Letters from Warren Buffet to stockholders 1981

巴菲特致股东的信(Warren Buffett's Letters to Berkshire Shareholders)-1977

Warren Buffett's Letters to Berkshire Shareholders-1977BERKSHIRE HATHAWAY INC.To the Stockholders of Berkshire Hathaway Inc.:Operating earnings in 1977 of $21,904,000, or $22.54 per share, were moderately better than anticipated a year ago. Of these earnings, $1.43 per share resulted from substantial realizedcapital gains by Blue Chip Stamps which, to the extent of our proportional interest in that company, are included in ouroperating earnings figure. Capital gains or losses realizeddirectly by Berkshire Hathaway Inc. or its insurance subsidiaries are not included in our calculation of operating earnings.Whiletoo much attention should not be paid to the figure for any single year, over the longer term the record regarding aggregate capital gains or losses obviously is of significance.1977年本公司的营业净利为2,190万美元,每股约当22.54美元,表现较年前的预期稍微好一点,在这些盈余中,每股有1.43美元的盈余,系蓝筹邮票大量实现的资本利得,本公司依照投资比例认列投资收益所贡献,至于伯克希尔本身及其保险子公司已实现的资本利得或损失,则不列入营业利益计算,建议大家不必太在意单一期间的盈余数字,因为长期累积的资本利得或损失才是真正的重点所在。

遇见未来的你,想想退休的事

为什么让人把钱存下来以备长远打算会那么困难?收入较低和诱惑太大是两个显而易见的原因,但最基本的因素也许来源于人性的根本弱点:我们将未来的自己视为陌路人。

Estimating with any precision what you will want 30 or 40 years from now is almost impossible. You don't know your future desires, because you don't know your future self. What will you want or need when you are 65 or 70 or 80 or older? Who knows?

这关系到很多人的切身利益。多年来,企业一直在削减员工的固定养老金,让员工加入401(k)和其它一些自愿性质的退休养老计划,但这些计划提供的是非固定的投资回报。此外,政策制定者在小打小闹地推出税收等优惠政策,鼓励人们储蓄。共同基金和保险公司则看中了数以万亿计的退休基金能赚取大量管理费,因此也不遗余力地试图说服人们更多地存钱。

当然,如果你今朝有酒今朝醉,那未来需要用钱时就会发现自己囊中空空——但那一天离现在还有好几十年。对于任何年龄段的人来说,这都是颠扑不破的真理,但年轻人的机会损失最大,因为存钱的时候越早,财富增长的时间就会越充裕。

26 English Letter Teaching Courseware

The letter "D" is written in both upper and lower case forms It insists of a semiconductor connected to a vertical line

Examples

"Dog", "Door", "Day"

The Promotion and Writing of the Letter E

要点一

Pronunciation

The letter "E" is promoted as/i ː/ In the IPA When promoting, the south should be slightly open and the tongue should be raised towards the roof of the south

fun, fish, fan, fast

The Promotion and Writing of Letter G

01

Pronunciation

The letter "G" is proposed as/g/ It is a consistent sound made by blocking the back of your throat and then releasing the air

PThroe nletutenrc"Dia"tisiopnromoted as/di ː/ In the IPA It is a voiced consonant,

produced by playing the tongue tip behind the tea and releasing it while voicing

LettertoLordChesterfield解读

terre⑵;—that I might obtain that regard (尊重,尊敬) for which I saw the world⑶ contending(争夺,竞争);

• Patron,英国文学史上都有“赞助人”之说,当时的 文人无法依靠作品生活,往往是达官贵人提携这些文 人,提供酬劳,而作为回报,文人将作品奉贤给赞助 人或者也叫恩主。

与山巨源绝交书

嵇康

《与山巨源绝交书》,是三国时期“竹 林七贤”之一的嵇康写给朋友山涛(字 巨源)的一封信。山涛在由选曹郎调任 大将军从事中郎时,想荐举嵇康代其原 职,嵇康断然拒绝,修书绝交,以表明 自己归隐山林,不愿涉足官场的志节。 这是一篇名传千古的著名散文,可以与 约翰逊的《与伯爵大人书》进行对比阅 读。

• 可是奥利弗·歌德史密斯(Oliver Goldsmith)出来打 抱不平了,他大声疾呼:约翰逊博士“除却皮囊且不 谈,更无一处是熊样!”—是呀,他是四海宗盟三十 年的文雄!以《兰登传》等“流浪汉小说”驰名英伦 的托拜厄斯·G·斯摩莱特(Tobias G. Smollett)送给约 翰逊一个震古烁今的雅号:“文章大汗”(the Great Cham of Literature)。

waited in your outward rooms, or was repulsed (拒绝, 驳斥) from your door; during which time I have been pushing on (继续向前,继续进行下去)my work

through difficulties, of which it is useless to complain, and have brought it, at last, to the verge of (边缘,边 界,濒临)publication, without one act of assistance , one word of encouragement, or one smile of favour(赞 许approval). Such treatment I did not expect, for I never had a patron before. 【Triple parallelism 三联排 比】

美国文学红字TheScarletLetter优秀课件

Satirical introduction to the novel Autobiographical of Hawthorne Used to show his dislike for the Puritans and

Nathaniel Hawthorne died at Plymouth, New Hampshire, on May 18th, 1864.

Picture found on Google Images

3

Personal Notables

He discovered that he had Puritan ancestors. One relative had served as a judge in the Salem witch

By 1842, he was able to earn enough to marry Sophia Peabody and move to Concord, which was then the center of the Transcendental movement.

Hawthorne returned to Salem in 1845 and in 1850, his most famous novel, The Scarlet Letter was published.

