债券和股票的定价

债券和股票估价的基本模型

债券和股票估价的基本模型

债券和股票的估价的基本模型主要包括以下几种:

1、债券估价的基本模型:

●平息债券模型:包含平价、折价和溢价。

其基本形式为:PV=I×(P/A,

i,n)+M×(P/F,i,n)。

其中,PV代表债券的价值,I代表票面利息,M代表到期的本金(债券面值),i代表折现率,n代表债券期数。

●纯贴现债券模型:折现发行模型为V=M×(P/F,i,n)。

一次还本

付息,单利计息模型为V=(M+M×i×n)×(P/F,i,n)。

●永久债券模型:永久债券的价值计算公式为PV=利息额/必要报酬

率。

●流通债券模型:先计算未来的现金流量折现到整数计息期,再折

现到估价时点。

2、股票估价的基本模型:

●固定增长股票模型:股利增长率固定不变,未来股利D1、D2、…、

Dn是呈等比关系。

●多阶段增长模型:假设股票未来股利的增长是变动的,通常采用

两阶段增长模型或多阶段增长模型。

请注意,以上模型的具体应用可能会因实际情况而有所不同。

在评估债券和股票的价值时,还需要考虑其他因素,如市场风险、公司的财务状况等。

5债券与股票定价

C

Div N 1 rg 2

.

5-25

一个不平稳增长的例子

一个普通股票支付股利$2,预计股利将以8%的速 度增长3年,然后以4%的速度持续增长下去。 这个股票值多少钱?

5-26

公式

C

T (1 g1 ) P 1 T N r g1 (1 r ) (1 r )

• 私人中介咨询机构(企业)计算违约风险和评估 信用等级。在公布评级之前,对借方收取一定量 的一次性费用。 (1) 穆迪 (2) 标准普尔

标准普尔

穆迪

描述

投资等级

AAA AA A BBB Aaa Aa A-1, A Baa 最高质量 高质量, 风险较最高等级债券高 中上等级, 存在可能恶化的因素 中等, 没有优异的投资特性

Div N 1 rg 2

$2 (1.08) (1.08) P 1 3 0.12 0.08 (1.12)

3

$2(1.08) (1.04) 0.12 0.04

3

(1.12)

3

P $54 1 0.8966

$2.16

$2.33

$2.52

0

1

$2.16 1.12

2

$2.33 (1.12)

2

3

P 3

$2.62 0.08

$32.75

P 0

$2.52 $32.75 (1.12)

$28.89

5-28

5.5 估计股利模型中的参数

800 0 0.01 0.02 0.03 0.04 0.05 0.06 0.07 6 3/8 0.08 0.09 0.1

公司理财(第八版)第5章 债券和股票的定价(1)解读

平息债券 (Level-Coupon Bonds)

• 债券利息在发行日和到期日之间进行有规律的定期支付,并且这 种定期支付在既定期间内保持不变,到期归还本金

平息债券

平息债券定价所需要的信息:

• 利息支付日期和到期时间 • 每期支付的利息 (C) 和面值 • 折现率

$C

0

$C

$C

$C $ F

T

• Using the formula:

• B = PV of annuity + PV of lump sum • B = 100[1 – 1/(1.11)5] / .11 + 1,000 / (1.11)5 • B = 369.59 + 593.45 = 963.04

7-8

Example 3

• Suppose you are reviewing a bond that has a 10% annual coupon and a face value of $1000. There are 20 years to maturity, and the yield to maturity is 8%. What is the price of this bond?

• Using the formula:

• B = PV of annuity + PV of lump sum • B = 100[1 – 1/(1.08)20] / .08 + 1000 / (1.08)20 • B = 981.81 + 214.55 = 1196.36

7-9

• 例题1中,债券以面值出售(sell at par) • 例题2中,债券以低于面值出售,被称为折价债券。 The bond sells for less than face value, it is called a discount bond.

