公司理财(英文版)题库2说课讲解

公司理财(英文版)题库2

CHAPTER 2Financial Statements & Cash Flow Multiple Choice Questions:I. DEFINITIONSBALANCE SHEETb 1. The financial statement showing a firm’s accounting value on a particular date is the:a. income statement.b. balance sheet.c. statement of cash flows.d. tax reconciliation statement.e. shareholders’ equity sheet.Difficulty level: EasyCURRENT ASSETSc 2. A current asset is:a. an item currently owned by the firm.b. an item that the firm expects to own within the next year.c. an item currently owned by the firm that will convert to cash within the next 12 months.d. the amount of cash on hand the firm currently shows on its balance sheet.e. the market value of all items currently owned by the firm.Difficulty level: EasyLONG-TERM DEBTb 3. The long-term debts of a firm are liabilities:a. that come due within the next 12 months.b. that do not come due for at least 12 months.c. owed to the firm’s suppliers.d. owed to the firm’s shareholders.e. the firm expects to incur within the next 12 months.Difficulty level: EasyNET WORKING CAPITALe 4. Net working capital is defined as:a. total liabilities minus shareholders’ equity.b. current liabilities minus shareholders’ equity.c. fixed assets minus long-term liabilities.d. total assets minus total liabilities.e. current assets minus current liabilities.Difficulty level: EasyLIQUID ASSETSd 5. A(n) ____ asset is one which can be quickly converted into cash without significantloss in value.a. currentb. fixedc. intangibled. liquide. long-termDifficulty level: EasyINCOME STATEMENTa 6. The financial statement summarizing a firm’s performance over a period of time is the:a. income statement.b. balance sheet.c. statement of cash flows.d. tax reconciliation statement.e. shareholders’ equity sheet.Difficulty level: EasyNONCASH ITEMSd 7. Noncash items refer to:a. the credit sales of a firm.b. the accounts payable of a firm.c. the costs incurred for the purchase of intangible fixed assets.d. expenses charged against revenues that do not directly affect cash flow.e. all accounts on the balance sheet other than cash on hand.Difficulty level: EasyMARGINAL TAX RATESe 8. Your _____ tax rate is the amount of tax payable on the next taxable dollar you earn.a. deductibleb. residualc. totald. averagee. marginalDifficulty level: EasyAVERAGE TAX RATESd 9. Your _____ tax rate measures the total taxes you pay divided by your taxable income.a. deductibleb. residualc. totald. averagee. marginalDifficulty level: EasyCASH FLOW FROM OPERATING ACTIVITIESa 10. _____ refers to the cash flow that results from the firm’s ongoing, normal businessactivities.a. Cash flow from operating activitiesb. Capital spendingc. Net working capitald. Cash flow from assetse. Cash flow to creditorsDifficulty level: MediumCASH FLOW FROM INVESTINGb 11. _____ refers to the changes in net capital assets.a. Operating cash flowb. Cash flow from investingc. Net working capitald. Cash flow from assetse. Cash flow to creditorsDifficulty level: MediumNET WORKING CAPITALc 12. _____ refers to the difference between a firm’s current assets and its current liabilities.a. Operating cash flowb. Capital spendingc. Net working capitald. Cash flow from assetse. Cash flow to creditorsDifficulty level: EasyCASH FLOW OF OPERATIONSd 13. _____ refers to the net total cash flow of the firm available for distribution to itscreditors and stockholders.a. Operating cash flowb. Capital spendingc. Net working capitald. Cash flow from operationse. Cash flow to creditorsCASH FLOW TO CREDITORSe 14. _____ refers to the firm’s interest payments less any net new borrowing.a. Operating cash flowb. Capital spendingc. Net working capitald. Cash flow from shareholderse. Cash flow to creditorsCASH FLOW TO STOCKHOLDERSe 15. _____ refers to the firm’s dividend payments less any net new equity raised.a. Operating cash flowb. Capital spendingc. Net working capitald. Cash flow from creditorse. Cash flow to stockholdersEARNINGS PER SHAREa 16. Earnings per share is equal to:a. net income divided by the total number of shares outstanding.b. net income divided by the par value of the common stock.c. gross income multiplied by the par value of the common stock.d. operating income divided by the par value of the common stock.e. net income divided by total shareholders’ equity.DIVIDENDS PER SHAREb 17. Dividends per share is equal to dividends paid:a. divided by the par value of common stock.b. divided by the total number of shares outstanding.c. divided by total shareholders’ equity.d. multiplied by the par value of the common stock.e. multiplied by the total number of shares outstanding.II. CONCEPTSCURRENT ASSETSa 18. Which of the following are included in current assets?I. equipmentII. inventoryIII. accounts payableIV. casha. II and IV onlyb. I and III onlyc. I, II, and IV onlyd. III and IV onlye. II, III, and IV onlyCURRENT LIABILITIESb 19. Which of the following are included in current liabilities?I. note payable to a supplier in eighteen monthsII. debt payable to a mortgage company in nine monthsIII. accounts payable to suppliersIV. loan payable to the bank in fourteen monthsa. I and III onlyb. II and III onlyc. III and IV onlyd. II, III, and IV onlye. I, II, and III onlyBALANCE SHEETd 20. An increase in total assets:a.means that net working capital is also increasing.b.requires an investment in fixed assets.c.means that shareholders’ equity must also increase.d.must be offset by an equal increase in liabilities and shareholders’ equity.e.can only occur when a firm has positive net income.LIQUIDITYc 21. Which one of the following accounts is generally the most liquid?a. inventoryb.buildingc.accounts receivabled.equipmente.patentLIQUIDITYe 22. Which one of the following statements concerning liquidity is correct?a.If you sold an asset today, it is a liquid asset.b.If you can sell an asset next year at a price equal to its actual value, the asset is highlyliquid.c.Trademarks and patents are highly liquid.d.The less liquidity a firm has, the lower the probability the firm will encounter financialdifficulties.e.Balance sheet accounts are listed in order of decreasing liquidity.LIQUIDITYd 23. Liquidity is:a. a measure of the use of debt in a firm’s capital structure.b.equal to current assets minus current liabilities.c.equal to the market value of a firm’s total assets minus its current liabilities.d.valuable to a firm even though liquid assets tend to be less profitable to own.e.generally associated with intangible assets.SHAREHOLDERS’ EQUITYd 24. Which of the following accounts are included in shareholders’ equity?I. interest paidII. retained earningsIII. capital surplusIV. long-term debta. I and II onlyb. II and IV onlyc. I and IV onlyd. II and III onlye. I and III onlyBOOK VALUEb 25. Book value:a. is equivalent to market value for firms with fixed assets.b.is based on historical cost.c.generally tends to exceed market value when fixed assets are included.d.is more of a financial than an accounting valuation.e.is adjusted to market value whenever the market value exceeds the stated book value. MARKET VALUEa 26. When making financial decisions related to assets, you should:a.always consider market values.b.place more emphasis on book values than on market values.c.rely primarily on the value of assets as shown on the balance sheet.d.place primary emphasis on historical costs.e.only consider market values if they are less than book values.INCOME STATEMENTd 27. As seen on an income statement:a.interest is deducted from income and increases the total taxes incurred.b.the tax rate is applied to the earnings before interest and taxes when the firm has bothdepreciation and interest expenses.c.depreciation is shown as an expense but does not affect the taxes payable.d.depreciation reduces both the pretax income and the net income.e.interest expense is added to earnings before interest and taxes to get pretax income. EARNINGS PER SHAREa 28. The earnings per share will:a. increase as net income increases.b.increase as the number of shares outstanding increase.c.decrease as the total revenue of the firm increases.d.increase as the tax rate increases.e.decrease as the costs decrease.DIVIDENDS PER SHAREe 29. Dividends per share:a. increase as the net income increases as long as the number of shares outstandingremains constant.b.decrease as the number of shares outstanding decrease, all else constant.c.are inversely related to the earnings per share.d.are based upon the dividend requirements established by Generally AcceptedAccounting Procedures.e.are equal to the amount of net income distributed to shareholders divided by thenumber of shares outstanding.REALIZATION PRINCIPLEb 30. According to Generally Accepted Accounting Principles,a.income is recorded based on the matching principle.b.income is recorded based on the realization principle.c.costs are recorded based on the liquidity principle. income is recorded based on the realization principle.e.depreciation is recorded as it affects the cash flows of a firm.MATCHING PRINCIPLEc 31. According to Generally Accepted Accounting Principles, costs are:a. recorded as incurred.b. recorded when paid.c. matched with revenues.d. matched with production levels.e. expensed as management desires.NONCASH ITEMSa 32. Depreciation:a. is a noncash expense that is recorded on the income statement.b.increases the net fixed assets as shown on the balance sheet.c.reduces both the net fixed assets and the costs of a firm.d.is a non-cash expense which increases the net operating income.e.decreases net fixed assets, net income, and operating cash flows.MARGINAL TAX RATEc 33. When you are making a financial decision, the most relevant tax rate is the _____ rate.a. averageb.fixedc.marginald.totale.variableOPERATING CASH FLOWa 34. An increase in which one of the following will cause the operating cash flow toincrease?a. depreciationb.change in net working capital working capitald.taxese.costsCHANGE IN NET WORKING CAPITALe 35. A firm starts its year with a positive net working capital. During the year, the firmacquires more short-term debt than it does short-term assets. This means that:a. the ending net working capital will be negative.b. both accounts receivable and inventory decreased during the year.c. the beginning current assets were less than the beginning current liabilities.d. accounts payable increased and inventory decreased during the year.e. the ending net working capital can be positive, negative, or equal to zero.CASH FLOW TO CREDITORSc 36. The cash flow to creditors includes the cash:a.received by the firm when payments are paid to suppliers.b.outflow of the firm when new debt is acquired.c. outflow when interest is paid on outstanding debt.d. inflow when accounts payable decreases.e. received when long-term debt is paid off.CASH FLOW TO STOCKHOLDERSa 37. Cash flow to stockholders must be positive when:a.the dividends paid exceed the net new equity raised.b.the net sale of common stock exceeds the amount of dividends paid.c.no income is distributed but new shares of stock are sold.d.both the cash flow to assets and the cash flow to creditors are negative.e.both the cash flow to assets and the cash flow to creditors are positive. BALANCE SHEETb 38. Which equality is the basis for the balance sheet?a. Fixed Assets = Stockholder's Equity + Current Assetsb. Assets = Liabilities + Stockholder's Equityc. Assets = Current Long-Term Debt + Retained Earningsd. Fixed Assets = Liabilities + Stockholder's Equitye. None of the above.BALANCE SHEETa 39. Assets are listed on the balance sheet in order of:a. decreasing liquidity.b. decreasing size.c. increasing size.d. relative life.e. None of the above.DEBTe 40. Debt is a contractual obligation that:a. requires the payout of residual flows to the holders of these instruments.b. requires a repayment of a stated amount and interest over the period.c. allows the bondholders to sue the firm if it defaults.d. Both A and B.e. Both B and C.CARRYING VALUEa 41. The carrying value or book value of assets:a. is determined under GAAP and is based on the cost of the asset.b. represents the true market value according to GAAP.c. is always the best measure of the company's value to an investor.d. is always higher than the replacement cost of the assets.e. None of the above.GAAPd 42. Under GAAP, the value of all the firm's assets are reported at:a. market value.b. liquidation value.c. intrinsic value.d. cost.e. None of the above.INCOME STATEMENTe 43. Which of the following statements concerning the income statement is true?a. It measures performance over a specific period of time.b. It determines after-tax income of the firm.c. It includes deferred taxes.d. It treats interest as an expense.e. All of the above.GAAP INCOME RECOGNITIONb 44. According generally accepted