The_economist_[经济学人2013-7]PC时代结束之后-After the personal computer

economist经济学人

BusinessThe future of the FirmMcKinsey looks set to stay top of the heap in management consultingIT IS one of the engines of global capitalism. Not only does McKinsey provide advice to most of the world's leading companies. It also pioneered the idea that business is a profession rather than a mere trade—and a profession that thrives on raw brainpower more than specialist industry knowledge or plain old common sense. Yet McKinsey's name has suffered a succession of blows in the past 15 years.The Firm, as it calls itself, was deeply involved in the Enron debacle: the energy company's boss, Jeff Skilling, was a McKinsey veteran who praised the consultancy for doing God's work, and the McKinsey Quarterly published articles on Enron as enthusiastically as Hello! runs pieces about the Beckhams. In 2010 Anil Kumar, a McKinsey consultant, admitted passing inside information to Raj Rajaratnam of Galleon, a hedge fund. Last year Rajat Gupta, a former McKinsey managing partner, was also convicted of passing inside information to Mr Rajaratnam.Life is getting tougher for professional-services firms. Midsized consultancies are already suffering: Monitor Group went bankrupt last year—Deloitte later bought it for120m—and Booz & Co and Roland Berger are agonising about their futures. If the legal profession is anything to go by, worse is to come: Dewey & LeBoeuf collapsed last year after borrowing heavily in a dash for growth, and other elite law firms are struggling to win business.So, are McKinsey's best days behind it? Two new publications offer some interesting answers. The Firm, by Duff McDonald, is a generally admiring book that nevertheless asks hard questions about the organisation's future. Consulting on the Cusp of Disruption, by Clayton Christensen and two colleagues, is a penetrating article in the October Harvard Business Review, arguing that the comfortable world of the strategy consultancies is about to be turned upside down.McKinsey's success depends above all on an unimpeachable reputation for integrity. It cannot continue to serve most of the world's leading companies if its consultants are willing to spill secrets. Mr McDonald argues that the firm's size makes it impossible to avoid repeats of the Kumar problem. It is now a giant factory with 1,200 consultants rather than the cosy club of old. The firm has to keep growing, not least to provide itspartners with the 1.5mor so a year that they earn. But every time it grows it puts its most important asset at risk.McKinsey's success also depends on its ability to remain at the cutting edge of business. But in recent years it has seemed to be on the wrong cutting edge. Mr McDonald points out that whereas McKinsey has led the financialisation of basic industries such as oil and gas, it has had little if any role in shaping the giants of the internet economy, such as Apple and Google.The new lords of business are engineers in hoodies, not MBAs in pinstripes. Mr Christensen focuses on a bigger subject: how the forces that have disrupted so many other businesses, from steel to publishing, are disrupting consulting.The big three strategy consultants—the other two are the Boston Consulting Group and Bain—are masters of opacity. But Mr Christensen argues that light is being let in on the magic. Companies are getting better at measuring results and demanding value for money. They also have access to more business expertise than ever before: the big three have more than 50,000 living alumni.The big three have been masters at bundling lots of different services into a single, high-priced package. But clients no longer want to pay fat fees for a bit of strategic advice from a senior partner and a lot of humdrum work from neophytes. Mr Christensen says low-priced competitors are beginning to dismember the consultants' business. Eden McCallum cuts costs by deploying freelancers, most of whom once worked for the big three. BeyondCore replaces overpriced junior analysts with Big Data, crunching vast amounts of information to identify trends. McKinsey clearly faces a more difficult market than it is used to.But it has overcome serious challenges before—such as in the 1980s, when it lost the intellectual high ground to BCG and then Bain before regaining it. The firm is fixing some of the problems from the Gupta era. It has elected two successive managing directors, Ian Davis and Dominic Barton, who have worked hard to restore its professional ethos. Mr Barton urges companies to embrace long-term capitalism rather than quarterly capitalism and corporate responsibility rather than financial engineering: the very opposite of the Enron-era McKinsey's gospel.Old boys everywhereMcKinsey also has two huge assets: talent and knowledge. It retains an unrivalled ability to recruit hundreds of clever young people and turn them into an army ofproblem-solving worker ants. It also has an enviable network of alumni, many of whom are happy to hire their old employer: in 2011 more than 150 ex-McKinseyites were running companies with more than 1 billion in annual sales.The firm has also invested heavily in knowledge for decades: perhaps no other organisation has as much interesting data on global capitalism. Though lesser firms may be facing disruption, McKinsey dispenses a special sort of consultorial fairy-dust that is hard to replicate, and as much in demand as ever. The global ruling class is seized with a toxic combination of status-obsession and status-insecurity. Decision-makers also fear being swept away by one of Mr Christensen's disruptive forces. They seek constant reassurance and reaffirmation from prestigious institutions. McKinsey knows better than almost anyone how to exploit this peculiar mindset. That will guarantee the Firm a solid future, even if no one can prove that its advice actually does any good.BusinessCommercial aircraftBombardier lights a fuseCanada's new passenger jet threatens an old duopolySINCE the late 1990s airlines wanting to buy short-to-medium-haul narrowbody planes with 100-200 seats have had little choice but to pick either Boeing's 737 or Airbus's A320. As orders for such planes have boomed in recent years, aircraft-makers in China, Russia and Canada have been working on new contenders to break this American-European duopoly.On September 16th Canada's Bombardier got there first, launching the maiden flight of its CSeries plane. Bombardier is duelling the duopolists because the prospects for the planes it already makes—regional jets of under 100 seats and corporate jets—are not as juicy as those for mainstream commercial airliners.Global passenger traffic is set to grow by 5% a year for the next two decades, reckons Boeing, and airlines are seeking ones that seat 100-200 to fill much of the new demand. In regional jets Bombardier has enjoyed a near-duopoly of its own, with Embraer of Brazil. But Japanese, Russian and Chinese rivals are moving in to the market just as operators of regional jets are going for bigger planes.Corporate jets and their owners took a knock in the financial crisis, and their prospects still look weak. Although lots of new metro systems are being built worldwide, Bombardier's other main business, building trains does not look so strong. Abouttwo-thirds of the division's revenues come from Europe, where trains are largely bought with public purses drained by faltering economies.Bombardier is trying to slip in under the radar, not competing head-on with its rivals. The first two versions of the CSeries will have only 100-150 seats, whereas most 737s and A320s sold are 150-200 seaters. However, Bombardier hopes airlines will be attracted by its plane's low fuel consumption—20% less than its rivals',it claims—and 15% lower running costs.Much of that advantage comes from a new engine, the geared turbofan, made by Pratt & Whitney, an American firm. So far, though, airlines have held back and waited to see how the CSeries flies. Only 177 firm orders have been placed as yet.Some analysts wonder if starting out at the bottom end of the range was a good idea: Darryl Genovesi of UBS, a bank, reckons that there are 5,000 jets of 90-150 seats in operation and that only 2,000 are likely to be replaced over the next five to ten years, with another 1,000 on the borderline. Furthermore, Boeing and Airbus are not giving up without a dogfight.Both are working on completely new narrowbodies, to be launched in a decade or so, and in the mean time their existing models are being upgraded. The 737 MAX andA320neo, out in a couple of years, will get improved engines, narrowing the efficiency gap with the CSeries. Indeed, buyers of the A320neo will be able to choose the geared turbofan.And as Zafar Khan of Societe Generale, a bank, notes, the CSeries is a new airframe and a new engine, a double risk. No doubt Boeing and Airbus have been pointing this out to customers, as well as offering attractive prices to deter airlines from taking a punt on the CSeries. Both are bound to worry that Bombardier will add a larger model carrying up to 200 passengers. Such concerns would intensify if Bombardier makes progress on its partnership with COMAC, a Chinese state firm strongly backed by its home government, which is also building a narrowbody plane.The market for the current CSeries models may be only around 100 planes a year. That may not deliver a decent return on its 4 billion development costs. But it will keep Bombardier in the skies, circling for a more vigorous counter-attack on the duopoly.BusinessSelling art onlineEnter AmazonThe internet giant's fine-art venture is unlikely to sell many masterpieces WITH a mouse click you can add Norman Rockwell's Willie Gillis: Package from Home to your Amazon shopping cart. But you will need boldness and a bulging bank account to proceed to checkout: it costs 4.85m.The oil painting went on sale in August, when Amazon splashily announced that it would add fine art to earth's biggest selection of consumables. But it will not be easy to sell art alongside books and barbecues. Amazon's arty initiative is not revolutionary. Hundreds of dealers already sell art online, swarming into every niche and bristling with gimmicks.Sedition sells digital works, some by famous artists. Artsy figures out buyers' tastes from their browsing activity. Artnet, the self-proclaimed market leader, auctioned15m-worth of art last year and provides online exhibition space to 1,700 galleries. Christie's and Sotheby's, the best-known auction houses, have long accepted online bids as an extension of their traditional sales. So far, all this has made little impression.Online art sales were 870m in 2012, less than 2% of the 56 billion global art market, according to a report published by Hiscox, an insurer. Assuming that art will progress online at the same rate as luxury goods, the report predicts that sales will more than double to 2.1 billion by 2017. Even then, online's share will still be modest.Pure online art sales, in which anyone can buy and deals are struck on a website, happen mainly on the blurry boundaries between art, craft and mass production. Jonas Almgren, the boss of London-based Artfinder, sees his site as a painterly version of Etsy, a successful American portal for selling handmade wares. Both cater to a popular craving for one-of-a-kind goods. Artspace sells mainly limited-edition prints and photographs.The lower end of the art market will largely shift online, predicts Skate's, anart-market research firm. Higher up, things get more complicated. Artists yearn to exhibit in real galleries; collectors want to experience first-hand a work's scale and texture. In the secondary market the spectre of forgery makes them wary of dealing with virtual vendors.When the price of an artwork tops 5,000, you want a relationship with a client, says Steve Lazarides, a specialist in urban art who runs both physical galleries and an online shop. The priciest bargains are struck between dealers and coteries of collectors they know well. The terms are almost always secret.With living artists, relationships matter even more. Dealers are expected to nurture their careers, which means managing prices, too. It is an unwritten law that they must never fall, says Friederike Hauffe, who teaches a course in art marketing atBerlin's Free University. Some dealers discourage collectors from selling the work of an artist they represent; if one comes up for auction they might bid up prices. To fail to sell an item at auction is to burn it.That does not mean that online marketing plays no role at the top end. Swanky galleries have long e-mailed images to potential buyers. Many exhibit art online to attract global interest but conduct transactions in cosier settings.Nearly four-fifths of galleries insist on some direct contact with buyers, according to the Hiscox report. Most online sales above 100,000 happen via the electronic bidding channels of auction houses such as Christie's. But this may be changing. The prices collectors are willing to pay online are creeping up. Friendships with dealers are beginning to seem less vital.Christie's launched online-only sales in 2011 with an auction of Elizabeth Taylor memorabilia. Saatchi Online thrusts itself into the heart of the new-art nexus: it represents artists directly, bypassing galleries, and is happy to sell to all kinds of people, says its chief curator, Rebecca Wilson.Amazon is not in the business of managing artists' careers. You can buy a Jeff Koons print on the site for 33,750 but are unlikely to find his giant steel Tulips. Mr Almgren thinks Amazon will struggle to sell even more modest works. There is an enormous mismatch between Amazon's utilitarian website and the inspirational approach you need to sell art, he thinks. Perhaps that is why, as late as September 18th, Willie Gillis was still for sale.E commerceTencent's worthA Chinese internet firm finds a better way to make moneyIS TENCENT one of the world's greatest internet firms? There are grounds for scepticism. The Chinese gaming and social media firm started in the same way many local internet firms have: by copying Western success. QQ, its instant messaging service, was a clone of ICQ, an Israeli invention acquired by AOL of America. And unlike global internet giants such as Google and Twitter, Tencent still makes its money in its protected