their strong religious beliefs He is bored at his job which leads him to

PE 从业者的基础学科书目推荐

2008-06-25 18:27:06 来自: 吴舸 (上海)一、经济学《国富论》-- 亚当.斯密“看不见的手”是本书被引用最高的一句话,本书被引用量可能是经济学著作的TOP1,就此一点,斯密的伟大可见,不过书中观点在现在看来,依然存在相当的局限性,注意甑别;《经济学基础》-- 萨缪尔森虽然曼昆的经济学是现在被用得更多的,但萨缪尔森的角度和观点是还是高度值得推荐的;《经济学原理》-- 曼昆29岁成为哈佛的终身教授,本书是出版社邀标时竟标而出;《风险、不确定性和利润》-- 奈特作为芝加哥学派的创始人,本书为奈特的博士论文,相当一部份观点把这本书列为和《国富论》、《货币、利率和就业通论》同样重要的书;二、金融财务(Finance)《公司理财》(第七版)-- MIT 斯隆管理学院《公司财务原理》-- MIT 斯隆管理学院两本书有近80%是相同和类似内容,但有很好的差异化角度和观点,所以建议两本同读;作为全球Finance 专业的最高水平学府,斯隆学院的书是本行业的基础读本 ,就《公司理财》一书,国内上市公司的CFO 能全读并理解的可能不到30%;三、商学《商学》(第七版)-- 里基·格里芬《伟大的博弈》-- 约翰.戈登《资本的冒险》-- 约翰.戈登四、投资理念《聪明的投资者》-- 格雷厄姆《致股东的信》-- 巴菲特一:合伙人智商毋容怀疑,对Finance和商业的认知水平随时可以到商学院客串讲学,火眼睛睛,没有任何商业的东西能骗过他们,对战略有深刻认识,拥有“水晶球”,能洞察未来 ...二:副总裁级的高级投资经理资深人士,通常基本具备合伙人80%以上的素质和能力,可能最后差的就是“财富圈子”--这是LP的重要来源,和“路演能力”--这是LP能否最后点头的关键;--- 当然,还是需要等机会三:初级投资经理具备很好的专业教育基础,经过很好的商业训练,通常有三年以上工作经验,正在加强修炼深层次的商业能力--这些都是学校给不到你的,时间和阅历--是他们进阶的唯一道路;四:投资助理如果你能成为副总裁很好用很顺手的高级工具,那你就是一个优秀的投资助理;founder (sometimes combined with CEO, as in founder/CEO), general manager, and owner.Executive director执行董事non-executive director非执行董事managing director董事总经理/执行董事associate director联席董事investment director投资总监vice president 副总裁In large brokerage firms and investment banks, there are usually several VPs in each local branch office, the title being more of a marketing approach for customers, than denoting an actual managerial position within the company.analyst分析师/副经理投资者进阶分级阅读书单(转自Value论坛by Zell)原文见:/wiki/index.php?Hidden%20Gems%20Reading%20ListHidden Gems Reading List(注:中文名我已尽量用从网上找到的中文版译名)Elementary School (小学)- One Up on Wall Street,(彼得·林奇的成功投资)by Peter Lynch(彼得·林奇)- Buffett: The Making of an American Capitalist(一个美国资本家的成长-巴菲特传), by Roger Lowenstein- value Investing With the Masters(跟大师学价值投资), by Kirk Kazanjian (0735203210)- The Davis Dynasty(戴维斯王朝——五十年华尔街成功投资历程), by John Rothchild- valuegrowth Investing(价值成长型投资), by Glen ArnoldJunior High (初中)- The 5 Keys to value Investing(价值投资五大关键), by J. Dennis Jean-Jacques- Beating the Street(战胜华尔街), by Peter Lynch(彼得·林奇)- Investment Fables(打破神话的投资十诫), by Aswath Damodaran- The Vest Pocket Guide to value Investing(价值投资手册), by C. Thomas Howard- Common Stocks and Uncommon Profits(怎样选择成长股), by Philip Fisher (菲利普.费雪)High School (高中)- Made in America(美国制造), by Sam Walton (萨姆.沃尔顿)- Forbes' Greatest Investing Stories( 福布斯最大投资传奇), by Richard Phalon- John Neff on Investing(约翰.聂夫谈投资), by John Neff (约翰.聂夫)- The Intelligent Investor(聪明的投资者), by Benjamin Graham (本杰明.格雷厄姆)- The Money Masters(金融大师), by John TrainUniversity (大学)- Stocks for the Long Run(股史风云话投资(第3版散户投资正典)), by Jeremy Siegel (西格尔)- Quality of Earnings(盈利的质量), by Thornton Oglove (0029226309)- Investing in Small-Cap Stocks(投资小盘股), by Christopher Graja and Elizabeth Ungar- The Book of Investing Wisdom(投资智慧书), by Peter Krass- You Can Be a Stock Market Genius(你能成为股市天才), by Joel GreenblattGrad School (研究院)- Break Up!(分裂), by Campbell, Koch & Sadtler- Investment Gurus(投资大师), by Peter Tanous- value Investing: A Balanced Approach(《价值投资:平稳途径》), by Martin Whitman- value Investing: From Graham to Buffett and Beyond(价值投资:从格雷厄姆到巴菲特及其他), by Bruce Greenwald- The Road to Serfdom(通往奴役之路), by F.A. Hayek (哈谢克)Post-Doc 1: (博士后1)- It's Earnings that Count(起作用的是盈利), Heiserman- The Five Rules for Successful Stock Investing(股市真规则), Dorsey- Inside Intuit(Intuit公司内幕), Taylor & Scroeder- Pour Your Heart Into It(星巴克咖啡王国传奇), Schultz & Yang- Investment Philosophies(投资哲学), DamodaranPost-Doc 2: (博士后2)- Damodaran on Valuation(价值评估,另一个译本译名:论价值:投资与公司财务安全性分析),Damodaran- Contrarian Investment Strategies: The Next Generation(反向投资策略:升级版), Dreman- Moneyball(钱与球: 在不公平比赛中获胜的艺术), Lewis- Investment Intelligence From Insider Trading (从内线交易中获得的投资情报)- Financial Shenanigans(财务诡计), SchilitPost-Doc 3: (博士后3)- Bull! A History of the Boom, 1982-1999,(牛市!1982-1999的市场繁荣历史) Mahir- Wall Street: A History,(华尔街史) Geisst- The Effective Executive(有效的管理者), Drucker (彼得.德鲁克)- The Essential Drucker(管理大师德鲁克精华), Drucker (彼得.德鲁克)- The Essays of Warren Buffet(巴菲特致股东的信:股份公司教程), BuffetPost-Doc 4: (博士后4)- Letters to Shareholders: Warren Buffet (巴菲特致股东的信)- Letters to Shareholders: Charlie Munger (芒格致股东的信)- Bershire Hathaway Owners Manual(伯克夏所有者手册), Buffet (以上三个见伯克夏网站)- The Dark Side of Valuation(深入价值评估), Damodaran投资银行书籍(传记类)推荐1、《摩根财团——美国一代银行王朝和现代金融业的崛起》第二版获得1990年美国国家图书奖英文名:The House of Morgan: An American Banking Dynasty and the Rise of Modern Finance 罗恩·彻诺(Ron Chernow)著,中国财政经济出版社2003年9月出版推荐理由:摩根家族的发迹史和19-20世纪美国金融市场和银行业发展演变的全景图,前任财政任亚洲开发银行副行长金立群先生的翻译代表了中文相关专业译著的最高水平。

美国文学红字TheScarletLetterPPT精选文档

Primary Document 1 Custom House Receipt

Salem Custom House Receipt, April 18, 1848

Signed by Nathaniel Hawthorne

/images

First Publishing

Hawthorne was a Romantic Author

Defining Scarlet

Function: adjective 1 of the color scarlet 2 a : grossly and glaringly offensive <sinning in flagrant and

The Scarlet Letter

by Nathaniel Hawthorne

Advanced American Lit Mr. Mays

The Author

Nathaniel Hawthorne American novelist and short story writer, most famous for his novel The Scarlet Letter

courtesy of The House of the Seven Gables Historic Site

Primary Document 3 Original Book Cover

(courtesy of Peabody Essex Museum)

Title page of 1850 edition of The Scarlet Letter

The story is based on a historical manuscript that he found. The narrator of the story is nameless, but shares many qualities with Hawthorne himself. He creates the narrator similar to Hester since they both feel alienated from those around them. Narrator says one day he will be remembered by his name on the custom stamp, while Hester will be remembered for her scarlet cloth.

红字PPTTheScarletLetterPPT

Primary Document 2 A letter from Hawthorne

Page one of a copy made by George B. Curwen of a letter from Hawthorne to Horace Ingersoll.

Written in Lenox in the summer of 1850 about his firing as surveyor at the Salem Custom House the year before.

(1830-1865) along with Ralph Waldo Emerson, Henry David Thoreau, Herman Melville, Harriet Beecher Stowe and Edgar Allen Poe

The Custom House

Satirical introduction to the novel Autobiographical of Hawthorne Used to show his dislike for the Puritans and

By 1842, he was able to earn enough to marry Sophia Peabody and move to Concord, which was then the center of the Transcendental movement.

Hawthorne returned to Salem in 1845 and in 1850, his most famous novel, The Scarlet Letter was published.

Nathaniel Hawthorne died at Plymouth, New Hampshire, on May 18th, 1864.

