会计英语第1章

1.会计英语第一章Accounting Environment

Ⅰ. Accounting: The Language of Business ( Ⅰ) Accounting is the information system that measures business activity, processes the information into reports, and communicates the results to decisions makers.

(Ⅲ) Corporation

A corporation is a business owned by stockholders, or shareholders. These are the people who own shares of ownership in the business. Corporation differ significantly from proprietorships and partnerships in another way. If a proprietorship or a partnership can not pay its debts, lenders can take the owners’ personal assets to satisfy the business’s obligation.

Management accounting focuses on information for internal decision makers, such as the company’s executives and the administrators of a hospital.

会计英语——精选推荐

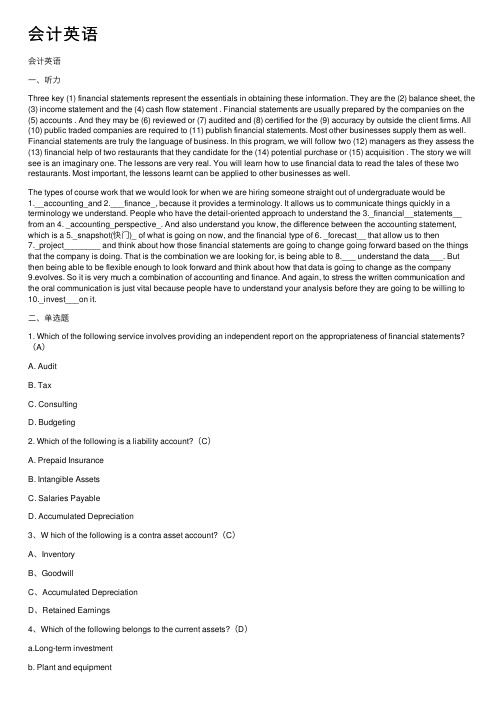

会计英语会计英语⼀、听⼒Three key (1) financial statements represent the essentials in obtaining these information. They are the (2) balance sheet, the (3) income statement and the (4) cash flow statement . Financial statements are usually prepared by the companies on the (5) accounts . And they may be (6) reviewed or (7) audited and (8) certified for the (9) accuracy by outside the client firms. All (10) public traded companies are required to (11) publish financial statements. Most other businesses supply them as well. Financial statements are truly the language of business. In this program, we will follow two (12) managers as they assess the (13) financial help of two restaurants that they candidate for the (14) potential purchase or (15) acquisition . The story we will see is an imaginary one. The lessons are very real. You will learn how to use financial data to read the tales of these two restaurants. Most important, the lessons learnt can be applied to other businesses as well.The types of course work that we would look for when we are hiring someone straight out of undergraduate would be1.__accounting_and2.___finance_, because it provides a terminology. It allows us to communicate things quickly in a terminology we understand. People who have the detail-oriented approach to understand the3._financial__statements__ from an4. _accounting_perspective_. And also understand you know, the difference between the accounting statement, which is a5._snapshot(快门)_ of what is going on now, and the financial type of6. _forecast__ that allow us to then7._project________ and think about how those financial statements are going to change going forward based on the things that the company is doing. That is the combination we are looking for, is being able to 8.___ understand the data___. But then being able to be flexible enough to look forward and think about how that data is going to change as the company9.evolves. So it is very much a combination of accounting and finance. And again, to stress the written communication and the oral communication is just vital because people have to understand your analysis before they are going to be willing to 10._invest___on it.⼆、单选题1. Which of the following service involves providing an independent report on the appropriateness of financial statements?(A)A. AuditB. TaxC. ConsultingD. Budgeting2. Which of the following is a liability account?(C)A. Prepaid InsuranceB. Intangible AssetsC. Salaries PayableD. Accumulated Depreciation3、W hich of the following is a contra asset account?(C)A、InventoryB、GoodwillC、Accumulated DepreciationD、Retained Earnings4、Which of the following belongs to the current assets?(D)a.Long-term investmentb. Plant and equipmentc. Intangible assetsd. Inventory5、W hich of the following belongs to the long-term liabilities?(C)A、Retained earningsB、Capital stockC、Dividend payableD、Bonds payable6、Financial statement does not include ( D)A、lance sheetB、come statementC、sh flow statementD、king sheet7、profit-making business operating as a separate legal entity and in which ownership is divided into shares of stock is known as a:(D)A. proprietorship.B. service business.C. partnership.D. corporation.8、2. If revenue was $45,000, expenses were $37,500, and the owner’s withdrawals were $10,000, the amount of net income or net loss would be:(B)A. $45,000 net income.B. $7,500 net income.C. $37,500 net loss.D. $2,500 net loss.9、Which of the following items represents a deferral?(A)A. Prepaid insuranceB. Wages payableC. Fees earnedD. Accumulated depreciation10、If the estimated amount of depreciation on equipment for a period is $2,000, the adjusting entry to record depreciation would be:(C)A. debit Depreciation Expense, $2,000; credit Equipment,$2,000.B. debit Equipment, $2,000; credit Depreciation Expense,$2,000.C. debit Depreciation Expense, $2,000; credit Accumulated Depreciation,$2,000.D. debit Accumulated Depreciation, $2,000; credit Depr eciation Expense, $2,000.11、Which of the following accounts would not be closed to the income summary account at the end of a period?(D)A. Depreciation ExpenseB. Wages ExpenseC. Rent ExpenseD. Accumulated Depreciation12、Which of the following is an example of an intangible asset?(D)A. PatentsB. GoodwillC. CopyrightsD. All of the above三、计算题(关于会计投资、筹资活动的现⾦流量)(2) Compute the net cash used (provided) by financing activities.Net cash provided by investing activities =81000-37000-53000=91000Net cash used by financing activities =47000-40000-85000-1000000= -78000四、填空题1、填字母(交易与相应的分类对上号)2、填数字(成本流转假设)——计算P553、排序题A. To record receipt of unearned revenue.B. To record this period’s earning of prior unearned revenue.C. To record payment of an accrued expense.D. To record receipt of an accrued revenue.E. To record an accrued expense.F. To record an accrued revenue.G. To record this period’s use of a prepaid expense.五、论述题(⼀)、chapter10(课本上96~97页)1、The factors that are directly relevant to an analysis of business performance:(1)、the size of the business(2)、the business risk(3)、the economic environment(4)、Industry trends ,effects of changes in technology2、The information that the public company provided includes:(1)、Chairman’s statement(2)、Director s’ report(3)、the balance sheet(4)、Statements of income and changes in equity(5)、Statement of cash flows(6)、Notes to the statements(7)、Auditors’ report(8)、External sources(⼆)、交易效果题(即资产、负债、所有者权益的增减问题)例:Describe the effects of each of the following business transactions on assets, liabilities and owners’equity.(1). Bought equipment on credit.(2). Paid salaries to employees.(3). Sold services for cash.答案:(1). Increase both asset and liability.(2). Decrease both asset and liability.(3). Increase both asset and owners’equity.知识点:第⼀章:1、Two objectives of financial statements(P5)会计⽬标2、Underlying Assumptions (P6)第三章:1、Financial statement consists (P19)财务报表的组成2、资产、负债、所有者的构成(P19~P20)——table 3-33、the format of balance sheet: the account form and the report (区别)例:In the report form,(报告式) the assets are listed on the left side of the page and liabilities and owner’s equity on the right side .(其中report form 应该是account form)*4、income Statement (P22-23)5、Three Categories of Cash Flows (区别)(P26)1、Investing activities2、Financing activities3、Operating activities第四章1、Accounting Equation: asset=liabilities+equity(P33)2、复式记账法(double-Entry Bookkeeping)的含义(P33)Debits must equal credits3、会计循环(Accounting Cycle)——排序题(P35)理解:过账、结账分录、试算平衡表、结账后试算平衡表的含义4、Accruals and deferrals adjustments 应计和递延项⽬的含义及能简单的区分它们5、close temporary accounts (P45)了解下期末的结算。

会计英语——用英语了解会计的定义和运用

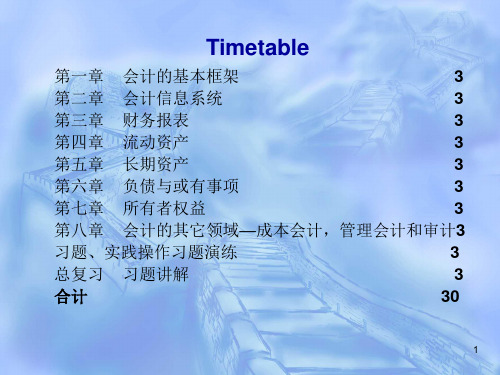

第一章 会计的基本框架

3

第二章 会计信息系统

3

第三章 财务报表

3

第四章 流动资产

3

第五章 长期资产

3

第六章 负债与或有事项

3

第七章 所有者权益

3

第八章 会计的其它领域—成本会计,管理会计和审计3

习题、实践操作习题演练

3

总复习 习题讲解

3

合计

30

1

Chapter 1

I. New words: 1. Account n. statement of money paid or owed for goods or services --The accounts show a profit of $9000. Open/close an account、account payable, account receivable, On account (1) pay part of the money (2)on credit --I will give you$30 on account. --buy things on account.

bank account -- Credit $8 to a customer / an account. Credit n. (1)permission to delay payment for goods and

services --No ~ is given at this shop. Payment must be in

prediction. --There is a lack of ~ between his promises

and his actions. ~ college, ~ column, ~course, ~school Corresponding a. more or less the same ~ fingerprints, the ~ period last year

会计英语第五版

会计英语第五版简介《会计英语第五版》是一本专门为会计专业学生和从业人员准备的英语教材。

本教材旨在帮助学生掌握并运用会计相关的英语词汇和表达方式,提高他们在国际商务环境中的沟通能力。

目录1.第一单元:会计基础– 1.1 会计的定义和职能– 1.2 会计的基本原理– 1.3 会计的分类和应用2.第二单元:会计准则和规范– 2.1 国际会计准则概述– 2.2 资产负债表– 2.3 损益表– 2.4 现金流量表3.第三单元:财务报表分析– 3.1 比率分析– 3.2 多年度比较分析– 3.3 垂直和水平分析– 3.4 公司绩效评估4.第四单元:成本会计– 4.1 成本会计的基本概念– 4.2 成本会计的方法和技术– 4.3 成本会计体系5.第五单元:预算和预测– 5.1 会计预算的概念和目的– 5.2 预算编制和控制– 5.3 预测方法和技术章节概述第一单元:会计基础本单元将介绍会计的定义和职能,帮助学生了解会计的基本原理和分类。

学生将学会使用正确的会计术语和表达方式,为后续的学习打下基础。

第二单元:会计准则和规范在本单元中,学生将学习国际会计准则的概述,并深入了解资产负债表、损益表和现金流量表的编制和分析方法。

他们将学会如何解读和分析财务报表,评估公司的财务状况。

第三单元:财务报表分析本单元将重点介绍财务报表分析的方法和工具,包括比率分析、多年度比较分析、垂直和水平分析等。

学生将学会如何利用这些分析工具评估公司的绩效并作出合理的决策。

第四单元:成本会计在本单元中,学生将深入了解成本会计的基本概念、方法和技术。

他们将学会如何计算和分配成本,并理解成本会计在管理决策中的重要性。

第五单元:预算和预测本单元将介绍会计预算的概念和目的,帮助学生学会编制和控制预算。

他们将学习各种预测方法和技术,为公司未来的发展提供参考和决策支持。

学习方法学生可以按照以下方法来学习《会计英语第五版》:1.阅读课本并理解每个章节的主要概念和要点。

会计英语(第二版)第一章中英文互译

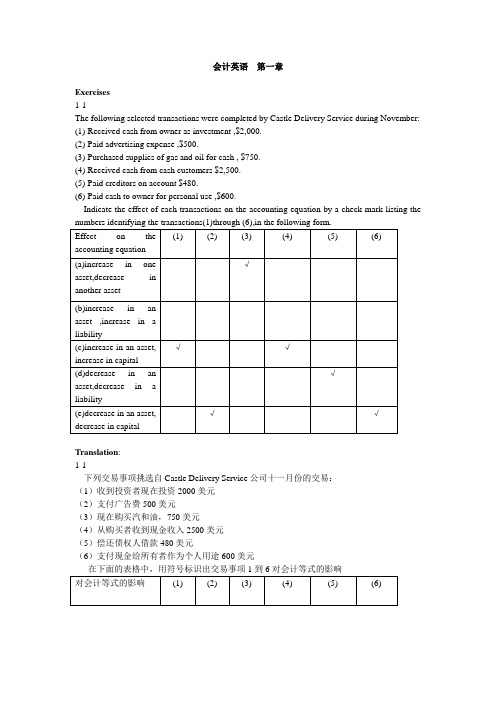

会计英语第一章Exercises1-1The following selected transactions were completed by Castle Delivery Service during November:(1)Received cash from owner as investment ,$2,000.(2)Paid advertising expense ,$500.(3)Purchased supplies of gas and oil for cash , $750.(4)Received cash from cash customers $2,500.(5)Paid creditors on account $480.(6)Paid cash to owner for personal use ,$600.Indicate the effect of each transactions on the accounting equation by a check mark listing theTranslation:1-1下列交易事项挑选自Castle Delivery Service公司十一月份的交易:(1)收到投资者现在投资2000美元(2)支付广告费500美元(3)现在购买汽和油,750美元(4)从购买者收到现金收入2500美元(5)偿还债权人借款480美元(6)支付现金给所有者作为个人用途600美元1-2Foreman Corporation, engaged in a service business , completed the following selected transactions during the period:1)Added additional investment, receiving cash2)Purchased supplies on account3)Returned defective supplies purchased on account and not yet paid for4)Received cash as a refund from the erroneous overpayment of an expense5)Charged customers for services sold on account6)Paid salary expense7)Paid a creditor on account8)Received cash on account from charge customer9)Paid cash for the owner’s personal use10)Determined the amount of supplies used during the monthTranslation :Foreman是一家从事服务行业的公司,以下是该公司在一段时间内的交易事项。

会计英语之固定资产

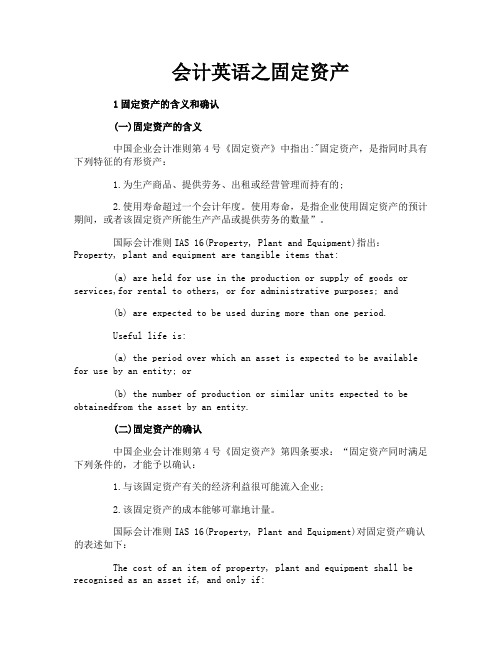

会计英语之固定资产1固定资产的含义和确认(一)固定资产的含义中国企业会计准则第4号《固定资产》中指出:"固定资产,是指同时具有下列特征的有形资产:1.为生产商品、提供劳务、出租或经营管理而持有的;2.使用寿命超过一个会计年度。

使用寿命,是指企业使用固定资产的预计期间,或者该固定资产所能生产产品或提供劳务的数量”。

国际会计准则IAS 16(Property, Plant and Equipment)指出:Property, plant and equipment are tangible items that:(a) are held for use in the production or supply of goods or services,for rental to others, or for administrative purposes; and(b) are expected to be used during more than one period.Useful life is:(a) the period over which an asset is expected to be available for use by an entity; or(b) the number of production or similar units expected to be obtainedfrom the asset by an entity.(二)固定资产的确认中国企业会计准则第4号《固定资产》第四条要求:“固定资产同时满足下列条件的,才能予以确认:1.与该固定资产有关的经济利益很可能流入企业;2.该固定资产的成本能够可靠地计量。

国际会计准则IAS 16(Property, Plant and Equipment)对固定资产确认的表述如下:The cost of an item of property, plant and equipment shall be recognised as an asset if, and only if:(a) it is probable that future economic benefits associated with theitem will flow to the entity; and(b) the cost of the item can be measured reliably.2固定资产的初始计量中国企业会计准则第4号《固定资产》第三章的第七条要求:“固定资产应当按照成本进行初始计量”,第八条要求:“外购固定资产的成本,包括购买价款、相关税费、使固定资产达到预定可使用状态前所发生的可归属于该项资产的运输费、装卸费、安装费和专业人员服务费等”。

会计英语 翻译chapter1

Chapter one Introduction to Accounting 1.1 Bookkeeping and AccountingAccounting is an information system that identifies,measures,records and communicates relevant,reliable,consistent,and comparable information about an organization’s economic activity. Its objective is to help people make better decisions.An understanding of the principles of bookkeeping and accounting is essential for anyone who is interested in a successful career in business. The purpose of bookkeeping and accounting is to provide information concerning the financial affairs of a business. Owners, managers, creditors, and governmental agencies need this information.An individual who earns living by recording the financial activities of business is known as a bookkeeper, while the process of classifying and summarizing business transactions and interpreting their effects is accomplished by an accountant. Accountant is the individual who understands the accounting principles, theoretical and practical application, and can manage, analyze, and interpret the accounting records. The bookkeeper is concerned with techniques involving the recording of transactions, and the accountant’s objective is the use of data for interpretation.第一章['tʃæptə]会计导论[.intrə'dʌkʃən]1.1 簿记与会计会计是一个信息系统,[ai'dentəfai]辨别、['meʒəz]测量、记录和交流相关的['reləvənt]、可靠的[ri'laiəbl]、持续的[kən'sistənt]和可比的['kɔmpərəbl]一个组织经济活动的信息。

会计英语基础

第一章金融资产一、内容概要金融资产在注会考试中属于非常重要的章节,经常结合会计差错、日后事项、递延所得税等在综合题中进行考查,例如,在2011年和2010年的考试中都结合会计差错题目进行了考查。

根据学员反馈,2013年考试中单独出现综合题。

2014年7月,新修订的《企业会计准则第37号——金融工具列报》发布。

在复习备考中应当重点复习交易性金融资产、持有至到期投资、可供出售金融资产、金融资产减值、金融资产转移等内容。

续表续表续表续表常用句型、连接词归纳总结1.常用句型总结The term…refers to……could be categorized into…The purpose to …is for…Except …from…2.常用连接词总结表包含关系的过渡词:include,表举例说明的过渡词:such as表转折对比的过渡词:unless,however表结果的过渡词:then三、详细讲解金融资产应当在初始确认时划分为下列四类:The initial recognition of financial assets could be categorized into 4 groups:1)以公允价值计量且其变动计入当期损益的金融资产;Financial assets measured at fair value and changes recorded into current period profit or loss (或:Financial assets at fair value through profit or loss)2)持有至到期投资;The investments which will be held-to-maturity; (或:held-to-maturity investments)3)贷款和应收款项;Loans and the accounts receivable; and4)可供出售金融资产。

李海红编著《实用会计英语第一章》中英文对照

CONTENTS 目录Chapter 1 General View of Accounting (1)第一章会计学概况Chapter 2 Forms of Business Organization (9)企业组织形式Chapter 3 Accounting Equation and Illustration (17)会计等式和举例说明Chapter 4 Accounts (24)账户(科目、账款、账目)Chapter 5 Double-Entry System (32)复式记账制(制度、体系、系统)Chapter 6 Journalizing (39)记日记账Chapter 7 Posting and Trial Balance (46)过账和试算平衡表Chapter 8 Adjustments (55)调账Chapter 9 Financial Statements (63)财务报表Chapter 10 Closing Entries (69)结账分录Chapter 11 Sales and Purchases (81)销货和购货Chapter 12 Cash and Marketable Securities (87)现金和有价证券Chapter 13 Accounts Receivable (92)应收账款Chapter 14 Notes Receivable (97)应收票据Chapter 15 Inventories (103)存货盘点to take inventories at the end of accounting period在会计期末盘点存货Chapter 16 Plant Assets (109)厂房设备资产Chapter 17 Bonds Payable (117)应付债券Chapter 18 Capital Stocks (122)股本Reference Answer (127)参考答案General View of AccountingCHAPTER 1Chapter 1General View of Accounting会计学概况As one of the oldest professions,作为历史最古老的职业之一,accounting is as old as the civilization of human.会计和人类文明一样历史悠久。

会计英语1-14章术语翻译(仅供参考,不足之处望批评指正。)

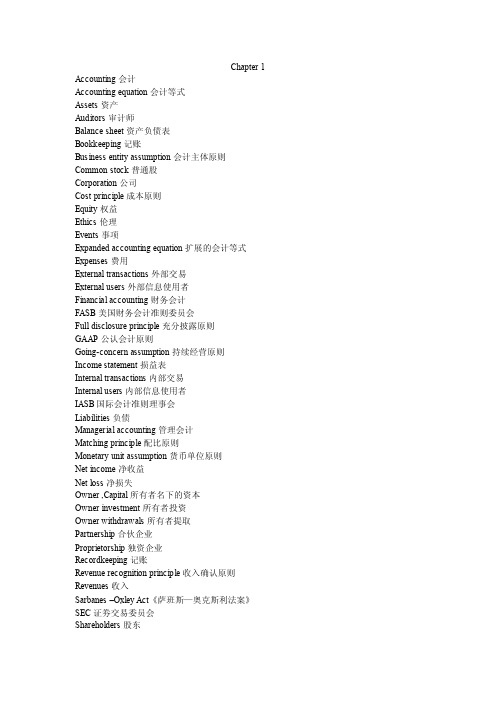

Chapter 1 Accounting会计Accounting equation会计等式Assets资产Auditors审计师Balance sheet资产负债表Bookkeeping记账Business entity assumption会计主体原则Common stock普通股Corporation公司Cost principle成本原则Equity权益Ethics伦理Events事项Expanded accounting equation扩展的会计等式Expenses费用External transactions外部交易External users外部信息使用者Financial accounting财务会计FASB美国财务会计准则委员会Full disclosure principle充分披露原则GAAP公认会计原则Going-concern assumption持续经营原则Income statement损益表Internal transactions内部交易Internal users内部信息使用者IASB国际会计准则理事会Liabilities负债Managerial accounting管理会计Matching principle配比原则Monetary unit assumption货币单位原则Net income净收益Net loss净损失Owner ,Capital所有者名下的资本Owner investment所有者投资Owner withdrawals所有者提取Partnership合伙企业Proprietorship独资企业Recordkeeping记账Revenue recognition principle收入确认原则Revenues收入Sarbanes –Oxley Act《萨班斯—奥克斯利法案》SEC证劵交易委员会Shareholders股东Shares股份Sole proprietorship个人独资企业Statement of cash flows现金流量表Statement of owner’s equity所有者权益表Stock股票Stockholders股东Time period assumption会计分期原则Withdrawals提取Chapter 2 Account账户Account balance账户余额Balance column account三栏式账户Chart of accounts会计科目表Compound journal entry复合日记账分录Credit贷方Creditors债权人Debit借方Debtors债务人Double-entry accounting复式记账法General journal普通日记账General ledger总分类账Journal日记账Journalizing 登记日记账Ledger分类账Posting过账(PR) column过账索引栏Source documents原始凭证T-account T型账户Trial balance试算平衡表Unearned revenue预收收入Chapter 3 Accounting period会计期间Accrual basis accounting权责发生制会计Accrued expenses应计费用Accrued revenues应计收入Adjusted trial balance调整后试算平衡表Adjusting entry调整分录Annual financial statements年度财务报表Book value账面价值Cash basis accounting收付实现制会计Contra account备抵账户Depreciation折旧Fiscal year会计年度Interim financial statements中期财务报表Matching principle配比原则Natural business year自然营业年度Plant assets固定资产Prepaid expenses预付费用Straight-line depreciation method直线折旧法Time period assumption会计分期原则Unadjusted trial balance调整前的试算平衡表Unearned revenues 预收收入Chapter 4 Accounting cycle会计循环Classified balance sheet分类资产负债表Closing entries结账分录Closing process结账过程Current assets流动资产Current liabilities流动负债Income summary损益汇总账户Intangible assets无形资产Long-term investments长期投资Long-term liabilities长期负债Operating cycle营业周期Permanent accounts永久性账户Post-closing trial balance结账后试算平衡表Pro forma financial statements预测财务报表Temporary accounts临时性账户Unclassified balance sheet未分类资产负债表Working papers工作底稿Work sheet工作底表Chapter 5 Cash discount现金折扣Cost of goods sold商品销售成本Credit memorandum贷记通知单Credit period 信用期Credit terms信用条件Debit memorandum借记通知单Discount period折扣期EOM月末FOB交货点General and administrative expenses一般及行政管理费用Gross margin毛利Gross profit毛利Inventory存货List price价目表价格Merchandise 商品Merchandise inventory库存商品Merchandiser商业企业Multiple-step income statement多步式损益表Periodic inventory system定期盘存制Perpetual inventory system永续盘存制Purchase discount购货折扣Retailer零售商Sales discount销售折扣Selling expenses销售费用Shrinkage损耗Single-step income statement单步式损益表Supplementary records辅助记录Trade discount商业折扣Wholesaler批发商Chapter 6 A verage cost平均成本Conservatism constraint稳健性原则Consignee 收货人Consignor发货人Consistency concept一致性原则FIFO先进先出法Interim statements中期报告LIFO后进先出法LCM成本与市价孰低法Net realizable value可变现净值Specific identification个别认定法Weighted average加权平均法Chapter 7 Accounts payable ledger应付账款分类账Accounts receivable ledger应收账款分类账Cash disbursements journal现金支出日记账Cash receipts journal现金收入日记账Check register支票登记薄Columnar journal多栏式日记账Compatibility principle适应性原则Controlling account统驭账户Control principle控制原则Cost-benefit principle成本—收益原则Flexibility princ iple灵活性原则General journal普通日记账Internal controls内部控制Purchases journal购货日记账Relevance principle相关性原则Sales journal销售日记账Schedule of accounts payable应付账款明细表Schedule of accounts receivable应收账款明细表Special journal特种日记账Subsidiary ledger明细分类账Chapter 8 Bank reconciliation银行存款余额调节表Bank statement银行对账单Canceled checks注销支票Cash 现金Cash equivalents现金等价物Cash over and short现金溢缺Check支票Deposit ticket存款单Deposits in transit在途存款EFT电子资金转账Internal control system内部控制制度Liquid assets流动资产Liquidity偿债能力Outstanding checks未兑现支票Petty cash备用金Principles of internal control内部控制原则Sarbanes-Oxley Act《萨班斯—奥克斯利法案》Signature card印鉴卡V oucher 凭单V oucher system凭单制Chapter 9 Accounts receivable应收账款Aging of accounts receivable应收账款账龄分析Allowance for Doubtful Accounts呆帐准备金Allowance method备抵法Bad debts坏账Direct write-off method直接核销法Interest 利息Maker of the note出票人Matching principle配比原则Materiality constraint重要性约束Maturity date of a note票据到期日Payee of the note票据收款人Principal of a note票据的本金Promissory note票据Realizable value可变现价值Chapter 10 Accelerated depreciation method加速折旧法Amortization摊销Asset book value资产账面价值Betterments改良工程投资Capital expenditures资本支出Change in an accounting estimate会计估计变更Copyright版权Cost成本Declining-balance method余额递减法Depletion折耗Depreciation折旧Extraordinary repairs非常修理Franchises特许权Goodwill商誉Impairment减损Inadequacy生产能力不足Indefinite life不确定使用年限Intangible assets无形资产Land improvements土地改良物Lease租约Leasehold租赁权Leasehold improvements租赁资产改良Lessee承租人Lessor 出租人Licenses特许权Limited life有限使用年限MACRS修正后的加速成本回收制度Natural resources自然资源Obsolescence陈旧,过时Ordinary repairs日常维修Patent专利权Plant asset age固定资产寿命Plant assets固定资产Plant asset useful life固定资产使用年限Revenue expenditures收益性支出Salvage value残值Straight-line depreciation直线折旧法Trademark or trade (brand) name商标或品牌Units-of-production depreciation工作量法Useful life使用年限Chapter 11 Contingent liability或有负债Current liabilities流动负债Current portion of long-term debt一年内到期的长期负债Employee benefits员工福利Estimated liability估计负债(FICA)Taxes联邦社会保险税FUTA联邦失业税Gross pay薪资总额Known liabilities已知负债Long-term liabilities长期负债Merit rating考绩Net pay薪资净额Payroll deductions薪资扣款Short-term note payable短期应付票据SUTA州失业救济税Warranty保修Chapter 12Bond 债券Bond certificate债券证书Bond indenture债券契约Carrying (book) value of bonds债券账面价值Discount on bonds payable应付债券折旧Installment note分期付款期票Market rate市场利率Mortgage抵押权Pension plan养老金计划Premium on bonds债券溢价Par value of a bond债券面值Straight-line bond amortization债券利息直线摊销法Chapter 13(AFS) securities可供出售证劵Comprehensive income综合收益Consolidated financial statements合并财务报表Equity method权益法Equity securities with controlling influence具有控制权的权益类证劵Equity securities with significant influence具有重大影响力的权益类证劵(HTM) securities持有至到期证劵Long-term investments长期投资Parent母公司Short-term investments短期投资Subsidiary子公司Trading securities交易性证劵Unrealized gain (loss)未实现收益(损失)Chapter 14Appropriated retained earnings拨定留存收益Authorized stock核定股本Call price赎回价格Callable preferred stock可赎回优先股Capital stock股本Changes in accounting estimates会计估计变更Common stock普通股Convertible preferred stock可转换优先股Corporation股份制公司Cumulative preferred stock累积优先股Date of declaration股利宣告日Date of payment股利发放日Date of record股权登记日Discount on stock股票折旧Dividend in arrears积欠股利Financial leverage财务杠杆Large stock dividend大额股票股利Liquidating cash dividend清算性现金股利Market value per share每股市价Minimum legal capital最低法定资本Noncumulative preferred stock非累积优先股Nonparticipating preferred stock非参与式股票No-par value stock无面值股票Organization expenses组建费Paid-in capital实收资本Paid-in capital in excess of par value资本溢价Participating preferred stock参与式股票Par value面值Par value stock有面值股票Preemptive right优先认股权Preferred stock优先股Premium on stock股票溢价Prior period adjustments前期损益调整Proxy授权委托书Restricted retained earnings限定用途留存收益Retained earnings 留存收益Retained earnings deficit留存收益赤字Reverse stock split并股Small stock dividend小额股票股利Stated value stock设定价值股票Statement of stockholders’ equity股东权益表Stock dividend股票股利Stock options股票期权Stock split股票分割Stockholders’ equity股东权益Treasury stock库藏股教你如何用WORD文档(2012-06-27 192246)转载▼标签:杂谈1. 问:WORD 里边怎样设置每页不同的页眉?如何使不同的章节显示的页眉不同?答:分节,每节可以设置不同的页眉。

会计学原理专业英语词汇对照(第一二章)

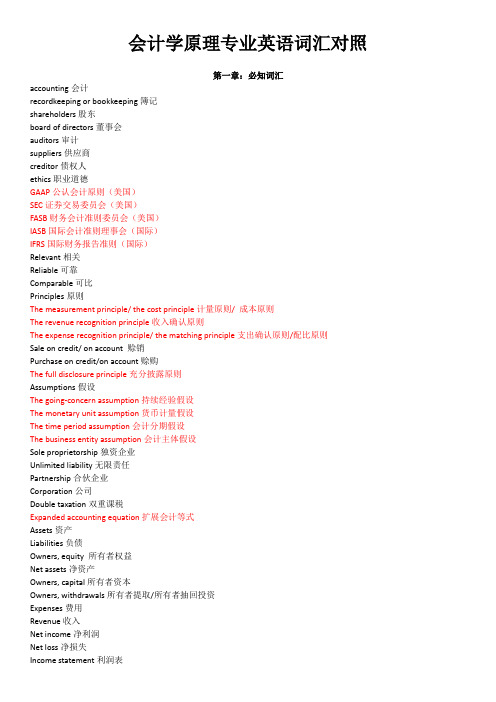

会计学原理专业英语词汇对照第一章:必知词汇accounting会计recordkeeping or bookkeeping簿记shareholders股东board of directors董事会auditors审计suppliers供应商creditor债权人ethics职业道德GAAP公认会计原则(美国)SEC证券交易委员会(美国)FASB财务会计准则委员会(美国)IASB国际会计准则理事会(国际)IFRS国际财务报告准则(国际)Relevant相关Reliable可靠Comparable可比Principles原则The measurement principle/ the cost principle计量原则/ 成本原则The revenue recognition principle收入确认原则The expense recognition principle/ the matching principle支出确认原则/配比原则Sale on credit/ on account 赊销Purchase on credit/on account赊购The full disclosure principle充分披露原则Assumptions假设The going-concern assumption持续经验假设The monetary unit assumption货币计量假设The time period assumption会计分期假设The business entity assumption会计主体假设Sole proprietorship独资企业Unlimited liability无限责任Partnership合伙企业Corporation公司Double taxation双重课税Expanded accounting equation扩展会计等式Assets资产Liabilities负债Owners, equity 所有者权益Net assets净资产Owners, capital所有者资本Owners, withdrawals所有者提取/所有者抽回投资Expenses费用Revenue收入Net income净利润Net loss净损失Income statement利润表Statement of owners, equity所有者权益表/所有者权益变动表Balance sheet资产负债表Statement of cash flows现金流量表第二章:必知词汇(上文有的不再重复)Accounting books/books会计帐簿Source documents原始凭证Account账户General ledger总分类账Ledger分类账Account receivable应收账款Note receivable应收票据Prepaid accounts/ prepaid expenses预付账款/待摊费用Account payable应付账款Note payable应付票据Unearned revenue预收账款Accrued liabilities应计负债Increase增加Decrease减少Chart of accounts会计科目表T-account T形账户Debit借方(Dr.)Credit贷方(Cr.)Account balance账户余额Normal balance正常余额Double entry accounting 复式记账法Journalizing登记日记账Journal日记账General journal普通日记账Journal entry日记账分录Posting过账Balance column account三栏式账户PR(posting reference)过账索引Trial balance试算平衡表Unadjusted statements调整前的财务报表必记口诀:有借必有贷,借贷必相等。

会计英语文章

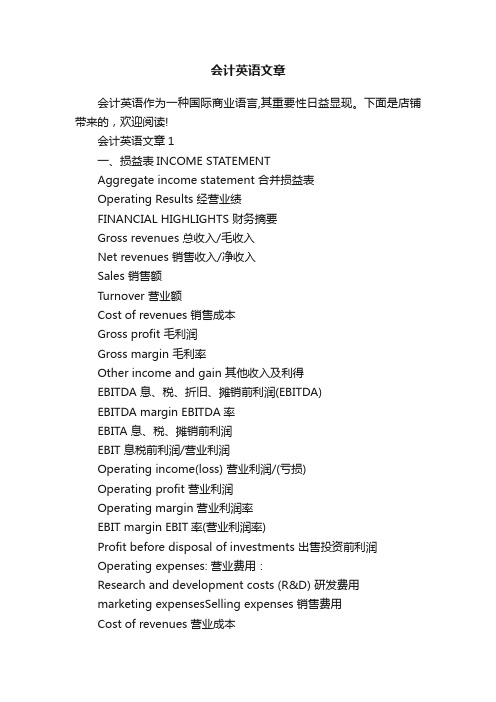

会计英语文章会计英语作为一种国际商业语言,其重要性日益显现。

下面是店铺带来的,欢迎阅读!会计英语文章1一、损益表INCOME STATEMENTAggregate income statement 合并损益表Operating Results 经营业绩FINANCIAL HIGHLIGHTS 财务摘要Gross revenues 总收入/毛收入Net revenues 销售收入/净收入Sales 销售额Turnover 营业额Cost of revenues 销售成本Gross profit 毛利润Gross margin 毛利率Other income and gain 其他收入及利得EBITDA 息、税、折旧、摊销前利润(EBITDA)EBITDA margin EBITDA率EBITA 息、税、摊销前利润EBIT 息税前利润/营业利润Operating income(loss) 营业利润/(亏损)Operating profit 营业利润Operating margin 营业利润率EBIT margin EBIT率(营业利润率)Profit before disposal of investments 出售投资前利润Operating expenses: 营业费用:Research and development costs (R&D) 研发费用marketing expensesSelling expenses 销售费用Cost of revenues 营业成本Selling Cost 销售成本Sales and marketing expenses Selling and marketing expenses 销售费用、或销售及市场推广费用Selling and distribution costs 营销费用/行销费用General and administrative expenses 管理费用/一般及管理费用Administrative expenses 管理费用Operating income(loss) 营业利润/(亏损)Profit from operating activities 营业利润/经营活动之利润Finance costs 财务费用/财务成本Financial result 财务费用Finance income 财务收益Change in fair value of derivative liability associated with Series B convertible redeemable preference shares 可转换可赎回优先股B相关衍生负债公允值变动Loss on the derivative component of convertible bonds 可換股債券衍生工具之損失Equity loss of affiliates 子公司权益损失Government grant income 政府补助Other (expense) / income 其他收入/(费用)Loss before income taxes 税前损失Income before taxes 税前利润Profit before tax 税前利润Income taxes 所得税taxes 税项Current Income tax 当期所得税Deferred Income tax 递延所得税Interest income 利息收入Interest income net 利息收入净额Profit for the period 本期利润Ordinary income 普通所得、普通收益、通常收入Comprehensive income 综合收益、全面收益Net income 净利润Net loss 净损失Net Margin 净利率Income from continuing operations 持续经营收益或连续经营部门营业收益 Income from discontinued operations 非持续经营收益或停业部门经营收益 extraordinary gain and loss 特别损益、非常损益Gain on trading securities 交易证券收益Net Profit attributable to Equity Holders of the Company 归属于本公司股东所有者的净利润Net income attributed to shareholders 归属于母公司股东的净利润或股东应占溢利(香港译法)Profit attributable to shareholders 归属于股东所有者(持有者)的利润或股东应占溢利(香港译法)Minority interests 少数股东权益/少数股东损益Change in fair value of exchangeable securities 可交换证券公允值变动Other comprehensive income — Foreign currency translation adjustment 其他综合利润—外汇折算差异Comprehensive (loss) / income 综合利润(亏损)Gain on disposal of assets 处分资产溢价收入Loss on disposal of assets 处分资产损失Asset impairments 资产减值Gain on sale of assets 出售资产利得Intersegment eliminations 公司内部冲销Dividends 股息/股利/分红Deferred dividends 延派股利Net loss per share: 每股亏损Earnings per share(EPS) 每股收益Earnings per share attributable to ordinaryequity holders of the parent 归属于母公司股东持有者的每股收益-Basic -基本-Diluted -稀释/摊薄(每股收益一般用稀释,净资产用摊薄)Diluted EPS 稀释每股收益Basic EPS 基本每股收益Weighted average number of ordinary shares: 加权平均股数:-Basic -基本-Diluted -稀释/摊薄Derivative financial instruments 衍生金融工具Borrowings 借貸Earnings Per Share, excluding the (loss)gain on the derivative component of convertible bonds and exchange difference 扣除可换股债券之衍生工具评估损益及汇兑损失后每股盈Historical Cost 历史成本Capital expenditures 资本支出revenues expenditure 收益支出Equity in earnings of affiliatesequity earnings of affiliates 子公司股权收益附属公司股权收益联营公司股权收益equity in affiliates 附属公司权益Equity Earning 股权收益、股本盈利Non-operating income 营业外收入Income taxes-current 当期所得税或法人税、住民税及事业税等(日本公司用法) Income taxes-deferred 递延所得税或法人税等调整项(日本公司用法)Income (loss) before income taxes and minority interest 所得税及少数股东权益前利润(亏损)Equity in the income of investees 采权益法认列之投资收益Equity Compensation 权益报酬Weighted average number of shares outstanding 加权平均流通股treasury shares 库存股票Number of shares outstanding at the end of the period 期末流通股数目Equity per share, attributable to equity holders of the Parent 归属于母公司所有者的每股净资产Dividends per share 每股股息、每股分红Cash flow from operations (CFFO) 经营活动产生的现金流量Weighted average number of common and common equivalent shares outstanding:加权平均普通流通股及等同普通流通股Equity Compensation 权益报酬Weighted Average Diluted Shares 稀释每股收益加权平均值Gain on disposition of discontinued operations 非持续经营业务处置利得(收益) Loss on disposition of discontinued operations 非持续经营业务处置损失 participation in profit 分红profit participation capital 资本红利、资本分红profit sharing 分红Employee Profit Sharing 员工分红(红利)Dividends to shareholders 股东分红(红利)Average basic common shares outstanding 普通股基本平均数Average diluted common shares outstanding 普通股稀释平均数Securities litigation expenses, net 证券诉讼净支出Intersegment eliminations 部门间消减ROA(Return on assets) 资产回报率/资产收益率ROE(Return on Equit) 股东回报率/股本收益率(回报率)净资产收益率Equit ratio 产权比率Current ration (times) 流动比率ROCE(Return on Capital Employed) 资本报酬率(回报率)或运营资本回报率或权益资本收益率或股权收益率RNOA(Return on Net Operating Assets) 净经营资产收益率(回报率) ROI(Return on Investment) 投资回报率OA(Operating Assets) 经营性资产OL(Operating Liabilites) 经营性负债NBC(Net Borrow Cost) 净借债费用OI(Operating Income) 经营收益NOA(Net Operating Assets) 净经营性资产NFE(Net Financial Earnings) 净金融收益NFO(Net Financial Owners) 净金融负债FLEV(Financial leverage) 财务杠杆OLLEV(Operating Liabilites leverage) 经营负债杠杆CSE(Common Stock Equity) 普通股权益SPREAD 差价RE(Residual Earning) 剩余收益会计英语文章2二、资产负债表balance sheet 资产负债表aggregate balance sheet 合并资产负债表Assets 资产Current assets 流动资产Non-current assets 非流动资产Interests in subsidiaries 附属公司权益Cash and cash equivalents 现金及现金等价物Hong Kong listed investments, at fair value 于香港上市的投资,以公允价值列示Investment deposits 投资存款Designated loan 委托贷款Financial assets 金融资产Pledged deposits 银行保证金 /抵押存款Trade accounts receivable 应收账款Trade and bills receivables 应收账款及应收票据Inventories 存货/库存Prepayments and other receivables 预付款及其他应收款Prepayments, deposits and other receivables 预付账款、按金及其它应收款 Total current assets 流动资产合计Tangible assets 有形资产Intangible assets 无形资产Investment properties 投资物业Goodwill 商誉Other intangible assets 其他无形资产Available-for-sale investments 可供出售投资Prepayments for acquisition of properties 收购物业预付款项fair value 公允价值Property, plant and equipment 物业、厂房及设备或财产、厂房及设备或固定资产Fixed Assets 固定资产Plant Assets 厂房资产Lease prepayments 预付租金Intangible assets 无形资产Deferred tax assets 递延税/递延税项资产Total assets 资产合计Liabilities 负债Current liabilities 流动负债Short-term bank loans 短期银行借款Current maturities of long-term bank loans 一年内到期的长期银行借款 Accounts and bills payable 应付账款及应付票据Accrued expenses and other payables 预提费用及其他应付款Total current liabilities 流动负债合计Long-term bank loans, less current maturities Deferred income Deferred tax liabilities 长期银行借款,减一年内到期的长期银行贷款Deferred income 递延收入Deferred tax liabilities 递延税Financial Net Debt 净金融负债Total liabilities 负债合计Commitments and contingencies 资本承诺及或有负债三、股东权益Donated shares 捐赠股票Additional paid-in capital 资本公积Statutory reserves 法定公积Retained earnings 未分配利润Accumulated other comprehensiveincome 累积其他综合所得Treasury shares 库存股票Total shareholders’ equity 股东权益合计Equity 股东权益、所有者权益、净资产Shareholder’s EquityStockholder's EquityOwner's Equity 股东权益、所有者权益Total liabilities and shareholders’ equity 负债和股东权益合计Capital and r eserves attributable to the Company’s equity holders 本公司权益持有人应占资本及储备Issued capital 已发行股本Share capital 股本Reserves 储备Cash reserves 现金储备Inerim dividend 中期股息Proposed dividend 拟派股息Proposed special dividend 拟派末期股息Proposed special dividend 拟派特别股息Proposed final special dividend 拟派末期特别股息Convertible bonds 可换股债券Shareholders’ fund 股东资金四、现金流量表STATEMENTS OF CASH FLOWSCash flow from operating activities 经营活动产生的现金流Net cash provided by / (used in) operating activities 经营活动产生的现金流量净额Net income /loss 净利润或损失Adjustments to reconcile net loss to net cash provided by/(used in) operating activities: 净利润之现金调整项:Depreciation and amortization 折旧及摊销Addition of bad debt expense 坏账增加数/(冲回数)Provision for obsolete inventories 存货准备Share-based compensation 股票薪酬Deferred income taxes 递延所得税Exchange loss 汇兑损失Loss of disposal of property,plant and equipment 处置固定资产损失Changes in operating assets and liabilities: 经营资产及负债的变化Trade accounts receivable 应收账款Inventories 存货Prepayments and other receivables 预付款及其他应收款Accounts and bills payable 应付账款及应付票据Accrued expenses and other payables 预提费用及其他应付款Net cash provided by / (used in) operating activities 经营活动产生/(使用)的现金Free cash flow 自由现金流Cash flow from investing activities 投资活动产生的现金流Net cash used in investing activities 投资活动产生的现金流量净额Purchases of property, plant and equipment 购买固定资产Payment of lease prepayment 支付预付租金Purchases of intangible assets 购买无形资产Proceeds from disposal of property, plant and equipment 处置固定资产所得 Government grants received 政府补助Equity in the income of investees 采权益法认列之投资收益Cash flow from financing activities 筹资活动产生的现金流Net cash provided by financing activities 筹资活动产生的现金流量净额Proceeds from borrowings 借款所得Repayment of borrowings 还款Decrease / (increase) in pledged deposits 银行保证金(增加)/ 减少 Proceeds from issuance of capital stock 股本发行所得Net cash provided by financing activities 筹资活动产生的现金Effect of exchange rate changes on cash and cash equivalents 现金及现金等价物的汇率变更的影响Net decrease in cash and cash equivalents 现金及现金等价物的净(减少)/ 增加Cash and cash equivalents at the beginning of period 期初现金及现金等价物 Cash and cash equivalents at the end of period 期末现金及现金等价物 Investments (incl. financial assets) 金融资产投资Investments in acquisitions 并购投资Net cash flow 现金流量净额。

会计英语.

• • •

4. GAAP 一般公认会计原则 5.IASs and IFRSs 国际会计准则及国际财务报告准则

• •

6. Assumptions and characteristics of financial statement. 财务报告的假设及特征

• • •

6.1 Underlying assumptions 基本假设 Accrual basis权责发生制 Going concern 持续经营

• • • • • •

6.2 Qualitative Characteristics of financial statement 财务报告的质量特征 Understandability可理解性 Relevance 相关性 Reliability 可靠性 Comparability 可比性

第 二 章

2.5 Posting from the day books to ledger 日记账结转至总账(分类账) After recording day books, the next step in the accounting process is to post transactions to the accounts in the general ledger and personal ledger.

Unit 2 Accounting cycle Ⅰ 第二章 会计循环Ⅰ

• • •

1. Documenting business transactions 记录企业业务交易 1.1 External documentation 外部凭证

• • • •

1.2 Internal documentation 内部凭证 1.2.1 invoices 发票 1.2.2 Credit Note 抵扣发票 1.2.3 Petty cash voucher 零用资金报 销单

会计专业英语lesson 1 Accounting an information system

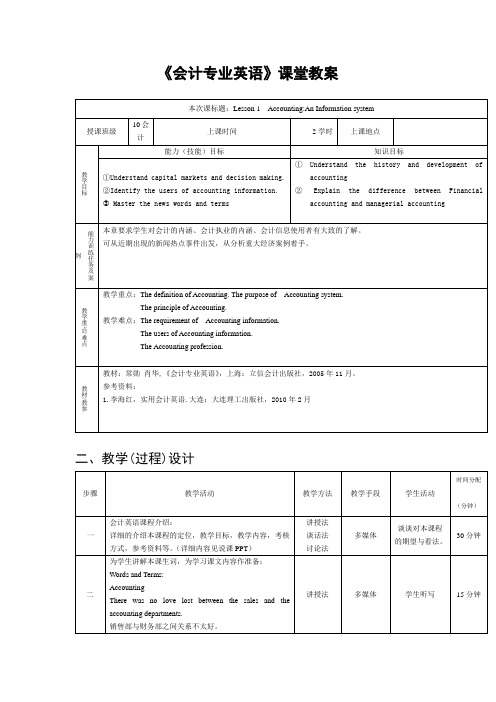

《会计专业英语》课堂教案本次课标题:Lesson 1 Accounting:An Information system授课班级10会计上课时间2学时上课地点教学目标能力(技能)目标知识目标①Understand capital markets and decision making.②Identify the users of accounting information.Master the news words and terms①Understand the history and development ofaccounting②Explain the difference between Financialaccounting and managerial accounting能力训练任务及案例本章要求学生对会计的内涵、会计执业的内涵、会计信息使用者有大致的了解。

可从近期出现的新闻热点事件出发,从分析重大经济案例着手。

教学重点/难点教学重点:The definition of Accounting. The purpose of Accounting system.The principle of Accounting.教学难点:The requirement of Accounting information.The users of Accounting information.The Accounting profession.教材/教参教材:常勋肖华,《会计专业英语》,上海:立信会计出版社,2005年11月。

参考资料:1.李海红,实用会计英语.大连:大连理工出版社,2010年2月二、教学(过程)设计步骤教学活动教学方法教学手段学生活动时间分配(分钟)一会计英语课程介绍:详细的介绍本课程的定位,教学目标,教学内容,考核方式,参考资料等。

(详细内容见说课PPT)讲授法谈话法讨论法多媒体谈谈对本课程的期望与看法。

第1章 Conceptual Framework《会计英语》PPT课件

requires the use of accounting for record keeping, planning, and

controlling operations. Many accountants work in government offices or

for nonprofit organizations. These two areas are often joined together

just one part of accounting. Accounting also identifies and

communicates information on transactions and events, and it includes

the crucial processes of analysis and interpretation.

Unit 1 Accounting and Accounting Profession

➢DISTINCTION BETWEEN BOOKKEEPING AND ACCOUNTING. Earlier

accounting procedures were simple in comparison with modern

assurance一词,我们在审计教材和文献中可能看到不同的提法,如“认证”、“

保证”等。根据2007年1月1日起实施的审计准则,这个术语应统一为“鉴证”

。

Special Terms

2. Certified Public Accountant (CPA) 注册会计师,指有资格执行审计业务的

专业人员,一般需要满足三个方面的条件才能获得这种资格:(1) 接受过专业教育,

[VIP专享]会计英语1-14章术语翻译(仅供参考,不足之处望批评指正。)

![[VIP专享]会计英语1-14章术语翻译(仅供参考,不足之处望批评指正。)](https://img.taocdn.com/s3/m/a09ad760b4daa58da1114a0d.png)

Chapter 1 Accounting会计Accounting equation会计等式Assets资产Auditors审计师Balance sheet资产负债表Bookkeeping记账Business entity assumption会计主体原则Common stock普通股Corporation公司Cost principle成本原则Equity权益Ethics伦理Events事项Expanded accounting equation扩展的会计等式Expenses费用External transactions外部交易External users外部信息使用者Financial accounting财务会计FASB美国财务会计准则委员会Full disclosure principle充分披露原则GAAP公认会计原则Going-concern assumption持续经营原则Income statement损益表Internal transactions内部交易Internal users内部信息使用者IASB国际会计准则理事会Liabilities负债Managerial accounting管理会计Matching principle配比原则Monetary unit assumption货币单位原则Net income净收益Net loss净损失Owner ,Capital所有者名下的资本Owner investment所有者投资Owner withdrawals所有者提取Partnership合伙企业Proprietorship独资企业Recordkeeping记账Revenue recognition principle收入确认原则Revenues收入Sarbanes –Oxley Act《萨班斯—奥克斯利法案》SEC证劵交易委员会Shareholders股东Shares股份Sole proprietorship个人独资企业Statement of cash flows现金流量表Statement of owner’s equity所有者权益表Stock股票Stockholders股东Time period assumption会计分期原则Withdrawals提取Chapter 2 Account账户Account balance账户余额Balance column account三栏式账户Chart of accounts会计科目表Compound journal entry复合日记账分录Credit贷方Creditors债权人Debit借方Debtors债务人Double-entry accounting复式记账法General journal普通日记账General ledger总分类账Journal日记账Journalizing 登记日记账Ledger分类账Posting过账(PR) column过账索引栏Source documents原始凭证T-account T型账户Trial balance试算平衡表Unearned revenue预收收入Chapter 3 Accounting period会计期间Accrual basis accounting权责发生制会计Accrued expenses应计费用Accrued revenues应计收入Adjusted trial balance调整后试算平衡表Adjusting entry调整分录Annual financial statements年度财务报表Book value账面价值Cash basis accounting收付实现制会计Contra account备抵账户Depreciation折旧Fiscal year会计年度Interim financial statements中期财务报表Matching principle配比原则Natural business year自然营业年度Plant assets固定资产Prepaid expenses预付费用Straight-line depreciation method直线折旧法Time period assumption会计分期原则Unadjusted trial balance调整前的试算平衡表Unearned revenues 预收收入Chapter 4 Accounting cycle会计循环Classified balance sheet分类资产负债表Closing entries结账分录Closing process结账过程Current assets流动资产Current liabilities流动负债Income summary损益汇总账户Intangible assets无形资产Long-term investments长期投资Long-term liabilities长期负债Operating cycle营业周期Permanent accounts永久性账户Post-closing trial balance结账后试算平衡表Pro forma financial statements预测财务报表Temporary accounts临时性账户Unclassified balance sheet未分类资产负债表Working papers工作底稿Work sheet工作底表Chapter 5 Cash discount现金折扣Cost of goods sold商品销售成本Credit memorandum贷记通知单Credit period 信用期Credit terms信用条件Debit memorandum借记通知单Discount period折扣期EOM月末FOB交货点General and administrative expenses一般及行政管理费用Gross margin毛利Gross profit毛利Inventory存货List price价目表价格Merchandise 商品Merchandise inventory库存商品Merchandiser商业企业Multiple-step income statement多步式损益表Periodic inventory system定期盘存制Perpetual inventory system永续盘存制Purchase discount购货折扣Retailer零售商Sales discount销售折扣Selling expenses销售费用Shrinkage损耗Single-step income statement单步式损益表Supplementary records辅助记录Trade discount商业折扣Wholesaler批发商Chapter 6 Average cost平均成本Conservatism constraint稳健性原则Consignee 收货人Consignor发货人Consistency concept一致性原则FIFO先进先出法Interim statements中期报告LIFO后进先出法LCM成本与市价孰低法Net realizable value可变现净值Specific identification个别认定法Weighted average加权平均法Chapter 7 Accounts payable ledger应付账款分类账Accounts receivable ledger应收账款分类账Cash disbursements journal现金支出日记账Cash receipts journal现金收入日记账Check register支票登记薄Columnar journal多栏式日记账Compatibility principle适应性原则Controlling account统驭账户Control principle控制原则Cost-benefit principle成本—收益原则Flexibility principle灵活性原则General journal普通日记账Internal controls内部控制Purchases journal购货日记账Relevance principle相关性原则Sales journal销售日记账Schedule of accounts payable应付账款明细表Schedule of accounts receivable应收账款明细表Special journal特种日记账Subsidiary ledger明细分类账Chapter 8 Bank reconciliation银行存款余额调节表Bank statement银行对账单Canceled checks注销支票Cash 现金Cash equivalents现金等价物Cash over and short现金溢缺Check支票Deposit ticket存款单Deposits in transit在途存款EFT电子资金转账Internal control system内部控制制度Liquid assets流动资产Liquidity偿债能力Outstanding checks未兑现支票Petty cash备用金Principles of internal control内部控制原则Sarbanes-Oxley Act《萨班斯—奥克斯利法案》Signature card印鉴卡Voucher 凭单Voucher system凭单制Chapter 9 Accounts receivable应收账款Aging of accounts receivable应收账款账龄分析Allowance for Doubtful Accounts呆帐准备金Allowance method备抵法Bad debts坏账Direct write-off method直接核销法Interest 利息Maker of the note出票人Matching principle配比原则Materiality constraint重要性约束Maturity date of a note票据到期日Payee of the note票据收款人Principal of a note票据的本金Promissory note票据Realizable value可变现价值Chapter 10 Accelerated depreciation method加速折旧法Amortization摊销Asset book value资产账面价值Betterments改良工程投资Capital expenditures资本支出Change in an accounting estimate会计估计变更Copyright版权Cost成本Declining-balance method余额递减法Depletion折耗Depreciation折旧Extraordinary repairs非常修理Franchises特许权Goodwill商誉Impairment减损Inadequacy生产能力不足Indefinite life不确定使用年限Intangible assets无形资产Land improvements土地改良物Lease租约Leasehold租赁权Leasehold improvements租赁资产改良Lessee承租人Lessor 出租人Licenses特许权Limited life有限使用年限MACRS修正后的加速成本回收制度Natural resources自然资源Obsolescence陈旧,过时Ordinary repairs日常维修Patent专利权Plant asset age固定资产寿命Plant assets固定资产Plant asset useful life固定资产使用年限Revenue expenditures收益性支出Salvage value残值Straight-line depreciation直线折旧法Trademark or trade (brand) name商标或品牌Units-of-production depreciation工作量法Useful life使用年限Chapter 11 Contingent liability或有负债Current liabilities流动负债Current portion of long-term debt一年内到期的长期负债Employee benefits员工福利Estimated liability估计负债(FICA)Taxes联邦社会保险税FUTA联邦失业税Gross pay薪资总额Known liabilities已知负债Long-term liabilities长期负债Merit rating考绩Net pay薪资净额Payroll deductions薪资扣款Short-term note payable短期应付票据SUTA州失业救济税Warranty保修Chapter 12Bond 债券Bond certificate债券证书Bond indenture债券契约Carrying (book) value of bonds债券账面价值Discount on bonds payable应付债券折旧Installment note分期付款期票Market rate市场利率Mortgage抵押权Pension plan养老金计划Premium on bonds债券溢价Par value of a bond债券面值Straight-line bond amortization债券利息直线摊销法Chapter 13(AFS) securities可供出售证劵Comprehensive income综合收益Consolidated financial statements合并财务报表Equity method权益法Equity securities with controlling influence具有控制权的权益类证劵Equity securities with significant influence具有重大影响力的权益类证劵(HTM) securities持有至到期证劵Long-term investments长期投资Parent母公司Short-term investments短期投资Subsidiary子公司Trading securities交易性证劵Unrealized gain (loss)未实现收益(损失)Chapter 14Appropriated retained earnings拨定留存收益Authorized stock核定股本Call price赎回价格Callable preferred stock可赎回优先股Capital stock股本Changes in accounting estimates会计估计变更Common stock普通股Convertible preferred stock可转换优先股Corporation股份制公司Cumulative preferred stock累积优先股Date of declaration股利宣告日Date of payment股利发放日Date of record股权登记日Discount on stock股票折旧Dividend in arrears积欠股利Financial leverage财务杠杆Large stock dividend大额股票股利Liquidating cash dividend清算性现金股利Market value per share每股市价Minimum legal capital最低法定资本Noncumulative preferred stock非累积优先股Nonparticipating preferred stock非参与式股票No-par value stock无面值股票Organization expenses组建费Paid-in capital实收资本Paid-in capital in excess of par value资本溢价Participating preferred stock参与式股票Par value面值Par value stock有面值股票Preemptive right优先认股权Preferred stock优先股Premium on stock股票溢价Prior period adjustments前期损益调整Proxy授权委托书Restricted retained earnings限定用途留存收益Retained earnings 留存收益Retained earnings deficit留存收益赤字Reverse stock split并股Small stock dividend小额股票股利Stated value stock设定价值股票Statement of stockholders’ equity股东权益表Stock dividend股票股利Stock options股票期权Stock split股票分割Stockholders’ equity股东权益Treasury stock库藏股。

会计英语

《会计英语》教学笔记第一部分:财务会计第一章:会计周期综述任何一个单位都要对自身的活动作出准确的记录。

簿记是会计系统中最基础(最不吸引人)的部分。

它对经济活动进行系统的量化的记录。

簿记系统十分简单,但进行定期的簿记十分重要(但簿记的重要性不管怎么说也不算夸大其辞)。

没有簿记,就不可能存在经济活动。

基础簿记历史悠久(也许可以追溯到语言和货币的产生之前)。

至今仍在使用的近代复式簿记系统,是1300—1400期间由意大利商人在佛罗伦萨,威尼斯,热那亚的贸易中心和银行中心从事活动的过程中创立的。

在过去的500年中,会计学的主要进步就在于利用簿记数据,不仅可以抓住经济活动的来龙去脉,而且可以评估某一企业的经营及盈亏状态。

根据会计记录编制的各种报表可以帮助报表使用者作出更好的经济决策。

每一份报表都是根据会计系统和一整套被称为会计程序或会计周期得出的数据制定出来的。

会计程序由两个相互关联的部分组成:(1)记录期,(2)报告期。

记录期是收集与经济交易和事件有关的信息,并将这些信息处理成会计程序可以利用的一种形式。

对大多数企业来说,记录的功能是建立在复式会计程序的基础之上。

在报告期间,要对记录的信息进行整理和总结,利用各种形式,达到各种决策的目的。

记录期与报告期有重叠部分,这是因为对交易的记录是一个永远进行的活动,它在会计周期结束之时也不会停止,而是不受干扰地进行(延续)下去,与此同时,对前期的交易与事件可以进行总结。

表1中列举的会计程序大致包括了以下这些明确规定的步骤:1 分析业务凭证;2 在分类帐中记录交易;3 将交易登入总帐;以上三者为记录期,以下五者为报告期:4 试算表;5 调整;6 财务报表;7 结帐分录;8 结帐后试算资产负债表(选择性的)。

1-1记录期如表1-1所示,记录期包括分析企业凭证,将交易记入分类帐中,以及将交易等入总帐。

在详细讨论这些步骤之前,有必要复习一下有关复式会计体系,因为实际上所有的企业都利用这一程序记录各自的交易。

国际会计第七版英文版课后答案(第一章)

Chapter 1IntroductionDiscussion Questions1.In the domestic case, accounting is an information service that provides financialinformation about a domestic entity to domestic users of that information. Internationalaccounting is distinctive in that the entity being reported on is either a multinationalcompany with operations and transactions that transcend national boundaries or involves an entiiy with reporting obligations to readers who are located outside the reportingentity’s country of domicile.2.Advantage: Some might argue that measurement, disclosure, and external auditing arethree distinct (although related) processes, involving different members of the company.For example, corporate attorneys often are involved in disclosure issues, but seldomintervene in measurement issues. The Board of Directors works with the external auditors but not necessarily with the comptroller s office. Thus, discussion of accountingrequirements and voluntary accounting choices in different jurisdictions is simplified by focusing on the three components of accounting. Disadvantage: measurement, disclosure and auditing are interdependent, and should not be viewed in isolation of one another. A company choosing to disclose as little as possible, for example, may use accountingmeasurement approaches that reduce the information content of financial statements, and select an external auditor who will be relatively lenient in enforcing accountingrequirements. One alternative classification might include accounting (measurement and disclosure), and auditing. A second classification might include financial reporting(annual and interim reporting, regulatory filings) and ad hoc disclosure (press releases,analyst meetings, etc). Any classification is arbitrary, and potentially useful depending on its purpose.3.Factors contributing to the internationalization of the subject of accounting include: thegrowth and spread of multinational operations around the world, the phenomenon ofglobal competition, the increasing number of cross-border mergers and acquisitions thatoccur almost daily, continued advances in information technology, and theinternationalization of the world’s capital markets.4.International trade involves importing and exporting activities. The major accountingissue associated with foreign trade involves accounting for foreign currency transactions.Foreign direct investment, on the other hand, involves conducting operations abroad.This activity exposes accountants to a new set of issues that run the gamut from having to consolidate foreign currency accounts based on diverse measurement rules to issues ofevaluating the performance of foreign subsidiary managers.5.Students will overwhelmingly argue in favor of harmonization. This is probably a goodstarting point for the course. After they are introduced to the chapters leading up toChapter 8, some may no longer feel that harmonization is necessarily the answer to all of their international accounting problems.6.Recent developments such as the growth and spread of multinational operations,Internationalization of the world’s capital markets, increased cross border mergers andacquisitions, the phenomenon of global competition and financial innovation haveincreased reader dependence on foreign financial statements. An understanding ofaccounting differences and their effect on reported measures of profitability, efficiency, solvency and liquidity are critical if proper decisions are to be made. Internationalaccounting issues have become more complex in recent years for several reasons.Financial transactions are becoming more complex, affecting both national andinternational accounting. For example, the use of complex financial instruments anddeveloping accounting standards for these exotic instruments has been problematic.Global financial markets also are becoming more volatile, leading to large changes in asset and balance sheet amounts (such as related to investments) and major sources of income and expense. The related accounting issues are difficult. The growinginternationalization of business also promotes complexity. Foreign currency transactions and translation have been troublesome accounting issues for years, and are becoming more important as cross-border business and finance increase. Also, differences innational accounting principles potentially are more troublesome as business becomes more international. However, as convergence efforts worldwide accelerate, and more and more companies and countries adopt International Financial Reporting Standards (IFRS), complexity arising from differences in national accounting principles will decrease.7.Examples of external reporting issues include:a. Does translation from one set of measurement rules to another change theinformation content of the original message?b. Should accounts of foreign operations be translated to parent currency whenconsolidated statements are prepared?c. Which exchange rates should be employed when translating from one currency toanother?Examples of internal reporting issues include:a. Which exchange rates should be used for budgeting purposes?b. Should foreign managers be evaluated in terms of parent currency or the localcurrency of the country in which the manager operates?c. Which prices should one use when transferring goods or services betweenmembers of the multinational enterprise- cost, market, cost-plus or some othermetric?8.Global capital market activities and transactions reach beyond single political or legaljurisdictions. For example, global capital market transactions include the following: (1) an American tourist buying Australian dollars for travel purposes in the South Pacific; (2)a Japanese insurance company buying German government bonds as an investment; and(3) a Nigerian agricultural development project receiving cash subsidies from theEuropean Union (EU).The international equities market is one global capital market. A second such market covers foreign exchange transactions, that is, when one national currency is exchanged into, traded forward, hedged, swapped, or otherwise converted to another nationalcurrency. This market is estimated at hundreds of billions of U.S. dollars per day. The total world foreign exchange market is the largest market on earth. The international bond market is still another global capital market. The bonds constituting this market areunderwritten by international syndicates of banks and are marketed and traded all over the world. Global capital markets are a vital part of the world economy.9.English should be designated as the formal international accounting language. Technicalaccounting terms ( terms of art) do not travel well internationally. Since technicalaccounting terms often have attributed meanings (for example, generally acceptedaccounting principles are neither generally accepted nor principles ), it is difficult orimpossible to translate these terms into other languages and retain their original meanings.In other disciplines, such considerations have caused the establishment of Latin as the universal language for botanical classifications, Italian as the language for specifying the tempo (and other matters of interpretation) of musical compositions, and English as the language of electronic computing. Since accounting is used worldwide, a singleworldwide language for accounting makes sense.Why should English be the worldwide language for accounting? English already hasbecome the language of world commerce and multinational business. Thus, the universal use of English in accounting would parallel a well-established business practice. Also, the accounting discipline was in many respects developed as an offshoot of Anglo-American economics, which means that the language roots of many accounting terms and concepts are English. Among non-English speaking people, English is the mostcommon second language. The vast majority of the world’s accounting literature iswritten in English, and nearly all international accounting conventions and conferences use English as the official language. Multinational corporations generally use English in their accounting and financial operating manuals, as well as for corporatecommunications, without regard to national domiciles. Therefore, the worldwide benefits of adopting English as the universal language of accounting are likely to be greater than for any other language, and the worldwide costs are likely to be less.10.Emerging markets are those whose financial systems are emerging from state dominationthrough a process of liberalization. Developed countries are those with liberalizedfinancial systems. Many people believe that liberalization is highly beneficial to sustained economic growth. Many different classifications of developed versus emerging market countries are used, and often the terms are not defined, although no one correct set of definitions for developed and emerging markets exists.Students should be encouraged to suggest their own criteria as to what constitutes adeveloped as opposed to an emerging market. The emerging market countries are in geographic regions that are generally not highly industrialized. But one cannot generalize here as extensive economic liberalization is taking place in these countries (in some more than in others). For example, entry barriers to foreign businesses, government regulation of banking operations, and credit controls have been eased in many of the countries once classified as “emerging.”11.Privatizations of state-owned corporations have had dramatic effects on global capitalmarkets. Often, the privatized entities are large, well-known companies in which thenational government retains a large ownership interest, and retail (individual, non-institutional) investors often are encouraged to buy shares in newly privatized entities. Asa result, the shareholder base in the market grows dramatically, investors become moreactive market participants, and market capitalization increases.Privatizations also mean that management must now compete in the market place formarket share, external capital and corporate control. In such a world, accounting systems must properly motivate managers to work toward the accomplishment of theorganization’s overall goals in an efficient manner while putting together credibleexternal financial statements that will enable it to secure the necessary capital to financecorporate growth. Many of these external and internal reporting issues are covered in the balance of the chapters in this book.12.Those opposed to outsourcing see it as a threat to domestic jobs and a form ofexploitation by companies engaged in the practice. Some even see it as a moral issue.However, they miss the point of international trade. While outsourcing may reduce jobs in one sector, they reflect differences in comparative advantage, which ultimately makes possible greater employment in other sectors and or lower consumer prices whichincreases real wealth. One need only look at higher education in America. Whereasstenographers in the U.S. may be losing jobs to stenographers in India, more and moreIndian families are sending their children to the U.S. for their higher education,increasing the demand for support services in the higher education sector.A look at Exhibit 1.2 shows that over time, countries with greater exports than importseventually become net importers and vice versa. The importance of internationalaccounting will not diminish. Countries have been trading with each other since antiquity and will continue to do. Even if the volume of trade were to diminish, an unlikely event, the network of trading partners continues to expand globally and with it accounting issues associated with international trade.Exercises1.For steps one and two in which the idea for the Proliant ML150 is spawned in Singaporeand approved in Texas, differences in legal practices regarding rights and compensationschemes for intellectual property development may vary between the U.S. and Singapore as the latter’s legal system has been influenced by the U.K. system. Internat ional taxissues also surface in terms of royalty payment arrangements and their tax consequences in both Singapore and the U.S.For step 4, language communications between Singapore and Taiwan could pose someissues of interpretation. Production in Taiwan raises internal reporting issues such asshould exchange rate fluctuations between the Taiwanese dollar and the U.S. dollar beincorporated into the cost of production or accounted for separately as a non-operatingforeign exchange gain or loss. In evaluating the creditworthiness of the Taiwanesemanufacturer, should the financial statements of the Taiwanese manufacturer betranslated to U.S. GAAP or not. If a ratio analysis is performed, should Taiwaneseliquidity and solvency ratios be interpreted based on U.S. financial norms or Taiwanesenorms?For step 5, should clients in Southeast Asian countries be charged identical prices orshould prices be flexed for differences in exchange rates, transportation arrangements and “facilitating” payments. What legal issues are raised in the case of bribes expected on the part of commercial buyers and how would these payments be treated under the U.S.Foreign Corrupt Practices Act?2. A suggested index might look like the following. The instructor should focus on thestudent’s rationale for his or her rating as some students may have more knowledge ofspecific country developments than others and students will naturally exhibit differentdegrees of risk-aversion.Industrialized CountriesUnited States 1Canada 1Japan 1United Kingdom 1France 1Germany 1Italy 1Australia 2New Zealand 2East AsiaHong Kong 1Indonesia 3South Korea 2Malaysia 2Phillipines 1Singapore 1Taiwan 3Thailand 2Latin AmericaArgentina 2Brazil 2Chile 2Colombia 2Mexico 1Peru 1Venezuela 2Middle East and AfricaEgypt 3Israel 2Morocco 2South Africa 1Turkey 2South AsiaBangladesh 2India 2Nepal 3Pakistan 3Sri Lanka 33.The compounded annual growth rate for merchandise exports from 1985 to 2005 wasapproximately 8.7%. The growth rate for merchandise imports was also 8.7% . The comparable growth rates for exports of services was 9.6% over the same 20 year period.It was 9.2% for imports. The outlook for accounting services to travel internationally are very good. Students interested in accounting careers should take note.4.The purpose of this exercise to get students to check out the wealth of stock relatedinformation available on the web. They will probably choose the five whose countriesare most familiar to them. Their exchanges will probably be located in highlyindustrialized economies and which afford access to relatively deep pools of capital. As one example, Luxembourg has long been popular because of its accommodating listingrequirements. However, students should note that the numbers of foreign companieslisted in markets other than the NYSE have been declining. This suggests that manyissuers question the benefits of such listings, and that the benefits of a foreign listinggenerally are greater in the United States. In particular, the U.S. represents a well-established market with strong investor protection. This is especially important in adown economy, as stringent disclosure requirements help to minimize perceivedinformation risk which, in turn, reduces price volatility.5.This exercise will require that students combine certain geographic categories ofmerchandise exports to achieve some comparability with Henekin’s disclosures. It would be interesting to poll students’ ex ante predictions of the correlations and have themponder reasons for any differences they find.Geographic Region Merchandise Exports Geographic Sales for HeinekenAfrica and Middle East 7.9% 12.6%Asia 29.2% 9.1%Europe 41% 65.5%Americas 17.6% 12.7%While correlations between percentage geographic distributions of merchandise exportsand beer sales are closer for Africa and the Middle East and for the Americas, there arebig differences in beer sales and merchandise export patterns for Asia and Europe.Obviously one cannot generalize microeconomic behavior from macroeconomic data.However, some students will be inclined to hypothesize similar patterns given thepopularity of beer consumption around the world. It will be fun brainstorming reasonsfor the observed differences. Might observed differences be due to national differencesin consumer tastes, import restrictions and perhaps the success of national advertisingcampaigns? More important, this exercise should reinforce the notion of environmentaldifferences as explanatory variables.6.The geographic spread of Heineken’s revenue streams suggest that the co mpany isexposed to foreign exchange rate risk. This complicates the process of forecasting thecompany’s future earnings and resultant cash flows. Moreover, the numbers beingreported are the results of a consolidation process. The cardinal rule to remember here is that when exchange rates change, data in parent currency may change even though local currency amounts may not. For managerial accountants, the conduct of foreignoperations raises numerous issues of financial control. For example, which currencyshould be used to evaluate foreign subsidiary performance, the parent currency or thelocal currency? In preparing operating budgets, which exchange rate combination should be used to translate original budgets and subsequently track performance? Whenplanning capital expenditures, how do you factor inflation, foreign exchange rate risk and sovereign risk into measures of future project cash flows, cost of capital estimates andplanned investment outlays? Should capital budgeting decisions be made from theproject’s perspective or a company perspective? Again, this exercise is designed to raise questions that will be addressed in subsequent chapters.7.Issues triggered by Exhibit 1-5 include :a. What criteria are used to determine when a foreign affiliate is to be consolidatedwith that of the parent company? While majority ownership is one criterion forconsolidation, do other criteria exist internationally and why?b. When consolidating the accounts of a foreign affiliate with that of the parentshould accountants first restate the accounting measurement rules of the foreignaffiliate to the reporting requirements of the parent company or should thereporting requirements of the affiliate’s country of domicile prevail? Whichmethod produces the more meaningful information for statement readers?c. When consolidating the accounts of a foreign affiliate should the accountanttranslate the currency of the affiliate to the reporting currency of the parentcompany? If so, which exchange rates should be employed for each balancesheet account? For each income statement account?d. If fluctuating exchange rates produce foreign currency gains and losses duringthe consolidation process, how should these gains and losses be accounted for?8.The ROE ratios for Electrolux based on IFRS and U.S. GAAP was derived as follows:IFRS U.S. GAAPROE 1,763/25,888 + 23,636 1,518/25,057 + 23,5672 2= 1,763/24,762 =1,518/24,3129.For this exercise, we consider information provided by three stock exchanges: TheLondon Stock Exchange, the Deutsche Boerse and the Tokyo Stock Exchange. TheLondon Stock Exchange Web site () provides highly useful information. However, under the U.K. regulatory structure, the Financial Services Authority, not the LSE, is responsible for the admission of securities to official listing and continuing obligations of listed companies.The Deutsche Boerse ()has a 117-page document covering insider trading and required ad hoc disclosure, but nothing in any detail concerning periodic financial disclosures. There is a bar chart that claimed to show the relative transparency of the various Deutsche Boerse exchanges. Without even the most basic frame ofreference, it s hard to describe such a chart as anything but opaque.It might be well to advise students not to investigate financial disclosure requirements for the Tokyo Stock Exchange (www.tse.or.jp). The TSE does not have independentfinancial disclosure requirements. Rather, companies must conform with therequirements of Japan’s Securities and Exchange Law and regulations. The TSE provides this brief summary: Under the Securities and Exchange Law, the registrants are required to file annual and semi-annual reports with the Ministry of Finance, with copies to the stock exchanges where the securities are listed. The financial statements to be included in security registration statements and annual reports must comply with a wide range of formats and contents relating to disclosures prescribed in the regulations. The regulations require both the consolidated financial statements and non-consolidated financialstatements of the registrant. The financial statements prepared under the Securities and Exchange Law and relevant regulations are in major areas equivalent to those prevailing internationally.This summary obviously raises many more questions than it answers. The TSE alsoprovides a flow chart showing which documents are required to be filed, and their filing deadlines, but nothing concerning the required contents of these documents.For an illustrative example, consider the Deutsche Boerse and the London StockExchange. Note that Web sites change continuously. Therefore, the responses shown below are indicative only.Ratings (obviously) will be subjective. Students should be evaluated on the thoroughness and thoughtfulness of their evaluations10.If we divide the total foreign company listings for each region by the total listings for thatregion as one measure of foreign listings, we would obtain the following results: The Americas: 1,174/3,758 = 31.2%Asia-Pacific: 274/2,375 = 11.53%Europe-Africa-Middle-East 1,188/10,383 = 11.4%Student answers to the second part of the question will vary depending on which region of the world they expect to experience the most rapid growth in the years ahead.11.In addition to eliciting a variety of investment strategies, this question should drive homethe connection between accounting information and international investing. Theaccounting issues that will influence country investment allocations will be the extent oftransparency of a company’s accounts, the degree to which its accounting standards areoriented toward investor decisions and the quality of the audit functions in each country. Case 1-1E-Centives, Inc.e-centives, Inc. — Raising Capital in Switzerland1. Possible factors (from Exhibit 1.7) relevant in e-centives decision to raise capital and list on the Swiss Exchange s New Market:•Ease of raising capital (point 3). The Swiss Exchange s New Market has simple listing requirements designed to appeal to small companies. The contrast with the complex,detailed listing and reporting requirements in the United States is striking.•Availability of capital (point 4). Switzerland has a large, well-developed capital market.•Reputation of the exchange (point 5). The Swiss Exchange is well known for providing a high quality, efficient trading environment.•Corporate profile and brand identity (point 6). A listing on the New Market would dovetail with the company s possible expansion into Switzerland by giving it a higherprofile in the Swiss market. While e-centives is interested in expanding into Switzerland, it also is considering Germany and the United Kingdom, which have much largerconsumer markets. Therefore, this is not an overwhelming point in Switzerland s favor.•Regulatory environment (point 7). It is highly likely that e-centives chose Switzerland because its regulatory environment is unlike that of the United States.•Availability of investors (point 9). e-centives might be interested in possible investment from large Swiss pension funds, but it s not likely that such funds would invest in aspeculative, start-up enterprise.2. a. Possible reasons why e-centives chose not to raise public equity in the United States:•One possible reason would be to avoid the complex and expensive process of registering securities with the U.S. Securities and Exchange Commission and keeping up with theCommission’s periodic reporting requirements.•e-centives probably would not satisfy the listing requirements of a U.S. stock exchange (such as Nasdaq or a regional stock exchange).•Management might think that raising money in Switzerland rather than the U.S. might give them an appearance of quality, cleverness, and exclusivity that would not bepossible with a U.S. listing. (Your authors believe that such reasoning is far-fetched, but it s not unknown.)b. Possible drawbacks to not raising capital in the U.S. public markets.•Lack of access to the largest pool of investment capital in the world.•Lack of following by U.S. investment analysts, and lack of access to individual U.S.investors.•Trading volume on the Swiss Exchange New Market is much smaller than on the U.S.exchanges.•Listing in Switzerland does little to establish the reputation or raise the profile of e-centives in the United States.•The degree to which (mostly European) investors in the New Market would be interested in a struggling U.S. start-up certainly can be questioned.3. Advantages and disadvantages to e-centives of using U.S. GAAP.Advantages: U.S. accounting standards are highly credible and well known, which is important to a new company seeking investment capital, and would be much more familiar to the company’s management, outside auditors, and investors domiciled in the U.S. than any other set of standards. Use of U.S. GAAP would eliminate some suspicions of the company trying to put something over on investors by using some other set of GAAP, and U.S. GAAP is accepted explicitly by the Swiss Exchange.Disadvantages: U.S. accounting standards are not particularly well known to investors participating on the Swiss Exchange, who would be expected to know Swiss GAAP, GAAP of other major European markets, and possibly IAS (International Accounting Standards). Compliance with U.S. GAAP is more complex and expensive than compliance with other standards (such as IAS), and the company might see some cost savings by avoiding U.S. GAAP if it isn’t required to use them.4. Should the Swiss Exchange require e-centives to prepare its financial statements using Swiss accounting standards?This is a debatable point. One would expect that investors on the Swiss Exchange would be more familiar with Swiss accounting standards than with any other, and that requiring Swiss accounting standards would make financial disclosures more easily understood toth em than any others. This wouldn’t be true, however, for non-Swiss investors participating on the exchange, and ignores the fact that IAS increasingly are becoming a common language for financial accounting disclosures. Accepting IAS almost certainly would increase the pool of investors that would be able readily to understand disclosures by listed companies, and this would give the exchange a powerful reason to accept IAS in addition to (if not instead of) Swiss accounting standards.5. What are listing and financial reporting requirements of the Swiss Exchange s New Market? Does e-centives appear to fit the profile of the typical New Market company?From the case: The New Market is designed to meet the financing needs of rapidly growing companies Listing requirements are simple. For example, companies must have an operating track record of 12 months [note: not necessarily a profitable operating track record], [and] the initial public listing must involve a capital increase. All of these conditions apply well to e-centives, and on that basis the company does appear to fit the profile of the typical New Market company. The uniqueness of e-centives is in its decision to skip the U.S. capital markets.Case 1-2Infosys Technologies LimitedThis case is designed to get students into reading non-domestic financial statements. Many students will be surprised at the information content of Infosys’ financial statements as the company does not fit the typical stereotype of sub-par financial reporting in emerging markets. Indeed the company illustrates how competitive the world of business has become and the success that accrues to firms that base their futures on innovative thinking and adaptability. Students unused to seeing the report form of balance sheet will find it at odds with the classified balance sheet format that they were taught in class. Other things they will note include but are not limited to: use of a fiscal as opposed to a calendar year, the fact that the financial statements。

会计英语1-5章 中文翻译(叶建芳 孙红星)

2

2006 年 2 月 16 日,中国的财政部宣布实行一项新的基本准则和 38 项新的会计准则,虽然这些准 则和国际会计准则相比有一些例外,但很大程度上已经和国际会计准则一致。新的基本准则类似于国 际会计准则委员会发布的概念框架,并且这新的 38 项会计准则覆盖了国际财务报告准则下的所有问 题。

1.4 财务报表

1.1 会计是一个信息系统

我们通常把会计描述为一个信息系统。作为一个信息系统,会计计量经济活动,将信息编制成财 务报表,并将财务报表传达给决策者。会计的范围包括:确认经济,进行计量记录汇总,把信息报告 给使用者。会计所涵盖的范围要大于簿记。表 1-1 是信息在会计系统内的流转图。簿记是对交易和 事件的记录,只是会计的一部分。会计还包括对会计信息的分析和阐述外部和内部的经济决策。

会计信息必须满足使用者的需求。主要使用者财务报表信息评价企业的盈利能力和偿债能力。财 务报表是会计程序的最终产品。财务报表应按一定的格式编制,并提供与决策相关的信息。

独资企业编制的四种财务报表有: - 利润表(又称为损益表) - 所有者权益变动表(又称为资本变动表,以及以后章节介绍的留存收益表) - 资产负债表 - 现金流量表

筑物和机器等。无形资产包括专利权,商标权和版权等。 资产的来源有两种一种是负债,另一种是所有者权益。IASB 框架对负债的定义如下: 负债是由过去的交易或事项形成的,预期会导致经济利益流出企业的,通过转移资产或向其他企

业提供服务等实现的义务。 负债包括应付账款,应付票据,应付工资,应付税款,应付利息和应付债券。 权益(独资企业的所有者权益,合伙企业的合伙人权益,及公司的股东权益)是剩余权益。IASB

资产=负债+所有者权益 经济交易是指影响该等式的商品或服务的交换。理解交易给会计等式带来的影响对理解会计的作 用很关键。 根据利润表,我们知道收入和费用等的关系如下:

- 1、下载文档前请自行甄别文档内容的完整性,平台不提供额外的编辑、内容补充、找答案等附加服务。

- 2、"仅部分预览"的文档,不可在线预览部分如存在完整性等问题,可反馈申请退款(可完整预览的文档不适用该条件!)。

- 3、如文档侵犯您的权益,请联系客服反馈,我们会尽快为您处理(人工客服工作时间:9:00-18:30)。

other information users. It measures and records business transactions and prepares financial statements to convey information.

会计英语

Chapter 1 Overview of Accounting

1.1 Accounting and Accounting Profession

Accounting is an information system designed to identify, record, and reflect economic activities and events about an enterprise with monetary unit as its main criterion.

◦ In addition

prediction, decision making, analysis, and so on.

1.1.3 Accounting Information Users

Internal users

◦ Internal users of accounting information are the users who are inside an enterprise and plan, organize, manage its business

1.2 Accounting Assumptions

A reasonable setting for the scope, contents, basic procedures, and methods of accounting.

The basic premise of accounting calculation

1.2.2 Going-concern

The business activities of an accounting entity will continue indefinitely, and will not disappear for bankruptcy, liquidation, and dissolution in the foreseeable future.

Four major accounting assumptions

◦ Business entity ◦ Going-concern ◦ Monetary unit ◦ Time period

1.2.1 Business Entity

A business entity should be accounted separately from other business entities, including its owner.

As the basic premise of accounting, it’s of great significance to identify the business entity.

◦ Firstly, business entity assumption helps to define the spacial scale of accounting.

Public accounting

◦ provides accounting services to the public on a compensable foundation base.

Private accounting

◦ modern accounting can be divided into two main branches: financial accounting and management accounting.

◦ management accounting help managers to choose, communicate, and implement appropriate strategies,

and then help the company fulfill its development targets.

By using the monetary form and certain methods or procedures, accounting records the economic activities, and then makes the necessary calculation, sorting, processing, and summarizing so as to put data into a series of information that could reflect accounting objects, and summarize producing and operating activities and their results.

◦ A legal entity must be a business entity, but a business entity is not always a legal entity.

◦ A business entity could be a legal entity and it also could be a non-legal entity.

When analyzing economic activities involving ethics, it is helpful for accountants to follow the following three steps.

① recognize the ethical situation and the involved ethical issues. ② identify and analyze the principal elements in the ethical situation in

◦ Such as board of directors, Chief Executive Officer (CEO), Chief Financial Officer (CFO), and so on.

◦ By reading and analyzing the detailed information about the company’s financial position and financial performance, these internal users could make their own decisions about operating, financing, and investing.

The buependence or relative independence in management or economy.

◦ Also an economic unit stands on its own interest.

1. to check and supervise the implementation of budget for each level of the government and all the non-profit organizations.

2. to identify, measure and report all the financial incomes and expenditures of government and nonprofit organizations as well as the corresponding result.

External users

◦ The users who are outside the enterprise

◦ Such as shareholders (investors), creditors (lenders), tax offices, external (independent) auditors, labor unions, and so on.

◦ Secondly, this assumption defines the scope of economic business activities and events that need to be treated by the accounting.

Business entity is different from legal entity.

Accounting for government and nonprofit organizations

◦ provides accounting service to government and nonprofit organizations. ◦ two major activities:

◦ Different external users need different kinds of information.

1.1.4 Accounting Profession

The accounting profession can be divided into three broad categories: public accounting, private accounting, and accounting for government and nonprofit organizations.

◦ Supervision function

to examine the authenticity, legality, and rationality of economic businesses of a specific accounting subject when the accounting personnel carry out the calculation function. Just as calculation function, it is one of the basic functions of accounting, and is also an important component of Chinese economic supervision system.