外文翻译---中国上市公司偏好股权融资:非制度性因素

中国上市公司股权融资偏好分析

中国上市公司股权融资偏好分析近年来,中国经济进步迅速,上市公司数量和规模不息增长。

股权融资作为上市公司的一种重要融资方式,对于企业的进步具有重要意义。

本文将从宏观和微观两个角度,分析中国上市公司股权融资的偏好。

一、宏观角度1. 资本市场的进步中国资本市场的规模和功能逐渐扩大,为上市公司提供了更多的融资渠道。

随着股东结构改革和市场机制的完善,公司股权在市场上的流淌性不息提高,增进了股权融资的进步。

2. 法律法规的完善中国政府近年来加强了对上市公司治理的监管力度,修订了《证券法》等相关法律法规,完善了公司股权分配与融资的体系。

这些法律法规的完善提供了更加稳定和透亮的环境,增加了企业融资的可行性。

3. 资本结构的优化随着经济结构调整和企业改革的深度,中国上市公司逐渐意识到优化资本结构的重要性。

通过股权融资,企业可以获得更多的资金用于扩大规模、研发创新和技术引进,提高企业的核心竞争力。

二、微观角度1. 股东利益的平衡在中国上市公司中,国有股和非国有股的比例日益趋于平衡。

同时,在国有股股权融资方面,政府通过股权来往平台等途径提供了更多便利。

非国有股股权融资则更容易吸引更多的社会资本参与,增加了企业融资的可能。

2. 股权融资的多元化上市公司在股权融资中的选择越来越多元化。

除了传统的公开发行股票外,债转股、配股、增发等方式也在不息涌现。

上市公司依据自身进步的需求,选择最适合的股权融资方式,以获得最大程度的融资效益。

3. 利润分配的可行性中国上市公司利润分配机制也在逐渐改变。

过去企业主要通过分红的方式回报投资者,而此刻越来越多的企业将利润留存用于将来的进步。

通过股权融资得到的资金可以更好地满足企业成长的需要,提高股东的长期回报。

综上所述,中国上市公司股权融资的偏好受到宏观和微观因素的影响。

在宏观层面,资本市场的进步、法律法规的完善和资本结构的优化推动了股权融资的偏好。

在微观层面,股东利益的平衡、股权融资的多元化和利润分配的可行性也在影响着上市公司的融资选择。

上市公司的融资渠道分析外文翻译

毕业论文外文原文及译文题目:上市公司的融资渠道分析专业:指导教师:学院:学号:班级:姓名:一、外文原文1.A Description of Efficient Capital MarketsAn efficient capital market is one in which stock prices fully reflect available information.To illustrate how an efficient market works,suppose the F-stop Camera Corporation(FCC) is attempting to develop a camera that will double the speed of the auto-focusing system now available.FCC believes this research has positive NPV.Now consider a share of stock in FCC.What determines the willingness of investors to hold shares of FCC at a particular price?One important factor is the probability that FCC will be the first company to develop the new auto-focusing system.In an efficient market,we would expect the price of the shares of FCC to increase if this probability increases.Suppose FCC hires a well-known engineer to develop the new auto-focusing system.In an efficient market,what will happen to FCC’s share price when this is announced?If the well-known scientist is paid a salary that fully reflects his or her contribution to the firm,the price of the stock will not necessarily change.Suppose,instead,that hiring the scientist is a positive NPV transaction.In this case,the price of shares in FCC will increase because the firm can pay the scientist a salary blew his or her ture value to the company.When will the increase in the price of FCC’s shares take place?Assume that the hiring announcement is made in a press release on Wednesday morning.In an efficient market,the price of shares in FCC will immediately adjust to this new information.Investors should not be able to buy the stock on Wednesday afternoon and make a profit on Thursday.This would imply that it took the stock market a day to realize the implication of the FCC press release.The efficient market hypothesis predicts that the price of shares of FCC stock on Wednesday afternoon will already reflect the information contained in the Wednesday morning press release.2. Independent Deviations from RationalitySuppose that FCC’s press release is not all that clear. How many new cameras are likely to be sold? At what price? What is the likely cost per camera? Will other camera companies be able to develop competing products? How long will this likely take? If these, and other,questions cannot be answered easily, it will be difficult to estimate NPV.Now imagine that, with so many questions going unanswered, many investors do not think clearly. Some investors might get caught up in the romance of a new product, hoping,and ultimately believing,in sales projections well above what is rational. They would overpay for new shares, And if they needed to sell shares (perhaps to finance current consumption), they would do so only at a high price. If these individuals dominate the market, the stock price would likely rise beyond what market efficiency would predict.However,due to emotional resistance, investors could just as easily react to new information in a pessimistic manner. Afterall, business historians tell us that investors were initially quite skeptical about the benefits of the telephone, the copier, the automobile, and the motion picture.Certainly, the could be overly skeptical about this new camera. If investors were primarily of this type, the stock price would likely rise less than market efficiency would predict.But suppose that about as many individuals were irrationally optimistic as were irrationally pessimistic. Prices would likely rise in a manner consistent with market efficiency,even though most investors would be classified as less than fully rational. Thus, market efficiency does not require rational individuals, only countervailing irrationalities.However, this assumption of offsetting irrationalities at all times may be unrealistic. Perhaps, at certain times,most investors are swept away by excsssive optimism and,at other times,are caught in the throes of extreme pessimism.But even here, there is an assumption that will produce efficiency.二、译文1 有效资本市场的描述有效的资本市场是股票价格充分反映可获得的信息。

中国上市公司偏爱股权融资

中国证券报/2002年/10月/17日/第011版第四期上证联合研究计划系列之四中国上市公司偏爱股权融资内容提要与公众股的市价相比,中国上市公司法人股转让价格折扣率高达78%-86%,因此利用流通股价格计算各种财务杠杆的市场价值会造成很大的偏差,但是简单地将非流通股按每股净资产计算也缺乏理论根据。

与发达国家的上市公司相比,中国上市公司往往更依赖对外融资,特别是较高水平的股权融资。

这可能是因为中国企业上市申请竞争比较激烈。

而一旦公司上市了,配股、增发相对比较容易争取到。

另一方面,是因为中国上市公司通常可以远远高出每股帐面净资产的价格卖出新股。

股权结构对资本结构有显著性影响,但是管理层持股比例与资本结构的相关性很弱。

这可能是因为中国上市公司管理层持股比例太低的缘故。

本课题研究了中国上市公司资本结构的现况及特点。

具体说来,我们尝试回答两个问题:比起私有产权更为普遍、市场机制已盛行多年的国家,中国上市公司的财务行为是否有所不同?影响其他国家资本结构的因素,是否对中国企业的资本结构有类似的影响?分析上市公司的资本结构,主要是看公司的各种财务杠杆,这里为简便起见,除非强调各种财务杠杆的差异,我们主要采用资产负债率指标(总负债占总资产的百分比)。

