宏观经济学布兰查德第六版第章课后作业答案

宏观经济学_布兰查德第六版_第8_12章课后作业答案

第1年的实际货币供给为M/P=4,第2、3、4年的货币 供给都为4,说明实际供给没有发生变化。

e.如果这些数据表示的是中期,那么已经对实际产 出增长率做了什么假设?

实际产出增长率不变

5.名义货币增长率永久下降的影响。

假设经济由下面三个方程所描述:

ut-ut-1=-0.4×(gyt-3%) 奥肯定律

f.你相信问题(e)中的答案吗?为什么?

不相信。因为在这种情况下,预期的通货膨胀率 等于过去(前一年)的通货膨胀率再加一个固定 的常数。按照这种预期机制,未来的通胀率就可 能无限大,这与事实不符。相当于人们又犯了系 统性错误,而对自己的预期没有修正。

4、重温货币中性 a.填写下表第一年后的空格部分

2ut=2%;同理可得: πt+1=4%, πt+2=6%, πt+3=8%。

现在假设一半的合同是指数化的。

b.新的菲利普斯曲线方程是什么?

πt= 0.5πt+0.5πt-1+0.1-2ut 整理得:πt= πt-1+0.2-4ut c.根据(b)中的答案,重新计算问题(a)中的通货膨胀率。

πt-1=0,ut=ut-1=0,根据b中新的菲利普斯关系式计算可得: πt=4%;πt+1=8%, πt+2=12%,

宏观经济学

第八章课后习题

1.运用本章学到的知识,判断下列陈述属于“正确 ”、“错误”、“不确定”中的哪一种情况,并 解释。

a.原始菲利普斯曲线是失业和通货膨胀的负向关系 ,这一现象最初是在英国发现的。

布兰查德课后习题答案(1-13章)(毕博).doc

第1-13章课后习题答案(布兰查德)第一章世界之旅pl4a.True.b.True/Uncertain. Stock prices certainly fell around the world in the crisis. Emerging marketstock prices mostly recovered as of 2010, stock prices in the United States and otheradvanced companies had not reached their pre-crisis levels as of 2012.c.False.d.False. There are problems with the statistics, but the consensus is that growth in China has been high.e.False. European unemployment rates have been higher for several decades.f.True.g.True.h.Falsea.14.7(1.026)=5.8(1.105/t= /n(14.7€.8)/[/r?(l.10^1.026)]t = 12.53 yrsThis answer can be confirmed with a spreadsheet, for students unfamiliar with the use oflogarithms.b.No. At current growth rates, Chinese output will exceed U.S. output within 31 years, but Chineseoutput per person (the Chinese standard of living) will still be less than U.S. output per person.c.China has increased the amount of capital per person. This is possible in the United States.China has imported a lot of technology from the United States and other countries. This ismore difficult to do in the United States since the number of technologies available for theUnited States to import that they do not already have is fewer.d.China does provide a model for other developing countries.第二章本书之旅p38第1题a.True/Uncertain. Real GDP increased by a factor of 5; nominal GDP increased by afactor of 28. We usually think of GDP in real termsb.False.c.True.d.False. The level of the CPI means nothing. The rate of change of the CPI is one measure of inflation.e.Uncertain. Which index is better depends on what we are trying to measure—inflation faced by consumers or by the economy as a whole.f.Trueg.Trueh.Falsei.False. The Phillips curve is a relation between the change in inflation and the level ofunemployment.第4题a.2005 GDP: 10($2z000)+4($l,000)+1000($l)=$25,0002006 GDP: 12($3,000)+6($500)+1000($l)=$40,000 Nominal GDP has increased by 60%.b.2005 real (2005) GDP: $25,0002006 real (2005) GDP: 12($2,000)+6($l z000)+1000($l)=$31,000Real (2006) GDP has increased by 24%.c.2005 real (2006) GDP: 10($3,000)+4($500)+l,000($l)=$33,0002006 real (2006) GDP: $40,000.Real (2006) GDP has increased by 21.2%.d.The answers measure real GDP growth in different units. Neither answer is incorrect,just as measurement in inches is not more or less correct than measurement incentimeters.第5题a.2005 base year:b.Deflator(2005)=l; Deflator(2006)=$40,000/$31,000=1.29 lnflation=29%c.2006 base year:Deflator(2005)=$25,000/$33,000=0.76; Deflator(2006)=llnflation=(l-0.76)/0.76=.32=32%d.Analogous to 4d.第6题a.2005 real GDP = 10($2,500) + 4($750) + 1000($l) = $29,0002006 real GDP = 12($2,500) + 6($750) + 1000($l) = $35,500b.(35,500-29,000)/29,000 = .224 = 22.4%c.Deflator in 2005=$25,000/$29,000=.86Deflator in 2006=$40,000/$35z500=1.13Inflation = (1.13 -.86)/.86 = .31 = 31%.a.Yes, see appendix for further discussion.第三章商品市场p64a.True.b.False. Government spending excluding transfers was 20.4% of GDP.c.False. The propensity to consume must be less than one for our model to make sense.d.True.e.False.f.False. The increase in equilibrium output is one times the multiplier.g.False.a.Output will fall.b.Since output falls, investment will also fall. Public saving will not change. Privatesaving will fall, since investment falls, and investment equals saving. Since output andconsumer confidence fall, consumption will also fall.c.Output, investment, and private saving would have risen.d.Clearly this logic is faulty. When output is low, what is needed is an attempt byconsumers to spend more. This will lead to an increase in output, and therefore—somewhat paradoxically—to an increase in private saving. Note, however,that with a linear consumption function, the private saving rate (private savingdivided by output) will fall when c0 rises.第四章金融市场p86a.False.b.False.c.False. Money demand describes the portfolio decision to hold wealth in the form ofmoney rather than in the form of bonds. The interest rate on bonds is relevant to thisdecision.d.True.e.False.f.False.g.True.h.True.a.8° = 50,000-60,000 (.35-i)If the interest rate increases by 10 percentage points, bond demand increases by $6,000.b.An increase in wealth increases bond demand, but has no effect on money demand, whichdepends on income (a proxy for transactions demand).c.An increase in income increases money demand, but decreases bond demand, since weimplicitly hold wealth constant.d.First of all, the use of "money" in this statement is colloquial. "Income" should be substituted for "money." Second, when people earn more income, their wealth does not change right away. Thus, they increase their demand for money and decrease their demand for bonds.a.All money is in checking accounts, so demand for central bank money equals demand forreserves. Therefore, demand for central bank money=0.1($Y)(.8-4/).b.$1000 = 0.1($5,000B)(.8-4/)上15%c.Since the public holds no currency, money multiplier = 1/reserve ratio =M=(10)$1000=$l,0000M= M d at the interest derived in part (b).d.If H increases to $300B the interest rate falls to 5%.e.The interest rate falls to 5%, since when H equals $3000, M=(10)$300B=$3,0000.a.True.b.True.c.False.d.e. False.f.第五章商品市场和金融市场pl07False. The balanced budget multiplier is positive (it equals one), so the IS curve shifts right. Uncertain. An increase in government spending leads to an increase in output (which tends to increase investment), but also to an increase in the interest rate (which tends to reduce investment).g. True.a.y=C+/+G=200+.25(r-200)+150+.25M000/+25001100-2000,b.M/P= 1600=2 r-8000//= W00-1/5c.Substituting from part (b) into part (a) gives X=1000.d.Substituting from part (c) into part (b) gives /=5%.e.C=400; /=350; G=250; C+/+G=1000f./=1040; /=3%; C=410; /=380. A monetary expansion reduces the interest rate and increasesoutput. Consumption increases because output increases. Investment increases becauseoutput increases and the interest rate decreases.g./=1200; /=10%; C=450; /=350. A fiscal expansion increases output and the interest rate.Consumption increases because output increases. Investment is affected in two ways: theincrease in output tends to increase investment, and the increase in the interest rate tendsto reduce investment. In this example, these two effects exactly offset one another, andinvestment does not change.第六章劳动力市场pl32第1题a.False. The participation rate has increased over time.b.False.c.False.d.True.e.False.f.Uncertain/False. The degree of bargaining power depends on the nature of the job andthe employee's skills.g.True.h.False.a.W/P=l/(l+|i)=V1.05=0.952b.Wage setting: u=l-W/P=l-0.952=4.8%c.W/P=l/l・l=・91; u=l-.91=9%. The increase in the markup lowers the real wage.Algebraically, from the wage-setting equation, the unemployment rate must rise for the realwage to fall. So the natural rate increases. Intuitively, an increase in the markup impliesmore market power for firms, and therefore less production, since firms will use theirmarket power to increase the price of goods by reducing supply. Less production impliesless demand for labor, so the natural rate rises.第七章所有市场集中:AS-AD曲线pl60a.True.b.True. In the AS relation, if P=P e/Y=Y n. Note that P e must be known to graph the AS curve.c.False. The AD curve slopes down because an increase in P leads to a fall in M/P, so thenominal interest rate increases, and / and Y fall.d.False. There are changes in autonomous expenditure and supply shocks, both of whichcause output to deviate from the natural level in the short run.e.True.f.False. Fiscal policy affects the interest rate in the medium run and therefore affectsinvestment.g.False. The natural level of output changes in response to a permanent supply shock(other than a change in P3). The price level changes in the medium run in response toeither a demand or a supply shock.第4题a.Money is neutral in the sense that the nominal money supply has no effect onoutput or the interest rate in the medium run. Output returns to its natural level.The interest rate is determined by the position of the IS curve and the natural levelof output. Despite the neutrality of money in the medium run, an increase in themoney supply will increase output and reduce the interest rate in the short run.Therefore, expansionary monetary policy can be used to speed up the economy'sreturn to the natural level of output when output is low.b.In the medium run, fiscal policy affects the interest rate and investment, so fiscal policy is not considered neutral.c.False. Labor market policies, such as the degree of unemployment insurance, can affect thenatural level of output.a.SR:short runMR: medium runb-c.C I Private SSR falls ambiguous ambiguousMR Increasesfrom SR butstill lowerthanoriginallevel rises (aboveoriginallevel)rises (aboveoriginal level)In the medium run, consumption must lower than its original level because disposableincome is unchanged, but consumer confidence is lower.The short-run change in investment is ambiguous, because the interest rate falls,whichtends to increase investment, but output also falls, which tends to reduceinvestment. Inthe medium run, investment must rise (as compared to its short-run and originallevels),because the interest rate falls but output returns to its original level.Since the budget deficit does not change in this problem, the change in privatesaving equals the change in investment. It is possible that private saving will fall inthe short run, but private saving must rise (above its short-run and original levels) inthe medium run.第八章菲利普斯曲线、自然失业率和通货膨胀P182第1题a.True.b.False.c.False.d.True.e.False.f.True.g.Falseh.Falsei.Truej.True第 4 题.The neutrality of money revisitedc.5% per yeard.0% per yeare.Output growth is zero (the economy is at a constant natural level of output).第九章次贷危机(略)第十章增长的事实第1题,快速测试a.True.b.False.c.Uncertain 一earlier evidence suggested this was false but more recent evidencesuggests it may be true.d.False.e.True.f.False.g.True.第3题a.r=63b./doubles.c.Yes.d.Y/N=(K/N)也e.K/N=4 implies Y/N=2. K/N=8 implies Y/N=2.83. Output less than doubles.f.No.g.No. In part (f), we are essentially looking at what happens to output when we increasecapital only, not capital and labor in equal proportion. There are decreasing returns tocapital.h.Yes.第十一章储蓄、资本积累和产出P248第1题,快速测试a.True, in a closed economy, and if saving includes public and private saving.b.False.c.True. In the model without depreciation, there is no steady state. A constant savingrate produces a positive but declining rate of growth. In the infinite-time limit, thegrowth rate equals zero. Output per worker rises forever without bound. In themodel with depreciation, if the economy begins with a level of capital per workerbelow the steady-state level, a constant saving rate also produces a positive butdeclining rate of growth, with a limit of zero. In this case, however, output perworker approaches a fixed number, defined by the steady-state condition of theSolow model. Note that depreciation is not needed to define a steady state if themodel includes labor force growth or technological progress.d.Uncertain. See the discussion of the golden-rule saving rate.e.Uncertain/False. It is likely that the U.S. rate is below the golden rule rate and thattransforming Social Security to a pay-as-you-go system would ultimately increase theU.S. saving rate. These premises imply that such a transformation would increase U.S.consumption in the future, but not necessarily in the present. Indeed, if the onlyeffect of such a transformation is to increase the saving rate, we know thatconsumption per worker will fall in the short run. Moreover; moving to a pay-as-you-go system requires transition costs. If these costs are borrowed, then the reductionin public saving will offset the increase in private saving during the transition. If thesecosts are not borrowed, then transitional generations must suffer either a reductionin promised benefits or an increase in taxes to finance their own retirement inaddition to the retirement of a previous generation. Thus, whether the U.S. "should"move to a pay-as-you-go system depends on the likely resolution ofintergenerational distributional issues and your view about the equity of such aresolution.f.Uncertain. The U.S. capital stock is below the golden rule, but that does not necessarily imply that there should be tax breaks for saving. Even if the tax breaks were effective in stimulating saving, the increase in future consumption would come at the cost of current consumption.g False. Even if you accept the premise that educational investment increases output, it doesnot necessarily follow that countries should increase educational saving, since futureincreases in output will come at the expense of current consumption. Of course,there are other arguments for subsidizing education, particularly for low-incomehouseholds.第9题b.K/N = (0.15/.075)2 = 4y/N= (4 严=2c.K/N=(0.M)・075)2 =7.11y/N=(7.11 严=2.67Capital per worker and output per worker increase.第十二章技术进步与增长P266第1题,快速测试a.True.b.True.c.False. In steady state, there is no growth of output per effective worker.d.True.e.False. The steady-state rate of growth of output per effective worker is zero. A highersaving rate leads to higher steady-state level of capital per effective worker, but hasno effect on the steady-state rate of growth of output per effective worker.f.True.g.False.h.False/Uncertain. Even pessimists about technological progress typically argue that therate of progress will decline, not that it will be zero. Strictly, however, the truth ofthis statement is uncertain, because we cannot predict the future.i.False, rapid growth in China has been due to both increases in technology and increases incapital.a.i. K/(AN) = (s/(8+g.+g/v))2 = 1ii.Y/(AN)“K/AN)Jiii.g伽N)=0iv.g Y/N= g*%v.g产g/gN=6%b.i. K/(AN) = (s/(8+g A+g N))2 = 0.64ii.Y/(AN)“K/AN)W=0.8iii.g伽N)=0iv.g Y/N= g.=8%v.g产g/g/lO%An increase in the rate of technological progress reduces the steady-state levels of capital and output per effective worker, but increases the rate of growth of output per worker.c.i. K/SN) = (s/0+gA+gN))2=O.64ii.Y/(AN)“K/AN)也=0.8iii.g伽N)=0iv.g Y/N= g*%v.g户gn+gg 10%People are better off in case a. Given any set of initial values, the level of technologyis the same in cases (a) and (c), but the level of capital per effective worker is higherat every point in time in case (a). Thus, since Y/N=AY/(AN)=A(K/(AN))V2=A}/z(K/N)V2,output per worker is always higher in case (a)-a.Probably affects A. Think of climate.b.Affects H and possibly A, if better education improves the fertility of research.c.Affects A. Strong protection tends to encourage more R&D but also to limit diffusionof technology.d.May affect A through diffusion.e.May affect K, H, and A. Lower tax rates increase the after-tax return on investment,and thus tend to lead to more accumulation of K and H and to more R&D spending.f.If we interpret K as private capital, then infrastructure affects A (e.g., bettertransportation networks may make the economy more productive by reducingcongestion time).g.Assuming no technological progress, a reduction in population growth implies anincrease in the steady-state level of output per worker. A reduction in populationgrowth leads to an increase in capital per worker. If there is technological progress,there is no steady-state level of output per worker. In this case, however, a reductionin population growth implies that output per worker will be higher at every point intime, for any given path of technology. See the answer to problem 6(c).第十三章技术进步、短期和长期p288第1题a.False. Productivity growth is unrelated to the natural rate of unemployment. If theunemployment rate is constant, employment grows at same rate as the labor force.b.False.c.True.d.True.e.True.f.True.g.False.h.False第3题An increase in labor productivity has no effect on the natural rate of unemployment, because the wage ultimately rises to capture the added productivity. The increase in the wage also implies that an increase in labor productivity has no permanent effect on inflation. From the price setting equation,P=(l+ rr\)W/A. If the wage (W) increases by the same proportion as productivity (A), the price level will not change.。

