历任美国财政部长

美国历届国家领导人及任期

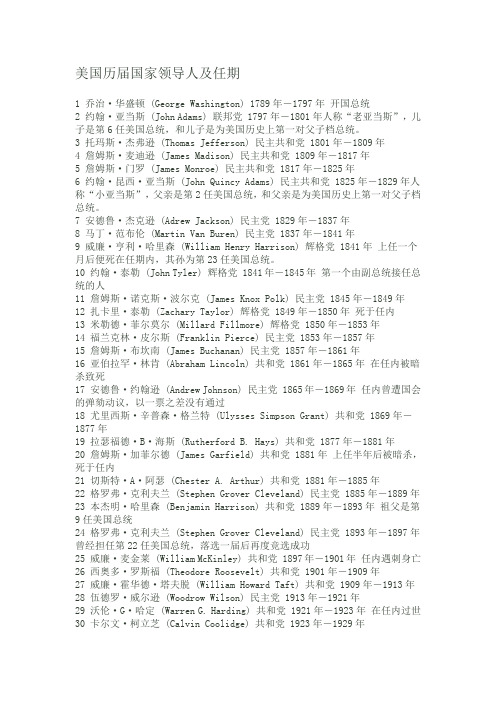

美国历届国家领导人及任期美国历届国家领导人及任期1 乔治·华盛顿(George Washington) 1789年-1797年开国总统2 约翰·亚当斯 (John Adams) 联邦党 1797年-1801年人称“老亚当斯”,儿子是第6任美国总统,和儿子是为美国历史上第一对父子档总统。

3 托玛斯·杰弗逊 (Thomas Jefferson) 民主共和党 1801年-1809年4 詹姆斯·麦迪逊(James Madison) 民主共和党1809年-1817年5 詹姆斯·门罗 (James Monroe) 民主共和党 1817年-1825年6 约翰·昆西·亚当斯 (John Quincy Adams) 民主共和党 1825年-1829年人称“小亚当斯”,父亲是第2任美国总统,和父亲是为美国历史上第一对父子档总统。

7 安德鲁·杰克逊 (Adrew Jackson) 民主党 1829年-1837年8 马丁·范布伦 (Martin Van Buren) 民主党 1837年-1841年9 威廉·亨利·哈里森 (William Henry Harrison) 辉格党 1841年上任一个月后便死在任期内,其孙为第23任美国总统。

10 约翰·泰勒 (John Tyler) 辉格党 1841年-1845年第一个由副总统接任总统的人11 詹姆斯·诺克斯·波尔克 (James Knox Polk) 民主党1845年-1849年12 扎卡里·泰勒 (Zachary Taylor) 辉格党 1849年-1850年死于任内13 米勒德·菲尔莫尔 (Millard Fillmore) 辉格党 1850年-1853年14 福兰克林·皮尔斯 (Franklin Pierce) 民主党 1853年-1857年15 詹姆斯·布坎南 (James Buchanan) 民主党 1857年-1861年16 亚伯拉罕·林肯 (Abraham Lincoln) 共和党 1861年-1865年在任内被暗杀致死17 安德鲁·约翰逊 (Andrew Johnson) 民主党 1865年-1869年任内曾遭国会的弹劾动议,以一票之差没有通过18 尤里西斯·辛普森·格兰特(Ulysses Simpson Grant) 共和党1869年-1877年19 拉瑟福德·B·海斯 (Rutherford B. Hays) 共和党 1877年-1881年20 詹姆斯·加菲尔德 (James Garfield) 共和党 1881年上任半年后被暗杀,死于任内21 切斯特·A·阿瑟 (Chester A. Arthur) 共和党 1881年-1885年22 格罗弗·克利夫兰 (Stephen Grover Cleveland) 民主党 1885年-1889年23 本杰明·哈里森(Benjamin Harrison) 共和党1889年-1893年祖父是第9任美国总统24 格罗弗·克利夫兰 (Stephen Grover Cleveland) 民主党 1893年-1897年曾经担任第22任美国总统,落选一届后再度竞选成功25 威廉·麦金莱 (William McKinley) 共和党 1897年-1901年任内遇刺身亡26 西奥多·罗斯福 (Theodore Roosevelt) 共和党 1901年-1909年27 威廉·霍华德·塔夫脱 (William Howard Taft) 共和党 1909年-1913年28 伍德罗·威尔逊 (Woodrow Wilson) 民主党 1913年-1921年29 沃伦·G·哈定 (Warren G. Harding) 共和党 1921年-1923年在任内过世30 卡尔文·柯立芝 (Calvin Coolidge) 共和党 1923年-1929年31 赫伯特·胡佛 (Herbert Hoover) 共和党 1929年-1933年32 富兰克林·德拉诺·罗斯福 (Franklin Delano Roosevelt) 民主党1933年-1945年任期最长的美国总统,连任四届,最后于任内过世33 哈利·S·杜鲁门 (Harry S. Truman) 民主党 1945年-1953年34 德怀特·D·艾森豪威尔 (Dwight D. Eisenhower) 共和党 1953年-1961年35 约翰·F·肯尼迪 (John F. Kennedy) 民主党 1961年-1963年任内被暗杀36 林登·约翰逊 (Lyndon Johnson) 民主党 1963年-1969年37 理查德·尼克松 (Richard Nixon) 共和党 1969年-1974年任内因水门事件而辞职38 杰拉尔德·福特(Gerald Ford) 共和党1974年-1977年唯一一名未经选举就接任副总统,然后接任总统的人39 吉米·卡特 (Jimmy Carter) 民主党 1977年-1981年40 罗纳德·里根 (Ronald Reagan) 共和党 1981年-1989年41 乔治·H·W·布什 (George H.W. Bush) 共和党 1989年-1993年其长子是第43任美国总统42 比尔·克林顿 (Bill Clinton) 民主党 1993年-2001年任内国会曾提起弹劾动议,但未获通过43 乔治·沃克·布什 (George W. Bush) 共和党 2001年-2009年父亲是第41任美国总统44 贝拉克·奥巴马(Barack Hussein Obama)民主党 2009年—2013年第56届美国总统,美国历史上首位非洲裔黑人总统。

珍妮特 耶伦

个人成就

2016年6月,《福布斯》公布,2016年度全月20日,美国《时代》杂志正式揭晓了“《时代》2017年全球影响力百人榜”,美联储主席耶伦入 选该榜最重磅的“巨人Titans”经济与社会领袖类别

2015年10月,美国财经杂志《彭博市场》公布了第五届全球金融50大最具影响力人物,美联储主席耶伦位列 首位。

人物活动

2021年10月26日上午,中共中央政治局委员、国务院副总理、中美全面经济对话中方牵头人刘鹤应约与美财 政部长耶伦举行视频通话。双方就宏观经济形势、多双边领域合作进行了务实、坦诚、建设性的交流。双方认为, 世界经济复苏正处于关键时刻,中美加强宏观政策沟通协调十分重要。中方表达了对美国取消加征关税和制裁、 公平对待中国企业等问题的关切。双方同意继续保持沟通。

人物事件

2022年3月10日美国财政部长耶伦表示,美国的高通胀形势可能会持续到2022年年底,而俄乌冲突则加剧了 这种情况。

2022年4月20日,在二十国集团(G20)财长和央行行长会议上,当俄罗斯代表开始发言时,耶伦与乌克兰代 表一道退出了会议现场。此前,耶伦曾公开表示美国将不会参加有俄罗斯参与的二十国集团会议 。

为政举措

金融危机发生后,即便美国经济开始复苏,耶伦也认为美国高失业率将持续存在,这使得经济增速持续低于 潜在增长率,经济面临的通缩风险大于通胀风险,耶伦驳斥了财政赤字必然导致高通胀的看法,为宽松财政政策 和货币政策的配合辩护。因此,即便美国2011年曾经面临通胀压力,耶伦等美联储鸽派人物还坚持主张在“一段 时间内维持利率在创纪录的低位”。珍妮特·耶伦演说

学术贡献

1997年,耶伦获耶鲁大学威尔伯十字勋章,1998年获布朗大学名誉法学博士学位,2000年获巴德学院人文主 义文学名誉博士学位。

南美洲历届领导人资料

委内瑞拉:1999.2.2-2002.4.12 乌戈·拉斐尔·查韦斯·弗里亚斯(Hugo Rafael Chávez Fr ías 直选,军人):曾因发动“二·四”军人政变入狱,出狱后查韦斯创立了左翼的第五共和运动以对抗民选的委内瑞拉总统。

他以拯救委内瑞拉的大量贫穷人口为号召,在1998年当选总统,2007年宣誓连任。

2011年被查出身体内有恶性肿瘤而接受手术,2012年公开宣布痊愈并竞选总统,10月赢得大选获得连任。

当地时间2013年3月5日下午4点25分查韦斯去世,享年58岁。

2002.4.12-2002.4.13 佩德罗·卡尔莫纳·埃斯坦加(Pedro Carmona Estanga 政变上台,政治家)埃斯坦加于2002年4月12日-2002年4月13日担任委内瑞拉政变临时总统。

迪奥斯达多·卡贝略(Diosdado Cabello 副总统代行总统职权)2002.4.14- 2013.3.5乌戈·拉斐尔·查韦斯·弗里亚斯(Hugo Rafael Chávez Frías)尼古拉斯·马杜罗·莫罗斯:代总统。

青年时期为学生运动领袖,曾担任加拉加斯地铁工会领导。

历任“玻利瓦尔革命运动200”全国领导人、“玻利瓦尔劳动者力量党”协调员和“第五共和国运动”动员部主任。

2008年参与创建执政党委内瑞拉统一社会主义党,现为统社党副主席。

1998年当选众议员,2005至2006年担任全国代表大会主席。

2006年8月被任命为外长。

2012年10月,被任命为副总统兼外长。

2013年4月15日当选为委内瑞拉总统。

洪都拉斯波尔菲里奥·洛沃,洪都拉斯政治人物。

2002年至2006年,洛沃任洪都拉斯国民议会议长。

2009年11月29日当选洪都拉斯新总统。

历届美联储主席

历届美联储主席1)1934-1948,Marriner EcclesMarriner Eccles(马瑞纳•伊寇斯,1890-1977),曾任美联储主席,1934年至1948年在任。

