固定收益证券试题

固定收益证券投资习题与答案(投资学)

1、一个面值为1000美元的债券,当前市场价格为960美元,票面利率为7%,距离到期时间为5年,并且1年按365天计算,那么此时买入该债券,到期收益率为:()A.6.5%B.7%C. 8.13%D.12%正确答案:C2、具有可转股条款的债券:()A.其他选项均不正确B.因为转股可能获得溢价,因而很具有吸引力C.相对于不可转股的类似债券而言,通常有一个更高的收益率D.当转股价格越低时可转债价格越低正确答案:B3、下列哪种方式债券以低于面值的方式卖出:()A.票面利率小于当期收益率,但大于到期收益率B.票面利率、当期收益率和到期收益率三者相等C.票面利率大于当期收益率,也大于到期收益率D.票面利率小于当期收益率,也小于到期收益率正确答案:D4、以下对信用风险描述正确的是:()A.利率水平增加时,信用风险增加B.信用风险上升,风险溢价增加C.信用风险上升,风险溢价降低D.利率水平降低时,信用风险增加5、期限越长的债券,其价格受到利率水平波动的影响()A.越小,因为修正久期越大B.越小,因为修正久期越小C.越大,因为修正久期越小D.越大,因为修正久期越大正确答案:D6、对债券到期收益率的影响可能来自于:()A.包含其他所有选项B.发债公司的净利润对利息的比例倍数上升C.发债公司短期内的流动性问题得到缓解D.发债公司的负债与股东权益之比增加正确答案:A7、目前,我国债券的种类比较多,其中风险最小,安全性最好的要属()A.企业债券B.公司债券C.金融债券D.政府债券正确答案:D8、债券与股票的共同点是()A.都是风险共担的证券B.偿还的方式相同C.都是有价证券D.都是能获得一定正收益的金融资产9、储蓄存款与债券、股票相比()A.收益高风险也高B.收益高而风险低C.收益低风险也低D.收益低而风险高正确答案:C10、利率期限结构是指A.一种证券的利率与其期限之间的关系B.以上选项都对C.所有不同证券的利率之间的关系.D. 债券收益率和违约率的关系正确答案:A11、根据期望假说理论, 斜率向上的收益率曲线说明A.利率被人们预期在未来会先降后升B.利率被人们预期在未来保持稳定.C.利率被人们预期在未来下降D.利率被人们预期在未来上升正确答案:D12、下表为不同期限零息债券的价格,面值均为1000美元。

固定收益证券试题及答案

固定收益证券试题及答案一、单项选择题(每题2分,共20分)1. 固定收益证券的主要风险不包括以下哪一项?A. 利率风险B. 信用风险C. 流动性风险D. 汇率风险答案:D2. 以下哪个不是固定收益证券的特点?A. 收益固定B. 投资期限长C. 风险较低D. 价格波动大答案:D3. 债券的票面利率与市场利率的关系是:A. 总是相等的B. 总是不等的C. 有时相等,有时不等D. 以上都不对答案:C4. 如果市场利率上升,而债券的票面利率保持不变,那么债券的:A. 价格上升B. 价格下降C. 价格不变D. 与市场利率无关答案:B5. 以下哪个不是固定收益证券的种类?A. 政府债券B. 企业债券C. 股票D. 金融债券答案:C6. 债券的到期收益率是指:A. 债券的票面利率B. 债券的当前市场价格C. 投资者持有到期的年化收益率D. 债券的发行价格答案:C7. 以下哪个因素不会影响固定收益证券的收益率?A. 发行主体的信用等级B. 债券的期限C. 市场利率水平D. 投资者的风险偏好答案:D8. 债券的久期是指:A. 债券的到期时间B. 债券的加权平均到期时间C. 债券的票面金额D. 债券的发行时间答案:B9. 以下哪个不是影响债券价格的因素?A. 债券的票面利率B. 债券的信用等级C. 债券的发行量D. 市场利率的变化答案:C10. 以下哪个是固定收益证券投资的主要目的?A. 资本增值B. 获得稳定的现金流C. 参与公司决策D. 投机取利答案:B二、多项选择题(每题3分,共15分)11. 固定收益证券的收益来源主要包括哪些?(ACD)A. 利息收入B. 股票升值C. 资本利得D. 再投资收益12. 以下哪些因素会影响固定收益证券的信用风险?(ABD)A. 发行主体的财务状况B. 经济环境的变化C. 投资者的个人偏好D. 法律和政策环境13. 固定收益证券的流动性通常与以下哪些因素有关?(ACD)A. 债券的发行量B. 债券的票面利率C. 市场交易的活跃度D. 债券的到期时间14. 以下哪些措施可以降低固定收益证券的投资风险?(ABD)A. 分散投资B. 选择信用等级较高的债券C. 增加投资金额D. 关注市场利率变动15. 固定收益证券的久期与以下哪些因素有关?(ABC)A. 债券的现金流时间B. 每笔现金流的金额C. 每笔现金流的现值D. 债券的票面利率三、判断题(每题1分,共10分)16. 固定收益证券的风险总是低于股票。

固定收益证券期末试题

固定收益证券期末试题一、选择题1. 根据发行主体的不同,固定收益证券可以分为以下哪种类型?A. 企业债券B. 政府债券C. 股票D. 人民币存款2. 收益率曲线是用来表示不同期限的债券收益率之间的关系的图形。

