最新国际会计准则IAS12

国际会计准则第12号

IAS12 International Accounting Standard12Income TaxesThis version includes amendments resulting from new and amended IFRSs issued up to 31December2004.The following Interpretations relate to IAS12:+SIC-21Income Taxes–Recovery of Revalued Non-Depreciable Assets;and+SIC-25Income Taxes–Changes in the Tax Status of an Entity or its Shareholders.IASCF761IAS12C ONTENTSparagraphs INTRODUCTION IN1–IN14 INTERNATIONAL ACCOUNTING STANDARD12INCOME TAXESOBJECTIVESCOPE1–4 DEFINITIONS5–11 Tax base7–11 RECOGNITION OF CURRENT TAX LIABILITIES AND CURRENT TAX ASSETS12–14 RECOGNITION OF DEFERRED TAX LIABILITIES AND DEFERRED TAXASSETS15–33 Taxable temporary differences15–23 Business combinations19 Assets carried at fair value20 Goodwill21–21B Initial recognition of an asset or liability22–23 Deductible temporary differences24–33 Initial recognition of an asset or liability33 Unused tax losses and unused tax credits34–36 Re–assessment of unrecognised deferred tax assets37 Investments in subsidiaries,branches and associates and interests in jointventures38–45 MEASUREMENT46–56 RECOGNITION OF CURRENT AND DEFERRED TAX57–68C Income statement58–60 Items credited or charged directly to equity61–65A Deferred tax arising from a business combination66–68 Current and deferred tax arising from share–based payment transactions68A–68C PRESENTATION69–78 Tax assets and tax liabilities69–76 Offset71–76 Tax expense77–78 Tax expense(income)related to profit or loss from ordinary activities77 Exchange differences on deferred foreign tax liabilities or assets78 DISCLOSURE79–88 EFFECTIVE DATE89–91 APPENDICESA Examples of temporary differencesB Illustrative computations and presentation762IASCFIAS12 International Accounting Standard12Income Taxes(IAS12)is set out in paragraphs1–91.All the paragraphs have equal authority but retain the IASC format of the Standard when it was adopted by the IASB.IAS12should be read in the context of its objective,the Preface to International Financial Reporting Standards and the Framework for the Preparation and Presentation of Financial Statements.IAS8Accounting Policies,Changes in Accounting Estimates and Errors provides a basis for selecting and applying accounting policies in the absence of explicit guidance.IASCF763IAS12IntroductionIN1This Standard(‘IAS12(revised)’)replaces IAS12Accounting for Taxes on Income(‘the original IAS12’).IAS12(revised)is effective for accounting periods beginning onor after1January1998.The major changes from the original IAS12are as follows.IN2The original IAS12required an entity to account for deferred tax using either the deferral method or a liability method which is sometimes known as the incomestatement liability method.IAS12(revised)prohibits the deferral method andrequires another liability method which is sometimes known as the balance sheetliability method.The income statement liability method focuses on timing differences,whereas thebalance sheet liability method focuses on temporary differences.Timingdifferences are differences between taxable profit and accounting profit thatoriginate in one period and reverse in one or more subsequent periods.Temporary differences are differences between the tax base of an asset or liabilityand its carrying amount in the balance sheet.The tax base of an asset or liabilityis the amount attributed to that asset or liability for tax purposes.All timing differences are temporary differences.Temporary differences also arisein the following circumstances,which do not give rise to timing differences,although the original IAS12treated them in the same way as transactions that dogive rise to timing differences:(a)subsidiaries,associates or joint ventures have not distributed their entireprofits to the parent or investor;(b)assets are revalued and no equivalent adjustment is made for tax purposes;and(c)the cost of a business combination is allocated to the identifiable assetsacquired and liabilities assumed by reference to their fair values,but noequivalent adjustment is made for tax purposes.Furthermore,there are some temporary differences which are not timingdifferences,for example those temporary differences that arise when:(a)the non-monetary assets and liabilities of an entity are measured in itsfunctional currency but the taxable profit or tax loss(and,hence,the taxbase of its non-monetary assets and liabilities)is determined in a differentcurrency;(b)non-monetary assets and liabilities are restated under IAS29FinancialReporting in Hyperinflationary Economies;or(c)the carrying amount of an asset or liability on initial recognition differs fromits initial tax base.IN3The original IAS12permitted an entity not to recognise deferred tax assets and liabilities where there was reasonable evidence that timing differences would notreverse for some considerable period ahead.IAS12(revised)requires an entity torecognise a deferred tax liability or(subject to certain conditions)asset for alltemporary differences,with certain exceptions noted below.764IASCFIAS12IN4The original IAS12required that:(a)deferred tax assets arising from timing differences should be recognisedwhen there was a reasonable expectation of realisation;and(b)deferred tax assets arising from tax losses should be recognised as an assetonly where there was assurance beyond any reasonable doubt that futuretaxable income would be sufficient to allow the benefit of the loss to berealised.The original IAS12permitted(but did not require)an entity todefer recognition of the benefit of tax losses until the period of realisation.IAS12(revised)requires that deferred tax assets should be recognised when it isprobable that taxable profits will be available against which the deferred tax assetcan be utilised.Where an entity has a history of tax losses,the entity recognises adeferred tax asset only to the extent that the entity has sufficient taxabletemporary differences or there is convincing other evidence that sufficient taxableprofit will be available.IN5As an exception to the general requirement set out in paragraph IN3above,IAS12 (revised)prohibits the recognition of deferred tax liabilities and deferred tax assetsarising from certain assets or liabilities whose carrying amount differs on initialrecognition from their initial tax base.Because such circumstances do not giverise to timing differences,they did not result in deferred tax assets or liabilitiesunder the original IAS12.IN6The original IAS12required that taxes payable on undistributed profits of subsidiaries and associates should be recognised unless it was reasonable toassume that those profits will not be distributed or that a distribution would notgive rise to a tax liability.However,IAS12(revised)prohibits the recognition ofsuch deferred tax liabilities(and those arising from any related cumulativetranslation adjustment)to the extent that:(a)the parent,investor or venturer is able to control the timing of the reversal ofthe temporary difference;and(b)it is probable that the temporary difference will not reverse in the foreseeablefuture.Where this prohibition has the result that no deferred tax liabilities have beenrecognised,IAS12(revised)requires an entity to disclose the aggregate amount ofthe temporary differences concerned.IN7The original IAS12did not refer explicitly to fair value adjustments made on a business combination.Such adjustments give rise to temporary differences andIAS12(revised)requires an entity to recognise the resulting deferred tax liabilityor(subject to the probability criterion for recognition)deferred tax asset with acorresponding effect on the determination of the amount of goodwill or anyexcess of the acquirer’s interest in the net fair value of the acquiree’s identifiableassets,liabilities and contingent liabilities over the cost of the combination.However,IAS12(revised)prohibits the recognition of deferred tax liabilitiesarising from the initial recognition of goodwill.IN8The original IAS12permitted,but did not require,an entity to recognise a deferred tax liability in respect of asset revaluations.IAS12(revised)requires anentity to recognise a deferred tax liability in respect of asset revaluations.IASCF765IAS12IN9The tax consequences of recovering the carrying amount of certain assets or liabilities may depend on the manner of recovery or settlement,for example:(a)in certain countries,capital gains are not taxed at the same rate as othertaxable income;and(b)in some countries,the amount that is deducted for tax purposes on sale of anasset is greater than the amount that may be deducted as depreciation.The original IAS12gave no guidance on the measurement of deferred tax assetsand liabilities in such cases.IAS12(revised)requires that the measurement ofdeferred tax liabilities and deferred tax assets should be based on the taxconsequences that would follow from the manner in which the entity expects torecover or settle the carrying amount of its assets and liabilities.IN10The original IAS12did not state explicitly whether deferred tax assets and liabilities may be discounted.IAS12(revised)prohibits discounting of deferredtax assets and liabilities.Paragraph B16(i)of IFRS3Business Combinations prohibitsdiscounting of deferred tax assets acquired and deferred tax liabilities assumed ina business combination.IN11The original IAS12did not specify whether an entity should classify deferred tax balances as current assets and liabilities or as non-current assets and liabilities.IAS12(revised)requires that an entity which makes the current/non-currentdistinction should not classify deferred tax assets and liabilities as current assetsand liabilities.IN12The original IAS12stated that debit and credit balances representing deferred taxes may be offset.IAS12(revised)establishes more restrictive conditions onoffsetting,based largely on those for financial assets and liabilities in IAS32Financial Instruments:Disclosure and Presentation.IN13The original IAS12required disclosure of an explanation of the relationship between tax expense and accounting profit if not explained by the tax rateseffective in the reporting entity’s country.IAS12(revised)requires thisexplanation to take either or both of the following forms:(a)a numerical reconciliation between tax expense(income)and the product ofaccounting profit multiplied by the applicable tax rate(s);or(b)a numerical reconciliation between the average effective tax rate and theapplicable tax rate.IAS12(revised)also requires an explanation of changes in the applicable taxrate(s)compared to the previous accounting period.IN14New disclosures required by IAS12(revised)include:(a)in respect of each type of temporary difference,unused tax losses and unusedtax credits:(i)the amount of deferred tax assets and liabilities recognised;and(ii)the amount of the deferred tax income or expense recognised in the income statement,if this is not apparent from the changes in theamounts recognised in the balance sheet;(b)in respect of discontinued operations,the tax expense relating to:766IASCFIAS12(i)the gain or loss on discontinuance;and(ii)the profit or loss from the ordinary activities of the discontinued operation;and(c)the amount of a deferred tax asset and the nature of the evidence supportingits recognition,when:(i)the utilisation of the deferred tax asset is dependent on future taxableprofits in excess of the profits arising from the reversal of existingtaxable temporary differences;and(ii)the entity has suffered a loss in either the current or preceding period in the tax jurisdiction to which the deferred tax asset relates.IASCF767IAS12International Accounting Standard12Income TaxesObjectiveThe objective of this Standard is to prescribe the accounting treatment for incometaxes.The principal issue in accounting for income taxes is how to account forthe current and future tax consequences of:(a)the future recovery(settlement)of the carrying amount of assets(liabilities)that are recognised in an entity’s balance sheet;and(b)transactions and other events of the current period that are recognised in anentity’s financial statements.It is inherent in the recognition of an asset or liability that the reporting entityexpects to recover or settle the carrying amount of that asset or liability.If it isprobable that recovery or settlement of that carrying amount will make future taxpayments larger(smaller)than they would be if such recovery or settlement wereto have no tax consequences,this Standard requires an entity to recognise adeferred tax liability(deferred tax asset),with certain limited exceptions.This Standard requires an entity to account for the tax consequences oftransactions and other events in the same way that it accounts for thetransactions and other events themselves.Thus,for transactions and other eventsrecognised in profit or loss,any related tax effects are also recognised in profit orloss.For transactions and other events recognised directly in equity,any relatedtax effects are also recognised directly in equity.Similarly,the recognition ofdeferred tax assets and liabilities in a business combination affects the amount ofgoodwill arising in that business combination or the amount of any excess of theacquirer’s interest in the net fair value of the acquiree’s identifiable assets,liabilities and contingent liabilities over the cost of the combination.This Standard also deals with the recognition of deferred tax assets arising fromunused tax losses or unused tax credits,the presentation of income taxes in thefinancial statements and the disclosure of information relating to income taxes. Scope1This Standard shall be applied in accounting for income taxes.2For the purposes of this Standard,income taxes include all domestic and foreign taxes which are based on taxable profits.Income taxes also include taxes,such aswithholding taxes,which are payable by a subsidiary,associate or joint venture ondistributions to the reporting entity.3[Deleted]4This Standard does not deal with the methods of accounting for government grants(see IAS20Accounting for Government Grants and Disclosure of GovernmentAssistance)or investment tax credits.However,this Standard does deal with theaccounting for temporary differences that may arise from such grants orinvestment tax credits.768IASCFIAS12 Definitions5The following terms are used in this Standard with the meanings specified: Accounting profit is profit or loss for a period before deducting tax expense.Taxable profit(tax loss)is the profit(loss)for a period,determined inaccordance with the rules established by the taxation authorities,uponwhich income taxes are payable(recoverable).Tax expense(tax income)is the aggregate amount included in thedetermination of profit or loss for the period in respect of current tax anddeferred tax.Current tax is the amount of income taxes payable(recoverable)in respect ofthe taxable profit(tax loss)for a period.Deferred tax liabilities are the amounts of income taxes payable in futureperiods in respect of taxable temporary differences.Deferred tax assets are the amounts of income taxes recoverable in futureperiods in respect of:(a)deductible temporary differences;(b)the carryforward of unused tax losses;and(c)the carryforward of unused tax credits.Temporary differences are differences between the carrying amount of an assetor liability in the balance sheet and its tax base.Temporary differencesmay be either:(a)taxable temporary differences,which are temporary differences that willresult in taxable amounts in determining taxable profit(tax loss)offuture periods when the carrying amount of the asset or liability isrecovered or settled;or(b)deductible temporary differences,which are temporary differences that willresult in amounts that are deductible in determining taxable profit(tax loss)of future periods when the carrying amount of the asset orliability is recovered or settled.The tax base of an asset or liability is the amount attributed to that asset orliability for tax purposes.6Tax expense(tax income)comprises current tax expense(current tax income)and deferred tax expense(deferred tax income).Tax base7The tax base of an asset is the amount that will be deductible for tax purposes against any taxable economic benefits that will flow to an entity when it recoversthe carrying amount of the asset.If those economic benefits will not be taxable,the tax base of the asset is equal to its carrying amount.IASCF769IAS12Examples1A machine cost100.For tax purposes,depreciation of30has already been deducted in the current and prior periods and the remaining costwill be deductible in future periods,either as depreciation or througha deduction on disposal.Revenue generated by using the machine istaxable,any gain on disposal of the machine will be taxable and anyloss on disposal will be deductible for tax purposes.The tax base of themachine is70.2Interest receivable has a carrying amount of100.The related interest revenue will be taxed on a cash basis.The tax base of the interest receivableis nil.3Trade receivables have a carrying amount of100.The related revenue has already been included in taxable profit(tax loss).The tax base of thetrade receivables is100.4Dividends receivable from a subsidiary have a carrying amount of100.The dividends are not taxable.In substance,the entire carrying amount ofthe asset is deductible against the economic benefits.Consequently,the tax baseof the dividends receivable is100.*5A loan receivable has a carrying amount of100.The repayment of the loan will have no tax consequences.The tax base of the loan is100.*Under this analysis,there is no taxable temporary difference.An alternativeanalysis is that the accrued dividends receivable have a tax base of nil and that atax rate of nil is applied to the resulting taxable temporary difference of100.Under both analyses,there is no deferred tax liability.8The tax base of a liability is its carrying amount,less any amount that will be deductible for tax purposes in respect of that liability in future periods.In thecase of revenue which is received in advance,the tax base of the resulting liabilityis its carrying amount,less any amount of the revenue that will not be taxable infuture periods.Examples1Current liabilities include accrued expenses with a carrying amount of 100.The related expense will be deducted for tax purposes on a cashbasis.The tax base of the accrued expenses is nil.2Current liabilities include interest revenue received in advance,with a carrying amount of100.The related interest revenue was taxed on acash basis.The tax base of the interest received in advance is nil.3Current liabilities include accrued expenses with a carrying amount of 100.The related expense has already been deducted for tax purposes.The tax base of the accrued expenses is100.770IASCFIAS12Continued from previous pageExamples4Current liabilities include accrued fines and penalties with a carrying amount of100.Fines and penalties are not deductible for taxpurposes.The tax base of the accrued fines and penalties is100.*5A loan payable has a carrying amount of100.The repayment of the loan will have no tax consequences.The tax base of the loan is100.*Under this analysis,there is no deductible temporary difference.An alternative analysis is that the accrued fines and penalties payable have a tax base of nil andthat a tax rate of nil is applied to the resulting deductible temporary difference of100.Under both analyses,there is no deferred tax asset.9Some items have a tax base but are not recognised as assets and liabilities in the balance sheet.For example,research costs are recognised as an expense indetermining accounting profit in the period in which they are incurred but maynot be permitted as a deduction in determining taxable profit(tax loss)until alater period.The difference between the tax base of the research costs,being theamount the taxation authorities will permit as a deduction in future periods,andthe carrying amount of nil is a deductible temporary difference that results in adeferred tax asset.10Where the tax base of an asset or liability is not immediately apparent,it is helpful to consider the fundamental principle upon which this Standard is based:that an entity shall,with certain limited exceptions,recognise a deferred taxliability(asset)whenever recovery or settlement of the carrying amount of an assetor liability would make future tax payments larger(smaller)than they would be ifsuch recovery or settlement were to have no tax consequences.Example Cfollowing paragraph52illustrates circumstances when it may be helpful toconsider this fundamental principle,for example,when the tax base of an asset orliability depends on the expected manner of recovery or settlement.11In consolidated financial statements,temporary differences are determined by comparing the carrying amounts of assets and liabilities in the consolidatedfinancial statements with the appropriate tax base.The tax base is determined byreference to a consolidated tax return in those jurisdictions in which such areturn is filed.In other jurisdictions,the tax base is determined by reference tothe tax returns of each entity in the group.Recognition of current tax liabilities and current tax assets12Current tax for current and prior periods shall,to the extent unpaid,be recognised as a liability.If the amount already paid in respect of currentand prior periods exceeds the amount due for those periods,the excessshall be recognised as an asset.13The benefit relating to a tax loss that can be carried back to recover current tax of a previous period shall be recognised as an asset.IASCF771IAS1214When a tax loss is used to recover current tax of a previous period,an entity recognises the benefit as an asset in the period in which the tax loss occursbecause it is probable that the benefit will flow to the entity and the benefit can bereliably measured.Recognition of deferred tax liabilities and deferred tax assetsTaxable temporary differences15A deferred tax liability shall be recognised for all taxable temporary differences,except to the extent that the deferred tax liability arises from:(a)the initial recognition of goodwill;or(b)the initial recognition of an asset or liability in a transaction which:(i)is not a business combination;and(ii)at the time of the transaction,affects neither accounting profit nor taxable profit(tax loss).However,for taxable temporary differences associated with investments insubsidiaries,branches and associates,and interests in joint ventures,adeferred tax liability shall be recognised in accordance with paragraph39.16It is inherent in the recognition of an asset that its carrying amount will be recovered in the form of economic benefits that flow to the entity in futureperiods.When the carrying amount of the asset exceeds its tax base,the amountof taxable economic benefits will exceed the amount that will be allowed as adeduction for tax purposes.This difference is a taxable temporary difference andthe obligation to pay the resulting income taxes in future periods is a deferred taxliability.As the entity recovers the carrying amount of the asset,the taxabletemporary difference will reverse and the entity will have taxable profit.Thismakes it probable that economic benefits will flow from the entity in the form oftax payments.Therefore,this Standard requires the recognition of all deferred taxliabilities,except in certain circumstances described in paragraphs15and39.ExampleAn asset which cost150has a carrying amount of100.Cumulativedepreciation for tax purposes is90and the tax rate is25%.The tax base of the asset is60(cost of150less cumulative tax depreciation of90).To recover the carrying amount of100,the entity must earn taxable income of100,butwill only be able to deduct tax depreciation of60.Consequently,the entity will payincome taxes of10(40at25%)when it recovers the carrying amount of the asset.Thedifference between the carrying amount of100and the tax base of60is a taxabletemporary difference of40.Therefore,the entity recognises a deferred tax liability of10(40at25%)representing the income taxes that it will pay when it recovers the carryingamount of the asset.772IASCFIAS1217Some temporary differences arise when income or expense is included in accounting profit in one period but is included in taxable profit in a differentperiod.Such temporary differences are often described as timing differences.Thefollowing are examples of temporary differences of this kind which are taxabletemporary differences and which therefore result in deferred tax liabilities:(a)interest revenue is included in accounting profit on a time proportion basisbut may,in some jurisdictions,be included in taxable profit when cash iscollected.The tax base of any receivable recognised in the balance sheet withrespect to such revenues is nil because the revenues do not affect taxableprofit until cash is collected;(b)depreciation used in determining taxable profit(tax loss)may differ fromthat used in determining accounting profit.The temporary difference is thedifference between the carrying amount of the asset and its tax base which isthe original cost of the asset less all deductions in respect of that assetpermitted by the taxation authorities in determining taxable profit of thecurrent and prior periods.A taxable temporary difference arises,and resultsin a deferred tax liability,when tax depreciation is accelerated(if taxdepreciation is less rapid than accounting depreciation,a deductibletemporary difference arises,and results in a deferred tax asset);and(c)development costs may be capitalised and amortised over future periods indetermining accounting profit but deducted in determining taxable profit inthe period in which they are incurred.Such development costs have a taxbase of nil as they have already been deducted from taxable profit.The temporary difference is the difference between the carrying amount ofthe development costs and their tax base of nil.18Temporary differences also arise when:(a)the cost of a business combination is allocated by recognising the identifiableassets acquired and liabilities assumed at their fair values,but no equivalentadjustment is made for tax purposes(see paragraph19);(b)assets are revalued and no equivalent adjustment is made for tax purposes(see paragraph20);(c)goodwill arises in a business combination(see paragraphs21and32);(d)the tax base of an asset or liability on initial recognition differs from itsinitial carrying amount,for example when an entity benefits fromnon-taxable government grants related to assets(see paragraphs22and33);or(e)the carrying amount of investments in subsidiaries,branches and associatesor interests in joint ventures becomes different from the tax base of theinvestment or interest(see paragraphs38–45).Business combinations19The cost of a business combination is allocated by recognising the identifiable assets acquired and liabilities assumed at their fair values at the acquisition date.Temporary differences arise when the tax bases of the identifiable assets acquiredand liabilities assumed are not affected by the business combination or areIASCF773。

国际会计准则第12号所得税会计

国际会计准则第12号所得税会计1.所得税负债与所得税资产:a.所得税负债是企业未来应纳税款的额度,这是企业在财务报表日期后根据普遍适用的税法规定计算得出的。

b.所得税资产是企业未来可以抵消应纳税款的额度,这是企业在财务报表日期后根据普遍适用的税法规定计算得出的。

2.对于税务纳税额与会计纳税额之间的差异,企业需要进行必要的会计处理,以反映出未来的税收效果。

这些差异可以是暂时性差异或永久性差异。

a.暂时性差异是指在当前财务报表期间内会计纳税额与税务纳税额之间的差异,但在以后的会计期间内会有所调整。

暂时性差异会导致会计纳税负债或所得税资产的发生和变动。

b.永久性差异是指在当前财务报表期间内会计纳税额与税务纳税额之间的不一致,且在以后的会计期间内不会有所调整。

永久性差异不会影响会计纳税负债和所得税资产。

3.在编制财务报表时,企业需要计算未计提以前年度的所得税负债或所得税资产,以反映出之前年度的差异。

4.对于所得税资产和所得税负债的计量,企业应使用税法确定的税率,该税率反映了当局对于企业所得税应纳税额的立法安排。

若有可使用的未来税率变化,企业需要根据最可能发生的情况来计量。

5.企业应在财务报表中披露所得税负债和所得税资产的发生和变动,以及与所得税负债和所得税资产相关的暂时性差异和永久性差异。

通过遵循国际会计准则第12号,企业可以确保在编制财务报表时正确处理所得税,以准确反映企业的财务状况和经营业绩。

该准则的要求提供了明确的指引,帮助企业遵守国际会计准则并避免在所得税会计方面的错误和不一致。

这有助于提高财务报表的可比性和准确性,增强投资者和其他利益相关方对企业的信任。

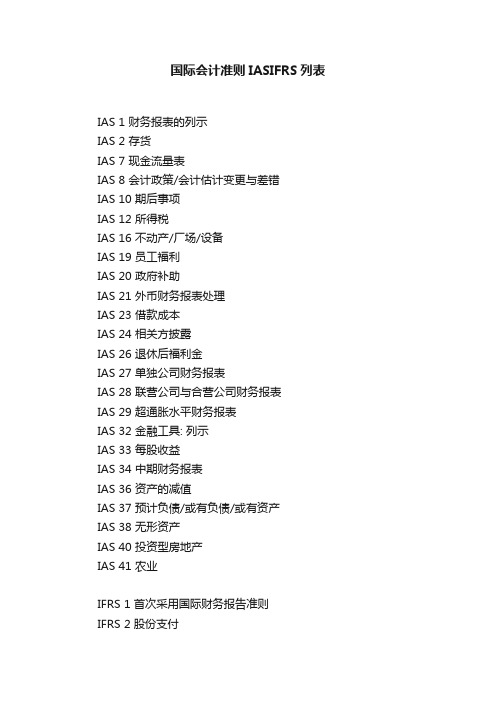

国际会计准则(1~41)中英文目录对照

国际会计准则(1~41)中英文目录对照国际会计准则(1~41)中英文目录对照1.IAS1:Presentation of Financial Statements《IAS1——财务报表的列报》2.IAS2:Inventories《IAS2——存货》3.IAS3:Consolidated Financial Statements《IAS3——合并财务报表》(已被IAS27和IAS28取代)4.IAS4:Depreciation Accounting《IAS4——折旧会计》(已被IAS16、IAS22和IAS38取代)5.IAS5:Information to Be Disclosed in Financial Statements《IAS5——财务报表中披露的信息》(已被IAS1取代)6.IAS6:Accounting Responses to Changing Prices《IAS6——物价变动会计》(已被IAS15取代)7.IAS7:Cash Flow Statements《IAS7——现金流量表》8.IAS8:Accounting Policies, Changes in Accounting Estimates and Errors 《IAS8——当期净损益、重大差错和会计政策变更》9.IAS9:Accounting for Research and Development Activities《IAS9——研发活动会计》(已被IAS38取代)10.IAS10:Events after the Balance Sheet Date《IAS10——资产负债表日后事项》11.IAS11:Construction Contracts《IAS11——建造合同》12.IAS12:Income Taxes《IAS12——所得税》13.IAS13:Presentation of Current Assets and Current Liabilities 《IAS13——流动资产和流动负债的列报》(已被IAS1取代)14.IAS14:Segment Reporting《IAS14——分部报告》15.IAS15:Information Reflecting the Effects of Changing Prices《IAS15——反映物价变动影响的信息》(2003年已被撤销)16.IAS16:Property, Plant and Equipment《IAS16——不动产、厂场和设备》17.IAS17:Leases《IAS17——租赁》18.IAS18:Revenue《IAS18——收入》19.IAS19:Employee Benefits《IAS19——雇员福利》20.IAS20:Accounting for Government Grants and Disclosure of Government Assistance《IAS20——政府补助会计和政府援助的披露》21.IAS21:The Effects of Changes in Foreign Exchange Rates《IAS21——汇率变动的影响》22.IAS22:Business Combinations《IAS22——企业合并》(已被IFRS3取代)23.IAS23:Borrowing Costs《IAS23——借款费用》24.IAS24:Related Party Disclosures《IAS24——关联方披露》25.IAS25:Accounting for Investments《IAS25——投资会计》(已被IAS39 和IAS40取代)26.IAS26:Accounting and Reporting by Retirement Benefit Plans《IAS26——退休福利计划的会计和报告》27.IAS27:Consolidated and Separate Financial Statements《IAS27——合并财务报表及对子公司投资会计》28.IAS28:Investments in Associates《IAS28——对联合企业投资会计》29.IAS29:Financial Reporting in Hyperinflationary Economies《IAS29——恶性通货膨胀经济中的财务报告》30.IAS30:Disclosures in the Financial Statements of Banks and Similar Financial Institutions《IAS30——银行和类似金融机构财务报表中的披露》31.IAS31:Interests in Joint Ventures《IAS31——合营中权益的财务报告》32.IAS32:Financial Instruments: Disclosure and Presentation《IAS32——金融工具:披露和列报》33.IAS33:Earnings per Share《IAS33——每股收益》34.IAS34:Interim Financial Reporting《IAS34——中期财务报告》35.IAS35:Discontinuing Operations《IAS35——终止经营》(已被IFRS5取代)36.IAS36:Impairment of Assets《IAS36——资产减值》37.IAS37:Provisions, Contingent Liabilities and Contingent Assets 《IAS37——准备、或有负债和或有资产》38.IAS38:Intangible Assets《IAS38——无形资产》39.IAS39:Financial Instruments: Recognition and Measurement《IAS39——金融工具:确认和计量》40.IAS40:Investment Property《IAS40——投资性房地产》41.IAS41:Agriculture《IAS41——农业》国际会计准则中文版文件格式:Pdf可复制性:可复制TAG标签:会计学点击次数:更新时间:2010-03-30 15:23介绍国际会计准则中文版,国际会计准则在2008年做了更新,中文版不知道是否同步更新,这个对于会计从业人员的帮助很大,在网上找了很久中文版都是2003的老版本,不知道楼主上传的版本对我是否有用。

IFRS国际会计准则最新修订和调整

IFRS国际会计准则最新修订和调整国际会计准则最新修订和调整《国际财务报告准则第15号—与客户之间的合同产生的收入》(IFRS 15)《国际财务报告准则第9号—金融工具》(IFRS 9)《国际财务报告准则第16号—租赁》(IFRS 16)的发布国际会计准则第1号(IAS 1)财务报表列报的生效国际会计准则第7号(IAS 7)现金流量表的修订国际会计准则第12号(IAS 12)所得税的修订Reasons for the new standardsIASBprinciple based, but limited guidance and were difficult to apply to complex transactions.FASBtoo many guidance, but lack of consistent principles in many cases.Objectives for the new standardsA B C D Improve comparability of revenue recognition practices across entities, industries, jurisdictions and capital markets.Provide a more robust framework for addressing revenue issues. Remove inconsistencies and weaknesses in previous revenue requirements.Provide improved disclosures.IFRS15 Scope✗Lease contracts (IAS 17 Leases)✗Insurance contracts (IFRS 4 Insurance Contracts)✗Financial instruments and other contractual rights or obligations within the scope of IFRS 9, IFRS 10, IAS 27 & IAS28✗无商业意义或虚假交易Non-monetary exchanges between entities in the same line of business to facilitate sales to customers or potentialcustomersIFRS 15 applies to all contracts with customers except:The five-step revenue recognition model•Identify the contract(s) with a customer辨认合约Step 1•Identify the performance obligation(s) in the contract辨认履约义务Step 2•Determine the transaction price确定交易价格Step 3•Allocate the transaction price to the performance obligations in the contract分摊交易价格Step 4•Recognise revenue when (or as) the entity satisfies a performance obligation确定确认收入的时间Step 5Step 1 –辨认合约Identify the contract C ontract para 9 criteria 8If each party has the unilateral enforceable right to terminate a wholly unperformed contract without compensating the other party (or parties) → no contract for the purposes of IFRS 15The contract is approved and the parties are committed to their obligations Rights to goods or services and payment terms can be identifiedThe entity can identify each party’s rights and the contract has commercial substance Collection of consideration is probableContracts with customers must meet ALL of these criteriaStep 2: Identify the performance obligations Promise to transfer a distinct good or service.Customer can benefit from good or service Promised good or service is separable from Other promises ⏹On its own.⏹Together with other readily available goods or services(including goods or services previously acquired from entity)⏹No significant service of integrating the good or service.⏹Good or service is not highly dependent on or interrelated with other goods or services.Controversial areasMultiple deliverables AMobile phoneMonthly usage chargeAirline: mileageComputerhardwaresoftware customization maintenanceStep 3: Determine the transaction priceAmount of consideration to which entity expects to be entitled in exchange for goods or services.Variable consideration Estimate using:Expected value or Most likely amount but ‘ Constrained’.Significant financingAdjust consideration if timing provide customer or entity with significant benefit of financing.Non-cash consideration Measure at fair value unless cannot be reasonably estimated.Consideration payable to customer Reduction of the TP unless in exchanges for a distinct good or service.Collectability将现行收入和建造合同两项准则纳入统一的收入确认模型以控制权转移替代风险报酬转移作为收入确认时点的判断标准对于包含多重交易安排的合同的会计处理提供更明确的指引对于某些特定交易(或事项)的收入确认和计量给出了明确规定涉及股权投资的准则间的相互关系公允价值选择权为何修改金融工具准则?金融在全球经济体中占据越来越重要的比重,应建立趋同的准则ACB原准则太复杂-简化原准则已无法反映实际(减值、套期)确认、分类和计量-减值转回公允价值计量变动直接计入权益a.可供出售金融资产-债权投资b.可供出售金融资产-权益投资摊余成本成本法可供出售金融资产-权益投资应转回并计入损益不得通过损益转回应转回并计入损益不得转回被投资人经营所处的技术、市场、经济和法律环境发生重大影响不利权益投资的公允价值发生严重或非暂时性下跌金融资产的分类Cash flows are solely payments of principal and interest (SPPI)Businessmodel = holdto collectBusinessmodel = holdto collectand sellOtherbusinessmodelsOther types ofcash flows(including all equity investment)Amortised cost FVOCIFVTPL FVTPLFVTPL剩余类FVTPLStep 1资产特征Step 2经营模式权益证券投资:成本豁免—公允价值计量+成本是公允价值的最佳估计All investments inequity instrumentsmust be measured atFV.在有限的情况下,成本是公允价值的适当估计成本永远不是上市股权的最佳计量基础此版权归秀财网所有成本不是公允价值适当估计的迹象Significant change in investee’s performance compared with budgets, plans or milestones.Changes in expectation, eg investee’s technical product milestones will be achieved.Significant change in the market for the investee’s equity or its products or potential products.Significant change in the global economy or the economic environment in which the investee operates.Significant change in the performance of comparable entities, or in the valuations implied by the overall market.Internal matters of the investee, eg :commercial disputes, litigation, changes in management or strategy.Evidence from external transactions in the investee’s equity, either by the investee (such as a fresh issue of equity), or by transfers of equity instruments between third parties.IFRS 9国际会计准则理事会(IASB)2014年发布的:《国际财务报告准则第9号-金融工具》(IFRS 9)终稿⏹背景和生效日期⏹针对金融资产的分类和计量模型的修订⏹金融资产的分类和计量模型汇总⏹预期损失减值模型。

国际会计准则第12号所得税会计.doc

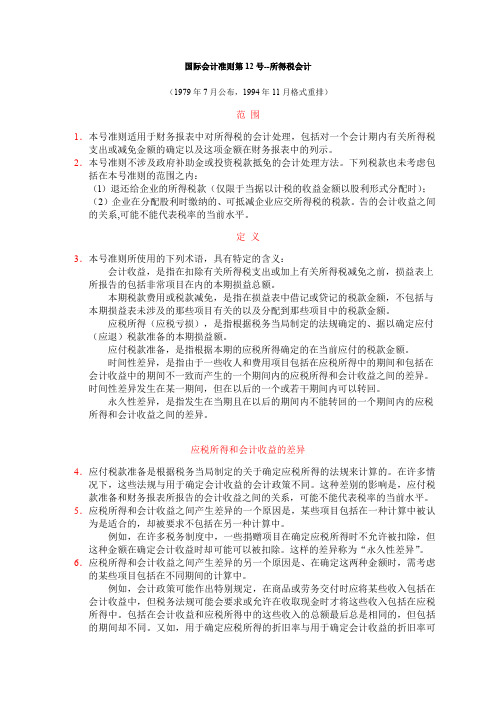

国际会计准则第12号--所得税会计(1979年7月公布,1994年11月格式重排)范围1.本号准则适用于财务报表中对所得税的会计处理,包括对一个会计期内有关所得税支出或减免金额的确定以及这项金额在财务报表中的列示。

2.本号准则不涉及政府补助金或投资税款抵免的会计处理方法。

下列税款也未考虑包括在本号准则的范围之内:(l)退还给企业的所得税款(仅限于当据以计税的收益金额以股利形式分配时);(2)企业在分配股利时缴纳的、可抵减企业应交所得税的税款。

告的会计收益之间的关系,可能不能代表税率的当前水平。

定义3.本号准则所使用的下列术语,具有特定的含义:会计收益,是指在扣除有关所得税支出或加上有关所得税减免之前,损益表上所报告的包括非常项目在内的本期损益总额。

本期税款费用或税款减免,是指在损益表中借记或贷记的税款金额,不包括与本期损益表未涉及的那些项目有关的以及分配到那些项目中的税款金额。

应税所得(应税亏损),是指根据税务当局制定的法规确定的、据以确定应付(应退)税款准备的本期损益额。

应付税款准备,是指根据本期的应税所得确定的在当前应付的税款金额。

时间性差异,是指由于一些收人和费用项目包括在应税所得中的期间和包括在会计收益中的期间不一致而产生的一个期间内的应税所得和会计收益之间的差异。

时间性差异发生在某一期间,但在以后的一个或若干期间内可以转回。

永久性差异,是指发生在当期且在以后的期间内不能转回的一个期间内的应税所得和会计收益之间的差异。

应税所得和会计收益的差异4.应付税款准备是根据税务当局制定的关于确定应税所得的法规来计算的。

在许多情况下,这些法规与用于确定会计收益的会计政策不同。

这种差别的影响是,应付税款准备和财务报表所报告的会计收益之间的关系,可能不能代表税率的当前水平。

5.应税所得和会计收益之间产生差异的一个原因是,某些项目包括在一种计算中被认为是适合的,却被要求不包括在另一种计算中。

例如,在许多税务制度中,一些捐赠项目在确定应税所得时不允许被扣除,但这种金额在确定会计收益时却可能可以被扣除。

国际会计准则IASIFRS列表

国际会计准则IASIFRS列表IAS 1 财务报表的列示IAS 2 存货IAS 7 现金流量表IAS 8 会计政策/会计估计变更与差错IAS 10 期后事项IAS 12 所得税IAS 16 不动产/厂场/设备IAS 19 员工福利IAS 20 政府补助IAS 21 外币财务报表处理IAS 23 借款成本IAS 24 相关方披露IAS 26 退休后福利金IAS 27 单独公司财务报表IAS 28 联营公司与合营公司财务报表IAS 29 超通胀水平财务报表IAS 32 金融工具: 列示IAS 33 每股收益IAS 34 中期财务报表IAS 36 资产的减值IAS 37 预计负债/或有负债/或有资产IAS 38 无形资产IAS 40 投资型房地产IAS 41 农业IFRS 1 首次采用国际财务报告准则IFRS 2 股份支付IFRS 3 企业合并 (对商誉的确认与计量)IFRS 5 待售非流动资产与终止经营业务 (代替IAS 35) IFRS 6 矿业资源的开采与评估IFRS 7 金融工具: 披露 (代替IAS 30)IFRS 8 运营部门报告 (代替IAS 14)IFRS 9 金融工具 (代替IAS 39)(金融资产/金融负债/权益工具/衍生品会计处理) IFRS 10 合并财务报表 (什么情况下合并)IFRS 11 合营安排IFRS 12 对其他实体利益的披露IFRS 13 公允价值IFRS 14 管制递延账户的使用IFRS 15 来自客户合同的收入 (代替IAS 11/IAS 18) IFRS 16 租赁 (代替IAS 17)IFRS 17 保险合同 (代替IFRS 4)。

国际会计准则最新变化

该准则对合并范围的判断标准进行了修订,明确了控制权的判断标准,并对商誉的会计处理进行了规 范。

租赁会计准则的改革

收入确认准则的修订

01

02

修订背景:随着全球经 济和商业模式的发展, 原有收入确认准则在实 务中存在一些模糊和争 议之处,需要进行修订 以提供更加清晰和一致 的指导。

保险合同准则,旨在规范 保险合同的会计处理,提 高财务报告透明度。

IFRS 18

收入准则,对收入的确认 和计量进行了统一规定, 以反映经济实质。

IFRS 19

租赁准则,要求公司将租 赁合同纳入资产负债表, 提高了租赁交易的透明度。

废止或不再适用的国际会计准则

IAS 18

收入准则,被IFRS 18取代,不再适用。

旧准则的废止

为了保持准则的时效性和一致性,IASB废止了一些不再适用的具体准则。这些 被废止的准则包括关于石油天然气行业的准则和关于矿产资源开发的准则等。

财务报告准则的更新

财务报告准则第10号(IFRS 10)

该准则对合并财务报表的定义和范围进行了修订,明确了控制权的判断标准,并引入了新 的披露要求。

要点二

最新变化

近年来,国际财务报告准则委员会 (IFRS)接替了IASC,继续推动国际 会计准则的制定与完善。IFRS制定了 一系列新的国际财务报告准则 (IFRSs),如《国际财务报告准则第 15号》(IFRS 15)和《国际财务报告 准则第16号》(IFRS 16),对租赁会 计和金融工具会计进行了重大改革。

具体准则的整合与简化

为了降低准则的复杂性并提高可理解性,IASB对一些具体准则进行了整合和简化。例如,将多个与租赁相关的准 则整合为一个单一的具体准则,以提供更加清晰和一致的指导。

新西兰根据国际会计准则第12号递延所得税会计处理【外文翻译】

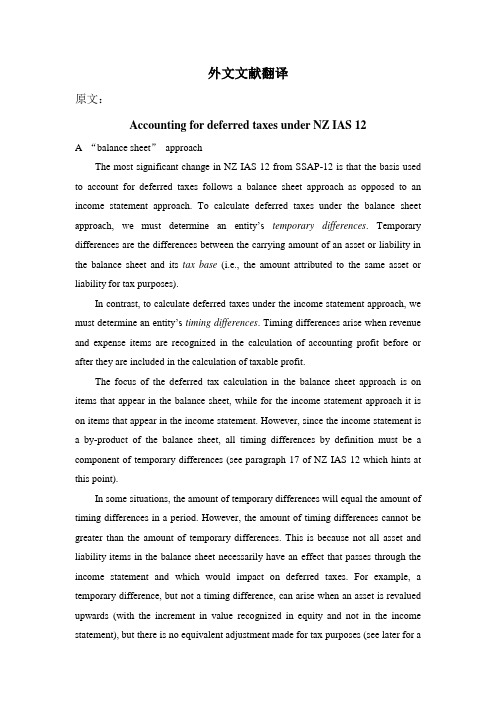

外文文献翻译原文:Accounting for deferred taxes under NZ IAS 12A “balance sheet”approachThe most significant change in NZ IAS 12 from SSAP-12 is that the basis used to account for deferred taxes follows a balance sheet approach as opposed to an income statement approach. To calculate deferred taxes under the balance sheet approach, we must determine an entity’s temporary differences. Temporary differences are the differences between the carrying amount of an asset or liability in the balance sheet and its tax base (i.e., the amount attributed to the same asset or liability for tax purposes).In contrast, to calculate deferred taxes under the income statement approach, we must determine an entity’s timing differences. Timing differences arise when revenue and expense items are recognized in the calculation of accounting profit before or after they are included in the calculation of taxable profit.The focus of the deferred tax calculation in the balance sheet approach is on items that appear in the balance sheet, while for the income statement approach it is on items that appear in the income statement. However, since the income statement is a by-product of the balance sheet, all timing differences by definition must be a component of temporary differences (see paragraph 17 of NZ IAS 12 which hints at this point).In some situations, the amount of temporary differences will equal the amount of timing differences in a period. However, the amount of timing differences cannot be greater than the amount of temporary differences. This is because not all asset and liability items in the balance sheet necessarily have an effect that passes through the income statement and which would impact on deferred taxes. For example, a temporary difference, but not a timing difference, can arise when an asset is revalued upwards (with the increment in value recognized in equity and not in the income statement), but there is no equivalent adjustment made for tax purposes (see later for amore detailed discussion of how this is accounted for under NZ IAS 12).Therefore, the main consequence of the balance sheet approach for entities when they adopt NZ IAS 12 is that it can capture a much wider range of items that will give rise to the recognition of deferred taxes in the financial statements. Further, the change to a balance sheet approach is consistent with the asset-liability orientation to financial reporting that is advocated for by the International Accounting Standards Board in its “Framework for the Preparation and Presentation of Financial Statements”and the New Zealand Institute of Chartered Accountants (formerly the Institute of Chartered Accountants of New Zealand) in its “Statement of Concepts for General Purpose Financial Reporting.”Recognition of all temporary differences-no “partial” recognitionNZ IAS 12 requires a deferred tax liability to be recognized for all taxable temporary differences. Taxable temporary differences result in taxable amounts that impact the taxable profit of future periods when the carrying amount of an asset or liability is recovered or settled. Further, NZ IAS 12 requires a deferred tax asset to be recognized for all deductible temporary differences, although this is subject to certain criteria. Deductible temporary differences result in amounts that are deductible in determining the taxable profit of future periods when the carrying amount of an asset or liability is recovered or settled. Therefore, while some very limited exceptions apply, the requirement in NZ IAS 12 is that all temporary differences (taxable and deductible) are to be recognized as deferred taxes (liability and asset, respectively) in the financial statements.In general, when all temporary differences are recognized as deferred tax, this is often referred to as tax effect accounting under a “comprehensive”basis. When only some, but not all, temporary differences are recognized as deferred tax, this is often referred to as tax effect accounting under a “partial”basis. Using this terminology and distinction, NZ IAS 12 can be viewed as following a comprehensive basis. On the other hand, SSAP-12 allows entities the choice to recognize deferred taxes either under a comprehensive basis or under a partial basis, although the preferred option is comprehensive. As such, this provides a significant variation between the twoaccounting standards because the partial basis is not allowed in NZ IAS 12.By and large the partial basis arose out of concerns regarding the recognition of deferred tax liabilities when tax effect accounting under the comprehensive basis was used. These concerns centre on the issue of whether taxable temporary differences “reverse”. There are situations where the temporary differences created under the comprehensive basis may cause an entity to report on its balance sheet a deferred tax liability that appears never to be settled and which may be ever growing in nature. This can occur if an entity has high investments and/or a policy of continually investing in depreciable assets. In such a case, the taxable temporary differences may not reverse because new temporary differences are created and recognized that more than offset any reversing temporary differences from a prior period. Hence, this gives the impression that settlement of the deferred tax liability can be postponed indefinitely. The partial basis would overcome this concern by recognizing as deferred taxes in the financial statements only those temporary differences that are expected to have a future cash flow effect (i.e., those that are expected to reverse).While many New Zealand entities currently use the comprehensive basis and recognize all timing differences as deferred tax, NZ IAS 12 will cast that net wider by requiring all temporary differences to be recognized. The effect of this on entities will be small if the total amount of temporary differences is similar to the total amount of timing differences. But the effect could be substantial for entities that currently use the partial basis under SSAP-12 and have a history of not recognizing deferred taxes from all timing differences. These unrecognized amounts will now have to be recognized, and for some entities, this will not be a trivial exercise. To illustrate, consider what happened to Air New Zealand when it reported a change in its accounting policy for income taxes from the partial basis to the comprehensive basis for its financial year ending 2000, albeit under the requirements of SSAP-12. The financial effect of doing so increased Air New Zealand’s deferred tax liability by $786 million, an amount that had previously been unrecognized. It also significantly contributed to Air New Zealand’s bottom line net loss of$600 million and substantially increased its debt to total assets ratio from 34 to 66 percent for its 2000financial year. Interestingly, Air New Zealand cited that its main reason for changing to the comprehensive basis was to bring its books in line with international accounting standard trends. More recently, Wong and Wong6 provide descriptive evidence that deferred taxes from unrecognized timing differences from a sample of New Zealand’s largest companies in 2002 and 2003 are not small.NZ IAS 12’s requirement to recognize all temporary differences as deferred tax will fuel further debate on the merits of tax effect accounting under the comprehensive and partial bases. The resolution of this debate is far from certain, especially given recent research findings that entities choose partial over the comprehensive basis because it provides more accurate and relevant information about the deferred tax figures presented in the financial statements when there are temporary differences that are not expected to reverse.Deferred tax assetsNZ IAS 12 and SSAP-12 both allow the recognition of deferred tax assets. However, the recognition conditions in NZ IAS 12 differ from those in SSAP-12. In NZ IAS 12, the recognition of a deferred tax asset depends on “the extent that it is probable that taxable profit will be available against which the deductible temporary difference can be utilized”(paragraph 24 of NZ IAS 12). In SSAP-12, the recognition of a deferred tax asset depends on “the extent that there is virtual certainty of its recovery in future periods”(paragraph 4.20 of SSAP-12). Hence, the recognition conditions in NZ IAS 12 regarding deferred tax assets appear to be less stringent than those in SSAP-12.The main consequence of this change in NZ IAS 12 is that entities are likely to recognize and report a higher incidence of deferred tax assets on their balance sheet than what we have seen under SSAP-12. However, NZ IAS 12 also requires that entities be conservative in their measurement of the deferred tax asset and they must review the carrying amount at each balance date. If there is a probability that there will no longer be sufficient taxable profits available to allow the benefit of part or the entire deferred tax asset to be utilized, then the carrying amount of the deferred tax asset must be reduced accordingly (paragraph 56 of NZ IAS 12). In addition, thefinancial effect of recognizing a deferred tax asset (or for that matter, a deferred tax liability) may be reduced if an entity offsets the deferred tax assets and deferred tax liabilities that they present on the balance sheet (paragraph 74 of NZ IAS 12). Revalued assetsAn interesting issue that arises in NZ IAS 12 concerns the revaluation of assets. In this situation, when an asset is revalued upwards in the financial statements, but there is no similar adjustment to the tax base of the asset, this creates a taxable temporary difference that requires the recognition of a deferred tax liability. In comparison, no deferred tax liability would be recognized in the balance sheet for an asset that is revalued under the income statement approach in SSAP-12. Generally, this is because of the way in which the depreciation charge from the revalued asset is handled in the income statement for accounting and tax purposes. While the depreciation expense for accounting purposes is based on the revalued amount, depreciation expense that is deducted for tax purposes must still be based on the asset’s original cost. This means that the depreciation expense that arises from the revaluation increment never has a tax effect (i.e., a timing difference does not arise from that part of the depreciation expense related to the revalued asset) under SSAP-12. Hence, the change in requirement in NZ IAS 12 could increase significantly the amount of the deferred tax liability that is recognized on the balance sheet because entities revalue their assets regularly.The measurement of the deferred tax liability from the revaluation in NZ IAS 12 depends on the manner in which the carrying amount of the asset is expected to be recovered at balance date (see paragraph 52 of NZ IAS 12, in particular example B) - that is, whether the asset is expected to be recovered through its further use or if the asset is expected to be recovered through its subsequent disposal. If the carrying amount of the asset is expected to be recovered through its further use, a deferred tax liability would be recognized by calculating the difference between the carrying amount (i.e., the revalued amount) and the tax base of the asset. If the carrying amount of the asset is expected to be recovered through its subsequent disposal, a deferred tax liability would be recognized by determining the difference between thecarrying amount and the tax base of the asset, but adjusted for any amount considered to be a capital gain (i.e., the expected proceeds from the disposal in excess of the original cost of the asset). This adjustment is necessary because capital gains are not taxable under current New Zealand tax legislation. Also, the deferred tax liability that is recognized from the revaluation of the asset must be charged directly to equity (paragraph 61 of NZ IAS 12). This is because the accounting for the revaluation itself involves the increment in value being recognized in equity and not in the income statement.To illustrate these two situations, consider this example. Assume an entity owns an asset that cost $100,000 to acquire. The carrying amount before the asset is revalued is $60,000, while the tax base is $50,000. The asset is revalued to $120,000, but no similar adjustment is made for tax purposes. The tax rate is 33 percent and capital gains from the sale of assets are not taxed.If the carrying amount of the revalued asset is expected to be recovered through its further use, the amount of the temporary difference would be $70,000 (i.e., $120,000- $50,000). This figure is a taxable temporary difference because the entity expects to recover benefits from the asset’s further use to the carrying amount of $120,000. Hence, the deferred tax liability that is recognized from the revalued asset would be $23,100 (i.e., $70,000 x 33 percent). If the carrying amount of the revalued asset is expected to be recovered through its subsequent disposal, the taxable temporary difference would again amount to $70,000 (i.e., $120,000-$50,000). However, $20,000 of this amount is a capital gain (found by deducting the original cost of $100,000 from the revalued amount of $120,000). This means that only $50,000 of the $70,000 temporary difference is actually taxable. Hence, the deferred tax liability that is recognized from the revalued asset would be $16,500 (i.e., $50,000 x 33 percent).We can see from the above example that not only will NZ IAS 12 require entities to recognize a deferred tax liability from an asset that is revalued upwards, but it will also require entities to make a decision about how their assets are expected to be recovered, as this will have a bearing on how entities measure the deferred taxliability.Wong, Norman. Accounting for deferred taxes under NZ IAS 12.[J] University of Auckland Business Review, 2006:55-59译文:新西兰根据国际会计准则第12号递延所得税会计处理一、一种“资产负债表”的研究方法在新西兰会计准则最重要的变化是关于国际会计准则第12号所得税会计,尤其是在用于计算递延税项的基础上,遵循资产负债表观,而不是损益表观。

国际会计准则第12号

国际会计准则第1 2 号(2 0 1 0 年版)正体中文版草案所得税(仅准则部分对外征求意见,有意见者请于99 年11 月30 日前,将意见以电子邮件方式寄至tifrs@.tw)财团法人中华民国会计研究发展基金会国际会计准则翻译覆审项目委员会征求意见函国际会计准则第12 号所得税A部分财团法人中华民国会计研究发展基金会国际会计准则翻译覆审项目委员会翻译国际会计准则第12 号正体中文版草案A1国际会计准则第12号所得税本版纳入截至2009 年12 月31 日止发布之国际财务报导准则对本准则所作之修正。

国际会计准则委员会(IASC)于1996 年10 月发布国际会计准则第12 号「所得税」,并取代国际会计准则第12 号「所得税之会计处理」(1979 年7 月发布)。

本准则第88 段已于1999 年5 月被国际会计准则第10 号「资产负债表日后事项」修正,并于2000 年4 月由于国际会计准则第40 号「投资性不动产」之结果进一步被修正。

国际会计准则委员会(IASC)于2000 年10 月核准修订,以明订股利所得税后果之会计处理。

国际会计准则理事会(IASB)于2001 年4 月决议,依旧章程所发布之所有准则及解释于修正或撤销前仍应适用。

其后,国际会计准则第12 号及随附之指引已被下列国际财务报导准则修正:_ 国际会计准则第1 号「财务报表之表达」(2003 年12 月修订)_ 国际会计准则第8 号「会计政策、会计估计变动及错误」(2003 年12 月发布)_ 国际会计准则第21 号「汇率变动之影响」(2003 年12 月修订)_ 国际会计准则第39 号「金融工具:认列与衡量」(2003 年12 月修订)_ 国际财务报导准则第2 号「股份基础给付」(2004 年2 月发布)_ 国际财务报导准则第3 号「企业合并」(2004 年3 月发布)_ 国际会计准则第1 号「财务报表之表达」(2007 年9 月修订)*_ 国际财务报导准则第3 号「企业合并」(2008 年1 月修订)†_ 国际财务报导准则第9 号「金融工具」(2009 年11 月发布)。

IAS简介(国际会计准则)[1]共75页PPT资料

![IAS简介(国际会计准则)[1]共75页PPT资料](https://img.taocdn.com/s3/m/4fe19649844769eae009ed7d.png)

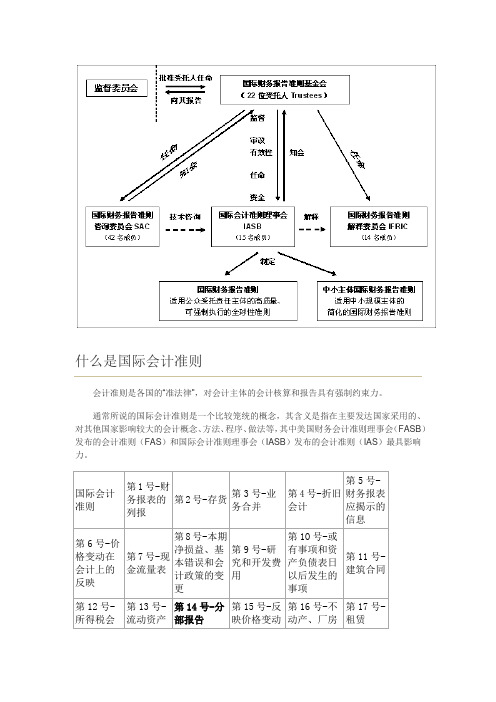

IASC的发展

2000年5月,IASC进行重新的改组(此次改革基 本上按照美国财务会计准则委员会的模式,有3名 美国人担任了该组织的重要职务,这是IASC为了 实现其目的与美国合作、妥协的产物。),设立 IASC基金会,下设“国际会计准则理事会” (IASB)、“国际财务报告解释委员会” (IFRIC)和“准则咨询委员会”(SAC)。其 中,IASB主要负责各项会计准则的研究、制定等 工作。这次改组使IASC在某种意义上由各国会计 准则“协调者”的身份转变成“全球会计准 则”“制定者”的身份。

IASC的建立

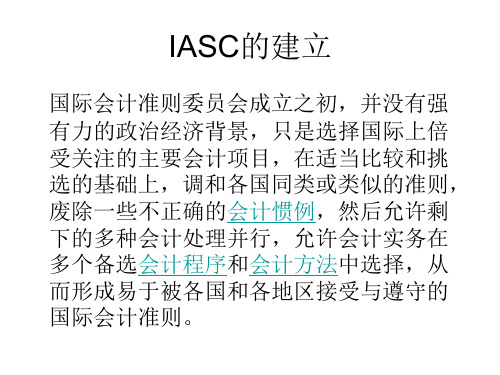

国际会计准则委员会成立之初,并没有强 有力的政治经济背景,只是选择国际上倍 受关注的主要会计项目,在适当比较和挑 选的基础上,调和各国同类或类似的准则, 废除一些不正确的会计惯例,然后允许剩 下的多种会计处理并行,允许会计实务在 多个备选会计程序和会计方法中选择,从 而形成易于被各国和各地区接受与遵守的 国际会计准则。

IASC的建立

经济全球化已经成为当代社会一个最明显的特征, 各市场之间的联系更加紧密,投资者和公司都在 不断寻找跨国界的机会,各国企业纷纷从单靠国 内资本市场融资转向依靠国际资本市场融资。比 如伦敦证券交易所的股票市值总额中有70%是非 英国公司的,德国证券交易所市值总额中有80% 是非德国公司的,区域性或全球性的资本市场正 在加速形成。全球化对国际会计协调的需求与日 俱增,大家都翘首期待高质量的、统一的国际会 计准则出台

IASC的建立

初期国际会计准则的制定中虽也强调“以 公众利益为目标”、“为改进和协调与编 报财务报表有关的条例、会计准则和程序 而开展广泛的工作”,但更关注的是获得 国际会计准则委员会全体成员的支持,使 国际会计准则争取到各国会计界的广泛认 同。如此制定出来的准则显然不是高质量 的准则。各国对国际会计准则经常反映折 衷意见和保留自由选择的做法一方面表示 接受,一方面又表示不满。

2024年载录——最新企业会计准则

2024年载录企业会计准则,也称为IFRS2024,是由国际会计准则理事会(IASC)修订的企业会计准则。

它的目的是为了促进全球投资者的证券市场和投资组合。

此外,它也为国际公司提供了披露要求,以帮助投资者和其他利益相关者理解有关公司运营情况和状况的资料。

IFRS2024主要由以下17部分组成:

1.国际会计准则和框架(IFRSs);

2.重要政策披露(IAPSs);

3.既定会计政策(IFRSs);

4.集团会计政策和重要政策披露(IAPSs);

5.公司报表结构(ICSs);

6.会计数据公开和披露(IASDs);

7.投资型企业会计政策(IASs);

8.财务准备会计政策(IFRSs);

9.汇率会计政策(IFRSs);

10.报表审计准则(IASs);

11.财务代理会计政策(IASs);

12.企业结构思考(ICSs);

13.资产折旧准则(IASs);

14.投资核算方法(IFRSs);

15.投资价值估计准则(IFRSs);

16.会计政策变动准则(IFRSs);

17.特殊重要性的披露(IASDs)。

IFRS2024政策主要涵盖公司报表结构,会计政策,会计数据公开和披露,投资型企业会计政策,集团会计政策,财务准备会计政策,汇率会计政策,财务代理会计政策,报表审计准则,企业结构思考。

单一交易确认的资产及负债的递延所得税处理——基于ias12修订征求

CICPA单一交易确认的资产及负债的递延所得税处理一基于IAS12修订征求意见稿的分析吕新建胡小东于海玉新租赁准则的适用普遍产生了一类同时等额确认一项资产和负债的单一交易或事项,而之前这类交易或事项鲜见于可能存在弃置义务的高危行业中。

这种单一交易事项产生的暂时性差异在当前中国所得税准则下满足递延所得税豁免确认条件,而这一豁免可能导致同一企业不同时期以及相同行业不同企业的有效税率因企业租赁活动的变化而不断变动,降低了会计信息的可比性。

在此背景下,国际会计准则理事会(IASB)发布了一份题为《与单一交易形成的资产和负债相关的递延所得税(针对<国际会计准则第12号〉作岀的修订建议)》的征求意见稿,旨在缩小递延所得税豁免确认的适用范围。

鉴于会计准则的全面趋同本文基于国内企业所得税法并结合《企业会计准则第18号-所得税》(CAS18),对该修订进行剖析,以期为实务工作及后续准则修订提供一定的借鉴。

二、递延所衞兑初始确认豁免CAS18第一条和第十三条对递延所得税的初始确认豁免作出了具体的规定,对于不是企业合并且发生时既不影响会计利润也不影响应纳税所得额的交易(“两不影响交易”)中产生的资产或负债的初始确认不确认递延所得税,此外,商誉的初始确认也豁免确认递延所得税负债O实务中非业务合并中的两不影响交易并不鲜见,在此举几个常见的例子:例1:在非业务合并的合并交易(资产收购)中,其类比适用《企业会计准则第4号-固定资产》(CAS4)中同时购入多项固定资产的总成本的公允价值分摊的方法,会导致合并报表中资产或负债的账面价值与计税基础的差异,但并没有改变会计利润和应纳税所得额。

上述单一交易也属于双不影响交易,但其又区别于前文中的豁免示例,在上述单一交易中.资产负债初始确认时会同时产生金额相等的应纳税暂时性差异和可抵扣暂时性差异尽管没有影响会计利润和应纳税所得额.但由于同时确认出递延所得税资产和递延所得税负债,可以不涉及资产负渍账面价值的调整.而这为单一交易的递延所得税确认提供了一种可能性。

最新国际会计准则IAS12

最新国际会计准则IAS12⽬录⼀、概述⼆、范围三、定义四、应税所得和会计收益的差异五、纳税影响的会计⽅法六、递延法七、负债法⼋、适⽤性九、递延税款借项⼗、应税亏损⼗⼀、资产的价值重估⼗⼆、附属公司和联营企业的未分配盈余⼗三、财务报表的呈报⼗四、揭⽰⼗五、纳税或有事项⼗六、过渡性规定⼗七、⽣效⽇期⼆、范围1.本号准则适⽤于财务报表中对所得税的会计处理,包括对⼀个会计期内有关所得税⽀出或减免⾦额的确定以及这项⾦额在财务报表中的列⽰。

2.本号准则不涉及政府补助⾦或投资税款抵免的会计处理⽅法。

下列税款也未考虑包括在本号准则的范围之内:(l)退还给企业的所得税款(仅限于当据以计税的收益⾦额以股利形式分配时);(2)企业在分配股利时缴纳的、可抵减企业应交所得税的税款。

告的会计收益之间的关系,可能不能代表税率的当前⽔平。

三、定义3.本号准则所使⽤的下列术语,具有特定的含义:会计收益,是指在扣除有关所得税⽀出或加上有关所得税减免之前,损益表上所报告的包括⾮常项⽬在内的本期损益总额。

本期税款费⽤或税款减免,是指在损益表中借记或贷记的税款⾦额,不包括与本期损益表未涉及的那些项⽬有关的以及分配到那些项⽬中的税款⾦额。

应税所得(应税亏损),是指根据税务当局制定的法规确定的、据以确定应付(应退)税款准备的本期损益额。

应付税款准备,是指根据本期的应税所得确定的在当前应付的税款⾦额。

时间性差异,是指由于⼀些收⼈和费⽤项⽬包括在应税所得中的期间和包括在会计收益中的期间不⼀致⽽产⽣的⼀个期间内的应税所得和会计收益之间的差异。

时间性差异发⽣在某⼀期间,但在以后的⼀个或若⼲期间内可以转回。

永久性差异,是指发⽣在当期且在以后的期间内不能转回的⼀个期间内的应税所得和会计收益之间的差异。

四、应税所得和会计收益的差异4.应付税款准备是根据税务当局制定的关于确定应税所得的法规来计算的。

在许多情况下,这些法规与⽤于确定会计收益的会计政策不同。

这种差别的影响是,应付税款准备和财务报表所报告的会计收益之间的关系,可能不能代表税率的当前⽔平。

42个国际会计准则

42个国际会计准则42个国际会计准则是国际会计准则委员会(International Accounting Standards Board,IASB)发布的一系列规范,旨在为全球范围内的企业提供统一的会计准则。