Marriner Eccles,在当代联储会主席中被有些人评价为得分最高的一位,美联储会华盛顿总部两座大楼中,有一座是以他的名字命名。

他在位的时间,横跨过了整个第二次世界大战的战前、战中以及战后时期。

他在任的所作所为,为其后的历届联储会主席,立下了一个评判的标准。

Eccles并没有受过正规的大学教育,这在联储会主席中是绝无仅有的。

他的父亲从苏格兰移民来踏上美国土地时,身无分文。

但是,Eccles的伟大之处在大萧条时期便显露出来。

他准确地看出,货币政策不可能在真空中实施。

Eccles向罗斯福政府提议,在当时情况下,为了使经济摆脱大萧条的阴影,除了积极的货币调节之外,财政刺激,也就是超出税收的开支,也是非要不可的。

Eccles还对1935年出台《银行法》产生过巨大影响。

这个《银行法》的确立,重振了美国银行体系的信心,加强了联储会制定并且实施货币政策的权力。

所以有人说,Eccles 最大的贡献,就是他领导着联储会独立于政府影响之外、不受财政部左右的种种努力。

的确,在Eccles的影响下,1935 年的《银行法》创立了“联邦开放市场委员会”这个重要的经济政策制定机构,白纸黑字地明文规定了“财政部长和货币审计长不得同时成为联储会成员”,这就使白宫无法介入联储会的独立决策了。

第二次世界大战以后的联邦财政部长辛德要求联储会继续锁定利率,Eccles针锋相对,认为这种办法确曾在第二次世界大战中帮助了财政部调动支援战争的财力,但是并不适用于战后时期。

用Eccles的话说,它会使联储会成为“一个通货膨胀的引擎”。

相比之下,Eccles 的后任Thomas McCabe就显得软弱得多了。

2)1948-1951,Thomas McCabeThomas McCabe(托马斯·麦克凯),美联储第二任主席,任期从1948年4月15日至1951年3月31日,由杜鲁门总统任命,朝鲜战争之后卸任。

美国财政部长盖特纳北京大学演讲中英文全文

The United States and China, Cooperating for Recovery and GrowthThe United States and China, Cooperating for Recovery and GrowthTreasury Secre tary Timothy F. GeithnerSpeech at Peking University - Beijing, ChinaIt is a pleasure to be back in China and to join you here today at this great university.I first came to China, and to Peking University, in the summer of 1981 as a co llege student studying Mandarin. I was here with a small group of graduate and undergraduate students from across the United States. I returned the next summ er to Beijing Normal Univ ersity.We studied reasonably hard, and had the privilege of working with many talente d professors, some of whom are here today. As we explored this city and travel ed through Eastern China, we had the chance not just to understand more about your history and your aspirations, but also to begin to see the United States through your eyes.Over the decades since, we have seen the beginnings of one of the most extraor dinary economic transformations in history. China is thriving. Economic reform has brought exceptionally rapid and sustained growth in incomes. China?.s eme rgence as a major economic force more fully integrated into the world economy has brought substantial benefits to the United States and to economies around the wor ld.In recognition of our mutual interest in a positive, cooperative, and comprehe nsive relationship, President Hu Jintao and President Obama agreed in April to establish the Strategic and Economic Dialogue. Secretary Clinton and I will ho st Vice Premier Wang and State Councilor Dai in Washington this summer for our first meeting. I have the privilege of beginning the economic discussions with a series of meetings in Beijing today and tomorrow.These meetings will give us a chance to discuss the risks and challenges on th e economic front, to examine some of the longer term challenges we both face i n laying the foundation for a more balanced and sustainable recovery, and to e xplore our common interest in international financial reform.Current Challenges and RisksThe world economy is going through the most challenging economic and financial stress in generations.The International Monetary Fund predicts that the world economy will shrink this year for the first time in more than six decades. The collapse of world tra de is likely to be the worst since the end of World War II. The lost output, c ompared to the world economys potential growth in a normal year, could be betw een three and four trillion dollars.In the face of this challenge, China and the United States are working together to help shape a strong global strategy to contain the crisis and to lay the foundation for recovery. And these efforts, the combined effect of forceful po licy actions here in China, in the United States, and in other major economies, have helped slow the pace of deteriorat ion in growth, repair the financial sy stem, and improve confidence.& nbsp;In fact, what distinguishes the current crisis is not just its global scale and its acute severity, but the size and speed of the global response.At the G-20 Leaders meeting in London in April, we agreed on an unprecedented program of coordinated policy actions to support growth, to stabilize and repair the financial system, to restore the flow of credit essential for trade and investment, to mobilize financial resources for emerging market economies thro ugh the international financial institutions, and to keep markets open for tra de and investment.That historic accord on a strategy for recovery was made possible in part by t he policy actions already begun in China and the United States.China moved quickly as the crisis intensified with a very forceful program of investments and financial measures to strengthen domestic demand.In the United States, in the first weeks of the new Administration, we put in place a comprehensive program of tax incentives and investments :C the larges t peace time recovery effort since World War II - to help arrest the sharp fal l in private demand. Alongside these fiscal measures, we acted to ease the hou sing crisis. And we have put in place a series of initiatives to bring more ca pital into the banking system and to restart the credit markets.These actions have been reinforced by similar actions in countries around the world.In contrast to the global crisis of the 1930s and to the major economic crises of the postwar period, the leaders of the world acted together. They acted qui ckly. They took steps to provide assistance to the most vulnerable economies, even as they faced exceptional financial needs at home. They worked to keep th eir markets open, rather than r etreating into self-defeating measures of disc rimination and protect ion.And they have committed to make sure this program of initiatives is sustained until the foundation for recovery is firmly established, a commitment the IMF will monitor closely, and that we will be able to uate together when the G-20 Leaders meet again in the United States this fall.We are starting to see some initial signs of improvement. The global recession seems to be losing force. In the United States, the pace of decline in economi c activity has slowed. Households are saving more, but consumer confidence has improved, and spending is starting to recover. House prices are falling at a s lower pace and the inventory of unsold homes has come down significantly. Orde rs for goods and services are somewhat stronger. The pace of deterioration in the labor market has slowed, and new claims for unemployment insurance have st arted to come down a bit.&nb sp;The financial system is starting to heal. The clarity and disclosure provided by our capital assessment of major U.S. banks has helped improve market confid ence in them, making it possible for banks that needed capital to raise it fro m private investors and to borrow without guarantees. The securities markets, including the asset backed securities markets that essentially stopped functio ning late last year, have started to come back. The cost of credit has fallen substantially for businesses and for families as spreads and risk premia have narrowed.These are important signs of stability, and assurance that we will succeed in averting financial collapse and global deflation, but they represent only the first steps in laying the foundation for recovery. The process of repair and a djustment is going to take time. ;China, despite your own manifest challenges a s a developing country, you are in an enviably strong position. But in most economies, the recession is still powerful and dangerous. Business and households in the United States, as in ma ny countries, are still experiencing the most challenging economic and financi al pressures in decades.The plant closures, and company restructurings that the recession is causing a re painful, and this process is not yet over. The fallout from these events ha s been brutally indiscriminant, affecting those with little or no responsibili ty for the events that now buffet them, as well as on some who played key role s in bringing about our troubles.The extent of the damage to financial systems entails significant risk that th e supply of credit will be constrained for some time. The constraints on banks in many major economies will make it hard for them to compensate fully for the damage done to the basic machi nery of the securitization markets, including t he loss of confidence in credit ratings. After a long period where financial i nstitutions took on too much risk, we still face the possibility that banks an d investors may take too little risk, even as the underlying economic conditio ns start to improve.And, after a long period of falling saving and substantial growth in household borrowing relative to GDP, consumer spending in the United States will be rest rained for some time relative to what is typically the case in recoveries.These are necessary adjustments. They will entail a longer, slower process of recovery, with a very different pattern of future growth across countries than we have seen in the past several recoveries.Laying the Foundation for Future GrowthAs we address this immediate financial and economic crisis, it is important th at we also lay the foundations for more balanced, sustained growth of the glob al economy once this recovery is firmly established.A successful transition to a more balanced and stable global economy will requ ire very substantial changes to economic policy and financial regulation aroun d the world. But some of the most important of those changes will have to come in the United States and China. How successful we are in Washington and Beijin g will be critically important to the economic fortunes of the rest of the wor ld. The effectiveness of U.S. policies will depend in part on Chinas, and the effectiveness of yours on ours.Although the United States and China start from very different positions, many of our domestic challenges are similar. In the United States, we are working t o reform our health care system, to improve the quality of education, to rebui ld our infrastructure, and to improve energy efficiency. These reforms are ess ential to boosting the productive capacity of our economy. These challenges ar e at the center of your reform priorities, too.We are both working to reform our financial systems. In the United States, our challenge is to create a more stable and more resilient financial system, with stronger protections for consumer and investors. As we work to strengthen and redesign regulation to achieve these objectives, our challenge is to preserve the core strengths of our financial system, which are its exceptional capacity to adapt and innovate and to channel capital for investment in new technologie s and innovative companies. You have the benefit of being able to learn from o ur shortcomings, which have proved so damaging in the present crisis, as well as f rom our strengths.Our common chall enge is to recognize that a more balanced and sustainable glo bal recovery will require changes in the composition of growth in our two econ omies. Because of this, our policies have to be directed at very different out comes.In the United States, saving rates will have to increase, and the purchases of U.S. consumers cannot be as dominant a driver of growth as they have been in t he past.In China, as your leadership has recognized, growth that is sustainable growth will require a very substantial shift from external to domestic demand, from a n investment and export intensive driven growth, to growth led by consumption. Strengthening domestic demand will also strengthen Chinas ability to weather f luctuations in global supply and demand.If we are successful on these respective paths, public and private saving in t he United States will increase as recovery strengthens, and as this happens, o ur current account deficit will come down. And in China, domestic demand will rise at a faster rate than overall GDP, led by a gradual shift to higher rates of consumption.Globally, recovery will have come more from a shift by high saving economies t o stronger domestic demand and less from the American consumer.The policy framework for a successful transition to this outcome is starting t o take shape.In the United States, we are putting in place the foundations for restoring fi scal sustainability.The President in his initial budget to Congress made it clear that, as soon as recovery is firmly established, we are going to have to bring our fiscal defic it down to a level that is sustainable over the medium term. This will mean bringing the imbalance between our fiscal resources and expenditures down to the point - roughly three percent of GDP — wh ere the overall level of public deb t to GDP is definitively on a dow nward path. The temporary investments and ta x incentives we put in place in the Recovery Act to strengthen private demand will have to expire, discretionary spending will have to fall back to a more m odest level relative to GDP, and we will have to be very disciplined in limiti ng future commitments through the reintroduction of budget disciplines, such a s pay-as-you go rules.The President also looks forward to working with Congress to further reduce ou r long-run fiscal deficit.And, critical to our long-term fiscal health, we have to put in place comprehe nsive health care reform that will bring down the growth in health care costs, costs that are the principal driver of our long run fiscal deficit.The President has also proposed steps to encourage private saving, including t hrough automatic enrollment in retirement savings accounts.。