home market.Yet the Chinese firm's stockmarket valuation briefly crossed the $100 billion mark this week for the first time. Given that the valuation of Facebook, the world's leading social media firm, itself crossed that threshold only a few weeks ago, it is reasonable to wonder whether Tencent is worth so much. However, Tencent now has bigger revenues and profits than Facebook. In the first half of this year Tencent enjoyed revenues of $4.5 billion and gross profits of $2.5 billion, whereas Facebook saw revenues of $3.3 billion and gross profits of $935m.The Chinese firm's market value reflects the phenomenal rise in its share price. A study out this week from the Boston Consulting Group found that Tencent had the highest shareholder total return( share price appreciation plus dividends) of any large firm globally from 2008 to 2012 -topping Amazon and even Apple.Tencent has created a better business model than its Western peers. Many internet firms build a customer base by giving things away, be they search results or social networking tools. They then seek to monetise their users, usually turning to online advertising. Google is a glorious example. Other firms try to make e commerce work. But as the case of revenue rich but profit poor Amazon suggests, this can also be a hard slog.Tencent does give its services away: QQ is used by 800m people, and its WeChat social networking app( which initially resembled's America WhatsApp) has several hundred million users. What makes it different from Western rivals is the way it uses these to peddle online games and other revenue raising offerings.Once users are hooked on a popular game, Tencent then persuades them to pay for" value added services" such as fancy weapons, snazzy costumes for their avatars and online VIP rooms. Whereas its peers are still making most of their money from advertising, Fathom China, a research firm, reckons Tencent gets 80% of its revenues from suchkit( see chart).This year China has overtaken America to become the world's biggest e commerce market, in terms of sales. It is also now the biggest market for smartphones. This means it may soon have the world's dominant market in" m commerce", purchases on mobile devices.Tencent's main rivals in Chinese m commerce are Baidu, which dominates search on desktop computers( helped by the government's suppression of Google) and Alibaba, an e commerce giant now preparing for a huge share offering. All three have gone on acquisition sprees, in an attempt to lead the market. The big worry for investors is the cost of this arms race.Alibaba recently invested $300m in AutoNavi, an online mapping firm, and nearly $600m in Sina Weibo, China's equivalent of Twitter. Baidu has been even more ambitious, spending $1.85 billion to buy 91 Wireless, the country's biggest third party store for smartphone apps, and $370m for PPS, an online video firm.Tencent may have an edge over its two rivals in m commerce because of the wild popularity of WeChat, which is used on mobile phones. But to ensure it stays in the race, it is also spending heavily. On September 16th it said it will spend $448m to acquire a big stake in Sogou, an online search firm; it plans to merge its own flagging searchengine( aptly named Soso) into the venture. It had previously invested in Didi Dache, China's largest taxi hailing app, and is rumoured to be interested in online travel and dating firms too.The three Goliaths are buying up innovative firms because they are too big and bureaucratic to create things themselves, mutter some entrepreneurs( presumably not those being bought out handsomely). A more pressing worry for Tencent's shareholders is that its lavish spending, on top of heavy investment in improving its unimpressive e commerce offerings, will eat into profits. Worse, the m commerce arms race risks distracting it from gaming and value added services, the cash cows that are paying for everything else. A $100 billion valuation might then seem too rich.Business this weekVerizon issued $49 billion in bonds, smashing the record for a sale of corporate debt. The telecoms company will use the proceeds to fund its $130 billion purchase of Vodafone's stake in Verizon Wireless, their joint venture. Pension funds and insurance companies flocked to the sale, tempted by the higher yields Verizon offered compared with other, similar quality bonds.Apple brought out two new iPhones, the 5C and the 5S. The 5S is the top-of-the range iPhone, with fingerprint ID replacing the traditional numerical locking code. The 5C is being billed as a cheaper handset, though at $549 in America and $733 in China, a market that Apple is keen to crack, it is still more expensive than many Android alternatives. Apple's share price fell by 5%.Koch Industries, a conglomerate, forked out $7.2 billion to buy Molex, which is based in Illinois and makes a wide range of electrical components and connectors used in industrial and consumer products, including the iPhone.Carl Icahn conceded defeat in his attempt to block the $24.8 billion buy-out of Dell by the computer-maker's founder, Michael Dell, days before a shareholder vote on the issue. Mr Icahn, a legendary activist investor, had proposed an alternative plan to Mr Dell's buy-out, which he thinks is undervalued. Mr Dell raised his offer to win over sceptics, leading Mr Icahn to claim that "shareholders would have gotten a lot less if I hadn't shown up."Meanwhile, Southeastern Asset Management, Mr Icahn's ally in his fight with Dell, revealed that it had built a 12% voting stake in News Corporation, making it the publishing group's second-biggest investor after Rupert Murdoch. Its regulatory filing suggests the investment is "passive".The Committee on Foreign Investment in the United States, which assesses the risks to national security from foreign takeovers, gave its approval to the $4.7 billion offer for Smithfield Foods from China's Shuanghui. When approved by shareholders it will be the biggest acquisition of an American company by a Chinese one, and create a global beast in pork products. Some American politicians had raised concerns about Chinesefood-safety standards.An investigation into allegations of corruption in the office that handles compensation claims for the 2010 BP oil spill found no wrongdoing among its senior management, and concluded that the processing of "honest" claims should continue. But the report, written by Louis Freeh, a former director of the FBI, also described the co-operation between some staff in the office and lawyers for the victims of the spill as "problematic", and possibly causing a "conflict of interest".TSB returned to the British high street as a stand-alone bank, 18 years after being merged with Lloyds. Following its bail-out by the British government Lloyds was ordered by the European competition authority in 2009 to sell off assets in retail banking. TSB hasbeen rebranded and is handling the accounts of 5m customers moved over from Lloyds. Lloyds will float TSB on the stockmarket next year.An ongoing study of income distribution found that the richest 1% in America took 19% of national income last year, their biggest share since 1928. The top 10% of earners held a record 48.2%. During the recovery between 2009 and 2012 real family incomes rose by an average of 4.6%, though this was skewed by a 31.4% increase for the top 1%. For the other 99% incomes rose by just 0.4%.Three companies are to be chucked out of the Dow Jones Industrial Average and three companies are joining, in the biggest shake-up of the stockmarket index in a decade. Alcoa, Bank of America and Hewlett-Packard are leaving, to be replaced by Goldman Sachs, Nike and Visa. The DJIA is composed of just 30 stocks and isprice-weighted, so dearer shares count for more. The share prices of Alcoa, BofA and HP have tumbled over the past five years.Japan's economy grew at a much faster rate in the second quarter than had been thought, because of more corporate and public investment. A revised estimate put the pace of growth at 3.8% at an annual rate, up from the 2.6% initially reported.Suntory, a Japanese company that sells a range of alcoholic and soft drinks, agreed to buy the Lucozade energy-drink and Ribena fruit-juice brands from GlaxoSmithKline, a British drugs company, for £1.35 billion ($2.1 billion). Both beverages are popular in Britain and elsewhere, and were marketed from the 1920s to the 1980s as aids to boosting health (Ribena) or recovery from sickness (Lucozade).bond marketsA big number from VerizonCompanies are still taking advantage of low yields to raise debt.DEBT crisis? What debt crisis? The biggest corporate bond issue ever was completed this week. Verizon Communications, an American telecoms group, issued a whopping $49 billion of bonds in order to finance the buy out of Vodafone's stake in its wireless operations. That shattered the previous record, Apple's paltry $17 billion issue earlier this year.The scale of Verizon's offering may be unprecedented, but its foray into the bond markets is anything but. In the first eight months of this year $1.4 trillion of corporatebonds were issued worldwide, according to Dealogic, a data provider, compared with $1.3 trillion in the same period of 2012. Firms have been keen to lock in long term financing at low yields, particularly since borrowing costs started rising after the Federal Reserve hinted in May at slowing its asset purchases.Oil and gas companies have been particularly enthusiastic issuers, according to Marcus Hiseman of Morgan Stanley, especially in the" Yankee" market where foreign businesses sell bonds, priced in dollars, mainly to American investors. Previously many foreign firms would issue debt in euros and swap the proceeds into dollars, but regulatory restrictions on banks make that much more expensive these days. This year 72% of investment grade issuance has been in dollars, compared with 58% in 2009, according to Morgan Stanley.If companies fear that bond yields are set to rise( meaning that bond prices will fall), why are investors so keen to buy? There was plenty of demand to absorb the Verizon issue, for instance: orders reportedly reached $100 billion. One reason is that corporate bonds offer a spread( excess interest rate) over government bonds that is still attractive in historical terms. The average yield on ten year investment grade debt is 3.5%, compared with just 2.95% on Treasury bonds of the same maturity. The sheer size of the Verizon issue required it to be more generous towards investors, as did its BBB + rating from Standard & Poor's, towards the bottom end of the investment grade category. The firm offered a yield of over 5% on its ten year bonds, for example, more than two percentage points above the equivalent Treasury issue.Many central banks, which hold a large part of their reserves in dollars, remain enthusiastic buyers of corporate debt. In addition, many investors in corporate debt are specialist fund managers who aim to beat the benchmark specific to their asset class, points out Paul Young of Citigroup; they care more about whether they pick the right bonds, as they are able to hedge the underlying interest rate risk.The influx of money nonetheless causes some to worry. The corporate bond market is a lot less liquid than it used to be, thanks largely to the effect of regulations on the willingness of banks to hold large inventories of corporate debt. This could cause a problem should bond investors want to sell their holdings in a rush. For the moment, however, that does not seem likely. Corporate balance sheets look strong and the default rate over the past 12 months, even on speculative debt, was just 2.9%, according to Moody's, another ratings agency.Smartphones in ChinaTaking a bite out of AppleXiaomi, often described as China's answer to Apple, is actually quite differentIT FEELS more like a rock concert than a press conference as the casually dressed chief executive takes to a darkened stage to unveil his firm's sleek new smartphone to an adoring crowd. Yet this was not the launch of the new iPhone by Apple on September 10th, but of the Mi - 3 handset by Xiaomi, a Chinese firm, in Beijing on September 5th. With its emphasis on snazzy design, glitzy launches and the cult like fervour it inspires in its users, no wonder Xiaomi is often compared to its giant American rival, both by admirers and by critics who call it a copycat. Xiaomi's boss, Lei Jun( pictured), even wears jeans and a black shirt, Steve Jobs style. Is Xiaomi really China's answer to Apple?Xiaomi sold 7.2m handsets last year, in China, Hong Kong and Taiwan, earning revenues of 12.6 billion yuan( $2.1 billion). Apple sold 125m smartphones globally, earning about $80 billion of its $157 billion sales. But since it was founded in 2010, Xiaomi has grown fast. A recent funding round valued it at $10 billion, more than Microsoft just paid for Nokia's handset unit. That made Xiaomi one of the 15 most heavily venture backed mobile start ups ever, says Rajeev Chand of Rutberg, an investment bank. In the second quarter of 2013 Xiaomi's market share in China was 5%, says Canalys, a research firm -- more than Apple's( 4.8%) for the first time.Yet" we have never compared ourselves to Apple -- we are more like Amazon," says Lin Bin, Xiaomi's co founder, who once worked for the Chinese arms of Microsoft and Google. Apple sells its iPhone 5 for around $860 in China and has the industry's highest margins. Xiaomi offers its handsets at or near cost: the Mi - 3, its new flagship, costs 2,000 yuan( $330). Xiaomi sells direct to customers online, rather than via network operators or retail stores, which also keeps prices down. Crucially, its business depends on selling services to its users, just as Amazon provides its Kindle readers at low prices and makes its money on the sale of e books. The idea is to make a profit from customers as they use the handset, rather than from the sale of the hardware, says Mr Lin.Xiaomi's services revenues were 20m yuan in August, up from 10m yuan in April. It is a classic internet business model: build an audience then monetise it later, as Google and Facebook did, notes Mr Lin. Selling games, custom wallpapers and virtual gifts may not sound very lucrative, but China's internet giants have found a huge market for virtual goods: the biggest, Tencent, sold $ 5 billion worth of them last year.。

