Forward Futures

金融外汇买卖相关英语词汇翻译

金融外汇买卖相关英语词汇翻译金融外汇买卖相关英语词汇翻译Accepted 承兑Accrued interest累计利息advance 放款American style 美式选择权appreciation 升值Arbitrage 套利交易asset allocation 资产分配原则Asset swap 就持有的资产利息进行交换Asset/liability management 资产负债管理Assets liquidity 资产的流动性Assets safety 资产安全Assets yield 资产的获利性AT the money (ATM) 价平Auction 标售Authority letter 授权书Banker’s acceptance 银行承兑汇票Basis swap (floating -against floating IRS)Bear call spread 买权看空价差Bear put spread 卖权看空价差Bearer form 持有人形式best order 最佳价格交易指示单Bid rate 借入利率(或买入价格,汇率)Big figure 大数(交易时忽略不报的前几位数)Book entry form 无实体形式Break-even exchange rate 两平点汇率Bretton Woods system 布莱登国际货币制度Broken date 畸零天期(见Odd date)Bull call spread 买权看多价差Bull put spread 卖权看多价差Buy call 买入买权Buy or sell forward 买卖远期Buy or sell spot 买卖即期Buy put 买入卖权Buyer 买方Calendar spread 水平式价差策略Call option 买权Calling customer 询价者Calling party 询价者Cash flow book 现金流量登记薄Cash flow gap 现金流量缺口Cash flow gap 资金缺口Cash flow projection现金流量之预期Cash 当日交割CD(certificate of deposit) 存单Chain method 联算法Chief money dealer首席货币交易员Clearing house 清算所Commercial hedge 进出口商避险Commercial paper商业本票Commodity futures trading commission 美国期货交易委员会Competitive bid 竞标Contract date 定约日Contract limit 契约额度Contract risk 契约风险Counter party 交易对手Country limit 国家额度Coupon rate 票面利率Coupon swap (fixed-against floating IRS)Cover 补回,冲销covered interest arbitrage 无汇率波动风险的套利操作Credit risk 信用风险Cross hedge 交叉避险Cross rates 交叉汇率(通过第三种货币计算两种货币的汇率)Currency future 外汇期货Currency futures contracts 外汇期货契约Currency futures 外汇期货Current yield 当期收益率Cut off time 营业截止时间Day trading 当日冲销(使当日净部位为零)Dealer’s authority 交易权限Dealing day 交易日Dealing room 交易室Dealing ticket 交易单Delivery Date 交割日Direct quotation=price quotation直接报价Discount 贴水Dj index future 道·琼斯指数期货合约Draft 汇票Duration 存续期间Easy money 低价货币Effective interest rate 有效利率Engineered swap transaction操纵式换率交易(将买入卖出两个不同交易合并,使其具有换汇交易的效果)European currency unit(ECU)欧洲货币单位Exchange control system 外汇管制制度Exercise price 履约价格Expiry date 到期日Face value 面值(股票、票据上记载的名目价值)Firm market 行情坚挺的市场Firm order 确定指示单Fixed exchange rate system 固定汇率制定Fixed rate liability 利率固定负债Fixing date 指标利率定订基准日Flat yield curve 水平收益率曲线floating exchange 浮动汇率制度Floor broker 场内经纪商Floor trader 场内交易商Follow up action 动态策略Forward against forward远期对远期换汇交易Forward rate agreement(FRA)远期利率协定Forward rate 远期汇率Forward value date 远期外汇到期日FT-SE 100 Index Future 伦敦金融时报指数期货Futures 期货FX risk 汇率风险Gapping 期差操作General floating 普遍浮动Generic Swap 标准型的IRS 交易gold exchange standard金汇兑本位制度gold export point 黄金输出点Gold rush 黄金抢购风gold standard 金本位制度Government bonds 政府债券Group of Twenty 20国委员会Hang Seng Index 恒生估价指数Hedging interest rate risk规避利率波动风险Hit 询价者以bid rate 卖出被报价币给报价银行Holding position 持有部位If order 附条件交易指示单IMM 芝加哥国际货币市场In the money (ITM) 价内Index swap 利率交换indirect quotation=quantity quotation 间接报价Inter bank offer rates 银行同业拆放利率Interest rate futures 利率期货Interest rate parity theory 利率平价理论Interest rate return 报酬率Interest rate swaps(IRS)利率交换intermediary 中间人international payment system 国际支付制度Intra day limit 日间额度Intra-day trader日间交易者,短线交易员Intrinsic value 隐含价值Junior money dealer资浅货币交易员LIBOR 伦敦银行同业拆借利率LIFFE 伦敦国际金融期货交易所Line of credit 信用额度Line of limit 额度限制liquidity premium流通性风险补贴London inter bank bid rate (LIBID) 伦敦银行间存款利率Long butterfly call spread 买入碟式买权价差Long butterfly put spread 买入碟式卖权价差Long currency future contract 买入外汇期货契约Long Straddle 买入跨式部位,下跨式部位Long strangle 买入不同履约价格的跨式部位Margin call 追加保证金Margin trading 保证金交易Mark to market 调整至市场价Market order 市场价格指示单Mismatch gapping 到期缺口Money market swap IRS持有时间短于两年者Money position 货币部位long position 买超或长部位(借入的金额大于贷)Monthly limit 每月限额multiple currency reserve system多种货币准备制度Nasdaq Index Future 纳斯达克指数期货Near the money 价近Negative yield curve 负收益率曲线Negotiable certificate of deposit 可转让定期存单Net mismatch 净缺口Nikki index future 日经指数期货Nominal interest rate 名目利率Nominal Interest rate名目利率(票面或双方约定的利率,减通货膨胀等于实质利率)Non earning asset 非利率敏感资产Non profitable liability非利率敏感负债Non reference currency 报价币Notional amount 承作金额Odd date(Odd maturity)畸零天期,畸零期(FX交易非整周整月的日期,如10天,40天)Off-balance Sheet 表外交易工具(衍生性金融产品)Offer rate 贷放利率(或卖出价格,汇率)Offset 对冲,轧平Open spot net position 即期净部位Operation risk 作业风险Option date forward 任选交割日的远期汇率Option 选择权Options reserve 选择权保留额度Order 交易指示单Out of the money(OTM) 价外Outright forward 远期直接汇率Over the counter店头市场,柜台交易市场Overall limit 总合限额Overbought 买超Overnight(O/N) 当日交割之隔夜拆放Oversold 卖超Par 报价与被报价币的利率相同,换汇汇率为零。

未来的高级表达英语

以下是一些可以用来表达“未来”的高级英语词汇或短语:

- Prospect:前景、前途,常用来描述未来的可能性或期望。

- Futurity:未来、将来,强调未来的时间段或状态。

- Ahead:在前面、未来,可表示朝着未来的方向。

- Tomorrowland:明日之地,形象地表示未来的领域或未来的世界。

- The road ahead:前方的道路,暗示未来的发展路径。

- Future-oriented:以未来为导向的,形容注重未来的规划和发展。

- Look forward to:期待、展望,常用于表达对未来的期望。

- Envisioned future:构想的未来,强调对未来的想象和规划。

例如:We are looking forward to a bright prospect.(我们期待着光明的前景。

)或者 The future-oriented approach will lead us to success.(以未来为导向的方法将引领我们走向成功。

)

这些表达方式可以让你的英语更加丰富和多样化。

未来可期的英文美句带翻译

Sam Levenson's quote encourages individuals to keep moving forward and making progress, regardless of the obstacles they encounter. It serves as a reminder to stay focused on our goals and not be deterred by setbacks. The translation of this quote would motivate non-English speakers to persevere through challenges and continue their journey towards success.

1. "Believe you can and you're halfway there." - Theodore Roosevelt

This powerful quote by Theodore Roosevelt emphasizes the significance of self-belief and confidence in achieving success. By believing in oneself, individuals can overcome obstacles, persevere through challenges, and reach their goals. The translation of this quote would be particularly motivating for non-English speakers, as it encourages them to have faithin their abilities and potential.

金融衍生品名词词解

金融衍生品专业术语AAccreting swap : 本金递增式互换在交换合约有效期间,其名义本金会逐步增加的互换交易。

相反情况则为Amortizing swap(本金递减式互换)Accrued benefit obligation : 应计给付义务员工目前已赚得的退休金收益的现值,不论是员工既得的还是非既得的。

