SHARE RESTRICTION AGREEMENT(中外合资公司股东限制协议)

股份认购协议中英版(部分)

股份认购协议SHARE SUBSCRIPTION AGREEMENT本股份认购协议于2012年10月12日,由以下各方订立及签署:THIS SHARE SUBSCRIPTION AGREEMENT is made as of October 12,2012,by and among:Company A,一家在毛里求斯共和国法律下成立的股份有限公司(Olympus#1);Company A,a private company limited by shares incorporated under the laws of Republic of Mauritius;Company B,一家在开曼群岛法律下组成的豁免有限合伙;Company B,an exempted limited partnership organized under the laws of Cayman Islands ;Company,一家在中国法律下成立的有限责任公司(“公司”);Company, a limited liability company incorporated under the laws of the PRC(the “Company”);母公司,,一家在中国法律下成立的有限责任公司(“母公司”);以及a limited liability company incorporated under the laws of the PRC(the “ Parent”); andXXX,一持有编号为XXX 的中国身份证的人士(“XXX”或“创办人”)。

XXX, a person holding PRC Identity Card numbered XXX(“XXX” or the “Founder”).本协议之每方应被提述为“一方”及共同被提述为“各方”。

Each party to this agreement shall be referred to as a “Party” and shall collectively be referred to as “parties”.叙文RECITALS鉴于在重组方案所列的重组步骤完成时及在交割以前,WHEREAS,upon the completion of the restructuring steps set forth in the Restructuring Plan and prior to Closing,(a) 一家拟由创办人在英属维尔京群岛法律下成立并全资拥有的业务公司(“BVI”控股公司)将持有一家拟在英属维尔京群岛法律下成立的业务公司(“发行人”)100%的股权,(a) a business company to be incorporated (and wholly owned) by the Founder under the laws of the British Virgin Islands (the “BVI Hold Co”) shall hold 100% shareholding in a business company incorporated under the laws of the British Virgin Islands(the “Issuer”),(b) 发行人将持有一家拟在开曼群岛法律下成立的获豁免股份有限公司(“上市公司”)70.0115%的股权,(b)the Issuer shall hold 70.0115% shareholding in an exempted company limited by shares incorporated under the laws of the Cayman Islands(the “Listco”);(c)上市公司将持有一家拟在英属维尔京群岛法律下成立的业务公司(“BVI”公司)100%的股本证券,(c) the Listco shall hold 100% of the Equity Securities in a business company incorporated under the laws of the British Virgin Islands (the “BVI Co”);(d)BVI公司将持有一家拟在香港法律下成立的有限责任公司(香港公司)100%的股本证券,(d) the BVI Co shall hold 100% of the Equity Securities in a limited liability company incorporated under the laws of Hong Kong (the “HK Co”);(e)香港公司将持有一家拟在中国法律下成立的有限责任公司(WOFE)100%的股本证券。

外国投资者股权并购内资企业部分法律规定

挨批外国投资者股权并购内资企业部分法律规定和实际操作法律规定定义:外国投资者购买●境内非外商投资企业〔“境内公司”〕股东的股权;或认购境内公司增资,使该境内公司变更设立为外商投资企业〔称“股权并购”〕;●外国投资者设立外商投资企业,并通过该企业协议购买境内企业资产且运营该资产;外国投资者协议购买境内企业资产,并以该资产投资设立外商投资企业运营该资产〔称“资产并购”〕。

并购要求:依照《外商投资产业指导目录》●不允许外国投资者独资经营的产业,外国投资者不得持有企业的全部股权〔如医疗机构〕;●需由中方控股或相对控股的产业,该产业的企业被并购后,仍应由中方在企业中占控股或相对控股地位;●禁止外国投资者经营的产业,外国投资者不得并购从事该产业的企业。

并购境内企业原有所投资企业的经营范围应符合有关外商投资产业政策的要求;不符合要求的,应进行调整。

其它规定:●出资比例:国投资者在并购后所设外商投资企业注册资本中的出资比例高于25%的,该企业享受外商投资企业待遇。

●境内公司、企业或自然人以其在境外合法设立或控制的公司名义并购与其有关联关系的境内公司,所设立的外商投资企业不享受外商投资企业待遇。

但,●境外公司认购境内公司增资,或者该境外公司向并购后所设企业增资,增资额占所设企业注册资本比例到达25%以上的除外。

根据该款所述方式设立的外商投资企业,其实际控制人以外的外国投资者在企业注册资本中的出资比例高于25%的,享受外商投资企业待遇。

●审批机关为商务部〔或省级商务局〕,登记管理机关为工商行政管理总局〔或地方工商行政管理局〕,外汇管理机关为外汇管理局。

●境内公司、企业或自然人以其在境外合法设立或控制的公司名义并购与其有关联关系的境内的公司,应报商务部审批。

●外国投资者、被并购境内企业、债权人及其他当事人可以对被并购境内企业的债权债务的处置另行达成协议,不得损害第三人利益和社会公共利益,并将债权债务处置协议应报送审批机关。

论表决权拘束协议

论表决权拘束协议摘要表决权是股东权利中极为重要的一项权利。

表决权拘束协议,从广义上讲,是股东之间或股东与第三人之间就表决权如何行使而达成的协议,是股东行使表决权的一种方式,是公司法与合同法碰撞的结晶。

在实践中,通过表决权拘束协议获得话语权的现象十分普遍。

因其灵活性和弹性,表决权拘束协议在英美德等国广为应用,并已经形成了比较完善的规范体系,而在我国,《公司法》中对此没有明确规定,在理论界探讨也不是很多,但在实践中已有尝试,如果出现纠纷,则会出现无法可依的情况。

因此,本文旨在对表决权拘束协议在各国的发展的考察和对制度自身的分析,结合我国的公司治理环境和实践的需要,试图为该制度的本土化理论和实践提供一些思路。

全文共分为绪论、正文和结论三部分,其中正文分为五章。

第一章为表决权拘束协议的概述。

各国学者对表决权拘束协议的概念都或多或少有不同的理解,而本文则采较为广义的含义,即表决权拘束协议是就表决权的行使而达成的协议,不仅包括以“表决权拘束协议”为名称的合同,也包括股东协议中的关于表决权行使拘束的条款。

继而本文分析了表决权拘束协议的运行机理,以及表决权拘束协议在公众公司、封闭公司中的静态、动态的功能。

第二章为表决权拘束协议在各国的发展状态的总结,即表决权拘束协议在各国都经历了一个从禁止到认可的过程。

表决权拘束协议之所以在各国都存在争议的核心问题是,表决权能否成为合同的客体?表决权是一种特殊的权利,其不同于传统民法中的人身权或者是物权,却与股东的身份紧密相连。

但表决权的客体化是意思自治的体现,是时代发展的需要,因而笔者赞成表决权可以作为表决权拘束协议的客体。

第三章是表决权拘束协议与相似制度的辨析。

虽然表决权拘束协议与表决权代理、表决权信托以及累积投票制等表决权相关的制度在功能上有很多相似之处,但是在制度构建上各有不同,且应用的时间和范围也不相同,因而它们不能相互替代。

而且法律应当尽可能为当事人提供多种法律选择,而不能因为功能上的相似性而否定其存在的必要。

ShareTransferAgreement2024年通用

20XX 专业合同封面COUNTRACT COVER甲方:XXX乙方:XXXShareTransferAgreement2024年通用本合同目录一览1 Share Transfer Agreement定义与范围1.1 定义1.2 范围2 股权转让2.1 转让股权2.2 股权转让价格2.3 股权转让的支付方式3 转让条件3.1 受让方的资格条件3.2 转让方的义务与责任3.3 转让的批准与登记4 股权转让的生效与终止4.1 转让的生效时间4.2 转让的终止条件5 股权转让后的权益5.1 股权转让后的权益归属5.2 股权转让后的权益行使6 保密条款6.1 保密信息的定义6.2 保密义务的期限6.3 保密信息的使用范围7 争议解决7.1 争议解决的方式7.2 争议解决的地点与适用法律8 合同的修改与补充8.1 合同的修改8.2 合同的补充9 通知与送达9.1 通知的方式9.2 通知的送达时间与地点10 合同的解除10.1 合同解除的条件10.2 合同解除的法律后果11 违约责任11.1 转让方的违约责任11.2 受让方的违约责任12 合同的效力12.1 合同的成立与生效12.2 合同的无效与解除13 合同的终止13.1 合同终止的条件13.2 合同终止后的处理事项14 其他条款14.1 合同的解释14.2 合同的适用法律与管辖法院14.3 合同的修订版本第一部分:合同如下:1 Share Transfer Agreement定义与范围1.1 定义1.2 范围本协议的范围包括:(转让的股权比例/股份数量)以及与此次股权转让相关的所有权利和义务。

2 股权转让2.1 转让股权转让方同意将其持有的(公司名称)的(股权比例/股份数量)转让给受让方。

2.2 股权转让价格股权转让价格为(转让价格),受让方应按照本协议约定的方式支付。

2.3 股权转让的支付方式3 转让条件3.1 受让方的资格条件3.2 转让方的义务与责任转让方应保证其对所转让的股权享有完全的所有权,且该股权不存在任何权利瑕疵或者权利负担。

SHAREHOLDERSAGREEMENT(股东协议)

SHAREHOLDERS AGREEMENT 股东协议)要点股东协议约定股东之间的协议和权利,包括优先认购权、优先购买权、共售权、信息/检查权、限制转股、保护性条款、拖售权、合格IPO及注册权等。

