自由现金流估值模型xls)(1).xls

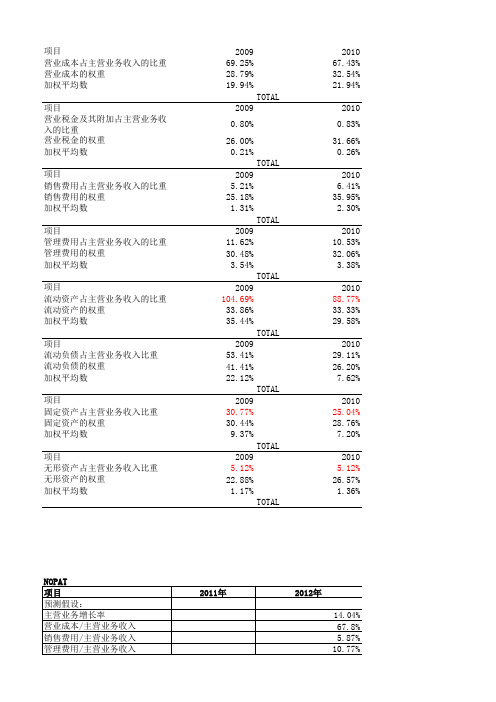

天相Excel模版——三阶段自由现金流DCF估值

利润分配表(已优化)

历史利润表 预测利润表

现金流量表(已优化)

历史数据 预测数据

行业发展分析 进行估值 自动模式

行业模版结构图 Excel V1.2 2009年2月18日

手动模式

重要名词缩写的解释:

DDM(Dividend Discounted Model)股利折现模型 DCF(Discounted Cash Flow)现金流折现模型 FCFF(Free Cash Flow for Firm)公司自由现金流 FCFE(Free Cash Flow for Equity)股东自由现金流 WACC(Weighted Average Cost of Capital)加权平均资本成本

天相投资顾问有限公司

北京西城区金融街五号新盛大厦B座5层 欢迎使用天相估值模版(行业V1.2) Excel引擎的相关设置(模版正常工作的前提):

1、确认“天相投资分析系统2008”安装并开启,确认成功安装并加载天相Excel 引擎,加载成功后,在Excel主菜单中能够看到“天相Excel引擎”的菜单,并可 以成功刷新历史数据。 2、确认Excel主菜单“工具→宏→安全性”选项框,安全级别设为“中”,并在 打开估值模版时,选择“启用宏”。 3、确认Excel主菜单“工具→选项→重新计算”选项框,选定“自动重算”选 项,保证在参数改变时,表格自动更新数据。

历史数据

资产债表

历史资债表

预测资债表

数据输入和引用说明:

1、此模版的所有表格中,“橙色背景”+“蓝色加粗”的字体,均为可手动调 整的数据,使用模板前应根据当前市场,调整相关参数,比如银行利率等。 2、数据引用的方法 → 所有显示的数据都可以引入到其它的Excel数据簿,将绝 对引用通过F4改为相对引用,拉拽选择框即可完成成片数据的引用。

