高顿名师讲解ACCA考试F5业绩管理知识点

F5 Performance management–业绩管理

F5 Performance management–业绩管理分享到:在系统学习F5的时候,学员们一定要注意Specialist cost and management techniques, Decision-making techniques, Budgeting, Standard costing and variance和Performance measurement and control这5个方面,因为网校的课程就是按照这五大大的模块进行教学的。

为了方便学员们的学习,网校也会针对这五大块进行总结,指导学员的学习和复习。

现在就让网校带领同学们一起来总结第一大块Specialist cost and management techniques中的知识。

在这一部分中,同学们已经接触到了有关Costing, Activity based costing (ABC), Target costing, Life cycle costing, Throughput costing和Environmental costing这6个小部分的内容,其中7中会计核算方法就奠定了以后学习和考试的基调,因为不管在做计算、预测或者是业绩评估的时候,都会用到其中的几种方法,所以,核心的一些计算步骤和方法就显得尤为重要。

一. Absorption costing1. Absorption costing is a traditional approach to dealing with overheads, involving three stages: allocation, apportionment and sorption.2. Absorption costing is a method of product costing which aims to include in the total cost of a product (unit, job and so on) an appropriate share of an organization’s total overhead, which is generally taken to mean an amount which reflects the amount of time and effort that has gone into producing the product.二. Marginal costing1. In marginal costing, inventories are valued at variable production cost whereas in absorption costing they are valued at their full production cost.2. Marginal costing is an alternative to absorption costing. Only variable costs (marginal costs) are charged as a cost of sales. Fixed costs are treated as period costs and are charged in full against the profit of the period in which they are incurred.三. Activity based costing (ABC)1. Activity based costing (ABC) involves the identification of the factors which causes the costs of an organization’s major activities. Support overheads are charged to products on the basis of their usage of the factor causing the overheads.2. Step 1 Identify an organization’s major activities.Step 2 Identify the factors which determine the size of the costs of an activity (Cost driver).Step 3 Collect the costs associated with each cost driver into what are known as cost pools.Step 4 Charge costs to products on the basis of their usage of the activity.四. Target costing1. Target costing involves setting a target cost by subtracting a desired profit margin froma competitive market price.五. Life cycle costing1. Life cycle costing tracks and accumulates costs and revenues attributable to each product over the entire product life cycle.2. The product life cycle includes development, introduction, growth, maturity and decline stage.六. Throughput accounting1. Throughput accounting is a product management system which aims to maximize throughput, and therefore cash generation from sales, rather than profit. A just in time (JIT) environment is operated, with buffer inventory kept only when there is a bottleneck resource.七. Environmental accounting1. Environmental accounting (EMA) is the generation and analysis of both financial andnon-financial information in order to support internal environmental management processes.。

ACCA考试辅导F5业绩管理重点讲义

【ACCA考试辅导】F5业绩管理重点讲义6本文由高顿ACCA整理发布,转载请注明出处Comparing costs per driver and per unit using traditional methods and ABCTraditional absorption costing charges overhead costs to products (or services) in an arbitrary way.The assumption that overhead expenditure is related to direct labour hours or machine hours in the production departments is no longer realistic for the vast majority of companies.This will lead to very different values of overheads absorbed per unit.Advantages and disadvantages of ABCABC has a number of advantages:§ It provides much better insight into what drives overhead costs.§ ABC recognises that overhead costs are not all related to production and sales volume.§ In many businesses, overhead costs are a significant proportion of total costs, and management needs to understand the drivers of overhead costs in order to manage the business properly. Overhead costs can be controlled by managing cost drivers.§ It can be applied to derive realistic costs in a complex business environment.§ ABC can be applied to all overhead costs, not just production overheads.§ ABC can be used just as easily in service costing as in product costing.§ Criticisms of ABC:§ It is impossible to allocate all overhead costs to specific activities.ABC costs are based on assumptions and simplifications. The choice of both activities and costs drivers might be inappropriate.§ ABC can be more complex to explain to the stakeholders of the costing exercise.§ The benefits obtained from ABC might not justify the costs.更多ACCA资讯请关注高顿ACCA官网:。

【ACCA考试辅导】F5业绩管理重点讲义1

【ACCA考试辅导】F5业绩管理重点讲义1本文由高顿ACCA整理发布,转载请注明出处Chapter 1Advanced costing methodChapter learning objectivesUpon completion of this chapter you will be able to:§ explain what is meant by the term cost driver§ identify appropriate cost drivers under activity-based costing (ABC)§ calculate costs per driver and per unit using (ABC)§ compare ABC and traditional methods of overhead absorption based on production units, labour hours or machine hours.§ explain the implications of switching to ABC on pricing, performance management and decision making.§ explain what is meant by the term ‘target cost’ in both manufacturing and service industries.§ derive a target cost in both manufacturing and service industries.§ explain the difficulties of using target costing in service industries§ explain the implications of using target costing on pricing, cost control and performance management.§ describe the target cost gap.§ suggest how a target cost gap might be closed.§ explain w hat is meant by the term ‘life-cycle costing’ in a manufacturing industry § identify the costs involved at different stages of the life-cycle.§ explain the implications of life-cycle costing on pricing, performance management and decision making.§ describe the process of back-flush accounting and contrast with traditional process accounting.§ explain, for a manufacturing business, the implications of back-flush accounting on performance management§ evaluate the decision to switch to back-flush accounting from traditional process control for a manufacturing business.§ explain throughput accounting and the throughput accounting ratio (TPAR), and calculate and interpret, a TPAR.§ suggest how a TPAR could be improved.§ apply throughput accounting to a given multi-production decision making problem.。

2015ACCA F5业绩管理精选讲义(3)