股票与债券收益率的市场资产定价模型

股票与债券收益率的市场资产定价模型市场资产定价模型(Capital Asset Pricing Model,CAPM)是描述市场上证券收益率与系统风险之间关系的理论模型。

该模型是根据一定的假设和逻辑推导出来的,其核心思想是通过将证券收益率与市场组合的收益率进行比较来确定风险溢价。

一、市场资产定价模型的假设CAPM模型建立在以下几个假设的基础上:1. 市场是完全有效的:即市场上的证券价格是公正、准确的,反映了所有可得到的信息。

2. 投资者是理性的:投资者在做出投资决策时都是以期望收益最大化为目标,并期望面临的风险最小化。

3. 无风险利率存在:投资者可以无风险地借贷或存款,且利率稳定不变。

4. 投资者可以在全球范围内无限制地进行资本市场的交易。

5. 投资者在投资组合选择时只考虑风险和收益两个方面,不关心具体的投资项目。

二、市场资产定价模型的公式根据CAPM模型,股票和债券的预期收益率可以通过以下公式计算:E(Ri) = Rf + βi * (E(Rm) - Rf)其中,E(Ri)表示证券i的预期收益率,Rf表示无风险利率,βi表示证券i的β值,E(Rm)表示市场组合的预期收益率。

三、股票与债券收益率的市场资产定价模型股票和债券的市场资产定价模型具体应用时有所不同。

1. 股票的市场资产定价模型对于股票而言,其β值可以通过对历史数据的回归分析得到。

根据CAPM模型的公式,股票的预期收益率等于无风险利率加上股票的β值乘以市场组合的预期收益率与无风险利率之差。

2. 债券的市场资产定价模型对于债券而言,CAPM模型的应用略有不同。

由于债券的收益率主要受到到期收益率的影响,因此债券的市场资产定价模型更多地使用了期望到期收益率模型(Expected Yield to Maturity Model)。

四、市场资产定价模型的局限性尽管市场资产定价模型在理论上是一个重要的工具,但也存在一定的局限性。

1. 假设的缺陷:CAPM模型的逻辑推理建立在一系列假设的基础上,而这些假设在现实市场中并不完全成立。

债券与股票的定价基础知识(ppt 23页)

分段增长模型

• 假设股利先以一个比例增长一个有限时段,然后再 以另一个比例无限增长

DivT 1

P0

T t 1

Div1(1 g1)t (1 r)t

r g2 (1 r)T

例3-3:股票定价

• 北方公司是一家网络开发公司,正处于高速增长期 ,销售额以每年80%的速度增长,预期股利在未来5 年内可以25%的速度增长,此后,股利将保持在5% 的水平。该股票昨天刚发放股利,每股0.75美元,该 股票的必要收益率为22%。北方公司的股票值多少 ?

:新创办的企业通常有一个高的增长率,然后,保 持在一个较低的增长水平上。 • 公司的增长依赖于公司的不断开拓和进取。

零增长模型

• 假设股利保持不变,即,D1 = D2 =…=Dt • 由于未来的股利永远不变,所以,利用永续年金公

式有: Pt = Dt+1 / r

持续增长模型

• 假设股利以一个不变的比例g持续增长, D1 = D0 x (1+g) D2 = D1 x (1+g), etc., etc.. and Dt = D0 x (1+g)t

第三章 债券与股票的定价

• 债券定价 • 债券定价:五个重要关系 • 普通股的定价:股利折现模型 • 股利折现模型参数的确定 • 增长机会:股票定价的另一种思路 • 市盈率

价值的含义

• 帐面价值:资产负债表上所列示的资产的价值。 • 市场价值:指资产在交易市场上的价格 • 内在价值:又称经济价值,用适当的贴现率贴现资

纯贴现债券

• 计算纯贴现债券所需知道的变量 到期日 (T) 面值 (F) 贴现率(r)

债券与股票的定价策略

Valuation of Bonds and Stock

• First Principles:

– Value of financial securities = PV of expected future cash flows

• To value bonds and stocks we need to:

presented by the security.

5.1 Definition and Example of a Bond

• A bond is a legally binding agreement between a borrower and a lender:

– Specifies the principal amount of the loan.

–

Since the coupon rate is 6 3/8 the payment is

$31.875.

