8、市净率=每股市价/每股净资产9、净资产收益率=净利润/年末净资产七、现金流量分析指标(一)现金流量的结构分析经营活动流量=经营活动流入-经营活动流出(二)流动性分析(反映偿债能力)1、现金到期债务比=经营现金流量净额/本期到期债务2、现金流动负债比(重点)=经营现金流量净额/流动负债(反映短期偿债能力)3、现金债务总额比(重点)=经营现金流量净额/债务总额(三)获取现金能力分析1、销售现金比率=经营现金流量净额/销售额2、每股营业现金流量(重点)=经营现金流量净额/普通股股数3、全部资产现金回收率=经营现金流量净额/全部资产×100%(四)财务弹性分析1、现金满足投资比率2、现金股利保险倍数(重点)=每股经营现金流量净额/每股现金股利(五)收益质量分析现金营运指数=经营现金的净流量/经营现金毛流量比率分析法相关指标详解1、变现能力比率变现能力是企业产生现金的能力,它取决于可以在近期转变为现金的流动资产的多少。

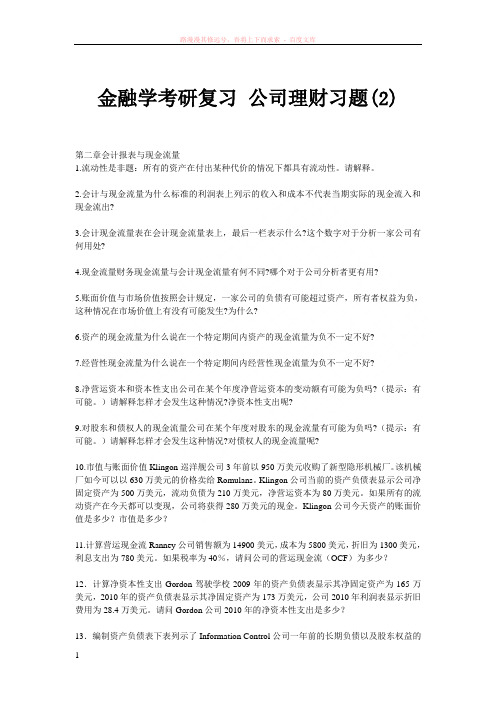

金融学考研复习 公司理财习题(2)

金融学考研复习公司理财习题(2)第二章会计报表与现金流量1.流动性是非题:所有的资产在付出某种代价的情况下都具有流动性。

请解释。

2.会计与现金流量为什么标准的利润表上列示的收入和成本不代表当期实际的现金流入和现金流出?3.会计现金流量表在会计现金流量表上,最后一栏表示什么?这个数字对于分析一家公司有何用处?4.现金流量财务现金流量与会计现金流量有何不同?哪个对于公司分析者更有用?5.账面价值与市场价值按照会计规定,一家公司的负债有可能超过资产,所有者权益为负,这种情况在市场价值上有没有可能发生?为什么?6.资产的现金流量为什么说在一个特定期间内资产的现金流量为负不一定不好?7.经营性现金流量为什么说在一个特定期间内经营性现金流量为负不一定不好?8.净营运资本和资本性支出公司在某个年度净营运资本的变动额有可能为负吗?(提示:有可能。

)请解释怎样才会发生这种情况?净资本性支出呢?9.对股东和债权人的现金流量公司在某个年度对股东的现金流量有可能为负吗?(提示:有可能。

)请解释怎样才会发生这种情况?对债权人的现金流量呢?10.市值与账面价值Klingon巡洋舰公司3年前以950万美元收购了新型隐形机械厂。

该机械厂如今可以以630万美元的价格卖给Romulans。

Klingon公司当前的资产负债表显示公司净固定资产为500万美元,流动负债为210万美元,净营运资本为80万美元。

如果所有的流动资产在今天都可以变现,公司将获得280万美元的现金。

Klingon公司今天资产的账面价值是多少?市值是多少?11.计算营运现金流Ranney公司销售额为14900美元,成本为5800美元,折旧为1300美元,利息支出为780美元。

