商业银行风险管理中英文对照外文翻译文献.

财务风险管理外文翻译英文文献

财务风险管理中英文资料翻译Financial Risk ManagementAlthough financial risk has increased significantly in recent years,risk and risk management are not contemporary issues. The resultof increasingly global markets is that risk may originate with eventsthousands of miles away that have nothing to do with the domesticmarket。

Information is available instantaneously,which means thatchange, and subsequent market reactions, occur very quickly.The economic climate and markets can be affected very quickly bychanges in exchange rates,interest rates, and commodity prices. Counterpartiescan rapidly become problematic. As a result,it is important toensure financial risks are identified and managed appropriately。

Preparationis a key component of risk management。

What Is Risk?Risk provides the basis for opportunity. The terms risk and exposure havesubtle differences in their meaning. Risk refers to the probability of loss,while exposure is the possibility of loss, although they are often usedinterchangeably。

外文翻译中英文对照

Strengths优势All these private sector banks hold strong position on CRM part, they have professional, dedicated and well-trained employees.所以这些私人银行在客户管理部分都持支持态度,他们拥有专业的、细致的、训练有素的员工。

Private sector banks offer a wide range of banking and financial products and financial services to corporate and retail customers through a variety of delivery channels such as ATMs, Internet-banking, mobile-banking, etc. 私有银行通过许多传递通道(如自动取款机、网上银行、手机银行等)提供大范围的银行和金融产品、金融服务进行合作并向客户零售。

The area could be Investment management banking, life and non-life insurance, venture capital and asset management, retail loans such as home loans, personal loans, educational loans, car loans, consumer durable loans, credit cards, etc. 涉及的领域包括投资管理银行、生命和非生命保险、风险投资与资产管理、零售贷款(如家庭贷款、个人贷款、教育贷款、汽车贷款、耐用消费品贷款、信用卡等)。

Private sector banks focus on customization of products that are designed to meet the specific needs of customers. 私人银行主要致力于为一些特殊需求的客户进行设计和产品定制。

