金融英语习题

国际金融英语试题及答案

国际金融英语试题及答案1. 以下哪个选项不是国际货币基金组织(IMF)的主要职能?A. 提供技术援助B. 监督成员国的经济政策C. 促进国际贸易D. 提供紧急财政援助答案:C2. 世界银行的主要目标是什么?A. 促进全球贸易B. 减少全球贫困C. 维护国际货币稳定D. 促进全球金融市场发展答案:B3. 什么是外汇储备?A. 一个国家持有的外国货币和黄金B. 一个国家持有的国内货币和黄金C. 一个国家持有的外国货币和证券D. 一个国家持有的国内货币和证券答案:A4. 根据国际收支平衡表,以下哪项交易不属于经常账户?A. 商品出口B. 服务进口C. 外国直接投资D. 工人汇款回国答案:C5. 什么是货币贬值?A. 一个国家的货币价值相对于其他国家货币的减少B. 一个国家的货币价值相对于黄金的减少C. 一个国家的货币价值相对于商品和服务的减少D. 一个国家的货币价值相对于外国投资的减少答案:A6. 什么是浮动汇率制度?A. 货币价值由市场供求关系决定B. 货币价值由政府固定C. 货币价值由国际货币基金组织决定D. 货币价值由中央银行决定答案:A7. 什么是国际金融市场?A. 跨国公司进行商品和服务交易的市场B. 跨国公司进行货币和金融资产交易的市场C. 跨国公司进行商品和金融资产交易的市场D. 跨国公司进行服务和金融资产交易的市场答案:B8. 什么是国际货币体系?A. 国际货币的发行和流通体系B. 国际货币的监管和管理体系C. 国际货币的交换和结算体系D. 国际货币的发行、监管和管理体系答案:D9. 什么是外汇交易?A. 一种货币兑换成另一种货币的交易B. 一种商品兑换成另一种商品的交易C. 一种服务兑换成另一种服务的交易D. 一种资产兑换成另一种资产的交易答案:A10. 什么是国际金融危机?A. 一个国家内部的金融体系崩溃B. 一个国家内部的货币体系崩溃C. 多个国家金融体系的崩溃D. 多个国家货币体系的崩溃答案:C。

金融英语练习题(附答案)

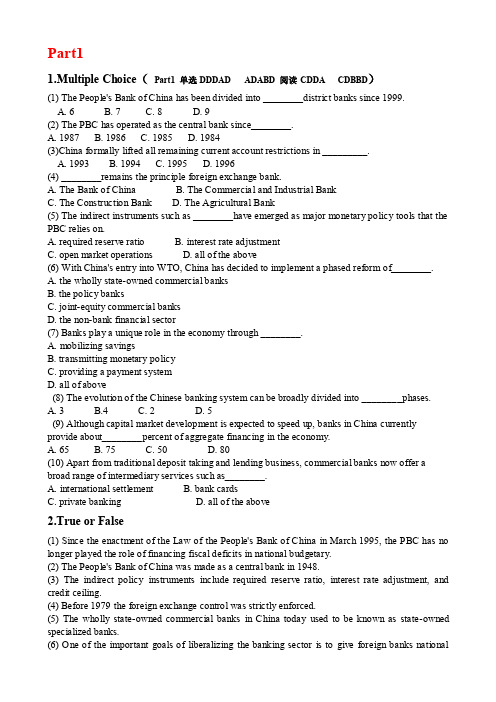

⾦融英语练习题(附答案)Multiple Choice1. The People’s Bank of China shall have the power to demand financial institutions to submit balance sheets, statements ofD and other financial and accounting reports and materials in pursuance of regulations.A. accountB. financial positionC. cash flowD. profit and loss2. A credit card such as Visa will D .A. gurantee chequesB. enable the holder to cash cheques at any bankC. enable the holder to buy goods on creditD. enable the holder to buy goods, up to certain amounts, on credit from certain persons3. Foreign trade can be conducted on the following terms except for DA. open accountB. documentary collectionC. documentary creditsD. public bonds4. Customers trading abroad in foreign currencies may protect against the exchange risk by arranging C .A. a contract of international sale of goodsB. a contract of marine insuranceC. a forward contract to fix the exchange rate in advance5. The danger to the exporter in open account trading is that by surrendering the shipping documents to the importer, heB before he has obtained payment for them.A. is in control of the goodsB. losses control of the goodsB. retain control of the goods D. gives up control of the goods6. Leasing is an arrangement whereby one party obtains on a long-term basis A which belongs to another party.A. the use of a capital assetB. the use of a current assetC. the use of working capitalD. the use of current liabilities7. From a Chinese bank’s point of view, the currency account which it maintains abroad is known as , while a RMB account operated in China for a foreign bank is termed B .A. a vostro account, a nostro accountB. a nostro account, a vostro accountC. a mirror account, a nostro accountD. a vostro account, a mirror account8. Find the interest on US $65,000 for 14 days at 3 percent per annum.B .A. US $37.91B. US $75.83C. US $113.74D. US $227.499. Which of the following can not be included in the functions ofmoney?D 。

金融英语期末试题及答案

金融英语期末试题及答案一、选择题1. What is the time value of money?A. The concept of money having different values at different times.B. The concept of money having the same value at all times.C. The concept of money having no value over time.D. The concept of money having a fixed value regardless of time.答案:A2. Which of the following is a type of risk in finance?A. Exchange rate riskB. Market riskC. Interest rate riskD. All of the above答案:D3. What is the purpose of diversification in investment?A. To concentrate investments in a single assetB. To reduce the overall risk of a portfolioC. To increase the potential return of a portfolioD. To eliminate all risk from a portfolio答案:B4. What is the function of a stock exchange?A. To regulate the trading of stocks and other securitiesB. To provide loans to individuals and businessesC. To monitor interest rates in the economyD. To facilitate international trade transactions答案:A5. What is the role of a financial analyst?A. To analyze economic trends and make investment recommendationsB. To issue and sell financial products to customersC. To manage the day-to-day operations of a financial institutionD. To set monetary policies for an economy答案:A二、填空题1. The process of buying and selling securities on the stock market is known as _________.答案:trading2. A document that outlines the terms and conditions of a loan is called a _________.答案:loan agreement3. The risk that an investment will lose value due to changes in the overall market is known as _________ risk.答案:market4. The interest rate at which banks lend money to each other overnight is called the _________ rate.答案:overnight5. The process by which a company raises capital by selling shares to the public is known as _________.答案:initial public offering (IPO)三、简答题1. Explain the difference between stocks and bonds.答案:Stocks represent ownership in a company and give investors the right to share in the company's profits and voting rights. Bonds, on the other hand, are debt securities issued by companies or governments to raise capital. Bondholders lend money to the issuer in exchange for periodic interest payments and the return of the principal amount at maturity.2. What factors can affect currency exchange rates?答案:Currency exchange rates can be influenced by factors such as interest rates, inflation, political stability, economic performance, and market speculation. Changes in these factors can cause the value of a currency to fluctuate relative to other currencies.3. What is the difference between a mutual fund and an exchange-traded fund (ETF)?答案:A mutual fund is a pooled investment vehicle that collects money from multiple investors to invest in a diversified portfolio of securities. Investors in mutual funds buy shares directly from the fund at the net asset value (NAV) price. An ETF, on the other hand, is a type of investment fund that is traded on a stock exchange like a common stock. ETFs can be bought and sold throughout the trading day at market prices, and their prices may deviate slightly from the underlying asset value.四、解释题1. Explain the concept of compound interest.答案:Compound interest is the interest that is earned on both the initial principal amount and any accumulated interest from previous periods. In other words, it is interest on interest. As interest is added to the principal, the total amount grows over time, and subsequently, the amount of interest earned in each period also increases. This compounding effect allows investments to grow at an accelerated rate compared to simple interest, where interest is only calculated on the initial principal.2. What is diversification in investment and why is it important?答案:Diversification refers to the practice of spreading investments across different assets, industries, or geographical regions to reduce risk. By diversifying a portfolio, an investor can decrease the impact of any single investment's performance on the overall portfolio. Different investments may have different risk levels and may react differently to economic or market conditions. Therefore, if one investment performs poorly, other investments in the portfolio may provide a buffer against potential losses. Diversification can help to achieve a more balanced risk-return profile and enhance the potential for long-term investment success.五、翻译题Translate the following sentence into English:中国货币政策的调整对全球金融市场有重要影响。

