Challenges in Quantitative Equity Management

财务会计术语中英文对照

accelerate ddepreciati on 加速折旧法account 帐户、会计科目accounting cycle会计循环accounting changes会计变动accounting income会计收益accounting policies会计政策accountingprinciplesboard(AP B)会计原则委员会accountin gstandards executive coomittee 会计准则执行委员会accountin g trendsand technique 会计趋势与技术accountsreceivables应收帐款accrual basis 权责发生制accruedexpenses应付费用accrueditems应计项目accruedrevenues应收收入accumulateddepreciation累计折旧acid-test ratio 酸性测试比率presentvalue现值markup再加价additionalmarkupcancellati on 再加价取消aditionalpaid-incapital资本公积adjusting调整aging oftheaccounts approach 帐龄分析法allowancefordoubtfulaccounts坏帐准备allowancemethod备抵法allowanceto reduceinventory to market 存货跌价准备allowance to reduce short-term investments to market 短期投资跌价准备American Accountin gAssociati on(AAA)美国会计学会American Institete of Certified PublicAccounta nts(AICP 美国会计师协会amortization摊销an annuity due 到期年金终值amount of anordinary annuity 普通年金终值analysis of long-term solvency 长期偿债能力分析analysis of returnon investmen 投资报酬分析analysis of short-term liquidity 短期偿债能力分析announce ment date 认股权宣告日annualeffective tax rate 全年有效税率annuity年金annuitydue到期年金annuitymethod年金法antidilutiv e effect 反稀释效果APBopinion & statement s APB发布的意见书及声明书appraisalsystem评价法appraisalvalue评定价值appropriaed指拨appropriatedretained earnings 拨定留存收益assetexpenditure资本支出assets资产associating cause and effect 因果关系直接配属attribution摊计auditor'sreport审计报告authorized capital stock 核准发行股份available for sale 备供出售者available-for-sale securities 备供出售证券averagecollection period 帐款收回平均天数average days tosell the inventory 存货周转平均天数bad debtexpense坏帐费用balancesheet approach 资产负债表法bankoverdraft银行透支bankreconcilia tion 银行往来调节表bankstatement对帐单baseinventory基期存货base year基期basicaccountin g equation 会计基本方程式basicprinciples基本原则bearer bonds 息票公司债beneficiary受益人betterment改良billingsonconstruction in process 预收工程款bonds payable 应付公司债bonus and profitsharing plan 员工奖金及分红bookvalue method 帐面价值法bookvalue ofnet assetsacquired股权净值callpremium收回溢价call price赎回价格callprovisions收回条款callable bonds 可收回公司债callablepreferred stock 可收回优先股capitalexpenditure资本支出capitallease资本租赁capitalstock股本capitalstocksubscribe d 已认购股份capitalsurplus资本公积capitalization of interest 利息资本化carryingvalue帐面价值cashdiscount现金折扣cashdividends现金股利cashequivalent s 现金等价物cash flowsfrom operation activities 营业活动的现金流量cash overand short现金短溢certificates ofdeposit定存单changefunds找零金changesinaccountin g estimate 会计估计的变动changes inaccountin g 会计原则变动changes inreporting entity 编制报表主体变动consistency一致性claim请求权closedcorporatio ns 非公开发行公司closing结帐collectionmethod收现法commonstock普通股common stocksubscribe d 已认普通股股本common-size financialstatement s 共同比财务报表comparability比较性comparativeanalysis比较分析comparativestatements比较报表compensatory stockoption plan 酬劳性认股计划completedperfoman ce method 全部履行法completed-contract method 全部完工法complexcapital structure 复杂资本结构compound interestmethod复利法comprehensive approach 全面改革法computersoftware costs 电脑软件成本condensed income statement 简明损益表conservatism稳健原则consignee承销人consignment-in承销品consignment-out寄销品consignor寄销人construction inprocess在建工程contingencies或有事项contingentliabilities或有负债continuityconventio n 持续经营惯例contraaccount抵减科目contributed capital投入资本controlling account统制帐户conventions惯例convertibl e bonds 可转换公司债convertibl epreferred stock 可转换优先股copyrights 著作权,版权cost addmarkup contract 成本加价合约costallocation method 成本分摊法costdepletion method 成本折耗法cost flowassumptio n 成本流动假设cost index成本指数costmethod成本法cost of goodsmanufact ured 产成品成本cost priociple; historicalcost principle 历史成本原则costrecovery method 成本回收法cost-benefit constraint 成本效益限制costs ofconstructi on 工程成本比例法costs ofissuing bonds 公司债发行成本cost-to-cost method 工程成本比例法coupons兑换券covenants债务条款credit贷credit card sale 信用卡销货creditratings信用评级crossreference交叉索引cumulative deficit累积亏损cumulativ e effect 累积影响数cumulativ e effectadjustmen t 当期调整法cumulativ e effect of change inaccountin g principle 会计原则变动累积影响数cumulativ e effect of changesin accountin g 会计原则变动累积影响数cumulativ epreferred stock 累积优先股currentadjustmen t 当期调整法currentassets流动资产currentliabilities流动负债currentmaturitiesof long-term debts 长期负债一年内到期部分currenttatio流动比率currenttax expense(b enefit)当期所得税费用(利益)date ofannoucement宣告日date ofdeclaratio n 股利宣告日date of expiration 过期失效日date ofex-right除权日date of payment 股利发放日date of record 股权登记日debenture bonds 无担保公司债debit借debit andcreditrules借贷法则debtsecurities债务证券debt to stockhold ers' equity 负债对股东权益比率debt tototalassetsratio负债比率decision usefulness 决策有用性deferredannuity递延年金deferredcharge递延借项deferredcompensa tion cost 递延酬劳成本deferredcredits递延贷项deferredgross profit 递延销货毛利deferreditems递延项目deferredmethod递延法deferredpayment contract 递延付款合约deferredrecognition递延认列deferred tax asset 递延所得税资产deferredtax liability 递延所得税负债depletableassets递耗资产depletion折耗deposit intransit在途存款depreciab ale assets 折旧性资产depreciable cost折旧成本depreciation base折旧基础depreciationexpense折旧费用derivativefinancialinstrumen ts 衍生性金融商品development costs开发成本dicision usefulness 决策的有用性dilutiveeffect稀释作用directfinancing lease 直接融资租赁direct method 直接冲销法directmethod直接法direct pricing 直接评价法directwrite-off method 直接冲销法discontinuedsegment停业部门discounton bonds payable 公司债折价discounton notes payable 应付票据折价discounton notes receivable 应收票据折价discounted presentvalue折现值discounting notes receivable 应收票据贴现dishonore d notes receivable 拒付票据、催收票据disposaldate处分日distributions to owners 分配给业主dividendpay-out ratio 股利支付率dividendrevenue股利收入dividend yield ratio 股利收益率dollar-valurLIFO retail method 金额后进先出零售价法dominantindustry segment 主要产业部门donatedassets受赠资产donatedtreasury stock 受赠的库藏股票double-declining-balance method 双倍余额递减法double-entrybookkeeping复式簿记dualpresentations双重表达dueprocess审慎程序dynamicstatements动态报表earingsper share每股盈余earlyextinguishment提前偿付earned已赚得earnedsurplus盈余公积earning盈余economicentityassumptio n 经济主体假设economicincome经济所得economicsubstance over legal form 经济实质重于法律形式effective interestrate method 实际利率法effectiverate有效利率effective yield 