金融风险管理外文翻译文献

金融风险管理外文翻译文献(文档含英文原文和中文翻译)原文:Enterprise Risk Management in InsuranceEnterprise Risk Management (hereinafter referred as “ERM”) interests a wide range of professions (e.g., actuaries, corporate financial managers, underwriters, accountants,and internal auditors), however, current ERM solutions often do not cover all risks because they are motivated by the core professional ethics and principles of these professions who design and administer them. In a typical insurance company all such professions work as a group to achieve the overriding corporate objectives.Risk can be defined as factors which prevent an organization in achieving its objectives and risks affect organizations holistically. The management of risk in isolation often misses its big picture. It is argued here that a holistic management of risk is logical and is the ultimate destination of all general management activities.Moreover, risk management should not be a separate function of the business process;rather, managing downside risk and taking the opportunities from upside risk should be thekey management goals. Consequently, ERM is believed as an approach to risk management, which provides a common understanding across the multidisciplinary groups of people of the organization. ERM should be proactive and its focus should be on the organizations future. Organizations often struggle to see and understand the full risk spectrum to which they are exposed and as a result they may fail to identify the most vulnerable areas of the business. The effective management of risk is truly an interdisciplinary exercise grounded on a holistic framework.Whatever name this new type of risk management is given (the literature refers to it by diverse names, such as Enterprise Risk Management, Strategic Risk Management, and Holistic Risk Management) the ultimate focus is management of all significant risks faced by the organization. Risk is an integral part of each and every action of the organization in the sense that an organization is a basket of contracts associated with risk (in terms of losses and opportunities). The idea of ERM is simple and logical, but implementation is difficult. This is because its involvement with a wide stakeholder community, which in turn involves groups from different disciplines with different beliefs and understandings. Indeed, ERM needs theories (which are the interest of academics) but a grand theory of ERM (which invariably involves an interdisciplinary concept) is far from having been achieved.Consequently, for practical proposes, what is needed is the development of a framework(a set of competent theories) and one of the key challenges of this thesis is to establish the key features of such a framework to promote the practice of ERM. Multidisciplinary Views of RiskThe objective of the research is to study the ERM of insurance companies. In line with this it is designed to investigate what is happening practically in the insurance industry at the current time in the name of ERM. The intention is to minimize the gap between the two communities (i.e., academics and practitioners) in order to contribute to the literature of risk management.In recent years ERM has emerged as a topic for discussion in the financial community,in particular, the banks and insurance sectors. Professional organizations have published research reports on ERM. Consulting firms conducted extensive studies and surveys on the topic to support their clients. Rating agencies included theERM concept in their rating criteria. Regulators focused more on the risk management capability of the financial organizations. Academics are slowly responding on the management of risk in a holistic framework following the initiatives of practitioners.The central idea is to bring the organization close to the market economy. Nevertheless,everybody is pushing ERM within the scope of their core professional understanding.The focus of ERM is to manage all risks in a holistic framework whatever the source and nature. There remains a strong ground of knowledge in managing risk on an isolated basis in several academic disciplines (e.g., economics, finance, psychology,sociology, etc.). But little has been done to take a holistic approach of risk beyond disciplinary silos. Moreover, the theoretical understanding of the holistic (i.e., multidisciplinary)properties of risk is still unknown. Consequently, there remains a lack of understanding in terms of a common and interdisciplinary language for ERM.Risk in FinanceIn finance, risky options involve monetary outcomes with explicit probabilities and they are evaluated in terms of their expected value and their riskiness. The traditional approach to risk in finance literature is based on a mean-variance framework of portfolio theory, i.e., selection and diversification. The idea of risk in finance is understood within the scope of systematic (non-diversifiable) risk and unsystematic (diversifiable)risk. It is recognized in finance that systematic risk is positively correlated with the rate of return. In addition, systematic risk is a non-increasing function of a firm’s growth in terms of earnings. Another established concern in finance is default risk and it is argued that the performance of the firm is linked to the firm’s default risk. A large part of finance literature deals with severa l techniques of measuring risks of firms’ investment portfolios (e.g., standard deviation, beta, VaR, etc.). In addition to the portfolio theory, Capital Asset Pricing Model (CAPM) was discovered in finance to price risky assets on the perfect capital markets. Finally, derivative markets grew tremendously with the recognition of option pricing theory.Risk in EconomicsRisk in economics is understood within two separate (independent) categories,i.e.,endogenous (controllable) risk and background (uncontrollable) risk. It is recognized that economic decisions are made under uncertainty in the presence of multiple risks.Expected Utility Theory argues that peoples’ risk attitude on the size of risk (small,medium, large) is derived from the utility-of-wealth function, where the utilities of outcomes are weighted by their probabilities. Economists argue that people are risk averse (neutral) when the size of the risks is large (small).Prospect theory provides a descriptive analysis of choice under risk. In economics, the concept of risk-bearing preferences of agents for independent risks was described under the notion of “ standard risk aversion.” Most of the economic research on risk is originated on the study of decision making behavior on lotteries and other gambles. Risk in PsychologyWhile economics assumes an individual’s risk preference is a function of probabilistic beliefs, psychology explores how human judgment and behavior systematically forms such beliefs. Psychology talks about the risk taking behavior (risk preferences).It looks for the patterns of human reactions to the context, reference point,mental categories and associations that influence how people make decisions.The psychological approach to risk draws upon the notion of loss aversion that manife sts itself in the related notion of “regret.” According to Willett; “risk affects economic activity through the psychological influence of uncertainty.” Managers’ attitude of risk taking is often described from the psychological point of view in terms of feelings.Psychologists argue that risk, as a multidisciplinary concept, can not be reduced meaningfully by a single quantitative treatment. Consequently, managers tend to utilize an array of risk measurers to assist them in the decision making process under uncertainty. Risk perception plays a central role in the psychological research on risk, where the key concern is how people perceive risk and how it differs to the actual outcome. Nevertheless, the psychological research on risk provides fundamental knowledge of how emotions are linked to decision making.Risk in SociologyIn sociology risk is a socially constructed phenomenon (i.e., a social problem) and defined as a strategy referring to instrumental rationality. The sociologicalliterature on risk was originated from anthropology and psychology is dominated by two central concepts. First, risk and culture and second, risk society. The negative consequences of unwanted events (i.e., natural/chemical disasters, food safety) are the key focus of sociological researches on risk. From a sociological