accounting principles (GAAP), revenue is recognized asincome when:a. a contract is signed to perform a service or deliver a good.b. the transaction is complete and the goods or services are delivered.c. payment is requested.d. income taxes are paid.e. All of the above.OPERATING CASH FLOWb 45. Which of the following is not included in the computation of operating cash flow?a. Earnings before interest and taxesb. Interest paidc. Depreciationd. Current taxese. All of the above are included.NET CAPITAL SPENDINGb 46. Net capital spending is equal to:a. net additions to net working capital.b. the net change in fixed assets.c. net income plus depreciation.d. total cash flow to stockholders less interest and dividends paid.e. the change in total assets.CASH FLOW TO STOCKHOLDERSd 47. Cash flow to stockholders is defined as:a. interest payments.b. repurchases of equity less cash dividends paid plus new equity sold.c. cash flow from financing less cash flow to creditors.d. cash dividends plus repurchases of equity minus new equity financing.e. None of the above.FREE CASH FLOWd 48. Free cash flow is:a. without cost to the firm.b. net income plus taxes.c. an increase in net working capital.d. cash flow in excess of that required to fund profitable capital projects.e. None of the above.CASH FLOWd 49. The cash flow of the firm must be equal to:a. cash flow to equity minus cash flow to debtholders.b. cash flow to debtholders minus cash flow to equity.c. cash flow to governments plus cash flow to equity.d. cash flow to equity plus cash flow to debtholders.e. None of the above.STATEMENT OF CASH FLOWSa 50. Which of the following are all components of the statement of cash flows?a. Cash flow from operating activities, cash flow from investing activities, and cash flowfrom financing activitiesb. Cash flow from operating activities, cash flow from investing activities, and cashflowfrom divesting activitiesc. Cash flow from internal activities, cash flow from external activities, and cash flowfrom financing activitiesd. Cash flow from brokering activities, cash flow from profitable activities, and cash flowfrom non-profitable activitiese. None of the above.III. PROBLEMSCURRENT ASSETSb 51. A firm has $300 in inventory, $600 in fixed assets, $200 in accounts receivables, $100in accounts payable, and $50 in cash. What is the amount of the current assets?a. $500b. $550c. $600d. $1,150e. $1,200NET WORKING CAPITALb 52. The total assets are $900, the fixed assets are $600, long-term debt is $500, and short-term debt is $200. What is the amount of net working capital?a. $0b. $100c. $200d. $300e. $400LIQUIDITYd 53. Brad’s Company has equipme nt with a book value of $500 that could be sold today at a50 percent discount. Their inventory is valued at $400 and could be sold to acompetitor for that amount. The firm has $50 in cash and customers owe them $300.What is the accounting value of their liquid assets?a. $50b. $350c. $700d. $750e. $1,000BOOK VALUEc 54. Martha’s Enterprises spent $2,400 to purchase equipment three years ago. Thisequipment is currently valued at $1,800 on today’s balance sheet but could actually besold for $2,000. Net working capital is $200 and long-term debt is $800. What is thebook value of shareholders’ equity?a.$200b.$800c.$1,200d.$1,400e. The answer cannot be determined from the information provided.NET INCOMEb 55. Art’s Boutique has sales of $640,000 an d costs of $480,000. Interest expense is$40,000 and depreciation is $60,000. The tax rate is 34%. What is the net income?a. $20,400b. $39,600c. $50,400d. $79,600e. $99,600MARGINAL TAX RATEc 56. Given the tax rates as shown, what is the average tax rate for a firm with taxableincome of $126,500?Taxable Income Tax Rate$ 0 - 50,000 15%50,001 - 75,000 25%75,001 - 100,000 34%100,001 - 335,000 39%a.21.38 percentb.23.88 percentc.25.76 percentd.34.64 percente. 39.00 percentTAXESd 57. The tax rates are as shown. Your firm currently has taxable income of $79,400. Howmuch additional tax will you owe if you increase your taxable income by $21,000?Taxable Income Tax Rate$ 0 - 50,000 15%50,001 - 75,000 25%75,001 - 100,000 34%100,001 - 335,000 39%a.$7,004b.$7,014c.$7,140d.$7,160e.$7,174OPERATING CASH FLOWd 58. Your firm has net income of $198 on total sales of $1,200. Costs are $715 anddepreciation is $145. The tax rate is 34 percent. The firm does not have interestexpenses. What is the operating cash flow?a.$93b.$241c.$340d.$383e. $485NET CAPITAL SPENDINGc. 59. Teddy’s Pillows has beginning net fixed assets of $480 and ending net fixed assets of$530. Assets valued at $300 were sold during the year. Depreciation was $40. What isthe amount of capital spending?a.$10b.$50c.$90d.$260e.$390CHANGE IN NET WORKING CAPITALb 60. At the beginning of the year, a firm has current assets of $380 and current liabilities of$210. At the end of the year, the current assets are $410 and the current liabilities are$250. What is the change in net working capital?a.-$30b.-$10c.$0d.$10e. $30CASH FLOW TO CREDITORSe 61. At the beginning of the year, long-term debt of a firm is $280 and total debt is $340. Atthe end of the year, long-term debt is $260 and total debt is $350. The interest paid is$30. What is the amount of the cash flow to creditors?a.-$50b.-$20c.$20d.$30e. $50CASH FLOW TO CREDITORSa 62. Pete’s Boats has beginning long-term debt of $180 and ending long-term debt of $210.The beginning and ending total debt balances are $340 and $360, respectively. Theinterest paid is $20. What is the amount of the cash flow to creditors?a.-$10b.$0c.$10d.$40e. $50CASH FLOW TO STOCKHOLDERSa 63. Peggy Grey’s Cookies has net income of $360. The firm pays out 40 percent of the netincome to its shareholders as dividends. During the year, the company sold $80 worthof common stock. What is the cash flow to stockholders?a.$64b.$136c.$144d.$224e. $296CASH FLOW TO STOCKHOLDERSa 64. Thompson’s Jet Skis has operating cash flow of $218. Depreciation is $45 and interestpaid is $35. A net total of $69 was paid on long-term debt. The firm spent $180 onfixed assets and increased net working capital by $38. What is the amount of the cashflow to stockholders?a.-$104b.-$28c.$28d.$114e. $142The following balance sheet and income statement should be used for questions #65 through #71:Nabors, Inc.2005 Income Statement($ in millions)Net sales $9,610Less: Cost of goods sold 6,310Less: Depreciation 1,370Earnings before interest and taxes 1,930Less: Interest paid 630Taxable Income $1,300Less: Taxes 455Net income $ 845Nabors, Inc.2004 and 2005 Balance Sheets($ in millions)2004 2005 2004 2005 Cash $ 310 $ 405 Accounts payable $ 2,720 $ 2,570 Accounts rec. 2,640 3,055 Notes payable 100 0 Inventory 3,275 3,850 Total $ 2,820 $ 2,570 Total $ 6,225 $ 7,310 Long-term debt 7,875 8,100 Net fixed assets 10,960 10,670 Common stock 5,000 5,250Retained earnings 1,490 2,060 Total assets $17,185 $17,980 Total liab.& equity $17,185 $17,980 CHANGE IN NET WORKING CAPITALc 65. What is the change in the net working capital from 2004 to 2005?a.$1,235b.$1,035c.$1,335d.$3,405e.$4,740NONCASH EXPENSESd 66. What is the amount of the non-cash expenses for 2005?a.$570b.$630c.$845d.$1,370e. $2,000NET CAPITAL SPENDINGc 67. What is the amount of the net capital spending for 2005?a.-$290b.$795c.$1,080d.$1,660e.$2,165OPERATING CASH FLOWd 68. What is the operating cash flow for 2005?a.$845b.$1,930c.$2,215d.$2,845e.$3,060CASH FLOW OF THE FIRMa 69. What is the cash flow of the firm for 2005?a.$430b.$485c.$1,340d.$2,590e.$3,100NET NEW BORROWINGe 70. What is the amount of net new borrowing for 2005?a.-$225b.-$25c.$0d.$25e.$225CASH FLOW TO CREDITORSd 71. What is the cash flow to creditors for 2005?a.-$405b.-$225c.$225d.$405e.$630The following information should be used for questions #72 through #79:Knickerdoodles, Inc.2004 2005Sales $ 740 $ 785COGS 430 460Interest 33 35Dividends 16 17Depreciation 250 210Cash 70 75Accounts receivables 563 502Current liabilities 390 405Inventory 662 640Long-term debt 340 410Net fixed assets 1,680 1,413Common stock 700 235Tax rate 35% 35%NET WORKING CAPITALd 72. What is the net working capital for 2005?a.$345b.$405c.$805d.$812e.$1,005CHANGE IN NET WORKING CAPITALa 73. What is the change in net working capital from 2004 to 2005?a.-$93b.-$7c.$7d.$85e.$97NET CAPITAL SPENDINGb 74. What is net capital spending for 2005?a.-$250b.-$57c.$0d.$57e.$477OPERATING CASH FLOWb 75. What is the operating cash flow for 2005?a.$143b.$297c.$325d.$353e.$367CASH FLOW OF THE FIRMd 76. What is the cash flow of the firm for 2005?a.$50b.$247c.$297d.$447e.$517NET NEW BORROWINGd 77. What is net new borrowing for 2005?a.-$70b.-$35c.$35d.$70e.$105CASH FLOW TO CREDITORSb 78. What is the cash flow to creditors for 2005?a.-$170b.-$35c.$135d.$170e.$205CASH FLOW TO STOCKHOLDERSd 79. What is the cash flow to stockholders for 2005?a.$408b.$417c.$452d.$482e.$503The following information should be used for questions #80 through #82:2005Cost of goods sold $3,210Interest $215Dividends $160Depreciation $375Change in retained earnings $360Tax rate 35%TAXABLE INCOMEe 80. What is the taxable income for 2005?a.$360b.$520c.$640d.$780e.$800OPERATING CASH FLOWd 81. What is the operating cash flow for 2005?a.$520b.$800c.$1,015d.$1,110e.$1,390SALESc 82. What are the sales for 2005?a.$4,225b.$4,385c.$4,600d.$4,815e. $5,000NET INCOMEb 83. Calculate net income based on the following information. Sales are $250; Cost ofgoods sold is $160; Depreciation expense is $35; Interest paid is $20; and the tax rateis 34%.a. $11.90b. $23.10c. $35.00d. $36.30e. $46.20IV. ESSAYSLIQUID ASSETS84. What is a liquid asset and why is it necessary for a firm to maintain a reasonable level ofliquid assets?Liquid assets are those that can be sold quickly with little or no loss in value. A firm that has sufficient liquidity will be less likely to experience financial distress.OPERATING CASH FLOW85. Why is interest expense excluded from the operating cash flow calculation?Operating cash flow is designed to represent the cash flow a firm generates from its day-to-day operating activities. Interest expense arises out of a financing choice and thus should be considered as a cash flow to creditors.CASH FLOW AND ACCOUNTING STATEMENTS86. Explain why the income statement is not a good representation of cash flow.Most income statements contain some noncash items, so these must be accounted for when calculating cash flows. More importantly, however, since GAAP is used to create income statements, revenues and expenses are booked when they accrue, not when their corresponding cash flows occur.BOOK VALUE AND MARKET VALUE87. Discuss the difference between book values and market values on the balance sheet andexplain which is more important to the financial manager and why.The accounts on the balance sheet are generally carried at historical cost, not market values.Although the book value of current assets and current liabilities may closely approximate market values, the same cannot be said for the rest of the balance sheet accounts. Ultimately, the financ ial manager should focus on the firm’s stock price, which is a market value measure. Hence, market values are more meaningful than book values.ADDITION TO RETAINED EARNINGS88. Note that in all of our cash flow computations to determine cash flow of the firm, we neverinclude the addition to retained earnings. Why not? Is this an oversight?The addition to retained earnings is not a cash flow. It is simply an accounting entry that reconciles the balance sheet. Any additions to retained earnings will show up as cash flow changes in other balance sheet accounts.DEPRECIATION AND CASH FLOW89. Note that we added depreciation back to operating cash flow and to additions to fixed assets.Why add it back twice? Isn’t this double-counting?In both cases, depreciation is added back because it was previously subtracted when obtaining ending balances of net income and fixed assets. Also, since depreciation is a noncash expense, we need to add it back in both instances, so there is no double counting. TAX LIABILITIES AND CASH FLOW90. Sometimes when businesses are critically delinquent on their tax liabilities, the tax authoritycomes in and literally seizes the business by chasing all of the employees out of the building and changing the locks. What does this tell you about the importance of taxes relative to our discussion of cash flow? Why might a business owner want to avoid such an occurrence?Taxes must be paid in cash, and in this case, they are one of the most important components of cash flow. The reputation of a business can undergo irreparable harm if word gets out that the tax authorities have confiscated the business, even if only for a couple of hours until the business owner can come up with the money to clear up the tax problem. The bottom line。