以下哪种情况可以导致收益率曲线倒挂?A. 经济衰退预期B. 通胀预期上升C. 政府债务水平下降D. 股票市场上涨3. 债券的名义本金是指:A. 购买债券时需要支付的本金B. 债券的面值C. 债券的发行价D. 债券的剩余偿还本金4. 下面哪种固定收益证券是由中央政府发行的?A. 地方政府债券B. 金融债券C. 中票D. 国债5. 利率风险可以通过以下哪种方法来管理?A. 多元化投资组合B. 套利交易C. 期货交易D. 外汇交易二、填空题1. _________是指固定收益证券的到期时间。

2. 成交量和交易金额之间的关系可以通过计算_________来表达。

3. 政府债券是由_________发行的一种固定收益证券。

4. 利率风险可以通过买入_________来进行对冲。

5. 债券的票面利率是指债券到期时按_________支付的利息。

三、简答题1. 简要说明固定收益证券的基本特点和投资风险。

固定收益证券是指具有固定还本付息期限的金融工具,其特点包括:- 收益权明确:债券持有人在固定的时间间隔内会获得固定的利息收益,同时在债券到期时可以收回本金。

- 本息保障:发行债券的主体会根据约定的利息和还本计划按时支付债券持有人的利息和本金。

- 流动性较高:固定收益证券在二级市场具有一定的流动性,投资者可以通过买卖债券来获得资金。

- 本金回收时间较长:债券的期限可能较长,投资者需要考虑资金的锁定期。

固定收益证券的投资风险主要包括:- 利率风险:债券价格与市场利率呈反向关系,市场利率上升会导致债券价格下降。

- 信用风险:发行债券的主体信用状况恶化或违约可能导致无法按期支付利息和本金。

- 流动性风险:二级市场上固定收益证券的买卖可能受限,投资者可能无法按时变现。

固定收益证券5套题

1、某8年期债券,第1~3年息票利率为6.5%,第4~5年为7%,第6~7年为7.5%,第8年升为8%,该债券就属于(A 多级步高债券)。

3、固定收益产品所面临的最大风险是(B 利率风险)。

5、目前我国最安全和最具流动性的投资品种是(B 国债)6、债券到期收益率计算的原理是(A 到期收益率是购买债券后一直持有到期的内含报酬率)。

7、在纯预期理论的条件下,下凸的的收益率曲线表示(B 短期利率在未来被认为可能下降)。

9、如果债券嵌入了可赎回期权,那么债券的利差将如何变化?(B 变小)11、5年期,10%的票面利率,半年支付。

债券的价格是1000元,每次付息是(B 50元)。

12、若收益率大于息票率,债券以(A 低于)面值交易;13、贴现率升高时,债券价值(A 降低)14、随着到期日的不断接近,债券价格会不断(C 接近)面值。

15、债券的期限越长,其利率风险(A 越大)。

16、投资人不能迅速或以合理价格出售公司债券,所面临的风险为(B 流动性风险)。

17、投资于国库券时可以不必考虑的风险是(A 违约风险)18、当市场利率大于债券票面利率时,一般应采用的发行方式为(B 折价发行)。

19、下列投资中,风险最小的是(B 购买企业债券)。

20、下面的风险衡量方法中,对可赎回债券风险的衡量最合适的是(B 有效久期)。

26、以下哪项资产不适合资产证券化?(D 股权)27、以下哪一种技术不属于内部信用增级?(C 担保)28、一位投资经理说:“对债券组合进行单期免疫,仅需要满足以下两个条件:资产的久期和债务的久期相等;资产的现值与负债的现值相等。

(B 不对,因为还必须考虑信用风险)固定收益市场上,有时也将(A.零息债券)称为深度折扣债券。

下列哪种情况,零波动利差为零?A.如果收益率曲线为平某人希望在5年末取得本利和20000元,则在年利率为2%,单利计息的方式下,此人现在应当存入银行(B.18181、82)元。

在投资人想出售有价证券获取现金时,证券不能立即出售的风险被称为(C.变现力风险)。

固定收益证券题目及解答

23、假设货币市场期限为3个月、6个月和9个月 的债券的实际季度收益率分别为0.75%、1.5%和 2%,再假设该市场上存在期限为3个月和9个月 的两种贴现国债,面值都是100元。如果投资者 的投资期限是3个月,并假定收益率曲线在未来3

个月里不会变化。请问该投资者应选择哪一种债 券投资?

3、一张期限为10年的等额摊还债券,每年等 额偿还的金额为100元;另有一张永久债券, 每年支付利息为50元。如果市场利率为8%, 试比较它们价格的大小。

4、若市场上有下表所示的两个债券,并假设 市场利率的波动率是10%,构建一个二期的利率 二叉树。

市场债券品种假设

品种 A

到期期限 息票利率 折现率 当前价格

12、考虑票面金额1000元、票面利率为8%、 期限为5年的每年付息一次的债券,现有两种 情况:到期收益率为7%时,上升1个百分点 所引起的债券价格变化率为多少? 到期收益 率为8%时,上升1个百分点所引起的债券价 格变化率为多少?哪种情况下债券价格变化率 大?

