课堂练习题(第十四章)

十四章内能的利用练习题

第十四章内能的利用14.1 热机1. 热机包括内燃机,柴油机和汽油机都属于内燃机,关于热机的下列说法中正确的是()A.汽油机顶部有喷油嘴,柴油机顶部有火花塞B.柴油机在吸气冲程中将柴油和空气的混合气吸入气缸C.四冲程汽油机在工作过程中,进、排气门同时关闭的冲程是做功冲程和压缩冲程D.在柴油机的压缩冲程中,机械能转化为柴油和空气混合物的内能2. 生活中常见的汽车和摩托车大多是采用四冲程汽油机来工作的.四冲程汽油机在一个工作循环中,下列说法不正确的是()A.对外做功一次B.有两次能量转化C.曲轴转动两周D.压缩冲程把内能转化为机械能3. 从原理的发现到实际的应用,往往要解决许多技术上的难题.如图所示的汽油机只有在做功冲程中燃气才给活塞一个动力,但汽油机却可以连续工作,其中关键部件是()A.火花塞 B.连杆 C.曲轴和飞轮 D.进气门和排气门4. 热机是将________能转化成机械能的机器,如图所示是汽油机的_______冲程.美国《大众科学》杂志评出2006~2007年度奇思妙想十大发明,其中最引人注意的是“六冲程引擎”,这种引擎在完成四冲程工作后,会把水注入汽缸,使水瞬间变成水蒸气,从而带动活塞运动,产生第五冲程,为汽车提供动力.第六冲程是让水蒸气进入冷凝器,变成可再次注入汽缸中的水.请你指出该“六冲程引擎”的一个优点:________.5. 如图所示,在透明塑料盒的底部钻一个孔,把电子式火花发生器的放电针管紧紧地塞进孔中,打开塑料盒盖,向盒中滴入数滴酒精,再将盒盖盖紧,然后揿动电火花发生器的按钮.你观察到的现象是________.图中情景演示的是“四冲程”汽油机工作过程中的________冲程,这个情景中________能转化为________能.【趣味链接】6. 如图所示为四缸发动机工作原理:内燃机通过连杆把四个汽缸的活塞连在一根曲轴上,并使各汽缸的做功过程错开,在飞轮转动的每半周里,都有一个汽缸在做功,其他三个汽缸分别在做吸气、压缩和排气工作.1.C解析:汽油机顶部有火花塞,柴油机顶部有喷油嘴,A选项错误;柴油机吸入的只是空气,B 选项错误;进、排气门都关闭的是压缩冲程和做功冲程,C选项正确;在柴油机的压缩冲程,机械能转化为空气的内能,D选项错误.故选C.2.D解析:在做功冲程中,气体推动活塞对外做功,将气体的内能转化为活塞的机械能,对外做功一次,选项A说法正确,不符合题意.在压缩冲程中,活塞对气缸内的气体做功,将机械能转化为内能;在做功冲程中,将气体的内能转化为活塞的机械能.故在一个工作循环中有两次能量转化,选项B说法正确,不符合题意.在汽油机的一个工作循环中,可以完成四个冲程,活塞往复两次,曲轴转动两周,选项C说法正确,不符合题意.在压缩冲程中,活塞对气缸内的气体做功,将机械能转化为内能,选项D说法错误,符合题意.故选D.3.C解析:解决此题要知道内燃机的工作过程:在一个工作循环中有四个冲程,活塞往复运动两次,曲轴和飞轮转动两周,只有在做功冲程中使机车获得动力,其他三个冲程均为辅助冲程,依靠惯性完成.在汽油机的做功冲程中,燃气给活塞一个动力,汽油机的曲轴和飞轮获得动能,虽然在其他冲程没有动力,但由于惯性汽油机可以连续工作;故选C.4. 内做功提高热机效率(节能、环保)解析:热机就是利用热来工作的,将内能转化为机械能;图中所示火花塞冒出电火花,活塞向下运动,进气门和排气门关闭,是做功冲程;我们都知道热机在工作时产生了大量的热,“六冲程引擎”可以利用水将这些热量转化为水蒸气,再次利用起来,大大地提高了热机的效率,节约了能源.5. 盒盖被弹飞,塑料盒口有白雾出现做功内机械解析:透明的塑料盒相当于一个气缸,塑料盒的盖相当于活塞,酒精在塑料盒内燃烧,产生高温高压的燃气,推动塑料盒盖运动,把内能转化为机械能,内能减小,温度降低,水蒸气液化成小水滴,此过程类似于内燃机中的做功冲程.6.思维点睛:(1)内机械(2)①1.2×105 0.5 ②600 (3)1.2×106解析:(1)发动机在做功冲程里,高温高压的燃气膨胀推动活塞做功,将燃气的内能转化为机械能.(2)①发动机在1 s内做功:W=Pt=120×103 W×1s=1.2×105 J.因为四缸总排量为2.0 L,单缸排量:V=2.0 L/4=0.5 L.②因为发动机在1 s内做功1.2×105 J,发动机有四个缸同时工作,所以每个缸1 s内做功:W=1.2×105 J/4=3×104 J.又因为转速为6000 r/min,四冲程内燃机每个工作循环曲轴转两周,做功一次,所以1s内做功50次,每个做功冲程做功:W′=3×104 J/50=600 J.(3)因为W′=pV,V=0.5 L=0.5×10-3 m3,所以燃气对活塞的压强:p= W′/ V=600 J/0.5×10-3 m3=1.2×106 Pa.14.2 热机的效率1. 日常生活中,我们使用了干木柴、煤炭、液化石油气、天然气、酒精等多种燃料。

毛概考试内容重点

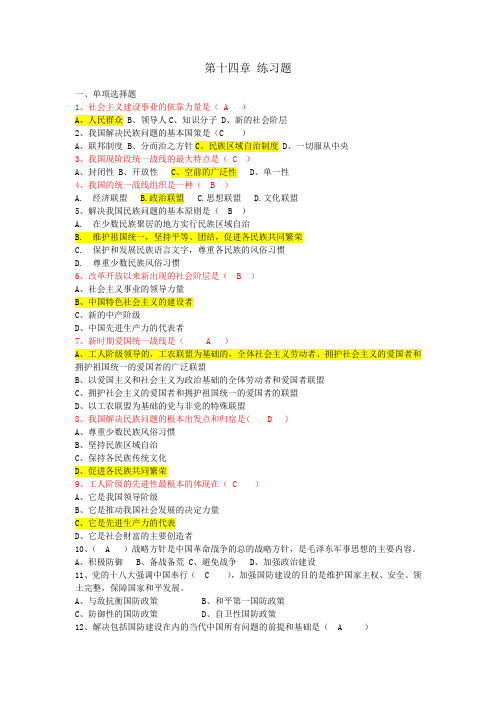

第十四章练习题一、单项选择题1、社会主义建设事业的依靠力量是( A )A、人民群众B、领导人C、知识分子D、新的社会阶层2、我国解决民族问题的基本国策是(C )A、联邦制度B、分而治之方针C、民族区域自治制度D、一切服从中央3、我国现阶段统一战线的最大特点是( C )A、封闭性B、开放性C、空前的广泛性D、单一性4、我国的统一战线组织是一种( B )A. 经济联盟B.政治联盟C.思想联盟D.文化联盟5、解决我国民族问题的基本原则是( B )A. 在少数民族聚居的地方实行民族区域自治B. 维护祖国统一,坚持平等、团结,促进各民族共同繁荣C. 保护和发展民族语言文字,尊重各民族的风俗习惯D. 尊重少数民族风俗习惯6、改革开放以来新出现的社会阶层是( B )A、社会主义事业的领导力量B、中国特色社会主义的建设者C、新的中产阶级D、中国先进生产力的代表者7、新时期爱国统一战线是( A )A、工人阶级领导的,工农联盟为基础的,全体社会主义劳动者、拥护社会主义的爱国者和拥护祖国统一的爱国者的广泛联盟B、以爱国主义和社会主义为政治基础的全体劳动者和爱国者联盟C、拥护社会主义的爱国者和拥护祖国统一的爱国者的联盟D、以工农联盟为基础的党与非党的特殊联盟8、我国解决民族问题的根本出发点和归宿是( D )A、尊重少数民族风俗习惯B、坚持民族区域自治C、保持各民族传统文化D、促进各民族共同繁荣9、工人阶级的先进性最根本的体现在( C )A、它是我国领导阶级B、它是推动我国社会发展的决定力量C、它是先进生产力的代表D、它是社会财富的主要创造者10、( A )战略方针是中国革命战争的总的战略方针,是毛泽东军事思想的主要内容。

A、积极防御B、备战备荒C、避免战争D、加强政治建设11、党的十八大强调中国奉行( C ),加强国防建设的目的是维护国家主权、安全、领土完整,保障国家和平发展。

A、与敌抗衡国防政策B、和平第一国防政策C、防御性的国防政策D、自卫性国防政策12、解决包括国防建设在内的当代中国所有问题的前提和基础是( A )A、坚持以经济建设为中心,集中力量把经济搞上去B、坚持党的领导,坚持社会主义建设C、坚定社会主义理想与信念D、坚持社会主义核心价值观13、建设中国特色社会主义事业的人数最多的基本依靠力量是(B )A、工人阶级B、农民阶级C、知识分子D、中产阶级14、( C )已经成为我国改革开放和社会主义现代化建设事业发展的关键因素。

第十四章急性腹膜炎病人的护理练习题(有答案)

第十四章急性化脓性腹膜炎与腹部损伤病人的护理一、选择题1、急性化脓性腹膜炎的常见病因,下列哪项是错误的【D】A、溃疡病急性穿孔B、急性阑尾炎穿孔C、肠管损伤破裂D、直肠下段损伤E、腹内脏器炎症的扩散2、急性腹膜炎腹痛的特点【D】A、疼痛阵发加剧B、病人转侧不安C、指不出确切部位D、原发病灶处最著E、解大便后减轻3、继发性腹膜炎的细菌感染多是【E】A、链球菌B、葡萄球菌C、绿脓杆菌D、变形杆菌E、大肠杆菌4、患者阑尾炎穿孔腹膜炎24小时,下列处置最关键是【E】A、补液,纠正水,电解质紊乱B、输血C、应用大量有效抗生素D、禁食、水,胃肠减压E、急诊手术5、急性弥漫性腹膜炎最常见的原因是【B】A、急性胆囊炎穿孔B、胃十二指肠溃疡穿孔C、总胆管结石D、肝破裂E、肠扭转6、原发性腹膜炎多发生于【C】A、老年人B、孕妇C、十岁以下体弱儿童D、从事重体力E、慢性咳嗽病人7、难以诊断之急性腹膜炎,最有价值的辅助检查是【E】A、白细胞计数分类B、血尿淀粉酶C、直肠指诊D、腹部X线平片E、腹腔穿刺8、诊断化脓性腹膜炎的主要依据是【C】A、病人是否有脉快和休克B、白细胞计数增高C、腹部有无压痛、反跳痛、肌紧张D、腹腔穿刺结果E、腹部X线摄片结果9、有关急性腹膜炎,下列哪项是错误的【E】A、有持续性腹痛B、恶心,呕吐C、腹肌紧张,压痛及反跳痛D、有移动性浊音E、肠鸣音亢进10、急性腹膜炎早期呕吐原因是【E】A、胃肠痉挛B、肠梗阻C、肠麻痹D、神经性呕吐E、反射性呕吐11、急性弥漫性腹膜炎的体征,下列哪项是错误的EA.板状腹B.反跳痛C.腹部压痛D.移动浊音E.肠音活跃12、急性腹膜炎最主要的症状应为CA.呕吐B.发热C.腹痛D.腹胀E.便秘13、继发性腹膜炎最常见的原因是AA.腹腔内脏穿孔破裂B.吻合口哆开腹膜炎C.细菌移位后腹膜炎D.闭合伤后腹膜炎E.壁透性腹膜炎14—16选项:A.草绿色透明腹水B.黄色、混浊、含胆汁、无臭气之腹水C.血性、臭气重之腹水D.血性透明腹水E.混浊、臭气重之腹水14、胃、十二指肠急性穿孔时腹腔穿刺液为B15、结核性腹膜炎腹腔穿刺液为A16、绞窄性肠梗阻时腹腔穿刺液为C17、继发性腹膜炎的病原菌,其中毒症状严重的原因为DA.金黄色葡萄球菌感染B.溶血性链球菌感染C.大肠杆菌感染D.各种细菌混合感染E.肺炎链球菌感染18、原发性腹膜炎的病因是DA.腹腔内脏器穿孔B.腹腔内脏器破裂C.腹腔内脏器炎症扩散D.病原菌经血行感染E.腹腔手术时细菌污染19、原发性腹膜炎与继发性腹膜炎的主要区别是AA.腹腔内有无原发病灶B.病原菌的种类C.腹肌紧张的程度D.腹痛的性质不同E.有无内脏损伤20、腹腔内实质性脏器损伤最可能的依据是EA.腹式呼吸消失B.腹肌紧张C.肝浊音界缩小D.移动性浊音阳性E.腹腔抽到不凝固血液21、区别空腔脏器破裂与实质脏器破裂的最重要的依据是EA.外伤史B.腹痛程度C.腹膜刺激征轻重D.有无移动性浊音E.腹腔穿刺液性状22、赵女士,急性腹膜炎,确诊的可靠体征是BA.腹胀B.腹膜刺激征C.肝浊音界消失D.肠呜音减弱E.移动性浊音23、腹部闭合性损伤中,较多见的实质性脏器损伤为哪一项【C】A、肝B、肾C、脾D、肾上腺E、胰24、腹部最易损伤的空腔脏器是【C】A、结肠B、胃C、小肠D、直肠E、十二指肠25、腹部损伤行腹腔穿刺抽得不凝血液,应考虑诊断为【B】A、空腔脏器破裂B、实质脏器破裂C、后腹膜血肿D、误穿入腹腔血管E、前腹壁血肿二、填空题1、继发性腹膜炎是急性化脓性腹膜炎中最常见的一种,占98%。

