Chapter 8 课后答案

CCNA_ENetwork_Chapter_8_答案(dengwenhui)-ccit

1大多数企业LAN 中的双绞线网络电缆使用哪种连接器?BNCRJ-11RJ-45F 型2以下哪项被视为选择无线介质的优点?主机移动更方便安全风险更低减少干扰的影响环境对有效覆盖面积的影响更小3以下哪些特征描述的是光缆?(选择两项)不受EMI 或RFI 影响。

每对电缆都包裹在金属箔中。

结合取消、屏蔽和绕绞技术来保护数据。

最高速度为100 Mbps。

最昂贵的LAN 电缆类型。

4网络中什么时候使用直通电缆?通过控制台端口连接路由器时连接两台交换机时连接主机与交换机时连接两台路由器时5在网络中传输数据时,物理层的主要作用是什么?创建信号以表示介质上每个帧中的比特为设备提供物理编址确定数据包的网络通路控制数据对介质的访问6数据传输的三种量度标准是什么?(选择三项)实际吞吐量频率幅度吞吐量串扰带宽7OSI 哪一层负责网络通信的二进制传输、电缆规格和物理方面?表示层传输层数据链路层物理层8哪种电缆通常与光缆相关联?主干电缆水平电缆跳线电缆工作区域电缆9以下哪项是单模光缆的特征?一般使用LED 作为光源因为有多条光通路,核心相对较粗价格比多模低一般使用激光作为光源10哪种信号传输方法使用无线电波传送信号?电光无线声11如果在网络中使用非屏蔽双绞线铜缆,导致线对内串扰的原因是什么?相邻线对周围的磁场使用编织线屏蔽相邻线对从电缆远端反射回来的电波因两个节点尝试同时使用介质而导致的冲突12请参见图示。

哪种 5 类电缆用于在主机 A 和主机 B 之间建立以太网连接?同轴电缆全反电缆交叉电缆直通电缆13在可能存在电气危险或电磁干扰的LAN 安装中,主干布线建议使用哪种类型的介质?同轴光纤5e 类UTP6 类UTPSTP14对网络电缆采用的连接器不正确可能产生什么后果?会将数据转发到错误的节点。