亚历山大·汉密尔顿——美国开国元勋之一

亚历山大·汉密尔顿——美国开国元勋之一亚历山大·汉密尔顿介绍中文名:亚历山大·汉密尔顿外文名:Alexander Hamilton国籍:美国出生地:英属西印度群岛的尼维斯岛印度群岛出生日期:1755年1月11日/1757年1月11日逝世日期:1804年7月12日职业:财经专家,政治家,军人毕业院校:哥伦比亚大学(当时称国王学院)主要成就:创建合众国第一银行代表作品:美国宪法,联邦党人文集政党:联邦党性别:男逝世地点:纽约亚历山大·汉密尔顿(Alexander Hamilton,1755年1月11日/1757年1月11日- 1804年7月12日),美国开国元勋之一,美国宪法的起草人之一,财经专家,美国的第一任财政部长,美国政党制度的创建者,在美国金融、财政和工业发展史上,占有重要地位。

因政党相争而决斗丧生。

2006年,汉密尔顿被美国的权威期刊《大西洋月刊》评为影响美国的100位人物第5名。

人物简介亚历山大·汉密尔顿来自英属西印度群岛的私生子,是个孤儿,11岁时到美国的宾夕法尼亚做伐木工,美国独立战争爆发后,18岁的汉密尔顿在波士顿战役中,加入了北美民兵,随后在战争中屡立战功并成为乔治·华盛顿最信任的左膀右臂。

后来,卷入一桩性丑闻,在与副总统阿伦·伯尔的决斗中命丧黄泉,享年47岁。

在美国的开国元勋中,没有哪位的生与死比亚历山大·汉密尔顿更富戏剧色彩了。

在为美国后来的财富和势力奠定基础方面,也没有哪位开国老臣的功劳比得上汉密尔顿。

虽然他也身为美国建国之父之一,却始终没能象别的人那样做上美国总统,而且在与其主要政治对手托马斯·杰斐逊的竞争中更是输得惨不忍睹,可孰料在其过世后,他的政治遗产,包括“工业建国之路”和建立一个强有力的中央政府等等,却在此后的美国历史中起着越来越显著的作用。

甚至一些影响了美国历史进程的总统,如亚伯拉罕·林肯和西奥多·罗斯福,他们所施行的政策就是建立在汉密尔顿的遗产基础上的。

美国历任内政部长

美国历任内政部长美国内政部长是美国内政部的领袖。

美国内政部长与其他国家的内政部长职位分工不同。

历任内政部长届次肖像名字籍贯上任离任美国总统1托马斯·尤因俄亥俄州1849年3月8日1850年7月22日扎卡里·泰勒米勒德·菲尔莫尔2托马斯·麦基恩·汤普森·麦肯纳宾夕法尼亚州1850年8月15日1850年8月26日3亚历山大·休·赫尔姆斯·斯图尔特弗吉尼亚州1850年9月14日1853年3月7日4罗伯特·麦克勒兰德密歇根州1853年3月8日1857年3月9日富兰克林·皮尔斯5雅各布·汤普森密西西比州1857年3月10日1861年1月8日詹姆斯·布坎南6迦勒·布罗德·史密斯印第安纳1861年3月5日1862年12月31亚伯拉罕·林肯州日7约翰·帕尔默·尤瑟印第安纳州1863年1月1日1865年5月15日安德鲁·约翰逊8詹姆斯·哈伦爱荷华州1865年5月16日1866年8月31日9奥维尔·西克曼·布朗宁伊利诺斯州1866年9月1日1869年3月4日10雅各布·多雷森·考克斯俄亥俄州1869年3月5日1870年10月31日尤利西斯·辛普森·格兰特11哥伦布·德拉诺俄亥俄州1870年11月1日1875年9月30日12撒迦利亚·钱德勒密歇根州1875年10月19日1877年3月11日13卡尔·舒尔茨密苏里州1877年3月12日1881年3月7日拉瑟福德·伯查德·海斯14塞缪尔·乔丹·柯克伍德爱荷华州1881年3月8日1882年4月17日詹姆斯·A·加菲尔德切斯特·艾伦·阿瑟15亨利·摩尔·特雷科罗拉多1882年41885年3州月18日月3日16卢修斯·昆图斯·欣欣拿特斯·拉马尔二世密西西比州1885年3月6日1888年1月10日格罗弗·克利夫兰17威廉·弗里曼·维拉斯威斯康辛州1888年1月16日1889年3月6日18约翰·沃克·诺贝尔密苏里州1889年3月7日1893年3月6日本杰明·哈里森19迈克尔·霍克·史密斯乔治亚州1893年3月6日1896年9月1日格罗弗·克利夫兰20大卫·罗兰·弗朗西斯密苏里州1896年9月3日1897年3月5日21科尼利厄斯·牛顿·毕雷斯纽约州1897年3月6日1899年2月19日威廉·麦金莱22伊森·艾伦·希区柯克密苏里州1899年2月20日1907年3月4日西奥多·罗斯福23詹姆斯·鲁道夫·加菲尔德俄亥俄州1907年3月5日1909年3月5日24理查德·阿基里斯·博林格华盛顿特区1909年3月6日1911年3月12日威廉·霍华德·塔夫脱25沃尔特·罗维·费舍尔伊利诺斯州1911年3月13日1913年3月5日26富兰克林·金特·拉尼加利福尼亚州1913年3月6日1920年2月29日伍德罗·威尔逊-亚历山大·T·维基莱桑(美国内政部副部长)加利福尼亚州1920年2月29日1920年3月13日27约翰·巴顿·佩恩伊利诺斯州1920年3月15日1921年3月4日28阿尔伯特·培根·弗洛新墨西哥州1921年3月5日1923年3月4日沃伦·盖玛利尔·哈定29休伯特·沃克科罗拉多州1923年3月5日1928年7月24日卡尔文·柯立芝30罗伊·欧文·威斯特伊利诺伊州1928年7月25日1929年3月4日31雷·莱曼·威尔伯加利福尼亚州1929年3月5日1933年3月4日赫伯特·胡佛伊利1933年31946年2富兰克林·德32哈乐德·L·伊科斯诺伊州月4日月15日拉诺·罗斯福哈利·S·杜鲁门-奥斯卡·利特尔顿·查普曼(美国内政部副部长)科罗拉多州1946年2月15日1946年3月18日33朱利叶斯·阿尔伯特·克鲁格威斯康辛州1946年3月18日1949年12月1日34奥斯卡·利特尔顿·查普曼科罗拉多州1949年12月1日1953年1月20日35道格拉斯·麦凯俄勒冈州1953年1月21日1956年4月15日德怀特·艾森豪威尔-克拉伦斯·A·戴维斯(美国内政部副部长)内布拉斯加州1956年4月15日1956年6月8日36弗雷德·安德鲁·斯顿内布拉斯加州1956年6月8日1961年1月20日37斯图尔特·李·尤德尔亚利桑那州1961年1月21日1969年1月20日约翰·肯尼迪林登·约翰逊38沃利·希克尔阿拉斯加1969年1月24日1970年11月25日理查德·尼克森-弗雷德·J·罗素(美国内政部副部长)加利福尼亚州1970年11月25日1971年1月29日39罗杰斯·莫顿马里兰州1971年1月29日1975年4月30日杰拉尔德·福特-D·肯特·费继尔(美国内政部副部长)堪萨斯州1975年4月30日1975年6月12日40斯坦利·克纳普·哈撒韦怀俄明州1975年6月12日1975年10月9日-D·肯特·费继尔(美国内政部副部长)堪萨斯州1975年10月9日1975年10月17日41托马斯·S·凯博北达科他州1975年10月17日1977年1月20日-阿尔弗雷德·G·艾伯特(美国内政部副部长)1977年1月20日1977年1月23日吉米·卡特42塞西尔·戴尔·安德爱达1977年11981年1鲁斯荷州月23日月20日43詹姆斯·盖乌斯·瓦特科罗拉多州1981年1月23日1983年11月8日罗纳德·里根-J·J·西蒙茨三世(美国内政部副部长)新泽西州1983年11月8日1983年11月18日44威廉·帕特里克·克拉克加利福尼亚州1983年11月18日1985年2月7日45唐纳德·保罗·霍戴尔弗吉尼亚州1985年2月8日1989年1月20日-厄尔·E·纪德(美国内政部副部长)弗吉尼亚州1989年1月20日1989年2月3日乔治·赫伯特·沃克·布什46纽曼尔·鲁加新墨西哥州1989年2月3日1993年1月20日47布鲁斯·爱德华·巴比特亚利桑那州1993年1月22日2001年1月2日比尔·克林顿-托马斯·N·斯纳克(美国内政部副部长)亚利桑那州2001年1月2日2001年1月31日乔治·沃克·布48盖尔·诺顿科罗拉多州2001年1月31日2006年3月31日什-林恩·史卡雷特(美国内政部副部长)加利福尼亚州2006年4月1日2006年5月26日49德克·肯普索恩爱达荷州2006年5月29日2009年1月19日-林恩·史卡雷特(美国内政部副部长)加利福尼亚州2009年1月19日2009年1月20日贝拉克·奥巴马50肯·萨拉查科罗拉多州2009年1月20日2013年4月10日50萨莉·朱厄尔华盛顿州2013年4月12日[2]2017年1月20日–凯文·霍格鲁德代理2017年1月20日2017年3月1日唐纳德·特朗普52瑞安·津凯蒙大拿州2017年3月1日现任。