实际利率、市场利率、有效收益率efficient markethypothesi s 效率市场假说efforts-expended method 工时进度比例法emergingissues task force 紧急问题处理小组employeediscount员工折扣employee stockoption plan 员工认股计划equitymethod权益法equitysecurities权益证券equivalentpercentage of interest 约当持股比例estimateditems估计项目estimatedliabilityunder warranties 估计产品保证负债estimatedresidualvalue估计残值excessearnings approach 超额盈余法exchangable可交换性exchangerate effects 汇率变动的影响ex-dividenddate除息日executory contract 待执行合同executorycosts履约成本exerciseof call privilege 行使赎回权expectedreturn on plan assets 退休金资产预期报酬expense warrantyaccrual method 保证费用计提法warranty approach 保证费用计提法expirationdate of the rights 认股权行使截止日expiration of return-right method 退货权逾期法exploration costs勘探成本ex-rightstock除权股extinguishment ofdebt债务清偿extraordinarygain(loss)非常损益extraordinaryrepairs大修faceamount面值face rate票面利率feedbackvalue回馈价值financialaccounting fundation 财务会计基金会financial accountin gstandards advisory council 财务会计准则咨询委员会financial accountin gstandards board(FA SB)财务会计准则委员会financialcapital财务资本flexibility财务弹性financialincome财务所得financialinstruments理财工具financialleverage index 财务杠杆指数financial mobility 财务机动性financingactivities理财活动finishedgoods inventory 产成品存货first-infirst-out先进先出fixedassets固定资产flexibility弹性floating浮动floor市价下限flow流量footnotes附注four-columnbank reconcilia tion 四栏式银行往来调节表fractionalyear depreciati on 不满一年的折旧计算franchise revenue 加盟特许收入franchisee加盟员franchises特许权franchisor加盟主free onboarddestinatio n 目的地交货free on boardshipping point 起运点交货full costing 全部成本法fulldisclosure principle 充分披露原则full-cost approach 全部成功法fully dilutedearnings per share 完全稀释每股盈余funds基金funds statement 资金状况表future amount ofan annuity due 到期年金终值future amount of anordinary annuity 普通年金终值futures期货gaincontingencies或有利得gain(loss)onconversio n of bonds 公司债转换(损)益gain(loss) on sale ofshort-term investmen ts 出售短期投资利益(损失)general journal 普通日记帐general purchasin g poweraccountin g 一般购买力会计general purposefinancial statement 一般目的财务报表generally accepted accountin gprinciples (GAAP)一般公认会计原则going concern(c ontinuity)assumptio n 持续经营假设goods intransit在途商品goodwill商誉grant date给予日greenmail绿色信函grossmethod总额法grossprofitmethod毛利率法guarantee d bonds 保证公司债guaranteed residualvalue保证残值held to maturity 持有至到期日held-to-maturity securities 持有至到期日证券high ratio of returnedmerchand ise to 高退货率的销货horizontalanalysis水平分析hostiletakeover恶意并购idealism理想性identifiable intangible assets 可明确辨认的无形资产imapairment of value 价值的减损impairment of assets 资产价值减损implicit rate computedby the lessor 出租人的隐含利率improvements改良imputed interest rate 隐含利率,设算利率inceptionof the lease 租赁开始日incomebeforeincometaxes税前净利incomestatementapproach损益表法incomesummary本期损益incometax allocation 所得税分摊incometax benefit 所得税利益incometaxes payable 应付所得税incometaxes withheld 扣缴所得税income(lo ss) from continuing operation 持续经营部门损益income(lo ss) from discontinued operation 停业部门损益increment alborrowing rate 增额借款利率incremental direct costs 增额直接成本incremental method增额法individualitem approach 个别比较法inducedconversion引诱转换industrypeculiarities行业特性industrysegments产业部门inflationaccountin g 通货膨胀会计infrequency ofoccurrence不常发生initial direct cost 原始直接成本initialfranchise fee 原始权利金installment accounts receivable 分期应收帐款installmen t sales 分期付款销货installment sales method 分期付款法in-substancedefeasance of debt视同清偿intangibleassets无形资产interestcosts利息成本interestondiscount贴现息interestrate swaps利率交换interest-bearingnote附息票据interimdebt中期负债internalauditing内部稽核internaldirect costs 内部直接成本internally developed 内部自行发展interperio d incometax allocation 跨期所得税分配interpolation插补法intraperiod incometax allocation 同期所得税分配inventorymethod盘存法inventory turnover 存货周转率investeme nt tax credit 投资租税抵减的处理investmen t revenue-discontinued operation 停业部门投资收益investmen t revenue-extraordin ary 非常投资收益investment revenue-ordinary 一般投资收益issuance date 认股权发行日issuancefor cash现金发行issue papers 待研究问题通报、问题报告issuedcapital stock 已发行股份issues in accounting education 会计教育问题研究journal 日记簿、分录簿journalizing分录junk bond垃圾债券just-in-timeinventory system 即时存货系统landimprovem ents 土地改良物largestock diveidend 大额股票股利last-infirst-out后进先出leaseterm(duration)租赁期间leasedassetundercapitalleases租赁资产leaseholdimprovements租赁改良legalcapital法定资本legal form法律形式leverage财务杠杆leveragebuyouts融资购并leverageleases杠杆租赁LIFO liquidatio n 后进先出存货的减少lifo reserve 后进先出存货准备line ofbusiness主要行业liquidity流动性listedcorporations上市公司long-termcapital to fixed assets 长期资金对固定资产比率long-terminvestments长期投资long-termliabilities长期负债long-termnotes payable 长期应付票据long-termoperation al assets 长期营业用资产losscontingencies或有损失loss fromdiscountin g of notes 票据贴现损失loss fromlong-termcontracts工程损失loss onimpairme nt 价值减损损失lower of cost ormarket method 成本与市价孰低法lump-sumpurchase整批购买managerialaccountin管理会计manufacturing cost制造成本marginaltax rate边际税率markdowncancellation减价取消marketmethod市价法marketvaluemethod市价法markup加价matchingprinciple配比原则materiality重要性maturityvalue到期值measurement date衡量日merchandiseinventory商品存货ity可衡量性mislead误导monetary assets 货币性资产monetary items 货币性项目moneycapital gain 货币资本利得mortgage bonds 抵押公司债movingaverage移动平均multiple-items approach 混合商品法multiple-pool method 多项组合法multiple-stepformat多步式multiple-stepincome statement 多步式损益表netaccounts receivable 应收帐款净额netadditionalmarkup净再加价netmarkdown净减价netmethod净额法netrealizablevalue method 净变现价值法neutrality中立性nominalaccount虚帐户rate名义利率noncompensatory plans 非酬劳性计划noncompe nsatory stockoption plan 非酬劳性认股计划noncumul ativepreferred stock 非累积优先股noninterest-bearing note 不附息票据nonmonet ary items 非货币性项目nonpartici patingpreferred stock 非参加优先股noparvaluestock无面额股normalshrinkage正常损耗notesreceivabledishonored(past due)拒付应收票据notesreceivables应收票据NSF (notsufficient fund)存款不足支票number ofcompoundingperiods复利次数obligations undercapital leases 应付租赁款off-balance-sheet financing 资产负债表外融资operatingcycle营业周期operatinglease营业租赁operational assets营业资产option选择权ordinaryannuity普通年金originalsellingprice原始售价output measures 产出单位比例法outstanding capital stock 流通在外股份outstandin g checks 未兑现支票paid-incapital投入资本par