布兰查德《宏观经济学》章节课后习题详解(商品市场和金融市场:IS-LM模型)【圣才出品】

第5章商品市场和金融市场:IS-LM模型一、概念题1.IS曲线(IS curve)答:IS曲线是指在商品的总产出等于总需求的情况下利率与总产出之间关系的曲线,它表示了产品市场的均衡条件,在IS曲线上的每一点都满足产品的总需求等于总产出。

财政扩张使得IS曲线向右移动,导致产出增长和利率上升;财政紧缩使得IS曲线向左移动,导致产出减少和利率下降。

2.LM曲线(LM curve)答:LM曲线是指在货币需求量等于货币供给量的情况下总产出与利率之间关系的曲线,它表示了金融市场的均衡条件,在LM曲线上的每一点均满足货币需求等于货币供给。

货币扩张使得LM曲线向下移动,产出增加,利率下降;货币紧缩使得LM曲线向上移动,产出减少,利率上升。

3.财政紧缩(fiscal contraction,fiscal consolidation)答:财政紧缩,是指政府在财政支出规模不变的前提下增加税收或是在财政收入规模不变的前提下减少政府支出,或是既增税又减少支出来收缩总需求的财政政策。

这是与扩张性财政政策相对应的财政政策,它可以通过减少公共支出或提高税收两条途径来实现。

(1)在减少公共支出方面,财政政策需要在维持债务性支出和基金性支出不变的前提下,减少经常性支出和建设性支出。

为了减少经常性支出,政府需要压缩国家机关和人员的支出、非营利性社会事业及其人员的支出、社会保障体系及其人员的支出。

为了减少建设性支出,政府需要大力压缩公共工程支出。

当然,政府在压缩公共支出总量的同时,还要根据经济建设的需要调整公共支出的结构。

(2)在提高税收方面,紧缩性财政政策可以从扩大税基(如缩小减免税或退税的企业范围、降低个人所得税的收入起征点)和提高税率(如提高个人所得税累进税率和将企业的消费型增值税改为生产型增值税)两方面着手。

财政支出的减少和税收的提高,既直接减少了投资和消费需求,又通过降低民间的收入而间接收缩了消费需求。

在财政预算上,财政支出降低和税收提高同步进行,意味着财政盈余的出现或赤字的减少。

宏观经济学习题参考答案(部分)