第十四章一次函数--教材课后练习题①

⊙ 学校: 班级: 姓名: 考号 ⊙⊙……………⊙……………装…⊙……………订……⊙………线………⊙……………装…⊙……………订……⊙………线…………⊙……………⊙第十四章一次函数--教材课后练习题①八 年 级 数 学 组1、一辆汽车的油箱中现有汽油50L .如果不再加油,那么油箱中的余油量 y (单位:L )随行驶里程x (单位:km )的增加而减少,平均每千米的耗油量为0.1L .(1)写出y 与x 之间的函数关系式; (2)写出自变量x 的取值范围;(3)汽车行驶200km 时,油箱中还有多少油? (4)汽车最多可行驶多少千米?2、如图:小明从家去菜地浇水,浇水后又去玉米地除草,然后回家. ①玉米地离小明家多少千米?②小明在菜地浇水的时间为多少分钟 ③小明在玉米地除草的时间为多少分钟。

3、正方形的边长为3,若边长增加X 则面积增加Y ,求Y 随X 变化的函数解析式?4、张强从家跑步去体育场,在那里锻炼了一阵后又走到文具店去买笔,然后散步走回家.其中x 表示时间,y 表示张强离家的距离.根据图象回答下列问题: (1)体育场离张强家多少千米;(2)体育场离文具店几千米?张强在文具店停留了多少分钟; (3)请计算:张强从文具店回家的平均速度是多少千米/分钟 ?5、某种活期储蓄的月利率是0.06%,存入100元本金,求本息y 元随所存月数x 变化的函数解析式,并计算存期为四个月时的本息和(本息和=本金+利息)6、甲车速度为20米每秒,乙车速度为25米每秒,现甲车在乙车前面500米,设x 秒后两车之间的距离为y 米,求y 随x 变化的函数解析式7、已知一次函数的图像过点(3,5)与(—4, —9),求这个一次函数的解析式(2)写出购买种子数量x与付款金额y之间的解析式,并画出图象.(3)若王大爷付款72元,请问他买了多少千克玉米?9、一个弹簧不挂重物时长12厘米,挂上重物后伸长的长度与所挂重物的质量成正比。

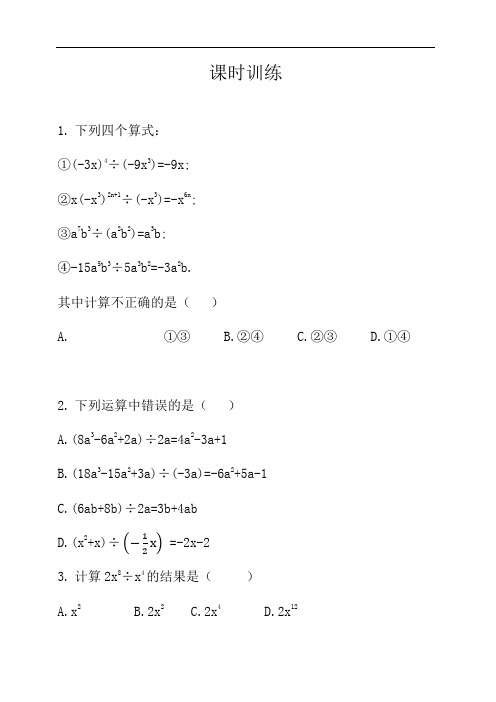

人教版八年级数学上册课堂练习 第十四章 14.1 整式的乘法 第八课时

课时训练1.下列四个算式:①(-3x)4÷(-9x3)=-9x;②x(-x3)2n+1÷(-x3)=-x6n;③a7b3÷(a2b2)=a3b;④-15a5b3÷5a3b2=-3a2b.其中计算不正确的是()A.①③B.②④C.②③D.①④2.下列运算中错误的是()A.(8a3-6a2+2a)÷2a=4a2-3a+1B.(18a3-15a2+3a)÷(-3a)=-6a2+5a-1C.(6ab+8b)÷2a=3b+4abx) =-2x-2D.(x2+x)÷ (−123.计算2x8÷x4的结果是()A.x2B.2x2C.2x4D.2x124.下面计算正确的是()A.x6÷x2=x3B.(-x)6÷(-x)4=-x2C.36a3b4÷9a2b=4ab3D.(2x3-3x2-x)÷(-x)=-2x2+3x5.下列计算中,错误的是()A.(6x3+3x2)÷ (12x) =12x2+6x B.(6m3-4m2+2m)÷2m=3m2-2mC.(9x5-3x3)÷ (−13x3) =-27x2+9 D. (14y2+y)÷ (−12y)=-12y-26.已知长方形的面积为18x3y4+9xy2-27x2y2,长为9xy,则宽为()A.2x2y3+y+3xyB.2x2y2-2y+3xyC.2x2y3+2y-3xyD.2x2y3+y-3xy7.任意给定一个非零数m,按下列程序计算,最后输出的结果是()m→平方→-m→÷m→+2→结果A.mB.m2C.m+1D.m-18.计算:(1)14x3y6÷7xy2=;(2)-24x3y3÷(-8x2y2)=;abc2) =;(3)-a2b4c3÷ (−23(4)(-3x3y2)3÷(-9xy)=.9.计算:(1)4a3b5÷2ab2=;(2)(6x4-8x3)÷(-2x2)=;(3)(-4a3+8a2b-3a3b3)÷(-2a2)=;(4)(3a n+1+6a n+2-9a n)÷3a n-1=.10.被除式为12xy-10xy2,商式为-4xy,余式为2xy2,则除式为.11.已知A,B为多项式,B=2x+1,计算A+B时,某同学把A+B看成A÷B,结果得4x2-2x+1,请你求出A+B的正确答案为.12.计算:(1)(5ab+b2)÷b=;(2)(4a2b2-3ab2)÷5ab=;(3)(21x3y3-15x2y2)÷(-3xy)=;(4)(-4a3+8a2b-3a3b3)÷(-2a2)=;(5) (−45a3b4−0.6a2b3−25ab2)÷35ab=.13.计算:(1)6x3y4z2÷4xz2;(2)12x12y8z6÷4x3y2z·3x9y6z5;(3)(2a2b)3·5ab2÷(-10a2b4);m3n2)] .(4)7m3n2÷ [(−7m5n3)÷ (−1314.计算:(1)(-a·a2)(-b)2+(-2a3b2)2÷(-2a3b2);(2)(-2x3y2-3x2y2+2xy)÷2xy.15.已知多项式2x3-4x2-1除以一个多项式A,得商式为2x,余式为x-1,求这个多项式.16.计算:(1)24x2y÷(-6xy);(2)(-5r2)2÷5r4;(3)7m(4m2p)2÷7m2;(4)6a6b4÷3a3b4+a2·(-5a).17.计算:(1)(12a3-6a2+3a)÷3a;(2)(a2b-2ab2-b3)÷b-(a-b)·(a+b);(3)[x(x2y2-xy)-y(x2-x3y)]÷3x2y;(4) [− (12a2x)2+ (13ax2·ax)]÷ (−16ax) .18.先化简,再求值.(1)[(5x+2y)(3x+2y)+4y(x-y)]÷2x,其中x=8,y=4;(2)[b(a-3b)-a(3a+2b)+(3a-b)(2a-3b)]÷(-3a),其中a,b满足2a-8b-5=0.19.小明在做练习册上的一道多项式除以单项式的习题时,一不小心一滴墨水污染了这道习题,只看见了被除式最后一项是“-3x2y”和中间的“÷”号,污染后的习题形式如下:[●-3x2y]÷●,小明翻看了书后的答案是“4x2y2-3xy+6x”,你能够复原这个算式吗?20.由(x-3)(x+4)=x2+x-12,可以得到(x2+x-12)÷(x-3)=x+4.这说明x2+x-12能被x-3整除,同时也说明多项式x2+x-12有一个因式x-3.另外,当x=3时,多项式x2+x-12的值为0.根据上面材料回答下列问题:(1)如果一个关于字母x的多项式A,当x=a时,A的值为0,那么A与代数式x-a之间有何关系?(2)利用上面的结果求解:已知x+3能整除x2+kx-18,求k的值.答案:1.C2.C3.C4.C5.B6.D7.C8.(1)2x2y4(2)3xy(3)32ab 3c (4)3x 8y 59. (1)2a 2b 3(2)-3x 2+4x (3)2a-4b+32ab 3 (4)a 2+2a 3-3a 10. -3+3y11.8x 3+2x+2 12. (1) 5a+b(2)45ab-35b(3)-7x 2y 2+5xy (4)2a-4b+32ab 3 (5) -43a 2b 3-ab 2-23b 13. (1)解:原式=32x 2y 4; (2)解:原式=9x 18y 12z 10;(3)解:原式=8a 6b 3·5ab 2÷(-10a 2b 4)=40a 7b 5÷(-10a 2b 4)=-4a 5b ;(4)解:原式=7m3n2÷21m2n=1mn.314. 解:(1)原式=-a3·b2+4a6b4÷(-2a3b2) =-a3b2-2a3b2=-3a3b2;(2)原式=-x2y-3xy+1.215. 解:A=[(2x3-4x2-1)-(x-1)]÷2x=(2x3-4x2-x)÷2x=x2-2x-1.216.(1)解:原式=[24÷(-6)]·x2-1·y1-1=-4x;(2)解:原式=25r4÷5r4=(25÷5)·r4-4=5;(3)解:原式=7m·16m4p2÷7m2=16m3p2;(4)解:原式=2a3-5a3=-3a3.17. (1)解:原式=4a 2-2a+1;(2)解:原式=a 2-2ab-b 2-(a 2-b 2)=a 2-2ab-b 2-a 2+b 2=-2ab ;(3)解:原式=(x 3y 2-x 2y-x 2y+x 3y 2)÷3x 2y=23xy-23; (4)解:原式= (−14a 4x 2+13a 2x 3) ÷ (−16ax) =32a 3x-2ax 2. 18. (1)解:原式=(15x 2+10xy+6xy+4y 2+4xy-4y 2)÷2x =(15x 2+20xy)÷2x=152x+10y. 当x=8,y=4时,原式=152×8+10×4=100. (2)解:原式=(ab-3b 2-3a 2-2ab+6a 2-9ab-2ab+3b 2)÷(-3a) =(3a 2-12ab)÷(-3a)=-a+4b.由题意,得2a-8b=5,a-4b=52,-a+4b=-52.∴原式=-52.19.解:除式为(-3x2y)÷6x=-12xy,被除式为(4x2y2-3xy+6x)· (−12xy)=-2x3y3+32x2y2-3x2y,∴算式为 (−2x3y3+32x2y2−3x2y)÷ (−12xy) .20.解:(1)多项式A能被x-a整除,同时也说明多项式A有一个因式x-a.(2)由上面的材料可知,如果x+3能整除x2+kx-18,就是说当x+3=0时,多项式x2+kx-18的值也为0,因此当x=-3时,x2+kx-18=0,所以(-3)2-3k-18=0,所以k=-3.。

