loan agreement1

贷款合同中英文

贷款合同中英文贷款合同 Loan Agreement1. 甲方:借款人 A Party: Borrower乙方:贷款人 B Party: Lender2. 合同目的 Contract Purpose本合同旨在明确甲方与乙方之间关于资金借贷的条款、条件及责任,保障双方权益并维护借贷交易的正常进行。

The purpose of this contract is to clarify the terms, conditions, and responsibilities of the funds borrowed between Party A and Party B, safeguard the interests of both parties, and ensure the normal operation ofthe loan transaction.3. 借款金额 Loan Amount甲方向乙方借款金额为人民币XXX万元整。

Party A borrows an amount of RMB XXX,XXX yuan from Party B.4. 利息和费用 Interest and Fees4.1 利息:根据借款金额和利率计算,利息计算方式及利率如下:Interest: Calculated based on the loan amount and interest rate, the calculation method and interest rate are as follows:4.1.1 利息计算方式:采用按季度计息,每季度支付一次利息。

Interest Calculation Method: Interest is calculated on a quarterly basis, and interest payment is made every quarter.4.1.2 利率:借款利率为XX%,如无特殊约定。

LOAN AGREEMENT (INTERNATIONAL)国际贷款协议

LOAN AGREEMENT (INTERNATIONAL)国际贷款协议LOAN AGREEMENT (INTERNATIONAL)国际贷款协议This ACREEMENT entered into as of ___ (Day) ___ (Month), 20__,between ABCcompany, a [Name of country]company (the "Borrower") and CREDlT BANK, N. A. , a national banking association of the United States of America (the "Bank").WITNESSETH:WHEREAS, the Borrower has requested the Bank to extend to the Borrower a termloan in the principal amount of One Million United States Dollars (U. S. $ 1,000, 000) upon the terms and subject to the Conditions of this Agreement; andWHEREAS, the Bank is prepared to make such a loan available to the Borrower uponthe terms and subject to the conditions of this Agreement;NOW, THEREFORE, in consideration of the mutual promises contained therein, theparties agree as follows:Article 1 DefinitionsSection 1. 1 For the Purposes of this Agreement, the following expressions havethe meanings set forth below:"Business Day": any day on which banks are open to conduct their regular bankingbusiness in London, England, and Los Angeles, California, and on which dealingsin Dollar deposits between banks are carried out in the London interbank market;"Commitment": the obligation of the Bank to make the loan to the Borrower on thedate hereof;"Credit Los Angeles": Credit Bank, International Division, Los Angeles,California;"Dollars" and the sign "$": lawful money of the United States of America and, inrelation to all payments hereunder, immediately available funds;"Event of Default": any of the events specified in Article Ⅷ of this Agreement;"Guarantor": XYZ Bank Limited;"Indebtedness": of any Person, or the Borrower, means all items of indebtednesswhich, in accordance with generally accepted accounting principles in [Name ofCountry] Would be included in determining liabilities as shown on the liabilityside of a balance sheet of such Person or the Borrower as of the dateindebtedness is to be determined, and shall also include all indebtedness andliabilities of others assumed or guaranteed or in respect of which the Borroweris secondarily or contingently liable (other than by endorsement of instrumentsin the course of collection) , whether by reason of any agreement to acquiresuch indebtedness or to supply or advance sums or otherwise;"Installment Payment Dates": subject to Section 4. 1, the dates which areeighteen months, twenty-four months, thirty months, thirty-six months, forty -two months, forty-eight months, fifty -four months and sixty months from thedate hereof;"Interest Payment Date": the last day of each Interest Period;"Interest Period": the period commencing on the date hereof and ending on theday which is ____ months after such date, and each period thereafter beginningon the last day of the immediately preceding Interest Period and ending on theday which is three months or six months after such date, as the Borrower mayelect; provided, however, that (I) any Interest Period which would otherwise endon a day which is a Business Day shall be extended to the next succeeding daywhich is a Business Day, and (II) any Interest Period commencing before andwhich would otherwise end after an Installment Payment Date shall end on suchInstallment Payment Date;"Interest Rate": the rate of interest to be determined as provided in sections2.4, 2.6 and 2.7, as the case may be;"Lending Office": the International Banking Facility of the Bank, or such otherbranch, office, affiliate or subsidiary of the Bank as it may at its discretionfrom time to time designate, from which the Loan will thereafter be made and forthe account of which the Loan will be outstanding and all payments hereunderwill be made;"Loan": the loan made by the Bank to the Borrower pursuant to Section 2. 1hereof; "Note": the promissory note of the Borrower to the order of the Bank insubstantially the form of Exhibit A hereto, evidencing the indebtedness of theBorrower to the Bank resulting from the Bank's Loan to the Borrower;"Person": any natural person, corporation, firm, association, government,governmental agency or any other entity other than the Borrower and whetheracting in an individual, fiduciary or other capacity.Article 2 The LoanSection 2.1. The CommitmentUpon the terms and subject to the conditions herein set forth, and relying uponthe representations and warranties of the Borrower, the Bank agrees, actingthrough its Lending office; on the date hereof to lend to the borrower, and the。

贷款协议英文样本sample-loanagree[1]

![贷款协议英文样本sample-loanagree[1]](https://img.taocdn.com/s3/m/5335672b647d27284b7351c4.png)