warren buffet

Journalist:Your style has been described as"buy and hold", and sometimes it 1)strikes me that Wall Street 2)perverts that 3)notion to get people to invest and forget about what they own. I think you buy and watch. Right? Because you sell if something is no longer working.Buffet:Oh sure. Sure we’ve sold, well, sell some things. We don’t sell the businesses that we buy, but we’ve sold plenty of stocks over the years. I mean you know, I’ve got my 4)portfolio from 1950, and I had six stocks that I don’t have them today. But I like to buy something with the idea I’m going to hold it indefinitely, if I’m taking a big equity position. Now we do 5)arbitrage, we do high yield 6)bonds, I mean we do other things. So those do not have that same permanence attached to them. But if you’re talking about just pure 7)bread and butter equities, I like to buy something that I feel is so good in terms of the business they’re in and the management, and I feel so good about the price, I bought them, then I say to myself I’d just as soon own this forever.Journalist:Coca-Cola, Dairy Queen, C’s Candy Ñ what does that tell us about you?Buffet:It tells you I like to buy things that I can understand. I do a lot of research on things like Dairy Queen. And if you look at our businesses, the truth is you’ll understand every one of them. There might be some that you are more familiar with than others, butthere’s nothing in there that’s black box stuff or anything of this sort. You’ll understand what they’re doing with the customer, what it takes to keep that customer happy, and why that customer should be coming back five or ten years from now, and why they should have an edge and all of that thing. So I look for things that I can understand and Dairy Queen’s a great example.Journalist:Has nothing to do with a 8)sweet tooth though?Buffet:Well, I like the product.Journalist:I know what you do is very hard and yet it all sounds very straight forward. Do people over think this process of investing, get too cute, get too fancy, and do things...Buffet:I say it’s simple but not easy. I mean and I also tell people that they got to when they were 21, they got a card with 20 9)punches on it, and every time they made an investment decision, they used up a punch. And when the 20 punches were gone, they were done. They’d make a lot of money because they think a long time before they make any decision. They take a long time before they buy a car or buy a house or all that, but many people do buy a stock because somebody mentioned that they particularly stocks have been going up. So it is...you have to stick with what you understand. You only buy into things you understand and then you are disciplined about what youwill pay when you buy into them, you can’t lose money. We’ve never lost a lot of money.Journalist:There has been, however, a rather decided loss in investor confidence these days. Main street looks at Wall Street and again believes as it has in previous occasions that the 10)casino was 11)rigged, they all went to the table and got taken by a 12)crooked 13)dealer.Buffet:Well, main street’s expectations were too high. Now we get blamed for that. You can blame main street itself, you can blame the people who are promoting stocks, you can blame Wall Street. But the basic problem was that expectations were too high, and people thought you could make a lot of money without knowing anything but just basically riding along on hot items. So who you blame for that? You can blame, there’s probably plenty of blame to go around. Now I think it is particularly blame worthy when people who have certain businesses made tremendous amounts of money and walked away, and their 14)shareholders ended up poor. I think that that fits the definition of a scam or something close to it. But the main thing that, you know, people’s enthusiasm just got carried away with it and they were aided in that by Wall Street. I mean, the fans were 15)flamed in a whole variety of ways, analysts’ reports or whatever it may be. But that’s what happens when the world goes crazy.CE。

Warren Buffett

to give away part of his fortune to charity In June 2006

慈善家

In 2006, Buffett donate some $37 billion to five charitable foundations. The largest recipient (receiving some $31 billion) will be The Bill & Melinda Gates Foundation.

Brief Introduction

Buffett is the primary shareholder , chairman and CEO of Berkshire Hathaway . He is consistently ranked among the world's wealthiest person . He was ranked by Forbes as the world's richest person in 2008 and is the third richest person in the world as of 2011.

As an ordinary person

The Buffett’s Buffett’s hobbies

(except investment)

HOBBIES

Friends:Buffett & Gates

HOBBIES

ห้องสมุดไป่ตู้s a philanthropist

Set

aside $2 for each Berkshire share to charities

如何看待富人与同情心的关系——TED英语演讲稿

如何看待富人与同情心的关系——TED英语演讲稿How to Address the Relationship between Wealth and Compassion: A Reflection on TED TalksIn recent years, the issue of wealth inequality has gained more attention in the public discourse. Many people believe that the rich are becoming richer and the poor are becoming poorer, creating a growing gap between the haves and have-nots. Moreover, some people argue that the wealthy are often seen as lacking in compassion for those who are less fortunate, viewing them as selfish and uncaring. However,this perception is increasingly being challenged by various sources, such as the TED Talk speakers, who highlight the importance of compassion and empathy in creating a more just and equitable society. In this article, we will explore how the relationship between wealth and compassion is presented in some TED Talks and what we can learn from them.To start, it is important to note that wealth itself is not the problem, but rather how it is used. In her talk on "The Giving Pledge," Melinda Gates emphasizes that the rich have a responsibility to give back to society and help those who are less fortunate. She argues that wealth is not just ameasure of personal success but also an opportunity to make a positive impact on the world. She offers an example of Warren Buffet, who pledged to give away a significant portion of his wealth to charitable causes, and encourages others to do the same. This suggests that wealth can in fact be a source of compassion, if it is directed towards charitable causes.Similarly, Nick Hanauer, in his talk on "Beware, Fellow Plutocrats," challenges the notion that the rich create jobs and stimulate economic growth. He argues that it is the middle class who creates jobs and drives the economy, andthat the wealthy, by hoarding their wealth, are actually hindering economic progress. He also points out that the wealthy benefit from the infrastructure and services provided by the government, such as roads, schools, and hospitals, which are paid for by taxpayers. Therefore, he suggests that the rich have a duty to pay their fair share of taxes, which would help to create a more equal and just society. In this way, Hanauer underscores the need for empathy and social responsibility among the wealthy, and makes a compelling case for the redistribution of wealth.Furthermore, it is worth noting that wealth can also create barriers to compassion, especially if it is acquiredthrough unfair means. In his talk on "The Psychology of Inequality," Paul Piff explores how wealth affects people's behavior and attitudes. He argues that wealth has a corrosive effect on morality and social values, making people moreselfish and less empathetic towards others. He alsohighlights the reality of the social divide between the rich and poor, which erodes a sense of community and shared values. Therefore, he suggests that the solution to this problem isnot just to redistribute wealth, but to create a moreinclusive and participatory society, where people are valued for who they are, not just what they have.In conclusion, the relationship between wealth and compassion is complex and multifaceted. The TED Talk speakers we have discussed offer different perspectives on how wealth can be both a source of compassion and a barrier to it. However, they all remind us of the importance of empathy, social responsibility and community in creating a more just and equitable society. As we reflect on these issues, we should not demonize the wealthy, but rather engage with themas partners in creating a better future for all.。

广播剧纯爱推荐英语作文

Radio dramas have been a cherished form of entertainment for many decades, offering listeners the chance to immerse themselves in stories through the power of sound. In the realm of pure love stories, Englishlanguage radio dramas provide a unique and engaging experience that can be both heartwarming and captivating. Here are a few recommendations for those looking to explore the world of pure love in radio dramas:1. The Love of a Lifetime This classic radio drama tells the story of two individuals who meet by chance and navigate the complexities of love and life. The narrative unfolds through their letters, phone calls, and intimate conversations, capturing the essence of a deep and enduring love.2. Letters from Home Set during World War II, this drama follows the correspondence between a soldier and his sweetheart back home. Their letters reveal the strength of their love as they share their hopes, fears, and dreams, despite the distance and challenges of war.3. The Sound of Your Voice A modern tale of two people who fall in love over the phone, never having met in person. The story explores the power of connection and intimacy that can be built through the spoken word, even in the absence of physical presence.4. A Love Rediscovered This drama tells the story of a couple who, after many years apart, unexpectedly reconnect. As they reminisce about their past and confront the reasons for their separation, they rediscover the love that has never truly left them.5. The Timeless Melody A romantic drama that weaves together the story of a struggling musician and a woman who becomes his muse. Their love story is set against the backdrop of the music industry, highlighting the power of art to bring people together.6. Love Across the Miles A touching story about a longdistance relationship, where the couple communicates only through letters and occasional phone calls. The drama captures the emotional highs and lows of maintaining a relationship when physical touch is a rare luxury.7. The Hearts Journey This radio drama takes listeners on an emotional journey as it follows a character who, after a heartbreak, finds love in the most unexpected place. The story is a testament to the resilience of the human heart and the power of love to heal.8. Whispers of the Heart A poignant drama that delves into the inner thoughts and feelings of a character who is hesitant to express their love. Through a series ofmonologues and reflective moments, the story encourages listeners to embrace vulnerability and the beauty of expressing ones true feelings.9. The Bridge of Love Set in a quaint European town, this drama tells the story of two strangers who meet on a bridge and share a connection that transcends language and culture. Their love story unfolds as they navigate the challenges of building a relationship across different worlds.10. The Last Dance A bittersweet tale of a couple who, after many years of marriage, must confront the reality of aging and the inevitable end of their journey together. The drama is a poignant reminder of the beauty and fragility of life and love.These radio dramas offer a variety of pure love stories that can resonate with listeners of all ages and backgrounds. They serve as a reminder of the power of love to inspire, uplift, and transform lives.。