13、某投资者购买了10张面值为100元,票 面利率为6%、每年付息一次的债券,债券刚 付息,持有3年,获得3年末的利息后出售。 期间获得的利息可以再投资,假设再投资收 益率为4.5%。每份债券购买价为103元,出 售价为107元。求该投资者的总收益率。

14、某一次还本付息债券,面值100元,票面 利率3.5%,期限3年,2011年12月10日到期。 债券交易的全价为99.40元,结算日为2009年9 月15日,试计算其到期收益率。

15、假设有3个不同期限债券,它们的数据

见下表,其中第一个为零息债券,后两个是附

息债券,且都是每年付息一次。试给出1年期

6、设某债券与上题B债券条件相同,但 为可回售债券,持有人有权在发行后的 第一年末以99.50元的价格向发行人回售, 利率二叉树与上题亦相同,试计算该债 券的价格。

固定收益证券期末考试A卷

精选资料,欢迎下载广东工业大学华立学院考试试卷( A )课程名称: 固定收益证券 ( 2学分) 考试时间: 201 年 月 日A 、普通股B 、债券C 、回购协议D 、大额可转让存单2、债券反映的是( )关系。

A 、所有权B 、信托C 、代理D 、债权债务3、下列哪一项不属于债券的基本要素( )。

A 、票面利率B 、偿还期限C 、利息D 、面值4、可转换公司债券的本质是一种( )交易。

A 、现货B 、远期C 、期货D 、期权5、债券投资者面临多种风险,以下不是系统风险的是( )。

A 、汇率风险B 、市场风险C 、管理风险D 、利率风险6、政府债券不包括( )。

A 、中央政府债券B 、地方政府债券C 、国际债券D 、政府机构债券7、货币市场金融工具不包括( )。

A 、贷款B 、商业票据C 、短期债券D 、央行票据8、债券市场交割方式T+0指的是( )交割。

A 、当日B 、次日C 、标准D 、例行日9、某上市公司首次发行债券的市场属于( )市场。

A 、一级B 、二级C 、流通D 、交易10、某上市公司发行债券筹集资金,该公司资产负债表资产( )、负债( )。

A 、减少 增加 B 、增加 增加 C 、减少 减少 D 、增加 减少( )11、某固定收益证券期限越长,则流动性越()、风险越()。

()A、弱大B、弱小C、强大D、强小12、债券资产的价格是()。

A、收益B、利息C、利率D、利润13、下列指标不考虑货币时间价值的是()。

A、适当贴现率B、到期收益率C、赎回收益率D、当期收益率14、“金边债券”指的是()。

A、国债B、公司债券C、国际债券D、金融债券15、一般情况下,下列资产风险最大的是()。

A、国库券B、银行存款C、股票D、固定收益债券16、以下债券不属于外国债券的是()。

A、扬基债券B、欧洲债券C、武士债券D、龙债券17、货币时间价值原理的四个基本参数不包括()。

A、期数B、每期利率C、期限D、现值E、终值18、债券评级机构评定债券等级,下列()债券安全性最高。

固定收益证券期末试题

固定收益证券期末试题一、选择题1. 固定收益证券的主要特点是()。

A. 收益固定B. 风险较低C. 流动性较好D. 所有以上选项2. 下列关于债券的陈述,哪一项是正确的?A. 债券的市场价格与利率呈正相关B. 债券的市场价格与利率呈负相关C. 债券的信用评级越高,其收益率越高D. 债券的到期时间越长,其价格对利率的敏感度越低3. 债券的到期收益率(YTM)是指()。

A. 债券的当前市场价格B. 债券的持有期回报率C. 债券的内部收益率D. 如果持有债券直到到期所能获得的年化收益率4. 债券的信用风险可以通过以下哪种方式降低?A. 购买高信用评级的债券B. 增加债券投资的多样性C. 购买债券期权D. 所有以上选项5. 以下哪种类型的债券通常具有最高的信用风险?A. 国债B. 地方政府债券C. 公司债D. 可转换债券二、简答题1. 请简述固定收益证券的定义及其主要类型。

2. 描述债券的久期以及它如何帮助投资者管理利率风险。

3. 解释债券信用评级的基本原理,并举例说明不同信用评级对投资者的意义。

三、计算题1. 假设你购买了一张面值为1000元,年票面利率为5%,剩余期限为10年的债券,当前市场价格为950元。

请计算该债券的到期收益率(YTM)。

2. 假设你持有一张面值为1000元,票面利率为6%,剩余期限为5年的债券,你预计在2年后将其出售。

如果当前的即期利率为4%,请使用久期估算你持有的债券在2年后的大致市场价格。

四、论述题1. 论述固定收益证券在投资组合管理中的作用及其对投资组合风险和收益的影响。

2. 分析当前经济环境下,投资者应如何选择合适的固定收益证券策略来优化其投资组合。

3. 讨论利率变动对固定收益证券市场的影响,以及投资者可以采取哪些策略来应对这些变动。

请注意,以上内容仅为试题框架,具体答案需要根据实际情况和所学知识进行详细解答。

在撰写答案时,应确保分析准确、逻辑清晰,并结合实际案例或数据支持观点。

固定收益证券的利率风险管理考核试卷

B.市场利率下降

C.证券的到期时间延长

D.证券的票面利率提高

12.以下哪种固定收益产品通常不会受到利率风险的影响?()

A.利率掉期

B.利率期货

C.利率期权

D.零息债券

13.利率风险的哪种形式是由于投资者对未来现金流的再投资利率的不确定性引起的?()

A.价格风险

B.久期风险

C.利差风险

D.再投资风险

14.在固定收益证券中,哪种因素会影响债券价格的利率敏感性?()

A.债券的面值

B.债券的票面利率

C.债券的到期时间

D.所有上述因素

15.以下哪个工具可以用来锁定未来的融资成本?()

A.利率期货

B.利率掉期

C.利率期权

D.信用违约互换

16.当投资者预计市场利率将下降时,他们可能会采取以下哪种策略?()

2.以下哪种固定收益证券对利率风险的敏感度最高?()

A.短期国债

B.长期企业债券

C.指数债券

D.浮动利率债券

3.当市场利率上升时,以下哪个现象会发生?()