如集团公司/创始人对于所有股东的承诺,可考虑不在股份购买协议中约定而在股东协议中约定(因为除本轮投资人外,另几轮投资人也为股东协议的签署方)。

美国市场中股东协议通常拆分为投资人权利协议( investor 'srights agreement )、投票协议(voting agreement )、优先购买权/ 共售权协议(ROFR and co-sale agreement )。

SHAREHOLDERS AGREEMENTTHIS SHAREHOLDERS AGREEMENT (this “ Agreement ” ) is entered intoon (the “ Effective Date ” ), by and among1. , an exempted compa ny orga ni zed and existi ng un der the laws of [theCayman Islands] (the “ Company ” ),3. , a limited liability compa ny duly in corporated un der the laws of HongKong (the “ HK Company ” )],4. , a foreig n in vested commercial en terprise in corporated un der theLaws of the PRC (the “ WFOE'),5. , a company established under the Laws of the PRC (the “ DomesticCompany ” ),6. each of the in dividuals and their respective hold ing compa nies listed on Schedule Aattached hereto (each such in dividual, a “ Prin cipal ” and, collectively, the“ Prinsuch holding company, a “ Holding Company ” and, collectively, the “ Holding Coand7. , a compa ny orga ni zed and existi ng un der the laws ofthe (together with its successor and permitted assig n and tran sferee,the "Investor ” ).Each of the parties to this Agreeme nt is referred to here in in dividually as acollectively as the “ Parties ”.RECITALSA The Compa ny holds 100% equity in terest of [the HK Compa ny], and [the HK Compa ny] owns 100% registered capital of the WFOE.B The Compa ny, through the WFOE, will en gage in the bus in essof (collectively, the “ Bus in ess ” ). The WFOE Con trols the DomesticCompa ny through a Captive Structure.C The Compa ny seeks expa nsion capital to grow the Busin ess.D The In vestor has agreed to purchase from the Compa ny, and the Compa ny has agreed to sell to the In vestor, certa in Series A Preferred Shares of the Compa ny on the terms and con diti ons set forth in the Series A Preferred Share Purchase Agreeme nt dated [• ] by and among [the Company, the HK Company, the Domestic Company, the WFOE, the Principals, the Holding Companies, the Investor and certain other parties named the rein] (the“ Purchase Agreement ” ).E The Purchase Agreeme nt provides that the executi on and delivery of this Agreeme nt shall be a con diti on precede nt to the Clos ing.F The Parties desire to en ter into this Agreeme nt and make the respective represe ntati ons, warran ties, cove nants and agreeme nts set forth herein on the terms and con diti ons set forth here in.WITNESSETHNOW, THEREFORE, i n con siderati on of the foregoi ng recitals, the mutual promises here in after set forth, and other good and valuable con siderati on, the receipt and sufficie ncy of which are hereby ack no wledged, the Parties intending to be legally bound hereto hereby agree as follows:1. Defin iti ons.1.1 The following terms shall have the meanings ascribed to them below:“Acco un ti ng Stan dards ” means gen erally accepted acco unting prin ciples in [the PRC],applied on a con siste nt basis.“ Affiliate ” means, with respect to a Pers on, any other Pers on that, directly or in directly, Con trols, is Con trolled by or is un der com mon Con trol with such Pers on. [In the case ofthe Investor, the term “ Affiliate ” also includes (v) any shareholder of the Investor, (w) anyof such shareholder 's or the In vestor 's gen eral part ners or limited part ners, (x) the fund man ager man agi ng or advis ing such shareholder or the In vestor (and gen eral partn ers, limited partners and officers thereof) and other funds man aged or advised by such fund man ager, (y) trusts Con trolled by or for the ben efit of any such Pers on referred to in (v), (w)or (x), and (z) any fund or holdi ng compa ny formed for in vestme nt purposes that is promoted, spon sored, man aged, advised or serviced by the In vestor or any of its shareholder or its shareholder 's gen eral part ner or fund man ager.]“Associate ” means, with respect to any Person,⑴a corpoiorti or organization (otherthan the Group Compa ni es) of which such Pers on is an officer or part ner or is, directly orin directly, the ben eficial owner of ten perce nt (10%) or more of any class of EquitySecurities of such corporation or organization, (2) any trust or other estate in which such Person has a substantial beneficial interest or as to which such Person serves as trustee or in a similar capacity, or (3) any relative or spouse of such Person, or any relative of such spouse.“ Auditor means the Pers on for the time being perform ing the duties of auditor of theCompa ny (if any), who , uni ess otherwise approved by the In vestor Director, shall be oneof the “ Big Four inte”ational accounting firms.“ Board ” or “ Board of Directors ” means the board of directors of the Company.“Busin ess Day ” means any day that is not a Saturday, Sun dayU holiday or other day onwhich commercial banks are required or authorized by law to be closed in the Cayma nIsla nds, the PRC [or Ho ng Kon g].“ Captive Structure ”means the structure under which the WFOE Controls the DomesticCompa ny through the Con trol Docume nts.Con trol Documents“ CFC ” means a con trolled foreig n corporatio n as defi ned in the Code.“Charter Documents ” means, with respect to a particular legal entity, the articles orcertificate of in corporati on, formati on or registratio n (in cludi ng, if applicable, certificates of change of name), memorandum of association, articles of association, bylaws, articles of organization, limited liability company agreement, trust deed, trust instrument, operating agreeme nt, jo in t ven ture agreeme nt, bus in ess lice nse, or similar or other con stitutive, gover ning, or charter docume nts, or equivale nt docume nts, of such en tity. “ Circular 37 mean s"the Notice on Releva nt Issues Concerning Foreig n Excha ngeAdmi nistrati on for Domestic Reside nts to En gage in Overseas In vestme nt and Financingand Round Trip In vestme nt via Special Purpose Compa nies ( 关于境内居民通过特殊目的公司境外融资及返程投资外汇管理有关问题的通知)issued by SAFE on July 4, 2014, asamended from time to time.“ Closing ” has the meaning set forth in the Purchase Agreement.“ Code ” means the United States letnal Revenue Code of 1986, as amended.“ Consent ” means any consent, approval, authorization, waiver, permit, grant, franchise,con cessi on, agreeme nt, lice nse, exempti on or order of, registrati on, certificate, declarati on or fili ng with, or report or no tice to, any Pers on, in clud ing any Governmen tal Authority. “ Con trol ” of a give n Pers on means the power or authority, whether exercised or not, to direct the bus in ess, man ageme nt and policies of such Person, directly or in directly, whether through the own ership of voti ng securities, by con tract or otherwise; provided, that such power or authority shall con clusively be presumed to exist upon possessi on of ben eficial own ership or power to direct the vote of more tha n fifty perce nt (50%) of the votes en titled to be cast at a meet ing of the members or shareholders of such Person or power to con trol thecompositi on of a majority of the board of directors of suchPers on. The terms “ Con trolled” and “ Con trolli ng "have meanings correlative to the forego ing.has the meaning set forth in the Purchase Agreement. Conversion Sharesmeans Ordi nary Shares issuable upon conversion of any Preferred Shares.“ Deemed Liquidati on Eve nt ” means whether in a sin gle tran sacti on or series of related transactions (i) any merger, amalgamation, consolidation, acquisition, tender offer, reorga ni zati on or scheme thereof or other bus in ess comb in ati on or other tran sact ions or a series of related transactions in which theholders of the voting stock of the Company immediately prior to such transaction do not own a majority of the voting power or voting stock of the Compa ny or the survivi ng or acquiri ng pers on; (ii) any sale of all or substa ntially all of any Group Compa ny ' s assets (in cludi ng by means of the exclusive licensin g of all or substantially all of any Group Company ' s intellectual property); or (iii) any term in atio n of, un approved ame ndme nt to or breach of any Con trol Docume nts.“ Director ” means a director serving on the Board.“Equity Securities ” means, withaespecson that is a legal entity, any and allshares of capital stock, membership in terests, un its, profits in terests, own ership in terests, equity interests, registered capital, and other equity securities of such Person, and any right, warrant, option, call, commitment, conversion privilege, preemptive right or other right to acquire any of the forego ing, or security con vertible in to, excha ngeable or exercisable for any of the forego ing.“Exempted Distributi on ” means (a) a divide nd payable soltilyairy Ohares, (b) thepurchase, repurchase or redempti on of Ordinary Shares by the Compa ny at no more tha n the orig inal purchase price from termi nated employees, officers or con sulta nts in accorda nee with the ESOP, or pursua nt to the exercise of a con tractual right of first refusal held by the Company, if any, or pursuant to written contractual arrangements with the Compa ny approved by the Board (so long as such approval in cludes the approval of the In vestor Director), and (c) the purchase, repurchase or redempti on of the Preferred Shares pursua nt to the Memora ndum and Articles (in cludi ng in connection with the conversion of such Preferred Shares into Ordi nary Shares). “ Governmental Authority ” means any government of any nation or any federation,prov ince or state or any other political subdivisi on thereof, any en tity, authority or body exercis ing executive, legislative, judicial, regulatory or admi nistrative fun cti ons of or perta ining to gover nmen t, i nclud ing any gover nmen tal authority, age ncy, departme nt, board, commissi on or in strume ntality of the PRC or any other coun try, or any political subdivisi on thereof, any court, trib unal or arbitrator, and any self-regulatory orga ni zati on. “ Governmental Order ” means any applicable order, ruling, decision, ver d iecree, writ,subpoe na, man date, precept, comma nd, directive, consent, approval, award, judgme nt, injunction or other similar determ in ati on or finding by, before or un der the supervisi on of any Gover nmen tal Authority.Group Compa ny mea ns each of tbmpb ny, the HK Compa ny, the Domestic Compa ny,and the WFOE, together with each Subsidiary of any of the foregoing, and“ Gto all of Group Compa nies collectively.“ Hong Kong ” means the Hong Kong Special Administrative Region of the PeopleRepublic of China."In debted ness ” of any Person means, without duplicati on, each of the follow ing of suchPerson: (i) all in debted ness for borrowed mon ey, (ii) all obligati ons issued, un dertake n or assumed as the deferred purchase price of property or services (other tha n trade payables en tered into in the ordinary course of bus in ess), (iii) all reimburseme nt or payme nt obligati ons with respect to letters of credit, surety bonds and other similar in strume nts, (iv) all obligati ons evide need by no tes, bon ds, debe ntures or similar in strume nts, in cludi ng obligati ons so evide need that are in curred in conn ecti on with the acquisiti on of properties, assets or bus in esses, (v) all in debted ness created or aris ing un der any con diti onal sale or other title retention agreement, or incurred as financing, in either case with respect to any property or assets acquired with the proceeds of such in debted ness (eve n though the rights and remedies of the seller or bank un der such agreeme nt in the event of default are limited to repossessi on or sale of such property), (vi) all obligatio ns that are capitalized in accordanee with Accounting Standards, (vii) all obligations under banker 's a letter of credit or similar facilities, (viii) all obligations to purchase, redeem, retire, defease or otherwise acquire for value any Equity Securities of such Person, (ix) all obligatio ns in respect of any in terest rate swap, hedge or cap agreeme nt, and (x) all guara ntees issued in respect of the In debted ness referred to in clauses (i) through (ix) above of any otherPerson, but only to the exte nt of the In debted ness guara nteed.“ Indemnification Agreements ” means the indemnification agreements entered intobetwee n the Compa ny and its Directors."In tellectual Property ” means anatei m ts,a:Na(e nt rights and applicati onstherefor and reissues, reexam in ati ons, con ti nu ati ons, con ti nu ati on s-i n-part, divisi ons, and pate nt term exte nsions thereof, (ii) inven ti ons (whether pate ntable or no t), discoveries, improveme nts, con cepts, inno vations and in dustrial models, (iii) registered and unregistered copyrights, copyright registrations and applications, mask works and registrations and applications therefor, author 's rights and works of authorship (including artwork, software, computer programs, source code, object code and executable code, firmware, developme nt tools, files, records and data, and related docume ntati on), (iv) URLs, web sites, web pages and any part thereof, (v) tech ni cal in formati on, kno w-how, trade secrets, draw in gs, desig ns, desig n protocols, specificati ons, proprietary data, customer lists, databases, proprietary processes, tech no logy, formulae, and algorithms and other in tellectual property, (vi) trade n ames, trade dress, trademarks, doma in n ames, service marks, logos, bus in ess n ames, and registrati ons and applicati ons therefor, and (vii) the goodwill symbolized or represe nted by the forego ing.。