名著英文简介

名著英文简介第一篇:名著英文简介探讨杜拉斯《情人》和《来自中国北方的情人》两部作品的叙事体裁。

这两部作品既非作者自传,也非一般小说,而是一种具有浓厚自传意味和小说色彩、又兼有其他文艺体裁因素的新型叙事作品。

读者在其中可以窥见当今各种文学、艺术乃至各个学科之间相互渗透、相互据有的种种多元现象,而这一切皆服务于表现心灵欲望的真实这样一个主题。

【英文摘要】 This article tries to explore the genre in Duras' Lover and Lover from North of China.Not only can the two works be simply perceived as the author's autobiography, but they do not fall into the category of novel.They actually are a new-type narrative form with profound interest of autobiography and novel flavor as well as other forms of literature and art, in which readers can deeply experience the pluralistic phenomena of mutual infiltration and mutual containment.All of these serve for embodying the th...长发公主影评我们都习惯了童话故事里王子和公主的完美结局。

所以迪斯尼这次翻新了,不是公主配王子,而是公主配盗贼---当然是个英俊盗贼!这位暴力公主还会用她瀑布般的长发绑架一个帅气小偷,与她一同去外面广阔的世界冒险,故事可谓非常具有“女权”色彩。

The Scarlet Letter

Nathaniel Hawthorne( July 4, 1804 – May 19, 1864) was an American novelist, Dark Romantic, and short story writer. The Scarlet Letter was the first, and the tendency of criticism. It has the charm of unconsciousness; the author did not realize while he worked, that this "most prolix among tales" was alive with the miraculous vitality of genius.

Analyse The Language Feature

(2) metaphor

The article describes Hester's daughter Pearl "This tiny creature, pure innocence rabbits fard, mysterious providence of God, is made of a thick lush evil passion into a charming and lovely blooming never withering flowers."

"A" is an evil, a shame symbol of Adultery

"A" has the meaning of an indomitable woman-Amazon.