perspective entrepreneurs remain liable for the risk of the society and responsible to share it in proportion to their respective contributions. Practically, the responsibilities are imposed and actions are monitored by state regulators and supervisors.Nevertheless, identification of a socially acceptable threshold of risk is a key challenge of many sociological researches on risk.Convergence of Multidisciplinary Views of RiskDifferent disciplinary views of risk are obvious. Whereas, economics and finance study risk by examining the distribution of corporate returns, psychology and sociology interpret risk in terms of its behavioral components. Moreover, economists focus on the economic (i.e., commercial) value of investments in a risky situation.In contrast, sociologists argue on the moral value (i.e., sacrifice) on the risk related activities of the firm. In addition, sociologists’ criticism of economists’concern of risk is that although they rely on risk, time, and preferences while describing the issues related to risk taking, they often miss out their interrelationships(i.e., narrow perspective). Interestingly, there appears some convergence of economics and psychology in the literature of economic psychology. The intention is to include the traditional economic model of individuals’ formal rational action in the understanding of the way they actually think and behave (i.e., irrationality).In addition, behavioral finance is seen as a growing discipline with the origin of economics and psychology. In contrast to efficient market hypothesis behaviour finance provides descriptive models in making judgment under uncertainty.The origin of this convergence was due to the discovery of the prospect theory in the fulfillment of the shortcomings of von Neumann-Morgenstern’s utility theory for providing reasons of human (irrational) behavior under uncertainty (e.g., arbitrage).Although, the overriding enquiry of disciplines is the estimation of risk, they comparing and reducing into a common metric of many types of risks are there ultimate difficulty. The key conclusion of the above analysis suggests that there existoverlaps on the disciplinary views of risk and their interrelations are emerging with the progress of risk research. In particular, the central idea of ERM is to obscure the hidden dependencies of risk beyond disciplinary silos.Insurance Industry PracticeThe practice of ERM in the insurance industry has been drawn from the author’s PhD research completed in 2006. The initiatives of four major global European insurers(hereinafter referred as “CASES”) were studied for this purpose. Out of these four insurers one is a reinsurer and the remaining three are primary insurers. They were at various stages of designing and implementing ERM. A total of fifty-one face-to-face and telephone interviews were conducted with key personnel of the CASES in between the end of 2004 and the beginning of 2006. The comparative analysis (compare-and-contrast) technique was used to analyze the data and they were discussed with several industry and academic experts for the purpose of validation. Thereafter,a conceptual model of ERM was developed from the findings of the data.Findings based on the data are arranged under five dimensions. They are understanding;evaluation; structure; challenges, and performance of ERM. Understanding of ERMIt was found that the key distinction in various perceptions of ERM remains between risk measurement and risk management. Interestingly, tools and processes are found complimentary. In essence, meaning that a tool can not run without a process and vice versa. It is found that the people who work with numbers (e.g.,actuaries, finance people, etc.) are involved in the risk modeling and management(mostly concerned with the financial and core insurance risks) and tend to believe ERM is a tool. On the other hand internal auditors, company secretaries, and operational managers; whose job is related to the human, system and compliance related issues of risk are more likely to see ERM as a process.ERM: A ProcessWithin the understanding of ERM as a process, four key concepts were found. They are harmonization, standardization, integration and centralization. In fact, they are linked to the concept of top-down and bottom-up approaches of ERM.The analysis found four key concepts of ERM. They are harmonization,standardization,integration and centralization (in decreasing order of importance). It was also found that a unique understanding of ERM does not exist within the CASES, rather ERM is seen as a combination of the four concepts and they often overlap. It is revealed that an understanding of these four concepts including their linkages is essential for designing an optimal ERM system.Linkages Amongst the Four ConceptsAlthough harmonization and standardization are seen apparently similar respondents view them differently. Whereas, harmonization allows choices between alternatives,standardization provides no flexibility. Effectively, harmonization offers a range of identical alternatives, out of which one or more can be adopted depending on the given circumstances. Although standardization does not offer such flexibility,it was found as an essential technique of ERM. Whilst harmonization accepts existing divergence to bring a state of comparability, standardization does not necessarily consider existing conventions and definitions. It focuses on a common standard, (a “top-down” approach). Indeed, integration of competent policies and processes,models, and data (either for management use, compliance and reporting) are not possible for global insurers without harmonizing and standardizing them. Hence, the research establishes that a sequence (i.e., harmonization, standardization, integration,and then centralization) is to be maintained when ERM is being developed in practice (from an operational perspective). Above all, the process is found important to achieve a diversified risk culture across the organization to allocate risk management responsibilities to risk owners and risk takers.ERM: A ToolViewed as a tool, ERM encompasses procedures and techniques to model and measure the portfolio of (quantifiable) enterprise risk from insurers’ core disciplinary perspective. The objective is to measure a level of (risk adjusted) capital(i.e., economic capital) and thereafter allocation of capital. In this perspective ERM is thought as a sophisticated version of insurers’ asset-liability management.Most often, extreme and emerging risks, which may bring the organization down,are taken into consideration. Ideally, the procedure of calculating economic capital is closely linked to the market volatility. Moreover, the objective is clear, i.e., meetingthe expectation of shareholders. Consequently, there remains less scope to capture the subjectivity associated with enterprise risks.ERM: An ApproachIn contrast to process and tool, ERM is also found as an approach of managing the entire business from a strategic point of view. Since, risk is so deeply rooted in the insurance business, it is difficult to separate risk from the functions of insurance companies. It is argued that a properly designed ERM infrastructure should align risk to achieve strategic goals. Alternatively, application of an ERM approach of managing business is found central to the value creation of insurance companies.In the study, ERM is believed as an approach of changing the culture of the organization in both marketing and strategic management issues in terms of innovating and pricing products, selecting profitable markets, distributing products, targeting customers and ratings, and thus formulating appropriate corporate strategies. In this holistic approach various strategic, financial and operational concerns are seen integrated to consider all risks across the organization.It is seen that as a process, ERM takes an inductive approach to explore the pitfalls (challenges) of achieving corporate objectives for broader audience (i.e.,stakeholders) emphasizing more on moral and ethical issues. In contrast, as a tool,it takes a deductive approach to meet specific corporate objectives for selected audience(i.e., shareholders) by concentrating more on monitory (financial) outcomes.Clearly, the approaches are complimentary and have overlapping elements. 作者:M Acharyya译文:保险业对企业风险管理的实证研究企业风险管理涉及各种行业(如保险精算师、公司财政经理、保险商、会计和内部审计员),当前企业风险管理解决方案往往不能涵盖所有的风险,因为这些方案取决于决策者和执行则的专业道德和原则。

