公司理财第12章

公司理财精要版原书第12版习题库答案Ross12e_Chapter01_TB

Fundamentals of Corporate Finance, 12e (Ross)Chapter 1 Introduction to Corporate Finance1) Which one of the following functions should be the responsibility of the controller rather than the treasurer?A) Depositing cash receiptsB) Processing cost reportsC) Analyzing equipment purchasesD) Approving credit for a customerE) Paying a vendor2) The treasurer of a corporation generally reports directly to the:A) board of directors.B) chairman of the board.C) chief executive officer.D) president.E) vice president of finance.3) Which one of the following correctly defines the upward chain of command in a typical corporate organizational structure?A) The vice president of finance reports to the chairman of the board.B) The chief executive officer reports to the president.C) The controller reports to the chief financial officer.D) The treasurer reports to the president.E) The chief operations officer reports to the vice president of production.4) An example of a capital budgeting decision is deciding:A) how many shares of stock to issue.B) whether or not to purchase a new machine for the production line.C) how to refinance a debt issue that is maturing.D) how much inventory to keep on hand.E) how much money should be kept in the checking account.5) When evaluating the timing of a project's projected cash flows, a financial manager is analyzing:A) the amount of each expected cash flow.B) only the start-up costs that are expected to require cash resources.C) only the date of the final cash flow related to the project.D) the amount by which cash receipts are expected to exceed cash outflows.E) when each cash flow is expected to occur.6) Capital structure decisions include determining:A) which one of two projects to accept.B) how to allocate investment funds to multiple projects.C) the amount of funds needed to finance customer purchases of a new product.D) how much debt should be assumed to fund a project.E) how much inventory will be needed to support a project.7) The decision to issue additional shares of stock is an example of:A) working capital management.B) a net working capital decision.C) capital budgeting.D) a controller's duties.E) a capital structure decision.8) Which one of the following questions is a working capital management decision?A) Should the company issue new shares of stock or borrow money?B) Should the company update or replace its older equipment?C) How much inventory should be on hand for immediate sale?D) Should the company close one of its current stores?E) How much should the company borrow to buy a new building?9) Which one of the following is a working capital management decision?A) What type(s) of equipment is (are) needed to complete a current project?B) Should the firm pay cash for a purchase or use the credit offered by the supplier?C) What amount of long-term debt is required to complete a project?D) How many shares of stock should the firm issue to fund an acquisition?E) Should a project should be accepted?10) Working capital management decisions include determining:A) the minimum level of cash to be kept in a checking account.B) the best method of producing a product.C) the number of employees needed to work during a particular shift.D) when to replace obsolete equipment.E) if a competitor should be acquired.11) Which one of the following terms is defined as the management of a firm's long-term investments?A) Working capital managementB) Financial allocationC) Agency cost analysisD) Capital budgetingE) Capital structure12) Which one of the following terms is defined as the mixture of a firm's debt and equity financing?A) Working capital managementB) Cash managementC) Cost analysisD) Capital budgetingE) Capital structure13) A firm's short-term assets and its short-term liabilities are referred to as the firm's:A) working capital.B) debt.C) investment capital.D) net capital.E) capital structure.14) Which one of the following questions is least likely to be addressed by financial managers?A) How should a product be marketed?B) Should customers be given 30 or 45 days to pay for their credit purchases?C) Should the firm borrow more money?D) Should the firm acquire new equipment?E) How much cash should the firm keep on hand?15) A business owned by a solitary individual who has unlimited liability for the firm's debt is called a:A) corporation.B) sole proprietorship.C) general partnership.D) limited partnership.E) limited liability company.16) A business formed by two or more individuals who each have unlimited liability for all of the firm's business debts is called a:A) corporation.B) sole proprietorship.C) general partnership.D) limited partnership.E) limited liability company.17) A business partner whose potential financial loss in the partnership will not exceed his or her investment in that partnership is called a:A) general partner.B) sole proprietor.C) limited partner.D) corporate shareholder.E) zero partner.18) A business created as a distinct legal entity and treated as a legal "person" is called a(n):A) corporation.B) sole proprietorship.C) general partnership.D) limited partnership.E) unlimited liability company.19) Which one of the following statements concerning a sole proprietorship is correct?A) A sole proprietorship is designed to protect the personal assets of the owner.B) The profits of a sole proprietorship are subject to double taxation.C) The owner of a sole proprietorship is personally responsible for all of the company's debts.D) There are very few sole proprietorships remaining in the U.S. today.E) A sole proprietorship is structured the same as a limited liability company.20) Which one of the following statements concerning a sole proprietorship is correct?A) The life of a sole proprietorship is limited.B) A sole proprietor can generally raise large sums of capital quite easily.C) Transferring ownership of a sole proprietorship is easier than transferring ownership of a corporation.D) A sole proprietorship is taxed the same as a C corporation.E) A sole proprietorship is the most regulated form of organization.21) Which of the following individuals have unlimited liability for a firm's debts based on their ownership interest?A) Only general partnersB) Only sole proprietorsC) All stockholdersD) Both limited and general partnersE) Both general partners and sole proprietors22) The primary advantage of being a limited partner is:A) the receipt of tax-free income.B) the partner's active participation in the firm's activities.C) the lack of any potential financial loss.D) the daily control over the business affairs of the partnership.E) the partner's maximum loss is limited to their capital investment.23) A general partner:A) is personally responsible for all partnership debts.B) has no say over a firm's daily operations.C) faces double taxation whereas a limited partner does not.D) has a maximum loss equal to his or her equity investment.E) receives a salary in lieu of a portion of the profits.24) A limited partnership:A) has an unlimited life.B) can opt to be taxed as a corporation.C) terminates at the death of any one limited partner.D) has at least one partner who has unlimited liability for all of the partnership's debts.E) consists solely of limited partners.25) A partnership with four general partners:A) distributes profits based on percentage of ownership.B) has an unlimited partnership life.C) limits the active involvement in the firm to a single partner.D) limits each partner's personal liability to 25 percent of the partnership's total debt.E) must distribute 25 percent of the profits to each partner.26) One disadvantage of the corporate form of business ownership is the:A) limited liability of its shareholders for the firm's debts.B) double taxation of distributed profits.C) firm's greater ability to raise capital than other forms of ownership.D) firm's potential for an unlimited life.E) firm's ability to issue additional shares of stock.27) Which one of the following statements is correct?A) The majority of firms in the U.S. are structured as corporations.B) Corporate profits are taxable income to the shareholders when earned.C) Corporations can have an unlimited life.D) Shareholders are protected from all potential losses.E) Shareholders directly elect the corporate president.28) Which one of the following statements is correct?A) A general partnership is legally the same as a corporation.B) Income from both sole proprietorships and partnerships that is taxable is treated as individual income.C) Partnerships are the most complicated type of business to form.D) All business organizations have bylaws.E) Only firms organized as sole proprietorships have limited lives.29) The articles of incorporation:A) describe the purpose of the firm and set forth the number of shares of stock that can be issued.B) are amended periodically especially prior to corporate elections.C) explain how corporate directors are to be elected and the length of their terms.D) sets forth the procedures by which a firm regulates itself.E) include only the corporation's name and intended life.30) Corporate bylaws:A) must be amended should a firm decide to increase the number of shares authorized.B) cannot be amended once adopted.C) define the name by which the firm will operate.D) describe the intended life and purpose of the organization.E) determine how a corporation regulates itself.31) A limited liability company:A) can only have a single owner.B) is comprised of limited partners only.C) is taxed similar to a partnership.D) is taxed similar to a C corporation.E) generates totally tax-free income.32) Which business form is best suited to raising large amounts of capital?A) Sole proprietorshipB) Limited liability companyC) CorporationD) General partnershipE) Limited partnership33) A ________ has all the respective rights and privileges of a legal person.A) sole proprietorshipB) general partnershipC) limited partnershipD) corporationE) limited liability company34) Sam, Alfredo, and Juan want to start a small U.S. business. Juan will fund the venture but wants to limit his liability to his initial investment and has no interest in the daily operations. Sam will contribute his full efforts on a daily basis but has limited funds to invest in the business. Alfredo will be involved as an active consultant and manager and will also contribute funds. Sam and Alfredo are willing to accept liability for the firm's debts as they feel they have nothing to lose by doing so. All three individuals will share in the firm's profits and wish to keep the initial organizational costs of the business to a minimum. Which form of business entity should these individuals adopt?A) Sole proprietorshipB) Joint stock companyC) Limited partnershipD) General partnershipE) Corporation35) Sally and Alicia are equal general partners in a business. They are content with their current management and tax situation but are uncomfortable with their unlimited liability. Which form of business entity should they consider as a replacement to their current arrangement assuming they wish to remain the only two owners of the business?A) Sole proprietorshipB) Joint stock companyC) Limited partnershipD) Limited liability companyE) Corporation36) The growth of both sole proprietorships and partnerships is frequently limited by the firm's:A) double taxation.B) bylaws.C) inability to raise cash.D) limited liability.E) agency problems.37) Corporate dividends are:A) tax-free because the income is taxed at the personal level when earned by the firm.B) tax-free because they are distributions of aftertax income.C) tax-free since the corporation pays tax on that income when it is earned.D) taxed at both the corporate and the personal level when the dividends are paid to shareholders.E) taxable income of the recipient even though that income was previously taxed.38) Financial managers should primarily focus on the interests of:A) stakeholders.B) the vice president of finance.C) their immediate supervisor.D) shareholders.E) the board of directors.39) Which one of the following best states the primary goal of financial management?A) Maximize current dividends per shareB) Maximize the current value per shareC) Increase cash flow and avoid financial distressD) Minimize operational costs while maximizing firm efficiencyE) Maintain steady growth while increasing current profits40) Which one of the following best illustrates that the management of a firm is adhering to the goal of financial management?A) An increase in the amount of the quarterly dividendB) A decrease in the per unit production costsC) An increase in the number of shares outstandingD) A decrease in the net working capitalE) An increase in the market value per share41) Financial managers should strive to maximize the current value per share of the existingstock to:A) guarantee the company will grow in size at the maximum possible rate.B) increase employee salaries.C) best represent the interests of the current shareholders.D) increase the current dividends per share.E) provide managers with shares of stock as part of their compensation.42) Decisions made by financial managers should primarily focus on increasing the:A) size of the firm.B) growth rate of the firm.C) gross profit per unit produced.D) market value per share of outstanding stock.E) total sales.43) The Sarbanes-Oxley Act of 2002 is a governmental response to:A) decreasing corporate profits.B) the terrorist attacks on 9/11/2001.C) a weakening economy.D) deregulation of the stock exchanges.E) management greed and abuses.44) Which one of the following is an unintended result of the Sarbanes-Oxley Act?A) More detailed and accurate financial reportingB) Increased management awareness of internal controlsC) Corporations delisting from major exchangesD) Increased responsibility for corporate officersE) Identification of internal control weaknesses45) A firm which opts to "go dark" in response to the Sarbanes-Oxley Act:A) must continue to provide audited financial statements to the public.B) must continue to provide a detailed list of internal control deficiencies on an annual basis.C) can provide less information to its shareholders than it did prior to "going dark".D) can continue publicly trading its stock but only on the exchange on which it was previously listed.E) ceases to exist.46) The Sarbanes-Oxley Act of 2002 holds a public company's ________ responsible for the accuracy of the company's financial statements.A) managersB) internal auditorsC) external legal counselD) internal legal counselE) Securities and Exchange Commission agent47) Which one of the following actions by a financial manager is most apt to create an agency problem?A) Refusing to borrow money when doing so will create losses for the firmB) Refusing to lower selling prices if doing so will reduce the net profitsC) Refusing to expand the company if doing so will lower the value of the equityD) Agreeing to pay bonuses based on the market value of the company's stock rather than on its level of salesE) Increasing current profits when doing so lowers the value of the company's equity48) Which one of the following is least apt to help convince managers to work in the best interest of the stockholders? Assume there are no golden parachutes.A) Compensation based on the value of the stockB) Stock option plansC) Threat of a company takeoverD) Threat of a proxy fightE) Increasing managers' base salaries49) Agency problems are most associated with:A) sole proprietorships.B) general partnerships.C) limited partnerships.D) corporations.E) limited liability companies.50) Which one of the following is an agency cost?A) Accepting an investment opportunity that will add value to the firmB) Increasing the quarterly dividendC) Investing in a new project that creates firm valueD) Hiring outside accountants to audit the company's financial statementsE) Closing a division of the firm that is operating at a loss51) Which one of the following is a means by which shareholders can replace company management?A) Stock optionsB) PromotionC) Sarbanes-Oxley ActD) Agency playE) Proxy fight52) Which one of the following grants an individual the right to vote on behalf of a shareholder?A) ProxyB) By-lawsC) Indenture agreementD) Stock optionE) Stock audit53) Which one of the following parties has ultimate control of a corporation?A) Chairman of the boardB) Board of directorsC) Chief executive officerD) Chief operating officerE) Shareholders54) Which of the following parties are considered stakeholders of a firm?A) Employees and the governmentB) Long-term creditorsC) Government and common stockholdersD) Common stockholdersE) Long-term creditors and common stockholders55) Which one of the following represents a cash outflow from a corporation?A) Issuance of new securitiesB) Payment of dividendsC) New loan proceedsD) Receipt of tax refundE) Initial sale of common stock56) Which one of the following is a cash flow from a corporation into the financial markets?A) Borrowing of long-term debtB) Payment of government taxesC) Payment of loan interestD) Issuance of corporate debtE) Sale of common stock57) Which one of the following is a primary market transaction?A) Sale of currently outstanding stock by a dealer to an individual investorB) Sale of a new share of stock to an individual investorC) Stock ownership transfer from one shareholder to another shareholderD) Gift of stock from one shareholder to another shareholderE) Gift of stock by a shareholder to a family member58) Shareholder A sold 500 shares of ABC stock on the New York Stock Exchange. This transaction:A) took place in the primary market.B) occurred in a dealer market.C) was facilitated in the secondary market.D) involved a proxy.E) was a private placement.59) Public offerings of debt and equity must be registered with the:A) New York Board of Governors.B) Federal Reserve.C) NYSE Registration Office.D) Securities and Exchange Commission.E) Market Dealers Exchange.60) Which one of the following statements is generally correct?A) Private placements must be registered with the SEC.B) All secondary markets are auction markets.C) Dealer markets have a physical trading floor.D) Auction markets match buy and sell orders.E) Dealers arrange trades but never own the securities traded.61) Which one of the following statements concerning stock exchanges is correct?A) NASDAQ is a broker market.B) The NYSE is a dealer market.C) The exchange with the strictest listing requirements is NASDAQ.D) Some large companies are listed on NASDAQ.E) Most debt securities are traded on the NYSE.62) Shareholder A sold shares of Maplewood Cabinets stock to Shareholder B. The stock is listed on the NYSE. This trade occurred in which one of the following?A) Primary, dealer marketB) Secondary, dealer marketC) Primary, auction marketD) Secondary, auction marketE) Secondary, OTC market63) Which one of the following statements is correct concerning the NYSE?A) The publicly traded shares of a NYSE-listed firm must be worth at least $250 million.B) The NYSE is the largest dealer market for listed securities in the United States.C) The listing requirements for the NYSE are more stringent than those of NASDAQ.D) Any corporation desiring to be listed on the NYSE can do so for a fee.E) The NYSE is an OTC market functioning as both a primary and a secondary market.11。