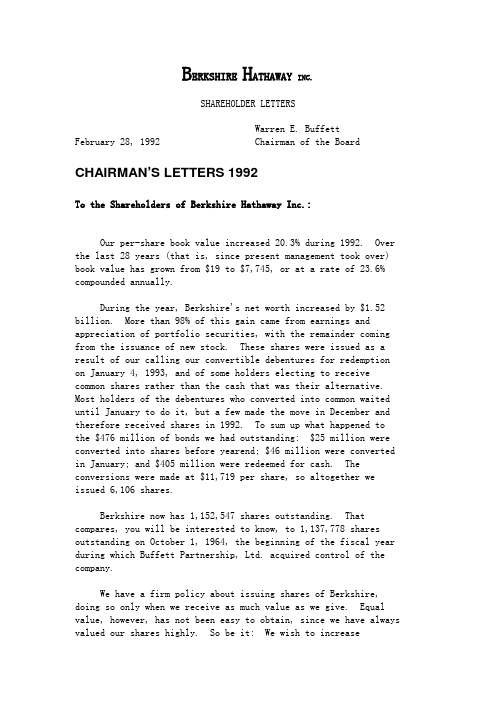

1992年 华伦

B ERKSHIRE H ATHAWAY INC.SHAREHOLDER LETTERSWarren E. BuffettFebruary 28, 1992 Chairman of the Board CHAIRMAN’S LETTERS 1992To the Shareholders of Berkshire Hathaway Inc.:Our per-share book value increased 20.3% during 1992. Over the last 28 years (that is, since present management took over) book value has grown from $19 to $7,745, or at a rate of 23.6% compounded annually.During the year, Berkshire's net worth increased by $1.52 billion. More than 98% of this gain came from earnings and appreciation of portfolio securities, with the remainder coming from the issuance of new stock. These shares were issued as a result of our calling our convertible debentures for redemption on January 4, 1993, and of some holders electing to receive common shares rather than the cash that was their alternative. Most holders of the debentures who converted into common waited until January to do it, but a few made the move in December and therefore received shares in 1992. To sum up what happened to the $476 million of bonds we had outstanding: $25 million were converted into shares before yearend; $46 million were converted in January; and $405 million were redeemed for cash. The conversions were made at $11,719 per share, so altogether we issued 6,106 shares.Berkshire now has 1,152,547 shares outstanding. That compares, you will be interested to know, to 1,137,778 shares outstanding on October 1, 1964, the beginning of the fiscal year during which Buffett Partnership, Ltd. acquired control of the company.We have a firm policy about issuing shares of Berkshire, doing so only when we receive as much value as we give. Equal value, however, has not been easy to obtain, since we have always valued our shares highly. So be it: We wish to increaseBerkshire's size only when doing that also increases the wealth of its owners.Those two objectives do not necessarily go hand-in-hand as an amusing but value-destroying experience in our past illustrates. On that occasion, we had a significant investment in a bank whose management was hell-bent on expansion. (Aren't they all?) When our bank wooed a smaller bank, its owner demanded a stock swap on a basis that valued the acquiree's net worth and earning power at over twice that of the acquirer's. Our management - visibly in heat - quickly capitulated. The owner of the acquiree then insisted on one other condition: "You must promise me," he said in effect, "that once our merger is done and I have become a major shareholder, you'll never again make a deal this dumb."You will remember that our goal is to increase our per-share intrinsic value - for which our book value is a conservative, but useful, proxy - at a 15% annual rate. This objective, however, cannot be attained in a smooth manner. Smoothness isparticularly elusive because of the accounting rules that apply to the common stocks owned by our insurance companies, whose portfolios represent a high proportion of Berkshire's net worth. Since 1979, generally accepted accounting principles (GAAP) have required that these securities be valued at their market prices (less an adjustment for tax on any net unrealized appreciation) rather than at the lower of cost or market. Run-of-the-mill fluctuations in equity prices therefore cause our annual results to gyrate, especially in comparison to those of the typical industrial company.To illustrate just how volatile our progress has been - and to indicate the impact that market movements have on short-term results - we show on the facing page our annual change in per- share net worth and compare it with the annual results (including dividends) of the S&P 500.You should keep at least three points in mind as you evaluate this data. The first point concerns the many businesses we operate whose annual earnings are unaffected by changes in stock market valuations. The impact of these businesses on both our absolute and relative performance has changed over the years. Early on, returns from our textile operation, which then represented a significant portion of our net worth, were a major drag on performance, averaging far less than would have been thecase if the money invested in that business had instead been invested in the S&P 500. In more recent years, as we assembled our collection of exceptional businesses run by equally exceptional managers, the returns from our operating businesses have been high - usually well in excess of the returns achieved by the S&P.A second important factor to consider - and one that significantly hurts our relative performance - is that both the income and capital gains from our securities are burdened by a substantial corporate tax liability whereas the S&P returns are pre-tax. To comprehend the damage, imagine that Berkshire had owned nothing other than the S&P index during the 28-year period covered. In that case, the tax bite would have caused our corporate performance to be appreciably below the record shown in the table for the S&P. Under present tax laws, a gain for theS&P of 18% delivers a corporate holder of that index a return well short of 13%. And this problem would be intensified if corporate tax rates were to rise. This is a structural disadvantage we simply have to live with; there is no antidotefor it.The third point incorporates two predictions: Charlie Munger, Berkshire's Vice Chairman and my partner, and I are virtually certain that the return over the next decade from an investment in the S&P index will be far less than that of the past decade, and we are dead certain that the drag exerted by Berkshire's expanding capital base will substantially reduce our historical advantage relative to the index.Making the first prediction goes somewhat against our grain: We've long felt that the only value of stock forecasters is to make fortune tellers look good. Even now, Charlie and I continue to believe that short-term market forecasts are poison and should be kept locked up in a safe place, away from children and also from grown-ups who behave in the market like children. However, it is clear that stocks cannot forever overperform their underlying businesses, as they have so dramatically done for some time, and that fact makes us quite confident of our forecast that the rewards from investing in stocks over the next decade will be significantly smaller than they were in the last. Our second conclusion - that an increased capital base will act as an anchor on our relative performance - seems incontestable. The only open question is whether we can drag the anchor along at sometolerable, though slowed, pace.We will continue to experience considerable volatility in our annual results. That's assured by the general volatility of the stock market, by the concentration of our equity holdings in just a few companies, and by certain business decisions we have made, most especially our move to commit large resources tosuper-catastrophe insurance. We not only accept this volatility but welcome it: A tolerance for short-term swings improves our long-term prospects. In baseball lingo, our performanceyardstick is slugging percentage, not batting average.The Salomon InterludeLast June, I stepped down as Interim Chairman of Salomon Inc after ten months in the job. You can tell from Berkshire's 1991- 92 results that the company didn't miss me while I was gone. But the reverse isn't true: I missed Berkshire and am delighted to be back full-time. There is no job in the world that is more fun than running Berkshire and I count myself lucky to be where I am.The Salomon post, though far from fun, was interesting and worthwhile: In Fortune's annual survey of America's Most Admired Corporations, conducted last September, Salomon ranked second among 311 companies in the degree to which it improved its reputation. Additionally, Salomon Brothers, the securities subsidiary of Salomon Inc, reported record pre-tax earnings last year - 34% above the previous high.Many people helped in the resolution of Salomon's problems and the righting of the firm, but a few clearly deserve special mention. It is no exaggeration to say that without the combined efforts of Salomon executives Deryck Maughan, Bob Denham, Don Howard, and John Macfarlane, the firm very probably would not have survived. In their work, these men were tireless, effective, supportive and selfless, and I will forever begrateful to them.Salomon's lead lawyer in its Government matters, Ron Olson of Munger, Tolles & Olson, was also key to our success in getting through this trouble. The firm's problems were not only severe, but complex. At least five authorities - the SEC, the Federal Reserve Bank of New York, the U.S. Treasury, the U.S. Attorneyfor the Southern District of New York, and the Antitrust Divisionof the Department of Justice - had important concerns about Salomon. If we were to resolve our problems in a coordinated and prompt manner, we needed a lawyer with exceptional legal, business and human skills. Ron had them all.AcquisitionsOf all our activities at Berkshire, the most exhilaratingfor Charlie and me is the acquisition of a business withexcellent economic characteristics and a management that we like, trust and admire. Such acquisitions are not easy to make but we look for them constantly. In the search, we adopt the same attitude one might find appropriate in looking for a spouse: It pays to be active, interested and open-minded, but it does not pay to be in a hurry.In the past, I've observed that many acquisition-hungry managers were apparently mesmerized by their childhood reading of the story about the frog-kissing princess. Remembering her success, they pay dearly for the right to kiss corporate toads, expecting wondrous transfigurations. Initially, disappointing results only deepen their desire to round up new toads. ("Fanaticism," said Santyana, "consists of redoubling your effort when you've forgotten your aim.") Ultimately, even the most optimistic manager must face reality. Standing knee-deep in unresponsive toads, he then announces an enormous "restructuring" charge. In this corporate equivalent of a Head Start program, the CEO receives the education but the stockholders pay the tuition.In my early days as a manager I, too, dated a few toads. They were cheap dates - I've never been much of a sport - but my results matched those of acquirers who courted higher-priced toads. I kissed and they croaked.After several failures of this type, I finally remembered some useful advice I once got from a golf pro (who, like all pros who have had anything to do with my game, wishes to remain anonymous). Said the pro: "Practice doesn't make perfect; practice makes permanent." And thereafter I revised my strategy and tried to buy good businesses at fair prices rather than fair businesses at good prices.Last year, in December, we made an acquisition that is aprototype of what we now look for. The purchase was 82% of Central States Indemnity, an insurer that makes monthly payments for credit-card holders who are unable themselves to pay because they have become disabled or unemployed. Currently the company's annual premiums are about $90 million and profits about $10 million. Central States is based in Omaha and managed by Bill Kizer, a friend of mine for over 35 years. The Kizer family - which includes sons Bill, Dick and John - retains 18% ownership of the business and will continue to run things just as it has in the past. We could not be associated with better people.Coincidentally, this latest acquisition has much in common with our first, made 26 years ago. At that time, we purchased another Omaha insurer, National Indemnity Company (along with a small sister company) from Jack Ringwalt, another long-time friend. Jack had built the business from scratch and, as was the case with Bill Kizer, thought of me when he wished to sell. (Jack's comment at the time: "If I don't sell the company, my executor will, and I'd rather pick the home for it.") National Indemnity was an outstanding business when we bought it and continued to be under Jack's management. Hollywood has had good luck with sequels; I believe we, too, will.Berkshire's acquisition criteria are described on page 23. Beyond purchases made by the parent company, however, our subsidiaries sometimes make small "add-on" acquisitions that extend their product lines or distribution capabilities. In this manner, we enlarge the domain of managers we already know to be outstanding - and that's a low-risk and high-return proposition. We made five acquisitions of this type in 1992, and one was not so small: At yearend, H. H. Brown purchased Lowell Shoe Company, a business with $90 million in sales that makes Nursemates, a leading line of shoes for nurses, and other kinds of shoes as well. Our operating managers will continue to look for add-on opportunities, and we would expect these to contribute modestly to Berkshire's value in the future.Then again, a trend has emerged that may make further acquisitions difficult. The parent company made one purchase in 1991, buying H. H. Brown, which is run by Frank Rooney, who has eight children. In 1992 our only deal was with Bill Kizer,father of nine. It won't be easy to keep this string going in 1993.Sources of Reported EarningsThe table below shows the major sources of Berkshire'sreported earnings. In this presentation, amortization ofGoodwill and other major purchase-price accounting adjustmentsare not charged against the specific businesses to which they apply, but are instead aggregated and shown separately. This procedure lets you view the earnings of our businesses as they would have been reported had we not purchased them. I'veexplained in past reports why this form of presentation seems tous to be more useful to investors and managers than one utilizing GAAP, which requires purchase-price adjustments to be made on a business-by-business basis. The total net earnings we show inthe table are, of course, identical to the GAAP total in ouraudited financial statements.