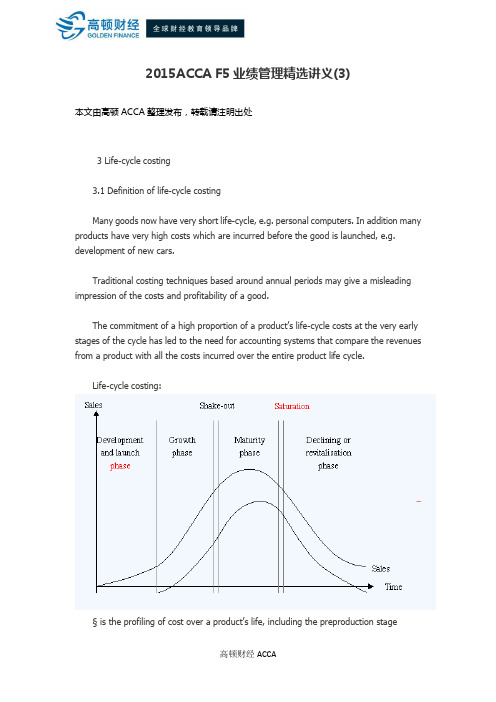

2015ACCA F5业绩管理精选讲义(3)本文由高顿ACCA整理发布,转载请注明出处3 Life-cycle costing3.1 Definition of life-cycle costingMany goods now have very short life-cycle, e.g. personal computers. In addition many products have very high costs which are incurred before the good is launched, e.g. development of new cars.Traditional costing techniques based around annual periods may give a misleading impression of the costs and profitability of a good.The commitment of a high proportion of a product’s life-cycle costs at the very early stages of the cycle has led to the need for accounting systems that compare the revenues from a product with all the costs incurred over the entire product life cycle.Life-cycle costing:§ is the profiling of cost over a product’s life, including the preproduction stage§ tracks and accumulates the actual costs and revenues attributable to each product from inception to abandonment§ enables a product’s true profitability to be determined at the end of its economic life.3.2 The costs involved at different stages in the product life-cycleMost products have a distinct product life-cycle:Specific costs may be associated with each stage.1 Development and launch stage- A high level of setup costs will already have been incurred by this stage (preproduction costs), including research and development (R&D), product design and building of production facilities.- Success depends upon awareness and trial of the product by consumers, so this stage is likely to be accompanied by extensive marketing and promotion costs.2 Growth stage- Marketing and promotion will continue through this stage.- In this stage sales volume increases dramatically, and unit costs fall as fixed costs are recovered over greater volumes.3 Maturity stage- Initially profits will continue to increase, as initial setup and fixed costs are recovered.- Marketing and distribution economies are achieved.- However, price competition and product differentiation will start to erode profitability as firms compete for the limited new customers remaining.4 Decline stage- Eventually, the product will move towards obsolescence as it is replaced by new and better alternatives.- The product will be abandoned when profits fall to an unacceptable level, or when further capital commitment is required.- Meanwhile, a replacement product will need to have been developed, incurring new levels of R&D and other product setup costs.- Alternatively additional development costs may be incurred to refine the model to extend the life-cycle (this is typical with cars where ‘product evolution’ is the norm rather than ‘product revolution’).3.3 The implications of life-cycle costingPricing§ Pricing decisions can be based on total life-cycle costs rather than simply the costs for the current period.Illustration 6 – Targeting costsA major bank and provider of credit cards wished to reduce the time taken to process credit card application forms and issue a credit card. The staff responsible for processing applications and issuing new cards were asked suggest how the period (of 14 days) could be reduced.The staff were unable to identify any significant time savings. The senior executive responsible for the area decided to pursue a version of target costing and instructed his staff that new cards were to be issued within 24 hours of an application being received and it was their responsibility to identify how this could be achieved.The imposition of this target forced a new approach to the problem and radical new ways of processing and approving applications were identified and implemented with the result that the 24-hour target was met.Decision making§ In deciding to produce or purchase a product or service, a timetable of life-cycle costs helps show what costs need to be allocated to a product so that an organization can recover its costs.§ If all costs cannot be recovered, it would not be wise to produce the product or service.§ Life-cycle costing allows an analysis of business function interrelationships, e.g. a decision towards lower R&D costs may lead to higher customer service costs in the future.Performance management – control§ Many companies find that 90% of the product’s life-cycle costs are determined by decisions made in the development and launch stages. Focusing on costs after the product has entered production results in only a small proportion of life-cycle costs being manageable.§ Target costs should be set throughout the life-cycle and revised/changed as needed.Performance management – reporting§ R&D, design, production setup, marketing and customer service costs are traditionally reported on an aggregated basis for all products and recorded as a period expense.§ Life-cycle costing traces these costs to individual products over their entire life cycles, to aid comparison with product revenues generated in later periods.更多ACCA资讯请关注高顿ACCA官网:。

ACCA考试《P5高级业绩管理》知识辅导5

ACCA考试《P5高级业绩管理》知识辅导5本文由高顿ACCA整理发布,转载请注明出处PERFORMANCE MEASURES TO SUPPORT COMPETITIVE ADVANTAGEby Graham Morgan 01 Aug 2005The emergence in the 1990s of low-cost airlines and the expansion of the European travel market has shown how competition can significantly affect the structure of an industry.Ryanair and easyJet are now well-established and their on-going success will depend upon a continuing ability to attract customers and maintain operational efficiency. This must be done in the context of increased competition from schedule and charter airlines that now recognise the effectiveness of the business model adopted by the low-cost carriers. This article examines how the balanced scorecard might be used to maintain the low-cost carriers' competitive edge.The business model adopted by low-cost carriers can be viewed as having three broad elements on which success is based:· route network development· brand development and marketing effectiveness· low-cost operations.These aspects can be seen to be structural as they reflect major decisions and developments which set the context for operational performance and day-to-day management.The route network is the product dimension of first importance to customers. Before European air travel was deregulated in the mid-1990s, the market was neatly divided. Schedule carriers focused primarily on business travellers with 75% of the market, the other 25% being provided by charter airlines as part of the package holiday industry. Low-cost carriers use aircraft which for European routes are generally larger than thoseused by schedule airlines and routes the balanced scorecardmust be selected to provide high load factors, ie percentage of available seats sold.Routes chosen should be new routes or those served by high-cost carriers, and have appeal to leisure and private travellers. This approach allows low-cost carriers to use secondary airports at major European cities or regional airports which provide overseas homeowners greater access to properties with minimum travel in the destination country. Another major aspect of the route network decision is the departure airport. Low-cost carriers' use of secondary airports in the UK provides convenience to travellers, and important cost savings for the company.Another important factor in the development of the route network is to avoid direct competition from other low-cost carriers. In 2002, of 128 low-cost routes, only 17 involved the same departure and destination airports - and Ryanair and easyJetadopted distinct positions in the market. While Ryanair has become the 'least-cost provider', easyJet has positioned itself to have a significant appeal to the businesstraveller by flying three times a day to major cities such as Amsterdam, Madrid, Paris, and Zurich from London's Luton and Gatwick airports, which are generally viewed asmore accessible from London than Stansted (Ryanair's base airport)。

ACCAF5知识要点汇总(精简版)