美国财政部长盖特纳北京大学演讲中英文全文

美国财政部长盖特纳北京大学演讲中英文全文The United States and China, Cooperating for Recovery and GrowthThe United States and China, Cooperating for Recovery and GrowthTreasury Secretary Timothy F. GeithnerSpeech at Peking University - Beijing, ChinaIt is a pleasure to be back in China and to join you here today at this great university.I first came to China, and to Peking University, in the summer of 1981 as a college student studying Mandarin. I was here with a small group of graduate and undergraduate students from across the United States.I returned the next summer to Beijing Normal Univ ersity.We studied reasonably hard, and had the privilege of working with many talented professors, some of whom are here today. As we explored this city and traveled through Eastern China, we had the chance not just tounderstand more about your history and your aspirations, but also to begin to see the United States through your eyes.Over the decades since, we have seen the beginnings of one of the most extraordinary economic transformations in history. China is thriving. Economic reform has brought exceptionally rapid and sustained growth in incomes. China¡¯s emergence as a major economic force more fully integrated into the world economy has brought substantial benefits to the United States and to economies around the wor ld.In recognition of our mutual interest in a positive, cooperative, and comprehensive relationship, President Hu Jintao and President Obama agreed in April to establish the Strategic and Economic Dialogue. Secretary Clinton and I will host Vice Premier Wang and State Councilor Dai in Washington this summer for our first meeting. I have the privilege of beginning the economic discussions with a series of meetings in Beijing today and tomorrow.These meetings will give us a chance to discussthe risks and challenges on the economic front, to examine some of the longer term challenges we both face in laying the foundation for a more balanced and sustainable recovery, and to explore our common interest in international financial reform.Current Challenges and RisksThe world economy is going through the most challenging economic and financial stress in generations.The International Monetary Fund predicts that the world economy will shrink this year for the first time in more than six decades. The collapse of world trade is likely to be the worst since the end of World War II. The lost output, compared to the world economys potential growth in a normal year, could be between three and four trillion dollars.In the face of this challenge, China and the United States are working together to help shape a strong global strategy to contain the crisis and to lay the foundation for recovery. And these efforts, the combined effect of forceful policy actions here inChina, in the United States, and in other major economies, have helped slow the pace of deteriorat ion in growth, repair the financial system, and improve confidence.& nbsp;In fact, what distinguishes the current crisis is not just its global scale and its acute severity, but the size and speed of the global response.At the G-20 Leaders meeting in London in April, we agreed on an unprecedented program of coordinated policy actions to support growth, to stabilize and repair the financial system, to restore the flow of credit essential for trade and investment, to mobilize financial resources for emerging market economies through the international financial institutions, and to keep markets open for trade and investment.That historic accord on a strategy for recovery was made possible in part by the policy actions already begun in China and the United States.China moved quickly as the crisis intensified with a very forceful program of investments and financial measures to strengthen domestic demand.In the United States, in the first weeks of the new Administration, we put in place a comprehensive program of tax incentives and investments ¨C the largest peace time recovery effort since World War II - to help arrest the sharp fall in private demand. Alongside these fiscal measures, we acted to ease the housing crisis. And we have put in place a series of initiatives to bring more capital into the banking system and to restart the credit markets.These actions have been reinforced by similar actions in countries around the world.In contrast to the global crisis of the 1930s and to the major economic crises of the postwar period, the leaders of the world acted together. They acted quickly. They took steps to provide assistance to the most vulnerable economies, even as they faced exceptional financial needs at home. They worked to keep their markets open, rather than r etreating into self-defeating measures of discrimination and protect ion.And they have committed to make sure this programof initiatives is sustained until the foundation for recovery is firmly established, a commitment the IMF will monitor closely, and that we will be able to uate together when the G-20 Leaders meet again in the United States this fall.We are starting to see some initial signs of improvement. The global recession seems to be losing force. In the United States, the pace of decline in economic activity has slowed. Households are saving more, but consumer confidence has improved, and spending is starting to recover. House prices are falling at a slower pace and the inventory of unsold homes has come down significantly. Orders for goods and services are somewhat stronger. The pace of deterioration in the labor market has slowed, and new claims for unemployment insurance have started to come down a bit.&nb sp;The financial system is starting to heal. The clarity and disclosure provided by our capital assessment of major banks has helped improve market confidence in them, making it possible for banks thatneeded capital to raise it from private investors and to borrow without guarantees. The securities markets, including the asset backed securities markets that essentially stopped functioning late last year, have started to come back. The cost of credit has fallen substantially for businesses and for families as spreads and risk premia have narrowed.These are important signs of stability, and assurance that we will succeed in averting financial collapse and global deflation, but they represent only the first steps in laying the foundation for recovery. The process of repair and adjustment is going to take time. ;China, despite your own manifest challenges a s a developing country, you are in an enviably strong position. But in most economies, the recession is still powerful and dangerous. Business and households in the United States, as in many countries, are still experiencing the most challenging economic and financial pressures in decades.The plant closures, and company restructuringsthat the recession is causing are painful, and this process is not yet over. The fallout from these events has been brutally indiscriminant, affecting those with little or no responsibility for the events that now buffet them, as well as on some who played key roles in bringing about our troubles.The extent of the damage to financial systems entails significant risk that the supply of credit will be constrained for some time. The constraints on banks in many major economies will make it hard for them to compensate fully for the damage done to the basic machi nery of the securitization markets, including the loss of confidence in credit ratings. After a long period where financial institutions took on too much risk, we still face the possibility that banks and investors may take too little risk, even as the underlying economic conditions start to improve.And, after a long period of falling saving and substantial growth in household borrowing relative to GDP, consumer spending in the United States will be restrained for some time relative to what is typicallythe case in recoveries.These are necessary adjustments. They will entail a longer, slower process of recovery, with a very different pattern of future growth across countries than we have seen in the past several recoveries.Laying the Foundation for Future GrowthAs we address this immediate financial and economic crisis, it is important that we also lay the foundations for more balanced, sustained growth of the global economy once this recovery is firmly established.A successful transition to a more balanced and stable global economy will require very substantial changes to economic policy and financial regulation around the world. But some of the most important of those changes will have to come in the United States and China. How successful we are in Washington and Beijing will be critically important to the economic fortunes of the rest of the world. The effectiveness of policies will depend in part on Chinas, and the effectiveness of yours on ours.Although the United States and China start from very different positions, many of our domestic challenges are similar. In the United States, we are working to reform our health care system, to improve the quality of education, to rebuild our infrastructure, and to improve energy efficiency. These reforms are essential to boosting the productive capacity of our economy. These challenges are at the center of your reform priorities, too.We are both working to reform our financial systems. In the United States, our challenge is to create a more stable and more resilient financial system, with stronger protections for consumer and investors. As we work to strengthen and redesign regulation to achieve these objectives, our challenge is to preserve the core strengths of our financial system, which are its exceptional capacity to adapt and innovate and to channel capital for investment in new technologies and innovative companies. You have the benefit of being able to learn from our shortcomings, which have proved so damaging in the present crisis, as well as f rom our strengths.Our common chall enge is to recognize that a more balanced and sustainable global recovery will require changes in the composition of growth in our two economies. Because of this, our policies have to be directed at very different outcomes.In the United States, saving rates will have to increase, and the purchases of consumers cannot be as dominant a driver of growth as they have been in the past.In China, as your leadership has recognized, growth that is sustainable growth will require a very substantial shift from external to domestic demand, from an investment and export intensive driven growth, to growth led by consumption. Strengthening domestic demand will also strengthen Chinas ability to weather fluctuations in global supply and demand.If we are successful on these respective paths, public and private saving in the United States will increase as recovery strengthens, and as this happens, our current account deficit will come down. And in China, domestic demand will rise at a faster rate than overallGDP, led by a gradual shift to higher rates of consumption.Globally, recovery will have come more from a shift by high saving economies to stronger domestic demand and less from the American consumer.The policy framework for a successful transition to this outcome is starting to take shape.In the United States, we are putting in place the foundations for restoring fiscal sustainability.The President in his initial budget to Congress made it clear that, as soon as recovery is firmly established, we are going to have to bring our fiscal deficit down to a level that is sustainable over the medium term. This will mean bringing the imbalance between our fiscal resources and expenditures down to the point - roughly three percent of GDP -- wh ere the overall level of public debt to GDP is definitively on a dow nward path. The temporary investments and tax incentives we put in place in the Recovery Act to strengthen private demand will have to expire, discretionary spending will have to fall back to a moremodest level relative to GDP, and we will have to be very disciplined in limiting future commitments through the reintroduction of budget disciplines, such as pay-as-you go rules.The President also looks forward to working with Congress to further reduce our long-run fiscal deficit.And, critical to our long-term fiscal health, we have to put in place comprehensive health care reform that will bring down the growth in health care costs, costs that are the principal driver of our long run fiscal deficit.The President has also proposed steps to encourage private saving, including through automatic enrollment in retirement savings accounts.。