通过该电缆传输的数据可能发生信号丢失。

将对该电缆中传输的数据采用不正确的信号方法。

该电缆中发送的数据所采用的编码方法将更改,用于补偿不当连接。

国际财务管理(英文版) 第11版 马杜拉 答案 Chapter 8

Chapter 8Relationships Among Inflation,Interest Rates, and Exchange Rates Lecture OutlinePurchasing Power Parity (PPP)Interpretations of PPPRationale Behind PPP TheoryDerivation of PPPUsing PPP to Estimate Exchange Rate EffectsGraphic Analysis of PPPTesting the PPP TheoryWhy PPP Does Not OccurPPP in the Long RunInternational Fisher Effect (IFE)Implications of the IFE for Foreign InvestorsDerivation of the IFEGraphic Analysis of the IFETests of the IFEWhy the IFE Does Not OccurComparison of IRP, PPP, and IFE TheoriesChapter ThemeThis chapter discusses the relationship between inflation and exchange rates according to the purchasing power parity (PPP) theory. Since this is one of the most popular subjects in inter-national finance, it is covered thoroughly. While PPP is a relevant theory, it should be emphasized that PPP will not always hold in reality. It does however, provide a foundation in understanding how inflation can affect exchange rates. The international Fisher effect (IFE) is also discussed in this chapter. This theory is also very important. Yet, it should again be emphasized that this theory does not always hold. If the PPP and IFE theories held consistently, decision making by MNCs would be much easier. Because these theories do not hold consistently, an MNC’s decision making is very challenging.Topics to Stimulate Class Discussion1. Provide reasoning for why highly inflated countries such as Brazil tend to have weak homecurrencies.2. Identify the inflation rate of your home country and some well-known foreign country. Thenidentify the percentage change of your home currency with respect to that foreign country.Did the currency change in the direction and by the magnitude that you would have expected according to PPP? If not, offer possible reasons for this discrepancy.3. Identify the quoted one-year interest rates in your home country and in a well-known foreigncountry as of one year ago. Also determine how your home currency changed relative to this foreign currency over the last year. Did the currency change according to the IFE theory? If not, does this information disprove IFE? Elaborate.4. Provide a simple explanation of the difference between interest rate parity (from the previouschapter), PPP (from this chapter), and IFE (from this chapter).Critical debateDoes PPP Eliminate Concerns about Long-Term Exchange Rate Risk?Proposition Yes. Studies have shown that exchange rate movements are related to inflation differentials in the long run. Based on PPP, the currency of a high-inflation country will depreciate against the home currency. A subsidiary in that country should generate inflated revenue from the inflation, which will help offset the adverse exchange effects when its earnings are remitted to the parent. If a firm is focused on long-term performance, the deviations from PPP will offset over time. In some years, the exchange rate effects may exceed the inflation effects, and in other years the inflation effects will exceed the exchange rate effects.Opposing view No. Even if the relationship between inflation and exchange rate effects is consistent, this does not guarantee that the effects on the firm will be offsetting. A subsidiary in a high-inflation country will not necessarily be able to adjust its price level to keep up with the increased costs of doing business there. The effects vary with each MNC’s situation. Even if the subsidiary can raise its prices to match the rising costs, there are short-term deviations from PPP. The investors who invest in an MNC’s stock may be concerned about short-term deviations fromPPP, because they will not necessarily hold the stock for the long term. Thus, investors may prefer that firms manage in a manner that reduces the volatility in their performance in short-run and long-run periods.With whom do you agree? State your reasons Examine the exchange rate policies of the major multinationals by referring to their annual reports. The Forbes listing of major multinationals on the web is a good starting point. In particular, consult the reports of Renault (France) and Phillips (Holland).ANSWER: It is possible that inflation and exchange rate effects will offset over the long run. However, many investors will not be satisfied because they may invest in the firm for just a few years or even a shorter term. Thus, they will prefer that MNCs assess their exposure to exchange rate risk and attempt to limit the risk.Answers to End of Chapter Questions1. PPP. Explain the theory of purchasing power parity (PPP). Based on this theory, what is ageneral forecast of the values of currencies in countries with high inflation?ANSWER: PPP suggests that the purchasing power of a consumer will be similar when purchasing goods in a foreign country or in the home country. If inflation in a foreign country differs from inflation in the home country, the exchange rate will adjust to maintain equal purchasing power.Currencies in countries with high inflation will be weak according to PPP, causing the purchasing power of goods in the home country versus these countries to be similar.2. Rationale of PPP. Explain the rationale of the PPP theory.ANSWER: When inflation is high in a particular country, foreign demand for goods in that country will decrease. In addition, that country’s demand for foreign goods should increase.Thus, the home currency of that country will weaken; this tendency should continue until the currency has weakened to the extent that a foreign country’s goods are no more attractive than the home country’s goods. Inflation differentials are offset by exchange rate changes. 3. Testing PPP. Explain how you could determine whether PPP exists. Describe a limitation intesting whether PPP holds.ANSWER: One method is to choose two countries and compare the inflation differential to the exchange rate change for several different periods. Then, determine whether the exchange rate changes were similar to what would have been expected under PPP theory.A second method is to choose a variety of countries and compare the inflation differential ofeach foreign country relative to the home country for a given period. Then, determine whether the exchange rate changes of each foreign currency were what would have been expected based on the inflation differentials under PPP theory.A limitation in testing PPP is that the results will vary with the base period chosen. The baseperiod should reflect an equilibrium position, but it is difficult to determine when such a period exists.4. Testing PPP. Inflation differentials between the U.S. and other industrialized countries havetypically been a few percentage points in any given year. Yet, in many years annual exchange rates between the corresponding currencies have changed by 10 percent or more.What does this information suggest about PPP?ANSWER: The information suggests that there are other factors besides inflation differentials that influence exchange rate movements. Thus, the exchange rate movements will not necessarily conform to inflation differentials, and therefore PPP will not necessarily hold.5. Limitations of PPP. Explain why PPP does not hold.ANSWER: PPP does not consistently hold because there are other factors besides inflation that influences exchange rates. Thus, exchange rates will not move in perfect tandem with inflation differentials. In addition, there may not be substitutes for traded goods. Therefore, even when a country’s inflation increases, the foreign demand for its products will not necessarily decrease (in the manner suggested by PPP) if substitutes are not available.6. Implications of IFE. Explain the international Fisher effect (IFE). What is the rationale forthe existence of the IFE? What are the implications of the IFE for firms with excess cash that consistently invest in foreign Treasury bills? Explain why the IFE may not hold.ANSWER: The IFE suggests that a currency’s value will adjust in accordance with the differential in interest rates between two countries.The rationale is that if a particular currency exhibits a high nominal interest rate, this may reflect a high anticipated inflation. Thus, the inflation will place downward pressure on the currency’s value if it occurs.The implications are that a firm that consistently purchases foreign Treasury bills will on average earn a similar return as on domestic Treasury bills.The IFE may not hold because exchange rate movements react to other factors in addition to interest rate differentials. Therefore, an exchange rate will not necessarily adjust in accordance with the nominal interest rate differentials, so that IFE may not hold.7. Implications of IFE. Assume UK interest rates are generally above foreign interest rates.What does this suggest about the future strength or weakness of the pound based on the IFE?Should UK investors invest in foreign securities if they believe in the IFE? Should foreign investors invest in UK securities if they believe in the IFE?ANSWER: The IFE would suggest that the pound will depreciate over time if UK interest rates are currently higher than foreign interest rates. Consequently, foreign investors who purchased UK securities would on average receive a similar yield as what they receive in their own country, and UK investors who purchased foreign securities would on average receive a yield similar to UK rates.8. Comparing Parity Theories. Compare and contrast interest rate parity (discussed in theprevious chapter), purchasing power parity (PPP), and the international Fisher effect (IFE).ANSWER: Interest rate parity can be evaluated using data at any one point in time to determine the relationship between the interest rate differential of two countries and the forward premium (or discount). PPP suggests a relationship between the inflation differential of two countries and the percentage change in the spot exchange rate over time. IFE suggestsa relationship between the interest rate differential of two countries and the percentagechange in the spot exchange rate over time. IFE is based on nominal interest rate differentials, which are influenced by expected inflation. Thus, the IFE is closely related to PPP.9. Real Interest Rate. One assumption made in developing the IFE is that all investors in allcountries have the same real interest rate. What does this mean?ANSWER: The real return is the nominal return minus the inflation rate. If all investors require the same real return, then the differentials in nominal interest rates should be solely due to differentials in anticipated inflation among countries.10. Interpreting Inflationary Expectations. If investors in the UK and Canada require the samereal interest rate, and the nominal rate of interest is 2 percent higher in Canada, what does this imply about expectations of UK inflation and Canadian inflation? What do these inflationary expectations suggest about future exchange rates?ANSWER: Expected inflation in Canada is 2 percent above expected inflation in the UK. If these inflationary expectations come true, PPP would suggest that the value of the Canadian dollar should depreciate by 2 percent against the pound.11. PPP Applied to the Euro. Assume that several European countries that use the euro as theircurrency experience higher inflation than the United States, while two other European countries that use the euro as their currency experience lower inflation than the United States.According to PPP, how will the euro’s value against the dollar be affected?ANSWER: The high European inflation overall would reduce the U.S. demand for European products, increase the European demand for U.S. products, and cause the euro to depreciate against the dollar.According to the PPP theory, the euro's value would adjust in response to the weighted inflation rates of the European countries that are represented by the euro relative to the inflation in the U.S. If the European inflation rises, while the U.S. inflation remains low, there would be downward pressure on the euro.12. Source of Weak Currencies. Currencies of some Latin American countries, such as Braziland Venezuela, frequently weaken against most other currencies. What concept in this chapter explains this occurrence? Why don’t all U.S.-based MNCs use forward contracts to hedge their future remittances of funds from Latin American countries to the U.S. even if they expect depreciation of the currencies against the dollar?ANSWER: Latin American countries typically have very high inflation, as much as 200 percent or more. PPP theory would suggest that currencies of these countries will depreciateagainst the U.S. dollar (and other major currencies) in order to retain purchasing power across countries. The high inflation discourages demand for Latin American imports and places downward pressure in their Latin American currencies. Depreciation of the currencies offsets the increased prices on Latin American goods from the perspective of importers in other countries.Interest rate parity forces the forward rates to contain a large discount due to the high interest rates in Latin America, which reflects a disadvantage of hedging these currencies. The decision to hedge makes more sense if the expected degree of depreciation exceeds the degree of the forward discount. Also, keep in mind that some remittances cannot be perfectly hedged anyway because the amount of future remittances is uncertain.13. PPP. Japan has typically had lower inflation than the United States. How would one expectthis to affect the Japanese yen’s value? Why does this expected relationship not always occur?ANSWER: Japan’s low inflation should place upward pressure on the yen’s value. Yet, other factors can sometimes offset this pressure. For example, Japan heavily invests in U.S.securities, which places downward pressure on the yen’s value.14. IFE. Assume that the nominal interest rate in Mexico is 48 percent and the interest rate in theUnited States is 8 percent for one-year securities that are free from default risk. What does the IFE suggest about the differential in expected inflation in these two countries? Using this information and the PPP theory, describe the expected nominal return to U.S. investors who invest in Mexico.ANSWER: If investors from the U.S. and Mexico required the same real (inflation-adjusted) return, then any difference in nominal interest rates is due to differences in expected inflation. Thus, the inflation rate in Mexico is expected to be about 40 percent above the U.S.inflation rate.According to PPP, the Mexican peso should depreciate by the amount of the differential between U.S. and Mexican inflation rates. Using a 40 percent differential, the Mexican peso should depreciate by about 40 percent. Given a 48 percent nominal interest rate in Mexico and expected depreciation of the peso of 40 percent, U.S. investors will earn about 8 percent.