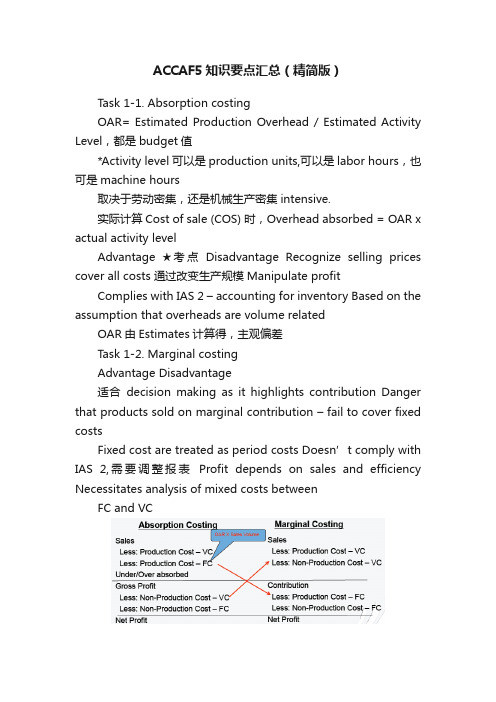

ACCAF5知识要点汇总(精简版)Task 1‐1. Absorption costingOAR= Estimated Production Overhead / Estimated Activity Level,都是budget值*Activity level可以是production units,可以是labor hours,也可是machine hours取决于劳动密集,还是机械生产密集intensive.实际计算Cost of sale (COS) 时,Overhead absorbed = OAR x actual activity levelAdvantage ★考点Disadvantage Recognize selling prices cover all costs 通过改变生产规模Manipulate profitComplies with IAS 2 – accounting for inventory Based on the assumption that overheads are volume relatedOAR由Estimates计算得,主观偏差Task 1‐2. Marginal costingAdvantage Disadvantage适合decision making as it highlights contribution Danger that products sold on marginal contribution – fail to cover fixed costsFixed cost are treated as period costs Doesn’t comply with IAS 2,需要调整报表Profit depends on sales and efficiency Necessitates analysis of mixed costs betweenFC and VC☆技巧 AC = MC + (Closing Inventory – Opening Inventory) x OAR*The absorption costing requires subjective judgments.预算估计主观判断太多*There is often more than one way to allocate the overheads.制造成本分摊可操纵Task 2. Activity‐based costing★考点Traditional absorption costing适用于★考点Activity‐based costing适用于 One or a few simple and similar products Production has become more complex Overhead costs 占很小比例proportion Assess product profitability realistically 资源consumption not driven by volumeLarger organizations & the service sector成本驱动drive:不同单位,不同OAR◆解题步骤:Cost Pool → Cost Drive → OAR → Absorbed → Full Cost★考点Adv antage ★考点DisadvantageMore accurate cost/unit.适用绩效appraisal.Time consuming & expensiveControl OC by managing cost drivers Limited benefit当成本和volume related Profitability analysis to customers或生产线Multiple cost drivers情况复杂,导致不精确Better understandingof what drives OC Arbitrary apportionment 任意分配★考点‐计算题(10.Dec.Q4) Problems when implementing ABC:‐ 耗时‐ 需要上层支持,因为缺乏信息‐ Project team运作,成员来自各个部门‐ IT部门支持‐ 了解成本结构‐ Cost‐benefit analysis★成本效益分析Target 3. Target costingCost plus pricing 传统成本法 Target costingFocus on internal Focus on external Steps of target costing 如何减少Cost gapProduct specifications ? Selling price ? Target profit: margin/ ROI ? Target cost ? Close the cost gap1) 购买便宜的材料(bulk buying 采购折扣或新供应商)2) 降低人工成本3) 提高生产能力,生产效率4) 以自动化替代人工automation 5) 减少无用环节eliminate non value added activities6) 尽量减少部件数量,或尽可能使用多的标准件注:不能在质量上妥协compromise ,不得影响质量★考点Implications of target costing‐ Cost control: 目标成本体系中,价格是首要考量consideration !开发development过程中就要考虑成本,而不是后来产生时再考虑。

ACCA考试辅导:F5业绩管理重点讲义5

ACCA考试辅导:F5业绩管理重点讲义52 Targeting costs2.1 Definition of target costingTarget costA target cost is a cost estimate derived by subtracting desired profit margin from a competitive market price.In effect it the opposite of conventional ‘cost plus pricing’ and is sometimes referred to as ‘price minus costing’.It may be used in both manufacturing and service industries.The main theme behind target costing is thus not finding what a new product does cost but what it should or needs to cost. The firm can then focus on which costs can be reduced and which can not to see whether such a target cost is achievable. Obviously cost reductions must be seen in the context of quality concerns as well. This will involve product comparisons with the competitors used to set the competitive market price in the first place.Illustrative 4 targeting costs§ Sony§ Toyota§ Swiss watchmakers – Swatch.Test your understanding 6Briefly identify the implications for a profit-orientated organisation if it chooses to use cost plus pricing.2.2 Deriving a target costSteps1 Estimate a selling price for a new product that will enable a firm to capture a required share of the market.2 Reduce this figure by the firm’s required level of profit. This could take into account the return required on any new investment and on working capital requirements or could involve a target margin on sales.3 Produce a target cost figure for product designers to meet.4 Reduce costs to provide a product that meets that target cost.Illustration 5 – Targeting costsKaty Inc, a toy manufacturer, is about to launch a new type of bicycle on which it requires a Return on Investment of 30%.Buildings and equipment needed for production are to cost $5,000,000.Expected sales levels are $40,000 toys pa at a selling price of $67.50 per item costs are currently estimated to be $32 per unit.Required:What is the target cost for annual production?SolutionWorking$Revenue(67.50×40,000)2,700,00Target costs(balancing figure)(1,200,000)Target return(30%×5,000,000)1,500,000参与ACCA考试的考生可按照复习计划有效进行,另外高顿网校官网ACCA考试辅导高清课程已经开通,还可索取ACCA考试通关宝典,针对性地讲解、训练、答疑、模考,对学习过程进行全程跟踪、分析、指导,可以帮助考生全面提升复习备考效果。

ACCA《F5业绩管理》复习指导

ACCA《F5业绩管理》复习指导本文由高顿ACCA整理发布,转载请注明出处Syllabus area DStandard costing and variances are then built on.所有出现在F2教材中的差异都会作为很有用的背景知识用在F5中,并且在业绩管理中还引入了新的差异,那就是混合差异、产量差异、计划差异和操作差异。