Sample Loan Agreement(demand note)Online Loan Agreement Form $12.99 (free trial)−−click hereLOAN AGREEMENT AND PROMISSORY NOTETHIS LOAN AGREEMENT AND PROMISSORY NOTE, is made this ____ day of ______________, 2010,by and among JOHN & DOE, a Partnership organized under the laws of the State of Arizona (hereinafterknown as "BORROWER") and JOHN SMITH, LLC, an LLC organized under the laws of the State of Alaska (hereinafter known as "LENDER"). BORROWER and LENDER shall collectively be known herein as "the Parties". In determining the rights and duties of the Parties under this Loan Agreement, the entire document must be read as a whole.PROMISSORY NOTEFOR VALUE RECEIVED, BORROWER promises to pay to the order of LENDER, the sum of $40,000.00dollars together with interest thereon at a rate of 7.5 percent per annum on the unpaid balance with interest to be compounded annually (hereinafter, "the Loan Balance"). The entire outstanding Loan Balance (including principal and any accrued interest) shall become fully due and payable by BORROWER within 15 days of written demand by BORROWER from LENDER or any subsequent assignee of this note. The method for making a proper "demand" upon BORROWER is set forth below. Should BORROWER fail to make payment in full to LENDER within 15 days of demand, BORROWER shall be in default of the terms of this loanagreement. This agreement is subject to additional terms found below.ADDITIONAL LOAN TERMSThe BORROWER and LENDER, hereby further set forth their rights and obligations to one another under this Loan Agreement and Promissory Note and agree to be legal bound as follows:Loan Payment Terms. BORROWER to pay $500 to LENDER every month for the life of the loan.The first payment shall be due 30 days from the date of the execution of this agreement and continueeach month on the monthly anniversary thereafter until the Loan Balance, including principal andaccrued interest, is paid in full or demand for payment in full is made by LENDER. In cases where apayment due date is the 29th, 30th, or 31st of a month and said month contains a shorter number ofdays, then the due date shall be the last day of the month.A. Demand by Lender . This is a "demand" loan agreement and promissory note under whichBORROWER is required to repay in full the entire outstanding Loan Balance within 15 days ofreceiving a written demand from LENDER for full repayment of the Loan Balance. Delivery ofwritten notice by LENDER to BORROWER via U.S. Postal Service Certified Mail shall constituteprima facie evidence of delivery. For mailing of said notice, LENDER shall use BORROWER'Saddress as stated below in the portion of this agreement pertaining to default.B. Method of Loan Payment . The BORROWER shall make all payments called for under this loanagreement by sending check or other negotiable instrument made payable to the following individualor entity at the address indicated:Bob Jones123 Home StreetChicago, IL 11111If Lender gives written notice to Borrower that a different address shall be used for making paymentsunder this loan agreement, Borrower shall use the new address so given by Lender.C. Default. The occurrence of any of the following events shall constitute a Default by the Borrower ofthe terms of this loan agreement and promissory note:Borrower's failure to pay any amount due as principal or interest on the date required underthis loan agreement1. Borrower seeks an order of relief under the Federal Bankruptcy laws2. Borrower becomes insolvent3. A federal tax lien is filed against the assets of Borrower4. D. Additional Provisions Regarding Default:Addressee and Address to which Lender is to give Borrower written notice of default:Tom Smith444 Main StreetSpringfield, IL 11111If Borrower gives written notice to Lender that a different address shall be used, Lender shalluse that address for giving notice of default (or any other notice called for herein) toBorrower.1. Cure of Default. Upon default, Lender shall give Borrower written notice of default. Mailingof written notice by Lender to Borrower via U.S. Postal Service Certified Mail shall constituteprima facie evidence of delivery. Borrower shall have 15 days after receipt of written noticeof default from Lender to cure said default. In the case of default due solely to Borrower'sfailure to make timely payment as called for in this loan agreement, Borrower may cure thedefault by making full payment of any principal and accrued interest (including interest onthese amounts) whose payment to Lender is overdue under the loan agreement and, also, thelate−payment penalty described below.2. Penalty for Late Payment. There shall also be imposed upon Borrower a 2% penalty for anylate payment computed upon the amount of any principal and accrued interest whose paymentto Lender is overdue under this loan agreement and for which Lender has delivered a noticeof default to Borrower. For example, if the agreement calls for monthly payments of $500upon the first day of each month and Borrower fails to make timely payment of said amount,Borrower (after receipt of a default notice from Lender) shall be liable to Lender for a penaltyof $10 (i.e., $500 x 2%) and, to cure the default, the Borrower must pay to Lender theoverdue Loan Balance of $500, interest upon the overdue Loan Balance, and a penalty of $10.3. Acceleration . If the Borrower fails to cure any default on or before the expiration of thefifteen (15) day cure period that starts on the date Borrower receives written notice fromLender that an event of default has occurred under this loan agreement, the entire unpaidprincipal, accrued interest, and penalties under this loan agreement shall accelerate andbecome due and payable immediately.4. Indemnification of Attorneys Fees and out−of−pocket costs. Should any party materially5. E. breach this agreement, the non−breaching party shall be indemnified by the breaching partyfor its reasonable attorneys fees and out−of−pocket costs which in any way relate to, or wereprecipitated by, the breach of this agreement. The term "out−of−pocket costs", as used herein,shall not include lost profits. A default by Borrower which is not cured within 15 days afterreceiving a written notice of default from Lender constitutes a material breach of thisagreement by Borrower.Parties that are not individuals. If any Party to this agreement is other than an individual (i.e., aF.corporation, a Limited Liability Company, a Partnership, or a Trust), said Party, and the individualsigning on behalf of said Party, hereby represents and warrants that all steps and actions have beentaken under the entity's governing instruments to authorize the entry into this Loan Agreement.Breach of any representation contained in this paragraph is considered a material breach of the LoanAgreement.Integration. This Agreement, including the attachments mentioned in the body as incorporated byG.reference, sets forth the entire agreement between the Parties with regard to the subject matter hereof.All prior agreements, representations and warranties, express or implied, oral or written, with respectto the subject matter hereof, are hereby superseded by this agreement. This is an integrated agreement.H.Severability. In the event any provision of this Agreement is deemed to be void, invalid, orunenforceable, that provision shall be severed from the remainder of this Agreement so as not tocause the invalidity or unenforceability of the remainder of this Agreement. All remaining provisionsof this Agreement shall then continue in full force and effect. If any provision shall be deemed invaliddue to its scope or breadth, such provision shall be deemed valid to the extent of the scope andbreadth permitted by law.I.Modification. Except as otherwise provided in this document, this agreement may be modified,superseded, or voided only upon the written and signed agreement of the Parties. Further, the physicaldestruction or loss of this document shall not be construed as a modification or termination of theagreement contained herein.J.Exclusive Jurisdiction for Suit in Case of Breach. The Parties, by entering into this agreement,submit to jurisdiction in Cook County, IL for adjudication of any disputes and/or claims between theparties under this agreement. Furthermore, the parties hereby agree that the courts of Cook County, ILshall have exclusive jurisdiction over any disputes between the parties relative to this agreement,whether said disputes sounds in contract, tort, or other areas of the law.K.State Law. This Agreement shall be interpreted under, and governed by, the laws of the state ofIllinois.IN WITNESS WHEREOF and acknowledging acceptance and agreement of the foregoing, BORROWER and LENDER affix their signatures hereto.BORROWER(S)LENDER(S)______________________________________________________________________John &Doe John Smith, LLCBy:By:Title:Title:Dated: _____________ ____, 2010Dated: _____________ ____, 2010 (Note: This page is not to be attached to your Loan Agreement and Promissory Note.)INSTRUCTIONS REGARDING EXECUTION OF YOURLoan Agreement and Promissory NoteA.Attachments. Please remember that in responding to our questionnaire, you indicated that you would prepare thefollowing separate attachments to go with this agreement:If you are to create an attachment for this contract, make sure it has a bold−type heading ATTACHMENT #__ (with thecorrection number for your attachment inserted, i.e., 1, 2 or 3. All attachments should be made part of the contract when itis executed and attached to each party's original. Do not add the attachments later.B.Read the entire contract carefully, but we suggest that you pay special attention to payment terms.We recommend that you execute an original of this Loan Agreement for each party who signed.C.D.For advice regarding the tax implications of loan transactions, consult with a tax accountant or lawyer before entering intothis agreement.What if I decide to make changes to my document? We will keep your responses to the online questionnaire in ourE.database for 60 days after the date of purchase. During this time, you may go to the User Administration section of oursite to call up your form questionnaire and make changes−−the URL is https:///user/ . You shallneed your "user name" and "password" to re−enter the system. Once in the User Administration area, click on the text linkto your form questionnaire which is located on the upper−left of the page. Make the desired changes to your responses inthe questionnaire and submit to create a revised document. If you have problems calling up your old data, email us atadministrator@. We do our best to give a prompt response to all inquiries, usually within a few hours.NOTE: Upon registration, our system emailed to you our record of your "user name" and "password".DISCLAIMERThe above is provided for informational purposes only and is NOT to be relied upon as legal advice.This service is not a substitute for the advice of an attorney and we encourage users to have alldocuments created on our site reviewed by an attorney. No attorney−client relationship is establishedby use of our online legal forms system and the user is not to rely upon any information foundanywhere on our site. THESE FORMS ARE SOLD ON AN "AS IS" BASIS WITH NO WARRANTIESOR GUARANTIES. If you wish personal assistance in deciding whether the document found on oursite is right for you or desire representations and warranties upon the legality of the document you arepurchasing in the jurisdiction you will be using it, contact an attorney licensed to practice law in yourstate.HOME FORMS INDEX PAGE RFP SYSTEM 。

Loan Agreement (中英文简化版)

Loan Agreement (中英文简化版)

借款协议

1. 甲方和乙方的说明

甲方:[借款人姓名/公司名称]

乙方:[出借人姓名/公司名称]

