审计学一种整合方法 课件Chapter11

审计学一种整合的方法1ppt课件

©2008 Prentice Hall Business Publishing, Auditing 12/e, Arens/Beasley/Elder

8-9

Understanding of the Client’s Business and Industry

Factors that have increased the importance of understanding the client’s business and industry:

Accept client and perform initial audit planning.

Understand the client’s business and industry.

Assess client business risk.

Perform preliminary analytical procedures.

8-7

Initial Audit Planning

➢ Client acceptance and continuance ➢ Identify client’s reasons for audit ➢ Obtain an understanding with the client ➢ Develop overall audit strategy

©2008 Prentice Hall Business Publishing, Auditing 12/e, Arens/Beasley/Elder

8-8

Learning Objective 3

Gain an understanding of the client’s business and industry.

审计学一种整合的方法课件

审计准则与审计标准

01 审计准则

审计准则是审计师在执行审计工作时必须遵循的 规范和原则,以确保审计质量和信誉。

02 审计标准

审计标准是衡量财务报表、内部控制和治理过程 可靠性的尺度,包括国际审计准则和国内审计准 则。

方法

采用生命周期评估方法, 从产品的设计、生产、使 用到废弃的整个过程进行 环境审计。

信息安全审计

定义

信息安全审计是一种对组织的信 息系统安全进行的审计,旨在评 估组织对信息安全的控制能力和

效果。

目的

确保组织的信息系统安全,防止信 息泄露、篡改或损坏,提高组织的 竞争力。

方法

采用风险评估方法,识别潜在的安 全风险,提出应对措施,并定期进 行安全审计。

国际化与本土化相结合

1 2 3

国际化趋势

随着经济全球化的不断发展,审计学逐渐走向国 际化,国际审计标准和准则逐渐成为各国审计的 基础。

本土化需求

各国在引进国际审计标准和准则的同时,也需要 根据本国实际情况进行适当的调整和修改,以适 应本土市场需求和发展。

国际化与本土化的平衡

各国在实现审计国际化的同时,要充分考虑本土 化需求,实现国际化和本土化的有机融合。

信息技术提高审计效率

随着信息技术的不断发展,审计学可以利用大数据、人工智能等 技术提高审计效率,减少人工操作,降低审计成本。

信息技术拓展审计范围

信息技术可以帮助审计学扩大数据来源和样本数量,从而更全面地 评估被审计单位的风险状况。

信息技术提高审计质量

通过信息技术,可以实现数据的实时监控和分析,及时发现潜在风 险,提高审计质量。

审计学-一种整合的方法

Steps to Develop Audit Objectives

•4. Know general audit objectives for • classes of transactions and accounts.

•5. Know specific audit objectives for • classes of transactions and accounts.

➢ Actions when the auditor knows of an illegal act

Learning Objective 4

Classify transactions and account balances into financial statement cycles and identify benefits of a cycle approach to segmenting the audit.

Auditor’s Responsibilities for Discovering Illegal Acts

➢ Evidence accumulation and other actions • when there is reason to believe direct- or • indirect-effect illegal acts may exist

•The Sarbanes-Oxley Act provides for criminal •penalties for anyone who knowingly falsely •certifies the statements.

Learning Objective 3

Explain the auditor’s responsibility for discovering material misstatements.

审计学一种整合的方法

statements and internal control

from the auditor’s responsibility

for verifying the financial

statements and effectiveness

of internal control.

PPT文档演模板

审计学一种整合的方法

审计学一种整合的方法

Transaction Flow Example

•Transactions •Sales

•Cash •receipts

•Journals •Sales •journal

•Cash receipts •journal

•Ledgers, •Trial Balance, •and Financial

➢ Material versus immaterial misstatements ➢ Reasonable assurance ➢ Errors versus fraud ➢ Professional skepticism ➢ Fraud resulting from fraudulent financial reporting versus misappropriation of assets

•Sales and •collection

•cycle

•Acquisition •and payment

•cycle

•Payroll and •personnel

•cycle

•Inventory and •warehousing

•cycle

PPT文档演模板

审计学一种整合的方法

Learning Objective 5

•Payroll •journal

审计学:一种整合方法第16版英文ppt课件arens_aud16_inppt11

Copyright Байду номын сангаас 2017 Pearson Education, Inc.

11-4

OBJECTIVE 11-2 Contrast management’s responsibilities for

maintaining internal control with the auditor’s responsibilities for evaluating and

Copyright © 2017 Pearson Education, Inc.

11-10

OBJECTIVE 11-3 Explain the five components of the COSO internal control framework.

Copyright © 2017 Pearson Education, Inc.

The SEC requires management to include its report on internal control in its annual Form 10-K report filed with the SEC.

An example of management’s report on internal control that complies with Section 404 requirements is shown in Figure 11-1.

reporting on internal control.

Copyright © 2017 Pearson Education, Inc.

11-5

MANAGEMENT AND AUDITOR RESPONSIBILITIES FOR INTERNAL CONTROL

审计学一种整合方法课件

Sarbanes-Oxley Act

This Act requires the auditor of a public company to attest to management’s report on the effectiveness of internal control over financial reporting.