value面额par valuemethod面额法par valuestock有面额股participatingpreferred stock 参加优先股percentageapproach百分比法percentagedepletion method 百分比折耗法percentag e of grossprofit method 毛利百分比法percentag e-of-completio n method 完工比例法percentag e-of-receivables approach 应收帐款百分比法percentage-of-sales approach 销货百分比法periodexpense期间费用periodicinventory system 定期盘存制permanent account实帐户permanent difference 永久性差异perpetualinventory system 永续盘存制petty cash零用金physicalcauses物质因素physical inventory 实地盘存制plantassets厂房设备point ofsale销货点pooling ofinterests method 权益结合法post-balancesheetevents期后事项posting过帐predictivevalue预测价值preemptiv e rights 优先认股权preferredstock优先股prepaidexpenses预付费用prepaidincome taxes 预付所得税preparingtrialbalance试算presentamount现值presentvalue ofan annuity due 到期年金现值present value of anordinary annuity 普通年金现值priceindex approach 物价指数法price-earningsratio(p/eratio)市盈率primaryearnings per share 基本每股盈余principal本金priorperiodadjustmen t 前期损益调整probable很有可能product warranty 产品售后服务保证pro-formaamounts拟制资料propertyrights财产权property,plant andequipment厂房设备proportionalmethod比例法proportionalperforman ce method 比例履行法、purchasecommitments进货合约purchasediscount进货折扣purchaseretuen and allowance 进货退回及折让quickassets速动资产quickratio速动比率rate ofreturn ontotal assets 总资产报酬率ratioanalysis比率分析rawmaterialinventory原料存货reacquisition price收回价格readilydetermina ble fair value 具有明确的公平价值readymarketability变现性realaccount实帐户real estate lease 不动产租赁reasonably possible有可能receivables应收款项receivable s turnover 应收帐款周转率recover回收recoverab ility test 可回收性测试refinancing再融资relatedpartytransactio ns 关系人交易relative salesvalue method 相对售价法relevance相关性reliability可靠性realizable可实现realized已实现remote极少可能repairsandmaintenan ce 修理与维护repaymentat maturity 到期直接偿付replacement cost重置成本replacement method重置法replenishof petty cash 零用金的拨补representationalfaithfulness忠实表达researchand developm ent costs 研究开发支出(成本)researchmonograph研究论丛reserve准备value残值restoratio n costs 回复原状成本retailinventory method-FIFO 先进先出成本零售价法retailmethod零售价法retainedearnings留存收益retroactiverestateme nt 追溯重编法return of capital 资本的退回return oninvestmen t 投资报酬率revenue(expense)expenditure收益支出revenuefromlong-termcontracts工程收入revenueprinciple;revenuerecognition principle 收入认列原则revenuescollectedinadvance预收收入reversingentry转回分录risk free无风险sales andleaseback售后租回salesdiscount销货折扣discount not taken 顾客未取得折扣salesreturn and allowance 销货退回与折让sales withbuyback agreement 附买回合约的销货sales withhigh rates of return 高退货率的销货salvagevalue残值secondarycapital market 次级资本市场secretreserve秘密准备secured bonds 附担保公司债securities and exchangecommissi on(SEC)证券交易委员会seethrough看穿segmentreporting分部报告self-constructed assets自建资产servicecosts服务成本servicehours method 工作时间法servicelife耐用年限short-terminvestments短期投资significant industry segment 重要产业部门significant influence 重大影响力simplecapital structure 简单资本结构simpleinterest单利single-stepformat单步式single-stepincome statement 单步式损益表sinkingfund method 偿债基金法sinkingfunds偿债基金smallstock dividend 小额股票股利softwareproductio n costs 软件生产成本sourcedocuments原始凭证specialcolumn专栏special journal 特种日记帐specificidentification个别认定specifically identifiabl 可个别辨认standardcost标准成本standardcost system 标准成本法statedcapital法定资本statedinterestrate票面利率stated rate名义利率statedvalue设定价值statementof cash flows 现金流量表statement of changesin financial 财务状况变动表statement of sources and applications of funds 资金来源运用表statement s of financialaccountin g 财务会计概念公报statement s of financial accounting standards and interpretat 财务会计准则公报及公报的解释staticanalysis静态分析staticstatements静态报表statutorydepletion method 法定折耗法stockdividends股票股利stockoption plan 员工认股计划stockrights认股权stocksplits股票分割stock warrants 认股权、认股证stockholders' equity股东权益stockholders' equity to fixed assets 股东权益对固定资产比率stockholders' equityto totalassets权益比率straight-linemethod直线法structuralanalysis结构分析subscribe d stock 已认购股本subscriptionsreceivable应收股款subsequent events期后事项subsidary accounts 明细帐、子目successfulefforts approach 勘探成功法sum-of-the-years'-digits method 年数合计法supermajority vote 绝大多数票决supplementaryinformation补充资讯supportingschedules补充附表swaps交换权systemma tic andrational allocation 系统而合理的分摊tax credit 所得税抵减taxable amount 应课税金额taxableincome课税所得taxesrefundreceivable应退税额technical bulletins 技术性公报technological feasibility 技术可行性temporaryaccount虚帐户temporarydifference s 暂时性差异temporaryinvestment临时投资theory理论timeperiodconventio n 会计期间惯例timevalue of the money 货币时间价值timeliness及时性times-interest-earned ratio 利息保障倍数timing difference 时间性差异total asset turnover 总资产周转率tradediscount商业折扣trade-ins抵换trademarks商标权trading securities 经常交易证券transactionapproach交易法treasurystock库藏股treasurystock method 库藏股票法trendanalysis趋势分析trial anderrormethod试误法trialbalance试算表troubleddebtrestructuri ngs 财务困难债务整理true nopar stock 无面值股票trustee信托人twotransactions concept 两项交易观念unaffiliated customer 非关系企业的客户unappropriated未指拨underlyingassumptions基本假设understandability可理解性unearnedfranchise fees 预收加盟特许收入unearnedinterest revenue 未实现利息收入uniformity统一性unit lifo method 单位后进先出法unit pricing 单位评价法unit-of-measure assumptio n; monetaryunit assumptio 货币计量假设units ofproductio n method 生产数量法units-of-output method 生产数量法unlisted or over-the-counter corporatio ns 上柜(非上市)公司unrealized capital 未实现资本unrealizedcapital gains or losses 未实现资本增值或损失unrealized gain on market value recoveryof short-term investmen ts 短期投资未实现市价回升利益unrealizedgain or loss 未实现损益holdinggain or loss 未实现持有损益unrealized loss onlong-term investmen ts 长期投资未实现跌价损失unrealized loss onshort-term investmen ts 短期投资未实现跌价损失unusual innature性质特殊valuationaccount评价科目variable costing 变动成本法verifiability可验证性verticalanalysis垂直分析vestedrights既得权利visualinspectionmethod目视法wateredstock掺水股本weightedaverage加权平均weighted-averageamount ofaccumulatedexpenditu res 累积支出的平均数and where-gone statement 资金来源与用途表withrecourse有追索权withholding代扣款项withoutrecourse无追索权work inprocess inventory 在产品存货workingcapital营运资金workingcapitalratio流动比率workingmodel作业模型worksheet method 工作底稿法years-of-service method 预期服务年数法。