The_economist_[经济学人2013-7]房地产市场的变化

![The_economist_[经济学人2013-7]房地产市场的变化](https://img.taocdn.com/s3/m/6060ca28192e45361066f557.png)

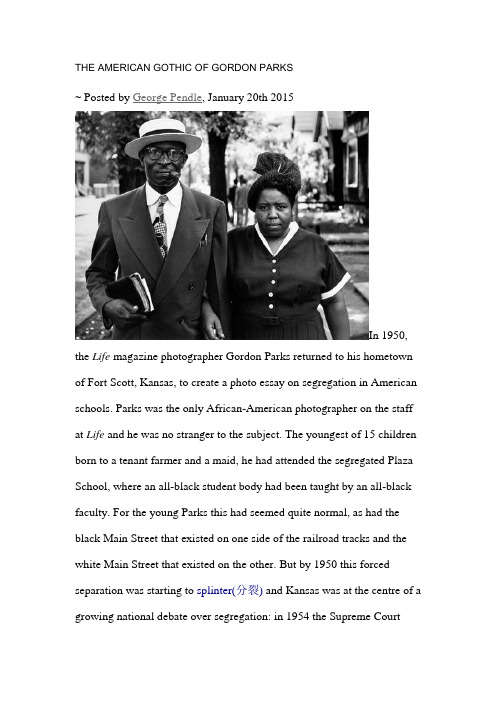

房地产市场的变化房地产市场最终适应了私人租房快速发展的现状2013 年7 月23 日在30岁左右中产阶层的晚宴上,人们谈论的话题已经从房价转变成房东上涨租金之快上。

恶劣的房东、狡猾的租房中介和快速上涨的租金令政客们感到震惊。

7月18日,一位国会议员建议对租房中介和房东实施更严格的监管。

英国财政大臣乔治·奥斯本(George Osborne)希望利用”帮助购买”(Help to Buy)抵押贷款补贴计划来帮助租客购买自己的房子。

一些工党(Labour)政客甚至暗示,希望恢复于1988年基本取消的租金管制规定。

自1999年以来,从私人房东那里租房的英国家庭数量已从200万增加到380万,占到总人口的17%。

租房不再局限于学生和从事短期工作的年轻人。

现在,大约87.4万对夫妇带着孩子租房住,在1999年仅有27.4万对。

在一些地方,例如伦敦的布伦特和纽汉地区,或布莱克普尔、伯恩茅斯和托培等海滨城镇,三分之一以上有孩子的家庭住在私人出租房屋里。

他们这样做并不总是很开心。

大部分租约持续半年或一年时间,之后业主就会赶走房客或提高租金。

慈善机构庇护所(Shelter)表示,在过去一年,拥有孩子的租房家庭的搬家次数可能是有房子家庭的十倍以上。

租户通常没有多少权利重新装修房屋和饲养宠物。

几乎所有的业主都拥有一所或两所房子,通常是为了退休储蓄而购买的。

智囊机构战略社会中心(Strategic Society Centre)的詹姆斯·劳埃德(James Lloyd)估算出,77%的业主除了出租房屋外,还有一份其它工作。