3. Auditor agrees with a departure from promulgated accounting principles

4. Emphasis of a matter

5. Reports involving other auditors

Substantial Doubt About Going Concern

Conditions for Standard Unqualified Audit Report

4. The financial statements are presented in accordance with generally accepted accounting principles.

Leare the five circumstances • when an unqualified report with • an explanatory paragraph or • modified wording is appropriate.

1. Significant recurring operating losses or working capital deficiencies.

2. Inability of the company to pay its obligations as they come due.

审计学一种整合的方法.pptx

statements and internal control

from the auditor’s responsibility

for verifying the financial

statements and effectiveness

of internal control.

©2008 Prentice Hall Business Publishing, Auditing 12/e, Arens/Beasley/Elder

6-8

Learning Objective 3

Explain the auditor’s responsibility for discovering material misstatements.

©2008 Prentice Hall Business Publishing, Auditing 12/e, Arens/Beasley/Elder

6-6

Management’s Responsibilities

Management is responsible for the financial statements and for internal control.

The Sarbanes-Oxley Act increases management’s responsibility for the financial statements.

©2008 Prentice Hall Business Publishing, Auditing 12/e, Arens/Beasley/Elder

6-3

Steps to Develop Audit Objectives

1. Understand objectives and responsibilities for the audit.

审计学-一种整合的方法

©2008 Prentice Hall Business Publishing, Auditing 12/e, Arens/Beasley/Elder

6-3

Steps to Develop Audit Objectives

1. Understand objectives and responsibilities for the audit.

©2008 Prentice Hall Business Publishing, Auditing 12/e, Arens/Beasley/Elder

6-5

Learning Objective 2

Distinguish management’s

responsibility for the financial

6-4Βιβλιοθήκη Steps to Develop Audit Objectives

4. Know general audit objectives for classes of transactions and accounts.

5. Know specific audit objectives for classes of transactions and accounts.

statements and internal control

from the auditor’s responsibility

for verifying the financial

statements and effectiveness

of internal control.

©2008 Prentice Hall Business Publishing, Auditing 12/e, Arens/Beasley/Elder

审计学-一种整合的方法-文档资料

©2008 Prentice Hall Business Publishing, Auditing 12/e, Arens/Beasley/Elder

6-6

Learning Objective 2

Distinguish management’s

responsibility for the financial

©2008 Prentice Hall Business Publishing, Auditing 12/e, Arens/Beasley/Elder

6-7

Management’s Responsibilities

Management is responsible for the financial statements and for internal control.

The Sarbanes-Oxley Act increases management’s responsibility for the financial statements.

➢ Actions when the auditor knows of an illegal act

©2008 Prentice Hall Business Publishing, Auditing 12/e, Arens/Beasley/Elder

6 - 13

Learning Objective 4

Learning Objective 1

Explain the objective of conducting an audit of financial statements and an audit of internal controls.

©2008 Prentice Hall Business Publishing, Auditing 12/e, Arens/Beasley/Elder

审计学-一种整合的方法

©2008 Prentice Hall Business Publishing, Auditing 12/e, Arens/Beasley/Elder

6 - 12

Learning Objective 4

6 - 15

Transaction Flow Example

Transactions

Cash disbursements

Payroll services and disbursements

Journals Cash

disbursements journal

Payroll journal

Ledgers, Trial Balance, and Financial

General ledger and subsidiary

records

General ledger trial balance

Acquisition of goods

and services

Acquisitions journal

Financial statements

©2008 Prentice Hall Business Publishing, Auditing 12/e, Arens/Beasley/Elder

6-6

Management’s Responsibilities

Management is responsible for the financial statements and for internal control.

The Sarbanes-Oxley Act increases management’s responsibility for the financial statements.