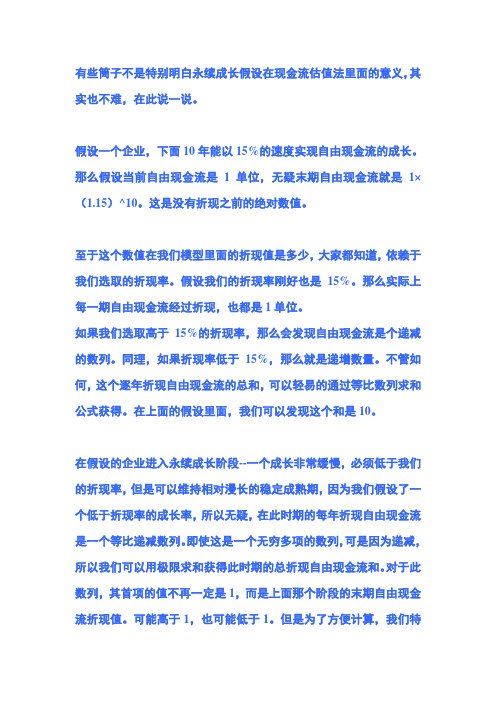

自由现金流计算模版

18,087,162.07 229,387,910.09

2013年

76.00% 39.51%

1,526,161,230.27 1,159,882,535.01

602,935,301.63 556,947,233.37

72,645,291.31

1,327,096,721.98 1,008,593,508.70

524,291,566.64 484,301,942.07 -20,768,521.55

2014年

2015年

76.00% 39.51%

76.00% 39.51%

1,724,562,190.21 1,310,667,264.56

681,316,890.85 629,350,373.71

892,250,278.66 824,195,104.90

62,813,945.64

2,430,577,002.36 1,847,238,521.79

960,239,749.90 886,998,771.90

62,803,666.99

资本性支出的增加

项目 预测假设: 无形资产/主营业务收入

主营业务收入 无形资产 无形资产的增加

72,403,140.34

1,914,264,031.13 1,454,840,663.66

756,261,748.84 698,578,914.82

69,228,541.11

2017年

2018年

76.00% 39.51%

76.00% 39.51%

2,258,480,767.85 1,716,445,383.57

98,632,492.97 70,402,195.13 -1,238,361.20 -1,062,150.44

自由现金流估值

有些筒子不是特别明白永续成长假设在现金流估值法里面的意义,其实也不难,在此说一说。

假设一个企业,下面10年能以15%的速度实现自由现金流的成长。

那么假设当前自由现金流是1单位,无疑末期自由现金流就是1×(1.15)^10。

这是没有折现之前的绝对数值。

至于这个数值在我们模型里面的折现值是多少,大家都知道,依赖于我们选取的折现率。

假设我们的折现率刚好也是15%。

那么实际上每一期自由现金流经过折现,也都是1单位。

如果我们选取高于15%的折现率,那么会发现自由现金流是个递减的数列。

同理,如果折现率低于15%,那么就是递增数量。

不管如何,这个逐年折现自由现金流的总和,可以轻易的通过等比数列求和公式获得。

在上面的假设里面,我们可以发现这个和是10。

在假设的企业进入永续成长阶段--一个成长非常缓慢,必须低于我们的折现率,但是可以维持相对漫长的稳定成熟期,因为我们假设了一个低于折现率的成长率,所以无疑,在此时期的每年折现自由现金流是一个等比递减数列。

即使这是一个无穷多项的数列,可是因为递减,所以我们可以用极限求和获得此时期的总折现自由现金流和。

对于此数列,其首项的值不再一定是1,而是上面那个阶段的末期自由现金流折现值。

可能高于1,也可能低于1。

但是为了方便计算,我们特意做了上面的那种假设,使得这个末期折现自由现金流刚好也是1单位。

这时候的问题出现了,对于这个永续成长模型,其永续成长率的选取对于极限和的影响极大。

我们继续上面的假设,令永续成长率为5%时,这个极限=1/(0.15-0.05)=10。

而如果我们选择2%永续成长,那么极限=1/0.13=7.7。

如果选择0%的永续成长,那么极限=1/0.15=6.67。

如果我们再夸张点,选择10%的永续成长率,那么极限会一下飙升到20。

把上面的两个和相加,就得到我们的企业估值=10+10=20倍的当期自由现金流。

(选取5%永续成长)那么假设我们的EPS全部可以是自由现金流,那么就是说我们对于企业的估值上限是20倍PE(当然,实际上由于EPS总是大于自由现金流,所以需要按其比例打折)。

自由现金流折现估值方法公式

自由现金流折现估值方法公式嘿,伙计们!今天咱们来聊一聊那个让无数企业家和投资者头疼的问题——如何用自由现金流去折现估值。

这个听起来有点拗口的方法,其实就像是我们用筷子夹起一块美味的红烧肉一样,简单又实用。

别担心,跟着我的步伐,咱们一起轻松搞定它!得明白什么是自由现金流。

这就好比是你的“钱包”,里面装着你的钱,能用来买房子、车子,甚至出去旅游。

而折现估值呢,就像是在计算你的“钱包”到底值多少钱。

简单来说,就是用你未来几年的“现金流”去“折现”(也就是算出它们的现值),这样就能知道你现在手里的“现金”到底值多少钱了。

那么,怎么折现呢?这就有点像是把一块块积木搭起来建房子一样。

你得先确定每一块积木(即每年的自由现金流)的大小,然后按照一定的规则(比如利率、时间等)把它们一块块地搭起来,看看最终能搭成多大的房子。

这个过程就像我们在计算一个公司的估值,只不过这里的“积木”换成了“现金流”。

举个例子,假设你有一个公司,每年都能赚100万,而且这些钱还能再赚20%。

也就是说,第一年赚了100万,第二年还能再赚20万。

那我们就可以这样折现:第一年的现金流100万,折现到现在就是100万;第二年的现金流20万,折现到现在就是20万加上第一年的100万,总共30万。

这样一算,这家公司现在的价值不就是30万吗?当然啦,折现估值可不是一件简单的事。

它需要我们有足够的“智慧”去分析公司的财务状况、市场环境以及未来的发展趋势。

就像我们在谈恋爱时,既要有甜言蜜语哄对方开心,还得有实际行动让对方感受到我们的真心。

在这个过程中,我们可能会遇到各种“难题”,但只要我们用心去解决,就一定能找到那个“对的人”。

我想说的是,折现估值就像是一场精彩的冒险旅程。

它让我们看到了公司的价值不仅仅是账面上的那些数字,而是那些真正为公司创造价值、推动公司前进的“现金流”。

所以,当我们面对一个公司时,不妨试着从它的“现金流”出发,去发现它真正的价值所在。

(整理)★自由现金流折现估值模型DCF.

★自由现金流折现估值模型DCF05 经济流的路径 2009-09-03 13:37 阅读354 评论0字号:大中小口袋中的经济常识_49 自由现金流折现估值模型之前所讨论的各种比率倍数(相对估值方法)的最大缺陷是:它们全部都以价格为基础,比较的是投资者为一支股票支付的价格和另一支股票支付的有什么不同。

相对估值法反映的是,公司股票目前的价格是处于相对较高还是相对较低的水平。

通过行业内不同公司的比较,可以找出在市场上相对低估的公司。

但这也并不绝对,如市场赋予公司较高的市盈率,也可能说明市场对公司的增长前景较为看好,愿意给予行业内的优势公司一定的溢价。

而且,不同行业公司的指标值不能做直接比较,其差异可能会很大。

不管怎样,比率不能告诉你一只股票实际上值多少钱。

内在价值的评估会让你关注公司的价值,而非股票的价格。

内在的价值是你思考:如果我能买下整个公司,我会买吗?现金流折现估值模型 DCF(Discounted cash flow)属于绝对估值法。

具体做法是:假设企业会快速成长若干年,然后平稳成长若干年(也有人算成永续成长),把未来所有赚的自由现金流(通常要预测15-30年,应该是企业的寿命吧),用折现率(WACC)折合成现在的价值。

这样,股票目前的价值就出来了:If 估值>当前股价,→当前股价被低估。

可以买入。

If 估值<当前股价,→当前股价被高估。

需回避或卖出。

股票的价值等于它未来现金流的折现值,不多也不少。

公司的价值取决于公司未来(在其寿命剩余期内)所创造的现金流折现的净值(注意:是净值。

所以要拿自由现金流来折现,而不是其他什么包含负债税息的收入来折现)。

企业的价值=前十年的自由现金流总和+永续经营价值为什么是前10年?因为通常很难估算企业十年后的现金流。

永续经营价值,就是第10年后直到无限远的价值。

1.自由现金流公司通过把资本投出去产生收益,一些收益补偿了营业费用,另外一些用于公司的再投资,其余的就是自由现金流。

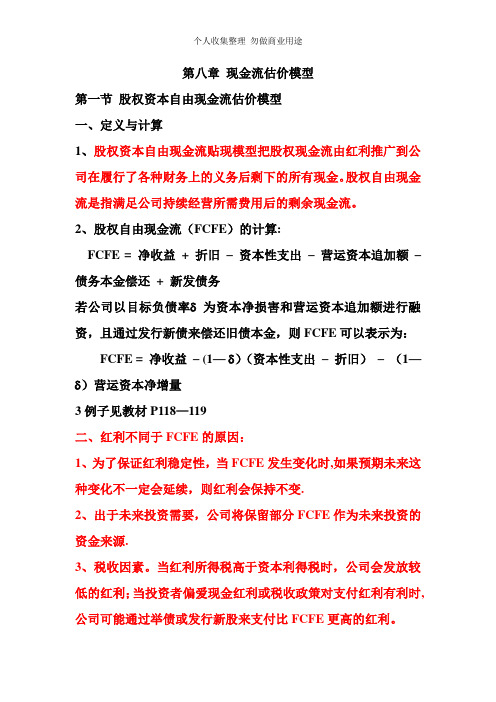

第八章现金流估价模型

第八章现金流估价模型第一节股权资本自由现金流估价模型一、定义与计算1、股权资本自由现金流贴现模型把股权现金流由红利推广到公司在履行了各种财务上的义务后剩下的所有现金。

股权自由现金流是指满足公司持续经营所需费用后的剩余现金流。

2、股权自由现金流(FCFE)的计算:FCFE = 净收益+ 折旧–资本性支出–营运资本追加额–债务本金偿还+ 新发债务若公司以目标负债率δ为资本净损害和营运资本追加额进行融资,且通过发行新债来偿还旧债本金,则FCFE可以表示为:FCFE = 净收益– (1—δ)(资本性支出–折旧)–(1—δ)营运资本净增量3例子见教材P118—119二、红利不同于FCFE的原因:1、为了保证红利稳定性,当FCFE发生变化时,如果预期未来这种变化不一定会延续,则红利会保持不变.2、出于未来投资需要,公司将保留部分FCFE作为未来投资的资金来源.3、税收因素。

当红利所得税高于资本利得税时,公司会发放较低的红利;当投资者偏爱现金红利或税收政策对支付红利有利时,公司可能通过举债或发行新股来支付比FCFE更高的红利。

4、公司常把红利支付额作为未来发展前景的信号,导致红利支付与FCFE 产生差异三、股权资本自由现金流估价模型 (一)稳定增长的FCFE 模型 1、计算公式: 股票每股价值P 0 FCFE1=下一年度预期的FCFE ;r 是投资者的要求收益率;g 为股权资本自由现金流的稳定增长率。

2、模型适用范围:公司处于稳定增长阶段,且增长率等于或稍低于名义经济增长率。

相对于红利增长模型,此模型更合理。

因为稳定增长的公司其红利支付不一定保持稳定(有时高于FCFE ,有时低于FCFE )。

但若红利支付与此同时FCFE 始终保持一致,则两种模型求得的结果是相同的。

3、模型限制条件:模型中使用的稳定增长率必须合理,一般等于或稍低于名义经济增长率. 公司处于稳定状态的假设要求公司必须具备其他维持稳定增长所需的条件,如资本性支出不可远高于折旧额。

企业自由现金流折现模型

企业自由现金流折现模型引言企业自由现金流折现模型是一种基于现金流量的估值方法,用于评估企业的价值。

该模型通过预测未来一段时间内的自由现金流,并将其折现到当前时点,从而得出企业的估值。

自由现金流的定义自由现金流是指企业在经营活动中所产生的净现金流量,排除了债务支付和股权融资所产生的现金流量。

通常,自由现金流包括经营活动所产生的净现金流、投资活动所产生的净现金流以及运营活动所产生的净现金流。

经营活动的自由现金流经营活动的自由现金流是指企业从正常经营活动中所产生的现金流量,包括销售收入、成本和费用支出、税款支付等。

投资活动的自由现金流投资活动的自由现金流是指企业在购买和出售固定资产、收回和发放贷款以及进行投资所产生的现金流量。

融资活动的自由现金流融资活动的自由现金流是指企业从股权融资和债务融资中所产生的现金流量,包括股息支付、利息支付、借款和偿还债务等。

自由现金流折现的原理自由现金流折现的原理基于时间价值的概念,即未来的现金流比当前的现金流更不值钱。

因此,我们需要将未来的自由现金流折现到当前时点,以计算出企业的价值。

折现率的选择折现率是自由现金流折现模型中的关键参数,它代表了投资的风险和机会成本。

折现率的选择应考虑以下几个因素:1.经济环境:折现率通常与经济环境相关,如果经济增长稳定且利率较低,折现率可能较低;反之,如果经济衰退或监管政策紧缩,折现率可能较高。

2.项目风险:折现率应反映项目的风险水平,风险越高,则折现率越高。

通常,风险较高的项目需要更高的回报率才能吸引投资者。

3.市场溢价:如果市场对某个行业或企业有溢价,那么该行业或企业的折现率可能较低。

4.通货膨胀率:通货膨胀率是衡量货币购买力下降的指标,如果通货膨胀率较高,折现率可能需要相应提高。

折现计算公式自由现金流折现模型的计算公式如下:其中,DCF代表折现现金流,FCF代表自由现金流,r代表折现率,n代表预测期限。

自由现金流折现模型的应用自由现金流折现模型是一种广泛应用于企业估值和投资决策的方法。

自由现金流估值模型例题

自由现金流估值模型例题自由现金流估值模型(DCF模型)是一种用于估计公司价值的财务模型。

它基于公司未来的自由现金流量,通过贴现这些现金流量到现值来计算公司的内在价值。

下面我将通过一个例题来说明如何使用自由现金流估值模型。

假设我们有一家公司,该公司预计未来五年的自由现金流量分别为100万美元、120万美元、130万美元、140万美元和150万美元。

在第六年以后,我们假设自由现金流量将稳定增长,每年增长率为3%。

现在假设我们选择一个适当的贴现率为10%。

首先,我们需要计算未来五年的自由现金流量的现值。

这可以通过以下公式来计算:现值 = 未来现金流量 / (1 + 贴现率) ^ 年数。

以第一年的现金流量100万美元为例,其现值为:100 / (1 + 0.10) ^ 1 = 90.91 万美元。

同样的方法计算第二年到第五年的现值,得到分别为109.09万美元、107.44万美元、104.55万美元和101.51万美元。

接下来,我们需要计算第六年以后的稳定增长期的现值。

这可以使用永续年金的公式来计算:永续年金 = 最后一年的现金流量 (1 + 稳定增长率) / (贴现率稳定增长率)。

假设在第六年的自由现金流量为150万美元,稳定增长率为3%,代入公式计算得到:150 (1 + 0.03) / (0.10 0.03) = 1857.14 万美元。

最后,我们将未来五年的现值和稳定增长期的现值相加,得到公司的内在价值:90.91 + 109.09 + 107.44 + 104.55 + 101.51 + 1857.14 = 2270.64 万美元。

因此,根据这个例题,我们使用自由现金流估值模型得出这家公司的内在价值为2270.64 万美元。

需要注意的是,自由现金流估值模型的结果取决于所选择的贴现率和稳定增长率。

这些参数的选择需要结合公司的特点和行业的情况进行合理的分析和估计。

自由现金流量模型

自由现金流量表现形式随自由现金流量的定义衍生出两种表现形式:股权自由现金流量(FCFE, Free Cash Flow of Equity)和公司自由现金流量(FCFF, Free Cash Flow of Firm), FCFE是公司支付所有营运费用,再投资支出,所得税和净债务支付(即利息、本金支付减发行新债务的净额)后可分配给公司股东的剩余现金流量,其计算公式为:FCFE=净收益+折旧-资本性支出-营运资本追加额-债务本金偿还+新发行债务FCFF是公司支付了所有营运费用、进行了必需的固定资产与营运资产投资后可以向所有投资者分派的税后现金流量。

FCFF 是公司所有权利要求者,包括普通股股东、优先股股东和债权人的现金流总和,其计算公式为:FCFF=息税前利润x (1-税率)+折旧-资本性支出-追加营运资本自由现金流的评估程序1.选定预测期间根据企业持续经营原则,预测期为n年,但通常,分析人员往往以5-10年作为预测期间,且以5年最为常见。

2.确定各年的自由现金流量自由现金流量的具体计算方法又有两种:无债法(Debt—Free Mothod)和杠杆法(Leverage Method),差别在于现金的定义和计算公式上。

无债法假使公司在预测期间不承担债务,其运用的现金流量无须考虑债务融资成本对现金流量的影响。

无债法确定的自由现金流量是:息税前收入(EBIT)-利息费用(f)=税前收入(EBT)税前收入(EBT)-税款支出=净收入(NI)净收入(NI)-投资(I)=自由现金流量(FCF)杠杆法是净现金流量(Net Cash Flow),以目前的资本结构为出发点,在现金流量的计算中考虑了债务融资成本对现金流量的影响。

该种方法确定的自由现金流量为:净收入(NI)+税后利息f(1-T)=经营现金收入×(1-T)经营现金收入×(1-T)-投资(I)=自由现金流量(FCF)3.测定公司的资本成本。

自由现金流折现模型

自由现金流折现模型我们知道,股票绝对估值法是将公司预期的未来现金流进行折现。

在股利折现模型中,对未来现金流理解为公司发放的现金股利。

但是,现实中,很多公司并不一定采取现金分红的股利政策,或者支付极少的现金股利,这时,采用自由现金流折现模型,能更好的对公司价值或股权价值进行评估。

自由现金流是公司在履行了财务义务和满足了再投资需要之后剩余的现金流。

相对于股利来说,自由现金流是一种受人为干扰更少的财务指标。

自由现金流折现模型的通用表达式如下:企业价值或股权价值V,等于各期自由现金流FCF的现值之和。

自由现金流可以分为两类:一是流向股权投资者的自由现金流,称为股权自由现金流,简称FCFE;二是流向企业的自由现金流,称为企业自由现金流,简称FCFF一、FCFE折现模型。

用股权自由现金流FCFE进行折现,可直接求出企业的股权价值。

FCFE折现模型的表达式如下:股权价值等于各期股权自由现金流FCFE的现值之和。

其中,折现率re为股权资本成本。

那么,股权自由现金流(FCFE) 如何计算呢?股权自由现金流(FCFE) 是企业在支付了各种经营性支出,并满足了投资的需要,以及履行了各种财务义务之后,可供企业普通股股东支配的剩余现金流。

我们可以从净利润、经营现金流、税息前收益、税息与折旧和摊销前收益等多个角度来计算股权自由现金流(FCFE) 。

例如,从净利润出发,股权自由现金流的计算公式如下:股权自由现金流=净利润+非现金支出净额-资本性支出一营运资本增加净额+负债净增加额计算出了股权自由现金流之后,我们还需要计算对应的折现率。

现金流必须与所使用的折现率相匹配,这是自由现金流折现公式中最不容忽视的原则。

股权自由现金流,应采用股权资本成本re (或称为权益资本成本Ke) 作为折现率。

股权资本成本的计算公式如下: 有了股权自由现金流和相应的折现率,就可以采用零增长、固定增长或多重增长模型,来计算股权的价值。

以多重增长模型中的两阶段增长模型为例,股权价值的计算公式如下。

自由现金流估值模型

第五讲股权资本自由现金流贴现模型第一节股权自由现金流与红利这一讲我们将介绍股权自由现金(以下简称FCFE)的具体计算方法。

同时在计算过程中我们还可以看到FCFE与红利之所以不同的原因以及这两种贴现模型所具有的不同含义。

一、FCFE的计算公司每年不仅需要偿还一定的利息或本金,同时还要为其今后的发展而维护现有的资产、购置新的资产。

当我们把所有这些费用从现金流入中扣除之后,余下的现金流就是股权自由现金流(FCFE)。

FCFE的计算公式为:FCFE=净收益+ 折旧- 资本性支出- 营运资本追加额- 债务本金偿还+ 新发行债务二、为什么红利不同于FCFEFCFE是公司能否顺利支付红利的一个指标。

有一些公司奉行将其所有的FCFE都作为红利支付给股东的政策,但大多数公司都或多或少地保留部分股权自由现金流。

FCFE之所以不同于红利,其原因有以下几条:(a)红利稳定性的要求。

一般来说公司都不愿意变动红利支付额。

而且因为红利的流动性远小于收益和现金流的波动性。

所以人们认为红利具有粘性。

(b)未来投资的需要。

如果一个公司预计其在将来所需的资本性支出会有所增加,那么它就不会把所有的FCFE当作红利派发给股东。

由于新发行股票的成本很高,公司往往保留一些多余的现金并把它作为满足未来投资所需资金的来源。

(c)税收因素。

如果对红利征收的所得税税率高于资本利得的税率,则公司会发放相对较少的红利现金。

并把多余的现金保留在企业内部。

(d)信号作用。

公司经常把红利支付额作为其未来发展前景的信号:如果红利增加。

则公司前景看好:如果红利下降,则公司前景黯淡。

第二节稳定增长(一阶段)FCFE模型如果公司一直处于稳定增长阶段,以一个不主烃的比率持续增长,那么这个公司就可以使用稳定增长的FCFE模型进行估价。

1、模型在稳定增长模型中股权资本的价值是三个变量的函数:下一年的预期FCFE、稳定增长率和投资者的要求收益率:P0 = FCFE1/(r – g n)其中:P0=股票当前的价值FCFE1=下一年预期的FCFEr=公司的股权资本成本(亦是投资者的要求收益率)g n=FCFE的稳定增长率2、限制条件这个模型的前提假设与Gordon增长模型非常相似,因此它在应用方面也面临着同样的限制条件。

自由现金流折现模型

1自由现金流折现模型运用自由现金流量模型对公司价值评估就是通过考虑公司未来自由现金流量和资本的机会成本来评估公司的价值。

它所反映的是公司经营活动所产生的、不影响公司正常发展并且可以为公司所有资本索取权者(股东和债权人)提供的现金流量。

构造自由现金流量模型的过程大致可分为四个阶段:预测公司的自由现金流量;确定公司的连续价值;确定一个合理的贴现率;以该贴现率计算出公司的价值。

1.1公司自由现金流折现模型(FCFF,Free Cash Flow of Firm)FCFF折现法的概述使用FCFF折现法需具备一定的假设条件:第一,所采用的财务报表数据必须真实可信赖;第二,企业的经营状况与环境保持稳定,经营期间无剧烈波动;第三,企业可以持续经营,并且能够保持一定程度的增长;第四,企业可以顺利筹资,且筹资成本不变。

1.1.1企业自由现金流企业自由现金流(FCFF,Free Cash Flow of Firm)一般是指企业将创造的利润进行再投资后剩余的可供企业自由支配的现金流量,也就是企业支付了所有为了支撑其继续发展营运费用、固定资产投资等活动后可以自由地向所有投资者分配的税后现金流量。

科普兰教授(Copeland)比较详尽地阐述了自由现金流量的计算方法:“自由现金流量等于企业的税后净营业利润(即将公司不包括利息收支的营业利润扣除实付所得税税金之后的数额)加上折旧及摊销等非现金支出,再减去营运资本的追加和物业厂房设备及其他资产方面的投资。

它是公司所产生的税后现金流量总额,可以提供给公司资本的所有供应者,包括债权人和股东。

”自由现金流量=EBIT*(1-T)+折旧及摊销-资本支出-营运资本增加另一种方法是对各种利益要求人的现金流加总求得的:企业自由现金流(FCFF)=FCFE(Free Cash Flow of Equity)+利息费用x (1一所得税税率)+债务本金的偿还-新债发行两种方法是从不同的角度出发的,但最终计算得出的结果是相同的,但第一种是比较常见的。