–

On January 1, 2002 the size and timing of cash

flows are:

5.2 How to Value Bonds

• Identify the size and timing of cash flows. • Discount at the correct discount rate.

• To value a Differential Growth Stock, we need to:

–

Estimate future dividends in the foreseeable

future.

–

Estimate the future stock price when the stock

第5章 债券和股票的定价

第5章债券和股票的定价1.息票利率债券发行商如何为所要发行的债券确定合适的息票率?债券的息票率与其必要报酬率之间有什么差别?解:息票率→票面利率(在定价公式的分子上)必要报酬率→市场利率(在定价公式的分母上)债券发行商一般参考已发行并具有相似期限和风险的债券来确定合适的息票率。

这类债券的收益率可以用来确定息票率,特别是所要发行债券以同样价格销售的时候。

债券发行者也会简单地询问潜在买家息票率定在什么价位可以吸引他们。

息票率是固定的,并且决定了债券所需支付的利息。

必要报酬率是投资者所要求的收益率,它是随时间而波动的。

只有当债券以面值销售时,息票率与必要报酬率才会相等。

2.债券市场在债券市场上,对于债券投资者而言,缺乏透明度意味着什么?解:缺乏透明度意味着风险较大,那么要求的必要报酬率就较高,愿意支付的价格就较低。

缺乏透明度意味着买家和卖家看不到最近的交易记录,所以在任何时间点,他们都很难判断最好的价格是什么。

3.股票估价为什么股票的价值取决于股利?解:任何一项金融资产的价格都是由它未来现金流(也就是投资者实际将要收到的现金流)的现值决定的,而股票的现金流就是股息,因此股票的价值取决于股利。

4.股票估价在纽约证券交易市场与纳斯达克上登记的相当一部分公司并不支付股利,但投资者还是有意愿购买他们的股票。

在你回答第3个问题后,思考为什么会这样?解:因为投资者相信公司有发展潜力,今后将有机会增值。

许多公司选择不支付股利,而依旧有投资者愿意购买他们的股票,这是因为理性的投资者相信他们在将来的某个时候会得到股利或是其他一些类似的收益,就算公司被并购时,他们也会得到相应现金或股份。

5.股利政策参照第3与第4个问题,思考在什么情况下,一家公司可能会选择不支付股利。

解:一家公司在拥有很多NPV为正值的投资机会时可能会选择不支付股利。

一般而言,缺乏现金的公司常常选择不支付股利,因为股利是一项现金支出。

正在成长中并拥有许多好的增长机会的新公司就是其中之一,另外一个例子就是财务困难的公司。

ch5 债券和股票定价

例子

3

利率为10%,面值为1,000,000, 到期的零息债券,其现值为:

20年

大约占面值的15%

平息债券

4

发行日和到期日之间进行有规律的定期支 付,每年得到价值为C 的年金

C是债券的票面利息,面值F=1000美元

使用年金现值公式

5

例子

6

假设现在是2006年11月,我们分析美国 的政府债券。我们在《华尔街日报》看到 2010年11月和一些“13s”的字样——这 表示年利率为13% 如果面值为1000美元,利息在每年的5月 和11月各支付一次,即每六个月支付65 美元 面值将于现在开始的4年后,即2010年11 月得到支付

累计选举法中,掌握公司多数股票的人不 能完全控制投票结果 多数选举法中,掌握公司多数股票的人可 以完全控制投票结果

例子

某公司的股东要为董事会选举出3位新董 事。目前,公司发行在外普通股股数为 2 000 000股,股价为每股5$。 如果公司采用累计投票制进行选举,那么 某个候选人要把自己选举成新董事,必须 的投票权所对应的股票价格是多少?

5.7.1 股利增长模型

41

第一期股利为Div1=0.4*10美元=4美元 留存收益比率为0.6(=1-0.4) 根据公司增长率公式,g=留存收益比率× 留存收益的回报率 g=0.6×0.2=0.12 运用股利增长模型公式,每股的价格为:

Div1 4 100 r g 0.16 0.12

如果一家公司将所有盈利都支付给投资者, 且每股盈利恒定,则有 EPS=Div EPS是每股盈利,Div是股利。这种类型 的公司经常称为“现金牛” 现金牛类型的公司股票价格:

债券与股票的定价策略(英文版)(ppt 39页)

$31.875 $31.875 $31.875

1/1/02 6/30/02 12/31/02 6/30/09

$1,031.875

12/31/09

Level-Coupon Bonds: Example Find the present value (as of January 1, 2002), of a 6-3/8 coupon T-bond with semi-annual payments, and a maturity date of December 2009 if the YTM is 5-percent.