如果税率为40%,请问公司的营运现金流(OCF)为多少?12.计算净资本性支出Gordon驾驶学校2009年的资产负债表显示其净固定资产为165万美元,2010年的资产负债表显示其净固定资产为173万美元,公司2010年利润表显示折旧费用为28.4万美元。

公司理财知识点整理重点

第一章总论1三大理财活动2公司理财的目标(选择判断)1、利润最大化缺陷:没有考虑利润取得的时间/利润取得和风险大小的关系易产生短期行为/易被操纵利润与投入资本额的关系2、每股收益最大化(EPS)缺陷:仅克服了未考虑利润与投入资本额的关系缺点3、股东财富最大化缺陷:股价波动与公司财务状况的实际变动不一定相一致未来现金流量及贴现率的估计也有一定的主观性3股东与管理者之间的代理问题含义:现代公司中所有权与控制权相分离导致所有者与管理者的利益矛盾。

股东的目标是公司财富最大化,管理者的目标是高报酬、优越的办公条件等。

解决方法(1)监督方式:与管理者签定合同,审计财务报表,限制管理者的决策权(2)激励方式:年薪制,股权激励股东与债权人之间的代理问题股东强调借入资金的收益性与债权人强调贷款的安全性的矛盾解决方法。

(债权人角度)(1)在借款合同中加入限制性条款。

如规定资金的用途、规定资产负债率、规定不得发行新债等。

(2)拒绝进一步合作。

不提供新的贷款或提前收回贷款。

第2章公司理财的价值观念之一:时间价值1.复利终值F=P(1+i)n== P*复利终值系数== P*(F/P,i,n)2.复利现值P=F(1+i)n=F*复利值现系数=F*(P/F, i,n)3后付年金终值(普通年金终值)F=A*(F/A,i,n)=A*ii n1)1(4后付年金现值(普通年金现值)P=A*(P/A,I,n)=A*ii n)1(15先付年金的终值=A*[(F/A,i,n+1)-1]6先付年金的现值=A*[(P/A,i,n-1)+1]7递延年金终值递延年金终值的计算方法与普通年金终值的计算方法相似,其终值的大小与递延期限无关。

8递延年金现值方法一:第一步把递延年金看作n 期普通年金,计算出递延期末的现值;第二步将已计算出的现值折现到第一期期初。

方法二,第一步计算出(m+n)期的年金现值;第二步,计算m期年金现值;第三步,将计算出的(m+n)期扣除递延期m 的年金1111n iF A i1111n iP A i现值,得出n 期年金现值。