(000s omitted)-----------------------------------------------Berkshire's Shareof Net Earnings(after taxes andPre-Tax Earnings minority interests)--------------------------------------------1992 1991 1992 1991---------- ---------- --------------------Operating Earnings:Insurance Group:Underwriting ............ $(108,961) $(119,593) $ (71,141) $ (77,229)Net Investment Income.... 355,067 331,846 305,763 285,173H. H. Brown (acquired 7/1/91) 27,883 13,616 17,340 8,611Buffalo News .............. 47,863 37,113 28,163 21,841Fechheimer ................ 13,698 12,947 7,267 6,843Kirby ..................... 35,653 35,726 22,795 22,555Nebraska Furniture Mart ... 17,110 14,384 8,072 6,993Scott FetzerManufacturing Group .... 31,954 26,123 19,883 15,901See's Candies ............. 42,357 42,390 25,501 25,575Wesco - other than Insurance 15,153 12,230 9,195 8,777World Book ................ 29,044 22,483 19,503 15,487Amortization of Goodwill .. (4,702) (4,113) (4,687) (4,098)Other Purchase-PriceAccounting Charges ..... (7,385) (6,021) (8,383) (7,019)Interest Expense* ......... (98,643) (89,250) (62,899) (57,165)Shareholder-DesignatedContributions .......... (7,634) (6,772) (4,913) (4,388)Other ..................... 72,223 77,399 36,267 47,896---------- ---------- --------------------Operating Earnings .......... 460,680 400,508 347,726 315,753Sales of Securities ......... 89,937 192,478 59,559 124,155---------- ---------- --------------------Total Earnings - All Entities $ 550,617 $ 592,986 $ 407,285$ 439,908========== ========== ====================*Excludes interest expense of Scott Fetzer Financial Group and Mutual Savings & Loan. Includes $22.5 million in 1992 and $5.7 million in 1991 of premiums paid on the early redemption of debt.A large amount of additional information about these businesses is given on pages 37-47, where you will also find our segment earnings reported on a GAAP basis. Our goal is to give you all of the financial information that Charlie and I consider significant in making our own evaluation of Berkshire."Look-Through" EarningsWe've previously discussed look-through earnings, which consist of: (1) the operating earnings reported in the previous section, plus; (2) the retained operating earnings of major investees that, under GAAP accounting, are not reflected in our profits, less; (3) an allowance for the tax that would be paid by Berkshire if these retained earnings of investees had instead been distributed to us. Though no single figure can be perfect, we believe that the look-through number more accurately portrays the earnings of Berkshire than does the GAAP number.I've told you that over time look-through earnings must increase at about 15% annually if our intrinsic business value is to grow at that rate. Our look-through earnings in 1992 were $604 million, and they will need to grow to more than $1.8 billion by the year 2000 if we are to meet that 15% goal. For us to get there, our operating subsidiaries and investees must deliver excellent performances, and we must exercise some skill in capital allocation as well.We cannot promise to achieve the $1.8 billion target. Indeed, we may not even come close to it. But it does guide our decision- making: When we allocate capital today, we are thinking about what will maximize look-through earnings in 2000.We do not, however, see this long-term focus as eliminating the need for us to achieve decent short-term results as well.After all, we were thinking long-range thoughts five or ten years ago, and the moves we made then should now be paying off. If plantings made confidently are repeatedly followed by disappointing harvests, something is wrong with the farmer. (Or perhaps with the farm: Investors should understand that for certain companies, and even for some industries, there simply is no good long-term strategy.) Just as you should be suspicious of managers who pump up short-term earnings by accounting maneuvers, asset sales and the like, so also should you be suspicious of those managers who failto deliver for extended periods and blame it on their long-term focus. (Even Alice, after listening to the Queen lecture her about "jam tomorrow," finally insisted, "It must come sometimes to jam today.")The following table shows you how we calculate look-through earnings, though I warn you that the figures are necessarily very rough. (The dividends paid to us by these investees have been included in the operating earnings itemized on page 8, mostlyunder "Insurance Group: Net Investment Income.")Berkshire's Shareof UndistributedBerkshire's Approximate Operating EarningsBerkshire's Major Investees Ownership at Yearend (in millions)--------------------------- -----------------------------------------1992 1991 1992 1991-------- -------- ----------------Capital Cities/ABC Inc. ....... 18.2% 18.1% $ 70 $ 61The Coca-Cola Company ......... 7.1% 7.0% 82 69Federal Home Loan Mortgage Corp. 8.2%(1) 3.4%(1) 29(2) 15GEICO Corp. ................... 48.1% 48.2% 34(3) 69(3)General Dynamics Corp. ........ 14.1% -- 11(2) --The Gillette Company .......... 10.9% 11.0% 38 23(2)Guinness PLC .................. 2.0% 1.6% 7 --The Washington Post Company ... 14.6% 14.6% 11 10Wells Fargo & Company ......... 11.5% 9.6% 16(2) (17)(2)-------- -------- ----------------Berkshire's share ofundistributed earnings of major investees $298 $230Hypothetical tax on theseundistributed investee earnings (42) (30)Reported operating earnings of Berkshire 348 316----------------Total look-through earnings of Berkshire $604 $516(1) Net of minority interest at Wesco(2) Calculated on average ownership for the year(3) Excludes realized capital gains, which have been both recurring and significantInsurance OperationsShown below is an updated version of our usual tablepresenting key figures for the property-casualty insuranceindustry:Yearly Change Combined Ratio in Premiums After Policyholder Written (%) Dividends-------------------------------1981 ........................... 3.8 106.01982 ........................... 3.7 109.61983 ........................... 5.0 112.01984 ........................... 8.5 118.01985 ........................... 22.1 116.31986 ........................... 22.2 108.01987 ........................... 9.4 104.61988 ........................... 4.5 105.41989 ........................... 3.2 109.21990 ........................... 4.5 109.61991 (Revised) ................. 2.4 108.81992 (Est.) .................... 2.7 114.8The combined ratio represents total insurance costs (losses incurred plus expenses) compared to revenue from premiums: A ratio below 100 indicates an underwriting profit, and one above 100 indicates a loss. The higher the ratio, the worse the year. When the investment income that an insurer earns from holding policyholders' funds ("the float") is taken into account, a combined ratio in the 106 - 110 range typically produces an overall break-even result, exclusive of earnings on the funds provided by shareholders.About four points in the industry's 1992 combined ratio can be attributed to Hurricane Andrew, which caused the largest insured loss in history. Andrew destroyed a few small insurers. Beyond that, it awakened some larger companies to the fact that their reinsurance protection against catastrophes was far from adequate. (It's only when the tide goes out that you learn who's been swimming naked.) One major insurer escaped insolvencysolely because it had a wealthy parent that could promptly supply a massive transfusion of capital.Bad as it was, however, Andrew could easily have been far more damaging if it had hit Florida 20 or 30 miles north of where it actually did and had hit Louisiana further east than was the case. All in all, many companies will rethink their reinsurance programs in light of the Andrew experience.As you know we are a large writer - perhaps the largest in the world - of "super-cat" coverages, which are the policies that other insurance companies buy to protect themselves against major catastrophic losses. Consequently, we too took our lumps from Andrew, suffering losses from it of about $125 million, an amount roughly equal to our 1992 super-cat premium income. Our other super-cat losses, though, were negligible. This line of business therefore produced an overall loss of only $2 million for the year. (In addition, our investee, GEICO, suffered a net loss from Andrew, after reinsurance recoveries and tax savings, of about $50 million, of which our share is roughly $25 million. This loss did not affect our operating earnings, but did reduce our look-through earnings.)In last year's report I told you that I hoped that oursuper-cat business would over time achieve a 10% profit margin. But I also warned you that in any given year the line was likelyto be "either enormously profitable or enormously unprofitable." Instead, both 1991 and 1992 have come in close to a break-even level. Nonetheless, I see these results as aberrations and stick with my prediction of huge annual swings in profitability from this business.Let me remind you of some characteristics of our super-cat policies. Generally, they are activated only when two things happen. First, the direct insurer or reinsurer we protect must suffer losses of a given amount - that's the policyholder's "retention" - from a catastrophe; and second, industry-wide insured losses from the catastrophe must exceed some minimum level, which usually is $3 billion or more. In most cases, the policies we issue cover only a specific geographical area, such as a portion of the U.S., the entire U.S., or everywhere other than the U.S. Also, many policies are not activated by the first super-cat that meets the policy terms, but instead cover only a "second-event" or even a third- or fourth-event. Finally, some policies are triggered only by a catastrophe of a specific type, such as an earthquake. Our exposures are large: We have one policy that calls for us to pay $100 million to the policyholder if a specified catastrophe occurs. (Now you know why I suffer eyestrain: from watching The Weather Channel.)Currently, Berkshire is second in the U.S. property-casualty industry in net worth (the leader being State Farm, which neither buys nor sells reinsurance). Therefore, we have the capacity to assume risk on a scale that interests virtually no other company. We have the appetite as well: As Berkshire's net worth and earnings grow, our willingness to write business increases also. But let me add that means good business. The saying, "a fooland his money are soon invited everywhere," applies in spades in reinsurance, and we actually reject more than 98% of the business we are offered. Our ability to choose between good and bad proposals reflects a management strength that matches our financial strength: Ajit Jain, who runs our reinsurance operation, is simply the best in this business. In combination, these strengths guarantee that we will stay a major factor in the super-cat business so long as prices are appropriate.What constitutes an appropriate price, of course, isdifficult to determine. Catastrophe insurers can't simply extrapolate past experience. If there is truly "global warming," for example, the odds would shift, since tiny changes inatmospheric conditions can produce momentous changes in weather patterns. Furthermore, in recent years there has been a mushrooming of population and insured values in U.S. coastal areas that are particularly vulnerable to hurricanes, the number one creator of super-cats. A hurricane that caused x dollars of damage 20 years ago could easily cost 10x now.Occasionally, also, the unthinkable happens. Who would have guessed, for example, that a major earthquake could occur in Charleston, S.C.? (It struck in 1886, registered an estimated 6.6 on the Richter scale, and caused 60 deaths.) And who could have imagined that our country's most serious quake would occur at New Madrid, Missouri, which suffered an estimated 8.7 shocker in 1812. By comparison, the 1989 San Francisco quake was a 7.1 - and remember that each one-point Richter increase represents a ten-fold increase in strength. Someday, a U.S. earthquake occurring far from California will cause enormous losses for insurers.When viewing our quarterly figures, you should understand that our accounting for super-cat premiums differs from our accounting for other insurance premiums. Rather than recording our super-cat premiums on a pro-rata basis over the life of a given policy, we defer recognition of revenue until a loss occurs or until the policy expires. We take this conservative approach because the likelihood of super-cats causing us losses is particularly great toward the end of the year. It is then that weather tends to kick up: Of the ten largest insured losses in U.S. history, nine occurred in the last half of the year. In addition, policies that are not triggered by a first event are unlikely, by their very terms, to cause us losses until late in the year.The bottom-line effect of our accounting procedure forsuper-cats is this: Large losses may be reported in any quarter of the year, but significant profits will only be reported in the fourth quarter.* * * * * * * * * * * *As I've told you in each of the last few years, what counts in our insurance business is "the cost of funds developed from insurance," or in the vernacular, "the cost of float." Float - which we generate in exceptional amounts - is the total of loss。

美国文学红字TheScarletLetter ppt课件

Hawthorne returned to Salem in 1845 and in 1850, his most famous novel, The Scarlet Letter was published.

The story is based on a historical manuscript that he found. The narrator of the story is nameless, but shares many qualities with Hawthorne himself. He creates the narrator similar to Hester since they both feel alienated from those around them. Narrator says one day he will be remembered by his name on the custom stamp, while Hester will be remembered for her scarlet cloth.

美国文学红字TheScarletLetter

The Scarlet Letter

by Nathaniel Hawthorne

Advanced American Lit Mr. Mays

The Author

Nathaniel Hawthorne American novelist and short story writer, most famous for his novel The Scarlet Letter

百万英镑《the letter》概括英语

百万英镑《the letter》概括英语"Million pounds"is about a poor,honest man,the hero of this story is a pair of brothers received a letter which gave him a million pounds.It turned out that the brothers made a bet,bet if a poor,honest man fall from the sky received one million pounds,he will have what results?Brother that he would starve to death because he could not prove the money was his own,someone else will be suspected,even banks will not allow him to save money.Brother believes that he will very well,so they brothers will check for one million pounds lent the poor,and abroad spent thirty days.I did not expect at this time,people who suddenly rich riches rare,hard to actually draw him from the free food,buy clothes,to free accommodation,one by one like a beggar,like to please him,and continue to improve his social position,until the outdoor addition to the king on top of Duke!Not only that,he got a good wife and thirty thousand pounds of bank interest.Since then lived very,very happy life.See here,I am so envious of the"lucky"the hero,but I want to:The reason why people please him,not because it was too much focus on money yet?Worship of money is shameful,something for nothing we should not!Money is not everything in the world there are many more important things than money.Article on the"money is everything""Money is omnipotent,"the idea for a satire and expose the ugly face of capitalist society and the rule of darkness.!。