$0

0

1

$0

$0

2

29

$1,000

$0$$1,00 1023209

30

PV (1 Fr)T($ 11 .0 ,0)6 3000$17.141

Level-Coupon Bonds Information needed to value level-coupon bonds: • Coupon payment dates and time to maturity (T) • Coupon payment (C) per period and Face value (F) • Discount rate

• Identify the size and timing of cash flows. • Discount at the correct discount rate.

• If you know the price of a bond and the size and timing of cash flows, the yield to maturity is the discount rate.

资产定价计算公式

资产定价计算公式

资产定价计算公式可以有多种,根据不同的资产类型和市场条件可能会使用不同的公式。

以下是一些常见的资产定价计算公式:

1. 股票定价:

- 常见的股票定价模型有股利折现模型(Dividend Discount Model, DDM),如Gordon Growth Model.

- 公式:股票价格 = 预期股利 / (折现率 - 成长率)

2. 债券定价:

- 债券的定价通常使用现金流折现模型(Discounted Cash Flow, DCF)。

- 公式:债券价格 = 可交换现金流的现值之和

3. 衍生品定价:

- 期权定价通常使用布莱克-斯科尔斯期权定价模型(Black-Scholes Options Pricing Model)。

- 公式:期权价格 = 标的资产价格 * N(d1) - 行权价 * e^(-r * t) * N(d2)

- 其中,d1 = (ln(S/K) + (r + (σ^2)/2)*t) / (σ * √t),d2 = d1 - σ * √t

- S:标的资产价格,K:行权价,r:无风险利率,σ:标的资产的波动率,t:期权到期时间

这些只是一些常见的资产定价计算公式,实际上,还有其他的

模型和方法可以用来进行资产定价。

需要根据具体情况选择合适的模型和公式进行计算。

债券和股票的价值公式一样吗

债券和股票的价值公式一样吗

债券和股票的价值公式并不一样。

债券的价值公式可以通过利用现金流量折现的方法来计算。

这种方法假设债券持有至到期,并假设债券的现金流为确定的利息和本金支付。

债券的价值公式可以表示为:

V = C/(1+r)^1 + C/(1+r)^2 + ... + C/(1+r)^n + F/(1+r)^n

其中,V是债券的价值,C是每期的利息支付,r是市场或折

现率,n是债券的期数,F是债券到期时的本金。

股票的价值公式则更加复杂,因为股票没有固定的现金流量和固定到期时间。

股票的价值公式可以通过利用贴现现金流量模型、股息折现模型或者基本面分析来进行估计。

一些常见的股票定价公式包括股票的贴现现金流量模型(DCF)、股息折现模型(DDM)和股票的市盈率模型(P/E)等。

在股票市场中,股票的价值通常是通过对公司未来现金流量的估计来确定的。

这包括对公司未来的盈利能力、市场份额和竞争优势等因素的分析和评估。

股票的价值也可以通过与其他类似公司的比较和行业平均值的比较来确定。

综上所述,债券和股票的价值公式并不一样。

债券的价值可以通过现金流折现的方法来计算,而股票的价值则需要考虑公司未来现金流量和市场情况等因素进行估计。

债券和股票的定价

债券和股票的定价债券和股票是金融市场上常见的两种投资工具。

债券是一种债权凭证,代表了投资者借给发行者一定金额的资金,并约定一定期限内支付利息。

股票则代表了投资者购买一家公司的部分所有权,投资者通过持有股票可以分享公司盈利和投票权利。

债券和股票的定价有一些共同的因素,但也有一些重要的区别。

首先来看债券的定价,债券的价格主要受到以下几个因素的影响:1.票面利率:债券发行时确定的年利率,也称为票面利率。

票面利率越高,债券的价格越高。

2.市场利率:市场利率是债券定价中最为关键的因素之一。

当市场利率上升时,意味着投资者可以通过购买其他债券获得更高的回报率,从而使现有债券的价格下降。

相反,市场利率下降将推高债券价格。

3.债券期限:债券的到期日越远,风险越大,因此价格通常会较低。

短期债券则相对价格较高。

4.发行人信用评级:债券发行人的信用评级也会对债券的价格产生影响。

高信用评级的发行人会吸引更多投资者购买其债券,从而提高价格。

相反,低信用评级会降低债券的价格。

在股票的定价中,以下几个因素是最重要的:1.公司盈利:股票价格与公司盈利之间存在着紧密的联系。

如果一家公司的盈利增长稳定且预期良好,股票价格通常会上涨。

相反,如果一家公司的盈利下降或者表现不佳,股票价格则可能下降。

2.市场情绪:投资者的情绪和市场预期也会对股票价格产生影响。

如果市场情绪乐观,投资者会更倾向于购买股票,从而推高价格。

相反,如果市场情绪悲观,投资者则可能抛售股票,导致价格下降。

3.行业前景:行业前景对于股票定价也非常重要。

如果一个行业的前景看好,投资者会对该行业的股票更感兴趣,价格会相应上涨。

相反,如果一个行业的前景不佳,股票价格则可能下跌。

总体而言,债券和股票的定价虽然受到许多因素的影响,但市场利率、公司盈利和市场情绪对于两者的定价影响最为明显。

投资者在进行债券或股票投资时,应该考虑这些因素以实现最佳的投资回报。

债券和股票是投资者在金融市场中常见的两种投资工具,它们有着不同的特点和定价机制。

金融市场与资产定价股票与债券定价模型

金融市场与资产定价股票与债券定价模型金融市场与资产定价股票与债券定价模型在金融市场中,资产定价是一个重要的问题。

股票和债券是两种常见的金融工具,在进行资产定价时,需要使用相应的定价模型。

本文将介绍股票和债券的定价模型,并探讨它们在金融市场中的应用。

一、股票定价模型股票的定价模型主要有两种:股利折现模型和资本资产定价模型(CAPM)。

1. 股利折现模型股利折现模型是最常用的股票定价模型之一。

这个模型基于股票的现金流量,假设股票的价格等于未来股利的现值之和。

股利折现模型的公式为:P0 = D1/(1+r) + D2/(1+r)^2 + ... + Dn/(1+r)^n其中,P0为股票的价格,D为未来的股利,r为期望收益率。

通过计算未来的股利,结合期望收益率,可以得出股票的合理价格。

2. 资本资产定价模型(CAPM)CAPM是一种衡量风险与收益之间关系的模型。

它认为,投资者的回报应该与风险有关,在衡量风险时考虑市场的整体风险水平。

CAPM的公式为:ri = rf + βi × (rm - rf)其中,ri为股票的期望回报率,rf为无风险回报率,βi为股票的系统性风险,rm为市场的期望回报率。

通过计算股票的期望回报率,可以得出股票的合理价格。

二、债券定价模型债券的定价模型主要有两种:名义利率模型和期限结构理论。

1. 名义利率模型名义利率模型基于债券的现金流量,假设债券的价格等于未来现金流量的现值之和。

名义利率模型的公式为:P0 = C/(1+r) + C/(1+r)^2 + ... + (C+M)/(1+r)^n其中,P0为债券的价格,C为每期的利息支付,M为到期时的本金,r为期望收益率。