当然这些差异也全都是和业绩评估相关的。

对于一位会计人员来说,将自己计算出来的数字阐述清楚,且将其与绩效方面的管理工作结合是一种能力。

所以,在ACCA F5的考题中,经常会出现这样的问法。

例如,一道综合题会出现3个小问,前两问都是需要学员们进行计算,但是最后一问会要求考生基于自己的计算结果,且结合题干中给出的实际案例,按照要求解释自己计算出来的结果的合理性或者题中公司/个人是否需要根据算出来的数据进行调整或是该怎样调整。

学员们还要有这样的心理准备,对于每新给出来一组数据,都需要有必要的说明,不论是文字还是计算说明,需要让判卷子的老师明白,您所用的数据是有据可查的,但是由于时间紧迫,所以,学员们在学习的过程中还要不断地提高自己的时间管理方面的技能,以便在考试中可以游刃有余。

但是如果学员们在考试的过程中,感到非常的紧张,甚至不知道该如何下笔的时候,可以先缓和一下自己的情绪,因为ACCA的考题并不是在文中不会出现暗示的。

往往在题目中,出题者会给考生一下数字上面的暗示,学员们需要在最后的复习阶段,从历年考题的书写中慢慢培养这样的能力。

Syllabus area E(第五部分)The syllabus concludes with management information systems and performance measurement and control (please note that management information systems are additions for exams from June 2013).The point is that this is a performance management paper and not a pure management accounting paper. Students must understand this and prepare accordingly.第五部分是整个大纲的核心部分。

ACCAF5知识要点汇总

ACCAF5知识要点汇总知识点一:成本与收益关系成本与收益关系是管理会计中的基本原理,也是制定和评估管理决策的重要依据。

在做出决策时,必须考虑成本和收益之间的关系,以确保决策是符合企业利益的。

知识点二:计算成本计算成本是管理会计的核心内容之一、成本的计算包括直接成本和间接成本两部分。

直接成本是可以直接与产品或服务相关联的成本,如原材料成本、直接人工成本等。

间接成本是无法直接与产品或服务相关联的成本,如间接人工成本、间接材料成本等。

知识点三:成本行为成本行为是指成本与产量或活动水平之间的关系。

成本行为可以分为固定成本、可变成本和半固定成本三种类型。

固定成本是不随产量或活动水平变化的成本,可变成本是随产量或活动水平变化的成本,半固定成本是产量或活动水平变化时部分固定、部分可变的成本。

知识点四:成本控制成本控制是指通过对成本的管理和控制,实现成本目标和利润目标的过程。

成本控制包括成本预算、成本分析和成本控制措施等。

成本预算是将预计成本与实际成本进行比较,以评估成本的控制效果。

成本分析是通过对成本的详细分析,找出成本的主要影响因素,以确定成本控制的重点。

成本控制措施是指通过采取各种措施,降低成本或提高效率,以实现成本控制的目标。

知识点五:决策分析决策分析是管理会计的核心内容之一,也是管理决策的重要工具和方法。

决策分析包括差异分析、边际成本分析和投资决策等。

差异分析是通过对实际成本与预算成本进行比较,找出成本差异的原因,以评估决策的效果。

边际成本分析是通过对变动成本与边际收益进行比较,确定最佳决策方案。

投资决策是基于投资项目的成本、收益和风险,确定是否进行投资。

知识点六:绩效评估绩效评估是指对企业绩效进行评价和分析,以衡量企业的经营状况和管理水平。

绩效评估包括财务绩效评价和非财务绩效评价两方面。

财务绩效评价是通过财务指标,如利润、资产回报率等,评估企业的经济效益和财务运营状况。

非财务绩效评价是通过其他非财务指标,如客户满意度、员工满意度等,综合评价企业的全面绩效和可持续发展能力。

ACCA考试F5业绩管理复习要点:本量利分析

ACCA考试F5业绩管理复习要点:本量利分析本文由高顿ACCA整理发布,转载请注明出处本量利分析是成本、业务量和利润三者依存关系分析的简称,它是指在成本习性分析的基础上,运用数学模型和图式,对成本、利润、业务量与单价等因素之间的依存关系进行具体的分析,研究其变动的规律性,以便为企业进行经营决策和目标控制提供有效信息的一种方法。

在F5 业绩管理,学员们会学到The equation method (等式法)、The contribution margin method (边际贡献法)和The graphical method (图表法)这三种方法,来协助企业在本量利分析上取得有效的成果。

1. The equation method (等式法)在等式法中,同学们要注意的两个比较重要的公式:第一个是Total revenue –Total variable costs –Total fixed = Profit;第二个就是(USP×Q) –(UVC×Q) –FC = P.在第二个公式中,USP代表单位销售价格(Unit selling price)、Q代表销量(Quantity sold)、UVC代表单位变动成本(Unit variable cost)、FC代表固定成本(Fixed cost)还有就是P代表利润(Profit)。

在用等式法进行本量利分析的时候,一般会将某产品的保本状态作为一项基础,也就是当总成本等于总利润的时候,能使企业达到保本点,这样根据题意算出产量等数据。

2. The contribution margin method (边际贡献法)在边际贡献法中,只有一个比较重要的公式,那就是Q = (FC + P)/UCM.公式中的UCM代表的是单位边际贡献(Unit contribution margin)。

针对于边际贡献法来说,不仅仅只有公式从等式法中演变而来的,计算的方法和思路也是从等式法中总结出来的。

ACCA F5考试重点

ACCA F5考试重点本文由高顿ACCA整理发布,转载请注明出处Theoverall concept of the F5 syllabus is that it builds from topics that you havelearnt at F2, gives you more management accounting techniques and focuses onthe core fundamentals of performance management. It is important to rememberthat this is a performance management paper and not a management accountingpaper.Youwill be expected to manipulate numerical information using techniques learntand also, perhaps more importantly, you will need to interpret that informationin the context of a scenario. Knowledge provided by the analytical review ofthis information is key for managers to make decisions for businesses and thisis the focus of this paper.Thefollowing are some of the key skills that are essential for passing the F5exam:1.Understanding the reasoning behind calculations and how these calculations willbe useful to management:Questionsthat are testing a management accounting technique will always try to make thelink between the technique and its use as a performance management tool.Youmust make sure that you have revised the syllabus thoroughly and have theknowledge required of these tools.Youmust make sure that you are applying your knowledge to the information in thequestion and using evidence from the scenario in your answer.Youmust practise the written elements of questions in full, as this is where theexaminer will test your understanding of the scenario and performancemanagement implications of the question.2.Managing your time effectively and identifying easy marks available:Theexaminer has previously pointed out that there will be easy marks available inthe exam and students who answer these parts of questions usually perform well.Studentswho do not manage their time and miss easy marks are making it much harder forthemselves to pass the exam.Youmust make sure that you are using your reading time effectively to identify anyparts of questions that you can easily tackle and plan the order in which youwill answer questions in the exam.3.Reading the question and understanding the requirement:Youmust read the question very carefully and identify the instructional verbsused, remember there may be more than one thing to answer within eachrequirement. You must use the mark allocation to work out how much depth youneed to go into in your answer.Makesure that you are answering the question set not the one that you would like toanswer.Commonpitfalls pointed out by the Paper F5 examiner include:Studentsfailure to make the step up from F2 to F5 - this is due to a lack of ability tointerpret the calculations performed with reference to the scenario given.Poorinterpretation of data - this would be due to lack of planning andunderstanding the requirements of the question.Poortechnical knowledge.Makesure that you are always thinking about these key skills during your revisionand that each time you practice a question you are thoroughly reviewing youranswer afterwards to identify if you need to work on any of these areas.更多ACCA资讯请关注高顿ACCA官网:。

2015年ACCA《F5业绩管理》辅导讲义(1)

2015年ACCA《F5业绩管理》辅导讲义(1)本文由高顿ACCA整理发布,转载请注明出处Chapter 1Advanced costing methodChapter learning objectivesUpon completion of this chapter you will be able to:§ explain what is meant by the term cost driver§ identify appropriate cost drivers under activity-based costing (ABC)§ calculate costs per driver and per unit using (ABC)§ compare ABC and traditional methods of overhead absorption based on production units, labour hours or machine hours.§ explain the implications of switching to ABC on pricing, performance management and decision making.§ explain what is meant by the term ‘target cost’ in both manufacturing and service industries.§ derive a target cost in both manufacturing and service industries.§ explain the difficulties of using target costing in service industries§ explain the implications of using target costing on pricing, cost control and performance management.§ describe the target cost gap.§ suggest how a target cost gap might be closed.§ explain what is meant by the term ‘life-cycle costing’ in a manufacturing industry§ identify the costs involved at different stages of the life-cycle.§ explain the implications of life-cycle costing on pricing, performance management and decision making.§ describe the process of back-flush accounting and contrast with traditional process accounting.§ explain, for a manufacturing business, the implications of back-flush accounting on performance management§ evaluate the decision to switch to back-flush accounting from traditional process control for a manufacturing business.§ explain throughput accounting and the throughput accounting ratio (TPAR), and calculate and interpret, a TPAR.§ suggest how a TPAR could be improved.§ apply throughput accounting to a given multi-production decision making problem.1 Activity based costing1.1 Introduction – absorption costIn F2 we saw how to determine a cost per unit for a product. Key issues of relevance here are the following:Firms have the choice of two basic costing methods – marginal costing and absorption costing.Under absorption costing it is necessary to absorb overheads into units of production using a suitable basis.The main basis of absorption used in F2 questions is direct labour hours. This involves calculating an overhead absorption rate (OAR) for each production department as follows:OAR =To enable this, all overheads must first be allocated/apportioned/reapportioned into production departments, again using a suitable basis (e.g. rent on the basis of floor area).Overhead expenses incurred/budgetedStep 1: Overheads allocated or apportioned to cost centres using suitable bases Cost centres (usually departments)Step 2: Service centre costs reapportioned to production centresStep 3: Overheads absorbed into units of production using an OAR (usually on the basis of direct labour hours) outputExpandable textThe assumption underlying the traditional method of costing is that overhead expenditure is connected to the volume of production activity.§ This assumption was probably valid many years ago, when production system were based on labour-intensive or machine-intensive mass production of fairly standard items. Overhead costs were also fairly small relative to direct materials and direct labour costs; therefore any inaccuracy in the charging of overheads to products costs was not significant.§ The assumption is not valid in a complex manufacturing environment, where production is based on smaller customised batches of products, indirect costs are high in relation to direct costs, and a high proportion of overhead activities – such as production scheduling, order handling and quality control – are not related to production volume.§ For similar reasons, traditional absorption costing is not well-suited to the costing of many services.更多ACCA资讯请关注高顿ACCA官网:。