大部分租金是由小型租房中介代理,声名狼藉的他们通常以虚假的理由向租户收取高额费用。

然而,大型房地产代理商第一太平戴维斯(Savills)的董事詹姆斯·科格希尔(James Coghill)表示,市场最终适应了这一现状。

进入租赁房产的机构投资开始加速增长,近年来这一现象在加拿大和德国等地变得非常普遍。

economist 经济学家.doc

economist 经济学家socialist economy 社会主义经济capitalist economy 资本主义经济collective economy 集体经济planned economy 计划经济controlled economy 管制经济rural economics 农村经济liberal economy 经济mixed economy 混合经济political economy 政治经济学protectionism 保护主义autarchy 闭关自守primary sector 初级成分private sector 私营成分,私营部门public sector 公共部门,公共成分economic channels 经济渠道economic balance 经济平衡economic fluctuation 经济波动economic depression 经济衰退economic stability 经济稳定economic policy 经济政策economic recovery 经济复原understanding 约定concentration 集中holding company 控股公司trust 托拉斯cartel 卡特尔rate of growth 增长economic trend 经济趋势economic situation 经济形势infrastructure 基本建设standard of living 生活标准,生活水平purchasing power, buying power 购买力scarcity 短缺stagnation 停滞,萧条,不景气underdevelopment 不发达underdeveloped 不发达的developing 发展中的initial capital 创办资本frozen capital 冻结资金frozen assets 冻结资产fixed assets 固定资产real estate 不动产,房地产circulating capital, working capital 流动资本available capital 可用资产capital goods 资本货物reserve 准备金,储备金calling up of capital 催缴资本allocation of funds 资金分配contribution of funds 资金捐献working capital fund 周转基金revolving fund 循环基金,周转性基金contingency fund 意外开支,准备金reserve fund 准备金buffer fund 缓冲基金,平准基金sinking fund 偿债基金investment 投资,资产investor 投资人self-financing 自筹经费,经费自给bank 银行current account 经常帐户(美作:checkingaccount)current-account holder 支票帐户(美作:checking-account holder)cheque 支票(美作:check)bearer cheque, cheque payable to bearer 无记名支票,来人支票crossed cheque 划线支票traveller's cheque 旅行支票chequebook 支票簿,支票本(美作:checkbook)endorsement 背书transfer 转让,转帐,过户money 货币issue 发行ready money 现钱cash 现金ready money business, no credit given 现金交易,概不赊欠change 零钱banknote, note 钞票,纸币(美作:bill)to pay (in)cash 付现金domestic currency, local currency] 本国货币convertibility 可兑换性convertible currencies 可兑换货币exchange rate 汇率,兑换率foreign exchange 外汇floating exchange rate 浮动汇率free exchange rates 汇兑市场foreign exchange certificate 外汇兑换券hard currency 硬通货speculation 投机saving 储装,存款depreciation 减价,贬值devaluation (货币)贬值revaluation 重估价runaway inflation 无法控制的通货膨胀deflation 通货紧缩capital flight 资本外逃securities business 证券市场stock exchange 贡市场stock exchange corporation 证券交易所stock exchange 证券交易所,贡交易所quotation 报价,牌价share 股份,贡shareholder, stockholder 贡持有人,股东dividend 股息,红利cash dividend 现金配股stock investment 贡投资investment trust 投资信托stock-jobber 贡经纪人stock company, stock brokerage firm 证券公司securities 有价证券share, common stock 普通股preference stock 优先股income gain 股利收入issue 发行贡par value 股面价格, 票面价格bull 买手, 多头bear 卖手, 空头assigned 过户opening price 开盘closing price 收盘hard times 低潮business recession 景气衰退doldrums 景气停滞dull 盘整ease 松弛raising limit 涨停板break 暴跌bond, debenture 债券Wall Street 华尔街short term loan 短期贷款long term loan 长期贷款medium term loan 中期贷款lender 债权人creditor 债权人debtor 债务人,借方borrower 借方,借款人borrowing 借款interest 利息rate of interest 利率discount 贴现,折扣rediscount 再贴现annuity 年金maturity 到期日,偿还日amortization 摊销,摊还,分期偿付redemption 偿还insurance 保险mortgage 抵押allotment 拨款short term credit 短期信贷consolidated debt 合并债务funded debt 固定债务,长期债务floating debt 流动债务drawing 提款,提存aid 援助allowance, grant, subsidy 补贴,补助金,津贴short term loan 短期贷款long term loan 长期贷款medium term loan 中期贷款lender 债权人creditor 债权人debtor 债务人,借方borrower 借方,借款人borrowing 借款interest 利息rate of interest 利率discount 贴现,折扣rediscount 再贴现annuity 年金maturity 到期日,偿还日amortization 摊销,摊还,分期偿付redemption 偿还insurance 保险mortgage 抵押allotment 拨款short term credit 短期信贷consolidated debt 合并债务funded debt 固定债务,长期债务floating debt 流动债务drawing 提款,提存aid 援助allowance, grant, subsidy 补贴,补助金,津贴cost 成本,费用expenditure, outgoings 开支,支出fixed costs 固定成本overhead costs 营业间接成本overheads 杂项开支,间接成本operating costs 生产费用,营业成本operating expenses 营业费用running expenses 日常费用,经营费用miscellaneous costs 杂项费用overhead expenses 间接费用,管理费用upkeep costs, maintenance costs 维修费用,养护费用transport costs 运输费用social charges 社会负担费用contingent expenses, contingencies 或有费用apportionment of expenses 分摊费用income 收入,收益earnings 利润,收益gross income, gross earnings 总收入,总收益gross profit, gross benefit 毛利,总利润利益毛额net income 纯收益,净收入,收益净额average income 平均收入national income 国收入profitability, profit earning capacity利润率赢利率yield 产量收益,收益率increase in value, appreciation 增值,升值duty 税taxation system 税制taxation 征税,纳税fiscal charges 财务税收progressive taxation 累进税制graduated tax 累进税value added tax 增值税income tax 所得税land tax 地租,地价税excise tax 特许权税basis of assessment 估税标准taxable income 须纳税的收入fiscality 检查tax-free 免税的tax exemption 免税taxpayer 纳税人tax collector 收税员China Council for the Promotion ofInternational Trade, C.C.P.I.T. 中国国际贸易促进委员会National Council for US-China Trade 美中贸易全国理事会Japan-China Economic Association 日中经济协会Association for the Promotion of InternationalTrade,Japan 日本国际贸易促进会British Council for the Promotion ofInternational Trade 英国国际贸易促进委员会International Chamber of Commerce 国际商会International Union of Marine Insurance 国际海洋运输保险协会International Alumina Association 国际铝矾土协会Universal Postal Union, UPU 万国邮政联盟Customs Co-operation Council, CCC 关税合作理事会United Nations Trade and Development Board联合国贸易与发展理事会Organization for Economic cooperation andDevelopment, DECD 经济合作与开发组织European Economic Community, EEC,European Common Market 欧洲经济共同体European Free Trade Association, EFTA 欧洲贸易联盟European Free Trade Area, EFTA 欧洲贸易区Council for Mutual Economic Aid, CMEA 经济互助委员会Eurogroup 欧洲集团Group of Ten 十国集团Committee of Twenty(Paris Club)二十国委员会Coordinating Committee, COCOM 巴黎统筹委员会Caribbean Common Market, CCM,Caribbean Free-Trade Association, CARIFTA 加勒比共同市场(加勒比贸易同盟)Andeans Common Market, ACM, AndeansTreaty Organization, ATO 安第斯共同市场Latin American Free Trade Association,LAFTA 拉丁美洲贸易联盟Central American Common Market, CACM中美洲共同市场African and Malagasy Common Organization,OCAM 非洲与马尔加什共同组织East African Common Market, EACM 东非共同市场Central African Customs and Economic Union,CEUCA 中非关税经济同盟West African Economic Community, WAEC西非经济共同体Organization of the Petroleum ExportingCountries, OPEC 石油输出国组织Organization of Arab Petroleum ExportingCountries, OAPEC 阿拉伯石油输出国组织Commonwealth Preference Area 英联邦特惠区Centre National du Commerce Exterieur, National Center of External Trade 法国对外贸易中心People's Bank of China 中国人银行Bank of China 中国银行International Bank for Reconstruction and development, IBRD 国际复兴开发银行World Bank 世界银行International Development association, IDA 国际开发协会International Monetary Found Agreement 国际货币基金协定International Monetary Found, IMF 国际货币基金组织European Economic and Monetary Union 欧洲经济与货币同盟European Monetary Cooperation Fund 欧洲货币合作基金Bank for International Settlements, BIS 国际结算银行African Development Bank, AFDB 非洲开发银行Export-Import Bank of Washington 美国进出口银行National city Bank of New York 花旗银行American Oriental Banking Corporation 美丰银行American Express Co. Inc. 美国万国宝通银行The Chase Bank 大通银行Inter-American Development Bank, IDB 泛美开发银行European Investment Bank, EIB 欧洲投资银行Midland Bank,Ltd. 米兰银行United Bank of Switzerland 瑞士联合银行Dresden Bank A.G. 德累斯敦银行Bank of Tokyo,Ltd. 东京银行Hongkong and Shanghai Corporation 香港汇丰银行International Finance Corporation, IFC 国际金融公司La Communaute Financieve Africane 非洲金融共同体Economic and Social Council, ECOSOC 联合国经济及社会理事会United Nations Development Program, NUDP 联合国开发计划署United Nations Capital Development Fund, UNCDF 联合国资本开发基金United Nations Industrial DevelopmentOrganization, UNIDO 联合国工业发展组织United Nations Conference on Trade andDevelopment, UNCTAD 联合国贸易与发展会议Food and Agricultural Organization, FAO 粮食与农业组织, 粮农组织Economic Commission for Europe, ECE 欧洲经济委员会Economic Commission for Latin America,ECLA 拉丁美洲经济委员会Economic Commission for Asia and Far East,ECAFE 亚洲及远东经济委员会Economic Commission for Western Asia,ECWA 西亚经济委员会Economic Commission for Africa, ECA 非洲经济委员会Overseas Chinese Investment Company 华侨投资公司New York Stock Exchange, NYSE 纽约证券交易所London Stock Market 伦敦贡市场Baltic Mercantile and Shipping Exchange 波罗的海商业和航运交易所instruction, education 教育culture 文化primary education 初等教育secondary education 中等教育higher education 高等教育the three R's 读、写、算school year 学年term, trimester 学季semester 学期school day 教学日school holidays 假期curriculum 课程subject 学科discipline 纪律timetable 课程表class, lesson 课homework 家庭作业exercise 练习dictation 听写spelling mistake 拼写错误(short)course 短训班seminar 研讨班playtime, break 课间,休息to play truant, to play hooky 逃学,旷课course (of study)学业student body 学生(总称)classmate, schoolmate 同学pupil 小学生student 大学生schoolboy 男生schoolgirl 女生auditor 旁听生swot, grind 用的学生old boy 老生grant, scholarship, fellowship 奖学金holder of a grant, scholar, fellow 奖学金获得者school uniform 校服teaching staff 教育工作者(总称)teachers 教师(总称)primary school teacher 小学老师teacher lecturer 大学老师professor 教授schooling 教授,授课assistant 助教headmaster 校长(女性为:headmistress)deputy headmaster, deputy head 副校长rector 校长dean 教务长laboratory assistant, lab assistant 实验员beadle, porter 门房,学校工友games master, gym teacher, gym instructor 体育教师private tutor 私人教师,家庭教师pedagogue 文学教师(蔑称)of school age 教龄beginning of term 开学matriculation 注册to enroll, to enroll 予以注册to take lessons (学生)上课to teach (老师)上课to study 学习to learn by heart 记住,掌握to revise, to go over 复习test 考试to test 考试to take an examination, to sit an examination,to do an examination 参加考试convocation notice 考试通知examiner 考试者board of examiners 考试团examination oral, written examination 口试,笔试question 问题question paper 试卷crib 夹带(美作:trot)to pass an examination (或exam), 通过考试pass, passing grade 升级prizegiving 分配奖品to fall an examination 未通过考试failure 未考好to repeat a year 留级degree 学位graduate 毕业生to graduate 毕业project, thesis 毕业论文General Certificate of Education 中学毕业证书(美作:high school diploma)holder of the General Certificate of Education 中学毕业生(美作:holder of a high school diploma)doctorate 博士学位doctor 博士competitive examination 答辩考试Chinese 语文English 英语Japanese 日语mathematics 数学science 理科gymnastics 体育history 历史algebra 代数geometry 几何geography 地理biology 生物chemistry 化学physics 物理physical geography 地球物理literature 文学sociology 社会学psycology 心理学philosophy 哲学engineering 工程学mechanical engineering 机械工程学electronic engineering 电子工程学medicine 医学social science 社会科学agriculture 农学astronomy 天文学economics 经济学politics 政治学commercial science 商学biochemistry 生物化学anthropology 人类学linguistics 语言学accounting 会计学law, jurisprdence 法学banking 银行学metallurgy 冶金学finance 财政学mass-communication 大众传播学journalism 新闻学atomic energy 原子能学civil engineering 土木工程architecture 建筑学chemical, engineering 化学工程accounting and statisics 会计统计business administration 工商管理library 图书馆学diplomacy 外交foreign language 外文botany 植物major 主修minor 辅修school 学校kindergarten 幼儿园infant school 幼儿学校primary school, junior school 小学secondary school 中学high school, secondary school 专科学校business school 商业学校technical school 工业学校technical college 专科学校(university)campus 大学university 大学boarding school 供膳宿的学校day school 日校,无宿舍学校,走读学校day student who has lunch at school 提供午餐的走读学生academy 专科学院faculty 系hall of residence 学校公寓classroom 教室lecture theatre 阅览室(美作:lecture theater)amphitheatre 阶梯教室(美作:amphitheater)staff room 教研室headmaster's study, headmaster's office 校长办公室(assembly)hall 礼堂library 图书馆playground 操场desk 课桌blackboard 黑板(a piece of)chalk 粉笔slate pencil 石板笔wall map 挂图skeleton map 廓图,示意图globe 地球仪text book 课本dictionary 词典encyclopedia 百科全书atlas地图集satchel 书包exercise book 练习本rough not book 草稿本(美作:scribblingpad)blotting paper 吸墨纸tracing paper 描图纸squared paper, graph paper 坐标纸(fountain)pen 自来水笔biro, ballpoint (pen)圆珠笔pencil 铅笔propelling pencil 自动铅笔pencil sharpener 铅笔刀,转笔刀ink 墨水inkwell 墨水池rubber, eraser 橡皮ruler, rule 尺slide rule 计算尺set square 三角板protractor 量角器compass, pair of compasses 圆规Ministry of Labour 劳工部(美作epartmentof Labor)labour market 劳工市场, 劳务市场Labour exchange, Employment exchange 职业介绍所(美作:Employment Bureau)labour management 职业介绍经纪人full employment 整日制工作to be paid by the hour 按小时付酬seasonal work 季节工作piecework work 计件工作timework work 计时工作teamwork work 联合工作shift work 换班工作assembly line work 组装线工作(美作:serialproduction)workshop 车间handicrafts, crafts 手艺, 技艺trade, craft 行当profession, occupation 职务employment, job 工作situation, post 位置job 一件工作vacancy 空缺, 空额work permit 工作许可证to apply for a job 求职, 找工作application(for a job)求职to engage, to employ 雇用work contract 劳务合同industrial accident 劳动事故occupational disease 职业病vocational guidance 职业指导vocational training 职业训练retraining, reorientation, rehabilitation 再训练, 再培训holidays, holiday, vacation 假期labour costs, labour input 劳力成本fluctuation of labour 劳力波动(美作f labor)worker 工作者permanent worker 长期工, 固定工personnel, staff 人员employee 职员clerk, office worker 办公室人员salary earner 雇佣工人workman 工人organized labour 参加工会的工人skilled worker 技术工人unskilled worker 非技术工人specialized worker 熟练工人farm worker 农场工人labourer worker 农业工人day labourer 日工seasonal worker 季节工collaborator 合作者foreman 工头trainee, apprentice 学徒工apprenticeship 学徒artisan, craftsman 工匠specialist 专家night shift 夜班shortage of labour, shortage of manpower 缺乏劳力working class 工人阶级proletarian 无产者proletariat 无产阶级trade union 工会(美作:labor union)trade unionist 工团主义者trade unionism 工团主义guild 行会,同会,公会association, society, union 协会emigration 移,移居employer 雇主,老板shop steward (工厂的)工会代表(美作:uniondelegate)delegate 代表representative 代表works council 劳资联合委员会labour law 劳工法working day, workday 工作日full-time employment, full-time job, full-timework 全天工作part-time employment, part-time job,part-time work 半日工作working hours 工作时间overtime 业余时间remuneration 报酬pay, wage, salary 工资wage index 工资指数minimum wage 最低工资basic wage 基础工资gross wages 全部收入net, real wages 实际收入hourly wages, wage rate per hour 计时工资monthly wages 月工资weekly wages 周工资piecework wage 计件工资maximum wage 最高工资(美作:wageceiling)sliding scale 按物价计酬法payment in kind 用实物付酬daily wages 日工资premium, bonus, extra pay 奖励payday 发工资日, 付薪日pay slip 工资单payroll 薪水册unemployment benefit 失业救济old-age pension 退休金,养老金collective agreement 工会代表工人与资方代表达成的协议retirement 退休claims 要求strike 罢工striker 罢工者go-slow 怠工(美作:slow-down)lockout 停工(业主为抵制工人的要求而停工)staggered strike 阶段性罢工strike picket 罢工纠察队员strike pay 罢工津贴(由工会给的)strikebreaker, blackleg 破坏罢工者down tools, sit-down strike 静坐demonstration, manifestation 示威sanction 制裁unemployment 失业seasonal unemployment 季节性失业underemployment 不充分就业unemployed man 失业者(个人)the unemployed 失业者(集体)to discharge, to dismiss 辞退,开除,解雇dismissal 开除,解雇to terminate a contract 结束合同,结束契约negotiation 谈判collective bargaining 劳资双方就工资等问题谈判receptionist 接待员typist 打字员key puncher 电脑操作员stenographer 速记员telephone operator 电话接线员programmer 电脑程序员system analyst 系统分析员shorthand typist 速记打字员office girl 女记事员public servants 公务员national public servant 国家公务员local public service employee 地方公务员nation railroad man 国营铁路职员tracer 绘图员illustrator 汇稿员saleswoman 女店员pilot 驾驶员simultaneous 同时译员publisher 出版人员graphic designer 美术设计员delivery boy 送报员secretary 秘书policeman 警察journalist 记者editor 编辑interpreter 通译者director 导演talent 星探actor 男演员actress 女演员photographer 摄影师scholar 学者translator 翻译家novelist 小说家playwright 剧作家linguist 语言学家botanist 植物学家economist 经济学家chemist 化学家scientist 科学家philosopher 哲学家politician 政治学家physicist 物理学家astropologist 人类学家archaeologist 考古学家geologist 地质学家expert on folklore 俗学家mathematician 数学家biologist 生物学家zoologist 动物学家statistician 统计学家physiologist 生理学家futurologist 未来学家artists 艺术家painter 画家musician 音乐家composer 作曲家singer 歌唱家designer 设计家sculptor 雕刻家designer 服装设计师fashion coordinator 时装调配师dressmaker 女装裁剪师cutter 裁剪师sewer 裁缝师tailor 西装师傅beautician 美容师model 模特ballerina 芭蕾舞星detective 刑警chief of police 警察局长taxi driver 出租车司机clerk 店员mailman 邮差newspaper boy 报童bootblack 擦鞋童poet 诗人copywriter 撰稿人producer 制片人newscaster 新闻评论人milkman 送奶人merchant 商人florist 卖花人baker 面包师greengrocer 菜贩fish-monger 鱼贩butcher 肉贩shoe-maker 鞋匠saleswoman 女店员stewardess 空中小姐conductor 车掌station agent 站长porter 行李夫car mechanic 汽车修理师architect 建筑师civil planner 城市设计师civil engineer 土木技师druggist, chemist, pharmacist 药剂师guide 导游oil supplier 加油工(public)health nurse 保健护士dentist 牙科医生supervisor 监工forman 工头doctor 医生nurse 护士宏观经济的macroeconomic通货膨胀inflation破产insolvency有偿还债务能力的solvent合同contract汇率exchange rate紧缩信贷tighten credit creation私营部门private sector财政管理机构fiscal authorities宽松的财政政策slack fiscal policy税法tax bill财政public finance财政部the Ministry of Finance平衡预算balanced budget继承税inheritance tax货币主义者monetariest增值税VAT (value added tax)收入revenue总需求aggregate demand货币化monetization赤字deficit经济不景气recessiona period when the economy of a country is notsuccessful, business conditions are bad,industrialproduction and trade are at a low level andthereis a lot of unemployment经济好转turnabout复苏recovery成本推进型cost push货币供应money supply生产率productivity劳动力labor force实际工资real wages成本推进式通货膨胀cost-push inflation需求拉动式通货膨胀demand-pull inflation双位数通货膨胀double- digit inflation极度通货膨胀hyperinflation长期通货膨胀chronic inflation治理通货膨胀to fight inflation最终目标ultimate goal坏的影响adverse effect担保ensure贴现discount萧条的sluggish认购subscribe to支票帐户checking account货币控制工具instruments of monetry control借据IOUs(I owe you)本票promissory notes货币总监controller of the currency拖收系统collection system支票清算或结算check clearing资金划拨transfer of funds可以相信的证明credentials改革fashion被缠住entangled货币联盟Monetary Union再购协议repo精明的讨价还价交易horse-trading欧元euro公共债务membership criteria汇率机制REM储备货币reserve currency劳动密集型labor-intensive贡交易所bourse竞争领先frontrun牛市bull market非凡的牛市a raging bull规模经济scale economcies买方出价与卖方要价之间的差价bid-askspreads期货(贡)futures经济商行brokerage firm回报率rate of return贡equities违约default现金外流cash drains经济人佣金brokerage fee存款单CD(certificate of deposit营业额turnover资本市场capital market布雷顿森林体系The Bretton Woods System 经常帐户current account套利者arbitrager远期汇率forward exchange rate即期汇率spot rate实际利率real interest rates货币政策工具tools of monetary policy银行倒闭bank failures跨国公司MNC (Multi-National Corporation)商业银行commercial bank商业票据comercial paper利润profit本票,期票promissory notes监督to monitor佣金(经济人)commission brokers套期保值hedge有价证券平衡理论portfolio balance theory外汇储备foreign exchange reserves固定汇率fixed exchange rate浮动汇率floating/flexible exchange rate货币选择权(期货)currency option套利arbitrage合约价exercise price远期升水forward premium多头买升buying long空头卖跌selling short按市价订购贡market order贡经纪人stockbroker国际货币基金the IMF七国集团the G-7监督surveillance同业拆借市场interbank market可兑换性convertibility软通货soft currency限制restriction交易transaction充分需求adequate demand短期外债short term external debt汇率机制exchange rate regime直接标价direct quotes资本流动性mobility of capital赤字deficit本国货币domestic currency外汇交易市场foreign exchange market国际储备international reserve利率interest rate资产assets国际收支balance of payments贸易差额balance of trade繁荣boom债券bond资本captial资本支出captial expenditures商品commodities商品交易所commodity exchange期货合同commodity futures contract普通贡common stock联合大企业conglomerate货币贬值currency devaluation通货紧缩deflation折旧depreciation贴现率discount rate归个人支配的收入disposable personalincome从业人员employed person汇率exchange rate财政年度fiscal year企业free enterprise国生产总值gross antional product库存inventory劳动力人数labor force债务liabilities市场经济market economy合并merger货币收入money income跨国公司Multinational Corproation个人收入personal income优先贡preferred stock价格收益比率price-earning ratio优惠贷款利率prime rate利润profit回报return on investment使货币升值revaluation薪水salary季节性调整seasonal adjustment关税tariff失业人员unemployed person效用utility价值value工资wages工资价格螺旋上升wage-price spiral收益yield补偿贸易compensatory trade, compensateddeal储蓄银行savings banks欧洲联盟the European Union单一的实体a single entity抵押贷款mortgage lending业主产权owner''''s equity普通股common stock无形资产intangible assets收益表income statement营业开支operating expenses行政开支administrative expenses现金收支一览表statement of cash flow贸易中的存货inventory收益proceeds投资银行investment bank机构投资者institutional investor垄断兼并委员会MMC招标发行issue by tender定向发行introduction代销offer for sale直销placing公开发行public issue信贷额度credit line国际债券international bonds欧洲货币Eurocurrency利差interest margin以所借的钱作抵押所获之贷款leveraged loan权利股发行rights issues净收入比例结合net income gearing外贸中常见英文缩略词1 C2 T/T(telegraphic transfer)电汇3 D/P(document against payment)付款交单4 D/A (document against acceptance)承兑交单5 C.O (certificate of origin)一般原产地证6 G.S.P.(generalized system of preferences)普惠制7 CTN/CTNS(carton/cartons)纸箱8 PCE/PCS(piece/pieces)只、个、支等9 DL/DLS(dollar/dollars)美元10 DOZ/DZ(dozen)一打11 PKG(package)一包,一捆,一扎,一件等12 WT(weight)重量13 G.W.(gross weight)毛重14 N.W.(net weight)净重15 C/D (customs declaration)报关单16 EA(each)每个,各17 W (with)具有18 w/o(without)没有19 FAC(facsimile)传真20 IMP(import)进口21 EXP(export)出口22 MAX (maximum)最大的、最大限度的23 MIN (minimum)最小的,最低限度24 M 或MED (medium)中等,中级的25 M/V(merchant vessel)商船26 S.S(steamship)船运27 MT或M/T(metric ton)公吨28 DOC (document)文件、单据29 INT(international)国际的30 P/L (packing list)装箱单、明细表31 INV (invoice)发票32 PCT (percent)百分比33 REF (reference)参考、查价34 EMS (express mail special)特快传递35 STL.(style)式样、款式、类型36 T或LTX或TX(telex)电传37 RMB(renminbi)人币38 S/M (shipping marks)装船标记39 PR或PRC(price)价格40 PUR (purchase)购买、购货41 S/C(sales contract)销售确认书42 L/C (letter of credit)信用证43 B/L (bill of lading)提单44 FOB (free on board)离岸价45 CIF (cost,insurance补充:CR=credit贷方,债主DR=debt借贷方(注意:国外常说的debt card,就是银行卡,credit card就是信誉卡。