第十四章练习题

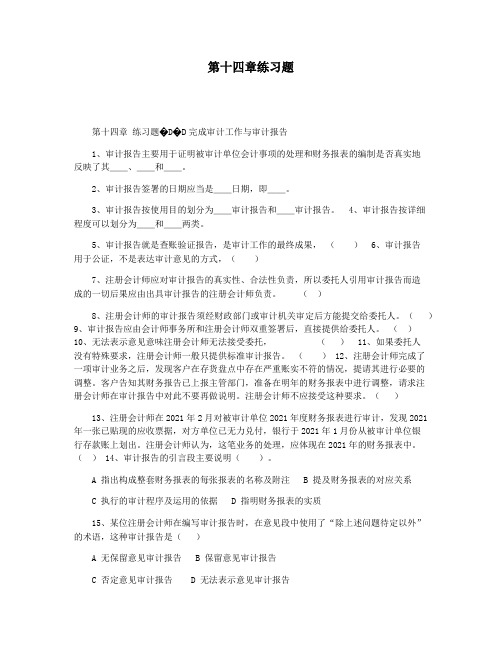

第十四章练习题第十四章练习题�D�D完成审计工作与审计报告1、审计报告主要用于证明被审计单位会计事项的处理和财务报表的编制是否真实地反映了其__、__和__。

2、审计报告签署的日期应当是__日期,即__。

3、审计报告按使用目的划分为__审计报告和__审计报告。

4、审计报告按详细程度可以划分为__和__两类。

5、审计报告就是查账验证报告,是审计工作的最终成果,()6、审计报告用于公证,不是表达审计意见的方式,()7、注册会计师应对审计报告的真实性、合法性负责,所以委托人引用审计报告而造成的一切后果应由出具审计报告的注册会计师负责。

()8、注册会计师的审计报告须经财政部门或审计机关审定后方能提交给委托人。

()9、审计报告应由会计师事务所和注册会计师双重签署后,直接提供给委托人。

()10、无法表示意见意味注册会计师无法接受委托,() 11、如果委托人没有特殊要求,注册会计师一般只提供标准审计报告。

() 12、注册会计师完成了一项审计业务之后,发现客户在存货盘点中存在严重账实不符的情况,提请其进行必要的调整。

客户告知其财务报告已上报主管部门,准备在明年的财务报表中进行调整,请求注册会计师在审计报告中对此不要再做说明。

注册会计师不应接受这种要求。

()13、注册会计师在2021年2月对被审计单位2021年度财务报表进行审计,发现2021年一张已贴现的应收票据,对方单位已无力兑付,银行于2021年1月份从被审计单位银行存款账上划出。

注册会计师认为,这笔业务的处理,应体现在2021年的财务报表中。

() 14、审计报告的引言段主要说明()。

A 指出构成整套财务报表的每张报表的名称及附注B 提及财务报表的对应关系C 执行的审计程序及运用的依据D 指明财务报表的实质15、某位注册会计师在编写审计报告时,在意见段中使用了“除上述问题待定以外”的术语,这种审计报告是()A 无保留意见审计报告B 保留意见审计报告C 否定意见审计报告D 无法表示意见审计报告16、某位注册会计师在编写审计报告时,在意见段中使用了“由于上述重要会计事项不能确定”的术语,这种审计报告是()。

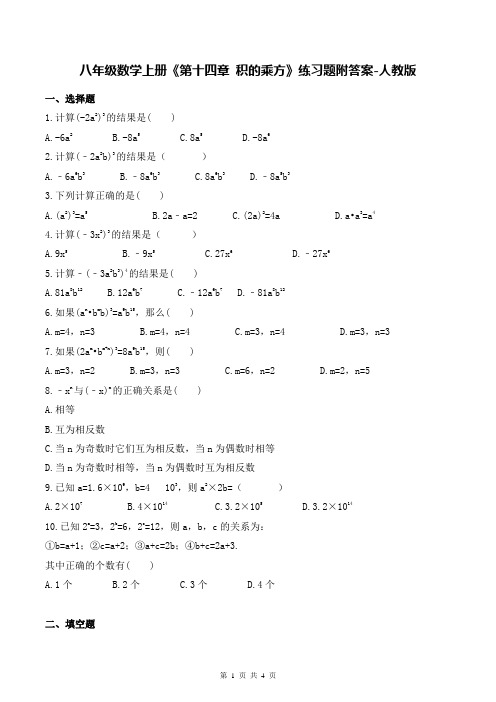

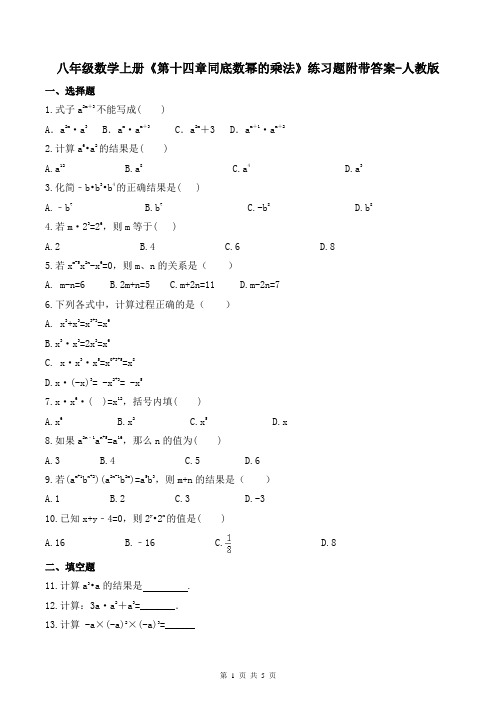

八年级数学上册《第十四章 积的乘方》练习题附答案-人教版

八年级数学上册《第十四章积的乘方》练习题附答案-人教版一、选择题1.计算(-2a2)3的结果是( )A.-6a2B.-8a5C.8a5D.-8a62.计算(﹣2a2b)3的结果是()A.﹣6a6b3B.﹣8a6b3C.8a6b3D.﹣8a5b33.下列计算正确的是( )A.(a2)3=a5B.2a﹣a=2C.(2a)2=4aD.a•a3=a44.计算(﹣3x2)3的结果是()A.9x5B.﹣9x5C.27x6D.﹣27x65.计算﹣(﹣3a2b3)4的结果是( )A.81a8b12B.12a6b7C.﹣12a6b7D.﹣81a8b126.如果(a n•b m b)3=a9b15,那么( )A.m=4,n=3B.m=4,n=4C.m=3,n=4D.m=3,n=37.如果(2a m•b m+n)3=8a9b15,则( )A.m=3,n=2B.m=3,n=3C.m=6,n=2D.m=2,n=58.﹣x n与(﹣x)n的正确关系是( )A.相等B.互为相反数C.当n为奇数时它们互为相反数,当n为偶数时相等D.当n为奇数时相等,当n为偶数时互为相反数9.已知a=1.6×109,b=4103,则a2×2b=()A.2×107B.4×1014C.3.2×105D.3.2×101410.已知2a=3,2b=6,2c=12,则a,b,c的关系为:①b=a+1;②c=a+2;③a+c=2b;④b+c=2a+3.其中正确的个数有( )A.1个B.2个C.3个D.4个二、填空题11.若x n=2,y n=3,则(xy)n=________.12.计算:(﹣2xy2)3= .13.填空:45×(0.25)5= (________×________)5= ________5= ________.14.计算:(-3a2)3= .15.已知2m+5n-3=0,则4m×32n的值为.16.已知2a=5,2b=10,2c=50,那么a、b、c之间满足的等量关系是 .三、解答题17.计算:[(-3a2b3)3]2;18.计算:(2x2)3-x2·x419.计算:(-2xy2)6+(-3x2y4)3;20.已知273×94=3x,求x的值.21.已知n是正整数,且x3n= 2,求(3x3n)3+(-2x2n)3的值.22.已知x3m=2,y2m=3,求(x2m)3+(y m)6-(x2y)3m·y m的值.23.(1)若2x+5y-3=0,求4x•32y的值.(2)若26=a2=4b,求a+b值.参考答案1.D2.B3.D4.D5.D6.A7.A8.D9.D10.D11.答案为:6.12.答案为:﹣8x3y6.13.答案为:4 0.25 1 114.答案为:-27a6.15.答案为:8.16.答案为:a+b=c.17.解:原式=729a12b18.18.解:原式=7x6;19.解:原式=37x6y12;20.解:因为273×94=(33)3×(32)4=39×38=39+8=317即3x=317,所以x=17.21.解:(3x3n)3+(-2x2n)3= 33×(x3n)3+(-2)3×(x3n)2= 27×8+(-8)×4= 184.22.解:原式=-5.23.解:(1)8;(2)11或-5;。

初二上数学十四章练习题

初二上数学十四章练习题在初二上学期的数学教学中,学生们学习了多个数学章节,其中第十四章是重要的章节之一。

为了帮助同学们巩固所学知识,以下是一些与第十四章相关的练习题。

通过解答这些题目,同学们可以巩固对相应知识点的理解,并提高解题能力。

1. 将下列各数化成标准形式:a) -0.0000432b) 0.0000005122. 计算下列各式的值:a) (3 - 4) × (7 + 2)b) 5 + 8 × (2 - 3)c) 12 ÷ (4 + 1)3. 解方程:a) 5x - 2 = 3x + 10b) 8(2 - x) = 5(3 + x)4. 若一边长为x的正方形的面积是20平方单位,则x等于多少?5. 判断下列各式是否成立,若成立请写“成立”,否则请写“不成立”:a) 5 + 3 = 9b) -6 × 4 = -24c) 4 × (2 + 3) = 106. 已知直角三角形的直角边分别为3cm和4cm,求其斜边长度。

7. 如果一个角的补角是85度,那么这个角是多少度?8. 王明和李华同走了一段路程,王明平均每小时走5千米,比李华快2千米。

如果他们同时出发,那么王明比李华早到目的地1小时。

请问这段路程有多长?9. 某数6除以另外一个数m,商是8余7。

求这个数m。

10. 某家商店原价500元的商品打7折出售,打折后的价格是多少?11. 解不等式:a) 3(x - 2) > 7b) 5 - 2x ≥ 4x + 312. 若一根木棍长8米,按m米长度卖出,木棍刚好被剪成6段,求m的值。

13. 若一个数加上30的结果是42,求该数。

14. 解方程组:a) 2x + 3y = 8x - 2y = 715. 将下列各分数化为小数:a) 2/5b) 3/816. 若一个矩形的长是宽的三倍,且周长为48米,求其长和宽各是多少?17. 解等式:a) 7x + 3 = 5x - 1b) 2y + 5 = 3y - 218. 若a+1=a/3,求a的值。

第十四章胶体分散系统和大分子溶液练习题及答案

第十四章胶体分散系统和大分子溶液练习题一、选择题1.溶胶与大分子溶液的区别主要在于:(A) 粒子大小不同;(B) 渗透压不同;(C) 丁铎尔效应的强弱不同;(D) 相状态和热力学稳定性不同。

2.以下说法中正确的是:(A) 溶胶在热力学和动力学上都是稳定系统;(B) 溶胶与真溶液一样是均相系统;(C) 能产生丁达尔效应的分散系统是溶胶;(D) 通过超显微镜能看到胶体粒子的形状和大小。

3.由过量KBr与AgNO3溶液混合可制得溶胶,以下说法正确的是:(A) 电位离子是Ag+(B) 反号离子是NO3-(C) 胶粒带正电(D) 它是负溶胶。

4.将含0.012 dm3 NaCl 和0.02 mol·dm-3 KCl 的溶液和100 dm3 0.005 mol·dm-3的AgNO3液混合制备的溶胶,其胶粒在外电场的作用下电泳的方向是:(A) 向正极移动(B) 向负极移动(C) 不作定向运动(D) 静止不动5.将橡胶电镀到金属制品上,应用的原理是:(A) 电解(B) 电泳(C) 电渗(D) 沉降电势6.在大分子溶液中加入大量的电解质, 使其发生聚沉的现象称为盐析, 产生盐析的主要原因是:(A) 电解质离子强烈的水化作用使大分子去水化(B) 降低了动电电位(C) 由于电解质的加入,使大分子溶液处于等电点(D) 动电电位的降低和去水化作用的综合效应7.在H3AsO3的稀溶液中,通入过量的H2S 气体,生成As2S3溶胶。