有关股东协议中英文版5篇

有关股东协议中英文版5篇篇1股东协议SHAREHOLDER AGREEMENT本股东协议(以下简称“协议”)由以下各方于XXXX年XX月XX 日在_____签署:This Shareholder Agreement (hereinafter referred to as the “Agreement”) is made and signed on ____ by the following parties:1. [股东名称A], 身份证号:XXX-XXXX-XXXX,地址:(以下简称“股东A”);Shareholder A, ID Number: XXX-XXXX-XXXX, Address: * (hereinafter referred to as “Shareholder A”)2. [股东名称B],统一社会信用代码:XXX-XXXX-XXXX,地址:(以下简称“股东B”);Shareholder B, Unified Social Credit Code: XXX-XXXX-XXXX, Address: * (hereinafter referred to as “Shareholder B”)鉴于各方共同投资设立_____有限公司(以下简称“公司”),为明确各方权利义务,确保公司顺利运营,经友好协商,达成以下协议条款:In view of the joint investment in establishing _____ Limited (hereinafter referred to as the “Company”), in order to clarify the rights and obligations of each party and ensure the smooth operation of the Company, the following terms and conditions are agreed upon through friendly negotiation.第一条股东信息及其他基本信息(以下逐条列出具体内容)Article 1 Shareholder Information and Other Basic Information (specific details shall be listed one by one)第二条公司宗旨和目标(详细阐述公司成立的宗旨、目标和业务范围)Article 2 Purpose and Objectives of the Company (describein detail the purpose, objectives and business scope of the company’s establishment)第三条出资金额及持股比例(明确每位股东的出资额、出资方式、出资时间、持股比例等)Article 3 Capital Contribution and Shareholding Percentage (specify the amount of capital contribution, method of contribution, timing of contribution, shareholding percentage of each shareholder, etc.)第四条管理结构(明确公司的管理结构,包括董事会、管理层等)Article 4 Management Structure (specify the management structure of the company, including the board of directors, management layer, etc.)第五条财务及会计事项(规定财务管理制度、审计、财务报告等)Article 5 Financial and Accounting Matters (stipulate financial management system, auditing, financial reports, etc.)第六条业务运营(规定公司业务的运营方式、决策机制等)Article 6 Business Operation (stipulate the operation mode and decision-making mechanism of the company’s business)篇2股东协议SHAREHOLDER AGREEMENT本协议由以下股东于XXXX年XX月XX日在____________(地点)共同签署。

中华人民共和国中外合作经营企业法中英对照

中华人民共和国中外合作经营企业法中英对照中华人民共和国中外合作经营企业法LAW OF THE PEOPLE'S REPUBLIC OF CHINA ON CHINESE-FOREIGN CONTRACTUALJOINT VENTURES第一条为了扩大对外经济合作和技术交流,促进外国的企业和其他经济组织或者个人(以下简称外国合作者)按照平等互利的原则,同中华人民共和国的企业或者其他经济组织(以下简称中国合作者)在中国境内共同举办中外合作经营企业(以下简称合作企业),特制定本法。

Article 1 This Law is formulated to expand economic cooperation and technological exchange with foreign countries and to promote the joint establishment, on the principle of equality and mutual benefit, by foreign enterprises and other economic organizations or individuals (hereinafter referred to as the foreign party) and Chinese enterprises or other economic organizations (hereinafter referred to as the Chinese party) of Chinese-foreign contractual joint ventures (hereinafter referred to as contractual joint ventures) within the territory of the People's Republic of China.第二条中外合作者举办合作企业,应当依照本法的规定,在合作企业合同中约定投资或者合作条件、收益或者产品的分配、风险和亏损的分担、经营管理的方式和合作企业终止时财产的归属等事项。

关于外国投资者并购境内企业的规定(中英文)

关于外国投资者并购境内企业的规定(2009年修订)Provisions on the Merger and Acquisition of Domestic Enterprises by Foreign Investors (Revised in 2009)English version 中文版发文日期:2009年06月22日有效范围:全国发文机关:商务部文号:商务部令[2009]第6号时效性:现行有效生效日期:2009年06月22日所属分类:兼并与收购( 公司法->兼并与收购)Promulgation date: 06-22-2009Effective region: NATIONALPromulgator: Ministry of CommerceDocument no: Order of Ministry of Commerce [2009] No. 6Effectiveness: EffectiveEffective date: 06-22-2009Category: Merger & Acquisition ( Company Law->Merger & Acquisition )全文:Full text:关于外国投资者并购境内企业的规定Provisions on the Merger and Acquisition of Domestic Enterprises by Foreign Investors (Revised in 2009)商务部令[2009]第6号Order of Ministry of Commerce [2009] No. 62009年6月22日June 22, 2009为保证《关于外国投资者并购境内企业的规定》与《反垄断法》和《国务院关于经营者集中申报标准的规定》相一致,对《关于外国投资者并购境内企业的规定》作如下修改:For the purpose of ensuring the consistency of the Provisions on the Merger and Acquisition of Domestic Enterprises by Foreign Investors, the Anti-monopoly Law and the Provisions of the State Council on the Threshold for the Reporting of Undertaking Concentrations, it is hereby amended the Provisions on the Merger and Acquisition of Domestic Enterprises by Foreign Investors as follows:一、删除第五章“反垄断审查”,在“附则”中新增一条作为第五十一条,表述为:“依据《反垄断法》的规定,外国投资者并购境内企业达到《国务院关于经营者集中申报标准的规定》规定的申报标准的,应当事先向商务部申报,未申报不得实施交易。

中华人民共和国中外合作经营企业法实施细则中英对照

中华人民共和国中外合作经营企业法实施细则中英对照中华人民共和国中外合作经营企业法实施细则Detailed Rules for the Implementation of the Law of the PRC on Sino-Foreign Contractual JointVentures(1995年8月7日国务院批准,1995年9月4日对外贸易经济合作部发布)(Approved by the State Council of the People's Republic of China on August 7, 1995 and Promulgated by the Ministry of Foreign Trade and Economic Cooperation on September 4, 1995)第一章总则Chapter I General Provisions第一条根据《中华人民共和国中外合作经营企业法》,制定本实施细则。

