(双语)》(中外合作会计)教学日历

东财中外合作办学会计专业大一的课程表

东财中外合作办学会计专业大一的课程表摘要:1.引言2.东财中外合作办学会计专业大一课程概述3.具体课程安排及实用性分析4.结语正文:【引言】作为一名东财中外合作办学会计专业的大一学生,你可能会对课程安排感到好奇和困惑。

这篇文章将为你详细介绍东财中外合作办学会计专业大一的课程,帮助你更好地规划学习生活和掌握专业知识。

【东财中外合作办学会计专业大一课程概述】东财中外合作办学会计专业大一的课程涵盖了会计、经济、金融、管理等多个领域,旨在为学生打下扎实的学科基础。

课程设置充分体现了国际化、实用性和创新性,为学生提供了宽广的发展空间。

【具体课程安排及实用性分析】1.基础会计:本课程旨在让学生掌握会计基本理论和方法,为后续专业课程打下基础。

2.财务会计:课程内容包括资产、负债、所有者权益、收入、费用等会计要素的确认、计量和披露,培养学生具备企业会计核算和报告的能力。

3.成本会计:通过本课程的学习,学生将掌握成本核算、成本控制和成本分析等成本管理的基本方法和技巧。

4.管理会计:课程涵盖了管理会计的基本概念、决策方法、绩效评价等方面的内容,培养学生为企业决策提供有效信息的能力。

5.财务管理:本课程教授企业财务管理的基本原理和实务,包括投资决策、筹资决策、营运管理和风险管理等。

6.经济法:课程内容涉及公司法、合同法、担保法等,培养学生具备企业法律事务处理的基本素养。

7.微观经济学:通过本课程的学习,学生将了解市场供求、消费者行为、企业策略等方面的基本原理。

8.宏观经济学:课程内容包括国民经济核算、货币政策和财政政策等,培养学生分析宏观经济形势的能力。

9.金融学:课程涵盖了金融市场、金融机构、金融政策等金融领域的基本知识和实务。

10.专业英语:本课程旨在提高学生的专业英语水平,为国际化人才培养奠定基础。

【结语】东财中外合作办学会计专业大一的课程安排丰富多样,注重培养学生的综合素质和国际视野。

希望这篇文章能帮助你更好地了解和应对大一的学习生活,为自己的未来发展打下坚实基础。

会计专业中英文双语融合教学法下的课程安排

会计专业中英文双语融合教学法下的课程安排论文关键词:中英文双语融合教学基础会计学中级财务会计论文摘要:中英文双语融合教学,客观上要求本着实事求是、一切从实际出发的态度,构建渐进的中英文双语融合教学目标体系,并在其基础上合理地进行课程设置。

只有课程设置合理了,才能激发学生的学习积极性,才能取得良好的中英文双语融合教学效果。

本文对《基础会计学》等课程应否进行中英文双语融合教学进行了详尽的阐述。

0引言为了顺利地开展中英文双语融合教学工作,必须要明确中英文双语融合教学目标、并结合学科特点科学地进行课程设置,这样才能取得较好的教学效果。

教学目标是教学体系建构的出发点,也是课程设置的依据和标准。

会计专业中英文双语融合教学目标的制定,应结合中英文双语融合教学的定义,反映经济全球化和教育国际化两个发展趋势,培养具有国际社会文化知识、懂外语、熟悉国际会计和商业惯例的高级会计管理人才。

通过中英文双语融合教学提高学生的外语水平,培养他们适应对外交流的能力,直接了解国外先进的会计理论和方法、掌握国际会计实务和惯例。

具体来讲,专业课中英文双语融合教学的目标应该是一个有差别的、层次分明的目标体系,在实践中要有一定的渐进性。

可以分为以下三个层次:第一层次,能大致听懂双语专业课程,能用常用英文词汇和句型进行简短的课堂发言,能借助字典看懂指定的专业英文教材,能正确使用英文完成作业;第二层次,能基本听懂专业双语课程,能用英文阐述自己的观点,能快速浏览教材并按要求查询重点,能用英语撰写简短专题文章;第三层次,能听懂双语课程,能用英文流利地表述观点、进行讨论,能熟练查阅国外专业期刊,能用英文撰写专题报告或论文。

根据上述中英文双语融合教学目标要求,结合会计学的学科特点及中英文双语融合教学实践反馈,笔者对下列会计专业主干课程应否采用中英文双语融合教学进行探讨。

1《基础会计学》课程中英文双语融合教学的课程在选择上应先易后难,逐步扩展范围,按教学目标层次逐步递进。

《大学英语》教学日历

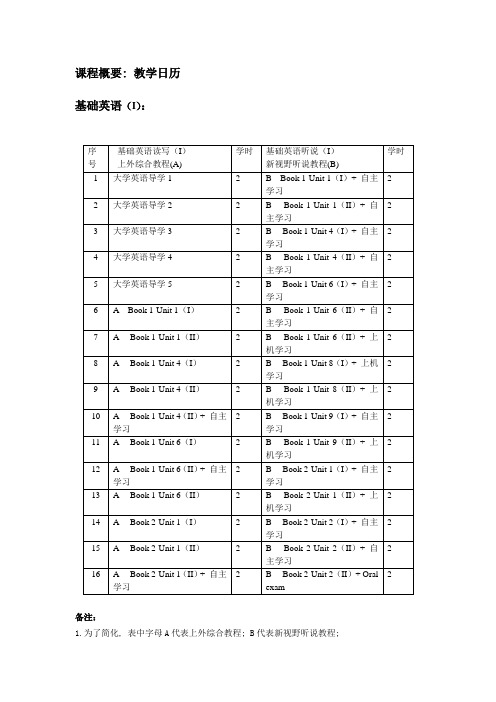

课程概要: 教学日历基础英语(I):备注:1.为了简化, 表中字母A代表上外综合教程; B代表新视野听说教程;2.自主学习安排从第九周起,每个课堂周次不一样,一共占用10学时。