2. 借款事项

甲方向乙方借款金额为[借款金额],借款用途为[借款用途]。

3. 偿还方式

借款本金和利息将按照以下方式偿还:

- 还款期限:[还款期限]

- 还款方式:[还款方式]

- 还款金额:[还款金额]

4. 利息和违约金

- 利息:借款按照[年利率]%计息,利息按照[计息方式]计算。

- 违约金:若甲方违反本协议约定未按时还款,乙方有权要求

甲方支付违约金,违约金金额为[违约金金额]。

5. 其他约定事项

- 质押物:甲方向乙方提供[质押物描述]作为本借款协议的担保。

- 争议解决:本协议履行过程中发生争议的,应通过友好协商

解决;协商不成,可提交相关争议至[仲裁机构]仲裁解决。

6. 法律适用和补充条款

- 法律适用:本协议的解释和适用适用[法律适用国家/地区]法律。

- 补充条款:对于本协议未尽事宜,甲乙双方可另行签订补充

协议,补充协议与本协议具有同等法律效力。

甲方(借款人): _____________________ 乙方(出借人): _____________________ 日期: _____________________。

Loan_Agreement(贷款协议)

LOAN AGREEMENTThis Loan Agreement (the “Agreement”) is entered into as of , 2009 by the following parties.Party A: AAA(“Party A”),Party B:王**(ID: 342601************)WHEREAS,1.Party A is a wholly foreign-owned enterprise incorporated in the People’sRepublic of China (the “PRC”);2.Party B is the citizens of the PRC who intends to hold or has held fifty percent(50%) of the equity interests of CCC(“Company”);3.Party A agrees to provide an interest-free loan RMB150,000 to Party B (the“Borrower”), solely for the Borrower to 50% share equity of Company.NOW THEREFORE, All parties agree as follows:1.Principal of the Loan. Party A agrees to provide a loan to the Borrower with theprincipal as RMB150,000 in accordance with the terms and conditions set forth in this Agreement. Borrower shall only use their loans solely to purchase 50% share equity of Company. Party B hereby acknowledges and confirms that the full amount of the principal of the loan had already been provided by Party A to the Borrower.2.Undertakings of the Borrower.Borrower shall use the total amount of the Loansolely purchase 50% share equity of Company.3.Term. The term of such loan starts from the date that Borrower received the loanuntil twenty (20) years after signing this Agreement and could be extended upon the written agreement of the parties through negotiations. During the term or extended term of such a loan, Party A may accelerate the loan repayment, if any of the following events occurs:(a)Any of the Borrower quits or is dismissed by Party A or its affiliates;(b)Any of the Borrower dies or becomes a person without capacity or withlimited capacity for civil acts;(c)Any of the Borrower commits a crime or is involved in a crime;(d)Party A has given a written notice to the Borrower and exercised its rightof purchase in accordance with the terms under the Exclusive EquityPurchase Option Agreement speculated in Article 4 of this agreement.Without Party A’s prior written consent, the Borrower shall not prepay all or any part of the Loan.4.Method of Repayment. The repayment of the Loan under this Agreement arepayable in cash or in other form or manner as agreed in writing by Party A and as permitted under the laws of the PRC including but not limited to by way of transfer to Party A or a third party designated by Party A at its sole discretion all or part of the Equity Interest in Company held by the Borrower (“Equity Interest”as defined in the Exclusive Equity Purchase Option Agreement (the “Exclusive Equity Purchase Option Agreement”) to be executed and delivered by the Borrower on the even date herewith) at a purchase price in accordance with the Exclusive Equity Purchase Agreement.5.Interest-free.5.1The parties agree and confirm that this loan is an interest-free loan except for incases as provided in Article 5.2 of this Agreement.5.2If Party A exercises its Purchase Right (as defined in the Exclusive EquityPurchase Option Agreement ) in accordance with the Exclusive Equity Purchase Option Agreement, on condition that the amount of the purchase price for the Equity Interests which Party A or its designee has to pay to the Borrower shall exceed the principal of the Loan due to the legal requirement or other reasons, to the extent permitted by PRC laws, the Borrower shall pay all proceeds they received from the transfer of the equity back to Party A or any person appointed by Party A to pay off the loan under this agreement, and any amount in excess of the principal of the Loan shall be regarded as an interests of the loan or the capital use cost.6.Security. Repayment of the Loan shall be secured by a pledge of any and allequity interest in Company as from time to time held by the Borrower as set out in an equity pledge agreement (the “Equity Pledge Agreement”) executed and delivered by the Borrower on the even date herewith. The Borrower shall execute and deliver such further documents and instruments and shall take such other further actions as may be required or appropriate to carry out the intent and purposes of this Article 6. The Borrower shall not dispose any of their equityinterests in Company as set out in the Equity Pledge Agreement in any manner without the prior consent of Party A, notwithstanding any contradicting provisions in any other agreements between the Borrower and Party A.7.Event of Default and Remedies. Any one of the following occurrences shallconstitute an “Event of Default” under this Agreement:(a)The Borrower fails to repay the Loan hereunder when due in accordancewith this Agreement;(b)The Borrower becomes insolvent or bankrupt, commits any act ofbankruptcy, generally fails to pay its debts as it become due, becomes thesubject of any proceedings or actions of any regulatory agency or anycourt, or makes an assignment for the benefit of its creditors, or enters intoany agreement for the composition, extension, or readjustment of all orsubstantially all of her obligations;(c)The Borrower fails to comply with any covenant contained in thisAgreement and does not cure such failure within fifteen (15) days afterreceiving written notice thereof; or(d)an event of default occurs under the Equity Pledge Agreement.Upon the occurrence of any Event of Default hereunder, the entire or part of the Loan shall, at the sole option of Party A and without notice or demand of any kind to the Borrower or any other person, immediately become due and payable, and Party A may pursue all remedies available under this Agreement, the Equity Pledge Agreement, and as available under law including but not limited to action against the pledged equity and seeking immediate repayment of the Loan in cash or, at Party A' s sole discretion, in any other form or manner in accordance with Article 3 above. Without prejudice to the rights of Party A under the immediately preceding sentence, the Borrower undertakes to indemnify Party A against any actions, charges, claims, costs, damages, demands, expenses, liabilities, losses and proceedings which Party A may sustain or incur as a consequence of the occurrence of any Event of Default hereunder.8.Party A' s Rights. No single or partial exercise of any power hereunder or underthe Equity Pledge Agreement shall preclude other or further exercises thereof or the exercise of any other power granted hereunder or under the Equity Pledge Agreement. Party A shall at all times have the right to proceed against any portion of the security for this Agreement in such order and in such manner as Party A may consider appropriate, without waiving any rights with respect to any of the security. Any delay or omission on the part of Party A in exercising any right hereunder or under the Equity Pledge Agreement shall not operate as a waiver ofsuch right, or of any other right under this Agreement or the Equity Pledge Agreement.9.Successors. This Agreement shall inure to the benefit of Party A and itssuccessors and assigns. The obligations of the Borrower hereunder or under the Equity Pledge Agreement shall not be assignable.10.Conflicting Agreements. In the event of any inconsistencies between the terms ofthis Agreement and the terms of any other document related to the loan evidenced by the Agreement, the terms of this Agreement shall prevail provided, however, that nothing in this Agreement is meant to supercede or limit any of the rights of Party A under any restricted share purchase option agreement, or similar agreement including, but not limited to, rights of repurchase in favor of Party A.11.Severability. Any provision of this Agreement which is invalid, illegal orunenforceable in any jurisdiction shall, as to that jurisdiction, be ineffective to the extent of such invalidity, illegality or unenforceability, without affecting in any way the remaining provisions hereof in such jurisdiction or rendering that or any other provision of this Agreement invalid, illegality or unenforceable in any other jurisdiction. The Parties shall, through fairly consultation, make reasonable efforts to replace those invalid, illegal or non-enforceable provisions with valid provisions that may bring the similar economic effects with the effects caused by those invalid, illegal or non-enforceable provisions.erning Law. This Agreement shall be governed by and construed inaccordance with the laws of the PRC.13.Arbitration. If the parties hereto are unable to settle any dispute arising from orin connection with the provisions of this Agreement through mediation, any party hereto can submit the dispute for final and binding arbitration to the China International Economic and Trade Arbitration Commission (“CIETAC”) in Beijing for arbitration before a panel of three (3) arbitrators pursuant to then-valid arbitration rules of CIETAC.[No text below][Signature Page]Party A: AAALegal Representative/Authorized Representative:_____________________________ Seal:Party B:王**Signature:。