(This answer used the inexact formula, since the concept is stressed here more than precision.)15. IFE. Shouldn’t the IFE discourage investors from attempting to capitalize on higher foreigninterest rates? Why do some investors continue to invest overseas, even when they have no other transactions overseas?ANSWER: According to the IFE, higher foreign interest rates should not attract investors because these rates imply high expected inflation rates, which in turn imply potential depreciation of these currencies. Yet, some investors still invest in foreign countries where nominal interest rates are high. This may suggest that some investors believe that (1) the anticipated inflation rate embedded in a high nominal interest rate is overestimated, or (2) the potentially high inflation will not cause substantial depreciation of the foreign currency (which could occur if adequate substitute products were not available elsewhere), or (3) thereare other factors that can offset the possible impact of inflation on the foreign currency’s value.16. Changes in Inflation. Assume that the inflation rate in Brazil is expected to increasesubstantially. How will this affect Brazil’s nominal interest rates and the value of its currency (called the real)? If the IFE holds, how will the nominal return to UK investors who invest in Brazil be affected by the higher inflation in Brazil? Explain.ANSWER: Brazil’s nominal interest rate would likely increase to maintain the real return required by Brazilian investors. The Brazilian real would be expected to depreciate according to the IFE. If the IFE holds, the return to UK investors who invest in Brazil would not be affected. Even though they now earn a higher nominal interest rate, the expected decline in the Brazilian real offsets the additional interest to be earned.17. Comparing PPP and IFE. How is it possible for PPP to hold if the IFE does not?ANSWER: For the IFE to hold, the following conditions are necessary:(1) investors across countries require the same real returns,(2) the expected inflation rate embedded in the nominal interest rate occurs,(3) the exchange rate adjusts to the inflation rate differential according to PPP.If conditions (1) or (2) do not hold, PPP may still hold, but investors may achieve consistently higher returns when investing in a foreign country’s securities. Thus, IFE would be refuted.18. Estimating Depreciation Due to PPP. Assume that the spot exchange rate of the Britishpound is $1.73. How will this spot rate adjust according to PPP if the United Kingdom experiences an inflation rate of 7 percent while the United States experiences an inflation rate of 2 percent?ANSWER: According to PPP, the exchange rate of the pound will depreciate by 4.7 percent.Therefore, the spot rate would adjust to $1.73 × [1 + (–.047)] = $1.65.19. Forecasting the Future Spot Rate Based on IFE. Assume that the spot exchange rate of theSingapore dollar is £0.35. The one-year interest rate is 11 percent in the United Kingdom and7 percent in Singapore. What will the spot rate be in one year according to the IFE? (Youmay use the approximate formula to answer this question.)ANSWER: £0.35 × (1 + .04) = £0.36420. Deriving Forecasts of the Future Spot Rate. As of today, assume the following informationis available:UK MexicoReal rate of interest requiredinvestors 2% 2%byNominal interest rate 11% 15%Spot rate — £0.05One-year forward rate — £0.049a. Use the forward rate to forecast the percentage change in the Mexican peso over the nextyear.ANSWER: (£0.049– £0.05)/£0.05 = –.02, or –2%b. Use the differential in expected inflation to forecast the percentage change in theMexican peso over the next year.ANSWER: 11% – 15% = –4%; the negative sign represents depreciation of the peso.c. Use the spot rate to forecast the percentage change in the Mexican peso over the next year.ANSWER: zero percent change21. Inflation and Interest Rate Effects. The opening of Russia's market has resulted in a highlyvolatile Russian currency (the rouble). Russia's inflation has commonly exceeded 20 percent per month. Russian interest rates commonly exceed 150 percent, but this is sometimes less than the annual inflation rate in Russia.a. Explain why the high Russian inflation has put severe pressure on the value of theRussian rouble.ANSWER: As Russian prices were increasing, the purchasing power of Russian consumers was declining. This would encourage them to purchase goods in the UK and elsewhere, which results in a large supply of roubles for sale. Given the high Russian inflation, foreign demand for roubles to purchase Russian goods would be low. Thus, the rouble’s value should depreciate against the dollar, and against other currencies.b. Does the effect of Russian inflation on the decline in the rouble’s value support the PPPtheory? How might the relationship be distorted by political conditions in Russia?ANSWER: The general relationship suggested by PPP is supported, but the rouble’s value will not normally move exactly as specified by PPP. The political conditions that could restrict trade or currency convertibility can prevent Russian consumers from shifting to foreign goods. Thus, the rouble may not decline by the full degree to offset the inflation differential between Russia and the UK Furthermore, the government may not allow the rouble to float freely to its proper equilibrium level.c. Does it appear that the prices of Russian goods will be equal to the prices of UK goodsfrom the perspective of Russian consumers (after considering exchange rates)? Explain.ANSWER: Russian prices might be higher than UK prices, even after considering exchange rates, because the rouble might not depreciate enough to fully offset the Russian inflation. The exchange rate cannot fully adjust if there are barriers on trade or currency convertibility.d. Will the effects of the high Russian inflation and the decline in the rouble offset eachother for UK importers? That is, how will UK importers of Russian goods be affected by the conditions?ANSWER: UK importers will likely experience higher prices, because the Russian inflation may not be completely offset by the decline in the rouble’s value. This may cause a reduction in the UK demand for Russian goods.22. IFE Application to Asian Crisis. Before the Asian crisis, many investors attempted tocapitalize on the high interest rates prevailing in the Southeast Asian countries although the level of interest rates primarily reflected expectations of inflation. Explain why investors behaved in this manner.Why does the IFE suggest that the Southeast Asian countries would not have attracted foreign investment before the Asian crisis despite the high interest rates prevailing in those countries?ANSWER: The investors' behavior suggests that they did not expect the international Fisher effect (IFE) to hold. Since central banks of some Asian countries were maintaining their currencies within narrow bands, they were effectively preventing the exchange rate from depreciating in a manner that would offset the interest rate differential. Consequently, superior profits from investing in the foreign countries were possible.If investors believed in the IFE, the Asian countries would not attract a high level of foreign investment because of exchange rate expectations. Specifically, the high nominal interest rate should reflect a high level of expected inflation. According to purchasing power parity (PPP), the higher interest rate should result in a weaker currency because of the implied market expectations of high inflation.23. IFE Applied to the Euro. Given the recent conversion of several European currencies to theeuro, explain what would cause the euro’s value to change against the dollar according to the IFE.ANSWER: If interest rates change in these European countries whose home currency is the euro, the expected inflation rate in those countries change, so that the inflation differential between those countries and the U.S. changes. Thus, there may be an impact on the value of the euro, because a change in the inflation differential affects trade flows and therefore affects the exchange rate.Advanced Questions24. IFE. Beth Miller does not believe that the international Fisher effect (IFE) holds. Currentone-year interest rates in Europe are 5 percent, while one-year interest rates in the U.S. are 3 percent. Beth converts $100,000 to euros and invests them in Germany. One year later, she converts the euros back to dollars. The current spot rate of the euro is $1.10.a. According to the IFE, what should the spot rate of the euro in one year be?b. If the spot rate of the euro in one year is $1.00, what is Beth’s percentage return from herstrategy?c. If the spot rate of the euro in one year is $1.08, what is Beth’s percentage return from herstrategy?d. What must the spot rate of the euro be in one year for Beth’s strategy to be successful?ANSWER:a.%90.11)05.1()03.1(1)1()1(−=−=−++=f h f i i eIf the IFE holds, the euro should depreciate by 1.90 percent in one year. This translates to a spot rate of $1.10 × (1 – 1.90%) = $1.079.b.1. Convert dollars to euros: $100,000/$1.10 = €90,909.092. Invest euros for one year and receive €90,909.09 × 1.05 = €95,454.553. Convert euros back to dollars and receive €95,454.55 × $1.00 = $95,454.55The percentage return is $95,454.55/$100,000 – 1 = –4.55%.c.1. Convert dollars to euros: $100,000/$1.10 = €90,909.092. Invest euros for one year and receive €90,909.09 × 1.05 = €95,454.553. Convert euros back to dollars and receive €95,454.55 × $1.08 = $103,090.91The percentage return is $103,090.91/$100,000 – 1 = 3.09%.d. Beth’s strategy would be successful if the spot rate of the euro in one year is greater than$1.079.25. Integrating IRP and IFE. Assume the following information is available for the U.S. andEurope:U.S. Europe Nominal interest rate 4% 6%Expected inflation 2% 5%Spot rate ----- $1.13One-year forward rate ----- $1.10a. Does IRP hold?b. According to PPP, what is the expected spot rate of the euro in one year?c. According to the IFE, what is the expected spot rate of the euro in one year?d. Reconcile your answers to parts (a). and (c).ANSWER:a.%89.11)06.1()04.1(1)1()1(−=−=−++=f h i i pTherefore, the forward rate of the euro should be $1.13 × (1 – 1.89%) = $1.109. IRP does not hold in this case.b.%86.21)05.1()02.1(1)1()1(−=−=−++=f h f I I eAccording to PPP, the expected spot rate of the euro in one year is $1.13 × (1 – 2.86%) = $1.098.c.%89.11)06.1()04.1(1)1()1(−=−=−++=f h f i i eAccording to the IFE, the expected spot rate of the euro in one year is $1.13 × (1 – 2.86%) = $1.098.Parts a and c combined say that the forward rate premium or discount is exactly equal to theexpectedpercentage appreciation or depreciation of the euro.26. IRP. The one-year risk-free interest rate in Mexico is 10%. The one-year risk-free rate in theUK is 2%. Assume that interest rate parity exists. The spot rate of the Mexican peso is £0.14.a. What is the forward rate premium?b. What is the one-year forward rate of the peso?c. Based on the international Fisher effect, what is the expected change in the spot rate over thenext year?d.If the spot rate changes as expected according to the IFE, what will be the spot rate in oneyear?pare your answers to (b) and (d) and explain the relationship.ANSWER:a. According to interest rate parity, the forward premium is07273.1)10.1()02.1(−=−++b. The forward rate is £0.14 × (1 – .07273) = £0.1298.c. According to the IFE, the expected change in the peso is:07273.1)10.1()02.1(−=−++or –7.273%d. £.14 × (1 – .07273) = £0.1298e. The answers are the same. When IRP holds, the forward rate premium and the expected percentage change in the spot rate are derived in the same manner. Thus, the forward premium serves as the forecasted percentage change in the spot rate according to IFE.27. Testing the PPP. How could you use regression analysis to determine whether therelationship specified by PPP exists on average? Specify the model, and describe how you would assess the regression results to determine if there is a significant difference from the relationship suggested by PPP.ANSWER: A regression model could be applied to historical data to test PPP. The model isspecified as:()e a a 1+I 1 + I u f 01U.S.f =+−⎡⎣⎢⎤⎦⎥+1where e f is the percentage change in the foreign currency’s exchange rate, I U.S. and I f are U.S.and foreign inflation rates, a 0 is a constant, a 1 is the slope coefficient, and u is an error term. If PPP holds, a 0 should equal zero, and a 1 should equal 1. A t-test on a 0 and a 1 is shown below.t -test for a : t = a 0s.e. of a t -test for a : t = a1s.e. of a 0001 1 1−−。

习题答案Principles of Corporate Finance第十版 Chapter8

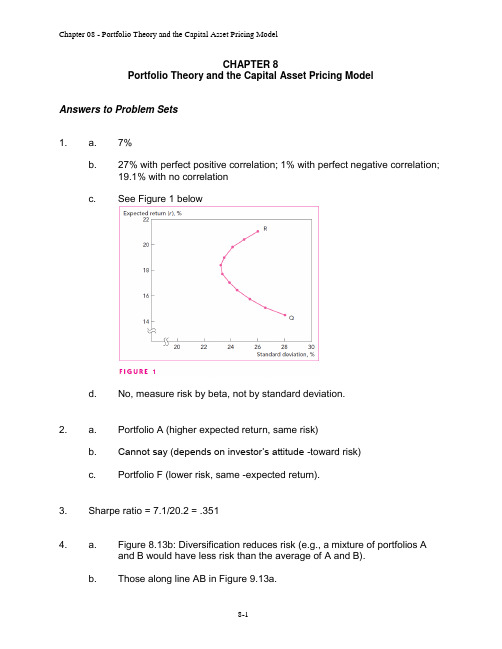

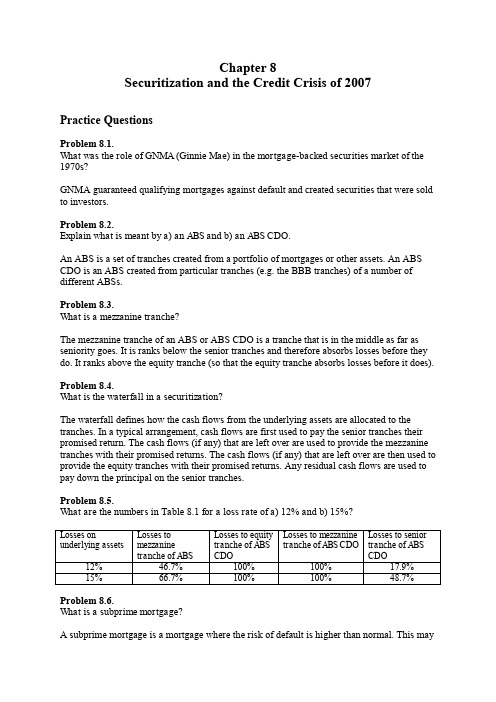

CHAPTER 8Portfolio Theory and the Capital Asset Pricing ModelAnswers to Problem Sets1. a. 7%b. 27% with perfect positive correlation; 1% with perfect negative correlation;19.1% with no correlationc. See Figure 1 belowd. No, measure risk by beta, not by standard deviation.2. a. Portfolio A (higher expected return, same risk)b. Cannot say (depends on investor’s attitude -toward risk)c. Portfolio F (lower risk, same -expected return).3. Sharpe ratio = 7.1/20.2 = .3514. a. Figure 8.13b: Diversification reduces risk (e.g., a mixture of portfolios Aand B would have less risk than the average of A and B).b. Those along line AB in Figure 9.13a.c. See Figure 2 below5. a. See Figure 3 belowb. A, D, Gc. Fd. 15% in Ce. Put 25/32 of your money in F and lend 7/32 at 12%: Expected return = 7/32X 12 + 25/32 X 18 = 16.7%; standard deviation = 7/32 X 0 + (25/32) X 32 =25%. If you could borrow without limit, you would achieve as high anexpected return as you’d like, with correspondingly high risk, of course.6. a. 4 + (1.41 X 6) = 12.5%b. Amazon: 4 + (2.16 X 6) = 17.0%c. Campbell Soup: 4 + (.30 X 6) = 5.8%d. Lower. If interest rate is 4%, r = 4 + (1.75 X 6) = 14.5%; if rate = 6%, r = 6 +(1.75 X 4) = 13.0%e. Higher. If interest rate is 4%, r = 4 + (.55 X 6) = 7.3%; if rate = 6%, r = 6 +(.55 X 4) 5 8.2%7. a. Trueb. False (it offers twice the market risk premium)c. False8. a. 7%b. 7 + 1(5) + 1(-1) + 1(2) = 13%c. 7 + 0(5) + 2(-1) + 0(2) = 5%d. 7 + 1(5) + (-1.5)(-1) + 1(2) = 15.5%.9. a. False – investors demand higher expected rates of return on stocks withmore nondiversifiable risk.b. False – a security with a beta of zero will offer the risk-free rate of return.c. False – the beta will be: (1/3 ⨯ 0) + (2/3 ⨯ 1) = 0.67d. Truee. True10. In the following solution, security one is Campbell Soup and security two isBoeing. Then:r1 = 0.031 σ1 = 0.158r2 = 0.095 σ2 = 0.237Further, we know that for a two-security portfolio:r p = x1r1 + x2r2σp2 = x12σ12 + 2x1x2σ1σ2ρ12 + x22σ22 Therefore, we have the following results:x1x2r pσπ σπ when ρ = 0 when ρ = 0.51 0 3.10% 0.02496 0.02496 0.9 0.1 3.74% 0.02078 0.02415 0.8 0.2 4.38% 0.01822 0.02422 0.7 0.3 5.02% 0.01729 0.02515 0.6 0.4 5.66% 0.01797 0.02696 0.5 0.5 6.30% 0.02028 0.02964 0.4 0.6 6.94% 0.02422 0.03320 0.3 0.7 7.58% 0.02977 0.03763 0.2 0.8 8.22% 0.03695 0.04294 0.1 0.9 8.86% 0.04575 0.04912 0 1 9.50% 0.05617 0.0561711.a.Portfolior 1 10.0% 5.1% 2 9.0 4.6 311.06.4b.See the figure below. The set of portfolios is represented by the curved line. The five points are the three portfolios from Part (a) plus thefollowing two portfolios: one consists of 100% invested in X and the other consists of 100% invested in Y.c. See the figure below. The best opportunities lie along the straight line. From the diagram, the optimal portfolio of risky assets is portfolio 1, and so Mr. Harrywitz should invest 50 percent in X and 50 percent in Y.00.050.10.150.020.040.060.080.1Standard DeviationExpected Return12. a. Expected return = (0.6 ⨯ 15) + (0.4 ⨯ 20) = 17%Variance = (0.62⨯ 202) + (0.42⨯ 222) + 2(0.6)(0.4)(0.5)(20)(22) = 327.04Standard deviation = 327.04(1/2) = 18.08%b. Correlation coefficient = 0 ⇒ Standard deviation = 14.88%Correlation coefficient = –0.5 ⇒ Standard deviation = 10.76%c. His portfolio is better. The portfolio has a higher expected return and alower standard deviation.13. a.Average SD Sharpe RatioSauros 14.6 15.2 0.77S&P500 14.4 10.5 1.09Risk Free 2.9 1.7b. We can calculate the Beta of her investment as follows (see Table 7.7):TOTALDeviationfrom Averagemkt return 17.2 -1.9 -8.0 1.4 -8.8Deviationfrom AverageSauros return 24.5 -3.6 -12.0 3.4 -12.3SquaredDeviationfrom Averagemarketreturn 296.5 3.5 63.7 2.0 77.1 442.8Product ofDeviationsfrom Averagereturns 421.9 6.8 95.8 4.8 108.0 637.2Marketvariance 88.6Covariance 127.4Beta 1.4To construct a portfolio with a beta of 1.4, we will borrow .4 at the risk free rateand invest this in the market portfolio. This gives us annual returns as follows:Average1.4 times market 20.1less 0.4 time rf -1.2net return 19.0The Sauros portfolio does not generate sufficient returns to compensate for itsrisk.14. a. The Beta of the first portfolio is 0.714 and offers an average return of 5.9%b. We can devise a superior portfolio with a blend of 85.5% Campbell’s Soupand 14.5% Amazon.15. a.b. Market risk premium = r m– r f = 0.12 – 0.04 = 0.08 = 8.0%c. Use the security market line:r = r f + β(r m– r f)r = 0.04 + [1.5 ⨯ (0.12 – 0.04)] = 0.16 = 16.0%d. For any investment, we can find the opportunity cost of capital using thesecurity market line. With β = 0.8, the opportunity cost of capital is:r = r f + β(r m– r f)r = 0.04 + [0.8 ⨯ (0.12 – 0.04)] = 0.104 = 10.4%The opportunity cost of capital is 10.4% and the investment is expected toearn 9.8%. Therefore, the investment has a negative NPV.e. Again, we use the security market line:r = r f + β(r m– r f)0.112 = 0.04 + β(0.12 – 0.04) ⇒β = 0.916. a. Percival’s current portfolio provides an expected return of 9% with anannual standard deviation of 10%. First we find the portfolio weights for acombination of Treasury bills (security 1: standard deviation = 0%) and theindex fund (security 2: standard deviation = 16%) such that portfoliostandard deviation is 10%. In general, for a two security portfolio:σP2 = x12σ12 + 2x1x2σ1σ2ρ12 + x22σ22(0.10)2 = 0 + 0 + x22(0.16)2x2 = 0.625 ⇒ x1 = 0.375Further:r p = x1r1 + x2r2r p = (0.375 ⨯ 0.06) + (0.625 ⨯ 0.14) = 0.11 = 11.0%Therefore, he can improve his expected rate of return without changingthe risk of his portfolio.b. With equal amounts in the corporate bond portfolio (security 1) and theindex fund (security 2), the expected return is:r p = x1r1 + x2r2r p = (0.5 ⨯ 0.09) + (0.5 ⨯ 0.14) = 0.115 = 11.5%σP2 = x12σ12 + 2x1x2σ1σ2ρ12 + x22σ22σP2 = (0.5)2(0.10)2 + 2(0.5)(0.5)(0.10)(0.16)(0.10) + (0.5)2(0.16)2σP2 = 0.0097σP = 0.985 = 9.85%Therefore, he can do even better by investing equal amounts in thecorporate bond portfolio and the index fund. His expected return increasesto 11.5% and the standard deviation of his portfolio decreases to 9.85%. 17. First calculate the required rate of return (assuming the expansion assets bearthe same level of risk as historical assets):r = r f + β(r m– r f)r = 0.04 + [1.4 ⨯ (0.12 – 0.04)] = 0.152 = 15.2%The use this to discount future cash flows; NPV = -25.2910 15 0.243 3.64NPV -25.2918. a. True. By definition, the factors represent macro-economic risks thatcannot be eliminated by diversification.b. False. The APT does not specify the factors.c. True. Different researchers have proposed and empirically investigateddifferent factors, but there is no widely accepted theory as to what thesefactors should be.d. True. To be useful, we must be able to estimate the relevant parameters.If this is impossible, for whatever reason, the model itself will be oftheoretical interest only.19. Stock P: r = 5% + (1.0 ⨯ 6.4%) + [(–2.0) ⨯ (–0.6%)] + [(–0.2) ⨯ 5.1%] = 11.58%Stock P2: r = 5% + (1.2 ⨯ 6.4%) + [0 ⨯ (–0.6%)] + (0.3 ⨯ 5.1%) = 14.21%Stock P3: r = 5% + (0.3 ⨯ 6.4%) + [0.5 ⨯ (–0.6%)] + (1.0 ⨯ 5.1%) = 11.72%20. a. Factor risk exposures:b1(Market) = [(1/3)⨯1.0] + [(1/3)⨯1.2] + [(1/3)⨯0.3] = 0.83b2(Interest rate) = [(1/3)⨯(–2.0)] +[(1/3)⨯0] + [(1/3)⨯0.5] = –0.50b3(Yield spread) = [(1/3)⨯(–0.2)] + [(1/3)⨯0.3] + [(1/3)⨯1.0] = 0.37b. r P = 5% + (0.83⨯6.4%) + [(–0.50)⨯(–0.6%)] + [0.37⨯5.1%] = 12.50%21. r Boeing = 0.2% + (0.66 ⨯ 7%) + (01.19 ⨯ 3.6%) + (-0.76 ⨯ 5.2%) = 5.152%R J&J = 0.2% + (0.54 ⨯ 7%) + (-0.58 ⨯ 3.6%) + (0.19 ⨯ 5.2%) = 2.88%R Dow = 0.2% + (1.05 ⨯ 7%) + (–0.15 ⨯ 3.6%) + (0.77 ⨯ 5.2%) = 11.014%r Msft= 0.2% + (0.91 ⨯ 7%) + (0.04 × 3.6%) + (–0.4 ⨯ 5.2%) = 4.346%22. In general, for a two-security portfolio:σp2 = x12σ12 + 2x1x2σ1σ2ρ12 + x22σ22and:x1 + x2 = 1Substituting for x2 in terms of x1 and rearranging:σp2 = σ12x12 + 2σ1σ2ρ12(x1– x12) + σ22(1 – x1)2Taking the derivative of σp2 with respect to x1, setting the derivative equal to zero and rearranging:x1(σ12– 2σ1σ2ρ12 + σ22) + (σ1σ2ρ12–σ22) = 0Let Campbell Soup be security one (σ1 = 0.158) and Boeing be security two(σ2 = 0.237). Substituting these numbers, along with ρ12 = 0.18, we have:x1 = 0.731Therefore:x2 = 0.26923. a. The ratio (expected risk premium/standard deviation) for each of the fourportfolios is as follows:Portfolio A: (22.8 – 10.0)/50.9 = 0.251Portfolio B: (10.5 – 10.0)/16.0 = 0.031Portfolio C: (4.2 – 10.0)/8.8 = -0.659Therefore, an investor should hold Portfolio A.b. The beta for Amazon relative to Portfolio A is identical.c. If the interest rate is 5%, then Portfolio C becomes the optimal portfolio, asindicated by the following calculations:Portfolio A: (22.8 – 5.0)/50.9 = 0.35Portfolio B: (10.5 – 5.0)/16.0 = 0.344Portfolio C: (4.2 – 5.0)/8.8 = -0.091The results do not change.24. Let r x be the risk premium on investment X, let x x be the portfolio weight of X (andsimilarly for Investments Y and Z, respectively).a. r x = (1.75⨯0.04) + (0.25⨯0.08) = 0.09 = 9.0%r y = [(–1.00)⨯0.04] + (2.00⨯0.08) = 0.12 = 12.0%r z = (2.00⨯0.04) + (1.00⨯0.08) = 0.16 = 16.0%b. This portfolio has the following portfolio weights:x x = 200/(200 + 50 – 150) = 2.0x y = 50/(200 + 50 – 150) = 0.5x z = –150/(200 + 50 – 150) = –1.5The portfolio’s sensitivities to the factors are:Factor 1: (2.0⨯1.75) + [0.5⨯(–1.00)] – (1.5⨯2.00) = 0Factor 2: (2.0⨯0.25) + (0.5⨯2.00) – (1.5⨯1.00) = 0Because the sensitivities are both zero, the expected risk premium is zero.c. This portfolio has the following portfolio weights:x x = 80/(80 + 60 – 40) = 0.8x y = 60/(80 + 60 – 40) = 0.6x z = –40/(80 + 60 – 40) = –0.4The sensitivities of this portfolio to the factors are:Factor 1: (0.8⨯1.75) + [0.6⨯(–1.00)] – (0.4⨯2.00) = 0Factor 2: (0.8⨯0.25) + (0.6⨯2.00) – (0.4⨯1.00) = 1.0The expected risk premium for this portfolio is equal to the expected riskpremium for the second factor, or 8 percent.d. This portfolio has the following portfolio weights:x x = 160/(160 + 20 – 80) = 1.6x y = 20/(160 + 20 – 80 ) = 0.2x z = –80/(160 + 20 – 80) = –0.8The sensitivities of this portfolio to the factors are:Factor 1: (1.6⨯1.75) + [0.2⨯(–1.00)] – (0.8⨯2.00) = 1.0Factor 2: (1.6⨯0.25) + (0.2⨯2.00) – (0.8⨯1.00) = 0The expected risk premium for this portfolio is equal to the expected riskpremium for the first factor, or 4 percent.e. The sensitivity requirement can be expressed as:Factor 1: (x x)(1.75) + (x y)(–1.00) + (x z)(2.00) = 0.5In addition, we know that:x x + x y + x z = 1With two linear equations in three variables, there is an infinite number of solutions. Two of these are:1. x x = 0 x y = 0.5 x z = 0.52. x x = 6/11 x y = 5/11 x z = 0The risk premiums for these two funds are:r1 = 0⨯[(1.75 ⨯ 0.04) + (0.25 ⨯ 0.08)]+ (0.5)⨯[(–1.00 ⨯ 0.04) + (2.00 ⨯ 0.08)]+ (0.5)⨯[(2.00 ⨯ 0.04) + (1.00 ⨯ 0.08)] = 0.14 = 14.0%r2 = (6/11)⨯[(1.75 ⨯ 0.04) + (0.25 ⨯ 0.08)]+(5/11)⨯[(–1.00 ⨯ 0.04) + (2.00 ⨯ 0.08)]+0 ⨯ [(2.00 ⨯ 0.04) + (1.00 ⨯ 0.08)] = 0.104 = 10.4%These risk premiums differ because, while each fund has a sensitivity of0.5 to factor 1, they differ in their sensitivities to factor 2.f. Because the sensitivities to the two factors are the same as in Part (b),one portfolio with zero sensitivity to each factor is given by:x x = 2.0 x y = 0.5 x z = –1.5The risk premium for this portfolio is:(2.0⨯0.08) + (0.5⨯0.14) – (1.5⨯0.16) = –0.01Because this is an example of a portfolio with zero sensitivity to eachfactor and a nonzero risk premium, it is clear that the Arbitrage PricingTheory does not hold in this case.A portfolio with a positive risk premium is:x x = –2.0 x y = –0.5 x z = 1.5。

国际经济学第九版英文课后答案 第8单元

*CHAPTER 8 (Core Chapter)TRADE RESTRICTIONS: TARIFFSOUTLINE8.1 Introduction8.2 Partial Equilibrium Analysis of a TariffCase Study 8-1: Average Tariff on Non-Agricultural Products in Major Developed CountriesCase Study 8-2: Average Tariff on Non-Agricultural Products in Some MajorDeveloping Countries8.2a Partial Equilibrium Effects of a Tariff8.2b Effects of a Tariff on Producer and Consumer Surplus8.2c Costs and Benefits of a TariffCase Study 8-3: The Welfare Effects of Liberalizing Trade in Some U.S. Products Case Study 8-4: The Welfare Effects of Liberalizing Trade in Some EU Products 8.3 The Theory of Tariff Structure8.3a The Rate of Effective Protection8.3b Generalization and Evaluation of the Theory of Effective ProtectionCase Study 8-5: Rising Tariff Rates with Degree of Domestic ProcessingCase Study 8-6: Structure of Tariffs on Industrial Products in U.S., EU, Japan, and Canada8.4 General Equilibrium Analysis of a Tariff in a Small Country8.4a General Equilibrium Effects of a Tariff in a Small Country8.4b Illustration of the Effects of a Tariff in a Small Country8.4c The Stolper-Samuelson Theorem8.5 General Equilibrium Analysis of a Tariff in a Large Country8.5a General Equilibrium Effects of a Tariff in a Large Country8.5b Illustration of the Effects of a Tariff in a Large Country8.6 The Optimum Tariff8.6a The Meaning of the Concept and Retaliation8.6b Illustration of the Optimum Tariff and RetaliationAppendix: A8.1 Partial Equilibrium Effects of a Tariff in a Large NationA8.2 Derivation of the Formula for the Rate of Effective ProtectionA8.3 The Stolper-Samuelson Theorem GraphicallyA8.4 Exception to the Stolper-Samuelson Theorem - The MetzlerParadoxA8.5 Short-run Effect of a Tariff on Factors' IncomeA8.6 Measurement of the Optimum TariffKey TermsTrade or commercial policies Consumer surplusImport tariff Rent or producer surplusExport tariff Protection cost or deadweight loss of a tariff Ad valorem tariff Nominal tariffSpecific tariff Rate of effective protectionCompound tariff Domestic value addedConsumption effect of a tariff Prohibitive tariffProduction effect of a tariff Stolper-Samuelson theoremTrade effect of a tariff Metzler paradoxRevenue effect of a tariff Optimum tariffLecture Guide1.I would cover sections 1 and 2 and assign problems 1-2 in the first lecture. Themost difficult part of section 2 is the meaning and measurement of consumer and producer surplus. Since a clear understanding of the meaning and measurementof consumer and producer surplus is crucial in evaluating the effect of tariffs, Iwould explain t hese concepts very carefully.2.I would then cover section 3 and assign problems 3-6 in the second lecture. Thetheory of tariff structure is also very difficult and important, and so I would alsoexplain this concept very carefully. I found that the best way to explain it is byusing the simple example used in the text of the suit with and without importedinputs.3.The rest of the chapter can be skipped without loss of continuity by thoseInstructors who do not wish to cover the general equilibrium effects of tariffs. 4.For those Instructors who wish to cover the rest of the chapter, I would take upanother two lectures to do so. I would also assign and grade problems 8-14 tomake sure that students understand the material.5.In covering section 8.4, I would pay special attention to the explanation of Figure8-5 and to the Stolper-Samuelson theorem.6.In covering Section 8.6, please note that the optimum tariff can only be discussedintuitively without trade indifference curves (examined in Appendix A8.6). Answer to Problems1.a) Consumption is 70Y, production is 10Y and imports are 60Y (see Figure 1 onthe next page).b) Consumption is 60Y, production is 20Y and imports are 40Y (see Figure 1).c) The consumption effect is -10Y, the production effect is +10Y, the trade effectis -20Y and the revenue effect is $40 (see Figure 1).2. a) The consumer surplus is $245 without and $l80 with the tariff (see Figure 1).b)Of the increase in the revenue of producers with the tariff (as compared withtheir revenues under free trade), $l5 represents the increase in production costsand another $15 represents the increase in rent or producer surplus (see Figure1).c) The dollar value or the protection cost of the tariff is $l0 (see Figure 1).3. This will increase the rate of effective protection in the nation.4. a) g = 0.4 - (0.5)(0.4) = 0.4 - 0.2 = 0.2 = 40%1.0 - 0.5 0.5 0.55. a) g=60%b) g=80%c) g=0d) g=20%6. a) g=70%b) See the first paragraph of section 8.3b.7. See Figure 2.8.When Nation 1 (assumed to be a small nation) imposes an import tariff oncommodity Y, the real income of labor falls and that of capital rises.9.Py/Px rises for domestic producers and consumers. As production of Y (the K-intensive commodity) rises and that of X falls, the demand and income of K rises and that of L falls. Therefore, r rises and w falls.10.If Nation 1 were instead a large nation, then Nation 1's terms of trade rise and thereal income of L may also rise.India is more likely to restrict imports of K-intensive commodities in which India has a comparative disadvantage and this is likely to increase the return to capitaland reduce the return to labor according to the Stolper-Samuelson theorem.12. See Figure 3 on the previous page.13. See Figure 4.14. a) The volume of trade may shrink to zero (the origin of offer curves).App. 1. The more elastic S H and S F are, the lower is the free trade priceof the commodity and the lower is the increase in the domesticprice of the commodity as a result of the tariff.App. 2a. The supply curve of the nation for the commodity shifts upand to the left (as with the imposition of any tax); this does not affectthe consumption of the commodity with free trade, but it reducesdomestic production and increases imports of the commodity; italso increases the revenue effect and reduces producers' surplus.b)The imposition of a tariff on imported inputs going into the domestic productionof the commodity will have no effect on the size of the protection cost ordeadweight loss.App. 3. See Figure 5 (on the next page).App. 4. See Figure 6.App. 5. Real w will fall in terms of Y and rise in terms of X. On theother hand, r eal r will rise in terms of Y and fall in terms of X. Thiscan be seen by drawing a figure similar to Figure 8-10, but with theVMPLy curve shifting upward.App. 6a. See Figure 7.c) After Nation 1 has imposed an optimum tariff and Nation 2 has retaliatedwith an optimum tariff of its own, the approximate terms of trade for Nation1 is 0.8, while the approximate terms of trade of Nation2 is 1.25.d) Nation 1's welfare declines from the reduction in the volume and in the termsof trade. Although nation 2's terms of trade are higher than under free trade,the volume of trade has shrunk so much that nation 2's welfare is also likelyto be lower than under free trade.Multiple-choice Questions1. Which of the following statements is incorrect?a. An ad valorem tariff is expressed as a percentage of the value of the traded commodityb. a specific tariff is expressed as a fixed sum of the value of the traded commodity.c. export tariffs are prohibited by the U.S. Constitution*d. The U.S. uses exclusively the specific tariff2. A small nation is one:a. which does not affect world price by its tradingb. which faces an infinitely elastic world supply curve for its import commodityc. whose consumers will pay a price that exceeds the world price by the amount of the tariff*d. all of the above3. If a small nation increases the tariff on its import commodity, its:a. consumption of the commodity increasesb. production of the commodity decreasesc. imports of the commodity increase*d. none of the above4.The increase in producer surplus when a small nation imposes a tariff is measured bythe area:*a. to the left of the supply curve between the commodity price with and without the tariffb. under the supply curve between the quantity produced with and without the tariffc. under the demand curve between the commodity price with and without the tariffd. none of the above.5. If a small nation increases the tariff on its import commodity:*a. the rent of domestic producers of the commodity increasesb. the protection cost of the tariff decreasesc. the deadweight loss decreasesd. all of the above6.Which of the following statements is incorrect with respect to the rate of effectiveprotection?a. for given values of ai and ti, g is larger the greater is tb. for a given value of t and ti, g is larger the greater is a ic. g exceeds, is equal to or is smaller than t, as t i is smaller than, is equal to or is larger than t*d. when a i t i exceeds t, the rate of effective protection is positive7. With a i=50%, t i=0, and t=20%, g is:*a. 40%b. 20%c. 80%d. 08. The imposition of an import tariff by a small nation:*a. increases the relative price of the import commodity for domestic producers and consumersb. reduces the relative price of the import commodity for domestic producers and consumersc. increases the relative price of the import commodity for the nation as a wholed. any of the above is possible9. The imposition of an import tariff by a small nation:a. increases the nation's welfare*b. reduces the nation's welfarec. leaves the nation's welfare unchangedd. any of the above is possible10. According to the Stolper-Samuelson theorem, the imposition of a tariff by a nation:a. increases the real return of the nation's abundant factor*b. increases the real return of the nation's scarce factorc. reduces the real return of the nation's scarce factord. any of the above is possible11. The imposition of an import tariff by a nation results in:a. an increase in relative price of the nation's import commodityb. an increase in the nation's production of its importable commodityc. reduces the real return of the nation's abundant factor*d. all of the above12. The imposition of an import tariff by a nation can be represented by a rotation of the: *a. nation's offer curve away from the axis measuring the commodity of its comparative advantageb. the nation's offer curve toward the axis measuring the commodity of its comparative advantagec. the other nation's offer curve toward the axis measuring the commodity of its comparative advantaged. the other nation's offer curve away from the axis measuring the commodity of its comparative advantage13. The imposition of an import tariff by a large nation:a. increases the nation's terms of tradeb. reduces the volume of tradec. may increase or reduce the nation's welfare*d. all of the above14. The imposition of an optimum tariff by a large nation:a. improves its terms of tradeb. reduces the volume of tradec. increases the nation's welfare*d. all of the above15. The optimum tariff for a small nation is:a. 100%b. 50%*c. 0d. depends on elasticities。

信号与系统奥本海姆英文版课后答案chapter8

.

Clearly, is just a shifted version of . Therefore,x(t)may be recovered from y(t) simply by multiplying y(t) by . There is no constraint that needs to be placed on to ensure that is recoverable from .

Chapter8 Answers

8.1Using Table 4.1, take the inverse Fourier transform of . This gives .

Therefor Y( ) of y(t) is given by

TheFourier transformof this signal is

.

Thisimplies that is zero for . When is passed through a lowpass fiter with cutoff frequency ,the output will clearly be zero .Therefore =0.

国际财务管理课后习题答案chapter-8

CHAPTER 8 MANAGEMENT OF TRANSACTION EXPOSURE SUGGESTED ANSWERS AND SOLUTIONS TO END-OF-CHAPTER QUESTIONS ANDPROBLEMSQUESTIONS1. How would you define transaction exposure? How is it different from economic exposure?Answer: Transaction exposure is the sensitivity of realized domestic currency values of the firm’s contractual cash flows denominated in foreign currencies to unexpected changes in exchange rates. Unlike economic exposure, transaction exposure is well-defined and short-term.2. Discuss and compare hedging transaction exposure using the forward contract vs. money market instruments. When do the alternative hedging approaches produce the same result?Answer: Hedging transaction exposure by a forward contract is achieved by selling or buying foreign currency receivables or payables forward. On the other hand, money market hedge is achieved by borrowing or lending the present value of foreign currency receivables or payables, thereby creating offsetting foreign currency positions. If the interest rate parity is holding, the two hedging methods are equivalent.3. Discuss and compare the costs of hedging via the forward contract and the options contract.Answer: There is no up-front cost of hedging by forward contracts. In the case of options hedging, however, hedgers should pay the premiums for the contracts up-front. The cost of forward hedging, however, may be realized ex post when the hedger regrets his/her hedging decision.4. What are the advantages of a currency options contract as a hedging tool compared with the forward contract?Answer: The main advantage of using options contracts for hedging is that the hedger can decide whether to exercise options upon observing the realized future exchange rate. Options thus provide a hedge against ex post regret that forward hedger might have to suffer. Hedgers can only eliminate the downside risk while retaining the upside potential.5. Suppose your company has purchased a put option on the German mark to manage exchange exposure associated with an account receivable denominated in that currency. In this case, your company can be said to have an ‘insurance’ policy on its receivable. Explain in what sense this is so.Answer: Your company in this case knows in advance that it will receive a certain minimum dollar amount no matter what might happen to the $/€exchange rate. Furthermore, if the German mark appreciates, your company will benefit from the rising euro.6. Recent surveys of corporate exchange risk management practices indicate that many U.S. firms simply do not hedge. How would you explain this result?Answer: There can be many possible reasons for this. First, many firms may feel that they are not really exposed to exchange risk due to product diversification, diversified markets for their products, etc. Second, firms may be using self-insurance against exchange risk. Third, firms may feel that shareholders can diversify exchange risk themselves, rendering corporate risk management unnecessary.7. Should a firm hedge? Why or why not?Answer: In a perfect capital market, firms may not need to hedge exchange risk. But firms can add to their value by hedging if markets are imperfect. First, if management knows about the firm’s exposure better than shareholders, the firm, not its shareholders, should hedge. Second, firms may be able to hedge at a lower cost. Third, if default costs are significant, corporate hedging can be justifiable because it reduces the probability of default. Fourth, if the firm faces progressive taxes, it can reduce tax obligations by hedging which stabilizes corporate earnings.8. Using an example, discuss the possible effect of hedging on a firm’s tax obligations.Answer: One can use an example similar to the one presented in the chapter.9. Explain contingent exposure and discuss the advantages of using currency options to manage this type of currency exposure.Answer: Companies may encounter a situation where they may or may not face currency exposure. In this situation, companies need options, not obligations, to buy or sell a given amount of foreign exchange they may or may not receive or have to pay. If companies either hedge using forward contracts or do not hedge at all, they may face definite currency exposure.10. Explain cross-hedging and discuss the factors determining its effectiveness.Answer: Cross-hedging involves hedging a position in one asset by taking a position in another asset. The effectiveness of cross-hedging would depend on the strength and stability of the relationship between the two assets.PROBLEMS1. Cray Research sold a super computer to the Max Planck Institute in Germany on credit and invoiced €10 million payable in six months. Currently, the six-month forward exchange rate is $1.10/€ and the foreign exchange advisor for Cray Research predicts that the spot rate is likely to be $1.05/€ in six months.(a) What is the expected gain/loss from the forward hedging?(b) If you were the financial manager of Cray Research, would you recommend hedging this euro receivable? Why or why not?(c) Suppose the foreign exchange advisor predicts that the future spot rate will be the same as the forward exchange rate quoted today. Would you recommend hedging in this case? Why or why not?Solution: (a) Expected gain($) = 10,000,000(1.10 – 1.05)= 10,000,000(.05)= $500,000.(b) I would recommend hedging because Cray Research can increase the expected dollar receipt by $500,000 and also eliminate the exchange risk.(c) Since I eliminate risk without sacrificing dollar receipt, I still would recommend hedging.2. IBM purchased computer chips from NEC, a Japanese electronics concern, and was billed ¥250 million payable in three months. Currently, the spot exchange rate is ¥105/$ and the three-month forward rate is ¥100/$. The three-month money market interest rate is 8 percent per annum in the U.S. and 7 percent per annum in Japan. The management of IBM decided to use the money market hedge to deal with this yen account payable.(a) Explain the process of a money market hedge and compute the dollar cost of meeting the yen obligation.(b) Conduct the cash flow analysis of the money market hedge.Solution: (a). Let’s first compute the PV of ¥250 million, i.e.,250m/1.0175 = ¥245,700,245.7So if the above yen amount is invested today at the Japanese interest rate for three months, the maturity value will be exactly equal to ¥25 million which is the amount of payable.To buy the above yen amount today, it will cost:$2,340,002.34 = ¥250,000,000/105.The dollar cost of meeting this yen obligation is $2,340,002.34 as of today.(b)___________________________________________________________________Transaction CF0 CF1____________________________________________________________________1. Buy yens spot -$2,340,002.34with dollars ¥245,700,245.702. Invest in Japan - ¥245,700,245.70 ¥250,000,0003. Pay yens - ¥250,000,000Net cash flow - $2,340,002.34____________________________________________________________________3. You plan to visit Geneva, Switzerland in three months to attend an international business conference. You expect to incur the total cost of SF 5,000 for lodging, meals and transportation during your stay. As of today, the spot exchange rate is $0.60/SF and the three-month forward rate is $0.63/SF. You can buy the three-month call option on SF with the exercise rate of $0.64/SF for the premium of $0.05 per SF. Assume that your expected future spot exchange rate is the same as the forward rate. The three-month interest rate is 6 percent per annum in the United States and 4 percent per annum in Switzerland.(a) Calculate your expected dollar cost of buying SF5,000 if you choose to hedge via call option on SF.(b) Calculate the future dollar cost of meeting this SF obligation if you decide to hedge using a forward contract.(c) At what future spot exchange rate will you be indifferent between the forward and option market hedges?(d) Illustrate the future dollar costs of meeting the SF payable against the future spot exchange rate under both the options and forward market hedges.Solution: (a) Total option premium = (.05)(5000) = $250. In three months, $250 is worth $253.75 = $250(1.015). At the expected future spot rate of $0.63/SF, which is less than the exercise price, you don’t expect to exercise options. Rather, you expect to buy Swiss franc at $0.63/SF. Since you are going to buy SF5,000, you expect to spend $3,150 (=.63x5,000). Thus, the total expected cost of buying SF5,000 will be the sum of $3,150 and $253.75, i.e., $3,403.75.(b) $3,150 = (.63)(5,000).(c) $3,150 = 5,000x + 253.75, where x represents the break-even future spot rate. Solving for x, we obtain x = $0.57925/SF. Note that at the break-even future spot rate, options will not be exercised.(d) If the Swiss franc appreciates beyond $0.64/SF, which is the exercise price of call option, you will exercise the option and buy SF5,000 for $3,200. The total cost of buying SF5,000 will be $3,453.75 = $3,200 + $253.75.This is the maximum you will pay.4. Boeing just signed a contract to sell a Boeing 737 aircraft to Air France. Air France will be billed €20 million which is payable in one year. The current spot exchange rate is $1.05/€ and the one -year forward rate is $1.10/€. The annual interest rate is 6.0% in the U.S. and5.0% in France. Boeing is concerned with the volatile exchange rate between the dollar and the euro and would like to hedge exchange exposure. (a) It is considering two hedging alternatives: sell the euro proceeds from the sale forward or borrow euros from the Credit Lyonnaise against the euro receivable. Which alternative would you recommend? Why?(b) Other things being equal, at what forward exchange rate would Boeing be indifferent between the two hedging methods?Solution: (a) In the case of forward hedge, the future dollar proceeds will be (20,000,000)(1.10) = $22,000,000. In the case of money market hedge (MMH), the firm has to first borrow the PV of its euro receivable, i.e., 20,000,000/1.05 =€19,047,619. Then the firm should exchange this euro amount into dollars at the current spot rate to receive: (€19,047,619)($1.05/€) = $20,000,000, which can be invested at the dollar interest rate for one year to yield:$20,000,000(1.06) = $21,200,000.Clearly, the firm can receive $800,000 more by using forward hedging.(b) According to IRP, F = S(1+i $)/(1+i F ). Thus the “indifferent” forward rate will be:F = 1.05(1.06)/1.05 = $1.06/€. $ Cost Options hedge Forward hedge $3,453.75 $3,150 0 0.579 0.64 (strike price) $/SF$253.755. Suppose that Baltimore Machinery sold a drilling machine to a Swiss firm and gave the Swiss client a choice of paying either $10,000 or SF 15,000 in three months.(a) In the above example, Baltimore Machinery effectively gave the Swiss client a free option to buy up to $10,000 dollars using Swiss franc. What is the ‘implied’ exercise exchange rate?(b) If the spot exchange rate turns out to be $0.62/SF, which currency do you think the Swiss client will choose to use for payment? What is the value of this free option for the Swiss client?(c) What is the best way for Baltimore Machinery to deal with the exchange exposure?Solution: (a) The implied exercise (price) rate is: 10,000/15,000 = $0.6667/SF.(b) If the Swiss client chooses to pay $10,000, it will cost SF16,129 (=10,000/.62). Since the Swiss client has an option to pay SF15,000, it will choose to do so. The value of this option is obviously SF1,129 (=SF16,129-SF15,000).(c) Baltimore Machinery faces a contingent exposure in the sense that it may or may not receive SF15,000 in the future. The firm thus can hedge this exposure by buying a put option on SF15,000.6. Princess Cruise Company (PCC) purchased a ship from Mitsubishi Heavy Industry. PCC owes Mitsubishi Heavy Industry 500 million yen in one year. The current spot rate is 124 yen per dollar and the one-year forward rate is 110 yen per dollar. The annual interest rate is 5% in Japan and 8% in the U.S. PCC can also buy a one-year call option on yen at the strike price of $.0081 per yen for a premium of .014 cents per yen.(a) Compute the future dollar costs of meeting this obligation using the money market hedge and the forward hedges.(b) Assuming that the forward exchange rate is the best predictor of the future spot rate, compute the expected future dollar cost of meeting this obligation when the option hedge is used.(c) At what future spot rate do you think PCC may be indifferent between the option and forward hedge?Solution: (a) In the case of forward hedge, the dollar cost will be 500,000,000/110 = $4,545,455. In the case of money market hedge, the future dollar cost will be: 500,000,000(1.08)/(1.05)(124)= $4,147,465.(b) The option premium is: (.014/100)(500,000,000) = $70,000. Its future value will be $70,000(1.08) = $75,600.At the expected future spot rate of $.0091(=1/110), which is higher than the exercise of $.0081, PCC will exercise its call option and buy ¥500,000,000 for $4,050,000 (=500,000,000x.0081).The total expected cost will thus be $4,125,600, which is the sum of $75,600 and $4,050,000.