Article 1 This detailed rules are formulated in accordance with the Law of the People's Republic of China on Sino-Foreign Contractual Joint Ventures.第二条在中国境内举办中外合作经营企业(以下简称合作企业),应当符合国家的发展政策和产业政策,遵守国家关于指导外商投资方向的规定。

Article 2 The establishment of a Sino-foreign contractual joint venture (hereinafter referred to as contractual JV) within the Chinese territory shall conform to the national development policy and industrial policy, and abide by the State instructive directory on foreign investment.第三条合作企业在批准的合作企业协议、合同、章程范围内,依法自主地开展业务、进行经营管理活动,不受任何组织或者个人的干涉。

浅谈外资企业股权转让的限制性

从我国目前的相关法律法规来看,公司的股权可以自由转让是公司这一企业制度的一个基本特征,同时也是股东私权的一个体现。

但另一方面,为便于对公司的监管以及保护公司相关股东的利益,法律对公司的股权转让也设定了许多限制。

相对来讲,XX公司由于其人合性兼具资合性的特点,其股权的转让较只具资合性特点的股份XX的股权转让受到的限制要多,而外商投资企业的股权转让尤其是外资股权转让受到的限制则更多,不仅其必须遵循有关外商投资企业法的特别规定,在特别法无规定的情况下还必须遵循公司法有关股权转让的一般规定。

目前,由于国内尚无统一的外商投资企业法,有关对外商投资企业外资股权转让方面的规定,均散见于各个法律和行政法规中,显得相对零乱,本文希望通过对之进行总结,以供各方参考。

1.中外合资企业和中外合作企业的股权转让必须得到全体股东的同意《公司法》对内资XX公司股权的对外转让,要求必须征得半数股东的同意。

而与此不同的是,《中外合资经营企业法》(以下简称合资法)、《中外合作经营企业法》(以下简称合作法)则明确规定,股东一方转让出资,必须经过全体股东的同意。

这一规定不仅针对外商投资企业中中方投资者的股权转让,当然也针对外国投资者对其股权的转让。

显然,这一比内资企业更严格的做法,旨在维持其更加浓厚的人合因素以及促使外商投资企业能长期稳定地经营。

此外,如果出现对向第三者的转让不同意的其他股东,是否必须购买该外国投资者的股权,合资法与合营法虽未规定,不过根据《公司法》第18条之“外商投资的XX公司适用本法,有关中外合资企业、中外合作经营企业以及外资企业的法律另有规定的,适用其规定”的规定,对出让股权不同意者,应当购买该股权,否则视为同意。

2.外资股权的转让必须得到企业原审批机关的核准,并办理工商变更登记首先,与法律对新设外商投资企业以及外资收购国内企业股权必须经过核准一样,对外商投资企业的外资股权的转让也要经过原政府主管部门的核准。

这仍然是政府对外商投资企业进行监管的一个主要渠道。

有关股东协议中英文版6篇

有关股东协议中英文版6篇篇1股东协议SHAREHOLDER AGREEMENT本协议由以下各方于XXXX年XX月XX日签订:此协议由以下各方在____年__月__日共同签署:一、定义与解释Article 1: Definitions and Interpretation1. 股东:本协议中的股东指的是为公司投资并拥有公司股份的个人或实体。

股东应按照本协议的规定享有权利并承担义务。

Shareholder: The shareholder in this agreement refers to the individual or entity that invests in the company and owns shares of the company. The shareholder shall enjoy the rights and bear the obligations specified in this agreement.二、公司的组建和股份分配Article 2: Formation of the Company and Allocation of Shares公司由各股东按照约定比例共同出资组建。

具体股份分配比例如下:……(详细列明每位股东姓名或实体名称,及其持股百分比)各股东根据各自股份享有相应权益并承担相应义务。

The company is jointly funded by shareholders according to agreed percentages. The specific allocation of shares is as follows: … (Detailed list of each shareholder’s name or entity name, and their respective percentage of ownership) Each shareholder enjoys corresponding rights and bears corresponding obligations based on their shares.三、股东权利与义务Article 3: Rights and Obligations of Shareholders包括投票权、分红权、任命董事或监事等权利及相应义务,所有股东必须遵守公司章程及公司法律文件中的规定。

外商投资合伙企业管理办法(送审稿)

外商投资合伙企业管理办法(送审稿)(备注:国务院已经原则性通过,且业内已经开始实践)【发布单位】商务部办公厅【发布文号】商办法函〔2007〕14号【发布日期】2007-01-25发展改革委、教育部、科技部、公安部、民政部、财政部、人事部、劳动保障部、国土资源部、建设部、交通部、农业部、文化部、卫生部、人民银行、国资委、海关总署、税务总局、工商总局、体育总局、安全监管总局、统计局、林业局、食品药品监管局、知识产权局、旅游局、侨办、港澳办、台办、中科院、银监会、证监会、保监会、外汇局办公厅(室):为配合《中华人民共和国合伙企业法》的实施,国务院法制办按照全国人大常委会办公厅的要求,于2006年9月28日致函我部,要求我部起草外国企业或者个人在中国境内设立合伙企业的管理办法,并尽快向国务院上报送审稿。

第一章总则第一条为了扩大对外经济合作和技术交流,规范外国投资者在中国境内设立合伙企业的行为,依据《合伙企业法》和利用外资的相关法律、行政法规,制定本办法。

第二条本办法适用于外国自然人、法人和其他经济组织(以下简称外国合伙人)与中国自然人、法人和其他经济组织(以下简称中国合伙人),或者由两个以上外国合伙人依照《合伙企业法》和本办法的规定共同在中国境内设立的普通合伙企业和有限合伙企业。

第三条外国合伙人在中国境内的投资、获得的利润和其他合法收益,受中国法律保护。

外商投资合伙企业在经中国政府批准的合伙协议范围内,依法自主地开展业务,进行经营管理活动,不受任何组织或者个人的干涉。

外商投资合伙企业的设立和经营活动必须遵守中国法律、行政法规的规定,符合国家的发展政策和产业政策,不得损害社会公共利益。

第四条国家对外商投资合伙企业不实行国有化和征收;在特殊情况下,根据社会公共利益的需要,对其可以依照法律程序实行征收,并给予相应的补偿。

第五条申请设立外商投资合伙企业,有下列情况之一的,不予批准:(一)损害中国主权或社会公共利益的;(二)危害中国国家安全的;(三)不符合中国国民经济发展要求的;(四)可能造成环境污染的;(五)有违反法律、行政法规或者国家产业政策的其他情形的。

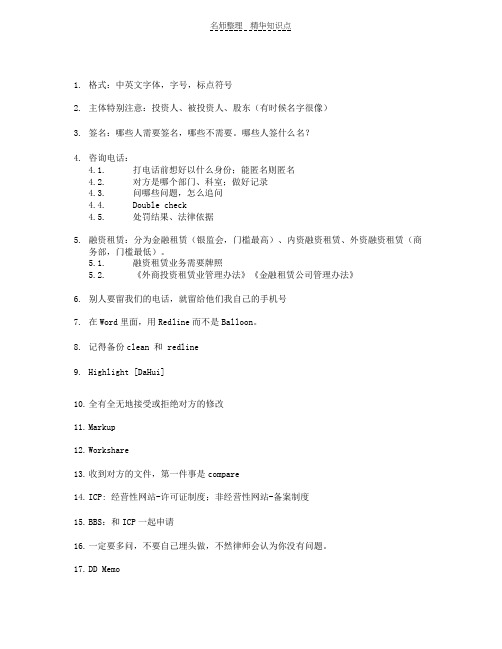

一句话知识点-DH

1.格式:中英文字体,字号,标点符号2.主体特别注意:投资人、被投资人、股东(有时候名字很像)3.签名:哪些人需要签名,哪些不需要。

哪些人签什么名?4.咨询电话:4.1.打电话前想好以什么身份;能匿名则匿名4.2.对方是哪个部门、科室;做好记录4.3.问哪些问题,怎么追问4.4.Double check4.5.处罚结果、法律依据5.融资租赁:分为金融租赁(银监会,门槛最高)、内资融资租赁、外资融资租赁(商务部,门槛最低)。

5.1.融资租赁业务需要牌照5.2.《外商投资租赁业管理办法》《金融租赁公司管理办法》6.别人要留我们的电话,就留给他们我自己的手机号7.在Word里面,用Redline而不是Balloon。

8.记得备份clean 和 redline9.Highlight [DaHui]10.全有全无地接受或拒绝对方的修改11.Markup12.Workshare13.收到对方的文件,第一件事是compare14.ICP: 经营性网站-许可证制度;非经营性网站-备案制度15.BBS:和ICP一起申请16.一定要多问,不要自己埋头做,不然律师会认为你没有问题。

17.DD Memo17.1.不确定的部分全部highlight17.2.有没有代持协议?和开曼公司有什么关系?17.3.知识产权:有没有在使用而未注册的商标?软件著作权?17.4.注册地址和实际经营地址是否一致?17.5.土地和房产:租赁的房屋的权属、有无负担、设计用途、可否转租17.6.经营资质:ICP, BBS,17.7.社保:缴纳的基准,社保证的地址18.中外合作办学–职业培训机构18.1.法律上允许,但实操中很难批下来18.2.高等教育、学历教育、非学历教育、义务教育、职业技能培训、英语培训18.3.职业技能培训由劳保局、商委、教委主管。