通过计算债券的现金流量,结合期望收益率,可以得出债券的合理价格。

2. 期限结构理论期限结构理论认为,不同期限的债券之间存在利率互换的关系。

债券的定价与债券的期限息息相关。

期限结构理论的公式为:r = r* + IP + RP其中,r为债券的收益率,r*为无风险利率,IP为利差溢价,RP为剩余期限溢价。

《股票与债券》PPT课件

可整理ppt

13

三、债券定价

(一)债券定价的基本方法

无论任何债券的定价,都需要预测该债券的未来现金流量和采用的贴现率。

P 1 C k 1 C k 2 1 C k 3 ... C 1 k M n t n 11 C k t 1 M k n

P-债券价格,C-每期利息收入,M-到期本金收入,k-要求的回报率,

可整理ppt

12

5.按发行方式分类 按照是否公开发行,债券可分为公募债券和私募债券。 6.按有无抵押担保分类 债券根据其有无抵押担保,可以分为信用债券和担保债券。 7.按是否记名分类 根据在券面上是否记名的不同情况,可以将债券分为记名债券和无记名债券。 8.按发行时间分类 根据债券发行时间的先后,可以分为新发债券和既发债券。 9. 按是否可转换分类 按是否可转换来区分,债券又可分为可转换债券与不可转换债券。

可整理ppt

3

(二)比较法 也称市场比较法,是通过将评估对象与类似的企业、企业所有者权益及 有价证券的市场售价进行对比,从而确定企业价值、企业所有者权益价 值以及有价证券价值的通用性评估方法。目前市场比较法是土地、房地 产最重要的评估方法。

三、资产类别与资产定价

(一)无形资产定价 (二)实物资产定价 (三)金融资产定价

如果年市场利率为6%,则债券价值为

P t 6 1 ( 1 0 4 3 % t0 ( 1 1 ) 3 % 0 6 0 4 0 ) 1 0 0 1 1 .0 1 1 1 3 .0 1 .0 6 3 3 1 1 0 0 .1 0 6 1 0 9 .7 27 2 76

从上面计算可以看出,当市场利率与票面利率相同时,债券按面值发行;当 市场利率大于票面利率时,债券要折价发行;当市场利率小于票面利率时, 债券按溢价发行。

股票和债券的定价

折现率(k):

✓是经过风险调整后的收益率, 可把预期收益率作为折现率, 而预期收益率可从SML求得。

即: K=

1、永久持有的股票评价模式

2、有限持有期的股票评价模式

• 其中, • 所以,

二、股利固定增长股价模型 ——不变增长模型

例1:某公司股票初期的股息为1.8美元/每股。经预

测该公司股票未来股息增长率永久性的保持在5%的 水平,假定贴现率为11%。那么,求该公司股票的 内在价值?

二、贴现债券的估价模型

➢ 贴现债券,又称零息票债券,面值是投资者未来惟一 的现金流。

➢例2:假定某种贴现债券的面值为$100万,期限为

20年,利率为10%,那么它的内在价值为:

(万美元) 换言之,该贴现债券的内在价值仅为其面值的15%左右。

三、附息债券的估价模型

➢ 投资者的未来现金流包括了两部分,本金与利息。 其内在价值公式如下:

➢ 解:有关数据见下表—5

(年)

二、马考勒久性定理

三、马考勒久性与债券价格的关系 ∵ ∴ ∵ ∴

• 当收益率采用一年计一次复利的形式时,常用修正 的久性(D*)来代替久性(D)。

定义:

则:

近似, 因此,债券的新价格为 :

四、持续期的应用:资产负债管理——组合免疫

• 在瑞定顿(F.M.Redington)的免疫策略中,风险管理者只需 构造合理的投资组合,使得组合的持续期等于零,或者使得 资产的持续期等于负债的持续期。

股票和债券的定价

2024年2月4日星期日

•学习要点: •1、收益法在股票定价和债券定价中的运用。

•2、债券久期的确定及其应用。

第一节 股票价值的确定 一、收益法的一般形式

按照某一折现率把发行公司未来各期盈余或 股东未来可以收到的现金股利折现成现值,用 该现值作为普通股的内在价值量。

- 1、下载文档前请自行甄别文档内容的完整性,平台不提供额外的编辑、内容补充、找答案等附加服务。

- 2、"仅部分预览"的文档,不可在线预览部分如存在完整性等问题,可反馈申请退款(可完整预览的文档不适用该条件!)。

- 3、如文档侵犯您的权益,请联系客服反馈,我们会尽快为您处理(人工客服工作时间:9:00-18:30)。

5-3

5.1 Definition and Example of a Bond

• Consider a U.S. government bond listed as 6 3/8 of December 2009.