用下列物质聚沉,其聚沉值大小顺序是:(A) Al(NO3)3>MgSO4>K3Fe(CN)6(B) K3Fe(CN)6>MgSO4>Al(NO3)3(C) MgSO4>Al(NO3)3>K3Fe(CN)6(D) MgSO4>K3Fe(CN)6>Al(NO3)38.对亚铁氰化铜负溶胶而言, 电解质KCl, CaCl2, K2SO4, CaSO4的聚沉能力顺序为:(A) KCl > CaCl2 > K2SO4 > CaSO4(B) CaSO4 > CaCl2 > K2SO4 > KCl(C) CaCl2 > CaSO4 > KCl > K2SO4(D) K2SO4 > CaSO4 > CaCl2 > KCl9.将大分子电解质NaR 的水溶液用半透膜和水隔开,达到Donnan 平衡时,膜外水的pH值:(A) 大于7 (B) 小于7 (C) 等于7 (D) 不能确定10.只有典型的憎液溶胶才能全面地表现出胶体的三个基本特性, 但有时把大分子溶液也作为胶体化学研究的内容, 一般地说是因为它们:(A) 具有胶体所特有的分散性,不均匀(多相)性和聚结不稳定性(B) 具有胶体所特有的分散性(C) 具有胶体的不均匀(多相)性(D) 具有胶体的聚结不稳定性11.溶胶的电学性质由于胶粒表面带电而产生,下列不属于电学性质的是:(A) 布朗运动(B) 电泳(C) 电渗(D) 沉降电势12.溶胶的聚沉速度与电动电位有关, 即:(A) 电动电位愈大,聚沉愈快(B) 电动电位愈小,聚沉愈快(C) 电动电位为零,聚沉愈快(D) 电动电位愈负,聚沉愈快13.Donnan平衡产生的本质原因是:(A) 溶液浓度大,大离子迁移速度慢;(B) 小离子浓度大,影响大离子通过半透膜;(C) 大离子不能透过半透膜且因静电作用使小离子在膜两边浓度不同;(D) 大离子浓度大,妨碍小离子通过半透膜。

宏观经济学第14章练习题及答案

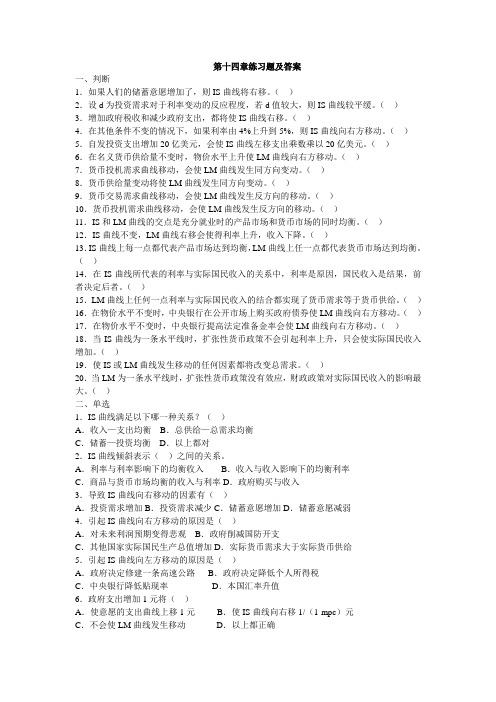

第十四章练习题及答案一、判断1.如果人们的储蓄意愿增加了,则IS曲线将右移。

()2.设d为投资需求对于利率变动的反应程度,若d值较大,则IS曲线较平缓。

()3.增加政府税收和减少政府支出,都将使IS曲线右移。

()4.在其他条件不变的情况下,如果利率由4%上升到5%,则IS曲线向右方移动。

()5.自发投资支出增加20亿美元,会使IS曲线左移支出乘数乘以20亿美元。

()6.在名义货币供给量不变时,物价水平上升使LM曲线向右方移动。

()7.货币投机需求曲线移动,会使LM曲线发生同方向变动。

()8.货币供给量变动将使LM曲线发生同方向变动。

()9.货币交易需求曲线移动,会使LM曲线发生反方向的移动。

()10.货币投机需求曲线移动,会使LM曲线发生反方向的移动。

()11.IS和LM曲线的交点是充分就业时的产品市场和货币市场的同时均衡。

()12.IS曲线不变,LM曲线右移会使得利率上升,收入下降。

()13.IS曲线上每一点都代表产品市场达到均衡,LM曲线上任一点都代表货币市场达到均衡。

()14.在IS曲线所代表的利率与实际国民收入的关系中,利率是原因,国民收入是结果,前者决定后者。

()15.LM曲线上任何一点利率与实际国民收入的结合都实现了货币需求等于货币供给。

()16.在物价水平不变时,中央银行在公开市场上购买政府债券使LM曲线向右方移动。

()17.在物价水平不变时,中央银行提高法定准备金率会使LM曲线向右方移动。

()18.当IS曲线为一条水平线时,扩张性货币政策不会引起利率上升,只会使实际国民收入增加。

()19.使IS或LM曲线发生移动的任何因素都将改变总需求。

()20.当LM为一条水平线时,扩张性货币政策没有效应,财政政策对实际国民收入的影响最大。

()二、单选1.IS曲线满足以下哪一种关系?()A.收入—支出均衡B.总供给—总需求均衡C.储蓄—投资均衡D.以上都对2.IS曲线倾斜表示()之间的关系。

A.利率与利率影响下的均衡收入B.收入与收入影响下的均衡利率C.商品与货币市场均衡的收入与利率D.政府购买与收入3.导致IS曲线向右移动的因素有()A.投资需求增加B.投资需求减少C.储蓄意愿增加D.储蓄意愿减弱4.引起IS曲线向右方移动的原因是()A.对未来利润预期变得悲观B.政府削减国防开支C.其他国家实际国民生产总值增加D.实际货币需求大于实际货币供给5.引起IS曲线向左方移动的原因是()A.政府决定修建一条高速公路B.政府决定降低个人所得税C.中央银行降低贴现率D.本国汇率升值6.政府支出增加1元将()A.使意愿的支出曲线上移1元B.使IS曲线向右移1/(1-mpc)元C.不会使LM曲线发生移动D.以上都正确7.在IS曲线不变的情况下,货币量减少会引起()A.y增加,r下降B.y增加,r上升C.y减少,r下降D.y减少,r上升8.在IS曲线上存在储蓄和投资均衡的收入和利率的组合点有()A.无数个B.一个C.一个或无数个D.一个或无数个都不可能9.在LM曲线不变的情况下,自发总需求增加会引起()A.收入增加利率上升B.收入增加利率不变C.收入增加利率下降D.收入不变利率上升10.货币供给量增加将()A.使IS曲线左移,并使利率和收入水平同时降低B.使IS曲线下移(右移),同时提高利率和收入水平C.使IS曲线右移,提高收入水平但降低利率D.使LM曲线右移,提高收入水平但降低利率11.导致LM曲线向右移动的因素有()A.投机货币需求减少B.交易货币需求减少C.货币供给量减少D.货币供给量增加12.假定其他条件不变,货币供给量增加将导致()A.y减少,r下降B.y增加,r下降C.y增加,r上升D.y减少,r上升13.若投资对利率的敏感程度越大,则()A.投资需求曲线斜率的值越大B.投资需求曲线越平缓C.IS越陡峭D.IS曲线越平缓14.若货币需求对利率的敏感度越小,则()A.货币需求曲线越平缓B.货币需求曲线越陡峭C.LM曲线越陡峭D.LM曲线越平缓15.如果净税收增加20亿元,会使IS曲线()A.右移税收乘数乘以20亿元B.左移税收乘数乘以20亿元C.右移支出乘数乘以20亿元D.左移支出乘数乘以20亿元16.LM曲线表示满足以下哪一种关系?()A.收入—支出均衡B.总供给—总需求均衡C.储蓄—投资均衡D.货币供求均衡17.当货币市场均衡时,利率与实际国民收入之间的关系是()A.互为因果,相互影响B.利率为原因,实际国民收入为结果,前者决定后者C.实际国民收入为原因,利率为结果,前者决定后者D.没有任何关系,各自独立决定18.货币市场和产品市场同时均衡出现于()A.所有收入水平上B.一种收入水平和利率组合的点上C.各种收入水平和一定的利率水平上D.一种收入水平和各种利率水平上19.净税收和政府购买性支出的等量增加,使得IS曲线()A.不变B.向右平移KB×ΔGC.向左平移KB×ΔG (KB指平衡预算乘数)D.向右平移ΔG单位20.设货币需求函数为L=ky-hr,货币供给增加10亿元,其他条件不变,则使LM曲线()A.右移10亿元B.右移k乘以10亿元C.右移10亿元除以k D.左移10亿元除以k21.设货币供给和价格水平不变,货币需求函数为L=ky-hr,则收入增加时,()A.货币需求增加,利率下降B.货币需求增加,利率上升C.货币需求减少,利率上升D.货币需求减少,利率下降22.如果中央银行在增税的同时减少货币供给,则()A.利率必然上升B.利率必然下降C.均衡的收入水平必然上升D.均衡的收入水平必然下降第十四章练习题答案一、1.F 2.F 3.F 4.F 5.F 6.F 7.F 8.T 9.T 10.T 11.F 12.F 13.T 14.F 15.T 16.T 17.F 18.T 19.T 20.T 二、1.D 2.B 3.A 4.C 5.D 6.D 7.D 8.A 9.A 10.D11.D 12.B 13.D 14.C 15.B 16.D 17.A 18.B 19.B 20.C 21.B 22.D。

房屋建筑学第十四章习题

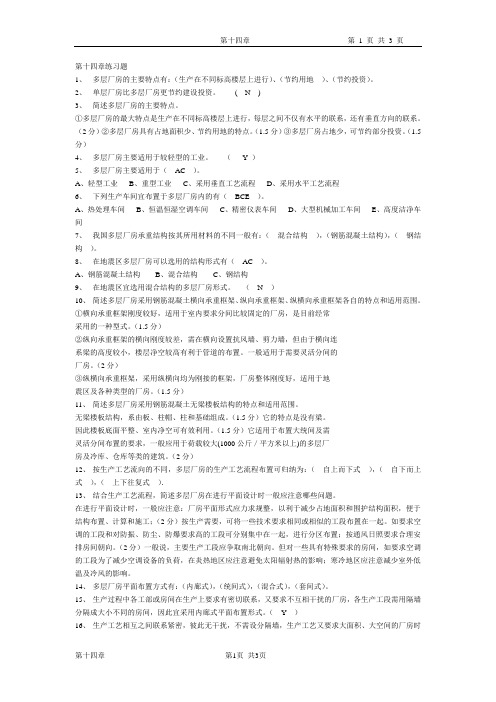

第十四章练习题1、多层厂房的主要特点有:(生产在不同标高楼层上进行)、(节约用地)、(节约投资)。

2、单层厂房比多层厂房更节约建设投资。

( N )3、简述多层厂房的主要特点。

①多层厂房的最大特点是生产在不同标高楼层上进行,每层之间不仅有水平的联系,还有垂直方向的联系。

(2分)②多层厂房具有占地面积少、节约用地的特点。

(1.5分)③多层厂房占地少,可节约部分投资。

(1.5分)4、多层厂房主要适用于较轻型的工业。

(Y )5、多层厂房主要适用于(AC )。

A、轻型工业B、重型工业C、采用垂直工艺流程D、采用水平工艺流程6、下列生产车间宜布置于多层厂房内的有(BCE)。

A、热处理车间B、恒温恒湿空调车间C、精密仪表车间D、大型机械加工车间E、高度洁净车间7、我国多层厂房承重结构按其所用材料的不同一般有:(混合结构),(钢筋混凝土结构),(钢结构)。