【大学】美国财政部长盖特纳北京大学演讲中英文全文

【关键字】大学美国财政部长盖特纳北京大学演讲中英文全文The United States and China, Cooperating for Recovery and GrowthThe United States and China, Cooperating for Recovery and GrowthTreasury Secretary Timothy F. GeithnerSpeech at Peking University - Beijing, ChinaIt is a pleasure to be back in China and to join you here today at this great university.I first came to China, and to Peking University, in the summer of 1981 as a college student studying Mandarin. I was here with a small group of graduate and undergraduate students from across the United States.I returned the next summer to Beijing Normal Univ ersity.We studied reasonably hard, and had the privilege of working with many talented professors, some of whom are here today. As we explored this city and traveled through Eastern China, we had the chance not just to understand more about your history and your aspirations, but also to begin to see the United States through youreyes.Over the decades since, we have seen the beginnings of one of the most extraordinary economic transformations in history. China is thriving. Economic reform has brought exceptionally rapid and sustained growth in incomes. China¡¯s emergence as a major economic force more fully integrated into the world economy has brought substantial benefits to the United States and to economies around the wor ld.In recognition of our mutual interest in a positive, cooperative, and comprehensive relationship, President Hu Jintao and President Obama agreed in April to establish the Strategic and Economic Dialogue. Secretary Clinton and I will host Vice Premier Wang and State Councilor Dai in Washington this summer for our first meeting. I have the privilege of beginning the economic discussions with a series of meetings in Beijing today and tomorrow.These meetings will give us a chance to discuss the risks and challenges on the economic front, to examine some of the longer term challenges we both face in laying the foundation for a more balanced andsustainable recovery, and to explore our common interest in international financial reform.Current Challenges and RisksThe world economy is going through the most challenging economic and financial stress in generations.The International Monetary Fund predicts that the world economy will shrink this year for the first time in more than six decades. The collapse of world trade is likely to be the worst since the end of World War II. The lost output, compared to the world economys potential growth in a normal year, could be between three and four trillion dollars.In the face of this challenge, China and the United States are working together to help shape a strong global strategy to contain the crisis and to lay the foundation for recovery. And these efforts, the combined effect of forceful policy actions here in China, in the United States, and in other major economies, have helped slow the pace of deteriorat ion in growth, repair the financial system, and improve confidence.& nbsp;In fact, what distinguishes the current crisis is not just its global scale and its acute severity, but the size and speed of the global response.At the G-20 Leaders meeting in London in April, we agreed on an unprecedented program of coordinated policy actions to support growth, to stabilize and repair the financial system, to restore the flow of credit essential for trade and investment, to mobilize financial resources for emerging market economies through the international financial institutions, and to keep markets open for trade and investment.That historic accord on a strategy for recovery was made possible in part by the policy actions already begun in China and the United States.China moved quickly as the crisis intensified with a very forceful program of investments and financial measures to strengthen domestic demand.In the United States, in the first weeks of the new Administration, we put in place a comprehensive program of tax incentives and investments ¨C the largest peace time recovery effort since World War II - to help arrest the sharp fall in private demand.Alongside these fiscal measures, we acted to ease the housing crisis. And we have put in place a series of initiatives to bring more capital into the banking system and to restart the credit markets.These actions have been reinforced by similar actions in countries around the world.In contrast to the global crisis of the 1930s and to the major economic crises of the postwar period, the leaders of the world acted together. They acted quickly. They took steps to provide assistance to the most vulnerable economies, even as they faced exceptional financial needs at home. They worked to keep their markets open, rather than r etreating into self-defeating measures of discrimination and protect ion.And they have committed to make sure this program of initiatives is sustained until the foundation for recovery is firmly established, a commitment the IMF will monitor closely, and that we will be able to uate together when the G-20 Leaders meet again in the United States this fall.We are starting to see some initial signs ofimprovement. The global recession seems to be losing force. In the United States, the pace of decline in economic activity has slowed. Households are saving more, but consumer confidence has improved, and spending is starting to recover. House prices are falling at a slower pace and the inventory of unsold homes has come down significantly. Orders for goods and services are somewhat stronger. The pace of deterioration in the labor market has slowed, and new claims for unemployment insurance have started to come down a bit.&nb sp;The financial system is starting to heal. The clarity and disclosure provided by our capital assessment of major banks has helped improve market confidence in them, making it possible for banks that needed capital to raise it from private investors and to borrow without guarantees. The securities markets, including the asset backed securities markets that essentially stopped functioning late last year, have started to come back. The cost of credit has fallen substantially for businesses and for families as spreads and risk premia have narrowed.These are important signs of stability, and assurance that we will succeed in averting financial collapse and global deflation, but they represent only the first steps in laying the foundation for recovery. The process of repair and adjustment is going to take time. ;China, despite your own manifest challenges a s a developing country, you are in an enviably strong position. But in most economies, the recession is still powerful and dangerous. Business and households in the United States, as in many countries, are still experiencing the most challenging economic and financial pressures in decades.The plant closures, and company restructurings that the recession is causing are painful, and this process is not yet over. The fallout from these events has been brutally indiscriminant, affecting those with little or no responsibility for the events that now buffet them, as well as on some who played key roles in bringing about our troubles.The extent of the damage to financial systems entails significant risk that the supply of credit willbe constrained for some time. The constraints on banks in many major economies will make it hard for them to compensate fully for the damage done to the basic machi nery of the securitization markets, including the loss of confidence in credit ratings. After a long period where financial institutions took on too much risk, we still face the possibility that banks and investors may take too little risk, even as the underlying economic conditions start to improve.And, after a long period of falling saving and substantial growth in household borrowing relative to GDP, consumer spending in the United States will be restrained for some time relative to what is typically the case in recoveries.These are necessary adjustments. They will entail a longer, slower process of recovery, with a very different pattern of future growth across countries than we have seen in the past several recoveries.Laying the Foundation for Future GrowthAs we address this immediate financial and economic crisis, it is important that we also lay the foundations for more balanced, sustained growth of theglobal economy once this recovery is firmly established.A successful transition to a more balanced and stable global economy will require very substantial changes to economic policy and financial regulation around the world. But some of the most important of those changes will have to come in the United States and China. How successful we are in Washington and Beijing will be critically important to the economic fortunes of the rest of the world. The effectiveness of policies will depend in part on Chinas, and the effectiveness of yours on ours.Although the United States and China start from very different positions, many of our domestic challenges are similar. In the United States, we are working to reform our health care system, to improve the quality of education, to rebuild our infrastructure, and to improve energy efficiency. These reforms are essential to boosting the productive capacity of our economy. These challenges are at the center of your reform priorities, too.We are both working to reform our financial systems. In the United States, our challenge is tocreate a more stable and more resilient financial system, with stronger protections for consumer and investors. As we work to strengthen and redesign regulation to achieve these objectives, our challenge is to preserve the core strengths of our financial system, which are its exceptional capacity to adapt and innovate and to channel capital for investment in new technologies and innovative companies. You have the benefit of being able to learn from our shortcomings, which have proved so damaging in the present crisis, as well as f rom our strengths.Our common chall enge is to recognize that a more balanced and sustainable global recovery will require changes in the composition of growth in our two economies. Because of this, our policies have to be directed at very different outcomes.In the United States, saving rates will have to increase, and the purchases of consumers cannot be as dominant a driver of growth as they have been in the past.In China, as your leadership has recognized, growth that is sustainable growth will require a verysubstantial shift from external to domestic demand, from an investment and export intensive driven growth, to growth led by consumption. Strengthening domestic demand will also strengthen Chinas ability to weather fluctuations in global supply and demand.If we are successful on these respective paths, public and private saving in the United States will increase as recovery strengthens, and as this happens, our current account deficit will come down. And in China, domestic demand will rise at a faster rate than overall GDP, led by a gradual shift to higher rates of consumption.Globally, recovery will have come more from a shift by high saving economies to stronger domestic demand and less from the American consumer.The policy framework for a successful transition to this outcome is starting to take shape.In the United States, we are putting in place the foundations for restoring fiscal sustainability.The President in his initial budget to Congress made it clear that, as soon as recovery is firmly established, we are going to have to bring our fiscaldeficit down to a level that is sustainable over the medium term. This will mean bringing the imbalance between our fiscal resources and expenditures down to the point - roughly three percent of GDP -- wh ere the overall level of public debt to GDP is definitively on a dow nward path. The temporary investments and tax incentives we put in place in the Recovery Act to strengthen private demand will have to expire, discretionary spending will have to fall back to a more modest level relative to GDP, and we will have to be very disciplined in limiting future commitments through the reintroduction of budget disciplines, such as pay-as-you go rules.The President also looks forward to working with Congress to further reduce our long-run fiscal deficit.And, critical to our long-term fiscal health, we have to put in place comprehensive health care reform that will bring down the growth in health care costs, costs that are the principal driver of our long run fiscal deficit.The President has also proposed steps to encourage private saving, including through automaticenrollment in retirement savings accounts. 此文档是由网络收集并进行重新排版整理.word可编辑版本!。