2013版《经济学人》中英文对照:一切都是相连的

The new politics of the internet 新互联网政治Everything is connected一切都是相连的Can internet activism turn into a real political movement?互联网激进主义能演变成一场真正的政治运动吗?Jan 5th 2013 | BERLIN AND DUBAI | from the print editionWHEN dozens of countries refused to sign a new global treaty on internet governance in late 2012, a wide range of activists rejoiced.They saw the treaty, crafted under the auspices of the International Telecommunication union (ITU), as giving governments pernicious powers to meddle with and censor the internet. For months groups with names like Access Now and Fight for the Future had2013版《经济学人》中英文对照:一切都是相连的_考研英语_考研1号网——专注考研!campaigned against the treaty. Their lobbying was sometimes hyperbolic. But it was also part of the reason the treaty was rejected by many countries, including America, and thus in effect rendered void.当数十个国家于2012年年底拒绝签署一项新的互联网管理国际条约时,各类积极分子深感欣慰。

The History and Influence of Fluctuation of Chinese Currency’s Exchange Rate

1Master of Global ManagementExam of Economic AnalysisThe History and Influence of Fluctuation of ChineseCurrency’s Exchange RateKaiyue ZhaoDoreen Sharleena KarimMonday, January 20, 2014Executive SummaryThis report offers a reflection on the history and influence of Chinese currency exchange rate. We provide a brief introduction of currency and exchange rate regimes. Then we provide a brief historical evolution of exchange rate regime over the last century. We also provide the factors that influences exchange rate fluctuations. Based on this foundation, we then looked at the Chinese currency and review the Chinese strategy on this. In last part, we briefly discussed about the influence that current situation of the exchange rate of RMB brought2Directory1.Introduction (1)1.1 What is Exchange Rate (1)1.1.1Floating Currency Exchange Rate: (1)1.1.2Pegged Currency Exchange Rate: (2)2.History (2)2.1The evolution of global exchange system (2)2.2The history of Chinese exchange rate regime (the choice china made) (4)2.2.1The Planned Economy Period (1949-1978) (4)2.2.2Economic Transition Period (1979-1993) (4)2.2.3The Socialist Market Economy Period (1994-now) (5)3.Analysis of current situation (7)3.1The continuous appreciation of external value (8)3.2The devaluation of intrinsic value (8)4.Influence of the change of nominal exchange rate (8)4.1 The impact on the domestic economy (9)4.1.1 The impact on purchase of consumer (9)4.1.2 The impact on employment (9)4.1.3 The impact on domestic financial market (10)4.1.4The impact on export trade (11)4.2 The impact on world economy (11)3Reference (13)41.IntroductionIn the simplest form, currency means money. We buy things that we want and need in our daily life by money. Our employers paid us for in the form of money, with which we buy foods, cloths, pay bills, live in a house etc. We sometimes put some money in the bank as savings for our future needs. Historically, currency was defined as a unit of purchasing power. It was a medium of exchange, a substitute for goods or services. Besides, currency (or money) is also the foundation of wealth.Over the last 3,000 years or so, the form of currency has evolved significantly, for example Commodity, Coins, Paper Money and Electronic Currency are all represent different forms of currency. In addition, world does not depend on one type of currency, albeit the forms are similar. Different countries have different currencies. As such, when we travel or go to different countries we are required to use the currency of that specific country. For example, US dollar cannot be used in Japan. To buy something in Japan, one first has to go to a bank and exchange the US dollar into Japanese Yen. This leads us to the question on how this exchange happens, under what rate and who determines that. In the next subsection we discuss this.1.1 What is Exchange RateCurrency Exchange Rate is the rate at which one currency may be converted into another, i.e., the exchange rate is used when simply converting one currency to another (such as for the purposes of travel to another country).There are a wide variety of factors, which influence the exchange rate, such as interest rates, inflation, and the state of politics and the economy in each country. Each country, through varying mechanisms, manages the value of its currency. As part of this function, it determines the exchange rate regime that will apply to its currency. For example, the currency may be free-floating, pegged or fixed, or a hybrid.1.1.1Floating Currency Exchange Rate:The market determines a floating exchange rate. In other word currency is worth whatever buyers are willing to pay. If a currency is free-floating, its exchange rate is allowed to vary against that of other currencies and is determined by the market forces of supply and demand.1Exchange rates for such currencies are likely to change almost constantly as quoted on financial markets, mainly by banks, around the world.1.1.2Pegged Currency Exchange Rate:A movable or adjustablepeg system is a system of fixed exchange rates, but with a provision for the revaluation (usually devaluation) of a currency. This rate will not change or fluctuate from day to day. The government has to work to keep the exchange rate stable. For example, between 1994 and 2005, the Chinese RMB was pegged to the United States dollar at RMB 8.2768 to $1. China was not the only country to do this; from the end of World War II until 1967, Western European countries all maintained fixed exchange rates with the US dollar based. But that system had to be abandoned in favor of floating, market-based regimes due to market pressures and speculations in the 1970s.2.History2.1The evolution of global exchange systemFor many years, the currencies of the world were backed by gold. That is, a piece of paper currency issued by any world government represented a real amount of gold held in a vault by that government. This monetary system is known as “Gold Standard” in whi ch the standard economic unit of account is based on a fixed quantity of gold. However, this “Gold Standard” collapsed entirely during the great depression of the 1930’s. Some economists explained this collapse by saying that the adherence to the gold standard had prevented monetary authorities from expanding the money supply rapidly enough to revive economic activity.To revive the world economy, representatives of most of the world's leading nations met at Bretton Woods, New Hampshire, USA in 1944 to create a new international monetary system. Because the United States at the time accounted for over half of the world's manufacturing capacity and held most of the world's gold, the leaders decided to tie world currencies to the U.S. dollar, which, in turn, they agreed should be convertible into gold at $35 per ounce. This monetary system is known as “Bretton Woods” system. Other countries followed this system and based the value of their currencies on the U.S. dollar. Since everyone knew how much gold a U.S. dollar was worth, then the value of any other currency against the dollar could be based on its value in gold. A currency worth twice as much gold as a U.S dollar was, therefore, also2worth two U.S. dollars.Under the Bretton Woods system, central banks of countries other than the United States were given the task of maintaining fixed exchange rates between their currencies and the dollar. They did this by intervening in foreign exchange markets. If a country's currency was too high relative to the dollar, its central bank would sell its currency in exchange for dollars, driving down the value of its currency. Conversely, if the value of a country's money was too low, the country would buy its own currency, thereby driving up the price.Unfortunately, the real world of economics outpaced this system. In late 1960, the U.S. dollar suffered from inflation (its value relative to the goods it could purchase decreased), while other currencies became more valuable and more stable. Americans urged Germany and Japan, both of which had favorable payments balances, to appreciate their currencies. But those nations were reluctant to take that step, since raising the value of their currencies would increases prices for their goods and hurt their exports. Eventually, the U.S. could no longer pretend that the dollar was worth as much as it had been, so the value was officially reduced so that 1 ounce of gold was now worth $70. The dollar's value was cut in half. Finally, the United States abandoned the fixed value of the dollar and allowed it to "float" (as mentioned in the earlier section as Floating Exchange Rate) that is, to fluctuate against other currencies. The dollar promptly fell. World leaders sought to revive the Bretton Woods system with the so-called Smithsonian Agreement in 1971, but the effort failed. By 1973, the United States and other nations agreed to allow exchange rates to float.Today, the U.S. dollar still dominates many financial markets. In fact, exchange rates are often expressed in terms of U.S. dollars. Currently, the U.S. dollar and the euro account for approximately 50 percent of all currency exchange transactions in the world. Adding British pounds, Canadian dollars, Australian dollars, and Japanese yen to the list accounts for over 80 percent of currency exchanges altogether.32.2The history of Chinese exchange rate regime(the choice china made)2.2.1The Planned Economy Period (1949-1978)On January 8, 1949, the people's bank of China began to publish the exchange rates of currency to public. Under the unified management of the central, Shanghai and guangzhou used tianjin exchange rate as the standard, took the local price situation into consideration, published their own exchange rate. In volatile financial background, to avoid a recession and maintain the stability of exchange rate with some long-term trade partners, RMB exchange rate, after a long historical period of a fixed exchange rate in planned economy period, now has been pegged to a basket of currencies. Dollar, yen, pound sterling, the deutsche mark, Swiss franc always play an2.2.2Economic Transition Period (1979-1993)In this period, China had a dual exchange rate system characterized by two parallel exchange rates: the market swap rate and the official rate. The official rate was much lower than the market swap rate. In 1981-1984, official RMB exchange rate has a trade internal settlement price and non-trade dual exchange rate system of open quotation. On January 1, 1985 the4central bank of China canceled internal settlement price, in order to eliminateexchange rateovervalued and to make the change in exchange rate suits the change in price of commodities , central bank adjust the official price several times. In 1988, foreign trade systemhas undergone majorreforms. The system for contracted responsibility was introduced to China. In 1991, foreign trade system turn to self-financing instead of subsidy mechanism. With the deepening of reform, exchange ratebecamethe primary means ofregulatingthe import and2.2.3The Socialist Market Economy Period (1994-now)In 1994, China unified these two rates into one single exchange rate based on the market swap rate. China began to peg its currency to the US dollar at 8.3 RMB per dollar since 1996. At the same time, China’s central bank, the People’s Bank of China (PBOC) enlarged the amount of foreign exchange for foreign firms in China. Meanwhile China also officially declared the convertibility of the RMB under current account at the end of 1996. At the end of 1998, China’s foreign exchange swap markets were abolished and China Foreign Exchange Trading Center (CFETC) began to buy and sell foreign exchange, with only three foreign currencies traded: the US dollar, the Hong Kong dollar (HKD), and the Japanese Yen (JPY). The foreign exchange rate market is intervened by the People’s Bank of China. And designatedforeign bank have to sell the foreign exchanges in the market when they exceed the margin limits assigned by the PBOC. At that time, there are 60% of foreign exchanges purchased by Chinese banks and 28% purchased by the PBOC. And the designated foreign banks can purchase only 12% of foreign exchanges. The demand and supply of foreign exchanges are not determined by the market but 。