中国上市公司资本结构特点何在所有者权益比重高。

对上市公司资本结构的研究可以从不同的角度着手,一份平均资产负债表也许可说明许多问题。

通过比较中国和G-7国家上市公司的平均资产负债表,我们发现:一方面,中国企业与G-7国家在资产负债表的资产组成中差别不大。

虽然中国公司的现金和短期投资比重似乎更多(18.0%),但是日本企业该项目比重更大(18.4%)。

又比如,中国公司的固定资产比日本和法国公司多,但比美国、英国和加拿大的少。

但另一方面,从负债类科目看,中国企业与G -7国家同行的差异就相当大。

中国公司的流动负债总额与G-7国家差不多,大都在35-43%之间,但中国公司的所有者权益比重高,超过50%,而G-7国家都在42%以下,相应地中国公司的长期负债水平相当低。

我国上市公司股权融资偏好的成因和对策

我国上市公司股权融资偏好的成因和对策[摘要]我国上市公司表现出强烈的股权融资偏好,这是由于政策环境、市场环境和市场上严重的投机倾向这些外部因素,以及上市公司股权融资的较低成本、股权结构的缺陷和内部人控制问题等这样的内部因素导致的。

股权融资偏好会带来降低募股资金使用效率和拖累上市公司经营业绩等问题。

我们可以通过调整上市公司股权结构,建立内部激励制度,完善资本市场规则等制度安排,以淡化上市公司股权融资偏好。

[关键词]上市公司股权融资偏好近几年来,我国不少上市公司千方百计争取股权融资机会,争先恐后发行股票,具有强烈的股权融资偏好,但这并不符合优序融资理论。

剖析我国上市公司股权融资偏好及其成因,完善我国上市公司融资结构,淡化股权融资偏好,对我国上市公司的健康发展具有重要的现实意义和历史意义。

一、上市公司股权融资偏好的表现1.上市公司融资方式分类根据不同标准,可以对上市公司融资方式进行不同分类。

本文仅涉及两个分类标准。

一是按照上市公司与投资者形成的不同产权关系,上市公司的融资方式分为股权融资和债权融资。

股权融资,是指上市公司以出让股份的方式向股东筹集资金,包括配股、增发新股以及股利分配中的送红股;债权融资,是指上市公司以发行债券、银行借贷方式向债权人融资的方式。

按照融资过程中资金来源的不同方向,可以把上市公司融资方式分为内源融资与外源融资。

内源融资是指企业将自己的储蓄转化为投资,一般包括折旧和留存收益。

外源融资是指上市公司吸收其他经济主体的储蓄,使之转化为自己的投资,包括发行股票、发行债券、银行借款等。

2.我国上市公司偏好外源融资按照普遍认同的“有序融资理论”(Pecking Order Theory)(梅耶斯,1984),在西方发达国家的上市公司中,最主要的融资方式是内源融资,约占资金来源的50%~97%;其次是外源融资中的债权融资,约占资金来源的11%~57%;最后才是股权融资,约占资金来源的3.3%~9%。

《2024年我国上市公司融资偏好及其影响因素研究》范文

《我国上市公司融资偏好及其影响因素研究》篇一一、引言随着中国资本市场的日益成熟和上市公司数量的不断增加,融资问题逐渐成为企业发展的重要议题。

融资是企业获取资金的重要手段,对于企业的扩张、研发、市场拓展等方面具有至关重要的作用。

本文旨在研究我国上市公司的融资偏好及其影响因素,以期为企业的融资决策提供参考。

二、我国上市公司融资偏好的现状当前,我国上市公司融资偏好主要表现在以下几个方面:1. 股权融资偏好我国上市公司普遍存在股权融资偏好,即更倾向于通过发行股票等股权方式进行融资。

这主要是因为股权融资能够为企业提供较为稳定的资金来源,且无需还本付息,减轻企业的财务压力。

此外,股权融资还能够提高企业的知名度和信誉度,为企业带来更多的合作机会。

2. 债务融资偏好尽管股权融资是我国上市公司的主要融资方式,但债务融资仍然占据一定比重。

企业通常通过银行贷款、债券发行等方式进行债务融资。

债务融资的优点在于利息支出可以在税前扣除,降低企业的税负,同时债务到期后只需还本付息,不会稀释企业的股权。

三、影响我国上市公司融资偏好的因素1. 政策环境政策环境是影响上市公司融资偏好的重要因素。

政府的政策导向、货币政策、财政政策等都会对企业的融资决策产生影响。

例如,政府鼓励高新技术企业通过股权融资方式获取资金,以促进科技创新和产业升级。

2. 企业自身条件企业自身条件也是影响其融资偏好的关键因素。

企业的规模、盈利能力、资产质量、信用状况等都会影响其融资能力和融资成本。

一般来说,规模较大、盈利能力较强、资产质量较好的企业更容易获得融资支持。

3. 资本市场状况资本市场状况对上市公司的融资偏好具有直接影响。

资本市场的流动性、融资成本、投资者信心等都会影响企业的融资决策。

在资本市场繁荣、流动性充足的情况下,企业更倾向于通过股权融资方式获取资金;而在资本市场低迷、融资成本较高的情况下,企业则可能更倾向于债务融资。

四、结论与建议通过对我国上市公司融资偏好的研究,我们发现政策环境、企业自身条件和资本市场状况是影响企业融资偏好的主要因素。

我国上市公司股权融资偏好研究

我国上市公司股权融资偏好研究我国上市公司股权融资偏好研究【引言】在我国经济发展的过程中,股权融资对于上市公司的发展起到了重要的推动作用。

然而,随着市场竞争的加剧以及外部环境的不稳定性,上市公司的股权融资选择面临着日益复杂的挑战。

本文旨在探讨我国上市公司在股权融资中的偏好,以及可能影响其选择的因素。

【一、我国上市公司股权融资的现状】我国上市公司目前主要通过股权融资来满足其资本需求。

在国内股权融资市场,上市公司可以通过向机构投资者发行新股、配股募集资金,也可以通过定向增发向特定投资者获取资金。

此外,上市公司还可以通过市场债务融资和非公开发行股票来筹措资金。

根据《中国证监会公开募集证券管理办法》规定,上市公司在股权融资时需经过证监会审批。

【二、上市公司股权融资偏好的影响因素】1. 公司规模和发展阶段随着公司规模的不断扩大以及发展阶段的转换,上市公司的股权融资偏好也会发生变化。

初创期的小型公司可能更倾向于发行新股来满足资本需求,而成熟期的大型公司可能更倾向于通过定向增发或发行可转债等方式来实现股权融资。

2. 盈利能力和财务状况上市公司的盈利能力和财务状况对其股权融资的偏好起着重要作用。

盈利能力较强的公司可能更容易通过发行新股来吸引投资者,而财务状况较好的公司可能更倾向于发行可转债等债务工具来实现融资。

3. 股权结构和股东背景上市公司的股权结构和股东背景也会影响其股权融资的偏好。

如果公司存在股权集中的情况或拥有强势股东,在股权融资时可能更倾向于选择定向增发等方式,以减少对现有股东的稀释。

4. 市场环境和投资者需求市场环境和投资者需求对上市公司的股权融资偏好有着重要影响。

在市场行情繁荣的时期,上市公司可能更容易通过发行新股来融资,而市场低迷或投资者偏好债券等固定收益工具的时期,上市公司可能更倾向于发行可转债等债务工具。

【三、上市公司股权融资偏好的问题与挑战】1. 市场需求的不确定性由于市场需求的不确定性,上市公司往往难以准确把握投资者的偏好。

35-5-外文翻译-我国上市公司股权融资偏好成因分析及治理策略

他们认为:如果公司遵循优序融资假说问题,因为将它们作为长期债务,债务风险低,成本低于发行股票发行债券的成本费用。由于大多数企业管理者和市场参与者之间的信息不对称,公平是更昂贵的问题。公司经理知道比市场更好的前景,因而不愿意发行股票,因为市场低估的公司具有良好的前景。公司会选择发行股票只为有良好的投资机会,足以克服抑价的信息不对称,这是债务成本高造成的。如果根据啄食顺序假说描述问题的选择,发行股票的概率将直接关系到公司和投资机会的风险和负相关的信息不对称。

关键词:房地产投资信托基金,安全问题,股权交易,啄食顺序模型,代理成本模式,定时模式,上市公司增发,工业领域

导言:当一个公司需要访问外部资本市场,公司的管理层须作出决定有关安全问题的类型。有迹象表明,描述了证券发行的决定不同类型的行列式的几个模型。这些模型能够描述的行为,可以作为实证,测试使用中的因变量,为企业面临问题的时候做出合适的选择。这些研究的结果表明,在债务,税收,代理机构与股票有关,工业公司应作出解释相关的成本问题的选择。这些研究发现管理行为与股东财富最大化是不一致的。

中国上市公司股权融资偏好研究

内容摘要优序融资理论(Pecking Order Theory)提出公司在融资时应该首先选择内部融资、然后是债权融资、末尾就要考虑的是股权融资方式了。

但针对中国上市企业融资行为进行分析之后发现中国的上市企业在融资的先后选择与该观点相背离—出现很清晰的偏好股权融资这种方式从而忽视了债权融资方式的现象。

根据这个现象,本文归纳了形成这一融资特征的原因及其影响,并对此融资现象带来的不良影响提出了若干建议。

关键词:上市企业融资偏好证券市场资本构架AbstractOn the basis of Pecking order theory, when corporate financed, they will obey the rule that the first internal financing, then debt financing, finally equity financing.But after analyzing the financing activities of Chinese listed companies, I find the phenomenon that listed companies in China prefer equity financing when they choose the way to finance. But the conclusion isn’t the same as Pecking order theory. Therefore, I summarize the reasons and influence of these financing characteristics in my paper. Finally I put forward some Suggestions how we can reduce the bad influence of the phenomenon.Key words:Listed company Financing preference The securities marketThe capital structure目录一、研究背景及意义 (1)(一)研究背景 (1)(二)研究意义 (1)(三)研究现状 (2)二、文献综述 (2)(一)股权融资偏好原因研究 (3)(二)债务融资偏好原因研究 (4)三、中国上市企业融资偏好特征 (5)四、我国上市企业存在股权融资偏好的原因 (6)(一)“内部人控制”现象 (6)(二)股权融资的低成本 (6)(三)债券市场发展滞后 (6)五、我国上市企业融资偏好的影响分析 (7)(一)导致资金使用效率不高 (7)(二)不利于公司资本结构的优化 (7)(三)加剧公司治理结构的失衡 (8)六、建议 (8)(一)从企业自身出发 (8)(二)从政府角度出发 (9)参考文献 (10)致谢 (11)中国上市企业股权融资偏好研究一、研究背景及现状(一)研究背景自上世纪90年代中国证券交易所成立之后,经过二十多年的迅猛发展产生的进步,中国的证券行业的改变可谓日新月异,上市企业如雨后春笋般出现,证券行业的不断做大。

我国上市公司股权融资偏好的原因分析

我国上市公司股权融资偏好的原因分析股权融资是指企业股东愿意让出部分企业所有权,通过企业增资的方式引进新的股东的融资方式。

股权融资所获得的资金,企业无需还本付息,但新股东将与老股东同样分享企业的盈利与增长。

股权融资按融资渠道来划分,主要有两大类,分别为公开市场发售和私募发售。

所谓公开市场发售就是通过股票市场向公众投资者发行企业的股票来募集资金,包括我们常说的企业的上市、上市企业的增发和配股都是利用公开市场进行股权融资的具体形式。

所谓私募发售,是指企业自行寻找特定的投资人,吸引其通过增资入股企业的融资方式。

因为绝大多数股票市场对于申请发行股票的企业都有一定的条件要求。

例如我国对公司上市除了要求连续三年盈利之外,还要企业有5000万的资产规模,因此对大多数中小企业来说,较难达到上市发行股票的门槛,私募成为民营中小企业进行股权融资的主要方式。

资本结构有广义和狭义之分,企业融资决策中的资本结构指的是狭义的资本结构,即长期负债资本与权益资本之间的构成比例关系。

融资顺序指企业对各种资金来源的选择的偏好和顺序,它在很大程度上决定了企业的资本结构,进而影响企业的市场价值,在西方受到企业理财者的重视。

然而在我国上市公司却出现了融资顺序理论与公司融资偏好的背离。

一、融资顺序假设理论经济学家Myers和Ma-jiluf在1984年提出了资本结构中著名的融资顺序假设,该理论认为,由于经营者比企业投资者更多地了解企业的状况,而且,企业的经营者总是试图为现有股东而不是新股东谋求价值的最大化,因此,如果企业经营状况良好、投资项目前景看好,经营者宁愿进行举债融资而利用财务杠杆的正效应获利,而不愿发行股票筹资使高额收益被外来者瓜分。

逆向选择的逻辑表明,投资者一般将企业发行新股票融资看作是一个坏消息的信号,因而企业一旦宣告发行股票融资,其股票价格就会下跌,结果是新的权益筹资很昂贵。

因此,企业遵循的融资顺序应首先是内部融资,然后是发行债券融资,最后才是发行股票融资。

我国上市公司股权融资偏好分析

我国上市公司股权融资偏好分析摘要:在现代金融环境下,上市公司存在多种融资方式,根据不同融资方式的特点,公司会选择不同的融资顺序,即所谓的“融资偏好”。

跟西方发达国家提出的融资优序理论相反,我国上市公司表现出强烈的股权融资偏好。

文章分析了这一偏好产生的原因及其在实践中对公司融资后资本使用效率、公司成长和治理、投资者利益等方面产生的不利影响,并提出相应的治理措施。

关键词上市公司,股权融资,偏好,成因Abstract: in modern financial environment, there are many listed companies financing, financing methods according to different characteristics, the company will choose different financing order, the so-called “financing preference”. With the western developed countries the optimal ordering theory put forward financing instead, the listed companies in China showed a strong equity financing preference. This paper analyzes the cause of this preference and in practice in corporate finance capital after use efficiency, the company growth and governance, investors interests unfavorable influences of the aspects, and puts forward corresponding treatment measures.Key words listed company, equity financing, preferences and causes引言根据以MM理论为主的西方现代融资顺序理论,上市公司存在着这样一个融资顺序:留存收益、债务融资、股权融资。