(c) When the option hedge is used, PCC will spend “at most” $4,125,000. On the other hand, when the forward hedging is used, PCC will have to spend $4,545,455 regardless of the future spot rate. This means that the options hedge dominates the forward hedge. At no future spot rate, PCC will be indifferent between forward and options hedges.7. Airbus sold an aircraft, A400, to Delta Airlines, a U.S. company, and billed $30 million payable in six months. Airbus is concerned with the euro proceeds from international sales and would like to control exchange risk. The current spot exchang e rate is $1.05/€ and six-month forward exchange rate is $1.10/€ at the moment. Airbus can buy a six-month put option on U.S. dollars with a strike price of €0.95/$ for a premium of €0.02 per U.S. dollar. Currently, six-month interest rate is 2.5% in the euro zone and 3.0% in the U.S.pute the guaranteed euro proceeds from the American sale if Airbus decides to hedge using aforward contract.b.If Airbus decides to hedge using money market instruments, what action does Airbus need to take?What would be the guaranteed euro proceeds from the American sale in this case?c.If Airbus decides to hedge using put options on U.S. dollars, what would be the ‘expected’ europroceeds from the American sale? Assume that Airbus regards the current forward exchange rate as an unbiased predictor of the future spot exchange rate.d.At what future spot exchange rate do you think Airbus will be indifferent between the option andmoney market hedge?Solution:a. Airbus will sell $30 million forward for €27,272,727 = ($30,000,000) / ($1.10/€).b. Airbus will borrow the present value of the dollar receivable, i.e., $29,126,214 = $30,000,000/1.03, and then sell the dollar proceeds spot for euros: €27,739,251. This is the euro amount that Airbus is going to keep.c. Since th e expected future spot rate is less than the strike price of the put option, i.e., €0.9091< €0.95, Airbus expects to exercise the option and receive €28,500,000 = ($30,000,000)(€0.95/$). This is gross proceeds. Airbus spent €600,000 (=0.02x30,000,000) upfr ont for the option and its future cost is equal to €615,000 = €600,000 x 1.025. Thus the net euro proceeds from the American sale is €27,885,000, which is the difference between the gross proceeds and the option costs.d. At the indifferent future spot rate, the following will hold:€28,432,732 = S T (30,000,000) - €615,000.Solving for S T, we obtain the “indifference” future spot exchange rate, i.e., €0.9683/$, or $1.0327/€.Note that €28,432,732 is the future value of the proceeds under money market hed ging:€28,432,732 = (€27,739,251) (1.025).Suggested solution for Mini Case: Chase Options, Inc.[See Chapter 13 for the case text]Chase Options, Inc.Hedging Foreign Currency Exposure Through Currency OptionsHarvey A. PoniachekI. Case SummaryThis case reviews the foreign exchange options market and hedging. It presents various international transactions that require currency options hedging strategies by the corporations involved. Seven transactions under a variety of circumstances are introduced that require hedging by currency options. The transactions involve hedging of dividend remittances, portfolio investment exposure, and strategic economic competitiveness. Market quotations are provided for options (and options hedging ratios), forwards, and interest rates for various maturities.II. Case Objective.The case introduces the student to the principles of currency options market and hedging strategies. The transactions are of various types that often confront companies that are involved in extensive international business or multinational corporations. The case induces students to acquire hands-on experience in addressing specific exposure and hedging concerns, including how to apply various market quotations, which hedging strategy is most suitable, and how to address exposure in foreign currency through cross hedging policies.III. Proposed Assignment Solution1. The company expects DM100 million in repatriated profits, and does not want the DM/$ exchange rate at which they convert those profits to rise above 1.70. They can hedge this exposure using DM put options with a strike price of 1.70. If the spot rate rises above 1.70, they can exercise the option, while ifthat rate falls they can enjoy additional profits from favorable exchange rate movements.To purchase the options would require an up-front premium of:DM 100,000,000 x 0.0164 = DM 1,640,000.With a strike price of 1.70 DM/$, this would assure the U.S. company of receiving at least:DM 100,000,000 – DM 1,640,000 x (1 + 0.085106 x 272/360)= DM 98,254,544/1.70 DM/$ = $57,796,791by exercising the option if the DM depreciated. Note that the proceeds from the repatriated profits are reduced by the premium paid, which is further adjusted by the interest foregone on this amount.However, if the DM were to appreciate relative to the dollar, the company would allow the option to expire, and enjoy greater dollar proceeds from this increase.Should forward contracts be used to hedge this exposure, the proceeds received would be:DM100,000,000/1.6725 DM/$ = $59,790,732,regardless of the movement of the DM/$ exchange rate. While this amount is almost $2 million more than that realized using option hedges above, there is no flexibility regarding the exercise date; if this date differs from that at which the repatriate profits are available, the company may be exposed to additional further current exposure. Further, there is no opportunity to enjoy any appreciation in the DM.If the company were to buy DM puts as above, and sell an equivalent amount in calls with strike price 1.647, the premium paid would be exactly offset by the premium received. This would assure that the exchange rate realized would fall between 1.647 and 1.700. If the rate rises above 1.700, the company will exercise its put option, and if it fell below 1.647, the other party would use its call; for any rate in between, both options would expire worthless. The proceeds realized would then fall between:DM 100,00,000/1.647 DM/$ = $60,716,454andDM 100,000,000/1.700 DM/$ = $58,823,529.This would allow the company some upside potential, while guaranteeing proceeds at least $1 million greater than the minimum for simply buying a put as above.Buy/Sell OptionsDM/$Spot Put Payoff “Put”Profits Call Payoff“Call”Profits Net Profit1.60 (1,742,846) 0 1,742,846 60,716,454 60,716,454 1.61 (1,742,846) 0 1,742,846 60,716,454 60,716,454 1.62 (1,742,846) 0 1,742,846 60,716,454 60,716,454 1.63 (1,742,846) 0 1,742,846 60,716,454 60,716,454 1.64 (1,742,846) 0 1,742,846 60,716,454 60,716,454 1.65 (1,742,846) 60,606,061 1,742,846 0 60,606,061 1.66 (1,742,846) 60,240,964 1,742,846 0 60,240,964 1.67 (1,742,846) 59,880,240 1,742,846 0 59,880,240 1.68 (1,742,846) 59,523,810 1,742,846 0 59,523,810 1.69 (1,742,846) 59,171,598 1,742,846 0 59,171,598 1.70 (1,742,846) 58,823,529 1,742,846 0 58,823,529 1.71 (1,742,846) 58,823,529 1,742,846 0 58,823,529 1.72 (1,742,846) 58,823,529 1,742,846 0 58,823,529 1.73 (1,742,846) 58,823,529 1,742,846 0 58,823,529 1.74 (1,742,846) 58,823,529 1,742,846 0 58,823,529 1.75 (1,742,846) 58,823,529 1,742,846 0 58,823,529 1.76 (1,742,846) 58,823,529 1,742,846 0 58,823,529 1.77 (1,742,846) 58,823,529 1,742,846 0 58,823,529 1.78 (1,742,846) 58,823,529 1,742,846 0 58,823,529 1.79 (1,742,846) 58,823,529 1,742,846 0 58,823,529 1.80 (1,742,846) 58,823,529 1,742,846 0 58,823,529 1.81 (1,742,846) 58,823,529 1,742,846 0 58,823,529 1.82 (1,742,846) 58,823,529 1,742,846 0 58,823,529 1.83 (1,742,846) 58,823,529 1,742,846 0 58,823,529 1.84 (1,742,846) 58,823,529 1,742,846 0 58,823,529 1.85 (1,742,846) 58,823,529 1,742,846 0 58,823,529Since the firm believes that there is a good chance that the pound sterling will weaken, locking them into a forward contract would not be appropriate, because they would lose the opportunity to profit from this weakening. Their hedge strategy should follow for an upside potential to match their viewpoint. Therefore, they should purchase sterling call options, paying a premium of:5,000,000 STG x 0.0176 = 88,000 STG.If the dollar strengthens against the pound, the firm allows the option to expire, and buys sterling in the spot market at a cheaper price than they would have paid for a forward contract; otherwise, the sterling calls protect against unfavorable depreciation of the dollar.Because the fund manager is uncertain when he will sell the bonds, he requires a hedge which will allow flexibility as to the exercise date. Thus, options are the best instrument for him to use. He can buy A$ puts to lock in a floor of 0.72 A$/$. Since he is willing to forego any further currency appreciation, he can sell A$ calls with a strike price of 0.8025 A$/$ to defray the cost of his hedge (in fact he earns a net premium of A$ 100,000,000 x (0.007234 –0.007211) = A$ 2,300), while knowing that he can’t receive less than 0.72 A$/$ when redeeming his investment, and can benefit from a small appreciation of the A$.Example #3:Problem: Hedge principal denominated in A$ into US$. Forgo upside potential to buy floor protection.I. Hedge by writing calls and buying puts1) Write calls for $/A$ @ 0.8025Buy puts for $/A$ @ 0.72# contracts needed = Principal in A$/Contract size100,000,000A$/100,000 A$ = 1002) Revenue from sale of calls = (# contracts)(size of contract)(premium)$75,573 = (100)(100,000 A$)(.007234 $/A$)(1 + .0825 195/360)3) Total cost of puts = (# contracts)(size of contract)(premium)$75,332 = (100)(100,000 A$)(.007211 $/A$)(1 + .0825 195/360)4) Put payoffIf spot falls below 0.72, fund manager will exercise putIf spot rises above 0.72, fund manager will let put expire5) Call payoffIf spot rises above .8025, call will be exercised If spot falls below .8025, call will expire6) Net payoffSee following Table for net payoff Australian Dollar Bond HedgeStrikePrice Put Payoff “Put”Principal Call Payoff“Call”Principal Net Profit0.60 (75,332) 72,000,000 75,573 0 72,000,2410.61 (75,332) 72,000,000 75,573 0 72,000,2410.62 (75,332) 72,000,000 75,573 0 72,000,2410.63 (75,332) 72,000,000 75,573 0 72,000,2410.64 (75,332) 72,000,000 75,573 0 72,000,2410.65 (75,332) 72,000,000 75,573 0 72,000,2410.66 (75,332) 72,000,000 75,573 0 72,000,2410.67 (75,332) 72,000,000 75,573 0 72,000,2410.68 (75,332) 72,000,000 75,573 0 72,000,2410.69 (75,332) 72,000,000 75,573 0 72,000,2410.70 (75,332) 72,000,000 75,573 0 72,000,2410.71 (75,332) 72,000,000 75,573 0 72,000,2410.72 (75,332) 72,000,000 75,573 0 72,000,2410.73 (75,332) 73,000,000 75,573 0 73,000,2410.74 (75,332) 74,000,000 75,573 0 74,000,2410.75 (75,332) 75,000,000 75,573 0 75,000,2410.76 (75,332) 76,000,000 75,573 0 76,000,2410.77 (75,332) 77,000,000 75,573 0 77,000,2410.78 (75,332) 78,000,000 75,573 0 78,000,2410.79 (75,332) 79,000,000 75,573 0 79,000,2410.80 (75,332) 80,000,000 75,573 0 80,000,2410.81 (75,332) 0 75,573 80,250,000 80,250,2410.82 (75,332) 0 75,573 80,250,000 80,250,2410.83 (75,332) 0 75,573 80,250,000 80,250,2410.84 (75,332) 0 75,573 80,250,000 80,250,2410.85 (75,332) 0 75,573 80,250,000 80,250,2414. The German company is bidding on a contract which they cannot be certain of winning. Thus, the need to execute a currency transaction is similarly uncertain, and using a forward or futures as a hedge is inappropriate, because it would force them to perform even if they do not win the contract.Using a sterling put option as a hedge for this transaction makes the most sense. For a premium of:12 million STG x 0.0161 = 193,200 STG,they can assure themselves that adverse movements in the pound sterling exchange rate will not diminish the profitability of the project (and hence the feasibility of their bid), while at the same time allowing the potential for gains from sterling appreciation.5. Since AMC in concerned about the adverse effects that a strengthening of the dollar would have on its business, we need to create a situation in which it will profit from such an appreciation. Purchasing a yen put or a dollar call will achieve this objective. The data in Exhibit 1, row 7 represent a 10 percent appreciation of the dollar (128.15 strike vs. 116.5 forward rate) and can be used to hedge against a similar appreciation of the dollar.For every million yen of hedging, the cost would be:Yen 100,000,000 x 0.000127 = 127 Yen.To determine the breakeven point, we need to compute the value of this option if the dollar appreciated 10 percent (spot rose to 128.15), and subtract from it the premium we paid. This profit would be compared with the profit earned on five to 10 percent of AMC’s sales (which would be lost as a result of the dollar appreciation). The number of options to be purchased which would equalize these two quantities would represent the breakeven point.Example #5:Hedge the economic cost of the depreciating Yen to AMC.If we assume that AMC sales fall in direct proportion to depreciation in the yen (i.e., a 10 percent decline in yen and 10 percent decline in sales), then we can hedge the full value of AMC’s sales. I have assumed $100 million in sales.1) Buy yen puts# contracts needed = Expected Sales *Current ¥/$ Rate / Contract size9600 = ($100,000,000)(120¥/$) / ¥1,250,0002) Total Cost = (# contracts)(contract size)(premium)$1,524,000 = (9600)( ¥1,250,000)($0.0001275/¥)3) Floor rate = Exercise – Premium128.1499¥/$ = 128.15¥/$ - $1,524,000/12,000,000,000¥4) The payoff changes depending on the level of the ¥/$ rate. The following table summarizes thepayoffs. An equilibrium is reached when the spot rate equals the floor rate.AMC ProfitabilityYen/$ Spot Put Payoff Sales Net Profit 120 (1,524,990) 100,000,000 98,475,010 121 (1,524,990) 99,173,664 97,648,564 122 (1,524,990) 98,360,656 96,835,666 123 (1,524,990) 97,560,976 86,035,986 124 (1,524,990) 96,774,194 95,249,204 125 (1,524,990) 96,000,000 94,475,010 126 (1,524,990) 95,238,095 93,713,105 127 (847,829) 94,488,189 93,640,360 128 (109,640) 93,750,000 93,640,360 129 617,104 93,023,256 93,640,360 130 1,332,668 92,307,692 93,640,360 131 2,037,307 91,603,053 93,640,360 132 2,731,269 90,909,091 93,640,360 133 3,414,796 90,225,664 93,640,360 134 4,088,122 89,552,239 93,640,360 135 4,751,431 88,888,889 93,640,360 136 5,405,066 88,235,294 93,640,360 137 6,049,118 87,591,241 93,640,360 138 6,683,839 86,966,522 93,640,360 139 7,308,425 86,330,936 93,640,360 140 7,926,075 85,714,286 93,640,360 141 8,533,977 85,106,383 93,640,360 142 9,133,318 84,507,042 93,640,360 143 9,724,276 83,916,084 93,640,360 144 10,307,027 83,333,333 93,640,360 145 10,881,740 82,758,621 93,640,360 146 11,448,579 82,191,781 93,640,360 147 12,007,707 81,632,653 93,640,360 148 12,569,279 81,081,081 93,640,360 149 13,103,448 80,536,913 93,640,360 150 13,640,360 80,000,000 93,640,360。

细胞生物学课后练习题及答案chapter8