在管理退休金基金的资产\负债比率时,它可作为一个重要的衡量指标。

All-or-nothing : 全付或不付期权亦称数字期权(Digital option)。

如果在期权到期时,指数低于(高于)执行价格,此种期权的卖权(买权)须支付一笔事先确定的固定金额(即“全付”含义)。

支付的金额,与指数低于(高于)执行价多少不相关;支付必将是全付或不作支付。

American option : 美式期权在到期前任何时间均可执行的齐全。

参见European option(欧式期权)。

Amortizing option : 本金递减型期权在期权有效期间,名义本金会递减的期权,比如本金递减型的利率上限期权、利率上下限期权或互换期权。

Amortizing swap : 本金递减型互换在互换合约的有效期间,名义本金递减的互换交易。

相反情况则称为Accreting swap(本金递增型互换)。

Annuity swap : 年金型互换支付固定利率的一方,其本金金额于互换交易的有效期间内,为分期摊还方式的一种互换交易。

Asian option : 亚洲式期权参见A verage rate option(平均价格期权)。

Asset-risk benchmark : 资产风险基准可据以度量企业资产风险性的基准。

在复杂的企业风险管理策略中,可使用资产风险基准管理债务投资组合的风险。

参见Benchmark(基准)。

Asset-sensitivity estimates : 资产敏感性估计对各个风险因素对资产价值的影响的估计。

Asset swap : 资产互换涉及有关资产现金流量的一种互换交易。

金融学14章金融答案翻译

CHAPTER 14FORWARD AND FUTURES PRICESObjectives∙ To explain the economic role of futures markets∙ To show what information can and cannot be inferred from forward and futures prices.∙Outline14.1 Distinctions Between Forward and Futures Contracts14.2 The Economic Function of Futures Markets14.3 The Role of Speculators14.4 Relation Between Commodity Spot and Futures Prices14.5 Extracting Information from Commodity Futures Prices14.6 Spot-Futures Price Parity for Gold14.7 Financial Futures14.8 The Implied Risk-Free Rate14.9 The Forward Price Is Not a Forecast of the Spot Price14.10 Forward-Spot Parity with Cash Payouts14.11 Implied Dividends14.12 The Foreign-Exchange Parity Relation14.13 The Role of Expectations in Determining Exchange RatesSummary∙ Futures contracts make it possible to separate the decision of whether to physically store a commodity from thedecision to have financial exposure to its price changes.∙ Speculators in futures markets improve the informational content of futures prices and make futures marketsmore liquid than they would otherwise be.∙ The futures price of wheat cannot exceed the spot price by more than the cost of carry:∙ The forward-spot price parity relation for gold is that the forward price equals the spot price times the cost ofcarry:This relation is maintained by the force of arbitrage . ∙One can infer the implied cost of carry and the implied storage costs from the observed spot and forward prices and the risk-free interest rate. ∙ The forward-spot parity relation for stocks is that the forward price equals the spot price times 1 plus the risk-free rate less the expected cash dividend.This relation can therefore be used to infer the implied dividend from the observed spot and forward prices and the risk-free interest rate. ∙ The forward-spot price parity relation for the dollar/yen exchange rate involves two interest rates:where F is the forward price of the yen, S is the current spot price, r Y is the yen interest rate, and r $ is the dollarinterest rate. ∙ If the forward dollar/yen exchange rate is an unbiased forecast of the future spot exchange rate, then one caninfer that forecast either from the forward rate or from the dollar-denominated and yen-denominated risk-free interest rates.F S C -≤F S r s =++()1F S r D=+-()1F r S r Y11+=+$Solutions to Problems at End of ChapterForward Contracts and Forward-Spot Parity.1. Suppose that you are planning a trip to England. The trip is a year from now, and you have reserved a hotel room in London at a price of ₤50 per day. You do not have to pay for the room in advance. The exchange rate is currently $1.50 to the pound sterling.a.Explain several possible ways that you could completely hedge theexchange rate risk in this situation.b.Suppose that r₤=.12 and r$=.08. Because S=$1.50, what must theforward price of the pound be?c.Show that if F is $0.10 higher than in your answer to part b, therewould be an arbitrage opportunity.SOLUTION:a.Ways to hedge the exchange rate risk:Pay for the room in advanceBuy the pounds you will need in the forward market.Invest the present value of the rental payments in a pound-denominated riskless asset.对冲外汇风险的几种方法:提前对这个房间付款;在期货市场购买英镑;将与现期价值的租金同等的英镑投资于无风险资产。

(9)远期、期货和互换

14

注:O/N = over night

15

例:假设A公司在6个月末需要一笔1000万元的资金,为 期3个月,为了锁定资金成本,该公司与某银行签订了一 份6×9的远期利率协议,协议利率为4%,名义本金为 1000万元。如果3月末市场利率上升为4.5%对A公司有何 影响。

18

中国期货品种

(1)上海期货交易所:铜、铝、锌、天然橡胶、燃油、黄 金、螺纹钢、线材 (2)大连商品交易所:大豆、豆粕、豆油、塑料、棕榈油 、玉米、PVC (3)郑州商品交易所:硬麦、强麦、棉花、白糖、pta、菜 籽油、籼稻 (4)中国金融期货交易所:股指期货

19

期货的基本概念: 标准化:合约规模,交割地点,交割日期 初始保证金(initial margin): (5% - 20%) 维持保证金(maintenance margin): 盯市(mark to market):每天交易结束时,根据期货价 格的涨跌调整保证金账户。

跨期套利、跨市套利、跨品种套利 正向套利,反向套利

23

正向套利(cash-and-carry arbitrage): 远期价格 < 交割价格:买入现货,卖出远期。 注:远期价格的高低取决于现价(见后文)。上式表明 现价偏低。

反向套利(reverse cash-and-carry arbitrage): 远期价格 > 交割价格:卖空现货,买入远期。 上式表明现价偏高。

解:这份远期合约的合理价格应该为

F 50e0.100.25 51.27

30

Example: A stock that pays no dividends has a current price of $50. The annual effective risk free rate of return is 5%. Calculate the forward price for purchasing the stock in one year. Solution:

国际贸易及国际金融英语词汇

主题:国际贸易词汇trade term / price term 价格术语world / international market price 国际市场价格FOB (free on board) 离岸价C&F (cost and freight) 成本加运费价CIF (cost, insurance and freight) 到岸价freight 运费wharfage 码头费landing charges 卸货费customs duty 关税port dues 港口税import surcharge 进口附加税import variable duties 进口差价税commission 佣金return commission 回佣,回扣price including commission 含佣价net price 净价wholesale price 批发价discount / allowance 折扣retail price 零售价spot price 现货价格current price 现行价格/ 时价indicative price 参考价格customs valuation 海关估价price list 价目表total value 总值贸易保险术语All Risks 一切险F.P.A. (Free from Particular Average) 平安险W.A. / W.P.A (With Average or With Particular Average) 水渍险War Risk 战争险F.W.R.D. (Fresh Water Rain Damage) 淡水雨淋险Risk of Intermixture and Contamination 混杂、玷污险Risk of Leakage 渗漏险Risk of Odor 串味险Risk of Rust 锈蚀险Shortage Risk 短缺险T.P.N.D. ( Theft, Pilferage & Non-delivery) 偷窃提货不着险Strikes Risk 罢工险贸易机构词汇WTO (World Trade Organization) 世界贸易组织IMF (International Monetary Fund) 国际货币基金组织CTG (Council for Trade in Goods) 货币贸易理事会EFTA (European Free Trade Association) 欧洲自由贸易联盟AFTA (ASEAN Free Trade Area) 东盟自由贸易区JCCT (China-US Joint Commission on Commerce and Trade) 中美商贸联委会NAFTA (North American Free Trade Area) 北美自由贸易区UNCTAD (United Nations Conference on Trade and Development) 联合国贸易与发展会议GATT (General Agreement on Tariffs and Trade) 关贸总协定贸易方式词汇stocks 存货,库存量cash sale 现货purchase 购买,进货bulk sale 整批销售,趸售distribution channels 销售渠道wholesale 批发retail trade 零售业hire-purchase 分期付款购买fluctuate in line with market conditions 随行就市unfair competition 不合理竞争dumping 商品倾销dumping profit margin 倾销差价,倾销幅度antidumping 反倾销customs bond 海关担保chain debts 三角债freight forwarder 货运代理trade consultation 贸易磋商mediation of dispute 商业纠纷调解partial shipment 分批装运restraint of trade 贸易管制RTA (Regional Trade Arrangements) 区域贸易安排favorable balance of trade 贸易顺差unfavorable balance of trade 贸易逆差special preferences 优惠关税bonded warehouse 保税仓库transit trade 转口贸易tariff barrier 关税壁垒tax rebate 出口退税TBT (Technical Barriers to Trade) 技术性贸易壁垒进出口贸易词汇commerce, trade, trading 贸易inland trade, home trade, domestic trade 国内贸易international trade 国际贸易foreign trade, external trade 对外贸易,外贸import, importation 进口importer 进口商export, exportation 出口exporter 出口商import licence 进口许口证export licence 出口许口证commercial transaction 买卖,交易inquiry 询盘delivery 交货order 订货make a complete entry 正式/完整申报bad account 坏帐Bill of Lading 提单marine bills of lading 海运提单shipping order 托运单blank endorsed 空白背书endorsed 背书cargo receipt 承运货物收据condemned goods 有问题的货物catalogue 商品目录customs liquidation 清关customs clearance 结关贸易伙伴术语trade partner 贸易伙伴manufacturer 制造商,制造厂middleman 中间商,经纪人dealer 经销商wholesaler 批发商retailer, tradesman 零售商merchant 商人,批发商,零售商concessionaire, licensed dealer 受让人,特许权获得者consumer 消费者,用户client, customer 顾客,客户buyer 买主,买方carrier 承运人consignee 收货人I.外汇与汇率通汇合约Agency Agreement通汇银行Correspondent Bank商业汇票Commercial Bill of Exchange 银行支票Banker’s Check国外汇票Foreign Bill of Exchange关键货币Key Currency汇率Exchange Rate直接标价法Direct Quotation间接标价法Indirect Quotation汇价点Point买入汇率Buying Rate卖出汇率Selling Rate中间汇率Medial Rate现钞汇率Bank Note Rate即期汇率Spot Rate远期汇率Forward Rate基本汇率Basic Rate套算汇率Cross Rate固定汇率Fixed Rate浮动汇率Floating Rate可调整的钉住Adjustable Peg单一汇率Single Rate复汇率Multiple Rate贸易汇率Commercial Rate金融汇率Financial Rate交叉汇率Cross Rate远期差额Forward Margin升水Premium贴水Discount平价At Par固定汇率制度Fixed Exchange Rate System 金本位Gold Standard纸币Paper Money贴现率Discount Rate浮动汇率制度Floating Exchange Rate System自由浮动汇率Freely Floating Exchange Rate管理浮动汇率Managed Floating Exchange Rate单独浮动汇率Single Floating Exchange Rate联合浮动汇率Joint Floating Exchange Rate钉住汇率制Pegged Exchange Rate区域性货币一体化Regional Monetary Integration欧洲货币体系European Monetary System (EMS)欧洲货币单位Eutopean Currency Unit (ECU)欧洲货币联盟European Monetary Union含金量Gold Content铸币平价Mint Par黄金输送点Gold Point官方储备Official Reserve外汇管制Foreign Exchange ControlII.外汇交易即期外汇交易Spot Exchange Transaction远期外汇交易Forward Exchange Transaction交割日固定的远期外汇交易Fixed Maturity Forward Transaction 选择交割日的远期交易(择期交易) Optional Forward Transaction掉期交易Swap即期对远期掉期Spot-Forward Swap即期对即期掉期Spot-Spot Swap远期对远期掉期Forward-Forward Swap地点套汇Space Arbitrage直接套汇(两角套汇) Direct Arbitrage (Two Points Arbitrage)间接套汇(三角套汇) Indirect Arbitrage (Three Points Arbitrage)时间套汇Time Arbitrage现代套汇交易Cash Against Currency Future套利Interest Arbitrage非抵补套利Uncovered Arbitrage非抵补利差Uncovered Interest Differential抵补套利Covered Arbitrage期货Futures期货交易Futures Transaction国际货币市场International Monetary Market (IMM)伦敦国际金融期货交易所London International Financial Futures Exchange (LIFFE) “逐日盯市”制度Market-to-Market期权Options外汇期权Foreign Currency Options协议价格Strike Price敲定价格Exercise Price期权费/权力金Premium期权到期日Expiration Date美式期权American Options欧式期权European Options看涨期权(买权,买入期权) Call Options 期权买方Call Buyer期权卖方Call Seller/Writer看跌期权(卖权,卖出期权) Put Options 期权协议价格Strike Price敲定价格(履约价格) Exercise Price期权费(期权权利金,保险费) Premium 期权保证金Margins期权内在价值Intrinsic value价内期权In the Money价外期权Out of the Money平价期权At the Money期权时间价值Time value易变性VolatilityIII.国际收支国际收支Balance of Payments国际货币基金组织International Monetary Fund国际收支平衡Balance of Payments Statement经常项目Current Account贸易收支Goods劳务收支Service单方面转移收支Unilateral Transfer资本项目Capital Account长期资本Direct Investment热钱/游资Hot Money平衡项目(储备项目/结算项目) Balancing or Settlement Account 官方储备Official Reserves自主性交易Autonomous Transaction调节性交易Accommodating Transaction事前交易Ex-ante Transaction事后交易Ex-post Transaction国际收支顺差Balance of Payments Surplus 国际收支逆差Balance of Paymentd Deficit 贸易差额Trade Balance经常项目差额The Current Account Balance IV.外汇风险管理外汇风险foreign Exchange Exposure获得利益Gain遭受损失Loss交易风险Transaction Exposure营业风险Operation Exposure转换风险Translation Exposure经济风险Economic Exposure竞争风险Competitive Exposure借款法Borrowing投资法Investing借款-即期合同-投资法Borrow-Spot-Invest 提前收付-即期合同-投资法Lead-Spot-Invest 提前或延期结汇Leads & Lags资产负债表保值法Balance Sheet Hedge资金部主管Treasury Head首席交易员Chief Dealer交易主任Senior Dealer交易员Dealer助理交易员Assistant Dealer当日平盘Day Trade隔夜敞口Over Night交易单Dealing Slip交易后线Settlement Office汇付Remittance电汇Telegraphic Transfer,T/T信汇Mail Transfer,M/T票汇Demand Draft,D/D托收Collection光票托收Clean Collection跟单托收Documentary Collection付款交单Documents against Payment,D/P 承兑交单documents against Acceptance,D/A 信托收据Trust Receipt,T/P信用证Credit;Letter of Credit,L/C银行保函Letter of Guarantee,L/G即期保函统一规则Uniform Rules for Demand Guarantee投标保函Tender Guarantee履约保函Performance Guarantee退款保函Guarantee for Refund of Advance Payment定金Down Payment还款保函Repayment Guarantee保留款保函Retention Money GuaranteeV.国际融资方式商业票据Commercial Paper (CP)短期国库券Treasury Bill (T. Bill/Bill)出价收益率(买入收益率) Bid Yield要价收益率(卖出收益率) Asked Yield大额可转让定期存单Negotiable Certificate of Deposit (CD) 息票率Coupon Rate贴现Discount贴现利息Discount Charges贴现市场Discount Market票据经纪人Bill Broker贴现商Bill Dealer票据商Note Dealer贴现公司Discount Houses承兑公司Acceptance Houses平价发行At Par溢价发行At Premium低价发行At Discount外国债券Foreign Bond扬基债券Yankee Bond欧洲债券Eurobond股票Stock普通股Common Share优先股Preferred Share证券存托凭证Depositary Receipt (DR)美国存托凭证American Depositary Receipt (ADR) 全球存托凭证Global Depositary Receipt (GDR) VI.国际储备与外债国际储备International Reserves黄金储备Monetary Gold外汇储备Foreign Exchange Reserves特别提款权Special Draw Right, SDRVII.国际信货储备部分贷款Reserve Tranche第一档信货部分贷款First Credit Tranche高档信货部分贷款Higher Credit Tranche出口波动补偿信贷Compensatory Financing Facility缓冲库存贷款Buffer Stock Finacing石油贷款Oil Facility中期贷款Extended Facility信托基金Trust Fund补充贷款Supp;ementary维特芬贷款The Witteveen Facility扩大贷款Enlarged Access Policy世界银行World Bank国际复兴开发银行International Bank for Reconstruction and Development,IBRD 国际开发协会International Development Association,IDA信贷Credit国际金融公司International Finance Corporation,IFC政府贷款Government Loan银行间同业拆借Inter-bank Offer伦敦银行同业拆放利率London Inter-Bank Offered Rate,LIBOR新加坡银行间同业拆放利率Singapore Inter-Bank Offered Rate,SIBOR 香港银行间同业拆放利率Hongkong Inter-Bank Offered Rate,HIBOR 出口信贷Export Credit卖方信贷Supplier Credit买方信贷Buyer Credit中长期票据收买业务(福费廷) Forfiting卖断Out-right Sell混合贷款Mixed LoanVIII.国际金融市场货币市场Currency Market国际资本市场International Capital Market银行中长期贷款Bank’s Medium Term and Long Term Loan国际黄金市场Gold MarketⅨ.国际金融电子化银行自动柜员机Automatic Teller Machine, ATM在线网络金融服务Online Financial Services销售点终端Point of Sales, POS电子货币Electronic Money万事达信用卡Master Card电子信用卡Electronic Credit Card电子钱夹Electronic Purse智能卡Intellectual Card, IC卡电子支票Electronic Check电子现金Electronic Cash, E-cash电子钱包Electronic Wallet环球银行间金融电讯系统the Society for World Interbank Financial Telecommunications, SWIFT美国纽约票据交换所银行间支付系统the Clearing House Interbank Payments System, CHIPS伦敦票据交换所自动支付系统the Clearing House Automated Payments System.CHAPS电子商务Electronic Commerce,EC网络银行Internet Bank现金管理系统Cash Management System,CMS增值网value Added Networks, VAN自动付费系统automated Payment System, APS百度文库- 让每个人平等地提升自我CA中心网站Certificate Authority, CA中心商户对顾客商务模式Business to Customer, B-C商户对商户商务模式business to Business, B-B网上投资Online InvestmentAAA服务Anytime Anywhere Anyway(任何时间,任何地方,任何方式) 三中卡的缩写Europay、Mondexcard、Visa,EMV96SET协议Secure Electronic Transaction14。

常见金融术语英汉对照与详解

Mark-to-Market (逐日盯市) Matching Algorithm (程式匹配) Matching Rules (匹配规则) Maturity Date (到期日) Maturity Range (到期日范围) Maximum Spread (最大跨价限额) Minimum Size (最小规模) Mistrade (错误交易) Modified Duration (修正存续期间) Money Market Products (资金市场产品)

� Early Exercise (提前执行) Equity Index Products (股票指数产品) Equity Products (股票产品) Eurex (欧洲期交所) Eurex Repo (欧洲期货交易所回购交易) EURIBOR (欧元銀行同业拆借利率) Euro-Bobl Futures (欧洲期交所德国欧元中期国债期货)

� Last Trading Day (最后交易日) Late Trade (延期交易) Leverage Effect (杠杆效应) Lifetime (产品周期) Limit Order (限价指令) Linked Trades (链接交易) Linking (链接) Local Area Network (局域网) Long Call (买入看涨期权) Long Position (长仓) Long Put (买入看跌期权) Low Exercise Price Option (低执行价期权)

� Haircut (估值折扣率) Hedge Fund (对冲基金)

Hedge Ratio (对冲比率) Hedging (对冲�套保) Historical Volatility (历史波动率) Horizontal Call Spread (水平看涨跨价) Horizontal Put Spread (水平看跌跨价) Horizontal Spread (水平跨价)

Lecture 8

3. What is a Futures Contract?

Standardization of Futures Contracts:

– The expiry date, or the time when the contract ceases to exist (or when the asset is actually traded, if applicable). For example, greasy wool futures expire in February / April / June / August / October and December up to 18 months in advance.

– What forward and futures contracts are; and, – The characteristics of forward and futures contracts.