审计学:一种整合方法 阿伦斯 英文版 第12版 课后答案 Chapter 11 Solutions Manual

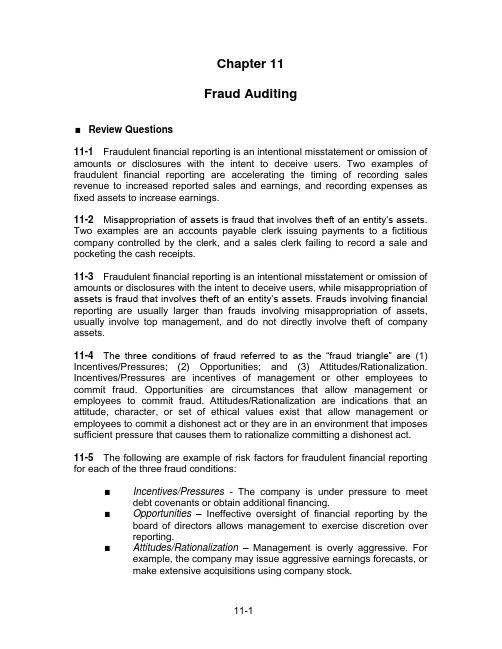

Chapter 11Fraud AuditingReview Questions11-1Fraudulent financial reporting is an intentional misstatement or omission of amounts or disclosures with the intent to deceive users. Two examples of fraudulent financial reporting are accelerating the timing of recording sales revenue to increased reported sales and earnings, and recording expenses as fixed assets to increase earnings.11-2Misappropriation of assets is fraud that involves theft of an entity’s assets. Two examples are an accounts payable clerk issuing payments to a fictitious company controlled by the clerk, and a sales clerk failing to record a sale and pocketing the cash receipts.11-3 Fraudulent financial reporting is an intentional misstatement or omission of amounts or disclosures with the intent to deceive users, while misappropriation of assets is fraud that involves theft of an entity’s assets. Frauds involving financial reporting are usually larger than frauds involving misappropriation of assets, usually involve top management, and do not directly involve theft of company assets.11-4 The three conditions of fraud referred to as the ―fraud triangle‖ are (1) Incentives/Pressures; (2) Opportunities; and (3) Attitudes/Rationalization. Incentives/Pressures are incentives of management or other employees to commit fraud. Opportunities are circumstances that allow management or employees to commit fraud. Attitudes/Rationalization are indications that an attitude, character, or set of ethical values exist that allow management or employees to commit a dishonest act or they are in an environment that imposes sufficient pressure that causes them to rationalize committing a dishonest act.11-5 The following are example of risk factors for fraudulent financial reporting for each of the three fraud conditions:Incentives/Pressures- The company is under pressure to meet debt covenants or obtain additional financing.Opportunities –Ineffective oversight of financial reporting by the board of directors allows management to exercise discretion overreporting.Attitudes/Rationalization –Management is overly aggressive. For example, the company may issue aggressive earnings forecasts, ormake extensive acquisitions using company stock.11-6 The following are example of risk factors for misappropriation of assets for each of the three fraud conditions:Incentives/Pressures- The individual is unable to meet personal financial obligations.Opportunities –There is insufficient segregation of duties that allows the individual to handle cash receipts and related accountingrecords.Attitudes/Rationalization –Management has disregarded the inadequate separation of duties that allows the potential theft ofcash receipts.11-7 Auditors use several sources to gather information about fraud risks, including:Information obtained from communications among audit team members about their knowledge of the company and its industry,including how and where the company might be susceptible tomaterial misstatements due to fraud.Responses to auditor inquiries of management about their views of the risks of fraud and about existing programs and controls toaddress specific identified fraud risks.Specific risk factors for fraudulent financial reporting and misappropriations of assets.Analytical procedures results obtained during planning that indicate possible implausible or unexpected analytical relationships.Knowledge obtained through other procedures such as client acceptance and retention decisions, interim review of financialstatements, and consideration of inherent or control risks.11-8 SAS 99 requires the audit team to conduct discussions to share insights from more experienced audit team members and to ―brainstorm‖ ideas that address the following:1. How and where they believe the entity’s financial statements mightbe susceptible to material misstatement due to fraud. This shouldinclude consideration of known external and internal factorsaffecting the entity that mightcreate an incentive or pressure for management to commit fraud.provide the opportunity for fraud to be perpetrated.indicate a culture or environment that enables management to rationalize fraudulent acts.2. How management could perpetrate and conceal fraudulent financialreporting.3. How assets of the entity could be misappropriated.4. How the auditor might respond to the susceptibility of materialmisstatements due to fraud.11-9 Auditors must inquire whether management has knowledge of any fraud or suspected fraud within the company. SAS 99 also requires auditors to inquire of the audit committee about its views of the risks of fraud and whether the audit committee has knowledge of any fraud or suspected fraud. If the entity has an internal audit function, the auditor should inquire about internal audit’s views of fraud risks and whether they have performed any procedures to identify or detect fraud during the year. SAS 99 further requires the auditor to make inquiries of others within the entity whose duties lie outside the normal financial reporting lines of responsibility about the existence or suspicion of fraud.11-10The corporate code of conduct establishes the ―tone at the top‖ of the importance of honesty and integrity and can also provide more specific guidance about permitted and prohibited behavior. Examples of items typically addressed in a code of conduct include expectations of general employee conduct, restrictions on conflicts of interest, and limitations on relationships with clients and suppliers.11-11 Management and the board of directors are responsible for setting the ―tone at the top‖ for ethical behavior in the company. It is important for management to behave with honesty and integrity because this reinforces the importance of these values to employees throughout the organization.11-12 Management has primary responsibility to design and implement antifraud programs and controls to prevent, deter, and detect fraud.The audit committee has primary responsibility to oversee the organization’s financial reporting and internal control processes and to p rovide oversight of management’s fraud risk assessment process and antifraud programs and controls.11-13The three auditor responses to fraud are: (1) change the overall conduct of the audit to respond to identified fraud risks; (2) design and perform audit procedures to address identified risks; and (3) perform procedures to address the risk of management override of controls.11-14Auditors are required to take three actions to address potential management override of controls: (1) examine journal entries and other adjustments for evidence of possible misstatements due to fraud; (2) review accounting estimates for biases; and (3) evaluate the business rationale for significant unusual transactions.11-15 Three main techniques use to manipulate revenue include: (1) recording of fictitious revenue; (2) premature revenue recognition including techniques such as bill-and-hold sales and channel stuffing; and (3) manipulation of adjustments to revenue such as sales returns and allowance and other contra accounts.11-16 Cash register receipts are particularly susceptible to theft. The notice ―your meal is free if we fail to give you a receipt‖ is designed to ensure that everycustomer is given a receipt and all sales are entered into the register, establish accountability for the sale.11-17 The three types of inquiry are informational, assessment, and interrogative. Auditors use informational inquiry to obtain information about facts and details that the auditor does not have.For example, if the auditor suspects financial statement fraud involving improper revenue recognition, the auditor may inquire of management as to revenue recognition policies. The auditor uses assessment inquiry to corroborate or contradict prior information. In the previous example, the auditor may attempt to corroborate the information obtained from management by making assessment inquiries of individuals in accounts receivable and shipping. Interrogative inquiry is used to determine if the interviewee is being deceptive or purposefully omitting disclosure of key knowledge of facts, events, or circumstances. For example, a senior member of the audit team might make interrogative inquiries of management or other personnel about key elements of the fraud where earlier responses were contradictory or evasive.11-18 When making inquiries of a deceitful individual, three examples of verbal cues are frequent rephrasing of the question, filler terms such as ―well‖ or ―to tell the truth,‖ and forgetfulness or acknowledgements of nervousne ss. Three examples of nonverbal cues by the individual are creating physical barriers by blocking their mouth, leaning away from the auditor, and signs of stress such as sweating or fidgeting.11-19When the auditor suspects that fraud may be present, SAS 99 requires the auditor to obtain additional evidence to determine whether material fraud has occurred. SAS 99 also requires the auditor to consider the implications for other aspects of the audit. When the auditor determines that fraud may be present, SAS 99 requires the auditor to discuss the matter and audit approach for further investigation with an appropriate level of management that is at least one level above those involved, and with senior management and the audit committee, even if the matter might be considered inconsequential. For public company auditors, the discovery of fraud of any magnitude by senior management is at least a significant deficiency and may be a material weakness in internal control over financial reporting. This includes fraud by senior management that results in even immaterial misstatements. If the public company auditor decides the fraud is a material weakness, the auditor’s report on internal control over financial reporting will contain an adverse opinion.■Multiple Choice Questions From CPA Examinations11-20 a. (3) b. (4) c. (1) d. (2)11-21 a. (1) b. (4)11-22 a. (1) b. (1) c. (1)■Discussion Questions and Problems11-2311-24a. Management fraud is often called fraudulent financial reporting, andis the intentional misstatement or omission of amounts ordisclosures by management with the intent to deceive users. Incontrast, defalcations, which are also called misappropriation ofassets, involve theft of an entity’s assets, and normally involveemployees and others below the management level.b. The auditor’s responsibility to detect management fraud is thesame as for other errors that affect the financial statement. Theauditor should design the audit to obtain reasonable assurance thatmaterial misstatements in the financial statements due to errors orfraud are detected.c. The auditor should evaluate the potential for management fraudusing the fraud triangle of incentives/pressures, opportunities, andattitudes/ rationalizations.Incentives/pressures –Auditors should evaluate incentives and pressures that management or other employees mayhave to misstate financial statements, including:1. Declines in the financial stability or profitability of thecompany due to economic, industry, or companyoperating conditions.2. Pressure to meet debt repayment or debt covenantterms.3. Net worth of managers or directors is materiallythreatened by financial performance.Opportunities –Circumstances provide an opportunity for management to misstate financial statements, such as:1. Financial statements include significant accountingestimates that are difficult to verify.2. Ineffective board of director or audit committeeoversight.3. High turnover in accounting personnel or ineffectiveaccounting, internal auditing, or IT staff.Attitudes/Rationalizations –An attitude, character, or set of values exist that allows management to rationalizecommitting a dishonest act.1. Inappropriate or ineffective communication of entityvalues.2. History of violations of securities laws or other lawsand regulations.3. Aggressive or unrealistic management goals orforecasts.d. There are potentially many factor s that should heighten an auditor’sconcern about the existence of management fraud. The factors (1) of an intended public placement of securities, and (2) management compensation dependent on operating results are both factors that affect incentives to manipulate financial statements. The auditor should be alert for other incentives, such as the existence of debt covenants or planned use of stock to acquire another company that may provide incentives to manipulate the financial statements.The third factor of deficient internal control reflects both an opportunity to misstatement financial statements, and an attitude that allows rationalization of actions to misstate the financial statements. As additional examples, the auditor should be alert to the potential to use accounting estimates or discretion over the timing of revenues to misstate financial statements. The auditor should also consider the attitude of management, and whether they are overly aggressive or have previously violated securities laws or other regulations.In addition to the risk factors from the fraud triangle, the auditor should consider other signals of the potential existence of management fraud. These signals may include unusual changes inratios or other performance measures, as well as inquiries ofmanagement and communication amount the audit team.11-25a.b. All of the deficiencies increase the likelihood of misappropriation of assets,by allowing individuals access to cash receipts or failing to maintain adequate records to establish accountability for cash receipts.c. The deficiencies have less of an effect on the likelihood of fraudulentfinancial reporting than they do for misappropriation of assets. The first four deficiencies increase the likelihood of fraudulent financial reporting forreported revenues due to the lack of adequate records to establish the number of patrons.11-261. a. Errorb. Internal verification of invoice preparation and posting by anindependent person.c. Test clerical accuracy of sales invoices.2. a. Fraud.b. The prelisting of cash receipts should be compared to thepostings in the accounts receivable master file and to thevalidated bank deposit slip.c. Trace cash received from prelisting to cash receipts journal.Confirm accounts receivable.3. a. Error.b. Use of prenumbered bills of lading that are periodicallyaccounted for.c. Trace a sequence of prenumbered bills of lading to recordedsales transactions. Confirm accounts receivable at year-end.4. a. Error.b. No merchandise may leave the plant without the preparationof a prenumbered bill of lading.c. Trace credit entries in the perpetual inventory records to billsof lading and the sales journal. Confirm accounts receivableat year-end.5. a. Error.b. Internal review and verification by an independent person.c. Test accuracy of invoice classification.6. a. Errorb. Online sales are supported by shipping documents andapproved online customer orders.c. Trace sales journal or listing entries to supporting documentsfor online sales, including sales invoices, shippingdocuments, sale orders, and customer orders.7. a. Errorb. Sales invoices are prenumbered, properly accounted for inthe sales journal, and a notation on the invoice is made ofentry into the sales journal.c. Account for numerical sequence of invoices recorded in thesales journal, watching for duplicates. Confirm accountsreceivable at year-end.8. a. Fraud.b. All payments from customers should be in the form of acheck payable to the company. Monthly statements shouldbe sent to all customers.c. Trace from recorded sales transactions to cash receipts forthose sales; confirm accounts receivable balances at year-end.11-27a. The lack of separation of duties was the major deficiency thatpermitted the fraud for Appliance Repair and Service Company.Gyders has responsibility for opening mail, prelisting cash, updatingaccounts receivable, and authorizing sales allowances and write-offs for uncollectible accounts. It is easy for Gyders to take the cashbefore it is prelisted and to charge off an accounts receivable as asales allowance or as a bad debt.b. The benefit of prelisting cash is to immediately document cashreceipts at the time that they are received by the company.Assuming all cash is included on the prelisting, it is then easy forsomeone to trace from the prelisting to the cash receipts journaland deposits. Furthermore, if a dispute arises with a customer, it iseasy to trace to the prelisting and determine when the cash wasactually received. The prelisting should be prepared by acompetent person who has no significant responsibilities foraccounting functions. The person should not be in a position towithhold the recording of sales, adjust accounts receivable or salesfor credits, or adjust accounts receivable for sales returns andallowances or bad debts.c. Subsequent to the prelisting of cash, it is desirable for anindependent person to trace from the prelisting to the bankstatement to verify that all amounts were deposited. This can bedone by anyone independent of whoever does the prelisting, orprepares or makes the deposit.d. A general rule that should be followed for depositing cash is that itshould be deposited as quickly as possible after it is received, andhandled by as few people as possible. It is, ideally, the personreceiving the cash that should prepare the prelisting and preparethe deposit immediately afterward. That person should then depositthe cash in the bank. Any unintentional errors in the preparation ofthe bank statement should be discovered by the bank. Theauthenticated duplicate deposit slip should be given to theaccounting department who would subsequently compare the totalto the prelisting. When an independent person prepares the bankreconciliation, there should also be a comparison of the prelisting tothe totals deposited in the bank.Any money taken before the prelisting should be uncovered by the accounting department when they send out monthlystatements to customers. Customers are likely to complain if theyare billed for sales for which they have already paid.11-28b. Deficiencies 1, 2, 4, 5, and 6 increase the likelihood of fraudinvolving misappropriation of assets. Fraud involvingmisappropriation of assets is relatively common for payroll,although the amounts are often not material. Fraudulent financialreporting involving payroll is less likely.11-29a. The auditor must conduct the audit to detect errors and fraud,including embezzlement, that are material to the financialstatements. It is more difficult to discover embezzlements thanmost types of errors, but the auditor still has significantresponsibility. In this situation, the deficiencies in internal controlare such that it should alert the auditor to the potential for fraud. Onthe other hand, the fraud may be immaterial and therefore not be ofmajor concern. The auditor of a public company must also considerthe impact of noted deficiencies when issuing the auditor’s reporton internal control over financial reporting. When noted deficienciesare considered to be material weaknesses, whether individually orcombined with other deficiencies, the auditor’s r eport must bemodified to reflect the presence of material weaknesses.b. The following deficiencies in internal control exist:1. The person who reconciles the bank account does notcompare payees on checks to the cash disbursementsjournal.2. The president signs blank checks, thus providing no controlover expenditures.3. No one checks invoices to determine that they are cancelledwhen paid.c. To uncover the fraud, the auditor could perform the following procedures:1. Comparison of payee on checks to cash disbursementsjournal.2. Follow up all outstanding checks that did not clear the bankduring the engagement until they clear the bank. Comparepayee to cash disbursements journal.11-30a.* Fraud involves intent. The circumstances suggest that there wasno intent on the part of Franklin to be deceptive. If the purpose ofomitting the footnote was to deceive the bank, then this casewould represent fraudulent financial reporting.11-311. a. There may be unrecorded cash disbursement transactions.b. Because the transactions relate to cash disbursements, thecash account will be affected. The accounts payableaccount may be misstated if the disbursement is thepayment on an account. If the disbursement is for the directpayment of an expense or is related to the purchase ofassets, then expense or asset accounts will be affected.Payments on other liability accounts would impact thoseliability accounts.c. Existing transactions are recorded (completeness).2. a. There may be fictitious accounts receivable accountsincluded in the master file.b. Accounts receivable and sales are likely to be affected byfictitious receivables.c. Amounts included exist (existence).3. a. Management may have manipulated key assumptionsso that pension expense and pension liability amounts wouldbe lower.b. Pension expense and pension liability accounts are likely tobe affected.c. Amounts included are stated at the correct values(Accuracy).4. a. The client may have shipped and recorded largeamounts of goods close to year end to third parties who mayhold the goods on consignment or who have full rights ofreturn. These shipments were made to record a fictitioussale and related receivable.b. Accounts receivable and sales and the related costs ofgoods sold and ending inventory would be affected by thisactivity.c. Recorded amounts existed (occurrence).5. a. Assets that were misappropriated may be concealedby recording purchase transactions using non-standard,fictitious vendor numbers.b. Accounts payable would be overstated and the related assetaccount would be increased by the unauthorized transaction.c. Recorded amounts existed (occurrence).6. a. Sales may be fictitiously recorded before any goodswere shipped.b. Sales and accounts receivable.c. Recorded amounts existed (occurrence).■Case11-32a. There are many fraud risk factors indicated in the dialogue. Among thefraud risk factors are the following:A significant portion of Mint’s compensation is represented bybonuses and stock options. Although this arrangement has beenapp roved by SCS’s Board of Directors, this may be a motivation forMint, the new CEO, to engage in fraudulent financial reporting.Mint’s statement to the stock analysts that SCS’s earnings would increase by 30% next year may be both an unduly aggressive andunrealistic forecast. That forecast may tempt Mint to intentionallymisstate certain ending balances this year that would increase theprofitability of the next year.SCS’s audit committee may not be sufficiently objective because Green, the chair of the audit committee, hired Mint, the new CEO,and they have been best friends for years.One individual, Mint, appears to dominate management without any compensating controls. Mint seems to be making all the importantdecisions without any apparent input from other members ofmanagement or resistance from the Board of Directors.There were frequent disputes between Brown, the prior CEO, who like Mint apparently dominated management and the Board ofDirectors, and Jones, the predecessor auditor. This fact mayindicate that an environment exists in which management will bereluctant to make any changes that Kent suggests.Management seems satisfied with an understaffed and ineffective internal audit department. This situation displays an inappropriateattitude regarding the internal control environment.Management has failed to properly monitor and correct a significant deficiency in its internal control—the lack of segregation of duties incash disbursements. This disregard for the control environment isalso a risk factor.Information about anticipated future layoffs has spread among the employees. This information may cause an increase in the risk ofmaterial misstatement arising from the misappropriation of assetsby dissatisfied employees.b. Kent has many misconceptions regarding the consideration of fraud in theaudit of SCS’s financial statements that are contained in the dialogue.Among Kent’s misconceptions are the following:Kent states that the auditor does not have specific duties regarding fraud. In fact, an auditor has a responsibility to specifically assessthe risk of material misstatement due to fraud and to consider thatassessment in designing the audit procedures to be performed.Kent is not concerned about Mint’s employment contract. Kent shou ld be concerned about a CEO’s contract that is based primarilyon bonuses and stock options because such an arrangement mayindicate a motivation for management to engage in fraudulentfinancial reporting.Kent does not think that Mint’s forecast for 2006 has an effect on the financial statement audit for 2005. However, Kent shouldconsider the possibility that Mint may intentionally misstate the2005 ending balances to increase the reported profit in 2006.Kent believes the audit programs are fine as is. Actually, Kent should modify the audit programs because of the many risk factorsthat are present in the SCS audit.Kent is not concerned that the internal audit department is ineffective and understaffed. In fact, Kent should be concerned thatSCS has permitted this situation to continue because it representsa risk factor relating to misstatements arising from fraudulentfinancial reporting and/or the misappropriation of assets.Kent states that an auditor provides no assurances about fraud because that is management’s job. In fact, an auditor has aresponsibility to plan and perform an audit to obtain reasonableassurance about whether the financial statements are free ofmaterial misstatement, whether caused by error or fraud.Kent is not concerned that t he prior year’s material weakness in internal control has not been corrected. However, Kent should beconcerned that the lack of segregation of duties in the cashdisbursements department represents a risk factor relating tomisstatements arising from the misappropriation of assets. If theclient was a publicly traded company, the presence of anuncorrected material weakness would significantly affect theauditor’s report on internal control over financial reporting.Kent does not believe the rumors about big layoffs in the next month have an effect on audit planning. In planning the audit, Kentshould consider this a risk factor because it may cause an increasein the risk of material misstatement arising from misappropriation ofassets by dissatisfied employees.c. SAS 99 requires that auditors document the following matters related tothe auditor’s consideration of material misstatements due to fraud:The discussion among engagement team personnel in planning the audit about the susceptibility of the enti ty’s financial statements tomaterial fraud.Procedures performed to obtain information necessary to identify and assess the risks of material fraud.Specific risks of material fraud that were identified, and a description of the auditor’s response to tho se risks.Reasons supporting a conclusion that there is not a significant risk of material improper revenue recognition.。