英文版国际金融试题和答案

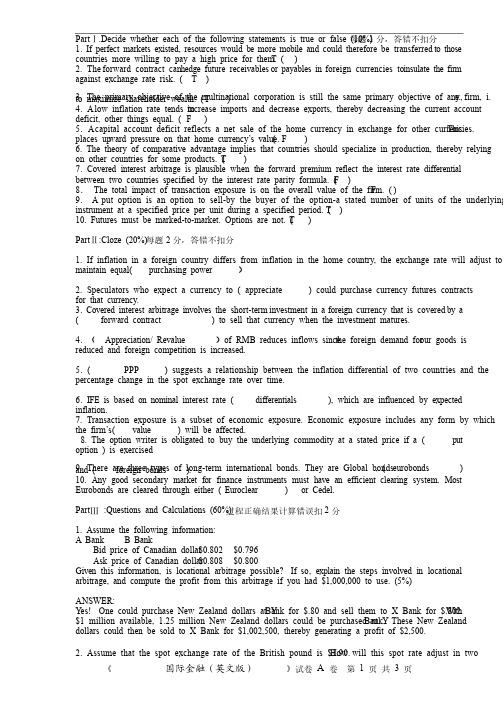

Part Ⅰ.Decide whether each of the following statements is true or false (10%)每题1分,答错不扣分分,答错不扣分1. 1. If If If perfect perfect perfect markets markets markets existed, existed, existed, resources resources resources would would would be be be more more more mobile mobile mobile and and and could could could therefore therefore therefore be transferred be transferred to to those those countries more willing to pay a high price for them. ( T ) 2. The forward contract can h edge hedge hedge future receivables future receivables or or payables payables payables in in in foreign currencies to foreign currencies to i nsulate insulate insulate the the the firm firm against exchange rate risk. ( T ) 3. The primary objective of the multinational corporation is still the same primary objective of any firm, i.e., to maximize shareholder wealth. ( T ) 4. A low inflation rate tends to increase imports and decrease exports, thereby decreasing the current account deficit, other things equal. ( F ) 5. A capital account deficit reflects a net sale of the home currency in exchange for other currencies. This places up ward pressure on that home currency’s value. ( F ) 6. The theory of comparative advantage implies that countries should specialize in production, thereby relying on other countries for some products. ( T ) 7. 7. Covered Covered Covered interest interest interest arbitrage arbitrage arbitrage is is is plausible plausible plausible when when when the the the forward forward forward premium premium premium reflect reflect reflect the the the interest interest interest rate rate rate differential differential between two countries specified by the interest rate parity formula. ( F ) 8. The total impact of transaction exposure is on the overall value of the firm. ( F ) 9. A put option is an option to sell-by the buyer of the option-a stated number of units of the underlying instrument at a specified price per unit during a specified period. ( T ) 10. Futures must be marked-to-market. Options are not. ( T ) Part Ⅱ:Cloze (20%)每题2分,答错不扣分分,答错不扣分1. If inflation in a foreign country differs from inflation in the home country, the exchange rate will adjust to maintain equal( purchasing power )2. Speculators who expect a currency to ( appreciate ) could purchase currency futures contracts for that currency. 3. 3. Covered Covered Covered interest interest interest arbitrage arbitrage arbitrage involves involves involves the short-term the short-term investment investment in in in a a a foreign foreign foreign currency currency currency that that that is covered is covered by by a a ( forward contract ) to sell that currency when the investment matures. 4. ( Appreciation/ Revalue )of RMB reduces inflows since the foreign demand for our goods is reduced and foreign competition is increased. 5. ( PPP ) suggests a relationship between the inflation differential of two countries and the percentage change in the spot exchange rate over time. 6. 6. IFE IFE IFE is is is based based based on on on nominal nominal nominal interest interest interest rate rate rate ( ( differentials ), ), which which which are are are influenced influenced influenced by by by expected expected inflation. 7. Transaction exposure is a subset of economic exposure. Economic exposure includes any form by which the firm’s ( ( value ) will be affected. 8. 8. The The The option option option writer writer writer is is is obligated obligated obligated to to to buy buy buy the the the underlying underlying underlying commodity commodity commodity at at at a a a stated stated stated price price price if if if a a a ( ( put option ) is exercised 9. There are three types of long-term international bonds. They are Global bonds , ( eurobonds ) and ( foreign bonds ). 10. 10. Any Any Any good good good secondary secondary secondary market market market for for for finance finance finance instruments instruments instruments must must must have have have an an an efficient efficient efficient clearing clearing clearing system. system. system. Most Most Eurobonds are cleared through either ( Euroclear ) or Cedel. Part Ⅲ :Questions and Calculations (60%)过程正确结果计算错误扣2分1. Assume the following information: A Bank B Bank Bid price of Canadian dollar $0.802 $0.796 Ask price of Canadian dollar $0.808 $0.800 Given Given this this this information, information, information, is is is locational locational locational arbitrage arbitrage arbitrage possible? possible? If If so, so, so, explain explain explain the the the steps steps steps involved involved involved in in in locational locational arbitrage, and compute the profit from this arbitrage if you had $1,000,000 to use. (5%) ANSWER: Y es! One could purchase New Zealand dollars at Y Bank for $.80 and sell them to X Bank for $.802. With $1 million available, 1.25 million New Zealand dollars could be purchased at Y Bank. These New Zealand dollars could then be sold to X Bank for $1,002,500, thereby generating a profit of $2,500. 2. Assume that the spot exchange rate of the British pound is $1.90. How will this spot rate adjust in two years if if the the the United United United Kingdom Kingdom Kingdom experiences experiences experiences an an an inflation inflation inflation rate rate rate of of of 7 7 7 percent percent percent per per per year year year while while while the the the United United United States States experiences an inflation rate of 2 percent per year?(10%) ANSWER: According to PPP , forward rate/spot=indexdom/indexfor the exchange rate of the pound will depreciate by 4.7 percent. Therefore, the spot rate would adjust to $1.90 × [1 + (–.047)] = $1.8107 3. 3. Assume Assume Assume that that that the spot the spot exchange exchange rate rate rate of the of the Singapore Singapore dollar dollar dollar is is is $0.70. $0.70. The The one-year one-year one-year interest interest interest rate rate rate is is is 11 11 percent in the United States and 7 percent in Singapore. What will the spot rate be in one year according to the IFE? (5%) (5%) ANSWER: according to the IFE,St+1/St=(1+Rh)/(1+Rf) $.70 × (1 + .04) = $0.728 4. Assume that XYZ Co. has net receivables of 100,000 Singapore dollars in 90 days. The spot rate of the S$ is $0.50, and the Singapore interest rate is 2% over 90 days. Suggest how the U.S. firm could implement a money market hedge. Be precise . (10%) ANSWER: The firm could borrow the amount of Singapore dollars so that the 100,000 Singapore dollars to be be received received received could could could be be be used used used to to to pay pay pay off off off the the the loan. loan. This This amounts amounts amounts to to to (100,000/1.02) (100,000/1.02) (100,000/1.02) = = = about about about S$98,039, which S$98,039, which could could be be be converted converted converted to to to about about about $49,020 $49,020 $49,020 and and and invested. invested. The The borrowing borrowing borrowing of of of Singapore Singapore Singapore dollars dollars dollars has has has offset offset offset the the transaction exposure due to the future receivables in Singapore dollars. 5. 5. A A U.S. company ordered ordered a a a Jaguar Jaguar Jaguar sedan. In sedan. In 6 6 months , months , it will pay pay ££30,000 30,000 for for for the the the car. car. car. It It worried worried that that pound ster1ing might rise sharply from the current rate($1.90). So, the company bought a 6 month pound call (supposed contract size = £35,000) with a strike price of $1.90 for a premium of 2.3 cents/£. (1)Is hedging in the options market better if the £ rose to $1.92 in 6 months? (2)what did the exchange rate have to be for the company to break even?(15%)Solution: (1)If the £ rose to $1.92 in 6 months, the U.S. company would rose to $1.92 in 6 months, the U.S. company would exercise the pound call option. The sum of the strike price and premium is $1.90 + $0.023 = $1.9230/£This is bigger than $1.92. So hedging in the options market is not better. (2) when we say the company can break even, we mean that hedging or not hedging doesn’t matter. And only when (strike price + premium )= the exchange rate , hedging or not doesn’t matter. So, the exchange rate =$1.923/£. 6. Discuss the advantages and disadvantages of fixed exchange rate system.(15%) textbook page50 答案以教材第50 页为准页为准P AR T Ⅳ: Diagram(10%) The strike price for a call is $1.67/£. The premium quoted at the Exchange is $0.0222 per British pound. Diagram the profit and loss potential, and the break-even price for this call option Solution: Following diagram shows the profit and loss potential, and the break-even price of this put option: P AR T Ⅴ:Additional Question Suppose Suppose that that that you you you are are are expecting expecting expecting revenues revenues revenues of of of Y Y 100,000 100,000 from from from Japan Japan Japan in in in one one one month. month. Currently, Currently, 1 1 1 month month forward contracts are trading at $1 = $105 Y en. Y ou have the following estimate of the Y en/$ exchange rate in one month. Price Probability 90 Y en/$ 4% 95 Y en/$ 25% 100 Y/$ 45% 105 Y en/$ 20% 110 Y en/$ 6% a) What position in forward contracts would you take to hedge your exchange risk? b) Calculate the expected value of the hedge. c) How could you replicate this hedge in the money market? Y ou are expecting revenues of Y100,000 in one month that you will need to covert to dollars. Y ou could hedge this in forward markets by taking long positions in US dollars (short positions in Japanese Y en). By locking in your price at $1 = Y105, your dollar revenues are guaranteed to be Y100,000/ 105 = $952 On the other hand, you can wait and use the spot markets. Exchange Rate Probability Revenue w/Hedge Revenue w/out Hedge V alue of Hedge 90 Y/$ 4% $1,111 $952 -$159 95 Y/$ 25% $1,052 $952 -$100 100 Y/$ 45% $1,000 $952 -$48 105 Y/$ 20% $952 $952 $0 110 Y/$ 6% $909 $952 $43 Expected V alue = (.02)(-159) + (.25)(-100) + (.45)(-48) + (.20)(0) + (.08)(43) = -$24 Y ou could replicate this hedge by using the following: a) Borrow in Japan b) Convert the Y en to dollars c) Invest the dollars in the US d) Pay back the loan when you receive the Y100,000 。

金融英语试题及答案

金融英语试题及答案一、选择题(每题2分,共20分)1. Which of the following is not a type of financial instrument?A. StockB. BondC. DerivativeD. Commodity2. The term "leverage" in finance refers to:A. The use of borrowed funds to increase the potential return of an investment.B. The amount of money invested in a project.C. The process of buying and selling securities.D. The risk associated with a particular investment.3. What does the acronym "IPO" stand for?A. International Public OfferingB. Initial Public OfferingC. Internal Private OfferingD. International Private Offering4. The primary market is where:A. Securities are issued for the first time to the public.B. Securities are traded after they have been issued.C. Companies buy back their own securities.D. Investors sell their securities to other investors.5. A bear market is characterized by:A. A prolonged period of falling prices.B. A period of economic growth.C. A period of high inflation.D. A period of low unemployment.6. The term "risk management" in finance involves:A. Predicting future market trends.B. Identifying potential risks and taking steps tomitigate them.C. Maximizing returns on investments.D. Managing the day-to-day operations of a financial institution.7. A "blue chip" stock refers to:A. A stock that is considered to be of high quality and carries a lower risk.B. A stock that is traded on a blue-colored chip.C. A stock that is considered to be very risky.D. A stock that is traded on a major stock exchange.8. The process of "short selling" involves:A. Borrowing securities and selling them in the hope of buying them back at a lower price.B. Selling securities that the investor does not own.C. Buying securities with the expectation that their price will increase.D. Holding securities for a long period of time.9. What is the role of a "broker" in finance?A. To provide financial advice to clients.B. To facilitate the buying and selling of securities between investors.C. To manage a company's financial transactions.D. To underwrite securities for companies.10. The "efficient market hypothesis" suggests that:A. Stock prices fully reflect all available information.B. It is possible to consistently beat the market by picking individual stocks.C. Investors are irrational and make poor decisions.D. The market is always undervalued.二、填空题(每题1分,共10分)11. The _______ is the process by which a company raisescapital by issuing shares to the public for the first time. 12. A _______ is a financial contract that obligates thebuyer to purchase an asset or the seller to sell an asset ata predetermined future date and price.13. The _______ is the market where existing securities are bought and sold.14. The _______ is a measure of the risk of an investment compared to the return it is expected to generate.15. When the stock market is experiencing a significant and sustained increase in prices, it is known as a _______ market.16. A _______ is a financial institution that acceptsdeposits and provides various types of loans to customers. 17. The _______ is a measure of the ability of a company to pay its current debts with its current assets.18. A _______ is a financial statement that shows a company's financial performance over a period of time.19. The _______ is a type of investment strategy that focuseson long-term growth potential.20. An _______ is a financial instrument that derives its value from an underlying asset.三、简答题(每题5分,共30分)21. Explain the difference between a "mutual fund" and a "hedge fund".22. Describe the concept of "diversification" in investment.23. What is "inflation" and how does it affect the value of money?24. Discuss the role of "central banks" in the economy.四、论述题(每题20分,共20分)25. Discuss the impact of globalization on the financial markets and provide examples to support your argument.五、案例分析题(每题20分,共20分)26. Analyze a recent financial crisis and discuss the factors that contributed to it, the impact it had on the global economy, and the lessons that can be learned from it.答案:一、选择题1-5 D A B A A6-10 B A A B A二、填空题11. Initial Public Offering (IPO)。