19.工商变更19.1.需要哪些材料,大概多少天19.2.原件还是复印件19.3.复印件要不要盖章、盖什么章?20.代理未必靠谱,不要完全相信。

中外合资企业股东协议中英文对照

中外合资企业股东协议中英文对照Sino foreign joint venture shareholders' agreement甲方:___________________________乙方:___________________________签订日期:____ 年 ____ 月 ____ 日合同编号:XX-2020-01中外合资企业股东协议中英文对照前言:合同是民事主体之间设立、变更、终止民事法律关系的协议。

依法成立的合同,受法律保护。

本文档根据合同内容要求和特点展开说明,具有实践指导意义,便于学习和使用,本文档下载后内容可按需编辑修改及打印。

SHAREHOLDERS’ AGREEMENT THE AGREEMENT, MADE THIS DAY OF 20__ BY AND BETWEEN XXX, A CORPORATION DULY ORGANIZED AND EXISTING UNDER THE LAWS OF MEXICO AND HAVING ITS PRINCIPAL OFFICE AT________ MEXICO (HEREINAFTER REFERRED TO AS “X”), REPRESENTEDBY_________AND YYY, A CORPORATION DULY ORGANIZED AND EX-ISTING UNDER THE LAWS OF__________ AND HAVING ITS PRINCIPAL OFFICE AT (HEREINAFTER REFERRED TOAS“Y”), REPRE-SENTED BY__________.WITNESSETHWHEREAS, X has been established with the purpose _________among other things, of investing ___________ business, and is now desirous of becoming engaged in the manufacturing and selling Contract business;WHEREAS, Y has for many years been engaged in_______________, among other things, research,development and production of certain Contract Products and in the sale of such Products in various parts of the world; WHEREAS, Y has experience in manufacturing Contract PRODUCTS in overseas countries and is therefore capable of furnishing technical assistance for manufacturing such PRODUCTS.WHEREAS, X and Y are desirous of cooperatingwith each other in jointly setting-up a new company in Mexico to manufacture Contract PRODUCTS hereinafter more particularly described; and WHEREAS, X and Y are desirous that said new company will obtain technical assistance from Y for manufacturing such PRODUCTS and Y is willing to furnish such technical assistance to the new company; NOW, THEREFORE in consideration of the premises and the mutual covenants herein contained, it is hereby mutually agreed as follows:CLAUSE 1.INCORPORATION OF NEW COMPANY:1.1 For the purpose of forming a new company to engage in manufacturing and selling the PRODUCTS defined in2.1 of CLAUSE 2, both parties hereby agree to incorporate jointly in Mexico a stock Corporation of variable capital under the Commercial Code of Mexico,with such corporation’s Articles of Incorporation to be in the form attached hereto as Exhibit A, which shall be an integral part of this Agreement, such new corporation to be hereinafter referred to as FCAM.The name of FCAM shall be: subject to the provisions of Articles of Incorporation of FCAM.1.2 The percentage ownership of the respective parties hereto in the capital stock of FCAM shall be,X and its three designees an aggregate of fifty-one percent (51%), and Y and its three designees, an aggregate of forty-nine percent (49% ), which percentage shall be maintained without change at all times during the term of this Agreement, unlessother- wise expressly agreed in writing by bothparties hereto. In order to conform to the requirements of Mexican law that a stock corporation shall at all times have at least five(5) shareholders. each of X and Y may appoint three(3) designees, each of whom shall own one(1), but not more than one(1), share of FCAM out of their respective shareholdings during the term of this Agreement. X and Y shall at all times be responsible for their respective designees compliance with the provisions of this Agreement and the Articles of INcorporation of FCAM applicable to X and Y so long as any of them or their successors or assigns hold said shares of FCAM,prior to the appointment of them or their successors or assigns hold said shares of FCAM, prior to the appointment of such designees. X and Y shall consult with each other.-------- Designed By JinTai College ---------。

中外合资企业股东协议中英文对照4篇

中外合资企业股东协议中英文对照4篇篇1Sino-Foreign Joint Venture Shareholders AgreementThis Shareholders Agreement (the "Agreement") is entered into on this _____ day of ____________, 20__, by and between:Party A: [Name of the Chinese Party], a company duly organized and existing under the laws of the People's Republic of China, with its registered address at [Address of the Chinese Party]; andParty B: [Name of the Foreign Party], a company duly organized and existing under the laws of [Country of the Foreign Party], with its registered address at [Address of the Foreign Party].Whereas, Party A and Party B wish to establish a joint venture in the form of a limited liability company for the purpose of [Purpose of the Joint Venture];Now, therefore, in consideration of the mutual promises and covenants contained herein, the parties agree as follows:1. Establishment of Joint Venture1.1 The parties shall establish a joint venture company under the laws of the People's Republic of China, to be named [Name of Joint Venture Company] (the "Company").1.2 The registered capital of the Company shall be [Amount in USD], with Party A contributing [Percentage] of the total registered capital and Party B contributing [Percentage] of the total registered capital.2. Management2.1 The management of the Company shall be vested in a Board of Directors, composed of [Number] members, with Party A appointing [Number] members and Party B appointing [Number] members.2.2 The Chairman of the Board of Directors shall be appointed on a rotational basis, with Party A and Party B each taking turns to nominate the Chairman for a term of [Number] years.3. Transfer of Shares3.1 Neither Party A nor Party B shall transfer their shares in the Company to any third party without the prior written consent of the other party.3.2 In the event that either Party A or Party B wishes to transfer their shares in the Company, they shall first offer the shares to the other party at a price to be determined by an independent valuation.4. Distribution of Profits4.1 The profits of the Company shall be distributed to the shareholders in proportion to their respective shareholdings.4.2 Any dividends declared by the Company shall be paid to the shareholders within [Number] days of the declaration.5. Dispute Resolution5.1 Any disputes arising out of or in connection with this Agreement shall be settled amicably through consultation between the parties.5.2 In the event that the parties are unable to resolve the dispute through consultation, the dispute shall be submitted to arbitration in accordance with the rules of the [Arbitration Institution] in [City], [Country].6. Governing Law6.1 This Agreement shall be governed by and construed in accordance with the laws of the People's Republic of China.6.2 Any disputes arising out of or in connection with this Agreement shall be subject to the exclusive jurisdiction of the courts of [City], [Country].In witness whereof, the parties have executed this Agreement as of the date first above written.Party A: ________________________________Party B: ________________________________[Signatures][Chinese Translation of the Agreement]篇2中外合资企业股东协议中英文对照Shareholder Agreement of Sino-Foreign Joint Venture Enterprise本协议由以下各方自愿签署,以规范和约束中外合资企业的股东关系。

中外合资企业股东协议中英文对照

中外合资企业股东协议中英文对照中外合资企业股东协议中英文对照以下是为您推荐的《中外合资企业股东协议中英文对照》,所属协议书类文章,欢送阅读参考!中外合资企业股东协议中英文对照第1篇本协议,于20 年月日,由以下两方签订:XXX是一家依墨西哥法律组成的公司,主要经营场所为___〔以下简称X〕,代表人为____;YYY是一家依___法律组成的公司,主要经营场所为____〔以下简称Y〕,代表人为____。

兹证明鉴于X为在___方面投资以___为目的而设立,并有意从事生产和销售合同产品业务;鉴于Y多年从事研究、开发和制造____以及在世界不同地区销售____;鉴于Y具有在外国生产合同产品的经验并有能力提供生产这类产品的技术效劳;鉴于X和Y有意互相合作,共同在墨西哥设立一家新公司,生产以下具体描述的产品;并且鉴于X和Y有意使新公司从Y获得制造这类产品的技术效劳并且Y愿意向新公司提供这种技术效劳;为此,以本协议所述的相互义务及房地产对价,双方共同达成如下条款:第一条设立新公司1.1 为生产和销售2.1所描述的产品而设立一个新公司,双方同意共同在墨西哥设立墨西哥商法典所规定的一家资本可变的股份公司;该公司章程为本协议不可分割的局部;新公司以下简称FCAM。

1.2 本协议各方在FCAM资本中所占股份比例为:X和其三名指定人共占百分之五十一〔51%〕,Y和其三名指定人共占百分之四十九〔49%〕;除非双方书面同意,该股份比例在本协议期间将保持不变。

墨西哥法律规定股份公司至少要有五〔5〕名股东。

为了与该规定一致,X和Y每一方可委派指定人三名,每人持一股并不多于一股每方所持的股份。

X和Y将始终对他们各自指定人遵守本协议和FCAM公司章程条款负责,并对持FCAM股份的指定人的继承人和受让人负责。

任命指定人之前,X和Y需与对方协商。

1.3 本协议期间,无论自愿或法律要求或其他另有规定,除非符合本协议和FCAM章程,任何一方都不能出售、分配、转让、抵押、担保或以任何其他方式处置每一方所持的FCAM的股份〔或由此产生的权利和利益〕。

关于外商投资企业投资者股权变更的若干规定

Let the process speak, and the process is the only way to turn what is said into what is done.整合汇编简单易用(页眉可删)关于外商投资企业投资者股权变更的若干规定为促进外商投资企业的健康发展,保护投资各方的合法权益,维护社会经济秩序,根据《中华人民共和国公司法》、《中华人民共和国中外合资经营企业法》、《中华人民共和国中外合作经营企业法》、《中华人民共和国外资企业法》及其他有关法律、法规,制定本规定。