– The Par Value of the bond is $1,000. – Coupon payments are made semi-annually (June 30 and December 31 for this particular bond). – Since the coupon rate is 6 3/8 the payment is $31.875. – On January 1, 2002 the size and timing of cash flows are:

• The rate should be appropriate to the risk presented by the security.

McGraw-Hill/Irwin

Copyright © 2002 by The McGraw-Hill Companies, Inc. All rights reserved.

F PV T (1 r )

McGraw-Hill/Irwin

Copyright © 2002 by The McGraw-Hill Companies, Inc. All Байду номын сангаасights reserved.

5-6

Pure Discount Bonds: Example

Find the value of a 30-year zero-coupon bond with a $1,000 par value and a YTM of 6%.

5-2

5.1 Definition and Example of a Bond

• A bond is a legally binding agreement between a borrower and a lender: – Specifies the principal amount of the loan. – Specifies the size and timing of the cash flows:

• In dollar terms (fixed-rate borrowing) • As a formula (adjustable-rate borrowing)

McGraw-Hill/Irwin

Copyright © 2002 by The McGraw-Hill Companies, Inc. All rights reserved.

5-4

5.2 How to Value Bonds

• Identify the size and timing of cash flows. • Discount at the correct discount rate.

– If you know the price of a bond and the size and timing of cash flows, the yield to maturity is the discount rate.

$31.875 $31.875

$31.875

$1,031.875

12 / 31 / 09

1 / 1 / 02 6 / 30 / 02

12 / 31 / 02

6 / 30 / 09

McGraw-Hill/Irwin

Copyright © 2002 by The McGraw-Hill Companies, Inc. All rights reserved.

• To value bonds and stocks we need to:

– Estimate future cash flows:

• Size (how much) and • Timing (when)

– Discount future cash flows at an appropriate rate:

McGraw-Hill/Irwin

Copyright © 2002 by The McGraw-Hill Companies, Inc. All rights reserved.

5-1

Valuation of Bonds and Stock

• First Principles:

– Value of financial securities = PV of expected future cash flows

5-0

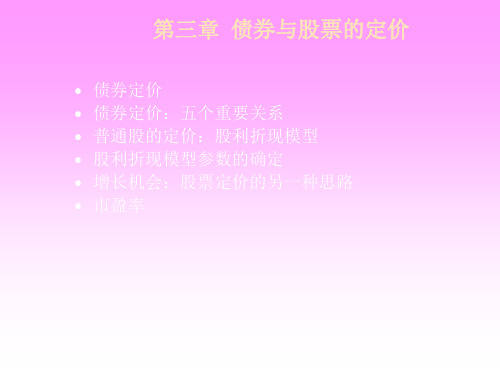

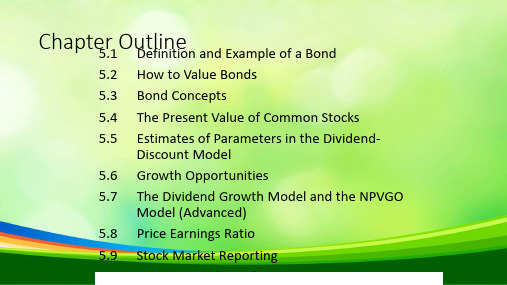

Chapter Outline

5.1 5.2 5.3 5.4 5.5 Definition and Example of a Bond How to Value Bonds Bond Concepts The Present Value of Common Stocks Estimates of Parameters in the DividendDiscount Model 5.6 Growth Opportunities 5.7 The Dividend Growth Model and the NPVGO Model (Advanced) 5.8 Price Earnings Ratio 5.9 Stock Market Reporting 5.10 Summary and Conclusions

McGraw-Hill/Irwin

Copyright © 2002 by The McGraw-Hill Companies, Inc. All rights reserved.

5-5

Pure Discount Bonds

Information needed for valuing pure discount bonds:

– Time to maturity (T) = Maturity date - today’s date – Face value (F) – Discount rate (r)

$0

0

$0

$0

$F

T

1

2

T 1

Present value of a pure discount bond at time 0: