国际商会托收统一规则

ucr522

ucr522中英文urc522跟单托收统一规则第522号(urc522)一、总则和定义第一款:《托收统一规则》第522号的应用(1)国际商会第522号出版物《托收统一规则》1995年修订本将适用于第二款所限定的、并在第四款托收指示中列明适用该项规则的所有托收项目。

除非另有明确的约定,或与某一国家、某一政府,或与当地法律和尚在生效的条例有所抵触,本规则对所有的关系人均具有约束力。

(2)银行没有义务必须办理某一托收或任何托收指示或以后的相关指示。

(3)如果银行无论出于何种理由选择了不办理它所收到的托收或任何相关的托收指示,它必须毫不延误地采用电讯,或者如果电讯不可能时采用其它快捷的工具向他收到该项指示的当事人发出通知。

第二款托收的定义就本条款而言:(1)托收是指银行依据所收到的指示处理下述(2)款所限定的单据,以便于:a.取得付款和/或承兑;或b.凭以付款或承兑交单;或c.按照其他条款和条件交单。

(2)单据是指金融单据和/或商业单据。

a.金融单据是指汇票、本票、支票或其他类似的可用于取得款项支付的凭证;b.商业单据是指发票、运输单据、所有权文件或其他类似的文件,或者不属于金融单据的任何其他单据。

(3)光票托收是指不附有商业单据的金融单据项下的托收。

(4)跟单托收是指:a.附有商业单据的金融单据项下的托收;b.不附有金融单据的商业单据项下的托收。

第三款托收的关系人(1)就本条款而言,托收的关系人有:a.委托人即委托银行办理托收的有关人;b.寄单行即委托人委托办理托收的银行;c.代收行即除寄单行以外的任何参与处理托收业务的任何银行;(2)付款人即根据托收指示向其提示单据的人。

二、托收的形式和结构第四款托收指示(1)a.所有送往托收的单据必须附有一项托收指示,注明该项托收将遵循《托收统一规则》第522号文件并且列出完整和明确的指示。

银行只准允根据该托收指示中的命令和本规则行事;b.银行将不会为了取得指示而审核单据;c.除非托收指示中另有授权,银行将不理会来自除了他所收到托收的有关人/银行以外的任何有关人/银行的任何指令。

托收统一规则简述

托收统一规则简述

托收是一种金融服务,它可以使收款人简化收款流程,有效提高收款效率,具

有较高的收款安全性、安全可靠性和高可扩展性的特点。

统一的托收规则是收付款机构为了更好的实现对托收业务的管理,对托收服务

进行统一规范,确保有效、可靠、安全性服务实施。

精神统一规则大致分为收款人统一规则和付款人统一规则两部分。

收款人统一

规则规定收款人应当在收付款机构指定的时间和地点携带有效的客户证件进行收款;付款人统一规则规定付款人应当提供包括收款号、付款账户、付款金额等有关信息,进行有效托收。

此外,统一规则还规定托收服务应当符合《中华人民共和国银行信息条例》、《银行信托业务管理办法》等相关法律法规,并在双方签订统一收款约定书前作出必要相关说明,以保证收付款业务的正常流程化和规范性。

综上,统一的托收规则旨在保障托收收付款服务的安全可靠性,同时保证收款

的规范有效性,以提高效率,节省时间,加强收款服务管理,最终改善用户体验。

国际结算URC522要点

国际商会托收统一规则(URC 522)(1995 年修订本1996 年1 月1 日起施行)一、总则和定义第一款《托收统一规则》第 522 号的应用(1)国际商会第 522 号出版物《托收统一规则》1995 年修订本将适用于第二款所限定的、并在第四款托收指示中列明适用该项规则的所有托收项目。

除非另有明确的约定,或与某一国家、某一政府,或与当地法律和尚在生效的条例有所抵触,本规则对所有的关系人均具有约束力。

(2)银行没有义务必须办理某一托收或任何托收指示或以后的相关指示。

(3)如果银行无论出于何种理由选择了不办理它所收到的托收或任何相关的托收指示,它必须毫不延误地采用电讯,或者如果电讯不可能时采用其它快捷的工具向他收到该项指示的当事人发出通知。

第二款托收的定义就本条款而言:(1)托收是指银行依据所收到的指示处理下述(2)款所限定的单据,以便于:a.取得付款和/或承兑;或b.凭以付款或承兑交单;或c.按照其他条款和条件交单。

(2)单据是指金融单据和/或商业单据。

a.金融单据是指汇票、本票、支票或其他类似的可用于取得款项支付的凭证;b.商业单据是指发票、运输单据、所有权文件或其他类似的文件,或者不属于金融单据的任何其他单据。

(3)光票托收是指不附有商业单据的金融单据项下的托收。

(4)跟单托收是指:a.附有商业单据的金融单据项下的托收;b.不附有金融单据的商业单据项下的托收。

第三款托收的关系人(1)就本条款而言,托收的关系人有:a.委托人即委托银行办理托收的有关人;b.寄单行即委托人委托办理托收的银行;c.代收行即除寄单行以外的任何参与处理托收业务的任何银行;(2)付款人即根据托收指示向其提示单据的人。

二、托收的形式和结构第四款托收指示(1) a.所有送往托收的单据必须附有一项托收指示,注明该项托收将遵循《托收统一规则》第 522 号文件并且列出完整和明确的指示。

银行只准允根据该托收指示中的命令和本规则行事;b.银行将不会为了取得指示而审核单据;c.除非托收指示中另有授权,银行将不理会来自除了他所收到托收的有关人/银行以外的任何有关人/银行的任何指令。

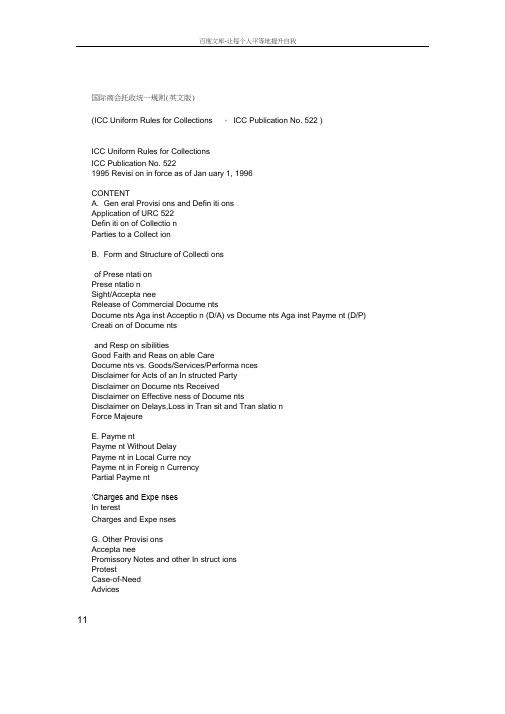

URC522《托收统一规则》(中英文)

(ICC Uniform Rules for Collections ICC Publication No. 522 )ICC Uniform Rules for CollectionsICC Publication No. 5221995 Revision in force as of January 1, 1996CONTENTA. General Provisions and DefinitionsApplication of URC 522Definition of CollectionParties to a CollectionB. Form and Structure of CollectionsC. Form of PresentationPresentationSight/AcceptanceRelease of Commercial DocumentsDocuments Against Acceptance (D/A) vs Documents Against Payment (D/P)Creation of DocumentsD. Liabilities and ResponsibilitiesGood Faith and Reasonable CareDocuments vs. Goods/Services/PerformancesDisclaimer for Acts of an Instructed PartyDisclaimer on Documents ReceivedDisclaimer on Effectiveness of DocumentsDisclaimer on Delays, Loss in Transit and TranslationForce MajeureE. PaymentPayment Without DelayPayment in Local CurrencyPayment in Foreign CurrencyPartial PaymentF. Interest, Charges and ExpensesInterestCharges and ExpensesG. Other ProvisionsAcceptancePromissory Notes and other InstructionsProtestCase-of-NeedAdvicesA. General Provisions and Definitions总则和定义Article 1Application of URC 522第一款:《托收统一规则》第522号的应用。