审计学:一种整合方法_第12版_英文版Chapter01-46页PPT资料

©2008 Prentice Hall Business Publishing, Auditing 12/e, Arens/Beasley/Elder

©2008 Prentice Hall Business Publishing, Auditing 12/e, Arens/Beasley/Elder

1-1

Learning Objective 1

Describe auditing.

©2008 Prentice Hall Business Publishing, Auditing 12/e, Arens/Beasley/Elder

1-2

Nature of Auditing

Auditing is the accumulation and evaluation of evidence about information to determine and report on the degree of correspondence between the information and established criteria.

1-7

Audit of a Tax Return Example

Competent, independent

person

Information

Federal tax returns filed by taxpayer

Internal Revenue

审计学-一种整合的方法-文档资料

6 - 16

Relationships Among Transaction Cycles

General cash

Capital acquisition and repayment cycle

Sales and collection

cycle

Acquisition and payment

cycle

Inventory and warehousing

©2008 Prentice Hall Business Publishing, Auditing 12/e, Arens/Beasley/Elder

6-5

Learning Objective 2

Distinguish management’s

responsibility for the financial

©2008 Prentice Hall Business Publishing, Auditing 12/e, Arens/Beasley/Elder

6 - 11

Auditor’s Responsibilities for Discovering Illegal Acts

➢ Evidence accumulation and other actions when there is reason to believe direct- or indirect-effect illegal acts may exist

➢ Actions when the auditor knows of an illegal act

©2008 Prentice Hall Business Publishing, Auditing 12/e, Arens/Beasley/Elder

审计学-一种整合方法

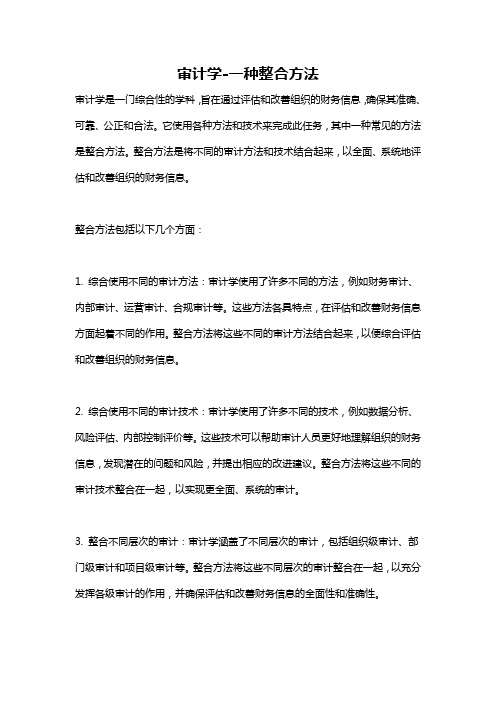

审计学-一种整合方法审计学是一门综合性的学科,旨在通过评估和改善组织的财务信息,确保其准确、可靠、公正和合法。

它使用各种方法和技术来完成此任务,其中一种常见的方法是整合方法。

整合方法是将不同的审计方法和技术结合起来,以全面、系统地评估和改善组织的财务信息。

整合方法包括以下几个方面:1. 综合使用不同的审计方法:审计学使用了许多不同的方法,例如财务审计、内部审计、运营审计、合规审计等。

这些方法各具特点,在评估和改善财务信息方面起着不同的作用。

整合方法将这些不同的审计方法结合起来,以便综合评估和改善组织的财务信息。

2. 综合使用不同的审计技术:审计学使用了许多不同的技术,例如数据分析、风险评估、内部控制评价等。

这些技术可以帮助审计人员更好地理解组织的财务信息,发现潜在的问题和风险,并提出相应的改进建议。

整合方法将这些不同的审计技术整合在一起,以实现更全面、系统的审计。

3. 整合不同层次的审计:审计学涵盖了不同层次的审计,包括组织级审计、部门级审计和项目级审计等。

整合方法将这些不同层次的审计整合在一起,以充分发挥各级审计的作用,并确保评估和改善财务信息的全面性和准确性。

4. 整合不同领域的知识:审计学需要综合运用经济学、会计学、法律学和管理学等多个领域的知识。

整合方法将这些不同领域的知识整合在一起,以提高审计人员的综合素质和能力,更好地完成审计任务。

整合方法在实践中具有重要的意义和应用价值。

首先,整合方法可以帮助审计人员更全面、系统地评估和改善组织的财务信息,发现潜在的问题和风险,并提出相应的改进建议。

其次,整合方法可以提高审计的效率和质量,避免重复的工作和信息孤岛现象,提高工作的一致性和准确性。

再次,整合方法能够发挥多学科和多层次的优势,提供更全面、客观和可靠的审计意见和结论,满足各方对财务信息的需求和期望。

然而,整合方法也面临一些挑战和难题。

首先,整合不同的方法、技术和知识需要审计人员具备较高的综合素质和能力,这对人才培养和选拔提出了更高的要求。

审计学-一种整合的方法

2008 Prentice Hall Business Publishing, Auditing 12/e, Arens/Beasley/Elder

8 - 15

Management and Governance

Management establishes the strategies and processes followed by the client's business. Governance includes the client's organizational structure, as well as the activities of the board of directors and the audit committee. Corporate charter and bylaws Code of ethics Meeting minutes

2008 Prentice Hall Business Publishing, Auditing 12/e, Arens/Beasley/Elder

8-5

Planning an Audit and Designing an Audit Approach

Set materiality and assess acceptable audit risk and inherent risk. Understand internal control and assess control risk. Gather information to assess fraud risks. Develop overall audit plan and audit program.