金融远期合约ForwardContracts是指双方约定在未来的

– 到期交割或现金结算(Delivery or Cash Settlement )

– 平仓(Offset)

– 期货转现货(Exchange-for-Physicals,EFP)

案例2.6 表2-7 2007年9月25日S&P500股指期货交易行情

金融远期合约(Forward Contracts)是指双方约定在未 来的某一确定时间,按确定的价格买卖一定数量的某种金 融资产的合约。在合约中,未来将买入标的物的一方称为多 方(Long Position),而在未来将卖出标的物的一方称为 空方(Short Position)。

远期合约并不能保证其投资者未来一定盈利,但投资 者可以通过远期合约获得确定的未来买卖价格,从而消除 了价格风险。

与远期合约的分类相似,根据标的资产不同,常见的金融期 货主要可分为股票指数期货、外汇期货和利率期货等。

-股票指数期货是指以特定股票指数为标的资产的期货合约, S&P500股指期货合约就是其典型代表。

-外汇期货则以货币作为标的资产,如美元、德国马克、法 国法郎、英镑、日元、澳元和加元等。

-利率期货是指标的资产价格依赖于利率水平的期货合约, 如欧洲美元期货和长期国债期货等。

2.远期外汇合约

远期外汇合约是指双方约定在将来某一时间按约定的汇率 买卖一定金额的某种外汇的合约。

按照远期的开始时期划分,远期外汇合约又分为直接远期 外汇合约和远期外汇综合协议。

注意,有些国家由于外汇管制,因此本金不可交割。这种外汇 远期合约称为本金不可交割远期(Non-Deliverable Forwards, NDF), 它与本金可交割但不交割远期(Non-Delivery Forwards)是不同的, 注意区别。

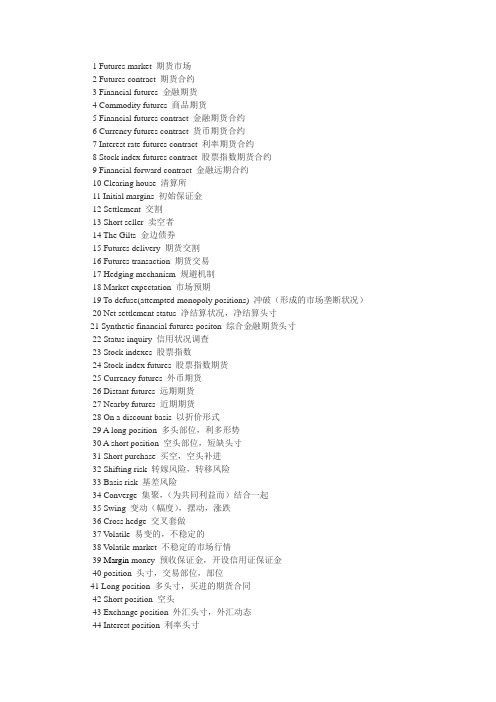

期货期权英语词汇

1 Futures market 期货市场2 Futures contract 期货合约3 Financial futures 金融期货4 Commodity futures 商品期货5 Financial futures contract 金融期货合约6 Currency futures contract 货币期货合约7 Interest rate futures contract 利率期货合约8 Stock index futures contract 股票指数期货合约9 Financial forward contract 金融远期合约10 Clearing house 清算所11 Initial margins 初始保证金12 Settlement 交割13 Short seller 卖空者14 The Gilts 金边债券15 Futures delivery 期货交割16 Futures transaction 期货交易17 Hedging mechanism 规避机制18 Market expectation 市场预期19 To defuse(attempted monopoly positions) 冲破(形成的市场垄断状况)20 Net settlement status 净结算状况,净结算头寸21 Synthetic financial futures positon 综合金融期货头寸22 Status inquiry 信用状况调查23 Stock indexes 股票指数24 Stock index futures 股票指数期货25 Currency futures 外币期货26 Distant futures 远期期货27 Nearby futures 近期期货28 On a discount basis 以折价形式29 A long position 多头部位,利多形势30 A short position 空头部位,短缺头寸31 Short purchase 买空,空头补进32 Shifting risk 转嫁风险,转移风险33 Basis risk 基差风险34 Converge 集聚,(为共同利益而)结合一起35 Swing 变动(幅度),摆动,涨跌36 Cross hedge 交叉套做37 V olatile 易变的,不稳定的38 V olatile market 不稳定的市场行情39 Margin money 预收保证金,开设信用证保证金40 position 头寸,交易部位,部位41 Long position 多头寸,买进的期货合同42 Short position 空头43 Exchange position 外汇头寸,外汇动态44 Interest position 利率头寸45 Swap position 调期汇率头寸46 Square position 差额轧平(未抵冲的外汇买卖余额的轧平状况)47 Brokerage firm 经纪商(号)48 Security bond 保付单49 Post 登记总帐,过帐50 Brokerage 经纪业,付给经纪人的佣金51 FX futures contract 外汇期货合约52 Foreign currency futures 外汇期货53 Futures price 期货价格54 Go long 买金,多头55 Total FX portfolio 外汇投资总额56 A long position 多头寸,买进的期货合约57 Go short 短缺,卖空,空头58 A short position 空头,卖出的期货合约59 Place an order 订购,下单60 Trading pit 交易场61 Open outcry 公开喊价,公开叫价62 Floor broker 场内经纪人63 Transactions costs 交易费用64 Zero-sum game 零和竞争65 Current futures price 现时的期货价格66 The open interest 未结清权益67 Building agreement 具有约束力的协定68 Pay up 付清,缴清69 In force (法律上的)有效的70 Kill a bet 终止赌博71 Settlement price 结算价格72 Date of delivery 交割期73 Point of delivery 交割地点74 Futures commission merchants 期货经纪公司75 Market order 市价订单76 Time order 限时订单77 Opening order 开市价订单78 Closing order 收市价订单79 Basis order 基差订单80 Corners 垄断81 Outright positon 单笔头寸82 Direct hedging 直接套做83 Indirect hedging 间接套做84 Short hedging 空头套做85 Long arbitrage 多头套做86 Back spreads 反套利87 Margin call 保证金统治88 Price discovery 价格发现1 Option 期权,选择权,买卖权2 Call and put options 买入期权和卖出期权3 Option buyer 期权的买方4 Option seller 期权的卖方5 Underlying securities 标的证券6 Exercise price, striking price 履约价格,认购价格7 Option fee =option premium or premium on option 期权费8 Intrinsic value 实际价值,内部价值9 Intrinsic utility 内在效用10 Arbitrage opportunity 套价机会11 Arbitrage 套购,套利,套汇12 Arbitrage of exchange or stock 套汇或套股13 Speculation on foreign exchange 外汇投机14 Speculation in stock 股票投机15 To be hedging 进行套做保值16 A put option on a debt security 债务证券的卖出期权17 Call options on an equity 权益(证券)的买入期权18 Cover 弥补,补进(卖完的商品等)19 Write 签发,签署,承保,编写20 Margin call 追加保证金的通知21 Close out 平仓,结清(帐)22 Notional sum 名义金额23 Notional principal 名义本金24 Equity portfolio 股票资产25 predetermined 预先约定的26 Strike price 协定价格27 Put (option) 卖方期权,看跌期权28 Call (option) 买方期权,看涨期权29 Open market 公开市场30 premium 期权费31 downside 下降趋势32 Open-ended 开口的,无限制的,无限度的33 Out-of-the-money 无内在价值的期权34 In-the-money 有内在价值的期权35 At-the-money 平值期权36 Crop up(out) 出现,呈现37 cap 带利率上限的期权38 floor 带利率下限的期权39 collar 带利率上限的期权40 Break-even 不亏不盈,收支相抵41 asymmetry 不对称42 symmetry 对称43 Sell forward 远期卖出44 Up-front fee 预付费用,先期费用45 Change hands 交换,换手46 Contractual value 合同价格47 Over-the-counter 场外的,不同过交易所的48 customize 按顾客要求制作49 Futures margin期货保证金50 Initial margin初始保证金51 Open position 头寸52 Maintenance margin最低保证金,维持保证金53 Variation margin盈亏保证金,变动保证54 Market makers 造市者55 Extrinsic value 外在价值56 Contracts of difference 差异合约57 Market-clearing 市场结算58 Adaptive expectations 适应性预期59 Bid-ask spread 递盘虚盘差价60 Small-order automatic system 小额定单执行系统61 dealers 批发商62 Dual trading 双重交易63 Mature liquid contracts 到期合约64 Back wardation 现货溢价65 Nearby contract 近期合约66 Short-lived securities 短期有效证券67 Cash-and-carry arbitrage 现货持有套利68 Open positions 敞口头寸69 Uncovered interest arbitrage 未担保利率套利70 prumium 期权权利金71 Call-options 认购期权72 Put-options 认售期权73 speculation 投机74 Cross hedging 交叉保值75 Hedging risk 套期保值风险76 Synthetic options 合成期权77 Option purchase price 期权的购进价格78 Options on futures contract 期货合同的期权交易79 Forward swap 远期掉期80 Swap rate 掉期率81 Risk transformation 风险转移82 Contract size 合约容量83 Daily limit 每日涨跌停板84 Double option 双向期权。

正在往好的方向发展英文句子-定义说明解析

正在往好的方向发展英文句子1.As we continue to grow and evolve, we are moving in the right direction2.We are on a positive path towards progress and success3.The future is looking bright as we steer towards improvement4.Our development is heading in a promising direction5.We are making strides towards a better tomorrow6.Every step we take is bringing us closer to a positive outcome7.Our journey is filled with growth and improvement8.We are moving forward with determination and purpose9.With each passing day, we are getting closer to where we want to be10.Our efforts are leading us towards a more promising future11.The momentum of our progress is unstoppable12.We are pushing towards a brighter and more successful future13.Our trajectory is set for success and growth14.The direction we are heading in is filled with opportunity and potential15.We are steadily advancing towards a more favorable outcome16.Our forward movement is guiding us towards positivechange17.We are on the right track towards improvement and success18.Our development is aligning with our goals and aspirations19.We are forging ahead on a path of growth and prosperity20.The direction we are moving in is bringing us closer to the future we envision21.The progress we've made is a clear indication of our commitment to moving in the right direction.22.With each step forward, we are getting closer to our goal of positive growth and development.23.The momentum we've built is propelling us towards a brighter and more successful future.24.Every achievement we've reached is a testament to our dedication to improving and advancing.25.We are on a steady path towards positive change and improvement.26.Our efforts are leading us in the direction of success and prosperity.27.The evolving landscape reflects the positive changes we are making.28.We are laying the groundwork for a better and more promising tomorrow.29.Our progress is evidence of the positive shift we are experiencing.30.As we continue to move forward, we are creating a more favorable environment for growth and success.31.The strides we are taking are positioning us for a brighter and more prosperous future.32.We are making significant strides towards a more positive and promising future.33.Each step we take is a step in the right direction towards improvement and advancement.34.The positive changes we are implementing are setting the stage for future success.35.Our forward momentum is a reflection of our commitment to positive growth.36.Every improvement we make is a step in the right direction towards success and prosperity.37.Our determination to evolve and progress is clear in the positive changes we are seeing.38.The progress we are making is evidence of ourforward-thinking and strategic approach.39.We are moving in a direction that promises a brighter and more successful future.40.The transformation we are undergoing is leading us towardsa more positive and promising outlook.41.With each step forward, we are making progress towards a better future.42.We are embracing change and striving for continual improvement.43.Our dedication to growth and development is propelling us in the right direction.44.Every decision and action is leading us towards a positive outcome.45.The momentum of our progress is unstoppable as we move forward with purpose.46.We are committed to building a foundation for success through our ongoing efforts.47.As we continue to evolve, we are creating new opportunities for a brighter tomorrow.48.Our focus on innovation and adaptability is driving us towards positive transformation.49.We are cultivating a culture of excellence that is guiding us towards success.50.The journey towards improvement is filled with endless possibilities and potential.51.Every achievement, no matter how small, is a step in the right direction.52.We are laying the groundwork for a future that is filled with promise and potential.53.Our determination to succeed is leading us down a path of prosperity and growth.54.We are embracing the challenges ahead as opportunities for learning and advancement.55.Through persistence and resilience, we are forging a path towards a better tomorrow.56.Our united efforts are creating a momentum that is propelling us in a positive direction.57.We are fueled by a vision of success and guided by a commitment to excellence.58.Together, we are moving forward with confidence and determination.59.Our collective aspirations are guiding us towards a future of endless possibilities.60.We are building a legacy of progress and achievement that will shape our future.61.By making small changes and improvements every day, we are slowly but surely moving in the right direction.62.The dedication and hard work of our team members are propelling us towards a positive and successful future.63.With each obstacle we overcome, we are proving to ourselves that we are capable of achieving great things.64.The positive feedback and support from our customers are clear indicators that we are on the right path of development.65.Our commitment to innovation and adaptability is steering us towards a future full of opportunities and growth.66.As we continue to learn from our experiences, we are gaining the knowledge and insight needed to progress in a favorable direction.67.The collaborative efforts of our team are laying a solid foundation for our continued development and success.68.With a clear vision and determined mindset, we are advancing steadily towards a bright and promising future.69.The consistent efforts and resilience of our team are leading us down the path of positive evolution and progress.70.With each milestone we reach, we are building momentum and moving closer to our ideal state of development.71.The recent achievements and successes are clear evidence that we are on the right track towards positive advancement.72.Every challenge we face is an opportunity for growth, andwe are embracing these opportunities to move forward in a positive direction.73.We are laying the groundwork for a prosperous and successful future through our unwavering commitment to improvement and growth.74.The positive changes we are witnessing within our organization are a testament to the fact that we are evolving in the right direction.75.Our ability to adapt and evolve in response to changing circumstances is positioning us for success and progress.76.The support and encouragement from our stakeholders are fueling our journey towards positive development and growth.77.The dedication and passion of our team members are driving us towards a future filled with accomplishments and triumphs.78.With each step we take, we are gaining momentum and moving closer to our desired state of development and progress.79.The transformation and improvement we are experiencing are clear indications that we are moving in a favorable direction.80.Through our collective efforts and determination, we are forging a path towards a future that is brimming with possibilities and achievements.81.With each step forward, we are getting closer to success.82.The progress we have made is a testament to our dedication and hard work.83.We are on the right path and nothing can derail us from achieving our goals.84.The momentum we have built will carry us even further towards excellence.85.Every challenge we overcome strengthens our resolve and resilience.86.Our commitment to growth and improvement is unwavering.87.Each obstacle we face is an opportunity for growth and learning.88.The positive changes we are seeing are a result of our efforts and determination.89.We are constantly evolving and adapting to the changing circumstances.90.The future holds endless possibilities for us as we continue to move forward.91.Our progress is a reflection of our unwavering dedication to excellence.92.We are laying down the foundation for a brighter and betterfuture.93.Each small victory brings us closer to the ultimate goal.94.The direction we are heading in is filled with promise and potential.95.We are determined to make the most of every opportunity that comes our way.96.The growth and development we are experiencing are setting the stage for greater achievements.97.Our journey towards success is marked by continuous improvement and innovation.98.Every step we take is a step towards creating a better tomorrow.99.The transformation we are undergoing is a testament to our resilience and adaptability.100.We are writing our own success story and each chapter brings us closer to our dreams.101.With dedicated effort and determination, we are making progress in the right direction.102.Our positive outlook and hard work are guiding us towards a bright future.103.Through perseverance and innovation, we are steering towards a positive trajectory of growth and success.104.We are moving in the right direction and building a path to success through our hard work and dedication.105.With our unwavering commitment and innovative ideas, we are propelling towards a positive future.106.Our continuous improvement and strategic planning are leading us towards a favorable outcome.107.Driven by ambition and hard work, we are moving towards a promising future.108.Our relentless pursuit of excellence is pushing us in the direction of success.109.Through our strategic decisions and perseverance, we are steadily approaching a positive outcome.110.We are steadfastly moving in the direction of progress and advancement with our forward-thinking approach.111.The progress we are making is evident in the positive feedback we have received from clients and partners.112.We are constantly striving to improve and evolve, ensuring that we are always moving in the right direction.113.The recent developments in our company are a testament to our commitment to growth and success.114.Our team's dedication and hard work have been instrumental in propelling us towards a brighter future.115.We are excited about the direction we are heading in and the opportunities that lie ahead.116.The positive momentum we have built is laying the foundation for even greater achievements in the future.117.Every step we take brings us closer to reaching our full potential and realizing our goals.118.We are on a path that is leading us towards continued success and prosperity.119.The changes we are implementing are designed to steer us in the right direction and set us up for long-term success.120.With each passing day, we are making strides towards a more promising and rewarding future.121.Our progress is a result of our unwavering commitment to excellence and innovation.122.We are building a legacy of success that will continue to grow and flourish in the years to come.123.The forward-thinking mindset of our team is driving us towards a future filled with potential and opportunity.124.We are always looking for ways to move forward and grow, constantly seeking new avenues for development.125.The positive changes we are making are positioning us as leaders in our industry and setting new standards for success.126.Our dedication to improvement and growth is evident in the positive changes and advancements we have made.127.We are focused on building a sustainable and successful future for our company and all those who are a part of it.128.The progress we are making is a result of our collective efforts and shared vision for the future.129.We are committed to building a strong and prosperous future, and every step we take brings us closer to that goal.130.The journey towards success is filled with challenges, but we are confident in our ability to overcome them and continue moving forward.。

Lecture2-Forwards-and-Futures

Marking to Market

… …

EXCHANGE

PAYMENTS

Marking to Market

FEB 25 2012 CLOSING

Sell Order (5 futures FEB of HSBC)

BROKER

Buy Order (5 futures BROKER FEB of HSBC)

Selling futures or forwards is also called “taking a short position” .

2-3

Spot Market vs. Forward/Future Market

Stock

Time = t t=0 (today) t=1 week t=2 weeks t=3 weeks t=4 weeks t=5 weeks t=6 weeks

2- 8

Where Can We Buy Forward/Futures?

Forwards?

Over-the-counter (OTC) A computer- and telephone-linked network of dealers at financial

institutions, corporations, and fund managers Contracts can be non-standard and there is some small amount of

2000 Shares

PAYMENT !!!!

HKD 170000

2000 Shares

SETTLEMENT 22 FEB 2012

2- 6

I am buying 5 futures (FEB

远期、期货和互换

16

维持保证金(maintenance margin): when the balance in a trader’s margin account falls below the maintenance margin level, the trader receives a margin call requiring the account to be topped up to the initial margin level. 对冲平仓(offset):最主要的一种结清头寸的方式 。 套保(hedging): a trade designed to reduce risk.

远期(forwards)

期货(futures)

互换(swaps)

期权(options)

3

一、远期(forward)

远期合约(forward contract):a contract to buy or sell a specified asset at a designated future time.

8

远期合约的类型: 商品远期合约 金融远期合约

远期利率协议 远期外汇合约 远期股票合约

下面仅介绍远期利率协议

9

远期利率(Forward Rate ):将来某个时点开始的一定 期限的利率。(rate of interest for a period of time in the future implied by today’s zero rates). zero rate = zero coupon interest rate.

5

盈亏(net payoff,profit),从回收中扣除建立仓位 所发生的初始费用的终值,即 Profit = payoff – FV of expenses incurred

最新CFA衍生工具(Derivatives)考点解析

CFA衍生工具(Derivatives)考点解析对于很多想参加CFA考试的同学来说,对于CFA的考试内容还不是很了解。

我就为大家分享一下CFA考试的考试科目:1、道德与职业行为标准(Ethics and Professional Standards)2、定量分析(Quantitative)3、经济学(Economics)4、财务报表分析(Financial Statement Analysis)5、公司理财(Corporate Finance)6、权益投资(Equity Investments)7、固定收益投资(Fixed Income)8、衍生工具(Derivatives)9、其他类投资(Alternative Investments)10、投资组合管理 (Portfolio Management)Derivatives(金融衍生品)很多CFA考生都认为一级里的Derivatives(金融衍生品)非常难,碰到这个章节就觉得十分头疼。

好在这个部分在考试中占比仅为5%,有些考生甚至采取了丢车保帅的做法。

提醒大家,不必对此产生畏难情绪。

CFA一级考试金融衍生品科目考试以前有一些计算,但现在以定性题目为主,要求考生能理解其中原由,难度有所下降。

随着国内逐渐开放衍生品市场,越来越需要有衍生品专业知识的人才。

这部分的衍生品主要介绍衍生品的一些基本知识,包括衍生品的种类及市场区分,4大类衍生品的基本定价原理,以及简单期权策略。

CFA一级考试的Derivatives(金融衍生品)具体的内容知识点包含1个study session,3个reading。

其中,Reading 57对衍生品市场进行了区别,并对4大类衍生品进行了基本定义;Reading 58讲衍生品的定价和估值的基本原理,并对4大类衍生品的基本定价做了介绍;Reading 59对期权做了进一步分析,介绍两种期权及两种期权策略的应用。

从CFA考试的重要度来看,Reading 58、Reading 59是最重要的,Reading 57其次,其他Reading重要性不大。

金融远期合约(Forward Contracts)是指双方约定在未来的...

交易者B

非 清 算 会员

期货保证金流程图

通过贯穿交易者-经纪公司-非清算会员-清算会员-清算机构整 个链条的保证金制度与每日盯市结算,期货交易实行的是严格无负 债的运行机制,这一点几乎从根本上保证了期货不太可能出现违约 现象。

注意:远期交易是到期一次性结算的,所以在远期存续期内,实 际交割价格始终不变,标的资产市场价格的变化给投资者带来的是账面浮 动盈亏,到期结算时标的资产的市场价格与交割价格的差异才是投资者的 真实盈亏。 期货则有所不同。由于期货是每日盯市结算实现真实盈亏的,因 此可以把期货看作一个每日以结算价平仓结清并以该结算价重新开立的合 约,每日结算价格就是不断变动的期货交割价格。

- (2)到期时间。到期时间是交易所为期货合约规定的另一个标准 化条款。 与到期时间相联系的有几个概念:

• 到期循环与到期月。 • 交割月(Delivery Month)、交割日(Delivery Day)与现金结算日 (Cash Settlement Day)。 • 最后交易日。

-(3)最小价格波动值

• 特定期货合约的合约规模、交割日期和交割地点等都是标准化的,在 合约上均有明确规定,无须双方再商定,价格是期货合约的唯一变量。 • 一般来说,常见的标准期货合约条款包括:

– (1)交易单位。交易所对每个期货产品都规定了统一的数量和数量单位, 统称“交易单位”(Trade Unit)或“合约规模”(Contract Size)。不同 交易所、不同期货品种的交易单位规定都各不相同。[例]

•

期货交易的基本特征就是标准化和在交易所集中交易,这两个特 征及其衍生出的一些交易机制,成为期货有别于远期的关键。

• 期货市场的第一个运行特征是在有组织的交易所内集中进行,交易双 方并不直接接触,交易所和清算机构充当所有期货买方的卖者和所有 期货卖方的买者,匹配买卖撮合成交,集中清算。这种交易方式克服 了远期交易信息不充分和违约风险较大的缺陷,在很大程度上提高了 市场流动性和交易效率,降低了违约风险,成为远期交易进化到期货 交易的一个关键。

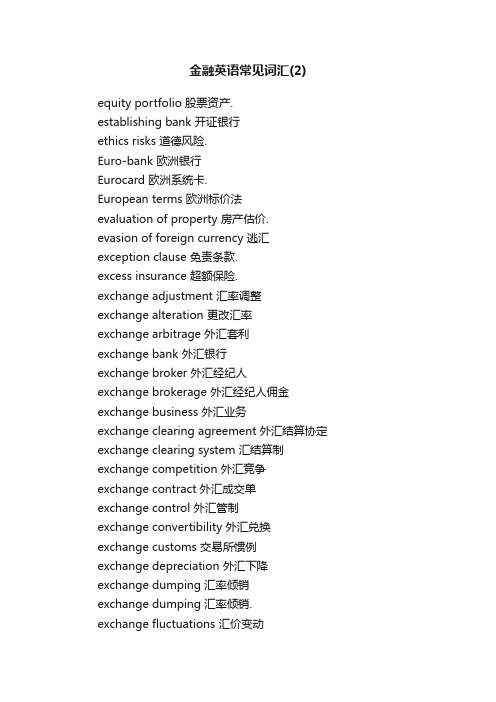

金融英语常见词汇(2)