business Cycle最终

经济萧条 长时期的高失业率、低产出、低投资、 企业信心降低、价格下跌和企业普遍 破产。工商业低落的一个温和的形式 是衰退(recession),它同萧条有许 多共同点,但在程度上较弱。今天, 衰退的精确定义是实际国民生产总值 至少连续两个季度下降。

Page 8

what keep business cycle going?

1929\10\24 "THE BLACK THURSDAY"

Before this day , the economy kept increasing until got into the peak. only after one night , the stock market broke. And enconomy started decreasing for long time.

The businese cycle allows the people to understand the direction the economy(GDP)is going [increase or decrease ] and plan accordingly.

Page

2

LOGO

The economy follows the BUSINESS CYCLE regularly!

Page

10

let us welcome

ቤተ መጻሕፍቲ ባይዱ

VICTORY WANG~

tell us about

History!!!!

Page 11

(误 )

Reason of talking about history

Page

12

1929——1933

TheEconomist《经济学人》常用词汇总结我眼泪都流出来了太珍.

两种变量系统地相互联系在一起的程度。

307、Cost ,average 平均成本等于总成本(参见 "总成本" , cost ,total )除以产出的单位数。

The Economist 《经济学人》常用词汇总结 我眼泪都流出来了 太珍The Economist 《经济学人》常用词汇总结 我眼泪都流出来了 太珍贵了 !! 16 小时前 301、Consumption function 消费函数 总消费与个人可支配收人( PDI ) 认为会对消费产生影响。

的数值对应关系。

总财富和其他变量也常被 302、Consumption-possibility line 消费可能线 见预算线( budget line )。

303、Cooperative equilibrium合作性均衡 博弈论中,指各方协调行动,以求共同的支付( joint pay - offs )最优化的 策略而达到的结果。

304、Corporate income tax 公司所得税对公司年净收入课征的税收。

305、Corporation 公司 现代资本主义经济中企业组织的主要形式。

它是由个人或其他公司所拥有的 企业,具有与个人一样的购买、销售和签订合同的权利。

公司和对公司负 责任" 的所有人二者,在法律上是不同的概念。

"有限306、Correlation相关308、Cost ,average fixed 平均固定成本等于固定成本除以产出的单位数。

309、Cost,average variable 平均可变成本等于可变成本(参见" 可变成本" ,cost ,variable )除以产出的单位数。

310、Cost ,fixed 固定成本一企业在某时段即使在产量为零时也会发生的成本。

总固定成本由诸如利息支出、抵押支出、管理者费用等契约性开支所组成。

311、Cost ,marginal 边际成本多生产1 单位产品所增加的成本(或总成本的增加额),或少生产1 单位产品总成本的减少额。

035《经济学家》读译参考之三十五走出博客-微软御用博客投身播客word精品文档5页

TEXT 35Blogging off走出博客(陈继龙编译)Jun 15th 2006 | NEW YORKFrom The Economist print edition“I LOVE Microsoft and Microsoft did notlose me,” protested Robert Scoble, alittle too loudly, on his blog last week,in a bid to end feverish speculation inthe blogosphere about why, exactly, hehad decided to leave Microsoft. The software g_______①'s “technical evangelist”, Mr Scoble has become the best-known example of a corporate blogger. On his blog, called Scobleizer, which he started in 2000, he writes about Microsoft's products, and has sometimes criticised them fiercely—(1)thereby both establishing his credibility and, by its willingness to tolerate him, helping to humanise his employer.“我热爱微软,微软也没有失去我。

”罗伯特·斯考伯上周在他的博客上义正词严地说。

他这么说是希望博客界不要再对他为何决定离开微软妄加臆测。

作为这一软件巨头的“技术专员”,斯考伯先生已经成为企业博客最知名的典范。

他的博客名叫Scobleizer,始建于2000年,主要写一些与微软产品有关的文章,有时候也会对其提出严厉批评——如此一来,不但树立了他的声望,也藉微软对他的宽容大度体现了微软的人性化。

经济学人-战后经济秩序的核心凯恩斯主义经济学

经济学人:战后经济秩序的核心:凯恩斯主义经济学Keynes advised the government during the firstworld war and participated in t he Versailles peace conference, which ended up extracting punitivereparation s from Germany.第一次世界大战期间,凯恩斯曾在出任政府顾问,参与过最终向德国索取惩罚性赔款的凡尔赛和谈。

The experience was dispiriting for Keynes, who wrotea number of scathing e ssays in the 1920s, pointing out the risks of the agreement and of thepost-wa r economic system more generally.这段经历令凯恩斯大失所望,促使他在20年代写了一系列尖锐的文章,从更为宏观的角度,指出了这些协议以及战后经济体系的风险。

Frustrated by his inability to change the minds of those in power, and by a d eepening global recession, Keynes set out to write a magnum opus criticising the economic consensus andlaying out an alternative.出于对自己改变当权者思想的无能为力以及日渐加深的全球衰退的受挫感,凯恩斯开始着手撰写一部批判经济共识并提出了一种替代共识的巨著。

He positioned the “General Theory” as a revolutionary text—and so it prove d.他对《通论》的定位是一份革命性文件——而且它也证明了自己的确如此。

The_Economist整理版(《经济学人》原版英文,有4000词汇即可,练习阅读绝好资料)