公司理财复习重点

公司理财复习重点在当今竞争激烈的商业环境中,公司理财是管理团队必须掌握的重要技能之一。

有效的公司理财策略对于企业的成功至关重要。

因此,理解和掌握公司理财的关键概念和方法变得尤为重要。

在本文中,我们将回顾一些公司理财的复习重点,以帮助您更好地了解和应用这些关键概念。

1. 资金需求分析公司理财的首要任务是确定和分析企业的资金需求。

这意味着公司需要评估其当前和未来的资金需求,以便做出相关的决策。

资金需求分析要考虑企业的运营资金需求、投资资金需求和筹资资金需求等方面。

2. 资本预算管理资本预算管理在公司理财中扮演着重要角色。

资本预算管理涉及确定和管理企业的长期投资项目。

这包括评估投资项目的潜在回报和风险,以及制定相应的投资决策,例如决定是否进行投资、何时进行投资以及如何融资等。

3. 资金成本管理资金成本管理是公司理财中的另一个重点。

企业需要有效地管理其资金成本,以最大化股东权益和企业价值。

资金成本管理要考虑到企业的债务成本和股本成本,并制定相应的融资策略和股权结构。

4. 现金流量分析现金流量是公司理财中的核心概念之一。

现金流量分析帮助企业预测和管理其日常业务中的现金流入和现金流出。

企业需要了解其现金流量状况,以便做出相关的经营和投资决策。

5. 资本结构管理资本结构管理是指企业如何融资和管理其资本结构。

企业可以通过债务融资和股权融资等方式来获得资金。

资本结构管理的目标是找到最佳的资本结构,以最大化股东权益,并平衡债务风险和股权分配。

6. 风险管理和保险风险管理是公司理财中的另一个重要方面。

企业需要评估和管理其面临的各种风险,包括市场风险、信用风险和操作风险等。

保险是一种常见的风险管理工具,可以帮助企业转移和减少潜在的风险。

7. 财务报表分析财务报表分析是评估企业财务状况和绩效的重要方法。

企业需要学会分析财务报表,包括利润表、资产负债表和现金流量表等。

财务报表分析可以揭示企业的利润能力、偿债能力和经营效率等关键指标。

公司理财知识点总结大全

公司理财知识点总结大全一、公司理财的基本概念与原则1. 简介公司理财是指公司运用资金和资源,以最优化的方式进行投资和资金管理,以达到降低风险、提高投资收益、增强经营活力和提高企业价值的目的。

公司理财是企业财务管理的重要组成部分,对于企业的发展和经营至关重要。

2. 基本概念(1)投资理念:公司理财的核心是投资,即公司运用自有资金进行投资和资金管理,以获取最大的利润和价值增值。

(2)风险管理:公司理财需要关注投资的风险,并且采取相应的风险管理措施,降低风险,保障资金的安全和稳健。

(3)流动性管理:公司理财需要合理安排资金的流动性,保证企业正常的营运活动,避免出现资金短缺和错失投资机会。

(4)财务规划:公司理财需要进行科学的财务规划,确定资金的投资方向和渠道,并结合企业的发展战略,优化资金配置,有序开展资金运作。

3. 基本原则(1)风险与收益之间的平衡原则:公司理财需要根据投资项目的风险水平,合理配置投资组合,以达到风险和收益的最佳平衡。

(2)流动性与盈利性的统一原则:公司理财需要同时关注资金流动性和盈利性,保证企业的正常经营和投资回报的最大化。

(3)多元化投资原则:公司理财需要进行多元化的投资,避免过于集中于某一种投资方式或领域,降低风险,提高收益。

二、公司理财的主要内容与方法1. 资金管理(1)资金计划:制定企业短期和长期的资金计划,合理安排资金的使用和募集,确保企业资金的充裕和有效运作。

(2)资金筹措:选择合适的资金来源,可通过发行债券、股权融资、银行贷款等方式筹措资金。

(3)资金运作:对企业现金流进行监控和分析,合理运用现金流,实现最大的盈利和效益。

2. 投资管理(1)投资评估:对投资项目进行分析评估,包括财务分析、风险评估、市场分析等,确定投资的可行性和前景。

(2)投资组合:根据企业的财务状况和风险承受能力,进行投资组合的选择和配置,实现最佳的风险和收益平衡。

(3)资产配置:合理配置资产,包括股票、债券、金融衍生品等,优化资产组合,提高投资回报率。

公司理财涉及的知识点

涉及的知识点一、选择题1.货币时间价值的分类、计算2.财务比率分析3.证券价值评估4.现金流量预测原则、计算方法5.风险的概念与类型6.杠杆系数的计算7.股利政策8.流动资产管理的内容9.财务比率分析10.投资项目回报期计算11.风险的比较12.最优资本结构13.实际利率与名义利率的计算14.存货管理15.财务比率计算二、判断题1.债券价值评估模型2.货币时间价值3.杠杆系数的计算4.资本结构优化决策5.股票融资的类型及性质6.应收账款的管理7.股利政策的内容8.投资项目净现值与内部收益率的关系9.风险与收益的关系10.风险的评价或比较涉及的计算题:1. 某企业计划某项投资活动,拟有甲、乙两个方案。

有关资料为:甲方案:原始投资为150万元,其中,固定资产投资100万元,流动资产投资50万元,全部资金于建设起点一次投入,该项目经营期5年,到期残值收入5万元,预计投产后年营业收入90万元,年总成本60万元。