英文版 借款协议 Loan agreement

英文版借款协议 Loan agreementLoan AgreementThis Loan Agreement (the "Agreement") is made and entered into as of [date], by and between [Lender's Name], with its principal place of business located at [Lender's Address], hereinafter referred to as the "Lender", and [Borrower's Name], with its principal place of business located at [Borrower's Address], hereinafter referred to as the "Borrower".1. Loan Amount and PurposeThe Lender agrees to lend the Borrower an amount of [Loan Amount] (the "Principal Amount") for the purpose of [Purpose of Loan], as requested by the Borrower. The Principal Amount shall be transferred to the Borrower's designated bank account on [Transfer Date].2. Interest Rate and Repayment2.1 Interest Rate: The Borrower agrees to pay interest on the outstanding Principal Amount at a fixed annual interest rate of [Interest Rate]. The interest shall be calculated on a daily basis, from the date of disbursement until the date of full repayment.2.2 Repayment Schedule: The Borrower shall repay the Principal Amount and accrued interest in [Number of Installments] equal monthly installments, commencing on [First Repayment Date], and continuing on the same day of each month thereafter until fully paid.3. Late Payment and Default3.1 Late Payment: In the event that any installment of the Principal Amount and/or interest is not paid within [Number of Days] days of its due date, the Borrower shall be considered in default and shall be liable for a late payment fee of [Late Payment Fee] on the outstanding amount.3.2 Default: If the Borrower fails to make any payment for a period exceeding [Number of Days] days from the due date, the Lender shall have the right to declare all outstanding amounts immediately due and payable, and to take legal actions to recover the debt, including the accrual of interest until the date of full repayment.4. PrepaymentThe Borrower may prepay the Principal Amount and/or the interest in part or in full, at any time before the due date, without incurring any penalty or additional fee.5. Governing Law and JurisdictionThis Agreement shall be governed by and construed in accordance with the laws of [Jurisdiction]. Any disputes arising out of or in connection with this Agreement shall be submitted to the exclusive jurisdiction of the courts of [Jurisdiction].6. Entire AgreementThis Agreement constitutes the entire agreement between the Lender and the Borrower regarding the loan, and supersedes all prior agreements, understandings, or representations, whether oral or written.Please carefully review and sign this Loan Agreement to indicate your acceptance of its terms and conditions. This Agreement shall be binding upon the parties and their respective successors and assigns.Lender: [Lender's Name]Signature: ____________________Date: _______________________Borrower: [Borrower's Name]Signature: ____________________Date: _______________________Note: This Loan Agreement is prepared for reference purposes only and should be reviewed by legal counsel before being used for any actual transactions.。

LoanAgreement(贷款协议)模板

Loan Agreement(贷款协议)模板1. 贷款金额本协议由贷款人(以下简称“甲方”)与借款人(以下简称“乙方”)签订。

甲方同意向乙方提供贷款,贷款金额为人民币(以下简称“元”) __________ (¥__________)。

2. 贷款利率本次贷款的利率为__________ %,自贷款发放之时起生效。

在本协议有效期内,甲方有权基于情况适时调整贷款利率,乙方需予以配合并按照调整后的利率支付利息。

3. 贷款期限本次贷款的期限为__________ 年/月/日至__________ 年/月/日。

如乙方无法按期归还贷款,甲方有权要求乙方立即偿还全部贷款本金及利息。

4. 还款方式乙方应按照以下方式还款:每个月/季度/半年/年(根据实际情况选择),以等额本息的方式偿还贷款本金及利息,分期还款期数为__________ 期。

5. 提前还款乙方可以随时提前还款,但必须提前__________ 天向甲方提出通知,并支付相应的违约金。

6. 贷款担保本次贷款由__________(担保公司/担保人/无需担保)担保。

如乙方无法按期归还贷款,甲方有权向担保人要求代偿。

7. 其他条款•本协议一式两份,甲乙双方各执一份。

本协议自甲方和乙方双方签定之日起生效。

•本协议的签订、履行以及争议解决均受中华人民共和国的法律管辖。

•如本协议中任何一条或多条无效或不可执行,不影响本协议其他条款的效力。

•本协议中未尽事宜,甲、乙双方可协商解决。

8. 签署甲方(盖章):__________ 乙方(签名):__________签署日期:__________。

英文借贷协议

英文借贷协议 Loan AgreementThis loan agreement (the “Agreement”) is entered into on the date of _____ (the “Effective Date”) by and between_______ (the “Lender”) and _________ (the “Borrower”) to govern the terms of a loan of $_______ (the “Loan”).1.0 Loan Terms 1.1 Loan Amount. The Lender agrees to lend the Borrower $_______ (the “Loan Amount”) to be repaid to the Lender pursuant to the terms set forth in this Agreement.1.2 Payment Due Date. The Borrower agrees to repay the Loan to the Lender in full by ____ (the “Payment Due Date”). 1.3 Interest. The Borrower will pay interest at the rate of ____% per annum on the outstanding Loan Amount (the “Interest Rate”) from the Effective Date until full repayment of the Loan Amount. 1.4 Late Payment Fee. In the event that the Borrower does not pay the outstanding Loan Amount andinterest by the Payment Due Date, the Borrower will pay alate payment fee of ____% of the outstanding Loan Amount. 1.5 Prepayment. The Borrower may prepay the outstanding balance of the Loan at any time without penalty.2.0 Disbursement and Repayment of the Loan 2.1 Disbursement. The Lender will disburse the Loan Amount in a lump sum to the Borrower via [check/wire transfer/cash]. 2.2 Repayment. The Borrower will repay the Loan Amount to the Lender in a lump sum on or before the Payment Due Date by [check/wire transfer/cash].3.0 Representations and Warranties 3.1 Representations of the Lender. The Lender represents and warrants that it has the authority and capacity to make the Loan and that the Loan Amount is free and clear of any liens or encumbrances. 3.2 Representations of the Borrower. The Borrower represents and warrants that it will use the Loan Amount for the purpose of[insert purpose of loan] and that it will repay the Loan to the Lender as set forth in this Agreement.4.0 Miscellaneous 4.1 Notice. All notices, requests and other communications under this Agreement shall be in writing and shall be deemed to have been duly given if personally delivered, sent by registered or certified mail, return receipt requested, or sent by email to the parties at their respective addresses set forth in this Agreement. 4.2 Governing Law and Jurisdiction. This Agreement shall be governed by the laws of the state of _________. Any dispute arising from or relating to this Agreement shall be subject to the exclusive jurisdiction of the courts located in_________. 4.3 Entire Agreement. This Agreement constitutes the entire agreement between the parties and supersedes all prior negotiations, understandings, and agreements between the parties concerning the Loan. 4.4 Amendment and Modification. This Agreement may only be amended or modified in writing signed by the parties hereto. 4.5 Waiver. Failure by either party to enforce any term or condition of this Agreement shall not be deemed as a waiver of such term or condition. 4.6 Binding Effect. This Agreement shall be binding upon and shall inure to the benefit of the parties and their respective heirs, successors, and assigns.SIGNED by the parties as of the Effective Date.Lender: Signature: ________ Name: ________ Address:________ Email Address: ________Borrower: Signature: ________ Name: ________ Address:________ Email Address: ________。