商业银行信贷风险管理外文翻译

文献信息:文献标题:Credit Risk Management Strategies and Their Impact on Performance of Commercial Banks in Kenya(信贷风险管理策略及其对肯尼亚商业银行绩效的影响)国外作者:Samuel Warui Mutua,Muoni Gekara文献出处:《Imperial Journal of Interdisciplinary Research》,2017, 3(4):1896-1904字数统计:英文2891单词,15678字符;中文4915汉字外文文献:Credit Risk Management Strategies and Their Impact on Performance of Commercial Banks in Kenya Abstract Credit risk management strategies are amongst the most critical factors to consider for any financial institution involved in any lending activity. Financial institutions have often find themselves making decisions between lending to potential borrowers thus effectively growing their balance sheets and effectively increasing their returns and being cautious in lending to caution themselves against any potential losses. Specifically, the research sought to examine credit risk management strategies and their impact on performance of commercial banks in Kenya. The research was guided by the liquidity theory of credit, portfolio theory, credit risk theory and the tax theory of credit.The research was based on a descriptive design which involves describing the current state of affairs by use of data collected through questionnaires and interviews. The research was focused on selected Tier III commercial banks in Kenya namely Consolidated Bank, African Banking Corporation and Credit Bank with reference to the loans department. The sampled population consists of 62 staff members from loans department of Consolidated Bank, African Banking Corporation and CreditBank. Primary data was collectedthrough the use of closed ended questionnaires, pick and drop procedure was used to collect data through use of the registered offices of the targeted loans departments of the target banks. Data analysis was done both quantitatively using tables and charts; this was then summarized, coded, tabulated and analyzed using both descriptive statistics and measures of variability with aid of SPSS package. Tables and graphs were used to present the data collected for ease of understanding and analysis. From the findings, the study concludes that credit risk management strategies including credit risk rating risks, credit approval risks, portfolio management risks and security perfection risks positively affect performance of commercial banks in Kenya.Key words: Credit risk management practices, commercial banks1.IntroductionCredit risk refers to the potential for loss as a resultof failure of counter party to meet their obligations of paying the financial institution according to the agreed terms. Credit exposures may arise from both banking and trading books. Management of credit risks requires a framework of well set out policies and procedures covering measurement and management of the credit risk (Barth et al, 2004).While financial institutions have faced difficulties over the years for a multitude of reasons, the major cause of serious banking problems continues to be directly related to lax credit standards for borrowers and counterparties, poor portfolio risk management, or a lack of attention to changes in economic or other circumstances that can lead to a deterioration in the credit standing of a bank’s counterparties. This experience is common in both the developed and developing countries.For most banks, loans are the largest and most obvious source of credit risk; however, other sources of credit risk exist throughout the activities of a bank,including in the banking book and in the trading book, and both on and off the balance sheet. Banks are increasingly facing credit risk (or counterparty risk) in various financial instruments other thanloans, including acceptances, interbank transactions, trade financing, foreign exchange transactions, financial futures, swaps,bonds, equities, options, and in the extension of commitments and guarantees, and the settlement of transactions.Each bank should develop a credit risk strategy or plan that establishes the objectives guiding thebank’s credit-granting activities and adopt the necessary policies and procedures for conducting such activities. The credit risk strategy, as well as significant credit risk policies, should be approved and periodically (at least annually) reviewed by the board of directors. The board needs to recognize thatthe strategy and policies must cover the many activities of the bank in which credit exposure is a significant risk (Haron et al, 2007).Credit Management is a financial management aspect that includes credit underwriting that encompasses analysis, approval, security perfection, portfolio management and debt recovery. Nzotta (2004) indicated that credit management directly influences the success or failures of financial institution involved in lending activities. He indicated that on the hindsight of lending being directly proportionalto the quantum of deposits received from the public, any unwise credit underwriting would translateto loss of depositors’ funds and losses to the financial institutions thereof.According to a report by Earnest and Young of 2013 on the banking environment in East Africa, it is reported that banks in Kenya, Tanzania, Uganda and Rwanda recorded growth rates in asset book of 16%, 14%, 13% and 12% respectively. This was on the advent of introduction of credit bureaus that was expected to improve on credit underwriting by improving decision making by 89% and effectively help reduce Non Performing portfolios across the board by 94%. Between the year 2009 and 2013, banks in Tanzania grew their CAGR by 17.5% with loans and advances outpacing overall asset growth which grew by 22.5% over the same period. In Uganda, the CAGR of banks grew by 13% whilst the growth in Rwanda was 12% in an economy that grew by 4.6%. In the period under review high loan provisioning occasioned by aggressive pursuit by various players to grow their balance sheets withouta simultaneous enhanced credit underwriting amongst other factors was highlighted as a reason high provisions were witnessed.Josiah Aduda and James Gitonga (2011) carried out a research on the relationship between credit risk management and profitability among the commercial banks in Kenya. They found out that a strong relationship does exist between credit management and profitability and that most banks held to this belief. Gatuhu (2011) conducted a research on the effect of financial performance of credit management on the financial performance of microfinance institutions in Kenya. Gatuhu found that there existed a strong relationship between credit appraisal of microfinance institutions, credit risk control and collection policy and the overall performance of microfinance institutions in Kenya. The period commencing second half of the year 2015 to the first half of 2016 witnessed particularly difficult times for the banking industry in Kenya with 3 out the then existing 43 commercial banks going under or being placed under statutory management. These were influenced by in one way directly or indirectly to issues revolving around weak credit management strategies.2.Statement of the ProblemThe main objective of any institution involved in money lending is to ensure that a healthy return is realized adequate to cover for all the risks assumedin addition to covering the foregone time value for money. In trying to attain this objective, prudence must be exercised to en sure that unnecessaryrisk isn’t taken that would most probably lead to unprecedented losses. It is for this reason that various institutions involved in money lending are guided by various frameworks to ensure care is exercised in making such decisions.There is an extensive literature on the managementof credit risk in commercial banks. Kealhofer (2003) did a research study on risk-adjusted performance measures in commercial banks. The measures, however, focus on risk-return trade-off, i.e. measuring the risk inherent in each activity and charge it accordingly for the capital required to support it. Greuning and Bratanovic (2003), studied sound credit granting process; maintaining an appropriate credit administration that involves monitoring process as well as adequate controls over credit risk.Clear established process for approving new credits and extending the existingcredits has been observed to be very important while managing credit risk (Heffernan, 2003). Mwirigi, (2006) didan assessment of the credit risk management techniques adopted by various MFIs in Kenya and ascertained that a considerable number of them had credit policies to enable them make informed credit decisions that stroke a balance between businessandrisk perspectives. Ndwiga, (2010) and Chege, (2010) both did a research to ascertain the relationship between credit risk management and the financial performance of MFIs in Kenya.There is no known study that has been done on strategic credit policies for risk management, thus knowledge gap. This study aims at establishing the credit risk management used by commercial banks and how they affect performance of the commercial banks. This research study is motivated to bridge the gap by investigating credit risk management strategies employed by commercial banks, especially Tier III banks in Kenya and how this impacts on their financial performance. In the commercial banks, management of credit risk has caused bank losses in developing