金融英语part6 exercise

Part6 1. Multiple Choice(1) Which is not the category of the risk-based five-category loan classification system?A. PassB. Special mentionC. SubstandardD. Bad debts(2) In _____, exporter's bank provides loans to the importer or to an importer's bank.A. buyer creditB. supplier creditC. forfeitingD. BOT approach(3) _______is an indicator of leverage ratios.A. Net income/net account receivableB. Net sales/net account receivableC. Quick assets/current liabilitiesD. Total liabilities/capital funds(4) In real estate loan, maximum amount of which is _______of the property. bank.A. 50%B. 60%C. 70%D. 80%(5) A typical forfaiting transaction involves five parties. They are__________.A. exporter, importer, forfaiter, investor, and importer's bankB. exporter, importer, forfaiter, investor, and exporter's bankC. exporter, importer, forfaiter, investor, and any bankD. exporter, importer, forfaiter, investor, and forfaiter's bank(6) ___________is a kind of short-term loan to meet temporary need and is supposed to pay back at one time.A. Credit cardB. Consumer creditC. Amortization loansD. Non-installment loan(7) In amortization loans, the borrower can pay back __________.A. at one timeB. interest at one timeC. principal at one timeD. at several times(8) _______is also called bridge loan.A. Credit cardB. Amortization loanC. Non-installment loanD. Short-term loan(9) BOT is an abbreviated form of_____________.A. build-or-technologyB. build-operate-transferC. build-operate-technologyD. benefit-operate-transfer(10) The first principle of budgetary control is to __________.A. record the actual performanceB. compare the actual performance with that plannedC. establish a plan or target of performance which coordinates all the activities of the businessD. act immediately, if necessary, to remedy the situation(11) Commercial banks require diversified assets for adequate___________.A. liquidityB. profitC. securityD. others(12) Department of Credit must consider budgetary target, net revenue and ___________.A. riskB. liquidityC. costD. others(13) When average loans is 100, net credit losses is 4.2 then, the credit loss ratio is_______.A. 4.2%B. 95.8%C. 0D. 2.1%(14) In credit mix, tenor refers to ___________.A. term of loanB. term structure of loanC. term structure of assetD. term of asset(15) If net sales is 1,000, cost of goods sold is 600, the gross profit is __________.A. 1,600B. 400C. 1,000D. 600(16) If working capital is 500, net sales is 600, how much is working capital turnover?A. 5/6B. 1.2C. 1,100D. 100(17) The 'five P' doesn't refer to ___________.A. peopleB. purposeC. paymentD. project(18) When current assets is 400, current liabilities is 300, how much of working capital?A. 700B. 1,200C. 0.75D. 100(19) __________refers to a 'second way out' in case the primary repayment source fails.A. The people factorB. The payment factorC. The protection factorD. The perspective factor(20) The most conservative leverage ratio shows the most debt and _________ net worth.A. mostB. leastC. bestD. fewest(21) If obligor's risk weight is 30%, its risk class is __________.A. AB. BC. 3AD. 2A(22) Securities subject to mortgage are excluding_________.A. title deedsB. life policiesC. contract of property insuranceD. stocks(23) In a case of an ordinary lien, ________is the owner of the property.A. bankB. borrowerC. lenderD. the other(24) The risk weight for substandard assets is ___________.A. 10%B. 20%C. 50%D. 100%2. True or False(1) Forfeiting provides a source of non-recourse finance through use of drafts, promissory notes or other instruments representing sums due to the exporter.A. trueB. false(2) Forfaiting banks require the institution to have aval by an internationally recognized bank for the purpose of reducing the risk. A. true B. false(3) Seller credit is that exporter's bank lends the money to a domestic exporter who then gives the importer the convenience of deferred payment. A. true B. false(4) Buyer credit is that exporter's bank directly lends the money to an importer or the importer's bank and the importer will pay for the goods with the loan.A. trueB. false(5) In supplier credit, exporter's bank provides loans to the importer directly. A. true B. false(6) The borrower's ability to borrow automatically reduces its need to hold liquid assets.A. trueB. false(7) The most common currency in Forfeiting is US dollar. A. true B. false(8) Common equity is an important part of Tier 1 capital. A. true B. false(9) When risk weight is zero, the risk-adjusted asset is zero. A. true B. false(10) Risk weight of treasure bill is 100%. A. true B. false(11) Fees revenue constitutes the main part of revenue of the bank. A. true B. false(12) The operating target of commercial banks is profit. A. true B. false(13) The 'five P' model dissects the information and focuses on profit. A. true B. false(14) Ratio analysis concentrates on the future rather than on the past. A. true B. false(15) Credit portfolio management entails that all credits judged to be uncollectable. A. true B. false3. Cloze1) fixed asset investment short-term loans mediumworking capital maturity long-term loansBy___1___, loans can be divided into two broad categories. Those with maturity of one year or less are called____2_____ while those with maturity exceeding one year are called___3___ or__________4____. Short-term loans are often used to satisfy_______5______ needs whereas long-term loans are often used to finance_______6_________. Loans can also be categorized according to the nature of contractual arrangement as well as intended use.2) Protection internal repayment capitalizationexternal collateral source guarantorhypothecated collateral cash flowA properly structured loan includes____1___ ----a "second way out" in case the primary_2____ source fails. Protection can be___3___ where the lender looks exclusively to the buyer, and ___4__where a third party adds its credit responsibility to the borrower. Internal protection relies on___5___, liquid (account receivable and inventory quality and composition), and fixed asset values. Internal protection can be either specific____6___ or future ____7____if the primary source of repayment is asset conversion. External protection most commonly takes the form of guarantees, endorsement, or repurchase agreements,___8__ , etc. However, loan based solely on the credit responsibility of the____9___ is normally a high-risk loan at the outset, because there is only one ___10__ of repayment.3) repay compare liabilities management assetsRatio analysis is used to____1______ certain factors, which may affect a company's ability to_____2____debt or otherwise satisfy its creditors. It provides the analyst with the tools to measure the quality and worth of____3_____, as well as the extent and nature of_____4_____. Ratios help measure the ability of a firm's_______5_______: Does the company earn a fair return? Can it withstand downturns? Does it have financial flexibility as measured by its ability to attract additional credit or investors?4. Translation1) Overdraft is an agreed line of credit operating directly through the current account.(2) Export Credit is government (government export credit agencies) guarantee lending channeled through a commercial bank to support export.(3) Forfaiting provides a source of non-recourse finance through use of drafts, promissory notes or other instruments representing sums due to the exporter.(4) Consumer Credits are high risk and high interest credit products, which are usually classified into three sorts: amortization loan, credit card and non-installment 1oan for purchasing cars or non-structure houses or investing a little amount and so on.(5) A syndicated loan is a large credit, generally more than USDl0 million, negotiated between a borrower and a single bank, but actually funded by several other banks.(6) Derivatively syndicated loans take two forms - loan sale and asset securitization.(7) All assets of commercial banks are classified into various risk assets by risk class of assets, and each c1ass of assets is assigned a risk weight.(8) The central bank requires commercial banks to keep adequate legal reserves and excess reserves.(9) In the management of their portfolio, commercial banks emphasize the importance of asset and earning diversification, the immediate recognition as losses of all credits judged to be uncollectable, and the maintenance of appropriate credit loss allowance.(10) The operating target of commercial banks is profit. The revenue of credit constitutes the main part of revenue of the banks.(11) Under the risk-based capital guideline, qualifying total capital consists of two types of capital components-Tier 1 and Tier 2. Tier 1 capital includes common stockholders' equity, qualifying perpetual preferred stock (subject to limitations) and minority interest in consolidated subsidiaries less goodwill and certain other deduction. Tier 2 capital includes preferred -stock not to be included in Tier 1 capital and subject to limitations, the allowance for credit losses, qualifying senior and subordinated debt, and limited-life preferred stock less certain deductions.(12) Ratio analysis concentrates on the past rather than on the future. A company's future performance may or may not be an extrapolation of past trends. However, we can learn from past performance about deteriorating trends, volatility, and often about management's control over these factors.(13) The IRR is an important test for assessing the quality of a project in financial and economic terms and is widely used by decision makers to determine whether a project is financially and economically viable. Whi1e the financial IRR measures whether a project is likely to be profitable enough to cover the average cost of capital of lenders and sponsors, the economic IRR indicates whether the project is efficiently using the country's resource, i. e. whether its economic IRR is higher than the opportunity cost of capital.5. Reading ComprehensionPassage OneA syndicated loan is arranged by either a bank or a securities house. The arranger then lines up the syndicate. Each bank in the syndicate provides the funds for which it has committed. The banks in the syndicate have the right to subsequently sell their parts of the loan to other banks. Characteristics of Bank Loans to Corporations Senior bank loans have a priority position over subordinated lenders(bond-holders) with respect to repayment of interest and principal. The interest rate on a syndicated bank loan is a rate that floats, which means that the loan rates based on some reference rate. The loan rate is periodically reset at the reference rate plus a spread. The reference rate is typically LIBOR, although it could be the prime rate (i.e., the rate that a bank charges its most credit worthy customers) or the rate on certificates of deposits. The term of the loan is fined. A syndicated loan is typically structured so that it is amortized according to a predetermined schedule, and repayment of principal begins after a specified number of years (typically not longer than five or six years). However, loans in which no repayment of the principal is made until the maturity date can be arranged. Such loans are referred to as bullet loans. Distribution of Loans Senior loans are distributed by two methods---assignments and participations. Each method has its advantages and relative disadvantages, though the assignment method is the more desirable of the two. When the holder of a loan is interested in selling his portion, he can do so by passing his interest in the loan by method of assignment. In this procedure, the seller transfers all his rights completely to the holder of the assignment, now called the assignee. The assignee is said to have privity of contract(合同关系不涉及第三方原则)with the borrower. Because of the clear path between the borrower and assignee, the assignment is the more desirable choice of transfer and ownership. A participation involves a holder of a loan 'participating out' a portion of his holding in that particular loan. The holder of the participation does not become a party to the loan agreement. His relationship is not with the borrower but with the seller of the participation. Unlike an assignment, a participation does not confer privity of contract on the holder of the participation. However, theholder of the participation has the right to vote on certain legal matters concerning amendments to the loan agreement.(1) A syndicated loan is arranged by ________.A. the central bankB. a securities houseC. a team of banksD. the government(2) The interest rate on a syndicated bank loan is a ________rate.A. fixedB. floatC. lower than LIBORD. unknown(3) Distribution of Loans Senior loans are distributed by two methods-assignments and participations. Each method has its advantages and relative disadvantages, though ________is the more desirable of the two.A. the assignment methodB. the participations methodC. sometimes, the assignment methodD. sometimes, the participations method(4) The reference rate for loans is________. A. SIBOR B. HIBOR C. LIBOR D. Prime(5) LIBOR is ________. A. fixed B. fine C. high D. flexible Passage TwoWHAT IS A MORTGAGE? By definition, a mortgage is a pledge of property to secure payment of a debt. Typically, property refers to real estate, which is often in the form of a house; the debt is the loan given to the buyer of the houses by a lender. Thus, a mortgage might be a pledge of a house to secure payment of a loan. If a homeowner (the mortgagor) fails to pay the lender the mortgage, the lender has the right to foreclose the loan and seize the property in order to ensure that it is repaid. When the lender makes the loan based on the credit of the borrower and on the collateral for the mortgage, the mortgage is said to be a conventional mortgage. The lender may require the borrower to obtain mortgage insurance to insure against default by the borrower. The types of real estate properties that can be mortgaged are divided into two broad categories: residential and nonresidential properties. The former category includes houses, condominiums, cooperatives, and apartments. Residential real estate can be subdivided into single-family (one-to-four family) residences and multifamily residences (apartment buildings in which more than four families reside). Nonresidential property includes commercial and farm properties.(1) Which doesn't belong to residential properties?________.A. HousesB. CondominiumsC. CooperativesD. Farm(2) If a homeowner (the mortgagor) fails to pay the lender the mortgage, the lender hasn't the right to______.A. foreclose the loanB. seize the propertyC. seize the furniture in the houseD. require the mortgagor repay the mortgage(3) A mortgage might be a pledge to secure payment of a loan except for________.A. houseB. foodC. farmD. apartment(4) The types of real estate properties that can be mortgaged are divided into________.A. 1B. 2C. 3D. 4(5) Property is________.A. real estateB. idle estateC. houseD. machine。

