国际结算第四章托收文稿演示

国际结算-第四章:国际结算方式-汇款与托收

学习目标: 熟练掌握汇款与托收 的概念及应用; 熟悉顺汇和逆汇 的概念。

关键概念: 汇款、电汇、信汇、票汇、托收、即期付款交单、 远期付款交单、承兑交单、《托收统一规则》

第一节 汇 款

一、汇款的当事人及相互关系

(一)汇款的当事人 1. 汇款人(Remitter):是申请汇出款项的一方。 2. 汇出行(Remitting Bank):是受汇款人委托而汇出款项的银

六、汇款的特点

(一)汇款属于商业信用 汇款属于商业信用,汇款的应用取决于交易一方对另一方的 信任,即:或卖方向买方提供信用,或买方向卖方提供信用, 因此交易中提供信用的一方必然承担着较大的风险。

(二)汇款属于顺汇法

在汇款业务中,汇款人主动将款项交给银行,委托银行通过 信汇/电汇委托书或银行汇票等支付工具,转托国外银行将款 项付给国外收款人,这种结算方式下的资金流向与支付工具 的传递方向是一致的,因此属于顺汇法。

2.托收行的责任

(1) 执行委托人的指示。 (2) 按托收申请书核实单据。 (3) 承担过失的损失。

3. 代收行的责任

(1) 对托收行指示的处理。 (2) 对单据的处理。 (3) 对货物的处理。 (4) 无延误地付款。 (5) 通知收款情况。

4. 付款人的责任

托收项下付款人的主要责任是履行贸易合同项下的付款义务, 在出口商向他提交了足以证明出口商已经履行了合同义务的 单据时,按合同规定汇款。当付款人收到代收行的付款提示 时,由于代收行与付款人之间并不存在契约关系,所以,付 款人对代收行是否付款,完全根据他与委托人之间所订立的 契约义务而决定,即以委托人提供的单据足以证明委托人已 经履行了合同下的义务为前提。

(三)票汇(Demand Draft,D/D):是汇出行应汇款人的申请,开 立以汇入行为付款人的银行汇票,交汇款人由其自行携带出 国或寄给收款人凭票取款的汇款方式。

国际结算之托收方式课件

收业务提供了统一的准则。

意义

实施《托收统一规则》有利于减 少托收业务中的纠纷,提高结算 效率,降低交易成本,促进国际

贸易的顺利进行。

国际商事合同法律适用原则

概述

意思自治原则

国际商事合同是指具有涉外因素的商业合 同,其法律适用原则对于确定合同权利义 务、解决合同争议具有重要意义。

02

托收方式的操作流程

卖方的交单

卖方根据合同规定, 将装运单据交给出口 地的银行,并委托其 代为收款。

卖方需按照合同规定 的时间和地点交单。

卖方需确保单据齐全 、正确,以便买方顺 利清关提货。

银行的寄单

出口地银行收到卖方提交的单据后, 会根据托收指示将单据寄给进口地银 行。

银行在寄单后,会及时通知卖方单据 已经寄出。

银行风险的防范措施包括:选择信誉良好的银行作为交易对手,对银行进行充分 的尽职调查和风险评估,以及在合同中明确约定银行的责任和义务等。

风险防范措施

综合运用多种风险防范措施,包括但不限于:建立完善的风险管理体系,提高风险管理水平;加强内 部控制和审计,确保业务流程的规范性和操作的准确性;投保相关保险,降低潜在的经济损失等。

国际结算之托收方式课件

目录 CONTENTS

• 托收方式概述 • 托收方式的操作流程 • 托收方式的单据 • 托收方式的风险与防范 • 托收方式的国际惯例与法律适用 • 托收方式案例分析

01

托收方式概述

托收的定义与特点

托收的定义

托收是指出口商通过银行将单据 转交给进口商所在地的银行,并 委托该银行代为收款的一种结算 方式。

THANKS

国际结算优秀第四章托收PPT参考课件

shipping documents are to be delivered against acceptance”.

2021/3/10

授课:XXX

19

阳光公司装运完毕,备齐各种单据于4月15日向G银

行申请办理D/A30天的托收手续。G银行选择法国F

远期付款交单:对进口商的不利影响大一些。出口 商至少可以避免钱货两空,但不少国家D/P远期作 为D/A处理,所以不提倡使用。

承兑交单:对出口商最不利。进口商可能承兑却不 付款,出口商钱货两空。

2021/3/10

授课:XXX

15

跟单托收类型

The buyer shall duly accept the documentary draft drawn by the seller at xxx days sight upon first presentation and make due payment on its maturity. The shipping documents are to be delivered against acceptance.

9

远期付款交单(D/P at … days sight)

出口商

进口商

①提交托收申 请书及汇票和 /或单据

⑦付款

③提示汇票 和/或单据

②寄出委托指示及 汇票和/或单据

托收行

④承兑汇票 ⑤到期付款赎单

代收行

⑥付款

(D/P at … days sight)

付款人在代收行提示单据时承兑汇票,到期日付款人付款赎单。

2021/3/10

授课:XXX

12

承兑交单,D/A

4 第四章 托收结算方式

风险 出口商:钱货两空

进口商:有利

Document Collection ——D/A

2 签发提单 9 凭单提货

Principal

1发货

4 12 付 款 开 出 回 执 3 签发汇票, 6 提示

Drawee

7 远期汇票 要求承兑 承 兑 汇 票 8 交 货 运 单 据 票到 付期 款日 提 示 汇 10

托收当事人

托收当事人之间的契约关系

买卖关系

委托人

委 托 代 理 关 系 托 收 申 请 书

付款人

按合同发货

托收指示及跟单汇票

托收行

委托代理协议

代收行

10

托收申请书的主要内容

•

A.交单方式:是付款交单还是承兑交单;是否可 以分批付款,分批赎票;远期汇票提前付款可否给 予进口商回扣或利息;逾期付款应否追加利息等。 B.货款收妥后的处理方式:托收行要在代收行已收 妥货款并划入托收行的账户后,才会将货款付给委 托人,代收行可以用电报或航函通知托收行,但用 哪一种方式则须根据托收行的要求。为此,委托人 须在委托代理合同中确定用电报还是航函通知。

托收指示的概念与内容

• 托收指示的重要性体现在三个方面: • (1)托收业务离不开托收指示,所有的托收业务 都必须附有一个单独的托收指示。 • (2)代收行仅依据托收指示中载明的指示办事。 • (3)代收行不从别处寻找指示,并且也没有义务 审核单据以获得指示。随附单据上不载有托收指 示,如果有的话,也将不予理会。

形 式 ① 金融单据 + 全套商业单据

② 仅全套商业单据

收款保证

Documents against Payment , D/P 付款交单 —— 代收行的交单以进口商的付款为条件。

国际结算之托收方式.ppt

(出口程图

①贸易合同

(进口人) 付款人

款付 单回③

书请申收托、据单运 货、票汇单跟期远②

据单和票汇示提⑥

兑承⑦ 款付期到⑨

据单运货交提⑩

托收行

④托收委托书、寄交跟单汇 票和货运单据

⑤回单

⑧承兑通知书

11 收妥通知

代收行

15

? 案例

某出口公司(甲)与中东地区进口商(乙)签 订了一份合同,向其出售一批机电产品,付款条件 为D/P 60 天 。甲委托国内的丙银行通过国外的代理 行丁代收货款。托收申请书和委托书中列明:“ D/P at 60 days after sight”(见票后60天付款交单)和 “Subject to Uniform Rules for Collection ICC Publication No.522”。

3

(二)托收行 1、含义

托收行(Remitting Bank):也称为寄单行,它还是出口方 银行(Exporter's Bank) 、托收汇票收款人(Payee of the Collection Bill)。它也可以是托收汇票的被背书人 (Endorsee)。 2、托收行的责任和义务 (1)缮制托收指示 (2)核验单据

⑧收妥通知

代收行

12

? 案例

某外贸公司与某美籍华人客商做了几笔顺利的小额 交易后,付款方式为预付。后来客人称销路已经打开, 要求增加数量,可是,由于数量太多,资金一时周转不 开,最好将付款方式该为D/P AT SIGHT 。当时我方考虑 到D/P AT SIGHT 的情况下,如果对方不去付款赎单,

6

三、托收方式的种类

(一)光票托收( Clean Collection ) 1、指金融单据托收,不伴随商业单据。 2、在国际贸易中,通常是货运单据直接寄交买方,仅

第四章国际结算方式之二——托收幻灯片资料

2020/8/16

7

4.付款人(Payer或Drawee)

代收行根据托收行的指示向其提示汇票、收取票款 的一方就是付款人,也是汇票的受票人。

付款人的责任:履行付款义务

另外,提示行(Presenting Bank)是向付款人提示单 据的银行。 再者,如果发生拒付的情况,委托人就可能需要有一 个代理人为其办理在货物运出目的港时所有有关货物 存仓、保险、重新议价、转售或运回等事宜。这个代 理人必须由委托人在委托书中写明,称作“需要时的 代理”(a representative to act as case-of-need)。

贷记报告单---你行账户已被贷记

开户行

出 口 托 收 行

2020/8/16

17

2、当代收行在托收行开立账户时,借记代收行账户

开户行

OC/collection advice---please collect the

proceeds and authorize us by cable/airmail

to debit you’re a/c with us.

进 collect and remit proceeds to X

帐 户 行

款项汇至你 口 Bank for credit of our a/c with

行贷记托收 代 them under their cable/airmail

2020/8/16

3

二、托收当事人及其责任

1.委托方(Principal) 在托收业务中,委托银行向国外付款方收款的人就是

托收委托人,因为是由他开具托收汇票的,所以也称 出票人。 委托人在贸易合同下的责任: 按时按质按量装运货物;提供符合合同要求的单据。 委托人在委托代理合同下的责任: (1)填写委托申请书,指示明确; (2)对意外情况及时指示; (3)承担收不到货款的损失。

国际结算——托收 讲义材料

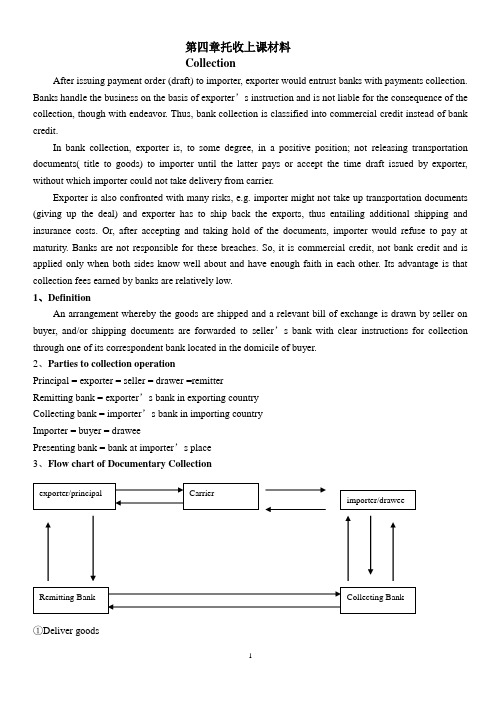

第四章托收上课材料CollectionAfter issuing payment order (draft) to importer, exporter would entrust banks with payments collection. Banks handle the business on the basis of exporter’s instruction and is not liable for the consequence of the collection, though with endeavor. Thus, bank collection is classified into commercial credit instead of bank credit.In bank collection, exporter is, to some degree, in a positive position; not releasing transportation documents( title to goods) to importer until the latter pays or accept the time draft issued by exporter, without which importer could not take delivery from carrier.Exporter is also confronted with many risks, e.g. importer might not take up transportation documents (giving up the deal) and exporter has to ship back the exports, thus entailing additional shipping and insurance costs. Or, after accepting and taking hold of the documents, importer would refuse to pay at maturity. Banks are not responsible for these breaches. So, it is commercial credit, not bank credit and is applied only when both sides know well about and have enough faith in each other. Its advantage is that collection fees earned by banks are relatively low.1、DefinitionAn arrangement whereby the goods are shipped and a relevant bill of exchange is drawn by seller on buyer, and/or shipping documents are forwarded to seller’s bank with clear instructions for collection through one of its correspondent bank located in the domicile of buyer.2、Parties to collection operationPrincipal = exporter = seller = drawer =remitterRemitting bank = exporter’s bank in exporting countryCollecting bank = importer’s bank in importing countryImporter = buyer = draweePresenting bank = bank at importer’s place3、Flow chart of Documentary Collection①Deliver goods②B/L③Documents and Instructions (Application)④Rept.⑤Collection Order or Instruction & docs.⑥Present⑦Pay⑧Release Documents D/A or D/P⑨Credit Advice or Debit Authorization⑩Hand in B/L((11))Deliver goods4、Delivering documents = Delivering goodsBuyer must take delivery of goods with bill of Lading (B/L), which is receipt issued by carrier when receiving goods delivered by seller for transportation. Importer must take delivery of goods against it. Without B/L, buyer could not get the goods at the carrier. For sight payment, only when buyer pay the sight draft drawn by seller would collecting bank release documents(B/L) to buyer. For time bill, only when buyer accepts time draft drawn by seller would collecting bank release documents to importer.(1)Documents against documents D/A①Time draft &other docs+application②Collection order& time draft & docs③Present time draft for acceptance④Accepted draft⑤docs= goods(The risk is that buyer would not pay after taking the goods,thoughgoods have been taken away.)⑥Present accepted draft for payment(Collecting bank keeps accepteddraft for exporter and at maturity, presents it for payment.)⑦pay(2)Document against payment D/P at sight①Sight draft& other docs,etc②Collection Order & sight Draft and docs③Presents for payment (Only one presentment for payment )(So, it is demanded that payment must be made on first presentation.)④Pay after checking (Importer would try to delay payment to wait the arrival of goods ) ⑤docs(3)Documents against payment at tenor D/P at tenor①Time draft & other docs ,application ②Collection order& time draft and other docs ③Present time draft for acceptance ④No docs after acceptance⑤pay (After payment at maturity, buyer gets documents.) ⑥docs(4)Documents against time promissory note made by buyer①Apply Docs.②Collection order & docs demanding time promissory note made by buyer(The risk is that buyer would not pay after taking the goods.)③Advise and demanding documents against time promissory note made by importer.④Time promissory note⑤docs⑥(Collecting bank keeps promissory note for seller and at maturity, presents it for payment.)Present timePromissory Note for payment⑦pay5、Presenting bank①ion&documents②Collection order&documents③Forwarddocuments④present6、In case of needCase of need might be seller’s close friend or agency in importing country, who would arrangeshipping back the goods or selling the goods to other buyer in importing country.①Documents (Application)②Collection Order and documents(In case of need, look for XXX)③present④refuse⑤present⑥Pay & take over docs.Exporter might have mentioned “case of need”on the draft when issuing it if exporter expects the possibility of importer’s dishonor.7、Types of collection(1): Documentary Collection①Deliver goods②B/L③Commercial docs+ financial Instrument OR not+ Application④Collection Order & docs,esp. transporting documents + bill of exchange or not⑤D/A or D/P ⑤present⑥Pay⑦Hand in B/L⑧Deliver goodsDocuments are released to importer against his payment or acceptance/Sometimes, importer pays against commercial documents, e.g. commercial invoice without financial draft to avoid stamp duty. (2): Clean Collection①Send sample ②Rept.③Delivery advice(①,②, ③,Post receipt is sent to buyer’s country together with sample by post office.) ④Hand in Delivery adv.⑤sample (④,⑤, Importer takes the advice to post office and get sample against it.) ⑥Only draft+Application⑦Collection Order& draft (Payment must be made through bank ) ⑧Present draft ⑨PayDividend warrant and time promissory note can also be used in clean collection (3): Direct Collection①Sign long terms contract with bank (Omit a tache, save much time )②Prenumbered presigned collection order③Deliver goods④B/L⑤Fill in collection order and forward documents and collection order directly to(As if it is sent by remitting bank whose responsibility is the same as under documentary collection.)⑥D/A or D/P (⑥present)⑦Pay⑧Hand in B/L⑨Deliver goods8、Collection order = Collection Instruction①Application filled in by exporter②Collection Order filled in by remitting bank[①, ②They are the same in contents, for remitting bank carry out order given by exporter (principal).]Specimen of collection orderPlease Collect the Under-mentioned Foreign Bill and /or Documents①Draft &other docs②Collection order& time draft & docs (Banks endeavor to collect for principals, but not responsible for unfavorable results.)③pay④docs(2)Bank’s responsibility①Banks must act upon the instructions given by principals②Banks check the documents received against order to see if there is any missingThe principal must be informed of any documents missing.③Banks are not responsible for examining the contents of documents, e.g. any discrepancies between docs.Sight bill: presentation for paymentTime bill: presentation for acceptance, then, presentation for payment10、Risks for exporter(1)Risks for exporter under documentary collection①Refuse to pay or accept time draft on some small inadvertent infraction of the sales contract.②Demand deep cut down of price, or refuse to accept the goods.③A heavy storage charge, fire insurance, demurrage and great expenses and time delay if court action is taken.(2)Risks for exporter under term payment①At the maturity of draft, importer refuses to pay②The excuse might be defective quality and ask for cut down of price or not having foreign exchange approved by authority.(3)Summary of possible reasons for dishonor①Economic reasons:e.g. defective quality of goods, short of flowing capital, downturn ofmarket, bankruptcy of importer,etc.②Political reasons: war, turbulence, foreign exchange control, having not got import license,etc.③The credit risk of importer (fraud) etc.(4)Protection for exporter ——Credit investigationFinancial credit and operational style of importerMarket trend of importing countryWhether import license or foreign exchange has been approved by relative authority.Whether political situation in importing country is steadyWhether a case of need could be found once dishonor happens, who could help handle returned goods, e.gwarehousing and insuring the goods, arranging shipmentof returned goods, finding another buyer for exporter, etc.Exporter could find an agency (usu.banks) to aid the investigation.To buy export credit insurance at government agency(e.g. import/export bank).Have direct control over documents, esp. the transporting documents,e.g. the consignee should be “to t he order of shipper, or collecting bank (with consent of collecting bank)”, which could be endorsed to importer only when payment is made.If it is non-negotiable transport document (e.g. airway bill), collecting bank should be the consignee who could issue delivery order to importer after the payment.(5)Example, Hedging OperationOn July 20,2000 an I/E corporation of China expected to receive €200 millions in 3 months and the spot rate of €is RMB7.6450, and 3-month forward rate is 7.6250 ~ 7.6630. As €has been weak against USD, to protect against the risk of €’s devaluation, the corporation signed a 3-month forward contract with Bank of China. After July 20, €devalued from USD0.91 all the way to USD 0.83. On Oct. 23, when the settlement was made € depreciated to RMB6.9570.Question: If the corporation was not engaged inhedging operation, how much loss would it suffer? And what is the percentage of the loss to the total amount of the contract?Answer :11、(1)Risks for importer under collection①Might be fraudulent documents.②Might be defective or dummy or not the model ordered by importer③Late shipment,and miss the optimal selling seasons.④In advance payment , can not inspect goods beforehand.⑤Dishonor would ruin importer’s reputation.(2)Protection for importerInvestigate exporter’s reputation and deal only with Credit worthy exporters.If it is time payment, payment time can be XX days/months after Bill of Lading date, which means that earlier delivery,earlier payment.Choose the most the favorable procedure of documents delivery basing on the credit standing, financial capability, market trend.e.g. if price is going high, use D/P. If price is going down,use D/A.Use D/P at tenor as possible as you can to confirm if goodsarrive at the harbor of your country.12、(1)Bill purchased under Documentary CollectionBank’s financing to exporterThere is no payment guarantee from collecting bank. So, remitting bank provide the service only for credit worthy client s.①Sight or time bill & full set of original Bill of Lading and apply for discounting the bill. ②Discounted amount③Collection Order & docs④Credit Advice or Debit Authorization ⑤Docs ⑥Pay ⑦Present(2)Discounting bill under documentary collectionThe payee on the draft is normally the discounting bank,e.g.13、Trust Receipt under D/P at tenor (1)This is Bank’s financingto importer①Time draft& other docs②Collection order & time draft and other docs ③Present time draft for acceptance ④Acceptance& IOU=T/R ⑤docs(④, ⑤ Importer borrows B/L and other documents by writing a Trust Receipt (T/R),usu. with permission of exporter.)⑥Accepted Bill &T/R ⑦pay(⑥, ⑦After selling the goods importer retires the bill with the money.) (2)The obligation of trustee, explanation of some points ①Not to put the goods in pledge to other personsthat is; trustee cannot pledge the goods to other banks for credit.②To settle claims of the collecting bank before liquidation in case of the trustee ’s bankruptcy.If trustee goes bankrupt, the entrusted goods would not joint the liquidation or entruster has first lien over the entrusted goods.③Entrusted goods should be stored and booked separately from other goods and can be examined by entruster any time.④Money from sale of entrusted goods should go directly to entruster ’s account. (3)Risks for collecting bank in T/R financingTrust Receipt does not prevent trustee from selling goods to (a third party) someone who buys the goods for value and without notice of trust (the goods does not belong to trustee). If trustee runs away with the money, the entruster could not sue the third party. Laws protects the purchaser in good faith.So, entruster usu. demands that a guarantor (usu. a bank) should sign the T/R in addition to trustee ’s signature.The principal presents an application for collection accompanied by draft and documents to the remitting bank for collection.An application for collection shows as follows:Commercial documents surrendered are below:B/L in triplicate, two originals and one copyInvoice in triplicate, two originals and one copyInsurance policy in duplicate, one original and one copyCertificate of origin in duplicate, One original and one copyPacking list in duplicate, One original and one copyCollection instructions are given below:Deliver documents against paymentRemit the proceeds by airmailAirmail advice of paymentCollection charges outside China from drawee, waive if refused by him.Airmail advice of non-payment with reasonsProtest waivedWhen collected, please credit proceeds to principal’s account with remitting bank. Remitting bank complete a collection instruction in accordance with principal’s application to add other requirements as follows:Ref No. OC2576459Date: 15 July,2000Please collect and remit proceeds to Bank of China, New York for credit of our account with them under their advice to usPlease produce a collection instruction attaching draft and documents to be forwarded to the collecting bank, Banque du Paris, Paris.Collection InstructionORIGINALTO:_________________ Date:_______Our Ref. No_______Dear Sirs,Please follow instruction marked”x”□Deliver documents against payments/acceptance.□Remit the proceeds by airmail/cable.□Airmail/cable advice of payment/acceptance.□Collect charges outside_____ from drawee,waive if refuse by him.□Collect interest for delay in payment____days after sight at____% per annum.□Airmail/cable advice of non-payment/non-acceptance with reasons.□Protest for non-payment/non-acceptance.□Protest waived.□When accepted, please advise us giving due date.□When collected, please credit our account with___.□Please collect and remit proceeds to ____for credit of our account with them under their advice to us. □Please collect proceeds and authorize us by airmail/cable to debit your account with us.Special InstructionsThis collection is subject to Uniform Rules for collection(1995 Revision) ICC Publication No.522Authorized signature(s)TRUST RECEIPTTO:__________ ________,________Received from the said bank a full set of shipping document evidencing the merchandise having an invoice value of______say______ as follows:And in consideration of such delivery in trust ,the undersigned hereby undertakes to land, pay customs duty and/or other charges or expenses ,store, hold and sell and deliver to purchasers the merchandise specified herein ,and to receive the proceeds as trustee for the said bank , and the undersigned promises and agrees not to sell the said merchandise or any part thereof on credit , but only for cash for a total amount not less than the invoice value specified above unless otherwise authorized by the said bank in writing.The undersigned further acknowledges assents and agrees that in the event the whole or any part of the merchandise specified herein is sold or delivered to a purchaser or purchaser any proceeds derived or to be derived from such sale or delivery shall be considered the property or the said bank and the undersigned hereby grants to be said bank full authority to collect such proceeds directly from the purchaser or purchaser without reference to the undersigned.The guarantor, as another undersigned, guarantees to the said bank the faith and proper fulfillment of the terms and conditions of the trust receipt.Guaranteed by: signed by:_____________ _______________________ ___________。

第四章 托收方式

4、凭其他条件交出商业单据

1.分批部分付款:指凭一部分即期付款其余部分 承兑在将来日期付款的单独汇票而交单。 2.凭本票交单:本票是由买方开立和签字的,包含

进口商在约定的未来日期付款的承诺。

3.凭付款承诺书交单:代替汇票和本票。 4.凭签字的信托收据交单

5.凭买方或银行开立保函担保在固定将来日期付款

是逆汇。

金融单据:是指汇票、本票、支票或其他类似的可

用于取得款项支付的凭证。

商业单据:是指发票、运输单据、所有权文件或其

他类似的文件,或者不属于金融单据的任何其他单据。

代表货物的各种单据

根据《URC522》(托收统一规则):

托收意指银行按照从出口商那里收到的指示办理:

1.获得金融单据的付款及/或承兑,或者 2.凭付款及/或承兑交出单据,或者 3.以其他条款和条件交出单据。=>通常是以“付款人交来本

托收行的责任和义务

1、缮制托收指示 根据托收申请书的内容缮制托收指示,并

将托收指示和单据寄给国外的代理行,指示其向收款人收款。

2、核验单据 审核单据的名称和份数是否与申请书相同。 3、按常规处理业务,及时通报信息 4、承担过失责任

代收行的责任和义务

1、执行托收指示 按托收指示处理单据 2、保管好单据 3、谨慎处理货物 4、汇票承兑的完整性和准确性 5、资金的及时划转

票/信托收据/承诺书等”

二、托收当事人

委托人(Principal) 托收行(Remitting Bank) 代收行(Collecting Bank) 付款人(Drawee) 提示行(Presenting Bank) 需要时的代理人 (Agent in Necessity)

- 1、下载文档前请自行甄别文档内容的完整性,平台不提供额外的编辑、内容补充、找答案等附加服务。

- 2、"仅部分预览"的文档,不可在线预览部分如存在完整性等问题,可反馈申请退款(可完整预览的文档不适用该条件!)。

- 3、如文档侵犯您的权益,请联系客服反馈,我们会尽快为您处理(人工客服工作时间:9:00-18:30)。

Remitting bank: This is the bank that accept the entrustment of the principal and achieve the collection by its overseas correspondent .Such a bank is normally the exporter’s bank.

Payer - buyer (drawee)

The payer is the debtor who the draft has appointed.

Representative in case of need This representative is appointed by the principal to act as case of need in the event of non-acceptance or non payment.

Principal—seller(drawer)

The liability of the principal according to

trade contract: shipment in time and provide the documents according with the contract.

从银行的角度划分,托收可以分为: ❖ 出口托收 (Outward Collection) ❖ 进口代收(Inward Collection) 根据托收中涉及的单据,托收可以分为: ❖ 光票托收 (Clean Collection) ❖ 跟单托收 (Documentary Collection)

光票托收

❖ 光票托收是对金融单据的托收,不附带商业 单据。光票托收的金额一般不大。

❖ 非贸易托收必定是光票托收

跟单托收

❖ 跟单托收是附带商业单据的托收。

❖ 两种情况:一是附有金融单据的商业单据托 收;二是不附有金融单据的商业单据托收。

Documentary Collection

A documentary collection is an operation in which a bank collects payment on behalf of the seller by delivering documents to the buyer.

托收业务中的单据

❖ 金融单据(Financial Documents) 收业务当事人

❖ 委托人(Principal) ❖ 托收行(Remitting Bank) ❖ 代收行(Collecting Bank) ❖ 提示行(Presenting Bank) ❖ 付款人(Drawee) ❖ 需要时的代理(Representative in Case of

国际结算第四章托收文稿演示

(优选)国际结算第四章托收

托收的定义

❖ 指出口商(或债权人)开立金融单据或商业 单据或两者兼有,委托托收行通过其国外的 分行或代理行向进口商(或债务人)收取货 款或劳务费用的结算方式。 托收既可用于贸易结算,又可用于非贸易结 算。

After the exporter has shipped the goods, he presents the draft and documents to his bank with his collection instruction. The bank will collect the proceeds on behalf of him.

Remitting bank:

The obligation :

(1)check up the application for collection and the documents

(2)make a collection instruction

Collecting bank

The bank that accept the consignment of remitting bank and get the payment from the debtor is the correspondent .

Collecting bank

The obligation :

(1)check up the documents;

(2)keep the documents ; (3)feed back the headway of collection in time; (4)deal with the goods prudently.

Need)

Principal—seller(drawer) Remitting bank Collecting bank Payer - buyer (drawee) Presenting bank Representative in case of need

Principal —seller(drawer) The principal is usually the exporter who entrusts the collection items to the bank. The principal consign the bank to receive the amount of the draft from overseas debtor, can also be called drawer .

❖ 《托收统一规则》(Uniform Rules for Collection, ICC Publication No. 522) (即

URC522)

The Uniform Rules for Collections(URC) form an internationally accepted code of practice covering documentary collection.

Relationship between the parties

Principal (Exporter)

Payer (Importer)

Application for collection

Remitting bank

Collection Advice

Collecting bank

托收业务流程

托收的种类