8、在地震区多层厂房可以选用的结构形式有(AC)。

A、钢筋混凝土结构B、混合结构C、钢结构9、在地震区宜选用混合结构的多层厂房形式。

(N )10、简述多层厂房采用钢筋混凝土横向承重框架、纵向承重框架、纵横向承重框架各自的特点和适用范围。

①横向承重框架刚度较好,适用于室内要求分间比较固定的厂房,是目前经常采用的一种型式。

(1.5分)②纵向承重框架的横向刚度较差,需在横向设置抗风墙、剪力墙,但由于横向连系梁的高度较小,楼层净空较高有利于管道的布置。

一般适用于需要灵活分间的厂房。

(2分)③纵横向承重框架,采用纵横向均为刚接的框架,厂房整体刚度好,适用于地震区及各种类型的厂房。

(1.5分)11、简述多层厂房采用钢筋混凝土无梁楼板结构的特点和适用范围。

无梁楼板结构,系由板、柱帽、柱和基础组成。

(1.5分)它的特点是没有梁。

因此楼板底面平整、室内净空可有效利用。

(1.5分)它适用于布置大统间及需灵活分间布置的要求,一般应用于荷载较大(1000公斤/平方米以上)的多层厂房及冷库、仓库等类的建筑。

人教版八年级上册第十四章14.1--14.3分节练习题 含答案

人教版八年级上册第十四章14.1--14.3分节练习题含答案14.1《整式的乘法》一.选择题1.计算(﹣2x2y3)•3xy2结果正确的是()A.﹣6x2y6B.﹣6x3y5C.﹣5x3y5D.﹣24x7y52.若()×(﹣xy)=3x2y2,则括号里应填的单项式是()A.﹣3y B.3xy C.﹣3xy D.3x2y3.下列计算正确的是()A.a2+a3=a5B.a2•a3=a6C.(a2)3=a6D.(ab)2=ab2 4.若(y+3)(y﹣2)=y2+my+n,则m、n的值分别为()A.m=5,n=6B.m=1,n=﹣6C.m=1,n=6D.m=5,n=﹣6 5.等式(x+4)0=1成立的条件是()A.x为有理数B.x≠0C.x≠4D.x≠﹣46.如(x+m)与(x+3)的乘积中不含x的一次项,则m的值为()A.﹣3B.3C.0D.17.计算的结果是()A.B.C.D.8.若2m=3,2n=4,则23m﹣2n等于()A.1B.C.D.9.若长方形的面积是4a2+8ab+2a,它的一边长为2a,则它的周长为()A.2a+4b+1B.2a+4b C.4a+4b+1D.8a+8b+210.如果一个三角形的底边长为2x2y+xy﹣y2,底边上的高为6xy,那么这个三角形的面积为()A.6x3y2+3x2y2﹣3xy3B.6x2y2+3xy﹣3xy2C.6x2y2+3x2y2﹣y2D.6x2y+3x2y211.已知a=8131,b=2741,c=961,则a,b,c的大小关系是()A.a>b>c B.a>c>b C.a<b<c D.b>c>a12.如图,甲、乙、丙、丁四位同学给出了四种表示该长方形面积的多项式:①(2a+b)(m+n);②2a(m+n)+b(m+n);③m(2a+b)+n(2a+b);④2am+2an+bm+bn,你认为其中正确的有()A.①②B.③④C.①②③D.①②③④二.填空题13.计算(﹣3a2b3)2•2ab=.14.计算6m5÷(﹣2m2)的结果为.15.计算:﹣2a2(a﹣3ab)=.16.计算:82014×(﹣0.125)2015=.17.代数式(x2+nx﹣5)(x2+3x﹣m)的展开式中不含x3,x2项,则mn=.18.已知:4x=3,3y=2,则:6x+y•23x﹣y÷3x的值是.19.对于实数a,b,c,d,规定一种运算=ad﹣bc,如=1×(﹣2)﹣0×2=﹣2,那么当=27时,则x=.三.解答题20.计算:(1)(x﹣y)2•(y﹣x)7•[﹣(x﹣y)3]2(2)(﹣3a3)2﹣3a5•a﹣(﹣2a2)321.计算:(4x3y﹣xy3+xy)÷(﹣xy).22.先化简,再求值:(x﹣2y)2﹣x(x+3y)﹣4y2,其中x=﹣4,y=.23.已知3m=2,3n=5.(1)求3m+n的值;(2)求9m﹣n(3)求3×9m×27n的值.24.若(x2+px﹣)(x2﹣3x+q)的积中不含x项与x3项(1)求p、q的值;(2)求代数式(﹣2p2q)2+(3pq)0+p2019q2020的值25.阅读材料:求1+2+22+23+24+…+22013的值.解:设S=1+2+22+23+24+…+22012+22013,将等式两边同时乘2得:2S=2+22+23+24+25+…+22013+22014将下式减去上式得2S﹣S=22014﹣1即S=22014﹣1即1+2+22+23+24+…+22013=22014﹣1请你仿照此法计算:(1)1+2+22+23+24+…+210(2)1+3+32+33+34+…+3n(其中n为正整数).参考答案一.选择题1.解:(﹣2x2y3)•3xy2=﹣6x2+1y3+2=﹣6x3y5.故选:B.2.解:∵()×(﹣xy)=3x2y2,∴括号里应填的单项式是:3x2y2÷(﹣xy)=﹣3xy.故选:C.3.解:(A)a2与a3不是同类项,故A错误;(B)原式=a5,故B错误;(D)原式=a2b2,故D错误;故选:C.4.解:∵(y+3)(y﹣2)=y2﹣2y+3y﹣6=y2+y﹣6,∵(y+3)(y﹣2)=y2+my+n,∴y2+my+n=y2+y﹣6,∴m=1,n=﹣6.故选:B.5.解:∵(x+4)0=1成立,∴x+4≠0,∴x≠﹣4.故选:D.6.解:∵(x+m)(x+3)=x2+3x+mx+3m=x2+(3+m)x+3m,又∵(x+m)与(x+3)的乘积中不含x的一次项,∴3+m=0,解得m=﹣3.故选:A.7.解:=••=•=1×=.故选:A.8.解:23m﹣2n=23m÷22n=(2m)3÷(2n)2=33÷42=.故选:D.9.解:另一边长是:(4a2+8ab+2a)÷2a=2a+4b+1,则周长是:2[(2a+4b+1)+2a]=8a+8b+2.故选:D.10.解:三角形的面积为:×(2x2y+xy﹣y2)×6xy=6x3y2+3x2y2﹣3xy3.故选:A.11.解:∵a=8131=(34)31=3124b=2741=(33)41=3123;c=961=(32)61=3122.则a>b>c.故选:A.12.解:①(2a+b)(m+n),本选项正确;②2a(m+n)+b(m+n),本选项正确;③m(2a+b)+n(2a+b),本选项正确;④2am+2an+bm+bn,本选项正确,则正确的有①②③④.故选:D.二.填空题13.解:原式=9a4b6•2ab=18a5b7,故答案为:18a5b7.14.解:6m5÷(﹣2m2)=﹣3m3,故答案为:﹣3m3.15.解:﹣2a2(a﹣3ab)=﹣2a3+6a3b.故答案为:﹣2a3+6a3b.16.解:原式=82014×(﹣0.125)2014×(﹣0.125)=(﹣8×0.125)2014×(﹣0.125)=﹣0.125,故答案为:﹣0.125.17.解:原式=x4+(n+3)x3+(3n﹣m﹣5)x2+(﹣mn﹣15)x+5m,根据展开式中不含x3,x2得:,解得:,∴mn=42,故答案为:42.18.解:∵4x=3,3y=2,∴6x+y•23x﹣y÷3x=6x•6y•23x÷2y÷3x=2x•3x•2y•3y(2x)3÷2y÷3x=2x•3y•(2x)3=(4x)2•3y=9×2=18,故答案为:18.19.解:∵=27,∴(x+1)(x﹣1)﹣(x+2)(x﹣3)=27,∴x2﹣1﹣(x2﹣x﹣6)=27,∴x2﹣1﹣x2+x+6=27,∴x=22;故答案为:22.三.解答题20.解:(1)(x﹣y)2•(y﹣x)7•[﹣(x﹣y)3]2=﹣(x﹣y)2•(x﹣y)7•(x﹣y)6=﹣(x﹣y)15;(2)(﹣3a3)2﹣3a5•a﹣(﹣2a2)3=9a6﹣3a6+8a6=14a6.21.解:原式=4x3y÷(﹣xy)﹣xy3)÷(﹣xy)+xy÷(﹣xy)=﹣8x2+2y2﹣3.22.解:原式=x2﹣4xy+4y2﹣x2﹣3xy﹣4y2=﹣7xy,当x=﹣4,y=时,原式=﹣7×(﹣4)×=14.23.解:(1)3m+n=2×5=10;(2)原式=(2)3×9m×27n=3×32m×33n=3×4×125=1500.24.解:(1)(x2+px﹣)(x2﹣3x+q)=x4﹣3x3+qx2+px3﹣3px2+pqx﹣x2+x﹣q=x4+(p﹣3)x3+(q﹣3p﹣)x2+(pq+1)x﹣q∵(x2+px﹣)(x2﹣3x+q)的积中不含x项与x3项∴∴(2)∵p=3,q=﹣(﹣2p2q)2+(3pq)0+p2019q2020的值=4p4q2+1+(pq)2019•q=4×81×+1﹣1×(﹣)=37+=37∴代数式(﹣2p2q)2+(3pq)0+p2019q2020的值为.25.解:(1)设S=1+2+22+23+24+ (210)将等式两边同时乘2得:2S=2+22+23+24+…+210+211,将下式减去上式得:2S﹣S=211﹣1,即S=211﹣1,则1+2+22+23+24+…+210=211﹣1;(2)设S=1+3+32+33+34+…+3n①,两边同时乘3得:3S=3+32+33+34+…+3n+3n+1②,②﹣①得:3S﹣S=3n+1﹣1,即S=(3n+1﹣1),则1+3+32+33+34+…+3n=(3n+1﹣1).14.2乘法公式14.2.1平方差公式基础题1.下列各式中能用平方差公式的是( )A.(x+y)(y+x) B.(x+y)(-y-x) C.(-x+y)(y-x) D.(x+y)(y-x) 2.将图1中阴影部分的小长方形变换到图2位置,你根据两个图形的面积关系得到的数学公式是.图1图23.如图1,把一张长方形纸片沿着线段AB剪开,把剪成的两张纸片拼成如图2所示的图形.图1图2(1)设图1中阴影部分面积为S1,图2中阴影部分面积为S2,请直接用含a,b的式子表示S1,S2;(2)请写出上述过程所揭示的乘法公式.4.运用平方差公式计算:(1)(m +2n)(m -2n); (2)(xy +5)(xy -5); (3)(-4a +3)(-4a -3); (4)(-x -y)(x -y).5.先化简,再求值:(x +1)(x -1)+x 2(1-x)+x 3,其中x =2.6.计算:(1)1 001×999; (2)1122-113×111.7.下列计算正确的是( )A .(a +3b)(a -3b)=a 2-3b 2B .(-a +3b)(a -3b)=-a 2-9b 2C .(-a -3b)(a -3b)=-a 2+9b 2D .(-a -3b)(a +3b)=a 2-9b 2中档题8.若(2x +3y)(mx -ny)=9y 2-4x 2,则( )A .m =2,n =3B .m =-2,n =-3C .m =2,n =-3D .m =-2,n =3 9.计算(x 2+14)(x +12)(x -12)的结果为( )A .x 4+116B .x 4-116C .x 4-12x 2+116D .x 4-18x 2+11610.三个连续奇数,若中间一个为n ,则它们的积是( )A .6n 3-6nB .4n 3-nC .n 3-4nD .n 3-n11.两个正方形的边长之和为5,边长之差为2,那么用较大的正方形的面积减去较小的正方形的面积,差是 . 12.计算:(1)(-3x 2+y 2)(y 2+3x 2); (2)(-3a -12b)(3a -12b); (3)(a +2b)(a -2b)-12b(a -8b).13.试说明:(14m 3+2n)(14m 3-2n)+(2n -4)(2n +4)的值和n 无关.14.解方程:(3x)2-(2x +1)(3x -2)=3(x +2)(x -2).15.某中学为了响应国家“发展体育运动,增强人民体质”的号召,决定建一个长方体游泳池,已知游泳池长为(4a 2+9b 2)m ,宽为(2a +3b)m ,深为(2a -3b)m ,请你计算一下这个游泳池的容积是多少? 综合题16.(1)计算并观察下列各式:(x -1)(x +1)= ; (x -1)(x 2+x +1)= ; (x -1)(x 3+x 2+x +1)= ;(2)从上面的算式及计算结果,你发现了什么?请根据你发现的规律直接写下面的空格. (x -1) =x 6-1; (3)利用你发现的规律计算:(x -1)(x 6+x 5+x 4+x 3+x 2+x +1)= ;(4)利用该规律计算:1+4+42+43+…+42 018= .14.2.2 完全平方公式基础题1.根据完全平方公式填空:(1)(x +1)2=(x)2+2×(x)×(1)+(1)2= ;(2)(-x +1)2=(-x)2+2×(-x)×(1)+(1)2= ;(3)(-2a -b)2=(-2a)2+2×(-2a)×(-b)+(-b)2= .2.下列计算正确的是( )A .(x +y)2=x 2+y 2B .(x -y)2=x 2-2xy -y 2C .(x +1)(x -1)=x 2-1D .(x -1)2=x 2-1 3.计算:(1)(y +3)2= ;(2)(-4x +12)2= . 4.如图1,从边长为a 的正方形中剪去一个边长为b 的小正方形,然后将剩余部分剪拼成一个长方形(如图2),则上述操作所能验证的公式是( )A .(a +b)(a -b)=a 2-b 2B .(a -b)2=a 2-2ab +b 2C .(a +b)2=a 2+2ab +b 2D .a 2+ab =a(a +b)5.如图,将完全相同的四个长方形纸片拼成一个正方形,则可得出一个等式为( )A .