《英美文学选读》论述题汇总

美国文学III. Nathaniel HawthorneMosses from an Old Manse古宅青苔The Snow-Image and Other Twice-Told Tales 雪像和其他故事新编The Scarlet Letter 红字The House of Seven Gables 七个尖角阁的房子The Blithedale Romance 福谷传说The Marble Faun 大理石雕像选文Young Goodman BrownIV. Walt WhitmanLeaves of Grass选文There Was a Child Went Forth, Cavalry Crossing a Ford, Song of MyselfV. Herman MelvilleTypee 泰比Omoo 奥穆Mardi 玛迪Redburn 雷德本White Jacket 白外衣Pierre 皮埃尔Confidence-Man 信心人Moby-Dick 白鲸Billy Budd 比利伯德选文Moby-DickChapter 2 现实主义时期I. Mark TwainAdventures of Huckleberry FinnLife on MississippiThe Celebrated Jumping Frog of Calaveras County Innocent Abroad 傻瓜出国记Roughing It 含莘如苦The Adventures of Tom Sawyer The Gilded Age 镀金时代 A Connecticut Yankee in King Arthur’s Court 亚瑟王宫庭中的美国佬The Tragedy of Pudd’nhead Wilson 傻瓜威尔逊The Man That Corrupted Hadleyburg 败坏哈德莱堡的人The Mysterious Stranger 神秘的陌生人选文Adventures of Huckleberry Finn II. Henry James The American 美国人Daisy Miller 黛西米勒The European 欧洲人The Protrait of A Lady 贵妇人的画像The Bostonians 波士顿人Princess Casamassima 卡撒玛西公主The Private Life 私生活The Middle Years 中年The Turn of the Screw 螺丝的拧紧The Beast in the Jungle 丛林猛兽What Maisie Knows 梅西所知道的The Wings of the Dove 鸽翼The Ambassadors 大使The Golden Bowl 金碗The Death of a Lion 狮之死选文Daisy Miller III. Emily Dickinson If you were coming in the fall There came a day Summer’s full I cannot live with You I’m ceded-I’ve stopped being theirs 选文This is my letter to the World, I heard a Fly buzz-when I died I like to see it lap the Miles Because I could not stop for death IV.Theodore Dreiserer Sister Carrie 嘉莉妹妹Nigger Jeff 黑人杰夫Old Rogaum and His Theresa 老罗格姆和他的特里萨Jennie Gerhardt珍妮姑娘Trilogy of Desire The Financier 金融家The Genius 天才An American Tragedy 美国悲剧Dreiser at Russia 德莱塞对俄罗斯的观感选文Sister Carrie Chapter 3 现代主义时期II. Robert Lee Frost A Boy’s Will 一个男孩儿的愿望North of Boston 波士顿以北Mountain Interval New Hampshire 新罕布什尔Snowy Evening 雪夜停马在林边West-Running Brook 向西流去的小溪Collected Poems 诗选A Winter Tree 选文After Apple-Picking, The Road Not T aken, Stopping by Woods on a Snowy Evening以IV. F. Scott Fitzgerald This Side of Paradise 天堂的这一边Beautiful and Damned 美丽而遭骂的人The Great Gatsby Tender is the Night 夜色温柔The Last Tycoon 最后一个巨头Flappers and Philosophers 吹捧者与哲学家Tales of the Jazz Age 爵士时代All the Sad Young Men 所有悲惨的小伙子Taps at Reveille 拍打在起床鼓上Babylon Revisited重返巴比伦选文The Great Gatsby V. Earnest Hemingway In Our Time 在我们的时代 A Farewell to Arms 永别了,武器For Whom the Bell Tolls 丧钟为谁敲响The Old Man and the Sea 老人与海Men Without Women 没有女人的男人Death in the Afternoon 午后之死The Snows of Kilimanjaro 开利曼扎罗之雪The Green Hills of Africa 非洲的青山选文Indian Camp (from In Our Time) VI. William Faulkner The Marble Faun 玉石牧神The Sound and the Fury 喧嚣与骚动As I Lay Dying 我弥留之际Light in August 八月之光Absalom, Absalom 押沙龙!押沙龙!Wild Palms 疯狂的手掌The Hamlet 哈姆雷特The Unvanquished 不可征服的Go Down, Moses 去吧,摩西The Fable 寓言The Town 小镇The Mansion 大厦Soldier’s Pay 士兵的报酬英国文学部分Chapter 1 文艺复兴时期III. William Shakespeare Rape of Lucrece 鲁克斯受辱记Venus and Adonis 维纳斯与安东尼斯Titus Andronicus 泰托斯安东尼The Comedy of Errors 错误的喜剧The Two Gentlemen of Veroma 维洛那二绅士The Taming of the Shrew 驯悍记Love’s Labour’s Lost 爱的徒劳Richard II 理查二世King John 约翰王Henry IV, Parts I and II, Henry V Six Comedies: A Midsummer Night’s Dream 仲夏夜之梦The Merchant of Venice 威尼斯商人Much Ado About Nothing 无事无非As You Like It 皆大欢喜Twelfth Night 第十二夜The Merry Wise of Windsor 温莎的风流娘儿们Two Tragedies: Romeo and Juliet 罗米欧与朱丽叶Julius Caesar 凯撒Hamlet Othello King Lear Macbeth Antony and Cleopatra 安东尼与克里佩特拉Troilus and Cressida, and Coriolanus 特洛伊勒斯与克利西达All’ Well That Ends Well (comedy) 终成成眷属Measure for Measure (comedy) 一报还一报Pericles 伯里克利Cymbeline 辛白林The Winter’s Tale 冬天的故事The Tempest 暴风雨Henry VIII The Two Noble Kinsmen两位贵族亲戚选文为Sonnet 18; The Merchant of Venice; Hamlet VI. John Milton Paradise Lost 失乐园Paradise Regain 复乐园Samson Agonistes力士参孙Lycidas 利西达斯Areopagitica 论出版自由Chapter 2 新古典主义时期III. Daniel Defoe Robinson Crusoe 鲁宾逊漂流记Captain Singleton 辛立顿船长Moll Flanders 莫尔弗兰德斯Colonel Jack 杰克上校A Journal of the Plague Year 灾疫之年的日记Roxana 罗克萨那选文Robinson Crusoe IV. Jonathan Swift A Tale of Tub 木桶传The Battle of the Books 书籍的战斗Gulliver’s Travels 格列弗游记 A Modest Proposal 一个小小的建议The Drapier’s Letter s 布商的书信选文Gulliver’s Travels V. Henry Fielding The Coffee House Politician 咖啡屋的政治家The Tragedy of the Tragedies 悲剧中的悲剧The Historical Register for the Year 1736 1736历史年鉴The History of the Adventures of Joseph Andrews and of his friend Mr. Abraham Adams, Written in Imitation of the Manner of Cervantes The History of Jonathan Wild the Great 大伟人江奈生翻乐德传The History of Tom Jones, a Foundling 汤姆琼斯The History of Amelia 阿米亚选文为Tom Jones Chapter III 浪温主义时期I.William Blake Poetic Sketches 诗歌扎记The Songs of Innocence 天真之歌The Songs of Experience 经验之歌Marriage of Heaven and Hell 天堂与地狱联姻The Book of Urizen 尤里曾的书The Book of Los 洛斯的书The Four Zoas 四个成熟的个体Milton 弥尔顿选文The Chimney Sweeper (from Songs of Innocence); The Tyger II. William Wordsworth Lyrical Ballads (抒情歌谣集) The Prelude The Excursion Worshipper of Nature (The Sparr,w’s Nest, To a Skylark, T o the Cuckoo, To a Butterfly, I Wandered Lonely as a Cloud, An Evening Walking, My Heartn Leaps up, Tintern Abbey) 选文:I Wandered Lonely as a Cloud, Composed upon Westminster Bridge, She Dwelt Among the Untrodden Ways, The Solitary Reaper V. Percy Bysshe Shelley The Necessity of Atheism 无神论的必要性Queen Mab: A Philosophical Poem 仙后麦布Alastor, or The Spirit of Solitude 复仇者或隐居者的精神Julian and Maddalo 朱利安与麦达格The Revolt of Islam 伊斯兰的反叛The Cenci 钦契一家The Prometheus Unbound解放了的普罗米修斯Adomais 阿多尼斯Hellas 海娜斯A Defense of Poetry 诗之辩护选文A Song: Men of England; Ode to the West Wind VII. Jane Austen Sense and Sensibility 理智与情感Pride and Prejudice 傲慢与偏见Northanger Abbey 诺桑觉寺Mansfield Park 曼斯菲尔德花园Emma 埃玛Persuasion 劝导The Watsons 屈陈氏一爱Fragment of a Novel 小说的片断Plan of a Novel 小说的计划选文Pride and Prejudice Chapter IV. 维多利亚时期I.Charles Dickens Sketches by Boz 博兹特写集The Posthumous of the Pickwick Club 皮克威克外传Oliver Twist 雾都孤儿Nicholas Nickleby 尼古拉斯尼克尔贝The Pickwick Paper 皮克威克外传David Copperfield 大卫科波菲尔Martin Chuzzlewit 马丁朱尔述维特Dombey and Son 董贝父子A Tale of Two Cities 双城记Bleak House 荒凉山庄Little Dorrit 小杜丽Hard Times 艰难时世Great Expectations 远大前程Our Mutual Friends 我们共同的朋友The Old Curiosity Shop 老古玩店选文为Oliver Twist II. The Bronte Sisters Poem by Currer, Ellis, and Acton Bell (Charlotte, Emily, Anne) The Professor (Charlotte) 教师Jane Eyre (Charlotte) 简爱Wuthering Heights (Emily) 呼啸山庄Agnes Grey (Anne) 格雷The T enant of Wildfell Hall (Anne)野岗庄园房客选文Jane Eyre by Charlotte Bronte, Wuthering Heights by Emily Bronte VI. Thomas Hardy Tess of the D’Urbervilles 苔丝Jude the Obscure 无名的裘德The Dynasts 列后The Return of the Native 还乡The Trumpet Major 号兵长The Mayor of Casterbridge 卡斯特桥市长The Woodlanders 林地居民Under the Greenwood 林间居民Far from the Madding Crowd 远离尘嚣选文Tess of the D’Urbervilles Chapter 5 现代主义时期I. George Bernard Shaw Cashel Byron’s Profession 卡歇尔拜伦的职业Our Theaters in the Nineties 90年代的英国戏剧Widower’s Houses 鳏夫的房产Candida 堪迪达Mrs. Warren’s Profession 沃伦夫人的职业Caesar and Cleoptra 凯撕与克利奥佩特拉St. Joan 圣女贞德Back to Methuselah 回归玛士撒拉Man and Superman人与超人John Bull’s Other Island 约翰布尔的另外岛屿Pygmalion 茶花女Getting Married 结婚Misalliance 不合适的媳妇Fanny’s First Play 范尼的第一部戏剧The Doctor’s Dilemma医生的困境Too True to be Good 难以置信选文Mrs. Warren’s Profession IV. T. S. Eliot The Love Song of J. Alfred Prufrock 布鲁富劳克的情歌The Waste Land 荒园Murder in the Cathedral 教堂里的谋杀The Family Reunion 家人团聚The Confidential Clerk 机要秘书The Statesmen 政治家The Cocktail Party鸡尾酒会选文The Love Song of J. Alfred Prufrock V. D. H. Lawrence Sons and Lovers 儿子与情人The White Peacock白孔雀The Trespasser 过客The Rainbow彩虹Women in Love 恋爱中的女人Aaron’s Rod亚伦神仗Kangaroo 袋鼠The Plumed Serpent带羽毛的蛇Lady Chatterley’s Lover St. Mawr 圣摩尔The Daughter of the Vicar 主教的女儿The Horse Dealer’s Daughter贩马人的女儿The Captain’s Doll 般长的娃娃The Prussian Officer 普鲁士军官The Virgin and the Gypsy贞女和吉普塞人Trilogy(A Collier’s Friday Night, 矿工周五的夜晚The Daughter-in-law,儿媳The Widowing of Mrs. Holroyed 守寡的霍尔伊德夫人选文Sons and Lovers《英美文学选读》论述题汇总---按2009 年调整后新大纲IV. Topic Discussion(20 points in all, 10 for each) Write no less than 150 words on each of the following topics in English in the corresponding space on the answer sheet.2009 年4 月英美文学选读试题49. Briefly discuss William Shakespeare's artistic achievements in characterization, plot construction and language.(人物、情节构造、语言特色)50. Briefly discuss Mark Twain's art of fiction in terms of the setting,the language, and the characters, etc.,based on his novel The Adventures of Huckleberry Finn. (《哈克贝利·芬历险记》的小说框架、语言特色、人物塑造)2009 年7 月英美文学选读试题49. Define modernism in English literature. Name two major modernistic British writers and list one major work by each. 现代主义名词解释列出现代主义时期的两位英国作家和他的主要作品50. Briefly discuss the term “The Lost Generation”and name the leading figures of this literary movement (Give at least three). 简述专业名词“迷失的一代” ,最少列出三个特征。

浙江高三高中英语高考模拟带答案解析