罗斯《公司理财》(第11版)章节题库(第12章 看待风险与收益的另一种观点:套利定价理论)【圣才出品

第12章看待风险与收益的另一种观点:套利定价理论一、选择题下列哪个不是CAPM 的假设?()A.投资者风险厌恶,且其投资行为是使其终期财富的期望效用最大B.投资者是价格承受者,即投资者的投资行为不会影响市场上资产的价格运动C.资产收益率满足多因子模型D.资本市场上存在无风险资产,且投资者可以无风险利率无限借贷【答案】C【解析】套利定价理论(APT)假设资产收益率满足多因子模型。

套利定价模型的优点之一是它能够处理多个因素,而资本资产定价模型就忽略了这一点。

根据套利定价的多因素模型,收益与风险的关系可以表示为:()()()()123123K F F F F F KR R R R βR R βR R βR R β=+-+-+-++- 式中,β1代表关于第一个因素的贝塔系数,β2代表关于第二个因素的贝塔系数,依此类推。

二、简答题1.请解释什么是证券组合的系统性风险和非系统性风险,并图示证券组合包含证券的数量与证券组合系统性风险和非系统性风险间的关系。

答:(1)系统风险亦称“不可分散风险”或“市场风险”,与非系统风险相对,指由于某些因素给市场上所有的证券都带来经济损失的可能性,如经济衰退、通货膨胀和需求变化给投资带来的风险。

这种风险影响到所有证券,不可能通过证券组合分散掉。

即使投资者持有的是收益水平及变动情况相当分散的证券组合,也将遭受这种风险。

对于投资者来说,这种风险是无法消除的。

系统风险的大小取决于两个方面,一是每一资产的总风险的大小,二是这一资产的收益变化与资产组合中其他资产收益变化的相关关系(由相关系数描述)。

在总风险一定的前提下,一项资产与市场资产组合收益变化的相关关系越强,系统风险越大,相关关系越弱,系统风险越小。

非系统风险,亦称“可分散风险”或“特别风险”,是指那些通过资产组合就可以消除掉的风险,是公司特有风险,例如某些因素对个别证券造成经济损失的可能性。

这种风险可通过证券持有的多样化来抵消,因此,非系统风险是通过多样化投资可被分散的风险。

罗斯《公司理财》(第11版)笔记和课后习题答案详解

精研学习>网>>>免费试用百分之20资料全国547所院校视频及题库全收集考研全套>视频资料>课后答案>历年真题>全收集本书是罗斯的《公司理财》(第11版)(机械工业出版社)的学习辅导书。

本书遵循该教材的章目编排,包括8篇,共分31章,每章由两部分组成:第一部分为复习笔记;第二部分为课(章)后习题详解。

本书具有以下几个方面的特点:(1)浓缩内容精华,整理名校笔记。

本书每章的复习笔记对本章的重难点进行了整理,并参考了国内名校名师讲授罗斯的《公司理财》的课堂笔记,因此,本书的内容几乎浓缩了经典教材的知识精华。

(2)精选考研真题,强化知识考点。

部分考研涉及到的重点章节,选择经典真题,并对相关重要知识点进行了延伸和归纳。

(3)解析课后习题,提供详尽答案。

国内外教材一般没有提供课(章)后习题答案或者答案很简单,本书参考国外教材的英文答案和相关资料对每章的习题进行了详细的分析。

(4)补充相关要点,强化专业知识。

一般来说,国外英文教材的中译本不太符合中国学生的思维习惯,有些语言的表述不清或条理性不强而给学习带来了不便,因此,对每章复习笔记的一些重要知识点和一些习题的解答,我们在不违背原书原意的基础上结合其他相关经典教材进行了必要的整理和分析。