(a +b)2=a 2+2ab +b 2B .(a -b)2=a 2-2ab +b 2C .a 2-b 2=(a +b)(a -b)D .(a +b)2=(a -b)2+4ab 6.计算:(a +1)2-a 2= .7.已知a 2+b 2=7,ab =1,则(a +b)2= .8.直接运用完全平方公式计算:(1)(3+5p)2; (2)(7x -2)2; (3)(-2a -5)2; (4)(-2x +3y)2.9.运用完全平方公式计算:(1)2012; (2)99.82.10.已知(a+b)2=25,ab=6,则a-b等于( )A.1 B.-1 C.1或-1 D.以上都不正确中档题11.小萌在利用完全平方公式计算一个二项整式的平方时,得到正确结果4x2+20xy+,但不小心把最后一项染黑了,你认为这一项是( )A.5y2B.10y2 C.100y2D.25y2 12.若(y+a)2=y2-6y+b,则a,b的值分别为( )A.a=3,b=9 B.a=-3,b=-9 C.a=3,b=-9 D.a=-3,b=9 13.已知a+b=5,ab=2,则(a-b)2的值为( )A.21 B.25 C.17 D.1314.将边长为a cm的正方形的边长增加4 cm后,所得新正方形的面积比原正方形的面积大( )A.4a cm2B.(4a+16)cm2C.8a cm2D.(8a+16)cm215.若(x-1)2=2,则式子x2-2x+5的值为.16.计算:(1)(a+b)2-(a-b)2;(2)(a-b)2(a+b)2;(3)(a-1)(a+1)(a2-1);(4)(2x-y)2-4(x-y)(x+2y).17.下面是小颖化简整式的过程,仔细阅读后解答所提出的问题.解:x(x+2y)-(x+1)2+2x=x2+2xy-x2+2x+1+2x第一步=2xy+4x+1第二步(1)小颖的化简过程从第步开始出现错误;(2)对此整式进行化简.综合题18.【关注数学文化】杨辉三角,又称贾宪三角,是二项式系数在三角形中的一种几何排列,如图,观察下面的杨辉三角:11 112 1133 11464 11510105 1(a+b)1=a+b(a+b)2=a2+2ab+b2(a+b)3=a3+3a2b+3ab2+b3(a+b)4=a4+4a3b+6a2b2+4ab3+b4……按照前面的规律,则(a+b)5=.参考答案:14.2乘法公式14.2.1平方差公式1.D2.(a+b)(a-b)=a2-b2.3.解:(1)S1=(a+b)(a-b),S2=a2-b2.(2)(a+b)(a-b)=a2-b2.4.(1)(m+2n)(m-2n);解:原式=m2-4n2.(2)(xy+5)(xy-5);解:原式=x2y2-25.(3)(-4a+3)(-4a-3);解:原式=(-4a)2-32=16a2-9.(4)(-x-y)(x-y).解:原式=(-y)2-x2=y2-x2.5.解:原式=x2-1+x2-x3+x3=2x2-1.当x=2时,原式=2×22-1=7.6.(1)1 001×999;解:原式=(1 000+1)×(1 000-1)=1 0002-12=999 999.(2)1122-113×111.解:原式=1122-(112+1)×(112-1)=1122-(1122-1)=1122-1122+1=1.7.C8.B9.B10.C11.10.12.(1)(-3x 2+y 2)(y 2+3x 2);解:原式=(y 2)2-(3x 2)2=y 4-9x 4.(2)(-3a -12b)(3a -12b); 解:原式=(-12b)2-(3a)2=14b 2-9a 2. (3)(a +2b)(a -2b)-12b(a -8b). 解:原式=a 2-(2b)2-12ab +4b 2 =a 2-12ab. 13.解:原式=(14m 3)2-(2n)2+(2n)2-42 =116m 6-4n 2+4n 2-16 =116m 6-16. ∴原式的值和n 无关.14.解:9x 2-(6x 2-4x +3x -2)=3(x 2-4),9x 2-6x 2+4x -3x +2=3x 2-12,x =-14.15.解:(4a 2+9b 2)(2a +3b)(2a -3b)=(4a 2+9b 2)(4a 2-9b 2)=16a 4-81b 4.答:这个游泳池的容积是(16a 4-81b 4)m 3.16.(1)x 2-1;x 3-1;x 4-1;(2)(x 5+x 4+x 3+x 2+x +1);(3)x 7-1; (4)42019-13.14.2.2 完全平方公式1.(1)x 2+2x +1;(2)x 2-2x +1;(3)4a 2+4ab +b 2.2.C3.(1)y 2+6y +9;(2)16x 2-4x +14.4.A5.D 6.2a +1.7.9.8.(1)(3+5p)2;解:原式=9+30p +25p 2.(2)(7x -2)2;解:原式=49x 2-28x +4.(3)(-2a -5)2;解:原式=4a 2+20a +25.(4)(-2x +3y)2.解:原式=4x 2-12xy +9y 2.9.(1)2012;解:原式=(200+1)2=2002+2×200×1+12=40 000+400+1=40 401.(2)99.82.解:原式=(100-0.2)2=1002-2×100×0.2+0.22=10 000-40+0.04=9 960.04.10.C11.D12.D13.C14.D15.6.16.(1)(a+b)2-(a-b)2;解:原式=(a2+2ab+b2)-(a2-2ab+b2)=a2+2ab+b2-a2+2ab-b2=4ab.(2)(a-b)2(a+b)2;解:原式=[(a-b)(a+b)]2=(a2-b2)2=a4-2a2b2+b4.(3)(a-1)(a+1)(a2-1);解:原式=(a2-1)(a2-1)=(a2-1)2=a4-2a2+1.(4)(2x-y)2-4(x-y)(x+2y).解:原式=4x2-4xy+y2-4(x2+2xy-xy-2y2) =4x2-4xy+y2-4x2-4xy+8y2=9y2-8xy.17.(1)一;(2)解:x(x+2y)-(x+1)2+2x=x2+2xy-x2-2x-1+2x=2xy-1.18.a5+5a4b+10a3b2+10a2b3+5ab4+b5.14.3 因式分解一、选择题1. 2019·唐山滦州期末若关于x的二次三项式x2-ax+36是完全平方式则a的值是( ) A.-6 B.±6 C.12 D.±122. 若a+b=3,a-b=7,则b2-a2的值为( )A.-21 B.21 C.-10 D.103. 计算(-2)2020+(-2)2019所得的正确结果是( )A.22019B.-22019C.1 D.24. 计算552-152的结果是( )A.40 B.1600 C.2400 D.28005. 2019·武汉期中把多项式3x3-6x2+3x分解因式下列结果正确的是( )A.x(3x+1)(x-3)B.3x(x2-2x+1)C.x(3x2-6x+3)D.3x(x-1)26. 2019·绍兴柯桥区月考若多项式x2-3(m-2)x+36能用完全平方公式分解因式则m的值为( )A.6或-2 B.-2 C.6 D.-6或27. 当a,b互为相反数时,式子a2+ab-4的值为( )A.-4 B.-3 C.0 D.48. 2019·毕节织金期末某同学粗心大意,分解因式时,把等式x4-■=(x2+4)(x+2)(x-▲)中的两个数字弄污了,则式子中的■,▲对应的一组数字是( )A .8,1B .16,2C .24,3D .64,89. 2019·扬州邗江区月考 若2m +n =25,m -2n =2,则(m +3n )2-(3m -n )2的值为( ) A .200B .-200C .100D .-10010. 若a ,b ,c 是三角形三边的长,则代数式2222a b c ab +--的值( ).A.大于零B.小于零 C 大于或等于零 D .小于或等于零二、填空题11. 因式分解:m 2n -6mn +9n =________.12. 观察下列从左到右的变形:⑴()()3322623a b a b ab -=-; ⑵()ma mb c m a b c -+=-+⑶()22261266x xy y x y ++=+;⑷()()22323294a b a b a b +-=- 其中是因式分解的有 (填括号)13. 分解因式x (x -2)+(2-x )的结果是________.14. 分解因式(x +2)2-3(x +2)的结果是____________.15. 把多项式x 2+mx +6分解因式得(x -2)(x +n ),则m =________.16. 2019·沈阳分解因式:-x 2-4y 2+4xy =________.17. 若2a =3b -1则4a 2-12ab +9b 2-1的值为________.18. 我们已经学过用面积来说明公式.如x 2+2xy +y 2=(x +y )2就可以用如图甲中的面积来说明.请写出图乙的面积所说明的公式:x 2+(p +q )x +pq =________.三、解答题19. 分解因式:26136x x -+20. 已知2246130a b a b +--+=,求a b +的值.21. 分解因式:2222()abcx a b c x abc +++22. 分解因式:2222(1)(2)(1)x x x x x x ++-++-人教版 九年级数学 14.3 因式分解课后训练-答案一、选择题1. 【答案】D [解析] 依题意得ax =±2×6x解得a =±12.2. 【答案】A3. 【答案】A [解析] (-2)2020+(-2)2019=-2×(-2)2019+(-2)2019=(-2)2019×(-2+1)=22019.4. 【答案】D [解析] 552-152=(55+15)×(55-15)=70×40=2800.5. 【答案】D [解析] 原式=3x(x 2-2x +1)=3x(x -1)2.6. 【答案】A [解析] 因为多项式x 2-3(m -2)x +36能用完全平方公式分解因式 所以-3(m -2)=±12.所以m =6或m =-2.7. 【答案】A [解析] 因为a ,b 互为相反数,所以a +b =0.所以a 2+ab -4=a(a +b)-4=0-4=-4.8. 【答案】B [解析] 由(x 2+4)(x +2)(x -▲)得出▲=2, 则(x 2+4)(x +2)(x -2)=(x 2+4)(x 2-4)=x 4-16,则■=16.9. 【答案】B [解析] 因为2m +n =25,m -2n =2, 所以(m +3n)2-(3m -n)2=[(m +3n)+(3m -n)][(m +3n)-(3m -n)]=(4m +2n)(-2m +4n)=-4(2m +n)(m -2n)=-4×25×2=-200.10. 【答案】B 【解析】222222222(2)()()()a b c ab a ab b c a b c a b c a b c +--=-+-=--=-+--又因为a ,b ,c 是三角形三边的长,所以a c b +>,a b c <+ 即0a b c -+>,0a b c --<,()()0a b c a b c -+--<,22220a b c ab +--<11. 【答案】n (m -3)2 【解析】m 2n -6mn +9n =n (m 2-6m +9)=n (m -3)2.12. 【答案】其中⑴是单项式变形,⑷是多项式的乘法运算,⑵中并没有写成几个整式的乘积的形式,只有⑶是因式分解13. 【答案】(x -2)(x -1) 【解析】公因式是(x -2),所以x (x -2)+(2-x )=(x -2)(x -1).14. 【答案】(x +2)(x -1) [解析] (x +2)2-3(x +2)=(x +2)(x +2-3)=(x +2)(x -1).15. 【答案】-5 [解析] 把x 2+mx +6分解因式得(x -2)(x +n),即x 2+mx +6=(x -2)(x +n)=x 2+(n -2)x -2n ,所以-2n =6,m =n -2.解得n =-3,m =-5.16. 【答案】-(x -2y)217. 【答案】0 [解析] 因为2a =3b -1所以2a -3b =-1.所以4a 2-12ab +9b 2-1=(2a -3b)2-1=(-1)2-1=0.18. 【答案】(x +p)(x +q) [解析] 根据题意可知 x 2+(p +q)x +pq =(x +p)(x +q).三、解答题19. 【答案】 (32)(23)x x --【解析】26136(32)(23)x x x x -+=--20. 【答案】5a b +=【解析】∵2246130a b a b +--+=,∴2244690a a b b -++-+=∴()()22230a b -+-=,∴2030a b -=⎧⎨-=⎩,∴23a b =⎧⎨=⎩,∴5a b +=()()abx c cx ab ++【解析】2222()()()abcx a b c x abc abx c cx ab +++=++22. 【答案】2(1)(21)(1)x x x x --++【解析】原式424322212x x x x x x x =+++----43221x x x =--+ 3(21)(21)x x x =---3(21)(1)x x =--2(1)(21)(1)x x x x =--++.。