美国财政部长盖特纳北京大学演讲中英文全文

美国财政部长盖特纳北京大学演讲中英文全文The Uni t t ed States a n n d China, Co o o perating fo r r Recovery a n n d GrowthTh e e United Sta t t es and Chin a a, Cooperati n n g for Recov e e ry and Grow t t hTreasury S e e cretary Tim o o thy F. Geit h h nerSpeech a a t Peking Un i i versity - B e e ijing, Chin a aIt is a pl e e asure to be back in Chi n n a and to jo i i n you here t t oday at thi s s great univ e e rsity.I fi r r st came to C C hina, and t o o Peking Uni v v ersity, in t t he summer o f f 1981 as a c c ollege stud e e nt studying Mandarin. I was here wi t t h a small g r r oup of grad u u ate and und e e rgraduate s t t udents from across the U U nited State s s.I returne d d the next s u u mmer to Bei j j ing Normal U U niv ersity.We studied r r easonably h a a rd, and had the privile g g e of workin g g with many t t alented pro f f essors, som e e of whom ar e e here today.. As we expl o o red this ci t t y and trave l l ed through E E astern Chin a a, we had th e e chance not just to und e e rstand more about your h h istory and y y ouraspirat i i ons, but al s s o to begin t t o see the U n n ited States through you r r eyes.Over the decades since, we h a a ve seen the beginnings o o f one of th e e most extra o o rdinary eco n n omic transf o o rmations in history. Ch i i na is thriv i i ng. Economi c c reform has brought exc e e ptionally r a a pid and sus t t ained growt h h in incomes.. China¡¯s e m m ergence as a a major econ o o mic force m o o re fully in t t egrated int o o the world e e conomy has b b rought subs t t antial bene f f its to the U U nited State s s and to eco n n omies aroun d d the wor ld..In recogni t t ion of our m m utual inter e e st in a pos i i tive, coope r r ative, and c c omprehensiv e e relationsh i i p, Presiden t t Hu Jintao a a nd Presiden t t Obama agre e e d in April t t o establish the Strateg i i c and Econo m m ic Dialogue.. Secretary C C linton and I I will host V V ice Premier Wang and St a a te Councilo r r Dai in Was h h ington this summer for o o ur first me e e ting. I hav e e the privil e e ge of begin n n ing the eco n n omic discus s s ions with a series of m e e etings in B e e ijing today and tomorro w w.These mee t t ings will g i i ve us a cha n n ce to discu s s s the risks and challen g g es on the e c c onomic fron t t, to examin e e some of th e e longer ter m m challenges we both fac e e inlaying t t he foundati o o n for a mor e e balanced a n n d sustainab l l e recovery,and to expl o o re our comm o o n interest i i n internati o o nal financi a a l reform.C u u rrent Chall e e nges and Ri s s ksThe worl d d economy is going throu g g h the most c c hallenging e e conomic and financial s t t ress in gen e e rations.Th e e Internatio n n al Monetary Fund predic t t s that the w w orld econom y y will shrin k k this year f f or the firs t t time in mo r r e than six d d ecades. The collapse of world trade is likely t o o be the wor s s t since the end of Worl d d War II. Th e e lost outpu t t, compared t t o the world economys po t t ential grow t t h in a norm a a l year, cou l l d be betwee n n three and f f our trillio n n dollars.I n n the face o f f this chall e e nge, China a a nd the Unit e e d States ar e e working to g g ether to he l l p shape a s t t rong global strategy to contain the crisis and t t o lay the f o o undation fo r r recovery. A A nd these ef f f orts, the c o o mbined effe c c t of forcef u u l policy ac t t ions here i n n China, in t t he United S t t ates, and i n n other majo r r economies,have helped slow the pa c c e of deteri o o rat ion in g g rowth, repa i i r the finan c c ial system,and improveconfidence.&& nbsp;In f a a ct, what di s s tinguishes t t he current c c risis is no t t just its g l l obal scale a a nd its acut e e severity, b b ut the size and speed o f f the global response.A t t the G-20 L e e aders meeti n n g in London in April, w e e agreed on a a n unprecede n n ted program of coordina t t ed policy a c c tions to su p p port growth,,to stabili z z e and repai r r the financ i i al system, t t o restore t h h e flow of c r r edit essent i i al for trad e e and invest m m ent, to mob i i lize financ i i al resource s s for emergi n n g market ec o o nomies thro u u gh the inte r r national fi n n ancial inst i i tutions, an d d to keep ma r r kets open f o o r trade and investment.That histori c c accord on a a strategy f o o r recovery w w as made pos s s ible in par t t by the pol i i cy actions a a lready begu n n in China a n n d the Unite d d States.Ch i i na moved qu i i ckly as the crisis inte n n sified with a very forc e e ful program of investme n n ts and fina n n cial measur e e s to streng t t hen domesti c c demand.In the United S S tates, in t h h e first wee k k s of the ne w w Administra t t ion, we put in place a c c omprehensiv e e program of tax incenti v v es and inve s s tments ¨C t h h e largest p e e ace time re c c overy effor t t since Worl d d War II- t o o help arres t t the sharp f f all in priv a a te demand. A A longside th e e se fiscal m e e asures, we a a cted to eas e e the housin g g crisis. An d d we have pu t t in place a series of i n n itiatives t o o bring more capital int o o the bankin g g system and to restart t t he credit m a a rkets.Thes e e actions ha v v e been rein f f orced by si m m ilar action s s in countri e e s around th e e world.In c c ontrast to t t he global c r r isis of the1930s and t o o the major e e conomic cri s s es of the p o o stwar perio d d, the leade r r s of the wo r r ld acted to g g ether. They acted quick l l y. They too k k steps to p r r ovide assis t t ance to the most vulner a a ble economi e e s, even as t t hey faced e x x ceptional f i i nancial nee d d s at home. T T hey worked t t o keep thei r r markets op e e n, rather t h h an r etreat i i ng into sel f f-defeating m m easures of d d iscriminati o o n and prote c c t ion.And t t hey have co m m mitted to m a a ke sure thi s s program of initiatives is sustaine d d until the f f oundation f o o r recovery i i s firmly es t t ablished, a commitment t t he IMF will monitor clo s s ely, and th a a t we will b e e able to ua t t e together w w hen the G-200Leaders me e e t again in t t he United S t t ates this f a a ll.We are s s tarting to s s ee some ini t t ial signs o f f improvemen t t. The globa l l recession s s eems to be l l osing force.. In the Uni t t ed States, t t he pace of d d ecline in e c c onomic acti v v ity has slo w w ed. Househo l l ds are savi n n g more, but consumer co n n fidence has improved, a n n d spending i i s starting t t o recover. H H ouse prices are falling at a slower pace and th e e inventory o o f unsold ho m m es has come down signif i i cantly. Ord e e rs for good s s and servic e e s are somew h h at stronger..The pace o f f deteriorat i i on in the l a a bor market h h as slowed, a a nd new clai m m s for unemp l l oyment insu r r ance have s t t arted to co m m e down a bi t t.&nb sp;Th e e financial s s ystem is st a a rting to he a a l. The clar i i ty and disc l l osure provi d d ed by our c a a pital asses s s ment of maj o o r banks ha s s helped imp r r ove market c c onfidence i n n them, maki n n g it possib l l e for banks that needed capital to r r aise it fro m m private in v v estors and t t o borrow wi t t hout guaran t t ees. The se c c urities mar k k ets, includ i i ng the asse t t backed sec u u rities mark e e ts that ess e e ntially sto p p ped functio n n ing late la s s t year, hav e e started to come back. T T he cost of c c redit has f a a llen substa n n tially for b b usinesses a n n d for famil i i es assprea d d s and risk p p remia have n n arrowed.Th e e se are impo r r tant signs o o f stability,,and assura n n ce that we w w ill succeed in averting financial c o o llapse and g g lobal defla t t ion, but th e e y represent only the fi r r st steps in laying the f f oundation f o o r recovery. The process of repair a n n d adjustmen t t is going t o o take time.;China, de s s pite your o w w n manifest c c hallenges a s a develop i i ng country,you are in a a n enviably s s trong posit i i on. But in m m ost economi e e s, the rece s s sion is sti l l l powerful a a nd dangerou s s. Business a a nd househol d d s in the Un i i ted States,as in many c c ountries, a r r e still exp e e riencing th e e most chall e e nging econo m m ic and fina n n cial pressu r r es in decad e e s.The plan t t closures, a a nd company r r estructurin g g s that the r r ecession is causing are painful, an d d this proce s s s is not ye t t over. The f f allout from these event s s has been b r r utally indi s s criminant, a a ffecting th o o se with lit t t le or no re s s ponsibility for the eve n n ts that now buffet them,, as well as on some who played key r r oles in bri n n ging about o o ur troubles..The extent of the dama g g e to financ i i alsystems e e ntails sign i i ficant risk that the su p p ply of cred i i t will be c o o nstrained f o o r some time..The constr a a ints on ban k k s in many m a a jor economi e e s will make it hard for them to com p p ensate full y y for the da m m age done to the basic m a a chi nery of the securit i i zation mark e e ts, includi n n g the loss o o f confidenc e e in credit r r atings. Aft e e r a long pe r r iod where f i i nancial ins t t itutions to o o k on too mu c c h risk, we s s till face t h h e possibili t t y that bank s s and invest o o rs may take too little r r isk, even a s s the underl y y ing economi c c conditions start to im p p rove.And, a a fter a long period of f a a lling savin g g and substa n n tial growth in househol d d borrowing r r elative to G G DP, consume r r spending i n n the United States will be restrain e e d for some t t ime relativ e e to what is typically t h h e case in r e e coveries.T h h ese are nec e e ssary adjus t t ments. They will entail a longer, s l l ower proces s s of recover y y, with a ve r r y different pattern of f f uture growt h h across cou n n tries than w w e have seen in the past several rec o o veries.Lay i i ng the Foun d d ation for F u u ture GrowthAs we addre s s s this imme d d iate financ i i al and econ o o miccrisis,it is impor t t ant that we also lay th e e foundation s s for more b a a lanced, sus t t ained growt h h of the glo b b al economy o o nce this re c c overy is fi r r mly establi s s hed.A succ e e ssful trans i i tion to a m o o re balanced and stable g g lobal econo m m y will requ i i re very sub s s tantial cha n n ges to econ o o mic policy a a nd financia l l regulation around the w w orld. But s o o me of the m o o st importan t t of those c h h anges will h h ave to come in the Unit e e d States an d d China. How successful w w e are in Wa s s hington and Beijing wil l l be critica l l ly importan t t to the eco n n omic fortun e e s of the re s s t of the wo r r ld. The eff e e ctiveness o f f policies w w ill depend i i n part on C h h inas, and t h h e effective n n ess of your s s on ours.A l l though the U U nited State s s and China s s tart from v e e ry differen t t positions,many of our domestic ch a a llenges are similar. In the United S S tates, we a r r e working t o o reform our health care system, to i i mprove the q q uality of e d d ucation, to rebuild our infrastruct u u re, and to i i mprove ener g g y efficienc y y. These ref o o rms are ess e e ntial to bo o o sting the p r r oductive ca p p acity of ou r r economy. T h h ese challen g g es are at t h h ecenter of your reform priorities,too.We are both workin g g to reform o o ur financia l l systems.I n n the United States, our challenge i s s to create a a more stabl e e and more r e e silient fin a a ncial syste m m, with stro n n ger protect i i ons for con s s umer and in v v estors. As w w e work to s t t rengthen an d d redesign r e e gulation to achieve the s s e objective s s, our chall e e nge is to p r r eserve the c c ore strengt h h s of our fi n n ancial syst e e m, which ar e e its except i i onal capaci t t y to adapt a a nd innovate and to chan n n el capital f f or investme n n t in new te c c hnologies a n n d innovativ e e companies.You have th e e benefit of being able t t o learn fro m m our shortc o o mings, whic h h have prove d d so damagin g g in the pre s s ent crisis,as well as f f rom our st r r engths.Our common chal l l enge is to recognize t h h at a more b a a lanced and s s ustainable g g lobal recov e e ry will req u u ire changes in the comp o o sition of g r r owth in our two economi e e s. Because o o f this, our policies ha v v e to be dir e e cted at ver y y different o o utcomes.In the United S S tates, savi n n g rates wil l l have to in c c rease, and t t he purchase s s of consum e e rs cannot b e e as dominan t t a driver o f f growth as t t hey have be e e n in thepa s s t.In China,,as your le a a dership has recognized, growth that is sustaina b b le growth w i i ll require a a very subst a a ntial shift from extern a a l to domest i i c demand, f r r om an inves t t ment and ex p p ort intensi v v e driven gr o o wth, to gro w w th led by c o o nsumption. S S trengthenin g g domestic d e e mand will a l l so strength e e n Chinas ab i i lity to wea t t her fluctua t t ions in glo b b al supply a n n d demand.I f f we are suc c c essful on t h h ese respect i i ve paths, p u u blic and pr i i vate saving in the Unit e e d States wi l l l increase a a s recovery s s trengthens,and as this happens, ou r r current ac c c ount defici t t will come d d own. And in China, dome s s tic demand w w ill rise at a faster ra t t e than over a a ll GDP, led by a gradua l l shift to h i i gher rates o o f consumpti o o n.Globally,,recovery w i i ll have com e e more from a a shift by h i i gh saving e c c onomies to s s tronger dom e e stic demand and less fr o o m the Ameri c c an consumer..The policy framework f o o r a success f f ul transiti o o n to this o u u tcome is st a a rting to ta k k e shape.In the United S S tates, we a r r e putting i n n place the f f oundations f f or restorin g g fiscal sus t t ainability.The Presiden t t in his ini t t ial budget t t o Congress m m ade it clea r r that, as s o o on as recov e e ry is firml y y establishe d d, we are go i i ng to have t t o bring our fiscal defi c c it down to a a level that is sustaina b b le over the medium term.. This will m m ean bringin g g the imbala n n ce between o o ur fiscal r e e sources and expenditure s s down to th e e point - ro u u ghly three p p ercent of G D D P -- wh ere the overall level of pu b b lic debt to GDP is defi n n itively on a a dow nward p p ath. The te m m porary inve s s tments and t t ax incentiv e e s we put in place in th e e Recovery A c c t to streng t t hen private demand will have to exp i i re, discret i i onary spend i i ng will hav e e to fall ba c c k to a more modest leve l l relative t o o GDP, and w e e will have t t o be very d i i sciplined i n n limiting f u u ture commit m m ents throug h h the reintr o o duction of b b udget disci p p lines, such as pay-as-y o o u go rules.The Presiden t t also looks forward to w w orking with Congress to further red u u ce our long--run fiscal d d eficit.And,, critical t o o our long-t e e rm fiscal h e e alth, we ha v v e to put in place compr e e hensive hea l l th care ref o o rm that wil l l bring down the growth i i n health ca r r e costs,co s s ts that are the princip a a l driver of our long ru n n fiscal def i i cit.The Pr e e sident has a a lso propose d d steps to e n n courage pri v v ate saving,including t h h rough autom a a tic enrollm e e nt in retir e e ment saving s s accounts.。