ACCA考试《P5高级业绩管理》知识辅导2

ACCA考试《P5高级业绩管理》知识辅导2本文由高顿ACCA整理发布,转载请注明出处REWARD SCHEMES FOR EMPLOYEES AND MANAGEMENTA major part of performance management involves managing employees and managers, as their performance will have a major effect on the performance of the organisation as a whole. This article looks at how reward schemes can be used to influence the behaviour of employeesMEANING OF REWARD SCHEMESA broad definition of reward schemes is provided by Bratton:‘Reward system refers to all the monetary, non-monetary and psychological payments that an organisation provides for its employees in exchange for the work they perform.’Rewards schemes may include extrinsic and intrinsic rewards. Extrinsic rewards are items such as financial payments and working conditions that the employee receives as part of the job. Intrinsic rewards relate to satisfaction that is derived from actually performing the job such as personal fulfilment, and a sense of contributing something to society. Many people who work for charities, for example, work for much lower salaries than they might achieve if they worked for commercial organisations. In doing so, they are exchanging extrinsic rewards for the intrinsic reward of doing something that they believe is good for society.OBJECTIVES OF A REWARD SCHEMEWhat do organisations hope to achieve from a reward scheme? The following are among the most important objectives:1. To support the goals of the organisation by aligning the goals of employees with these.2. To ensure that the organisation is able to recruit and retain sufficient number of employees with the right skills.3. To motivate employees.4. To align the risk preferences of managers and employees with those of the organisation.5. To comply with legal regulations.6. To be ethical.7. To be affordable and easy to administer.ALIGNING THE GOALS OF THE ORGANISATION AND EMPLOYEESThe reward scheme should support the organisation’s goals. At the strategic level, the reward scheme must be consistent with the strategy of the organisation. If a strategy of differentiation is chosen, for example, staff may receive more generous benefits, and these may be linked to achieving certain skills or achieving pre determined targets. In an organisation that has a strategy of cost leadership, a simple reward scheme offering fairly low wages may be appropriate as less skilled staff are required, new staff are easy to recruit and need little training, so there is less incentive to offer generous rewards. The US supermarket group Walmart competes on low cost. It recruits employees with low skills, and pays low wages. It discourages staff from working overtime, as it wishes to avoid paying overtime rates.TO RECRUIT AND RETAIN SUFFICIENT EMPLOYEES WITH THE RIGHT SKILLSIf rewards offered are not competitive, it will be difficult to recruit staff since potential employees can obtain better rewards from competitors. Existing staff may also be tempted to leave the organisation if they are aware that their reward system is uncompetitive.High staff turnover can lead to higher costs of recruitment and training of new staff. Losing existing employees may also mean that some of the organisation’s accumulated knowledge is lost forever. For many knowledge-based organisations, the human capital may be one of the most valuable assets they have. High technology companies such as Microsoft are companies that trade on knowledge, so offer competitive remuneration to key staff.TO MOTIVATE EMPLOYEESMotivation of employees is clearly an important factor in the overall performance of an organisation. Organisations would like their employees to work harder, and be flexible. The link between reward schemes and motivation is a complex issue that is hotly debated in both accounting and human resource-related literature.A well-known theory relating to motivation is Maslow’s hierarchy of needs. Maslow stated that people’s wants and needs follow a hierarchy. Once the needs of one level of the hierarchy are met, the individual will then focus on achieving the needs of the next level in the hierarchy. The lower levels of the hierarchy are physiological, relating to the need to survive (eg eating and being housed);once these have been met, humans then desire safety, followed by love, followed by esteem, and finally at the top of the hierarchy, self actualisation, or self fulfilment.Applying Maslow’s hierarchy of needs to reward schemes suggests that very junior staff, earning very low wages will be motivated by receiving higher monetary rewards, as this will enable them to meet their physiological needs. As employees become progressively more highly paid, however, monetary rewards become relatively less important as other needs in the hierarchy, such as job security, ability to achieve one’s potential, and feeling of being needed become more important.Herzberg argued that increasing rewards only motivates employees temporarily. Once they become de-motivated again, it is necessary to ‘recharge their batteries’ with another increase. A far better way to motivate employees is to ‘install a generator in an employee’ so they can recharge their own batteries; in other words to find out what really motivates them. According to Herzberg, it is the intrinsic factors in a job that motivate employees, such as ‘achievement, recognition for achievement, the work itself, responsibility and growth or advancement.’ Giving greater responsibility to employees, for example, can increase motivation.Perhaps the conclusion to be gained from this is that monetary rewards alone are insufficient to motivate employees. Other factors such as giving greater recognition and greater responsibility may be equally important, for example giving praise at company meetings, promoting staff, and involving staff more in decision making.ALIGNING THE RISK PREFERENCES OF MANAGERS AND EMPLOYEES WITH THOSE OF THE ORGANISATIONManagers and senior employees make decisions on behalf of the company, acting as agents of the company. It is desirable that the risk preferences of these employees should match the risk preferences of the organisation and its stakeholders. One problem with many reward schemes is that managers are too risk averse, and will not make investments that may risk their targets not being met.The events leading up to the financial crisis of 2008 are a good example of the opposite situation, where the risk appetites of employees at investment banks did not match the risk appetites of the owners. During this period, individuals working in the banks were paid large commissions for selling mortgage loans to customers. The problem was that the employees were selling loans to customers that posed a large risk to the banks, due to their low credit worthiness.The problem was confounded by the fact that in many cases, the employees of the banks were paid commissions on the date that the loan agreements were signed, while the loans lasted for 25 years. In situations where the borrower defaulted, however, there was no claw back, so the employee would not be required to repay the commission.Many countries have put in place new laws and codes to change this situation. In the UK for example, the financial services authority introduced a code whereby remuneration structures should be based on sound risk management practices,incentive payments should be deferred over a number of years, and there should be claw back provisions whereby employees are required to repay bonuses in the event that the longer term results of their actions leads to similar problems experiences in the financial crisis.Share options may also create a miss-match between the risks faced by the organisation and the risks faced by the holders of the options, since the holders benefit if share prices increase, but do not bear any losses if the share price falls. Share options are discussed in more detail later in this article.COMPLYING WITH LEGAL REGULATIONSRewards should comply with legal regulations. Typically, employment laws include areas such as minimum pay, and equal pay legislation to ensure that no groups are prejudiced against. There have been high profile cases of female investment bankerswinning legal cases against their employers because their bonuses were far less than those paid to male colleagues.ETHICS AND REWARD SCHEMESIn recent decades there has been a move away from fixed remuneration systems towards reward systems where at least part of an employee’s rewards are based on performance of the individual and the business as a whole. Some writers claim that this is unethical for two reasons. First, such systems tend to place increased business risk onto employees. Second, such systems undermine collective bargaining systems, and reduce the power of unions. This leads to a situation where employees as a collective have less bargaining power.The size of total remunerations paid to directors of large public companies has also become a hot political issue, with a perception that the gap between top earners, and average earners is becoming larger. In the US, the average directors of S&P 500 companies earn 200 times more than the average household income in the US. Defenders of such large differences in pay point out that this difference has actually declined in recent years; in the year 2000, directors of S&P 500 companies earned 350 times the average household income. According to some research, such high packages are justified as they do reflect the performance of those directors.THE PYRAMIDS AND PITFALLS OF PERFORMANCE MEASUREMENTby Shane Johnson 01 Sep 2005It has become increasingly important for organisations to develop systems of performance measurement which not only reflect the growing complexity of the business environment but also monitor their strategic response to this complexity. The need for good performance management is an ongoing issue which should be addressed by the management of all organisations.This article considers issues which are central to the understanding and assessment of performance measurement within any organisation. The main issues requiring consideration by management are:linking performance to strategysetting performance standards and targetslinking rewards to performanceconsidering the potential benefits and problems of performance measures.In attempting to establish a clear link between performance and strategy it is vital that management ensures that the performance measures target areas within the business where success is a critical factor. The performance measures chosen should:measure the effectiveness of all processes including products and/or services that have reached the final customermeasure efficiency in terms of resource utilisation within the organisationcomprise an appropriate mix of both quantitative and qualitative methodscomprise an appropriate focus on both the long-term and short-termbe flexible and adaptable to an ever-changing business environment.The last point stresses how important it is that performance measurement systems are dynamic so that they remain relevant and continue to reflect the issues important to any business. There are a number of models of performance measurement which can be used by management. This article considers the 'performance pyramid' of Lynch and Cross (1991)1. The model represents an acknowledgement by the writers that traditional performance measurement systems were falling short of meeting the needs of managers in a much changed business environment.Lynch and Cross suggest a number of measures that go far beyond traditional financial measures such as profitability, cash flow and return on capital employed. The measures that they propose relate to business operating systems, and they address the driving forces that guide the strategic objectives of the organisation. Lynch and Cross propose that customer satisfaction, flexibility and productivity are the driving forces upon which company objectives are based. They suggest that thestatus of these driving forces can be monitored by various indicators which can be derived from lower level (departmental)measures of waste, delivery, quality and cycle time. The performance pyramid derives from the idea that an organisation operates at different levels each of which has a different focus. However, it is vital that these differentlevels support each other. Thus the pyramid links the business strategy with day-to-day operations.In proposing the use of the performance pyramid Lynch and Cross suggest measuring performance across nine dimensions. These are mapped onto the organisation - from corporate vision to individual objectives.Within the pyramid the corporate vision is articulated by those responsible for the strategic direction of the organisation. The pyramid views a range of objectives for both external effectiveness and internal efficiency. These objectives can be achieved through measures at various levels as shown in the pyramid. These measures are seen to interact with each other both horizontally at each level, and vertically across the levels in the pyramid.George Brown (1998)2 explains what Lynch and Cross refer to as 'getting it done in the middle' focuses on business operating systems where each system is geared to achieve specific objectives, and will cross departmental/functional boundaries, with one department possibly serving more than one operating system. For example, an operating system may have new product introduction as its objective, and is likely to involve a number of departments from design and development to marketing. At this level, performance focus will be on three needs. First, there will be a focus on the need to ensure customer satisfaction. Second, there will be a focus on the need for flexibility in order to accommodate changes in methods and customer requirements. Third, there will be a focus on the need to achieve productivity which necessitates looking for the most cost effective and timely means of achieving customer satisfaction and flexibility.At the bottom level of the pyramid is what Lynch and Cross refer to as 'measuring in the trenches'. Here the objective is to enhance quality and delivery performance and reduce cycle time and waste. At this level a number of non-financial indicators will be used in order to measure the operations. The four levels of the pyramid are seen to fit into each other in the achievement of objectives. For example, reductions in cycle time and/or waste will increase productivity and hence profitability and cash flowThe strength of the performance pyramid model lies in the fact that it ties together the hierarchical view of business performance measurement with the business process review. It also makes explicit the difference between measures that are of interest to external parties - such as customer satisfaction, quality and delivery - and measures that are of interest within the business such as productivity, cycle time and waste.Lynch and Cross concluded that it was essential that the performance measurement systems adopted by an organisation should fulfil the following functions:The measures chosen should link operations to strategic goals. It is vital that departments are aware of the extent to which they are contributing - separately and together - in achieving strategic aims.The measures chosen must make use of both financial and non-financial information in such a manner that is of value to departmental managers. In addition, the availability of the correct information as and when required is necessary to support decision-making at all levels within an organisation.The real value of the system lies in its ability to focus all business activities on the requirements of its customers.These conclusions helped to shape the performance pyramid which can be regarded as a modeling tool that assists in the design of new performance measurement systems, or alternatively the re-engineering of such systems that are already in operation. See Figure 1.Figure 1: the performance pyramid (Lynch and Cross, 1991)David Otley (2005)3 has observed that other related frameworks exist, such as the results and determinants framework by Fitzgerald et al (1991),the balanced scorecard by Kaplan and Norton (1992)and Neely et al's performance prism. A common thread in all of them is that performance measures should:be linked to corporate strategyinclude external as well as internal measuresinclude non-financial as well as financial measuresmake explicit the trade-offs between different dimensions of performanceinclude all important but difficult to measure factors as well as easily measurable onespay attention to how the selected measures will motivate managers and employees.Setting standards and targets To set standards and targets, management could choose to make use ofbenchmarking and/or target costing while being mindful of the critical need to link rewards to performance as appropriate.更多ACCA资讯请关注高顿ACCA官网:。