(公司理财)英文版罗斯公司理财习题答案C

CHAPTER 20INTERNATIONAL CORPORATE FINANCEAnswers to Concepts Review and Critical Thinking Questions1. a.The dollar is selling at a premium because it is more expensive in the forward market than inthe spot market (SFr 1.53 versus SFr 1.50).b.The franc is expected to depreciate relative to the dollar because it will take more francs to buyone dollar in the future than it does today.c.Inflation in Switzerland is higher than in the United States, as are nominal interest rates.2.The exchange rate will increase, as it will take progressively more pesos to purchase a dollar. This isthe relative PPP relationship.3. a.The Australian dollar is expected to weaken relative to the dollar, because it will take moreA$ in the future to buy one dollar than it does today.b.The inflation rate in Australia is higher.c.Nominal interest rates in Australia are higher; relative real rates in the two countries are thesame.4. A Yankee bond is most accurately described by d.5. No. For example, if a country’s currency strengthens, imports become cheaper (good), but its exportsbecome more expensive for others to buy (bad). The reverse is true for currency depreciation.6.Additional advantages include being closer to the final consumer and, thereby, saving ontransportation, significantly lower wages, and less exposure to exchange rate risk. Disadvantages include political risk and costs of supervising distant operations.7.One key thing to remember is that dividend payments are made in the home currency. Moregenerally, it may be that the owners of the multinational are primarily domestic and are ultimately concerned about their wealth denominated in their home currency because, unlike a multinational, they are not internationally diversified.8. a.False. If prices are rising faster in Great Britain, it will take more pounds to buy the sameamount of goods that one dollar can buy; the pound will depreciate relative to the dollar.b.False. The forward market would already reflect the projected deterioration of the euro relativeto the dollar. Only if you feel that there might be additional, unanticipated weakening of the euro that isn’t reflected in forward rates today, will the forward hedge protect you against additional declines.c.True. The market would only be correct on average, while you would be correct all the time.9. a.American exporters: their situation in general improves because a sale of the exported goods fora fixed number of euros will be worth more dollars.American importers: their situation in general worsens because the purchase of the imported goods for a fixed number of euros will cost more in dollars.b.American exporters: they would generally be better off if the British government’s intentionsresult in a strengthened pound.American importers: they would generally be worse off if the pound strengthens.c.American exporters: they would generally be much worse off, because an extreme case of fiscalexpansion like this one will make American goods prohibitively expensive to buy, or else Brazilian sales, if fixed in cruzeiros, would become worth an unacceptably low number of dollars.American importers: they would generally be much better off, because Brazilian goods will become much cheaper to purchase in dollars.10.IRP is the most likely to hold because it presents the easiest and least costly means to exploit anyarbitrage opportunities. Relative PPP is least likely to hold since it depends on the absence of market imperfections and frictions in order to hold strictly.11.It all depends on whether the forward market expects the same appreciation over the period andwhether the expectation is accurate. Assuming that the expectation is correct and that other traders do not have the same information, there will be value to hedging the currency exposure.12.One possible reason investment in the foreign subsidiary might be preferred is if this investmentprovides direct diversification that shareholders could not attain by investing on their own. Another reason could be if the political climate in the foreign country was more stable than in the home country. Increased political risk can also be a reason you might prefer the home subsidiary investment. Indonesia can serve as a great example of political risk. If it cannot be diversified away, investing in this type of foreign country will increase the systematic risk. As a result, it will raise the cost of the capital, and could actually decrease the NPV of the investment.13.Yes, the firm should undertake the foreign investment. If, after taking into consideration all risks, aproject in a foreign country has a positive NPV, the firm should undertake it. Note that in practice, the stated assumption (that the adjustment to the discount rate has taken into consideration all political and diversification issues) is a huge task. But once that has been addressed, the net present value principle holds for foreign operations, just as for domestic.14.If the foreign currency depreciates, the U.S. parent will experience an exchange rate loss when theforeign cash flow is remitted to the U.S. This problem could be overcome by selling forward contracts. Another way of overcoming this problem would be to borrow in the country where the project is located.15.False. If the financial markets are perfectly competitive, the difference between the Eurodollar rateand the U.S. rate will be due to differences in risk and government regulation. Therefore, speculating in those markets will not be beneficial.16.The difference between a Eurobond and a foreign bond is that the foreign bond is denominated in thecurrency of the country of origin of the issuing company. Eurobonds are more popular than foreign bonds because of registration differences. Eurobonds are unregistered securities.Solutions to Questions and ProblemsNOTE: All end-of-chapter problems were solved using a spreadsheet. Many problems require multiple steps. Due to space and readability constraints, when these intermediate steps are included in this solutions manual, rounding may appear to have occurred. However, the final answer for each problem is found without rounding during any step in the problem.Basicing the quotes from the table, we get:a.$50(€0.7870/$1) = €39.35b.$1.2706c.€5M($1.2706/€) = $6,353,240d.New Zealand dollare.Mexican pesof.(P11.0023/$1)($1.2186/€1) = P13.9801/€This is a cross rate.g.The most valuable is the Kuwait dinar. The least valuable is the Indonesian rupiah.2. a.You would prefer £100, since:(£100)($.5359/£1) = $53.59b.You would still prefer £100. Using the $/£ exchange rate and the SF/£ exchange rate to find theamount of Swiss francs £100 will buy, we get:(£100)($1.8660/£1)(SF .8233) = SF 226.6489ing the quotes in the book to find the SF/£ cross rate, we find:(SF 1.2146/$1)($0.5359/£1) = SF 2.2665/£1The £/SF exchange rate is the inverse of the SF/£ exchange rate, so:£1/SF .4412 = £0.4412/SF 13. a.F180= ¥104.93 (per $). The yen is selling at a premium because it is more expensive in theforward market than in the spot market ($0.0093659 versus $0.009530).b.F90 = $1.8587/£. The pound is selling at a discount because it is less expensive in the forwardmarket than in the spot market ($0.5380 versus $0.5359).c.The value of the dollar will fall relative to the yen, since it takes more dollars to buy one yen inthe future than it does today. The value of the dollar will rise relative to the pound, because it will take fewer dollars to buy one pound in the future than it does today.4. a.The U.S. dollar, since one Canadian dollar will buy:(Can$1)/(Can$1.26/$1) = $0.7937b.The cost in U.S. dollars is:(Can$2.19)/(Can$1.26/$1) = $1.74Among the reasons that absolute PPP doe sn’t hold are tariffs and other barriers to trade, transactions costs, taxes, and different tastes.c.The U.S. dollar is selling at a discount, because it is less expensive in the forward market thanin the spot market (Can$1.22 versus Can$1.26).d.The Canadian dollar is expected to appreciate in value relative to the dollar, because it takesfewer Canadian dollars to buy one U.S. dollar in the future than it does today.e.Interest rates in the United States are probably higher than they are in Canada.5. a.The cross rate in ¥/£ terms is:(¥115/$1)($1.70/£1) = ¥195.5/£1b.The yen is quoted too low relative to the pound. Take out a loan for $1 and buy ¥115. Use the¥115 to purchase pounds at the cross-rate, which will give you:¥115(£1/¥185) = £0.6216Use the pounds to buy back dollars and repay the loan. The cost to repay the loan will be:£0.6216($1.70/£1) = $1.0568You arbitrage profit is $0.0568 per dollar used.6.We can rearrange the interest rate parity condition to answer this question. The equation we will useis:R FC = (F T– S0)/S0 + R USUsing this relationship, we find:Great Britain: R FC = (£0.5394 – £0.5359)/£0.5359 + .038 = 4.45%Japan: R FC = (¥104.93 – ¥106.77)/¥106.77 + .038 = 2.08%Switzerland: R FC = (SFr 1.1980 – SFr 1.2146)/SFr 1.2146 + .038 = 2.43%7.If we invest in the U.S. for the next three months, we will have:$30M(1.0045)3 = $30,406,825.23If we invest in Great Britain, we must exchange the dollars today for pounds, and exchange the pounds for dollars in three months. After making these transactions, the dollar amount we would have in three months would be:($30M)(£0.56/$1)(1.0060)3/(£0.59/$1) = $28,990,200.05We should invest in U.S.ing the relative purchasing power parity equation:F t = S0 × [1 + (h FC– h US)]tWe find:Z3.92 = Z3.84[1 + (h FC– h US)]3h FC– h US = (Z3.92/Z3.84)1/3– 1h FC– h US = .0069Inflation in Poland is expected to exceed that in the U.S. by 0.69% over this period.9.The profit will be the quantity sold, times the sales price minus the cost of production. Theproduction cost is in Singapore dollars, so we must convert this to U.S. dollars. Doing so, we find that if the exchange rates stay the same, the profit will be:Profit = 30,000[$145 – {(S$168.50)/(S$1.6548/$1)}]Profit = $1,295,250.18If the exchange rate rises, we must adjust the cost by the increased exchange rate, so:Profit = 30,000[$145 – {(S$168.50)/1.1(S$1.6548/$1)}]Profit = $1,572,954.71If the exchange rate falls, we must adjust the cost by the decreased exchange rate, so:Profit = 30,000[$145 – {(S$168.50)/0.9(S$1.6548/$1)}]Profit = $955,833.53To calculate the breakeven change in the exchange rate, we need to find the exchange rate that make the cost in Singapore dollars equal to the selling price in U.S. dollars, so:$145 = S$168.50/S TS T = S$1.1621/$1S T = –.2978 or –29.78% decline10. a.If IRP holds, then:F180 = (Kr 6.43)[1 + (.08 – .05)]1/2F180 = Kr 6.5257Since given F180 is Kr6.56, an arbitrage opportunity exists; the forward premium is too high.Borrow Kr1 today at 8% interest. Agree to a 180-day forward contract at Kr 6.56. Convert the loan proceeds into dollars:Kr 1 ($1/Kr 6.43) = $0.15552Invest these dollars at 5%, ending up with $0.15931. Convert the dollars back into krone as$0.15931(Kr 6.56/$1) = Kr 1.04506Repay the Kr 1 loan, ending with a profit of:Kr1.04506 – Kr1.03868 = Kr 0.00638b.To find the forward rate that eliminates arbitrage, we use the interest rate parity condition, so:F180 = (Kr 6.43)[1 + (.08 – .05)]1/2F180 = Kr 6.525711.The international Fisher effect states that the real interest rate across countries is equal. We canrearrange the international Fisher effect as follows to answer this question:R US– h US = R FC– h FCh FC = R FC + h US– R USa.h AUS = .05 + .035 – .039h AUS = .046 or 4.6%b.h CAN = .07 + .035 – .039h CAN = .066 or 6.6%c.h TAI = .10 + .035 – .039h TAI = .096 or 9.6%12. a.The yen is expected to get stronger, since it will take fewer yen to buy one dollar in the futurethan it does today.b.h US– h JAP (¥129.76 – ¥131.30)/¥131.30h US– h JAP = – .0117 or –1.17%(1 – .0117)4– 1 = –.0461 or –4.61%The approximate inflation differential between the U.S. and Japan is – 4.61% annually.13. We need to find the change in the exchange rate over time, so we need to use the relative purchasingpower parity relationship:F t = S0 × [1 + (h FC– h US)]TUsing this relationship, we find the exchange rate in one year should be:F1 = 215[1 + (.086 – .035)]1F1 = HUF 225.97The exchange rate in two years should be:F2 = 215[1 + (.086 – .035)]2F2 = HUF 237.49And the exchange rate in five years should be:F5 = 215[1 + (.086 – .035)]5F5 = HUF 275.71ing the interest-rate parity theorem:(1 + R US) / (1 + R FC) = F(0,1) / S0We can find the forward rate as:F(0,1) = [(1 + R US) / (1 + R FC)] S0F(0,1) = (1.13 / 1.08)$1.50/£F(0,1) = $1.57/£Intermediate15.First, we need to forecast the future spot rate for each of the next three years. From interest rate andpurchasing power parity, the expected exchange rate is:E(S T) = [(1 + R US) / (1 + R FC)]T S0So:E(S1) = (1.0480 / 1.0410)1 $1.22/€ = $1.2282/€E(S2) = (1.0480 / 1.0410)2 $1.22/€ = $1.2365/€E(S3) = (1.0480 / 1.0410)3 $1.22/€ = $1.2448/€Now we can use these future spot rates to find the dollar cash flows. The dollar cash flow each year will be:Year 0 cash flow = –€$12,000,000($1.22/€) = –$14,640,000.00Year 1 cash flow = €$2,700,000($1.2282/€) = $3,316,149.86Year 2 cash flow = €$3,500,000($1.2365/€) = $4,327,618.63Year 3 cash flow = (€3,300,000 + 7,400,000)($1.2448/€) = $13,319,111.90And the NPV of the project will be:NPV = –$14,640,000 + $3,316,149.86/1.13 + $4,4327,618.63/1.132 + $13,319,111.90/1.133NPV = $914,618.7316. a.Implicitly, it is assumed that interest rates won’t change over the life of the project, but theexchange rate is projected to decline because the Euroswiss rate is lower than the Eurodollar rate.b.We can use relative purchasing power parity to calculate the dollar cash flows at each time. Theequation is:E[S T] = (SFr 1.72)[1 + (.07 – .08)]TE[S T] = 1.72(.99)TSo, the cash flows each year in U.S. dollar terms will be:t SFr E[S T] US$0 –27.0M –$15,697,674.421 +7.5M 1.7028 $4,404,510.222 +7.5M 1.6858 $4,449,000.223 +7.5M 1.6689 $4,493,939.624 +7.5M 1.6522 $4,539,332.955 +7.5M 1.6357 $4,585,184.79And the NPV is:NPV = –$15,697,674.42 + $4,404,510.22/1.13 + $4,449,000.22/1.132 + $4,493,939.62/1.133 + $4,539,332.95/1.134 + $4,585,184.79/1.135NPV = $71,580.10c.Rearranging the relative purchasing power parity equation to find the required return in Swissfrancs, we get:R SFr = 1.13[1 + (.07 – .08)] – 1R SFr = 11.87%So, the NPV in Swiss francs is:NPV = –SFr 27.0M + SFr 7.5M(PVIFA11.87%,5)NPV = SFr 123,117.76Converting the NPV to dollars at the spot rate, we get the NPV in U.S. dollars as:NPV = (SFr 123,117.76)($1/SFr 1.72)NPV = $71,580.10Challenge17. a.The domestic Fisher effect is:1 + R US = (1 + r US)(1 + h US)1 + r US = (1 + R US)/(1 + h US)This relationship must hold for any country, that is:1 + r FC = (1 + R FC)/(1 + h FC)The international Fisher effect states that real rates are equal across countries, so:1 + r US = (1 + R US)/(1 + h US) = (1 + R FC)/(1 + h FC) = 1 + r FCb.The exact form of unbiased interest rate parity is:E[S t] = F t = S0 [(1 + R FC)/(1 + R US)]tc.The exact form for relative PPP is:E[S t] = S0 [(1 + h FC)/(1 + h US)]td.For the home currency approach, we calculate the expected currency spot rate at time t as:E[S t] = (€0.5)[1.07/1.05]t= (€0.5)(1.019)tWe then convert the euro cash flows using this equation at every time, and find the present value. Doing so, we find:NPV = –[€2M/(€0.5)] + {€0.9M/[1.019(€0.5)]}/1.1 + {€0.9M/[1.0192(€0.5)]}/1.12 + {€0.9M/[1.0193(€0.5/$1)]}/1.13NPV = $316,230.72For the foreign currency approach, we first find the return in the euros as:R FC = 1.10(1.07/1.05) – 1 = 0.121Next, we find the NPV in euros as:NPV = –€2M + (€0.9M)/1.121 + (€0.9M)/1.1212+ (€0.9M)/1.1213= €158,115.36And finally, we convert the euros to dollars at the current exchange rate, which is:NPV ($) = €158,115.36 /(€0.5/$1) = $316,230.72。