countries, including Kenya. Effective credit risk management system minimizes the credit risk, hence the level of loan losses.3.Theoretical Review3.1.Liquidity Theory of CreditThis theory, first proposed by (Emery, 2009), proposes that credit rationed firms use more trade credit than those with normal access to financial institutions. The central point of this notion is that when a firm is financially inhibited the offer of trade credit can make up for the decline of credit offer from lending institutions.Inaccordwith thisview,those firms presenting good liquidity or better access to capital markets can finance those that are credit rationed. Several methodologies have tried to obtain empirical confirmation in order to support this assumption. Nielsen (2012), using small firms as proxy for credit rationed firms, firms find that when there is liquidity tightening in the economy, to ensure their sustainability, they are obligated to advance credit terms to their customers. As financially liberal firms are less likely to seek trade credit terms and more likely toextend the same, a negative relation between a buyers’ access to other sources of financing and trade credit is expected. (Petersen & Rajan, 2007) obtained evidence supporting this negative relation.3.2.Portfolio TheoryPortfolio theory of investment tries to optimize the expected portfolio return for a given proportion of portfolio risk or equivalently decrease the risk for a given level of anticipated return, by carefully choosing the mixed proportions of several assets. Portfolio theory is extensively used in practice in the financial sector and several of its inventors won a Nobel Prize for the same. In modern years the basic portfolio theory has been widely criticized by fields such as behavioral economics (Markowitz, 1952). Portfolio theory was devel oped in 1950’s all through to the early 1970’s and was considered a vital progression in the mathematical modeling of finance. Many theoretical and practical criticisms have since been developed against the same. This include the fact that financial returns do not follow a Gaussian distribution or indeed any symmetric distribution and those correlations between asset classes (Sproul, 1998)3.3.Tax Theory of CreditThe rationale of whether or not to accept a trade credit is based on the ability to access other sources of finances. A buyer is obliged to compare different financing options to find out which will be the most economically viable for them in making cost savings. In any business deal, payment may be on the spot or deferred to a date in the future, in which case a deferred cost element is attached to it in the form of interest. Thus, to find the best sources of funding, the buyer ought to investigate the real cost of borrowing. (Brick and Fung, 1984) suggest that, the tax effect should be considered in order to compare the trade credit cost with the cost of other financing options. The main reason for this is that if sellers and buyers are in different tax brackets, they have different costs of borrowing as their interests are tax allowable. The autho rs’ hypothesis is that; businesses in a high tax bracket tend to advance more trade credit thanthosein low brackets. Subsequently, only buyers in a low tax bracket than the seller will accept credit terms, since those in a higher tax brackets couldborrow more cheaply and directly from a financial organization. Another assumption is that businesses associated with a given sector and placed in a tax bracket below the specific sector average; cannot benefit from offering trade credit. Thus, (Brick and Fung 1984) propose that firms can’t use and offer trade credit.3.4.Credit Risk TheoryUntil barely the 1970s’, Credit risk had not been widely studied, although people have been facing credit risk ever since the very early times. Before 1974, early literature on credit risk used traditional actuarial methods of assessing the same, whosemajor challenge lies in their extensive dependence on historical data. Up to now there are three quantitative approaches of analyzing credit risk: structural approach, reduced form appraisal and incomplete information approach (Crosbie et al, 2003). Melton 1974, presented the credit risk theory else called the structural theory; which said the default event originates from a firm’s asset development displayed by a diffusion process with constant parameters.Such models are ordinarily defined as ‘Structural model’ and based on variables connected to a particular issuer. An evolution of this grouping is characterized by asset of models where the loss provisional on default is exogenously precise. In these models, the nonpayment can happenthroughout all the life of a corporate bond and not only at maturity (Longstaff and Schwartz, 1995).4.MethodologyThe study used descriptive research designAccording to Oso and Onen (2009) prior to carrying out the study there is need to determine the respondents, the data collection procedures, tools and instruments which would aid in data collection. According to Kothari, 2007. It involves describing the current state of affairs by use of data collected through questionnaires and interviews. Descriptive research design is qualitative whose main purpose is description of the state of affairs as it exists.Descriptive research seeks to establish factors associated with certain occurrences, outcomes, conditions or types of behavior. A complete set of people, events or objects from which the study seeks to generalize the results is known aspopulation (Mugenda, 2009). The study will concentrate on the 20 Tier III Commercial Banks Licensed by Central Bank of Kenya.Stratified sampling technique will be used in the collectionofsampleswherethe20TierIIIcommercial banks will be stratified into three categories which are; Government owned, Local Investors owned and Foreign Investor owned, further into male and female, also a mix of Experienced Managers, Senior Officers and Junior Credit officers, out of which 62 Employees will be selected to participate in the study. Purposive sampling will also be used so as to include Heads of Credit Units and also ensure all key credit operational areas are covered in the sample.In this study, a population consists of 62 staff from loans department of Consolidated Bank, African Banking Corporation and Credit Bank.The main tool for data collection in this study was a questionnaire. A closed ended questionnaire was preferred. The questions were designed based on Likert scale which allowed the respondentsto express their view on the study variables. According to Kothari (2007) open - ended questions allow respondents to give answers in their own way, whilst Closed - ended questions or forced choice questions provide an assortment of alternative answers from which the respondent is constrained to choose.The data collected was analyzed and interpretations drawn based on the analysis. Descriptive statistics was used in the analysis of quantitative data. The statistical tool for the analysis was the statistical package for the social sciences (SPSS) Version 20, which was used to analyze the data whereby the questionnaires would be coded and frequency distributions and percentages run.5.ConclusionsThey have a positive significant relationship on performance of commercial banksin Kenya. Sound credit rating mechanism is perceived as a great contributor towards the performance of credit facilities in commercial banks. This by and large affects the performance of the banks as a whole since the banks’ profitability are hinged on its credit services. There needs to be frequent credit trainings to improve onstaff competencies to ensure they are always kept abreast with developments in the industry to ensure appropriate credit underwriting is always done, this will inturn ensure, proper segmentation and accounts review is also done with an aim to ensure the credit element in a bank is well covered.There is need for inclusion of collateral appraisal. Since the credit approval risks are in turn influenced by therisk appetite of various commercial banks, a matrix acceptable to all banks based on factors such as capital strength and customer bases should be developed to ensure that an institution doesn’t necessarily take up risks that is too high that might impairably damage their overall financial strength and health should any unprecedented shocks materialize due to the risks taken by a bank.There is however need to review the provision requirementsas detailed by the Prudential Guidelines (PGs) to realign the same with the evolving banking environment which has seen a significant shift since the PGs were last reviewed. An all-inclusive forumto realign the provision requirement should be held between all the relevant stakeholders including the regulator (CBK) and the Commercial banks to arrive at ideal reviewed rates in line with the evolved banking environment.There is however need for Tier III banks to be more risk averse to unsecured lending and opt for asset backed lending. This is more so influencedby the fact that their balance sheets are relatively smaller which makes them unable to withstand shocks that may emanate from provisioning that would be occasionedby higherrequirements toprovision forthe unsecured borrowings or weakly secured exposures.中文译文:信贷风险管理策略及其对肯尼亚商业银行绩效的影响摘要信用风险管理策略是所有参与贷款活动的金融机构最重要的考虑因素之一。