上机学习内容为新视野视听说教程。

3.作业要求:每完成一个读写单元布置一次作业,共批改4次。

以写作为主。

4.平时成绩占20%,期末成绩占70%,自主学习占10%。

5.期末考试涵盖四本教材所有内容。

6.请各位老师根据各班具体情况灵活掌握进度,注意与其他老师基本保持一致。

基础英语(II):备注:1.为了简化, 表中字母A代表上外综合教程; B代表新视野听说教程;2.自主学习安排从第九周起,每个课堂周次不一样,一共占用10学时。

上机学习内容为新视野视听说教程。

3.作业要求:每完成一个读写单元布置一次作业,共批改4次。

以写作为主。

4.平时成绩占20%,期末成绩占70%,自主学习占10%。

5.期末考试涵盖四本教材所有内容。

6.请各位老师根据各班具体情况灵活掌握进度,注意与其他老师基本保持一致。

提高课程ESP(专门用途英语)模块:学术英语听说基本教学内容与学时安排教材:自编讲义参考书:1.《朗文英语听说教程》,Rost M,南开大学出版社出版社,2003.2.English for Academic Study, Listening Colin Campbell and Jonathan Smith,Gernet Education提高课程ESP(专门用途英语)模块:学术英语读写教材:大学英语阅读进阶John Langan(外研社)参考书(其他资源):–美国大学英语写作第六版John Langan(外研社)–英语写作手册修订本丁往道等(外研社)–英汉写作对比研究(蔡基刚)–提高课程视听说模块:英语媒体视听基本教学内容与学时安排:课后的学生辅助练习:1. 提供课外自主学习时间的听力练习材料,主要是慢速及常速英语新闻,逐步训练学生的听力水平。

1515P1037《西方会计》

1515P1037《西方会计》《西方会计》(双语课程)教学大纲课程号:1515p1037课程类型:专业选修课程名称:《西方会计》英文名称:westernaccounting学分:2适用专业:会计学一、本课程的性质、目的和任务《西方会计》(双语课程)是会计学专业(国际会计方向)的一门专业选修课。

通过对本课程的学习,学生能系统地了解国际会计准则[ias]、美国公认会计原则[gaap]的基本概念与原理以及与中国企业会计准则的差异;熟练掌握中、英文双语环境下的会计核算程序,能独立进行日常交易与事项的帐务处理,完成英文资产负债表(balance-sheet)、利润表(profitstatement)、现金流量表(cashflowstatement)的编制及报表分析工作,并利用财务报告分析的结果履行会计管理职能。

本课程的任务是使用中、英文两种语言(英文授课比例不少于70%)讲授gaap概念框架下的基本会计理论与实务,培养学生中英文双语环境下对日常经营业务的会计处理能力,使其在毕业之后能够独立胜任外资企业或跨国公司的财务会计工作。

二、课程教学目标1.专业知识目标1.1系统了解国际会计准则[IAS]和美国公认会计原则[GAAP]的基本概念和原则,以及与中国企业会计准则的差异;1.2掌握gaap概念框架下的基本会计理论与实务;1.3熟练掌握英文环境下的会计核算流程;2.专业技能目标2.1能够在双语环境下独立处理日常事务;2.2完成英文资产负债表(balance-sheet)、利润表(profitstatement)、现金流量表(cashflowstatement)的编制及报表分析工作;2.3能胜任外商投资企业或跨国公司的一般财务会计工作2.4有能力参与外商投资企业或跨国公司的内部会计控制;3.专业素质目标3.1双语财经环境下的日常沟通与交际能力;3.2解释和分析国内外财务趋势的能力;3.3双语环境下财经文献的阅读、翻译能力。

广东外语外贸大学本科教学全英双语课程信息表

A. 30%及以下B.30%~50%C.50%及以上D.全外文授课

学院审批意见

负责人(盖章):年月日

教务处意见

负责人(盖章):年月日

注:1.“课程类别”栏目请填写:公共基础课、学科基础课、专业模块必修课、专业模块选修课、通选课。

2.本表须一式二份,一份学院留存,一份教务处留存。

广东外语外贸大学本科教学全英/双语课程信息表

学院: 授课专业班级:填表日期: 年 月 日

课程号

开课学年学期

学分

主讲教师姓名

职称

学历

教师学习经历(包括出国或培训)

使用教材

详细信息

教材名称

作者姓名

出版机构

外文教材类型

A.进口的国外原版教材或国内影印版B.国内双语教材

C.自编讲义D.其它

会计学(双语)

中国海洋大学本科生课程大纲课程属性:公共基础/通识教育/学科基础/专业知识/工作技能,课程性质:必修、选修一、课程介绍1.课程描述:会计学是CFA实验班的主干课程,也是后续学习《财务报表分析》课程的重要基础。

本课程具有综合性、应用性强的特点,且由于是双语授课,要求学生有比较扎实的数学、经济学与英语等方面的知识基础。

本课程学习的目的是使得学生掌握会计学的基本原理,掌握现代企业会计核算的理论和方法,掌握企业财务报表的编制,并能够运用财务报表的数据进行简单的财务分析,为学生将来参与企业的财务管理工作打下坚实的基础。

Accounting is the main course of the CFA experimental class, and it is also an important foundation for the follow-up Financial Statement Analysis course. This course has the characteristics of comprehensiveness and strong application, and because it is taught in both Chinese and English, students are required to have a solid foundation of knowledge in mathematics, economics and English. The purpose of this course is to enable students to master the basic principles of accounting, master the theories and methods of modern corporate accounting, master the preparation of corporate financial statements, and be able to use financial statement data for simple financial analysis. This course lays a solid foundation for students to participate in the financial management of enterprises in the future.- 3 -2.设计思路:一是突出应用性特点。