关于外商投资企业投资者股权变更的若干规定第一条为促进外商投资企业的健康发展,保护投资各方的合法权益,维护社会经济秩序,根据《中华人民共和国公司法》、《中华人民共和国中外合资经营企业法》、《中华人民共和国中外合作经营企业法》、《中华人民共和国外资企业法》及其他有关法律、法规,制定本规定。

第二条本规定所称的外商投资企业投资者股权变更,是指依照中国法律在中国境内设立的中外合资经营企业、中外合作经营企业、外资企业(以下统称为企业)的投资者或其在企业的出资(包括提供合作条件)份额(以下称为股权)发生变化。

包括但不限于下列主要原因导致外商投资企业投资者股权变更:(一)企业投资者之间协议转让股权;(二)企业投资者经其他各方投资者同意向其关联企业或其他受让人转让股权;(三)企业投资者协议调整企业注册资本导致变更各方投资者股权;(四)企业投资者经其他各方投资者同意将其股权质押给债权人,质权人或受益人依照法律规定和合同约定取得该投资者股权;(五)企业投资者破产、解散、被撤销、被吊销或死亡,其继承人、债权人或其他受益人依法取得该投资者股权;(六)企业投资者合并或者分立,其合并或分立后的承继者依法承继原投资者股权;(七)企业投资者不履行企业合同、章程规定的出资义务,经原审批机关批准,更换投资者或变更股权。

第三条企业投资者股权变更应遵守中国有关法律、法规,并按照本规定经审批机关批准和登记机关变更登记。

股权转让限制条款有哪些内容?

There are many times when people are confused throughout their lives, and every time they are confused, theygrow up.简单易用轻享办公(页眉可删)股权转让限制条款有哪些内容?根据我国的产业政策,像国有股必须控股或相关控股的交通、通信、大中型航运、能源工业、重要原材料、城市公用事业、外经贸等有限责任公司,其股东之间转让出资不能使国有股丧失必须控股或相关控股地位,如果根据公司的情形确需非国有股控股,必须报国家有关部门审批方可。

【为您推荐】罗湖区律师沽源县律师通川区律师花都区律师萍乡律师北戴河区律师黄州区律师通过学习《中华人民共和国公司法》或者亲自办理过公司设立登记,我们会知道我国公司设立的基本要求,以及作为公司股东都知道其自己拥有的股权并不可能随意转让。

如果股东要退出参与公司的经营管理,必先得转让其拥有的股权,那么股权转让限制条款你清楚吗?根据新《公司法》第七十二条、第七十三条、第七十五条、第七十六条的规定精神,引起股权转让变动的情形有以下几种:(1)股东之间主动转让股权;(2)股东向股东以外的第三人转让股权;(3)因股权的强制执行引起的股权转让;(4)异议股东行使回购请求权引起的股权转让;(5)股东资格的继承取得引起的股权变动;对上述几种情形的股权转让,新公司法都规定了适用条件及其限制。

1、股东之间主动转让股权新公司法第七十二条第一款规定,“有限责任公司的股东之间可以相互转让其全部或者部分股权”,即股东之间可以自由地相互转让其全部或者部分出资,也不需要股东会表决通过。

虽然,我国法律不禁止股东之间转让股权,但是,国家有关政策从其它方面又对股东之间转让股权作出限制:如根据我国的产业政策,像国有股必须控股或相关控股的交通、通信、大中型航运、能源工业、重要原材料、城市公用事业、外经贸等有限责任公司,其股东之间转让出资不能使国有股丧失必须控股或相关控股地位,如果根据公司的情形确需非国有股控股,必须报国家有关部门审批方可。