公司财务风险中英文对照外文翻译文献

中英文资料外文翻译外文资料Financial firm bankruptcy and systemic riskIn Fall 2008 when the Federal Reserve and the Treasury injected $85 billion into the insurance behemoth American International Group (AIG), themoney lent to AIGwent straight to counterparties, and very few funds remained with the insurer. Among the largest recipients was Goldman Sachs, to whomabout $12 billionwas paid to undoAIG’s credit default swaps (CDSs). The bailout plan focused on repaying the debt by slowly selling off AIG’s assets, w ith no intention of maintaining jobs or allowing the CDSmarket to continue to function as before. Thus, the government’s effort to avoid systemic risk with AIG was mainly about ensuring that firms with which AIG had done business did not fail as a result. T he concerns are obviously greatest vis-a-vis CDSs, ofwhich AIG had over $400 billion contracts outstanding in June 2008.In contrast, the government was much less enthusiastic about aiding General Motors, presumably because they believed its failure would not cause major macroeconomic repercussions by imposing losses on related firms. This decision is consistent with the view in macroeconomicresearch that financialfirmbankruptcies pose a greater amount of systemic risk than nonfinancial firmbankruptcies. For example, Bordo and Haubrich (2009) conclude that “...more severe financial events are associated withmore severe recessions...” Likewise, Bernanke (1983) argues the Great Depressionwas so severe because ofweakness in the banking systemthat affected the amount of credit available for investment. Bernanke et al. (1999) hypothesize a financial accelerator mechanism, whereby distress in one sector of the economy leads to more precarious balance sheets and tighter credit conditions. This in turn leads to a drop in investment, which is followed by less lending and a widespread downturn. Were shocks to the economy always to come in the form of distress at nonfinancial firms, these authors argue that the business downturns would not be so severe.We argue instead that the contagious impact of a nonfinancial firm’s bankruptcy is expected to be far larger than that of a financial firm like AIG, although neither would be catastrophic to the U.S. economy through counterparty risk channels. This is not to say that an episode ofwidespread financial distress among our largest banks would not be followed by an especially severe recession, only that such failures would not cause a recession or affect the depth of a recession. Rather such bankruptcies are symptomatic of common factors in portfolios that lead to wealth losses regardless of whether any firm files for bankruptcy.Pervasive financial fragility may occur because the failure of one firm leads to the failure of other firms which cascades through the system (e.g., Davis and Lo, 1999; Jarrow and Yu, 2001). Or systemic risk may wreak havoc when a number of financial firms fail simultaneously, as in the Great Depression when more than 9000 banks failed (Benston, 1986). In the former case, the failure of one firm, such as AIG, Lehman Brothers or Bear Stearns, could lead to widespread failure through financial contracts such as CDSs. In the latter case, the fact that so many financial institutions have failed means that both the money supply and the amount of credit in the economy could fall so far as to cause a large drop in economic activity (Friedman and Schwartz, 1971).While a weak financial systemcould cause a recession, the recession would not arise because one firm was allowed to file bankruptcy. Further, should one or the other firmgo bankrupt, the nonfinancial firmwould have the greater impact on the economy.Such extreme real effects that appear to be the result of financial firm fragility have led to a large emphasis on the prevention of systemic risk problems by regulators. Foremost amo ng these policies is “too big to fail” (TBTF), the logic of which is that the failure of a large financial institution will have ramifications for other financial institutions and therefore the risk to the economywould be enormous. TBTF was behind the Fed’s decisions to orchestrate the merger of Bear Stearns and J.P.Morgan Chase in 2008, its leadership in the restructuring of bank loans owed by Long Term Capital Management (LTCM), and its decision to prop up AIG. TBTF may be justified if the outcome is preven tion of a major downswing in the economy. However, if the systemic risks in these episodes have been exaggerated or the salutary effects of these actions overestimated, then the cost to the efficiency of the capital allocation system may far outweigh any po tential benefits from attempting to avoid another Great Depression.No doubt, no regulator wants to take the chance of standing down while watching over another systemic risk crisis, sowe do not have the ability to examine empiricallywhat happens to the economy when regulators back off. There are very fewinstances in themodern history of the U.S.where regulators allowed the bankruptcy of amajor financial firm.Most recently,we can point to the bankruptcy of Lehman,which the Fed pointedly allowed to fail.However,with only one obvious casewhere TBTFwas abandoned, we have only an inkling of how TBTF policy affects systemic risk. Moreover, at the same time that Lehman failed, the Fed was intervening in the commercial paper market and aiding money marketmutual fundswhile AIGwas downgraded and subsequently bailed out. In addition, the Federal Reserve and the Treasury were scaremongering about the prospects of a second Great Depression to make the passage of TARPmore likely. Thuswewill never knowifthemarket downturn th at followed the Lehman bankruptcy reflected fear of contagion from Lehman to the real economy or fear of the depths of existing problems in the real economy that were highlighted so dramatically by regulators.In this paper we analyze the mechanisms by which such risk could cause an economy-wide col-lapse.We focus on two types of contagion that might lead to systemic risk problems: (1) information contagion,where the information that one financial firmis troubled is associatedwith negative shocksat other financ ial institutions largely because the firms share common risk factors; or (2) counterparty contagion,where one important financial institution’s collapse leads directly to troubles at other cred-itor firms whose troubles snowball and drive other firms into distress. The efficacy of TBTF policies depends crucially on which of these two types of systemic riskmechanisms dominates.Counterparty contagion may warrant intervention in individual bank failureswhile information contagion does not.If regulators do not ste p in to bail out an individual firm, the alternative is to let it fail. In the case of a bank, the process involves the FDIC as receiver and the insured liabilities of the firmare very quickly repaid. In contrast, the failure of an investment bank or hedge fund does not involve the FDIC andmay closely resemble a Chapter 11 or Chapter 7 filing of a nonfinancial firm. However, if the nonbank financial firm inquestion has liabilities that are covered by the Securities Industry Protection Corporation (SIPC), the firmi s required by lawunder the Securities Industry Protection Act (SIPA) to liquidate under Chapter 7 (Don and Wang, 1990). This explains in large partwhy only the holding company of Lehman filed for bankruptcy in 2008 and its broker–dealer subsidiaries were n ot part of the Chapter 11 filing.A major fear of a financial firm liquidation, whether done through the FDIC or as required by SIPA, is that fire sales will depress recoveries for the creditors of the failed financial firm and that these fire saleswill have ramifications for other firms in related businesses, even if these businesses do not have direct ties to the failed firm (Shleifer and Vishny, 1992). This fear was behind the Fed’s decision to extend liquidity to primary dealers inMarch 2008 – Fed Chairman Bernanke explained in a speech on financial system stability that“the risk developed that liquidity pressuresmight force dealers to sell assets into already illiquid markets. Thismight have resulted in...[a] fire sale scenario..., inwhich a cascade of failures andliquidations sharply depresses asset prices, with adverse financial and economic implications.”(May 13, 2008 speech at the Federal Reserve Bank of Atlanta conference at Sea Island, Georgia) The fear of potential fire sales is expressed in further detail in t he same speech as a reason for the merger of Bear Stearns and JP Morgan:“Bear...would be forced to file for bankruptcy...[which] wouldhave forced Bear’s secured creditors and counterparties to liquidate the underlying collateral and, given the illiquidity of markets, those creditors and counter parties might well have sustained losses. If they responded to losses or the unexpected illiquidity of their holdings by pulling back from providing secured financing to other firms, a much broader liquidity crisis wou ld have ensued.”The idea that creditors of a failed firm are forced to liquidate assets, and to do so with haste, is counter to the basic tenets of U.S. bankruptcy laws, which are set up to allow creditors the ability to maximize the value of the assets now under their control. If that value is greatest when continuing to operate, the laws allow such a reorganization of the firm. If the value in liquidation is higher, the laws are in no way prejudiced against selling assets in an orderly procedure. Bankruptcy actually reduces the likelihood of fire sales because assets are not sold quickly once a bankruptcy filing occurs. Cash does not leave the bankrupt firm without the approval of a judge.Without pressure to pay debts, the firm can remain in bankruptcy for months as it tries to decide on the best course of action. Indeed, a major complaint about the U.S. code is that debtors can easily delay reorganizing and slow down the process.If, however, creditors and management believe that speedy assets sales are in their best interest, then they can press the bankruptcy judge to approve quick action. This occurred in the case of Lehman’s asset sale to Barclays,which involved hiring workers whomight have split up were their divisions not sold quickly.金融公司破产及系统性的风险2008年秋,当美联邦储备委员会和财政部拒绝85亿美金巨资保险投入到美国国际集团时,这边借给美国国际集团的货款就直接落到了竞争对手手里,而投保人只得到极少的一部分资金。

美国次贷危机对我国商业银行外文文献翻译 (2)