乙方案:原始投资为210万元,其中,固定资产投资120万元,流动资产投资90万元,全部资金于建设起点一次投人,该项目建设期2年,经营期5年,到期残值收入8万元。

该项目投产后,预计年营业收入170万元,年经营成本80万元。

该企业按直线法计提折旧,全部流动资金于终结点一次收回,适用所得税率33%,资金成本率为10%。

要求:采用净现值法评价甲、乙方案是否可行,并决定选择哪一个方案。

有关资金时间价值系数如下:t 2 4 5 6 7(P/F,10%,t)0.621 0.513(P/A,10%,t) 1.736 3.170 4.3552. 某企业每年销售额为70万元,变动成本率为60%,年固定成本总额为18万元(不包括利息),所得税税率为40%,资本总额为50万元,其中普通股股本为30万元(发行普通股3万股,每股面值10元),债务资本为20万元,年利息为10%。

(10分)要求:(1)计算该企业的经营杠杆、财务杠杆。

(完整版)公司理财学习笔记

公司财务课程学习笔记一、学习内容(30分)1. 学习目标直接目标:能够具体掌握公司财务的基本理论、基础知识和基本方法,提高运用公司财务知识分析和解决实际问题的能力以及动手操作能力。

最终目标:(1)通过对本门课程的学习,能够对公司财务方面的基本知识、基本概念、基本理论有较全面的理解和较深刻的认识,对财务管理、资本预算、证券投资等基本范畴有较系统的掌握,并且能够了解和接触到世界上主流公司财务理论和最新研究成果、实务运作的机制及最新发展。

(2)能够系统地理解和掌握公司财务的基本理论和基本方法,具有从事经济和管理工作所必需公司财务专业知识以及运用会计专业知识分析和解决实际问题的基本技能。

2.章节重点及关键词第一章导论章节重点:要了解《公司财务》这本书所讲解的大致内容,同时掌握金融与财务的概述知识,了解财务管理的主要环节以及目标,了解财务管理理论的发展现状。

关键词:1、金融活动的三个层次涉及到三个不同的主体:政府、企业、家庭,分别对应着财政金融、公司财务与个人理财。

2、金融研究内容:人们是如何跨期分配稀缺的资源的,特别是投资是现在进行的而收益是未来的现金流量以及未来的现金流量是不确定的。

3、金融研究的主要问题包括:公司财务(金融)、投资(资产定价)、金融市场与金融中介、宏观层次:财政、货币银行。

第二章财务管理基础章节重点了解时间价值的概念,掌握时间价值以及年金的相关计算,重点掌握时间价值的应用,即债券与股票定价,掌握分离定理。

关键词1、时间价值:指不承担任何风险,扣除通货膨胀补偿后随时间推移而增加的价值。

也就是投资收益扣除全部风险报酬后所剩余的那一部分收益。

2、单利:指在规定期限内只就本金计算利息,每期的利息收入在下一期不作为本金,不产生新的利息收入。

计算公式为: 错误!未找到引用源。

其中P是初始投资价值,F是期末价值,t 是计息3、复利:指每期的利息收入在下一期转化为本金,产生新的利息收入。

下一期的利息收入由前一期的本利和共同生成。

双学位《公司理财学2》期末复习重点

双学位《公司理财学2》期末复习重点第一讲长期筹资管理1、销售百分比法对资本需要总量、敏感负债自发筹集的资本量、外部筹资数额的预测,资本需要总量的来源及顺序;2、融资租赁租金的确定,主要是平均分摊法的应用;3、债务资本的双刃剑效应对企业筹资带来的有利影响与不利影响;4、五种个别资本资本的计算、综合资本成本的计算;5、边际资本成本中筹资总额分界点的确定;6、经营杠杆的产生原理,经营杠杆系数的计算及影响因素分析;7、财务杠杆的产生原理,财务杠杆系数的计算及影响因素分析;8、联合杠杆的性质,联合杠杆系数的计算,联合杠杆影响因素的综合分析及重点调节对象;9、资本成本比较法、无差别点法对最佳资本结构的确定及其各自的不足;10、公司价值比较法对最佳资本结构的确定;11、融资优序理论中西方企业的实际筹资顺序。