上市公司股权融资中英文对照外文翻译文献

上市公司股权融资中英文对照外文翻译文献(文档含英文原文和中文翻译)原文:Chinese Listed Companies Preference to Equity Fund:Non-Systematic FactorsAbstract :This article concentrates on the listed companies’ financing activities in China, analyses the reasons that why the listed companies prefer to equity fund from the aspect of non-systematic factors by using western financing theories, such as financing cost, types and qualities of the enterprises’ assets, profitability, industry factors, shareholding structure factors, level of financial management and society culture, and concludes that the preference to equity fund is a reasonable choice to the listed companies according to Chinese financing environment. At last, there are someconcise suggestions be given to rectify the companie s’ preference to equity fund. Keywords: Equity fund, Non-systematic factors, financial cost1. IntroductionThe listed companies in China prefer to equity fund, According to the statistic data showed in <China Securities Journal>, the amount of the listed companies finance in capital market account to 95.87 billions in 1997, among which equity fund take the proportion of 72.5%, and the proportion is 72.6% in 1998 and 72.3% in 1999, on the other hand, the proportion of debt fund to total fund is respective 17.8%, 24.9% and 25.1% in those three years. The proportion of equity fund to total fund is lower in the developed capital market than that in China. Take US for example, when American enterprises need to fund in the capital market, they prefer to debt fund than equity fund. The statistic data shows that, from 1970 to 1985, the American enterprises’ debt fund financed occupied the 91.7% proportion of outside financing, more than equity fund. Yan Dawu etc. found that, approximately 3/4 of the listed companies preferred to equity fund in China. Many researchers agree upon that the listed companies’ outside financing following this order: first one is equity fund, second one is convertible bond, third one is short-term liabilities, last one is long-term liabilities. Many researchers usually analyze our national listed companies’ preference to equity fund with the systematic factors arising in the reform of our national economy. They thought that it just because of those systematic facts that made the listed com panies’ financial activities betray to western classical financing theory. For example, the “picking order” theory claims that when enterprise need fund, they should turn to inside fund (depreciation and retained earnings) first, and then debt fund, and the last choice is equity fund. In this article, the author thinks that it is because of the specific financial environment that activates the enterprises’ such preference, and try to interpret the reasons of that preference to equity fund by combination of non-systematic factors and western financial theories.2. Financings cost of the listed company and preference to equity fund According to western financing the theories, capital cost of equity fund is more than capital cost of debt fund, thus the enterprise should choose debt fund first, then is theturn to equity fund when it fund outside. We should understand that this conception of “capital cost” is taken into account by investors, it is somewhat opportunity cost of the investors, can also be called expected returns. It contains of risk-free rate of returns and risk rate of returns arising from the investors’ risk investment. It is different with financing cost in essence. Financing cost is the cost arising from enterprises’ financing activities and u sing fund, we can call it fund cost. If capital market is efficient, capital cost should equal to fund cost, that is to say, what investors gain in capital market should equal to what fund raisers pay, or the transfer of fund is inevitable. But in an inefficient capital market, the price of stock will be different from its value because of investors’ action of speculation; they only chase capital gain and don’t want to hold the stocks in a long time and receive dividends. Thus the listed companies can gain fund with its fund cost being lower than capital cost.But in our national capital market, capital cost of equity fund is very low; it is because of the following factors: first, the high P/E Ratio (Price Earning Ratio) of new issued shares. According to calculation, average P/E Ratio of Chinese listed companies’ shares is between 30 and 40, it also is maintained at 20 although drops somewhat recently. But the normal P/E Ratio should be under 20 according to experience. We can observe the P/E was only 13.2 from 1874 to 1988 in US, and only 10 in Hong Kong. High P/E Ratio means high share issue price, then the capital cost of equity fund drops even given the same level of dividend. Second, low dividend policy in the listed companies, capital cost of equity fund decided by dividend pay-out ratio and price of per share. In China, many listed companies pay little or even no dividends to their shareholders. According to statistic data, there were 488 listed companies paid no dividend to their shareholders in 1998, 58.44 percents of all listed companies, there were 590, 59.83 percents in 1999, even 2000 in which China Securities Regulatory Commission issue new files to rule dividend policy of companies, there were only 699 companies which pay dividends, 18.47 percents more than that in 1999, but dividend payout ratio deduce 22%. Thus capital cost of equity is very low. Third, there is no rigidity on equity fund, if the listed companies choose equity fund, they can use the fund forever and has no obligation to return this fund. Most of listedcompanies are controlled by Government in China, taking financing risk into account, the major stockholders prefers to equity fund. The management also prefer equity fund because its lower fund cost and needn’t to be paid off, then their position will be more stable than financing in equity fund. We can conclude from the above analysis that cost of equity fund is lower than cost of debt fund in Chinese listed companies and the listed companies prefer to such low-cost fund.3. Types and qualities of assets in listed companies and preference to equity fund Static Trade-off Theory tells us, the value of enterprise with financial leverage is decided by the value of self-owned capital; value arising from tax benefit, cost of financial embarrassment and agency cost. Cost of financial embarrassment and agency cost are negative correlative to the types and qualities of companies’ assets, if the enterprise has more intangible assets, more assets with lower quality, it will has lower liquidity and its assets have lower mortgage value. When this kind of enterprise faces to great financial risk, it will have no way to solve its questions by selling its assets. Furthermore, because care for the ability of turning into cash of the mortgage assets, the creditors will high the level of rate and lay additional items in financial contract to rule the debtor’s action, all of those will enhance the agency cost and deduce the companies’ value. Qualcomm is supplier of wireless data and communication service in America, it is the inventor and user of CDMA and it also occupies the technology of HDR. The market value of its share is 1120 billions dollars at the end of March, 2000, but the quantities of long-term liabilities is zero. Why? Some reasons may be that there are some competitors in the market who own analogous technologies and the management of Qualcomm Company takes conservative attitude in financing activities. But the most important factor may be Qualcomm Company owns a mass of intangible assets which will have lower convertibility and the company’s value will decline when it has no enough money to pay for its debt.Many listed companies in China are transformed from the national enterprises. In the transformation, these listed companies take over the high-quality assets of the national enterprises, but with the development of economy, some projects can not coincidewith the market demand and the values of relative assets decline. On the other hand, there are many intangible assets in new high-tech companies. State-owned companies and high-tech companies are the most parts of the capital market. We can conclude that the qualities of listed companies’ assets are very low. This point is supported by the index of P/B (Price-to-Book value) which is usually thought as one of the most important indexes which can weigh the qualities of the listed companies’ assets. According to statistic data coming from Shenzhen Securities Information Company, by the end of November 14, 2003, there were 412 companies whose P/B is less than 2, take the 30% proportions of total listed companies which issue A-share in China, among them, there were 150 companies whose P/B is less than 1.53, and weighted average P/B of the stock market is 2.42. Lower qualities of assets means more cost may be brought out from debt fund and lower total value of the listed companies. Thus the listed companies prefer to equity fund when need outside financial support in China.4. Profitability and preference to equity fundFinancial Leverage Theory tells us that a small change in company’s profit may make great change in company’s EPS (Earnings per share). Just like leverage, we can get an amplified action by use of it. Debt fund can supply us with this leverage, by use of debt fund, these companies which have high level of profitability will get higher level of EPS because debt fund produces more profit for shareholders than interest shareholder shall pay. On the contrary, these companies which have low level of profitability will get lower level of EPS by use of debt fund because debt fund can not produce enough profit for shareholder to fulfill the demand of paying off the interests. Edison International Company has steady amount of customers and many intangible assets, these supply it with high level of profitability and ability to gain debt fund, its debt account to 67.2% proportions of its total assets in 1999.Listed companies in developed countries or regions always have high level of profitability. Take US for example, there are many listed companies which have excellent performance in American capital market when do business, such as J.P Morgan, its EPS is $11.16 per share in 1999. Besides it, GM, GE, Coca Cola, IBM,Intel, Microsoft, Dell etc. all always are profitable. In Hong Kong, most of those companies whose stock included in Hang Sang Index have the level of EPS more than 1 HKD, many are more than 2 HKD. Such as Cheung Kong (Holdings) Limited, its EPS is 7.66 HKD. But listed companies do not have such excellent performance in profitability in China inland. Their profitability is common low. Take the performance of 2000 for example, the weighted average EPS of total listed companies is only 0.20 Yuan per share, and the weighted average P/B is 2.65 Yuan per share, 8.55 percents of these listed companies have negative profit. With low or no profit, the benefit nixes, listed companies’ preference to equity fund is a reasonable phenomenon. Can be gained from debt fund is very little; the listed companies can even suffer from the financial distress caused by debt fund. So with the consideration of shareholders’ interest, the listed companies prefer to equity fund when need outside financial support in China.5. Shareholding structure factors and preference to equity fundListed companies not only face to external financing environmental impacts, but also the structure of the companies shares. Shareholding structure of Chinese listed companies shows characteristics as followed: I. Ownership structure is fairly complex. In addition to the public shares, there are shares held with inland fund and foreign stocks, state-owned shares, legal person shares, and internal employee shares, transferred allotted shares, A shares, B shares, H shares And N shares, and other distinction. From 1995 to 2003, Chinese companies’ outstanding shares of the total equity share almost have no change, even declined slightly. II. There are different prices, dividends, and rights of shares issued by same enterprise. III. The over-concentration of shares. We use the quantity of shares of the three major shareholders who top the list of shareholders of the listed companies to measure the concentration of stock. We study he concentration of stock of these companies which issue new share publicly in the years from 1995 to 2003 and focus on the situation of Chinese listed companies over the same period. The results showed that: from 1995 to 2003, the company-Which once transferred or allotted shares-whose top three shareholders’ shareholding ratio are generally high er than the average level of all thelisted companies, and most of these company's top three shareholders holding 40 percent or higher percent of companies’ shares. In some years, the maximum number even is more than 90 percent, indicating that the company with the implementation of transferred and allotted shares have relatively high concentration rate of shares and major shareholders have absolute control over it. In short, transferring allotting shares and the issuance of additional shares have a certain relevance to the company’s concentration of ownership structure; the company's financing policy is largely controlled by the major shareholders.Chinese listed companies’ special shareholding structure effects its financing action. Because stockholders of the state-owned shares, legal person shares, social and outstanding shares, foreign share have a different objective function, their modes of financing preferences vary, and their preference affect the financing structure of listed companies. Controlling shareholders which hold state-owned shares account for the status of enterprises and carry out financing decisions in accordance with their own objective function. When the objective function conflict with the other shareholders benefit, they often damage the interests of other shareholders by use of the status of controlling. As the first major shareholders of the companies, government has multiple objectives, not always market-oriented, it prefers to use safe fund such as equity fund to maintain the value of state-owned assets, thus resulting in listed company’s preference to equity financing. Debt financing bring business with greater pressure to pay off the par value and interests. Therefore, the state-owned companies are showing a more offensive attitude to debt fund, again because of Chinese state-controlled listed companies have the absolute status in all listed company.From: International Journal of Business and Management; October, 2009.译文:中国上市公司偏好股权融资:非制度性因素摘要:本文把重点集中于中国上市公司的融资活动,运用西方融资理论,从非制度性因素方面,如融资成本、企业资产类型和质量、盈利能力、行业因素、股权结构因素、财务管理水平和社会文化,分析了中国上市公司倾向于股权融资的原因,并得出结论,股权融资偏好是上市公司根据中国融资环境的一种合理的选择。

我国上市公司股权融资偏好的原因及对策研究

我国上市公司股权融资偏好的原因及对策研究摘要:上市公司融资决策是财务管理研究的热点问题之一。

目前中国上市公司的融资结构中,内源融资所占比例普遍很低,外源融资占绝对的比重,且在外源融资中,股权融资比重平均已超过50%,预计随股票市场的进一步发展,这一平均水平还将继续上升。

我国上市公司融资特点是主要依靠外部融资且“轻债务融资重股权融资”,这与优序融资理论的先内部融资而后外部融资以及权衡理论中的有效利用债务融资能使企业价值增大等思想相悖。

因此,需结合我国实际情况,分析其产生的具体原因,从而提出解决的建议和对策。

关键词:上市公司;融资结构;股权倾向一、我国企业融资结构的历史变迁及当前上市公司融资现状随着收入分配结构和投融资体制变迁,我国经济呈现出从财政支持型经由社会借贷型向社会资本型经济转变的特点,企业融资的方式也随之不断变化。

其过程大致经历了两个阶段:第一阶段是1984年以前财政融资为主阶段。

其特点是企业资金来源主要是财政拨款,银行只向企业提供小部分流动资金,信贷供给制对企业融资作用甚小,信贷资金对企业的约束是软的,贷款几乎无成本。

这一阶段虽然有其他融资手段存在,如企业自筹、银行融资等,但财政融资仍占绝对优势。

第二阶段是1984年后进入的多元化融资阶段。

其又可分为两个子阶段,一是1984-1989年,以间接融资为主、直接融资处于萌芽的多元化融资探索阶段。

二是从1990年到现在,直接融资处于快速发展的多元化融资初级阶段。

在这一阶段中发展了更多的融资方式,如证券融资、商业融资、国外融资等,且间接融资比重在不断下降,直接融资发展迅速、比重不断上升。

无论从理论上还是国外企业的实际融资结构上讲,负债经营是现代企业的基本特征之一,其原理是保证公司财务稳定前提下,充分发挥财务杠杆的作用,以谋求股东收益最大化。

但是,国内上市公司中,1999年年报有%的上市公司资产负债率低于30%,2000年有%的上市公司资产负债率低于年更有%的上市公司资产负债率低于30%。

中国上市公司偏好股权融资:非制度性因素

毕业论文(设计)外文翻译题目:中国上市公司偏好股权融资:非制度性因素系部名称:经济管理系专业班级:学生姓名:学号:指导教师:教师职称:讲师译文:中国上市公司偏好股权融资:非制度性因素国际商业管理杂志摘要:本文把重点集中于中国上市公司的融资活动,运用西方融资理论,从非制度性因素方面,如融资成本、企业资产类型和质量、盈利能力、行业因素、股权结构因素、财务管理水平和社会文化,分析了中国上市公司倾向于股权融资的原因,并得出结论,股权融资偏好是上市公司根据中国融资环境的一种合理的选择。

最后,针对公司的股权融资偏好提出了一些简明的建议。

关键词:股权融资,非制度性因素,融资成本一、前言中国上市公司偏好于股权融资,根据中国证券报的数据显示,1997年上市公司在资本市场的融资金额为95.87亿美元,其中股票融资的比例是72.5%,,在1998年和1999年比例分别为72.6%和72.3%,另一方面,债券融资的比例分别是17.8%,24.9%和25.1%。

在这三年,股票融资的比例,在比中国发达的资本市场中却在下跌。

以美国为例,当美国企业需要的资金在资本市场上,于股权融资相比他们宁愿选择债券融资。

统计数据显示,从1970年到1985年,美日企业债券融资占了境外融资的91.7%,比股权融资高很多。

阎达五等发现,大约中国3/4的上市公司偏好于股权融资。

许多研究的学者认为,上市公司按以下顺序进行外部融资:第一个是股票基金,第二个是可转换债券,三是短期债务,最后一个是长期负债。

许多研究人员通常分析我国上市公司偏好股权是由于我们国家的经济改革所带来的制度性因素。

他们认为,上市公司的融资活动违背了西方古典融资理论只是因为那些制度性原因。

例如,优序融资理论认为,当企业需要资金时,他们首先应该转向内部资金(折旧和留存收益),然后再进行债权融资,最后的选择是股票融资。

在这篇文章中,笔者认为,这是因为具体的金融环境激活了企业的这种偏好,并结合了非制度性因素和西方金融理论,尝试解释股权融资偏好的原因。

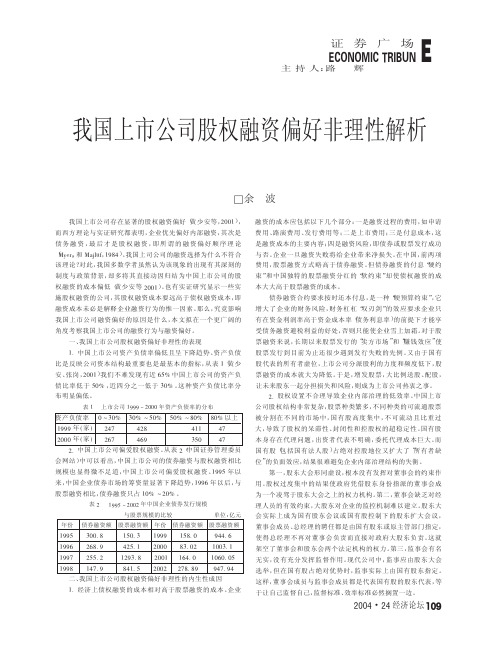

我国上市公司股权融资偏好非理性解析

#..3 #..2 #..9 #../

5""1 / !2/1 . !331 ! #091 .

#3"1 5 0!31 # #!.51 / /0#1 3

#... !""" !""# !""!

#3/1 " /51 "! #201 " !9/1 /.

.001 2 #""51 # #"2"1 "3 .091 .0

表# 上市公司 #... 6 !""" 年资产负债率的分布

波

融资的成本应包括以下几个部分: 一是融资过程的费用, 如申请 费用、 路演费用、 发行费用等; 二是上市费用; 三是付息成本, 这 是融资成本的主要内容; 四是融资风险, 即债券或股票发行成功 与否。 企业一旦融资失败将给企业带来净损失。 在中国, 前两项 费用, 股票融资方式略高于债券融资。 但债券融资的付息 “ 硬约 束” 和中国独特的股票融资分红的 “ 软约束 ” 却使债权融资的成 本大大高于股票融资的成本。 债券融资合约要求按时还本付息, 是一种 “ 硬预算约束 ” , 它 增大了企业的财务风险, 财务杠杠 “ 双刃剑 ” 的效应要求企业只 有在资金利润率高于资金成本率 ( 债务利息率 ) 的前提下才能享 受债务融资避税利益的好处, 否则只能使企业雪上加霜。 对于股 票融资来说, 长期以来股票发行的 “ 卖方市场 ” 和“ 赚钱效应 ” 使 股票发行到目前为止还很少遇到发行失败的先例。 又由于国有 股代表的所有者虚位, 上市公司分派股利的力度和频度低下, 股 票融资的成本就大为降低。 于是, 增发股票, 大比例送股、 配股, 让未来股东一起分担损失和风险, 则成为上市公司热衷之事。 中国上市 !1 股权设置不合理导致企业内部治理的低效率。 公司股权结构非常复杂, 股票种类繁多, 不同种类的可流通股票 被分割在不同的市场中, 国有股高度集中, 不可流动且比重过 大, 导致了股权的呆滞性、 封闭性和控股权的超稳定性。 国有股 本身存在代理问题, 出资者代表不明确, 委托代理成本巨大。 而 国有股 ( 包括国有法人股 ) 占绝对控股地位又扩大了 “ 所有者缺 位” 的负面效应, 结果很难避免企业内部治理结构的失衡。 第一, 股东大会形同虚设, 根本没有发挥对董事会的约束作 用。 股权过度集中的结果使政府凭借股东身份指派的董事会成 为一个凌驾于股东大会之上的权力机构。 第二, 董事会缺乏对经 理人员的有效约束, 大股东对企业的监控机制难以建立。 股东大

“我国上市公司股权融资偏好分析”文献综述

“我国上市公司股权融资偏好分析”文献综述“The Research on the Preference for Financing of Chinese Listed Companies” Literature Summarize摘要:企业融资问题,尤其是股权融资偏好问题,已经成为我国进入21世纪以来资本市场争论的焦点之一。

随着不对称信息的引入改变了MM定理“结构不相关”的结论,西方发达国家认为,基于原有股东的利益,企业在进行融资决策时会严格遵循“内部融资-债务融资-股权融资”的啄食顺序理论,而我国的融资现实表现出强烈的股权融资偏好,并且股权融资资金利用效率低下也是一个普遍存在的问题。

基于上述背景,本文系统梳理并研究了西方企业融资理论的发展及我国的一些相关研究成果,这些理论对本文将要研究的思路和方法有很重要的指导意义。

关键词:融资结构;股权融资;债券融资Abstract:Nowadays, the question of the corporate financing, especially the question of the preference of equity financing has been the focus of the capital market since the early 21st century in China. The introduction of the asymmetry information to the financial theory has changed the MM Theory of “Irrelevance Structure”. Western developed countries argue that firms will strictly act on the Pecking Order of the internal financing, equity financing, and debt financing. However, there is a strong preference for equity financing in listed companies. The low efficiency of using equity capital is also a popular problem. According to the former analysis, this paper systematically discusses the development of Western capital structure theories and some of Chinese relevant research results. These theories offer very important guiding significances to my research ideas and methods.Key words:Capital Structure;Equity Financing;Debt Financing1引言企业的融资方式主要包括内源融资和外源融资两类,其中内源融资是企业生产过程中自有资金的积累,包括留存收益和折旧;外源融资即企业的外部资金来源部分,包括股权融资和债权融资。

中国公司偏好股权融资的原因1

第四,健全法制、法规与政策环境。具体工作包括:完善新股发行、配股及增发规则。如规定参与各方的权利与义务、规定只有发放股利的公司才有资格再融资等;加强信息披露管理。加强信息披露管理,构建信号传递机制,是降低融资结构优化成本的有效手段,进一步健全相关法规。现有相关法律法规,由于在制定时的条件所限,所涉及的内容都带有明显的时代特征,随着资本市场的发展,部分条例在新的时期已迫切需要重新修订。

在竞争激烈、价格战频繁的行业,企业当前资本结构将影响后续产品市场竞争能力。高财务杠杆对企业后续投资能力与价格战的财务承受能力具有显著的负面影响,使得公司处于经营与战略上的劣势。仅经营效率高并不能保证企业生存,只有经营效率高兼备与财务资源充足,即财务杠杆低的企业才能长期生存。当前选择股权融资有助于在盈利能力与现金流下降时,保持再投资能力;更进一步,如果竞争对手选择股权融资,选择债务融资可能会促使竞争对手发动价格战、营销战来逼迫企业退出。

ห้องสมุดไป่ตู้

股权结构因素

中国上市公司特殊的股权结构影响到其融资行为。因为国有股、法人股、社会流通股与外资股各自有着不同的目标函数,故融资方式偏好也不尽相同,进而影响着上市公司的融资结构。国有股股东占控股地位的企业,在进行融资决策时会根据其自身的目标函数来进行。当与其他股东目标函数冲突时,其控股地位使它们常常会损害其他股东的利益。由于国有股和法人股非流通性,其利益所在不是股票市场价格的上升,而是账面价值,即每股净资产,而社会流通股股东只能通过股票市场价格的上涨或股利来获利。非流通股的转让以净资产为基础确定,作为第一大股东的政府机构,其目标多重化,行为方式没有市场化,非流通股股东的财富最大化是以净资产的大小来衡量的,而发行股票融资的高溢价必然导致净资产的成倍增加,导致上市公司偏好股权融资。而债务融资则有定期还本付息的“硬约束”,这将会对它们的经营带来较大的压力。因此,国有控股公司对债务融资呈现出较为厌恶的态度,再由于中国上市公司国有控股处于绝对地位,因此上市公司对股权融资的偏好也就不足为奇。