公司理财及财务管理知识分析(双语)(ppt 45页)

5-12 Decision Criteria Test - Payback

Does the payback rule account for the time value of money?

Does the payback rule account for the risk of the cash flows?

5- 8

NPV – Decision Rule

Minimum Acceptance Criteria: Accept if NPV >0

Ranking Criteria: Choose the highest NPV

Example9.1 see page263

McGraw Hill/Irwin

a discounted basis within the specified time

McGraw Hill/Irwin

9-14 Copyright © 2003 by The McGraw-Hill Companies, Inc. All rights reserved

5-15 Computing Discounted Payback for

of later cash flows Biased toward liquidity

Disadvantages

Ignores the time value of money

Requires an arbitrary cutoff point

Ignores cash flows beyond the cutoff date

Does the decision rule adjust for the time value of money?

Does the decision rule adjust for risk?

公司理财课资料新件英文版(ppt 25)

C1

C1 Y1=1.2m

Saver (lending)

B

1+r

Y

1

slope = -(1+r) Spender (borrowing)

A

© Professor Ho-Mou Wu

C0 Y0=1m PV(Y) Y0

Corporate Finance

Y1 (1 r)

C0 2-5

(I) Saving (Financing) Decision

• If you were to be promised $10,000 due in one year when interest rates are at 5-percent, your investment

be worth $9,523.81 in today’s dollars.

© Professor Ho-Mou Wu

(RWJ Ch 3, 4)

© Professor Ho-Mou Wu

Corporate Finance

2-0

Investment Decision

Example 1: Suppose an investment that promises to pay $10,000 in one year is offered for sale for $9,500. Your interest rate is 5%. Should you buy?

© Professor Ho-Mou Wu

Corporate Finvaluation in a Riskless World

Why do we use NPV as the investment criterion ? Assume Perfect Capital Market and Two Period

公司理财相关知识英文版)