宏观经济学习题参考答案(部分)宏观经济学习题参考答案(部分)本人精心整理的文档,文档来自网络本人仅收藏整理如有错误还请自己查证!宏观经济学习题参考答案(部分)第一章国民收入的核算一、选择题1、D2、C3、A4、C5、B6、B7、A8、E9、C 10、B11、A 12、B 13、E 14、B 15、C16、C 17、A 18、C 19、E 20、C21、C 22、B 23、D 24、D 25、A26、B 27、A二、填空题1. 国民生产总值2. 资本消耗折旧3. 居民厂商政府国际市场4. 用物品和劳务来满足自己需要的行为5. 投资6. 储存不是用于目前消费的收入的行为7. 更新投资净投资8.居民的储蓄厂商的储蓄折旧费不分配的利润9. 增加值10.支出法三、名词解释1.实际国民生产总值是以具有不变购买力的货币单位衡量的国民生产总值国民生产总值通常是以现行货币单位来表现一国在一定时期(通常为一年)内的全部社会最终产品和劳务的总和但由于通货膨胀和通货紧缩会抬高或降低物价因为会使货币的购买力随物价的波动而发生变化为了消除价格变动的影响一般是以某一年为基期以该年的价格为不变价格然后用物价支书来矫正按当年价格计算的国民生产总值而计算出实际国民生产总值2、当前收入中不用于消费的部分即收入减去消费如寸入银行的存款、购买的有价证券、保存在手中的货币等都称为储蓄储蓄包括政府机构储蓄、企业储蓄和个人及家庭储蓄三种国民生产总值(GNP)是以国民原则来核算的国民收入它被定义为经济社会在一定时期(通常是一年)内运用生产要素所生产的全部最终产品的市场价值GNP是一个市场价值概念它测度的是最终产品而不是中间产品的价值是一定时期内所生产而不是所售卖的最终产品价值是流量而不是存量四、计算题(1)按收入法计算GNP得GNP=工资+利息+租金+利润=100+10+30+30=170(2)按支出法计算GNP得GNP=消费+投资+政府支出+(出口-进口)=90+60+30+(60-70)=170(亿元)(3)所得税-转移支付=30-5=25(亿元)所以政府预算赤字=政府支出-政府收入=30-25=5(亿元)(4)家庭将收入分配为消费、储蓄或税收因此收入=消费+储蓄+(税收-转移支付)所以储蓄=收入-消费-(税收-转移支付)=170-90-25=55(亿元)或者由等式(投资-储蓄)+(政府支出-政府收入)+(出口-进口)=0得储蓄=(政府支出-政府收入)+(出口-进口)+投资=5+(60-70)+60=55(亿元)(5)净出口=出口-进口=60-70=-10(亿元)第二章国民收宏观经济学习题参考答案(部分)入的均衡一、选择题1、D2、D3、B4、A5、A6、B7、D二、填空题1. 消费支出可支配收入2. 越大右上方3. 消费支出可支配收入4. 边际消费倾向5. 储蓄可支配收入6. 越多右上方7. 平均储蓄倾向8. 储蓄增量与可支配收入增量之比9. 同反10.自发投资三、名词解释1、消费函数现代西方经济学所谓的消费函数是指消费与决定消费的各种因素之间的依存关系但凯恩斯理论假定在影响消费的各种因素中收入是消费的唯一的决定因素收入的变化决定消费的变化随着收入的增加消费也会增加但是消费的增加不及收入的增加多收入和消费两个经济变量之间的这种关系叫做消费函数或消费倾向2、储蓄函数储蓄与决定储蓄的各种因素之间的依存关系是现代西方经济学的基本分析工具之一由于在研究国民收入决定时假定储蓄只受收入的影响故储蓄函数又可定义为储蓄与收入之间的依存关系四、计算题(1)在C=120+0.75y中令C=1120得y=1333(2)从消费函数知MPC=0.75从而MPS=0.25(3)在C=120+0.75y中令y=3000得C=2370第三章国民收入的变化一、单项选择题1、B2、B3、C4、D5、A6、C7、D8、B9、B二、多项选择题1.AC三、填空题1. 消费支出投资政府支出出口2. 储蓄政府税收进口3. 投资的增加所引起的国民收入增加的倍数1/(1-MPC)4. 具有5. 越大6. 增加支出减少税收增加同量的支出和税收7. 1(1-MPC)MPC/(1-MPC)8. 平衡预算9. 为了达到充分就业的国民收入总支出曲线向上移动的距离10. 为了消除通货膨胀总支出曲线向下移动的距离四、计算题1、(1)由Y=C+I0得Y=8000(亿元)从而C=6500(亿元)S=1500(亿元)I=1500(亿元)(2)因为△I=250(亿元)K=1/(1-MPC)=1/(1-0.75)=4所以△Y=K*△I=4*250=1000(亿元)于是在新的均衡下收入为8000+1000=9000(亿元)相应地C=7250(亿元)S=1750(亿元)(3)若消费函数斜率增大即MPC增大则乘数亦增大反之相反2、(1)可支配收入:Yd=Y-Tn=Y-50消费C=30+0.8(Y-50)=30+0.8Y-40=0.8Y-10均衡收入:Y=C+I+G=0.8Y-10+60+50+50-0.05Y=0.75Y+150得Y=150/0.25 =600......均衡收入(2)净出口余额:NX=50-0.05Y =50-0.05×600=20(3)KI=1/(1-0.8+0.05)宏观经济学习题参考答案(部分)=4(4)投资从60增加到70时Y=C+I+G+NX=0.8Y-10+70+50+50-0.05Y=0.75Y+160 160得Y =150/0.25 =640......均衡收入净出口余额:NX=50-0.05Y=50-0.05×640=50-32=18(5)当净出口函数从NX=50-0.05Y变为X=40-0.05Y时的均衡收入:Y=C+I+G+X=0.8Y-10+60+50+40-0.05Y=0.75Y+140得Y=140/0.25 =560......均衡收入净出口余额NX=40-0.05Y=40-0.05×560=40-28=12(6)自发投资增加10使均衡收入增加40(640-600=40)自发净出口减少10(从NX=50-0.05Y变为NX=40-0.05Y)使均衡收入减少额也是40(600-560=40)然而自发净出口变化对净出口余额的影响更大一些自发投资增加10时净出口余额只减少2(20-18=2)而自发净出口减少10时净出口余额减少8(20-12=8)五、论述题乘数也叫倍数宏观经济学中所运用的乘数是指国民收入函数中由于某个自变量的变化而引起的国民收入的变化投资乘数是指投资量变化数与国民收入变化数的比率它表明投资的变动将会引起国民收入若干倍的变动投资之所以具有乘数作用是因为各经济部门是相互关联的某一部门的一笔投资不仅会增加本部门的收入而且会在国民经济各部门引起连锁反应从而增加其他部门的投资与收入最终使国民收入成倍增长发挥投资乘数作用有三个前提条件:(1)在消费函数或储蓄函数为即定的条件下一定的投资可以引起收入的某种程度的增加即投资的乘数作用可以相当顺利地发挥出来(2)要有一定数量的劳动力可以被利用(3)要有一定数量的存货可以被利用第四章宏观财政政策一、单项选择题1、A2、D3、C4、A5、B6、B7、A8、A9、B 10、A二、填空题1. 通货紧缩通货膨胀2. 财政支出财政收入3. 政府通过改变支出来影响国民收入水平4. 财政收入政策5. 累进的税收制度福利社会支出制度厂商和居民的储蓄6. 增加抑制减少阻碍7. 增加扩张减少收缩8. 直接税间接税公司收入税9. 赤字10. 当政府用增税的方法来偿还债务时人们为了逃避高税率而减少工作时间第五章货币的需求和供给一、填空题1. 人们普遍接受的交换媒介2. 交换媒介计算单位价值储蓄延期支付的手段3. 把货币留在手中的偏好4. 交易预防投机交易余额预防余额投机宏观经济学习题参考答案(部分)余额5. 国民收入利息率6. 作为货币单位的基础的商品7. 货币供给量8. 纸币硬币9. 商业银行的活期存款10. 通货活期存款M1-A 可转让的提款单ATS第六章货币对经济的影响一、填空题1. 货币需求货币供给2. 货币需求量利息率右下方3. 垂直4. 利息率5. 向右下降6. 投资支出利息率右下方7. 货币需求量对利息率变化反映的敏感程度8. 投资的利息弹性9. 货币数量的增加已不能降低利息率10. 价格水平货币数量二、单项选择题1、B2、C3、A4、D5、B6、D7、A8、D9、C第七章宏观货币政策一、单项选择题1、D2、B3、D4、C5、D6、A7、A8、C二、多项选择题1、ABC2、AC三、简答题1、中央银行的主要货币政策工具是:公开市场活动准备金要求以及贴现率2、中央银行的两种主要负债是:中央银行发行的、在流通中的通币以及商业银行在中央银行的存款3、持有货币的三种主要动机是:交易动机预防动机以及投机动机4、有许多货币的组成部分并不支付利息例如通货和活期存款利率是持有货币的机会成本持有货币没有支付利息但放弃了用于其他金融资产时所能得到的利息收入当利息上升时持有货币的成本就增加了因此人们就要减少自己的货币持有量并用货币去购买其它金融资产以便获得更高的利率四、计算题(1)货币乘数时货币供给量(M)与货币基础(MB)的比率:mm=M/MB=5000亿/2022年亿=2.5(2)可以计算a=C/D,b=R/D并用第一题的公式计算货币乘数:a=C/D=1000亿/5000亿=0.2b=R/D=500亿/5000亿=0.1mm= 1+a/a+b = 1+0.2/0.2+0.1 = 1.2/0.3 = 4(3)题中已经给出b=R/D=0.1,但仍需计算a=C/D.从题中可以知道C的值但不知道D的值我们可以根据已知的b和R计算出D=R/b因此D=R/b=500亿/0.1=5000亿a=C/D=1500/5000=0.3mm=1+a/a+b=1+0.3/0.3+0.1=1.3/0.4=3第八章国民收入和货币的均衡一、单项选择题1、A2、A3、B4、C5、A6、A7、C8、D9、C二、多项选择题1、ABD三、名词解释:1、IS曲线--在产品市场达到均衡时收入和利率的各种组合的点的轨迹在两部门经济中IS曲线的数学表达式为I(r)=S(Y)它的斜率为负这表明IS曲线一般是一条向右下方倾斜的曲线一般来说在产品市场上位于IS曲线右方的收入宏观经济学习题参考答案(部分)和利率的组合都是投资小于储蓄的非均衡组合;位于IS曲线左方的收入和利率的组合都是投资大于储蓄的非均衡组合只位于IS曲线上的收入和利率的组合才是投资等于储蓄的均衡组合2、LM曲线--表示货币市场中货币供给等于货币需求时收入与利率的各种组合的点的轨迹LM曲线的数学表达式为M/P=ky-hr 它的斜率为正这表明LM曲线一般是向右上方倾斜的曲线一般说来在货币市场上位于LM曲线右方的收入和利率的组合都是货币需求大于货币供给的非均衡组合位于LM曲线左方的收入和利率的组合都是货币需求小于货币供给的非均衡组合只有位于LM曲线上的收入和利率的组合才是货币需求等于货币供给的均衡组合3、凯恩斯陷阱--又称流动偏好陷阱或流动性陷阱指由于流动偏好的作用利息不再随货币供给量的增加而降低的情况西方经济学认为利息是人们在一定时期内放弃流动偏好的报酬利息率的高低取决于货币的供求流动偏好代表了货币的需求货币数量代表了货币的供给货币数量的多少由中央银行的政策决定货币数量的增加在一定程度上可以降低利息率但是由于流动偏好的作用低于这一点人们就不肯储蓄宁肯把货币保留在手中四、简答题1、计划的总支出是包括自发支出与引致支出在IS-LM模型分析中自发支出取决于利率引致支出取决于实际国民生产总值所以只有当利率与实际国民生产总值为某一特定值的结合时所决定的计划的总支出才能与实际国民生产总值相等从而实现物品市场的均衡2、极端的凯恩斯主义者认为当存在流动性陷阱时人们在即定的利率时愿意持有任何数量的货币所以LM曲线为一条水平线自发支出的增加使IS曲线向右方移动实际国民生产总值增加而利率不变由于财政政策所引起的自发支出增加不会引起利率上升所以也就没有挤出效应财政政策的作用最大而且流动陷阱的情况在现实中是存在的第九章国民收入和价格水平的均衡一、单项选择题1、B2、A3、A4、B5、B6、C7、C8、A9、D第十章失业和通货膨胀一、单项选择题1、A2、B3、B4、B5、B6、D7、B二、多项选择题1、ACE2、ABC3、AC4、AB三、简答题:滞胀(或译停止膨胀)就是实际国民生产总值增长率停滞(不增长甚至下降)与通货膨胀率加剧并存的状况第十一章经济周期一、单项选择题1、C2、B3、B4、B5、A6、A7、C8、A9、A第十二、十三章经济的增长和发展一、单项选择宏观经济学习题参考答案(部分)题1、B2、A3、C4、C5、B6、B7、A8、C9、C 10、A11、D 12、C 13、D 14、A 15、B16、A 17、B 18、D二、简答题1、人均生产函数表明了在技术为既定的情况下人均产量如何随人均存量增加而增加如果资本积累率提高那么人均资本存量也就更迅速地提高这就意味着人均产量迅速增长即更高的增长率可以用沿着人均生产函数的变动来说明这一点2、有几种方法可以克服经济增长的障碍其中已被证明最成功的一种是较为自由的国际贸易的扩大香港、新加坡等国家或地区通过生产自己具有比较优势的产品迅速地增加了人均收入获得国际贸易的好处3、在哈罗德- 多马模型G= S/V 中V=4G=7%从而S=G?V=7%×4=28%三、论述题1、英国经济学家哈罗德、美国经济学家多马把凯恩斯理论的短期比较静态分析扩展为长期动态分析在凯恩斯就业理论的基础上分别建立了自己的增长模型由于二者基本内容大致相同通称为哈罗德-多马模型(1)哈罗德模型哈罗德指出凯恩斯收入均衡论的局限性认为要保证经济长期均衡增长必须要求投资保持一定的增长率为分析实现经济稳定增长的均衡条件哈罗德建立了经济增长模型假设条件有:①全社会只生产一种产品不用于消费部分都用于投资②储蓄倾向不变储蓄由收入水平决定③社会生产中只有劳动和资本两种生产要素两种要素的比例不变而且每单位产品消耗的生产要素也不变④技术水平不变边际资本系数等于平均资本系数即资本产量比率不变⑤资本和劳动的边际生产率递减(2)多马模型投资两重性:一方面投资增加有效需求和国民收入即扩大了需求另一方面投资还增加了资本存量和生产能力即扩大了供给多马认为:通过增加投资解决失业问题就必须在下一时期增加更多的支出(需求)才能保证新增加的资本存量及其潜在的生产能力得到充分利用(3)哈罗德-多马模型的理论观点把哈罗德-模型和多马模型合在一起从哈罗德-多马模型出发可得出以下三个观点①经济稳定增长的条件当一定得合意储蓄率与合意得资本-产量比率决定的经济增长率是有保障的增长率时社会经济就能够实现稳定增长②短期经济波动的原因如果实际增长率与有保障的增长率不相等就会引起经济波动实际增长率和有保证的增长率一致是很少见的、偶然的所以社会经济必然要出现波动在收缩和扩张的交替中发展③经济长期波动的原因有保证的增长率和自然增长率之间的关系变化成为经济社会长期波动的原因宏观经济学习题参考答案(部分)(4)哈罗德-多马模型的理论基础是凯恩斯主义理论它不仅在理论上是投资等于储蓄这一公式的长期化与动态化而且在分析中也沿用了凯恩斯主义的某些脱离现实的抽象心理概念例如对经济增长具有重要作用的有保证的增长率是资本家感到满意并准备继续下去的增长率这里所强调的仍然是资本家的心理预测即凯恩斯所说的资本边际效率这样就和凯恩斯同样把资本家的乐观或悲观的情绪扩大为决定经济发展的因素哈罗德-多马模型关于短期与长期经济波动的分析和其他经济周期理论一样否认了波动的根本原因--资本主义社会的基本矛盾用一些抽象的技术经济关系来说明经济波动的产生哈罗德虽然也承认资本主义社会经济波动的必然性但他仍然相信资本主义是可以实现稳定的长期增长的他的整个分析正是为实现这种稳定增长而出谋划策当然对哈罗德-多马模型如果加以改造或使用不同的解释也可以为我们所借鉴例如把哈罗德-多马模型的储蓄率(s)解释为积累率把产量-资本之比(1/c)解释为投资的经济效果即每单位增加的可以造成的产量的增加那么该模型的公式即可变为国民收入增长率=积累率×投资的经济效果或G= s 1/c式中:投资的经济效果为资本-产出之比的倒数至少在理论上它的数值式可能被事先估算出来的在已知投资经济效果的情况下哈罗德-多马模型可以被认为是表明国民收入增长率和积累率之间的数量关系的公式。

宏观经济学第六版课后习题答案解析(高鸿业版)

第十二章国民收入核算1.宏观经济学和微观经济学有什么联系和区别?为什么有些经济活动从微观看是合理的,有效的,而从宏观看却是不合理的,无效的?解答:两者之间的区别在于:(1)研究的对象不同。

微观经济学研究组成整体经济的单个经济主体的最优化行为,而宏观经济学研究一国整体经济的运行规律和宏观经济政策。

(2)解决的问题不同。

微观经济学要解决资源配置问题,而宏观经济学要解决资源利用问题。

(3)中心理论不同。

微观经济学的中心理论是价格理论,所有的分析都是围绕价格机制的运行展开的,而宏观经济学的中心理论是国民收入(产出)理论,所有的分析都是围绕国民收入(产出)的决定展开的。

(4)研究方法不同。

微观经济学采用的是个量分析方法,而宏观经济学采用的是总量分析方法。

两者之间的联系主要表现在:(1)相互补充。

经济学研究的目的是实现社会经济福利的最大化。

为此,既要实现资源的最优配置,又要实现资源的充分利用。

微观经济学是在假设资源得到充分利用的前提下研究资源如何实现最优配置的问题,而宏观经济学是在假设资源已经实现最优配置的前提下研究如何充分利用这些资源。

它们共同构成经济学的基本框架。

(2)微观经济学和宏观经济学都以实证分析作为主要的分析和研究方法。

(3)微观经济学是宏观经济学的基础。

当代宏观经济学越来越重视微观基础的研究,即将宏观经济分析建立在微观经济主体行为分析的基础上。

由于微观经济学和宏观经济学分析问题的角度不同,分析方法也不同,因此有些经济活动从微观看是合理的、有效的,而从宏观看是不合理的、无效的。

例如,在经济生活中,某个厂商降低工资,从该企业的角度看,成本低了,市场竞争力强了,但是如果所有厂商都降低工资,则上面降低工资的那个厂商的竞争力就不会增强,而且职工整体工资收入降低以后,整个社会的消费以及有效需求也会降低。