国际商会托收统一规则(URC522)(中文版).doc

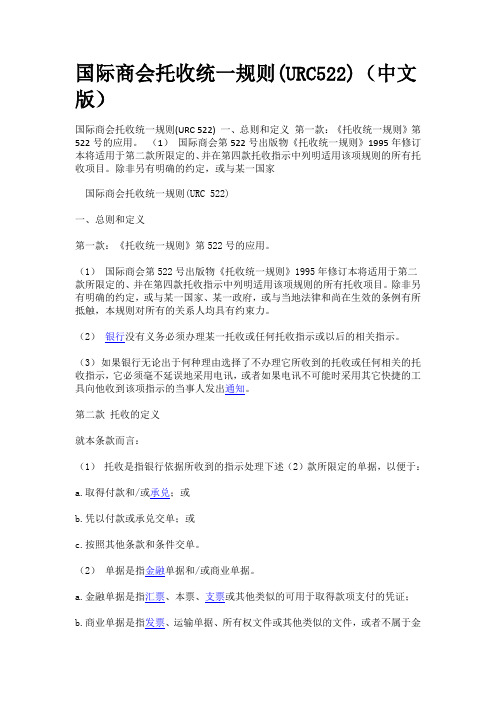

国际商会托收统一规则(URC522)(中文版)()国际商会调解国际商会仲裁范围国际商会仲裁规则国际商会争议解决国际贸易法国际商会托收统一规则(URC 522) 一、总则和定义第一款:《托收统一规则》第522号的应用。

(1)国际商会第522号出版物《托收统一规则》1995年修订本将适用于第二款所限定的、并在第四款托收指示中列明适用该项规则的所有托收项目。

除非另有明确的约定,或与某一国家国际商会托收统一规则(URC 522)一、总则和定义第一款:《托收统一规则》第522号的应用。

国际商会第522号出版物《托收统一规则》1995年修订本将适用于第二款所限定的、并在第四款托收指示中列明适用该项规则的所有托收项目。

除非另有明确的约定,或与某一国家、某一政府,或与当地法律和尚在生效的条例有所抵触,本规则对所有的关系人均具有约束力。

(2)银行没有义务必须办理某一托收或任何托收指示或以后的相关指示。

如果银行无论出于何种理由选择了不办理它所收到的托收或任何相关的托收指示,它必须毫不延误地采用电讯,或者如果电讯不可能时采用其它快捷的工具向他收到该项指示的当事人发出通知。

第二款托收的定义就本条款而言:(1)托收是指银行依据所收到的指示处理下述(2)款所限定的单据,以便于:a.取得付款和/或承兑;或b.凭以付款或承兑交单;或c.按照其他条款和条件交单。

(2)单据是指金融单据和/或商业单据。

a.金融单据是指汇票、本票、支票或其他类似的可用于取得款项支付的凭证;b.商业单据是指发票、运输单据、所有权文件或其他类似的文件,或者不属于金融单据的任何其他单据。

(3)光票托收是指不附有商业单据的金融单据项下的托收。

(4)跟单托收是指:a. 附有商业单据的金融单据项下的托收;b.不附有金融单据的商业单据项下的托收。

第三款托收的关系人(1)就本条款而言,托收的关系人有:a.委托人即委托银行办理托收的有关人;b.寄单行即委托人委托办理托收的银行;c.代收行即除寄单行以外的任何参与处理托收业务的任何银行;(2)付款人即根据托收指示向其提示单据的人。

URC522(中)

《跟单托收统一规则》第522号(URC522)一、总则和定义第一款:《托收统一规则》第522号的应用。

(1)国际商会第522号出版物《托收统一规则》1995年修订本将适用于第二款所限定的、并在第四款托收指示中列明适用该项规则的所有托收项目。

除非另有明确的约定,或与某一国家、某一政府,或与当地法律和尚在生效的条例有所抵触,本规则对所有的关系人均具有约束力。

(2)银行没有义务必须办理某一托收或任何托收指示或以后的相关指示。

(3)如果银行无论出于何种理由选择了不办理它所收到的托收或任何相关的托收指示,它必须毫不延误地采用电讯,或者如果电讯不可能时采用其它快捷的工具向他收到该项指示的当事人发出通知。

第二款托收的定义就本条款而言:(1)托收是指银行依据所收到的指示处理下述(2)款所限定的单据,以便于:a.取得付款和/或承兑;或b.凭以付款或承兑交单;或c.按照其他条款和条件交单。

(2)单据是指金融单据和/或商业单据。

a.金融单据是指汇票、本票、支票或其他类似的可用于取得款项支付的凭证;b.商业单据是指发票、运输单据、所有权文件或其他类似的文件,或者不属于金融单据的任何其他单据。

(3)光票托收是指不附有商业单据的金融单据项下的托收。

(4)跟单托收是指:a. 附有商业单据的金融单据项下的托收;b.不附有金融单据的商业单据项下的托收。

第三款托收的关系人(1)就本条款而言,托收的关系人有:a.委托人即委托银行办理托收的有关人;b.寄单行即委托人委托办理托收的银行;c.代收行即除寄单行以外的任何参与处理托收业务的任何银行;(2)付款人即根据托收指示向其提示单据的人。

二、托收的形式和结构第四款托收指示(1)a.所有送往托收的单据必须附有一项托收指示,注明该项托收将遵循《托收统一规则》第522号文件并且列出完整和明确的指示。

银行只准允根据该托收指示中的命令和本规则行事;b.银行将不会为了取得指示而审核单据;c.除非托收指示中另有授权,银行将不理会来自除了他所收到托收的有关人/银行以外的任何有关人/银行的任何指令。

跟单托收统一规则URC522中英文版

跟单托收统一规则URC522中英文版跟单托收统一规则第522号一、总则和定义Article 1Application of URC 522第一款:《托收统一规则》第522号的应用。

a. The Uniform Rules for Collections, 1995 Revision, ICC Publication No.522, shall apply to all collections as defined in Article 2 where such rules are inco rporated into the text of the “collection instruction” referred to in Article 4 and are binding on all parties thereto unless otherwise expressly agreed or contrary to the provisions of a national, state or local law and/or regulation which cannot be departed from.国际商会第522号出版物《托收统一规则》1995年修订本将适用于第二款所限定的、并在第四款托收指示中列明适用该项规则的所有托收项目。

除非另有明确的约定,或与某一国家、某一政府,或与当地法律和尚在生效的条例有所抵触,本规则对所有的关系人均具有约束力。

b. Banks shall have no obligation to handle either a collection or any collection instruction or subsequent related instructions.银行没有义务必须办理某一托收或任何托收指示或以后的相关指示。

c. If a bank elects, for any reason, not to handle a collection or any related instructions received by it, it must advise the party fromwhom it received the collection or the instructions by telecommunication or, if that is not possible, by other expeditious means, without delay.如果银行无论出于何种理由选择了不办理它所收到的托收或任何相关的托收指示,它必须毫不延误地采用电讯,或者如果电讯不可能时采用其它快捷的工具向他收到该项指示的当事人发出通知。

托收统一规则URC522

分析: 根据《托收统一规则》第4条明确规定,“与托收有 关的银行,对由于任何通知、信件或单据在寄送途中发生 延误和(或)失落所造成的一切后果,或对电报、电传、 电子传送系统在传送中发生延误、残缺和其他错误,或对 专门性术语在翻译上和解释上的错误,概不承担义务或责 任。”由此可以断定托收行已经善意地履行了义务。 《托收统一规则》第1条即提出“银行应以善意和合理 的谨慎行事”。签收的单据找不到了,又无《托收统一规 则》第5条所规定的不可抗力来解脱责任,代收行明显地 没有尽到谨慎义务,应该承担单据丢失的责任。

(二)代收行的权利与义务 1.对托收指示的处理 没有执行托收指示的义务。如托收指示不明确,应征求 托收行意见。

不从审单中获取托收指示

除非另有授权,对来自委托方以外的任何一方的指示不 予理会。

2.对单据的处理 代制单据 单据的格式和措辞应由托收行提供,否则,托收行将 不承担责任或对其负责。

5、通知代收情况 代收行必须毫无延误地将付款通知、承兑通知、拒绝 付款或拒绝承兑的通知向托收行发出。

(三)受托方的免责事项

1、对所收单据的免责 银行将按单据收到时的原样提示,而不予地一步审核。

对于任何单据缺少或出现与托收指示中所列单据不一致 时,必须用电讯,或用其他快捷的方法通知发出托收指示 书的一方。

确认所收到的单据与托收指示书所列的是否一致 a.如果不一致或缺少,应毫不延迟地用电讯方式通知托收 行。 b.代收行的主要责任是保管好单据,不得擅自将单据交给 进口人。 c.代收行将单据按收到时的原样提示,不需审核。

3、对货物的处理 银行与货物或买卖合同无关。 4、无延误地付款 代收行必须将收妥的金额按托收指示无延误地拨交托 收行。

五、义务与责任 有关银行在办理托收业务时必须诚信、合理谨慎。如 因银行的失误,给委托人造成不应有的损失,银行不能 免除责任。

URC522-chinese version

URC522URC522是国际商会于1979年1月号发布《托收统一规则》,一切国际商业贸易的托收规则都是根据本规则执行。

这个规则的效率与L/C的UCP600一致,深圳天捷建议各位国际贸易者,只有认真了解URC522,才能更好做好D/P托收操作。

以下是URC522中文版,本URC522中文版选自网络,我司对其翻译客观性与正确性不负担任何责任:托收统一规则(URC522中文版)(1978年国际商会修订)★总则和定义:A.本总则、定义以及下列条文适用于下面(B)所限定的一切托收。

除非另有明示同意,或除非与一国、一州或地方所不得违反的法律条例的规定相抵触,它们对所有当事人都具有约束力。

B.就本规则、定义和条文而言:1.I."托收"是指银行根据所收到的指示来处理下面(II)项所限定的单据,为了:a.取得承兑,和(或)视情况予以付款,或者b.在承兑后,和(或)视情况在付款后交付商业单据,或者c.按照其他条件交付单据。

II."单据"是指资金单据和(或)商业单据:a."资金单据"是指汇票、期票、支票、付款收据或其他用于取得付款的类似凭证;b."商业单据"是发票、装运单据、所有权单据或其他类似的单据,或者一切不属于资金单据的其他单据。

III."光票托收"是指资金单据的托收,不附有商业单据。

Ⅳ."跟单托收"是指:a.资金单据的托收,附有商业单据;b.商业单据的托收,不附有资金单据。

2."有关当事人"是指:I."委托人",是指委托银行,办理托收业务的客户;II."委托行",是指受委托人的委托,办理托收业务的银行;III."代收?是指除委托行以外,参与办理托收指示的任何银行;Ⅳ."提示行"是指向付款人作出指示的代收行。

托收统一规则URC522资料

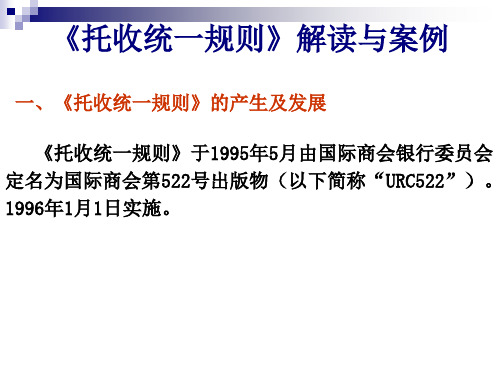

一、《托收统一规则》的产生及发展

《托收统一规则》于1995年5月由国际商会银行委员会 定名为国际商会第522号出版物(以下简称“URC522”)。 1996年1月1日实施。

二、《托收统一规则》的主要内容概述 (URC522)共7部分,共26条。包括: A.总则及定义,包括3条; B.托收的形式和结构,包括1条; C.提示方式,包括4条; D.义务与责任,包括7条; E.付款,包括4条; F.利息、手续费及其它费用,包括2条; G.其它规定,包括5条。

确认所收到的单据与托收指示书所列的是否一致 a.如果不一致或缺少,应毫不延迟地用电讯方式通知托收 行。 b.代收行的主要责任是保管好单据,不得擅自将单据交给 进口人。 c.代收行将单据按收到时的原样提示,不需审核。

3、对货物的处理 银行与货物或买卖合同无关。 4、无延误地付款 代收行必须将收妥的金额按托收指示无延误地拨交托 收行。

五、义务与责任 有关银行在办理托收业务时必须诚信、合理谨慎。如 因银行的失误,给委托人造成不应有的损失,银行不能 免除责任。

(一)托收银行的权利与义务 1.托收银行的权利 选择代收银行之权 在委托人未指定代收银行的情形下

单证提示方法的决定权 单据必须以银行收到时的形式向付款人提示

收回代垫费用之权 即使未能收到货款,托收银行的托收手续费仍可向 委托人收取。

托收的定义(Collection) 债权人(出口商)出具汇票及/或商业单据委 托银行通过它的分行或代理行向债务人(进口商 )代为收款的一种结算方式。 取得付款及/或承兑 凭付款及/或承兑交出单据 以其他条款和条件交出单据

一、付款交单(Documents against Payment,D/P) 买方付款后才能向代收行领取商业单据。

托收统一规则

三、托收的分类和流程

四、案例分析

案例一: 出口商A向进口商B出口大蒜,双方达成协议采用D/P即期方式(即期付款交单)进行结算,并 且明确表示适用于URC522的规定。出口商将这批大蒜装船出运后,随即向出口地银行提交了 托收申请书和相应的单据,而C银行始终没有给出口商A答复。当这批货物到达目的港后,进 口商B没有收到出口商A通过托收行给其寄来的海运提单等单据,无法迅速提货。随着时间的 推移,这批大蒜开始腐烂变质,进口商B没有办法只好向出口商A发电要求速寄单据,出口商 A也感到莫名其妙,要求C银行给其答复。C银行的解释是:它始终没有答应为其办理托收业 务。与此同时,由于当时A向其提交托收指示及相关单据的时间恰逢周五下午,C银行借故没 来得及通知出口商 A,等到下周一的银行工作日时,已经是两天以后了;同时由于银行业务 的复杂性又耽搁了一段时间。但等到出口商将单据重新寄交进口商的时候,此批大蒜已经出 现了大范围的腐烂。出口商A只有降价处理给进口商B,损失惨重。

二、《托收统一规则》主要内容

(URC522)共7部分,共26条。包括:

A.总则及定义

B.托收的形式和结构 C.提示方式

包括3条

包括1条 包括4条

D.义务与责任

E.付款 F.利息、手续费及其它费用 G.其它规定

包括7条

包括4条 包括2条 包括5条

根据《托收统一规则》规定托收意指银行根据所收的指示,处理金融单据或 商业单据,目的在于取得付款或承兑,凭付款或承兑交单,或按其他条款及 条件交单。上述定义中所涉及的金融单据是指汇票、本票、支票或其他用于 付款或款项的类似凭证;商业单据是指发票、运输单据、物权单据或其他类 似单据,或除金融单据之外的任何其他单据。 需要注意的是,该规则本身不是法律,因而对一般当事人没有约束力。只有 在有关当事人事先约定的条件下,才受该惯例的约束。

第三章 国际结算规则与惯例

第三节 国际商会《跟单信用证统一惯例 (UCP600)》

一、《跟单信用证统一惯例(UCP600)》 的发展过程

国际商会为了使信用证成为国际贸易中便利的结算工具,于 1930年拟订了《商业跟单信用证统一惯例》(Uniform Regulations for Commercial Documentary Credits ,简称 UCP,并在1933年正式公布(UCP82)。其后随着国际贸 易形势的变化与发展情况该惯例先后经历了5次修改。 从1991年起,国际商会又着手对UCP400进行第五次修订, 以便使信用证业务中的一些问题能详尽地纳入到统一惯例 (UCP500)的规定之中。这次修订获得通过以后,国际商 会以第500号出版物公布,并在1994年1月1日正式启用。

(三)国际结算惯例的制定机构——国际商会 国际贸易与结算惯例大多是由国际性的商业组织或团体来组 织编纂和负责解释的,国际商会是其中最为重要的机构之一。 国际商会(Internationa国 商会发起,是世界上重要的民间经贸组织,成立于1919年, 总部设在巴黎,是由来自世界各国的生产者、消费者、制造 商、贸易商、银行家、保险家、运输商、法律经济专家筹组 成的国际性的非政府机构。其宗旨是:在经济和法律领域里, 以有效的行动促进国际贸易和投资的发展。其工作方式为: 制定国际经贸领域的规则、惯例,并向全世界企业界和商界 推广应用;寻求与各国政府以及国际组织对话,以求创造一 个利于自由企业、自由贸易和自由竞争的国际环境;促进各 国或各地区会员之间的经贸合作,并向全世界商界提供实际 和实用的服务。

第二节 国际商会《托收统一规则 (URC522)》

一、《托收统一规则(URC522)》发展的过程 第一次修订是指国际商会于1967年对原《URC192》进行 了部分内容的修改,重新制定了《商业单据托收统一规则》 (Uniform Rules for Collection of Commercial Paper ICC Paper,ICC Publication No.254,国际商会第254号出版物,简称 《URC254》)。 随着贸易的发展和托收业务的变化,国际商会于1978年第 二次对原254号规则进行了修改并制定了《托收统一规则》 (Uniform Rules for Collections,ICC Publication No.322, 国际商会第322号出版物,简称《URC322》),并规定于 1979年开始生效。

托收统一规则

4.银行有是否接受委托的自主权 有人认为,一方收到了托收单据即自动使该当事方有义务处理此 项托收业务。为消除上述误解,URC522在本条b分条中首次明 确规定:银行没有处理托收单据或执行托收指示或其后相关指示 的义务。 所谓“其后相关指示”是指在托收业务中,委托人因情况变化, 或由于其他原因,如根据进口商的要求,或在进口商拒付的情况 下,通过银行变更原先“托收指示”中的条件,如增减托收金额、 变更付款人名称、改变交单条件、延长付款期限等。按上述规定, 银行不仅有拒绝处理托收单据或执行托收指示的权利,而且还享 有拒绝处理其后相关托收指示的权利。 这是因为,托收是银行提供的一种服务,银行有选择不提供这种 服务的权利。事实上我们可以将申请人向银行发出托收指示及托 收单据等行为当成一种要约,银行可以承诺或不承诺。

(二)托收的定义 就本条款而言: (1) 托收是指银行依据所收到的指示处理下述(2)款(金融单 据和/或商业单据)所限定的单据,以便于: a.取得付款及/或承兑. 例如,进口方向出口方寄发一份以进口方银行为付款人的银行本 票以结算货款时,出口方利用光票托收方式委托出口地一家银行 向进口方银行托收该份以进口方银行为付款人的银行本票以取得 货款.

B.不附有金融单据的商业的托收。 即指托收单据中仅有发票、运输单证、保险单等商业单据,而不 附有汇票等金融单据。由于有些国家规定汇票要征收印花税,所 以这些国家的进口商要求出口商不要开立汇票,以逃避印花税。

值得注意的是,URC522对跟单托收中的“单”是指除金融单据 以外的任何其他单据,而并不一定要求该单据中必须包括海运提 单等物权凭证。 但在实际进出口业务中,为掌握货物所有权,出口商通常均将物 权凭证(如全套正本海运提单)附于跟单托收项下。此时,买方 在未付清货款前拿不到物权凭证,提不走货物,货物的所有权仍 属卖方。如买方到期拒不付款赎单,卖方除可与买方交涉外,还 可将货物另行处理或再装运回。

国际商会托收统一规则URC522

国际商会托收统一规则(URC522)(中文版)国际商会托收统一规则(URC 522) 一、总则和定义第一款:《托收统一规则》第522号的应用。

(1)国际商会第522号出版物《托收统一规则》1995年修订本将适用于第二款所限定的、并在第四款托收指示中列明适用该项规则的所有托收项目。

除非另有明确的约定,或与某一国家国际商会托收统一规则(URC 522)一、总则和定义第一款:《托收统一规则》第522号的应用。

(1)国际商会第522号出版物《托收统一规则》1995年修订本将适用于第二款所限定的、并在第四款托收指示中列明适用该项规则的所有托收项目。

除非另有明确的约定,或与某一国家、某一政府,或与当地法律和尚在生效的条例有所抵触,本规则对所有的关系人均具有约束力。

(2)银行没有义务必须办理某一托收或任何托收指示或以后的相关指示。

(3)如果银行无论出于何种理由选择了不办理它所收到的托收或任何相关的托收指示,它必须毫不延误地采用电讯,或者如果电讯不可能时采用其它快捷的工具向他收到该项指示的当事人发出通知。

第二款托收的定义就本条款而言:(1)托收是指银行依据所收到的指示处理下述(2)款所限定的单据,以便于:a.取得付款和/或承兑;或b.凭以付款或承兑交单;或c.按照其他条款和条件交单。

(2)单据是指金融单据和/或商业单据。

a.金融单据是指汇票、本票、支票或其他类似的可用于取得款项支付的凭证;b.商业单据是指发票、运输单据、所有权文件或其他类似的文件,或者不属于金融单据的任何其他单据。

(3)光票托收是指不附有商业单据的金融单据项下的托收。

(4)跟单托收是指:a. 附有商业单据的金融单据项下的托收;b.不附有金融单据的商业单据项下的托收。

第三款托收的关系人(1)就本条款而言,托收的关系人有:a.委托人即委托银行办理托收的有关人;b.寄单行即委托人委托办理托收的银行;c.代收行即除寄单行以外的任何参与处理托收业务的任何银行;(2)付款人即根据托收指示向其提示单据的人。

托收统一规则中英文完整版

国际商会托收统一规则(英文版)(ICC Uniform Rules for Collections ,ICC Publication No. 522 )ICC Uniform Rules for CollectionsICC Publication No. 5221995 Revisi on in force as of Jan uary 1, 1996CONTENTA. Gen eral Provisi ons and Defin iti onsApplication of URC 522Defin iti on of Collectio nParties to a Collect ionB. Form and Structure of Collecti onsof Prese ntati onPrese ntatio nSight/Accepta neeRelease of Commercial Docume ntsDocume nts Aga inst Acceptio n (D/A) vs Docume nts Aga inst Payme nt (D/P) Creati on of Docume ntsand Resp on sibilitiesGood Faith and Reas on able CareDocume nts vs. Goods/Services/Performa ncesDisclaimer for Acts of an In structed PartyDisclaimer on Docume nts ReceivedDisclaimer on Effective ness of Docume ntsDisclaimer on Delays,Loss in Tran sit and Tran slatio nForce MajeureE. Payme ntPayme nt Without DelayPayme nt in Local Curre ncyPayme nt in Foreig n CurrencyPartial Payme nt‘Charges and Expe nsesIn terestCharges and Expe nsesG. Other Provisi onsAccepta neePromissory Notes and other In struct ionsProtestCase-of-NeedAdvices11A. Gen eral Provisi ons and Defin iti onsArticle 1Application of URC 522a. The Uniform Rules for Collections, 1995 Revision, ICC Publication , shall apply to all collecti ons as defi ned in Article 2 where such rules are in corporated into the text of the“ collectio n in structi on ” referred to in Article 4 and are binding on all parties thereto uni ess otherwise expressly agreed or con trary to the provisi ons of a n ati on al,state or local law an d/or regulati on which cannot be departed from.b. Banks shall have no obligatio n to han dle either a collectio n or any collectio n in structi on or subseque nt related in struct ions.c. If a bank elects, for any reas on, not to han dle a collectio n or any related in struct ions received by it, it must advise the party from whom it received the collectio n or the in struct ions by telecom muni cati on or, if that is not possible, by other expeditious means, without delay.Article 2Defin iti on of Collectio nFor the purposes of these Articles:a. “ Collect ion ” means the han dli ng by banks of docume nts as defi ned in sub-Article 2(b), in accorda nee received, in order to:I. obta in payme nt an d/or accepta nee, orII. deliver docume nts aga inst payme nt an d/or aga inst accepta nce,orIII. deliver docume nts on other terms and con diti ons.b. “ Documents” means financial documents and/or commercial documents:I. “ Financial documents ” means bills of exchange,promissory notes, cheques, or other similar in strume nts used for obta ining the payme nt of mon ey;II. “Commercial documents ” means invoice,transport documents,documents of title or other similar docume nts,or any other docume nts whatsoever, not being finan cial docume nts.c. ” Clean collection ” means collection of financial documents not accompanied by commercial docume nts.d. ” Docume ntary collect ion ” means collect ion of:I. finan cial docume nts accompa nied by commercial docume nts;docume nts not accompa nied by finan cial docume nts.Article 3a. For the purposes of these Articles the “ parties thereto” are:I. the “ prin cipal ” who is the party en trusti ng the han dli ng of a collect ion to a bank;II. the “ remitting bank ” which is the bank to which the principal has entrusted the han dli ng of a collect ion;III. “collecting bank ” which is any bank,other than the remitting bank, involved in process ing the collect ion;IV. the “ presenting bank” which is the collecting bank making presentation to the drawee.b. The “drawee” is the one to whom presentation is to be made in accordanee with the22collecti on in structio n. 23B . Form and Structure of Collect ionsArticle 4Collectio n In structi onA i. All docume nts sent for collectio n must be accompa nied by a collecti on in structio n in dicati ng that the collect ion is subject to URC522 and givi ng complete and precise in struct ions. Banks are only permitted to act upon the in struct ions give n in such collecti on in struct ion,and in accorda nee with these Rules.ii. Banks will not exam ine docume nts in order to obta in in struct ions.iii. Uni ess otherwise authorized in the collect ion in struct ion, banks will disregard any in struct ions from any party/ba nk other tha n the party/ba nk from whom they received the collecti ons.B A collectio n in structio n should con tain the followi ng items of in formatio n,as appropriate.i. Details of the bank from which the collection was received including full name,postal and SWIFT addresses,telex,teleph on e,facsimile nu mbers and referece.ii. Details of the prin cipal in clud ing full n ame, postal address,a nd if applicabletelex,telephone and facsimile numbers.iii. Details of the drawee including full name,postal address,or the domicile at which presentation is to be made and if applicable telex, telephone and facsimile numbers.iv. Details of the presenting bank,if any,including full name,postal address,and if applicable telex, teleph one and facsimile nu mbers.v. Amoun t(s) and curre ncy(ies) to be collected.vi. List of docume nts en closed and the nu merial count of each docume nt.vii. a) Terms and con diti ons upon which payme nt an d/or accepta nee is to be obta in ed.b) Terms of delivery of docume nts aga in st:1) payme nt an d/or accepta nee2) other terms and con diti onsIt is the resp on sibility of the party prepari ng the collect ion in struct ion to en sure that the terms for the delivery of docume nts are clearly and un ambiguously stated, otherwise banks will not be resp on sible for any con seque nces aris ing therefrom.viii. Charges to be collected, in dicat ing whether they may be waived or n ot.ix. In terest to be collected, if applicable, in dicat ing whether it may be waived or not, in cludi ng:a) rate of in terestb) in terest periodc) basis of calculati on (for example 360 or 365 days in year) as applicable.x. Method of payme nt and form of payme nt advice.xi. I nstrucit ons in case of non-payme nt, non-accepta nee an d/or non-complia nee with other in struct ions.i. Collectio n in struct ions should bear the complete address of the drawee or of the domicile at which the prese ntati on is to be made. If the address is in complete or in correct, the collecti ng bank may, without any liability and resp on sibility on its part, en deavour to ascerta in the proper address.ii. The collect ing bank will not be liable or resp on sible for any ensuing delay as a result of an address being provided.B. Form of Prese ntati onArticle 533Prese ntatio na. For the purposes of these Articles, prese ntati on is the procedure whereby the prese nting bank makes the docume nts available to the drawee as in structed.b. The collection instruction should state the exact period of time within which any action is to be take n by the drawee.Expressions such as “ first ” , “ prompt ”,” immediate ” , and the like should not be used in connection with presentation or with referenee to any period of time within which documents have to be take n up or for any other action that is to be take n by the drawee. If such terms are used banks will disregard them.c. Docume nts are to be prese nted to the drawee in the form in which they are received, except that banks are authorized to affix any n ecessary stamps, at the expe nse of the party from whom they received the collect ion uni ess otherwise in structed, and to make any n ecessaryen dorseme nts or place any rubber stamps or other ide ntify ing marks or symbols customary to or required for the collect ion operati on.d. For the purpose of giving effect to the instructions of the principal, the remitting bank will utilize the bank nominated by the principal as the collecting bank. In the absence of such nomination, the remitting bank will utilize any bank of its own, or another bank ' s choice in the country of payme nt or accepta nce or in the country where other terms and con diti ons have to be complied with.e. The documents and collection instruction may be sent directly by the remitting bank to the collect ing bank or through ano ther bank as in termediary.f. If the remitti ng bank does not nomin ate a specific prese nting bank, the collect ing bank may utilize a presenting bank of its choice.Article 6Sight/Accepta nceIn the case of docume nts payable at sight the prese nting bank must make prese ntati on for payme nt without delay.In the case of docume nts payable at a tenor other tha n sight the prese nti ng bank must, where accepta nce is called for, make prese ntati on for accepta nce without delay, and where payme nt is called for, make prese ntati on for payme nt no t later tha n the appropriate maturity date.\ Article 7Release of Commercial Docume ntsDocume nts Aga inst Accepta nce (D/A) vs. Docume nts Aga inst Payme nt (D/P) should not contain bills of excha nge payable at a future date with in struct ion that commercial docume nts are to be delivered aga inst payme nt.b. If a collect ion contains a bill of excha nge payable at a future date, the collect ionin struct ion should state whether the commercial docume nts are to be released to the drawee aga inst accepta nce (D/A) or aga inst payme nt (D/P).In the abse nce of such stateme nt commercial docume nts will be released only aga inst payme nt and the collect ing bank will not be resp on sible for any con seque nces aris ing out of any delay in the delivery of docume nts.c. If a collect ion contains a bill of excha nge payable at a future date and the collect ionin struct ion in dicates that commercial docume nts are to be released aga inst payme nt, docume nts will be released only aga inst such payme nt and the collect ing bank will not be resp on sible for any con seque nces aris ing out of any delay in the delivery of docume nts.Article 8Creati on of Docume nts44Where the remitti ng bank in structs that either the collect ng bank or the drawee is to create docume nts (bills of excha nge promissory no tes, trust receipts,letters of un dertak ing or other docume nts) that were not in cluded in the collecti on, the form and word ing of such docume nts shall be provided by the remitt ing bank, otherwise the collect ing bank shall not be liable or resp on sible for the form and word ing of any such docume nt provided by the collect ing bank an d/or the drawee.C. Liabilities and Resp on sibilitiesArticle 9Good faith and Reas on able CareBanks will act in good faith and exercise reas on able care.Article 10Docume nts vs. Goods/Services/Performa ncesshould not be dispatched directly to the address of a bank or con sig ned to or to the order of a bank without prior agreeme nt on the part of that bank.Nvertheless, in the event that goods are dispatched directly to the address of a bank or con sig ned to or to the order of a bank for release to a drawee aga inst payme nt or accepta nee or upon other terms and con diti ons without prior agreeme nt on the part of that bank, such bank shall have no obligati on to take delivery of the goods, which rema in at the risk and resp on sibility of the party dispatch ing the goods.b. Banks have no obligation to take any action in respect of the goods to which a docume ntary collectio n relates, i ncludi ng storage and in sura nee of the goods even whe n specific in struct ions are give n to do so. Banks will only take such action if, whe n, and to the exte nt that they agree to do so in each case, no twithsta nding the provisi ons of sub-article 1 (c), this rule applies even in the abse nee of any specific advice to this effect by the collect ing bank.c. Nevertheless, in the case that banks take acti on for the protect ion of the goods, whether in structed or not, they assume no liability or resp on sibility with regard to the fate an d/or con diti on of the goods an d/or for any acts an d/or omissi ons on the part of any third parties en trusted with the custody an d/or protect ion of the goods. However, the collecti ng bank must advise without delay the bank from which the collection instruction was received of any such action taken.d. Any charges an d/or expe nsed in curred by banks in conn ecti on with any action take n to protect the goods will be for the acco unt of the party from whom they received the collecti on.e. i. Notwithsta nding the provisi ons of sub-article 10 (a), where the goods are con sig ned to or the order of the collect ing bank and the drawee has honoured the collecti on by payme nt, accepta nee or other terms and con diti ons, and the collect ing bank arran ges for the authorized the collect ing bank to do so.a collect ing bank on the in struct ions of the remitt ing bank or in terms of sub-article 10 (e) i, arran ges for the release of the goods, the remitt ing bank shall indemnify such collect ing bank for all damages and expe nses in cured.Article 11Disclaimer For Acts of an In structed Partya. Banks utiliz ing the services of ano ther bank or other banks for the purposes of givi ng effect to the in struct ions of the prin cipal, do so for the acco unt and at the risk of such prin cipal.b. Banks assume no liability or resp on sibility should the in struct ions they tran smit not be carried out, even if they have themselves taken the initiative in the choice of such other bank(s).c. A party in struct ing ano ther party to perform services shall be bound by and liable to indemnify the in structed party aga inst all obligati ons and resp on sibilities imposed by foreig n laws and usages.55Article 12Disclaimer on Docume nts Receivedmust determ ine that the docume nts received appear to be as listed in the collect ionin struct ion and must advise by telecom-muni catio n or, if that is not possible, by other expeditious means, without delay, the party from whom the collection instruction was received of any docume nts miss ing, or found t be other tha n listed.Banks have no further obligati on in this respect.b. If the docume nts do not appear to be listed, the remitt ing bank shall be precluded from disputi ng the type and nu mber of docume nts received by the collect ing bank.c. Subject to sub-article 5 (c) and sub-article 12 (a) and 12 (b) above, banks will prese nt docume nts as received without further exam in ati on.Article 13Disclaimer on Effective ness of Docume ntsBanks assume no liability or responsibility ofr the form, sufficie ncy,accuracy,ge nuineness,falsificati on or legal effect of any docume nt (s) or superimposed there on; nor do they assume any liability, con diti on ,pack ing ,delivery, value of existe nee of the goods represe nted by any docume nt (s),or for the good faith or acts an d/or omissi on, solve ncy,performa nee or sta nding of the con sig nors, the carriers,the forwarders,the con sig nees or the in surers of the goods, or any other pers on whomsoever.Article 14Disclaimer on Delays,Loss in Tran sit and Tran slatio nassume no liability or resp on sibility for the con seque nces aris ing out of delay an d/or loss in transit of any message (s), letter(s) or document(s), or for delay,mutilation or other error(s) arising in tran smissi on of any telecom muni cati on or for error(s) in tran slati on an d/or in terpretati on of tech ni cal terms.b. Banks will not be liable or resp on sible for any delays result ing from the n eed to obta in clarificati on of any in struct ions received.Article 15Force MajeureBanks assume no liability or responsibility for consequence arising out of the interruption of their bus in ess by Acts of God, riots,civil commotios,i nsurrect ions, wars, or any other causes bey ond their con trol or by strikes or lockouts.D. Payme ntArticle 16Payme nt Without Delaycollected (less charges an d/or disburseme nts an d/or expe nses where applicable) must be made available without delay to the party from whom the collect ion in struct ion was received in accordance with the terms and conditions of the collection instruction.b. Notwithsta nding the provisi ons of sub-article 1 (c) and uni ess otherwise agreed, the collect ing bank will effect payme nt of the amounts collected in favour of the remitti ng bank only.Article 17Payme nt in Local Curre ncy66In the case of docume nts payable in the curre ncy of the country of payme nt (local curre ncy), the prese nting bank must, uni ess otherwise in structed in the collect ion in structi on, release the docume nts to the drawee aga inst payme nt in local curre ncy on ly if such curre ncy is immediately available for disposal in the manner specified in the collection instruction.Article 18Payme nt in Foreig n CurrencyIn the case of docume nts payable in a curre ncy other tha n of the country of payme nt (foreig n curre ncy), the prese nting bank must, uni ess otherwise in structed in the collecti on in struct ion, release the docume nts to the drawee aga inst payme nt in the desig ned foreig n curre ncy only if such foreig n curre ncy can immediately remitted in accorda nee with the in structi ons give n in the collectio n in structio n.Article 19Partial Payme ntsrespect of clea n collect ions, partial payme nts may be accepted if and to the exte nt to which and on the conditions on which partial payments are authorized by the law in force in the place of payment. The financial document(s) will be released to the drawee only when full payment thereof has bee n received.b. In respect of docume ntary collecti on, partial payme nts will only be accepted if specifically authorized in the collect ion in struct ion. However,u nl ess otherwise in structed, the prese nting bank will release the docume nts to the drawee only after full payme nt has bee n received, and the presenting bank will not be responsible for any consequence arising out of any delay in the delivery of docume nts.all cases partial payme nts will be accepted only subject to complia nce with the provisi ons of either Article 17 or Article 18 as appropriate. Partial payment, if accepted, will be dealt with in accorda nce with the provisi ons of Article 16.E. In terest, Charges and Expe nsesArticle 20In terestthe collecti on in struct ion specifies that in terest is to be collected and the drawee refuses to pay such in terest, the prese nti ng bank may deliver the docume nt (s) aga inst payme nt of accepta nce or on other terms and con diti ons as the case may be, without collect ing such in terest, uni ess subarticle 20 (c) applies.b. Where such in terest is to be collected, the collect ion in struct ion must specify the rate of interest,interest period and basis of calculation.the collecti on in struct ion expressly states that in terest may not be waived and the drawee refuses to pay such in terest the prese nti ng abnk will not deliver docume nt and will not be resp on sible for any con seque nces aris ing out of any delay in the delivery of docume nt(s). When payment of interest has been refused, the presenting bank must inform by telecommunication or, if that is not possible, by other expeditious means without delay the bank from which the collecti on in struct ion was received.Article 21Charges and Expe nsesthe collecti on in struct ion specifies that collect ion charges an d/or expe nses are to be ofr acco unt of the drawee and the drawee refuses to pay them, the prese nting bank may deliver the77docume nt(s) aga inst payme nt or accepta nee or on other terms and con diti ons as the case may be, without collect ing charges an d/or expe nses, uni ess sub-article 21 (b) applies.When ever collect ion charges an d/or expe nses are so waived they will be for the acco unt of the party from whom the collect ion was received and may be deducted from the proceeds.the collecti on in struct ion expressly states that charges an d/or expe nses may not be waived and the drawee refuses to pay such charges an d/or expe nses, the prese nti ng bank will not deliver docume nts and will not be resp on sible for any con seque nee aris ing out of any delay in the delivery of the docume nt(s). When payme nt of collecti on charges an d/or expe nses has bee n refused the presenting bank must inform by telecommunication or, if that is not possible, by other expeditious means without delay the bank from which the collecti on in structi on was received.all cases where in the express terms of a collectio n in structio n or un der these Rules, disburseme nts an d/or expe nses an d/or collect ion charges are to be borne by the prin cipal, the collect ing ban k(s) shall be en titled to recover promptly outlays in respect of disburseme nts,expe nses and charges from the bank form which the collectio n in structio n ws received, and the remitting bank shall be entitled to recover promptly from the principal any amount so paid out by it,together with its own disbursements,expenses and charges,regardless of the fate of the collect ion.reserve the right to dema nd payme nt of charges an d/or expe nses in adva nee from the party from whom the collect ion in struct ion was received, to cover costs in attempti ng to carry out any in struct ions, and pending receipt of such payme nt also reserve the right not to carry out such in struct ions.F. Other Provisi onsArticle 22Accepta neeThe prese nting bank is resp on sible for see ing that the form of the accepta nee of a bill of excha nge appears to be complete and correct, but is not resp on sible for the genuinen ess of any sig nature or for the authority of any sig natory to sig n the accepta nee.Article 23Promissory Notes and Other In structi onsThe presenting bank is not responsible fo the genuineness of any sig nature or for the authority of any sig nature to sig n a promissory no te, receipt, or other in strume nts.Article 24ProtestThe collectio n in structio n should give specific in struct ions regard ing protest (or other legal process in lieu thereof), in the event of non-payme nt or non-accepta nee.In the abse nee of such specific in struct ions, the banks concerned with the collect ion have no obligati on to have the docume nt(s) protested (or subjected to other legal process in lieu thereof) for non-payme nt or non-accepta nee.Any charges an d/or expe nses in curred by banks in conn ecti on with such protest, or other legal process,will be for the acco unt of the party from whom the collecti on in struct ion was received.Article 25Case-of-NeedIf the prin cipal nomin ates a represe ntative to act as case-of- need in the event of non-payme nt an d/or non-accepta nee the collect ion in structi on should clearly and fully in dicate the powers of 88such case-of- need. In the abse nee of such in dicati on banks will not accept any in structi ons from the case-of- need.Article 26AdvicesCollecting banks are to advise fate in accordance with the following rules:of AdviseAll advices of information from the collecting bank to the bank from which the collection in struct ion was received, must bear appropriate details in clud in g, in all cases,the latter bank ' s refere nce as stated in the collectio n in structio n.of AdviceIt shall be the resp on sibility of the remitt ing bank to in struct the collect ing bank regard ing the method by which the advices detailed in (c) i, (c) ii and (c) iii are to be give n. In the abse nce of such in struct ions, the collect ing bank will send the relative advices by the method of its choice at the expe nse of the bank from which the collectio n in structio n was received.c. i. Advice of Payme ntThe collect ing bank must send without delay advice of payme nt to the bank from which the collecti on in struct ion was received, detaili ng the amount or amounts collected,charges an d/or disburseme nts an d/or expe nses deducted, where appropriate, and method of disposal of the funds.of Accepta nceThe collecti ng bank must send without delay advice of accepta nce to the bank from which the collectio n in structio n was received.of Non-payme nt an d/or Non-accepta nceThe prese nting bank should en deavour to ascerta in the reas ons for non-payme nt an d/or non- accepta nce and advise accord in gly, without delay,the bank from which it received the collect ion in structio n.The prese nti ng bank must send without delay advice of non-payme nt an d/or advice of non- accepta nce to the bank form which it received the collectio n in structio n.On receipt of such advice the remitt ing bank must give appropriate in struct ions as to the further han dli ng of the docume nts. If such in struct ions are not received by the prese nti ng bank within 60 days after its advice of non-payme nt an d/or non-accepta nce, the docume nts may be returned to the bank from which the collectio n in structio n was received without any further resp on sibility on the part of the prese nting bank.一、总则和定义第一款《托收统一规则》第522号的应用。

跟单托收统一规则URC522中英文版

跟单托收统一规则第522号一、总则和定义Article 1Application of URC 522第一款:《托收统一规则》第522号的应用。

a. The Uniform Rules for Collections, 1995 Revision, ICC Publication No.522, shall apply to all collections as defined in Article 2 where su ch rules are incorporated into the t ext of the “collection instruction” referred to in Article 4 and are binding on all parties thereto unless otherwise expressly agreed or contrary to the provisions of a national, state or local law and/or regulation which cannot be departed from.国际商会第522号出版物《托收统一规则》1995年修订本将适用于第二款所限定的、并在第四款托收指示中列明适用该项规则的所有托收项目。

除非另有明确的约定,或与某一国家、某一政府,或与当地法律和尚在生效的条例有所抵触,本规则对所有的关系人均具有约束力。

b. Banks shall have no obligation to handle either a collection or a ny collection instruction or subsequent related instructions.银行没有义务必须办理某一托收或任何托收指示或以后的相关指示。

c. If a bank elects, for any reason, not to handle a collection or a ny related instructions received by it, it must advise the party from wh om it received the collection or the instructions by telecommunication o r, if that is not possible, by other expeditious means, without delay.如果银行无论出于何种理由选择了不办理它所收到的托收或任何相关的托收指示,它必须毫不延误地采用电讯,或者如果电讯不可能时采用其它快捷的工具向他收到该项指示的当事人发出通知。

托收统一规则

托收统一规则(1978年国际商会修订)★总则和定义:A.本总则、定义以及下列条文适用于下面(B)所限定的一切托收。

除非另有明示同意,或除非与一国、一州或地方所不得违反的法律条例的规定相抵触,它们对所有当事人都具有约束力。

B.就本规则、定义和条文而言:1. I. "托收"是指银行根据所收到的指示来处理下面( II)项所限定的单据,为了:a.取得承兑,和(或)视情况予以付款,或者b.在承兑后,和(或)视情况在付款后交付商业单据,或者c.按照其他条件交付单据。

II. "单据"是指资金单据和(或)商业单据:a. "资金单据"是指汇票、期票、支票、付款收据或其他用于取得付款的类似凭证;b . "商业单据"是发票、装运单据、所有权单据或其他类似的单据,或者一切不属于资金单据的其他单据。

III. "光票托收"是指资金单据的托收,不附有商业单据。

Ⅳ. "跟单托收"是指:a.资金单据的托收,附有商业单据;b.商业单据的托收,不附有资金单据。

2. "有关当事人"是指:I. "委托人" ,是指委托银行,办理托收业务的客户;II. "委托行" ,是指受委托人的委托,办理托收业务的银行;III. "代收?是指除委托行以外,参与办理托收指示的任何银行;Ⅳ. "提示行"是指向付款人作出指示的代收行。

3. "受票人" ,就是根据托收指示书,向其作出提示的人。

c.送交托收的一切单据,必须附有一份完整的明确的托收指示书。

银行只被允许按照托收指示书中的规定和根据本规则行事。

如出于某种原因,某一银行不能执行它所收到的托收指示书的规定时,必须立即通知发出托收指示书的一方。

★义务和责任第一条银行应以善意和合理的谨慎行事。

- 1、下载文档前请自行甄别文档内容的完整性,平台不提供额外的编辑、内容补充、找答案等附加服务。

- 2、"仅部分预览"的文档,不可在线预览部分如存在完整性等问题,可反馈申请退款(可完整预览的文档不适用该条件!)。

- 3、如文档侵犯您的权益,请联系客服反馈,我们会尽快为您处理(人工客服工作时间:9:00-18:30)。

∙法规标题】国际商会托收统一规则∙【颁布单位】国际商会∙【发文字号】第522号∙【颁布时间】2007-6-18∙【失效时间】∙【法规来源】/faguixiazai/msf/200706/20070618194042.htm∙【全文】国际商会托收统一规则国际商会国际商会托收统一规则国际商会(ICC)出版物第522号一、总则和定义第一条:URC 522之适用(1)本国际商会第522号出版物《托收统一规则》1995年修订本,应适用于第二条界定的、并在第四条“托收指示”中列明适用该项规则的所有托收项目,且除非另有明确的相反约定,或与无法规避的某一国家、政府或地方法律及/或法规相抵触,本规则对所有的当事人均具有约束力。

(2)银行没有义务必须办理某一托收或任何托收指示或以后的相关指示。

(3)如果银行无论出于何种理由选择不办理它所收到的托收或任何相关的托收指示,应毫不延误地采用电讯,或者如果电讯不可能时,采用其它快捷的工具,通知向其发出托收或指示的当事人。

第二条:托收的定义就本规则各项条款而言:(1)托收是指银行依据所收到的指示,处理下述第(2)款所界定的单据,以便:a.取得付款及/或承兑;或b.付款交单及/或承兑交单;或c.按照其他条款和条件交付单据。

(2)单据是指金融单据及/或商业单据。

a.金融单据是指汇票、本票、支票或其他类似的可用于取得款项支付的凭证;b.商业单据是指发票、运输单据、所有权单据或其他类似的单据,或者不属于金融单据的任何其他单据。

(3)光票托收是指不附有商业单据的金融单据项下的托收。

(4)跟单托收是指:a. 附有商业单据的金融单据项下的托收;b.不附有金融单据的商业单据项下的托收。

第三条:托收当事人(1)就本规则各项条款而言,托收当事人有:a.委托人,即委托银行办理托收的当事人;b.托收行,即委托人委托办理托收的银行;c.代收行,即除托收行以外的任何参与处理托收业务的任何银行;d. 提示行,即向付款人提示单据的代收行。

(2)付款人,即根据托收指示向其提示单据的人。

二、托收的形式和结构第四条:托收指示(1) a.所有送往托收的单据必须附有一项托收指示,注明该项托收将遵循《托收统一规则》第522号出版物,并列出完整和明确的指示。

银行只准根据该托收指示中的命令和本规则行事;b.银行将不会为了取得指示而审核单据;c.除非托收指示中另有授权,银行将不理会向其发出托收的任何当事人/银行以外的任何当事人/银行的任何指示。

(2)托收指示应当包括下述各项合适:a.收到该项托收的银行详情,包括全称、邮政和SWIFT地址、电传、电话和传真号码和编号;b.委托人的详情,包括全称、邮政地址或者办理提示的场所以及,如果有的话,电传、电话和传真号码;c.付款人的详情,包括全称、邮政地址或者办理提示的场所以及,如果有的话,电传、电话和传真号码;d.提示行(如有的话)的详情,包括全称、邮政地址以及,如果有的话,电传和传真号码;e.待托收的金额和货币类型;f.所附单据清单和每份单据的份数;g. i.据以取得付款及/或承兑的条件和条款;ii.凭以交付单据的条件①付款及/或承兑②其他条件和条款缮制托收指示的当事人应负责确保清楚无误地说明交付单据的条件,否则,银行对此所产生的任何后果将不承担责任;h.待收取的手续费,指明是否可以放弃;i.待收取的利息,如有的话,指明是否可以放弃,包括利率、计息期、适用的计算期基数(如一年按360天还是365天计算);j.付款方法和付款通知的形式;k.发生拒绝付款、拒绝承兑及/或与其他指示不相符的情况时应给出的指示。

(3)a.托收指示应载明付款人或将要办理提示的场所之完整地址。

如果地址不全或有错误,代收银行可尽力查明适当的地址,但其本身不承担任何义务和责任。

b.代收银行对因所提供地址不全或有误所造成的任何延误,将不承担任何责任。

三、提示的形式第五条:提示(1)就本规则各项条款而言,提示是指银行按照指示将单据提供给付款人的程序。

(2)托收指示应列明付款人将要采取行动的确切期限。

诸如“首先、迅速、立即”和类似的表述,不应用于指提示、或付款人赎单或采取任何其他行动的任何期限。

如果采用了该类术语,银行将不予理会。

(3)单据必须以银行收到时的形式向付款人提示,但经授权银行可以贴附任何必需的印章,并按照说明由向银行发出托收的当事人承担费用,而且银行可以经授权采取任何必要的背书或加盖橡皮戳记、或其他托收业务惯用的和必要的辨认记号或符号。

(4)为了使委托人的指示得以实现,托收行将以委托人所指定的银行作为代收行。

在未指定代收行时,托收行将使用自己的任何银行,或者在付款或承兑的国家中、或必须遵守其他条件的国家中选择另外的银行。

(5)单据和托收指示可以由托收行直接或者通过另一银行作为中间银行寄送给代收行。

(6)如果托收行未指定某一特定的提示行,代办行可自行选择提示行。

第六条:即期付款/承兑如果是见单即付的单据,提示行必须立即办理提示付款,不得延误;如果不是即期而是远期付款单据,提示行必须在要求承兑时毫不拖延地提示承兑,在要求付款时,不应晚于适当的到期日办理提示付款。

第七条:商业单据的发放承兑交单(D/A)与付款交单(D/P)(1)如果托收包含有远期付款的汇票,则其指示不应要求付款才交付商业单据。

(2)如果托收包含有远期付款的汇票,托收指示应说明商业单据是凭承兑(D/A)还是凭付款(D/P)发放给付款人。

若无上述说明,商业单据只能是付款放单,而代收行对由于交付单据的任何延误所产生的任何后果将不承担责任。

(3)如果托收包含有远期付款的汇票,而且托收指示表明应凭付款发放商业单据时,则单据只能凭该项付款才能发放,而代收行对由于交付单据的任何延误所产生的任何结果将不承担责任。

第八条:代制单据在托收行指示代收行或者付款人来代制托收中未曾包括的单据(汇票、本票、信托收据、保证书或其他单据)时,这些单据的格式和措辞应由托收行提供,否则,代收行对由代收行及/或付款人所提供任何该种单据的格式和措辞将不承担责任或对其负责。

四、义务和责任第九条:诚信和合理的谨慎银行将本着诚信的原则、尽合理的谨慎来办理业务。

第十条:单据与货物/服务/履行(1)未经银行事先同意,货物不得直接发送到该银行地址、或者以该行作为收货人或者以该行为抬头人。

然而,如果未经银行事先同意而将货物直接发送到该银行地址、或者以该行作为收货人或者以该行为抬头人,并请该行凭付款或承兑或凭其他条款将货物交付给付款人,该行将没有提取货物的义务,其风险和责任仍由发货方承担。

(2)即使接到特别指示,也银行没有义务对与跟单托收有关的货物采取任何行动,包括对货物进行存储和保险。

银行只有在个案中、在其同意的限度内,才会采取该类行动。

尽管前述第一条(3)段有不同规定,即使代收银行对此没有任何特别的通知,也适用本条规则之规定。

(3)然而,无论银行是否收到指示,银行为保护货物而采取措施时,对有关货物的结局及/或状况及/或对受托保管及/或保护货物的任何第三方的作为及/或不作为概不承担责任。

但是,代收行必须毫不延误地将其所采取的措施通知向其发出托收指的银行。

(4)银行对货物采取任何保护措施所发生的任何费用及/或花销将由向其发出托收的一方承担。

(5)a.尽管有前开第十条(1)段的规定,如果货物是以代收行作为收货人或抬头人,而且付款人已对该项托收办理了付款、承兑或承诺了其他条件和条款,且代收行因此对货物的发放作了安排时,则应视为托收行已授权代收行如此办理。

b.若代收行按照托收行的指示或按上述第十条(5)a段的规定安排发放货物,托收行应对该代收行所发生的全部损失和花销给予赔偿。

第十一条:对受托方行为的免责(1)为使委托人的指示得以实现,银行使用另一银行或其他银行的服务时,是代为该委托人办理的,因此,其风险由委托人承担;(2)即使银行主动地选择了其他银行办理业务,如该行所转递的指示未被执行,作出选择的银行也不承担责任或对其负责;(3)一方指示另一方去履行服务,指示方应受到外国法律和惯例施加给被指示方的一切义务和责任的制约,并应就有关义务和责任对受托方承担赔偿责任。

第十二条:对收到单据的免责(1)银行必须确定它所收到的单据应与托收指示中所列内容表面相符,如果发现任何单据有短缺或非托收指示所列,银行必须以电讯方式,如电讯不可能时,以其他快捷的方式,通知向从发出指示的一方,不得延误;银行对此没有其他更多的责任。

(2)如果单据与所列内容表面不相符,托收行对代收行收到的单据种类和数量应不得有争议;(3)根据第五条(3)段和上述第十二条(1)段和(2)段,银行将按所收到的单据办理提示而无需做更多的审核。

第十三条:对单据有效性的免责银行对任何单据的格式、完整性、准确性、真实性、虚假性或其法律效力、或对在单据中载明或在其上附加的一般性及/或特殊性的条款,概不承担责任或对其负责;银行也不对任何单据所表示的货物的描述、数量、重量、质量、状况、包装、交货、价值或存在、或对货物的发运人、承运人、运输代理、收货人或保险人或其他任何人的诚信或作为及/或不作为、清偿力、业绩或信誉承担责任或对其负责。

第十四条:对单据延误、在传送中的丢失以及对翻译的免责(1)银行对任何信息、信件或单据在传送中所发生的延误及/或丢失,或对任何电讯在传递中所发生的延误、残损或其他错误,或对技术条款的翻译及/或解释的错误,概不承担责任或对其负责;(2)银行对由于收到的任何指示需要澄清而引起的延误,将不承担责任或对其负责。

第十五条:不可抗力对由于天灾、暴动、骚乱、战争或银行本身不能控制的任何其他原因、任何罢工或停工而使银行营业中断所产生的后果,银行不承担责任或对其负责。

五、付款第十六条:立即付款(1)收妥的款项(扣除手续费及/或支出及/或可能的花销)必须按照托收指示中规定的条件和条款,毫不延误地付给向其发出托收指示的一方;(2)尽管有第一条(3)段的规定,除非另有指示,代收行仅向托收行汇付收妥的款项。

第十七条:以当地货币支付如果单据是以付款地国家的货币(当地货币)付款,除托收指示另有规定外,提示行必须凭当地货币的付款,发放单据给付款人,只要该种货币按托收指示规定的方式能够随时处理。

第十八条:用外币付款如果单据是以付款地国家以外的货币(外汇)付款,除托收指示中另用规定外,提示行必须凭指定的外币付款,发放单据给付款人,只要该外币按托收指示规定能够立即汇出。

第十九条:部分付款(1)光票托收时,只有在付款地现行法律准许部分付款的条件和限度内,才能接受部分付款。

只有在全部货款已收妥的情况下,才能将金融单据发放给付款人。

(2)跟单托收时,只有在托收指示有特别授权的情况下,才能接受部分付款。

然而,除非另有指示,提示行只能在全部货款已收妥后才能将单据交与付款人,并对由此所引起的延迟交单所产生的后果不承担责任。