A.固定收益证券价格上升

B.固定收益证券价格下降

C.证券的到期收益率上升

D.证券的到期收益率下降

4.哪个工具通常被用于衡量固定收益证券的利率风险?()

固定收益证券的利率风险管理考核试卷

考生姓名:答题日期:得分:判卷人:

一、单项选择题(本题共20小题,每小题1分,共20分,在每小题给出的四个选项中,只有一项是符合题目要求的)

1.利率风险对固定收益证券的影响主要体现在以下Βιβλιοθήκη 个方面?()A.证券价格的波动

B.证券的信用风险

C.证券的流动性风险

D.证券的再投资风险

固定收益证券全书习题

第一章固定收益证券简介三、计算题1.如果债券的面值为1000美元,年息票利率为5%,则年息票额为?答案:年息票额为5%*1000=50美元。

四、问答题1.试结合产品分析金融风险的基本特征。

答案:金融风险是以货币信用经营为特征的风险,它不同于普通意义上的风险,具有以下特征:客观性. 社会性.扩散性. 隐蔽性2.分析欧洲债券比外国债券更受市场投资者欢迎的原因。

答案:欧洲债券具有吸引力的原因来自以下六方面:1)欧洲债券市场部属于任何一个国家,因此债券发行者不需要向任何监督机关登记注册,可以回避许多限制,因此增加了其债券种类创新的自由度与吸引力。

2)欧洲债券市场是一个完全自由的市场,无利率管制,无发行额限制。

3)债券的发行常是又几家大的跨国银行或国际银团组成的承销辛迪加负责办理,有时也可能组织一个庞大的认购集团,因此发行面广4)欧洲债券的利息收入通常免缴所得税,或不预先扣除借款国的税款。

5)欧洲债券市场是一个极富活力的二级市场。

6)欧洲债券的发行者主要是各国政府、国际组织或一些大公司,他们的信用等级很高,因此安全可靠,而且收益率又较高。

3.请判断浮动利率债券是否具有利率风险,并说明理由。

答案:浮动利率债券具有利率风险。

虽然浮动利率债券的息票利率会定期重订,但由于重订周期的长短不同、风险贴水变化及利率上、下限规定等,仍然会导致债券收益率与市场利率之间的差异,这种差异也必然导致债券价格的波动。

正常情况下,债券息票利率的重订周期越长,其价格的波动性就越大。

三、简答题1.简述预期假说理论的基本命题、前提假设、以及对收益率曲线形状的解释。

答案:预期收益理论的基本命题预期假说理论提出了一个常识性的命题:长期债券的到期收益率等于长期债券到期之前人们短期利率预期的平均值。

例如,如果人们预期在未来5年里,短期利率的平均值为10%,那么5年期限的债券的到期收益率为10%。

如果5年后,短期利率预期上升,从而未来20年内短期利率的平均值为11%,则20年期限的债券的到期收益率就将等于11%,从而高于5年期限债券的到期首。

固定收益证券作业及答案

固定收益证券作业及答案1.三年后收到的100元现在的价值是多少?分别考虑复利20%、复利100%、复利0%、复利20%(半年计息)、复利20%(季计息)和复利20%(连续计息)的情况。

2.以连续复利方式计息,分别计算复利4%、复利20%(年计息)、复利20%(季计息)和复利100%的利率。

3.考虑以下问题:a。

___在交易日92年9月16日给出了票面利率为91/8's在92年12月31日到期,92年9月17日结算的政府债券,其标价为买入价101:23,卖出价101:25.求该债券的买入和卖出的收益率。

b。

在同一交易日,___对同时在92年12月31日到期和在92年9月17日结算的T-bill报出的买入和卖出折现率分别是2.88%和2.86%。

是否存在套利机会?(“买入”和“卖出”是从交易者的角度出发,你是以“买入价”卖出,以“卖出价”买入)4.在交易日92年9月16日,以10-26的价格买入了一张面值为2000万美元、到期日为2021年11月15日的STRIPs (零息债券)。

求该债券的到期收益率。

5.今天是1994年10月10日,星期一,是交易日。

以下是三种债券的相关信息:发行机构票面利率到期日到期收益___ 10% 8.00% 星期二,1/31/95费城(市政) 9% 7.00% 星期一,12/2/95___(机构) 8.50% 8% 星期五,7/28/95这三种债券的面值均为100美元,每半年付息一次。