ACCA《F5业绩管理》专题介绍

ACCA《F5业绩管理》专题介绍本文由高顿ACCA整理发布,转载请注明出处一. Environmental activity-based costing (环境成本作业法)学习过F2 管理会计和F5 业绩管理(前段)的内容,就会对Activity-based costing的内容有所了解。

在作业成本法中,各企业的管理会计会将引发成本的因素归结为不同的Cost driver(成本动因),这样使个发生的成本有了更为合理的分配基础,从而达到优化企业利润核算的目的。

环境成本作业法是借助了成本作业法的特性,将环境成本分为因不同的成本动因而发生的成本,并且分配到不同的Cost pool(成本池)中,在对相应的环节进行把控,从而达到降低环境成本的目的,例如降低废水排放量、降低废品量等方式。

二. Input output analysis (投入产出分析)投入产出分析不仅仅会在成本效益原则中起到作用,同样会在分析企业的环境成本中起到主导性的作用。

例如,在投料是100%的情况下,只有80%的产出是企业想要得到的产品,15%是可以回收再利用的废料,还有5%是不得不处理的垃圾或者不相关的物品。

在这时,企业中的环境管理会计就必须要注意到这个5%是不是对总产量产生了巨大的影响,也许从数据上看来是微不足道的,但是可能因为这5%引起的后续成本也是企业需要考虑到的。

三. Flow cost accounting (流量成本法)流转成本法实际上是一种更深入和更细致的投入产出分析法,流量成本法不仅仅在实物投入和实物产出之间严格把控,而是将投入产出分析运用到了每次材料和服务的流转出,从而进行得失比例的分析。

让企业从点滴做起,节省成本,从而不断地进行优化。

四. Life cycle costing (生命周期成本法)生命周期成本法相对以上几种方法来说更为全面,因为在一个企业进行经营活动中,不是所有的环境成本都会在生产过程中得以体现,例如一些清洁的费用,就只能在整个生产过程结束以后才会发生。

2015新年回顾,《F5业绩管理》重点知识辅导(1)

2015新年回顾,《F5业绩管理》重点知识辅导(1)本文由高顿ACCA整理发布,转载请注明出处Targeting costs1 Definition of target costingTarget costA target cost is a cost estimate derived by subtracting desired profit margin from a competitive market price.In effect it the o pposite of conventional ‘cost plus pricing’ and is sometimes referred to as ‘price minus costing’。