同样,一个人或者一个家庭实行节约,可以增加家庭财富,但是如果大家都节约,社会需求就会降低,生产和就业就会受到影响。

宏观经济学 布兰查德第六版 第6章劳动力市场

对于给定的z和m,能得到均衡 1 F (u n , z ) 的实际工资和失业率Un, 1 m

说明

• 换句话说,自然失业率为工资制定关系所选的实际工资 与价格制定关系导出的实际工资相等时的失业率。

• 当劳动力市场均衡时的实际工资被称为均衡实际工资; 此时的失业率被称为均衡失业率(Un),即自然失业率。

6.2 失业变动

• 失业率更高时对工人福利的影响(121)

6.3 工资决定与价格决定

• 一、工资决定 (价格给定时工资的决定) • 二、价格决定 (工资给定时价格的决定)

一、工资决定

问题引入:

• 现实中,制定工资的方式有: –厂商与工会谈判确定;——集体谈判 –厂商与雇员商议确定;——单独谈判 –厂商单方面决定。——垄断势力 事实:工人拿到的工资总是超过其保留工资。 原因: 工人一方:有一定的谈判能力;

依据前面推导的失业率、就业和产出的关系,可以得到 自然产出水平: Yn 1

L 1 m

自然产出水平是在相应的失业率下,使得工资制定关系选择的 实际工资等于价格制定关系导出的实际工资。130 •思考:本章的工资制定关系与劳动力供求关系有什么联系?

小结

• 假设Pe = P,则:WS推出的实际工资为失业率的减函 数;PS推出的实际工资为常数。 • 劳动力市场均衡要求WS与PS选择的实际工资相等。这 一条件决定了均衡失业率,该失业率就是自然失业率, 与其相联系的就是自然就业水平与自然产出水平。

思考:当企业通过逐步提高产出来对需 求做出反应时,会发生什么情况?

产出

要求

就业

导致

失业率

施加

产品价格

要求

迫使

产出成本

增加

工资压力

工资

宏观经济学课后习题及答案

宏观经济学课后习题及答案复习与思考题:1.名词解释宏观经济学实证分析规范分析存量分析流量分析事前变量分析事后变量分析2.宏观经济学的研究对象是什么?主要研究哪些问题?3.宏观经济学的研究方法主要有哪些?4.请谈谈宏观经济学和微观经济学的联系与区别?参考答案2.答:宏观经济学以整个国民经济作为研究对象,它考察总体经济的运行状况、发展趋势和内部各个组成部分之间的相互关系。

它涉及到经济中商品与劳务的总产量与收入、通货膨胀和失业率、国际收支和汇率、长期的经济增长和短期的经济波动等现象,揭示这些经济现象产生的原因及其相互关系。

3.答:实证分析方法与规范分析法、总量分析法、均衡分析与非均衡分析、事前变量分析与事后变量分析、存量分析与流量分析、即期分析与跨时期分析、静态、比较静态与动态分析、经济模型分析法。

4.答:参考第二节。

(撰稿:刘天祥)本章习题一、概念题国内生产总值、国民生产总值、国内生产净值、国民收入、个人可支配收入、名义GDP、实际GDP、GDP折算指数二、单项选择题1. 下列产品中不属于中间产品的是()A. 某造船厂购进的钢材B. 某造船厂购进的厂房C. 某面包店购进的面粉D. 某服装厂购进的棉布2. 在一个四部门经济模型中,GNP=()。

A. 消费十净投资十政府购买十净出口B. 消费十总投资十政府购买十净出口C. 消费十净投资十政府购买十总出口D. 消费十总投资十政府购买十总出口3. 下列各项中,属于要素收入的是()A. 企业间接税B. 政府的农产品补贴C. 公司利润税D. 政府企业盈余4. 经济学的投资是指()。

A. 企业增加一笔存货B. 建造一座厂房C. 购买一台机器D. 以上都是5. 已知在第一年名义GNP为500,如到第六年GNP核价指数增加一倍,实际产出上升40%,则第六年的名义GNP为()。

A. 2022年B. 1400C. 1000D. 750三、判断题1. 农民生产并用于自己消费的粮食不应计入GNP。

Removed_曼昆《宏观经济学》(第6、7版)课后习题详解(第6章 失 业 )51

曼昆《宏观经济学》(第6、7版)第6章失业课后习题详解跨考网独家整理最全经济学考研真题,经济学考研课后习题解析资料库,您可以在这里查阅历年经济学考研真题,经济学考研课后习题,经济学考研参考书等内容,更有跨考考研历年辅导的经济学学哥学姐的经济学考研经验,从前辈中获得的经验对初学者来说是宝贵的财富,这或许能帮你少走弯路,躲开一些陷阱。

以下内容为跨考网独家整理,如您还需更多考研资料,可选择经济学一对一在线咨询进行咨询。

一、概念题1.自然失业率(natural rate of unemployment)答:自然失业率又称“有保证的失业率”、“正常失业率”、“充分就业失业率”等,它是经济围绕其波动的平均失业率,是经济在长期中趋近的失业率,是充分就业时仍然保持的失业水平。

自然失业率是在没有货币因素干扰的情况下,让劳动市场和商品市场自发供求力量起作用时,总供给和总需求处于均衡状态时的失业率。

“没有货币因素干扰”是指失业率的高低与通货膨胀率的高低之间不存在替代关系。

自然失业率决定于经济中的结构性和摩擦性的因素,取决于劳动市场的组织状况、人口组成、失业者寻找工作的能力愿望、现有工作的类型、经济结构的变动、新加入劳动者队伍的人数等众多因素。

任何把失业降低到自然失业率以下的企图都将造成加速的通货膨胀。

任何时候都存在着与实际工资率结构相适应的自然失业率。

自然失业率是弗里德曼对菲利普斯曲线发展的一种观点,他将长期的均衡失业率称为“自然失业率”,它可以和任何通货膨胀水平相对应,且不受其影响。

2.摩擦性失业(frictional unemployment)答:摩擦性失业指劳动力市场运行机制不完善或者因为经济变动过程中的工作转换而产生的失业。

摩擦性失业是劳动力在正常流动过程中所产生的失业。

在一个动态经济中,各行业、各部门和各地区之间劳动需求的变动是经常发生的。

即使在充分就业状态下,由于人们从学校毕业或搬到新城市而要寻找工作,总是会有一些人的周转。

宏观经济学第六版课后习题答案解析(高鸿业版)

第十二章国民收入核算1.宏观经济学和微观经济学有什么联系和区别?为什么有些经济活动从微观看是合理的,有效的,而从宏观看却是不合理的,无效的?解答:两者之间的区别在于:(1)研究的对象不同。

微观经济学研究组成整体经济的单个经济主体的最优化行为,而宏观经济学研究一国整体经济的运行规律和宏观经济政策。

(2)解决的问题不同。

微观经济学要解决资源配置问题,而宏观经济学要解决资源利用问题。

(3)中心理论不同。

微观经济学的中心理论是价格理论,所有的分析都是围绕价格机制的运行展开的,而宏观经济学的中心理论是国民收入(产出)理论,所有的分析都是围绕国民收入(产出)的决定展开的。

(4)研究方法不同。

微观经济学采用的是个量分析方法,而宏观经济学采用的是总量分析方法。

两者之间的联系主要表现在:(1)相互补充。

经济学研究的目的是实现社会经济福利的最大化。

为此,既要实现资源的最优配置,又要实现资源的充分利用。

微观经济学是在假设资源得到充分利用的前提下研究资源如何实现最优配置的问题,而宏观经济学是在假设资源已经实现最优配置的前提下研究如何充分利用这些资源。

它们共同构成经济学的基本框架。

(2)微观经济学和宏观经济学都以实证分析作为主要的分析和研究方法。

(3)微观经济学是宏观经济学的基础。

当代宏观经济学越来越重视微观基础的研究,即将宏观经济分析建立在微观经济主体行为分析的基础上。

由于微观经济学和宏观经济学分析问题的角度不同,分析方法也不同,因此有些经济活动从微观看是合理的、有效的,而从宏观看是不合理的、无效的。

例如,在经济生活中,某个厂商降低工资,从该企业的角度看,成本低了,市场竞争力强了,但是如果所有厂商都降低工资,则上面降低工资的那个厂商的竞争力就不会增强,而且职工整体工资收入降低以后,整个社会的消费以及有效需求也会降低。

同样,一个人或者一个家庭实行节约,可以增加家庭财富,但是如果大家都节约,社会需求就会降低,生产和就业就会受到影响。

《宏观经济学》课后答案(布兰查德版)