注意到上表中最后一列是到期收益,它反映了给定到期日、某种特定债券的标准惯例。

在计算日期时,不考虑闰年,同时也要忽略假期。

回答以下问题时,需要写清楚计算过程,不能只是用计算器计算价格。

a。

计算___发行的国债的报价,假定该国债按照标准结算方式结算。

b。

计算费城发行的城市债券的报价,假定该债券的标准结算期为三天。

c。

计算___发行的机构债券的报价,假定该债券按照标准结算方式结算。

本题需要根据给定的到期收益曲线来计算固定付息债券的全价,以及在曲线上下移动100个基点时的全价。

固定收益证券试题及部分答案

固定收益证券试题及部分答案国际经济贸易学院研究生课程班《固定收益证券》试题班级序号:学号:姓名:成绩:1)Explain why you agree or disagree with the following statement: “The price of a floater will always trade at its par value.”Answer:I disagree with the statement: “The price of a floater will always trade at its par value.” First, the coupon rate of a floating-rate security (or floater) is equal to a reference rate plus some spread or margin. For example, the coupon rate of a floater can reset at the rate on a three-month Treasury bill (the reference rate) plus 50 basis points (the spread). Next, the price of a floater depends on two factors: (1) the spread over the reference rate and (2) any restrictions that may be imposed on the resetting of the coupon rate. For example, a floater may have a maximum coupon rate called a cap or a minimum coupon rate called a floor. The price of a floater will trade close to its par value as long as (1) the spread above the reference rate that the market requires is unchanged and (2) neither the cap nor the floor is reached. However, if the market requires a larger (smaller) spread, the price of a floater will trade below (above) par. If the coupon rate is restricted from changing to the reference rate plus the spread because of the cap, then the price of a floater will trade below par.2)A portfolio manager is considering buying two bonds. Bond A matures in three years and has a coupon rate of 10% payable semiannually. Bond B, of the same credit quality, matures in 10 years and has a coupon rate of 12% payable semiannually.Both bonds are priced at par.(a) Suppose that the portfolio manager plans to hold the bond that is purchased for three years. Which would be the best bond for the portfolio manager to purchase?Answer:The shorter term bond will pay a lower coupon rate but it will likely cost less for a given market rate.Since the bonds are of equal risk in terms of creit quality (The maturity premium for the longer term bond should be greater),the question when comparing the two bond investments is:What investment will be expecte to give the highest cash flow per dollar invested?In other words,which investment will be expected to give the highest effective annual rate of return.In general,holding the longer term bond should compensate the investor in the form of a maturity premium and a higher expected return.However,as seen in the discussion below,the actual realized return for either investment is not known with certainty.To begin with,an investor who purchases a bond can expect to receive a dollar return from(i)the periodic coupon interest payments made be the issuer,(ii)an capital gainwhen the bond matures,is called,or is sold;and (iii)interest income generated from reinvestment of the periodic cash flows.The last component of the potential dollar return is referred to as reinvestment income.For a standard bond(our situation)that makes only coupon payments and no periodic principal payments prior to the maturity date,the interim cash flows are simply the coupon payments.Consequently,for such bonds the reinvestment income is simply interest earned from reinvesting the coupon interest payments.For these bonds,the third component of the potential source of dollar return is referred to as the interest-on-interest components.If we are going to coupute a potential yield to make a decision,we should be aware of the fact that any measure of a bond’s potential yield should take into consideration each of the three components described above.The current yield considers only the coupon interest payments.No consideration is given to any capital gain or interest on interest.The yield to maturity takes into account coupon interest and any capital gain.It also considers the interest-on-interest component.Additionally,implicit in the yield-to-maturity computation is the assumption that the coupon payments can be reinvested at the computed yield to maturity.The yield to maturity is a promised yield and will be realized only if the bond is held to maturity and the coupon interest payments are reinvested at the yield to maturity.If the bond is not held to maturity and the coupon payments are reinvested at the yield to maturity,then the actual yield realized by an investor can be greater than or less than the yield to maturity.Given the facts that(i)one bond,if bought,will not be held to maturity,and(ii)the coupon interest payments will be reinvested at an unknown rate,we cannot determine which bond might give the highest actual realized rate.Thus,we cannot compare them based upon this criterion.However,if the portfolio manager is risk inverse in the sense that she or he doesn’t want to buy a longer term bond,which will likel have more variability in its return,then the manager might prefer the shorter term bond(bondA) of thres years.This bond also matures when the manager wants to cash in the bond.Thus,the manager would not have to worry about any potential capital loss in selling the longer term bond(bondB).The manager would know with certainty what the cash flows are.If These cash flows are spent when received,the managerwould know exactly how much money could be spent at certain points in time.Finally,a manager can try to project the total return performance of a bond on the basis of the panned investment horizon and expectations concerning reinvestment rates and future market yields.This ermits the portfolio manager to evaluate thich of several potential bonds considered for acquisition will perform best over the planned investment horizon.As we just rgued,this cannot be done using the yield to maturity as a measure of relative /doc/6814708511.html,ing total return to assess performance over some investment horizon is called horizon analysis.When a total return is calculated oven an investment horizon,it is referred to as a horizon return.The horizon analysis framwor enabled the portfolio manager to analyze the performance of a bond under different interest-rate scenarios for reinvestment rates and future market yields.Only by investigating multiple scenarios can the portfolio manager see how sensitive the bond’s performance will be to each scenario.This can help the manager choosebetween the two bond choices.(b) Suppose that the portfolio manager plans to hold the bond that is purchased for six years instead of three years. In this case, which would be the best bond for the portfolio manager to purchase?Answer:Similear to our discussion in part(a),we do not know which investment would give the highest actual relized return in six years when we consider reinvesting all cash flows.If the manager buys a three-year bond,then there would be the additional uncertainty of now knowing what three-year bondrates would be in three years.The purchase of the ten-year bond would be held longer than previously(six years compared to three years)and render coupon payments for a six-year period that are known.If these cash flows are spent when received,the manager will know exactly how much money could be spent at certain points in timeNot knowing which bond investment would give the highest realized return,the portfolio manager would choose the bond that fits the firm’s goals in terms of maturity.3) Answer the below questions for bonds A and B.Bond A Bond BCoupon 8% 9%Yield to maturity 8% 8%Maturity (years) 2 5Par $100.00 $100.00Price $100.00 $104.055(a) Calculate the actual price of the bonds for a 100-basis-point increase in interest rates.Answer:For Bond A, we get a bond quote of $100 for our initial price if we have an 8% coupon rate and an 8% yield. If we change the yield 100 basis point so the yield is 9%, then the value of the bond (P) is the present value of the coupon payments plus the present value of the par value. We have C = $40, y = 4.5%, n = 4, and M = $1,000. Inserting these numbers into our present value of coupon bond formula, we get:41111(1)(10.045)$40$143.5010.045nr P C r --++===The present value of the par or maturity value of $1,000 is: 4$1,000$838.561(1)(1.045)n M r ==+ Thus, the value of bond A with a yield of 9%, a coupon rate of 8%, and a maturity of 2years is: P = $143.501 + $838.561 = $982.062. Thus, we get a bond quote of $98.2062. We already know that bond B will give a bond value of $1,000 and a bond quote of $100 since a change of 100 basis points will make the yield and coupon。

固定收益证券试题及答案

一.名词解释一般责任债券:指地方政府以其信用承诺支付本息而发行的债券。

一般责任债券并无特定的还款来源,地方政府必须利用税收来偿还本息。

金融债券:银行等金融机构作为筹资主体为筹措资金而面向个人发行的一种有价证券,是表明债务、债权关系的一种凭证。

债券按法定发行手续,承诺按约定利率定期支付利息并到期偿还本金。

它属于银行等金融机构的主动负债。

资产抵押债券:是以资产(通常是房地产)的组合作为抵押担保而发行的债券,是以特定“资产池(AssetPool)”所产生的可预期的稳定现金流为支撑,在资本市场上发行的债券工具。

零息债券:零息债券是指以贴现方式发行,不附息票,而于到期日时按面值一次性支付本利的债券。

零息债券发行时按低于票面金额的价格发行,而在兑付时按照票面金额兑付,其利息隐含在发行价格和兑付价格之间。

零息债券的最大特点是避免了投资者所获得利息的再投资风险。

连续复利:如果利率是按年复利,那么投资终值为:A(1+R)N,如果利率对应一年复利m次。

则投资终值为::A(1+R/m)Nm,当m趋于无穷大时所对应的利率称为连续复利,在连续复利下,可以证明数量为A的资金投资N年时,投资终值为Aern收益债券:指规定无论利息的支付或是本金的偿还均只能自债券发行公司的所得或利润中拔出的公司债券。

公司若无盈余则累积至有盈余年度始发放,这种债券大多于公司改组或重整时才发生,一般不公开发行。

这种债券的利息并不固定,发期有无利润和利润大小而定,如无利润则不付息。

因此,这种债券与优先股类似。

所不同的是优先股无到期日,而它需到期归还本金。

扬基债券:在美国债券市场上发行的外国债券,即美国以外的政府、金融机构、工商企业和国际组织在美国国内市场发行的、以美元为计值货币的债券。

即期利率:借贷交易达成后立即贷款形成的利率称为即期利率。

即期利率是指债券票面所标明的利率或购买债券时所获得的折价收益与债券当前价格的比率。

它是某一给定时点上无息证券的到期收益率。

《固定收益证券》综合测试题六

《固定收益证券》综合测试题六一、单项选择题(每题2分,共计20分)1.假定到期收益率曲线是水平的,都是 5%。

一个债券票面利率为 6%,每年支付一次利息,期限 3年。

如果到期收益率曲线平行上升一个百分点,则债券价格变化()。

A.2.32B. 2.72C. 3.02D. 3.222. 某一8年期债券,第1~3年息票利率为6.5%,第4~5年为7%,第6 ~7年为7.5%,第8年升为8%就属于()A. 多级步高债券B. 递延债券C.区间债券D.棘轮债券3.在纯预期理论的条件下,先下降后上升的的收益率曲线表示:()A.对短期债券的需求下降,对长期债券的需求上升B.短期利率在未来被认为可能下降C. 对短期债券的需求上升,对长期债券的需求下降D.投资者有特殊的偏好4. 5年期债券的息票率为10%,当前到期收益率为8%,该债券的价格会()A.等于面值B.高于面值C.低于面值D.无法确定5.下面的风险衡量方法中,对含权债券利率风险的衡量最合适的是()。

A.麦考利久期B.有效久期C.修正久期D.凸度6. 债券组合管理采用的指数策略非常困难是()A.主要指数中包含的债券种类太多,很难按适当比例购买B.许多债券交易量很小,所以很难以一个公平的市场价格买到C.投资经理需要大量的管理工作A、B和C7. 债券的期限越长,其利率风险()。

A.越大B.越小C.与期限无关D.无法确定8. 一个投资者按 85 元的价格购买了面值为 100元的两年期零息债券。

投资者预计这两年的通货膨胀率将分别为 4%和 5%。

则该投资者购买这张债券的真实到期收益率为()。

A.3.8B.5.1C.2.5D.4.29. On-the-run债券与off-the-run债券存在不同,On-the-run债券()A.比off-the-run债券期限更短B.比off-the-run债券期限更长C.为公开交易,off-the-run债券则不然D. 是同类债券中最新发行的10. 一位投资经理说:“对债券组合进行单期免疫,仅需要满足以下两个条件:资产的久期和债务的久期相等;资产的现值与负债的现值相等。

固定收益证券

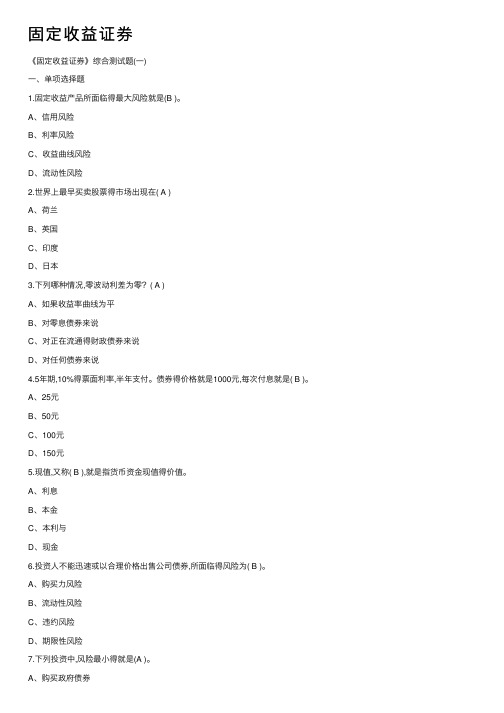

固定收益证券《固定收益证券》综合测试题(⼀)⼀、单项选择题1.固定收益产品所⾯临得最⼤风险就是(B )。

A、信⽤风险B、利率风险C、收益曲线风险D、流动性风险2.世界上最早买卖股票得市场出现在( A )A、荷兰B、英国C、印度D、⽇本3.下列哪种情况,零波动利差为零?( A )A、如果收益率曲线为平B、对零息债券来说C、对正在流通得财政债券来说D、对任何债券来说4.5年期,10%得票⾯利率,半年⽀付。

债券得价格就是1000元,每次付息就是( B )。

A、25元B、50元C、100元D、150元5.现值,⼜称( B ),就是指货币资⾦现值得价值。

A、利息B、本⾦C、本利与D、现⾦6.投资⼈不能迅速或以合理价格出售公司债券,所⾯临得风险为( B )。

A、购买⼒风险B、流动性风险C、违约风险D、期限性风险7.下列投资中,风险最⼩得就是(A )。

A、购买政府债券B、购买企业债券C、购买股票D、投资开发项⽬8.固定收益债券得名义收益率等于(A )加上通货膨胀率。

A、实际收益率B、到期收益率C、当期收益率D、票⾯收益率9.零息票得结构没有(B ),⽽且对通胀风险提供了最好得保护。

A、流动性风险B、再投资风险C、信⽤风险D、价格波动风险10.下列哪⼀项不就是房地产抵押市场上得主要参与者(D )A、最终投资者B、抵押贷款发起⼈C、抵押贷款服务商D、抵押贷款交易商11.如果采⽤指数化策略,以下哪⼀项不就是限制投资经理复制债券基准指数得能⼒得因素?( B)A、某种债券发⾏渠道得限制B、⽆法及时追踪基准指数数据C、成分指数中得某些债券缺乏流动性D、投资经理与指数提供商对债券价格得分歧12.利率期货合约最早出现于20世纪70年代初得(A )A、美国B、加拿⼤C、英国D、⽇本⼆、多项选择题1.⼴义得有价证券包括(ABC):A、商品证券B、货币证券C、资本证券D、上市证券2.债券得收益来源包括哪些?(ABCD)B、再投资收⼊C、资本利得D、资本损失3.到期收益率包含了债券收益得各个组成部分,它得假设条件就是(AB):A、投资者持有债券⾄到期⽇B、投资者以相同得到期收益率将利息收⼊进⾏再投资C、投资者投资债券不交税D、投资者投资债券要交税4.信⽤风险得形式包括(BCD):A、赎回风险B、违约风险C、信⽤利差风险D、降级风险5.为什么通胀指数化债券得发⾏期限⼀般⽐较长? (ABD)A、债券得期限越长,固定利率得风险越⼤B、期限长能体现通胀指数化债券得优势C、期限长能够增加投资者收益D、减少了发⾏短期债券带来得频繁再融资得需要6.通胀指数化债券得现⾦流结构包括(ABD)。

固定收益证券章节练习

《固定收益证券》章节练习题第一章固定收益证券简介1、某8年期债券,第1~3年息票利率为6.5%,第4~5年为7%,第6~7年为7.5%,第8年升为8%,该债券就属于()。

A 多级步高债券B 递延债券C 区间债券D 棘轮债券2、风险具有以下基本特征()。

A风险是对事物发展未来状态的看法B风险产生的根源在于事物发展未来状态所具有的不确定性C风险和不确定性在很大程度上都受到经济主体对相关信息的掌握D风险使得事物发展的未来状态必然包含不利状态的成分3、固定收益产品所面临的最大风险是()。

A 信用风险B 利率风险C 收益曲线风险D 流动性风险4、如果债券的面值为1000美元,年息票利率为5%,则年息票额为?5、固定收益市场上,有时也将()称为深度折扣债券。

A 零息债券 B步高债券 C递延债券 D浮动利率债券6、试结合产品分析金融风险的基本特征。

7、分析欧洲债券比外国债券更受市场投资者欢迎的原因。

8、金融债券按发行条件分为()。

A普通金融债券 B 累进利息金融债券 C贴现金融债券 D 付息金融债券9、目前我国最安全和最具流动性的投资品种是()A 金融债B 国债C 企业债D 公司债10、请判断浮动利率债券是否具有利率风险,并说明理由。

第二章债券的收益率1.债券到期收益率计算的原理是()。

A.到期收益率是购买债券后一直持有到期的内含报酬率B.到期收益率是能使债券每年利息收入的现值等于债券买入价格的折现率C.到期收益率是债券利息收益率与资本利得收益率之和D.到期收益率的计算要以债券每年末计算并支付利息、到期一次还本为前提2.下列哪种情况,零波动利差为零?A.如果收益率曲线为平B.对零息债券来说C.对正在流通的财政债券来说D.对任何债券来说3.在纯预期理论的条件下,下凸的的收益率曲线表示:A.对长期限的债券的需求下降B.短期利率在未来被认为可能下降C.投资者对流动性的需求很小D.投资者有特殊的偏好4.债券的收益来源包括哪些?A.利息B.再投资收入C.资本利得D.资本损失。

固定收益证券练习题

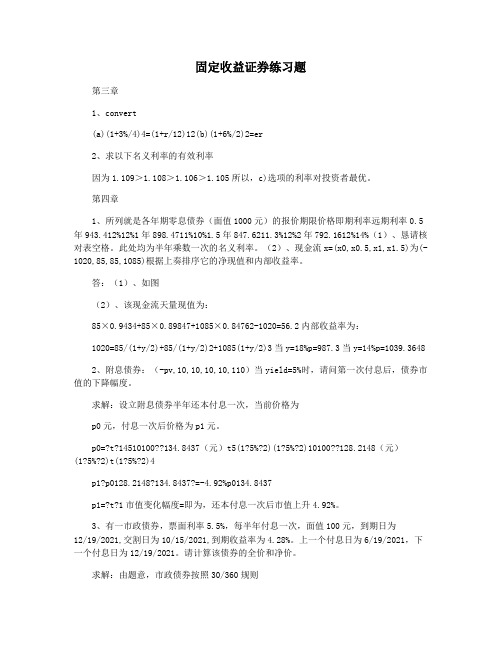

固定收益证券练习题第三章1、convert(a)(1+3%/4)4=(1+r/12)12(b)(1+6%/2)2=er2、求以下名义利率的有效利率因为1.109>1.108>1.106>1.105所以,c)选项的利率对投资者最优。

第四章1、所列就是各年期零息债券(面值1000元)的报价期限价格即期利率远期利率0.5年943.412%12%1年898.4711%10%1.5年847.6211.3%12%2年792.1612%14%(1)、恳请核对表空格。

此处均为半年乘数一次的名义利率。

(2)、现金流x=(x0,x0.5,x1,x1.5)为(-1020,85,85,1085)根据上奏排序它的净现值和内部收益率。

答:(1)、如图(2)、该现金流天量现值为:85×0.9434+85×0.89847+1085×0.84762-1020=56.2内部收益率为:1020=85/(1+y/2)+85/(1+y/2)2+1085(1+y/2)3当y=18%p=987.3当y=14%p=1039.36482、附息债券:(-pv,10,10,10,10,110)当yield=5%时,请问第一次付息后,债券市值的下降幅度。

求解:设立附息债券半年还本付息一次,当前价格为p0元,付息一次后价格为p1元。

p0=?t?14510100??134.8437(元)t5(1?5%?2)(1?5%?2)10100??128.2148(元)(1?5%?2)t(1?5%?2)4p1?p0128.2148?134.8437?=-4.92%p0134.8437p1=?t?1市值变化幅度=即为,还本付息一次后市值上升4.92%。

3、有一市政债券,票面利率5.5%,每半年付息一次,面值100元,到期日为12/19/2021,交割日为10/15/2021,到期收益率为4.28%。

上一个付息日为6/19/2021,下一个付息日为12/19/2021。

- 1、下载文档前请自行甄别文档内容的完整性,平台不提供额外的编辑、内容补充、找答案等附加服务。

- 2、"仅部分预览"的文档,不可在线预览部分如存在完整性等问题,可反馈申请退款(可完整预览的文档不适用该条件!)。

- 3、如文档侵犯您的权益,请联系客服反馈,我们会尽快为您处理(人工客服工作时间:9:00-18:30)。

固定收益证券试题

1)Explain why you agree or disagree with the following statement: “The price of a floater will always trade at its par value.”

2)A portfolio manager is considering buying two bonds. Bond A matures in three years and has a coupon rate of 10% payable semiannually. Bond B, of the same credit quality, matures in 10 years and has a coupon rate of 12% payable semiannually. Both bonds are priced at par.

(a) Suppose that the portfolio manager plans to hold the bond that is purchased for three years. Which would be the best bond for the portfolio manager to purchase? (b) Suppose that the portfolio manager plans to hold the bond that is purchased for six years instead of three years. In this case, which would be the best bond for the portfolio manager to purchase?

3)Answer the below questions for bonds A and B.

Bond A Bond B

Coupon 8% 9%

Yield to maturity 8% 8%

Maturity (years) 2 5

Par $100.00 $100.00

Price $100.00 $104.055

(a) Calculate the actual price of the bonds for a 100-basis-point increase in interest rates.

(b) Using duration, estimate the price of the bonds for a 100-basis-point increase in interest rates.

(c) Using both duration and convexity measures, estimate the price of the bonds for a 100-basis-point increase in interest rates.

(d) Comment on the accuracy of your results in parts b and c, and state why one approximation is closer to the actual price than the other.

(e) Without working through calculations, indicate whether the duration of the two bonds would be higher or lower if the yield to maturity is 10% rather than 8%.

4)Suppose a client observes the following two benchmark spreads for two bonds: Bond issue U rated A: 150 basis points

Bond issue V rated BBB: 135 basis points

Your client is confused because he thought the lower-rated bond (bond V) should offer a higher benchmark spread than the higher-rated bond (bond U). Explain why the benchmark spread may be lower for bond U.

5)The bid and ask yields for a Treasury bill were quoted by a dealer as 5.91% and 5.89%, respectively. Shouldn’t the bid yield be less than the ask yield, because the bid yield indicates how much the dealer is willing to pay and the ask yield is what the dealer is willing to sell the Treasury bill for?

6)What is the difference between a cash-out refinancing and a rate-and-term refinancing?

7)Describe the cash flow of a mortgage pass-through security.

8)Explain the effect on the average lives of sequential-pay structures of including an accrual tranche in a CMO structure.。