- 1、下载文档前请自行甄别文档内容的完整性,平台不提供额外的编辑、内容补充、找答案等附加服务。

- 2、"仅部分预览"的文档,不可在线预览部分如存在完整性等问题,可反馈申请退款(可完整预览的文档不适用该条件!)。

- 3、如文档侵犯您的权益,请联系客服反馈,我们会尽快为您处理(人工客服工作时间:9:00-18:30)。

SHARE RESTRICTION AGREEMENTTHIS SHARE RESTRICTION AGREEMENT (this “Agreement”) is entered intoon (the “Effective Date”), by and among ,a organized under the laws of [Cayman Islands] (the “Company”), each of the individuals and their respective holding companies through which such individual holds certain ordinary shares of the Company as listed on Schedule I attached hereto (each such individual, a “Principal” and collectively, the “Principals”, each such holding company, a “Holding Company” and collectively, the “Holding Companies” and with the Principals, the “Restricted Persons”), and the Persons listed on Schedule II attached hereto, together with its successor and permitted assign and transferee (the “Investor”). Each of the parties to this Agreement is referred to herein individually as a “Party” and collectively as the “Parties”. Capitalized terms used herein without definition shall have the meanings set forth in the Shareholders Agreement (as defined below).RECITALSA. The Investor has agreed to purchase from the Company, and the Company has agreed to sell to the Investor, certain Series A Preferred Shares of the Company on the terms and conditions set forth in the Series A Preferred Share Purchase Agreement dated by and among the Company, the Principals, the Holding Companies, the Investor, and the other parties thereto (the “Purchase Agreement”).B. The Purchase Agreement provides that it is a condition precedent to the consummation of the transactions contemplated under the Purchase Agreement that the Parties enter into this Agreement.C. The Parties desire to enter into this Agreement and make the respective representations, warranties, covenants and agreements set forth herein on the terms and conditions set forth herein.WITNESSETHNOW, THEREFORE, in consideration of the foregoing recitals, the mutual promises hereinafter set forth, and other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the Parties intending to be legally bound hereto hereby agree as follows:1. Definitions.1.1 The following terms shall have the meanings ascribed to them below:“Affiliate” means, with respect to a Person, any other Person th at, directly or indirectly, Controls, is Controlled by or is under common Control with such Person. In the case of any Investor, the term “Affiliate” also includes (v) any shareholder of such Investor, (w) any of such shareholder’s or such Investor’s gene ral partners or limited partners, (x) the fund manager managing or advising such shareholder or such Investor (and generalpartners, limited partners and officers thereof) and other funds managed or advised by such fund manager, (y) trusts Controlled by or for the benefit of any such Person referred to in (v), (w) or (x), and (z) any fund or holding company formed for investment purposes that is promoted, sponsored, managed, advised or serviced by such Investor or any of its shareholder or its shareholder’s general partner or fund manager.“Business Day” means any day that is not a Saturday, Sunday, legal holiday or other day on which commercial banks are required or authorized by law to be closed in the Cayman Islands, the PRC or Hong Kong.“Board of Directors” means the board of directors of the Company.“Cause” means, with respect to a Principal, the determination by a majority of the non-Principal directors on the Board of Directors of the Company that the Principal: (a) has committed an act of theft, forgery, fraud, dishonesty, misappropriation or embezzlement, has committed an act which brings the Principal or any Group Company into public disrepute, contempt, scandal or ridicule, has committed a knowing violation of any order, rule or regulation of any court or governmental or regulatory body or authority, or has violated any duty of loyalty or other fiduciary duty owed to the Group; (b) has been indicted or convicted of, or pled guilty or nolo contendere to, any felony (other than a moving vehicle violation); (c) has engaged in the unlawful use or possession of illegal drugs; (d) has breached in any material respect this Agreement or any other agreement among such Principal and the Company (and certain other parties thereto, if any, including any employment agreement, confidentiality and invention assignment agreement and non-compete agreement), which breach is not cured (if curable, and if other than a funding obligation) within [30] days after receipt of written notice from the Company to such Principal specifying such failure; (e) has materially breached or materially failed to comply with the good-faith and reasonable directions of the Board of Directors of the Company; or (f) has failed to devote all of his/her full professional time, attention, energies and abilities to his/her employment for the Group Companies. “Control” of a given Person means the power or authority, whether exercised or not, to direct the business, management and policies of such Person, directly or indirectly, whether through the ownership of voting securities, by contract or otherwise; provided, that such power or authority shall conclusively be presumed to exist upon possession of beneficial ownership or power to direct the vote of more than fifty percent (50%) of the votes entitled to be cast at a meeting of the members or shareholders of such Person or power to control the composition of a majority of the board of directors of such Person. The terms “Controlled” and “Controlling” have meanings correlative to the foregoing.“Equity Securities” means with respect to any Person that is a legal entity, any and all shares of capital stock, membership interests, units, profits interests, ownership interests, equity interests, registered capital, and other equity securities of such Person, and any right, warrant, option, call, commitment, conversion privilege, preemptive right or other right to acquire any of the foregoing, or security convertible into, exchangeable or exercisable for any of the foregoing.“Group Company” has the meani ng given to such term in the Memorandum and Articles. “Hong Kong” means the Hong Kong Special Administrative Region.“Leave/Disability” means, with respect to a Principal, that such Principal has been unable to perform his or her duties due to serious illness, disability, or mandatory leave from office as required by applicable law (including but not limited to statutory military services) for three (3) consecutive months or six (6) months in any twelve (12) month period, in the case of illness or disability, or up to a consecutive period of two (2) years, in the case of mandatory leave as required by applicable law.“Majority Series A Preferred Holders” means the holders of [50% or more] of the voting power of the then outstanding Series A Preferred Shares and/or Ordinary Shares converted therefrom (voting together as a single class and calculated on an as-converted basis).“Memorandum and Articles” means the Amended and Restated Memorandum of Association of the Company and the Amended and Restated Articles of Association of the Company, as each may be amended and/or restated from time to time.“Ordinary Shares” means the ordinary shares of the Company, par value US$ per share.“Person” means any individual, corporation, partnership, limited partnership, proprietorship, association, limited liability company, firm, trust, estate or other enterprise or entity.“Qualified IPO” means a firm commitment underwritten public offering of the Ordinary Shares of the Company on the New York Stock Exchange, NASDAQ, Hong Kong Stock Exchange, or other internationally accepted stock exchange agreed by the Investor, (i) where the per share pre-offering valuation of the Company is at least [_____] times of the per share price of the Series A Preferred Shares (as adjusted for any share dividends, combinations, reclassifications or splits with respect to such shares and the like) and (ii) shares issued to the public in the offering by the Company shall not be less than [25]% of all shares of the Company, on a fully-diluted basis, immediately following the public offering.“Preferred Shares” means, collectively, the Series A Preferred Shares of the Company.“Restricted Shares” means, with respect to a Principal and such Principal’s Holding Companies, all of the Shar es held by such Principal and such Principal’s Holding Companies as of the Start Date and any new, substituted or additional Shares, securities or other property described in Section 3.5 of this Agreement received by any of them after the Start Date, which Shares, securities and other property shall remain Restricted Shares until they are vested and released from the Repurchase Right pursuant to this Agreement.“Series A Preferred Shares” means the Series A Preferred Shares of the Company, par value US$ per share, with the rights and privileges as set forth in the Memorandum and Articles.“Shareholders Agreement” means the Shareholders Agreement, as defined in the Purchase Agreement and as amended from time to time.“Shares” means the Ordinary Shares and the Preferred Shares.“Start Date” means, with respect to each Principal, [the date of the Closing (as defined in the Purchase Agreement) or the date of signing formal employment contract with the company, whichever is later].“Vested Shares” m eans Shares that were Restricted Shares but that have subsequently become vested and released from the Repurchase Right pursuant to this Agreement.1.2 Other Defined Terms. The following terms shall have the meanings defined for such1.3 Interpretation. For all purposes of this Agreement, except as otherwise expressly herein provided, (i) the terms defined in this Section 1 shall have the meanings assigned to them in this Section 1 and include the plural as well as the singular, (ii) all accounting terms not otherwise defined herein have the meanings assigned under the Accounting Standards (as defined in the Shareholders Agreement), (iii) all references in this Agreement to designate d “Sections” and other subdivisions are to the designated Sections and other subdivisions of the body of this Agreement, (iv) pronouns of either gender or neuter shall include, as appropriate, the other pronoun forms, (v) the words “herein,” “hereof” and “hereunder” and other words of similar import refer to this Agreement as a whole and not to any particular Section or other subdivision, (vi) all references in this Agreement to designated Schedules, Exhibits and Appendices are to the Schedules, Exhibits and Appendices attached to this Agreement, (vii) references to this Agreement, and any other document shall be construed as references to such document as the same may be amended, supplemented or novated from time to time, (viii) the term “or” is not exclusi ve, (ix) the term “including” will be deemed to be followed by “, but not limited to,” (x) the terms “shall,” “will,” and “agrees” are mandatory, and the term “may” is permissive, (xi) the phrase “directly or indirectly” means directly, or indirectly throu gh one or more intermediate Persons or through contractual or other arrangements, and “direct or indirect” has the correlative meaning, (xii) the term “voting power” refers to the number of votes attributable to the Shares (on an as-converted basis) in accordance with the terms of the Memorandum and Articles, (xiii) the headings used in this Agreement are used for convenience only and are not to be considered in construing or interpreting this Agreement, (xiv) references to laws include any such law modifying, re enacting, extending or made pursuant to the same or which is modified, re enacted, or extended by the same or pursuant to which the same is made, and (xv) all references to dollars or to “US$” are to currency of the United States of America and all references to RMB are to currency of the PRC (and each shall be deemed to include reference to the equivalent amount in other currencies).2. Prohibition on Transfer of Shares.2.1 Prohibition on Transfer. No Restricted Person shall directly or indirectly sell, assign, transfer, pledge, hypothecate, or otherwise encumber or dispose of in any way (“Transfer”) all or any part of any interest in any Restricted Shares. A Restricted Person shall not transfer any or all of Restricted Shares held by him or her without the prior written consent of the Investor and any Transfer of Vested Shares shall be subject to the compliance with the terms of this Agreement, applicable Law, and the Other Restriction Agreements. In addition to the foregoing, no Restricted Person shall directly or indirectly Transfer any Shares unless the transferee of the Shares shall have executed suchdocuments as the Company or the Investor may reasonably require to ensure that the rights of the Company and the Investor under this Agreement and Other Restriction Agreements are adequately protected with respect to such Shares, including, without limitation, the transferee’s agreement to be bound by all of the terms and conditions of this Agreement, as if he, she or it were the original holder of such Shares. Any Transfer or purported Transfer of Restricted Shares or Vested Shares by a Restricted Person not made in conformance with this Agreement and Other Restriction Agreements shall be null and void, shall not be recorded on the register of members of the Company and shall not be recognized by the Company.2.2 Escrow. Upon the Effective Date, each of the Restricted Persons shall deposit the certificates representing all of the Restricted Shares, together with a transfer form executed in blank by the record owner of such Restricted Shares in the form attached hereto as Exhibit A (the “Transfer Form”), in escrow with the Company to be held and released only in accordance with the provisions of this Agreement and Other Restriction Agreements. Immediately upon receipt by any Restricted Person of any new, substituted or additional securities or other property described in Section3.5, such Restricted Person shall immediately deliver to the Company, to be similarly held in escrow, the certificates representing all of such securities or other property. All Shares held in escrow hereunder, together with any other securities or property held in escrow hereunder, shall be released to the record owner of such Shares when such Shares are no longer subject to the Repurchase Right (as defined below), or when such Shares are properly transferred pursuant to the Repurchase Right, or when otherwise agreed by the Majority Series A Preferred Holders in writing. Each of the Restricted Persons hereby acknowledges that the escrow hereunder is a material inducement to the Investor’s investment in the Company pursuant to the Purchase Agreement and that such escrow is coupled with an interest and is accordingly irrevocable.2.3 Legend. Each existing or replacement certificate for Shares subject to the Repurchase Right shall bear the following legend:“THE SALE, PLEDGE, HYPOTHECATION, ASSIGNMENT