第二讲长期投资管理1、现金流量的概念,现金流量与会计利润的对比;2、现金流量的构成项目及对折旧的理解;3、营业现金流量的估计及计算;4、投资回收期PP、净现值NPV、内含报酬率IRR、获利指数PI的计算及应用;5、净现值折现率的选取范围,NPV=0时不同折现率下所表达的含义;6、每年NCF相等时,按内含报酬率确定的年金现值系数PVIFA IRR,n与投资回收期的关系;7、已折旧固定资产出售时变现价值与账面折余价值的比较,及变现引起的现金流量的计算;8、固定资产更新决策、项目寿命期不等决策、固定资产更新与项目寿命期不等结合分析、资本限量决策的应用。

第三讲营运资金管理1、适中、紧缩、宽松的营运资金政策的理解及适用的企业范围;2、现金浮游量的含义;3、现金管理相关成本的理解,持有成本、转换成本的计算;4、存货模型应当满足的假设条件,对现金管理总成本、最佳现金持有量的确定;5、存货管理相关成本的理解,储存成本、订货成本的计算;6、存货经济批量模型对最佳经济批量、最佳订货次数、最佳订货周期、最佳经济批量占用资金的确定;7、数量折扣下存货经济批量的确定;8、订货点、保险储备的理解及计算;9、应收账款相关成本的理解,机会成本的计算;10、应收账款信用期限对企业销售规模、边际利润、信用成本的影响;11、考虑信用期限与现金折扣时,应收账款最佳信用政策的确定;12、免费信用、有代价信用、展期信用的含义,应付账款机会成本(放弃现金折扣成本)的理解及计算。