金囿学堂CFA一级另类投资【精讲】

capital.

内z Real estate: direct ownership or indirectly through real estate equity/debt

Investment Structures

堂 General Partner (GP) : the fund 传 Limited Partners (LPs) : investors

Funds are generally structured with a management fee based on assets under

囿 Financial Reporting and Analysis Corporate Finance

Portfolio Management

Equity Investment

禁10 20 7

严7 10

Fixed Income Derivatives

,

10 5

Study Session 18

料 Alternative Investments

4

资 Overview of Level I Alternative Investments

部Study Session 18 Alternative Investments

内 Hedge Funds

Private Equity

Real Estate

Commodities Infrastructure

Risks for alternative investments

最高效最详细的的CFA协会ESG证书备考计划

最高效率、最详细的CFA协会ESG证书备考计划ESG是环境、社会和治理的缩写,是一种关注企业环境、社会和治理绩效的投资理念和商业决策。

它强调企业应该注重环境保护、社会责任和公司治理结构等方面,以实现可持续发展和长期价值创造。

ESG有助于超越单一财务底线,实现利益相关者共赢和社会可持续发展。

在投资领域,ESG投资是一种将ESG因素纳入投资决策的投资方法,旨在评估企业的ESG绩效,并选择那些在ESG方面表现良好的企业进行投资。

这种投资方法可以帮助投资者了解企业的可持续发展能力和风险控制能力,从而做出更加明智的投资决策。

因此,备考协会CFA的ESG证书需要了解ESG的基本概念、ESG投资的理论和实践以及如何评估企业的ESG绩效等方面的知识。

同时,也需要了解如何运用ESG投资策略进行资产配置和风险管理等方面的技能。

以下为CFA协会ESG证书备考计划的详细内容及复习步骤:1.制定详细的学习计划:在备考过程中,制定一个详细的学习计划,包括每天的学习时间和学习内容等。

这有助于确保你在考试前已经分了解考试的范围和要求,并且可以合理地分配时间来学习各个知识点。

2.注重知识点的理解和掌握:CFA协会的ESG证书考试涉及面较广,因此需要注重知识点的理解和掌握。

在备考过程中,要认真阅读教材和其他相关资料,深入理解每个知识点,并能够熟练地应用这些知识来解决实际问题。

3.多做模拟题和真题:模拟题和真题是备考CFA协会ESG证书考试的最好资料。

通过多做模拟题和真题,可以熟悉考试形式和提高答题速度,同时也可以更好地了解自己的弱点和需要改进的地方。

4.提高英文表达和阅读理解能力:由于CFA协会的ESG证书考试采用全英文形式,因此需要提高英文表达和阅读理解能力。

在备考过程中,要多读英文文章和进行口语练习,以提高英文表达能力和阅读理解能力。

5.调整好心态和状态:备考CFA协会ESG证书考试需要耐心和恒心,不要过度自信或过于紧张。

要保持积极的心态和良好的状态,合理安排时间进行学习和休息,以保持最佳的考试状态。

对外经贸大学金融硕士罗斯《公司理财》讲义13

对外经贸大学金融硕士考研罗斯《公司理财》讲义第十三章公司融资决策和有效资本市场1.如何创造有价值的融资机会:愚弄投资者,降低成本或提高补贴,创造一种新证券。

2.有效市场假说EMH重要意义:由于信息立刻反映在价格里,投资者应该只能预期获得正常收益率。

公司从他出售的证券中应该预期得到公允价值。

基于假设:理性,即假设所有投资者都是理性的。

独立的理性偏差,即并不要求全部是理性的个人,只要相互抵消各种非理性。

套利,即假设只有两种人,非理性的业余投资者与理性的专业投资者。

因而如果专业投资者套利能够控制业余投资者的投机,市场依然有效。

具体类型:分析三种信息对价格的作用,即过去价格的信息,公开信息,所有信息。

1.弱型有效市场:满足弱型有效假说(资本市场完全包含了过去价格的信息)。

数学表示:=+期望收益+随机误差股票价格遵循随机游走。

2.半强型有效市场:价格反映了所有公开可用的信息,包括财报和历史价格。

除了内幕信息,被公开的信息就可以为每位投资者所有。

无论什么类型的投资者,对所有公开的信息判断都一致。

3.强型有效市场:价格反映了所有的信息,包括公开的和内幕信息。

信息的产生,公开,处理,反馈,几乎是同时的。

有关信息的公开是真实的,信息处理正确,反馈准确。

常见误解:投掷效率,价格波动,股东漠不关心。

3.序列相关系数:即时间序列相关系数,衡量一种证券现在收益与过去收益之间的相关关系。

如果该系数接近零,说明股票市场与随机游走假说一致。

2016年专业课考研真题答题黄金攻略名师点评:认为只要专业课重点背会了,就能拿高分,是广大考生普遍存在的误区。

而学会答题方法才是专业课取得高分的关键。

下面易研老师以经常考察的名词解释、简答题、论述题、案例分析为例,来讲解标准的答题思路。

(一)名词解析答题方法【考研名师答题方法点拨】名词解释最简单,最容易得分。

在复习的时候要把参考书中的核心概念和重点概念夯实。

近5-10年的真题是复习名词解释的必备资料,通过研磨真题你可以知道哪些名词是出题老师经常考察的,并且每年很多高校的名词解释还有一定的重复。

2015CMA中文考试-part2-真题-题库精选易错题题(wiley)

题目3:2D1-CQ02某公司正在构建风险分析体系,以量化数据中心面临的各种类型风险的威胁程度。

在调整保险赔偿金后,下列哪项将代表年度最高损失?发生的频率:1年损失金额:15000美元保险责任范围:85%。

发生的频率:100年损失金额:400000美元保险责任范围:50%。

发生的频率:8年损失金额:75000美元保险责任范围:80%。

发生的频率:20年损失金额:200000美元保险责任范围:80%。

预计的年度损失应该是12,750 [15,000×(0.85)]。

频率为8,预计的年度损失= (75,000/8)×(0.8) = 9,375×(0.8) = 7,500;频率为20,预计的年度损失=(200,000/20)×(0.8) = 100,000×(0.8) = 8,000;频率为100,预计的年度损失= (400,000/100)×(0.5) = 4,000×(0.5) = 2,000。

34.衍生金融工具的名义金额指的是:合同的初始购买价格。

标的资产的数量。

行使未到期合同的费用。

合同的固定价格。

衍生金融工具是交易双方之间的合同,单个付款(或多个付款)是在双方之间进行的。

合同的名义金额(或面值)可以是由一个特定的事件引发的预先确定的数量,也可以是标的资产价值数量的变化。

衍生金融工具的“名义金额”既指一定数量的货币金额,也可能指一定数量的股份,还可能指衍生金融工具合同所约定的一定数量的其他项目。

5.斯坦利公司的会计师利用以下的信息计算公司的加权平均资本成本(WACC)。

得出的公司加权平均资本成本是多少?17% 。

13.4% 。

10.36% 。

11.5% 。

加权平均资金成本计算如下:加权平均资本成本=长期债务的权重×长期债务的税后成本+普通股的权重×普通股的成本+留存收益的权重×留存收益的成本长期债务、普通股和留存收益的总额=10,000,000美元+ 10,000,000美元+ 5,000,000美元=25,000,000美元。