Loan-Agreement(贷款协议)

LOAN AGREEMENTThis Loan Agreement (the “Agreement”) is entered into as of , 2009 by the following parties.Party A: AAA(“Party A”),Party B:王**(ID: 342601************)WHEREAS,1.Party A is a wholly foreign-owned enterprise incorporated in thePeople’s Republic of China (the “PRC”);2.Party B is the citizens of the PRC who intends to hold or has heldfifty percent (50%) of the equity interests of CCC(“Company”);3.Party A agrees to provide an interest-free loan RMB150,000 to PartyB (the “Borrower”), solely for the Borrower to 50% share equity ofCompany.NOW THEREFORE, All parties agree as follows:1.Principal of the Loan. Party A agrees to provide a loan to theBorrower with the principal as RMB150,000 in accordance with the terms and conditions set forth in this Agreement. Borrower shall only use their loans solely to purchase 50% share equity of Company. Party B hereby acknowledges and confirms that the full amount of the principal of the loan had already been provided by Party A to the Borrower.2.Undertakings of the Borrower.Borrower shall use the total amountof the Loan solely purchase 50% share equity of Company.3.Term. The term of such loan starts from the date that Borrowerreceived the loan until twenty (20) years after signing this Agreement and could be extended upon the written agreement of the parties through negotiations. During the term or extended term of such a loan, Party A may accelerate the loan repayment, if any of the following events occurs:(a)Any of the Borrower quits or is dismissed by Party A or itsaffiliates;(b)Any of the Borrower dies or becomes a person without capacityor with limited capacity for civil acts;(c)Any of the Borrower commits a crime or is involved in a crime;(d)Party A has given a written notice to the Borrower andexercised its right of purchase in accordance with the termsunder the Exclusive Equity Purchase Option Agreementspeculated in Article 4 of this agreement.Without Party A’s prior written consent, the Borrower shall not prepay all or any part of the Loan.4.Method of Repayment. The repayment of the Loan under thisAgreement are payable in cash or in other form or manner as agreed in writing by Party A and as permitted under the laws of the PRC including but not limited to by way of transfer to Party A or a third party designated by Party A at its sole discretion all or part of the Equity Interest in Company held by the Borrower (“Equity Interest” as defined in the Exclusive Equity Purchase Option Agreement (the “Exclusive Equity Pu rchase Option Agreement”) to be executed and delivered by the Borrower on the even date herewith) at a purchase price in accordance with the Exclusive Equity Purchase Agreement.5.Interest-free.5.1The parties agree and confirm that this loan is an interest-free loanexcept for in cases as provided in Article 5.2 of this Agreement.5.2If Party A exercises its Purchase Right (as defined in the ExclusiveEquity Purchase Option Agreement ) in accordance with the Exclusive Equity Purchase Option Agreement, on condition that the amount of the purchase price for the Equity Interests which Party Aor its designee has to pay to the Borrower shall exceed the principal of the Loan due to the legal requirement or other reasons, to the extent permitted by PRC laws, the Borrower shall pay all proceeds they received from the transfer of the equity back to Party A or any person appointed by Party A to pay off the loan under this agreement, and any amount in excess of the principal of the Loan shall be regarded as an interests of the loan or the capital use cost.6.Security. Repayment of the Loan shall be secured by a pledge ofany and all equity interest in Company as from time to time held by t he Borrower as set out in an equity pledge agreement (the “Equity Pledge Agreement”) executed and delivered by the Borrower on the even date herewith. The Borrower shall execute and deliver such further documents and instruments and shall take such other further actions as may be required or appropriate to carry out the intent and purposes of this Article 6. The Borrower shall not dispose any of their equity interests in Company as set out in the Equity Pledge Agreement in any manner without the prior consent of Party A, notwithstanding any contradicting provisions in any other agreements between the Borrower and Party A.7.Event of Default and Remedies. Any one of the followingoccurrences shall constitute an “Event of Default” under this Agreement:(a)The Borrower fails to repay the Loan hereunder when due inaccordance with this Agreement;(b)The Borrower becomes insolvent or bankrupt, commits any actof bankruptcy, generally fails to pay its debts as it become due,becomes the subject of any proceedings or actions of anyregulatory agency or any court, or makes an assignment for thebenefit of its creditors, or enters into any agreement for thecomposition, extension, or readjustment of all or substantiallyall of her obligations;(c)The Borrower fails to comply with any covenant contained inthis Agreement and does not cure such failure within fifteen (15)days after receiving written notice thereof; or(d)an event of default occurs under the Equity Pledge Agreement.Upon the occurrence of any Event of Default hereunder, the entire or part of the Loan shall, at the sole option of Party A and without notice or demand of any kind to the Borrower or any other person, immediately become due and payable, and Party A may pursue all remedies available under this Agreement, the Equity Pledge Agreement, and as available under law including but not limited to action against the pledged equity and seeking immediate repayment of the Loan in cash or, at Party A' s sole discretion, in any other form or manner in accordance with Article 3 above. Without prejudice to the rights of Party A under the immediately precedingsentence, the Borrower undertakes to indemnify Party A against any actions, charges, claims, costs, damages, demands, expenses, liabilities, losses and proceedings which Party A may sustain or incur as a consequence of the occurrence of any Event of Default hereunder.8.Party A' s Rights. No single or partial exercise of any powerhereunder or under the Equity Pledge Agreement shall preclude other or further exercises thereof or the exercise of any other power granted hereunder or under the Equity Pledge Agreement. Party A shall at all times have the right to proceed against any portion of the security for this Agreement in such order and in such manner as Party A may consider appropriate, without waiving any rights with respect to any of the security. Any delay or omission on the part of Party A in exercising any right hereunder or under the Equity Pledge Agreement shall not operate as a waiver of such right, or of any other right under this Agreement or the Equity Pledge Agreement.9.Successors. This Agreement shall inure to the benefit of Party A andits successors and assigns. The obligations of the Borrower hereunder or under the Equity Pledge Agreement shall not be assignable.10.Conflicting Agreements. In the event of any inconsistencies betweenthe terms of this Agreement and the terms of any other document related to the loan evidenced by the Agreement, the terms of this Agreement shall prevail provided, however, that nothing in this Agreement is meant to supercede or limit any of the rights of PartyA under any restricted share purchase option agreement, or similaragreement including, but not limited to, rights of repurchase in favor of Party A.11.Severability. Any provision of this Agreement which is invalid, illegalor unenforceable in any jurisdiction shall, as to that jurisdiction, be ineffective to the extent of such invalidity, illegality or unenforceability, without affecting in any way the remaining provisions hereof in such jurisdiction or rendering that or any other provision of this Agreement invalid, illegality or unenforceable in any other jurisdiction. The Parties shall, through fairly consultation, make reasonable efforts to replace those invalid, illegal or non-enforceable provisions with valid provisions that may bring the similar economic effects with the effects caused by those invalid, illegal or non-enforceable provisions.erning Law. This Agreement shall be governed by andconstrued in accordance with the laws of the PRC.13.Arbitration. If the parties hereto are unable to settle any disputearising from or in connection with the provisions of this Agreement through mediation, any party hereto can submit the dispute for final and binding arbitration to the China International Economic and Trade Arbitration Commission (“CIETAC”) in Beijing for arbitration before a panel of three (3) arbitrators pursuant to then-valid arbitration rules of CIETAC.[No text below][Signature Page]Party A: AAALegal Representative/Authorized Representative:_____________________________Seal:Party B:王**Signature:。

英文版借款合同范本

英文版借款合同范本借款合同(Loan Agreement)本合同由以下双方缔结,即甲方(借出人)和乙方(借款人),为借款事宜达成以下约定:一、定义和解释1.1 借出人:甲方是指借出款项给乙方的一方,以下简称甲方。

1.2 借款人:乙方是指从甲方处借入款项的一方,以下简称乙方。

二、借款金额和用途2.1 借款金额:甲方同意借款给乙方的金额为(填写具体数字),以下简称借款本金。

2.2 借款用途:借款本金将用于(填写具体借款用途)。

三、利率和还款方式3.1 利率:借款利率为(填写具体利率),根据实际借贷情况和相关法律规定进行确定。

3.2 还款方式:乙方在借款期限内按照以下方式偿还借款本金和利息:(1)每月等额本息还款:乙方每月支付相等的本金和利息金额,直到借款全部偿还。

(2)一次性还款:乙方在借款到期时一次性支付借款本金和利息。

四、借款期限4.1 借款期限:借款期限为(填写具体期限),从本合同生效之日起计算。

4.2 提前还款:乙方如有意愿在借款期限结束前提前还款,应及时通知甲方,并支付相应的提前还款手续费。

五、保证与违约5.1 甲方保证:甲方保证在本合同项下所有陈述、承诺和保证完全合理、真实和准确。

5.2 乙方保证:乙方保证所提供的相关资料和信息完全真实、准确,不存在虚假陈述。

5.3 违约责任:(根据实际情况进行约定)六、不可抗力6.1 不可抗力:若由于不可抗力导致本合同的履行出现问题或延迟,双方均应互相理解和支持。

七、适用法律和争议解决7.1 适用法律:本合同适用于所在国家/地区的法律。

7.2 争议解决:如因本合同引起的争议,双方应友好协商解决;协商不成,可提交有管辖权的仲裁机构进行仲裁。

八、其他条款8.1 本合同如需修改或补充,应经双方书面同意,并签署相应的补充协议。

8.2 本合同一式两份,甲方和乙方各持一份。

8.3 本合同自双方签署之日起生效,并具有法律效力。

以上为本合同的全部内容,甲方和乙方均经确切理解和认同后签署。

借款合同Loan Agreement

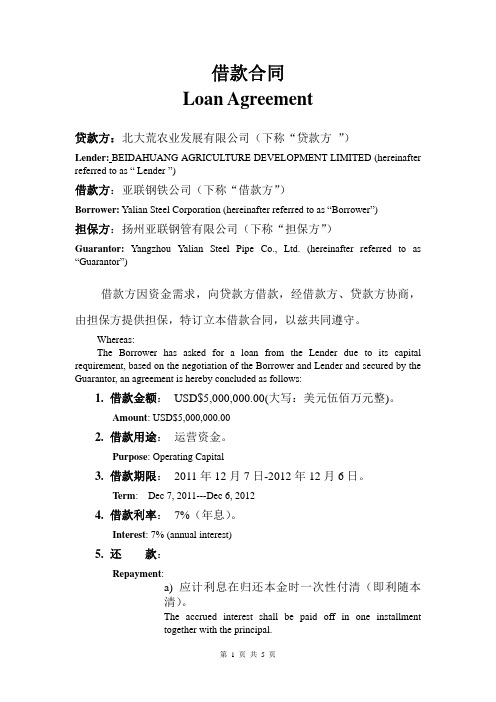

借款合同Loan Agreement贷款方:北大荒农业发展有限公司(下称“贷款方”)Lender:BEIDAHUANG AGRICULTURE DEVELOPMENT LIMITED (hereinafter referred to as “ Lender ”)借款方:亚联钢铁公司(下称“借款方”)Borrower: Yalian Steel Corporation (hereinafter referred to as “Borrower”)担保方:扬州亚联钢管有限公司(下称“担保方”)Guarantor: Yangzhou Yalian Steel Pipe Co., Ltd. (hereinafter referred to as “Guarantor”)借款方因资金需求,向贷款方借款,经借款方、贷款方协商,由担保方提供担保,特订立本借款合同,以兹共同遵守。

Whereas:The Borrower has asked for a loan from the Lender due to its capital requirement, based on the negotiation of the Borrower and Lender and secured by the Guarantor, an agreement is hereby concluded as follows:1.借款金额: USD$5,000,000.00(大写:美元伍佰万元整)。

Amount: USD$5,000,000.002.借款用途:运营资金。

Purpose: Operating Capital3.借款期限: 2011年12月7日-2012年12月6日。

Term: Dec 7, 2011---Dec 6, 20124.借款利率: 7%(年息)。

Interest: 7% (annual interest)5.还款:Repayment:a) 应计利息在归还本金时一次性付清(即利随本清)。

英文贷款合同

英文贷款合同Loan Agreement。

This Loan Agreement ("Agreement") is entered into as of [Date], by and between [Lender's Name], with a principal place of business at [Address] ("Lender"), and [Borrower's Name], with a principal place of residence at [Address] ("Borrower").1. Loan Amount: Lender agrees to lend Borrower the principal amount of [Loan Amount] ("Loan").2. Interest Rate: The Loan shall accrue interest at the rate of [Interest Rate] per annum, calculated on the outstanding principal balance and payable monthly.3. Repayment Terms: The Loan shall be repaid in [Number of Payments] equal monthly installments of [Amount] each, beginning on [Date], until the entire outstanding balance, including accrued interest, is paid in full.4. Security: The Loan shall be secured by [Collateral], which shall serve as collateral for the repayment of the Loan.5. Default: In the event of default by Borrower, Lender shall have the right to declare the entire outstanding balance, including accrued interest, immediately due and payable.6. Governing Law: This Agreement shall be governed by and construed in accordance with the laws of[State/Country].7. Dispute Resolution: Any dispute arising out of or in connection with this Agreement shall be resolved through arbitration in [City, State/Country], in accordance with the rules of [Arbitration Organization].8. Entire Agreement: This Agreement constitutes the entire understanding between the parties with respect to the subject matter hereof, and supersedes all prior andcontemporaneous agreements and understandings.IN WITNESS WHEREOF, the parties have executed this Agreement as of the date first above written.[Lender's Name] [Borrower's Name]______________________ ______________________。

借款协议英文

篇一:中英文借款协议借款协议loan agreement甲方(出借方):party a (borrower):乙方(借款方):party b (lender):甲方为乙方股东之一,就甲方借款给乙方相关事宜,经协商一致达成以下协议: partyais one shareholder of party b, regarding the issue that party a lend aloan to party b, after parties friendly negotiation , agreed as follows: 第一条借款金额 the amount of the loan甲方借给乙方人民币______________。

甲方所指定的第三人【姓名:身份证号:】向乙方出借的款项视同出借方本人向乙方的出借款。

party a lends to party b. capital that lending from the 3rd party (name:id no.: ) that designated by party a would beregarded as partya’s lent capital to party b.第二条借款期限term of the loan借款期限自_____ 年__ 月__ 日至_____ 年__ 月__ 日止。

the term shall start from [mm/dd/yyyy] and end to [mm/dd/yyyy].第三条借款利率lending rate借款利率为【】%/30天换算)。

the lending rate should be which would be calculated as actual number of lending days (one month account for 30 days).第四条还款方式method of repayment1./ 3借款期限届满到期一次性还清借款本金及利息。

《借贷合同书》

《借贷合同书》英文回答:Loan Agreement。

This Loan Agreement (the "Agreement") is made and entered into this [Date] by and between [Borrower's Name], a [State of Incorporation] corporation with its principal place of business at [Borrower's Address] ("Borrower"), and [Lender's Name], a [State of Incorporation] corporation with its principal place of business at [Lender's Address] ("Lender").1. Loan。

A. Lender agrees to lend to Borrower the principal sum of [Amount] (the "Loan").B. The Loan shall be disbursed to Borrower in one lump sum upon the execution and delivery of this Agreement.2. Interest。

A. Borrower shall pay interest on the outstanding balance of the Loan at a rate of [Interest Rate] per annum.B. Interest shall be calculated on a daily basis and shall be payable in arrears on the last day of each calendar month.3. Term。

贷款英文合同范本

贷款英文合同范本Loan Agreement TemplateIntroduction:A loan agreement is a legally binding contract between a lender and a borrower, detailing the terms and conditions of a loan. In this article, we will present a sample loan agreement in English, outlining the key components to include. Remember, it is essential to consult with legal professionals when creating or signing any contract to ensure compliance with local laws and regulations.1. Parties Involved:The loan agreement should clearly state the full names, addresses, and contact information of both the lender and the borrower. Additionally, it should specify their roles and responsibilities throughout the agreement.2. Loan Amount and Purpose:Specify the loan amount in both numeric and written form, and indicate the currency. Furthermore, include the purpose of the loan, whether it is for personal, business, or any other specific use. This clause helps ensure transparency and clarity between the parties involved.3. Repayment Terms:Outline the repayment terms in detail, including the repayment schedule, interest rate, and the total amount of interest payable over the loan term. Additionally, specify if the interest is fixed or variable, and if there are any penalties for late payments or early repayment.4. Collateral and Guarantees:In some loan agreements, collateral or guarantees may be required to secure the loan. If applicable, clearly describe the collateral or guarantees involved and the consequences of defaulting on the loan. It is crucial to identify the property or assets being used as collateral and their estimated value.5. Default and Remedies:Define the conditions under which the borrower would be considered in default and the corrective actions that the lender can take. This section should cover aspects such as late payment penalties, foreclosure or repossession rights, and dispute resolution mechanisms.6. Confidentiality and Non-Disclosure:Both parties may have access to confidential information during the loan agreement, such as financial statements or business plans. Include a clause to ensure the confidentiality of such information, prohibiting its disclosure without prior written consent.7. Governing Law and Jurisdiction:Specify the governing law that will be used to interpret and enforce the loan agreement. Define the jurisdiction in which any disputes or legal proceedings will be resolved. This helps establish a clear framework for resolving potential conflicts.8. Entire Agreement and Amendment:Include a clause stating that the loan agreement represents the entire understanding between the parties and supersedes any previous agreements or promises. Additionally, outline the procedure for making amendments to the agreement, requiring written consent from both parties.Conclusion:Creating a loan agreement using a template can serve as a solid starting point for structuring your document. However, it is essential to personalize the agreement to reflect the unique terms and conditions of your specific situation. Always seek legal advice to ensure compliance with local laws and protect the interests of all parties involved.。

贷款协议英文样本sample-loanagree[1]

![贷款协议英文样本sample-loanagree[1]](https://img.taocdn.com/s3/m/5335672b647d27284b7351c4.png)