美国历届政府

【美国总统】(第一任)乔治·华盛顿(1732-1799)(1789-1797在任)(第二任)约翰·亚当斯(1735-1826)(1797-1801在任)(第三任)托马斯·杰斐逊(1743-1826)(1801-1809在任)(第四任)詹姆斯·麦迪逊(1751-1836)(1809-1817在任)(第五任)詹姆斯·门罗(1758-1831)(1817-1825在任)(第六任)约翰·昆西·亚当斯(1767-1848)(1825-1829在任)(第七任)安德鲁·杰克逊(1767-1845)(1829-1837在任)(第八任)马丁·范布伦(1782-1862)(1837-1841在任)(第九任)威廉·亨利·哈里森(1773-1841)(1841.3-1841.4在任)(第十任)约翰·泰勒(1790-1862)(1841-1845在任)(第十一任)詹姆斯·诺克斯·波尔克(1795-1849)(1845-1849在任)(第十二任)扎卡里·泰勒(1784-1850)(1849.3-1850.7在任)(第十三任)米勒德·菲尔莫尔(1800-1874)(1850-1853在任)(第十四任)富兰克林·皮尔斯(1804-1869)(1853-1857在任)(第十五任)詹姆斯·布坎南(1791-1868)(1857-1861在任)(第十六任)亚伯拉罕·林肯(1809-1865)(1861-1865在任)(第十七任)安德鲁·约翰逊(1808-1875)(1865-1869在任)(第十八任)尤里西斯·格兰特(1822-1885)(1869-1877在任)(第十九任)拉瑟福德·伯查德·海斯(1822-1893)(1877-1881在任)(第二十任)詹姆斯·加菲尔德(1831-1881)(1881.3-1881.9在任)(第二十一任)切斯特·阿瑟(1829-1886)(1881-1885在任)(第二十二任)格罗弗·克利夫兰(1837-1908)(1885-1889在任)(第一次)(第二十三任)本杰明·哈里森(1833-1901)(1889-1893在任)(第二十四任)格罗弗·克利夫兰(1837-1908)(1893-1897在任)(第二次)(第二十五任)威廉·麦金莱(1843-1901)(1897-1901在任)(第二十六任)西奥多·罗斯福(1858-1919)(1901-1909在任)(第二十七任)威廉·霍华德·塔夫脱(1857-1930)(1909-1913在任)(第二十八任)伍德罗·威尔逊(1856-1924)(1913-1921在任)(第二十九任)沃伦·甘梅利尔·哈定(1865-1923)(1921-1923在任)(第三十任)卡尔文·柯立芝(1872-1933)(1923-1929在任)(第三十一任)赫伯特·胡佛(1874-1964)(1929-1933在任)(第三十二任)富兰克林·罗斯福(1882-1945)(1933-1945在任)(第三十三任)哈里·杜鲁门(1884-1972)(1945-1953在任)(第三十四任)德怀特·艾森豪威尔(1890-1969)(1953-1961在任)(第三十五任)约翰·肯尼迪(1917-1963)(1961-1963在任)(第三十六任)林登·约翰逊(1908-1973)(1963-1969在任)(第三十七任)理查德·尼克松(1913-1994)(1969-1974在任)(第三十八任)杰拉尔德·福特(1913-2006)(1974-1977在任)(第三十九任)吉米·卡特(1924-至今)(1977-1981在任)(第四十任)罗纳德·里根(1911-2004)(1981-1989在任)(第四十一任)乔治·赫伯特·沃克·布什(1924-至今)(1989-1993在任)(第四十二任)比尔·克林顿(1946-至今)(1993-2001在任)(第四十三任)乔治·沃克·布什(1946-至今)(2001-2009在任)(第四十四任)贝拉克·奥巴马(1961-至今)(2009-至今在任)【美国副总统】(第一任)约翰·亚当斯(1735-1826)(1789-1797在任)(第二任)托马斯·杰斐逊(1743-1826)(1797-1801在任)(第三任)阿伦·伯尔(1756-1836)(1801-1805在任)(第四任)乔治·克林顿(1739-1812)(1805.3-1812.4在任)(1812.4-1813.3缺任)(第五任)埃尔布里奇·格里(1744-1814)(1813.3-1814.11在任)(1814.11-1817.3缺任)(第六任)丹尼尔·汤普金斯(1774-1825)(1817-1825在任)(第七任)约翰·卡尔霍恩(1782-1850)(1825.3-1832.12在任)(1832.12-1833.3缺任)(第八任)马丁·范布伦(1782-1862)(1833-1837在任)(第九任)理查德·约翰逊(1780-1850)(1837-1841在任)(第十任)约翰·泰勒(1790-1862)(1841.3-1841.4在任)(1841.4-1845.3缺任)(第十一任)乔治·达拉斯(1792-1864)(1845-1849在任)(第十二任)米勒德·菲尔莫尔(1800-1874)(1849.3-1850.7在任)(1850.7-1853.3缺任)(第十三任)威廉·鲁福斯·金(1786-1853)(1853.3-1853.4在任)(1853.4-1857.3缺任)(第十四任)约翰·布雷肯里奇(1821-1875)(1857-1861在任)(第十五任)汉尼巴尔·哈姆林(1809-1891)(1861-1865在任)(第十六任)安德鲁·约翰逊(1808-1875)(1865.3-1865.4在任)(1865.4-1869.3缺任)(第十七任)斯凯勒·科尔法克斯(1823-1885)(1869-1873在任)(第十八任)亨利·威尔逊(1812-1875)(1873.3-1875.11在任)(1875.11-1877.3缺任)(第十九任)威廉·惠勒(1877-1881在任)(第二十任)切斯特·阿瑟(1829-1886)(1881.3-1881.9在任)(1881.9-1885.3缺任)(第二十一任)托马斯·亨德里克斯(1885.3-1885.11在任)(1885.11-1889.3缺任)(第二十二任)利瓦伊·莫顿(1889-1893在任)(第二十三任)阿德莱·史蒂文森(1893-1897在任)(第二十四任)加勒特·霍巴特(1844-1899)(1897.3-1899.11在任)(1899.11-1901.3缺任)(第二十五任)西奥多·罗斯福(1858-1919)(1901.3-1901.9在任)(1901.9-1905.3缺任)(第二十六任)查尔斯·费尔班克斯(1852-1918)(1905-1909在任)(第二十七任)詹姆斯·舍曼(1855-1912)(1909.3-1912.10在任)(1912.10-1913.3缺任)(第二十八任)托马斯·马歇尔(1854-1925)(1913-1921在任)(第二十九任)卡尔文·柯立芝(1872-1933)(1921.3-1923.8在任)(1923.8-1925.3缺任)(第三十任)查尔斯·道斯(1865-1951)(1925-1929在任)(第三十一任)查尔斯·柯蒂斯(1860-1936)(1929-1933在任)(第三十二任)约翰·加纳(1868-1967)(1933-1941在任)(第三十三任)亨利·华莱士(1888-1965)(1941-1945在任)(第三十四任)哈里·杜鲁门(1884-1972)(1945.1-1945.4在任)(1945.4-1949.1缺任)(第三十五任)阿尔本·巴克利(1877-1956)(1949-1953在任)(第三十六任)理查德·尼克松(1913-1994)(1953-1961在任)(第三十七任)林登·约翰逊(1908-1973)(1961.1-1963.11在任)(1963.11-1965.1缺任)(第三十八任)休伯特·汉弗莱(1911-1978)(1965-1969在任)(第三十九任)斯皮罗·阿格纽(1918-1996)(1969.1-1973.10在任)(1973.10-1973.12缺任)(第四十任)杰拉尔德·福特(1913-2006)(1973.12-1974.8在任)(1974.8-1974.12缺任)(第四十一任)纳尔逊·洛克菲勒(1908-1979)(1974.12-1977.1在任)(第四十二任)沃尔特·蒙代尔(1928-至今)(1977-1981在任)(第四十三任)乔治·赫伯特·沃克·布什(1924-至今)(1981-1989在任)(第四十四任)丹·奎尔(1947-至今)(1989-1993在任)(第四十五任)艾伯特·戈尔(1948-至今)(1993-2001在任)(第四十六任)理查德·切尼(1941-至今)(2001-2009在任)(第四十七任)约瑟夫·拜登(1942-至今)(2009-至今在任)【美国国务卿】(第1任)托马斯·杰斐逊(1743-1826)(1789.9-1793.12在任)(第2任)埃德蒙·伦道夫(1753-1813)(1794.1-1795.8在任)(第3任)蒂莫西·皮克林(1745-1829)(1795.12-1800.5在任)(第4任)约翰·马歇尔(1755-1835)(1800.6-1801.3在任)(第5任)詹姆斯·麦迪逊(1751-1836)(1801.5-1809.3在任)(第6任)罗伯特·史密斯(1757-1842)(1809.3-1811.4在任)(第7任)詹姆斯·门罗(1758-1831)(1811.4-1814.9,1815.2-1817.3在任)(第8任)约翰·昆西·亚当斯(1767-1848)(1817-1825在任)(第9任)亨利·克莱(1777-1852)(1825-1829在任)(第10任)马丁·范布伦(1782-1862)(1829.3-1831.5在任)(第11任)爱德华·利文斯顿(1764-1836)(1831-1833在任)(第12任)路易斯·麦克莱恩(1786-1857)(1833.5-1834.6在任)(第13任)约翰·福塞斯(1780-1841)(1834.7-1841.3在任)(第14任)丹尼尔·韦伯斯特(1782-1852)(1841.3-1843.5在任)(第一次)(第15任)埃布尔·厄普舍(1790-1844)(1843.7-1844.2在任)(第16任)约翰·卡尔霍恩(1782-1850)(1844.4-1845.3在任)(第17任)詹姆斯·布坎南(1791-1868)(1845-1849在任)(第18任)约翰·克莱顿(1796-1856)(1849.3-1850.7在任)(第19任)丹尼尔·韦伯斯特(1782-1852)(1850.7-1852.10在任)(第二次)(第20任)爱德华·埃弗里特(1794-1865)(1852.11-1853.3在任)(第21任)威廉·马西(1786-1857)(1853-1857在任)(第22任)刘易斯·卡斯(1782-1866)(1857.3-1860.12在任)(第23任)杰里迈亚·布莱克(1810-1883)(1860.12-1861.3在任)(第24任)威廉·苏厄德(1801-1872)(1861-1869在任)(第25任)伊莱休·沃什伯恩(1816-1887)(1869.3在任)(第26任)汉密尔顿·菲什(1808-1893)(1869-1877在任)(第27任)威廉·埃瓦茨(1818-1901)(1877-1881在任)(第28任)詹姆斯·布莱恩(1830-1893)(1881.3-1881.12在任)(第一次)(第29任)弗雷德里克·弗里林海森(1817-1885)(1881.12-1885.3在任)(第30任)托马斯·贝亚德(1828-1898)(1885-1889在任)(第31任)詹姆斯·布莱恩(1830-1893)(1889.3-1892.6在任)(第二次)(第32任)约翰·沃森·福斯特(1836-1917)(1892.6-1893.2在任)(第33任)沃尔特·格雷沙姆(1832-1895)(1893.3-1895.5在任)(第34任)理查德·奥尔尼(1835-1917)(1895.6-1897.3在任)(第35任)约翰·舍曼(1823-1900)(1897.3-1898.4在任)(第36任)威廉·戴伊(1849-1923)(1898.4-1898.9在任)(第37任)约翰·海伊(1838-1905)(1898.9-1905.7在任)(第38任)伊莱休·鲁特(1845-1937)(1905.7-1909.1在任)(第39任)罗伯特·培根(1860-1919)(1909.1-1909.3在任)(第40任)菲兰德·诺克斯(1853-1921)(1909-1913在任)(第41任)威廉·詹宁斯·布莱恩(1860-1925)(1913.3-1915.6在任)(第42任)罗伯特·兰辛(1864-1928)(1915.6-1920.2在任)(第43任)班布里奇·科尔比(1869-1950)(1920-1921在任)(第44任)查尔斯·埃文斯·休斯(1862-1948)(1921-1925在任)(第45任)弗兰克·凯洛格(1856-1937)(1925-1929在任)(第46任)亨利·史汀生(1867-1950)(1929-1933在任)(第47任)科德尔·赫尔(1871-1955)(1933.3-1944.12在任)(第48任)爱德华·斯退丁纽斯(1900-1949)(1944.12-1945.6在任)(第49任)詹姆斯·伯恩斯(1879-1972)(1945.7-1947.1在任)(第50任)乔治·马歇尔(1880-1959)(1947-1949在任)(第51任)迪安·艾奇逊(1893-1971)(1949-1953在任)(第52任)约翰·福斯特·杜勒斯(1888-1959)(1953.1-1959.4在任)(第53任)克里斯蒂安·赫脱(1895-1966)(1959.4-1961.1在任)(第54任)迪安·腊斯克(1909-1994)(1961-1969在任)(第55任)威廉·罗杰斯(1913-2001)(1969.1-1973.9在任)(第56任)亨利·基辛格(1923-至今)(1973.9-1977.1在任)(第57任)赛勒斯·万斯(1917-2002)(1977.1-1980.4在任)(第58任)埃德蒙·马斯基(1914-1996)(1980.5-1981.1在任)(第59任)亚历山大·黑格(1924-2010)(1981.1-1982.7在任)(第60任)乔治·舒尔茨(1920-至今)(1982.7-1989.1在任)(第61任)詹姆斯·贝克(1930-至今)(1989.1-1992.8在任)(第62任)劳伦斯·伊格尔伯格(1930-2011)(1992.8-1993.1在任)(第63任)沃伦·克里斯托弗(1925-2011)(1993-1997在任)(第64任)马德琳·奥尔布赖特(1937-至今)(1997-2001在任)(女)(第65任)克林·鲍威尔(1937-至今)(2001-2005在任)(第66任)康多莉扎·赖斯(1954-至今)(2005-2009在任)(女)(第67任)希拉里·克林顿(1947-至今)(2009-2013在任)(女)(第68任)约翰·克里(1943-至今)(2013-至今在任)。