ACCA指出:吸引和保留财会人员成为企业最大挑战ACCACAT考试.doc

ACCA(特许公认会计师公会)日前在上海发布“财会专业人才管理报告”。

报告指出,吸引和留住核心财会专业人才,是本世纪全球各行业公司之间都面临的最大挑战之一。

在这项对ACCA来自83个国家的870个会员公司的调查中,经济全球化,人口结构变化、商业模式复杂化,被认为是引起企业和财会人员在21世纪面临重大挑战的主要原因。

有59%的受访者把“人才管理”定义为:一种吸引、发展和留住高潜力员工的措施。

几乎所有人认为,相对于传统的资本投资和收益最大化,人才作为一项特殊的稀缺资源,重要性已与上述两者不相上下。

参与调查的全球各行业的主要决策者中,有85%的者表示人才管理中的财会人才管理的重要性在上升。

ACCA全球合伙人TonyOsude称,对于财会的定义正在变得更加多元,一方面是监管力度不断加强,另一方面是资本市场更加复杂,这对财务报告的精准度和全面性提出了一个新的挑战,对财会专业人才的要求也在不断上升。

此外,有79%的公司承认,财会人才的短缺会是未来业务发展的主要阻碍。

在这个问题上,东方比西方显示出更严重的担忧。

亚洲有高达91%的受访者认为会面临财会人才短缺,而在北美地区这一数字是77%,在英国和爱尔兰,只有68%的公司认为这是一个问题。

关于公司内部财会人才的管理目的的讨论也在持续升温,74%的受访者表示实施人才管理战略,吸引和留住人才是公司战略管理的关键之一。

在所有行业中,有10%的受访者认为财会人才管理的对象应针对公司高层。

在对于各地区的调查中,有超过20%的英国和爱尔兰受访者表示在他们的公司,高管不支持对普通员工实施人才管理;这一数字在亚洲和澳大利亚是10%,在北美地区仅有5%.但人认为这项管理应贯穿整个组织的各个层级,有超过50%的公司表示人才管理应该包括那些普通员工。

在这些公司,人才管理计划往往“变形”为员工发展计划,因而每个员工的才能都可以通过这项计划得到培养和提升。

作为人力资源管理中一项新的发展,培训和指导被认为是发展人才的最有效措施,有60%的受访者表示会采用上述措施。

CFA一考试之quantitative的想法

CFA一级考试之quantitative的想法quantitative没有什么太多重要的,运气很关键吧。

正式考试还是挺难的,一道题目里可能考两个考点。

尤其是stats和probability部分,我考试之前练习了很多hypothesis testing,还有那些chi-square, t-distribution的计算,但是实际上把Z-test那几个critical value记住就够用啦。

不会考太难的运算。

但是它可能会考点比较偏的,比如MAD和standard derivative比较什么的。

当时一看就有点懵。

time value部分应该说算是送分的,因为毕竟如果这个做不熟练后面的asset valuation也没法做,算是考用financial calculator的基本功吧。

基本上这个部分中国的同学都可以拿到70%以上。

CFA考试有大量复杂的公式需要背诵 CFA考试对数学的要求不高,充其量就是大学一、二年级的统计学还有概率论这两本教材,其实很多计算都很基础。

我们要明确的知道,CFA考察的重点是计算,并非是精算师而是分析师,分析师自然重点是对数据的有效性和实用性进行评判。

比如大家学习到CFA一级的偏度和峰度的时候,会发现里面的公式很复杂,其实这里是不需要背诵的,这里只需要大家知道偏度和峰度的具体含义,你看到一个分布给你均值和中值你要会评判当二者不相等时会是左偏还是右偏。

又比如CFA二级的定量分析里公式很多,但是需要背诵的仍然是寡寡无几,因为这里考察的是你对一个方程式的评判还有总结,一个分析师做出了一个回归分析,你判断他里面是否出现错误还有数据的筛选错误,这些都是不需要我们背诵,需要我们进行理解的。

再比如债券的估值,考察的主要就是对债券品种的特性把握还有债券的yield curve的预测,并不需要太多的公式记忆。

各位考生,2015年CFA备考已经开始,为了方便各位考生能更加系统地掌握考试大纲的重点知识,帮助大家充分备考,体验实战,网校开通了全免费的高顿题库(包括精题真题和全真模考系统),题库里附有详细的答案解析,学员可以通过多种题型加强练习,通过针对性地训练与模考,对学习过程进行全面总结。

第七届中金所杯全国大学生金融知识大赛参考题库

第七届“中金所杯”全国大学生金融知识大赛参考题库第一部分金融基础知识部分一、单选题1.下列债券中,久期最长的债券是()。

A.8年期,息票率8%,年付息的固定利率债券B.8年期,息票率8%,半年付息的固定利率债券C.20年期,参考利率为6个月SHIBOR的半年付息的浮动利率债券D.10年期,息票率8%,年付息的固定利率债券2.下列关于久期的描述,错误的是()。

A.在其他条件相同的情况下,债券的息票率越高,久期越大B.零息债券的麦考利久期等于它的到期期限C.在其他条件不变情况下,债券的到期期限越久,久期一般也越大D.在其他条件不变情况下,债券的到期收益率越低,久期越大3.假设一个投资组合由一个期望收益为12%,标准差为25%的风险投资组合,以及一个收益率为7%的无风险资产组成,如果总的投资组合的标准差为15%,则总投资组合的收益为()。

A.11%B.10%C.9%D.8%4.假设当前1年期即期利率为5%,1年后的1年期远期利率为7%,那么2年期的即期利率近似为()。

A.4%B.6%C.8%D.10%5.已知无风险利率为3%,某股票的风险溢价为10%,则该股票的期望收益率为()。

A.3%B.7%C.10%D.13%6.根据信用风险事件的不同类型,可以将信用风险划分为一些类别。

这些信用风险类别中一般不包括()。

A.违约风险B.交易对手风险C.价差风险D.信用等级转移风险7.假设一个基金在2018年决定采取基金定投策略进行基金投资,初始资金100万,每月月初从本金中拿出10万元投资追踪沪深300指数的基金,剩余金额不做任何操作;为了对照,假设相同的操作用于固定收益投资,即初始资金100万,每月月初从本金中拿出10万元投资追踪无风险债券,剩余金额不做任何操作,设无风险债券年化月复率为5%。

设2018年未来10个月沪深300指数走势如表所示,则关于该基金的投资策略投资终值(精确到万,选择最接近的金额)和相比固定收益投资的效果描述正确的是()。

challenge 金融术语

challenge 金融术语

金融术语是用来描述与金融相关的概念、原则和操作的专业术语。

下面是一些常见的金融术语:

1. 资产:指个人或公司拥有并能为其带来经济利益的东西,如现金、股票、房地产等。

2. 负债:个人或公司需要偿还的债务或承担的义务,如贷款、信用卡债务等。

3. 资本:用于投资和运营企业的资源,如股东投资的资金或公司的资产。

4. 利息:借贷资金所产生的成本或收益,在贷款方面称为利息支出,在存款方面称为利息收入。

5. 结算:指完成金融交易并进行支付或清算的过程。

6. 股票:公司的所有权证书,购买股票意味着成为公司的股东,并分享公司的利润和决策权。

7. 股息:公司向股东支付的利润分配,通常以每股的金额表示。

8. 汇率:两种货币之间的兑换比例,如美元对人民币的汇率。

9. 利率:借款时需要支付的利息比例,或者将现金存入银行时可以获得的利息比例。

10. 经济指标:用于测量和衡量经济活动和表现的指标,如国

内生产总值(GDP)、通货膨胀率等。

这只是从众多金融术语中挑选的一些常见术语,金融术语因其特定背景和涵义而具有一定的复杂性和多样性。

采访对话的英文范文

采访对话的英文范文An Insightful Interview with a Local Entrepreneur.Good morning, everyone. Today, we are joined by a remarkable individual who has made significantcontributions to our local business community. A serial entrepreneur with a passion for innovation and a drive to succeed, our guest today is Mr. John Doe, the founder and CEO of Doe Enterprises. John, thank you for taking the time to speak with us.John: My pleasure, it's an honor to be here.Host: John, you've started several successful businesses. Can you tell us about your journey and what inspired you to become an entrepreneur?John: My journey began when I was a young boy, watching my father work hard to make ends meet. I saw the challenges he faced and the dedication he showed, and that instilledin me a sense of determination and resilience. I always knew I wanted to create something of my own, something that could make a difference.Host: What has been the most challenging aspect of being an entrepreneur?John: The challenges are many, but I believe the most significant one is managing risk. As an entrepreneur,you're constantly making decisions that could potentially impact your business's future. It requires a lot of courage and faith to take those leaps of faith, knowing that not every decision will turn out as planned.Host: And what about the most rewarding part?John: The most rewarding part is seeing my ideas come to life and knowing that I've created something that not only adds value to society but also provides opportunities for others. When I see my team growing and succeeding, or when I receive feedback from customers who appreciate our products or services, it gives me a sense of fulfillmentand accomplishment that money can't buy.Host: John, you've mentioned your team several times. How important is teamwork in your business?John: Absolutely crucial. I believe that no business can succeed without a strong team behind it. It's essential to hire people who are not only skilled and qualified but also share your vision and values. Building a culture of trust and collaboration is paramount, as it鼓励s innovation and creativity, which are essential for any business to thrive.Host: What advice would you give to aspiring entrepreneurs who are just starting out?John: My advice would be to stay focused and passionate about your vision. Don't get distracted by the shiny objects or the latest trends. Be patient and willing to learn from your mistakes. And always remember, success doesn't happen overnight. It takes hard work, dedication, and perseverance. But if you're passionate about whatyou're doing and believe in yourself, you can achieve anything.Host: John, thank you so much for sharing your insights and experiences with us. We're sure our viewers have gained a lot of valuable insights from your words of wisdom.John: My pleasure. I'm happy to help inspire the next generation of entrepreneurs.And with that, our interview with John Doe comes to an end. We hope you've enjoyed learning about his journey asan entrepreneur and have found some inspiration for yourown path. Remember, with hard work and dedication, you can achieve anything you set your mind to. Thank you for watching, and we look forward to seeing you again next time.。

Quantitative Investment Strategy Quant Developer职位

Quantitative Investment Strategy QuantDeveloper职位描述与岗位职责Quantitative Investment Strategy Quant Developer是一种与金融市场有关的计算机科学职业。

他们开发、测试和维护标准化的金融投资策略,具有高度的数学和计算机编程技能。

以下是Quantitative Investment Strategy Quant Developer的职位描述与岗位职责:职位描述:作为Quantitative Investment Strategy Quant Developer,你将与投资人员、交易员、产品开发人员及其他实施策略的团队密切合作。

你将负责开发和实施复杂的数学模型和算法,以便在金融市场上制定适当的投资策略。

你将支持量化研究、监控和回测策略,并对实时交易演进和绩效进行有效的跟踪和管理。

岗位职责:1. 设计和开发金融模型和算法。

2. 帮助执行各种金融交易策略。

3. 支持后测策略对比,分析策略性能并提供优化建议。

4. 与投资组合经理和交易员合作,提供量化解决方案。

5. 设计、制定和管理数据维护流程,以便在更有效地开发解决方案的同时保持数据质量。

6. 使用金融数据和新兴技术,为优化策略提供新的数据源和工具。

7. 跟踪市场变化和趋势,并相应的实时调整策略。

8. 分析成本、风险和收益,同时保持足够的认真和慎重。

技能要求:1. 数学与计算机编程能力。

2. 金融市场和交易的基础知识。

3. 熟悉Python、C++、MatLab等编程语言。

4. 统计学知识与常用模型。

5. 高度技术技能,以便有效地解决量化领域的挑战。

6. 经验丰富的金融数学和数据分析技能,以便准确地执行开发并测试交易策略。

7. 对细节的高度关注以及良好的沟通能力。

8. 严格的个人操守,以满足所有日常操作中的固定时间要求以及全国性的交易日历。

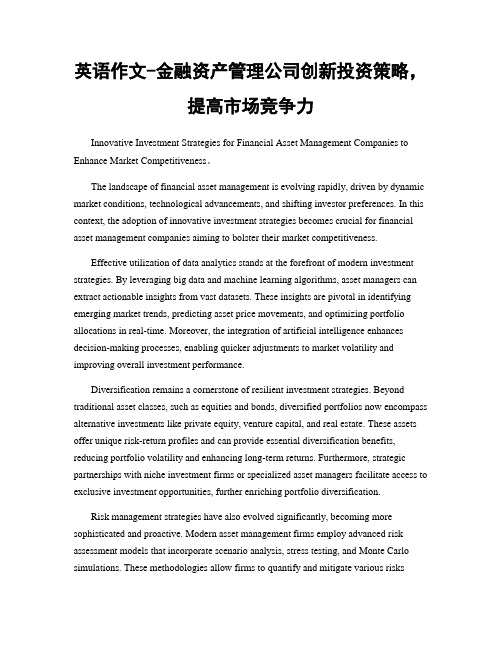

英语作文-金融资产管理公司创新投资策略,提高市场竞争力

英语作文-金融资产管理公司创新投资策略,提高市场竞争力Innovative Investment Strategies for Financial Asset Management Companies to Enhance Market Competitiveness。

The landscape of financial asset management is evolving rapidly, driven by dynamic market conditions, technological advancements, and shifting investor preferences. In this context, the adoption of innovative investment strategies becomes crucial for financial asset management companies aiming to bolster their market competitiveness.Effective utilization of data analytics stands at the forefront of modern investment strategies. By leveraging big data and machine learning algorithms, asset managers can extract actionable insights from vast datasets. These insights are pivotal in identifying emerging market trends, predicting asset price movements, and optimizing portfolio allocations in real-time. Moreover, the integration of artificial intelligence enhances decision-making processes, enabling quicker adjustments to market volatility and improving overall investment performance.Diversification remains a cornerstone of resilient investment strategies. Beyond traditional asset classes, such as equities and bonds, diversified portfolios now encompass alternative investments like private equity, venture capital, and real estate. These assets offer unique risk-return profiles and can provide essential diversification benefits, reducing portfolio volatility and enhancing long-term returns. Furthermore, strategic partnerships with niche investment firms or specialized asset managers facilitate access to exclusive investment opportunities, further enriching portfolio diversification.Risk management strategies have also evolved significantly, becoming more sophisticated and proactive. Modern asset management firms employ advanced risk assessment models that incorporate scenario analysis, stress testing, and Monte Carlo simulations. These methodologies allow firms to quantify and mitigate various riskseffectively, including market risk, credit risk, liquidity risk, and operational risk. By implementing robust risk management frameworks, companies can safeguard investor capital while maintaining competitive performance metrics.In response to growing environmental, social, and governance (ESG) considerations, sustainable investing has gained prominence across asset management sectors. Integrating ESG factors into investment strategies not only aligns with ethical principles but also mitigates risks associated with regulatory changes and reputational damage. Sustainable investments encompass a broad spectrum, ranging from renewable energy projects to socially responsible corporate bonds, thereby attracting a diverse investor base and enhancing overall portfolio resilience.Technological innovation continues to redefine client engagement and service delivery within asset management. The proliferation of digital platforms and fintech solutions enables firms to offer personalized investment advice, real-time portfolio monitoring, and seamless transaction capabilities. Additionally, leveraging blockchain technology enhances transparency, security, and efficiency in managing investment operations and fund distributions.Amidst the evolving landscape, agility emerges as a critical determinant of competitive advantage. Financial asset management companies must embrace a culture of innovation and adaptability, continually refining investment strategies to capitalize on emerging opportunities and navigate evolving market dynamics. Proactive monitoring of global macroeconomic trends, geopolitical developments, and regulatory changes is essential to anticipate market shifts and optimize investment outcomes.In conclusion, the pursuit of innovative investment strategies is imperative for financial asset management companies seeking to enhance market competitiveness. By harnessing data analytics, diversifying portfolios, strengthening risk management frameworks, embracing sustainable investing practices, leveraging technological advancements, and fostering organizational agility, firms can position themselves at the forefront of the industry. Ultimately, a commitment to innovation not only drives superiorinvestment performance but also cultivates long-term client trust and satisfaction in an increasingly competitive marketplace.。

资源利用英语作文

In todays world,the efficient use of resources is a critical issue that every society must address.As the population grows and the demand for resources increases,it is essential to ensure that we are utilizing our resources in a sustainable and efficient manner.This essay will explore the importance of resource utilization,the challenges we face,and the strategies that can be employed to optimize the use of our resources.Importance of Resource Utilization1.Sustainability:The concept of sustainability is at the heart of resource utilization.It is about meeting the needs of the present without compromising the ability of future generations to meet their own needs.Efficient use of resources ensures that we do not deplete them at a rate that is faster than they can be replenished.2.Economic Growth:Efficient resource use can lead to economic growth by reducing waste and increasing productivity.When resources are used effectively,more goods and services can be produced with less input,leading to cost savings and increased profits.3.Environmental Protection:Overuse and misuse of resources can lead to environmental degradation.By managing our resources carefully,we can reduce pollution,preserve ecosystems,and mitigate the impacts of climate change.Challenges in Resource Utilization1.Overconsumption:One of the major challenges is the culture of overconsumption, especially in developed countries.This leads to the depletion of resources at an unsustainable rate.2.Inequality:There is often an unequal distribution of resources,with some regions or groups having access to far more than others.This can lead to social and economic disparities and conflicts.3.Technological Limitations:While technology can aid in the efficient use of resources, there are limitations to what current technologies can achieve.Innovation is needed to develop more efficient methods of resource use.Strategies for Optimizing Resource Utilization1.Recycling and Reuse:Encouraging recycling and the reuse of materials can significantly reduce the demand for new resources.This can be achieved through public education campaigns and incentives for businesses to adopt sustainable practices.2.Conservation Practices:Implementing conservation practices in agriculture,forestry, and fisheries can help to preserve natural resources.This includes sustainable farming methods,responsible logging,and fishery management.3.Technological Innovation:Investing in research and development can lead to breakthroughs in technology that enable more efficient use of resources.This could include advancements in renewable energy,water conservation,and waste reduction.4.Policy and Regulation:Governments can play a crucial role by implementing policies and regulations that encourage resource efficiency.This could involve setting standards for energy efficiency,promoting the use of public transportation,and regulating the use of natural resources.5.Public Awareness:Raising public awareness about the importance of resource conservation is vital.This can be done through education,media campaigns,and community initiatives that promote sustainable living.In conclusion,the efficient use of resources is a multifaceted issue that requires a collective effort from individuals,businesses,and governments.By adopting sustainable practices,investing in innovation,and fostering a culture of conservation,we can ensure that our resources are used in a way that benefits both current and future generations.It is a responsibility that we all share and one that is essential for the longterm health of our planet.。

智力资本的评估

The measurement of intellectual capital 作者: 王瑾瑜

作者机构: 清华大学经济管理学院,北京100084

出版物刊名: 科研管理

页码: 79-83页

主题词: 智力资本;评估;现代企业;高技术企业;公司;价值;知识管理

摘要:随着知识相对于其它生产要素的地位的提升,智力资本也成为学者关注的对象.现代企业(特别是高技术企业)的市场价值与账面价值相差悬殊,有形资产投资与财务业绩之间的相关性越来越小,这些现象使得智力资本这一价值驱动因素日益凸现出来.本文对公司层次上的智力资本进行了界定,并介绍了三种评估智力资本的方法,即市场价值与账面价值比较法、托宾q法和智力资本报算法.运用这些方法我们可以对一家公司的智力资本进行大致的评估,为公司智力资本的管理和投资提供依据.如何在智力资本投资和公司业绩之间建立联系以及怎样利用其中的联系增加公司的价值是今后研究的重点.。

哈佛商学院投资新动向

哈佛商学院投资新动向

Ann Cullen

【期刊名称】《董事会》

【年(卷),期】2005(000)002

【摘要】@@ 也许一旦被视为贪婪的市场扰乱者,公司的黎明就要到来了,尤其是那些急需重建的问题公司.人们现在关注的热门话题是:风险投资已经风光不再,私募股权投资可以登场了.不良私募股权已经被视为商业环境中的必然组成部分,而且是一种可行的投资品种.

【总页数】1页(P101)

【作者】Ann Cullen

【作者单位】哈佛商学院

【正文语种】中文

【相关文献】

1.哈佛商学院何时该听激进投资者的话 [J], Robin Greenwood;Michael Schor

2.导读:2015年,投资去哪儿?——揭秘杭州天使投资人新动向 [J], 夏夏

3.第三届亚太投资峰会:迎接中国投资市场的新动向与大机会 [J],

4.国际投资仲裁中投资者与东道国利益平衡问题研究

——以ICSID仲裁规则修订新动向为视角 [J], 周新军;叶如凡;牛竞晗

5.外商投资监管的新动向‐外商投资法简析 [J], 王蓓蓓

因版权原因,仅展示原文概要,查看原文内容请购买。

中金所全答案题库

“中金所杯"全国高校大学生金融期货及衍生品知识竞赛参考题库第一部分股指期货一、单选题1. 沪深300股指期货对应的标的指数采用的编制方法是(D)。

A. 简单股票价格算术平均法 B。

修正的简单股票价格算术平均法C。

几何平均法 D. 加权股票价格平均法2。

在指数的加权计算中,沪深 300 指数以调整股本为权重,调整股本是( B).A. 总股本B. 对自由流通股本分级靠档后获得C. 非自由流通股D. 自由流通股3。

1982年,美国堪萨斯期货交易所推出(B)期货合约。

A. 标准普尔500指数B. 价值线综合指数C。

道琼斯综合平均指数 D. 纳斯达克指数4. 最早产生的金融期货品种是(D)。

A。

利率期货 B. 股指期货C. 国债期货 D。

外汇期货5。

在下列选项中,属于股指期货合约的是(C )。

A. NYSE交易的SPYB. CBOE交易的VIXC. CFFEX交易的IFD. CME交易的JPY6。

股指期货最基本的功能是(D)。

A. 提高市场流动性 B。

降低投资组合风险C. 所有权转移和节约成本D. 规避风险和价格发现7。

利用股指期货可以回避的风险是(A )。

A。

系统性风险 B。

非系统性风险C. 生产性风险 D。

非生产性风险8。

当价格低于均衡价格,股指期货投机者低价买进股指期货合约;当价格高于均衡价格,股指期货投机者高价卖出股指期货合约,从而最终使价格趋向均衡.这种做法可以起到( D)作用.A。

承担价格风险 B。

增加价格波动C。

促进市场流动 D. 减缓价格波动9。

关于股指期货与商品期货的区别描述正确的是( C)A。

股指期货交割更困难 B。

股指期货逼仓较易发生C. 股指期货的持仓成本不包括储存费用D. 股指期货的风险高于商品期货的风险10。

若IF1401 合约在最后交易日的涨跌停板价格分别为2700 点和3300 点,则无效的申报指令是(C ).A。

以2700。

0 点限价指令买入开仓1 手IF1401 合约B。

【读书笔记】《基于资源的企业》读书笔记

《基于资源的企业》读书笔记一关于作者wernerfelt 现任麻省斯隆商学院管理科学系教授博士管理委员会的主席。

1 所受教育:哈佛大学管理经济学博士学位哥本哈根大学经济学硕士学位哥本哈根大学哲学学士学位2 工作经历:西北大学战略管理的助理教授密歇根大学管理与政策控制的助理教授哥本哈根大学经济系研究员《营销科学》的地区主编《管理科学》的副主编一系列营销、战略管理和经济学杂志的编委3 头衔:美国经济协会的会员战略管理协会的会员国际管理协会的会员4 著作:营销方向32篇以下面两篇最为著名:1“implementing quality improvement programs designed to enhance customer satisfaction: quasi-experiments in the united states and spain” journal of marketing research 37 no.1 february pp. 102-112 XX.2 “customer satisfaction based incentive systems” (with john r. hauser and duncan i. simester) marketing science 13 no.4 winter pp. 327-50 1994. finalist 1994 j.d.c. little best paper award informs college of marketing.经济学方向16篇以下面两篇最为著名:1 “why should the boss own the assets?” journal of economics and management strategy 11 no. 3 fall pp. 473-85 XX.2 “general equilibrium with real time search in labor and product markets” journal of political economy 96 no.3 august pp. 821-31 1988.战略管理方向17篇以下面两篇最为著名:1 “strategy and the research process: reply” (with cynthia a. montgomery and srinivasan balakrishnan) strategic management journal 12 no. 1 january pp. 83-84 1991.2 “a resource-based view of the firm” strategic management journa l 5 no. 2 april-june pp. 171-80 1984.5 奖项:1920xx年战略管理协会奖就是这篇文章。

- 1、下载文档前请自行甄别文档内容的完整性,平台不提供额外的编辑、内容补充、找答案等附加服务。

- 2、"仅部分预览"的文档,不可在线预览部分如存在完整性等问题,可反馈申请退款(可完整预览的文档不适用该条件!)。

- 3、如文档侵犯您的权益,请联系客服反馈,我们会尽快为您处理(人工客服工作时间:9:00-18:30)。

Which investment style make a good performance?

1. Indicates that the search to identify new and/or unique factors was the most frequently cited strategy; complementary to it was the intention to use new models. 2. Regression is the state of the art of today’s toolkit. To get better performance, we will have to enlarge the tool kit and add information and dynamic and static models. People are always changing things; maybe we will be changing things just a bit quicker. 3. A good trading algorithm collapsed to three to four years in the mid-1990s and has now collapsed to just two to three months (Urstadt 2007). Berman added that he expects to see the life cycle of a successful algorithm continue to drop.

Percentage of survey participants using numerical only, both numerical and rule-based, and only rule-based modeling approaches

Rule Based Only Numerical Only Numerical and Rule Based

3.

4.

5.

0

20

40

60

80

100

120

140

How do you capture more information?

1.

2.

3. 4. 5.

6.

There is no simple formula, everything is unique. To understand the process, you need to know the philosophy and understand how it performs in specific markets-for example, in markets that are trending up, down, or sideways. You need to understand what drives the returns. We have seen many processes that are very simple but work and others that are complex and do not work. A quantitative process is a process that quantifies things. Experience has shown that a pure data-mining approach—at least at the level of mining time series of equity returns—is not feasible. In our multifactor quantitative model, there is a focus on fundamental factors. These account for 90 percent of the factors in our approach; technical factors account for the remaining 10 percent of the factors

2. .Some sources cited the fact that quantitative funds are based on a more complex process than fundamental funds and so are harder to explain and more difficult to sell to investors. The successful active fundamental manager is almost like a machine: He does not fall in love with a stock or a CFO and he admits mistakes. Quant products are unglamorous. There are no ‘story ’ stocks, so it makes it a hard sell for consultants to their clients. Quant do not hit the ball out of the park, but they deliver stable performance.

What is a quantitative investment management process?

Input system

Forecasting engine

Portfolio construction engine

Dose that fundamental overlay add value to the quantitative process?

Relative strength of selling points of a quantitative products as rated

Statistics-Based Stock Selection Lower Trading Costs Lower Management Fees Nondiscretionary No style drift Greater Diversification Rule-Based Process Transparent Process Better risk management Enhanced Investment Discipline Alpha Generation

2.

Diversification

Improve performance Ensure more stable returns Tighter risk control

3.

0

20

40

60

80

100

120

140

What is the selling point of market quantitative pquantitative process?

1. The most compelling finding was that quant managers outperformed fundamental managers with half risk. Quant managers as a group are better at quantifying the all-around risks and what is likely to go wrong. Quant has an advantage when there is an element of financial engineering. The investment process is the same, but quant adds value when it comes to picking components and coming up with products such as 130-30. This profitability comes from the fact that (1) a quant process can be scaled to different universes all run by the same team and (2) a quant process allows more strategies about when and how to trade.

Response to: The most effective equity portfolio management process combines quantitative tools and a fundamental overlay

2.

3.

No Opinion Agree Disagree

Factors behind a firm’s motivation to adopt(at least partially) a quantitatively driven equity investment management process

Reduce Management costs Improve cost-to-revenues ratio Stabilize costs,revenues,performance Add new products Investor Demand Scalabity Profile of Founders/In-House Culture

Challenges in Quantitative Equity Management

Wenlong Jiao Oct.2010

What is Quant future in the industry?

• Most quant were value investors. • Models will run the entirety of the investment management process? • All models make forecasts (based on trend following). • It is a fool buying under the assumption that a bigger fool will buy in the future. • Active management is still a zero-sum game.