本书提供电子书及打印版,方便对照复习。

第1篇概论第1章公司理财导论1.1复习笔记1.2课后习题详解第2章会计报表与现金流量2.1复习笔记2.2课后习题详解第3章财务报表分析与长期计划3.1复习笔记3.2课后习题详解第2篇估值与资本预算第4章折现现金流量估价4.1复习笔记4.2课后习题详解第5章净现值和投资评价的其他方法5.1复习笔记5.2课后习题详解第6章投资决策6.1复习笔记6.2课后习题详解第7章风险分析、实物期权和资本预算7.1复习笔记7.2课后习题详解第8章利率和债券估值8.1复习笔记8.2课后习题详解第9章股票估值9.1复习笔记9.2课后习题详解第3篇风险第10章收益和风险:从市场历史得到的经验10.1复习笔记10.2课后习题详解第11章收益和风险:资本资产定价模型11.1复习笔记11.2课后习题详解第12章看待风险与收益的另一种观点:套利定价理论12.1复习笔记12.2课后习题详解第13章风险、资本成本和估值13.1复习笔记13.2课后习题详解第4篇资本结构与股利政策第14章有效资本市场和行为挑战14.1复习笔记14.2课后习题详解第15章长期融资:简介15.1复习笔记15.2课后习题详解第16章资本结构:基本概念16.1复习笔记16.2课后习题详解第17章资本结构:债务运用的限制17.1复习笔记17.2课后习题详解第18章杠杆企业的估价与资本预算18.1复习笔记18.2课后习题详解第19章股利政策和其他支付政策19.1复习笔记19.2课后习题详解第5篇长期融资第20章资本筹集20.1复习笔记20.2课后习题详解第21章租赁21.1复习笔记21.2课后习题详解第6篇期权、期货与公司理财第22章期权与公司理财22.1复习笔记22.2课后习题详解第23章期权与公司理财:推广与应用23.1复习笔记23.2课后习题详解第24章认股权证和可转换债券24.1复习笔记24.2课后习题详解第25章衍生品和套期保值风险25.1复习笔记25.2课后习题详解第7篇短期财务第26章短期财务与计划26.1复习笔记26.2课后习题详解第27章现金管理27.1复习笔记27.2课后习题详解第28章信用和存货管理28.1复习笔记28.2课后习题详解第8篇理财专题第29章收购与兼并29.1复习笔记29.2课后习题详解第30章财务困境30.1复习笔记30.2课后习题详解第31章跨国公司财务31.1复习笔记31.2课后习题详解。

公司理财学原理第12章习题答案

公司理财学原理第十二章习题答案二、单选题1、关于预算的编制方法下列各项中正确的是( C )。

A、零基预算编制方法适用于非盈利组织编制预算时采用B、固定预算编制方法适用于产出较难辨认的服务性部门费用预算的编制C、固定预算编制方法适用于业务量水平较为稳定的企业预算的编制D、零基预算编制方法适用于业务量水平较为稳定的企业预算的编制2、( B )是只使用实物量计量单位的预算。

A、产品成本预算B、生产预算C、管理费用预算D、直接材料预算3、某企业编制“直接材料预算”,预计第四季度期初存量600千克,该季度生产需用量2400千克,预计期末存量为400千克,材料单价为11.7元,若材料采购货款有60%在本季度内付清,另外40%在下季度付清,不考虑税收,则该企业预计资产负债表年末“应付账款”项目为( C )元。

A、8800B、10269C、10296D、130004、某企业编制“销售预算”,已知上上期的含税销售收入为600万元, 上期的含税销售收入为800万元,预计预算期销售收入为1000万元,销售收入的20%于当期收现,60%于下期收现,20%于下下期收现,假设不考虑其他因素,则本期期末应收账款的余额为( D )万元。

A、760B、860C、660D、9605、直接材料预算包括直接材料数量和直接材料金额两个方面的内容所组成。

其数量预算的编制基础是( D )A、销售预算B、投资决策预算C、销售费用预算D、生产预算6、编制全面财务预算的起点是( A )A、销售预算B、投资决策预算C、销售费用预算D、生产预算7、根据预算内正常的、可实现的某一业务量水平编制的预算是( B )A、弹性预算B、固定预算C、滚动预算D、概率预算8、现金预算中不能反映( C )A、资本性支出B、资金的筹措C、损益情况D、现金余缺9、企业编制“销售预算”,上期销售收入为300万元,预计预算期销售收入为500万元,销售收入的60%会在本期收到,40%将在下期收到,则预算期的经营现金收入为( A )万元。

公司理财(精要版·原书第12版)PPT中文Ch07 利率和债券估值

示例7.1

▪ 有多少票息支付? ▪ 什么是半年一次的息票支付? ▪ 半年收益率是多少? ▪ 债券价格是多少?

▪ 债券价格= 70[1 – 1/(1.08)14] / .08 + 1,000 / (1.08)14 = 917.56

▪ Or PMT = 70; N = 14; I/Y = 8; FV = 1,000; CPT PV = -917.56

当期收益率与到期收益率

• 当期收益率=年票息/价格 • 到期收益率=当期收益率+资本利得收益率 • 例:10%息票债券,票面价值1,000元,到期20年,价格为

示例7.1

• 如果普通债券的票面利率是14%那么所有者每年总共将得 到140美元,但这140美元将分两次支付,每次70美元。 到期收益率报16%。这种债券7年后到期。

• 注:债券收益率的报价类似于内含报酬率;引用的汇率等于 每一时期的实际汇率乘以时期的数量

7-11

Copyright © 2019 McGraw-Hill Education. All rights reserved. No reproduction or distribution without the prior written consent of McGraw-Hill Education.

债券定价方程

Bond

Value

1 C

1 (1 r)t

r

FV (1 r) t

7-10

Copyright © 2019 McGraw-Hill Education. All rights reserved. No reproduction or distribution without the prior written consent of McGraw-Hill Education.

公司理财(精要版·原书第12版)PPT中文Ch01公司理财概论

独资制

• 优点

▪ 易于组建

▪ 管制最少 ▪ 独资企业的所有者保留

企业全部的利润

▪ 所有企业的全部收入都 视同个人所得而纳税

• 缺点

▪ 限于所有者的寿命 ▪ 可以筹集到的权益金额

限于所有者个人财富的 金额

▪ 无限责任

▪ 所有权的转让困难

1-8

Copyright © 2019 McGraw-Hill Education. All rights reserved. No reproduction or distribution without the prior written consent of McGraw-Hill Education.

WEB示例

• 互联网提供了大量关于个别公司的信息。 • 雅虎财经就是一个很好的网站。 • 去网站,选择一个公司,看看你能找到什么信息!

1-14

Copyright © 2019 McGraw-Hill Education. All rights reserved. No reproduction or distribution without the prior written consent of McGraw-Hill Education.

学习目标

• 财务管理决策的基本类型和财务经理的作用 • 财务管理的目标 • 不同组织形态的企业的财务影响 • 经理和所有者之间的利益冲突

1-2

Copyright © 2019 McGraw-Hill Education. All rights reserved. No reproduction or distribution without the prior written consent of McGraw-Hill Education.

罗斯《公司理财》(第11版)笔记和课后习题详解

读书笔记模板

01 思维导图

03 读书笔记 05 作者介绍

目录

02 内容摘要 04 目录分析 06 精彩摘录

思维导图

本书关键字分析思维导图

习题

笔记

经典 书

第章

风险

预算

笔记

教材

习题 复习

收益

第版

笔记

市场

习题

定价

资本

期权

内容摘要

内容摘要

本书是罗斯的《公司理财》(第11版)(机械工业出版社)的学习辅导电子书。本书遵循该教材的章目编排, 包括8篇,共分31章,每章由两部分组成:第一部分为复习笔记;第二部分为课(章)后习题详解。本书具有以 下几个方面的特点:(1)浓缩内容精华,整理名校笔记。本书每章的复习笔记对本章的重难点进行了整理,并参 考了国内名校名师讲授罗斯的《公司理财》的课堂笔记,因此,本书的内容几乎浓缩了经典教材的知识精华。(2) 选编考研真题,强化知识考点。部分考研涉及到的重点章节,选编经典真题,并对相关重要知识点进行了延伸和 归纳。(3)解析课后习题,提供详尽答案。国内外教材一般没有提供课(章)后习题答案或者答案很简单,本书 参考国外教材的英文答案和相关资料对每章的习题进行了详细的分析。(4)补充相关要点,强化专业知识。一般 来说,国外英文教材的中译本不太符合中国学生的思维习惯,有些语言的表述不清或条理性不强而给学习带来了 不便,因此,对每章复习笔记的一些重要知识点和一些习题的解答,我们在不违背原书原意的基础上结合其他相 关经典教材进行了必要的整理和分析。

12.1复习笔记 12.2课后习题详解

第13章风险、资本成本和估值

13.1复习笔记 13.2课后习题详解

罗斯公司理财PPT12

n

12-4

12.2 系统性风险与贝塔系数

贝塔系数( b)告诉我们股票收益对系统 性风险的反应有多大。

在资本资产定价模型中,b计量的是某只证 券的收益对某一特定系统风险因素--市场 组合收益的反应程度。

bi

Cov( Ri , RM

2 (RM )

)

• 现在,我们还将再考虑其他的系统性风险类型。

12-5

R R - 2.305% 1.50 (-3%) 0.50 (-10%) 1%

12-10

例:系统性风险与贝塔系数

R R - 2.305% 1.50 (-3%) 0.50 (-10%) 1%

最后,假定该股票的与其收益率为8%,则:

R 8% R 8% - 2.305% 1.50 (-3%) 0.50 (-10%) 1% R -12%

12-1

套利定价理论

如果投资者能构造一个肯定能获利的零 投资组合,套利就会发生。

由于并不需要占用任何投资,投资者能 通常持有大量头寸来赚得巨额的利润。

在有效的市场中,能赚钱的套利机会往 往很快就会消失。

12-2

总风险

总风险 = 系统性风险+ 非系统性风险 收益的标准差衡量的总风险的大小 对风险分散效果好的投资组合来说,非系

塔系数是不同

βC 0.50 的

因素 F的收益

12-15

投资组合与多元化

我们知道,投资组合的收益是组合中个别资产 收益的加权平均值:

RP X1R1 X 2R2 Xi Ri X N RN

Ri Ri βi F εi RP X1(R1 β1F ε1) X 2 (R2 β2F ε2 ) X N (RN βN F εN )