公司理财考研知识点总结

公司理财考研知识点总结一、公司理财基础知识1. 公司理财的概念及重要性公司理财是指公司运用财务管理技术,通过合理配置和管理资金,以实现财务管理目标的过程。

公司理财的重要性在于实现公司财务目标、提高资金利用率、优化资金结构、促进企业发展等。

2. 公司理财的目标公司理财的目标主要包括财务收益最大化、风险最小化、资金利用最优化等。

在实际操作中,公司需要兼顾这些目标,通过合理的财务管理来实现。

3. 公司理财的方法公司理财的方法主要包括现金管理、资本预算、资金筹集与运用等。

现金管理涉及到流动资金的管理,资本预算则是考虑对长期投资的决策,资金筹集与运用则是涉及到公司资金来源和运用的问题。

4. 公司理财的环境公司理财的环境包括宏观经济环境、微观市场环境、公司内部环境等。

这些环境会影响公司财务决策的制定和执行,需要公司进行合理的应对和管理。

二、公司财务管理1. 公司财务分析公司财务分析是对公司财务状况和经营成果的分析评价,主要包括财务比率分析、共同大小分析、财务状况变动分析等。

财务分析可以帮助公司了解自身的经营状况和财务健康度,从而作出合理的经营决策。

2. 公司财务预算公司财务预算是指按照一定的程序和方法,依据预期的经济环境和企业目标,对未来一定时期内的收入、支出、利润等进行的估计和计划。

公司通过财务预算来制定经营计划和目标,指导企业的经营活动。

3. 公司财务风险管理公司财务风险管理是指对公司的财务风险进行评估和管理,包括市场风险、信用风险、流动性风险等。

公司需要通过多样化的风险管理工具和方法,来降低不确定性和风险带来的影响。

4. 公司资本结构管理公司资本结构管理是指企业在资本构成和资本规模上的管理,主要包括债务与股权的比例、财务杠杆比例等。

公司需要通过资本结构管理,来优化资本配置和降低资本成本,以实现财务目标。

三、投资与筹资决策1. 公司投资决策公司投资决策是指公司在长期资产投资中所进行的决策,主要包括资本预算、投资项目评价等。

公司理财期末重点知识

公司理财期末重点知识公司理财重点知识第一章公司理财导论1.公司理财概念:公司理财又称财务管理,是对公司财务活动的规划和管理。

即根据资金运动规律,对公司生产经营过程中资金的筹措、投放、运用、收益分配等进行的系统管理。

(P9)2.公司理财的主要内容:公司投资、公司融资、盈利分配和营运资金管理四大部分。

(P10—12)3.公司理财目标理论:(1)利润最大化:优点,反应了企业经营行为的本质动机,也为企业加强管理、降低成本、提高生产效率提供了动力,简单明了,可以精确计量;缺点,未考虑资金时间价值、风险价值,公司的管理者会不惜损害长期利益,追求短期利益;(2)股东财富最大化:应在既定的风险水平下使股东的投资回报(即资本收益或者红利)最大化。

优点:考虑了货币的时间价值和风险价值,克服追求短期利润的行为,容易量化,便于考核和奖励;缺点:片面强调了股东利益,忽视了企业其他的利益相关者。

(3)公司价值最大化:为各利益相关者创造最大价值。

(4)英美:股东财富最大化欧洲和日本、中国:公司价值最大化(P13—14)第二章金融系统与公司理财1.理财环境定义:财务决策必须在一个复杂的外部环境里做出,这个环境包括法律制度、金融系统、税收体质等。

外部环境不但决定了公司财务决策可以选择的集合,也直接影响公司财务决策的效果。

(P19)经济环境(宏观经济、微观经济)2.公司理财的外部环境法律与监管(法律、制度. 监管)金融系统(金融机构、金融市场)P20第三章财务报表和财务分析一、三张表的构成等式及反映的情况1.资产负债表(36-40)资产负债表反映的是公司在一定日期财务状况的财务报表,是企业某一时点的财务状况的报表。

资产=负债+所有者权益2.利润表利润表是反映公司在一定期间生产和经营业绩的财务报表,反映会计期间的报表,是期间数据,动态报表。

利润=收入-费用3.现金流量表现金流量表是综合反映企业一定会计期间内现金来源和运用及其增减变动情况的报表,是以收付实现原则记账的。

公司理财知识点归纳

公司理财知识点归纳公司理财是指企业根据经营发展和财务状况的需要,运用一系列的财务工具和策略,合理配置企业的资金和资产,以实现最大化的经济效益和财务安全。

下面是关于公司理财的精要知识点归纳:1.理财目标:-最大化收益:通过有效的资金配置和投资决策,实现企业的盈利增长和股东价值的最大化。

-安全性:确保企业的资金和资产受到充分的保护,降低财务风险和经营风险。

-流动性:保持足够的流动性,确保企业能够应对各种经济和市场变动的需求。

2.短期理财:-现金管理:通过合理管理企业的现金流量,包括资金募集、支付和储备,以满足企业的日常经营需求。

-现金预测:通过准确预测企业的现金流动情况,制定相应的现金管理策略,使企业能够合理应对不同的现金需求。

3.中长期理财:-资本预算:通过评估不同的投资项目,选择最有利可行的项目进行投资,以提高企业的盈利能力和市场竞争力。

-资产管理:根据企业的经营特点和市场环境,合理配置和管理企业的资产,同时控制风险,以提高资产的收益率和价值。

-资本结构:确定企业的资本结构和融资策略,通过债务和股权的合理结构来平衡公司的融资成本和财务风险。

4.风险管理:-市场风险:针对企业面临的金融市场风险,如利率风险、外汇风险和股票市场风险等,制定相应的对冲和保值策略,降低市场波动对企业的影响。

-信用风险:评估企业的合作伙伴和客户的信用风险,制定相应的信用管理和收款策略,降低应收账款的风险。

-操作风险:建立有效的内部控制和审核机制,降低企业的操作风险,防止潜在的内部失误和欺诈行为。

5.税务筹划:-税务规划:通过合理的税务筹划,包括合理利用税收优惠政策、控制税务成本和合规性,以降低企业的税负。

-合规管理:确保企业在税务上的合规性,遵循相关税法法规和规定,规避潜在的税务风险和税务纠纷。

6.利润分配:-保留利润:将一部分利润留用于企业内部投资和发展,以提高企业的盈利能力和竞争力。

-分红政策:合理制定分红政策,平衡企业的股东利益和发展需求,同时符合相关法律和法规的规定。

公司理财 备考笔记

当谈论公司理财备考笔记时,我可以为您提供一些基本的理财知识和备考建议。

以下是一些建议供您参考:

1. 理财基础知识:

-了解财务报表:掌握资产负债表、利润表和现金流量表等基本财务报表的内容和分析方法。

-理解财务比率:学习常用的财务比率,如偿债能力、盈利能力和运营能力等指标,以评估公司的财务健康状况。

-学习投资基本原理:了解投资的基本原理,如风险与收益的关系、分散投资、长期投资等。

2. 考试重点:

-理财规划:学习如何制定公司的理财目标和计划,并了解如何进行预算和资金管理。

-资本预算:掌握资本预算的概念和方法,包括净现值、内部收益率和投资回收期等。

-财务风险管理:了解企业面临的各种财务风险,如市场风险、信用风险和汇率风险,并学习相应的风险管理策略。

3. 备考建议:

-学习理论知识:参考相关教材和学习资料,全面掌握理财的基本理论知识。

-刷题和模拟考试:通过刷题和模拟考试来提高解题能力和应试技巧,并熟悉考试形式和题型。

-注重实践经验:理财是实践性较强的学科,积累一定的实践经验,如进行真实案例分析、参与投资模拟等。

请注意,公司理财备考涵盖的内容较为广泛,具体备考策略和重点可能因考试要求和个人实际情况而有所不同。

建议您根据自身需求,结合相关教材和培训机构的指导,制定适合自己的备考计划,并保持良好的学习方法和时间管理,以提高备考效果。

- 1、下载文档前请自行甄别文档内容的完整性,平台不提供额外的编辑、内容补充、找答案等附加服务。

- 2、"仅部分预览"的文档,不可在线预览部分如存在完整性等问题,可反馈申请退款(可完整预览的文档不适用该条件!)。

- 3、如文档侵犯您的权益,请联系客服反馈,我们会尽快为您处理(人工客服工作时间:9:00-18:30)。

公司理财复习重点----by LisaThe primary objective for our companies is to maximize the shareholders’ value.财务工具:1)利率与货币的时间价值The Interest Rate: The rate at which we can exchange money today for money in the future is determined by the current interest rate.利率:将今天的货币转换成未来的货币的比率,是由当前的利息率决定的。

The Time Value of Money: The difference in value between money today and money in the future.货币时间价值:今天的货币价值与未来的货币价值之间的差额。

2)现值与净现值决策法则概念:When the value of a cost or benefit is computed in terms of cash today, we refer to it as the present value. Similarly, we define the net present value(NPV)of a project orinvestment as the difference between the present value of its benefits and the present value.成本或收益的价值以今天的现金来计量时,称为现值。

类似地,讲收益的现值与成本的现值之差定义为项目或投资的净现值。

The NPV Decision Rule: When making an investment decision, take the alternative with the highest NPV. Choosing this alternative is equivalent to receiving its NPV in cash today.净现值决策法则:制定投资决策时,要选择净现值最高的项目。

选择这样的项目就相当于今天收到数额等于项目净现值的现金。

3)无套利与证券价格Arbitrage: The practice of buying and selling equivalent goods in different markets to take advantage of a price different is known as arbitrage.套利:利用同一商品在不同市场的价格差别而进行买卖获利的行为称做套利。

)=PV(A llPriceSecurity(cashby thesecurity)flowspaidRisk-free interest rate = bank deposit rate证券的无套利价格:流)=证券价格PV(证证券支付的全部现4)货币时间价值The Time Value of Money: The equivalent value of two cash flows at two different points in time is sometimes referred to as the time value of money货币时间价值:有时将两个不同时点的现金流的等效值,称为货币时间价值。

5)时间轴的作用We can represent a stream of cash flows on a timeline, a linear representation of the timing of the expected cash flows.可用时间线来表示系列现金流,时间线是对于其现金流的发生时期的线性表述。

6)系列现金流的净现值(benefits)PV-NPV=PVcosts)(PV=(NPVPV(成本)-)收益7)有效年利率The Effective Annual Rate: Interest rates are often started as an effective annual rate(EAR), which indicates the total amount of interest that will be earned at the end of one year.有效年利率:利率通常表述为年利率:利率通常表述为有效年利率,表示在1年后能赚到利息总额。

8)投资决策(NPV,IRR,时间回报率等)①NPV RuleThe NPV Decision Rule: When making an investment decision, take the alternative with the highest NPV. Choosing this alternative is equivalent to receiving its NPV in cash today.净现值决策法则:制定投资决策时,要选择净现值最高的项目。

选择这样的项目就相当于今天收到数额等于项目净现值的现金。

②Alternative Decision RuleThe Payback Rule: This simplest investment rule is the payback investment rule, which is based on the notion that an opportunity that pays back its initial investment quickly is a good idea.投资回收期法则:最简单的投资法则是投资回收期法则,它是基于这样的想法:初始投资回收得越快,就越是好的投资机会。

③The Internal Rate of Return RuleIRR Investment Rule: Take any investment opportunity where IRR exceeds the opportunity cost of capital. Turn down any opportunity whose IRR is less than the opportunity cost of capital.内涵回报率(内部收益率):接受任何IRR大于资本机会成本的投资机会,拒绝IRR小于资本机会成本的投资机会。

短期融资:1)营运资本Working capital includes the cash that is needed to run the firm on a day-to-day basis. It does not include excess cash, which is cash that is not require to run the business and can be invested at a market rate.营运资本包括公司日常运营所需要的现金,但不包括超额现金,公司运营并不需要超额现金,可以按照市场利率用超额现金投资。

2)商业信用与应收应付账款Trade Credit:The credit that the firm is extending to its customer is known as trade credit.商业信用:公司提供给客户的信用,称作商业信用。

Benefits of Trade Credit:1、trade credit is simple and convenient to use.2、it is a flexible source of funds, and can be used as needed.3、it is sometimes the only source of funding available to a firm.商业信用的收益:1、商业信用简便易行;2、它是一种灵活的资金来源;3、有时商业信用甚至是公司可获得资金的唯一来源。

Trade Credit Versus Standard Loans:1、providing financing at below-market rates is an indirect way to lower prices.2、it may have more information about the credit quality of the customer than a traditional outsider such as a bank.商业信用与标准贷款的比较:1、以低于市场水平的利率提供融资;2、供应商可能与其客户保持长期的业务关系,比银行的传统的外部贷款方更了解客户的信用质量。

Receivable Management(应收账款管理):Determining the Credit Policy确定信用政策:Establishing credit standards 设定信用标准Establishing credit terms 设定信用条件Establishing a collection policy 设定收款政策Monitoring Accounts Receivable 监控应收账款Accounts Receivable Days 应收账款周转天数Aging Schedule 账龄分析表Payable Management 应付账款管理:Determining Accounts Payable Days Outstanding 确定应付账款周转天数Stretching Accounts Payable 应付账款展期3)短期财务计划:①Forecasting Short-Term Financing Needs:1、a company forecast its cash flows todetermine whether it will have surplus cash or a cash deficit is for each period.2、management needs to decide whether that surplus or deficit is temporary or permanent.短期融资需求预测:1、通过预测现金流,公司可以确定煤气的现金流是过剩还是短缺;2、管理者要确定现金的过剩或短缺时暂时性的还是永久性的。

②The Management Principle: The matching principle states that short-term needs shouldbe financed with short-term debt and long-term needs should be financed withlong-term sources of funds.匹配原则:匹配原则表明,短期资金需求应该由短期债务融资来支持,长期资金需求应该由长期资金来源提供。