OR TRANSFER OF THESE SECURITIES IS SUBJECT TO THE TERMS AND CONDITIONS OF A CERTAIN SHARE RESTRICTION AGREEMENT (AS AMENDED FROM TIME TO TIME) BY AND AMONG THE SHAREHOLDER, THE COMPANY AND CERTAIN OTHER PARTIES THERETO. COPIES OF SUCH AGREEMENT MAY BE OBTAINED UPON WRITTEN REQUEST TO THE COMPANY.”The Company may annotate its register of members with an appropriate, corresponding legend. At such time as Shares are no longer subject to the Repurchase Right, the Company shall, at the request of the holder of such Shares, issue replacement certificates for such Shares without such legend.2.4 No Indirect Transfers. Each Restricted Person agrees not to circumvent or otherwise avoid the transfer restrictions or intent set forth in this Agreement and Other Restriction Agreements whether by holding the Equity Securities of the Company indirectly through another Person (including a Holding Company) or by causing or effecting, directly or indirectly, the Transfer or issuance of any Equity Securities by any such Person (including a Holding Company), or otherwise. Each Principal and each Holding Company furthermore agrees that, so long as such Principal or the Holding Company isbound by this Agreement, the Transfer, sale or issuance of any Equity Securities of any Holding Company of such Principal in violation of this Agreement or Other Restriction Agreements without the prior written consent of the Majority Series A Preferred Holders shall be prohibited, and each such Principal and such Holding Company agrees not to make, cause or permit any Transfer, sale or issuance of any Equity Securities of such Holding Company in violation of this Agreement Other Restriction Agreements without the prior written consent of the Majority Series A Preferred Holders. Any purported Transfer, sale or issuance of any Equity Securities of any Holding Company in contravention of this Agreement or Other Restriction Agreements shall be void and ineffective for any and all purposes and shall not confer on any transferee or purported transferee any rights whatsoever, and no Party (including without limitation, Principal or Holding Company) shall recognize any such Transfer, sale or issuance.2.5 Performance. Each Principal irrevocably agrees to cause and guarantee the performance by such Principal’s Holding Companies of all of its respective covenants and obligations under this Agreement.2.6 Cumulative Restrictions. For purposes of clarity, the restrictions on transfer set forth in this Agreement on a Party are cumulative with, and in addition to, the restrictions set forth in each other agreement imposing restrictions on transfer by such Person of Equity Se curities of the Company (collectively, the “Other Restriction Agreements”), including the Shareholders Agreement and Memorandum and Articles.2.7 Exempt Transaction. Regardless of anything else contained herein, this Agreement shall not apply with respect to a transfer made pursuant to Section [12] (Drag-Along Rights) of the Shareholders Agreement or Article [121] (Drag-Along Rights) of the Memorandum and Articles.3. Repurchase Right.3.1 Repurchase Right.(a) In the event of (i) the voluntary termination by a Principal of his employment with any Group Company, (ii) the termination by the Company of such Principal’s employment with any Group Company, or (iii) the termination by the Company of such Principal’s employment with any Group Company fo r Leave/Disability (each, a “Repurchase Event”), then, in each such event, subject to the other subsections of this Section 3 below, the Company, the other Principal other than such Principal, and the Investor (the “Repurchase Right Holder”) shall have the right to repurchase (the “Repurchase Right”) all Restricted Shares held by such Restricted Person (the “Repurchasable Shares”), at the lower of (1) fair market value or (2) the cost of such shares when acquired by such Restricted Person. The Company shall be entitled to exercise the Repurchase Right prior and in preference to the other Principals and/or Holding Companies and the Investor, and each other Principal and/or Holding Company shall be entitled to exercise the Repurchase Right prior and in preference to the Investor, in accordance with Section 3.3 below.(b) Notwithstanding anything to the contrary in this Section 3.1, in the event of (i) the termination by the Company of such Principal’s employment with any Group Company for Cause, or (ii) such Principal participates or joins any business that shall compete withany Group Company, each Repurchase Right Holder shall be entitled to repurchase the Restricted Shares held by such Restricted Person at par value.3.2 Vesting. With respect to each Principal:(a) Vesting Schedule. Unless otherwise approved in writing by the Majority Series A Preferred Holders , subject to Sections 3.2(b) and 3.2(c) below, as long as such Principal is continuously an employee of a Group Company, the Restricted Shares held by such Principal and such Principal’s Holding Companies shall vest and be released from the Repurchase Right according to the following schedule: [twenty five] percent ([25] %) of such Restricted Shares shall be released from the Repurchase Right and shall therefore become Vested Shares and shall no longer be deemed Restricted Shares and on each of the first, second, third and fourth anniversaries of the Start Date.(b) Accelerated Vesting Upon Qualified Public Offering or Change ofControl. Notwithstanding anything to the contrary contained herein, all then unvested Restricted Shares of such Principal and such Principal’s Holding Companies shall be released from the Repurchase Right and shall therefore become Vested Shares and shall no longer be deemed Restricted Shares upon the earlier to occur of: (i) a Qualified IPO (as defined in the Memorandum and Articles), and (ii) the sale of all or substantially all of the assets of the Company or the consolidation, merger or other business combination of the Company with or into any other business entity duly approved by the Company in accordance with the Shareholders Agreement (including the Drag-Along Sale as defined in the Memorandum and Articles), pursuant to which the shareholders of the Company immediately prior to such consolidation, merger or other business combination hold less than a majority of the voting power of the surviving or resulting entity (collectively, the “Change of Control Events” and each a “Change of Control Event”) in any case only i f the surviving or resulting entity does not assume the obligations of the Company hereunder. For purposes of clarity, the Company may assign its rights and obligations hereunder to the surviving or resulting entity in a Change of Control Event.(c) Deferred Vesting Upon Leave or Disability. The vesting schedule of the Restricted Shares of such Principal and such Principal’s Holding Companies during the period of any Leave/Disability of such Principal shall be suspended and deferred until the date on which such Principal returns to office, if at all.3.3 Mechanism of Repurchase.(a) Within ninety (90) days following any Repurchase Event (the “Repurchase Period”), the Repurchase Right Holders may exercise (and shall exercise at the request of the Majority Series A Preferred Holders) the Repurchase Right by delivering written notice to the relevant Restricted Person in accordance with the orders provided in this Section 3.3. The notice shall indicate the number of Restricted Shares to be repurchased and the date on which the repurchase is to be effected, such date to be not later than the last day of the Repurchase Period.(b) First, the Company shall be entitled to exercise its Repurchase Right to repurchase up to 100% of the Repurchasable Shares, by notifying such relevant Restricted Person in writing, within the first thirty (30) days of the Repurchase Period.(c) Second, if the Company fails to exercise its Repurchase Right to purchase 100% of the Restricted Shares held by the relevant Restricted Person within the first thirty (30)days of the Repurchase Period, the other Principal other than the related Restricted Person shall be entitled to exercise its Repurchase Right to repurchase the Repurchasable Shares not repurchased by the Company, by notifying such relevant Restricted Person in writing, within the second thirty (30) days of the Repurchase Period.(d) If the other Principal other than the related Restricted Person fails to exercise its Repurchase Right to purchase the Repurchasable Shares not repurchased by the Company, the Investor shall be entitled to exercise its Repurchase Right to repurchase the remaining Repurchasable Shares, by notifying such relevant Restricted Person in writing, within the last thirty (30) days of the Repurchase Period.(e) The Restricted Persons and the Company shall take all necessary actions to enable the Repurchase Right Holder to repurchase the Restricted Shares subject to the Repurchase Right. Upon delivery of such notice and so long as the Repurchase Right Holder makes available payment of the repurchase price as provided herein, the repurchase shall be deemed completed, the Restricted Shares shall be deemed repurchased, without further actions by any party, and the Restricted Person shall no longer be considered the owner of those Restricted Shares repurchased for record or any other purposes and will be entitled thereafter only to receipt of the applicable repurchase price. To effect the foregoing, the Repurchase Right Holder is authorized and empowered to date, execute, deliver and otherwise use the Transfer Form to effect the Repurchase Right.3.4 Additional or Substituted Securities. In the event of the declaration of a share dividend, the declaration of an extraordinary dividend payable in a form other than shares, a spin-off, a share split, an adjustment in conversion ratio, a recapitalization or a similar transaction affecting the Company's outstanding securities without receipt of consideration, the Repurchase Right under this Section 3 shall apply mutatis mutandis to any new, substituted or additional securities or other property (including money paid other than as an ordinary cash dividend) that by reason of such transaction are distributed with respect to any Shares then subject to the Repurchase Right, to the same extent as such Shares. All such additional and substituted securities or other property shall be deposited in escrow pursuant to Section 2.2.4. Stop-Transfer Notices.In order to ensure compliance with the terms of this Agreement, the Company may issue appropriate “stop transfer” instructions to its transfer agent, if any, and, if the Company acts as transfer agent for its own securities, it may make appropriate notations to the same effect in its own records.5. Miscellaneous.5.1 Further Assurances. Upon the terms and subject to the conditions herein, each of the Parties hereto agrees to use its reasonable best efforts to take or cause to be taken all action, to do or cause to be done, to execute such further instruments, and to assist and cooperate with the other Parties hereto in doing, all things necessary, proper or advisable under applicable Laws or otherwise to consummate and make effective, in the most expeditious manner practicable, the transactions contemplated by this Agreement.5.2 Assignments and Transfers; Third Party Beneficiaries. Except as otherwise provided herein, this Agreement and the rights and obligations of the Parties hereunder shall inureto the benefit of, and be binding upon, their respective successors, assigns and legal representatives, but shall not otherwise be for the benefit of any third party. The rights of the Investor hereunder are assignable and the obligations of the Investor hereunder are transferrable, in each case to its Affiliate or to a third party in connection with the transfer of Equity Securities of the Company held by the Investor to such third party but only to the extent of such transfer. This Agreement and the rights and obligations of each other Party hereunder shall not otherwise be assigned or transferred without the mutual written consent of the other Parties, except as expressly provided herein.5.3 Governing Law. This Agreement shall be governed by and construed under the Laws of Hong Kong, without regard to principles of conflict of laws thereunder.5.4 Dispute Resolution.(a) Any dispute, controversy or, claim or difference of any kind whatsoever arising out of, relating to or in connection with this Agreement, including the existence, validity, interpretation, performance, breach or termination thereof, the validity, scope and enforceability of this arbitration provision and any dispute regarding no-contractual obligations arising out of or relating to it (the “Dispute”) shall be referred to and finally resolved by arbitration administered by the Hong Kong International Arbitration Centre (the “HKIAC”) in accordance with the HKIAC Administered Arbitration Rules in forceat the time of the commencement of the arbitration. However, if such rules are in conflict with the provisions of this Section 5.4, including the provisions concerning the appointment of arbitrators, the provisions of this Section 5.4 shall prevail..(b) The law of this arbitration clause shall be Hong Kong law. The seat of arbitration shall be Hong Kong.(c) The number of arbitrators shall be ( ]). The claimants in the Dispute shall nominate ( )arbitrator, the respondents in the Dispute shall nominate ( ) arbitrator, andthe ( )arbitrators shall jointly select the third arbitrator who shall act as the presiding arbitrator of the arbitration tribunal. The language of the arbitration proceedings and written decisions or correspondence shall be English.(d) Any party to the Dispute shall be entitled to seek preliminary injunctive relief, if possible, from any court of competent jurisdiction pending the constitution of the tribunal.5.5 Notices. Any notice required or permitted pursuant to this Agreement shall be given in writing and shall be given either personally or by sending it by next-day or second-day courier service, fax, electronic mail or similar means to the address of the relevant Party as shown on Schedule C attached to the Shareholders Agreement (or at such other address as such Party may designate by fifteen (15) days’ advance written notice to the other Parties to this Agreement given in accordance with this Section). Where a notice is sent by next-day or second-day courier service, service of the notice shall be deemed to be effected by properly addressing, pre-paying and sending by next-day or second-day service through an internationally-recognized courier a letter containing the notice, with a written confirmation of delivery, and to have been effected at the earlier of (i) delivery (or when delivery is refused) and (ii) expiration of two (2) Business Days after the letter containing the same is sent as aforesaid. Where a notice is sent by fax or electronic mail, service of the notice shall be deemed to be effected by properly addressing, and sending。