金融英语常见词汇(2)equity portfolio 股票资产.establishing bank 开证银行ethics risks 道德风险.Euro-bank 欧洲银行Eurocard 欧洲系统卡.European terms 欧洲标价法evaluation of property 房产估价. evasion of foreign currency 逃汇exception clause 免责条款.excess insurance 超额保险.exchange adjustment 汇率调整exchange alteration 更改汇率exchange arbitrage 外汇套利exchange bank 外汇银行exchange broker 外汇经纪人exchange brokerage 外汇经纪人佣金exchange business 外汇业务exchange clearing agreement 外汇结算协定exchange clearing system 汇结算制exchange competition 外汇竞争exchange contract 外汇成交单exchange control 外汇管制exchange convertibility 外汇兑换exchange customs 交易所惯例exchange depreciation 外汇下降exchange dumping 汇率倾销exchange dumping 汇率倾销. exchange fluctuations 汇价变动exchange for forward delivery 远期外汇业务exchange for spot delivery 即期外汇业务exchange freedom 外汇自由兑换exchange loss 汇率损失exchange parity 外汇平价exchange position 外汇头寸exchange position 外汇头寸;外汇动态. exchange premium 外汇升水exchange profit 外汇利润exchange proviso clause 外汇保值条款exchange quota system 外汇配额制exchange rate 汇价exchange rate fluctuations 外汇汇价的波动exchange rate parity 外汇兑换的固定汇率exchange rate risks 外汇汇率风险. exchange reserves 外汇储备exchange restrictions 外汇限制exchange risk 外汇风险exchange risk 兑换风险.exchange settlement 结汇exchange speculation 外汇投机exchange stability 汇率稳定exchange surrender certificate 外汇移转证exchange transactions 外汇交易exchange value 外汇价值exchange war 外汇战excise 货物税,消费税.exercise date 执行日exercise price, striking price 履约价格,认购价格. expenditure tax 支出税.expenditure tax regime 支出税税制. expenses incurred in the purchase 购买物业开支. expiration date 到期日export and import bank 进出口银行export gold point 黄金输出点exposure 风险.external account 对外帐户extraneous risks 附加险.extrinsic value 外在价值.face value 面值facultative insurance 临时保险.fair and reasonable 公平合理far future risks 长远期风险.farm subsidies 农产品补贴farmland occupancy tax 耕地占用税. favourable exchange 顺汇fax base 税基.feast tax 筵席税.feathered assets 掺水资产.fee 不动产.fee interest 不动产产权.fictions payee 虚构抬头人.fictitious assets 虚拟资产.fictitious capital 虚拟资本.fiduciary a. 信托的,信用的,受信托的(人) fiduciary field 信用领域,信托领域finance broker 金融经纪人.financial advising services 金融咨询服务financial arrangement 筹资安排.financial crisis 金融危机financial crisis 金融危机financial crisis 金融危机financial forward contract 金融远期合约. financial futures 金融期货.financial futures contract 金融期货合约. financial insolvency 无力支付.financial institutions' deposit 同业存款financial lease 金融租赁.financial leases 金融租赁.financial risk 金融风险.financial statement analysis 财务报表分析. financial system 金融体系financial system 金融体系financial system 金融体系financial transaction 金融业务financial transaction 金融业务financial transaction 金融业务financial unrest 金融动荡financial unrest 金融动荡financial unrest 金融动荡financial world 金融界financial world 金融界financial world 金融界first mortgage 第一抵押权.fiscal and monetary policy 财政金融政策fiscal and monetary policy 财政金融政策fiscal and monetary policy 财政金融政策fixed assets 固定资产.fixed assets ratio 固定资产比率fixed assets ratio 固定资产比率fixed assets ratio 固定资产比率fixed assets ration 固定资产比率.fixed assets turnover ratio 固定资产周转率fixed assets turnover ratio 固定资产周转率fixed assets turnover ratio 固定资产周转率fixed capital 固定资本.fixed costs 固定成本.fixed deposit (=time deposit) 定期存款fixed deposit by installment 零存整取fixed exchange rate 固定汇率fixed par of exchange 法定汇兑平价fixed savings withdrawal 定期储蓄提款fixed-rate leases 固定利率租赁.flexibility and mobility 灵活性与机动性flexibility of exchange rates 汇率伸缩性flexible exchange rate 浮动汇率floating exchange rate 浮动汇率floating policy 流动保险单.floating-rate leases 浮动利率租赁.floor 带利率下限的期权.floor broker 场内经纪人.fluctuations in prices 汇率波动foregift 权利金.foreign banks 外国银行foreign correspondent 国外代理银行foreign currency futures 外汇期货.foreign enterprises income tax 外国企业所得税. foreign exchange certificate 外汇兑换券foreign exchange crisis 外汇危机foreign exchange cushion 外汇缓冲foreign exchange dumping 外汇倾销.foreign exchange earnings 外汇收入foreign exchange liabilities 外汇负债foreign exchange loans 外汇贷款foreign exchange parity 外汇平价foreign exchange quotations 外汇行情foreign exchange regulations 外汇条例foreign exchange reserves 外汇储备foreign exchange restrictions 外汇限制foreign exchange retaining system 外汇留存制foreign exchange risk 外汇风险.foreign exchange risk 外汇风险.foreign exchange services 外汇业务foreign exchange transaction centre 外汇交易中心forward exchange 期货外汇forward exchange intervention 期货外汇干预forward exchange sold 卖出期货外汇forward foreign exchange 远期外汇汇率forward operation 远期(经营)业务forward swap 远期掉期.fraternal insurance 互助保险.free depreciation 自由折旧.free foreign exchange 自由外汇freight tax 运费税.fringe bank 边缘银行full insurance 定额保险.full payout leases 充分偿付租赁.full progressive income tax 全额累进所得税. fund 资金,基金fund account 基金帐户fund allocation 基金分配fund appropriation 基金拨款fund balance 基金结存款fund demand 资金需求.fund for relief 救济基金fund for special use 专用基金fund in trust 信托基金fund liability 基金负债fund obligation 基金负担fund raising 基金筹措fundamental insurance 基本险.funds statement 资金表futures commission merchants 期货经纪公司. futures contract 期货合约.futures delivery 期货交割.futures margin 期货保证金.futures market 期货市场.futures price 期货价格.futures transaction 期货交易.FX futures contract 外汇期货合约. galloping inflation 恶性通货膨胀galloping inflation 恶性通货膨胀galloping inflation 恶性通货膨胀gap 跳空general endorsement 不记名背书.general fund 普通基金general mortgage 一般抵押.Giro bank 汇划银行given rate 已知汇率go long 买进,多头.go short 短缺;卖空,空头.going away 分批买进going rate 现行汇率Gold Ear Credit Card 金穗卡.government revenue 政府收入.graduated reserve requirement 分级法定准备金graduated reserve requirement 分级法定准备金graduated reserve requirement 分级法定准备金Great Wall card 长城卡.gross cash flow 现金总流量guarantee of payment 付款保证.guaranteed fund 保证准备金guaranteed fund 保证准备金guaranteed fund 保证准备金hammering the market 打压市场handling charge 手续费.harmony of fiscal and monetary policies 财政政策和金融政策的协调harmony of fiscal and monetary policies 财政政策和金融政策的协调harmony of fiscal and monetary policies 财政政策和金融政策的协调hedge 套头交易hedge against inflation 为防通货膨胀而套购hedge buying 买进保值期货hedge fund 套利基金hedging mechanism 规避机制.hedging risk 套期保值风险hire purchase 租购.hit the bid 拍板成交hoarded money 储存的货币holding the market 托盘horizontal price movement 横盘hot issue 抢手证券hot money deposits 游资存款hot stock 抢手股票house property tax 房产税. hypothecation 抵押idle capital 闲置资本idle cash (money) 闲散现金,游资idle demand deposits 闲置的活期存款immobilized capital 固定化的资产. immovable property 不动产.import regulation tax 进口调节税. imposition 征税;税;税款.imprest bank account 定额银行存款专户in force (法律上)有效的.in the tank 跳水inactive market 不活跃市场income in kind 实物所得.income tax liabilities 所得税责任,所得税债务. income taxes 所得税.indemnity 赔偿,补偿.indirect arbitrage 间接套汇indirect finance 间接金融.indirect hedging 间接套做.indirect leases 间接租赁(即:杠杆租赁). indirect rate 间接汇率indirect taxation 间接税.individual income regulation tax 个人调节税.individual income tax 个人所得税.individual savings 私人储蓄Industrial and Commercial Bank of China 中国工商银行industrial financing 工业融资.industrial-commercial consolidated tax 工商统一税. industrial-commercial income tax 工商所得税. industrial-commercial tax 工商税.inflation 通货膨胀inflation 通货膨胀inflation 通货膨胀inflation rate 通货膨胀率inflation rate 通货膨胀率inflation rate 通货膨胀率inflationary spiral 螺旋式上升的通货膨胀inflationary spiral 螺旋式上升的通货膨胀inflationary spiral 螺旋式上升的通货膨胀inflationary trends 通货膨胀趋势inflationary trends 通货膨胀趋势inflationary trends 通货膨胀趋势infrastructure bank 基本建设投资银行initial margin 初始保证金.initial margin 期初保证权.initial margins 初始保证金.initial reserve 初期准备金initial reserve 初期准备金initial reserve 初期准备金insider 内幕人installment savings 零存整取储蓄institution 机构投资者insurance appraiser 保险损失评价人.insurance broker 保险经纪人.insurance contract 保险契约,保险合同. insurance saleman 保险外勤.insurance services 保险业务insure against fire 保火险.insured 被保险人.interbank market 银行同业市场inter-business credit 同行放帐.interest on deposit 存款利息interest per annum 年息interest per month 月息interest rate futures contract 利率期货合约. interest rate policy 利率政策interest rate policy 利率政策interest rate policy 利率政策interest rate position 利率头寸.interest rate risk 利率风险.interest restriction 利息限制interest subsidy 利息补贴interest-rate risk 利息率风险.interim finance 中间金融.intermediary bank 中间银行intermediate account 中间帐户internal reserves 内部准备金internal reserves 内部准备金internal reserves 内部准备金international banking services 国际银行业务International Investment Bank (IIB) 国际投资银行international leasing 国际租赁.in-the-money 有内在价值的期权.intraday 日内intrinsic utility 内在效用.intrinsic value 实际价值,内部价值.inward documentary bill for collection 进口跟单汇票,进口押汇(汇票)isolation of risk 风险隔离.issue bank 发行银行JCB card JCB卡.joint financing 共同贷款.key risk 关键风险.kill a bet 终止赌博.land use tax 土地使用税.large deposit 大额存款large leases 大型租赁.latent inflation 潜在的通货膨胀latent inflation 潜在的通货膨胀latent inflation 潜在的通货膨胀lease agreement 租约.lease and release 租借和停租.lease broker 租赁经纪人.lease financing 租赁筹租.lease immovable 租借的不动产.lease in perpetuity 永租权.lease insurance 租赁保险.lease interest insurance 租赁权益保险.lease land 租赁土地.lease mortgage 租借抵押.lease out 租出.lease property 租赁财产.lease purchase 租借购买.lease rental 租赁费.lease territory 租借地. leaseback 回租.leasebroker 租赁经纪人.leased immovable 租借的不动产. leasehold 租赁土地.leasehold 租借期,租赁营业,租赁权. leasehold property 租赁财产. leasehold property 租赁财产. leaseholder 租赁人. leaseholder 承租人,租借人. leases agent 租赁代理.leases arrangement 租赁安排. leases company 租赁公司. leases structure 租赁结构. leasing 出租.leasing agreement 租赁协议. leasing amount 租赁金额. leasing asset 出租财产,租赁财产. leasing clauses 租赁条款. leasing consultant 租赁顾问. leasing contract 租赁合同. leasing cost 租赁成本.leasing country 承租国. leasing division 租赁部. leasing equipment 租赁设备. leasing industry 租赁业. leasing industry (trade) 租赁业. leasing money 租赁资金. leasing period 租赁期.leasing regulations 租赁条例.legal interest 法定利息legal tender 法定货币legal tender 本位货币,法定货币lessee 承租人,租户.lessor 出租人.letter of confirmation 确认书.letter transfer 信汇leveraged leases 杠杆租赁.lien 扣押权,抵押权.life insurance 人寿保险.life of assets 资产寿命.limit order 限价指令limited floating rate 有限浮动汇率line of business 行业,营业范围,经营种类. liquidation 清仓liquidity 流动性liquidity of bank 银行资产流动性liquidity of bank 银行资产流动性liquidity of bank 银行资产流动性listed stock 上市股票livestock transaction tax 牲畜交易税. loan account 贷款帐户loan amount 贷款额.loan at call 拆放.loan bank 放款银行loan volume 贷款额.loan-deposit ratio 存放款比率loan-deposit ratio 存放款比率loan-deposit ratio 存放款比率loans to financial institutions 金融机构贷款loans to government 政府贷款local bank 地方银行local income tax (local surtax) 地方所得税. local surtax 地方附加税.local tax 地方税.long arbitrage 多头套利.long position 多头头寸long position 多头寸;买进的期货合同.long-term certificate of deposit 长期存款单long-term credit bank 长期信用银行long-term finance 长期资金融通.loss leader 特价商品,亏损大项loss of profits insurance 收益损失保险.loss on exchange 汇兑损失low-currency dumping 低汇倾销low-currency dumping 低汇倾销.M/T (= Mail Transfer) 信汇main bank 主要银行maintenance margin 最低保证金,维持保证金. major market index 主要市场指数management risk 管理风险.managing bank of a syndicate 财团的经理银行manipulation 操纵margin 保证金margin call 保证金通知.margin call 追加保证金的通知.margin money 预收保证金,开设信用证保证金. margin rate 保证金率.markdown 跌价.market discount rate 市场贴现率.market expectations 市场预期.market makers 造市者.market order 市价订单.market risk 市场风险.marketability 流动性market-clearing 市场结算.Master card 万事达卡.matching 搭配.mature liquid contracts 到期合约.maximum limit of overdraft 透支额度. measures for monetary ease 金融缓和措施measures for monetary ease 金融缓和措施measures for monetary ease 金融缓和措施medium rate 中间汇率medium-term finance 中期金融.member bank 会员银行Million card 百万卡.minimum cash requirements 最低现金持有量(需求) minimum reserve ratio 法定最低准备比率minimum reserve ratio 法定最低准备比率minimum reserve ratio 法定最低准备比率mint parity 法定平价monetary action 金融措施monetary action 金融措施monetary action 金融措施monetary aggregates 货币流通额monetary and credit control 货币信用管理monetary and credit control 货币信用管理monetary and credit control 货币信用管理monetary and financial crisis 货币金融危机monetary and financial crisis 货币金融危机monetary and financial crisis 货币金融危机monetary area 货币区monetary assets 货币性资产monetary base 货币基础monetary circulation 货币流通monetary device 金融调节手段monetary device 金融调节手段monetary device 金融调节手段monetary ease 银根松动monetary market 金融市场monetary market 金融市场monetary market 金融市场monetary risk 货币风险.monetary stringency 银根奇紧monetary stringency 银根紧monetary stringency 银根奇紧monetary stringency 银根奇紧monetary unit 货币单位money capital 货币资本.money collector 收款人money credit 货币信用money down 付现款money equivalent 货币等价money paid on account 定金.money-flow analysis 货币流量分析money-over-money leases 货币加成租赁. moral hazard 道德风险.mortgage bank 抵押银行motor vehicle and highway user tax 机动车和公路使用税. movables all risks insurance 动产综合保险.movables insurance 动产保险.multinational bank 跨国银行multiunit 公寓楼.mutual insurance company 相互保险公司.national bank 国家银行nationalized bank 国有化银行near money 准货币nearby contracts 近期合约.nearby futures 近期期货.nearby risks 近期风险.negotiability 流通性negotiating bank 议付银行nesting 配套.net settlement status 净结算状况,净结算头寸.neutral money 中介货币neutrality of the central bank 中央银行的中立性neutrality of the central bank 中央银行的中立性neutrality of the central bank 中央银行的中立性nominal account 名义帐户nominal deposit 名义存款non-member bank 非会员银行non-resident account 非居民存款notional principal 名义本金.notional sum 名义金额.off-balance-sheet 表外业务.offer rate 卖出汇率official borrowing 政府借款.official devaluation 法定贬值official rate (of exchange) 官方汇价official short-term credit 官方短期信用.offset reserve 坏帐准备金offset reserve 坏帐准备金offset reserve 坏帐准备金on a discount basis (以)折价形式.open account business (= open account tr赊帐交易open an account 开户open fair transaction tax 集市交易税.open market 公开市场.open market operation 公开市场业务open market operation 公开市场业务open market operation 公开市场业务open market policy 公开市场政策open market policy 公开市场政策open market policy 公开市场政策open mortgage 可资抵押.open negotiation 公开议付.open outcry 公开喊价,公开叫价.open policy 预约保单.open position (期货交易中的)头寸.open positions 敞口头寸.open-ended 开口的,无限制的,无限度的.opening order 开市价订单.operating bank 营业银行operating cash flow 营运现金流(量).operating lease 经营租赁.operating leases 操作租赁.operating risk 经营风险.operation account 交易帐户option 期权,选择权,买卖权.option buyer 期权的买方.option fee (=option premium or premium o期权费.option purchase price 期权的购进价格.option seller 期权的卖方.options on futures contract 期货合同的期权交易.ordinary bank 普通银行ordinary deposit 普通存款ordinary time deposit 普通定期存款our bank 开户银行out-of-the-money 无内在价值的期权.output-capital ratio 产出与资本的比率output-capital ratio 产出与资本的比率output-capital ratio 产出与资本的比率outright position 单笔头寸.outward documentary bill for collection 出口跟单汇票,出口押汇outward remittance 汇出汇款over-loan position 贷款超额over-loan position 贷款超额over-loan position 贷款超额overnight call loan 日拆.overseas bank 海外银行overseas branches 国外分行oversold 超卖over-the-counter 场外的,买卖双方直接交易的,不通过交易所交易的.over-the-counter (OTC) option 场外交易市场overvalued 估。