商业银行风险管理Arunkumar Dr. G. Kotreshwar1.序言1.1个风险管理银行业的未来无疑将十分关注风险管理动态,只有行之有效的风险管理系统银行才能在未来的市场中长期生存。

信用风险管理对于经融机构全面风险管理来说是一项重要的、长期的、行之有效的风险管理,由于银行对其本质业务的继承,所以信用风险是其最老、最大的风险管理。

只不过由于各种原因在不久之前获得了重大发展。

其中最要的是在全球范围内一时兴起的经济自由化。

印度也不由自主的走向了这个经济自由化,从而加剧了从内部到外部的国家经济竞争。

无论在数量上还是体制上都导致了市场的动荡,这就导致了风险的多样性。

前期成功的信贷风险管理是一个所涉及的风险信贷,银行风险中定量的每一项投资组合作为组合信用风险。

信用风险管理的基础是建立一个框架,这个框架规定了企业优先级别、信贷批准流程、信用风险评级系统,经过风险调整定价系统,贷款审查机制和全面的报告系统。

1.2研究的意义:单个银行的基本贷款业务给整个银行系统带来了麻烦。

因此,我们必须让银行系统有足够的个别项目的信用评估,评估风险以及整合行业为一个整体。

一般来说,印度各银行通过传统的提案项目融资工具进行评估,计算最大的允许范围,评估管理功能和顶级的处方的行业风险。

由于银行业进行到一个高性能的世界融资和交易中,新的风险,需要的是更加复杂和多样性的系统为风险评估、监测和控制风险敞口。

因此,它是银行管理层装备完全应对需求的创建工具和系统能够评估、监控和风险敞口采用的科学方法。

信用风险,即违约的借款人偿还贷款,至今为止仍是重要的风险管理。

信用风险的支配地位甚至能反映组成的经济资本,银行必须警惕身边有各种针对性的风险。

就统计,信贷风险需要占到70%,剩下的30%是另外两个之间共享的主要风险,即市场风险(变化的市场价格和运营风险失败、内部控制等)质量借款人能够直接进入资本市场而无需通过债务途径。

因此,现在相对较小的借款人贷款途径更加开放。

商业银行信用卡风险管理外文文献翻译最新译文

商业银行信用卡风险管理外文文献翻译最新译文This article discusses the importance of credit risk management for commercial banks。

Credit risk is a major concern for banks as it can lead to XXX methods used by banks to manage credit risk。

including credit scoring。

credit limits。

and loanXXX to credit risk management。

The article XXX of credit risk to ensure the long-term XXXCredit risk management is a XXX to manage credit risk XXX。

it is essential for banks to adopt us methods to manage credit risk。

These methods include credit scoring。

credit limits。

and loanXXX are used to limit the amount of credit XXXXXX credit risk management。

The credit risk management department should work XXX departments。

such as lending and complianceXXX。

XXX that they are aware of the latest developments in credit risk management。

XXX of credit risk are critical for the long-term XXX that they are effective and up-to-date。