专访美国财政部长盖特纳

专访美国财政部长盖特纳作者:MiriamFisher本期人物:蒂莫西·盖特纳(Timothy Franz Geithner),美国经济学家,现任美国财政部长。

1961年出生于纽约布鲁克林,曾先后就读于美国达特茅斯学院和约翰斯·霍普金斯大学,并学习过中文和日语。

1988年进入美国财政部工作;1995~2001年,历任财政部助理部长帮办、助理部长高级帮办、助理部长和负责国际事务的副部长。

此后曾在美国外交学会和国际货币基金组织任职,被奥巴马任命为财政部长前担任纽约联邦储备银行行长一职。

上任之前,盖特纳深度参与了美国政府化解金融危机的各项工作。

Geithner’s Promises盖特纳的承诺Shui: Mr. Secretary, welcome to China.Geithner: Thank you for having me.Shui: I noted that yesterday you were in Peking University to give the speech and the headline. Afterwards,all the media, including Chinese and foreign media, are quoting you as saying that the Chinese investments in the United States are safe. Can you elaborate a little bit? Because in front of the television, hundreds of thousands of Chinese audience are also eager to know and they also have some kind of concern. So I would like to invite you to elaborate a little bit—tell them that it is safe, one hundred percent.Geithner: It is a very important issue. Let me just begin, though, by saying that we are, as your government is, doing exceptional things to try to bring growth back on track, to try to make sure that we have a strong financial system both in the United States and around the world. So we are doing exceptional things to try to address this global crisis. That has required temporary increases in our deficits and some exceptional actions to help stabilize the financial system, restore the growth of credit. Those are necessary steps, similar to what your government is doing here to try to make sure growth is strong and sustainable for the future. But we are very committed to make sure that when recovery is established, we go back to living within our means, that we bring our fiscal deficits down to a sustainable level, that we unwind1) and reverse these exceptional measures we’ve taken in the financial sector. We have a strong independent central bank which is committed to keep inflation low and stable over time. We’re committed to a strong dollar. We have the deepest, most l iquid2) treasury market in the world, and we will do everything we can and everything that is necessary to try to make sure we’re sustaining confidence in U.S. financial markets, financial assets, not just in the United States but around the world. I’ve ac tually found a lot of confidence here in China, justifiable confidence in the strength and resilience and dynamism of the American economy.China-U.S. Strategic and Economic Dialogue中美战略经济对话Shui: As Treasury Secretary, this is your first visit to China, and this is also a very important trip of ahigh-ranking official from the Obama administration. We know that actually trade issue is not the only issue that you’re going to discuss with our leaders. The other issue, which is very important, i s the so-called China-U.S. strategic and economic dialogue. People say that you’re going to restart or restructure it. Tell us a little bit about how you are going to restructure this dialogue, or what the new initiative you’re going to introduce is.Ge ithner: Let me focus on two things. First, we’re going to elevate3) the importance of the strategic part ofthe dialogue to make sure that alongside a very strong set of interactions on the economic side, we have an equally strong set of interactions on th e political strategic side. So that’s one side that we’re making. We’re going to try to have these run together on a coordinated basis, so we’re looking across all the issues of importance to both our economies. On the economic side, I would just highlight a few important things. First, of course, we want this global economy to get back to a growth path. We need to act very forcefully, working with other countries to address the immediate crisis. We want to make sure that as we come out of this crisis, we have a stronger, more balanced, sustainable foundation for growth globally, less dependent on the U.S. consumer, frankly, and more reliant on stronger domestic-demand-led growth, not just in China, but in countries around the world. Third thing, what I’d li ke to just focus on is that we want to work very closely with China and other major economies to strengthen the international financial architecture, to reduce the risk of future financial crises, and to put in place stronger standards enforced more evenly on risk-taking in the financial markets. We want to strengthen the international financial institutions, give China a greater role in those institutions, and reform them to make them more effective.Shui: It sounds to me that actually you are setting a kind of a little bit different tone compared with previous administrations, because for quite some years people are saying that China’s rise, or China’s development, rapid growth is kind of a threat. And you sounded, to me at least, it’s not kind of an issue for you to concern.Geithner: I agree. I think China’s success will be good for the United States, good for the rest of the world. It is true that China’s emergence, China’s rapid growth, has been challenging to many countries around the world.I t’s been enormously consequential4) in its impact on countries around the world. But on balance, China’s growth is good for the world economy, good for the United States, and we have a strong compelling interest in the success of your reform efforts.Stimulus Package5)详解财政刺激方案Shui: I heard that actually you have some kind of suggestions for China, in fighting against this financial crisis, combined with China’s stimulus package, about five hundred billion U.S. dollars, and China is encouragin g a kind of domestic consumption. What is your suggestion for China to fight against this crisis? Because, as you say, challenges are lying ahead, and we have to be prepared.Geithner: Well, I think that the leadership of China has laid out a very ambitious program of reforms to strengthen the healthcare system, strengthen the safety net, reform the financial system, allow market prices to operate more fully across the economy, and reinforce a transition towards more domestic-demand-led growth in the future, less heavy investment-intensive, less export-intensive growth. That overall orientation we think is not just in the interest of6) China but in the interest of the world economy as well. It’s very important to us—the process will take time, but it’s ve ry important to us that China continue and succeed on that basic path, because as I said, in the United States private savings and public savings are going to have to increase. The world is going to be less able to rely on strong consumption domestically in the United States and outside the United States. Not just in China but outside the United States, we seem to see a shift towards more domestic-demand-led growth. But as I said, I think that the leadership of China has laid out a very impressive, a very ambitious set of reforms on that front, and your success will be our reward.Shui: What is the effect so far about your government’s stimulus package, about eight hundred billion? That’s huge. Is it big enough?Geithner: Well, it’s a very powerful pac kage of tax measures and investments, largest in peacetime, and it is starting to help stabilize the declining growth and what we just talked about, which is the beginning of stabilization.Foundation for recovery is in part due to the forcefulness of that stimulus program, and is in part due to the actions that we’ve taken to help stabilize the financial system and improve credit markets. So you’ve seen the cost of credit start to come down; you’ve seen more confidence in the financial system alongside thi s very powerful program of tax cuts, and support for infrastructure, support for states and local governments. And those things are working together as they were designed to.Shui: And I do believe that you have future and further steps.Geithner: Yes, the program was designed to provide substantial stimulus over a two-year period of time, two years, but I want to emphasize this—once recovery is established, those exceptional, temporary actions will expire, and we’ll begin to bring our deficits down to the point where, again, we’re living within our means.Shui: Allow me to ask you, if I may, can you give us a personal assessment? When are we going to see the end of this crisis? When are we going to see a very blue sky?Geithner: You know, I think it depends on what we do, not just in the United States but in China and countries around the world. It depends on the quality and the force of the policy measures we’re putting in place to improve confidence. So again, we’ve seen some initial signs, some encouraging signs of positive impact from those policies. That’s, I think, a significant reason why confidence is starting to improve, but I would just say it depends on the continued ability and willingness of our government and your government and other countries to reinforce these early signs of improvement.A China Expert中国通Shui: You spent quite some time, even in childhood, in China, and people call you a China expert in the Obama administration. Yesterday you showed your relationship with China in Peking University. Maybe my audience will ask you, “Do you still speak some Chinese?”Geithner: I speak very little Chinese, but I was enormously fortunate to be able to study in China twice. I studied Chinese for six years in college and graduate school. I actually taught Chinese as an assistant teacher for three years.Shui: Really?Geithner: Well, my Chinese is not good, but I was lucky early on to have some very good professors, and that had an enormous effect on me— just to c ome here early in China’s transformation.Shui: You are the expert, and I guess you are the expert to tell the world, and also to tell your fellow countrymen in the United States how big the change is.Geithner: Yes, it’s a remarkable amount of chang e, and China is clearly thriving, enormously important transformation, but I just want to give you something that I still remember.Shui: Sure.Geithner: I remember being here as a student traveling around China. I remember walking once in a market in Beijing, and one of your countrymen came up to me and said, “Are you American?” And I said, “Yes.” And he said, “I’m so glad. You know, you Americans, you’re like us. You’re open, candid, direct and confident, like the Chinese.”Shui: Ah!Geithner: I still basically remember that, and it’s a good basis for a relationship between our two countries.Shui: Exactly.1. unwind [7Qn5waInd] vt. 展开2. liquid [5lIkwId] adj. 流动的,易变为现金的3. elevate [5elIveIt] vt. 提高,提升4. consequential [7kCnsI5kwenFEl] adj. 作为后果、结果或结局随之发生的5. stimulus package:一揽子刺激计划,财政刺激方案6. in the interest of:为了……的利益。

美国历届国家领导人及任期

美国历届国家领导人及任期1 乔治·华盛顿 (George Washington) 1789年-1797年开国总统2 约翰·亚当斯 (John Adams) 联邦党 1797年-1801年人称“老亚当斯”,儿子是第6任美国总统,和儿子是为美国历史上第一对父子档总统。