八年级数学上册《第十四章同底数幂的乘法》练习题附带答案-人教版

八年级数学上册《第十四章同底数幂的乘法》练习题附带答案-人教版一、选择题1.式子a2m+3不能写成( )A.a2m·a3 B.a m·a m+3 C.a2m+3 D.a m+1·a m+22.计算a6•a2的结果是( )A.a12B.a8C.a4D.a33.化简﹣b•b3•b4的正确结果是( )A.﹣b7B.b7C.-b8D.b84.若m·23=26,则m等于( )A.2B.4C.6D.85.若x m-5x2n-x6=0,则m、n的关系是()A. m-n=6B.2m+n=5C.m+2n=11D.m-2n=76.下列各式中,计算过程正确的是()A. x3+x3=x3+3=x6B.x3·x3=2x3=x6C. x·x3·x5=x0+3+5=x8D.x·(-x)3= -x2+3= -x57.x·x6·( )=x12,括号内填( )A.x6B.x2C.x5D.x8.如果a2n﹣1a n+5=a16,那么n的值为( )A.3B.4C.5D.69.若(a m+1b n+2)(a2n-1b2m)=a5b3,则m+n的结果是()A.1B.2C.3D.-310.已知x+y﹣4=0,则2y•2x的值是( )A.16B.﹣16C.D.8二、填空题11.计算a3•a的结果是.12.计算:3a·a2+a3=_______.13.计算 -a×(-a)2×(-a)3=______14.若a m=2,a n=3,则a m+n= .15.若2x+1=16,则x=______.16.已知4×5x+3=n,则用含n的代数式表示5x为____.三、解答题17.计算:a3•a2•a4+(﹣a)2;18.计算:10×10+102×102;19.计算:-x2·(-x)4·(-x)3;20.计算:(m-n)·(n-m)3·(n-m)4;21.已知4x=8,4y=32,求x+y的值.22.已知4×2a×2a+1=29,且2a+b=8,求a b的值.23.已知(a+b)a·(b+a)b=(a+b)5,且(a-b)a+4·(a-b)4-b=(a-b)7,求a a b b的值.24.阅读下列材料:小明为了计算1+2+22+…+22017+22018的值,采用以下方法:设S=1+2+22+…+22017+22018①则2S=2+22+…+22018+22019②②-①得2S-S=S=22019-1∴S=1+2+22+…+22017+22018=22019-1请仿照小明的方法解决以下问题:(1)1+2+22+…+29=________;(2)3+32+…+310=________;(3)求1+a+a2+…+a n的和(a>0,n是正整数,请写出计算过程).参考答案1.C2.B3.C4.D5.B6.D7.C8.B9.B10.A11.答案为:a 4.12.答案为:4a 313.答案为:a 6;14.答案为:6.15.答案为:3.16.答案为:500n 17.解:原式=a 9+a 2;18.原式=2000019.原式=-x 2·x 4·(-x 3)=x 2·x 4·x 3=x 9.20.原式=-(n -m)·(n -m)3·(n -m)4=-(n -m)1+3+4=-(n -m)8.21.解:4x ·4y =8×32=256=44而4x ·4y =4x +y ∴x +y=4.22.解:由题意得,2a+3=9解得:a=3则b=8﹣2a=8﹣6=2a b =9.23.解:∵(a +b)a ·(b +a)b =(a +b)5,(a -b)a +4·(a -b)4-b =(a -b)7∴⎩⎨⎧a +b =5,a +4+4-b =7.解得⎩⎨⎧a =2,b =3.∴a a b b =22×33=108.24.解:(1)设S =1+2+22+ (29)则2S=2+22+ (210)②-①得2S-S=S=210-1∴S=1+2+22+…+29=210-1;(2)设S=3+32+33+34+…+310①,则3S=32+33+34+35+…+311②,②-①得2S=311-3,所以S=311-32,即3+32+33+34+ (310)311-32;(3)设S=1+a+a2+a3+a4+…+a n①,则aS=a+a2+a3+a4+…+a n+a n+1②,②-①得:(a -1)S=a n+1-1,a=1时,不能直接除以a-1,此时原式等于n+1;a不等于1时,a-1才能做分母,所以S=a n+1-1a-1,即1+a+a2+a3+a4+…+a n=a n+1-1a-1.。

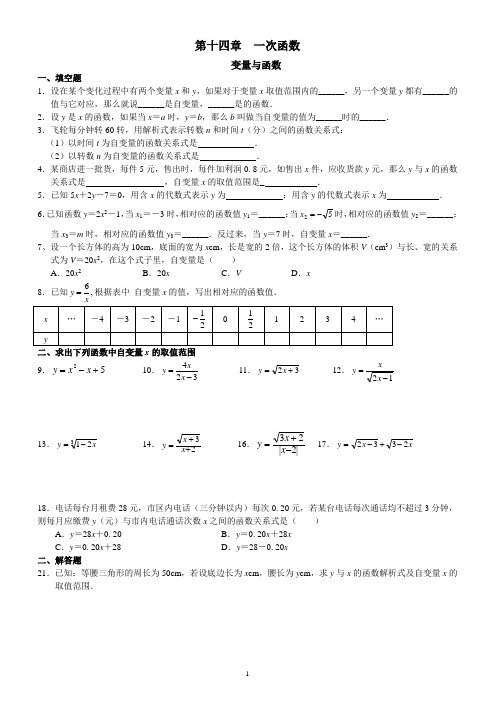

一次函数章节练习题

第十四章 一次函数变量与函数一、填空题1.设在某个变化过程中有两个变量x 和y ,如果对于变量x 取值范围内的______,另一个变量y 都有______的值与它对应,那么就说______是自变量,______是的函数.2.设y 是x 的函数,如果当x =a 时,y =b ,那么b 叫做当自变量的值为______时的______. 3.飞轮每分钟转60转,用解析式表示转数n 和时间t (分)之间的函数关系式: (1)以时间t 为自变量的函数关系式是 . (2)以转数n 为自变量的函数关系式是 .4.某商店进一批货,每件5元,售出时,每件加利润0.8元,如售出x 件,应收货款y 元,那么y 与x 的函数关系式是 ,自变量x 的取值范围是_ .5.已知5x +2y -7=0,用含x 的代数式表示y 为 ;用含y 的代数式表示x 为 . 6.已知函数y =2x 2-1,当x 1=-3时,相对应的函数值y 1=______;当52-=x 时,相对应的函数值y 2=______;当x 3=m 时,相对应的函数值y 3=______.反过来,当y =7时,自变量x =______.7、设一个长方体的高为10cm ,底面的宽为x cm ,长是宽的2倍,这个长方体的体积V (cm 3)与长、宽的关系式为V =20x 2,在这个式子里,自变量是( ) A .20x 2 B .20x C .V D .x8.已知,6y =根据表中 自变量x 的值,写出相对应的函数值.二、求出下列函数中自变量x 的取值范围9.52+-=x x y 10.324-=x x y11.32+=x y 12.12-=x x y13.321x y -=14.23++=x x y 16.|2|23-+=x x y 17.x x y 2332-+-=18.电话每台月租费28元,市区内电话(三分钟以内)每次0.20元,若某台电话每次通话均不超过3分钟,则每月应缴费y (元)与市内电话通话次数x 之间的函数关系式是( )A .y =28x +0.20B .y =0.20x +28xC .y =0.20x +28D .y =28-0.20x 二、解答题21.已知:等腰三角形的周长为50cm ,若设底边长为x cm ,腰长为y cm ,求y 与x 的函数解析式及自变量x 的取值范围.22(1)写出y 与x 的函数关系式:______;(2)该商贩要想使销售的金额达到250元,至少需要卖出多少千克的苹果?函数的图象1.用“描点法”分别画出下列各函数的图象. (1)x y 21=(2)321+=x y解:函数321+=x y 的自变量x 的取值范围是______. 问题:当(2)中的自变量x 的取值范围变为-2≤x <4时,请在上图中标出相应的图象部分.2.如图2-1,下面的图象记录了某地一月份某大的温度随时间变化的情况,请你仔细观察图象回答下面的问题:(1)在这个问题中,变量分别是______,时间的取值范围是______;(2)20时的温度是______℃,温度是0℃的时刻是______时,最暖和的时刻是_______时,温度在-3℃以下的持续时间为______小时; (3)你从图象中还能获得哪些信息?(写出1~2条即可)答:__________________________.3.图2-2中,表示y是x的函数图象是()图2-25.如图2-3是护士统计一位病人的体温变化图,这位病人中午12时的体温约为()A.39.0℃B.38.2℃C.38.5℃D.37.8℃6.如图2-4,某游客为爬上3千米的山顶看日出,先用1小时爬了2千米,休息0.5小时后,再用1小时爬上山顶,游客爬山所用时间t(小时)与山高h(千米)间的函数关系用图象表示是()图2-4二、填空题7.星期日晚饭后,小红从家里出去散步,图2-5所示,描述了她散步过程中离家的距离s(m)与散步所用的时间t(min)之间的函数关系,该图象反映的过程是:小红从家出发,到了一个公共阅报栏,看了一会报后,继续向前走了一段,在邮亭买了一本杂志,然后回家了.依据图象回答下列问题图2-5(1)公共阅报栏离小红家有______米,小红从家走到公共阅报栏用了______分;(2)小红在公共阅报栏看新闻一共用了______分;(3)邮亭离公共阅报栏有______米,小红从公共阅报栏到邮亭用了______分;(4)小红从邮亭走回家用了______分,平均速度是______米/秒.三、解答题8.已知:线段AB=36米,一机器人从A点出发,沿线段AB走向B点.(1)求所走的时间t(秒)与其速度V(米/秒)的函数解析式及自变量V的取值范围;(2)利用描点法画出此函数的图象.拓展、探究、思考9.大家知道,函数图象特征与函数性质之间存在着必然联系.请根据图2-6中的函数图象特征及表中的提示,说出此函数的变化规律.此外,你还能说出此函数的哪些性质?图2-6一、填空题1.形如______的函数叫做正比例函数.其中______叫做比例系数.2.可以证明,正比例函数y=kx(k是常数.k≠0)的图象是一条经过______点与点(1,______的__________,我们称它为______.3.如图3-1,当k>0时,直线y=kx经过______象限,从左向右______,因此正比例函数y =kx,当k>0时,y随x的增大而______;当k<0时,直线y=kx经过______象限,从左向右______,因此正比例函数y =kx,当k<0时,y随x的增大反而______.图3-14.若直线y=kx经过点A(-5,3),则k=______.如果这条直线上点A的横坐标x A=4,那么它的纵坐标y A=______.5.若⎩⎨⎧-=-=6,4y x 是函数y =kx 的一组对应值,则k =______,并且当x ≥5时,y ______;当y <-2时,x ____________.二、选择题6.下列函数中,是正比例函数的是( )A .y =2xB .xy 21=C .y =x 2D .y =2x -1 7.如图3-2,函数y =-x (x <0)的图象是()图3-28.函数y =-2x 的图象一定经过下列四个点中的( )A .点(1,2)B .点(-2,1)C .点)1,21(-D .点)21,1(-9.如果函数y =(k -2)x 为正比例函数,那么( )A .k >0B .k >2C .k 为实数D .k 为不等于2的实数 10.如果函数|1|)2(--=m x m y 是正比例函数,那么( )A .m =2或m =0B .m =2C .m =0D .m =1若函数12)2(--=m x m y是正比例函数,则m =11图象经过(1,2)的正比例函数的表达式是 。

第十四章 货币政策

第十四章货币政策第一部分练习题一、解释名词1 、通货膨胀目标制2 、相机抉择与规则3 、道义劝告4 、窗口指导5 、货币政策时滞6 、政策搭配理论7 、国际间政策协调二、填空1 、美国联邦储备系统把经济增长、、和国际收支平衡等作为货币政策目标。

2 、典型市场经济条件下,调控货币供给的传统货币政策工具包括、和。

3 、根据《中华人民共和国中国人民银行法》,我国货币政策目标的规范表述是:“。

”三、判断1 、在经济疲软、萧条的形势下,要想通过扩张的宏观经济政策克服需求不足,以促使经济转热,财政政策不如货币政策。

2 、任何国家,任何国家的任何时期,货币政策的目标无论是如何描述的,无论是否有明文规定,稳定币值都是其中的一个目标。

3 、由于货币政策操作必然影响资本市场的价格,并通过资本市场影响到其他微观经济行为,所以多数货币当局对资本市场的运行负有干预责任。

4 、货币政策决策维持必要的透明度,即可取得公众的信任,使得公众的推测常常符合货币当局决策的意向,从而成为贯彻货币政策的积极的助力。

5 、对于发展中国家来说,在“三元冲突”中理想的选择当然是保住货币政策独立性和汇率稳定,而放弃资本自由流动,也即实行外汇管制。

6 、固定汇率制下,扩张性货币政策在造成本国产出的上升的同时,却使得外国的产出下降,是一种典型的“以邻为壑”政策。

四、不定项选择1 、关于货币政策的传导机制,凯恩斯主义者和货币主义者分别重视哪些中介指标的作用:A 、利率和货币供应量B 、货币供应量和利率C 、价格水平和货币需求D 、货币需求和价格水平2 、以下属于货币政策远期中介指标的有:A 、货币供给量B 、利率C 、基础货币D 、超额准备金3 、无论各国货币当局对货币政策目标如何表述,其首要目标通常是:A 、充分就业B 、经济增长C 、稳定物价D 、国际收支平衡4 、以下采用过通货膨胀目标制货币政策的国家有:A 、中国B 、美国C 、新西兰D 、英国5 、泰勒规则论证,美联储联邦基金利率的确定应取决于以下哪些因素:A 、当前的通货膨胀率B 、均衡实际利率C 、现实的通货膨胀率与目标通货膨胀率之差D 、现实的 GDP 产出与潜在 GDP 产出之差五、问答1 、世界各国货币政策或采用“单目标”,或采用“多目标”,考虑的依据是什么 ? 根据近几年的实践,你认为我国的货币政策目标应作怎样的表述 ?2 、试概括货币政策的传导机制主要有哪些 ?3 、为什么要设置货币政策中介指标 ? 选择时需考虑哪些因素 ? 试列举若干典型的货币政策中介指标。