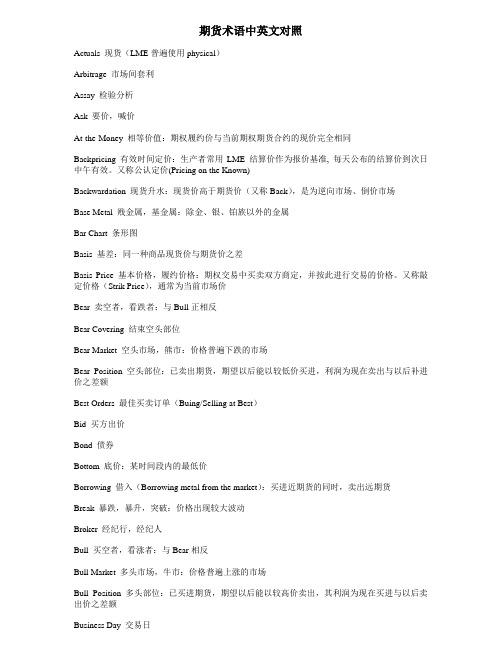

期货术语中英文对照

期货术语中英文对照Actuals 现货(LME普遍使用physical)Arbitrage 市场间套利Assay 检验分析Ask 要价,喊价At-the-Money 相等价值:期权履约价与当前期权期货合约的现价完全相同Backpricing 有效时间定价:生产者常用LME 结算价作为报价基准, 每天公布的结算价到次日中午有效。

又称公认定价(Pricing on the Known)Backwardation 现货升水:现货价高于期货价(又称Back),是为逆向市场、倒价市场Base Metal 贱金属,基金属:除金、银、铂族以外的金属Bar Chart 条形图Basis 基差:同一种商品现货价与期货价之差Basis Price 基本价格,履约价格:期权交易中买卖双方商定,并按此进行交易的价格。

又称敲定价格(Strik Price),通常为当前市场价Bear 卖空者,看跌者:与Bull正相反Bear Covering 结束空头部位Bear Market 空头市场,熊市:价格普遍下跌的市场Bear Position 空头部位:已卖出期货,期望以后能以较低价买进,利润为现在卖出与以后补进价之差额Best Orders 最佳买卖订单(Buing/Selling at Best)Bid 买方出价Bond 债券Bottom 底价:某时间段内的最低价Borrowing 借入(Borrowing metal from the market):买进近期货的同时,卖出远期货Break 暴跌,暴升,突破:价格出现较大波动Broker 经纪行,经纪人Bull 买空者,看涨者:与Bear相反Bull Market 多头市场,牛市:价格普遍上涨的市场Bull Position 多头部位:已买进期货,期望以后能以较高价卖出,其利润为现在买进与以后卖出价之差额Buying Hedge (Long Hedge)买进套期保值Buy In 补进:平仓、对冲或关闭一个空头部位Buy on Close 收市买进:在收市时按收市价买进Buy on Opening 开市买进:在开市时按开市价买进Call Option 看涨期权,延买期权:允许购买者按一特定的基价购买一种指定期货合约的权力。

【2020CFA二级高清讲义】CFA二级高清-衍生品

CFA Level IIDerivativesCONTENTS目录Pricing and Valuation of ForwardCommitmentsValuation of Contingent ClaimsWarm-up●Pricing:确定远期价格(t=0).●Valuation:签订合约期间的某一时刻是否赚钱(t=t).●合约签订期初时,双方的价值都为0(forward commitment )。

Warm-upt=0Pricingt=t Valuationt=T Settlement●No-Arbitrage Rule ●Equity Forward and Futures●Interest Rate Forward and Futures (FRA)●Fixed-income Forward and Futures●Currency Forward and Futures●Interest Rate Swap●Currency Swap●Equity SwapPricing and Valuation of Forward Commitments Non-Arbitrage Principle●Arbitrage:在不同市场同时买卖相同资产并获利(低买高卖).●Arbitrage opportunities:相同的东西卖不同的价格.●The no-arbitrage principle(Law of one price):不存在任何套利机会.●The no-arbitrage principle 可以用来对衍生品进行定价。

FP=S 0×(1+R f )T●Cash-and-carry Arbitrage:正向套利。

If FP>S0×(1+Rf)TNon-Arbitrage PrincipleAt initiation At settlement date1.借钱S2.买资产3.Short一份远期合约1.把资产交割给long方2.获得FP的现金3.偿还本金和利息Profit=FP-S0×(1+R f)T●Reverse-cash-and-carry Arbitrage: 反向套利。

- 1、下载文档前请自行甄别文档内容的完整性,平台不提供额外的编辑、内容补充、找答案等附加服务。

- 2、"仅部分预览"的文档,不可在线预览部分如存在完整性等问题,可反馈申请退款(可完整预览的文档不适用该条件!)。

- 3、如文档侵犯您的权益,请联系客服反馈,我们会尽快为您处理(人工客服工作时间:9:00-18:30)。

Elisa Nicolato (Aarhus University Department of Fixed Income and Derivative Securities Economics and Business)

Spring 2012

8 / 20

Determination of Forward (Futures) Prices

2 / 20

Forward and Futures Contracts

Forward Contracts

A forward contract is an agreement to buy or sell an asset at a certain future time (expiry or maturity or delivery date) for a certain price (delivery price) Contrasted with a spot contract which is an agreement to buy or sell today. The forward price is the delivery price which makes the today value of the contract equal to zero. The forward price may be different for contracts of different maturities.

Futures Contracts

A futures contract is an agreement between two parties to buy or sell an asset at a certain time in the future for a certain price Similar to forward contracts, but the principal difference lies in the way payments are being made. Under the forward contract, the whole gain or loss is realized at the end of the life of the contract. Under the futures contract, the gain or loss is realized day by day through a mechanism known as marking to market. There are subtle differences between when interest rates are not constant. However we will allow ourself to identify futures with forwards prices.

Elisa Nicolato (Aarhus University Department of Fixed Income and Derivative Securities Economics and Business)

Spring 2012

10 / 20

Determination of Forward (Futures) Prices

The forward price of a non-dividend paying asset

In general (under our assumptions) the forward price F0 for a maturity T of a non-dividend paying asset, with spot price S0 under interest rate r must be F0 = S0 e rT Sketch of Proof: If F0 > S0 e rT then buying today the underlying asset by borrowing at r and taking a short position on a forward provides an arbitrage opportunity. If F0 < S0 e rT then selling today the underlying asset, making a deposit at r and taking a long position on a forward provides an arbitrage opportunity. Then it must be that F0 = S0 e rT

Elisa Nicolato (Aarhus University Department of Fixed Income and Derivative Securities Economics and Business)

Spring 2012

5 / 20

Determination of Forward (Futures) Prices

Forward contract: Payoffs

- The party that has agreed to buy has what is termed a long position - The party that has agreed to sell has what is termed a short position

Elisa Nicolato (Aarhus University Department of Fixed Income and Derivative Securities Economics and Business)

Spring 2012

11 / 20

Determination of Forward (Futures) Prices

Determination of Forward (Futures) Prices

Elisa Nicolato (Aarhus University Department of Fixed Income and Derivative Securities Economics and Business)

Symbology

- S0 : Spot price today - F0 : Forward price today - T : Time until maturity - r : Risk-free interest rate for maturity T , p.a., continuously compounded (will be so for the main part of the course)

Forward and Futures Contracts

Elisa Nicolato (Aarhus University Department of Fixed Income and Derivative Securities Economics and Business)

Spring 2012

Elisa Nicolato (Aarhus University Department of Fixed Income and Derivative Securities Economics and Business)

Spring 2012

7 / 20

Determination of Forward (Futures) Prices

Fixed Income and Derivative Securities

Forward and Futures Contracts, Hull Chap. 5

Elisa Nicolato

Aarhus University Department of Economics and Business

Spring 2012

What if the underlying asset pays dividends?

Assume that the underlying investment asset provides a known dollar income. Then the forward price is given by F0 = (S0 − I )e rT where I is the present value of the income during the life of the forward contract. See Hull, Chapter 5.5

Elisa Nicolato (Aarhus University Department of Fixed Income and Derivative Securities Economics and Business)

Spring 2012

9 / 20

Determination of Forward (Futures) Prices

Arbitrage construction

Elisa Nicolato (Aarhus University Department of Fixed Income and Derivative Securities Economics and Business)

Spring 2012

1 / 20

Forward and Futures Contracts

Elisa Nicolato (Aarhus University Department of Fixed Income and Derivative Securities Economics and Business)

Spring 2012

3 / 20

Forward and Futures Contracts

Hale Waihona Puke Elisa Nicolato (Aarhus University Department of Fixed Income and Derivative Securities Economics and Business)