12-20

b 与预期收益的关系

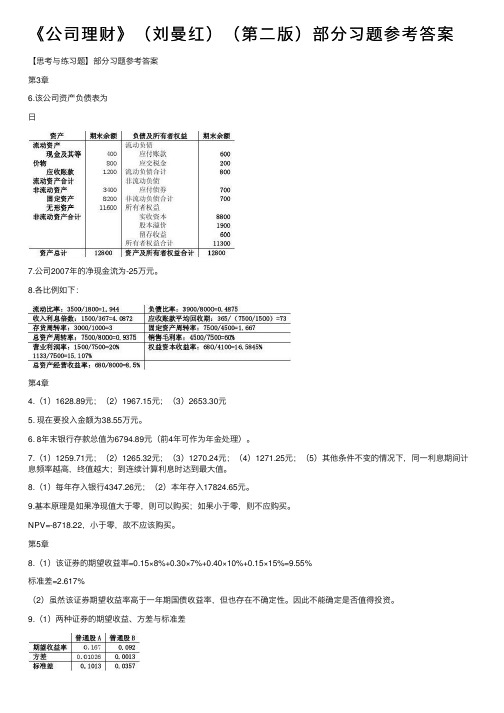

《公司理财》(刘曼红)(第二版)部分习题参考答案

《公司理财》(刘曼红)(第⼆版)部分习题参考答案【思考与练习题】部分习题参考答案第3章6.该公司资产负债表为⽇7.公司2007年的净现⾦流为-25万元。

8.各⽐例如下:第4章4.(1)1628.89元;(2)1967.15元;(3)2653.30元5. 现在要投⼊⾦额为38.55万元。

6. 8年末银⾏存款总值为6794.89元(前4年可作为年⾦处理)。

7.(1)1259.71元;(2)1265.32元;(3)1270.24元;(4)1271.25元;(5)其他条件不变的情况下,同⼀利息期间计息频率越⾼,终值越⼤;到连续计算利息时达到最⼤值。

8.(1)每年存⼊银⾏4347.26元;(2)本年存⼊17824.65元。

9.基本原理是如果净现值⼤于零,则可以购买;如果⼩于零,则不应购买。

NPV=-8718.22,⼩于零,故不应该购买。

第5章8.(1)该证券的期望收益率=0.15×8%+0.30×7%+0.40×10%+0.15×15%=9.55%标准差=2.617%(2)虽然该证券期望收益率⾼于⼀年期国债收益率,但也存在不确定性。

因此不能确定是否值得投资。

9.(1)两种证券的期望收益、⽅差与标准差(2)根据风险与收益相匹配的原则,⽬前我们还不能确定哪种证券更值得投资。

10.各证券的期望收益率为:%4.11%)6%12(9.0%6%15%)6%12(5.1%6%1.11%)6%12(85.0%6%2.13%)6%12(2.1%6=-?+==-?+==-?+==-?+=A A B A r r r r11. (1)该组合的期望收益率为15.8% (2)组合的β值945.051==∑=ii ip w ββ(3)证券市场线,图上组合中每种股票所在位置第6章5.(1)当市场利率分别为:8%;6%;10%时,该债券的价格分别为:39.8759.376488.4983769.010004622.1240)2/1(1000)2/1(40%1010004.456612.5434564.010005903.1340)2/1(1000)2/1(408%8.11487.5531.5955537.010008775.1440)2/1(1000)2/1(406%2040)(2020102020102020100=+=?+?=+++=≈+=?+?=+++==+=?+?=+++=+=∑∑∑===r r B r r B r r B PV PV B t tt tt t时,则当市场利率为时,则当市场利率为时,则当市场利率为次。

罗斯《公司理财》(第9版)配套题库【章节题库-套利定价理论】

第12章套利定价理论一、单选题下列哪个不是CAPM的假设?()(中央财大2011金融硕士)A.投资者风险厌恶,且其投资行为是使其终期财富的期望效用最大B.投资者是价格承受者,即投资者的投资行为不会影响市场上资产的价格运动C.资产收益率满足多因子模型D.资本市场上存在无风险资产,且投资者可以无风险利率无限借贷【答案】C【解析】套利定价理论(APT)假设资产收益率满足多因子模型。

套利定价模型的优点之一是它能够处理多个因素,而资本资产定价模型就忽略了这一点。

根据套利定价的多因素模型,收益与风险的关系可以表示为:式中,β1代表关于第一个因素的贝塔系数,β2代表关于第二个因素的贝塔系数,依此类推。

二、简答题1.请解释什么是证券组合的系统性风险和非系统性风险,并图示证券组合包含证券的数量与证券组合系统性风险和非系统性风险间的关系。

(对外经贸大学2004研)答:(1)系统风险亦称“不可分散风险”或“市场风险”,与非系统风险相对,指由于某些因素给市场上所有的证券都带来经济损失的可能性,如经济衰退、通货膨胀和需求变化给投资带来的风险。

这种风险影响到所有证券,不可能通过证券组合分散掉。

即使投资者持有的是收益水平及变动情况相当分散的证券组合,也将遭受这种风险。

对于投资者来说,这种风险是无法消除的。

系统风险的大小取决于两个方面,一是每一资产的总风险的大小,二是这一资产的收益变化与资产组合中其他资产收益变化的相关关系(由相关关系描述)。

在总风险一定的前提下,一项资产与市场资产组合收益变化的相关关系越强,系统风险越大,相关关系越弱,系统风险越小。

非系统风险,亦称“可分散风险”或“特别风险”,是指那些通过资产组合就可以消除掉的风险,是公司特有风险,例如某些因素对个别证券造成经济损失的可能性。

这种风险可通过证券持有的多样化来抵消,因此,非系统风险是通过多样化投资可被分散的风险。

多样化投资之所以可以分散风险,是因为在市场经济条件下,投资的收益现值是随着收益风险和收益折现率的变化而变化的。

公司理财(精要版·原书第12版)PPT中文Ch01公司理财概论

学习目标

• 财务管理决策的基本类型和财务经理的作用 • 财务管理的目标 • 不同组织形态的企业的财务影响 • 经理和所有者之间的利益冲突

1-2

Copyright © 2019 McGraw-Hill Education. All rights reserved. No reproduction or distribution without the prior written consent of McGraw-Hill Education.

管理经理

• 经理人薪酬

▪ 激励可以用来协调管理层和股东的利益。 ▪ 激励机制需要精心设计,以确保实现目标。

• 企业的控制

▪ 接管的威胁可能会导致更好的管理。

• 其他利益相关者

1-13

Copyright © 2019 McGraw-Hill Education. All rights reserved. No reproduction or distribution without the prior written consent of McGraw-Hill Education.

独资制

• 优点

▪ 易于组建

▪ 管制最少 ▪ 独资企业的所有者保留

企业全部的利润

▪ 所有企业的全部收入都 视同个人所得而纳税

• 缺点

▪ 限于所有者的寿命 ▪ 可以筹集到的权益金额

限于所有者个人财富的 金额

▪ 无限责任

▪ 所有权的转让困难

1-8

Copyright © 2019 McGraw-Hill Education. All rights reserved. No reproduction or distribution without the prior written consent of McGraw-Hill Education.

公司理财(罗斯光盘)

公司理财(精要版)(原书第6版)Fundamentals of Corporate Finance(6th edition)斯蒂芬A. 罗斯(Stephen A. Ross )(麻省理工学院)伦道夫W. 威斯特菲尔德(Randolph W. Westerfield )(南加利福尼亚大学)布拉德福德D. 乔丹(Bradford D. Jordan )(肯塔基大学)方红星译(美)著斯蒂芬A. 罗斯(Stephen A. Ross )现任麻省理工学院(MIT )斯隆管理学院(Sloan School ofManagement )弗朗科·莫迪格利安尼(Franco Modigliani )财务与经济学教授,在此之前任耶鲁大学商学院经济学与财务学教授,是世界上著述最丰的财务学家和经济学家之一。

罗斯教授以其在“套利定价理论”(APT )方面的杰出成果而闻名于世,并且在信号理论、代理理论、期权定价以及利率的期间结构理论等领域有深厚造诣。

他曾任美国财务学会会长,现任多家学术和实践类杂志副主编,加州教师退休基金会(CalTech )托管人,大学退休权益基金会(CREF )及Freddie Mac 公司董事,罗尔-罗斯资产管理公司董事会主席。

伦道夫W. 威斯特菲尔德(Randolph W. Westerfield )南加利福尼亚大学(USC )马歇尔商学院(Marshall School ofBusiness )院长,罗伯特R. 朵克森(Robert R. Dockson )工商管理教席教授。

1988~1993年任该院财务与企业经济学系主任,财务学教授。

此前曾在宾夕法尼亚大学(UPenn )沃顿(Wharton )商学院任教长达20年,并担任财务学系主任,怀特(Rodney L. White )财务学研究中心高级副主任。

他的学术专长包括公司财务政策、投资管理与分析、兼并与收购以及股票市场价格行为等。

他还兼任健康管理协会(NYSE :HMA )、William Lyon 住宅公司(NYSE :WLS )、Lord 基金会、AACSB 国际等公司董事,曾任美国电报电话(AT&T )、美孚(Mobil )石油、太平洋企业等著名公司以及美国联邦政府、司法部、劳工部和加利福尼亚州顾问。