Sample Loan Agreement(demand note)Online Loan Agreement Form $12.99 (free trial)−−click hereLOAN AGREEMENT AND PROMISSORY NOTETHIS LOAN AGREEMENT AND PROMISSORY NOTE, is made this ____ day of ______________, 2010,by and among JOHN & DOE, a Partnership organized under the laws of the State of Arizona (hereinafterknown as "BORROWER") and JOHN SMITH, LLC, an LLC organized under the laws of the State of Alaska (hereinafter known as "LENDER"). BORROWER and LENDER shall collectively be known herein as "the Parties". In determining the rights and duties of the Parties under this Loan Agreement, the entire document must be read as a whole.PROMISSORY NOTEFOR VALUE RECEIVED, BORROWER promises to pay to the order of LENDER, the sum of $40,000.00dollars together with interest thereon at a rate of 7.5 percent per annum on the unpaid balance with interest to be compounded annually (hereinafter, "the Loan Balance"). The entire outstanding Loan Balance (including principal and any accrued interest) shall become fully due and payable by BORROWER within 15 days of written demand by BORROWER from LENDER or any subsequent assignee of this note. The method for making a proper "demand" upon BORROWER is set forth below. Should BORROWER fail to make payment in full to LENDER within 15 days of demand, BORROWER shall be in default of the terms of this loanagreement. This agreement is subject to additional terms found below.ADDITIONAL LOAN TERMSThe BORROWER and LENDER, hereby further set forth their rights and obligations to one another under this Loan Agreement and Promissory Note and agree to be legal bound as follows:Loan Payment Terms. BORROWER to pay $500 to LENDER every month for the life of the loan.The first payment shall be due 30 days from the date of the execution of this agreement and continueeach month on the monthly anniversary thereafter until the Loan Balance, including principal andaccrued interest, is paid in full or demand for payment in full is made by LENDER. In cases where apayment due date is the 29th, 30th, or 31st of a month and said month contains a shorter number ofdays, then the due date shall be the last day of the month.A. Demand by Lender . This is a "demand" loan agreement and promissory note under whichBORROWER is required to repay in full the entire outstanding Loan Balance within 15 days ofreceiving a written demand from LENDER for full repayment of the Loan Balance. Delivery ofwritten notice by LENDER to BORROWER via U.S. Postal Service Certified Mail shall constituteprima facie evidence of delivery. For mailing of said notice, LENDER shall use BORROWER'Saddress as stated below in the portion of this agreement pertaining to default.B. Method of Loan Payment . The BORROWER shall make all payments called for under this loanagreement by sending check or other negotiable instrument made payable to the following individualor entity at the address indicated:Bob Jones123 Home StreetChicago, IL 11111If Lender gives written notice to Borrower that a different address shall be used for making paymentsunder this loan agreement, Borrower shall use the new address so given by Lender.C. Default. The occurrence of any of the following events shall constitute a Default by the Borrower ofthe terms of this loan agreement and promissory note:Borrower's failure to pay any amount due as principal or interest on the date required underthis loan agreement1. Borrower seeks an order of relief under the Federal Bankruptcy laws2. Borrower becomes insolvent3. A federal tax lien is filed against the assets of Borrower4. D. Additional Provisions Regarding Default:Addressee and Address to which Lender is to give Borrower written notice of default:Tom Smith444 Main StreetSpringfield, IL 11111If Borrower gives written notice to Lender that a different address shall be used, Lender shalluse that address for giving notice of default (or any other notice called for herein) toBorrower.1. Cure of Default. Upon default, Lender shall give Borrower written notice of default. Mailingof written notice by Lender to Borrower via U.S. Postal Service Certified Mail shall constituteprima facie evidence of delivery. Borrower shall have 15 days after receipt of written noticeof default from Lender to cure said default. In the case of default due solely to Borrower'sfailure to make timely payment as called for in this loan agreement, Borrower may cure thedefault by making full payment of any principal and accrued interest (including interest onthese amounts) whose payment to Lender is overdue under the loan agreement and, also, thelate−payment penalty described below.2. Penalty for Late Payment. There shall also be imposed upon Borrower a 2% penalty for anylate payment computed upon the amount of any principal and accrued interest whose paymentto Lender is overdue under this loan agreement and for which Lender has delivered a noticeof default to Borrower. For example, if the agreement calls for monthly payments of $500upon the first day of each month and Borrower fails to make timely payment of said amount,Borrower (after receipt of a default notice from Lender) shall be liable to Lender for a penaltyof $10 (i.e., $500 x 2%) and, to cure the default, the Borrower must pay to Lender theoverdue Loan Balance of $500, interest upon the overdue Loan Balance, and a penalty of $10.3. Acceleration . If the Borrower fails to cure any default on or before the expiration of thefifteen (15) day cure period that starts on the date Borrower receives written notice fromLender that an event of default has occurred under this loan agreement, the entire unpaidprincipal, accrued interest, and penalties under this loan agreement shall accelerate andbecome due and payable immediately.4. Indemnification of Attorneys Fees and out−of−pocket costs. Should any party materially5. E. breach this agreement, the non−breaching party shall be indemnified by the breaching partyfor its reasonable attorneys fees and out−of−pocket costs which in any way relate to, or wereprecipitated by, the breach of this agreement. The term "out−of−pocket costs", as used herein,shall not include lost profits. A default by Borrower which is not cured within 15 days afterreceiving a written notice of default from Lender constitutes a material breach of thisagreement by Borrower.Parties that are not individuals. If any Party to this agreement is other than an individual (i.e., aF.corporation, a Limited Liability Company, a Partnership, or a Trust), said Party, and the individualsigning on behalf of said Party, hereby represents and warrants that all steps and actions have beentaken under the entity's governing instruments to authorize the entry into this Loan Agreement.Breach of any representation contained in this paragraph is considered a material breach of the LoanAgreement.Integration. This Agreement, including the attachments mentioned in the body as incorporated byG.reference, sets forth the entire agreement between the Parties with regard to the subject matter hereof.All prior agreements, representations and warranties, express or implied, oral or written, with respectto the subject matter hereof, are hereby superseded by this agreement. This is an integrated agreement.H.Severability. In the event any provision of this Agreement is deemed to be void, invalid, orunenforceable, that provision shall be severed from the remainder of this Agreement so as not tocause the invalidity or unenforceability of the remainder of this Agreement. All remaining provisionsof this Agreement shall then continue in full force and effect. If any provision shall be deemed invaliddue to its scope or breadth, such provision shall be deemed valid to the extent of the scope andbreadth permitted by law.I.Modification. Except as otherwise provided in this document, this agreement may be modified,superseded, or voided only upon the written and signed agreement of the Parties. Further, the physicaldestruction or loss of this document shall not be construed as a modification or termination of theagreement contained herein.J.Exclusive Jurisdiction for Suit in Case of Breach. The Parties, by entering into this agreement,submit to jurisdiction in Cook County, IL for adjudication of any disputes and/or claims between theparties under this agreement. Furthermore, the parties hereby agree that the courts of Cook County, ILshall have exclusive jurisdiction over any disputes between the parties relative to this agreement,whether said disputes sounds in contract, tort, or other areas of the law.K.State Law. This Agreement shall be interpreted under, and governed by, the laws of the state ofIllinois.IN WITNESS WHEREOF and acknowledging acceptance and agreement of the foregoing, BORROWER and LENDER affix their signatures hereto.BORROWER(S)LENDER(S)______________________________________________________________________John &Doe John Smith, LLCBy:By:Title:Title:Dated: _____________ ____, 2010Dated: _____________ ____, 2010 (Note: This page is not to be attached to your Loan Agreement and Promissory Note.)INSTRUCTIONS REGARDING EXECUTION OF YOURLoan Agreement and Promissory NoteA.Attachments. Please remember that in responding to our questionnaire, you indicated that you would prepare thefollowing separate attachments to go with this agreement:If you are to create an attachment for this contract, make sure it has a bold−type heading ATTACHMENT #__ (with thecorrection number for your attachment inserted, i.e., 1, 2 or 3. All attachments should be made part of the contract when itis executed and attached to each party's original. Do not add the attachments later.B.Read the entire contract carefully, but we suggest that you pay special attention to payment terms.We recommend that you execute an original of this Loan Agreement for each party who signed.C.D.For advice regarding the tax implications of loan transactions, consult with a tax accountant or lawyer before entering intothis agreement.What if I decide to make changes to my document? We will keep your responses to the online questionnaire in ourE.database for 60 days after the date of purchase. During this time, you may go to the User Administration section of oursite to call up your form questionnaire and make changes−−the URL is https:///user/ . You shallneed your "user name" and "password" to re−enter the system. Once in the User Administration area, click on the text linkto your form questionnaire which is located on the upper−left of the page. Make the desired changes to your responses inthe questionnaire and submit to create a revised document. If you have problems calling up your old data, email us atadministrator@. We do our best to give a prompt response to all inquiries, usually within a few hours.NOTE: Upon registration, our system emailed to you our record of your "user name" and "password".DISCLAIMERThe above is provided for informational purposes only and is NOT to be relied upon as legal advice.This service is not a substitute for the advice of an attorney and we encourage users to have alldocuments created on our site reviewed by an attorney. No attorney−client relationship is establishedby use of our online legal forms system and the user is not to rely upon any information foundanywhere on our site. THESE FORMS ARE SOLD ON AN "AS IS" BASIS WITH NO WARRANTIESOR GUARANTIES. If you wish personal assistance in deciding whether the document found on oursite is right for you or desire representations and warranties upon the legality of the document you arepurchasing in the jurisdiction you will be using it, contact an attorney licensed to practice law in yourstate.HOME FORMS INDEX PAGE RFP SYSTEM 。

借款合同LoanAgreement

借款合同LoanAgreement本借款合同(以下简称“合同”)由以下双方于 [合同签订日期] 签订:甲方(借款人):[甲方全称]地址:[甲方地址]乙方(贷款人):[乙方全称]地址:[乙方地址]鉴于甲方因 [借款目的] 需要向乙方借款,乙方同意根据本合同的条款和条件向甲方提供借款,双方本着平等互利的原则,经协商一致,订立本合同如下:第一条借款金额甲方同意向乙方借款人民币(大写)[金额]元(¥[金额]元)。

第二条借款期限借款期限自 [借款起始日期] 至 [借款到期日期]。

第三条利率和利息借款利率为 [年利率]%,利息按 [计息方式] 计算。

利息应于 [付息日期] 支付。

第四条借款用途甲方保证将借款用于 [借款用途],未经乙方书面同意,不得改变借款用途。

第五条还款方式甲方应按照以下方式偿还借款本金及利息:1. [还款计划]。

2. 甲方应确保在每个还款日前将足额款项存入乙方指定的账户。

第六条担保甲方应提供 [担保方式] 作为本合同项下借款的担保。

第七条违约责任1. 如甲方未按期偿还借款本金或利息,应按逾期金额的 [逾期利率]%向乙方支付逾期利息。

2. 如甲方违反本合同其他条款,乙方有权要求甲方立即偿还全部借款本金及利息,并可要求甲方支付违约金。

第八条合同的变更和解除本合同一经双方签字盖章,未经双方协商一致,任何一方不得擅自变更或解除。

第九条争议解决因本合同引起的或与本合同有关的任何争议,双方应首先通过友好协商解决;协商不成时,任何一方均可向 [仲裁机构/法院] 提起仲裁或诉讼。

第十条其他1. 本合同的解释、效力及争议的解决均适用 [适用法律]。

2. 本合同一式两份,甲乙双方各执一份,具有同等法律效力。

甲方(签字):________________________日期:___________乙方(签字):________________________日期:___________(以下无正文)[注:以上内容仅为模板,具体条款需根据实际情况调整。