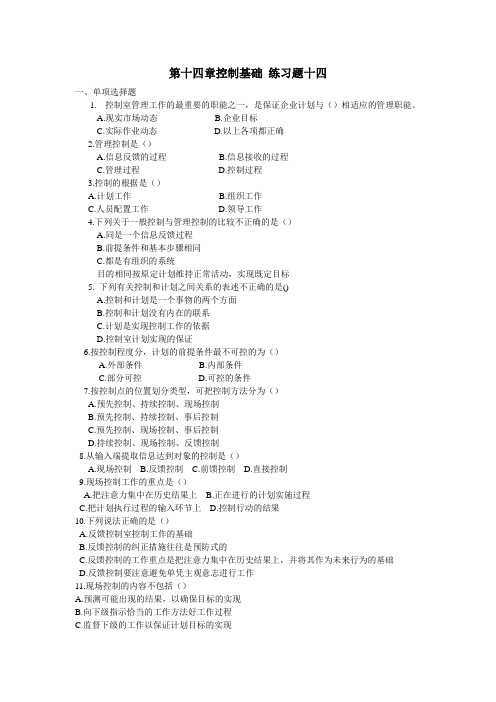

第十四章 控制基础

第十四章控制基础练习题十四一、单项选择题1.控制室管理工作的最重要的职能之一,是保证企业计划与()相适应的管理职能。

A.现实市场动态B.企业目标C.实际作业动态D.以上各项都正确2.管理控制是()A.信息反馈的过程B.信息接收的过程C.管理过程D.控制过程3.控制的根据是()A.计划工作B.组织工作C.人员配置工作D.领导工作4.下列关于一般控制与管理控制的比较不正确的是()A.同是一个信息反馈过程B.前提条件和基本步骤相同C.都是有组织的系统目的相同按原定计划维持正常活动,实现既定目标5. 下列有关控制和计划之间关系的表述不正确的是()A.控制和计划是一个事物的两个方面B.控制和计划没有内在的联系C.计划是实现控制工作的依据D.控制室计划实现的保证6.按控制程度分,计划的前提条件最不可控的为()A.外部条件B.内部条件C.部分可控D.可控的条件7.按控制点的位置划分类型,可把控制方法分为()A.预先控制、持续控制、现场控制B.预先控制、持续控制、事后控制C.预先控制、现场控制、事后控制D.持续控制、现场控制、反馈控制8.从输入端提取信息达到对象的控制是()A.现场控制B.反馈控制C.前馈控制D.直接控制9.现场控制工作的重点是()A.把注意力集中在历史结果上B.正在进行的计划实施过程C.把计划执行过程的输入环节上D.控制行动的结果10.下列说法正确的是()A.反馈控制室控制工作的基础B.反馈控制的纠正措施往往是预防式的C.反馈控制的工作重点是把注意力集中在历史结果上,并将其作为未来行为的基础D.反馈控制要注意避免单凭主观意志进行工作11.现场控制的内容不包括()A.预测可能出现的结果,以确保目标的实现B.向下级指示恰当的工作方法好工作过程C.监督下级的工作以保证计划目标的实现D.发现不合标准的偏差时,立即采取纠正措施12.将控制类型划分为同期控制、反馈控制和前馈控制的分类标准是()A.时机、对象和目的的不同B.控制原因C.控制结果D.外因和内因13.“治病不如防病,防病不如讲究卫生”,根据这一说法,一下几种控制方式中最重要的是()A.预先控制B.实时控制C.控制结果D.外因和内因14.所以权和经营权相分离的股份公司,为强化对经营行为的约束,往往设计有各种治理和制衡的手段,包括:①股东们要召开大会对董事和监事人选进行投票表决;②董事会要对经理人员的行为进行监督和控制;③监事会哟啊对董事会和经理人员的经营行为进行检查监督;④要强化审计监督,如此等等。

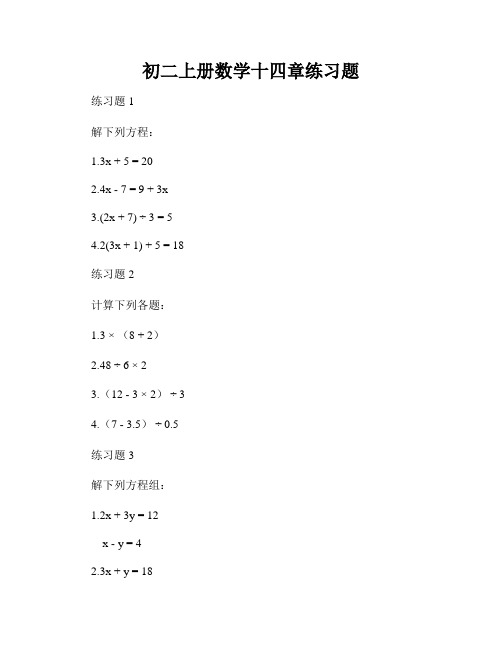

初二上册数学十四章练习题

初二上册数学十四章练习题练习题1解下列方程:1.3x + 5 = 202.4x - 7 = 9 + 3x3.(2x + 7) ÷ 3 = 54.2(3x + 1) + 5 = 18练习题2计算下列各题:1.3 ×(8 + 2)2.48 ÷ 6 × 23.(12 - 3 × 2) ÷ 34.(7 - 3.5) ÷ 0.5练习题3解下列方程组:1.2x + 3y = 12x - y = 42.3x + y = 182x - 3y = -11练习题4计算下列各题:1.3 ÷ 1/42.5 - 1/4 + 2/53.2 3/4 × 5/64.(3/4) ÷(1/2)练习题5解下列关于比例的问题:1.一块长方形花坛长为6m,宽为8m,求长与宽的比例。

2.一辆汽车在1小时内行驶了40km,求汽车的平均速度。

3.一条直线需要7小时走完,已走了5小时,求当前已走的路程占总路程的比例。

4.一个正方形的周长为24cm,求正方形的边长和面积。

练习题6解下列关于几何图形的问题:1.计算一个边长为6cm的正方形的面积和周长。

2.计算一个底边长为5cm,高为8cm的三角形的面积。

3.计算一个半径为4cm的圆的面积和周长。

4.计算一个底边长为6cm,高为3cm的梯形的面积。

练习题7解下列应用题:1.小明家有苹果和橘子,苹果的数量是橘子的2倍,若橘子的数量增加40个,则两者数量相等,求苹果和橘子的数量。

2.一辆汽车以每小时60km的速度行驶,一辆自行车以每小时20km 的速度行驶,汽车出发后1小时,求自行车离出发点的距离。

3.一块地方有两个小摊,甲摊每天卖出的橙子是乙摊的3倍,如果每天甲摊卖出的橙子增加20个,两个摊卖出的橙子数量相等,求原来每天两个小摊各自卖出的橙子数量。

4.某菜市场共有苹果和香蕉两种水果,苹果的数量是香蕉的3倍,当香蕉的数量增加20kg时,两种水果的总重量相等,苹果和香蕉原来的总重量是多少kg?练习题8解下列几何图形的问题:1.判断以下说法是否正确:平行四边形的对边是相等的。

- 1、下载文档前请自行甄别文档内容的完整性,平台不提供额外的编辑、内容补充、找答案等附加服务。

- 2、"仅部分预览"的文档,不可在线预览部分如存在完整性等问题,可反馈申请退款(可完整预览的文档不适用该条件!)。

- 3、如文档侵犯您的权益,请联系客服反馈,我们会尽快为您处理(人工客服工作时间:9:00-18:30)。

Exercise(Chapter 14)1.Is the amortization of goodwill permitted according to?U.S. GAPP International Accounting Standards (IAS)A. Yes YesB. Yes NoC. No YesD. No No2.Which of the following statements regarding the differences between the purchase method of accounting for mergers and acquisitions and the pooling of interests method is least accurate? A. The purchase method recognizes one firm as being acquired by another, while the pooling of interests method views both participants as equals.B. The operating results of both companies prior to the acquisition are restated under the purchase method, but are not restated under the pooling of interests methodC. The purchase method recognizes any excess purchase price on the balance sheet as an intangible asset, while the pooling of interest method does not acknowledge market value and combines the two companies using accounting book values.D. The underlying cash flows and economics of a merger or acquisition are same whether the purchase or the pooling of interests method is utilized3. Under which accounting method, purchase or pooling, is net profit margin and return on equity likely to be lower?Net profit margin Return on equityA. Purchase PurchaseB. Purchase PoolingC. Pooling PurchaseD. Pooling Pooling4. Which of the following statements about the pooling and purchase methods is most accurate?A. In the purchase method, the statements is structured so that all the liabilities and assets ofboth companies are combined together while the consolidated equity equals the parent’s equity.B. In the pooling method, the balance sheet and income statements are added together afteradjusting the target firm’s statements to reflect the fair values of the acquired firm.C. In the purchase method, prior period statements are restated to reflect the results of theacquired operating activities...D. In the purchase method, the balance sheet and income statements of the acquirer is restatedwhile financial statements of the target remains unchanged.5. On December 31, 2001 Company P issues 25 shares worth 750 to acquire Company T with the book value of equity at 500, the market value of which is 600. Before the acquisition, the book value of Company P’s equity is 1500. what values of equity and goodwill will be reported on the consolidated balance sheet?Equity GoodwillA. 2000 250B. 2250 150C. 2100 150D. 2000 1506. Same conditions as in question 5. what is the consolidated equity under the pooling method?A. 2000millionsB. 2250 millionsC. 2100 millionsD. 1350millions7. On December 31, 2001, Company P acquires Company T with a premium. Among the all assets and liabilities acquired, there is a bond with a book value of 20 but valued 28 at current market rate and an equipment with a book value of 250 and fair value of 350. Assuming that bond premium and the equipment are all amortized using the straight-line method in 4 years, what is the adjustments on the consolidated income statement under purchase method?A. no effectB. amortization of bond premium increases expense by 2 while the equipment amortization increases expense by 25C. amortization of bond premium decreases expense by 2 while the equipment amortization increases expense by 25D. amortization of bond premium decreases expense by 2 while the equipment amortization decreases expense by 258. Under the purchase method of accounting for a merger or acquisition, if the fair market value of the tangible assets is less than the purchase price, the excess purchase price is:A. attributed to goodwill, which is depreciated over the estimated remaining life.B. proportionately allocated across all tangible assets as an adjustment to their cost basis.C. attributed to separately identifiable tangible and intangible assets, which the tangible assets are depreciated over their estimated remaining life.D. proportionately allocated across all tangible assets, which is depreciated over their estimated remaining life.参考答案1. C2. BOperating results are restated under the pooling of interests methods but not the purchase method.3. AThe purchase method recognizes both assets fair value, which is always higher than their caring amount or book value and fair value of the target’s equity. As a result, fair-value- based amortization and depreciation is higher than historical-cost-based, which results in lower profit.4. AAnswer B is for purchase method. Answer C is for the pooling method. Answer D should be reversed, that is the acquirer remains unchanged while the target needs restatements.5. BGoodwill reported on the consolidated balance sheet is the excess of the purchase price over the fair value of the target’s net assets or equity and equals 150(=750-600). The equity of the target does not enter the consolidated balance sheet and the consolidated equity is the sum of the parent’s original equity plus the market value of newly issued shares, which is 2250(=1500+750).6. AUnder the pooling method, the consolidated equity is the sum of the book value of the target’ equity and the acquirer’ equity, which is 2000 millions(= 1500+500).7. CAmortization of bond premium decreases expense while equipment amortization based on fair value increases expense.8. CThe excess purchase price will be allocated to separately identifiable tangible and intangible assets. The tangible assets are depreciated accordingly. Any excess remaining value is attributed to goodwill.。