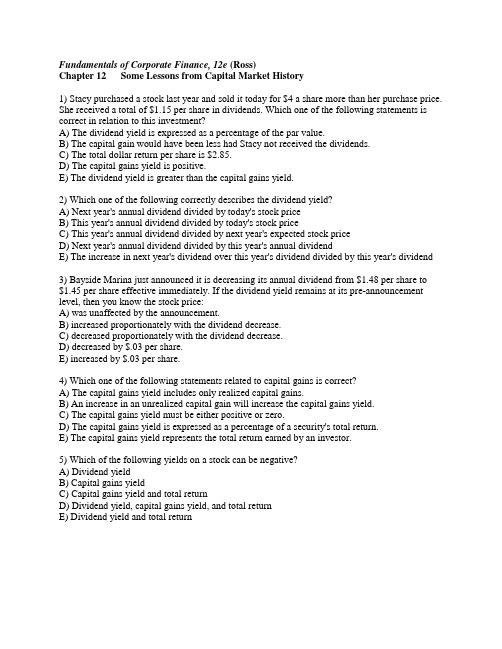

公司理财精要版原书第12版习题库答案Ross12e_Chapter12_TB

Fundamentals of Corporate Finance, 12e (Ross)Chapter 12 Some Lessons from Capital Market History1) Stacy purchased a stock last year and sold it today for $4 a share more than her purchase price. She received a total of $1.15 per share in dividends. Which one of the following statements is correct in relation to this investment?A) The dividend yield is expressed as a percentage of the par value.B) The capital gain would have been less had Stacy not received the dividends.C) The total dollar return per share is $2.85.D) The capital gains yield is positive.E) The dividend yield is greater than the capital gains yield.2) Which one of the following correctly describes the dividend yield?A) Next year's annual dividend divided by today's stock priceB) This year's annual dividend divided by today's stock priceC) This year's annual dividend divided by next year's expected stock priceD) Next year's annual dividend divided by this year's annual dividendE) The increase in next year's dividend over this year's dividend divided by this year's dividend3) Bayside Marina just announced it is decreasing its annual dividend from $1.48 per share to $1.45 per share effective immediately. If the dividend yield remains at its pre-announcement level, then you know the stock price:A) was unaffected by the announcement.B) increased proportionately with the dividend decrease.C) decreased proportionately with the dividend decrease.D) decreased by $.03 per share.E) increased by $.03 per share.4) Which one of the following statements related to capital gains is correct?A) The capital gains yield includes only realized capital gains.B) An increase in an unrealized capital gain will increase the capital gains yield.C) The capital gains yield must be either positive or zero.D) The capital gains yield is expressed as a percentage of a security's total return.E) The capital gains yield represents the total return earned by an investor.5) Which of the following yields on a stock can be negative?A) Dividend yieldB) Capital gains yieldC) Capital gains yield and total returnD) Dividend yield, capital gains yield, and total returnE) Dividend yield and total return6) Small-company stocks, as the term is used in the textbook, are best defined as the:A) 500 newest corporations in the U.S.B) companies whose stock trades OTC.C) smallest 20 percent of the companies listed on the NYSE.D) smallest 25 percent of the companies listed on NASDAQ.E) companies whose stock is listed on NASDAQ.7) The historical record for the period 1926–2016 supports which one of the following statements?A) When large-company stocks have a negative return, they will have a negative return for at least two consecutive years.B) The return on U.S. Treasury bills exceeds the inflation rate by at least .5 percent each year.C) There was only one year during the period when double-digit inflation occurred.D) Small-company stocks have lost as much as 50 percent and gained as much as 100 percent in a single year.E) The inflation rate was positive each year throughout the period.8) Which one of the following time periods is associated with low rates of inflation?A) 1941–1942B) 1973–1974C) 2014–2015D) 1979–1980E) 1946–19479) For the period 1926–2016, U.S. Treasury bills always:A) provided an annual rate of return that exceeded the annual inflation rate.B) had an annual rate of return in excess of 1.2 percent.C) provided a positive annual rate of return.D) earned a higher annual rate of return than long-term government bonds.E) had a greater variation in returns year-over-year than did long-term government bonds.10) Which one of the following statements is a correct reflection of the U.S. financial markets for the period 1926–2016?A) U.S. Treasury bill returns never exceeded a return of 9 percent in any one year.B) U.S. Treasury bills had an annual return in excess of 10 percent in three or more years.C) Inflation equaled or exceeded the return on U.S. Treasury bills every year during the period.D) Long-term government bonds outperformed U.S. Treasury bills every year during the period.E) National deflation occurred in at least one year during every decade during the period.11) For the period 2009–2016, U.S. Treasury bills had an annual rate of return that was:A) between .5 and 1 percent.B) between 1 and 2 percent.C) negative in at least one year.D) negative for two or more years.E) between 0 and .25 percent.12) Which one of the following categories of securities had the highest average annual return for the period 1926–2016?A) U.S. Treasury billsB) Large-company stocksC) Small-company stocksD) Long-term corporate bondsE) Long-term government bonds13) Which one of the following categories of securities had the lowest average risk premium for the period 1926–2016?A) Long-term government bondsB) Small-company stocksC) Large-company stocksD) Long-term corporate bondsE) U.S. Treasury bills14) The rate of return on which type of security is normally used as the risk-free rate of return?A) Long-term Treasury bondsB) Long-term corporate bondsC) Treasury billsD) Intermediate-term Treasury bondsE) Intermediate-term corporate bonds15) For the period 1926–2016, the average risk premium on large-company stocks was about:A) 12.7 percent.B) 10.4 percent.C) 8.6 percent.D) 6.9 percent.E) 7.3 percent.16) Assume that last year T-bills returned 2.8 percent while your investment in large-company stocks earned an average of 7.6 percent. Which one of the following terms refers to the difference between these two rates of return?A) Risk premiumB) Geometric average returnC) Arithmetic average returnD) Standard deviationE) Variance17) Which one of the following statements correctly applies to the period 1926–2016?A) Large-company stocks earned a higher average risk premium than did small-company stocks.B) The average inflation rate exceeded the average return on U.S. Treasury bills.C) Large-company stocks had an average annual return of 14.7 percent.D) Inflation averaged 2.6 percent for the period.E) Long-term corporate bonds outperformed long-term government bonds.18) The excess return is computed as the:A) return on a security minus the inflation rate.B) return on a risky security minus the risk-free rate.C) risk premium on a risky security minus the risk-free rate.D) risk-free rate plus the inflation rate.E) risk-free rate minus the inflation rate.19) Which one of the following earned the highest risk premium over the period 1926–2016?A) Long-term corporate bondsB) U.S. Treasury billsC) Small-company stocksD) Large-company stocksE) Long-term government bonds20) What was the average rate of inflation over the period of 1926–2016?A) Less than 2.0 percentB) Between 2.0 and 2.4 percentC) Between 2.4 and 2.8 percentD) Between 2.8 and 3.2 percentE) Greater than 3.2 percent21) Assume you invest in a portfolio of long-term corporate bonds. Based on the period 1926–2016, what average annual rate of return should you expect to earn?A) Less than 5 percentB) Between 5 and 6 percentC) Between 6 and 7 percentD) Between 7 and 8 percentE) More than 8 percent22) The average annual return on small-company stocks was about ________ percent greater than the average annual return on large-company stocks over the period 1926–2016.A) 3B) 5C) 7D) 9E) 1123) Based on the period 1926-2016, the actual real return on large-company stocks has been around:A) 9 percent.B) 10 percent.C) 6 percent.D) 7 percent.E) 8 percent.24) To convince investors to accept greater volatility, you must:A) decrease the risk premium.B) increase the risk premium.C) decrease the real return.D) decrease the risk-free rate.E) increase the risk-free rate.25) Which one of the following best defines the variance of an investment's annual returns over a number of years?A) The average squared difference between the arithmetic and the geometric average annual returnsB) The squared summation of the differences between the actual returns and the average geometric returnC) The average difference between the annual returns and the average return for the periodD) The difference between the arithmetic average and the geometric average return for the periodE) The average squared difference between the actual returns and the arithmetic average return26) Which one of the following categories of securities had the most volatile annual returns over the period 1926–2016?A) Long-term corporate bondsB) Large-company stocksC) Intermediate-term government bondsD) U.S. Treasury billsE) Small-company stocks27) If the variability of the returns on large-company stocks were to decrease over the long-term, you would expect which one of the following as related to large-company stocks to occur as a result?A) Increase in the risk premiumB) Increase in the average long-term rate of returnC) Decrease in the 68 percent probability range of returnsD) Increase in the standard deviationE) Increase in the geometric average rate of return28) Which one of the following statements is correct based on the historical record for the period 1926–2016?A) The standard deviation of returns for small-company stocks was double that of large-company stocks.B) U.S. Treasury bills had a zero standard deviation of returns because they are considered to be risk-free.C) Long-term government bonds had a lower return but a higher standard deviation on average than did long-term corporate bonds.D) Inflation was less volatile than the returns on U.S. Treasury bills.E) Long-term government bonds were less volatile than intermediate-term government bonds.29) What is the probability that small-company stocks will produce an annual return that is more than one standard deviation below the average?A) 1.0 percentB) 2.5 percentC) 5.0 percentD) 16 percentE) 32 percent30) Which one of the following is a correct ranking of securities based on the volatility of their annual returns over the period of 1926–2016? Rank from highest to lowest.A) Large-company stocks, U.S. Treasury bills, long-term government bondsB) Small-company stocks, long-term corporate bonds, large-company stocksC) Long-term government bonds, long-term corporate bonds, intermediate-term government bondsD) Large-company stocks, small-company stocks, long-term government bondsE) Intermediate-term government bonds, long-term corporate bonds, U.S. Treasury bills31) Which one of the following had the least volatile annual returns over the period of 1926–2016?A) Large-company stocksB) InflationC) Long-term corporate bondsD) U.S. Treasury billsE) Intermediate-term government bonds32) Which one of the following statements is correct based on the period 1926–2016?A) Long-term government bonds had more volatile annual returns than did the long-term corporate bonds.B) The standard deviation of the annual rate of inflation was less than 3 percent.C) U.S Treasury bills have a zero variance in returns because they are risk-free.D) The risk premium on small-company stocks was less than 10 percent.E) The risk premium on all U.S. government securities is 0 percent.33) Generally speaking, which of the following best correspond to a wide frequency distribution?A) High standard deviation, low rate of returnB) Low rate of return, large risk premiumC) Small risk premium, high rate of returnD) Small risk premium, low standard deviationE) High standard deviation, large risk premium34) Standard deviation is a measure of which one of the following?A) Average rate of returnB) VolatilityC) ProbabilityD) Risk premiumE) Real returns35) Which one of the following is defined by its mean and its standard deviation?A) Arithmetic nominal returnB) Geometric real returnC) Normal distributionD) VarianceE) Risk premium36) Which of the following statements are true based on the historical record for 1926–2016?A) Risk-free securities produce a positive real rate of return each year.B) Bonds are generally a safer, or less risky, investment than are stocks.C) Risk and potential reward are inversely related.D) The normal distribution curve for large-company stocks is narrower than the curve for small-company stocks.E) Returns are more predictable over the short term than they are over the long term.37) Estimates of the rate of return on a security based on the historical arithmetic average will probably tend to ________ the expected return for the long-term and estimates using the historical geometric average will probably tend to ________ the expected return for the short-term.A) overestimate; overestimateB) overestimate; underestimateC) underestimate; overestimateD) underestimate; underestimateE) accurately estimate; accurately estimate38) The primary purpose of Blume's formula is to:A) compute an accurate historical rate of return.B) determine a stock's true current value.C) consider compounding when estimating a rate of return.D) determine the actual real rate of return.E) project future rates of return.39) The average compound return earned per year over a multiyear period is called the ________ average return.A) arithmeticB) standardC) variantD) geometricE) real40) The return earned in an average year over a multiyear period is called the ________ average return.A) arithmeticB) standardC) variantD) geometricE) real41) Assume all stock prices fairly reflect all of the available information on those stocks. Which one of the following terms best defines the stock market under these conditions?A) Riskless marketB) Evenly distributed marketC) Zero volatility marketD) Blume's marketE) Efficient capital market42) Which one of the following statements best defines the efficient market hypothesis?A) Efficient markets limit competition.B) Security prices in efficient markets remain steady as new information becomes available.C) Mispriced securities are common in efficient markets.D) All securities in an efficient market are zero net present value investments.E) All securities provide the same positive rate of return when the market is efficient.43) Which one of the following is the most likely reason why a stock price might not react at all on the day that new information related to the stock's issuer is released? Assume the market is semistrong form efficient.A) Company insiders were aware of the information prior to the announcement.B) Investors do not pay attention to daily news.C) Investors tend to overreact.D) The news was positive.E) The information was expected.44) Which one of the following is most indicative of a totally efficient stock market?A) Extraordinary returns earned on a routine basisB) Positive net present values on stock investments over the long-termC) Zero net present values for all stock investmentsD) Arbitrage opportunities which develop on a routine basisE) Realizing negative returns on a routine basis45) Which one of the following statements is correct concerning market efficiency?A) Real asset markets are more efficient than financial markets.B) If a market is efficient, arbitrage opportunities should be common.C) In an efficient market, some market participants will have an advantage over others.D) A firm will generally receive a fair price when it issues new shares of stock if the market is efficient.E) New information will gradually be reflected in a stock's price to avoid any sudden price changes in an efficient market.46) Efficient financial markets fluctuate continuously because:A) the markets are continually reacting to old information as that information is absorbed.B) the markets are continually reacting to new information.C) arbitrage trading is limited.D) current trading systems require human intervention.E) investments produce varying levels of net present values.47) Inside information has the least value when financial markets are:A) weak form efficient.B) semiweak form efficient.C) semistrong form efficient.D) strong form efficient.E) inefficient.48) Evidence seems to support the view that studying public information to identify mispriced stocks is:A) effective as long as the market is only semistrong form efficient.B) effective provided the market is only weak form efficient.C) ineffective.D) effective only in strong form efficient markets.E) ineffective only in strong form efficient markets.49) Which one of the following statements related to market efficiency tends to be supported by current evidence?A) It is easy for investors to earn abnormal returns.B) Short-run price movements are easy to predict.C) Markets are most likely only weak form efficient.D) Mispriced stocks are easy to identify.E) Markets tend to respond quickly to new information.50) Which form of market efficiency would most likely offer the greatest profit potential to an outstanding professional stock analyst?A) WeakB) SemiweakC) SemistrongD) StrongE) Perfect51) You are aware that your neighbor trades stocks based on confidential information he overhears at his workplace. This information is not available to the general public. This neighborcontinually brags to you about the profits he earns on these trades. Given this, you would tend to argue that the financial markets are at best ________ form efficient.A) weakB) semiweakC) semistrongD) strongE) perfect52) The U.S. Securities and Exchange Commission periodically charges individuals with insider trading and claims those individuals have made unfair profits. Given this, you would be most apt to argue that the markets are less than ________ form efficient.A) weakB) semiweakC) semistrongD) strongE) perfect53) Individual investors who continually monitor the financial markets seeking mispriced securities:A) earn excess profits on all of their investments.B) make the markets increasingly more efficient.C) are never able to find a security that is temporarily mispriced.D) are overwhelmingly successful in earning abnormal profits.E) are always quite successful using only historical price information as their basis of evaluation.54) One year ago, you purchased a stock at a price of $43.20 per share. The stock pays quarterly dividends of $.18 per share. Today, the stock is selling for $45.36 per share. What is your capital gain on this investment?A) $1.44B) $2.16C) $2.80D) $1.74E) $2.3455) Six months ago, you purchased 300 shares of stock in Global Trading at a price of $26.19 a share. The stock pays a quarterly dividend of $.12 a share. Today, you sold all of your shares for $27.11 per share. What is the total amount of your dividend income on this investment?A) $36B) $72C) $348D) $144E) $20456) One year ago, you purchased 200 shares of SL Industries stock at a price of $18.97 a share. The stock pays an annual dividend of $1.42 per share. Today, you sold all of your shares for $17.86 per share. What is your total dollar return on this investment?A) $50B) $91C) $58D) $62E) $8257) You own 850 shares of Western Feed Mills stock valued at $53.15 per share. What is the dividend yield if your total annual dividend income is $1,256?A) 2.67 percentB) 2.78 percentC) 1.83 percentD) 2.13 percentE) 2.54 percent58) West Wind Tours stock is currently selling for $52.30 a share. The stock has a dividend yield of 2.48 percent. How much dividend income will you receive per year if you purchase 600 shares of this stock?A) $824.96B) $836.20C) $724.80D) $762.00E) $778.2259) One year ago, you purchased a stock at a price of $38.22 a share. Today, you sold the stock and realized a total loss of 11.09 percent on your investment. Your capital gain was –$4.68 a share. What was your dividend yield?A) 1.15 percentB) .88 percentC) 1.02 percentD) .67 percentE) .38 percent60) You just sold 427 shares of stock at a price of $19.07 a share. You purchased the stock for $18.83 a share and have received total dividends of $614. What is the total capital gain on this investment?A) $716.48B) $511.52C) $102.48D) $618.48E) $476.5261) Last year, you purchased 400 shares of Analog stock for $12.92 a share. You have received a total of $136 in dividends and $4,301 in proceeds from selling the shares. What is your capital gains yield on this stock?A) 9.09 percentB) 6.73 percentC) −16.78 percentD) −14.14 percentE) −11.02 percent62) Today, you sold 540 shares of stock and realized a total return of 7.3 percent. You purchased the shares one year ago at a price of $24 a share and have received a total of $86 in dividends. What is your capital gains yield on this investment?A) 5.68 percentB) 6.64 percentC) 6.39 percentD) 7.26 percentE) 7.41 percent63) Four months ago, you purchased 900 shares of LBM stock for $7.68 a share. Last month, you received a dividend payment of $.12 a share. Today, you sold the shares for $9.13 a share. What is your total dollar return on this investment?A) $1,305B) $1,413C) $1,512D) $1,394E) $1,08064) One year ago, you purchased 100 shares of Best Wings stock at a price of $38.19 a share. The company pays an annual dividend of $.46 per share. Today, you sold for the shares for $37.92 a share. What is your total percentage return on this investment?A) 2.62 percentB) 1.93 percentC) 2.72 percentD) 1.08 percentE) .50 percent65) Suppose a stock had an initial price of $76 per share, paid a dividend of $1.42 per share during the year, and had an ending share price of $81. What was the capital gains yield?A) 6.17 percentB) 6.69 percentC) 7.05 percentD) 6.58 percentE) 5.44 percent66) Suppose you bought a $1,000 face value bond with a coupon rate of 5.6 percent one year ago. The purchase price was $987.50. You sold the bond today for $994.20. If the inflation rate last year was 2.6 percent, what was your exact real rate of return on this investment?A) 4.88 percentB) 5.32 percentC) 3.65 percentD) 3.78 percentE) 4.47 percent67) Leo purchased a stock for $63.80 a share, received a dividend of $2.68 a share and sold the shares for $59.74 each. During the time he owned the stock, inflation averaged 2.8 percent. What is his approximate real rate of return on this investment?A) −.64 percentB) −4.96 percentC) −2.16 percentD) 2.16 percentE) 4.96 percent68) Christina purchased 500 shares of stock at a price of $62.30 a share and sold the shares for $64.25 each. She also received $738 in dividends. If the inflation rate was 3.9 percent, what was her exact real rate of return on this investment?A) 4.20 percentB) 1.54 percentC) 1.60 percentD) 3.95 percentE) 5.50 percent69) What is the amount of the risk premium on a U.S. Treasury bill if the risk-free rate is 3.1 percent, the inflation rate is 2.6 percent, and the market rate of return is 7.4 percent?A) 0 percentB) 2.8 percentC) .5 percentD) 1.7 percentE) 4.3 percent70) You've observed the following returns on Crash-n-Burn Computer's stock over the past five years: 7 percent, 13 percent, 19 percent, −8 percent, and 15 percent. Suppose the average inflation rate over this time period was 2.6 percent and the average T-bill rate was 3.1 percent. Based on this information, what was the average nominal risk premium?A) 6.6 percentB) 6.1 percentC) 9.2 percentD) 1.2 percentE) 3.5 percent71) You bought one of Shark Repellant's 6 percent coupon bonds one year ago for $867. These bonds pay annual payments, have a face value of $1,000, and mature 12 years from now. Suppose you decide to sell your bonds today when the required return on the bonds is 7.4 percent. The inflation rate over the past year was 2.9 percent. What was your total real return on this investment?A) 6.48 percentB) 6.61 percentC) 8.18 percentD) 7.44 percentE) 9.70 percent72) You find a certain stock that had returns of 8 percent, −3 percent, 12 percent, and 17 percent for four of the last five years. The average return of the stock for the past five-year period was 6 percent. What is the standard deviation of the stock's returns for the five-year period?A) 10.39 percentB) 4.98 percentC) 7.16 percentD) 9.25 percentE) 5.38 percent73) A stock had returns of 5 percent, 14 percent, 11 percent, −8 percent, and 6 percent over the past five years. What is the standard deviation of these returns?A) 7.74 percentB) 8.21 percentC) 9.68 percentD) 8.44 percentE) 7.49 percent74) The common stock of Air Express had annual returns of 11.7 percent, 8.8 percent,16.7 percent, and −7.9 percent over the last four years, respectively. What is thestandard deviation of these returns?A) 8.29 percentB) 9.14 percentC) 11.54 percentD) 7.78 percentE) 10.66 percent75) A stock had annual returns of 5.3 percent, −2.7 percent, 16.2 percent, and 13.6 percentover the past four years. Which one of the following best describes the probability that this stock will produce a return of 20 percent or more in a single year?A) Less than 2.5 percent but more than .5 percentB) More than 16 percentC) Less than .5 percentD) Less than 1 percent but more than .5 percentE) Less than 16 percent but more than 2.5 percent76) A stock has an expected rate of return of 9.8 percent and a standard deviation of 15.4 percent. Which one of the following best describes the probability that this stock will lose at leasthalf of its value in any one given year?A) less than 16 percentB) less than .5 percentC) less than 1.0 percentD) less than 2.5 percentE) less than 5.0 percent77) A stock had annual returns of 11.3 percent, 9.8 percent, −7.3 percent, and 14.6percent for the past four years. Based on this information, what is the 95 percentprobability range of returns for any one given year?A) −2.4 to 17.5 percentB) −2.60 to 11.80 percentC) −12.5 to 26.7 percentD) −10.4 to 12.3 percentE) −10.9 to 25.1 percent78) Aimee is the owner of a stock with annual returns of 17.6 percent, −11.7 percent, 5.6 percent, and 9.7 percent for the past four years. She thinks the stock may achieve a returnof 17 percent again this coming year. What is the probability that your friend is correct?A) Less than .5 percentB) Greater than .5 percent but less than 1 percentC) Greater than 1 percent but less than 2.5 percentD) Greater than 2.5 percent but less than 16 percentE) Greater than 16 percent79) A stock had returns of 3 percent, 12 percent, 26 percent, −14 percent, and −1 percent for the past five years. Based on these returns, what is the approximate probability that this stock will return at least 20 percent in any one given year?A) Approximately .1 percentB) Approximately 5 percentC) Approximately 2.5 percentD) Approximately .5 percentE) Approximately 16 percent80) A stock had returns of 14 percent, 13 percent, −10 percent, and 7 percent for thepast four years. Which one of the following best describes the probability that this stockwill lose no more than 10 percent in any one year?A) Greater than .5 but less than 1.0 percentB) Greater than 1 percent but less than 2.5 percentC) Greater than 2.5 percent but less than 16 percentD) Greater than 84 percent but less than 97.5 percentE) Greater than 95 percent。