Chapter 8: Strategy and Analysis in Using Net Present Value Concept Questions - Chapter 88.1 ∙What are the ways a firm can create positive NPV.1.Be first to introduce a new product.2.Further develop a core competency to product goods or services at lower coststhan competitors.3.Create a barrier that makes it difficult for the other firms to competeeffectively.4.Introduce variation on existing products to take advantage of unsatisfieddemand5.Create product differentiation by aggressive advertising and marketingnetworks.e innovation in organizational processes to do all of the above.∙How can managers use the market to help them screen out negative NPV projects?8.2 ∙What is a decision tree?It is a method to help capital budgeting decision-makers evaluating projectsinvolving sequential decisions. At every point in the tree, there are differentalternatives that should be analyzed.∙What are potential problems in using a decision tree?Potential problems 1) that a different discount rate should be used for differentbranches in the tree and 2) it is difficult for decision trees to capture managerialoptions.8.3 ∙What is a sensitivity analysis?It is a technique used to determine how the result of a decision changes whensome of the parameters or assumptions change.∙Why is it important to perform a sensitivity analysis?Because it provides an analysis of the consequences of possible prediction orassumption errors.∙What is a break-even analysis?It is a technique used to determine the volume of production necessary to breakeven, that is, to cover not only variable costs but fixed costs as well.∙Describe how sensitivity analysis interacts with break-even analysis.Sensitivity analysis can determine how the financial break-even point changeswhen some factors (such as fixed costs, variable costs, or revenue) change. Answers to End-of-Chapter ProblemsQUESTIONS AND PROBLEMSDecision Trees8.1 Sony Electronics, Inc., has developed a new type of VCR. If the firm directly goes to the market with the product, there is only a 50 percent chance of success. On the other hand, if the firm conducts test marketing of the VCR, it will take a year and will cost $2 million.Through the test marketing, however, the firm is able to improve the product and increase the probability of success to 75 percent. If the new product proves successful, the present value (at the time when the firm starts selling it) of the payoff is $20 million, while if it turns out to be a failure, the present value of the payoff is $5 million. Should the firm conduct test marketing or go directly to the market? The appropriate discount rate is 15 percent.8.1 Go directly:NPV = 0.5 ⨯ $20 million + 0.5 ⨯ $5 million= $12.5 millionTest marketing:NPV = -$2 million + (0.75 ⨯ $20 million + 0.25 ⨯ $5 million) / 1.15= $12.13 millionGo directly to the market.8.2 The marketing manager for a growing consumer products firm is considering launching a new product. To determine consumers’ interest in such a product, the manager can conduct a focus group that will cost $120,000 and has a 70 percent chance of correctly predicting the success of the product, or hire a consulting firm that will research the market at a cost of $400,000. The consulting firm boasts a correct assessment record of 90 percent. Of course going directly to the market with no prior testing will be the correct move 50 percent of the time. If the firm launches the product, and it is a success, the payoff will be $1.2 million.Which action will result in the highest expected payoff for the firm?8.2 Focus group: -$120,000 + 0.70 ⨯ $1,200,000 = $720,000Consulting firm: -$400,000 + 0.90 ⨯ $1,200,000 = $680,000Direct marketing: 0.50 ⨯ $1,200,000 = $600,000The manager should conduct a focus group.8.3 Tandem Bicycles is noticing a decline in sales due to the increase of lower-priced import products from the Far East. The CFO is considering a number of strategies to maintain its market share. The options she sees are the following:• Price the products more aggressively, resulting in a $1.3 million decline in cash flows.The likelihood that Tandem will lose no cash flows to the imports is 55 percent; there is a45 percent probability that they will lose only $550,000 in cash flows to the imports.• Hire a lobbyist to convince the regulators that there should be important tariffs placed upon overseas manufacturers of bicycles. This will cost Tandem $800,000 and will have a 75 percent success rate, that is, no loss in cash flows to the importers. If the lobbyists do not succeed, Tandem Bicycles will lose $2 million in cash flows. As the assistant to the CFO, which strategy would you recommend to your boss? Accounting Break-Even Analysis8.3 Price more aggressively:-$1,300,000 + (0.55 ⨯ 0) + 0.45 ⨯ (-$550,000)= -$1,547,500Hire lobbyist:-$800,000 + (0.75 ⨯ 0) + 0.25 ⨯ (-$2,000,000)= -$1,300,000Tandem should hire the lobbyist.8.4 Samuelson Inc. has invested in a facility to produce calculators. The price of the machine is $600,000 and its economic life is five years. The machine is fully depreciated by the straight-line method and will produce 20,000 units of calculators in the first year. The variable production cost per unit of the calculator is $15, while fixed costs are $900,000. The corporate tax rate for the company is 30 percent. What should the sales price per unit of the calculator be for the firm to have a zero profit?8.4 Let sales price be x.Depreciation = $600,000 / 5 = $120,000BEP: ($900,000 + $120,000) / (x - $15) = 20,000x = $668.5 What is the minimum number of units that a distributor of big-screen TVs must sell in a given period to break even?Sales price _ $1,500Variable costs _ $1,100Fixed costs _ $120,000Depreciation _ $20,000Tax rate _ 35%8.5 The accounting break-even= (120,000 + 20,000) / (1,500 - 1,100)= 350 units8.6 You are considering investing in a fledgling company that cultivates abalone for sale to local restaurants. The proprietor says he’ll return all profits to you after covering operating costs and his salary. How many abalone must be harvested and sold in the first year of operations for you to get any payback? (Assume no depreciation.)Price per adult abalone _ $2.00Variable costs _ $0.72Fixed costs _ $300,000Salaries _ $40,000Tax rate _ 35%How much profit will be returned to you if he sells 300,000 abalone?8.6 a. The accounting break-even= 340,000 / (2.00 - 0.72)= 265,625 abalonesb. [($2.00 ⨯ 300,000) - (340,000 + 0.72 ⨯ 300,000)] (0.65)= $28,600This is the after tax profit.Present Value Break-Even Analysis8.7 Using the information in the problem above, what is the present value break-even point if the discount rate is 15 percent, initial investment is $140,000, and the life of the project is seven years? Assume a straight-line depreciation method with a zero salvage value.A = $33,6508.7 EAC = $140,000 / 715.0Depreciation = $140,000 / 7 = $20,000BEP = {$33,650 + $340,000 ⨯ 0.65 - $20,000 ⨯ 0.35} / {($2 - $0.72) ⨯ 0.65}= 297,656.25≈ 297,657 units8.8 Kids & Toys Inc. has purchased a $200,000 machine to produce toy cars. The machine will be fully depreciated by the straight-line method for its economic life of five years and will be worthless after its life. The firm expects that the sales price of the toy is $25 while its variable cost is $5. The firm should also pay $350,000 as fixed costs each year. The corporate tax rate for the company is 25 percent, and the appropriate discount rate is 12 percent. What is the present value break-even point?8.8 Depreciation = $200,000 / 5 = $40,000A = $200,000 / 3.60478EAC = $200,000 / 512.0= $55,482BEP = {$55,482 + $350,000 ⨯ 0.75 - $40,000 ⨯ 0.25} / {($25 - $5) ⨯ 0.75}= 20,532.13≈ 20533 units8.9 The Cornchopper Company is considering the purchase of a new harvester. The company is currently involved in deliberations with the manufacturer and the parties have not come to settlement regarding the final purchase price. The management of Cornchopper has hired you to determine the break-even purchase price of the harvester.This price is that which will make the NPV of the project zero. Base your analysis on the following facts: • The new harvester is not expected to affect revenues, but operating expenses will be reduced by $10,000 per year for 10 years.• The old harvester is now 5 years old, with 10 years of its scheduled life remaining. It was purchased for $45,000. It has been depreciated on a straight-line basis.• The old harvester has a current market value of $20,000.• The new harvester will be depreciated on a straight-line basis over its 10-year life.• The corporate tax rate is 34 percent.• The firm’s required rate of return is 15 percent.• All cash flows occur at year-end. However, the initial investment, the proceeds from selling the old harvester, and any tax effects will occur immediately. Capital gains and losses are taxed at the corporate rate of 34 percent when they are realized.• The expected market value of both harvesters at the end of their economic lives is zero.8.9 Let I be the break-even purchase price.Incremental C0$20,000Tax effect 3,400Total $23,400Depreciation per period= $45,000 / 15= $3,000Book value of the machine= $45,000 - 5 ⨯ $3,000= $30,000Loss on sale of machine= $30,000 - $20,000= $10,000Tax credit due to loss= $10,000 ⨯ 0.34= $3,400Incremental cost savings:$10,000 (1 - 0.34) = $6,600Incremental depreciation tax shield:[I / 10 - $3,000] (0.34)The break-even purchase price is the Investment (I), which makes the NPV be zero.NPV = 0= -I + $23,400 + $6,600 1015.0A+ [I / 10 - $3,000] (0.34) 1015.0A= -I + $23,400 + $6,600 (5.0188)+ I (0.034) (5.0188) - $3,000 (0.34) (5.0188)I = $61,981Scenario Analysis8.10 Ms. Thompson, as the CFO of a clock maker, is considering an investment of a $420,000 machine that has a seven-year life and no salvage value. The machine is depreciated by a straight-line method with a zero salvage over the seven years. The appropriate discount rate for cash flows of the project is 13 percent, and the corporate tax rate of the company is 35 percent. Calculate the NPV of the project in the following scenario. What is your conclusion about the project?Pessimistic Expected OptimisticUnit sales 23,000 25,000 27,000Price $ 38 $ 40 $ 42Variable costs $ 21 $ 20 $ 19Fixed costs $320,000 $300,000 $280,0008.10 Pessimistic:NPV = -$420,000 +(){}23,000$38$21$320,0000.65$60,0000.351.13tt17--⨯+⨯=∑= -$123,021.71 Expected:NPV = -$420,000 +(){}25,000$40$20$300,0000.65$60,0000.351.13t7--⨯+⨯=∑t1= $247,814.17 Optimistic:NPV = -$420,000 +(){}27,000$42$19$280,0000.65$60,0000.351.13tt17--⨯+⨯=∑= $653,146.42Even though the NPV of pessimistic case is negative, if we change one input while all others are assumed to meet their expectation, we have all positive NPVs like the one before. Thus, this project is quite profitable.Pessimistic NPVUnit sales 23,000 $132,826.30Price $38 $104,079.33Variable costs $21 $175,946.75Fixed costs $320,000 $190,320.248.11 You are the financial analyst for a manufacturer of tennis rackets that has identified a graphite-like material that it is considering using in its rackets. Given the following information about the results of launching a new racket, will you undertake the project?(Assumptions: Tax rate _ 40%, Effective discount rate _ 13%, Depreciation _ $300,000per year, and production will occur over the next five years only.)Pessimistic Expected OptimisticMarket size 110,000 120,000 130,000Market share 22% 25% 27%Price $ 115 $ 120 $ 125Variable costs $ 72 $ 70 $ 68Fixed costs $ 850,000 $ 800,000 $ 750,000Investment $1,500,000 $1,500,000 $1,500,0008.11 Pessimistic:NPV = -$1,500,000+(){}1100000220000600000401131,.$850,.$300,..⨯--⨯+⨯=∑$115$725tt= -$675,701.68Expected:NPV = -$1,500,000+(){}1200000250000600000401131,.$800,.$300,..⨯--⨯+⨯=∑$120$705tt= $399,304.88Optimistic:NPV = -$1,500,000+(){}130,0000.27$125$68$750,0000.60$300,0000.401.13tt15⨯--⨯+⨯=∑= $1,561,468.43The expected present value of the new tennis racket is $428,357.21. (Assuming there are equal chances of the 3 scenarios occurring.)8.12 What would happen to the analysis done above if your competitor introduces a graphite composite that is even lighter than your product? What factors would this likely affect? Do an NPV analysis assuming market size increases (due to more awareness of graphite-based rackets) to the level predicted by the optimistic scenario but your market share decreases to the pessimistic level (due to competitive forces). What does this tell you about the relative importance of market size versus market share?8.12 NPV =(){}-+⨯--⨯+⨯=∑1,500,000130,0000.22$120$70$800,0000.60$300,0000.401.13tt15= $251,581.17The 3% drop in market share hurt significantly more than the 10,000 increase in marketsize helped. However, if the drop were only 2%, the effects would be about even. Market size is going up by over 8%, thus it seems market share is more important than market size. The Option to Abandon8.13 You have been hired as a financial analyst to do a feasibility study of a new video game for Passivision. Marketing research suggests Passivision can sell 12,000 units per year at $62.50 net cash flowper unit for the next 10 years. Total annual operating cash flow is forecasted to be $62.50 _ 12,000 _ $750,000. The relevant discount rate is 10 percent.The required initial investment is $10 million.a. What is the base case NPV?b. After one year, the video game project can be abandoned for $200,000. After one year,expected cash flows will be revised upward to $1.5 million or to $0 with equalprobability. What is the option value of abandonment? What is the revised NPV?A) = -$5,391,574.678.13 a. NPV = -$10,000,000 + ( $750, 000 ⨯1010.A)b.Revised NPV = -$10,000,000 + $750,000 / 1.10 + [(.5 ⨯ $1,500,000 ⨯9.10+ (.5 ⨯ $200,000 )] / 1.10= -$5,300,665.58Option value of abandonment = -$5,300,665.58 – ( -$5,391,574.67 )= $90,909.098.14 Allied Products is thinking about a new product launch. The vice president of marketing suggests that Allied Products can sell 2 million units per year at $100 net cash flow per unit for the next 10 years. Allied Products uses a 20-percent discount rate for new product launches and the required initial investment is $100 million.a. What is the base case NPV?b. After the first year, the project can be dismantled and sold for scrap for $50 million. If expected cash flows can be revised based on the first year’s experience, when would it make sense to abandon the project? (Hint: At what level of expected cash flows does it make sense to abandon the project?)A) = $738.49Million8.14 a. NPV = -$100M + ( $100 ⨯ 2M ⨯10.20Ab.$50M = C9.20C = $12.40 Million (or 1.24 Million units )。

(公司理财)英文版罗斯公司理财习题答案C

CHAPTER 20INTERNATIONAL CORPORATE FINANCEAnswers to Concepts Review and Critical Thinking Questions1. a.The dollar is selling at a premium because it is more expensive in the forward market than inthe spot market (SFr 1.53 versus SFr 1.50).b.The franc is expected to depreciate relative to the dollar because it will take more francs to buyone dollar in the future than it does today.c.Inflation in Switzerland is higher than in the United States, as are nominal interest rates.2.The exchange rate will increase, as it will take progressively more pesos to purchase a dollar. This isthe relative PPP relationship.3. a.The Australian dollar is expected to weaken relative to the dollar, because it will take moreA$ in the future to buy one dollar than it does today.b.The inflation rate in Australia is higher.c.Nominal interest rates in Australia are higher; relative real rates in the two countries are thesame.4. A Yankee bond is most accurately described by d.5. No. For example, if a country’s currency strengthens, imports become cheaper (good), but its exportsbecome more expensive for others to buy (bad). The reverse is true for currency depreciation.6.Additional advantages include being closer to the final consumer and, thereby, saving ontransportation, significantly lower wages, and less exposure to exchange rate risk. Disadvantages include political risk and costs of supervising distant operations.7.One key thing to remember is that dividend payments are made in the home currency. Moregenerally, it may be that the owners of the multinational are primarily domestic and are ultimately concerned about their wealth denominated in their home currency because, unlike a multinational, they are not internationally diversified.8. a.False. If prices are rising faster in Great Britain, it will take more pounds to buy the sameamount of goods that one dollar can buy; the pound will depreciate relative to the dollar.b.False. The forward market would already reflect the projected deterioration of the euro relativeto the dollar. Only if you feel that there might be additional, unanticipated weakening of the euro that isn’t reflected in forward rates today, will the forward hedge protect you against additional declines.c.True. The market would only be correct on average, while you would be correct all the time.9. a.American exporters: their situation in general improves because a sale of the exported goods fora fixed number of euros will be worth more dollars.American importers: their situation in general worsens because the purchase of the imported goods for a fixed number of euros will cost more in dollars.b.American exporters: they would generally be better off if the British government’s intentionsresult in a strengthened pound.American importers: they would generally be worse off if the pound strengthens.c.American exporters: they would generally be much worse off, because an extreme case of fiscalexpansion like this one will make American goods prohibitively expensive to buy, or else Brazilian sales, if fixed in cruzeiros, would become worth an unacceptably low number of dollars.American importers: they would generally be much better off, because Brazilian goods will become much cheaper to purchase in dollars.10.IRP is the most likely to hold because it presents the easiest and least costly means to exploit anyarbitrage opportunities. Relative PPP is least likely to hold since it depends on the absence of market imperfections and frictions in order to hold strictly.11.It all depends on whether the forward market expects the same appreciation over the period andwhether the expectation is accurate. Assuming that the expectation is correct and that other traders do not have the same information, there will be value to hedging the currency exposure.12.One possible reason investment in the foreign subsidiary might be preferred is if this investmentprovides direct diversification that shareholders could not attain by investing on their own. Another reason could be if the political climate in the foreign country was more stable than in the home country. Increased political risk can also be a reason you might prefer the home subsidiary investment. Indonesia can serve as a great example of political risk. If it cannot be diversified away, investing in this type of foreign country will increase the systematic risk. As a result, it will raise the cost of the capital, and could actually decrease the NPV of the investment.13.Yes, the firm should undertake the foreign investment. If, after taking into consideration all risks, aproject in a foreign country has a positive NPV, the firm should undertake it. Note that in practice, the stated assumption (that the adjustment to the discount rate has taken into consideration all political and diversification issues) is a huge task. But once that has been addressed, the net present value principle holds for foreign operations, just as for domestic.14.If the foreign currency depreciates, the U.S. parent will experience an exchange rate loss when theforeign cash flow is remitted to the U.S. This problem could be overcome by selling forward contracts. Another way of overcoming this problem would be to borrow in the country where the project is located.15.False. If the financial markets are perfectly competitive, the difference between the Eurodollar rateand the U.S. rate will be due to differences in risk and government regulation. Therefore, speculating in those markets will not be beneficial.16.The difference between a Eurobond and a foreign bond is that the foreign bond is denominated in thecurrency of the country of origin of the issuing company. Eurobonds are more popular than foreign bonds because of registration differences. Eurobonds are unregistered securities.Solutions to Questions and ProblemsNOTE: All end-of-chapter problems were solved using a spreadsheet. Many problems require multiple steps. Due to space and readability constraints, when these intermediate steps are included in this solutions manual, rounding may appear to have occurred. However, the final answer for each problem is found without rounding during any step in the problem.Basicing the quotes from the table, we get:a.$50(€0.7870/$1) = €39.35b.$1.2706c.€5M($1.2706/€) = $6,353,240d.New Zealand dollare.Mexican pesof.(P11.0023/$1)($1.2186/€1) = P13.9801/€This is a cross rate.g.The most valuable is the Kuwait dinar. The least valuable is the Indonesian rupiah.2. a.You would prefer £100, since:(£100)($.5359/£1) = $53.59b.You would still prefer £100. Using the $/£ exchange rate and the SF/£ exchange rate to find theamount of Swiss francs £100 will buy, we get:(£100)($1.8660/£1)(SF .8233) = SF 226.6489ing the quotes in the book to find the SF/£ cross rate, we find:(SF 1.2146/$1)($0.5359/£1) = SF 2.2665/£1The £/SF exchange rate is the inverse of the SF/£ exchange rate, so:£1/SF .4412 = £0.4412/SF 13. a.F180= ¥104.93 (per $). The yen is selling at a premium because it is more expensive in theforward market than in the spot market ($0.0093659 versus $0.009530).b.F90 = $1.8587/£. The pound is selling at a discount because it is less expensive in the forwardmarket than in the spot market ($0.5380 versus $0.5359).c.The value of the dollar will fall relative to the yen, since it takes more dollars to buy one yen inthe future than it does today. The value of the dollar will rise relative to the pound, because it will take fewer dollars to buy one pound in the future than it does today.4. a.The U.S. dollar, since one Canadian dollar will buy:(Can$1)/(Can$1.26/$1) = $0.7937b.The cost in U.S. dollars is:(Can$2.19)/(Can$1.26/$1) = $1.74Among the reasons that absolute PPP doe sn’t hold are tariffs and other barriers to trade, transactions costs, taxes, and different tastes.c.The U.S. dollar is selling at a discount, because it is less expensive in the forward market thanin the spot market (Can$1.22 versus Can$1.26).d.The Canadian dollar is expected to appreciate in value relative to the dollar, because it takesfewer Canadian dollars to buy one U.S. dollar in the future than it does today.e.Interest rates in the United States are probably higher than they are in Canada.5. a.The cross rate in ¥/£ terms is:(¥115/$1)($1.70/£1) = ¥195.5/£1b.The yen is quoted too low relative to the pound. Take out a loan for $1 and buy ¥115. Use the¥115 to purchase pounds at the cross-rate, which will give you:¥115(£1/¥185) = £0.6216Use the pounds to buy back dollars and repay the loan. The cost to repay the loan will be:£0.6216($1.70/£1) = $1.0568You arbitrage profit is $0.0568 per dollar used.6.We can rearrange the interest rate parity condition to answer this question. The equation we will useis:R FC = (F T– S0)/S0 + R USUsing this relationship, we find:Great Britain: R FC = (£0.5394 – £0.5359)/£0.5359 + .038 = 4.45%Japan: R FC = (¥104.93 – ¥106.77)/¥106.77 + .038 = 2.08%Switzerland: R FC = (SFr 1.1980 – SFr 1.2146)/SFr 1.2146 + .038 = 2.43%7.If we invest in the U.S. for the next three months, we will have:$30M(1.0045)3 = $30,406,825.23If we invest in Great Britain, we must exchange the dollars today for pounds, and exchange the pounds for dollars in three months. After making these transactions, the dollar amount we would have in three months would be:($30M)(£0.56/$1)(1.0060)3/(£0.59/$1) = $28,990,200.05We should invest in U.S.ing the relative purchasing power parity equation:F t = S0 × [1 + (h FC– h US)]tWe find:Z3.92 = Z3.84[1 + (h FC– h US)]3h FC– h US = (Z3.92/Z3.84)1/3– 1h FC– h US = .0069Inflation in Poland is expected to exceed that in the U.S. by 0.69% over this period.9.The profit will be the quantity sold, times the sales price minus the cost of production. Theproduction cost is in Singapore dollars, so we must convert this to U.S. dollars. Doing so, we find that if the exchange rates stay the same, the profit will be:Profit = 30,000[$145 – {(S$168.50)/(S$1.6548/$1)}]Profit = $1,295,250.18If the exchange rate rises, we must adjust the cost by the increased exchange rate, so:Profit = 30,000[$145 – {(S$168.50)/1.1(S$1.6548/$1)}]Profit = $1,572,954.71If the exchange rate falls, we must adjust the cost by the decreased exchange rate, so:Profit = 30,000[$145 – {(S$168.50)/0.9(S$1.6548/$1)}]Profit = $955,833.53To calculate the breakeven change in the exchange rate, we need to find the exchange rate that make the cost in Singapore dollars equal to the selling price in U.S. dollars, so:$145 = S$168.50/S TS T = S$1.1621/$1S T = –.2978 or –29.78% decline10. a.If IRP holds, then:F180 = (Kr 6.43)[1 + (.08 – .05)]1/2F180 = Kr 6.5257Since given F180 is Kr6.56, an arbitrage opportunity exists; the forward premium is too high.Borrow Kr1 today at 8% interest. Agree to a 180-day forward contract at Kr 6.56. Convert the loan proceeds into dollars:Kr 1 ($1/Kr 6.43) = $0.15552Invest these dollars at 5%, ending up with $0.15931. Convert the dollars back into krone as$0.15931(Kr 6.56/$1) = Kr 1.04506Repay the Kr 1 loan, ending with a profit of:Kr1.04506 – Kr1.03868 = Kr 0.00638b.To find the forward rate that eliminates arbitrage, we use the interest rate parity condition, so:F180 = (Kr 6.43)[1 + (.08 – .05)]1/2F180 = Kr 6.525711.The international Fisher effect states that the real interest rate across countries is equal. We canrearrange the international Fisher effect as follows to answer this question:R US– h US = R FC– h FCh FC = R FC + h US– R USa.h AUS = .05 + .035 – .039h AUS = .046 or 4.6%b.h CAN = .07 + .035 – .039h CAN = .066 or 6.6%c.h TAI = .10 + .035 – .039h TAI = .096 or 9.6%12. a.The yen is expected to get stronger, since it will take fewer yen to buy one dollar in the futurethan it does today.b.h US– h JAP (¥129.76 – ¥131.30)/¥131.30h US– h JAP = – .0117 or –1.17%(1 – .0117)4– 1 = –.0461 or –4.61%The approximate inflation differential between the U.S. and Japan is – 4.61% annually.13. We need to find the change in the exchange rate over time, so we need to use the relative purchasingpower parity relationship:F t = S0 × [1 + (h FC– h US)]TUsing this relationship, we find the exchange rate in one year should be:F1 = 215[1 + (.086 – .035)]1F1 = HUF 225.97The exchange rate in two years should be:F2 = 215[1 + (.086 – .035)]2F2 = HUF 237.49And the exchange rate in five years should be:F5 = 215[1 + (.086 – .035)]5F5 = HUF 275.71ing the interest-rate parity theorem:(1 + R US) / (1 + R FC) = F(0,1) / S0We can find the forward rate as:F(0,1) = [(1 + R US) / (1 + R FC)] S0F(0,1) = (1.13 / 1.08)$1.50/£F(0,1) = $1.57/£Intermediate15.First, we need to forecast the future spot rate for each of the next three years. From interest rate andpurchasing power parity, the expected exchange rate is:E(S T) = [(1 + R US) / (1 + R FC)]T S0So:E(S1) = (1.0480 / 1.0410)1 $1.22/€ = $1.2282/€E(S2) = (1.0480 / 1.0410)2 $1.22/€ = $1.2365/€E(S3) = (1.0480 / 1.0410)3 $1.22/€ = $1.2448/€Now we can use these future spot rates to find the dollar cash flows. The dollar cash flow each year will be:Year 0 cash flow = –€$12,000,000($1.22/€) = –$14,640,000.00Year 1 cash flow = €$2,700,000($1.2282/€) = $3,316,149.86Year 2 cash flow = €$3,500,000($1.2365/€) = $4,327,618.63Year 3 cash flow = (€3,300,000 + 7,400,000)($1.2448/€) = $13,319,111.90And the NPV of the project will be:NPV = –$14,640,000 + $3,316,149.86/1.13 + $4,4327,618.63/1.132 + $13,319,111.90/1.133NPV = $914,618.7316. a.Implicitly, it is assumed that interest rates won’t change over the life of the project, but theexchange rate is projected to decline because the Euroswiss rate is lower than the Eurodollar rate.b.We can use relative purchasing power parity to calculate the dollar cash flows at each time. Theequation is:E[S T] = (SFr 1.72)[1 + (.07 – .08)]TE[S T] = 1.72(.99)TSo, the cash flows each year in U.S. dollar terms will be:t SFr E[S T] US$0 –27.0M –$15,697,674.421 +7.5M 1.7028 $4,404,510.222 +7.5M 1.6858 $4,449,000.223 +7.5M 1.6689 $4,493,939.624 +7.5M 1.6522 $4,539,332.955 +7.5M 1.6357 $4,585,184.79And the NPV is:NPV = –$15,697,674.42 + $4,404,510.22/1.13 + $4,449,000.22/1.132 + $4,493,939.62/1.133 + $4,539,332.95/1.134 + $4,585,184.79/1.135NPV = $71,580.10c.Rearranging the relative purchasing power parity equation to find the required return in Swissfrancs, we get:R SFr = 1.13[1 + (.07 – .08)] – 1R SFr = 11.87%So, the NPV in Swiss francs is:NPV = –SFr 27.0M + SFr 7.5M(PVIFA11.87%,5)NPV = SFr 123,117.76Converting the NPV to dollars at the spot rate, we get the NPV in U.S. dollars as:NPV = (SFr 123,117.76)($1/SFr 1.72)NPV = $71,580.10Challenge17. a.The domestic Fisher effect is:1 + R US = (1 + r US)(1 + h US)1 + r US = (1 + R US)/(1 + h US)This relationship must hold for any country, that is:1 + r FC = (1 + R FC)/(1 + h FC)The international Fisher effect states that real rates are equal across countries, so:1 + r US = (1 + R US)/(1 + h US) = (1 + R FC)/(1 + h FC) = 1 + r FCb.The exact form of unbiased interest rate parity is:E[S t] = F t = S0 [(1 + R FC)/(1 + R US)]tc.The exact form for relative PPP is:E[S t] = S0 [(1 + h FC)/(1 + h US)]td.For the home currency approach, we calculate the expected currency spot rate at time t as:E[S t] = (€0.5)[1.07/1.05]t= (€0.5)(1.019)tWe then convert the euro cash flows using this equation at every time, and find the present value. Doing so, we find:NPV = –[€2M/(€0.5)] + {€0.9M/[1.019(€0.5)]}/1.1 + {€0.9M/[1.0192(€0.5)]}/1.12 + {€0.9M/[1.0193(€0.5/$1)]}/1.13NPV = $316,230.72For the foreign currency approach, we first find the return in the euros as:R FC = 1.10(1.07/1.05) – 1 = 0.121Next, we find the NPV in euros as:NPV = –€2M + (€0.9M)/1.121 + (€0.9M)/1.1212+ (€0.9M)/1.1213= €158,115.36And finally, we convert the euros to dollars at the current exchange rate, which is:NPV ($) = €158,115.36 /(€0.5/$1) = $316,230.72。