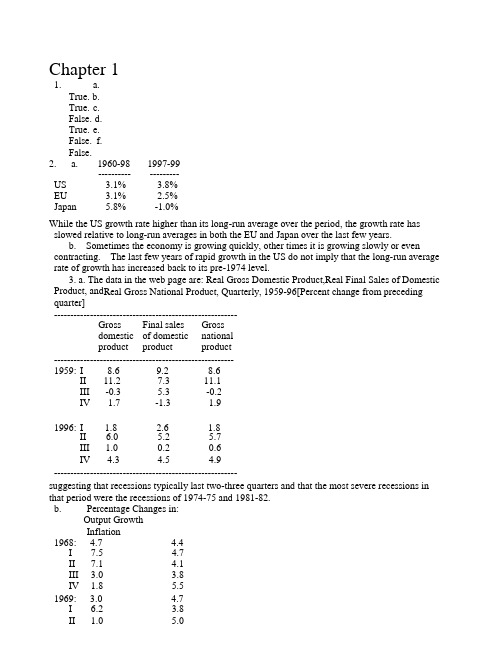

Chapter 11. a.True. b.True. c.False. d.True. e.False. f.False.2. a. 1960-98 1997-99-------------------US 3.1% 3.8%EU 3.1% 2.5%Japan 5.8%-1.0%While the US growth rate higher than its long-run average over the period, the growth rate has slowed relative to long-run averages in both the EU and Japan over the last few years.b. Sometimes the economy is growing quickly, other times it is growing slowly or even contracting. The last few years of rapid growth in the US do not imply that the long-run average rate of growth has increased back to its pre-1974 level.3. a. The data in the web page are: Real Gross Domestic Product,Real Final Sales of Domestic Product, and Real Gross National Product, Quarterly, 1959-96[Percent change from preceding quarter]--------------------------------------------------------Gross Final sales Grossdomestic of domestic nationalproduct product product-------------------------------------------------------1959: I 8.6 9.2 8.6II11.27.311.1III-0.3 5.3-0.2IV 1.7-1.3 1.91996: I 1.8 2.6 1.8II 6.0 5.2 5.7III 1.00.20.6IV 4.3 4.5 4.9--------------------------------------------------------suggesting that recessions typically last two-three quarters and that the most severe recessions in that period were the recessions of 1974-75 and 1981-82.b. Percentage Changes in:Output GrowthInflation1968: 4.7 4.4I7.5 4.7II7.1 4.1III 3.0 3.8IV 1.8 5.51969: 3.0 4.7I 6.2 3.8II 1.0 5.0III 2.3 5.8IV-2.0 5.11970: 0.1 5.3I-0.7 6.0II0.6 5.7III 3.7 3.4IV-3.9 5.41971: 3.3 5.2I11.3 6.4II 2.3 5.5III 2.6 4.4IV 1.1 3.3If history simply repeats itself, the United States might have a short recession (lasting perhaps oneyear) accompanied by an acceleration in the rate of inflation by about one percentage point.4. a. Banking services, business services.b. Not only has the relative demand for skilled workers increased but the industries wherethis effect is the strongest are making up a greater fraction of the economy.5. 1. Low unemployment might lead to an increase in inflation.2. Although measurement error certainly contributes to the measured slowdown ingrowth, there are other issues to consider as well, including the productivity of newresearch and accumulation of new capital.3. Although labor market rigidities may be important, it is also important to consider thatthese rigidities may not be excessive, and that high unemployment may arise from flawed macroeconomic policies.4. Although there were serious problems with regard to the management of Asian financial systems, it is important to consider the possibility that the flight of foreign capital from thesecountries worsened the situation by causing a severe stock market crash and exchange rate depreciation.5. Although the Euro will remove obstacles to free trade between European countries,each country will be forced to give up its own monetary policy.* 6. a. From Chapter 1: US output 1997=$8b; Ch ina output 1996=$.84b. Note that China’s outputin 1997 is $(.84)*(1.09) b. Equating output for some time t in the future:8*(1.03)t=(.84*1.09)*(1.09)t8/(.84*1.09)=(1.09/1.03)t8.737=(1.058)tt =ln(8.737)/ln(1.058) H38yrsb. From Chapter 1: US output/worker in 1997=$29,800; China output/per worker in1996=$70029.8*(1.03)t=(.7*1.09)*(1.09)tt H65 yearsChapter 21. a. False.b. Uncertain: real or nominalGDP. c. True.d. True.e. False. The level of the CPI means nothing. Its rate of change tells us about inflation.f. Uncertain. Which index is better depends on what we are trying to measure—inflationfacedby consumers or by the economy as a whole.2. a. +$100; Personal ConsumptionExpenditures b. nochange:intermediategoodc. +$200 million; Gross PrivateDomesticFixedInvestmentd. +$200 million; Net Exportse. no change: the jet was already counted when it was produced, i.e., presumably whenDelta(or some other airline) bought it new as an investment.*3. a. Measured GDP increases by $10+$12=$22.b. True GDP should increase by much less than $22 because by working for an extra hour,you are no longer producing the work of cooking within the house. Since cooking within the house is a final service, it should count as part of GDP. Unfortunately, it is hard to measure the value of work within the home, which is why measured GDP does not include it.4. a. $1,000,000 the value of the silver necklaces.b. 1st Stage:$300,000.2ndStage:$1,000,00-$300,000=$700,000.GDP: $300,000+$700,000=$1,000,000.c. Wages: $200,000 + $250,000=$450,000.Profits: ($300,000-$200,000)+($1,000,000-$250,000-300,000)=$100,000+$450,000=$550,000.GDP:$450,000+$550,000=$1,000,000.5. a. 1998 GDP: 10*$2,000+4*$1,000+1000*$1=$25,0001999 GDP: 12*$3,000+6*$500+1000*$1=$40,000Nominal GDP has increased by 60%.b. 1998 real (1998) GDP: $25,0001999 real (1998) GDP: 12*$2,000+6*$1,000+1000*$1=$31,000Real (1998) GDP has increased by 24%.c. 1998 real (1999) GDP: 10*$3,000+4*$500+1,000*$1=$33,0001999 real (1999) GDP: $40,000.Real (1999) GDP has increased by 21.2%.d. True.6. a. 1998 base year:Deflator(1998)=1; Deflator(1999)=$40,000/$31,000=1.29Inflation=29%b. 1999 base year:Deflator(1998)=$25,000/$33,000=0.76; Deflator(1999)=1Inflation=(1-0.76)/0.76=.32=32% c. Yes7. a. 1998 real GDP = 10*$2,500 + 4*$750 + 1000*$1 = $29,0001999 real GDP = 12*$2,500 + 6*$750 + 1000*$1 = $35,500b. (35,500-29,000)/29,000 = .224 = 22.4%c. Deflator in 1998=$25,000/$29,000=.86Deflator in 1999=$40,000/$35,500=1.13Inflation = (1.13 -.86)/.86 = .314 = 31.4%.8. a. The quality of a routine checkup improves over time. Checkups now may includeEKGs, for example. Medical services are particularly affected by this problem due toconstant improvements in medical technology.b. You need to know how the market values pregnancy checkups with and withoutultra-sounds in that year.c. This information is not available since all doctors adopted the new technologysimultaneously. Still, you can tell that the quality adjusted increase will be lower than20%.*9. a. approximately 2.5% b. 1992 real GDP growth: 2.7%;unemployment rate Jan 92: 7.3%; unemployment rate Jan 93: 7.3%Supports Okun's law because the unemployment rate does not change when the growth rate of real GDP is near 2.5% c. -2 percentage points change in the unemployment rate; 5percent GDP growth d. The growth rate of GDP must increase by 2.5 percentage points.Chapter 31. a. True.b. False. Government spending was 18% if GDP without transfers.c. False. The propensity to consume must be less than one for our model to be welldefined.d.True.false.f. False. The increase in output is one times the multiplier.2. a. Y=160+0.6*(Y-100)+150+150 0.4Y=460-60 Y=1000b. Y D=Y-T=1000-100=900c. C=160+0.6*(900)=7003. a. No. The goods market is not in equilibrium. Frompart 2a, Demand=1000=C+I+G=700+150+150b. Yes. The goods market is in equilibrium.c. No. Private saving=Y-C-T=200. Public saving =T-G=-50. National saving (or inshort, saving) equals private plus public saving, or 150. National saving equalsinvestment.4. a. Roughly consistent. C/Y=700/1000=70%; I/Y=G/Y=150/1000=15%.b. Approximately -2%.c. Y needs to fall by 2%, or from 1000 to 980. The parameter c0needs to fall by20/multiplier,or by 20*(.4)=8. So c0needs to fall from 160 to 152.d. The change in c0(-8) is less than the change in GDP (-20) due to the multiplier.5. a. Y increases by 1/(1-c1) b. Y decreases by c1/(1- c1)c. The answers differ because spending affects demand directly, but taxes affectdemand through consumption, and the propensity to consume is less than one.d. The change in Y equals 1/(1-c1) - c1/(1- c1) = 1. Balanced budget changes in G and Tare not macroeconomically neutral.e. The propensity to consume has no effect because the balanced budget tax increase abortsthe multiplier process. Y and T both increase by on unit, so disposable income, and hence consumption, do not change.*6. a. The tax rate ilessthanone.b.Y=c0+c1Y D+I+G impliesY=[1/(1-c1+c1t1)]*[c0-c1t0+I+G]c. The multiplier = 1/(1-c1+c1t1) <1/(1- c1), so the economy responds less to changes inautonomous spending when t1is positive.d. Because of the automatic effect of taxes on the economy, the economy responds less tochanges in autonomous spending than in the case where taxes are independent of income. So output tends to vary less, and fiscal policy is called an automatic stabilizer.*7. a. Y=[1/(1-c1+c1t1)]*[c0-c1t0+I+G] b. T = c1t0+ t1*[1/(1-c1+c1t1)]*[c0-c1t0+I+G]c. Both Y and T decrease.d. If G is cut, Y decreases even more.Chapter 41.a.True.b.Fals.c.True.d.True.e.False.f.False.g.True.2. a. i=0.05: Money demand = $18,000; Bond demand = $32,000i=.1: Money demand = $15,000; Bond demand = $35,000b. Money demand decreases when the interest rate increases; bond demand increases. Thisis consistent with the text.c. The demand for money falls by 50%. d. The demand formoney falls by 50%.e. A 1% increase (decrease) in income leads to a 1% increase (decrease) in money demand.This effect is independent of the interest rate.3. a. i=100/$P B–1; i=33%; 18%; 5% when $P B=$75; $85; $95.b. Negative.c. $P B=100/(1.08) $934. a. $20=M D=$100*(.25-i) i=5%b. M=$100*(.25-.15)M=$105. a. B D= 50,000 - 60,000 (.35-i)An increase in the interest rate of 10% increases bond demand $6,000.b. An increase in wealth increases bond demand, but has no effect on money demand.c. An increase in income increases money demand, but decreases bond demand.d. When people earn more income, this does not change their wealth right away. Thus,they increase their demand for money and decrease their demand for bonds.6. a. Demand for high-powered money=0.1*$Y*(.8-4i)b. $100 b = 0.1*$5,000b*(.8-4i) i=15%c. M=(1/.1)*$100 b=$1,000 b M= M d at the interest derived in part b.6. d. If H increases to $300, falls to 5%.e. M=(1/.1)*$300 b=$3,000 b7. a. $16 is withdrawn on each trip to the bank.Money holdings—day one: $16; day two: $12; day three: $8; day four: $4.b. Average money holdings are $10.c. $8 dollar withdrawals; money holdings of $8; $4; $8; $4.d. Average money holdings are $6.e. $16 dollar withdrawals; money holdings of $0; $0; $0; $16.f. Average money holdings are $4.g. Based on these answers, ATMs and credit cards have reduced money demand.8. a. velocity=1/(M/$Y)=1/L(i)b. Velocity roughly doubled between the mid 1960s and the mid 1990s.c. ATMS and credit cards reduced L(i) so velocity increased.Chapter 51.a.Trub.Truc.Fal.d. False. The balanced budget multiplier is positive (it equals one), so the IS curve shiftsright.e. False.f. Uncertain. An increase in G leads to an increase in Y (which tends to increaseinvestment), but an increase in the interest rate (which tends to reduce investment).g. True.*2. Firms deciding how to use their own funds will compare the return on bonds to the return on investment. When the interest rate on bonds increases, they become more attractive, and firms are more likely to use their funds to purchase bonds, rather than to finance investment projects.a.Y=[1/(1-c1)]*[c0-c1T+I+G]The multiplier is 1/(1-c1).b. Y=[1/(1-c1-b1)]*[c0-c1T+ b0-b2i +G]The multiplier is 1/(1-c1-b1). Since the multiplier is larger than the multiplier in part a, the effect of a change in autonomous spending is bigger than in part a.c. Substituting for the interest rate in the answer to partb: Y=[1/(1-c1-b1+ b2d1/d2)]*[c0-c1T+ b0+(b2*M/P)/d2+G]The multiplier is 1/(1-c1-b1+ b2d1/d2).d. The multiplier is greater (less) than the multiplier in part a if (b1- b2d1/d2) is greater (less)than zero. The multiplier is big if b1is big, b2is small, d1is small, and/or d2is big, i.e., if investment is very sensitive to Y, investment is not very sensitive to i, money demand is not very sensitive to Y, money demand is very sensitive to i.4. a. The IS curve shifts left. Output and the interest rate fall. The effect on investmentis ambiguous because the output and interest rate effects work in opposite directions: the fall in output tends to reduce investment, but the fall in the interest rate tends to increase it.b. From 3c: Y=[1/(1-c1-b1)]*[c0-c1T+ b0-b2i +G]c. From the LM relation: i= Y*d1/d2–(M/P)/d2To obtain the equilibrium interest rate, substitute for Y from part b.d. I= b0+ b1Y- b2i= b0+ b1Y- b2Y* d1/d2+ b2(M/P)/d2To obtain equilibrium investment, substitute for Y from part b.e. Holding M/P constant, I increases with equilibrium output when b1>b2d1/d2.Since a decrease in G reduces output, the condition under which a decrease in G increases investment is b1<b2d1/d2.f. The interpretation of the condition in part e is that the effect on I from Y has to be lessthan the effect from i after controlling for the endogenous response of i and Y, determined by the slope of the LM curve, d1/d2.5. a. Y=C+I+G=200+.25*(Y-200)+150+.25Y-1000i+250Y=1100-2000ib.M/P=1600=2Y-8000i i=Y/4000-1/5c. Substituting b into a: Y=1000d. Substituting c into b: i=1/20=5%e. C=400; I=350; G=250; C+I+G=1000f. Y=1040; i=3%; C=410; I=380. A monetary expansion reduces the interest rate andincreases output. The increase in output increases consumption. The increase in output and the fall in the interest rate increase investment.g. Y=1200; i=10%; C=450; I=350. A fiscal expansion increases output and the interestrate. The increase in output increases consumption.h. The condition from problem 3 is satisfied with equality (.25=1000*(2/8000)), socontractionary fiscal policy will have no effect on investment. When G=100: i=0%;Y=800; I=350; and C=350.*6. a. The LM curve is flatb. Japan was experiencing a liquidity trap. c. Fiscal policy is more effective.7. a. Increase G (or reduce T) and increase M.b. Reduce G (or increase T) and increase M. The interest rate falls. Investment increases,since the interest rate falls while output remains constant.CHAPTER 61.a.Fals.b.Fals.c.Falsd.False.Truf.Falsg.Uncertaih.True.i. False.2. a. (Monthly hires+monthly separations)/monthly employment =6/93.8=6.4%b. 1.6/6.5=25%c. 2.4/6.5=37%. Duration is 1/.37 or 2.7 months.d. 4.9/57.3=9%.e. new workers: .35/4.9=7%; retirees: .2/4.9=4%.3. a and b. Answers will depend on when the page is accessed.c. The decline in unemployment does not equal the increase in employment, because thelabor force is not constant. It has increased over the period.4. a. 66%; 66%*66%*66%= 29%; (66%)6= 8%b. (66%)6= 8%c. (for 1998): 875/6210= .145. a. Answers will vary.b and c. Most likely, the job you will have ten years later will pay a lot more thanyour reservation wage at the time (relative to your typical first job).d. The later job is more likely to require training and will probably be a much harderjob to monitor. So, as efficiency wage theory suggests, your employer will be willing to pay a lot more than your reservation wage for the later job, to ensure low turnover and low shirking.6. a. The computer network administrator has more bargaining power. She is muchharder to replace.6. b. The rate of unemployment is a key statistic. For example, when there are manyunemployed workers it becomes easier for firms to find replacements. This reduces the bargaining power of workers.7. a. W/P=1/(1+ )=1/1.05=.95 b. Price setting: u=1-W/P=5%c. W/P=1/1.1=.91; u=1-.91=9%. The increase in the markup lowers the real wage.From the wage-setting equation, the unemployment rate must rise for the real wage to fall.So the natural rate increases.CHAPTER 71.a.Trub.Trc.Falsd.Fale.Truf.Falg.Fal2. a. IS right, AD right, AS up, LM up, Y same, i up, P upb. IS left, AD left, AS down, LM down, Y same, i down, P down3. a.WS PS AS AD LM IS Y i PShort run:up same up same up same down up upMedium run:up same up same up same down up upb.WS PS AS AD LM IS Y i PShort run:same up down same down same up down downMedium run:same up down same down same up down down4. a. After an increase in the level of the money supply, output and the interest-rate eventually return to the same level. However, monetary policy is useful, because it can accelerate the return to the natural level of output.b. In the medium run, investment and the interest rate both change with fiscal policy.c. False. Labor market policies, such as unemployment insurance, can affect the naturallevel of output.*5. a. Open answer. Firms may be so pessimistic about sales that they do not want to borrow at any interest rate.b. The IS curve is vertical; the interest rate does not affect equilibrium output.c. No change.d. The AD curve is vertical; the price level does not affect equilibrium output.e. The increase in z reduces the natural level of output and shifts the AS curve up. SincetheAD curve is vertical, output does not change, but prices increase. Note that output is above its natural level.f. The AS curve shifts up forever, and prices keep increasing forever. Output does notchange, and remains above its natural level forever.6. a. The natural level of output is Y n. Assuming that output starts at is naturallevel, P0= M0- (1/c)*Y nb. Assuming that P e=P0: Y = 2cM0-cP=2cM0-cP0-cdY+cdY nRecalling that Y n=c(M0-P0): Y= Y n+ (c/(1+c d))*M0c. Investment goes up because output is higher and the interest rate is lower.d. In the medium run, Y = Y ne. In the medium run, investment returns to its previous level, because output and the interestrate return to their previous levels.CHAPTER 81.a.Trb.Fac.Fad.Tre.Faf.Tr2. a. No. In the 1970s, we experienced high inflation and high unemployment. The expectations- augmented Phillips curve is a relationship between inflation and unemployment conditional on the natural rate and inflation expectations. Given inflation expectations,increases in the natural rate (which result from adverse shocks to labor market institutions—increases in z—or from increases in the markup—which encompass oil shocks) lead to an increase in both theunemployment rate and the inflation rate. In addition, increases in inflation expectations imply higher inflation for any level of unemployment and tend to increase the unemployment rate inthe short run (think of an increase in the expected price level, given last period’s price,in the AD-AS framework). In the 1970s, both the natural rate and expected inflation increased, so both unemployment and inflation were relatively high.b. No. The expectations-augmented Phillips curve implies that maintaining a rate ofunemployment below the natural rate requires increasing (not simply high) inflation. This is because inflation expectations continue to adjust to actual inflation.3. a. u n=0.1/2 =5%b. t=0.1-2*.03 = 4% every year beginning with year t.c. e= 0 and =4% forever. Inflation expectations will be forever wrong. This isunlikely.t td. ⎝ might increase because pe ople’s inflation expectations adapt to persistently positiveinflation. The increase in ⎝ has no effect on u n.e. 5= 4+.1-.06=4%+4%=8%For t>5, repeated substitution implies, t= 5+(t-5)*4%.So, 10=28%; 15=48%.f. Inflation expectations will again be forever wrong. This is unlikely.4. a. t= t-1+ 0.1 - 2u t= t-1+ 2%t=2%; t+1=4%; t+2=6%; t+3=8%.b. t=0.5 t+ 0.5 t-1+ 0.1 - 2u tor, t= t-1+ 4%4. c. t=4%; t+1=8%; t+2=12%; t+3=16%d. As indexation increases, low unemployment leads to a larger increase in inflation overtime.5. a. A higher cost of production means a higher markup.b. u n=(0.08+0.1⎧)/2; Thus, the natural rate of unemployment increases from 5% to 6% as⎧increases from 20% to 40%.6. a. Yes. The average rate of unemployment is down. In addition, the unemploymentrate is at a historical low and inflation has not risen.b. The natural rate of unemployment has probably decreased.7. An equation that seems to fit well is: t- t-1=6-u t, which implies a natural rate of approximately 6%.8. The relationships imply a lower natural rate in the more recent period. CHAPTER 91. F TT F FT TT2. a. The unemployment rate will increase by 1% per year when g=0.5%. Unemploymentwill increase unless the growth rate exceeds the sum of productivity growth and labor force growth.b. We need growth of 4.25% per year for each of the next four years.c. Okun’s law is likely to beco me: u t-u t-1=-0.4*(g yt-5%)3. a. u n= 5%b. g yt= 3%; g mt=g yt+ t= 11%c. u g yt g mtt-1:8%5%3%11%t:4%9%-7%-3%t+1:4%5%13%17%t+2:4%5%3%7%4. a. t- t-1= -(u t-.05)u t- u t-1= -.4*(g mt- t-.03)b. t=6.3%; u t=8.7%t+1=1%; u t+1=10.3%c. u=5%; g y=3%; =-3%;5. a. See text for full answer. Gradualism reduces need for large policy swings, with effectsthat are difficult to predict, but immediate reduction may be more credible and encourage rapid, favorable changes in inflation expectations. On the other hand, the staggering ofwagedecisions suggests that, if the policy is credible, a gradual disinflation is the optionconsistent with no change in the unemployment rate.b. Not clear, probably fast disinflation, depending on the features inc.5. c. Some important features: the degree of indexation, the nature of the wage-settingprocess, and the initial rate of inflation.*6. a. u n=K/2; sacrifice ratio=.5 b. t=10%; t+1=8%; t+2=6%; t+3=4%; t+4=2%c. 5 years; sacrifice ratio=(5 point years of excess unemployment)/(10 percentage pointreduction in inflation)=.5d. t=7.5%; t+1=4.125%; t+2=1.594%; 3 years of higher unemployment for a reduction of10%: sacrifice ratio=0.3 e. t+1f. Take measures to enhance credibility.7. a. Inflation will start increasing.b.It should let unemployment increase to its new, higher, natural rate.Chapter 101. TTTFFFTU2. a. Example: France: (1.042)48*5.150=$37.1 k.Germany: $43.4 k; Japan: $76.5 k; UK: $22.5 k; U.S.:$31.7k b. 2.4c. yes.3. a. $5,000b. 2,500 pesos c. $500d. $1,000e. Mexican standard of living relative to the U.S.—exchange rate method:1/10; PPP method: 1/54. a. Y=63b. Y doubles. c. Yes.d. Y/N=(K/N)1/2e. K/N=4 implies Y/N=2. K/N=8 implies Y/N=2.83. Output less than doubles.f. No.g. No. In part f, we are looking at what happens to output when we increasecapital only, not capital and labor in equal proportion. There are decreasing returns tocapital.h. Yes.5. The United States was making the most important technical advances. However, theother countries were able to make up much of their technological gap by importing thetechnologies developed in the United States, and hence, have higher technological progress.6.Convergence for the France, Belgium, and Italy; no convergence for the second set ofcountriesChapter 111. a. Uncertain. True if saving includes public and private saving. False if saving onlyincludes private saving.b. False.c.Uncert UTFFd2. a. No. (1) The Japanese rate of growth is not so high anymore. (2) If the Japanesesaving rate has always been high, then this cannot explain the difference between the rate of growth inJapan and the US in the last 40 or 50 years. (3) If the Japanese saving rate has been higher thanit used to be, then this can explain some of the high Japanese growth. The contribution of high saving to growth in Japan should, however, come to an end.3. After a decade: higher growth rate. After five decades: growth rate back to normal, higher level of output per worker.4. a. Higher saving. Higher output per workerb. Same output per worker. Higher output per capita.5.*YYYd. Y/N = (K/N)1/3e. In steady state, sf(K/N) = ™K/N, which, given the production function in part d,implies: K/N=(s/™)3/2f. Y/N =(s/™)1/2g. Y/N = 2h. Y/N = 21/26.* a. 1b. 1c. K/N=.35; Y/N=.71d. Using equation (11.3), the evolution of K/N is: 0.9, 0.82, 0.757. a. K/N=(s/(2™))2; Y/N=s/(4™) b. C/N=s(1-s)/(4™)c-e. Y/N increases with s; C/N increases until s=.5, then decreases. CHAPTER 121.TFTFTFTUF2. a. Lower growth in poorer countries. Higher growth in rich countries.b. Increase in R&D and in output growth.c. A decrease in the fertility of applied research; a (small) decrease in growth.d. A decrease in the appropriability of drug research. A drop in the development of newdrugs. Lower technological progress and lower growth.3. See discussion in section 12.2.4. Examples will vary. Weakening patent protection would accelerate diffusion, but mightalso discourage R&D.5. a. Year 1: 3000; Year 2: 3960b. Real GDP: 3300; output growth: 10%c. 20%d. Real GDP/Worker=30 in both years; productivity growth is zero.e. RealGDP:3990;outputgrowth:33%.f. -0.8%g. Proper measurement implies real gdp/worker=36.3 in year 2. With improper measurement, productivity growth would be 21 percentage points lower and inflation 21% points higher.6. a. Both lead to an initial decrease in growthb. Only the first leads to a permanent decrease in growth7. a. (K/(AN))*=(s/(™+g A+g N))2=1; (Y/(AN))*=(1)1/2; g Y/(AN)=0; g Y/N=4%; g Y=6%b. (K/(AN))=(4/5)2; (Y/(AN))*=(4/5); g Y/(AN)=0; g Y/N=8%; g Y=10%c. (K/(AN))=(4/5)2; (Y/(AN))*=(4/5); g Y/(AN)=0; g Y/N=4%; g Y=10%People are better off in case a. Given any set of initial values, the level of technology is the same in cases a and c, but the level of capital per effective worker is higher atevery point in time in case a. Thus, since Y/N=A*(Y/(AN))=A*(K/(AN))1/2, output per worker is always higher in case a.8. There is a slowdown in growth and the rate of technological progress in the modernperiod. Japan’s growth rate of technological progress is higher because it is catching upto the U.S. level of technology. Not all of the difference in growth rates of output per worker is attributable to the difference in rates of technological progress. A big part is attributable to the difference in rates of growth of capital per worker.9.* a. ProbablyaffectsA.Thinkofclimate.b.Affects H.c. Affects A. Strong protection tends to encourage more R&D but also to limit diffusion of technology.d. May affect A through diffusion.e. May affect K, H, and A. Lower tax rates increase the after-tax return on investment,and thus tend to lead to more accumulation of K and H and more R&D spending.f. If we interpret K as private capital, than infrastructure affects A—e.g., bettertransportation networks may make the economy more productive by reducing congestion time.g. Assuming no technological progress, lower population growth implies highersteady-state level of output per worker. Lower population growth leads to higher capital per worker. Ifthere is technological progress, there is no steady-state level of output per worker. In this case, however, lower population growth implies that output per worker will be higher at every point in time, for any given path of technology. See the answer to problem 7c.Chapter 131.FFTTTTTTF2. a. u=1-(1/(1+⎧))(A/A e)b. u=1-(1/(1+⎧))=4.8%c. No. Since wages adjust to expected productivity, an increase in productivityeventuallyleads to equiproportional increases in the real wage implied by wage setting and price setting, at the original natural rate of unemployment. So equilibrium can bemaintained without any change in the natural rate of unemployment.3.* a. P=P e(1+⎧)(A e/A)(Y/L)(1/A)b. AS shifts down. Given A e/A=1, an increase in A implies a fall in P, given Y. Thisoccurs because for a given level of Y, unemployment is higher, so wages are lower and so, in turn, is the price level.c. There is now an additional effect, a fall in A e/A. In effect, workers do not receive asmuchof an increase in wages as warranted by the increase in productivity. Compared to part b, nominal wages are lower, leading to a lower value of P given Y.4. Discussion question.5. a. Reduce the gap, if this leads to an increase in the relative supply of skilled workers.b. Reduce the gap, since it leads to a decrease in the relative supply of unskilled workers.c. Reduce the gap, since it leads to an increase in the relative supply of skilled workers.d. Increase the gap, if U.S. firms hire unskilled workers in Central America, since itreduces the relative demand for U.S. unskilled workers.6. a. Textiles production is moving to low wage countries.b. Possibly demographic changes, increased availability of child care outside the home,decline in labor supply for these positions.c. Technological progress.7. Discussion question.CHAPTER 14。

宏观经济学第六版课后习题答案(高鸿业版)

第十二章国民收入核算1.宏观经济学和微观经济学有什么联系和区别?为什么有些经济活动从微观看是合理的,有效的,而从宏观看却是不合理的,无效的?解答:两者之间的区别在于:(1)研究的对象不同。

微观经济学研究组成整体经济的单个经济主体的最优化行为,而宏观经济学研究一国整体经济的运行规律和宏观经济政策。

(2)解决的问题不同。

微观经济学要解决资源配置问题,而宏观经济学要解决资源利用问题。

(3)中心理论不同。

微观经济学的中心理论是价格理论,所有的分析都是围绕价格机制的运行展开的,而宏观经济学的中心理论是国民收入(产出)理论,所有的分析都是围绕国民收入(产出)的决定展开的。

(4)研究方法不同。

微观经济学采用的是个量分析方法,而宏观经济学采用的是总量分析方法。

两者之间的联系主要表现在:(1)相互补充。

经济学研究的目的是实现社会经济福利的最大化。

为此,既要实现资源的最优配置,又要实现资源的充分利用。

微观经济学是在假设资源得到充分利用的前提下研究资源如何实现最优配置的问题,而宏观经济学是在假设资源已经实现最优配置的前提下研究如何充分利用这些资源。

它们共同构成经济学的基本框架。

(2)微观经济学和宏观经济学都以实证分析作为主要的分析和研究方法。

(3)微观经济学是宏观经济学的基础。

当代宏观经济学越来越重视微观基础的研究,即将宏观经济分析建立在微观经济主体行为分析的基础上。

由于微观经济学和宏观经济学分析问题的角度不同,分析方法也不同,因此有些经济活动从微观看是合理的、有效的,而从宏观看是不合理的、无效的。

例如,在经济生活中,某个厂商降低工资,从该企业的角度看,成本低了,市场竞争力强了,但是如果所有厂商都降低工资,则上面降低工资的那个厂商的竞争力就不会增强,而且职工整体工资收入降低以后,整个社会的消费以及有效需求也会降低。

同样,一个人或者一个家庭实行节约,可以增加家庭财富,但是如果大家都节约,社会需求就会降低,生产和就业就会受到影响。

布兰查德《宏观经济学》课后习题详解-核心部分中期【圣才出品】

Ⅱ中期第6章劳动力市场一、概念题1.非社会公共机构的平民人口(non institutional civilian population)答:非社会公共机构的平民人口是指总人口中除去低于工作年龄的人口(16岁以下)、军队服役和监狱服刑的人口外所剩余的人口。

2.劳动力,非劳动力(labor force ,out of the labor force)答:(1)劳动力指一国或地区法定劳动年龄以上的,或者在工作,或者在积极寻找工作,或者因为暂时失业而等待重新得到工作的所有人。

劳动力包括失业者和就业者。

一国劳动力的规模取决于人口总量、人口结构、劳动力参工率以及移民等因素。

劳动力是既包括就业者又包括失业者的工人总量,用公式可以表示为:劳动力=就业者人数+失业者人数。

(2)非劳动力指一国人口中不工作也不找工作的那部分人。

需要注意的是,失业者属于劳动力而不是非劳动力,同时非劳动力是一个动态的概念,一部分失业者可能因为较长时期的失业丧失了劳动能力而成为非劳动力。

成年人口的增加将减少非劳动力的数量,退休人口增加将增加非劳动力的数量。

3.参工率(participation rate)答:劳动力参工率是指劳动力人数与属于劳动年龄人口总数的比率。

这一统计指标反映了劳动年龄人口中选择参与劳动市场的人的比率。

劳动力参工率用公式表示为:100%=⨯劳动力人数劳动力参工率劳动年龄人口总数劳动力参工率主要取决于经济发展水平和教育的发达程度。

影响这一指标的重要因素是劳动资源中从事家务劳动的人数和正在接受教育的学生人数。

国民经济的发展和科学技术在生产过程中的广泛运用,对劳动者的文化技术水平提出了更高的要求,劳动者接受教育的时间延长,劳动资源中受教育的人所占比重上升。

因此,在经济发达国家,劳动力参工率有稍许下降的趋势。

4.失业率(unemployment rate)答:失业率是指失业人数占劳动力人数的比率。

失业率是劳工统计中用来反映一国或一个地区失业程度的主要指标。

布兰查德《宏观经济学》章节课后习题详解(本书之旅)【圣才出品】

第2章本书之旅一、概念题1.国民收入和生产账户(national income and product accounts)答:国民收入和生产账户,简称国民收入账户,是指对一国一定时期(通常为一年)内国民收入进行系统记录的账户。

国民收入指一个国家在一定时期(通常为一年)内物质资料生产部门的劳动者新创造的价值的总和,即社会总产品的价值扣除用于补偿消耗掉的生产资料价值的余额。

反映国民收入的两个主要统计数字是GDP和GNP,前者计算一段特定时期本地进行的生产,而后者则计算本地居民的总体收入。

衡量国民收入的方法有三种:收入法、支出法和产出(产品)法。

常用的两个核算公式为:①国内生产总值=消费(C)+私人投资(I)+政府支出(G)+净出口(X-IM);②国内生产总值=工资或其他劳动收入+利息、租金及其他财产收入+间接税+折旧+利润。

其经济意义为:①国民收入的生产结构和经济成分结构指标综合地反映出一国的国民经济结构;②国民收入指标综合地反映社会再生产中各种错综复杂的经济关系;③反映了国民收入的生产、分配和使用中的各种比例关系;④国民收入是反映宏观经济效益的综合指标。

2.总产出(aggregate output)答:总产出是指一个国家或地区一定时期内(核算期内)全部生产活动的总成果,即全部生产单位生产的物质产品和服务的总价值之和,包括本期生产的已出售和可供出售的物质产品和服务、在建工程以及自产自用消费品和自制固定资产价值。

一般按生产价格计算。

经济总产出的主要衡量指标有国内生产总值(GDP)、国民生产总值(GNP)等。

3.国内生产总值(gross domestic product,GDP)答:国内生产总值是指一个国家(地区)的领土范围内,本国(地区)居民和外国居民在一定时期内所生产和提供的最终使用的产品和劳务的价值总和。

国内生产总值之所以称为总值,是因为它包含了生产中的固定资产消耗(固定资产折旧)。

其一般通过支出法、增值法和收入法三种方法进行核算。

布兰查德《宏观经济学》章节课后习题详解 第1篇 导 论【圣才出品】

第1篇导论第1章世界之旅一、概念题1.欧洲联盟(欧盟)(European Union,EU)答:欧洲联盟(European Union),简称欧盟(EU),总部设在比利时首都布鲁塞尔,是由欧洲共同体(European Community,又称欧洲共同市场)发展而来的,它建立在经济与货币联盟、外交与安全政策、协调各国内政与司法事务三项内容的基础上。

欧盟是一个集政治实体和经济实体于一身、在世界上具有重要影响的区域一体化组织。

1991年12月,欧洲共同体马斯特里赫特首脑会议通过《欧洲联盟条约》,通称《马斯特里赫特条约》(简称《马约》)。

1993年11月1日,《马约》正式生效,欧盟正式诞生。

至今,欧盟现有成员国27个,分别是:英国、法国、德国、意大利、荷兰、比利时、卢森堡、丹麦、爱尔兰、希腊、葡萄牙、西班牙、奥地利、瑞典、芬兰、马耳他、塞浦路斯、波兰、匈牙利、捷克、斯洛伐克、斯洛文尼亚、爱沙尼亚、拉脱维亚、立陶宛、罗马尼亚、保加利亚等。

这27个国家一起形成了一股强大的经济力量。

这些国家的联合产出几乎等于美国的产出,其中许多国家的生活水平以人均衡量接近美国。

2.共同货币区(Common Currency Area)答:共同货币区是指使用同一种货币的所有国家和地区所构成的区域,如欧元区。

共同货币区,能够加强区域内成员之间的经济联系,消除贸易壁垒,促进要素的自由流动,从而推动共同货币区成员的经济发展。

但与此同时,共同货币区一般会设立统一的央行并实施统一的货币政策,从而使成员国丧失货币政策的独立性。

3.欧元区(Euro area)答:欧元区是指欧洲联盟成员中使用欧盟的统一货币——欧元的国家区域。

1999年1月1日,欧盟国家开始实行单一货币欧元和在实行欧元的国家实施统一货币政策。

欧元区共有19个成员,另有9个国家和地区采用欧元作为当地的单一货币。

但是作为美元的世界储备货币的竞争者,欧元的流通已经不限于上述地区。

二、计算与分析题1.运用本章学到的知识,判断以下陈述属于“正确”、“错误”和“不确定”中的哪一种情况,并简要解释。

宏观经济学-布兰查德第六版-第6-7章课后作业参考-答案

i

IS

LM(P1)

AD

LM(P2)

P1

P2

Yn

Y

Y0

Y

现在假设投资对利率不作出反应,假设经济开始于产出的自然水平。由 于对综合变量z的冲击,AS曲线上移。

e.对价格和产出的短期影响是什么?用文字解释

正确。自然产出水平指经济处于自然失业率时的产出水平。当 价格等于预期价格水平时,产出就等于自然率的产出水平。当价 格等于预期价格水平时,产出就等于自然率的产出水平,故从总 供给关系中可以得到经济的自然率产出水平。

c.总需求关系之所以下滑,是因为在更高的价格水平下,消费者 购买的商品减少。

错误。总需求关系表明了价格水平对产出的影响。总需求关系 是从模型中推导出来的。在该模型中,价格水平的上升减少了实 际货币存量,提高利率,从而减少产出

率等于i。货币扩张短期影响使LM曲线从LM移动到LM',均衡从 A移动到A'。利率下降,产出增加。随着时间的推移,价格水 平进一步上升,从而减少了实际货币存量,使得LM曲线又向上 移动。因此LM沿着IS曲线不断上移:利率上升,产出下降。最 后,LM又回到名义货币增加之前的位置。中期内,经济在A点 达到平衡。

e.在中期,扩张性货币政策对产出水平没有影响。 正确。在中期,货币是中性的,他对产出没有影响,货

币变化反应为价格水平的同比例上升,因此,扩张性货币政 策对产出水平没有影响。 f.财政政策在中期不能影响投资,因为产出总返回它的自然 水平。

错误。以紧缩性的财政政策为例:预算赤字下降时,IS 曲线左移;中期内,虽然产出反悔自然率水平,但利率低于 原利率水平,投资提高。

布兰查德《宏观经济学》(第6版) 笔记和课后习题详解复习答案

布兰查德《宏观经济学》(第6版)笔记和课后习题详解完整版>精研学习䋞>无偿试用20%资料全国547所院校视频及题库全收集考研全套>视频资料>课后答案>往年真题>职称考试第1篇导论第1章世界之旅1.1复习笔记1.2课后习题详解第2章本书之旅2.1复习笔记2.2课后习题详解第2篇核心部分第3章商品市场3.1复习笔记3.2课后习题详解第4章金融市场4.1复习笔记4.2课后习题详解第5章商品市场和金融市场:IS-LM模型5.1复习笔记5.2课后习题详解第6章劳动力市场6.1复习笔记6.2课后习题详解第7章所有市场集中:AS-AD模型7.1复习笔记7.2课后习题详解第8章菲利普斯曲线、自然失业率和通货膨胀8.1复习笔记8.2课后习题详解第9章美国次贷危机9.1复习笔记9.2课后习题详解第10章增长的事实10.1复习笔记10.2课后习题详解第11章储蓄、资本积累和产出11.1复习笔记11.2课后习题详解第12章技术进步与增长12.1复习笔记12.2课后习题详解第13章技术进步:短期、中期与长期13.1复习笔记13.2课后习题详解第3篇扩展部分第14章预期:基本工具14.1复习笔记14.2课后习题详解第15章金融市场和预期15.1复习笔记15.2课后习题详解第16章预期、消费和投资16.1复习笔记16.2课后习题详解第17章预期、产出和政策17.1复习笔记17.2课后习题详解第18章商品市场和金融市场的开放18.1复习笔记18.2课后习题详解第19章开放经济中的商品市场19.1复习笔记19.2课后习题详解第20章产出、利率和汇率20.1复习笔记20.2课后习题详解第21章汇率制度21.1复习笔记21.2课后习题详解第22章政策制定者是否应当受到限制?22.1复习笔记22.2课后习题详解第23章财政政策:一个总结23.1复习笔记23.2课后习题详解第24章货币政策:一个总结24.1复习笔记24.2课后习题详解第25章后记:宏观经济学的故事25.1复习笔记25.2课后习题详解。