公司理财(精要版·原书第12版)PPT中文Ch08 股票估价

学习目标

• 解释如何根据未来的股利及其增长率计算股票价 格

• 展示如何通过相对倍数来对股票进行估值 • 展示公司总监通常选择使用的不同估值方法 • 解释股票市场的运作机制

8-2

Copyright © 2019 McGraw-Hill Education. All rights reserved. No reproduction or distribution without the prior written consent of McGraw-Hill Education.

预测股利:特殊情况

• 股息零增长 ▪ 公司将永远支付固定股息 ▪ 像优先股一样 ▪ 价格是用永续公式计算的

• 股息固定增长 ▪ 公司将每段时期以固定的百分比增加股息 ▪ 价格是使用增长永续模型计算的

• 股息超常增长 ▪ 股利增长最初并不稳定,但最终会趋于稳定增长 ▪ 价格是用多级模型计算的

8-9

Copyright © 2019 McGraw-Hill Education. All rights reserved. No reproduction or distribution without the prior written consent of McGraw-Hill Education.

你预期它会在一年后支付2美元的股利并且你相信你可以在支付股利之后马上以14美元的价格出售如果你针对股票的风险所要求的回报率为20你愿意为一股股票支付的最高价格是多少

第8章

股票估价

Copyright © 2019 McGraw-Hill Education. All rights reserved. No reproduction or distribution without the prior written consent of McGraw-Hill Education.

公司理财(罗斯)第十二章

❖

科学,你是国力的灵魂;同时又是社 会发展 的标志 。下午1时53分 29秒下 午1时53分13:53:2920.12.25

❖

每天都是美好的一天,新的一天开启 。20.12.2520.12.2513:5313:53:2913:53:29Dec-20

❖

相信命运,让自己成长,慢慢的长大 。2020年12月25日星 期五1时 53分29秒Friday, December 25, 2020

报酬率

二、报酬率 用百分比来表示报酬率比用现金更直观 股利收益率= 每股股利/期初股票价格 资本利得收益率= ( 股票期末价格 –股票

期初价格) / 股票期初价格 ❖ 股票总收益率 = 股利收益率 + 资本利得收

益率

例子 – 计算股票报酬率

❖ 你用35美元买了一支股票 ,每股股利是 1.25美元。现在这支股票卖了40美元。

❖

精益求精,追求卓越,因为相信而伟 大。2020年12月25日 星期五 下午1时 53分29秒13:53:2920.12.25

❖

让自己更加强大,更加专业,这才能 让自己 更好。2020年12月下 午1时53分20.12.2513:53December 25, 2020

❖

这些年的努力就为了得到相应的回报 。2020年12月25日星 期五1时 53分29秒13:53:2925 December 2020

在有效和非有效市场中股价对新

股价 信息的反应

过度反应 和复原

有效市场 对新信息反应

延迟反应

–30 –20 –10 0 +10 +20 +30

公布前(-)天数 和公布后(+)天数

什么使得市场更有效率?