这些准则涵盖了各个方面的会计处理和披露要求,对于确保财务报告的准确性和可比性起到了重要的作用。

接下来将介绍其中一些重要的准则。

IAS 1《财务报表展示》规定了财务报表的编制和展示要求。

该准则规定了财务报表的基本要素,如资产、负债、所有者权益、收入和费用,并规定了报表的格式和披露要求,以确保财务报表的真实和公正。

IAS 16《固定资产》规定了固定资产的会计处理和披露要求。

该准则明确了固定资产的初始计量、后续计量和资产减值测试,并规定了折旧和摊销的方法,以确保固定资产在财务报表中得到正确的反映。

第三,IAS 36《资产减值》规定了资产减值测试的要求。

该准则要求企业在每个会计期末对资产进行减值测试,以确定其是否有发生减值的迹象。

如果有减值迹象,企业需要根据减值测试的结果进行相应的减值准备。

第四,IAS 38《无形资产》规定了无形资产的会计处理和披露要求。

该准则明确了无形资产的初始计量和后续计量,以及无形资产的摊销和资产减值测试的方法,确保无形资产在财务报表中得到正确的反映。

第五,IAS 37《拨备、资产负债和担保》规定了拨备、资产负债和担保的会计处理和披露要求。

该准则要求企业根据相关法规和会计准则的规定,对潜在负债进行计量和披露,并对可能的拨备进行估计。

第六,IAS 12《所得税》规定了所得税的会计处理和披露要求。

该准则明确了企业在财务报表中计量和披露所得税负债和所得税资产的方法,以确保所得税在财务报表中得到正确的反映。

除了上述几个准则外,还有许多其他重要的国际会计准则,如IAS 2《存货》、IAS 7《现金流量表》、IAS 17《租赁》、IAS 18《收入》等。

每个准则都有其独特的会计处理和披露要求,旨在确保财务报表的准确性和可比性。

国际会计准则(国际会计准则委员会制定并公布的会计规范)

主要规定

制定程序

规定

已颁发的准则

国际会计准则主要规定: ①会计报表中的某些项目应如何计量; ②应提供报表资料的最低限度。

国际会计准则的制定程序是:由国际会计准则委员会理事会选定题目,提交筹划组;

国际会计准则初稿经理事会2/3以上表决通过,作为征求意见稿广为分发,搜集意见;征询期通常为6个月, 期满时由筹划组根据各方面意见研究修改,修改稿交理事会审议,经3/4以上表决通过,用国际会计准则委员会名 义颁发。在制定准则以前,还可能对某些题目发表讨论文件。从选题到制定颁发,一般约需3年。

准则区别

国际会计准则与美国会计准则的比较

美国会计准则通常被称为“公认会计准则”(GAAP),主要由美国财务会计准则委员会发布,包括150多项财 务会计准则(FAS)。按照美国法律,美国会计准则的制定或管理权力属于美国证监会(SEC),美国证监会将制定会 计准则的工作委托给美国财务会计准则委员会(FASB),但保留了否决权。美国财务会计准则委员会成立于1972年, 性质上是民间专业机构,由高等院校专家、会计师事务所专家等组成,具有较高的专业性和独立性。

不同点:一是出发点不同。 IASB的出发点是制定全球通用的会计准则,FASB则主要根据美国国内经济活 动的需要制定会计原则,主要适用于美国。二是基础不同。

谢谢观看

国际会计准则(国际会计准则委员会 制定并公布的会计规范)

国际会计准则委员会制定并公布的会计规范

01 基本介绍

03 主要规定

目录

02 历史沿革 04 准则区别

国际会计准则(International Accounting Standards,简称IAS)是由国际会计准则委员会制定并公布的会 计一般规范。其目的是促成国际范围内的会计行为的规范化。它不直接约束各国的会计活动,而通过纳入各国的 会计规范系统来对各国 (主要是国际会计准则委员会会员所在国)的会计活动施加影响。现已公布的国际会计准 则有“会计政策的披露”、“存货估价”、“折旧会计”、“财务报表”、“合并财务报表”、“财务状况变动 表”、“会计对价格变动的反映”、“非常事项与前期事项的处理和会计政策的改变”、“研究和开发活动的会 计”、“或有事项和资产负债表日以后发生事项的处理”、“建筑合同会计”、“所得税会计”及“流动资产流 动负债的列示”,等等。

IAS简介国际会计准则

IASC的发展

2000年5月,IASC进行重新的改组(此次改革基 本上按照美国财务会计准则委员会的模式,有3名 美国人担任了该组织的重要职务,这是IASC为了 实现其目的与美国合作、妥协的产物。),设立 IASC基金会,下设“国际会计准则理事会” (IASB)、“国际财务报告解释委员会” (IFRIC)和“准则咨询委员会”(SAC)。其 中,IASB主要负责各项会计准则的研究、制定等 工作。这次改组使IASC在某种意义上由各国会计 准则“协调者”的身份转变成“全球会计准 则”“制定者”的身份。

IASC的建立

国际会计准则委员会成立之初,并没有强 有力的政治经济背景,只是选择国际上倍 受关注的主要会计项目,在适当比较和挑 选的基础上,调和各国同类或类似的准则, 废除一些不正确的会计惯例,然后允许剩 下的多种会计处理并行,允许会计实务在 多个备选会计程序和会计方法中选择,从 而形成易于被各国和各地区接受与遵守的 国际会计准则。

IASC的建立

经济全球化已经成为当代社会一个最明显的特征, 各市场之间的联系更加紧密,投资者和公司都在 不断寻找跨国界的机会,各国企业纷纷从单靠国 内资本市场融资转向依靠国际资本市场融资。比 如伦敦证券交易所的股票市值总额中有70%是非 英国公司的,德国证券交易所市值总额中有80% 是非德国公司的,区域性或全球性的资本市场正 在加速形成。全球化对国际会计协调的需求与日 俱增,大家都翘首期待高质量的、统一的国际会 计准则出台

国际会计准则第33号(IAS 33)——每股 收益 国际会计准则第34号(IAS 34)——中期 财务报告 国际会计准则第35号(IAS 35)——终止 经营 (已被于2005年生效的IFRS 5取代)

IAS的具体准则

国际会计准则第36号(IAS 36)——资产 减值 国际会计准则第37号(IAS 37)——准备、 或有负债和或有资产 国际会计准则第38号(IAS 38)——无形 资产

国际会计准则目录【1-41号】

第37号-准备、或有负债和或有资产

第38号-无形资产

第39号-金融工具:确认与计量

第40号-投资性房地产

第41号-农业

备注:国际会计准则第3号已失效,由准则第27号和第28号替代;国际会计准则第4号被于1998年发布或修订的IAS 16、IAS 22和IAS 38取代;国际会计准则第5号已失效,由准则第1号替代;已失效,由准则第1号替代;国际会计准则第6号已失效,由准则第15号替代;国际会计准则第9号被1999年7月1日生效的IAS 38取代;国际会计准则第13号已失效,由准则第1号替代。

什么是国际会计准则

会计准则是各国的“准法律”,对会计主体的会计核算和报告具有强制约束力。

通常所说的国际会计准则是一个比较笼统的概念,其含义是指在主要发达国家采用的、对其他国家影响较大的会计概念、方法、程序、做法等,其中美国财务会计准则理事会(FASB)发布的会计准则(FAS)和国际会计准则理事会(IASB)发布的会计准则(IAS)最具影响力。

第13号-流动资产和流动负债的列报

第14号-分部报告

第15号-反映价格变动影响的信息

第16号-不动产、厂房和设备

第17号-租赁

国际会计准则第18号-收入

第19号-退休金费用

第20号-政府补助会计和对政府援助的揭示

第21号-外汇汇率变动的影响

第22号-企业合并

第23号-借款费用

第24号-对关联者的揭示

国际会计准则

第1号-财务报表的列报

第2号-存货

第3号-业务合并

第4号-折旧会计

第5号-财务报表应揭示的信息

第6号-价格变动在会计上的反映

第7号-现金流量表

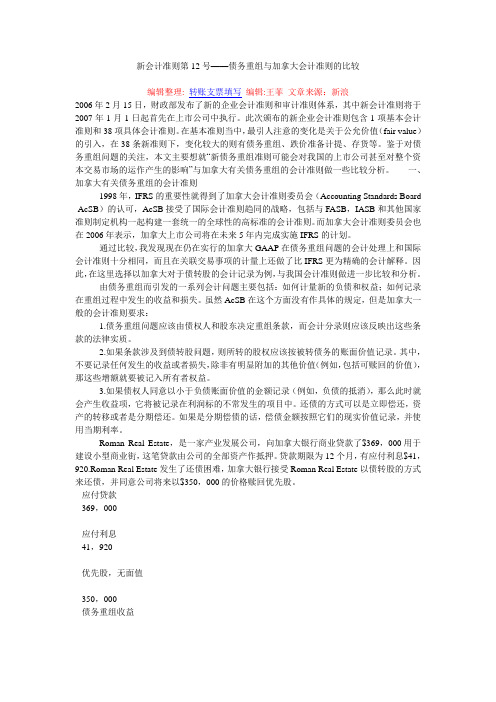

新会计准则第12号

新会计准则第12号——债务重组与加拿大会计准则的比较---------------------------------------------------------------------------------------------------------------------- 编辑整理: 转账支票填写编辑:王菲文章来源:新浪2006年2月15日,财政部发布了新的企业会计准则和审计准则体系,其中新会计准则将于2007年1月1日起首先在上市公司中执行。

此次颁布的新企业会计准则包含1项基本会计准则和38项具体会计准则。

在基本准则当中,最引人注意的变化是关于公允价值(fair value)的引入,在38条新准则下,变化较大的则有债务重组、跌价准备计提、存货等。

鉴于对债务重组问题的关注,本文主要想就“新债务重组准则可能会对我国的上市公司甚至对整个资本交易市场的运作产生的影响”与加拿大有关债务重组的会计准则做一些比较分析。

一、加拿大有关债务重组的会计准则1998年,IFRS的重要性就得到了加拿大会计准则委员会(Accounting Standards Board -AcSB)的认可,AcSB接受了国际会计准则趋同的战略,包括与FASB,IASB和其他国家准则制定机构一起构建一套统一的全球性的高标准的会计准则。

而加拿大会计准则委员会也在2006年表示,加拿大上市公司将在未来5年内完成实施IFRS的计划。

通过比较,我发现现在仍在实行的加拿大GAAP在债务重组问题的会计处理上和国际会计准则十分相同,而且在关联交易事项的计量上还做了比IFRS更为精确的会计解释。

因此,在这里选择以加拿大对于债转股的会计记录为例,与我国会计准则做进一步比较和分析。

由债务重组而引发的一系列会计问题主要包括:如何计量新的负债和权益;如何记录在重组过程中发生的收益和损失。

虽然AcSB在这个方面没有作具体的规定,但是加拿大一般的会计准则要求:1.债务重组问题应该由债权人和股东决定重组条款,而会计分录则应该反映出这些条款的法律实质。

- 1、下载文档前请自行甄别文档内容的完整性,平台不提供额外的编辑、内容补充、找答案等附加服务。

- 2、"仅部分预览"的文档,不可在线预览部分如存在完整性等问题,可反馈申请退款(可完整预览的文档不适用该条件!)。

- 3、如文档侵犯您的权益,请联系客服反馈,我们会尽快为您处理(人工客服工作时间:9:00-18:30)。

目录一、概述二、范围三、定义四、应税所得和会计收益的差异五、纳税影响的会计方法六、递延法七、负债法八、适用性九、递延税款借项十、应税亏损十一、资产的价值重估十二、附属公司和联营企业的未分配盈余十三、财务报表的呈报十四、揭示十五、纳税或有事项十六、过渡性规定十七、生效日期二、范围1.本号准则适用于财务报表中对所得税的会计处理,包括对一个会计期内有关所得税支出或减免金额的确定以及这项金额在财务报表中的列示。