It may be used in both manufacturing and service industries.The main theme behind target costing is thus not finding what a new product does cost but what it should or needs to cost. The firm can then focus on which costs can be reduced and which can not to see whether such a target cost is achievable. Obviously cost reductions must be seen in the context of quality concerns as well. This will involve product comparisons with the competitors used to set the competitive market price in the first place.Illustrative 4 targeting costs§ Sony§ Toyota§ Swiss watchmakers – Swatch.Test your understanding 6Briefly identify the implications for a profit-orientated organisation if it chooses to use cost plus pricing.2 Deriving a target costSteps1 Estimate a selling price for a new product that will enable a firm to capture a required share of the market.2 Reduce thi s figure by the firm’s required level of profit. This could take into account the return required on any new investment and on working capital requirements or could involve a target margin on sales.3 Produce a target cost figure for product designers to meet.4 Reduce costs to provide a product that meets that target Illustration 5 – Targeting costsKaty Inc, a toy manufacturer, is about to launch a new type of bicycle on which it requires a Return on Investment of 30%.Buildings and equipment needed for production are to cost $5,000,000.Expected sales levels are $40,000 toys pa at a selling price of $67.50 per item costs are currently estimated to be $32 per unit.Required:What is the target cost for annual production?SolutionWorking$Revenue(67.50×40,000)2,700,00Target costs(balancing figure)(1,200,000)Target return(30%×5,000,000)1,500,000更多ACCA资讯请关注高顿ACCA官网:。

F5 Performance management(业绩管理)备考指南一

F5 Performance management(业绩管理)备考指南一本文由高顿ACCA整理发布,转载请注明出处

成本的分类(在完全成本法下的分类)

首先,帮同学们理清或者疏通的是,在F5的学习中,会碰到的几乎所有的成本。

建议学员们在自己的心理形成一个成本架构,这样也更有助于做最后的业绩评估和控制,因为知道到哪一类的成本该从哪里能够找到。

总成本(Total cost),总成本可以理解为在日常经营生产活动中财务部门经常提到的所有的成本,在总成本中,可以分为两大类,第一大类是直接成本,第二大类是间接成本。

直接成本(Direct cost),在网校的基础班中,同学们已经听过老师重复了很多遍的料工费了,或者是以Material cost, labour cost and expenses的形式出现也是一样的,其实不管在题目中怎样变化,直接成本在现阶段就只能分为这三大类成本。

另一个大类就是间接成本(Indirect cost/Overhead)。

在间接成本中,管理会计又分成了两大主线,一条是与生产息息相关的(Production overhead),另外一条线就是除与生产相关的间接成本(Non-production overhead)。

但是,学员们也一定要注意,在Production overhead中会存在过度或者补足吸收的问题,类似这些比较系的知识点,网校会通过以后的复习短篇和学员们慢慢分享。

最后,高顿网校预祝您顺利通过考试!

更多ACCA资讯请关注高顿ACCA官网:。

【ACCA考试辅导】F5业绩管理重点讲义6

【ACCA考试辅导】F5业绩管理重点讲义6本文由高顿ACCA整理发布,转载请注明出处1.5 Comparing costs per driver and per unit using traditional methods and ABCTraditional absorption costing charges overhead costs to products (or services) in an arbitrary way.The assumption that overhead expenditure is related to direct labour hours or machine hours in the production departments is no longer realistic for the vast majority of companies.This will lead to very different values of overheads absorbed per unit.1.6 Advantages and disadvantages of ABCABC has a number of advantages:§ It provides much better insight into what drives overhead costs.§ ABC recognises that overhead costs are not all related to production and sales volume.§ In many businesses, overhead costs are a significant proportion of total costs, and management needs to understand the drivers of overhead costs in order to manage the business properly. Overhead costs can be controlled by managing cost drivers.§ It can be applied to derive realistic costs in a complex business environment.§ ABC can be applied to all overhead costs, not just production overheads.§ ABC can be used just as easily in service costing as in product costing.§ Criticisms of ABC:§ It is impossible to allocate all overhead costs to specific activities.ABC costs are based on assumptions and simplifications. The choice of both activities and costs drivers might be inappropriate.§ ABC can be more complex to explain to the stakeholders of the costing exercise.§ The benefits obtained from ABC might not justify the costs.更多ACCA资讯请关注高顿ACCA官网:。

- 1、下载文档前请自行甄别文档内容的完整性,平台不提供额外的编辑、内容补充、找答案等附加服务。

- 2、"仅部分预览"的文档,不可在线预览部分如存在完整性等问题,可反馈申请退款(可完整预览的文档不适用该条件!)。

- 3、如文档侵犯您的权益,请联系客服反馈,我们会尽快为您处理(人工客服工作时间:9:00-18:30)。

名师讲解xx年ACCA考试F5业绩管理知识点

Qualitative factors of Make –or-buy decision

- Relevant to paper F5

Make or buy decision is one of the most critical decision an organisation are often facing with in modern business environment. Hence, having a sound understanding of make or buy decision from F5 is crucial. Make-or-Buy decision (also called the outsourcing decision) is a judgment made by management whether to make a component internally or buy it from the market.

Make-or-buy decisions usually arise when a firm that has developed a product or part—or significantly modified a product or part—is having trouble with current suppliers, or has diminishing capacity or changing demand.

While making the decision, both qualitative and quantitative factors must be considered.

2. Make-or-buy analysis is conducted at the operational level

At the operational level the factors in favor of making a part

in-house.

· Cost considerations (less expensive to make the part)

· Desire to integrate plant operations

· Productive use of excess plant capacity to help absorb fixed overhead (using existing idle capacity)

· Need to exert direct control over production and/or quality

· Better quality control

· Design secrecy is required to protect proprietary technology · Unreliable suppliers

· No competent suppliers

· Desire to maintain a stable workforce (in periods of declining sales)

· Quantity too small to interest a supplier

· Control of lead time, transportation, and warehousing costs · Greater assurance of continual supply

· Provision of a second source

· Political, social or environmental reasons (union pressure) · Emotion (e.g., pride)

Factors that may influence firms to buy a part externally include:

· Lack of expertise

· Suppliers' research and specialized know-how exceeds that of the buyer

· cost considerations (less expensive to buy the item)

· Small-volume requirements

· Limited production facilities or insufficient capacity

· Desire to maintain a multiple-source policy

· Indirect managerial control considerations

· Procurement and inventory considerations

· Brand preference

· Item not essential to the firm's strategy

This article has discussed the qualitative factors at the both strategic and operational level while making the decision of

make-or-buy. The quantitative factors will be discussed later.。