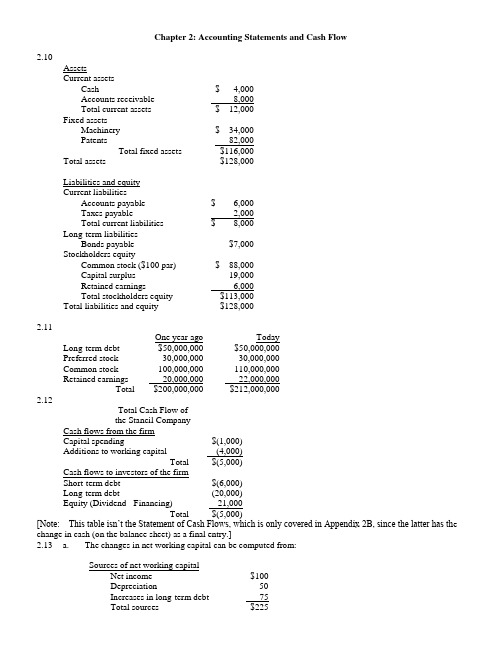

公司理财英文版第二章

US Corporation Income Statement – Table 2.2

Insert new Table 2.2 here (US Corp Income Statement)

2-19

Hale Waihona Puke Income Statement Analysis

• There are three things to keep in mind when analyzing an income statement:

2-13

• Which one of the following is included in a firm's market value but yet is excluded from the firm's accounting value? A. real estate investment B. good reputation of the company C. equipment owned by the firm D. money due from a customer E. an item held by the firm for future sale

• Which one of the following accounts is the most liquid? A. inventory B. building C. accounts receivable D. equipment E. land

• Which one of the following represents the most liquid asset? A. $100 account receivable that is discounted and collected for $96 today B. $100 of inventory which is sold today on credit for $103 C. $100 of inventory which is discounted and sold for $97 cash today D. $100 of inventory that is sold today for $100 cash E. $100 accounts receivable that will be collected in full next week

公司理财原版英文课件Chap020

There are two methods for selecting an underwriter

Competitive Negotiated

20-9

Firm Commitment Underwriting

The issuing firm sells the entire issue to the underwriting syndicate. The syndicate then resells the issue to the public. The underwriter makes money on the spread between the price paid to the issuer and the price received from investors when the stock is sold. The syndicate bears the risk of not being able to sell the entire issue for more than the cost. This is the most common type of underwriting in the United States.

《公司理财》课后答案(英文版,第六版).doc