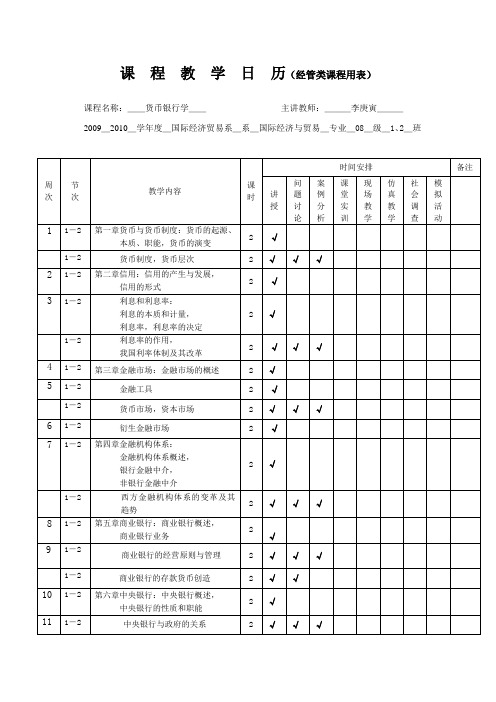

课程教学日历(经管类课程用表)

课程教学日历(经管类课程用表)课程名称:__货币银行学__主讲教师:___李庚寅___2009_2010_学年度_国际经济贸易系_系_国际经济与贸易_专业_08_级_1、2_班系(部)主任:年月日注:本表一式三份,由主讲教师填写,经批准后,分别交系(部)秘书、教务处各1份,教师自存1份。

广东外语外贸大学南国商学院全日制本科教学日历2009~2010学年第2学期课程名称货币银行学课程性质必修课学时 54学时学分 3学分适用专业(方向)经济学各专业及方向学生年级、人数 08电子商务开课单位经济系国际金融教研室授课教师姓名、职称李庚寅教授教务处制二00九年九月填写说明一、本表格相关内容必须与人才培养方案(教学计划)一致。

填写时,统一用宋体、5号字。

表格可视需要放大或缩小,页面不够可以另外加页,但不能改变基本格式。

课程教学不涉及表中相关栏目的,可不填写。

二、“教研室主任(签字)”、“系主任(签字)”只需签最后一页。

三、“课程性质”指必修课、专业选修课或公共选修课等。

“开课单位”填写授课教师所在系(部)和教研室;无教研室的只填系(部)或任职单位名称。

“学时分配”栏中,各种类别所占学时的总和应等于总学时。

四、“考试(考核)”方式填写开卷考试、闭卷考试、实验操作、操行评定、撰写论文、其他等。

采用多种考试(考核)方式的,可以填写其中两种主要形式。

五、“教材类别”填写面向21世纪规划教材,教育部或相关部委、行业协会推荐教材,获省部级奖励教材,公开出版教材、自编教材等。

推荐教材、奖励教材应写明推荐单位、奖励单位。

六、“多媒体技术”指利用计算机综合处理文字、声音、图像、图形、动画等信息技术,不包括纯文字的powerpoint;“授课语言”中的“全外语”指全部用某种外语编写的教材并全部用该语种教学;“双语”指全部用某种外语编写的教材并用这种外语授课的课时至少达到该课程总课时的50%。

七、某一门课程由多名教师共同讲授,应在封面“授课教师”栏目中列出所有授课教师姓名,并在第1页“教学任务安排”相关栏目中填写教学分工情况。

国际会计(双语)国际会计(双语)大纲

《国际会计》(双语)课程教学大纲课程编号:02133制定单位:会计学院制定人(执笔人):宋京津,王宏*******制定(或修订)时间:2011年8月26日江西财经大学教务处《国际会计》(双语)课程教学大纲一、课程总述本课程大纲是以2011年国际会计(双语)本科专业人才培养方案为依据编制的。