西方经济学(宏观部分)第6版课后习题答案详解

第十二章国民收入核算1.宏观经济学和微观经济学有什么联系和区别?为什么有些经济活动从微观看是合理的,有效的,而从宏观看却是不合理的,无效的?解答:两者之间的区别在于:(1)研究的对象不同。

微观经济学研究组成整体经济的单个经济主体的最优化行为,而宏观经济学研究一国整体经济的运行规律和宏观经济政策。

(2)解决的问题不同。

微观经济学要解决资源配置问题,而宏观经济学要解决资源利用问题。

(3)中心理论不同。

微观经济学的中心理论是价格理论,所有的分析都是围绕价格机制的运行展开的,而宏观经济学的中心理论是国民收入(产出)理论,所有的分析都是围绕国民收入(产出)的决定展开的。

(4)研究方法不同。

微观经济学采用的是个量分析方法,而宏观经济学采用的是总量分析方法。

两者之间的联系主要表现在:(1)相互补充。

经济学研究的目的是实现社会经济福利的最大化。

为此,既要实现资源的最优配置,又要实现资源的充分利用。

微观经济学是在假设资源得到充分利用的前提下研究资源如何实现最优配置的问题,而宏观经济学是在假设资源已经实现最优配置的前提下研究如何充分利用这些资源。

它们共同构成经济学的基本框架。

(2)微观经济学和宏观经济学都以实证分析作为主要的分析和研究方法。

(3)微观经济学是宏观经济学的基础。

当代宏观经济学越来越重视微观基础的研究,即将宏观经济分析建立在微观经济主体行为分析的基础上。

由于微观经济学和宏观经济学分析问题的角度不同,分析方法也不同,因此有些经济活动从微观看是合理的、有效的,而从宏观看是不合理的、无效的。

例如,在经济生活中,某个厂商降低工资,从该企业的角度看,成本低了,市场竞争力强了,但是如果所有厂商都降低工资,则上面降低工资的那个厂商的竞争力就不会增强,而且职工整体工资收入降低以后,整个社会的消费以及有效需求也会降低。

同样,一个人或者一个家庭实行节约,可以增加家庭财富,但是如果大家都节约,社会需求就会降低,生产和就业就会受到影响。

西方经济学(宏观部分)第6版课后习题解答详解

第十二章国民收入核算1.宏观经济学和微观经济学有什么联系和区别?为什么有些经济活动从微观看是合理的,有效的,而从宏观看却是不合理的,无效的?解答:两者之间的区别在于:(1)研究的对象不同。

微观经济学研究组成整体经济的单个经济主体的最优化行为,而宏观经济学研究一国整体经济的运行规律和宏观经济政策。

(2)解决的问题不同。

微观经济学要解决资源配置问题,而宏观经济学要解决资源利用问题。

(3)中心理论不同。

微观经济学的中心理论是价格理论,所有的分析都是围绕价格机制的运行展开的,而宏观经济学的中心理论是国民收入(产出)理论,所有的分析都是围绕国民收入(产出)的决定展开的。

(4)研究方法不同。

微观经济学采用的是个量分析方法,而宏观经济学采用的是总量分析方法。

两者之间的联系主要表现在:(1)相互补充。

经济学研究的目的是实现社会经济福利的最大化。

为此,既要实现资源的最优配置,又要实现资源的充分利用。

微观经济学是在假设资源得到充分利用的前提下研究资源如何实现最优配置的问题,而宏观经济学是在假设资源已经实现最优配置的前提下研究如何充分利用这些资源。

它们共同构成经济学的基本框架。

(2)微观经济学和宏观经济学都以实证分析作为主要的分析和研究方法。

(3)微观经济学是宏观经济学的基础。

当代宏观经济学越来越重视微观基础的研究,即将宏观经济分析建立在微观经济主体行为分析的基础上。

由于微观经济学和宏观经济学分析问题的角度不同,分析方法也不同,因此有些经济活动从微观看是合理的、有效的,而从宏观看是不合理的、无效的。

例如,在经济生活中,某个厂商降低工资,从该企业的角度看,成本低了,市场竞争力强了,但是如果所有厂商都降低工资,则上面降低工资的那个厂商的竞争力就不会增强,而且职工整体工资收入降低以后,整个社会的消费以及有效需求也会降低。

同样,一个人或者一个家庭实行节约,可以增加家庭财富,但是如果大家都节约,社会需求就会降低,生产和就业就会受到影响。

- 1、下载文档前请自行甄别文档内容的完整性,平台不提供额外的编辑、内容补充、找答案等附加服务。

- 2、"仅部分预览"的文档,不可在线预览部分如存在完整性等问题,可反馈申请退款(可完整预览的文档不适用该条件!)。

- 3、如文档侵犯您的权益,请联系客服反馈,我们会尽快为您处理(人工客服工作时间:9:00-18:30)。

f.你相信问题(e)中的答案吗?为什么?

不相信。因为在这种情况下,预期的通货膨胀率 等于过去(前一年)的通货膨胀率再加一个固定 的常数。按照这种预期机制,未来的通胀率就可 能无限大,这与事实不符。相当于人们又犯了系 统性错误,而对自己的预期没有修正。

4、重温货币中性 a.填写下表第一年后的空格部分

M名义货币 gm名义货币 P价格水平( 通货膨胀率

年份

供给(十亿 供给增长( 指数)第二年

美元)

%)

为100

(%)

1

380.95

95.2

2

400

5

100

5

3

420

5

105.0

5

4

441

5

110.25

b.原始菲利普斯曲线关系被证明在不同国家和不同 时间内是非常稳定的。

错误。20世纪60年代,美国的失业率和通货膨胀 呈反方向变化,但从1970年开始,美国的失业率 和通货膨胀之间的关系就消失了。国家间的自然 失业率也很大。

c.在20世纪70年代以前,总供给关系和菲利普斯曲 线一致,但从那以后就不再一致了。

c.你相信问题(b)中的答案吗?为什么?(提示: 考虑人们如何形成通货膨胀预期。)

不相信。因为(b)中的前提是π et= 0,而πt永远 等于4%,意味着人们未来的预期通胀都为零,仅 仅用过去的通胀水平表示未来的通胀水平而不加 任何修正,而且这样通胀预期将会永远维持下去 。但是因为预期通货膨胀率是由通货膨胀率决定 的,所以正的π t不可能永远只产生等于零的π et。 事实上,人们不可能犯这样的系统性错误,因而 (b)中的答案是不可能的。

错误。在20世纪70年代以前,总供给关系和菲利 普斯曲线吻合的较好,但从70年代以后,失业率 和通货膨胀的变化之间是负向关系,是变异的菲 利普斯曲线。

d.政策制定者只能在短暂时间内对通货膨胀和失业 进行权衡取舍。

正确。菲利普斯曲线在短期确实存在失业和通货 膨胀的替代关系。即失业率较高,则通货膨胀率 较低,若失业率较低,则通货膨胀率较高。但是 在长期,由于预期因素的缘故,二者不存在替代 关系。

现在假设在t+5年,θ从0增加到1.假设政府仍然决定 把u永远保持在3%。

d.为什么θ可能会这样增加。 θ可能会这样增加是因为人们的通货膨胀预期要不 断调整,从而与真实的通货膨胀率相一致,而真 实的通胀率一般为正。

e.第t+5、t+6和t+7年的通货膨胀率是多少?

πt+5= πt+4+0.1-0.06=4%+4%=8% πt= πt-1+0.1-2×0.03,因此πt+6=12%;πt+7=16%

宏观经济学

第八章课后习题

1.运用本章学到的知识,判断下列陈述属于“正确 ”、“错误”、“不确定”中的哪一种情况,并 解释。

a.原始菲利普斯曲线是失业和通货膨胀的负向关系 ,这一现象最初是在英国发现的。

正确,1958年,A.W.菲利普斯画出了英国从 1861年到1957年间每年的通货膨胀率和失业率 之间的关系图,他发现通货膨胀和失业之间存在 负向关系。

率。在第t年,当局决定把失业率降低到3%并永 远保持在该水平。

b.求第t、t+1、t+2、t+5年的通货膨胀率。

因为假设θ最初等于0,所以 πt=0.1-2×0.03=4% ;θ等于0意味着过去的通货膨胀对未来不构成影 响,通货膨胀没有惯性,只与失业率有关,由于 政府一直将失业率保持在3%,所以通货膨胀率 将保持在0.1-2×0.03=4%的水平。因此第t、t+1 、t+2、t+5年的通货膨胀率均为4%。

3.菲利普斯曲线的变异 假设菲利普斯曲线由下式给出:

πt= πet-1+0.1-2ut a.自然失业率是什么? 当实际通货膨胀率等于预期通货膨胀率时,实际失

业率等于自然失业率。 令πt-πe=0.1-2ut=0,解得ut=un=5%

假设

πet= θπt-1 同时假设θ最初等于0.假设失业率最初等于自然失业

h.所有国家的自然失业率都相同。

错误。自然失业率取决于很多因素,这些因素因 国家而异,不同国家的失业率不同,欧洲要比美 国高很多。

i.反通货膨胀意味着通货膨胀是负的。

错误。反通货膨胀是指政府采取一定的政策措施 以减缓和消除物价持续上升的行为。反通货膨胀 是通货膨胀率的下降。通货紧缩才是价格水平的 下降,等效于负通货膨胀。

e.在20世纪60年代末,经济学家米尔顿·弗里德曼和埃德蒙·菲尔普 斯认为政策制定者能够获得他们想要的低失业率。

错误。在20世纪60年代末,即使当时的原始的菲利普斯曲线仍然能 对数据进行很好的描述,两位经济学家米尔顿·弗里德曼和埃德 蒙·菲尔普斯对失业率和通货膨胀之间的交替关系的存在性提出 了质疑,他们根据逻辑推理对它提出了疑问。他们认为,这一 交替关系仅当工资制定者系统的偏低地预测通货膨胀时才能够 存在,而工资制定者不可能这么做。他们也提出,如果政府试 图通过接受更高的通货膨胀来维持更低的失业,这种交替关系 最终会消失;失业率不能被维持在一个特定水平之下,他们把 该水平称为“自然失业率”。事实证明他们是正确的,失业率 和通货膨胀之间的交替关系确实消失了。

Hale Waihona Puke j.如果卢卡斯是正确的,如果货币政策是完全可信 的,失业率和通货膨胀之间的关系就不存在了( 即不存在菲利普斯曲线关系)。

正确。卢卡斯将预期因素引入反通货膨胀分析。 他认为,工资制定者也会预期到政策的变化。如 果工资制定者认为政府的反通货膨胀具有可信性 ,那么他们会坚信通货膨胀比过去低,他们将降 低对通货膨胀的预期,从而引起实际通货膨胀率 的下降,而失业率没有必要变化。此时通货膨胀 率与失业率之间就不存在联系,即菲利普斯曲线 不存在。

f.附加预期的菲利普斯曲线和20世纪60年代的宏观 经济经历之后的工人与企业调整预期的行为相一 致。

正确。附加预期的菲利普斯曲线是修正的菲利普斯 曲线,他是根据20世纪60年代的宏观经济经历对 他们的预期进行调整而修正的。

g.一个国家的自然失业率不会随时间而变化。

错误。自然失业率取决于很多因素,这些因素随 时间而变化,欧洲的自然失业率自20世纪60年代 以来有了很大的提升;美国的自然失业率从20世 纪60年代到20世纪80年代一直上升,之后出现下 降。