2.本号准则不涉及政府补助金或投资税款抵免的会计处理方法。

下列税款也未考虑包括在本号准则的范围之内:(l)退还给企业的所得税款(仅限于当据以计税的收益金额以股利形式分配时);(2)企业在分配股利时缴纳的、可抵减企业应交所得税的税款。

告的会计收益之间的关系,可能不能代表税率的当前水平。

三、定义3.本号准则所使用的下列术语,具有特定的含义:会计收益,是指在扣除有关所得税支出或加上有关所得税减免之前,损益表上所报告的包括非常项目在内的本期损益总额。

本期税款费用或税款减免,是指在损益表中借记或贷记的税款金额,不包括与本期损益表未涉及的那些项目有关的以及分配到那些项目中的税款金额。

应税所得(应税亏损),是指根据税务当局制定的法规确定的、据以确定应付(应退)税款准备的本期损益额。

应付税款准备,是指根据本期的应税所得确定的在当前应付的税款金额。

时间性差异,是指由于一些收人和费用项目包括在应税所得中的期间和包括在会计收益中的期间不一致而产生的一个期间内的应税所得和会计收益之间的差异。

时间性差异发生在某一期间,但在以后的一个或若干期间内可以转回。

永久性差异,是指发生在当期且在以后的期间内不能转回的一个期间内的应税所得和会计收益之间的差异。

四、应税所得和会计收益的差异4.应付税款准备是根据税务当局制定的关于确定应税所得的法规来计算的。

在许多情况下,这些法规与用于确定会计收益的会计政策不同。

这种差别的影响是,应付税款准备和财务报表所报告的会计收益之间的关系,可能不能代表税率的当前水平。

5.应税所得和会计收益之间产生差异的一个原因是,某些项目包括在一种计算中被认为是适合的,却被要求不包括在另一种计算中。

例如,在许多税务制度中,一些捐赠项目在确定应税所得时不允许被扣除,但这种金额在确定会计收益时却可能可以被扣除。

这样的差异称为“永久性差异”。

6.应税所得和会计收益之间产生差异的另一个原因是、在确定这两种金额时,需考虑的某些项目包括在不同期间的计算中。

例如,会计政策可能作出特别规定,在商品或劳务交付时应将某些收入包括在会计收益中,但税务法规可能会要求或允许在收取现金时才将这些收入包括在应税所得中。

包括在会计收益和应税所得中的这些收入的总额最后总是相同的,但包括的期间却不同。

又如,用于确定应税所得的折旧率与用于确定会计收益的折旧率可能不同。

这种差异称为“时间性差异”。

7.当将利得或损失直接贷记或借记股东权益帐户时,时间性差异和永久性差异也可能会产生。

8.时间性差异的产生和转回可能涉及一个以上的会计期间。

关于这些时间性差异的性质和金额的信息常被认为对财务报表使用者是有用的。

但是,反映时间性差异的影响的方法是各种各样的。

有时将这种信息包括在财务报表附注中,有时则将这些差异的影响通过纳税影响的会计方法来加以反映。

9.对财务报表中个别资产的重新估价或现值会计的一般应用,可能会导致应税所得和会计收益之间的差异。

此种情况在第31-33段中阐述。

五、纳税影响的会计方法10.本期税款费用应在纳税影响的会计方法的基础上,使用递延法或负债法来确定。

所用的方法应予以揭示。

11.根据纳税影响的会计方法,所得税被视为企业在获取收益时发生的一种费用,并应随同与它们有关的收入和费用计入同一期间内。

时间性差异所产生的纳税影响应包括在损益表的税款费用以及资产负债表的递延税款余额中。

很多国家在所得税会计中采用纳税影响的会计方法。

常用的方法称为递延法和负债法。

六、递延法12.在递延法下,当期的时间性差异的纳税影响,应予以递延并分配给时间性差额转回的未来各个期间。

由于资产负债表上递延税款的余额,并不被认为代表收款的权利或付款的义务,所以它们并不需要调整以反映税率的变更或新税的征收。

13.在递延法下,某一期间的税款费用包括:(1)应付税款准备;(2)递延至以后的期间或自以前的期间递延转来的时间性差异的纳税影响。

14.发生在本期的时间性差异的纳税影响,应用现行税率确定。

发生在前期而在本期转回的个别时间性差异的纳税影响一般用原先采用的税率确定。

为了便于应用这个方法,相似的时间性差异可以进行归类。

七、负债法15.在负债法下,本期时间性差异的预计纳税影响,或者作为将来应付税款的负债来确定和报告,或者作为代表预付未来税款的资产来确定和报告。

递延税款的余额应随着税率的变动或课征新税而加以调整。

该余额也可能随着税率在未来的变动而进行调整。

16.在负债法下,某一期间的税款费用包括:(1)应付税款准备;(2)根据本期发生或转回的时间性差异预计应付的或认为需要预付的税款金额;(3)为了反映税率变动或课征新税的需要而对资产负债表中递延税款余额进行的调整数。

17.在负债法下,本期发生或转回的时间性差异的纳税影响,以及对递延税款余额的调整,均应使用现行税率加以确定,除非有其他信息表明采用另一种税率更为适当,例如,当税率的变动已经宣布并将在以后年度使用时。

八、适用性18.所使用的纳税影响的会计方法通常应适用于所有的时间性差异。

但是,当有合理的证据可以表明,在今后相当长的时期内(至少3年),某些时间性差异物不会转回时,一个期间的税款费用可以不包括这些时间性差异的纳税影响,而且还不需要指出在这个期间以后这些时间性差异可能会转回。

时间性差异的金额,不论是本期的还是累计的,只要没有进行会计处理,均应予以揭示。

九递延税款借项19.导致一个借方余额或递延税款余额的一个借项产生的时间性差异的纳税影响,除非能合理地预期它们的实现,否则不应结转。

20.时间性差异的会计处理可能会导致一个借方余额或递延税款余额的一个借项的产生。

为了慎重考虑起见,只有在可以合理地预期其实现时,例如,在时间性差异将转回的期间内,如有足够的未来应税所得会产生,这样一个借方金额才可以转入资产负债表。

十、应税亏损21.税法常常规定,本期的应税亏损可以用来追溯期内已经缴付的税款,或者减少或抵消将在未税款。

这种亏损提供了在亏损时期税款的减免,或者间潜在的税款减免。

在确定财务报表中的净收益时,退回在特定的来期间需缴的在某些未来期这种税款减免可以包括在不同的会计期间内。

22.作为应税亏损向前期追溯的结果所追回的与前期有关的税款,应包括在亏损或内的净收益中。

应退回但尚未收到的金额应作为应收帐款包括在资产负债表中。

23.把应税亏损追溯到前期所退回的税款,代表了在亏损期内已有效地实现了的并已包括在那一期间财务报表中的净收益或净亏损中的税款减免。

在确定减免金额时,需要对现存递延税款余额作适当的调整。

24.当应税亏损可以向后结转用来确定未来期间的应税所得时,与应税亏损有类的潜在的税款准免,除了第25和第26段所述的增况外,在其实现或前不应包括在净收益中。

25.如果未来的应税所得确实无疑足以使亏损的减税利益得以实现,那么与所结转的应税亏损有关的潜在的税款减免可以包括在确定亏损期的净收益中。

26.如果第25段所制定的标准不能得到满足,但是如果在要求将应税亏损作为祛税利益的期间,具有递延税款的贷方净余额将会转回或能够转回,在这一限度内,与所结转的应税亏损有关的税敌祛免应包括在确定亏损期的净收益中。

27.如果在第23段所述的向前期追溯以后,尚有应税亏损存在,与此应税亏损金额有关的潜在的税款减免的实施,要求在未来期间内存在应税所得。

为此,与向后期结转的应税亏损有关的潜在税款减免,通常不包括在确定亏损期的净收益中。

28.但是在极少数情况下,在确定亏损期的净收益时,把这种潜在的税款减免包括在内,被认为是适宜的。

如果按照这种方式处理一项潜在的税款减免,需要审慎考虑的是,对将来的应税所得足以使亏损的减税利益获得实现,是否具有无可怀疑的保证。

例如,存在如下条件就可认为是有了无可怀疑的保证:(l)亏损是由于一个可以辨明的并且不是反复发生的原因产生的,以及(2)企业已经建立了很长时间的获利记录并预期将继续保持下去。

29.递延税款余额中贷方金额的存在,可以证明与结转后期的应税亏损有关的税款减免至少能够部分实现。

在递延税款余额中反映的时间性差异的转回,本身将形成一笔数额相等的应税所得,可以抵消由应税亏损获得的税款的减免。

如果税法限制了将应税亏损结转后期以抵消将来的应税所得的期限,那么只有在这一有限的期限内将要转回或可以转回的时间性差异,才可以用来抵消应税亏损从而实现税款的减免。

作为抵消应税亏损的结果的税款减免,应包括在亏损期的净收益中,而其借项则应结转下期,作为资产负债表中递延税款贷方余额的一部分。

这一借项的金额应加以揭示。

30.如果与过去的应税亏损有关的税款减免并未包括在亏损年度的净收益中,以后用应税亏损与应税所得相抵消的办法而实现的税款减免,应包括在实现期的净收益中,并应加以揭示。

十一、资产的价值重估31.在财务报表中一项资产重估后的金额如果超过了其历史成本或以前的重估价、这一替代金额一般不能成为确定应付税款的基础。

只要重估的资产可以对不是根据历史成本或税法允许的其他方法计算的会计收益产生借项或贷项,应税所得和会计收益之间就将存在一项差异。

对这种差异进行会计处理,应根据与价值重估一致的会计处理方法进行。

32.一种处理方法是确定与资产帐面价值增加有关的纳税影响,并将此金额从价值重估帐户转入递延税款余额中。

在这种处理方法下,当第对段所述的差异在价值重估以后的期间发生时,与此差异有关的纳税影响应借记递延税款余额,因而不反映在税款费用中。

在有些情况下,纳税影响反映在税款费用中,因而相应的金额就从递延税款余额转入价值重估帐户之中。

33.另一种处理方法是在财务报表附注中揭示与价值重估日资产帐面价值的增加有关的潜在纳税影响的金额。

在以后的各期中,潜在纳税影响的金额应加以修订,以反映第五段所述差异的纳税影响。

十二、附属公司和联营企业的未分配盈余34.在附属公司的未分配利润分配给母公司时,无论是母公司还是附属公司的应付税款,都应确认为使用和负债,除非有理由假定对这些利润不再进行分配,或者分配不会引起纳税负债。

35.在附属公司的未分配利润分配给母公司时,既不确认母公司应付的税款,也不确认附属公司应付的税款的一个理由,可能是母公司为了长期再投资而将这些利润保留并且有权力保留在附属公司中。

如果没有确认有关的未分配利润的税款,有时应揭示这些利润的累计金额。