2008 Prentice Hall Business Publishing, Auditing 12/e, Arens/Beasley/Elder

审计学一种整合方法Chapter11

A history of violations of laws is known

Management has a practice of making overly aggressive or unrealistic forecasts

©2008 Prentice Hall Business Publishing, Auditing 12/e, Arens/Beasley/Elder

11 - 8

Examples of Risk Factors for Misappropriation of Assets

Incentives/Pressures: Personal financial obligations create pressure

©2008 Prentice Hall Business Publishing, Auditing 12/e, Arens/Beasley/Elder

11 - 19

Example Elements for a Code of Conduct

Organization records and communications Dealing with outside people and organizations Prompt communications Privacy and confidentiality

11 - 16

Corporate Governance Oversight to Reduce Fraud Risks

1. Culture of honesty and high ethics

2. Management's responsibility to evaluate risks of fraud

- 1、下载文档前请自行甄别文档内容的完整性,平台不提供额外的编辑、内容补充、找答案等附加服务。

- 2、"仅部分预览"的文档,不可在线预览部分如存在完整性等问题,可反馈申请退款(可完整预览的文档不适用该条件!)。

- 3、如文档侵犯您的权益,请联系客服反馈,我们会尽快为您处理(人工客服工作时间:9:00-18:30)。

©2008 Prentice Hall Business Publishing, Auditing 12/e, Arens/Beasley/Elder

11 - 3

Learning Objective 2

Describe the fraud triangle and identify conditions for fraud.

There is an inadequate internal control over assets

©2008 Prentice Hall Business Publishing, Auditing 12/e, Arens/Beasley/Elder

11 - 10

Examples of Risk Factors for Misappropriation of Assets

©2008 Prentice Hall Business Publishing, Auditing 12/e, Arens/Beasley/Elder

11 - 13

Sources of Information Gathered to Assess Fraud Risks

Communication among audit team Inquiries of management Risk factors Analytical procedures Other information

11 - 5

©2008 Prentice Hall Business Publishing, Auditing 12/e, Arens/Beasley/Elder

Examples of Risk Factors for Fraudulent Reporting

Incentives/Pressures: Financial stability or profitability is threatened by economic, industry, or entity operating conditions

Examples of Risk Factors for Fraudulent Reporting

Attitudes/Rationalization: Inappropriate or inefficient communication and support of the entity’s values is evident A history of violations of laws is known Management has a practice of making overly aggressive or unrealistic forecasts

Excessive pressure exists for management to meet debt requirements

Personal net worth is materially threatened

©2008 Prentice Hall Business Publishing, Auditing 12/e, Arens/Beasley/Elderisks Reasons

Other conditions

Results

Nature of communications

©2008 Prentice Hall Business Publishing, Auditing 12/e, Arens/Beasley/Elder 11 - 15

©2008 Prentice Hall Business Publishing, Auditing 12/e, Arens/Beasley/Elder

11 - 9

Examples of Risk Factors for Misappropriation of Assets

Opportunities: There is a presence of large amounts of cash on hand or inventory items

©2008 Prentice Hall Business Publishing, Auditing 12/e, Arens/Beasley/Elder

11 - 18

Example Elements for a Code of Conduct

Relationships with clients and suppliers Gifts, entertainment, and favors Kickbacks and secret commissions Organization funds and other assets

Attitudes/Rationalization: Disregard for the need to monitor or reduce risk of misappropriating assets exists There is a disregard for internal controls

©2008 Prentice Hall Business Publishing, Auditing 12/e, Arens/Beasley/Elder

11 - 4

The Fraud Triangle

Incentives/Pressures

Opportunities

Attitudes/Rationalization

©2008 Prentice Hall Business Publishing, Auditing 12/e, Arens/Beasley/Elder

11 - 8

Examples of Risk Factors for Misappropriation of Assets

Incentives/Pressures: Personal financial obligations create pressure to misappropriate assets Adverse relationships between management and employees motivate employees to misappropriate assets

High turnover or ineffective accounting internal audit, or information technology staff exists

©2008 Prentice Hall Business Publishing, Auditing 12/e, Arens/Beasley/Elder 11 - 7

©2008 Prentice Hall Business Publishing, Auditing 12/e, Arens/Beasley/Elder

11 - 11

Learning Objective 3

Understand the auditor’s responsibility for assessing the risk of fraud and detecting material misstatements due to fraud.

©2008 Prentice Hall Business Publishing, Auditing 12/e, Arens/Beasley/Elder

11 - 12

Assessing the Risk of Fraud

SAS 99 provides guidance to auditors in assessing the risk of fraud. SAS 1 states that, in exercising professional skepticism, an auditor “neither assumes that management is dishonest nor assumes unquestioned honesty.”

11 - 6

Examples of Risk Factors for Fraudulent Reporting

Opportunities: There are significant accounting estimates that are difficult to verify There is ineffective oversight over financial reporting

©2008 Prentice Hall Business Publishing, Auditing 12/e, Arens/Beasley/Elder

11 - 19

Example Elements for a Code of Conduct

Organization records and communications Dealing with outside people and organizations Prompt communications Privacy and confidentiality

Fraud Auditing

Chapter 11

©2008 Prentice Hall Business Publishing, Auditing 12/e, Arens/Beasley/Elder

11 - 1

Learning Objective 1

Define fraud and distinguish between fraudulent financial reporting and misappropriation of assets.

©2008 Prentice Hall Business Publishing, Auditing 12/e, Arens/Beasley/Elder

11 - 17

Example Elements for a Code of Conduct