❖ 那是许多投资者做的调查。 ❖ 许多信息来到时常,它们被分析后,这些

- 1、下载文档前请自行甄别文档内容的完整性,平台不提供额外的编辑、内容补充、找答案等附加服务。

- 2、"仅部分预览"的文档,不可在线预览部分如存在完整性等问题,可反馈申请退款(可完整预览的文档不适用该条件!)。

- 3、如文档侵犯您的权益,请联系客服反馈,我们会尽快为您处理(人工客服工作时间:9:00-18:30)。

Chapter 12: Risk, Return, and Capital BudgetingConcept Questions - Chapter 1212.1∙ What is the disadvantage of using too few observations when estimating beta?Small samples can lead to inaccurate estimations.∙What is the disadvantage of using too many observations when estimating beta?Firms may change their industries over time making observations from the distantpast out-of-date.∙What is the disadvantage of using the industry beta as the estimate of the beta of an individual firm?The operations of a particular firm may not be similar to the industry average. 12.2∙What are the determinants of equity betas?1.The responsiveness of a firm's revenues to economy wide movements.2.The degree of a firm's operating leverage.3.The degree of a firm's financial leverage.∙What is the difference between an asset beta and an equity beta?Financial leverage.12.6 What is liquidity?Liquidity in this context means the cost of buying and selling stocks. Those stocks that are expensive to trade are considered less liquid.What is the relation between liquidity and expected return?There is a high expected return for illiquid stocks with high trading costs.What is adverse selection?Adverse selection occurs when individuals have ignorance about traits, trends, orother information hidden in a population. For instance, a trader may suffer fromadverse selection if certain market knowledge is hidden from him but is available to some investors.What can a corporation do to lower its cost of capital?A corporation can be proactive in taking actions that will lower trading costs,thereby lowering its cost of capital.Answers to End-of-Chapter Problems12.1 Cost of equityR S = 5 + 0.95 (9) = 13.55%NPV of the project= -$1.2 million +$340,.0001135515tt =∑= -$20,016.52Do not undertake the project. 12.2 a. R D = (-0.05 + 0.05 + 0.08 + 0.15 + 0.10) / 5 = 0.066 R M = (-0.12 + 0.01 + 0.06 + 0.10 + 0.05) / 5 = 0.02b.D R - D RM R -R M(M R -M R )2 (D R -R D )(M R -R M )-0.116 -0.14 0.0196 0.01624 -0.016 -0.01 0.0001 0.00016 0.014 0.04 0.0016 0.00056 0.084 0.08 0.0064 0.00672 0.034 0.03 0.0009 0.001020.02860.02470Beta of Douglas = 0.02470 / 0.0286 = 0.86412.3 R S = 6% + 1.15 ⨯ 10% = 17.5% R B = 6% + 0.3 ⨯ 10% = 9% a. Cost of equity = R S = 17.5% b. B / S = 0.25 B / (B + S) = 0.2 S / (B + S) = 0.8WACC = 0.8 ⨯ 17.5% + 0.2 ⨯ 9% (1 - 0.35)= 15.17%12.4 C σ = ()2104225.0 = 0.065 M σ = ()2101467.0 = 0.0383Beta of ceramics craftsman = CM ρC σ M σ / M σ2 = CM ρC σ/ M σ = (0.675) (0.065) / 0.0383 = 1.146 12.5a. To compute the beta of Mercantile Manufacturing’s stock, you need the product of the deviations of Mercantile’s returns from their mean and the deviations of the market’s returns from their mean. You also need the squares of the deviations ofthe market’s returns from their mean.The mechanics of computing the means and the deviations were presented in an earlier chapter.R T = 0.196 / 12 = 0.016333 R M = 0.236 / 12 = 0.019667E(T R -R T ) (M R -R M ) = 0.038711E(M R -R M )2 = 0.038588 β = 0.038711 / 0.038588= 1.0032b.The beta of the average stock is 1. Mercantile’s beta is close to 1, indicating that its stock has average risk.12.6 a.R M can have three values, 0.16, 0.18 or 0.20. The probability that M R takes one of these values is the sum of the joint probabilities of the return pair that include theparticular value of M R . For example, if M R is 0.16, R J will be 0.16, 0.18 or 0.22. The probability that M R is 0.16 and R J is 0.16 is 0.10. The probability that R M is 0.16 and R J is 0.18 is 0.06. The probability that M R is 0.16 and R J is 0.22 is 0.04. The probability that M R is 0.16 is, therefore, 0.10 + 0.06 + 0.04 = 0.20. The same procedure is used to calculate the probability that M R is 0.18 and the probability that M R is 0.20. Remember, the sum of the probability must be one.M RProbability 0.16 0.20 0.18 0.60 0.20 0.20 b. i. R M= 0.16 (0.20) + 0.18 (0.60) + 0.20 (0.20) = 0.18ii. 2M σ = (0.16 - 0.18) 2 (0.20) + (0.18 - 0.18) 2(0.60) + (0.20 - 0.18) 2 (0.20)= 0.00016iii.M σ = ()2100016.0 = 0.01265c. R J Probability .18 .20 .20 .40 .22 .20.24 .10d. i. E j = .16 (.10) + .18 (.20) + .20 (.40) + .22 (.20) + .24(.10) = .20 ii. σj 2 = (.16 - .20)2 (.10) + (.18 - .20)2 (.20) + (.20 - .20)2 (.40) + (.22 - .20)2 (.20) + (.24 - .20)2 (.10) = .00048 iii. σj = ()2100048.0 = .02191e. Cov mj= (.16 - .18) (.16 - .20) (.10) + (.16 - .18) (.18 - .20) (.06)+ (.16 - .18) (.22 - .20) (.04) + (.20 - .18) (.18 - .20) (.02)+ (.20 - .18) (.22 - .20) (.04) + (.20 - .18) (.24 - .20) (.10)= .000176Corr mj = (0.000176) / (0.01265) (0.02191) = 0.635f. βj = (.635) (.02191) / (.01265) = 1.1012.7 i. The risk of the new project is the same as the risk of the firm without the project.ii. The firm is financed entirely with equity.12.8 a. Pacific Cosmetics should use its stock beta in the evaluation of the project only ifthe risk of the perfume project is the same as the risk of Pacific Cosmetics.b. If the risk of the project is the same as the risk of the firm, use the firm’s stock beta.If the risk differs, then use the beta of an all-equity firm with similar risk as theperfume project. A good way to estimate the beta of the project would be toaverage the betas of many perfume producing firms.12.9 E(R S) = 0.1 ⨯ 3 + 0.3 ⨯ 8 + 0.4 ⨯ 20 + 0.2 ⨯ 15 = 13.7%E(R B) = 0.1 ⨯ 8 + 0.3 ⨯ 8 + 0.4 ⨯ 10 + 0.2 ⨯ 10 = 9.2%E(R M) = 0.1 ⨯ 5 + 0.3 ⨯ 10 + 0.4 ⨯ 15 + 0.2 ⨯ 20 = 13.5%State {R S - E(R S)}{R M - E(R M)}Pr {R B - E(R B)}{R M - E(R M)}Pr1 (0.03-0.137)(0.05-0.135)⨯0.1 (0.08-0.092)(0.05-0.135)⨯0.12 (0.08-0.137)(0.10-0.135)⨯0.3 (0.08-0.092)(0.10-0.135)⨯0.33 (0.20-0.137)(0.15-0.135)⨯0.4 (0.10-0.092)(0.15-0.135)⨯0.44 (0.15-0.137)(0.20-0.135)⨯0.2 (0.10-0.092)(0.20-0.135)⨯0.2Sum 0.002056 0.00038= Cov(R S, R M) = Cov(R B, R M)σM 2= 0.1 (0.05 - 0.135)2 + 0.3 (0.10-0.135)2+ 0.4 (0.15-0.135)2 + 0.2 (0.20-0.135)2= 0.002025a. Beta of debt = Cov(R B, R M) / σM2 = 0.00038 / 0.002025= 0.188b. Beta of stock = Cov(R S, R M) / σM2 = 0.002055 / 0.002025= 1.015c. B / S = 0.5Thus, B / (S + B) = 1 / 3 = 0.3333S / (S + B) = 2 / 3 = 0.6667Beta of asset = 0.188 ⨯ 0.3333 + 1.015 ⨯ 0.6667= 0.73912.10The discount rate for the project should be lower than the rate implied by the use of theSecurity Market Line. The appropriate discount rate for such projects is theweighted average of the interest rate on debt and the cost of equity. Since theinterest rate on the debt of a given firm is generally less than the firm’s cost o fequity, using only the stock’s beta yields a discount rate that is too high. Theconcept and practical uses of a weighted average discount rate will be in a laterchapter.12.11i. RevenuesThe gross income of the firm is an important factor in determining beta. Firmswhose revenues are cyclical (fluctuate with the business cycle) generally have highbetas. Firms whose revenues are not cyclical tend to have lower betas.ii. Operating leverageOperating leverage is the percentage change in earnings before interest and taxes(EBIT) for a percentage change in sales, [(Change in EBIT / EBIT) (Sales / Changein sales)]. Operating leverage indicates the ability of the firm to service its debt andpay stockholders.iii. Financial leverageFinancial leverage arises from the use of debt. Financial leverage indicates theability of the firm to pay stockholders. Since debt holders must be paid beforestockholders, the higher the financial leverage of the firm, the riskier its stock.The beta of common stock is a function of all three of these factors. Ultimately, theriskiness of the stock, of which beta captures a portion, is determined by thefluctuations in the income available to the stockholders. (As was discussed in thechapter, whether income is paid to the stockholders in the form of dividends or it isretained to finance projects are irrelevant as long as the projects are of similar riskas the firm.) The income available to common stock, the net income of the firm,depends initially on the revenues or sales of the firm. The operating leverageindicates how much of each dollar of revenue will become EBIT. Financialleverage indicates how much of each dollar of EBIT will become net income.12.12 a. Cost of equity for National Napkin= 7 + 1.29 (13 - 7)= 14.74%b. B / (S + B) = S / (S + B) = 0.5WACC = 0.5 ⨯ 7 ⨯ 0.65 + 0.5 ⨯ 14.74= 9.645%12.13 B = $60 million ⨯ 1.2 = $72 millionS = $20 ⨯ 5 million = $100 millionB / (S + B) = 72 / 172 = 0.4186S / (S + B) = 100 / 172 = 0.5814WACC = 0.4186 ⨯ 12% ⨯ 0.75 + 0.5814 ⨯ 18%= 14.23%12.14 S = $25 ⨯ 20 million = $500 millionB = 0.95 ⨯ $180 million = $171 millionB / (S + B) = 0.2548S / (S + B) = 0.7452WACC = 0.7452 ⨯ 20% + 0.2548 ⨯ 10%⨯ 0.60= 16.43%12.15 B / S = 0.75B / (S + B) = 3 / 7S / (S + B) = 4 / 7WACC = (4 / 7) ⨯ 15% + (3 / 7) ⨯ 9%⨯ (1 - 0.35)= 11.08%NPV = -$25 million +$7(.)milliont t101108 15+=∑= $819,299.04Undertake the project.12.16WACC = (0.5) x 28% + (0.5) x 10% x (1 - 0.35)= 17.25%NPV = - $1,000,000 + (1 - 0.35) $600,000 51725.0A = $240,608.50Mini Case: Allied ProductsAssumptionsPP&E Investment 42,000,000 Useful life of PP&E Investment (years) 7NEW GPWS price/unit (Year 1) 70,000 NEW GPWS variable cost/unit (Year 1) 50,000 UPGRADE GPWS price/unit (Year 1) 35,000 UPGRADE GPWS variable cost/unit (Year 1) 22,000Year 1 marketing and admin costs 3,000,000 Annual inflation rate 3.00% Corporate Tax rate 40.00%Beta (9/27 Valueline) 1.20 Rf (30 year U.S. Treasury Bond) 6.20%NEW GPWS Market Growth (Strong Growth) 15.00%NEW GPWS Market Growth (Moderate Growth) 10.00%NEW GPWS Market Growth (Mild Recession) 6.00%NEW GPWS Market Growth (Severe Recession state of economy) 3.00%Total Annual Market for UPGRADE GPWS (units) 2,500Allied Signal Market Share in each market 45.00%Year 0 1 2 3 4 5 SalesNEWUnits 97 107 118 130 144 Price 70,000 72,100 74,263 76,491 78,786 Total NEW 6,772,500 7,688,654 8,736,317 9,935,345 11,308,721 UPGRADEUnits 1,125 1,125 1,125 1,125 1,125 Price 35,000 36,050 37,132 38,245 39,393 Total UPGRADE 39,375,000 40,556,250 41,772,938 43,026,126 44,316,909 Total Sales 46,147,500 48,244,904 50,509,254 52,961,470 55,625,630 Variable CostsNEW 4,837,500 5,491,896 6,240,226 7,096,675 8,077,658 UPGRADE 24,750,000 25,492,500 26,257,275 27,044,993 27,856,343 Total Variable Costs 29,587,500 30,984,396 32,497,501 34,141,668 35,934,001SG&A 3,000,000 3,090,000 3,182,700 3,278,181 3,376,526 Depreciation 6,001,800 10,285,800 7,345,800 5,245,800 3,750,600EBIT 7,558,200 3,884,708 7,483,253 10,295,821 12,564,503 Interest 0 0 0 0 0 Tax 3,023,280 1,553,883 2,993,301 4,118,329 5,025,801 Net Income 4,534,920 2,330,825 4,489,952 6,177,493 7,538,702EBIT + Dep - Taxes 10,536,720 12,616,625 11,835,752 11,423,293 11,289,302 Less: Change in NWC 2,000,000 307,375 104,870 113,218 122,611 (2,648,074) Less: Captial Spending 42,000,000 (10,948,080) CF from Assets: (44,000,000) 10,229,345 12,511,755 11,722,534 11,300,682 24,885,455 Discounted CF from Assets 9,304,480 10,351,583 8,821,741 7,735,381 15,494,120Total Discounted CF from Assets 51,707,305Results。