(完整word版)国际金融题库(英文版).doc

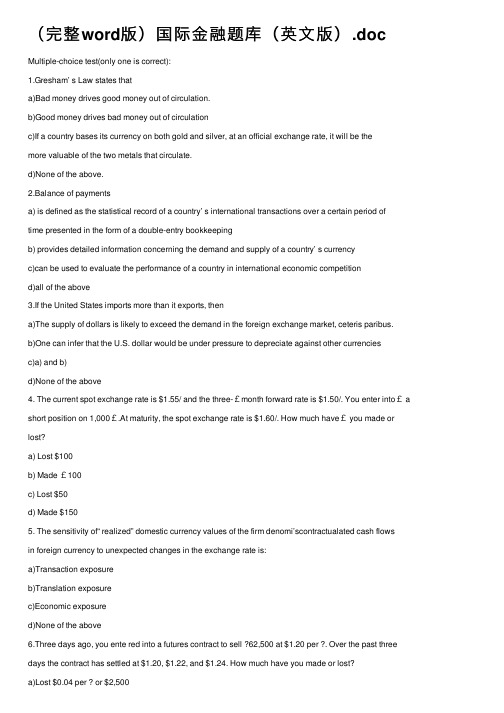

(完整word版)国际⾦融题库(英⽂版).doc Multiple-choice test(only one is correct):1.Gresham’ s Law states thata)Bad money drives good money out of circulation.b)Good money drives bad money out of circulationc)If a country bases its currency on both gold and silver, at an official exchange rate, it will be themore valuable of the two metals that circulate.d)None of the above.2.Balance of paymentsa) is defined as the statistical record of a country’ s international transactions over a certain period oftime presented in the form of a double-entry bookkeepingb) provides detailed information concerning the demand and supply of a country’ s currencyc)can be used to evaluate the performance of a country in international economic competitiond)all of the above3.If the United States imports more than it exports, thena)The supply of dollars is likely to exceed the demand in the foreign exchange market, ceteris paribus.b)One can infer that the U.S. dollar would be under pressure to depreciate against other currenciesc)a) and b)d)None of the above4. The current spot exchange rate is $1.55/ and the three-£month forward rate is $1.50/. You enter into£ a short position on 1,000£.At maturity, the spot exchange rate is $1.60/. How much have£ you made or lost?a) Lost $100b) Made £100c) Lost $50d) Made $1505. The sensitivity of“ realized” domestic currency values of the firm denomi’scontractualated cash flowsin foreign currency to unexpected changes in the exchange rate is:a)Transaction exposureb)Translation exposurec)Economic exposured)None of the above6.Three days ago, you ente red into a futures contract to sell ?62,500 at $1.20 per ?. Over the past three days the contract has settled at $1.20, $1.22, and $1.24. How much have you made or lost?a)Lost $0.04 per ? or $2,500b)Made $0.04 per ? or $2,500c)Lost $0.06 per ? or $3,750d)None of the above7.A swap banka)Can act as a broker, bringing together counterparties to a swapb)Can act as a dealer, standing ready to buy and sell swapsc)Both a) and b)d)Only sometimes a) but never ever b)8.Suppose that the one-year interest rate is 5.0 percent in the United States, the spot exchange rate is$1.20/?, and the one -year forward exchange rate is $1.16/?. What must one -year interest rate be in the euro zone?a) 5.0%b) 1.09%c) 8.62%d) None of the above.a b$1.89 =1£.00. If you were to buy $10,000,000 worth of British pounds and then sell them five minutes later, how much of your $10,000,000 would be“ eaten-ask”spread?bythe bida)$1,000,000b)$52,910.05c)$100,000d)$52,631.5810.Under the gold standard, international imbalances of payment will be corrected automatically underthea)Gresham Exchange Rate regimeb)European Monetary Systemc)Price-specie-flow mechanismd)Bretton Woods Accord11.With any hedgea)Your losses on one side should about equal your gains on the other sideb)You should try to make money on both sides of the transaction: that way you make money comingand goingc)You should spend at least as much time working the hedge as working the underlying deal itselfd)You should agree to anything your banker puts in front of your face12. Comparing“ forward” and“ futures” exchange contracts, we can say that:a)They are both“ marked-to-market” daily.b)Their major difference is in the way the underlying asset is priced for future purchase or sale:futures settle daily and forwards settle at maturity.c) A futures contract is negotiated by open outcry between floor brokers or traders and is traded on organized exchanges, while forward contract is tailor-made by an international bank for its clients and is traded OTC.d)b) and c)13.An “ option ” isa) a contract giving the seller (writer) the right, but not the obligation, to buy or sell a given quantityof an asset at a specified price at some time in the futureb) a contract giving the owner (buyer) the right, but not the obligation, to buy or sell a given quantity of an asset at a specified price at some time in the futurec)not a derivative, nor a contingent claim, securityd)unlike a futures or forward contract14.Economic exposure refers toa)the sensitivity of realized domestic currency values of the firm ’contractuals cash flows denominated in foreign currencies to unexpected exchange rate changesb)the extent to which the value of the firm would be affected by unanticipated changes in exchange ratec) the potential that the firm ’consolidated financial statement can be affected by changes in exchange ratesd)ex post and ex ante currency exposures15.Under a purely flexible exchange rate systema)Supply and demand set the exchange ratesb)Governments can set the exchange rate by buying or selling reservesc)Governments can set exchange rates with fiscal policyb) and c) are correct.。

《金融专业英语》习题集

Chapter One Functions of Financial Markets一.Translate the following specialized terms into Chinese1.China’s banking industry is now supervised by the PBC and CBRC. In addition, the MOFis in charge of financial accounting and taxation part of banking regulation and management.1。

中国银行业现在由央行与银监会监管。

此外,财政部是在财务会计和银行监管和管理税务部主管。

2.Currently Chinese fund management companies are engaged in the following business:securities investment fund, entrusted asset management, investment consultancy, management of national social security funds, enterprise pension funds and QDII businesses.2。

目前中国基金管理公司从事以下业务:证券投资基金,委托资产管理,投资咨询,全国社会保障基金的管理,企业年金基金及QDII业务。

3.China's economy had 10% growth rate in the years before the world financial crisisof 2008. That economic expansion resulted from big trade surpluses and full investment.Now China is seeking to move away from that growth model. The country is working to balance exports with demand at home.3。

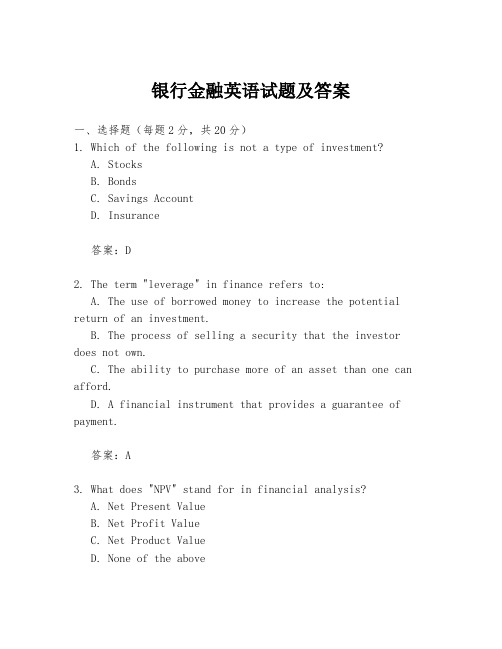

银行金融英语试题及答案

银行金融英语试题及答案一、选择题(每题2分,共20分)1. Which of the following is not a type of investment?A. StocksB. BondsC. Savings AccountD. Insurance答案:D2. The term "leverage" in finance refers to:A. The use of borrowed money to increase the potential return of an investment.B. The process of selling a security that the investor does not own.C. The ability to purchase more of an asset than one can afford.D. A financial instrument that provides a guarantee of payment.答案:A3. What does "NPV" stand for in financial analysis?A. Net Present ValueB. Net Profit ValueC. Net Product ValueD. None of the above答案:A4. A "bear market" is characterized by:A. A long period of falling prices.B. A period of economic growth.C. A market where only bears are traded.D. A market with high volatility.答案:A5. The process of evaluating a company's financial health is known as:A. Financial AnalysisB. Market AnalysisC. Risk AnalysisD. Portfolio Management答案:A6. Which of the following is a measure of a company's profitability?A. EBITDAB. ROIC. P/E RatioD. All of the above答案:D7. In banking, "LIBOR" stands for:A. London Interbank Borrowed RateB. London International Banking OrganizationC. London International Business OrganizationD. London Interbank Business Rate答案:A8. A "derivative" in finance is:A. A product that derives its value from the value of another underlying asset.B. A type of savings account.C. A type of insurance policy.D. A type of investment fund.答案:A9. What is the primary function of a central bank?A. To manage the country's monetary policy.B. To provide financial advice to individuals.C. To offer personal loans to consumers.D. To manage the country's foreign exchange reserves.答案:A10. The term "forex" refers to:A. Foreign exchange market.B. Forward exchange rate.C. Financial exchange rate.D. Future exchange rate.答案:A二、填空题(每题1分,共10分)11. The current account balance is a record of a country's transactions with the rest of the world, excluding ______.答案:capital flows12. A ______ is a financial contract that obligates the buyer to purchase an asset or the seller to sell an asset, such as a physical commodity or a financial instrument, at a predetermined future date and price.答案:futures contract13. The ______ ratio is used to measure how efficiently a company is using its assets to generate profit.答案:asset turnover14. An increase in interest rates will generally lead to a______ in bond prices.答案:decrease15. The term "short selling" refers to the practice ofselling securities that the seller does not own, with the hope of buying them back later at a ______ price.答案:lower16. The ______ is the difference between the total assets and the total liabilities of a company.答案:equity17. A ______ is a type of investment account that allows individual investors to pool their money with other investors to invest in a portfolio of stocks, bonds, or other securities.答案:mutual fund18. The ______ is the process of determining the value of a business or financial security.答案:valuation19. A ______ is a financial statement that shows the changes in a company's financial position over a specified period of time.答案:cash flow statement20. The ______ is the rate at which banks lend money to each other overnight.答案:federal funds rate三、简答题(每题5分,共30分)21. Explain the difference between a "fixed deposit" and a "demand deposit" in a bank.答案:A fixed deposit is a type of savings account where money is deposited for a fixed term at a predetermined interest rate. The depositor cannot withdraw the money before the end of the term without incurring a penalty. A demand deposit, on the other hand, is a type of bank account that allows the depositor to withdraw funds at any time without penalty. It typically earns a lower interest rate compared to a fixed deposit.22. What is a "call option" and how does it differ from a "put。