二、教学时数分配三、单元教学目的、教学重难点和内容设置Study guide for international accountingCHAPTER 1Introduction to international accountingLEARNING OBJECTIVES:1.To identify and understand the importance of the eight factors that has asignificant influence on accounting development.2.To understand the definition of IA of this textbook.3.To be familiar with the detailed contents of IACHAPTER OUTLINEDevelopment of IAEight factors▪Sources of Finance–In countries with strong equity markets, Disclosures are extensive to meet the requirements of widespread public ownership.–in credit-based systems where bans are the dominant source of finance, accounting focuses on creditor protection through conservative accounting measurements. Development of IA▪Legal System. The legal system determines how individuals and institutions interact.▪Taxation . tax legislation effectively determines accounting standards because companies must record revenues and expenses in their accounts to claim them for tax purposes.▪Political and Economic Ties. Accounting ideas and technologies are transferred through conquest, commerce, and similar forces.Development of IA▪Inflation. Inflation distorts historical cost accounting and affects the tendency of a country to incorporate price changes into the accounts.▪Level of Economic Development. This factor affects the types of business transactions conducted in an economy and determines which ones are most prevalent.Development of IA▪Education Level. Highly sophisticated accounting standards and practices are useless if they are misunderstood and misused.▪Culture. Cultural variables underlie nations’ institutional arrangements (such as legal systems)Definition of IAInternational accounting can be viewed in terms of the accounting issues uniquely confronted by companies involved in international business. It also can be viewed more broadly as the study of how accounting is practiced in each and every country around the world, learning about and comparing the differences in financial reporting and other accounting practices that exist across countries.Definition of IAThis book is designed to be used in a course that attempts to provide an overview of the broadly defined area of international accounting, and that focuses on the International Financial Reporting Standards (IFRSs) issued by International Accounting Standards Board (IASB) and some international hot topics.Detailed Contents on IA▪International accounting is a well-established specialty area within accounting and has two major dimensions:▪Comparative: Examining how and why accounting principles differ from country to country▪Pragmatic: accounting for the operational problems and issues encountered by individuals and firms in international business.Detailed Contents on IA▪L. Radebaugh and S. Gray (1993, p. 9) also write that the study of international accounting involves two major areas:▪descriptive/comparative accounting and the accounting dimensions of international transactions/multinational enterprises.▪principally covers the problems encountered by multinational corporations: Financial reporting problems, translation of foreign currency financial statements, information systems, budgets and performance evaluation, audits, and taxes.Objectives of Research on IA▪Global Harmonization. As business entities increasingly operate in multiple counties, they encounter the cost of dealing with diversity in financial reporting requirements.▪Financial Reporting in Emerging Economics. As ever increasing amounts of capital are invested in countries with emerging economics, the quality of financial reporting in these countries is coming under the microscope. Objectives of Research on IA▪Social and Environmental Reporting. One of the consequences of the globalization of business enterprises is that companies now have stakeholders not just in their home country but in all the countries where they operate.CHAPTER 2International accounting harmonizationLEARNING OBJECTIVES:1. Recognize the arguments for and against harmonization.2. Identify the pressures for and the obstacles to harmonization.3. Become familiar with the main organizations involved in harmonization. CHAPTER OUTLINEHistory and Recent Developments▪Prior to 1960, there was little effort devoted to the international harmonization of accounting standards. Efforts have been made by a number of organizations to reduce the differences between accounting systems since then.Main International Bodies InvolvedPrinciples-Based vs. Rules-Based Approaches▪Principles-based standards represent the best approach for guiding financial reporting and standard setting, of any given transaction.▪Rules-based standards provide companies the opportunity to structure transactions to meet the requirements for particular accounting treatments.Obstacles to Harmonization▪Differences in the regulatory framework .▪The "true and fair view" .▪The various interpretation of fundamental principle .▪ A binding tax accounting linkLikely future trends▪The convergence of IAS and national accounting standards is, and always has been one of the IASB's key objectives. Three basic future roles exist for the IASB:✓Producing standards for those countries that have no standards of their own✓Assisting in the reduction of diverse national practices✓Acting as an umbrella organizing for national standard settersImplication▪The demand of international capital markets helps to drive harmonization. IASB has become more cognizant of the need to work with national standard setters and bring them into membership of IASB, which may be possible to eliminate the differences between national and international standards. The current agreement could then be viewed as the first step in a much longer process.IASB ( International Accounting Standards Board)▪IASB's responsibilities:✓Develop and issue International Financial Reporting Standards and Exposure Drafts, and✓Approve Interpretations developed by the International Financial Reporting Interpretations Committee (IFRIC).CHAPTER 3ACCOUNTING FOR FOREIGN CURRENCYLEARNING OBJECTIVES:▪ 1. Provide an overview of foreign exchange markets and define related terminology.▪ 2. Describe the different types of foreign exchange exposure and exchange difference.▪ 3. Understand some of the more common foreign currency transactions. CHAPTER OUTLINEAccounting for Foreign Currency Transactions▪ a transaction that requires payment or receipt (settlement) in a foreign currency is called a foreign currency transaction.▪Exchange difference is the difference resulting from reporting the same number of units of a foreign currency in the reporting currency at different exchange rates. Accounting for Foreign Currency Transactions▪Importing or Exporting of Goods or Services✓At the date the transaction is first recognized.✓At each balance sheet date that occurs between the transaction date and the settlement date.✓At the settlement date.Accounting for Foreign Currency Transactions▪Recognition of Exchange Differences✓the single- transaction approach✓the two- transaction approachHedging Foreign Exchange Rate Risk▪A derivative instrument may be defined as a financial instrument that by its terms at inception or upon occurrence of a specified event, provides the holder (or writer) with the right (or obligation) to participate in some or all of the price changes of another underlying value of measure, but does not require the holder to own or deliver the underlying value of measure.Hedging Foreign Exchange Rate Risk▪two broad categories✓Forward-based derivatives, such as forwards, futures, and swaps, in which either party can potentially have a favorable or unfavorable outcome, but not both simultaneously (e.g., both will not simultaneously have favorable outcomes).✓Option-based derivatives, such as interest rate caps, option contracts, and interest rate floors, in which only one party can potentially have a favorable outcome and itagrees to a premium at inception for this potentiality; the other party is paid the premium, and can potentially have only an unfavorable outcome.Hedging Foreign Exchange Rate Risk▪Forward Exchange Contracts▪Options▪Fair Value Hedge – Using a Forward Contract▪Hedging an Identifiable Foreign Currency Commitment Using a Forward Contract (A Fair Value Hedge)▪Hedging a Forecasted Transaction Using an Option (Cash Flow Hedge) Translation Of Foreign Financial Statements▪Derivation of the Issue of Foreign Currency Translation✓Translation exposure, sometimes also called accounting exposure, refers to gains or losses caused by the translation of foreign currency assets and liabilities into the currency of the parent company for accounting purposes.✓The choice of any method for the translation of the financial statements of a foreign business operation involves two basic questions:(i) how shall foreign currency financial statements be translated——in particular what exchange rates are to be used for different assets/liabilities/equity accounts?(ii) how and when shall foreign exchange gains or losses be recognized?CHAPTER 4Business combinationsLEARNING OBJECTIVES:•(1)Understand the economic motivations underlying business combinations.•(2)Learn about the alternative forms of business combinations, from both the legal and accounting perspectives.•(3)Introduce concepts of accounting for business combinations;•(4)emphasizing the purchase method.•(5)See how firms make cost allocatCHAPTER OUTLINE➢ 4.1 The Accounting Concept of Business Combinations➢ 4.2 The Legal Form of Business Combinations➢ 4.3 Reasons for Business Combinations➢ 4.4 Accounting for Business Combinations Under the Purchase Method ➢ 4.5 The measurement of Goodwill and ControversyCHAPTER 5Consolidated financial statementsLEARNING OBJECTIVES:•(1)Recognize the benefits and limitations of consolidated financial statements.•(2)Understand the requirements for inclusion of a subsidiary in consolidated financial statements.•(3)Apply the consolidation concepts to parent company recording of the investment in a subsidiary at the date of acquisition.•(4)Allocate the excess of the fair value over the book value of the subsidiary at the date of acquisition.CHAPTER OUTLINE➢ 5.1 Demand from IAS 27➢ 5.2 The adjustment of Intercompany Transactions➢ 5.3 Parent Company Recording and Consolidated Statement of financial position at Acquisition Date➢ 5.4 Subsequent Statement of financial positionCHAPTER 6Accounting for changing priceLEARNING OBJECTIVES:▪ 1. Explain basic concepts relating to inflation accounting. Understand the distinction between changes in the general level of prices in an economy, which affect the purchasing power of the measuring unit, and changes in the prices of specific assets and liabilities, which affect balance sheet valuations and income measurement.▪ 2. Explain the underlying thoughts and methods of dealing with inflation.▪ 3. Restate conventional financial statements based on historical costs to a common measuring unit.CHAPTER OUTLINEDefects of historical cost accounting▪The results of comparison of performance and position statements over time will be unreliable, because amounts are not valued in terms of common units.▪Borrowings are shown in monetary terms, but in a time of rising prices a gain is actually made (or a loss in times of falling prices) at the expense of the lender as, in real terms, the value of the loan has decreased or increased.▪Conversely, gains arising from holding assets are not recognized.▪Depreciation writes off the historical cost over time, but, where asset values are low (because based on outdated historical costs), depreciation will becorrespondingly lower, so that a realistic charge for asset consumption is not matched against revenue in the performance statements.Overview of Accounting for changing prices▪Changing prices affect financial reports in two principal ways:✓Measuring unit problem✓Valuation problemAccounting Measurement Alternatives▪Acquisition Cost/Nominal Dollar Accounting▪Acquisition Cost/Constant Dollar Accounting▪Current Cost/Nominal Dollar Accounting▪Current Cost/Constant Dollar AccountingRestatement of Monetary and Non-monetary Items▪ A monetary item is a claim receivable or payment in a specified number of dollars, regardless of changes in the purchasing power of the dollar.▪ A non-monetary item is any asset, liability, or shareholders’ e quity account that has no claim to or for a specified number of dollars.Evaluation of Acquisition Cost/Constant Dollar Accounting▪When compared with current-cost accounting (discussed next), constant-dollar accounting carries a higher level of objectivity. Independent accountants can examine canceled checks, invoices, and other documents to verify acquisition-cost valuations and transaction dates. The restatements to constant dollars use general price indexes published by governmental bodies. Evaluation of Current Cost/Nominal Dollar Accounting▪Current-cost accounting measures performance and financial position in terms of the current market prices. Managers likely make decisions in terms of current costs, not out-of-date acquisition costs. Thus, for asses sing management’s actions, current-cost financial statements provide information on the same basis that management used to make decisions.▪Critics note two shortcomings of current cost/nominal dollar accounting:✓auditors cannot as easily verify current-replacement-cost valuations as they can acquisition-cost valuations.✓the use of nominal dollars means that the measuring unit underlying current-replacement-cost valuations varies across time.CHAPTER 7Accounting for financial instrumentLEARNING OBJECTIVES:1. Examine budgeting and performance evaluation issues for international firms.2. Discuss global risk management tools and strategies including multinational capitalbudgeting and foreign exchange risk management.3. Identify the main constituents of cross-border transfer pricing policies, define thetransfer pricing methods, and consider the issues in devising a transfer pricing strategy.4. Recognize the critical role of information technology systems in the effectiverecording, processing and dissemination of financial and managerial accounting information.CHAPTER OUTLINE1 Challenge for the accounting profession2 Accounting and Reporting for Financial Instruments: International Developments▪In the process of completing the most recent series of amendments, the IASB conducted an extensive due process, which began in 2001 and included the following:▪(1) Conducting numerous board deliberations prior to the June 2002 exposure drafts;2.1 Overview of IAS 32▪The following are the major U.S. standards that address financial instruments accounting and reporting:▪(1) SFAS 107, Disclosures About Fair Value of Financial Instruments.▪(2) SFAS 133, Accounting for Derivative Financial Instruments and Hedging Activities.▪(3) SFAS 140, Accounting for Transfers and Servicing of Financial Assets and Extinguishments of Liabilities.▪(4) SFAS 150, Accounting for Certain Financial Instruments with Characteristics of Both Debt and Equity.2.2 Overview of IAS 392.3 Recognition and Derecognition of Financial Assets and Liabilities2.4 Hedge Accounting Guidance2.5 Impairment of Financial Instruments2.6 Convergence with U.S. GAAP3 Financial instruments3.1 Illustration of Traditional Financial Instrument3.2 Illustration of Derivative Financial Instrument4 DERIV ATIVES USED FOR HEDGING▪SFAS No. 133 established accounting and reporting standards for derivative financial instruments used in hedging activities. Special accounting is allowed for two types of hedges—fair value and cash flow hedges.4.1 Fair Value Hedge4.2 Illustration of Interest Rate Swap4.3 Cash Flow Hedge5 OTHER REPORTING ISSUES▪Additional issues of importance are as follows:▪(1) The accounting for embedded derivatives.▪(2) Qualifying hedge criteria.▪(3) Disclosures about financial instruments and derivatives.Chapter 8 financial reporting in different countriesLearning objectives:•Identify the major policy-setting bodies and their role in the standard-setting process.•Appreciate US GAAP .•Understand convergence of US GAAP to IFRSs.Chapter outline:Parties Involved in Standard SettingSecurities and Exchange CommissionAmerican Institute of CPAsFinancial Accounting Standards BoardFinancial Accounting Standards BoardDue ProcessTypes of PronouncementsGovernmental Accounting Standards BoardGenerally Accepted Accounting PrinciplesIssues in Financial ReportingIssues in Financial ReportingConceptual FrameworkDevelopment of Conceptual FrameworkChapter 9 corporate governanceLearning objectives:1.describe the definition of corporate governance2.describe some corporate governance theory3.describe the principle of corporate governancechapter outline:2 What is corporate governance?3 Corporate governance theoryPrincipal-agent theoryClassical Stewardship Theory3.3 Modern Stewardship Theory3.4 Stakeholder TheoryPrinciples of corporate governanceCorporate governance modelsMechanisms and controls of corporate governance Features of poor corporate governance。