银行信用风险外文文献翻译

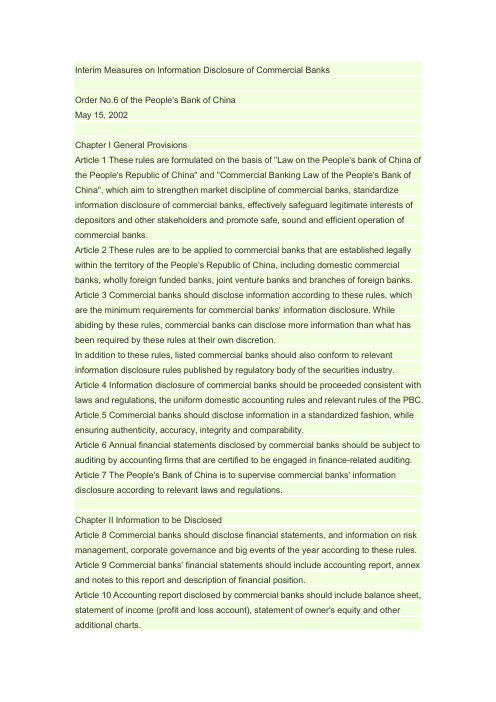

Interim Measures on Information Disclosure of Commercial BanksOrder No.6 of the People's Bank of ChinaMay 15, 2002Chapter I General ProvisionsArticle 1 These rules are formulated on the basis of "Law on the People's bank of China of the People's Republic of China" and "Commercial Banking Law of the People's Bank of China", which aim to strengthen market discipline of commercial banks, standardize information disclosure of commercial banks, effectively safeguard legitimate interests of depositors and other stakeholders and promote safe, sound and efficient operation of commercial banks.Article 2 These rules are to be applied to commercial banks that are established legally within the territory of the People's Republic of China, including domestic commercial banks, wholly foreign funded banks, joint venture banks and branches of foreign banks. Article 3 Commercial banks should disclose information according to these rules, which are the minimum requirements for commercial banks' information disclosure. While abiding by these rules, commercial banks can disclose more information than what has been required by these rules at their own discretion.In addition to these rules, listed commercial banks should also conform to relevant information disclosure rules published by regulatory body of the securities industry. Article 4 Information disclosure of commercial banks should be proceeded consistent with laws and regulations, the uniform domestic accounting rules and relevant rules of the PBC. Article 5 Commercial banks should disclose information in a standardized fashion, while ensuring authenticity, accuracy, integrity and comparability.Article 6 Annual financial statements disclosed by commercial banks should be subject to auditing by accounting firms that are certified to be engaged in finance-related auditing. Article 7 The People's Bank of China is to supervise commercial banks' information disclosure according to relevant laws and regulations.Chapter II Information to be DisclosedArticle 8 Commercial banks should disclose financial statements, and information on risk management, corporate governance and big events of the year according to these rules. Article 9 Commercial banks' financial statements should include accounting report, annex and notes to this report and description of financial position.Article 10 Accounting report disclosed by commercial banks should include balance sheet, statement of income (profit and loss account), statement of owner's equity and other additional charts.Article 11 Commercial banks should indicate inconsistence between the basis of preparation and the basic preconditions of accounting in their notes to the accounting report.Article 12 Commercial banks should explain in their notes to the accounting report the important policy of accounting and accounting estimates, including: Accounting standards, accounting year, reporting currency, accounting basis and valuation principles; Type and scope of loans; Accounting rules for investment; Scope and method of provisions against asset losses; Principle and method of income recognition; Valuation method for financial derivatives; Conversion method for foreign currency business and accounting report; Preparation method for consolidated accounting report; Valuation and depreciation method for fixed assets; Valuation method and amortization policy for intangible assets; Amortization policy for long-term deferred expenses; Accounting practice for income tax. Article 13 Commercial banks should indicate in their notes to the accounting report crucial changes of accounting policy and estimates, contingent items and post-balance sheet items, transfer and sale of important assets.Article 14 Commercial banks should indicate in their annex and notes to the accounting report the total volume of related party transactions and major related party transactions. Major related party transactions refer to those with trading volume exceeding 30 million yuan or 1% of total net assets of the commercial bank.Article 15 Commercial banks should indicate in their notes to the accounting report detailed breakdown of key categories in the accounting report, including:(1) Due from banks by the breakdown of domestic and overseas markets.(2) Interbank lending by the breakdown of domestic and overseas markets.(3) Outstanding balance of loans at the beginning and the end of the accounting year by the breakdown of credibility loans, committed loans, collateralized loans and pledged loans.(4) Non-performing loans at the beginning and end of the accounting year resulted from the risk-based loan classification.(5) Provisions for loan losses at the beginning and the end of the accounting year, new provisions, returned provisions and write-offs in the accounting year. General provisions, specific provisions and special provisions should be disclosed separately.(6) Outstanding balance and changes of interest receivables.(7) Investment at the beginning and the end of the accounting year by instruments.(8) Interbank borrowing in domestic and overseas markets.(9) Calculation, outstanding balance and changes of interest payables.(10) Year-end outstanding balance and other details of off-balance sheet categories, including bank acceptance bills, external guarantees, letters of guarantee for financing purposes, letters of guarantee for non-financing purposes, loan commitments, letters ofcredit (spot), letters of credit (forward), financial futures, financial options, etc.(11) Other key categories.Article 16 Commercial banks should disclose in their notes to the accounting report status of capital adequacy, including total value of risk assets, amount and structure of net capital, core capital adequacy ratio and capital adequacy ratio.Article 17 Commercial banks should disclose auditing report provided by the appointed accounting firms.Article 18 Description of financial position should cover the general performance of the bank, generation and distribution of profit and other events that have substantial impact on financial position and performance of the bank.Article 19 Commercial banks should disclose following risks and risk management details: (1) Credit risk. Commercial banks should disclose status of credit risk management, credit exposure, credit quality and earnings, including business operations that generate credit risks, policy of credit risk management and control, organizational structure and division of labor in credit risk management, procedure and methods of classification of asset risks, distribution and concentration of credit risks, maturity analysis of over-due loans, restructuring of loans and return of assets.(2) Liquidity risk. Commercial banks should disclose relevant parameters that can represent their status of liquidity, analyze factors affecting liquidity and indicate their strategy of liquidity management.(3) Market risk. Commercial banks should disclose risks brought by changes of interest rates and exchange rate on the market, analyzing impacts of such changes on profitability and financial positions of the bank and indicating their strategy of market risk management.(4) Operation risk. Commercial banks should disclose risks brought by flaws and mistakes of internal procedures, staff and system or by external shocks and indicate the integrity, rationality and effectiveness of their internal control mechanism.(5) Other risks. Other risks that may bring severe negative impact to the bank.Article 20 Commercial banks should disclose following information on corporate governance:(1) Shareholders' meeting during the year.(2) Members of the board of directors and its work performance.(3) Members of the board of supervisors and its work performance.(4) Members of the senior management and their profiles.(5) Layout of branches and function departments.Article 21 Chronicle of events disclosed by commercial banks in the year should at least include the following contents:(1) Names of the ten biggest shareholders and changes during the year.(2) Increase or decrease of registered capital, splitting up and merger.(3) Other important information that is necessary for the general public to know.Article 22 Information of foreign bank branches is to be collected and disclosed by the primary reporting branch.Foreign bank branches don't need to disclose information that is only mandated and required for disclosure by institutions with legal person status.Foreign bank branches should translate into Chinese and disclose the summary of information disclosed by their head offices.Article 23 Commercial banks need not disclose information of unimportant categories. However, if the omission or misreporting of certain categories or information may chan ge or affect the assessment or judge of the information users, commercial banks should regarded the categories as key information categories and disclose them.Chapter III Management of Information DisclosureArticle 24 Commercial banks should prepare in Chinese their annual reports with all the information to be disclosed and publish them within 4 month after the end of each accounting year. If they are not able to disclose such information on time due to special factors, they should apply to the People's Bank of China for delay of disclosure at least 15 days in advance.Article 25 Commercial banks should submit their annual reports to the People's Bank of China prior to disclosure.Article 26 Commercial banks should make sure that their shareholders and stakeholders could obtain the annual reports on a timely basis.Commercial banks should put their annual reports in their major operation venue, so as to ensure such reports are readily available for the general public to read and check. The PBC encourage commercial banks to disclose main contents of their annual reports to the public through media.Article 27 Boards of directors in commercial banks are responsible for the information disclosure. If there is no board of directors in the bank, the president (head) of the bank should assume such a responsibility.Boards of directors and presidents (heads) of commercial banks should ensure the authenticity, accuracy and integrity of the disclosed information and take legal responsibility for their commitments.Article 28 Commercial banks and their involved staff that provide financial statements with false information or concealing important facts should be punished according to the " Rules on Punishment of Financial Irregularities".Accounting firms and involved staff that provide false auditing report should be punished according to the "Interim Measures on Finance-related Auditing Business by AccountingFirms".Chapter IV Supplementary ProvisionsArticle 29 Commercial banks with total assets below RMB 1 billion or with total deposits below RMB 500 million are exempted from the compulsory information disclosure. However, the People's Bank of China encourages such commercial banks to disclose information according to these rules.Article 30 The People's Bank of China is responsible for the interpretation of these rules. Article 31 These rules shall enter into force as of the date of promulgation and are to be applied to all commercial banks except city commercial banks.City commercial banks should adopt these rules gradually from January 1, 2003 to January 1, 2006.中国人民银行令[2002]第6号2002年5月15日第一章总则第一条为加强商业银行的市场约束,规范商业银行的信息披露行为,有效维护存款人和相关利益人的合法权益,促进商业银行安全、稳健、高效运行,依据《中华人民共和国中国人民银行法》、《中华人民共和国商业银行法》等法律法规,制定本办法。