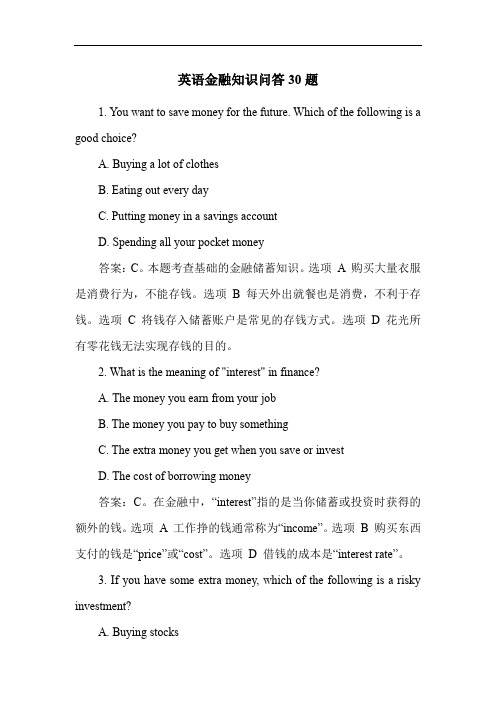

英语金融知识问答30题

英语金融知识问答30题1. You want to save money for the future. Which of the following is a good choice?A. Buying a lot of clothesB. Eating out every dayC. Putting money in a savings accountD. Spending all your pocket money答案:C。

本题考查基础的金融储蓄知识。

选项A 购买大量衣服是消费行为,不能存钱。

选项B 每天外出就餐也是消费,不利于存钱。

选项 C 将钱存入储蓄账户是常见的存钱方式。

选项 D 花光所有零花钱无法实现存钱的目的。

2. What is the meaning of "interest" in finance?A. The money you earn from your jobB. The money you pay to buy somethingC. The extra money you get when you save or investD. The cost of borrowing money答案:C。

在金融中,“interest”指的是当你储蓄或投资时获得的额外的钱。

选项A 工作挣的钱通常称为“income”。

选项B 购买东西支付的钱是“price”或“cost”。

选项D 借钱的成本是“interest rate”。

3. If you have some extra money, which of the following is a risky investment?A. Buying stocksB. Buying a houseC. Putting money in a fixed depositD. Keeping money at home答案:A。

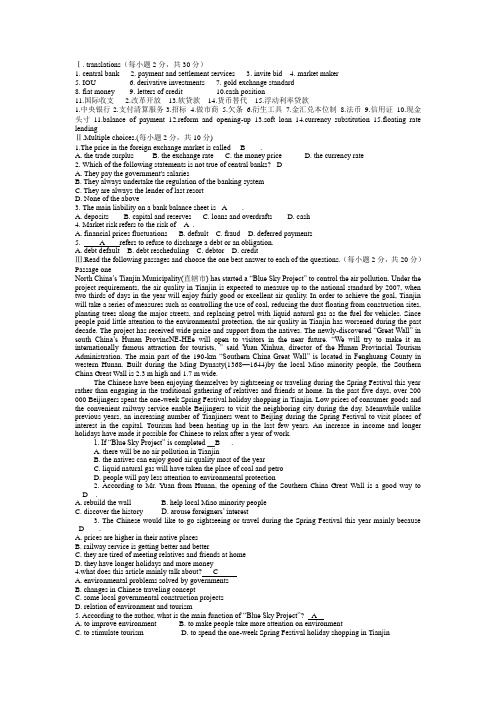

金融英语习题

1. Usually the low interest rate currency trades at a ______ to the high interest rate currency in the forward market.A. premiumB. parC. discountD. bar2. Which of the following statements about standby letters of credit is true?______.A. They can serve as a guarantee to a buyer against a seller defaultingB. They are contrary to the general rule that letters of credit may only be used for the actual movement of goodsC. They are unlike a tender bond in their legal standing and method of operationD. They are unlike a tender bond with its fixed expiry date3. The most liquid of all assets is ______.A. the stock of commercial banksB. M 1C. intelligenceD. the debt of major corporations4. Beta and standard deviation differ as risk measures in that beta measures ______.A. only unsystematic risk,while standard deviation measures total riskB. only systematic risk,while standard deviation measures total riskC. both systematic and unsystematic risk,while standard deviation measures only unsystematic riskD. both systematic and unsystematic risk,while standard deviation measures only systematic risk5. What information would you find in a statement of cash flows that you would not be able to get from the other two primary financial statements?______.A. Cash provided by or used in financing activitiesB. Cash balance at the end of the periodC. Total liabilities due to creditors at the end of the periodD. Net income6. An analyst estimates that a stock has the following probabilities of return depending on the state of the economy:State of economyProbabilityReturn Good 0.1 15% Normal 0.6 13% Poor 0.3 7%The expected return of the stock is ______.A. 7.8%B. 11.4%C. 11.7%D. 13.0%7. According to the rules of debit and credit for balance sheet accounts ______.A. increases in asset,liability,and owner’s equity accounts are recorded by debitsB. decreases in asset and liability accounts are recorded by creditsC. increases in asset and owner’s equity accounts are recorded by debitsD. decreases in liability and owner’s equity accounts are recorded by debits8. Individuals will accept the medium of exchange in return for goods and services only if they are confident that ______.A. the inflation rate is zeroB. it possesses intrinsic valueC. they can pass it on to othersD. they can exchange it for gold9. When a country’s currency appreciates,the country’s goods abroad become ______ and foreign goods in that country become ______.A. cheaper... more expensiveB. more expensive... cheaperC. cheaper...cheaperD. more expensive... more expensive10. A US company is bidding for a contract in China. Its Chinese customer asks for aperformance bond. What is the most likely course of action?______.A. It asks its bank to issue a tender bond which can be converted into a performance bondB. It gives up its bidC. It consults its bank about issuing a standby letter of creditD. It asks its bank to issue a performance bond11. ABC Co. Ltd. has a $3 500 account receivable from XYZ Store. On March 20,XYZ makes a partial payment of $2 100 to ABC. The journal entry made on Mdrch20 by ABC to record this transaction includes ______.A. a debit to the cash received account of $2 100B. a credit to the Accounts Receivable account of $2 100C. a debit to the Cash account of $1 400D. a debit to the Accounts Receivable account of $1 40012. Intervention in the foreign exchange market means the government ______.A. restricts individuals from buying and selling foreign exchangeB. restricts the importation of certain goodsC. or central bank buys or sells foreign exchangeD. devalues the currency in the foreign-exchange market13. Which of the following is not a form of countertrade?______.A. CounterpurchaseB. Buy-backC. OffsetD. Balance trade14. A credit to a revenue account ______.A. decreases revenuesB. increases equityC. decreases equityD. increases assets15. If the government guaranteed that anyone wishing a job would be provided one,the likely result would be ______.A. massive layoffsB. an increase in the money supplyC. an increase in inflationary expectationsD. the development of a barter system17. Economists assume that most people take risks ______.A. because doing so is excitingB. only when they have no riskless alternativeC. very infrequentlyD. if they are compensated for taking the risks18. The Phillips Curve shows the relationship between ______.A. aggregate demand and aggregate supplyB. interest rates and inflationC. recessions and boomsD. inflation and the unemployment rate19. In a fixed exchange rate system,speculative selling of a currency is based on anticipation of .A. appreciationB. devaluationC. a foreign trade surplusD. interest rate increase20. A collecting bank is employed by ______.A. the principalB. the remitting bankC. the drawerD. the drawee,who is its customer1. What are the expected returns for Stocks X and Y respectively?______.A. 20% and 10%B. 18% and 12%C. 20% and 11%D. 18% and 5%2. Which of the following payment terms eliminates the exchange risk,assuming the exporter invoices in foreign currency?______.A. Confirmed irrevocable documentary creditB. Open accountC. Documentary collection D/AD. None of the above3. ABC Co. Ltd. purchased a car for $ 12 000,making a down payment of $5 000 cash and signing a $7 000 note payable due in 60 days. Which of the following is not correct?______.A. From the viewpoint of a short-term creditor,this transaction makes the business less solventB. Total liabilities increased by $7 000C. Total assets increased by $12 000D. This transaction had no immediate effect on the owner‘s equity in the business4. Which of the following terms of payment will entirely eliminate country risk?______.A. Revocable documentary creditsB. Confirmed Irrevocable documentary creditsC. Documentary collection D/PD. Documentary collection D/A5. The expiry date of a documentary credit is Sunday,24 February,and documents have to be A presented to you. Which of the following is an acceptable presentation?______.A. Presentation to you on Monday 25 February with the bill of lading dated 25 FebruaryB. Presentation on Monday 25 February with the bill of lading dated Sunday 24 FebruaryC. Presentation on Tuesday 26 February with the bill of lading dated Sunday 24 FebruaryD. Presentation on Friday 22 February with the bill of lading dated Sunday 29 January6. What are the standard deviations of returns on Stocks X and Y respectively?______.A. 15% and 26%B. 24% and 13%C. 20% and 4%D. 28% and 8%7. Who makes the first presentation of documents under a transferable credit?______.A. ApplicantB. First beneficiaryC. Second beneficiaryD. None of the above8. A transaction caused a $10 000 decrease in both total assets and total liabilities. This transaction could have been ______.A. repayment of a $ 10 000 bank loanB. an asset with a cost of $10000 was destroyed by fireC. purchase of a delivery truck for $10 000 cashD. collection of a $10 000 account receivable9. Money ceases to serve as an effective store of value when ______.A. the government runs large deficitsB. the unemployment rate is very highC. productivity in the economy declinesD. rapid inflation occurs10. An indication that the money supply is greater than the desirable amount would be .A. insufficient spending and excessive savingB. deflationC. inadequate spending and rising unemploymentD. rising wages and prices1. Which of the following is not a function of money?______.A. To act as a medium of exchangeB. To act as a unit of accountC. To act as a store of valueD. To provide a double coincidence of wantsE. To act as a means of payment2. The price in the foreign exchange market is called ______.A. the trade surplusB. the exchange rateC. the money priceD. the currency rate3. Market risk refers to the risk of______.A. financial prices fluctuationsB. defaultC. fraudD. deferred payments4. Which of the following is not among the generally accepted accounting principles?______.A. Cash basis B . Prudence C. ConsistencyD. Going concernE. Money measurement.5. What is a documentary letter of credit?______.A. A conditional bank undertaking to pay an exporter on production of stipulated documentationB. A method of lending against documentary securityC. An international trade settlement system biased in favour of importersD. All of the above6. Holding a group of assets reduces risk as long as the assets ______.A. are perfectly correlatedB. are completely independentC. do not have precisely the same pattern of returnsD. have a correlation coefficient greater than one7. An amount,payable in money goods,or service,owed by a business to a creditor,is known as a/an .A. liabilityB. debtC. equityD. asset8. What function is money serving when you buy a ticket to a movie?______.A. store of valueB. a medium of exchangeC. transaction demandD. a unit of account9. If foreigners expect that the future price of sterling will be lower,the ______.A. supply of sterling will increase,demand for sterling will fall,and the exchangerate will fallB. supply of sterling will increase,demand for sterling will rise,and the exchange rate may or may not increaseC. supply of sterling will fall,demand for sterling will increase,and the exchange rate will riseD. supply of sterling will fall,demand for sterling will fall,and the exchange rate may or may not fall10. The documentary collection provides the seller with a greater degree of protection than shipping on ______.A. open accountB. bank‘s letter of guaranteeC. banker‘s draftD. documentary credit11. Which of the following statements is not true of central banks?______.A. They pay the government‘s salariesB. They always undertake the regulation of the banking systemC. They are always the lender of last resortD. None of the above12. When GBP/USD rate goes from 1.6150 to 1.8500,we say the dollar ______.A. appreciates by 12.70%B. depreciates by 14.55%C. depreciates by 12.70%D. appreciates by 14.55%13. According to diversification principle in investment,suppose you invest Stock X and Stock Y with equal funds,which of the following is not true?______.A. If X and Y are totally independent with each other,the risk of the portfolio is reducedB. If X and Y are perfectly negatively correlated,the risk of the portfolio is perfectly offsetC. If X and Y are perfectly positively correlated,the risk of the portfolio is neither reduced nor increasedD. If X and Y are perfectly negatively correlated,the risk of the portfolio is neither reduced nor increased15. The main liability on a bank balance sheet is ______.A. depositsB. capital and reservesC. loans and overdraftsD. cash16. ______ shows that net income for a specified period of time and how it was calculated.A. The income statementB. The capital statementC. The accounting statementD. The statement of financial condition17. Why must the liabilities and assets of a bank be actively managed?______.A. Because assets and liabilities are not evenly matched on the same time scaleB. Because assets and liabilities are evenly matchedC. Because the interbank market uses LIBORD. Because assets and liabilities can be underwritten18. If the expected returns of two risky assets have a perfect negative correlation,then risk .A. is increasedB. falls to zeroC. is unaffectedD. is reduced by one-half19. A possible disadvantage of freely fluctuating exchange rates with no official intervention is that .A. some nations would experience continual deficitsB. the exchange rates may experience wide and frequent fluctuationsC. nations would no longer be able to undertake domestic policies designed to achieve and maintain full employmentD. nations would need a larger supply of international reserves than otherwise20. What are your GBP/USD position and the average rate if you sell 4m at 1.6350 buy 5m at 1.6340 and sell $5m at 1.6348?A. Short 2 058 478.10 long $3 370 000 at 1.6371B. Long 5 941 521.90 short $9710 000 at 1.6342C. Short 5 941 521.90 long $9 710 000 at 1.6342D. Long 4 058 478.10 short $6 630 000 at 1.6336答案:1.D2.B3.A4.A5.A6.C7.A8.B9.A 10.A11.B 12.B 13.D 14.B 15.A 16.A 17.A 18.B 19.B 20.DII. True or False Questions26. As a general rule,the shorter the maturity of an asset and the more readily it can be sold,the more liquid is the asset.27. Investors in the capital markets are not subject to any tax on their investments.28. CMO is a security backed by a pool of pass-through rates,structured so that there are several classes of bondholders with varying maturities,called tranches. 29. The purpose of the letter of credit is to facilitate trade,typically international trade by substituting the known credit worthiness of a bank for the buyer,which may be unknown or unacceptable to the seller.30. According to the Phillips Curve,the economy cannot be at full employment and stable prices at the same time.31. When total reserves are equal to required reserves,the banking system cannot extend loans anymore.32. A bill of lading that covers the shipment of goods on two separate vessels is known as thorough bill of lading.33. Usually the more liquid asset is less risky.34. Where the bill of exchange is not accompanied by documents,these having been sent to the importer,the transaction is known as a clean collection.35. The velocity of money is the speed with which it can be converted into a liquid asset.36. Primitive securities yield returns that depend on additional factors pertaining to the prices of other assets,while a derivative security offers returns based only on the status of the issuer.37. A car loan offered by a bank is a derivative security.38. Options give buyers the obligation to buy or sell an asset at a present price over a specific period.39. Futures contracts usually end in the delivery of the underlying commodity.40. The forward exchange rate is the current spot rate adjusted for the interest rate differentials.41. Dirty price is the bond price excluding accrued interest,i.e.,the price paid by the bond buyer.42. Every transaction must produce a debit and credit entry of the same financial amount.43. There are three parties to a life policy in addition to the issuing company:the insurer,the life assured and the beneficiary.44. A guarantee is an agreement that may be evidenced in writing or in oral form.45. An insurable interest is assumed where people take life assurance on their own lives or where the relationship is that of husband and wife.46. Profit does not equal cash and some profitable businesses have failed for want of cash.47. Bills are negotiated with recourse to customers in the event of nonpayment.48. A firm‘s gearing is the level of fixed assets as a percenta ge of total assets.49. A bank must obtain a judgment if it wishes to pursue its legal remedies against a debtor.50. When a country borrows from abroad,its balance of international payments shows an outflow of foreign exchange.1. Under which one of the following circumstances would it be wise for your customer to arrange a forward foreign exchange contract?______.A. Import of goods priced in a foreign currencyB. Import of goods priced in RMBC. Export of goods priced in RMBD. Export of goods priced in a foreign currency where the rate of exchange has been agreed in the sales contract2. Incoterms address ______.A. the risks of loss between the partiesB. breaches of contractC. ownership rightsD. type of ship used3. Which of the following is or was an example of representative full-bodied money?______.A. Debt moneyB. ATS accountC. Gold certificateD. Demand deposit4. Risks associated with investing in foreign countries are the following except ______.A. voting riskB. exchange rate riskC. country riskD. political risk5. An exporter sells goods to a customer abroad on FOB and on CIF term. Who is responsible for the freight charges in each?______.A. Exporter; ExporterB. Exporter; ImporterC. Importer; ImporterD. Importer; Exporter6. Default risk refers to the possibility that a borrower may ______.A. be unable to repay the principal on his loanB. be unable to make the interest payments on his loanC. go bankruptD. all of the above7. What is the reserve requirement?______.A. The requirement of a bank to deposit a percentage of moneyB. The requirement for deposits in cashC. The percentage of a bank‘s deposits in the form of cash reservesD. The requirement for cash reserves8. A draft is like a check that can be endorsed but it isn‘t a title to goods,like ______.A. a bill of ladingB. an inspection certificateC. a certificate of originD. an insurance certificate9. Arbitrage ______.A. is a general economic term for buying something where it is cheap and selling it where it is dearB. keeps exchange rates consistent across marketsC. has been outlawed by the International Monetary FundD. cannot occur where there is a forward exchange marketE. both A and B10. What is the purpose of comparing the ledger entries with the documents?______.A. To prove that all the transactions have made for the right amountsB. To prove that all the accounts have been posted correctlyC. To check the number of all the debits and creditsD. To post the right accountsFECT-Exercises-2(1)1. Usually the low interest rate currency trades at a ______ to the high interest rate currency in the forward market.A. premiumB. parC. discountD. bar2. Which of the following statements about standby letters of credit is true? ______.A. They can serve as a guarantee to a buyer against a seller defaultingB. They are contrary to the general rule that letters of credit may only be used for the actual movement of goodsC. They are unlike a tender (or other) bond in their legal standing and method of operationD. They are unlike a tender bond with its fixed expiry date3. The most liquid of all assets is ______.A. the stock of commercial banksB. M 1C. intelligenceD. the debt of major corporations4. Beta and standard deviation differ as risk measures in that beta measures ______.A. only unsystematic risk, while standard deviation measures total riskB. only systematic risk, while standard deviation measures total riskC. both systematic and unsystematic risk, while standard deviation measures only unsystematic riskD. both systematic and unsystematic risk, while standard deviation measures only systematic risk5. What information would you find in a statement of cash flows that you would not be able to get from the other two primary financial statements? ______.A. Cash provided by or used in financing activitiesB. Cash balance at the end of the periodC. Total liabilities due to creditors at the end of the periodD. Net income6. An analyst estimates that a stock has the following probabilities of return dependingA. 7.8%B. 11.4%C. 11.7%D. 13.0%7. According to the rules of debit and credit for balance sheet accounts ______.A. increases in asset, liability, and owner's equity accounts are recorded by debitsB. decreases in asset and liability accounts are recorded by creditsC. increases in asset and owner's equity accounts are recorded by debitsD. decreases in liability and owner's equity accounts are recorded by debits 2658. Individuals will accept the medium of exchange in return for goods and services only if they are confident that ______.A. the inflation rate is zeroB. it possesses intrinsic valueC. they can pass it on to othersD. they can exchange it for gold9. When a country's currency appreciates, the country's goods abroad become ______ and foreign goods in that country become ______.A. cheaper... more expensiveB. more expensive... cheaperC. cheaper...cheaperD. more expensive... more expensive10. A US company is bidding for a contract in China. Its Chinese customer asks for a performance bond. What is the most likely course of action? ______.A. It asks its bank to issue a tender bond which can be converted into a performance bondB. It gives up its bidC. It consults its bank about issuing a standby letter of creditD. It asks its bank to issue a performance bond11. ABC Co. Ltd. has a $3 500 account receivable from XYZ Store. On March 20, XYZ makes a partial payment of $2 100 to ABC. The journal entry made on Mdrch20 by ABC to record this transaction includes ______.A. a debit to the cash received account of $2 100B. a credit to the Accounts Receivable account of $2 100C. a debit to the Cash account of $1 400D. a debit to the Accounts Receivable account of $1 40012. Intervention in the foreign exchange market means the government ______.A. restricts individuals from buying and selling foreign exchangeB. restricts the importation of certain goodsC. or central bank buys or sells foreign exchangeD. devalues the currency in the foreign-exchange market13. Which of the following is not a form of countertrade? ______.A. CounterpurchaseB. Buy-backC. OffsetD. Balance trade14. A credit to a revenue account ______.A. decreases revenuesB. increases equityC. decreases equityD. increases assets15. If the government guaranteed that anyone wishing a job would be provided one, the likely result would be ______.A. massive layoffsB. an increase in the money supplyC. an increase in inflationary expectationsD. the development of a barter system16. Given $100 000 to invest, what is the expected risk premium in dollars of investing in equities versus risk-free T-bills(U.S. Treasury bills) based on the17. Economists assume that most people take risks ______.A. because doing so is excitingB. only when they have no riskless alternativeC. very infrequentlyD. if they are compensated for taking the risks18. The Phillips Curve shows the relationship between ______.A. aggregate demand and aggregate supplyB. interest rates and inflationC. recessions and boomsD. inflation and the unemployment rate19. In a fixed exchange rate system, speculative selling of a currency is based on anticipation of .A. appreciationB. devaluationC. a foreign trade surplusD. interest rate increase20. A collecting bank is employed by ______.A. the principalB. the remitting bankC. the drawerD. the drawee, who is its customer21. The following statements describing net income are all correct except that ______.A. net income is computed in the income statement, appears in the statement of owner's equity, and increases owner's equity in the balance sheetB. net income is equal to revenues minus expensesC. net income is computed in the income statement, appears in the statement of owner's equity, and increases the amount of cash shown in the balance sheetD. net income can be determined using the account balances appearing in an adjusted trial balance22. A strong dollar encourages ______.A. travel to the United States by foreignersB. purchase of American goods by foreignersC. Americans to travel abroadD. Americans to save dollars23. In what circumstances would the beneficiary of a confirmed documentary credit not receive payment? ______.A. Failure of the applicantB. Failure of the issuing bankC. Failure to fulfil the credit termsD. Failure to fulfil the commercial contract24. The balance in the owner's capital account of ABC Co. Ltd. at the beginning of the year was $65 000. During the year, the company earned revenue of $430 000 and incurred expenses of $360 000, the owner withdrew $50 000 in assets, and the balance of the Cash account increased by $10 000. At year-end, the company's net income and the year-end balance in the owner's capital account were, respectively .A. $20 000 and $95 000B. $70 000 and $95 000C. $70 000 and $85 000D. $60 000 and $75 00025. Assume the inflation rate is expected to be 5 percent and the unemployment rate is 8 percent. If workers wish to get a 2 percent real wage increase, they should bargain for a money wage increase of______.A. 3 percentB. 5 percentC. 7 percentD. 13 percent26. Which statement about portfolio diversification is correct? .A. Proper diversification can reduce or eliminate systematic riskB. As more securities are added to a portfolio, total risk typically would be expected to fall at a decreasing rateC. The risk-reducing benefits of diversification do not occur meaningfully until at least 30 individual securities are included in the portfolioD. Diversification reduces the portfolio's expected return because it reduces a portfolio's total risk27. Your customer is the applicant for a documentary credit. Which of the following points would appear to be illogical if they appeared on the application form? ______.A. Invoice price shown as FOB, bills of lading to be marked freight paidB. Last date for shipment one week before expiry dateC. Invoice price shown as C&F, but no insurance document requestedD. No mention of the latest date of shipment28. Portfolio theory as described by Markowitz is most concerned with ______.A. the effect of diversification on portfolio riskB. B. the elimination of systematic riskC. active portfolio management to enhance returnD. the identification of unsystematic risk29. Commercial bank deposits with the central bank are part of the bank's ______.A. net worthB. demand depositsC. loan portfolioD. reserves30. Foreign trade can be conducted on the following terms except for ______.A. open accountB. documentary collectionC. documentary creditsD. public bonds31。