UIC校历表

UNITED INTERNATIONAL COLLEGEAcademic Calendar of Semester 1, 2011-2012Sun Mon Tue Wed Thu Fri SatWeek No.27-28 Registration of Year 1 Students 1 2 3 4 5 6 27-28 新生报到 29-30 Year 1 Students Orientation 7 8 9 10 11 12 13 29-30 迎新营31 English Enhancement Programme 14 15 16 17 18 19 20 31新生英语强化课程 for Year 1 Students 21 22 23 24 25 26 27AUG28 29 30 311-3 English Enhancement Programme 1 2 3 1-3 新生英语强化课程 for Year 1 Students4 5 6 7 8 9 10 13-4 Registration of Year 2-4 Students 11 12 13 14 15 16 17 2 3-4 二至四年级学生报到 5 Semester 1 Begins 18 19 20 21 22 23 24 3 5 第一学期开始 12 Mid-autumn Festival 25 26 27 28 29 30 4 12 中秋节 8-22 Subjects Adding/Dropping SEP 8-22课程科目增减 1-5 National Day Holidays 1 4 1-5国庆节假期 2 3 4 5 6 7 8 5 9 10 11 12 13 14 15 6 16 17 18 19 20 21 22 7 23 24 25 26 27 28 29 8OCT 30 31 95 HKBU 52nd Commencement 1 2 3 4 5 9 5HKBU 第52届毕业典礼 20 College Sports Days6 7 8 9 10 11 12 10 20校运会 23 College Sports Days (afternoon only)13 14 15 16 17 18 19 11 23 校运会(仅下午) 20 21 22 23 24 25 26 12NOV27 28 29 30 138-9 Make-up Classes or Revision 1 2 3 13 8-9 补课或复习9 Last Day of Classes (1stSemester) 4 5 6 7 8 9 10 14 9 第一学期最后授课日 12-24 Semester 1 Final Examinations1112 13 14 15 16 17 12-24 第一学期期末考试 17 CET 4/6 18 19 20 21 22 23 24 17 大学英语四/六级考试 25-26 Christmas Holidays25 26 27 28 29 30 31 25-26 圣诞节假期 27-31 Military Training for Year 1 Students 27-31 一年级学生军训 27-31 English Immersion Programme27-31 英语浸泡营 30Div. BOE Meeting DEC30学部考试委员会议 1-2New Year Holidays 1 2 3 4 5 6 7 1-2元旦 3-4 English Immersion Programme8 9 10 11 12 13 14 3-4 英语浸泡营 4 College BOE Meeting 15 16 17 18 19 20 21 4 考试委员会议 4 UIC Senate Meeting22 23 24 25 26 27 284 UIC 教务议会会议5 Partial Grade Report Release (P/F) 29 30 31 5 成绩表发放(P/F) 6-9 Make-up & Suppl. Examinations 6-9 第一学期补考 13 College BOE Meeting 13 考试委员会议 13 UIC Senate Meeting 13 UIC 教务议会会议 13 Semester 1 Ends 13 第一学期结束 14 Release of Grade Reports 14 成绩表发放 23 Lunar New YearJAN23 春节4-5 Registration of All Students 1 2 3 4 4-5 一至四年级学生报到 6 Semester 2 Begins 5 6 7 8 9 10 11 6 第二学期开始 12 13 14 15 16 17 18 19 20 21 22 23 24 25FEB26272829Remarks: (1) Shaded areas: holidays;(2) Regular classes will be arranged on Saturdays.UNITED INTERNATIONAL COLLEGEAcademic Calendar of Semester 2, 2011-2012Remarks: (1) Shaded areas: holidays;(2) Regular classes will be arranged on Saturdays;(3) * Normal teaching classes should not be affected.。