- 1、下载文档前请自行甄别文档内容的完整性,平台不提供额外的编辑、内容补充、找答案等附加服务。

- 2、"仅部分预览"的文档,不可在线预览部分如存在完整性等问题,可反馈申请退款(可完整预览的文档不适用该条件!)。

- 3、如文档侵犯您的权益,请联系客服反馈,我们会尽快为您处理(人工客服工作时间:9:00-18:30)。

有关企业融资的毕业论文外文翻译(原文+译文)原文:Chinese Listed Companies Preference to Equity Fund:Non-Systematic FactorsAbstract :This article concentrates on the listed companies’ financing activities in China, analyses the reasons that why the listed companies prefer to equity fund from the aspect of non-systematic factors by using western financing theories, such as financing cost, types and qualities of the enterprises’ assets, profitability, industry factors, shareholding structure factors, level of financial management and society culture, and concludes that the preference to equity fund is a reasonable choice to the listed companies according to Chinese financing environment. At last, there are some concise suggestions be given to rectify the companies’ preference to equity fund.Keywords: Equity fund, Non-systematic factors, financial cost1. IntroductionThe listed companies in China prefer to equity fund, According to the statistic data showed in <China Securities Journal>, the amount of the listed companies finance in capital market account to 95.87 billions in 1997, among which equity fund take the proportion of 72.5%, and the proportion is 72.6% in 1998 and 72.3% in 1999, on the other hand, the proportion of debt fund to total fund is respective 17.8%, 24.9% and 25.1% in those three years. The proportion of equity fund to total fund is lower in the developed capital market than that in China. Take US for example, when American enterprises need to fund in the capital market, they prefer to debt fund than equity fu nd. The statistic data shows that, from 1970 to 1985, the American enterprises’ debt fund financed occupied the 91.7% proportion of outside financing, more than equity fund. Yan Dawu etc. found that, approximately 3/4 of the listed companies preferred to equity fund in China. Many researchers agree upon that the listed companies’ outside financing following this order: first one is equity fund, second one is convertible bond, third one is short-term liabilities, last one is long-term liabilities. Many resea rchers usually analyze our national listed companies’ preference to equity fund with the systematic factors arising in the reform of our national economy. They thought that it just because of those systematic facts that made the listed companies’ financial activities betray to western classical financing theory. For example, the “picking order” theory claims that when enterprise need fund, they should turn to inside fund (depreciation and retained earnings) first, and then debt fund, and the last choice is equity fund. In this article, the author thinks that it is because of the specific financial environment that activates the enterprises’ such preference, and try to interpret the reasons of that preference to equity fund by combination of non-systematic factors and western financial theories.2. Financings cost of the listed company and preference to equity fundAccording to western financing the theories, capital cost of equity fund is more than capital cost of debt fund, thus the enterprise should choose debt fund first, then is the turn to equity fund when it fund outside. We should understand that this conception of “capital cost” is taken into account by investors, it is somewhat opportunity cost of the investors, can also be called expected returns. Itcontains of risk-free rate of returns and risk rate of returns arising from the investors’ risk investment. It is different with financing cost in essence. Financing cost is the cost arising from enterprises’ financing activities and using fund, we can call it fund cost. If capital market is efficient, capital cost should equal to fund cost, that is to say, what investors gain in capital market should equal to what fund raisers pay, or the transfer of fund is inevitable. But in an inefficient capital ma rket, the price of stock will be different from its value because of investors’ action of speculation; they only chase capital ga in and don’t want to hold the stocks in a long time and receive dividends. Thus the listed companies can gain fund with its fund cost being lower than capital cost.But in our national capital market, capital cost of equity fund is very low; it is because of the following factors: first, the high P/E Ratio (Price Earning Ratio) of new issued shares. According to calculation, ave rage P/E Ratio of Chinese listed companies’ shares is between 30 and 40, it also is maintained at 20 although drops somewhat recently. But the normal P/E Ratio should be under 20 according to experience. We can observe the P/E was only 13.2 from 1874 to 1988 in US, and only 10 in Hong Kong. High P/E Ratio means high share issue price, then the capital cost of equity fund drops even given the same level of dividend. Second, low dividend policy in the listed companies, capital cost of equity fund decided by dividend pay-out ratio and price of per share. In China, many listed companies pay little or even no dividends to their shareholders. According to statistic data, there were 488 listed companies paid no dividend to their shareholders in 1998, 58.44 percents of all listed companies, there were 590, 59.83 percents in 1999, even 2000 in which China Securities Regulatory Commission issue new files to rule dividend policy of companies, there were only 699 companies which pay dividends, 18.47 percents more than that in 1999, but dividend payout ratio deduce 22%. Thus capital cost of equity is very low. Third, there is no rigidity on equity fund, if the listed companies choose equity fund, they can use the fund forever and has no obligation to return this fund. Most of listed companies are controlled by Government in China, taking financing risk into account, the major stockholders prefers to equity fund. The management also prefer equity fund because its lower fund cost and needn’t to be paid off, then their position will be more stable than financing in equity fund. We can conclude from the above analysis that cost of equity fund is lower than cost of debt fund in Chinese listed companies and the listed companies prefer to such low-cost fund.3. Types and qualities of assets in listed companies and preference to equity fundStatic Trade-off Theory tells us, the value of enterprise with financial leverage is decided by the value of self-owned capital; value arising from tax benefit, cost of financial embarrassment and agency cost. Cost of financial embarrassment and agency cost are negative correlative to the types and qualities of companies’ assets, if the enterprise has more intangible assets, more assets with lower quality, it will has lower liquidity and its assets have lower mortgage value. When this kind of enterprise faces to great financial risk, it will have no way to solve its questions by selling its assets. Furthermore, because care for the ability of turning into cash of the mortgage assets, the creditors will high the level of rate and lay additional items in financial contract to rule the debtor’s action, all of those will enhance the agency cost and deduce the companies’ value. Qualcomm is supplier of wireless data and communication service in America, it is the inventor and user of CDMA and it also occupies the technology of HDR. The market value of its share is 1120 billions dollars at the end of March, 2000, but the quantities of long-term liabilities is zero. Why? Some reasons may be that there are some competitors in the market who own analogoustechnologies and the management of Qualcomm Company takes conservative attitude in financing activities. But the most important factor may be Qualcomm Company owns a mass of intangible assets which will have lower convertibility and the company’s value will decline when it has no enough money to pay for its debt.Many listed companies in China are transformed from the national enterprises. In the transformation, these listed companies take over the high-quality assets of the national enterprises, but with the development of economy, some projects can not coincide with the market demand and the values of relative assets decline. On the other hand, there are many intangible assets in new high-tech companies. State-owned companies and high-tech companies are the most parts of the capital market. We can conclude that the qualities of listed companies’ assets are very low. This point is supported by the index of P/B (Price-to-Book value) which is usually thought as one of the most important indexes which can weigh the qualities of the listed companies’ assets. According to statistic data coming from Shenzhen Securities Information Company, by the end of November 14, 2003, there were 412 companies whose P/B is less than 2, take the 30% proportions of total listed companies which issue A-share in China, among them, there were 150 companies whose P/B is less than 1.53, and weighted average P/B of the stock market is 2.42. Lower qualities of assets means more cost may be brought out from debt fund and lower total value of the listed companies. Thus the listed companies prefer to equity fund when need outside financial support in China.4. Profitability and preference to equity fundFinancial Leverage Theory t ells us that a small change in company’s profit may make great change in company’s EPS (Earnings per share). Just like leverage, we can get an amplified action by use of it. Debt fund can supply us with this leverage, by use of debt fund, these companies which have high level of profitability will get higher level of EPS because debt fund produces more profit for shareholders than interest shareholder shall pay. On the contrary, these companies which have low level of profitability will get lower level of EPS by use of debt fund because debt fund can not produce enough profit for shareholder to fulfill the demand of paying off the interests. Edison International Company has steady amount of customers and many intangible assets, these supply it with high level of profitability and ability to gain debt fund, its debt account to 67.2% proportions of its total assets in 1999.Listed companies in developed countries or regions always have high level of profitability. Take US for example, there are many listed companies which have excellent performance in American capital market when do business, such as J.P Morgan, its EPS is $11.16 per share in 1999. Besides it, GM, GE, Coca Cola, IBM, Intel, Microsoft, Dell etc. all always are profitable. In Hong Kong, most of those companies whose stock included in Hang Sang Index have the level of EPS more than 1 HKD, many are more than 2 HKD. Such as Cheung Kong (Holdings) Limited, its EPS is 7.66 HKD. But listed companies do not have such excellent performance in profitability in China inland. Their profitability is common low. Take the performance of 2000 for example, the weighted average EPS of total listed companies is only 0.20 Yuan per share, and the weighted average P/B is 2.65 Yuan per share, 8.55 percents of these listed companies have negative profit. With low or no profit, the benefit nixes, listed companies’ preference to equity fund is a reasonable phenomenon. Can be gained from debt fund is very little; the listed companies can even suffer from the financial distre ss caused by debt fund. So with the consideration of shareholders’ interest, the listed companies prefer to equity fund when need outside financial support in China.5. Shareholding structure factors and preference to equity fundListed companies not only face to external financing environmental impacts, but also the structure of the companies shares. Shareholding structure of Chinese listed companies shows characteristics as followed: I. Ownership structure is fairly complex. In addition to the public shares, there are shares held with inland fund and foreign stocks, state-owned shares, legal person shares, and internal employee shares, transferred allotted shares, A shares, B shares, H shares And N shares, and other distinction. From 1995 to 2003, Chines e companies’ outstanding shares of the total equity share almost have no change, even declined slightly. II. There are different prices, dividends, and rights of shares issued by same enterprise. III. The over-concentration of shares. We use the quantity of shares of the three major shareholders who top the list of shareholders of the listed companies to measure the concentration of stock. We study he concentration of stock of these companies which issue new share publicly in the years from 1995 to 2003 and focus on the situation of Chinese listed companies over the same period. The results showed that: from 1995 to 2003, the company-Which once transferred or allotted shares-whose top three shareholders’ shareholding ratio are generally higher than the average level of all the listed companies, and most of these company's top three shareholders holding 40 percent or higher percent of companies’ shares. In some years, the maximum number even is more than 90 percent, indicating that the company with the implementation of transferred and allotted shares have relatively high concentration rate of shares and major shareholders have absolute control over it. In short, transferring allotting shares and the issuance of additional shares have a certain relevance to the company’s concentration of ownership structure; the company's financing policy is largely controlled by the major shareholders.Chinese listed companies’ special s hareholding structure effects its financing action. Because stockholders of the state-owned shares, legal person shares, social and outstanding shares, foreign share have a different objective function, their modes of financing preferences vary, and their preference affect the financing structure of listed companies. Controlling shareholders which hold state-owned shares account for the status of enterprises and carry out financing decisions in accordance with their own objective function. When the objective function conflict with the other shareholders benefit, they often damage the interests of other shareholders by use of the status of controlling. As the first major shareholders of the companies, government has multiple objectives, not always market-oriented, it prefers to use safe fund such as equity fund to maintain the value of state-owned assets, thus resulting in listed company’s preference to equity financing. Debt financing bring business with greater pressure to pay off the par value and interests. Therefore, the state-owned companies are showing a more offensive attitude to debt fund, again because of Chinese state-controlled listed companies have the absolute status in all listed company.From: International Journal of Business and Management; October, 2009.译文:中国上市公司偏好股权融资:非制度性因素摘要:本文把重点集中于中国上市公司的融资活动,运用西方融资理论,从非制度性因素方面,如融资成本、企业资产类型和质量、盈利能力、行业因素、股权结构因素、财务管理水平和社会文化,分析了中国上市公司倾向于股权融资的原因,并得出结论,股权融资偏好是上市公司根据中国融资环境的一种合理的选择。