金融英语考试试题及答案

金融英语考试试题及答案金融英语是金融领域中不可或缺的一部分,对于从事金融行业的人士来说,掌握金融英语的知识非常重要。

为了帮助大家更好地备考金融英语考试,本文将为大家提供一些常见的金融英语考试试题及答案。

一、选择题1. What is the meaning of IPO?a) Initial Public Offeringb) International Purchase Orderc) Investment Portfolio Optimizationd) International Partnership Organization答案:a) Initial Public Offering2. What does the term "capital market" refer to?a) The market for physical capitalb) The market for financial assets with a maturity of less than a yearc) The market for financial assets with a maturity of more than a yeard) The market for real estate properties答案:c) The market for financial assets with a maturity of more than a year3. Which of the following is an example of a derivative?a) Stockb) Bondc) Optiond) Certificate of Deposit答案:c) Option4. What is the opposite of a deficit?a) Surplusb) Debtc) Liabilityd) Equity答案:a) Surplus5. What is the term for a loan that is secured by collateral?a) Unsecured loanb) Subordinated loanc) Secured loand) Revolving loan答案:c) Secured loan二、填空题1. The study of how individuals and institutions make financial decisions and how these decisions affect the allocation of resources is known as__________.答案:finance2. When a company issues shares for the first time and offers them to the public, it is called an ____________.答案:IPO (Initial Public Offering)3. The interest rate that a commercial bank charges its most creditworthy customers is known as the _________.答案:prime rate4. A financial instrument that represents ownership in a corporation is called a ___________.答案:stock5. The basic economic problem of having seemingly unlimited human wants in a world of limited resources is known as ________.答案:scarcity三、解答题1. Explain the concept of time value of money.答案:The time value of money refers to the idea that a dollar today is worth more than a dollar in the future. This is because money can be invested and earn interest over time. Therefore, receiving a dollar today ismore desirable than receiving the same amount in the future. The time value of money is an important concept in finance and is used to calculate the present value of future cash flows.2. What are the main functions of a central bank?答案:The main functions of a central bank include:- Monetary policy: Central banks are responsible for formulating and implementing monetary policy to control the money supply and interest rates in an economy. This is done to achieve specific macroeconomic objectives, such as price stability and economic growth.- Banker to the government: Central banks act as the government's bank and provide services such as managing the government's accounts, issuing government securities, and acting as a lender of last resort.- Banker to commercial banks: Central banks also provide banking services to commercial banks, including maintaining accounts, providing short-term loans, and overseeing the stability of the banking system.- Currency issuance: Central banks are responsible for issuing and circulating the national currency.- Financial stability: Central banks play a crucial role in maintaining financial stability and monitoring risks in the banking system.总结:本文为大家提供了一些常见的金融英语考试试题及答案。

金融英语题库完整版(附答案)