《国际会计》课程教学大纲

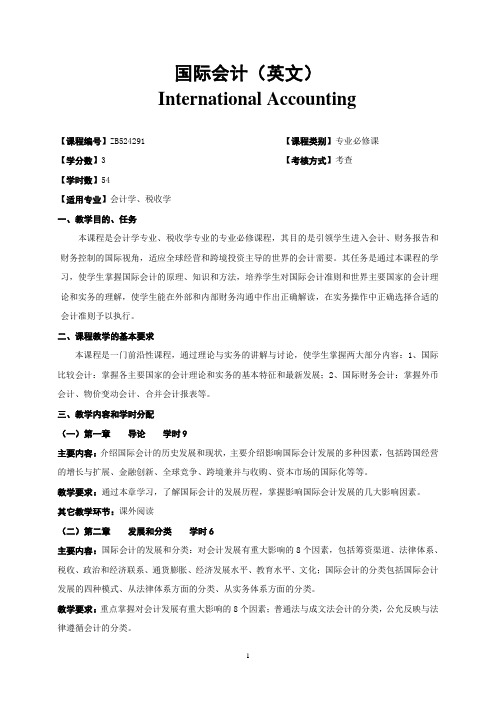

国际会计(英文)International Accounting【课程编号】ZB524291 【课程类别】专业必修课【学分数】3 【考核方式】考查【学时数】54【适用专业】会计学、税收学一、教学目的、任务本课程是会计学专业、税收学专业的专业必修课程,其目的是引领学生进入会计、财务报告和财务控制的国际视角,适应全球经营和跨境投资主导的世界的会计需要。

其任务是通过本课程的学习,使学生掌握国际会计的原理、知识和方法,培养学生对国际会计准则和世界主要国家的会计理论和实务的理解,使学生能在外部和内部财务沟通中作出正确解读,在实务操作中正确选择合适的会计准则予以执行。

二、课程教学的基本要求本课程是一门前沿性课程,通过理论与实务的讲解与讨论,使学生掌握两大部分内容:1、国际比较会计:掌握各主要国家的会计理论和实务的基本特征和最新发展;2、国际财务会计:掌握外币会计、物价变动会计、合并会计报表等。

三、教学内容和学时分配(一)第一章导论学时9主要内容:介绍国际会计的历史发展和现状,主要介绍影响国际会计发展的多种因素,包括跨国经营的增长与扩展、金融创新、全球竞争、跨境兼并与收购、资本市场的国际化等等。

教学要求:通过本章学习,了解国际会计的发展历程,掌握影响国际会计发展的几大影响因素。

其它教学环节:课外阅读(二)第二章发展和分类学时6主要内容:国际会计的发展和分类:对会计发展有重大影响的8个因素,包括筹资渠道、法律体系、税收、政治和经济联系、通货膨胀、经济发展水平、教育水平、文化;国际会计的分类包括国际会计发展的四种模式、从法律体系方面的分类、从实务体系方面的分类。

教学要求:重点掌握对会计发展有重大影响的8个因素;普通法与成文法会计的分类,公允反映与法律遵循会计的分类。

其它教学环节:课外阅读(三)第三章比较会计:欧洲学时6主要内容:捷克、法国、德国、荷兰、英国的会计体系背景信息、监管和实施会计的制度框架和基于当地公认会计准则的财务呈报。

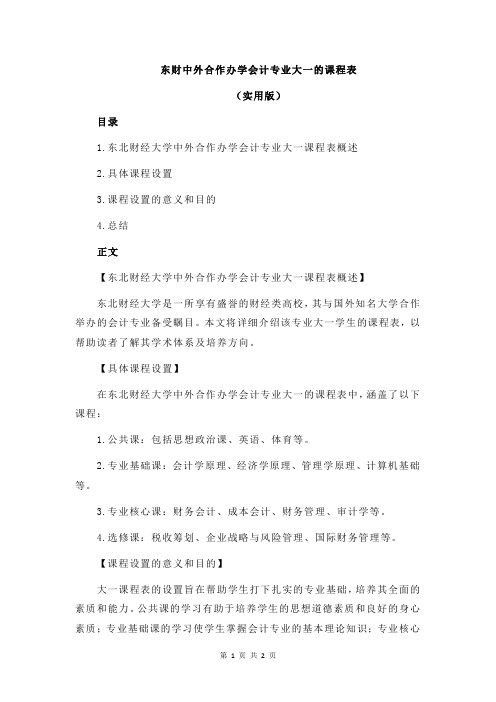

东财中外合作办学会计专业大一的课程表

东财中外合作办学会计专业大一的课程表

(实用版)

目录

1.东北财经大学中外合作办学会计专业大一课程表概述

2.具体课程设置

3.课程设置的意义和目的

4.总结

正文

【东北财经大学中外合作办学会计专业大一课程表概述】

东北财经大学是一所享有盛誉的财经类高校,其与国外知名大学合作举办的会计专业备受瞩目。

本文将详细介绍该专业大一学生的课程表,以帮助读者了解其学术体系及培养方向。

【具体课程设置】

在东北财经大学中外合作办学会计专业大一的课程表中,涵盖了以下课程:

1.公共课:包括思想政治课、英语、体育等。

2.专业基础课:会计学原理、经济学原理、管理学原理、计算机基础等。

3.专业核心课:财务会计、成本会计、财务管理、审计学等。

4.选修课:税收筹划、企业战略与风险管理、国际财务管理等。

【课程设置的意义和目的】

大一课程表的设置旨在帮助学生打下扎实的专业基础,培养其全面的素质和能力。

公共课的学习有助于培养学生的思想道德素质和良好的身心素质;专业基础课的学习使学生掌握会计专业的基本理论知识;专业核心

课的学习使学生深入了解会计实务操作,为将来的职业生涯奠定基础;选修课的学习则让学生根据自己的兴趣和发展方向,拓宽知识面,提升自身竞争力。

【总结】

东北财经大学中外合作办学会计专业大一的课程表设置科学合理,既注重培养学生的专业素质,又关注学生的全面发展。

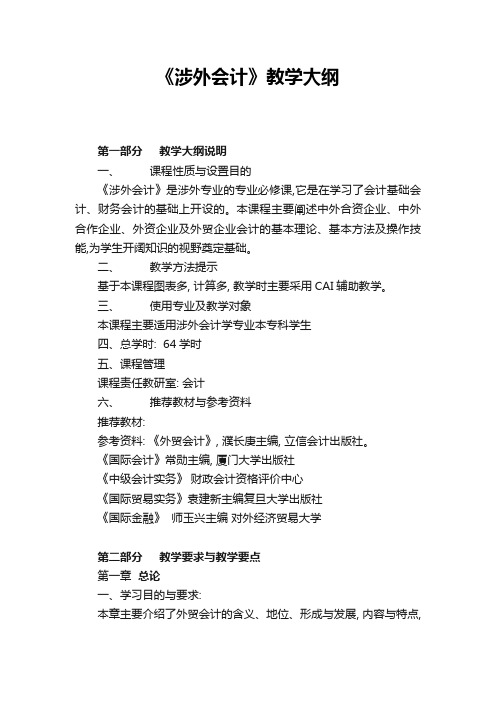

《涉外会计》教学大纲

《涉外会计》教学大纲第一部分教学大纲说明一、课程性质与设置目的《涉外会计》是涉外专业的专业必修课,它是在学习了会计基础会计、财务会计的基础上开设的。

本课程主要阐述中外合资企业、中外合作企业、外资企业及外贸企业会计的基本理论、基本方法及操作技能,为学生开阔知识的视野奠定基础。

二、教学方法提示基于本课程图表多, 计算多, 教学时主要采用CAI辅助教学。

三、使用专业及教学对象本课程主要适用涉外会计学专业本专科学生四、总学时: 64学时五、课程管理课程责任教研室: 会计六、推荐教材与参考资料推荐教材:参考资料: 《外贸会计》, 濮长庚主编, 立信会计出版社。

《国际会计》常勋主编, 厦门大学出版社《中级会计实务》财政会计资格评价中心《国际贸易实务》袁建新主编复旦大学出版社《国际金融》师玉兴主编对外经济贸易大学第二部分教学要求与教学要点第一章总论一、学习目的与要求:本章主要介绍了外贸会计的含义、地位、形成与发展, 内容与特点,以及会计确认与计量的基本内容, 基本假设、一般原则、帐户设置、记账方法和结算方式。

二、教学时数: 6 学时三、重点和难点1.企业涉外会计的主要内容和特点, 企业涉外会计的帐户设置、记账方法和结算方式。

2.对会计基本假设及核算一般原则的理解, 企业涉外会计的实务操作模型。

四、教学内容:(一)外贸企业会计概述1.外贸企业会计的含义2.企业涉外会计的重要地位3.企业涉外会计的形成与发展(二)外贸会计的主要内容与特点1.外贸企业会计的对象2.外贸企业会计的内容3.外贸企业会计的特点(三)会计核算的前提和一般原则1.企业涉外会计的基本假设2.企业涉外会计的一般原则(四)外贸企业的会计要素与会计科目1.外贸企业会计要素2.外贸企业会计科目3.帐户4.企业涉外会计业务的核算程序5.企业涉外会计的记账方法第二章外币业务与国际结算一、学习目的与要求: 本章主要介绍了外汇的管理、外汇的分类, 购汇与结汇的程序;外汇汇率的折算与标价方法;记账统账制的运用及汇兑损益的会计处理。

《国际贸易(双语)》64学时教学日历

Consumer Surplus

Producer Surplus

P24

图形

6

11

Section2 National Market with No Trade and the Opening of Trade and its’ Effects

2

12

Chapter4Traditional theories of international trade

Section 2Effects of a Tariff

Section 3Tariff Schedule

Section4 The effective rate of Protection

2

通过本章的学习,学生应理解关税的含义、种类、海关税则的构成。学会计算有效关税保护率。Key Point:Tariff and classification;

64学时

其

中

理论课

54学时

实验课

学时

课程设计(大型作业)

学时

习题(含课程作文)课

学时

讨论课

4学时

阶段测验

2学时

现场教学

学时

机动

4学时

周

次

课

次

授课内容摘要

时

数

目的要求

课外作业

1

1

Chapter 1

Introductiontointernational trade

What is International Trade?

长春大学光华学院

教学日历

2010—2011学年第二学期

专业名称:

课程名称:

主讲教师:

授课班级:

- 1、下载文档前请自行甄别文档内容的完整性,平台不提供额外的编辑、内容补充、找答案等附加服务。

- 2、"仅部分预览"的文档,不可在线预览部分如存在完整性等问题,可反馈申请退款(可完整预览的文档不适用该条件!)。

- 3、如文档侵犯您的权益,请联系客服反馈,我们会尽快为您处理(人工客服工作时间:9:00-18:30)。

2011至2012学年第2 学期

教学日历

课程名称:财务管理学A 学时:72

课号:10634004 学分:4.5

使用教材:《Fundamentals of Financial Management》

教师姓名:王长莲任课班级:会H10 学院:教学院长签字

系:系(教研室) 年月日

教研室:主任签字:年月日

安徽工业大学

说明:1.本表一式三份,任课教师、所在系和教务处各一份。

2.本表经教研室主任批准执行,教师不得任意更改,如有必要更改须办理审批手续。

3.各项目均需认真填写。

“讲次”一栏填讲课顺序。

说明:1.本表一式三份,任课教师、所在系和教务处各一份。

2.本表经教研室主任批准执行,教师不得任意更改,如有必要更改须办理审批手续。

3.各项目均需认真填写。

“讲次”一栏填讲课顺序。

说明:1.本表一式三份,任课教师、所在系和教务处各一份。

2.本表经教研室主任批准执行,教师不得任意更改,如有必要更改须办理审批手续。

3.各项目均需认真填写。

“讲次”一栏填讲课顺序。

2.本表经教研室主任批准执行,教师不得任意更改,如有必要更改须办理审批手续。

3.各项目均需认真填写。

“讲次”一栏填讲课顺序。